外贸函电Terms of Payment..

- 格式:ppt

- 大小:2.86 MB

- 文档页数:76

Terms of PaymentWarm- upHow many instruments of payment do you know?How many basic methods of payment do you know?Have you ever heard about L/C?Why is L/C generally used in international trade?Learning objectives⏹To learn the basic three instruments of payment –bill of exchange, promissory note and cheque.⏹To learn the modes of payment in int’l trade – remittance, collection, letter of credit.⏹To be aware of the advantage and disadvantage under different payment methods.⏹To learn the letter of asking for easier terms⏹To learn the letter of replying for negotiate payment termsTerms of PaymentThe terms of payment are an important part of the sales contract both sellers and buyers are concerned about.Conditions under which the seller and buyer agree to settle the financial amount of the sales contract.International payment arrangements are much complicated because:Financial instruments⏹In int’l trade, currencies and bills are two major means of payment.⏹It is difficult for the buyer to pay and the seller to deliver the goods face to face.⏹They use documents to fulfill their respective obligations, i.e., the seller delivers the goods and is paid against the documents, meanwhile the buyer makes payment and get the goods against the documents. Banks are intermediaries, and bills are instruments of payment.Instruments of Int’l SettlementClassification of drafts1.According to time when the draft falls due:----Sight (Demand ) Bill(Draft)----Time ( Usance) Bill (Draft)2.According to the Shipping documents attached or not:----Clean Bill (no conditions)----Documentary Bill3.According to who the drawer is:----Commercial Bill----Banker’s Bill※An Example of a Banker’s DraftAn Example of a Commercial DraftPromissory Note 本票中国建设银行现金支票样本Three Main Methods of PaymentTypes of RemittanceRemittance is chiefly used forPayment in advance;Cash with order;Delivery first and payment afterwards;Small quantity of goods;Commission;Sundry chargesTypes of Remittance⏹Mail Transfer, M/T⏹Cheap but slow, seldom used⏹Telegraphic Transfer, T/T⏹Fast and safe for exporter to get the money⏹The most commonly used type of remittance⏹Demand Draft, D/D⏹Flexible to draw money⏹Convenient for the exporterTypes of CollectionTypes of Collection⏹Collection belongs to commercial credit.⏹The banker only functions as a middleman, and his obligation is only to provide services of delivering documents and collect payment. The seller sends goods first, and gets payment later. Whether the seller can get the payment or not is reliable on the buyer’s credit. The buyer gets financing from the seller.Letter of Credit, L/C信用证⏹A L/C is a conditional written undertaking given by bank on the request of an importer to pay at sight or at determinable future date a certain amount of money to the exporter against stipulated documents, provided that the terms and conditions of the credit are complied with.Letter of Credit, L/C信用证The Characteristics of L/CThe advantages of using an L/CIt is reliable and safe for both sellers and buyers.Because the issuing bank use its own credit to guarantee the payment of orders.The disadvantages of using an L/CComplicated procedure of applying for a L/CBanks will charge service fee for issuing a L/C, therefore it add more cost to the buyer.Confirmed , Irrevocable,Documentary Credit, at sight⏹Modes of payment means a series of acts or operations to realize the funds flow from one country to another.Modes of Int’l PaymentDocumentary CreditRevocable Documentary CreditIrrevocable Documentary CreditConfirmed Irrevocable CreditSight Payment Credit/Negotiation Credit议付Deferred Payment Credit/Acceptance Credit承兑Transferable CreditNon-transferable CreditRevolving Credit循环信用证Reciprocal Credit对开Anticipatory Credit预支信用证Remittance and Collectioncommercial credit offered by companies.Letter of Creditbanker’s credit offered by banks.Letter of CreditL/C: the most generally used method of payment, which is reliable and safe for both sellers and buyers.Characteristics of L/C(1) L/C is an independent instrument compared to contract, and not affected by contract.(2) The bank bears responsibility of First Payment.(3) The bank bears responsibility of the documents not the commodity itself.---- “Document Business”(4) L/C is an agreement among the bankers, beneficiary, opener and all other parties concerned and all parties concerned will be bound by the term on L/C.Terms of PaymentQuestionsQuestionsMain points of Asking for easier paymentOpening:a.reference to the relative order or contract; Mention the contract, goods, etc.Body :b.putting forward favorable payment terms; Propose the terms of paymentC.stating the reasons;Closing:d.expecting acceptance. Wish the reader to accept.Sample letter study1. Agree to the requirements:Opening:a.receiving the letter; State that you have received the letter.Body :b.acceptance of the payment terms;C.stating the reasons of acceptance;Give your reply of agreeing or refusing and your reason.Closing :d.expecting cooperation of acceptance. State your good will and your wish to do business with the reader.2. disagree to the requirements:Opening:a.receiving the letter;Body :b.expressing refusal and stating reasons;C.providing suggestions of new payment terms or insisting on previous terms;Closing :d.hoping to cooperate in the future.Amending payment termsWords & PhrasesDear Mr. Smith,Referring to the contract No. 123, we place an order with you for12000 Spinning Machine (纺纱机) Parts.In the past, our purchases of Spinning Machine Parts from you havenormally been paid by confirmed, irrevocable letters of credit. Thisarrangement has cost us a great deal of money. From the moment weopen the credit until our buyers pay us normally it ties up funds for aboutfour months. This is currently a particularly serious problem for us in view ofthe difficult economic climate and the prevailing high interest rates.If you could offer us easier payment terms, it would probably lead to anincrease in business between our companies. We propose either cash againstdocuments on arrival of goods, or drawing on us at three months’ s ight.We hope our request will meet with your agreement and look forward toyour early reply.Writing StepsUseful ExpressionsUseful ExpressionsWords & PhrasesDear Mr. Clinton,We enclose our Order No. 365. We have examined thespecifications and price list for your range of cotton shirts andnow wish to place an order with you.In the past we have traded with you on a sight credit basis.We would now like to propose a different arrangement. Whenthe goods are ready for shipment and the freight spacebooked, you will fax us and we will then remit the full amountby telegraphic transfer (T/T).We are asking for this payment so that we can giveour customers a specific delivery date and also save theexpense of opening a letter of credit. As we believe thatthis arrangement should make little difference to you andhelp with our sales, we trust that you will agree to ourrequest.We look forward to receiving confirmation of our orderand your agreement to the new arrangements forpayment.Writing StepsUseful ExpressionsUseful ExpressionsWords & PhrasesWriting StepsUseful ExpressionsUseful ExpressionsWords & PhrasesDear Mr. Merton,Thank you for your letter of 11 November 2005.We have considered your request for a trial deliveryof china on documents against acceptance terms, butregret to say that we cannot agree to your proposal.As an exception, the best we can do for the trial is tooffer D/P.If you accept our proposal you run very little risk, sinceour china is well known for its quality, attractive design andreasonable price. Our lines sell very well all over the worldand have done so far for the last 50 years. We do not thinkyou will have any difficult in achieving a satisfactoryvolume of sales.If you find our proposal acceptable, please let us knowand we can then expedite the transaction.Yours sincerely ,Writing StepsUseful ExpressionsAnalyzing the letterParagraph 1: identifying the referenceParagraph 2: accepting the proposal, giving the reasonsParagraph 3: making it clear that the concession does not apply to future transactions Paragraph 4: detailing the enclosureLanguage Points1. pay v. 付款1) pay in advance 预付2) pay by installments 分期付款3) pay on delivery 货到付款4) pay by 30 days L/Cpay by time L/C at 30 days以见票后30天议付的信用证付款5) pay by sight L/C 以即期信用证付款We trust you will pay our draft on presentation.我们相信你方在见到我们的汇票时即照付。

Unit 7 Terms of PaymentI. IntroductionThe payment plays a very important role in business. The final result of all business activity should be to recover the value of goods supplied or services rendered. If payment is not ensured then all will be meaningless. Both the exporter and importer face risks in an export transition because there is always the possibility that the other party may not fulfill the contract.For exporters there is the risk that buyers defaults; the customers might not pay in full for the goods. There are several reasons for this: the importers might go bankrupt; a war might ban importers of certain commodities. Another possibility is that the importer might run into difficulties getting the foreign exchange to pay for the goods. It is even possible that the importers are not reliable and simply refuse to pay the agreed amount of money.For the importers there is risk that the goods will be delayed and they might only receive them after paying them. This may caused by port congestion or strikes. Delays in fulfillment of orders by exporters and difficult customs clearance in the importing country can cause loss of business. There is also a risk that the wrong goods might be sent.Payment in foreign trade is complicated and settlement for foreign accounts may be made in a number of ways. The method of payment for each transaction is to be agreed upon between the two trading parties at the time of placing an order. The most often adopted method of payment in our foreign trade is payment by L/C,Terms of payment means way or method of making payment. The methods we use in payment in the clearing of international trade are remittance, collection and the letter of credit (L/C).Remittance is classified into 3 kinds: 1)Mail transfer (M/T) 2)Telegraphic transfer (T/T) 3)Demand draft (D/D) The buyer buys a draft from a local bank and sends it by mail to the seller, the seller or his appointed person can collect money from the relative bank at his end against the draft sent by the buyer.Sometimes, the importer requests payment to be made by collection through banks under the terms of documents against payment (D/P) or documents against acceptance (D/A). In this case, the banks will only do the service of collecting and remitting and will not be liable for non-payment of the importer. D/P calls for actual payment against transfer of shipping documents. There are D/P at sight and D/P after sight. The former requires immediate payment by the importer to get hold of the documents. In the latter condition, the importer is given a certain period to make payment as 30, 45, 60 or 90 days after presentation of the documents, but he is not allowed to get hold of the documents until he pays. D/A calls for delivery of documents against acceptance of the draft drawn by the exporter. D/A is always after sight.L/C is used in cases where the exporter wishes to avoid the risk, and it involves a guarantee of the bank opening the L/C. An L/C is a document issued by a bank (issuing bank) stating its commitment to pay the seller a stated amount of money on behalf of the buyer as long as the seller meets very specific terms and conditions. There are many types of L/C, such as Documentarty L/C, Irrevocable L/C, Revocable L/C, Transferable L/C, Sight L/C, Time L/C, Confirmed L/C, Unconfirmed L/C. Parties concerned to a documentary credit are: the applicant, the issuing bank, the advising bank, negotiating bank, the paying bank, confirming bank and the beneficiary.The letters of payment of payment in international trade may discuss which terms of payment of OK for both parties, accept or decline a method of payment, urge to open the relevant L/C or ask for amendment to the L/C.II. Study of sample lettersLetter 1 Payment on D/P termsDear Mr. Baker,Thank you for your order of May 10. As requested, we have arranged to ship the electric hair dryers by S.S. Fenghua, leaving Shanghai on May 20.As the urgency of your order left us no time to make usual inquiries about the payment, we have to place this transaction on a cash basis and have drawn on you through the Bank of China for the amount of the enclosed invoice. The bank will instruct its correspondent in Melbourne to pass the bill of lading to you against payment of the draft.When you have seen our products, we are sure that you will find them satisfactory. We hope that your present order will order will be the first of many to follow in the near future.Yours sincerely,Wang MeiWang MeiSales ManagerLetter 2 Payment on D/A termsDear Mr. Johns,We are pleased to inform you that arrangements have now been made to ship the sewing machines you ordered on October 22. The consignment will leave Shanghai by S.S. Jinan, due to arrive at Port Klang sometime in late November.In keeping with our usual terms of payment, we have drawn on you at 60 says and passed the draft and shipping documents to our banker. The documents will be presented to you by the Standard Chartered Bank against your acceptance of the draft in the usual way.Yours sincerely,Zhang PingZhang PingSales ManagerLetter 3 Urge establishment of L/CDear Mr. Thompson,With reference to the 4,000 dozen Shirts under our Sales Confirmation No. TE 151, we wish to draw your attention to the fact that the date of delivery is approaching but up to the present we have not received the covering L/C. Please do your utmost to expedite its establishment so that we may execute the order within the prescribed time.In order to avoid subsequent amendments, please see to it that the L/C stipulations are in exact accordance with the terms of the contract.We look forward to receiving your favorable response at an early date.Yours sincerely,Zhang HuaZhang HuaSales ManagerLetter 4 Request to amend L/CDear Ms. Mays,We are in receipt of your letter of May 23 requesting us to send all of your Order On. MC-471 in one lot. We are sorry that we are unable to comply with your request.Due to the size of your order, we will not be able to meet your requested delivery date of June 15 if we send in one lot. We plan to ship about two-thirds of the order first, the remaining one-third will arrive two weeks later.Please amend the L/C to allow for partial shipment, and to extend the validity period to cover the second shipment.We trust that this arrangement will meet with your approval, as we are attempting to get as many bedding as possible for you at the earliest date. We look forward to your early reply.Yours sincerely,Zhuo JingZhuo JingSales ManagerLetter 5 Payment on L/C termsDear Sir,We refer to our letter of enquiry dated 5 October. We have received your Proforma Invoice No. 03688 and now wish to place an initial order for 1,500 tapes Type No. EM 127DN. The Order number is 7213.We have instructed our bank, the General Commercial Bank of Venezuela to open an irrevocable documentary L/C in your favor. The amount is $ 1,275.00. This credit will be confirmed soon by our bank’s correspondent in London. You are authorized to draw a 60 days’draft on our bank against this credit for the amount of your invoice. Your draft must be accompanied by a complete set of shipping documents, consisting of:A full set of clean shipped Bill of LadingCommercial Invoice 5 copiesThe Insurance Certificate 2 copiesOur bank will accept your 60 days’ draft on them for the amount of your invoice including the cost of freight and insurance, as agreed. Your bill will therefore be at 60d/s for full CIF invoice value. The credit is valid until the 12th February.Yours sincerely,Judy LowJudy LowManagerLetter 6 Accept payment on L/C termsDear Sir,We thank you for your letter of 14th November, 2013.We are pleased to receive your order, and wish to say that we have adequate stocks of Type EM127DN tapes in our warehouse, and that delivery date can be met.Payment by irrevocable L/C is convenient for us, and we shall draw a 60 b/s bill on your bank.We are now waiting the arrival of your L/C, on receipt of which we shall make the necessary arrangements for the shipment of your order. Any request for further assistance or information will receive our immediate attention.Yours sincerely,Kevin GreenKevin GreenManagerIII. Useful expressions1. Our usual mode of payment is by confirmed, irrevocable L/C in our favor, available by draft at sight, reaching us ahead of shipment and allowing transshipment and partial shipments.2. On examination, we find that the amount of your L/C is insufficient. Please increase the unit price from RMB¥0.55 to RMB¥0.60 and total amount to RMB¥37,000.00.3. In compliance with your request, we will make an exception to our rules and accept delivery against D/P at sight, but this should not be regarded as a precedent.4. We regret having to inform to you that although it is our desire to pave the way for a smooth development of business between us, we cannot accept payment by D/D.5. We regret our inability to make any arrangement contrary to our usual practice, which is payment by confirmed, irrevocable L/C payable against presentation of shipping documents and valid for at least 15 days beyond the promised date of shipment.6. We wish to draw your attention to the fact that as a special sign of encouragement, we shall consider accepting payment by D/P during this sales-pushing stage. We trust this will greatly facilitate your efforts in sales.7. Payment is to be made against sight draft drawn under a confirmed, irrevocable and transferable L/C without recourse for the full amount of purchase.8. As the amount of our Order No.111 is below £1000, please agree to payment by D/P, because an L/C will cost us much.9. We propose to pay by bill of exchange at 30 days’ documents against acceptance. Please confirm if this is acceptable to you.10 Much to our surprise, our draft on you dated 11 May and due 1 July was returned dishonored yesterday by our bank.11. Please amend L/C No. 2345 to read as follows:a)“metric ton”, as was contracted, instead of “long ton”;b)“shipment latest 30th September and partial shipments and transshipment allowed.”12. The shipment covered by your Credit No. 552 has been ready for quite some time, but the amendment advice has not yet arrived, and now an extension of 15 days is required.ExercisesI. Put the following Chinese into English:1. 汇付2. 托收3.保兑信用证4. 信汇5. 电汇6. 票汇7. 托收行8. 运输单据9. 付款交单10. 承兑交单11. 跟单信用证12. 金额为13. 洁净已装船提单14. 承兑汇票II. Multiple choice:1. Payment should be made ___ sight draft.A. atB. uponC. byD. after2. Mr Yin could agree ___ D/P terms.A. WithB. toC. inD. ever3. 90% of the credit amount must be paid __the presentation of documents.A. atB. byC. againstD. when4. You don’t say whether you wish the transaction to be __cash or __ credit.A.at; onB. by; byC. on; inD.in; by5. We have opened an L/C in your favor __ the amount of RMB¥2,000.A.onB. inC. byD. at6. In order to promote business between us to our mutual advantage, we shall consider ______payment by D/P at 60 days.A. acceptingB. acceptC. to acceptD. acceptance7. Emphasis has to be laid to the point _____ shipment must be made within the validity of the L/C.A. whatB. whichC. thatD.as8. _____ subsequent amendments, please see to it that the L/C stipulations are strictly in accordance with the contract terms.A. AvoidB. Having avoidedC. To avoidD. Being avoided9. We shall open the L/C _____ the bank of Boston.A. inB. withC. forD. at10. We advised our bank to ______ L/C No.6543 to read “Partial shipments to be permitted.A. changeB. amendC. alterD. add11. We think it impossible to have the L/C ______ again.A. extendedB. extendingC. to extendD. extends12. As we are ______ of these goods, please expedite shipment after receiving our L/C.A. in badly needB. in urgently needC. urgent in needD. badly in need13. An L/C should be established ______ our favor available by documentary draft ______sixty days’ sight.A. in, afterB. on, inC. in, forD. in, at14. We regret ______ to accept your terms of payment and therefore have to return theorder to you.A. not be ableB. cannotC. not ableD. being unable15. The amount in your L/C appears insufficient. The correct total CFR value of your ordercomes to USD9,328.00 instead of 3,928.00, the difference ______ USD5,400.00.A. beB. is to beC. beingD. beenIII. Fill in the blanks with an appropriate words from the table.request settled be whose had commitments receiving with have allow in forDear Sir,We have received and checked your statement __1__ the quarter ended January 27 and agree with the balance of & 7,780 shown to __2__ due.Up to now we have __3__ no difficulty in meeting our __4__ and have always __5__ our accounts __6__ you promptly. We could have done so now, but for the bankruptcy of an importantcustomer, __7__ affairs are not likely to be settled for some time. We should therefore be most grateful if you would __8__ us to defer payment of your present account __9__ the end of April.During the next few weeks, we shall be __10__ payments under a number of large contracts and if you grant our __11__, we shall have no difficulty in settling with you __12__ full when the time comes.Yours sincerely,IV. Put the following sentences into English:1. 我们通常支付方式是保兑的、不可撤消的信用证,凭即期汇票付款。

外贸英文函电买方讨价还价范文Buyer Negotiation in Foreign Trade Correspondence.Dear [Seller's Name],。

We are pleased with the product offerings presented in your recent catalog and are interested in exploring the possibility of establishing a business relationship with your esteemed company. However, before we proceed further, we would like to discuss a few key points regarding the pricing and terms of the proposed transaction.Firstly, we note that the prices quoted in your catalog are higher than those offered by some of your competitorsin the market. While we appreciate the quality of your products, we believe that a more competitive pricing structure would enable us to negotiate a more favorable deal for both parties. We request you to reconsider your pricing and provide us with a more competitive quote that reflects a long-term commitment to mutual growth andprofitability.Secondly, we would like to discuss the terms of payment and delivery. We propose a payment term of 30 days from the date of invoice, which we believe is standard in the industry. Additionally, we would prefer a flexible delivery schedule that allows us to adjust our orders based onmarket demand and inventory levels. We hope that you can accommodate these requests as they are crucial for us to maintain the efficiency and profitability of our operations.Lastly, we would like to emphasize the importance of maintaining high-quality standards throughout theproduction process. We understand that this might involve additional costs, but we believe that it is a necessary investment to ensure customer satisfaction and brand reputation. We request you to provide us with assurancesthat your products will meet our strict qualityrequirements and that you will adhere to all relevant industry standards and regulations.We look forward to your prompt response and theopportunity to discuss these matters further. We are confident that with your cooperation and flexibility, we can establish a successful business partnership that benefits both our companies.Thank you for your attention to this matter. We look forward to hearing from you soon.Best regards,。

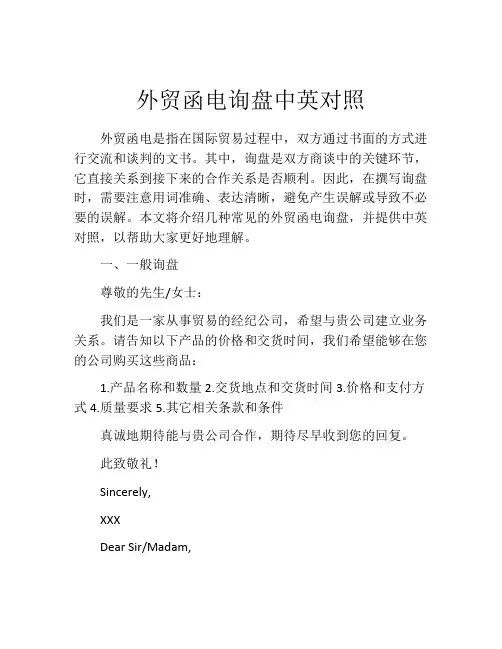

外贸函电询盘中英对照外贸函电是指在国际贸易过程中,双方通过书面的方式进行交流和谈判的文书。

其中,询盘是双方商谈中的关键环节,它直接关系到接下来的合作关系是否顺利。

因此,在撰写询盘时,需要注意用词准确、表达清晰,避免产生误解或导致不必要的误解。

本文将介绍几种常见的外贸函电询盘,并提供中英对照,以帮助大家更好地理解。

一、一般询盘尊敬的先生/女士:我们是一家从事贸易的经纪公司,希望与贵公司建立业务关系。

请告知以下产品的价格和交货时间,我们希望能够在您的公司购买这些商品:1.产品名称和数量2.交货地点和交货时间3.价格和支付方式4.质量要求5.其它相关条款和条件真诚地期待能与贵公司合作,期待尽早收到您的回复。

此致敬礼!Sincerely,XXXDear Sir/Madam,We are a trading company and would like to establish business relations with your company. Please quote us your lowest prices on the following goods:1. Description and quantity2. Delivery time and place3. Terms of payment4. Quality requirements5. Other conditionsWe look forward to your early reply.Yours faithfully,XXX二、样品询盘尊敬的先生/女士:我们是一家贸易公司,想了解您公司的以下产品的样品和相关信息:1. 产品名称和数量2. 样品描述和相关材料3. 样品费用和运费4. 交货时间和交货口岸5. 支付方式请尽快告知我们相关信息和费用,我们将安排支付并等待您的回复。

此致敬礼!Sincerely,XXXDear Sir/Madam,We are a trading company and would like to request samples and information on the following products:1. Description and quantity2. Specification and related materials3. Sample charge and shipping cost4. Delivery time and port of shipment5. Terms of paymentPlease let us have the information and charges as soon as possible, and we will arrange payment and wait for your reply.Yours faithfully,XXX三、价格询盘尊敬的先生/女士:我们注意到您公司在外贸方面有很好的口碑,我们希望成为您的客户。

二. 短语翻译1.From English to Chinese1) terms of payment 2) net weight 3) Bill of Lading 4) Country of origin2. From Chinese to English1) 供求2)标题项下的货物3)商会4)共同努力5)保兑信用证6)会签三. 句子翻译1. 我们男士衬衫的包装为每件套一塑料袋,五打装一纸箱。

内衬防潮纸,外打铁箍两道。

2. 因无直达班轮,请允许转船。

3.我们得悉上述货物的有关信用证即将开出。

保证一收到贵方信用证,我们将尽早安排第一艘可以定得舱位的船只装运。

三. 信件翻译敬启者:你公司11月5日的报价单和尼龙女式运动成衣样品都已收到,谢谢。

我公司对价格和品质均感满意,并乐意按你方报价单所提条件订购下列货物:小号尼龙运动衣每打80美元成本加保险费加运费到伦敦价, 5打。

中号尼龙运动衣每打120美元成本加保险费加运费到伦敦价7打。

大号尼龙运动衣每打160美元成本加保险费加运费到伦敦价4打。

只有在满足12月15日前将货运到的条件下,我公司才订购上述尼龙运动衣。

我公司通常的付款条件是60天承兑交单。

请告你公司是否同意这一条件。

….谨上二.翻译短语翻译1.支付条件2.净重3. 提单4. 原产地1. supply and demand2. the captioned goods3.the chamber of commerce4.joint effort5. confirmed L/C6.countersign句子翻译1. Our Men’s Shirts are packed in poly bags, five dozen to a carton lined with damp-proof paper and secured with 2 iron straps outside.2. As there is no direct steamer, please allow transshipment.3. We have learned that the relative L/C for the above-mentioned goods will be opened immediately. You are assured that upon receipt of your L/C, we will arrange to ship by the first available steamer.信件翻译(注意格式)Dear sirsWe thank you for your quotation of Nov.5 and the samples of ready-made nylon women’s sports garments. We are satisfied with both the quality and price,and pleased to order the following goods according to the terms of your quotation:Small size women’s sports coat US$80 per dozen CIF London 5 dozens .Medium size women’s sports coat US$120 per dozen CIF London 7dozens.Large size women’s sports coat US$160 per dozen CIF London 4dozens.We place the order with you for the above-mentioned goods subject to your delivery of the goods prior to December 15.Our normal term of payment is D/A after 60 days.Please let us know whether you agree to the terms of payment.Yours faithfully,外贸函电试题库MatchA. “INCOTERMS” ( ) 1. 货交承运人B. FOB ( ) 2. 信用证C. FCA ( ) 3. 欧洲主要口岸D. T/T ( ) 4. 海运提单E. D/P ( ) 5. 装运港船上交货F. L/C ( ) 6. 协会货物条款G. EMP ( ) 7. 国际贸易术语解释通则H. FPA ( ) 8. 平安险I. B/L ( ) 9. 付款交单J. ICC ( ) 10. 电汇A. “INCOTERMS” ( ) 1. 货交承运人B. FOB ( ) 2. 信用证C. FCA ( ) 3. 欧洲主要口岸D. T/T ( ) 4. 海运提单E. D/P ( ) 5. 装运港船上交货F. L/C ( ) 6. 协会货物条款G. EMP ( ) 7. 国际贸易术语解释通则H. FPA ( ) 8. 平安险I. B/L ( ) 9. 付款交单J. ICC ( ) 10. 电汇A. “INCOTERMS” ( ) 1. 运费、保险费付至B. CFR ( ) 2. 承兑交单C. CIP ( ) 3. 银行保证书D. D/D ( ) 4. 预计到港时间E. D/A ( ) 5. 国际贸易术语解释通则F. L/G ( ) 6. 海运提单G. ETA ( ) 7. 中国人民保险海洋运输货物保险条款H. WPA ( ) 8. 票汇I. B/L ( ) 9. 水渍险J. CIC ( ) 10. 成本加运费Answers:7,5,1,10,9,2,3,8,4,67,5,1,10,9,2,3,8,4,65,10,1,8,2,3,4,9,6,7Business terms translation1. Chamber of commerce ______________2. Quotation ________________3. Counter-offer _____________4. Customs invoice _____________5. Open account terms ____________6. Certificate of origin _____________7. Import quotas system _____________8. Bill of exchange ______________9. Promissory note _______________ 10. Confirmed L/C ______________1. Quantity Discount ________________2. Proforma Invoice ________________3. Non-Tariff Barriers _______________4. Sales Contract _______________5. Documentary Bill ________________6. Sight Draft ________________7. Irrevocable L/C _________________ 8. On Board B/L ________________9. More or Less Clause ________________ 10. Insurance Policy _______________1. Cash Discount ______________2. Commercial Invoice _________________3. Import Licence System ____________4. Sales Confirmation ________________5. Commercial Draft ______________6. Time Draft ________________7. Collection ______________ 8. Clean B/L _______________9. Warehouse to Warehouse Clause ______ 10. Insurance Certificate ____________Answers:1.商会2。

外贸函电常用词汇第一期:General Terms1. establishing business relation-建立业务关系2. inquiry-询盘3. offer-报盘4. counter offer-还盘5. quantity-数量6. packing-包装7. time of shipment-装运期8. price-价格9. discount-折扣10. terms of payment-支付条款11. insurance-保险12. commodity[kə'mɔditi] inspection-商品检验13. acceptance-接受14. signing a contract-签订合同15. claim [kleim]:索赔16. agency ['eidʒənsi]:代理17. commission [kə'miʃən]:佣金18. exclusive[iks'klu:siv] (独有的,独占的,专用的) sales: 包销19. joint [dʒɔint] venture-合资企业20. compensation[,kɔmpen'seiʃən] trade-补偿贸易21. processing and assembling trade-加工装配贸易22. the terms of international trade-国际贸易术语第二期:Establishing business relation 建立业务关系1. recommendation [,rekəmen'deiʃən]:推荐、介绍2. inform 通知3. enter into business relations :建立业务关系4. catalogue ['kætəlɔ:g]:目录5. for your reference :供您参考6. specific inquiry:具体询价7. promptly [prɔmptli]:立即8. representative [repri'zentətiv]:代表9. chamber ['tʃeimbə] of commerce ['kɔmə:s]:商会10. specialize['speʃəlaiz](专攻;专门从事)in:专营11. on the bases['beisi:z] of equality[i:'kwɔliti] and mutual['mju:tʃuəl] benefit['benifit]:在平等互利的基础上12. pamphlet['pæmflit]:小册子They issued a pamphlet concerning[kən'sə:niŋ] the worsening environment [in'vaiərənmənt].他们出了一本有关环境恶化的小册子。