8、外贸函电之信用证付款

- 格式:doc

- 大小:28.00 KB

- 文档页数:2

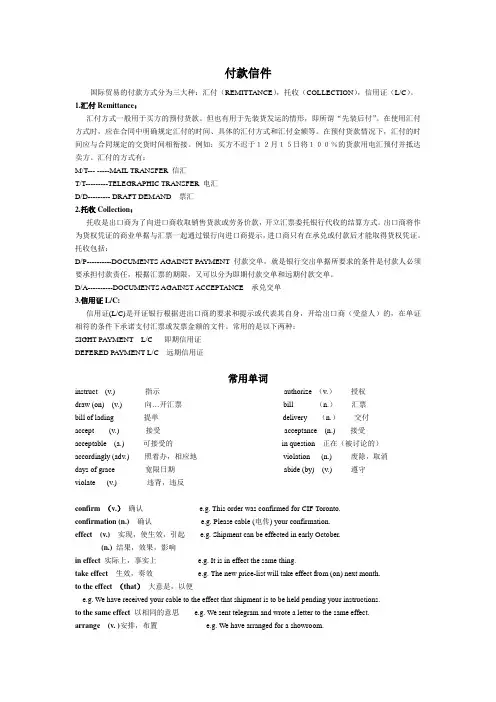

付款信件国际贸易的付款方式分为三大种:汇付(REMITTANCE),托收(COLLECTION),信用证(L/C)。

1.汇付Remittance:汇付方式一般用于买方的预付货款。

但也有用于先装货发运的情形,即所谓“先装后付”。

在使用汇付方式时,应在合同中明确规定汇付的时间、具体的汇付方式和汇付金额等。

在预付货款情况下,汇付的时间应与合同规定的交货时间相衔接。

例如:买方不迟于12月15日将100%的货款用电汇预付并抵达卖方。

汇付的方式有:M/T--- -----MAIL TRANSFER 信汇T/T---------TELEGRAPHIC TRANSFER 电汇D/D--------- DRAFT DEMAND 票汇2.托收Collection:托收是出口商为了向进口商收取销售货款或劳务价款,开立汇票委托银行代收的结算方式。

出口商将作为货权凭证的商业单据与汇票一起通过银行向进口商提示,进口商只有在承兑或付款后才能取得货权凭证。

托收包括:D/P----------DOCUMENTS AGAINST PAYMENT 付款交单,就是银行交出单据所要求的条件是付款人必须要承担付款责任,根据汇票的期限,又可以分为即期付款交单和远期付款交单。

D/A----------DOCUMENTS AGAINST ACCEPTANCE 承兑交单3.信用证L/C:信用证(L/C)是开证银行根据进出口商的要求和提示或代表其自身,开给出口商(受益人)的,在单证相符的条件下承诺支付汇票或发票金额的文件。

常用的是以下两种:SIGHT PAYMENT L/C 即期信用证DEFERED PAYMENT L/C 远期信用证常用单词instruct (v.) 指示authorize (v.)授权draw (on) (v.) 向…开汇票bill (n.)汇票bill of lading 提单delivery (n.)交付accept (v.) 接受acceptance (n.) 接受acceptable (a.) 可接受的in question 正在(被讨论的)accordingly (adv.) 照着办,相应地violation (n.) 废除,取消days of grace 宽限日期abide (by) (v.) 遵守violate (v.) 违背,违反confirm (v.)确认 e.g. This order was confirmed for CIF Toronto.confirmation (n.) 确认 e.g. Please cable (电传) your confirmation.effect (v.) 实现,使生效,引起 e.g. Shipment can be effected in early October.(n.) 结果,效果,影响in effect 实际上,事实上 e.g. It is in effect the same thing.take effect 生效,奏效 e.g. The new price-list will take effect from (on) next month.to the effect (that)大意是,以便e.g. We have received your cable to the effect that shipment is to be held pending your instructions.to the same effect 以相同的意思 e.g. We sent telegram and wrote a letter to the same effect.arrange (v. )安排,布置 e.g. We have arranged for a showroom.verify (v.) 证实,核实 e.g. Please recheck the coding (译码) and verify it.recall (v.) 回忆,忆起 e.g. We cannot recall the details.取消,撤销 e.g. The order has been recalled.样信1.付款条款Dear Sirs,We have thoroughly considered the terms of payment discussed with your Mr. Wu. We are in agreement with your proposals and hereby give you in writing the terms and conditions which have been agreed upon as follows:(1)Your terms of payment are confirmed, irrevocable L/C with draft at sight instead of D/P at sight.(2)The price quoted to us is net with no discount whatsoever.The above terms of payment were approved by our manager and will be acted upon accordingly. The relative order is now being prepared and will be sent to you in the course of next week.Taking this opportunity, we would like to inform you that our representative at the forthcoming Guangzhou Fair will be Mr. Brown, who will doubtlessly write to you about it. We sincerely hope that future discussions between our two companies will result in further business to our mutual advantage.Yours faithfully,xxx2.开立汇票以支付装运费Dear Sirs,In order to cover the shipment we will draw a draft at sight on you under an irrevocable letter of credit and ask you to honor it on presentation to you.Yours,xxx3.要求变更汇票日期Dear Sirs,You require a draft at sight under irrevocable L/C as payment terms.However would you make them a little easier?We would like you to allow us a draft at 90 d/s under an irrevocable L/C.Yours,xxx4.要求对方开立包括各种费用的汇票Dear Sirs,As for the payment,we would like you to draw a draft at 30 d/s on us for the invoice amount plus shipping and other expenses with a 10% commission.Yours,Xxx5.要求连同汇票寄来装船文件Dear Sirs,Please draw on us for the full amount of your invoice at 60 d/s and attach such relative shipping documents as the commercial invoices, bill of lading, insurance policy, packing lists, certificate and list of weight and/ormeasurement, to your draft. ……6.同意变更汇票的付款条件Dear Sirs,As our maximum concession to the payment, we will admit your payment of a draft at 60 d/s under documents against acceptance.Therefore please let us know immediately if thes e terms are acceptable to you. ……7.要求寄送装运的汇票及提单Dear Sirs,As to the execution of this order, we agree to accept our order in three shipments. Therefore we request you send a sight draft on us under documents against payment at every shipment attaching the B/L. ……8.通知对方愿意接受汇票Dear Sirs,In order to ensure your earlier shipment, we have instructed The Mitsui Bank, New York to accept a draft drawn on them by you for a sum of US $35 000.Yours,Xxx9.通知接受汇票,并要求迅速履行订货Dear Sirs,We have today instructed our bankers, the Bank of Tokyo, London to accept your draft at 90 d/s on us drawn under irrevocable L/C and would ask you to execute our order promptly. ……10.要求接受汇票并付款Dear Sirs,As to this business, we will draw our draft at 30 d/s on you against the 100 units of the construction machines for a sum amounting to US$750 000 under the L/C.We ask you to accept it on presentation and honor it on maturity. …..11.提议变更付款条件Dear Sirs,Concerning the payment of this transaction, we suggest a 90 d/s draft under D/A apart from the usual terms of business. The market here is quite dull and we are overstocked now. Therefore we believe this is quite acceptable to you. ……12.建议使用见票后30天应付的信用证支付Dear Sirs,We wish to place with you an order for 1 000 casks Iron Nails at your price of US $150.00 per cask CIF Lagos for shipment during July/August.For this particular order we would like to pay by 30 days L/C. Involving about US $150 000, this order is comparatively a big one. As we have only moderate means at hand, the tie-up of funds for as long as three to four months indeed presents problem to us.It goes without saying that we very much appreciate the support you have extended us in the past. If you can do us a special favour this time, please send us your contract, upon receipt of which we will establish the relative L/C immediately.Yours faithfully,xxx13.要求更易于接受的付款条款Dear Sirs,Our past purchase of Mild Steel Sheet from you has been paid as a rule by confirmed, irrevocable L/C.On this basis, it has indeed cost us a great deal. From the moment to open credit till the time our buyers pay us, the tie-up of our funds lasts about four months. Under the present circumstances, this question is particularly taxing owing to the tight money condition and unprecedentedly high bank interest.If you would kindly make easier payment terms, we are sure that such an accommodation would be conducive to encouraging business between us. We propose either “Cash against Documents on Arrival of Goods” or “Drawing on Us at Three Months’ Sight”. Your kindness in giving priority to the consideration of the above request and giving us an early favourable reply will be highly appreciated.Yours faithfully,xxx14.答应改变付款方式Dear Sirs,Thank you for your letter of 9th February. We have carefully considered your proposal to receive a trial delivery of our cutlery on D/A, but wish to inform you that to promote business the best we can exceptionally do as a trial will be on D/P at sight terms. In accepting our proposal you assume no risks since our cutlery is well-known for its good quality, attractive design and reasonable price. This cutlery sells well in many other countries and we think it will have a good sale in your store.If you are interested in our proposal, please write to us by return and we will approach you further.Yours faithfully,Xxx15.要求银行开立信用证Dear Sirs:We request you to open for our account by air mail with the Bank of China, Shanghai Branch, an Irrevocable and Without Recourse letter of Credit in favor of Shanghai Textile Import & Export Corp, China to the extent of US $30 000(US Dollars Thirty Thousand only)available by draft in duplicate drawn on us at 90 days after sight for full invoice value against shipment of 20 000 yards Shanghai Printed Pure Silk Fabrics as per our order No.3154 dated 15 May 2007 accompanied by the following documents:(1)Invoice in triplicate.(2)Packing list in triplicate.(3)Full set Clean Bills of Lading made out to order and endorsed in blank notify Buyers marked freight payable at destination.(4)Evidence of shipment of the said merchandise to be effected on or before end of June 2007 from Shanghai to San Francisco. Partial shipments are not permitted. Transshipments are not allowed.(5)Marine insurance to be effected by Buyers in San Francisco.We hereby agree duly to accept the above mentioned draft on presentation, and pay the amount thereof at maturity, provided such draft shall be negotiated within three months from this date.Yours faithfully,xxx16.索取形式发票Dear Sirs,One of our clients has asked us to obtain a pro forma invoice for the following product:Lion Brand Nail Clippers Model 21 chrome plated.Please send us your pro forma invoice in triplicate for 500 dozens of the above product as soon as possible so that we can get our client’s confirmation. We will have no problem in obtaining the import licence. As soon as this is approved, a letter of credit will be opened in your favour.Yours faithfully,Tom17.寄送形式发票Dear Mr. Green,In reply to your request, dated 14 July 2006,we have much pleasure in sending you our pro forma invoice in triplicate. For your information, our offers usually remain open for about a week. Seeing that our nail clippers are selling very fast, we suggest that you act on the quotation without delay. We look forward to hearing from you. Yours sincerely,Lui18.付款通知Dear Sir/MadamWe refer to your payment request of 1st November,2006. We have made an application to our bank for remittance as requested. Our remittance details are as follows:(1)Amount of 1st Installment: US $50 000.(2)Value Date of Payment: 30th November,2006.(3)Payment Method: By T.T. remittance.(4)Remitting Bank: The Bank of Newcastle, Queensway Branch, London.If you do not receive advice on our remittance from your bank within one week, please do not hesitate to contact us. ……19.告知付款账户Dear Sir,Firstly, We’d like to apologize for the late reply due to the problem of our computer network. We have repaired the machine and mailed back to you. Do you receive it? The repair charge is US$1 500,and the receipt will be based on the US$1 200 as you requested. After the confirmation, please transfer US$1 500 repairing charge to the following a/c. To show our sincerity, we are willing to reduce price of US$120 000 to the lowest US $114 000.Besides,regarding to the 3 items you request, we will mail to you by express. Thank you for your cooperation and we wish you success in your business.Yours,xxxP.S.: We are the SMT Machine manufacturer, and we only produce the new machines. Since we do not carry on the sales of used machines, we are unable to provide you the related information.20.通知收到付款Dear Mr. Green,Thank you for your letter dated yesterday, advising us of your remittance.We confirm receipt of US $50 000 in our account with The Bank of China, Dinghuisi Branch, his morning. Thank you again for your remittance. ……21.回函拒绝对方付款方式Dear Sirs,We thank you for your order No.23A46 for 200 Air Conditioners and appreciate your intention to push the sales of our products in your country. However, your suggestion of payment by time L/C is unacceptable. Our usual practice is to accept orders against confirmed, irrevocable L/C at sight, valid for 3 weeks after shipment is made and allow transshipment and partial shipments.As per the above terms we have done substantial business. We hope you will not hesitate to come to the agreement with us on payment terms so as to get the first transaction concluded.Your favorable reply will be highly appreciated. ……22.接受对方付款方式Dear Sirs,Thank you for your order of Iron Nails as per your letter of May 5.Your proposal of paying by letter of credit at 30 days has been carefully studied by us. Usually, time credit is not acceptable to us. However, in view of our long pleasant relations as well as our willingness to support our African friends, we agree with you this time. But let us make it clear that this accommodation is only for this transaction, which will in no case set a precedent.Attached here with is our Sales Contract No.105 covering the above order. Please follow the usual procedure…….。

国际贸易实务付款方式一、信用证信用证是国际贸易中常用的付款方式之一。

它是由进口商与银行约定,由银行作为中介来保证交易的支付。

进口商向银行开出信用证后,银行会根据信用证的约定向出口商支付货款。

信用证的主要优势在于保障进口商的货款安全,也可以增加出口商的信任度。

二、托收托收是一种将支付文件委托给银行来处理的付款方式。

出口商将出口货物的相关文件提交给银行,银行将文件发送给进口商,并代收货款。

进口商在收到货物后,支付货款给银行,银行再将货款支付给出口商。

托收的优势在于结构简单,处理速度较快,适用于一些支付金额较小的贸易。

三、电汇电汇是一种通过银行进行国际支付的方式。

出口商将货款的汇票交给银行,银行根据汇票信息将货款直接转账到出口商的账户。

电汇的主要优势在于操作简便,处理速度较快,适用于一些支付金额较小或支付迅速的贸易。

四、跨境支付平台近年来,随着电子商务的快速发展,一些跨境支付平台也开始逐渐流行起来。

这些支付平台如PayPal、国际等,可以提供便捷的跨境支付服务。

出口商和进口商可以通过这些平台进行在线支付,无需通过银行的中介和手续费。

跨境支付平台的优势在于操作方便快捷,成本较低,适用于一些小额支付或频繁支付的贸易。

五、信汇信汇是一种通过邮政局进行国际支付的方式。

出口商将货款的邮政汇票寄给进口商所在的邮政局,邮政局再将货款支付给进口商。

信汇的优势在于操作简便,适用于一些支付金额较小或支付迅速的贸易。

,国际贸易实务中常用的付款方式包括信用证、托收、电汇、跨境支付平台和信汇等。

根据具体情况,进口商和出口商可以选择合适的付款方式进行支付。

读书破万卷,下笔如有神外贸函电:信用证付款September 12, 200#Norseman Vehicle Building Ltd.12 Nobel StreetStockholm, SwedenDear Sirs:We spoke to your representative, Mr. Bergman, at the international Automobile Expo in Tokyo last week, and he showed us a number of snowmobiles which you produce, and informed us of your terms and conditions.We were impressed with the vehicles, and have decided to place a trial order forten of them, your Cat. No SM18. The enclosed order, No.98918, is for prompt dilivery as the winter season is only a few weeks away.As Mr. Bergman assured us that you could meet any order from stock, we have instructed our bank, Bank of China, Tianjing Branch, to open a confirmed irrevocable letter of credit for USD 108,000 in your favor, valid until December 1, 200#.Our bank informs us that credit will be confirmed by their agents, Scandinavian Bank, Strindberg Street, Stockholm, once you have contacted them, and they will also supply us with a certificate of quality once you have informed them that the order has been made up and they have checked it.You may draw on the agents for the full amount of the invoice at 60 days, and your draft should be presented with the following documents:Six copiesof the bill of lading好记性不如烂笔头。

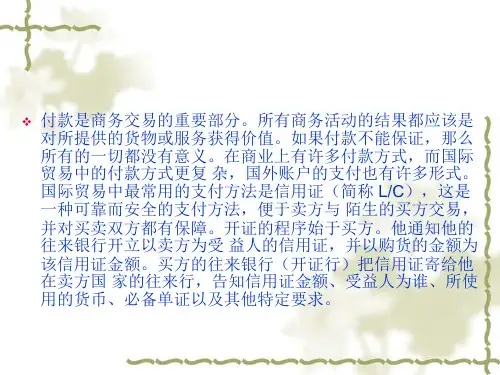

外贸英语函电信用证Unit 9 Letter of Credit信用证9.1 Introduction(简介)目的:掌握如何申请开立信用证、或对信用证进行修改、延期及相关的回复。

信用证(Letter of Credit)是国际贸易中最常用的支付方式,不仅适用于个别交易,也适用于系列交易。

信用证的开证程序始于进口方。

进口方通知开证行(Issuing Bank)开立以出口方为受益人(Beneficiary)的信用证。

信用证包含进出双方达成交易的详细内容信用开出后由包含进出口双方达成交易的详细内容。

信用证开出后,由开证行将信用证寄给出口方所在地的通知行(NotifyingBank)。

接到信用证后,银行和出口方会对信用证进行审核。

根据审核无误的信用证,出口方就可备货装运。

装运后,出口方就可以缮制符合信用证要求的单据,再据此向议付行(Negotiation Bank)交单议付,取得货款。

9.2 Writing Skills(写作技巧)催证信函的写作步骤及常见表达方式:写作步骤表达方式(1)提醒买方我方货已备妥待运或交货期已临近,但尚未收到相关信用证In regard to 25 000 yards of cotton prints under the Sales Confirmation No.789, we would like to draw your attention to the fact that the date of delivery is approaching, but up to now we have not received your relative letter of credit.(我们提醒你方注意,789号售货确认书项下25 000码印花布的交货期已临近,但我方至今尚未收到相关信用证。

)(2)向对方说明需及时开立信用证的原因(或重要性)We wish to remind you that it was agreed when placing the order, that youwould establish the required L/C upon receipt of our Confirmation.(我方提醒你方注意,订货时双方约定,一接到我方确认书,你方就开立信用证。

双语学院2009级外贸函电期末试题学号:0301090317姓名:谢茹辉班级:09031. Analysis of The Three Most Common Modes of Payment inInternational Trade, with Particular Emphasis on L/C During the international trade, the payment is the most important part, because all the commercial activities are on the basis of the acceptable benefits, but if the payment can not be ensured, then all this commercial activities will all be insignificant, or everything will be gone. However, the payment in international trade is more complicated than in domestic market. Besides, there are lots of payments in international trade. Generally, the following three payments are the most common modes in international trade: remittance, collection and letter of credit.1. RemittanceRemittance is the simplest payment in international trade. There four parties in remittance: remitter, payee, remitting bank, and receiving bank—the paring bank. Remittance has three ways: telegraphic transfer, mail transfer, remittance by banker’s demand draft.2. CollectionCollection belonging to commercial credit, when bank deal the collection business, neither do they have the obligation to check shipping documents complete or correct or not, nor assume responsibility for the payer which must be paid by them. Although the collection is handled through the bank, but the bank is acting as a trustee of the exporter, and do not undertake the responsibility to pay. If the importer does not pay, it has nothing to do with the bank. When the exporter receives the payment from the importer, it is still dependent on the importer’s commercial credit.There two types of collection: Documents against Payment--D/P, Documents against Acceptance--D/A. It involved the following four parties: the principal; the remitting bank; collecting bank; the payer. Besides, we have to pay attention to the following: the bank is under no obligation to take care of the goods in case the importer dishonors the draft.3. Letter of CreditLetter of Credit is the most important and common used payment type, which is a bank credit with safe advantages to the seller. As an usual practice, the L/C is to be established and to reach the seller one month prior to the date of shipment so as to leave enough time for the seller to make preparations for shipment. The most important is that an L/C is the written promise of a bank that acts at the request and on the instructions of the applicant and undertakes to pay the beneficiary the amount specified in the credit, provided that theterms and conditions of the credit are observed by the beneficiary.Ⅰ.L/C has different types: sight L/C and after sight L/C; irrevocable L/C and revocable L/C (L/C, established at present, almost is irrevocable L/C ); confirmed L/C and unconfirmed L/C; transferable L/C and nontransferable L/C; documentary L/C and clean L/C; revolving L/C, back to back of L/C.Ⅱ. The parties Relating to a L/C: 1) The applicant: It is generally the buyer or importer who applies to the bank for issuance of L/C. 2). The beneficiary: The beneficiary under L/C is usually the seller or the exporter. 3).The opening bank or issuing bank: It is the bank that issues the L/C on behalf of the applicant, and will be responsible for payment commonly. A first class bank is always be required as an opening bank by the seller. 4). The advising bank: It is usually the exporter’s local bank. The advising bank passes the L/C on to the beneficiary under the instruction from issuing bank and is not responsible for payment. It may be a branch of issuing bank or its correspondent. 5). The negotiating bank: The negotiating bank is ready to pay for the drafts and get the full set of documents or only receive the drafts and documents without responsibility of payment, then mail them to the issuing bank for reimbursement. The negotiating bank may be the advising bank. 6).The paying bank: The paying bank is responsible for the payment specified by the L/C. Usually it is the issuing bank or appointed by the issuing bank.Ⅲ. L/C contents:Number; amount; date of opening and validity, presentation and presentation place; Names of the parties; Commodity descriptions, quantity, packing, unit price; requirements for shipment, mode, shipping date, partial and Transshipment; Requirement for documentsⅣ. The nature of L/C: 1). The bank is the payer; 2). An independent document;3). Exchange of documents.Ⅴ. The advantage of L/C1). For the seller, L/C offer an reliable payer—the bank. If they got an L / C that does not comply with agreements, then they can terminate the contract without days, and got an additional claim, such as, any market loss of use).2). For the buyer, they pay for the goods only when the goods are already shipped. Besides, they can also ask the bank for a credit, but without any guarantee.3). It can avoid the risk of the preparation payment, then the problem of payment and offer between the seller and buyer;Ⅵ. The disadvantage of L/C1). For the buyer, establishing an L/C costs a lot; and when opening an L/C, frozen capital is needed; besides, they have to worry about the discrepancy2). If the documents of L/C is complicated, this is very important. For the seller, the less, the simple, more reliable. But if not, everything will be on the other side.That’s all my analysis of the three most common modes of payment in international trade.2.Analysis of the Importance of Documentation in Import andExport TradeWhen we talking about the importance documentation in import and export, we should know that the shipping document play such a great part in the international trade that it got the name “the trade of documents”, or “th e symbolic trade”, because shipping documents is on behalf of the title of the goods.The main shipping documents in the international trade content the commercial invoice, bill of lading and the insurance certificate. Of course, it also includes other documents, if acquired by the buyer. Actually, there are five major categories by ICC—The International Chamber of Commerce: 1. the commercial documents; 2. the transport documents; 3. the finance documents;4. insurance documents;5. other documents.1. The commercial documents1). Pro forma invoicePro forma invoice is an invoice that provided by a supplier prior to a sale or shipment of merchandise, informing the buyer of the kinds and the qualities of goods to be sent, their value, and important specifications. Besides, the most important thing that we should pay attention to is that a pro forma invoice has legal status.2). Commercial invoiceCommercial invoice, generally called invoice, is the description of the quality, quality of the goods, the unit and the total price. Besides, it is also on the basis of which other documents are to be prepared, and banks check the conformity between credit terms, documents and the conformity between the documents.3). Quality certificateA quality certificate makes sure that the quality or specification of a particular consignment of goods complies with the sales contract at the time of shipment.4). Weight certificateA weight certificate makes sure that the weight of the goods complies with the sales contract at the time of shipment.2. The transport documents: in the following will I the concrete details introduce with importance.1). Shipping noteA shipping note is a note that shows us the information about a particularexport consignment when offered for shipment.2). Packing listThe main purpose of this packing list is to give an inventory of the shipping goods.3). Bill of ladingThis is the most important part in the five major categories. Bill of lading is a document that is issued by the captain, agent, or owner of a vessel, furnishing written evidence regarding receipt of the goods, the conditions on which transportation is made( contract of carriage), and the engagement to deliver goods at the prescribed port of destination to the lawful holder of the bill of lading.----- from dictionary of international trade.The main contents of B/L are: carrier, shipper, consignee, notify party, a general description of the goods, shipping marks, the port of the shipment and destination, freight, place of issuance of B/L, the date of the issuance of B/L. B/L include two types:the clean B/L and the unclean B/L, shipped(on board) B/L and received for shipment B/L, straight B/L and blank B/L, order B/L, transshipment B/L, through B/L, container B/L, on deck B/L, stale B/L.4). Consignment noteConsignment note conclude the rail consignment note and the road consignment note, which serve as the contract of carriage between the railway/ roadway and consignor, approving the receipt of the goods and the date of acceptance for carriage by the carrier. It is different from B/L, because it is not the document of the title and also is not transferable or negotiable. 5). Air waybillThe air waybill is the consignment note used for the carriage of the goods by air. Basically it is a receipt of the goods for dispatch and evidence of the contract of carriage between the carrier and the consignor. The air waybill is not negotiable.6). Parcel post receiptIt is issued by the post office for goods sent by parcel post.7). Combined transport Documents3. Finance documents: 1). Application form for international money transfer; 2). Draft; 3). Application for L/C; 4). Letter of credit4. The insurance documents5. Other documentsOther documents conclude five main parts: 1). Import license; 2). Certificate of origin; 3). Inspection certificate; 4). Consular invoice; 5). Customs invoiceBesides, and finally, there is a GSP, which is short for Generalized System of Preferences.That’s all my Analysis of the Importance of Documentation in Import and Export Trade。

外贸函电支付方式范文主题:关于支付方式的商讨。

尊敬的[客户姓名]:嗨呀,咱这生意谈得差不多了,现在就差这支付方式没好好唠唠呢。

你看啊,咱们常用的支付方式有好几种。

先说这电汇(T/T)吧,就像你给远方的朋友直接打钱一样方便。

要是你能在发货前就把款给我们电汇过来,那可就太省心啦。

这就好比你提前买了电影票,我们就可以安心准备货物,保证准时给你发货。

对于我们来说,资金立马到账,我们也能更好地安排生产、采购原材料啥的。

而且这电汇手续费相对来说也比较合理,就像你坐公交,花点小钱就能到达目的地一样。

再说说信用证(L/C)吧。

这个信用证就像是一个有信用的中间人担保。

你向银行申请开证,银行就像一个公正的裁判,按照咱们商量好的条款来操作。

虽然办理信用证的手续可能稍微麻烦点,就像你要参加一个很正规的比赛得填不少表格一样,但它对咱们双方都有保障呀。

对我们来说,只要按照信用证的要求把货物准备好,提交单据,就能拿到钱,心里踏实。

对你来说,也不用担心我们收到钱不发货之类的事儿。

还有托收(Collection)这种方式呢。

托收就有点像你委托别人去办事。

你把单据交给银行,银行帮你去收钱。

不过这个托收啊,相对来说风险就稍微大一点,有点像放风筝,线有点长,不太好控制。

但是它手续简单呀,如果咱们之间信任度很高的话,也不失为一种选择。

我觉得咱可以根据这次交易的具体情况来选择支付方式。

要是你订单比较急,电汇就很合适;要是你想更安全保险一点,信用证也是个很棒的选择;要是咱们是老伙伴,彼此信任得很,托收也能让咱的交易更便捷。

你那边对支付方式是咋想的呀?希望咱们能尽快达成一致,这样就可以顺利推进这笔生意啦。

祝好![你的名字] [具体日期]。

外贸函电支付方式范文主题:关于支付方式的商讨。

尊敬的[客户公司名称]:您好呀!我是[您的公司名称]的[您的名字]。

今天想跟您聊聊咱们这笔生意的支付方式这个小事情呢。

您知道的,在国际贸易里,支付方式就像一座桥梁,得又稳又安全,这样咱们两边才能顺利地完成交易。

我们公司通常接受几种支付方式,我给您详细说说哈。

另外一个方式呢,是信用证(L/C)。

这就像是一份来自银行的超级保证书。

您让您那边的银行开个信用证给我们,这就等于告诉我们:“放心干活吧,银行给你们担保呢!”我们按照信用证里规定的条款把货物准备好,然后提交相应的单据,只要单据都符合要求,银行就会把钱付给我们啦。

不过呢,这个信用证办理起来可能稍微麻烦一点,就像走一个有点复杂的迷宫,但是它的安全性可是相当高的哟,就像给咱们的交易穿上了一层厚厚的铠甲。

我们还可以考虑托收这种方式,不过这个就有点像把命运交到了一个中间人的手里。

托收分为付款交单(D/P)和承兑交单(D/A)。

付款交单就是您那边的代收行要等您付了款才能把单据给您,您拿到单据才能提货。

这就好比您得先交钱才能拿到宝贝的钥匙。

承兑交单呢,是您先承兑汇票,然后就能拿到单据去提货,之后再付款。

不过这个承兑交单对我们来说风险稍微大一点,就像把小宝贝暂时借给您,然后等您后面付钱,我们心里总是有点小忐忑呢。

我觉得呀,对于咱们这次的合作,电汇是个挺不错的选择。

简单又快捷,对咱们双方都很方便。

不过呢,如果您有其他的想法或者建议,欢迎随时跟我说说哦。

咱们就像好朋友一样,商量出一个最适合咱们俩的支付方式,然后顺顺利利地把这笔生意做成,之后还可以继续愉快地合作呢!期待您的回复呀!祝您生活愉快![您的名字] [具体日期]。

外贸信用证付款方式操作流程

外贸信用证付款方式操作流程如下:

1. 买卖双方签订合同,明确规定采用信用证付款方式。

2. 买方向开证行提交开证申请并交纳一定的开证押金或提供其它保证后开立信用证。

3. 通知行收到信用证(报文形式)后通知卖方(通知行通知受益人的最大优点就是安全)。

4. 卖方组织生产并根据信用证要求制单,进行安排出货,报关,装船等手续。

5. 卖方将正本单据交付通知行,通知行寄往开证行。

6. 开证行进行审核,然后将正本单据交付买方,买方审核不符点或确认支付。

7. 通知行收到货款扣除银行费用后向卖方付款。

以上就是外贸信用证付款方式的操作流程,虽然除了买卖双方,增加了银行的介入,使得流程看起来稍显复杂,但其实是将货物和货币之间的直接交换转变为凭单据收付款,因此更好地保障了卖方收到货款的权益。

外贸函电开立信用证范文第1篇外贸行业竞争激烈,如果能熟练掌握外贸英语无疑会增强自身的竞争力!今天就从实用的外贸英语函电学起吧!怎样建立贸易关系呢?Dear Sirs,We have obtained your address from the Commercial Counsellor of your Embassy in London and are now writing you for the establishment of business relations. We are very well connected with all the major dealers here of light industrial products, and feel sure we can sell large quantities of Chinese goods if we get your offers at competitive prices. As to our standing, we are permitted to mention the Bank of England, London, as a reference.Please let us have all necessary information regarding your products for export.Yours faithfully外贸函电开立信用证范文第2篇编号:年字号致:中国银行股份有限公司行现我司因业务需要,依据我司与贵行签署的编号为________ _____的□《授信额度协议》/□《授信业务总协议》及其“附件1:用于开立国际信用证”和编号为的《开立国际信用证申请书》/□《开立国际信用证合同》,向贵行申请修改由贵行开立的编号为的信用证。

由于此产生的权利义务,均按照前述协议及其附件/合同、申请书和本申请书的约定办理。

信用证支付函电_商务信函信用,是价值运动的特殊形式。

信用证,即购货方开户银行为保证在交易合同规定的范围内代付货款,向售货方开户银行签发的凭证。

在签发信用证前,购货方应先半贷款提交开户银行,另立帐户保管。

售货方接到其开户银行通知后,在信用证限额以内,可按合同规寂向购货方主动发货,并就地向争行结算收取货款。

拟写信用证支付的有关函电,要不得根据业务的进展情况,适时地对信用下支付业务提出合理要求,以防发生因失误而造成的纠纷。

--------------------------------------------------------------------------------范文1:信用证展期范文2:改证范文3:催证范文4:磋商推迟付款范文1 信用证展期——————:信用证展期我们遗憾地告诉你方,直到今天我方才收到你方有关上述售货确认书的信用证。

在所述确认书上清楚地规定有关信用证应不迟于8月底到达我处。

虽然你方信用证到达的期限已过,但鉴于我们之间的长期友好关系,我们仍愿装运你方订货。

然而,由于信用证迟到,我们不能按售货确认书所定间装运货物。

因此,需将信用证展期如下:(1)将装运期延期至10月底(2)将信用证有效期展至11月15日请注意我们要求在9月30日之前收到信用证修改收。

否则,我们无法如期装运货物。

期盼及早收到你方信用证修改通知书。

SPECIMEN:EXTENDING V ALIDITY OF THE L/CDear Sirs:RE:EXTENDING V ALIDITY F THE L/CWe regret to say that we have not received your L/C related jto above mentioned sales Confirmation until today. It is stipulated clearly in the Sales Confirmation that the relevant L/C must reach to us not later than the end of Aug Alought the reaching time of the L/C is overdue,we would like still to ship your goods in view of long-standing friend relationship between us . However , we can not make ship ment of your goods within the time stipulated in the Sales Conifrmatin owing to the delay of th L/C, Therefore, the /C needs to be extended as follows.(1)l/time of shipment will be extended to the end of Oct(2)Validity of the L/C will be extended to NOv15,Your kind attention is inveited to the fact tht we must receive your L/C amendment before Sept 30.Otherwise, we will not be able to effect the shipment in time Looking forward to receiving your L/C amendment early we remain.Yours truely范文2 改证————————:请更正信用证兹收到你方9月1日来函,通知我们你方已按我第90-US1064号销售确认书开立了第A-894号信用证。

外贸函电之信用证付款

信用证付款PaymentByL/C

International Sports Equipment Ltd. 375 Jiefang Street, Tianjing 30000, China

Tel:(020) 200000 Fax: 2000001

September 12, 200#

Norseman Vehicle Building Ltd.

12 Nobel Street

Stockholm, Sweden

Dear Sirs:

We spoke to your representative, Mr. Bergman, at the international Automobile Expo in Tokyo last week, and he showed us a number of snowmobiles which you produce, and informed us of your terms and conditions.

We were impressed with the vehicles, and have decided to place a trial order for ten of them, your Cat. No SM18. The enclosed order, No.98918, is for prompt dilivery as the winter season is only a few weeks away.

As Mr. Bergman assured us that you could meet any order from stock, we have instructed our bank, Bank of China, Tianjing Branch, to open a confirmed irrevocable letter of credit for USD 108,000 in your favor, valid until December 1, 200#.

Our bank informs us that credit will be confirmed by their agents, Scandinavian Bank, Strindberg Street, Stockholm, once you have contacted them, and they will also supply us with a certificate of quality once you have informed them that the order has been made up and they have checked it.

You may draw on the agents for the full amount of the invoice at 60 days, and your draft should be presented with the following documents:

Six copiesof the bill of lading

Five copies of the commercial invoice, c,i,f. Tianjin

Insurance Certificate for USD 118,800(A. R.)

Certificate of origin

Certificate of quality}

The credit will cover the invoices, discounting, and any other bank charges. Please fax us confirming that the order has been accepted and the vehicles can be delivered within the next six weeks.

Yours faithfully

QIAN Jin( Mr. )

Purchase Department

Encl.。