外贸函电-付款方式

- 格式:ppt

- 大小:160.00 KB

- 文档页数:31

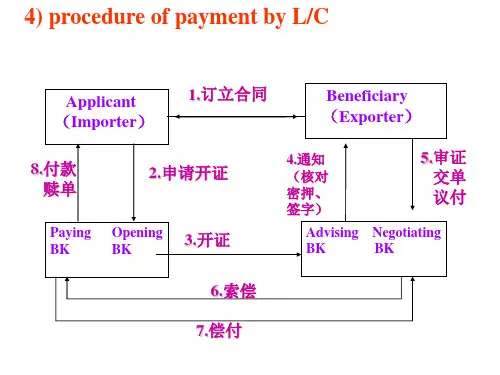

Terms of PaymentWarm- upHow many instruments of payment do you know?How many basic methods of payment do you know?Have you ever heard about L/C?Why is L/C generally used in international trade?Learning objectives⏹To learn the basic three instruments of payment –bill of exchange, promissory note and cheque.⏹To learn the modes of payment in int’l trade – remittance, collection, letter of credit.⏹To be aware of the advantage and disadvantage under different payment methods.⏹To learn the letter of asking for easier terms⏹To learn the letter of replying for negotiate payment termsTerms of PaymentThe terms of payment are an important part of the sales contract both sellers and buyers are concerned about.Conditions under which the seller and buyer agree to settle the financial amount of the sales contract.International payment arrangements are much complicated because:Financial instruments⏹In int’l trade, currencies and bills are two major means of payment.⏹It is difficult for the buyer to pay and the seller to deliver the goods face to face.⏹They use documents to fulfill their respective obligations, i.e., the seller delivers the goods and is paid against the documents, meanwhile the buyer makes payment and get the goods against the documents. Banks are intermediaries, and bills are instruments of payment.Instruments of Int’l SettlementClassification of drafts1.According to time when the draft falls due:----Sight (Demand ) Bill(Draft)----Time ( Usance) Bill (Draft)2.According to the Shipping documents attached or not:----Clean Bill (no conditions)----Documentary Bill3.According to who the drawer is:----Commercial Bill----Banker’s Bill※An Example of a Banker’s DraftAn Example of a Commercial DraftPromissory Note 本票中国建设银行现金支票样本Three Main Methods of PaymentTypes of RemittanceRemittance is chiefly used forPayment in advance;Cash with order;Delivery first and payment afterwards;Small quantity of goods;Commission;Sundry chargesTypes of Remittance⏹Mail Transfer, M/T⏹Cheap but slow, seldom used⏹Telegraphic Transfer, T/T⏹Fast and safe for exporter to get the money⏹The most commonly used type of remittance⏹Demand Draft, D/D⏹Flexible to draw money⏹Convenient for the exporterTypes of CollectionTypes of Collection⏹Collection belongs to commercial credit.⏹The banker only functions as a middleman, and his obligation is only to provide services of delivering documents and collect payment. The seller sends goods first, and gets payment later. Whether the seller can get the payment or not is reliable on the buyer’s credit. The buyer gets financing from the seller.Letter of Credit, L/C信用证⏹A L/C is a conditional written undertaking given by bank on the request of an importer to pay at sight or at determinable future date a certain amount of money to the exporter against stipulated documents, provided that the terms and conditions of the credit are complied with.Letter of Credit, L/C信用证The Characteristics of L/CThe advantages of using an L/CIt is reliable and safe for both sellers and buyers.Because the issuing bank use its own credit to guarantee the payment of orders.The disadvantages of using an L/CComplicated procedure of applying for a L/CBanks will charge service fee for issuing a L/C, therefore it add more cost to the buyer.Confirmed , Irrevocable,Documentary Credit, at sight⏹Modes of payment means a series of acts or operations to realize the funds flow from one country to another.Modes of Int’l PaymentDocumentary CreditRevocable Documentary CreditIrrevocable Documentary CreditConfirmed Irrevocable CreditSight Payment Credit/Negotiation Credit议付Deferred Payment Credit/Acceptance Credit承兑Transferable CreditNon-transferable CreditRevolving Credit循环信用证Reciprocal Credit对开Anticipatory Credit预支信用证Remittance and Collectioncommercial credit offered by companies.Letter of Creditbanker’s credit offered by banks.Letter of CreditL/C: the most generally used method of payment, which is reliable and safe for both sellers and buyers.Characteristics of L/C(1) L/C is an independent instrument compared to contract, and not affected by contract.(2) The bank bears responsibility of First Payment.(3) The bank bears responsibility of the documents not the commodity itself.---- “Document Business”(4) L/C is an agreement among the bankers, beneficiary, opener and all other parties concerned and all parties concerned will be bound by the term on L/C.Terms of PaymentQuestionsQuestionsMain points of Asking for easier paymentOpening:a.reference to the relative order or contract; Mention the contract, goods, etc.Body :b.putting forward favorable payment terms; Propose the terms of paymentC.stating the reasons;Closing:d.expecting acceptance. Wish the reader to accept.Sample letter study1. Agree to the requirements:Opening:a.receiving the letter; State that you have received the letter.Body :b.acceptance of the payment terms;C.stating the reasons of acceptance;Give your reply of agreeing or refusing and your reason.Closing :d.expecting cooperation of acceptance. State your good will and your wish to do business with the reader.2. disagree to the requirements:Opening:a.receiving the letter;Body :b.expressing refusal and stating reasons;C.providing suggestions of new payment terms or insisting on previous terms;Closing :d.hoping to cooperate in the future.Amending payment termsWords & PhrasesDear Mr. Smith,Referring to the contract No. 123, we place an order with you for12000 Spinning Machine (纺纱机) Parts.In the past, our purchases of Spinning Machine Parts from you havenormally been paid by confirmed, irrevocable letters of credit. Thisarrangement has cost us a great deal of money. From the moment weopen the credit until our buyers pay us normally it ties up funds for aboutfour months. This is currently a particularly serious problem for us in view ofthe difficult economic climate and the prevailing high interest rates.If you could offer us easier payment terms, it would probably lead to anincrease in business between our companies. We propose either cash againstdocuments on arrival of goods, or drawing on us at three months’ s ight.We hope our request will meet with your agreement and look forward toyour early reply.Writing StepsUseful ExpressionsUseful ExpressionsWords & PhrasesDear Mr. Clinton,We enclose our Order No. 365. We have examined thespecifications and price list for your range of cotton shirts andnow wish to place an order with you.In the past we have traded with you on a sight credit basis.We would now like to propose a different arrangement. Whenthe goods are ready for shipment and the freight spacebooked, you will fax us and we will then remit the full amountby telegraphic transfer (T/T).We are asking for this payment so that we can giveour customers a specific delivery date and also save theexpense of opening a letter of credit. As we believe thatthis arrangement should make little difference to you andhelp with our sales, we trust that you will agree to ourrequest.We look forward to receiving confirmation of our orderand your agreement to the new arrangements forpayment.Writing StepsUseful ExpressionsUseful ExpressionsWords & PhrasesWriting StepsUseful ExpressionsUseful ExpressionsWords & PhrasesDear Mr. Merton,Thank you for your letter of 11 November 2005.We have considered your request for a trial deliveryof china on documents against acceptance terms, butregret to say that we cannot agree to your proposal.As an exception, the best we can do for the trial is tooffer D/P.If you accept our proposal you run very little risk, sinceour china is well known for its quality, attractive design andreasonable price. Our lines sell very well all over the worldand have done so far for the last 50 years. We do not thinkyou will have any difficult in achieving a satisfactoryvolume of sales.If you find our proposal acceptable, please let us knowand we can then expedite the transaction.Yours sincerely ,Writing StepsUseful ExpressionsAnalyzing the letterParagraph 1: identifying the referenceParagraph 2: accepting the proposal, giving the reasonsParagraph 3: making it clear that the concession does not apply to future transactions Paragraph 4: detailing the enclosureLanguage Points1. pay v. 付款1) pay in advance 预付2) pay by installments 分期付款3) pay on delivery 货到付款4) pay by 30 days L/Cpay by time L/C at 30 days以见票后30天议付的信用证付款5) pay by sight L/C 以即期信用证付款We trust you will pay our draft on presentation.我们相信你方在见到我们的汇票时即照付。

付款方式函电英语范文Title: Payment Terms and Conditions.Dear [Recipient's Name],。

We hope this letter finds you well. As a follow-up to our recent business discussions, we would like to clarify and finalize the payment terms and conditions for the transaction at hand. This letter outlines the details of the payment arrangement and serves as a formal agreement between our two parties.Firstly, we would like to confirm the total value of the transaction, which amounts to [Insert Amount]. This figure includes all the agreed-upon products and services specified in our contract.Regarding the payment schedule, we propose a [Insert Number]-month installment plan. The first payment, equal to [Insert Amount], is due within [Insert Number] businessdays from the date of this letter. Subsequent payments, each equal to [Insert Amount], will be due on the same day of each subsequent month until the full amount is paid in full.We accept payments via [Insert Payment Methods, e.g., bank transfer, credit card, PayPal, etc.]. For your convenience, we have attached a detailed payment instructions sheet that outlines the specific steps for each payment method. Please ensure that all payments are made in accordance with these instructions to avoid any delays or penalties.It is important to note that any late payments may be subject to a late fee of [Insert Amount] or [Insert Percentage], whichever is greater. We value yourpunctuality and ask for your cooperation in adhering to the agreed-upon payment schedule.To ensure the smooth processing of payments, we request that you provide us with the necessary documentation and information, such as proof of payment, bank details, or anyother relevant information, as soon as possible. This will help us to promptly reconcile your payments and avoid any potential misunderstandings or discrepancies.We also want to emphasize that our payment terms and conditions are non-negotiable. By agreeing to these terms, you are acknowledging and agreeing to abide by them. If there are any changes or exceptions that need to be made, we must discuss and agree upon them in writing before the transaction proceeds.We understand that clarity and transparency are crucial in business transactions, and we are committed to providing you with the best possible service and support throughout this process. If you have any questions or concerns regarding the payment terms and conditions, please do not hesitate to contact us. We will be happy to address any issues or clarify any points of confusion.Finally, we would like to express our gratitude for the opportunity to work with you. We look forward to a successful and mutually beneficial partnership and to thesuccessful completion of this transaction.Thank you for your attention to this matter. We look forward to receiving your prompt reply.Best regards,。

买方要求修改付款方式的外贸函电范文你好呀!希望你们最近都过得不错!我是买方公司名称的您的名字,咱们的合作一直很顺利,对此我们真是满心欢喜。

不过,今天有个小小的事情想和你们商量一下。

咱们在之前讨论的付款方式上,可能需要做些微调。

你知道的,咱们的合作是基于互信和友谊的基础上,这一直是我们之间的“润滑油”,不过,最近公司内部做了一些调整,付款流程上也有了些变化。

所以,原来咱们约定的那种付款方式可能对我方来说有些不太方便。

换句话说,咱们这边希望能在付款方式上做一些小改动,能不能再考虑一下呢?我知道这可能会有些麻烦,但请相信,我们真心希望双方能继续保持良好的合作关系。

我先给你简单说说我们现在的想法。

原本咱们是按照原定付款方式来支付的,对吧?不过随着公司财务制度的变化,现在他们更倾向于新提议的付款方式,这样对我们来说操作起来会更加方便,也能更顺畅地完成支付。

相信你们也知道,现在公司内部的审批流程越来越复杂,稍微改个付款方式就能省去不少麻烦,也能确保款项按时到账。

我理解你们也一定希望尽快收到款项,咱们可不想拖拖拉拉的,不是吗?你可能会想,这种变动是不是会影响你们的安排,或者让你们的流程也变得复杂。

我非常理解这种担忧,毕竟,谁也不愿意在忙碌的日程中再增加不必要的负担。

可是,放心,我会尽量确保整个调整过程对你们的影响降到最低。

无论如何,咱们的目标是一致的,就是希望尽快把事情搞定,大家都能够高高兴兴地收付款。

要说到付款这事儿,咱们可是一直秉持着“讲信用”的原则的,钱到位了,货自然就到了。

这个我敢打包票,你们肯定也能理解咱们的心情。

所以,这次小小的改动并不是想给你们添麻烦,反而是想通过更高效的方式让我们之间的合作更加顺畅。

毕竟,大家都知道,时间就是金钱,谁能省掉不必要的流程,谁就能更快地做成事儿。

说实话,改付款方式这个事儿,我真的是不想搞得太复杂,所以我特地给你们写了这封信。

希望通过这种沟通,能够让你们清楚了解我们的需求,同时也希望能得到你们的理解和支持。

外贸函电支付方式范文主题:关于支付方式的商讨。

尊敬的[客户姓名]:嗨呀,咱这生意谈得差不多了,现在就差这支付方式没好好唠唠呢。

你看啊,咱们常用的支付方式有好几种。

先说这电汇(T/T)吧,就像你给远方的朋友直接打钱一样方便。

要是你能在发货前就把款给我们电汇过来,那可就太省心啦。

这就好比你提前买了电影票,我们就可以安心准备货物,保证准时给你发货。

对于我们来说,资金立马到账,我们也能更好地安排生产、采购原材料啥的。

而且这电汇手续费相对来说也比较合理,就像你坐公交,花点小钱就能到达目的地一样。

再说说信用证(L/C)吧。

这个信用证就像是一个有信用的中间人担保。

你向银行申请开证,银行就像一个公正的裁判,按照咱们商量好的条款来操作。

虽然办理信用证的手续可能稍微麻烦点,就像你要参加一个很正规的比赛得填不少表格一样,但它对咱们双方都有保障呀。

对我们来说,只要按照信用证的要求把货物准备好,提交单据,就能拿到钱,心里踏实。

对你来说,也不用担心我们收到钱不发货之类的事儿。

还有托收(Collection)这种方式呢。

托收就有点像你委托别人去办事。

你把单据交给银行,银行帮你去收钱。

不过这个托收啊,相对来说风险就稍微大一点,有点像放风筝,线有点长,不太好控制。

但是它手续简单呀,如果咱们之间信任度很高的话,也不失为一种选择。

我觉得咱可以根据这次交易的具体情况来选择支付方式。

要是你订单比较急,电汇就很合适;要是你想更安全保险一点,信用证也是个很棒的选择;要是咱们是老伙伴,彼此信任得很,托收也能让咱的交易更便捷。

你那边对支付方式是咋想的呀?希望咱们能尽快达成一致,这样就可以顺利推进这笔生意啦。

祝好![你的名字] [具体日期]。

外贸函电支付方式范文主题:关于支付方式的商讨。

尊敬的[客户公司名称]:您好呀!我是[您的公司名称]的[您的名字]。

今天想跟您聊聊咱们这笔生意的支付方式这个小事情呢。

您知道的,在国际贸易里,支付方式就像一座桥梁,得又稳又安全,这样咱们两边才能顺利地完成交易。

我们公司通常接受几种支付方式,我给您详细说说哈。

另外一个方式呢,是信用证(L/C)。

这就像是一份来自银行的超级保证书。

您让您那边的银行开个信用证给我们,这就等于告诉我们:“放心干活吧,银行给你们担保呢!”我们按照信用证里规定的条款把货物准备好,然后提交相应的单据,只要单据都符合要求,银行就会把钱付给我们啦。

不过呢,这个信用证办理起来可能稍微麻烦一点,就像走一个有点复杂的迷宫,但是它的安全性可是相当高的哟,就像给咱们的交易穿上了一层厚厚的铠甲。

我们还可以考虑托收这种方式,不过这个就有点像把命运交到了一个中间人的手里。

托收分为付款交单(D/P)和承兑交单(D/A)。

付款交单就是您那边的代收行要等您付了款才能把单据给您,您拿到单据才能提货。

这就好比您得先交钱才能拿到宝贝的钥匙。

承兑交单呢,是您先承兑汇票,然后就能拿到单据去提货,之后再付款。

不过这个承兑交单对我们来说风险稍微大一点,就像把小宝贝暂时借给您,然后等您后面付钱,我们心里总是有点小忐忑呢。

我觉得呀,对于咱们这次的合作,电汇是个挺不错的选择。

简单又快捷,对咱们双方都很方便。

不过呢,如果您有其他的想法或者建议,欢迎随时跟我说说哦。

咱们就像好朋友一样,商量出一个最适合咱们俩的支付方式,然后顺顺利利地把这笔生意做成,之后还可以继续愉快地合作呢!期待您的回复呀!祝您生活愉快![您的名字] [具体日期]。