外贸函电-付款

- 格式:pdf

- 大小:167.47 KB

- 文档页数:10

外贸函电订单范文(共18篇)(经典版)编制人:__________________审核人:__________________审批人:__________________编制单位:__________________编制时间:____年____月____日序言下载提示:该文档是本店铺精心编制而成的,希望大家下载后,能够帮助大家解决实际问题。

文档下载后可定制修改,请根据实际需要进行调整和使用,谢谢!并且,本店铺为大家提供各种类型的经典范文,如工作总结、工作计划、合同协议、条据文书、策划方案、句子大全、作文大全、诗词歌赋、教案资料、其他范文等等,想了解不同范文格式和写法,敬请关注!Download tips: This document is carefully compiled by this editor. I hope that after you download it, it can help you solve practical problems. The document can be customized and modified after downloading, please adjust and use it according to actual needs, thank you!Moreover, our store provides various types of classic sample essays for everyone, such as work summaries, work plans, contract agreements, doctrinal documents, planning plans, complete sentences, complete compositions, poems, songs, teaching materials, and other sample essays. If you want to learn about different sample formats and writing methods, please stay tuned!外贸函电订单范文(共18篇)外贸函电订单范文第1篇支付 Payment1.催款函提及相关订单。

付款方式函电英语范文 Payment Instructions Letter Template.[Your Name][Your Address][Your City, Postal Code][Your Email Address][Your Phone Number][Date][Bank Name][Bank Address][Bank City, Postal Code]Re: Payment Instructions for [Invoice Number]Dear [Bank Contact Name],。

Please find below the payment instructions for the invoice referenced above. We request that you initiate the payment as soon as possible.Beneficiary Name: [Beneficiary Name]Beneficiary Address: [Beneficiary Address]Beneficiary Account Number: [Beneficiary Account Number]Beneficiary Bank: [Beneficiary Bank Name]Beneficiary Bank Address: [Beneficiary Bank Address]Swift Code: [Swift Code]Payment Amount: [Payment Amount]Payment Currency: [Payment Currency]Payment Method: Wire Transfer (TT)。

Additional Instructions:Please ensure that the payment is made in the correct amount and currency as specified above.Please include the invoice number in the payment reference field.Please notify us once the payment has been processed.We appreciate your cooperation in this matter. If you have any questions or require any further clarification, please do not hesitate to contact us.Thank you for your attention to this matter.Sincerely,。

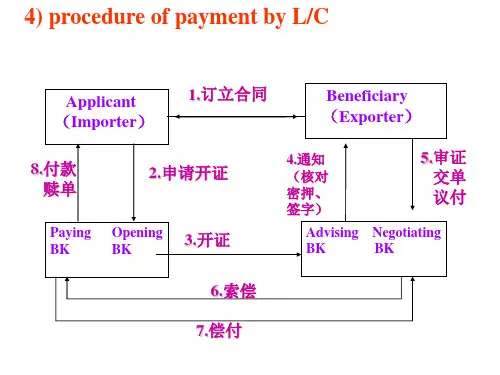

双语学院2009级外贸函电期末试题学号:0301090317姓名:谢茹辉班级:09031. Analysis of The Three Most Common Modes of Payment inInternational Trade, with Particular Emphasis on L/C During the international trade, the payment is the most important part, because all the commercial activities are on the basis of the acceptable benefits, but if the payment can not be ensured, then all this commercial activities will all be insignificant, or everything will be gone. However, the payment in international trade is more complicated than in domestic market. Besides, there are lots of payments in international trade. Generally, the following three payments are the most common modes in international trade: remittance, collection and letter of credit.1. RemittanceRemittance is the simplest payment in international trade. There four parties in remittance: remitter, payee, remitting bank, and receiving bank—the paring bank. Remittance has three ways: telegraphic transfer, mail transfer, remittance by banker’s demand draft.2. CollectionCollection belonging to commercial credit, when bank deal the collection business, neither do they have the obligation to check shipping documents complete or correct or not, nor assume responsibility for the payer which must be paid by them. Although the collection is handled through the bank, but the bank is acting as a trustee of the exporter, and do not undertake the responsibility to pay. If the importer does not pay, it has nothing to do with the bank. When the exporter receives the payment from the importer, it is still dependent on the importer’s commercial credit.There two types of collection: Documents against Payment--D/P, Documents against Acceptance--D/A. It involved the following four parties: the principal; the remitting bank; collecting bank; the payer. Besides, we have to pay attention to the following: the bank is under no obligation to take care of the goods in case the importer dishonors the draft.3. Letter of CreditLetter of Credit is the most important and common used payment type, which is a bank credit with safe advantages to the seller. As an usual practice, the L/C is to be established and to reach the seller one month prior to the date of shipment so as to leave enough time for the seller to make preparations for shipment. The most important is that an L/C is the written promise of a bank that acts at the request and on the instructions of the applicant and undertakes to pay the beneficiary the amount specified in the credit, provided that theterms and conditions of the credit are observed by the beneficiary.Ⅰ.L/C has different types: sight L/C and after sight L/C; irrevocable L/C and revocable L/C (L/C, established at present, almost is irrevocable L/C ); confirmed L/C and unconfirmed L/C; transferable L/C and nontransferable L/C; documentary L/C and clean L/C; revolving L/C, back to back of L/C.Ⅱ. The parties Relating to a L/C: 1) The applicant: It is generally the buyer or importer who applies to the bank for issuance of L/C. 2). The beneficiary: The beneficiary under L/C is usually the seller or the exporter. 3).The opening bank or issuing bank: It is the bank that issues the L/C on behalf of the applicant, and will be responsible for payment commonly. A first class bank is always be required as an opening bank by the seller. 4). The advising bank: It is usually the exporter’s local bank. The advising bank passes the L/C on to the beneficiary under the instruction from issuing bank and is not responsible for payment. It may be a branch of issuing bank or its correspondent. 5). The negotiating bank: The negotiating bank is ready to pay for the drafts and get the full set of documents or only receive the drafts and documents without responsibility of payment, then mail them to the issuing bank for reimbursement. The negotiating bank may be the advising bank. 6).The paying bank: The paying bank is responsible for the payment specified by the L/C. Usually it is the issuing bank or appointed by the issuing bank.Ⅲ. L/C contents:Number; amount; date of opening and validity, presentation and presentation place; Names of the parties; Commodity descriptions, quantity, packing, unit price; requirements for shipment, mode, shipping date, partial and Transshipment; Requirement for documentsⅣ. The nature of L/C: 1). The bank is the payer; 2). An independent document;3). Exchange of documents.Ⅴ. The advantage of L/C1). For the seller, L/C offer an reliable payer—the bank. If they got an L / C that does not comply with agreements, then they can terminate the contract without days, and got an additional claim, such as, any market loss of use).2). For the buyer, they pay for the goods only when the goods are already shipped. Besides, they can also ask the bank for a credit, but without any guarantee.3). It can avoid the risk of the preparation payment, then the problem of payment and offer between the seller and buyer;Ⅵ. The disadvantage of L/C1). For the buyer, establishing an L/C costs a lot; and when opening an L/C, frozen capital is needed; besides, they have to worry about the discrepancy2). If the documents of L/C is complicated, this is very important. For the seller, the less, the simple, more reliable. But if not, everything will be on the other side.That’s all my analysis of the three most common modes of payment in international trade.2.Analysis of the Importance of Documentation in Import andExport TradeWhen we talking about the importance documentation in import and export, we should know that the shipping document play such a great part in the international trade that it got the name “the trade of documents”, or “th e symbolic trade”, because shipping documents is on behalf of the title of the goods.The main shipping documents in the international trade content the commercial invoice, bill of lading and the insurance certificate. Of course, it also includes other documents, if acquired by the buyer. Actually, there are five major categories by ICC—The International Chamber of Commerce: 1. the commercial documents; 2. the transport documents; 3. the finance documents;4. insurance documents;5. other documents.1. The commercial documents1). Pro forma invoicePro forma invoice is an invoice that provided by a supplier prior to a sale or shipment of merchandise, informing the buyer of the kinds and the qualities of goods to be sent, their value, and important specifications. Besides, the most important thing that we should pay attention to is that a pro forma invoice has legal status.2). Commercial invoiceCommercial invoice, generally called invoice, is the description of the quality, quality of the goods, the unit and the total price. Besides, it is also on the basis of which other documents are to be prepared, and banks check the conformity between credit terms, documents and the conformity between the documents.3). Quality certificateA quality certificate makes sure that the quality or specification of a particular consignment of goods complies with the sales contract at the time of shipment.4). Weight certificateA weight certificate makes sure that the weight of the goods complies with the sales contract at the time of shipment.2. The transport documents: in the following will I the concrete details introduce with importance.1). Shipping noteA shipping note is a note that shows us the information about a particularexport consignment when offered for shipment.2). Packing listThe main purpose of this packing list is to give an inventory of the shipping goods.3). Bill of ladingThis is the most important part in the five major categories. Bill of lading is a document that is issued by the captain, agent, or owner of a vessel, furnishing written evidence regarding receipt of the goods, the conditions on which transportation is made( contract of carriage), and the engagement to deliver goods at the prescribed port of destination to the lawful holder of the bill of lading.----- from dictionary of international trade.The main contents of B/L are: carrier, shipper, consignee, notify party, a general description of the goods, shipping marks, the port of the shipment and destination, freight, place of issuance of B/L, the date of the issuance of B/L. B/L include two types:the clean B/L and the unclean B/L, shipped(on board) B/L and received for shipment B/L, straight B/L and blank B/L, order B/L, transshipment B/L, through B/L, container B/L, on deck B/L, stale B/L.4). Consignment noteConsignment note conclude the rail consignment note and the road consignment note, which serve as the contract of carriage between the railway/ roadway and consignor, approving the receipt of the goods and the date of acceptance for carriage by the carrier. It is different from B/L, because it is not the document of the title and also is not transferable or negotiable. 5). Air waybillThe air waybill is the consignment note used for the carriage of the goods by air. Basically it is a receipt of the goods for dispatch and evidence of the contract of carriage between the carrier and the consignor. The air waybill is not negotiable.6). Parcel post receiptIt is issued by the post office for goods sent by parcel post.7). Combined transport Documents3. Finance documents: 1). Application form for international money transfer; 2). Draft; 3). Application for L/C; 4). Letter of credit4. The insurance documents5. Other documentsOther documents conclude five main parts: 1). Import license; 2). Certificate of origin; 3). Inspection certificate; 4). Consular invoice; 5). Customs invoiceBesides, and finally, there is a GSP, which is short for Generalized System of Preferences.That’s all my Analysis of the Importance of Documentation in Import and Export Trade。

外贸函电支付方式范文主题:关于支付方式的商讨。

尊敬的[客户姓名]:嗨呀,咱这生意谈得差不多了,现在就差这支付方式没好好唠唠呢。

你看啊,咱们常用的支付方式有好几种。

先说这电汇(T/T)吧,就像你给远方的朋友直接打钱一样方便。

要是你能在发货前就把款给我们电汇过来,那可就太省心啦。

这就好比你提前买了电影票,我们就可以安心准备货物,保证准时给你发货。

对于我们来说,资金立马到账,我们也能更好地安排生产、采购原材料啥的。

而且这电汇手续费相对来说也比较合理,就像你坐公交,花点小钱就能到达目的地一样。

再说说信用证(L/C)吧。

这个信用证就像是一个有信用的中间人担保。

你向银行申请开证,银行就像一个公正的裁判,按照咱们商量好的条款来操作。

虽然办理信用证的手续可能稍微麻烦点,就像你要参加一个很正规的比赛得填不少表格一样,但它对咱们双方都有保障呀。

对我们来说,只要按照信用证的要求把货物准备好,提交单据,就能拿到钱,心里踏实。

对你来说,也不用担心我们收到钱不发货之类的事儿。

还有托收(Collection)这种方式呢。

托收就有点像你委托别人去办事。

你把单据交给银行,银行帮你去收钱。

不过这个托收啊,相对来说风险就稍微大一点,有点像放风筝,线有点长,不太好控制。

但是它手续简单呀,如果咱们之间信任度很高的话,也不失为一种选择。

我觉得咱可以根据这次交易的具体情况来选择支付方式。

要是你订单比较急,电汇就很合适;要是你想更安全保险一点,信用证也是个很棒的选择;要是咱们是老伙伴,彼此信任得很,托收也能让咱的交易更便捷。

你那边对支付方式是咋想的呀?希望咱们能尽快达成一致,这样就可以顺利推进这笔生意啦。

祝好![你的名字] [具体日期]。

读书破万卷,下笔如有神外贸函电:用英语回复客户的付款1. How to begin your letter?Thank you for your payment of $327.80 for your recent order of books from Oceanic Press.Thank you for your credit transfer for $1327.80 in payment of our invoice.We have received your check for $327.80 in payment of our July statement.2. How to praise the customer for prompt payment?Our bank advised us today that your transfer of $3327.80 was credited to our account. Thank you for prompt payment.Starting from this month, we’ll deduct 3% from your monthly bill eachtime you pay.3. How to end your letter?We appreciate your cooperation and look forward to serving you again.Thank you for paying so promptly, and we hope to serve you again soon.We welcome your next order and hope that you will contact us whenever we canhelp you.II. SAMPLE范文1. Response To Prompt PaymentDear ____________:Thank you for your payment of our July statement.We are pleased to inform you that, starting with this month (August),we’ll deduct 3% from your monthly bill each time you pay by the 15th. This好记性不如烂笔头。

外贸函电词汇句型:付款Payment Terms(一)Payment is to be effected (made) before the end of this month. 这个月末以前应该付款。

It's convenient to make payment in pound sterling. 用英镑付款较方便。

Now, as regards payment, we've agreed to use Dollar, am I right? 至于付款,我们已同意用美圆,对吗?We may have some difficulties making payment in Japanese yen. 用日圆付款可能会有困难。

I've never made payment in Renminbi before. 我从未用过人民币付款。

We can't accept payment on deferred terms. 我们不能接受延期付款。

What's your reason for the refusal of payment? 你们拒付的理由是什么?Collection is not paid. 托收款未得照付。

We don't think you'll refuse to pay. 我们相信你们不会拒付。

Only one refusal of payment is acceptable to thebank. 银行只接受一次拒付。

You ought to pay us the bank interest once payment is wrongly refused. 如果拒付错了,你们应该偿付我方的银行利息。

We'll not pay until shipping documents for the goods have reached us. 见不到货物装船单据,我们不付款。

买方要求修改付款方式的外贸函电范文你好呀!希望你们最近都过得不错!我是买方公司名称的您的名字,咱们的合作一直很顺利,对此我们真是满心欢喜。

不过,今天有个小小的事情想和你们商量一下。

咱们在之前讨论的付款方式上,可能需要做些微调。

你知道的,咱们的合作是基于互信和友谊的基础上,这一直是我们之间的“润滑油”,不过,最近公司内部做了一些调整,付款流程上也有了些变化。

所以,原来咱们约定的那种付款方式可能对我方来说有些不太方便。

换句话说,咱们这边希望能在付款方式上做一些小改动,能不能再考虑一下呢?我知道这可能会有些麻烦,但请相信,我们真心希望双方能继续保持良好的合作关系。

我先给你简单说说我们现在的想法。

原本咱们是按照原定付款方式来支付的,对吧?不过随着公司财务制度的变化,现在他们更倾向于新提议的付款方式,这样对我们来说操作起来会更加方便,也能更顺畅地完成支付。

相信你们也知道,现在公司内部的审批流程越来越复杂,稍微改个付款方式就能省去不少麻烦,也能确保款项按时到账。

我理解你们也一定希望尽快收到款项,咱们可不想拖拖拉拉的,不是吗?你可能会想,这种变动是不是会影响你们的安排,或者让你们的流程也变得复杂。

我非常理解这种担忧,毕竟,谁也不愿意在忙碌的日程中再增加不必要的负担。

可是,放心,我会尽量确保整个调整过程对你们的影响降到最低。

无论如何,咱们的目标是一致的,就是希望尽快把事情搞定,大家都能够高高兴兴地收付款。

要说到付款这事儿,咱们可是一直秉持着“讲信用”的原则的,钱到位了,货自然就到了。

这个我敢打包票,你们肯定也能理解咱们的心情。

所以,这次小小的改动并不是想给你们添麻烦,反而是想通过更高效的方式让我们之间的合作更加顺畅。

毕竟,大家都知道,时间就是金钱,谁能省掉不必要的流程,谁就能更快地做成事儿。

说实话,改付款方式这个事儿,我真的是不想搞得太复杂,所以我特地给你们写了这封信。

希望通过这种沟通,能够让你们清楚了解我们的需求,同时也希望能得到你们的理解和支持。