经济学原理第8章

- 格式:pdf

- 大小:1.73 MB

- 文档页数:35

![[经济学]第八章-分配理论](https://uimg.taocdn.com/066777995f0e7cd185253601.webp)

曼昆《经济学原理(微观经济学分册)》(第6版)第8章应用:赋税的代价课后习题详解跨考网独家整理最全经济学考研真题,经济学考研课后习题解析资料库,您可以在这里查阅历年经济学考研真题,经济学考研课后习题,经济学考研参考书等内容,更有跨考考研历年辅导的经济学学哥学姐的经济学考研经验,从前辈中获得的经验对初学者来说是宝贵的财富,这或许能帮你少走弯路,躲开一些陷阱。

以下内容为跨考网独家整理,如您还需更多考研资料,可选择经济学一对一在线咨询进行咨询。

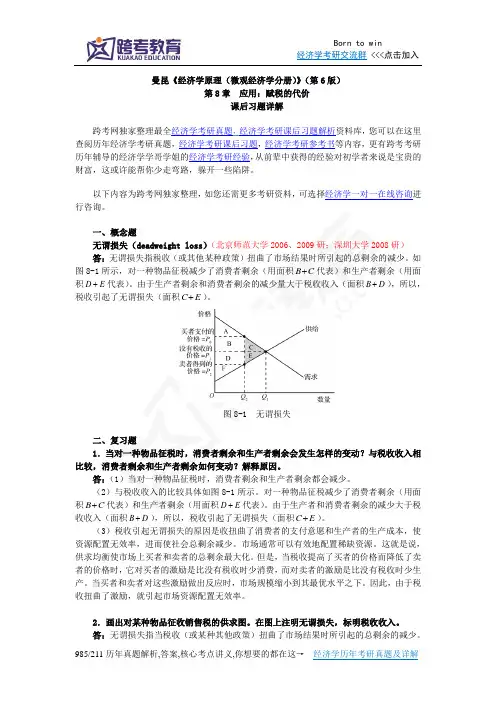

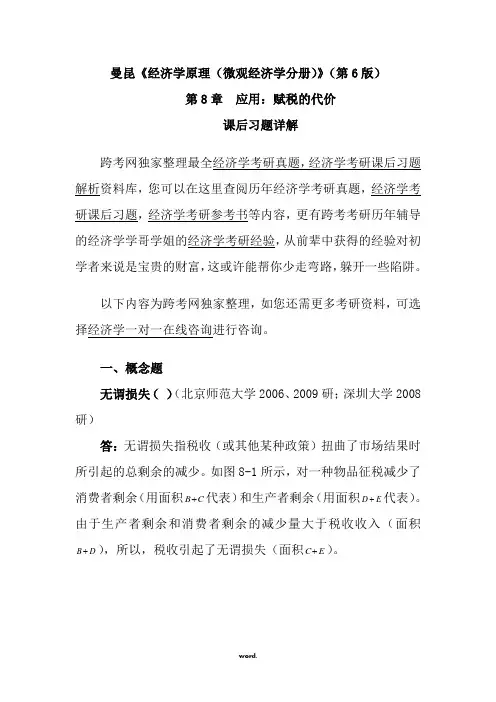

一、概念题无谓损失(deadweight loss)(北京师范大学2006、2009研;深圳大学2008研)答:无谓损失指税收(或其他某种政策)扭曲了市场结果时所引起的总剩余的减少。

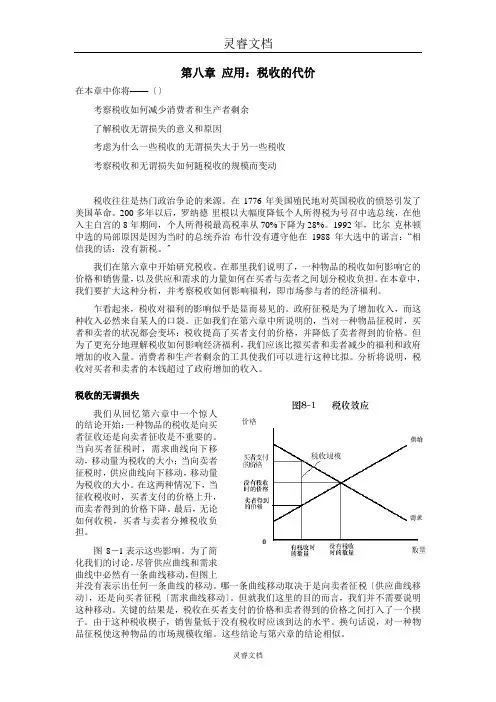

如图8-1所示,对一种物品征税减少了消费者剩余(用面积B C+代表)和生产者剩余(用面积D E+代表)。

由于生产者剩余和消费者剩余的减少量大于税收收入(面积B D+),所以,税收引起了无谓损失(面积C E+)。

图8-1 无谓损失二、复习题1.当对一种物品征税时,消费者剩余和生产者剩余会发生怎样的变动?与税收收入相比较,消费者剩余和生产者剩余如何变动?解释原因。

答:(1)当对一种物品征税时,消费者剩余和生产者剩余都会减少。

(2)与税收收入的比较具体如图8-1所示。

对一种物品征税减少了消费者剩余(用面积B C+代表)。

由于生产者和消费者剩余的减少大于税+代表)和生产者剩余(用面积D E收收入(面积B D+),所以,税收引起了无谓损失(面积C E+)。

(3)税收引起无谓损失的原因是收扭曲了消费者的支付意愿和生产者的生产成本,使资源配置无效率,进而使社会总剩余减少。

市场通常可以有效地配置稀缺资源。

这就是说,供求均衡使市场上买者和卖者的总剩余最大化。

但是,当税收提高了买者的价格而降低了卖者的价格时,它对买者的激励是比没有税收时少消费,而对卖者的激励是比没有税收时少生产。

当买者和卖者对这些激励做出反应时,市场规模缩小到其最优水平之下。

《微观经济学:原理与模型》第8章市场失灵与微观经济政策第五节公共物品一、私人物品与公共物品私人物品(personal goods),是指所有权属于个人的物品,具备竞争性和排他性,能够过市场机制达到资源优化配臵的产品。

一个人使用或消费私人物品意味着他人不能同时使用或消费该物品。

例如,一双鞋不可能同时供两个以上的人穿在脚上。

私人物品的这种排他性也称之为消费上的“竞争性”。

市场机制良好运行是以私人物品为基础的。

具有私人物品属性的资源要实现最佳的配置效率,主要应该在明确界定的产权束和相应的立法保障的基础上,市场机制交易来实现的。

公共物品(public goods),是指具有非竞争性和非排他性,不能依靠市场机制实现有效配臵的产品。

具体说是指这样一类物品,它一旦提供出来,生产者就无法排斥那些不为物品付费的个人使用,或者排他的成本过高以至于变得难以实现。

公共物品在消费或使用上是不排他的,每个人对公共物品的消费,均不会造成其他人消费的减少。

公共物品的自然属性或技术属性决定了要排斥某些人使用或消费公共物品一般是不可能的,或者说排他的费用太高。

生活中公共物品同私人物品一样不可缺少,诸如国防、警察、公交运输、广播电视、灯塔等无一例外地直接影响着人们的日常生活。

公共物品所具备的非排他属性导致公共物品存在着外部性问题。

二、公共物品的最优数量私人物品的排他性特点,可以按边际效益等于边际成本原则确定其最优产量,而公共物品的非排他性决定的外部件,其最优数量的确定较为复杂。

如图8-所示:图8-4 公共物品的最优产量(注:公共物品的市场需求曲线,不是个人需求曲线之和,每个消费者的消费量与总消费量相等,所有消费者支付价格总和等于总消费量所支付的全部价格。

)图中,横轴代表公共物品数量Q ,纵轴代表公共物品价格P ,S 为公共物品的供给曲线。

A D ,B D 为消费者A 和B 对公共物品的需求曲线,D 为公共物品的总需求曲线。

公共物品的总需求曲线不是A ,B 的需求曲线A D 和B D 的水平相加,而是A D 和B D 的垂直相加和,即公共物品的总需求量不是B A Q Q +,而是Q 。

《经济学原理》总目录第一篇导论第一章导论第二篇微观经济理论第二章需求、供给与均衡第三章消费者行为理论第四章生产者行为理论第五章产品市场理论第六章生产要素理论第七章微观经济政策第三篇宏观经济理论第八章国民收入的核算与决定理论第九章失业与通货膨胀理论第十章经济周期与经济增长理论第十一章宏观经济政策第十二章开放经济第一章导论一、单项选择1、作为经济学的两个组成部分,微观经济学与宏观经济学是()A.互相对立的 B.没有任何联系的 C.相互补充的 D.部分联系的2、古典经济学家亚当·斯密所谓的“看不见的手”是指()A.技术 B.信息 C.价格 D.行政命令3、经济学研究的基本问题是()A.生产什么 B.如何生产 C.为谁生产 D.以上都是4、资源的稀缺性是指()。

A.世界上的资源最终会由于人们生产更多的物品而消耗光B.相对于人们无穷的欲望而言,资源总是不足的C.生产某种物品所需资源的绝对数量很少D.由于存在资源浪费而产生的稀缺5、微观经济学解决的问题是()。

A.资源配置 B.资源利用 C.市场出清 D.完全理性6、宏观经济学的中心理论是()。

A.失业理论 B.通货膨胀理论C.国民收入决定理论 D.经济增长理论7、关于实证经济学与规范经济学说法正确的是()A.两者并不是绝对相互排斥的,而应当是相互补充的。

B.规范经济学是以实证经济学为基础,而实证经济学则是以规范经济学作为指导的。

C.一般来说,越是具体的问题,实证的成分越多,而越是高层次的、决策性的问题,就越具有规范性。

D.以上说法都对二、多项选择1、微观经济学的主要内容包括()A.体格决定理论 B.消费者行为理论C.生产者行为理论 D.市场理论和分配理论等2、宏观经济学的基本内容有()A.宏观经济政策 B.经济周期与增长理论C.国民收入决定理论 D.失业与通货膨胀理论3、下列关于资源稀缺性的正确的说法有()A.资源稀缺性是相对于欲望的无限性而言的B.地球上的资源本来就少C.资源稀缺性存在于世界各地D.资源稀缺性存在于人类历史的各个时期三、判断题1、资源的稀缺性决定了资源可以得到充分的利用,不会出现资源浪费的现象。

曼昆《经济学原理(微观经济学分册)》(第6版)第8章应用:赋税的代价课后习题详解跨考网独家整理最全经济学考研真题,经济学考研课后习题解析资料库,您可以在这里查阅历年经济学考研真题,经济学考研课后习题,经济学考研参考书等内容,更有跨考考研历年辅导的经济学学哥学姐的经济学考研经验,从前辈中获得的经验对初学者来说是宝贵的财富,这或许能帮你少走弯路,躲开一些陷阱。

以下内容为跨考网独家整理,如您还需更多考研资料,可选择经济学一对一在线咨询进行咨询。

一、概念题无谓损失()(北京师范大学2006、2009研;深圳大学2008研)答:无谓损失指税收(或其他某种政策)扭曲了市场结果时所引起的总剩余的减少。

如图8-1所示,对一种物品征税减少了消费者剩余(用面积B C+代表)和生产者剩余(用面积D E+代表)。

由于生产者剩余和消费者剩余的减少量大于税收收入(面积+),所以,税收引起了无谓损失(面积C E+)。

B D图8-1 无谓损失二、复习题1.当对一种物品征税时,消费者剩余和生产者剩余会发生怎样的变动?与税收收入相比较,消费者剩余和生产者剩余如何变动?解释原因。

答:(1)当对一种物品征税时,消费者剩余和生产者剩余都会减少。

(2)与税收收入的比较具体如图8-1所示。

对一种物品征税减少了消费者剩余(用面积B C+代表)和生产者剩余(用面积D E+代表)。

由于生产者和消费者剩余的减少大于税收收入(面积B D+),所以,税收引起了无谓损失(面积C E+)。

(3)税收引起无谓损失的原因是收扭曲了消费者的支付意愿和生产者的生产成本,使资源配置无效率,进而使社会总剩余减少。

市场通常可以有效地配置稀缺资源。

这就是说,供求均衡使市场上买者和卖者的总剩余最大化。

但是,当税收提高了买者的价格而降低了卖者的价格时,它对买者的激励是比没有税收时少消费,而对卖者的激励是比没有税收时少生产。

当买者和卖者对这些激励做出反应时,市场规模缩小到其最优水平之下。

曼昆《经济学原理(微观经济学分册)》(第6版)第8章应用:赋税的代价课后习题详解跨考网独家整理最全经济学考研真题,经济学考研课后习题解析资料库,您可以在这里查阅历年经济学考研真题,经济学考研课后习题,经济学考研参考书等内容,更有跨考考研历年辅导的经济学学哥学姐的经济学考研经验,从前辈中获得的经验对初学者来说是宝贵的财富,这或许能帮你少走弯路,躲开一些陷阱。

以下内容为跨考网独家整理,如您还需更多考研资料,可选择经济学一对一在线咨询进行咨询。

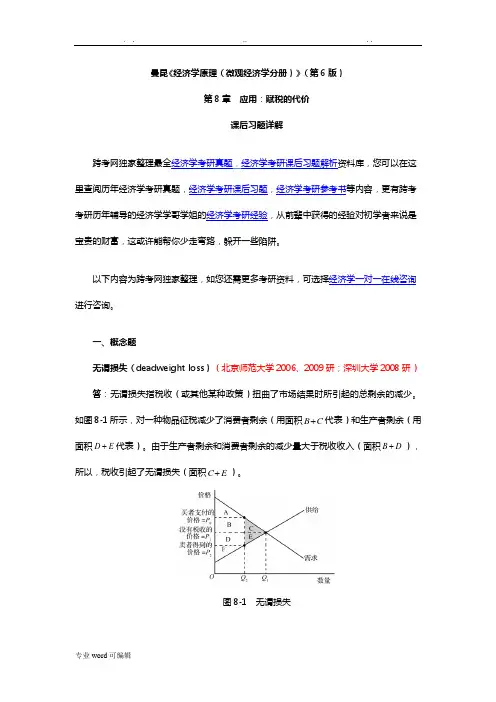

一、概念题无谓损失(deadweight loss)(北京师范大学2006、2009研;深圳大学2008研)答:无谓损失指税收(或其他某种政策)扭曲了市场结果时所引起的总剩余的减少。

如图8-1所示,对一种物品征税减少了消费者剩余(用面积B C+代表)和生产者剩余(用面积D E+代表)。

由于生产者剩余和消费者剩余的减少量大于税收收入(面积B D+),所以,税收引起了无谓损失(面积C E+)。

图8-1 无谓损失二、复习题1.当对一种物品征税时,消费者剩余和生产者剩余会发生怎样的变动?与税收收入相比较,消费者剩余和生产者剩余如何变动?解释原因。

答:(1)当对一种物品征税时,消费者剩余和生产者剩余都会减少。

(2)与税收收入的比较具体如图8-1所示。

对一种物品征税减少了消费者剩余(用面积B C+代表)和生产者剩余(用面积D E+代表)。

由于生产者和消费者剩余的减少大于税收收入(面积B D+)。

+),所以,税收引起了无谓损失(面积C E(3)税收引起无谓损失的原因是收扭曲了消费者的支付意愿和生产者的生产成本,使资源配置无效率,进而使社会总剩余减少。

市场通常可以有效地配置稀缺资源。

这就是说,供求均衡使市场上买者和卖者的总剩余最大化。

但是,当税收提高了买者的价格而降低了卖者的价格时,它对买者的激励是比没有税收时少消费,而对卖者的激励是比没有税收时少生产。

当买者和卖者对这些激励做出反应时,市场规模缩小到其最优水平之下。

曼昆《经济学原理(微观经济学分册)》(第6版)第8章应用:赋税的代价课后习题详解跨考网独家整理最全经济学考研真题,经济学考研课后习题解析资料库,您可以在这里查阅历年经济学考研真题,经济学考研课后习题,经济学考研参考书等内容,更有跨考考研历年辅导的经济学学哥学姐的经济学考研经验,从前辈中获得的经验对初学者来说是宝贵的财富,这或许能帮你少走弯路,躲开一些陷阱。

以下内容为跨考网独家整理,如您还需更多考研资料,可选择经济学一对一在线咨询进行咨询。

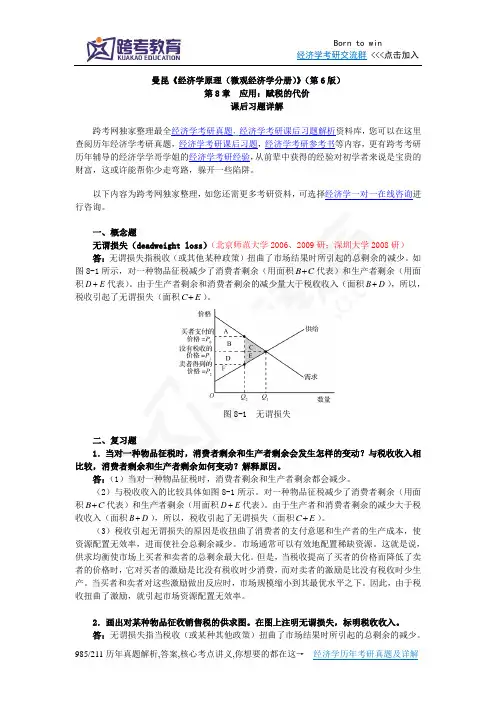

一、概念题无谓损失(deadweight loss)(北京师范大学2006、2009研;深圳大学2008研)答:无谓损失指税收(或其他某种政策)扭曲了市场结果时所引起的总剩余的减少。

如图8-1所示,对一种物品征税减少了消费者剩余(用面积B C+代表)和生产者剩余(用面积D E+代表)。

由于生产者剩余和消费者剩余的减少量大于税收收入(面积B D+),所以,税收引起了无谓损失(面积C E+)。

图8-1 无谓损失二、复习题1.当对一种物品征税时,消费者剩余和生产者剩余会发生怎样的变动?与税收收入相比较,消费者剩余和生产者剩余如何变动?解释原因。

答:(1)当对一种物品征税时,消费者剩余和生产者剩余都会减少。

(2)与税收收入的比较具体如图8-1所示。

对一种物品征税减少了消费者剩余(用面积B C+代表)。

由于生产者和消费者剩余的减少大于税+代表)和生产者剩余(用面积D E收收入(面积B D+),所以,税收引起了无谓损失(面积C E+)。

(3)税收引起无谓损失的原因是收扭曲了消费者的支付意愿和生产者的生产成本,使资源配置无效率,进而使社会总剩余减少。

市场通常可以有效地配置稀缺资源。

这就是说,供求均衡使市场上买者和卖者的总剩余最大化。

但是,当税收提高了买者的价格而降低了卖者的价格时,它对买者的激励是比没有税收时少消费,而对卖者的激励是比没有税收时少生产。

当买者和卖者对这些激励做出反应时,市场规模缩小到其最优水平之下。

第八章应用:税收的代价在本章中你将——〔〕考察税收如何减少消费者和生产者剩余了解税收无谓损失的意义和原因考虑为什么一些税收的无谓损失大于另一些税收考察税收和无谓损失如何随税收的规模而变动税收往往是热门政治争论的来源。

在1776年美国殖民地对英国税收的愤怒引发了美国革命。

200多年以后,罗纳德·里根以大幅度降低个人所得税为号召中选总统,在他入主白宫的8年期间,个人所得税最高税率从70%下降为28%。

1992年,比尔·克林顿中选的局部原因是因为当时的总统乔治·布什没有遵守他在1988年大选中的诺言:“相信我的话:没有新税。

〞我们在第六章中开始研究税收。

在那里我们说明了,一种物品的税收如何影响它的价格和销售量,以及供应和需求的力量如何在买者与卖者之间划分税收负担。

在本章中,我们要扩大这种分析,并考察税收如何影响福利,即市场参与者的经济福利。

乍看起来,税收对福利的影响似乎是显而易见的。

政府征税是为了增加收入,而这种收入必然来自某人的口袋。

正如我们在第六章中所说明的,当对一种物品征税时,买者和卖者的状况都会变坏:税收提高了买者支付的价格,并降低了卖者得到的价格。

但为了更充分地理解税收如何影响经济福利,我们应该比拟买者和卖者减少的福利和政府增加的收入量。

消费者和生产者剩余的工具使我们可以进行这种比拟。

分析将说明,税收对买者和卖者的本钱超过了政府增加的收入。

税收的无谓损失我们从回忆第六章中一个惊人的结论开始:一种物品的税收是向买者征收还是向卖者征收是不重要的。

当向买者征税时,需求曲线向下移动,移动量为税收的大小;当向卖者征税时,供应曲线向下移动,移动量为税收的大小。

在这两种情况下,当征收税收时,买者支付的价格上升,而卖者得到的价格下降。

最后,无论如何收税,买者与卖者分摊税收负担。

图8-l表示这些影响。

为了简化我们的讨论,尽管供应曲线和需求曲线中必然有一条曲线移动,但图上并没有表示出任何一条曲线的移动。

第六章1.已知产量为8个单位时,总成本为80元,当产量增加到9个单位时,平均成本为11元,那么此时的边际成本为()。

A1元B 19元C 88元D 20元2.企业购买生产要素所引起的费用是()。

A隐性成本B 显性成本C 变动成本D 经济成本3.短期平均成本曲线呈U型的原因是()。

A外部经济问题B 内部经济问题C 规模收益问题D 边际收益(报酬)问题4.厂商的长期平均成本曲线呈U型的原因是()。

A外部经济问题B 外部不经济问题C 规模经济问题D 边际收益问题5.以下说法正确的是()。

A MC大于AC时,AC下降B MC小于AC时,AC下降C MC等于AC时,AC下降D MC等于AC时,AC达到最低点6.随着产量的增加,固定成本()。

A增加B 不变C 减少D 先增后减7.随着产量的增加,平均固定成本()。

A在开始时间少,然后趋于增加,B 一直趋于减少C 一直趋于增加D 在开始时增加,然后趋于减少8.边际成本曲线与平均成本曲线的相交点是()。

A边际成本曲线的最低点B 平均成本曲线的最低点C 平均成本曲线下降阶段的任何一点D 边际成本曲线的最高点9.固定成本是指()。

A厂商在短期内必须支付的不能调整的生产要素的费用B 厂商增加产量所要增加的费用C 厂商购进生产要素时所要支付的费用D 厂商在短期内必须支付的可能调整的生产要素的费用10.已知产量为500单位时,平均成本为2元,当产量增加到550单位时,平均成本等于2.5元,在这一产量变化范围内,边际成本()。

A随着产量的增加而增加,并小于平均成本B 随着产量的增加而减少,并大于平均成本C 随着产量的增加而减少,并小于平均成本D 随着产量的增加而增加,并大于平均成本11.某厂商生产5件衣服的总成本为1500元,其中厂房和机器折旧为500元,工人工资及原材料费用为1000元,那么平均可变成本为()。

A300元B 100元C 200元D 500元,12.全部成本等于()。

第8章 经济增长理论8.1 考点难点归纳经济增长理论研究国民经济长期发展的问题,其发展主要经过了三个阶段:哈罗德-多马模型、新古典经济增长模型和内生增长模型。

经济增长理论中,基本的模型为哈罗德-多马模型,而哈罗德-多马模型的不稳定性为考查的重点。

经济增长理论属于西方经济学中较难的部分,有些名牌大学的考研题非常难,报考这类大学的考生需要对其做深入的分析和理解(如北京大学2000年就考了solow 经济增长模型)。

1.经济增长的含义和源泉在宏观经济学中,经济增长通常被定义为产量的增加。

具体理解有两层含义:(1)经济增长指一个经济体所产生的物质产品和劳务在一个相当长时期内的持续增长,即经济总产量的增长;(2)经济增长是按人口平均计算的实际产出的持续增长,即人均产量的增长。

作为经济增长源泉的最主要的因素是:劳动数量增加和质量提高(即人力资本的增长)、资本存量的增加和技术进步(是广义概念,包括采用新技术、新产品、先进管理手段以及资源配置的高效率等)。

增长率的分解式为:K L A Y G G G G βα++=,式中,G Y 为产出的增长率;G A 为技术进步增长率;G L 和G K 分别为劳动和资本的增长率;a 和β为参数,分别是劳动和资本的产出弹性。

2.哈罗德-多马模型哈罗德-多马模型主要研究在保持充分就业的条件下,储蓄和投资的增长与收入增长之间的关系。

(1)模型的假设前提①全社会只生产一种产品。

②储蓄S 是国民收入Y 的函数,即S =sY (s 代表这个社会的储蓄比例,即储蓄在国民收入中所占的份额。

)③生产过程中只使用两种生产要素,即劳动L 和资本K 。

④不存在技术进步,也不存在资本折旧问题。

⑤劳动力按照一个固定不变的比率增长。

⑥生产规模报酬不变,即生产任何一单位产品所需要的资本和劳动的数量都是固定不变的。

⑦不存在货币部门,且价格水平不变。

(2)模型的基本方程 哈罗德模型的基本方程为:vs Y Y G =∆= 式中,G 表示国民收入增长率△Y/Y (即经济增长率),s 表示储蓄率S/Y ,v 表示边际资本-产量比率△K/△Y (假定边际资本—产量比率等于资本—产量比率K/Y ),且v =I/△Y 。

15.资本主义商品的生产价格构成是( C )A.生产成本加剩余价值B.生产成本加利润C.生产成本加平均利润D.生产成本加垄断利润16.商业资本参与利润平均化后,全社会的平均利润率是(d )A.剩余价值与全部借贷资本的比率B.剩余价值与全部商业资本的比率C.剩余价值与全部产业资本的比率D.剩余价值与产业资本加商业资本的比率17.个别生产价格低于社会生产价格的差额是()A.剩余价值B.平均利润C.超额利润D.超额剩余价值15.某产业资本家,依靠200万元借贷资本经营产业,年利息率为6%,1年后得到20万元利润,该产业资本家获得的企业利润是( B )A.6万元B.8万元C.12万元D.20万元16.借贷资本所有者贷出货币资本时( A )A.没有放弃资本所有权,转让了资本使用权B.放弃了资本所有权,没有转让资本使用权C.既放弃了资本所有权,又转让了资本使用权D.既没有放弃资本所有权,又没有转让资本使用权17.土地的资本主义经营垄断使农产品的社会生产价格决定于农业生产中的(D )A.优等地生产条件B.中等地生产条件C.劣等地生产条件D.社会平均生产条件15.在资本主义社会,生产成本是生产单位产品( D )A.所预付的全部资本B.所耗费的全部可变资本C.所耗费的全部不变资本D.所耗费的不变资本和可变资本16.商业资本所获得的利润相当于()A.企业利润B.平均利润C.超额利润D.创业利润17.商业利润是商业职工( A )A.必要劳动时间创造的剩余价值B.剩余劳动时间实现的剩余价值C.必要劳动时间实现的剩余价值D.全部劳动时间实现的剩余价值15.资本主义经济中的利润是(A)A.剩余价值的转化形式B.商品价值的转化形式C.生产成本的转化形式D.生产价格的转化形式16.资本主义条件下所有权和使用权分离的资本形态是(C)A.产业资本 B.商业资本C.借贷资本 D.农业资本17.土地价格是(B)A.土地价值的货币表现B.资本化的地租C.农业资本家向地主缴纳的全部货币额 D.级差地租和绝对地租的总和14.利润率和剩余价值率的量的关系表现在()A.二者相等 B.利润率小于剩余价值率C.利润率大于剩余价值率 D.二者没有关系15.商业利润的真正来源是(D)A.流通领域中商品买卖的差额 B.流通中创造的价值C.生产过程与流通过程共同创造的价值 D.产业工人创造的剩余价值16.利息率的变动区间是(B)A.利润率和零之间B.平均利润率和零之间C.剩余价值率和零之间D.年剩余价值率和零之间17.资本主义级差地租产生的原因是(D)A.土地的资本主义私有制 B.农业工人提供了剩余劳动C.农业工人工资低于其他部门 D.土地的资本主义垄断经营15.平均利润的形成是()A.部门内部竞争的结果B.部门之间竞争的结果C.资本有机构成提高的结果D.资本积累的结果16.资本主义商业中的纯粹流通费用是指( A )A.商品的保管费和广告费B.商品的保管费和簿记费C.单纯由商品的价值运动所引起的费用D.单纯由商品的使用价值运动所引起的费用17.借贷资本主要来源于产业资本循环过程中闲置的( A )A.货币资本B.生产资本C.商品资本D.不变资本15.资本主义银行利润的最终来源是(A )A. 存款利息低于贷款利息的差额B. 存款利息高于贷款利息的差额C. 银行雇员创造的剩余价值D. 产业工人创造的剩余价值16.平均利润形成后,价值规律的作用形式是(B )A. 市场价格围绕价值上下波动B. 市场价格围绕生产价格上下波动C. 生产价格围绕价值上下波动D. 商品价值围绕价格上下波动17.商业资本执行的是产业资本运动中的( D )A. 货币资本职能B. 商品资本职能C. 生产资本职能D. 流动资本职能18.两块面积和肥沃程度相同的土地,一块离市场较近,一块离市场较远,租用前者须多交的地租属于()A. 绝对地租B. 级差地租ⅠC. 级差地租ⅡD. 垄断地租13.利息率和平均利润率的关系是( C )A.利息率等于平均利润率B.利息率高于平均利润率C.利息率的最高界限是平均利润率D.利息率的最低界限是平均利润率12.利息率是指一定时期内 DA.剩余价值量与借贷资本总量的比率B.利润量与借贷资本总量的比率C.平均利润量与借贷资本总量的比率D.利息量与借贷资本总量的比率11.平均利润的形成过程,实际上是全社会的剩余价值在( D )A.各个部门的创造过程B.各个部门内部的转移过程C.各个部门内部各企业之间的瓜分过程D.各部门之间重新分配的过程10.生产成本的构成内容是(A)A.c+v+m B.c+vC.v+m D.c+m12.在资本主义条件下,部门内部竞争的结果形成(D)A.商品的生产价格B.平均利润率C.商品的社会价值D.平均利润10.生产价格的变动归根结底是由(B )A.商品价值的变动引起的B.商品供求关系的变动引起的C.平均利润的变动引起的D.货币供应量的多少引起的11.资本主义企业生产成本是( D )A.c+v B.c+mC.v+m D.c+v+m12.利润转化为平均利润()A.只是质的转化,在量上没有变化B.只是量的转化,在质上没有变化C.无论在质上还是在量上都没有变化D.无论在质上还是在量上都发生了变化13.资本主义地租是( D )A.农业工人所创造的全部剩余价值B.农产品价值低于生产价格的差额C.平均利润或农业工人工资的一部分D.超过平均利润的超额利润10.平均利润率是社会剩余价值总量和社会预付( A )A.总资本的比率B.不变资本的比率C.可变资本的比率D.流动资本的比率11.借贷资本参与剩余价值分配时,平均利润分割为()A.产业利润和商业利润B.产业利润和利息C.商业利润和利息D.企业利润和利息12.绝对地租产生的原因是(C )A.土地肥沃程度和地理位置不同B.土地私有权的垄断C.土地的经营垄断D.农业资本有机构成偏低10.资本主义级差地租形成的条件是( D )A.土地的资本主义经营垄断B.农业资本有机构成低于社会平均资本有机构成C.土地的私有权垄断D.土地有肥沃程度和地理位置的不同11.当剩余价值被看作全部预付资本的产物时,剩余价值就转化为( A )A.生产成本B.生产价格C.平均利润D.利润34.生产性流通费用包括(BCD )A.广告费B.包装费C.保管费D.运输费E.店员工资34.影响利润率最低的因素有(ABCD)A.剩余价值率的高低B.资本有机构成的高低C.资本周转速度的快慢D.不变资本节省的状况E.所用资本和所费资本之间的差额33.在剩余价值分配中,能够获得平均利润的资本有()A.产业资本B.商业资本C.借贷资本D.银行资本E.农业资本35.生产价格与价值的关系是(AB)A.生产价格是价值的转化形式B.生产价格的形成以价值为基础C.资本有机构成高的部门其产品的生产价格高于价值D.资本有机构成低的部门其产品的生产价格低于价值E.全社会的生产价格总额和价值总额相等35.资本主义级差地租是()A.与土地的不同等级相联系的地租B.由农产品的个别生产价格低于社会生产价格形成的C.租种劣等土地必须缴纳的地租D.租种优等土地缴纳的地租E.农业工人所创造的超过平均利润以上的那部分剩余价值35.资本主义银行利润()A.在数量上相当于平均利润B.是由贷款利息总和构成的C.是由存款利息和贷款利息的差额构成的D.来自产业工人创造的一部分剩余价值E.是由银行雇员在剩余劳动时间实现的35.在资本主义条件下,剩余价值采取的具体形式有()A. 产业利润B. 商业利润C. 利息D. 级差地租E. 绝对地租35.影响利润率的因素是()A.剩余价值率B.资本有机构成C.资本周转速度D.不变资本节省E.资本周转时间36.资本主义地租体现的阶级关系包括()A.工业资本家B.农业资本家C.借贷资本家D.土地所有者E.农业工人35.部门之间的竞争会导致()A.不同生产部门的利润率趋于平均化B.不同生产部门所获利润完全相等C.不同生产部门的超额利润消失D.全社会平均利润总额与剩余价值总额不相等E.资本从利润率低的部门转移到利润率高的部门36.资本主义制度下决定土地价格高低的因素有(CDE )A.剩余价值率B.平均利润率C.利息率D.地租量E.土地价值35.利润转化为平均利润的过程,同时也是()A.生产要素在不同部门之间转移的过程B.商品价值转化为生产价格的过程C.剩余价值转化为利润的过程D.剩余价值率转化为利润率的过程E.各部门资本家重新瓜分剩余价值的过程43.资本主义土地价格由什么因素决定?43.简述股票价格的概念及其影响因素。