金融英语证书考试FECT模拟试题及答案-5

- 格式:doc

- 大小:113.00 KB

- 文档页数:11

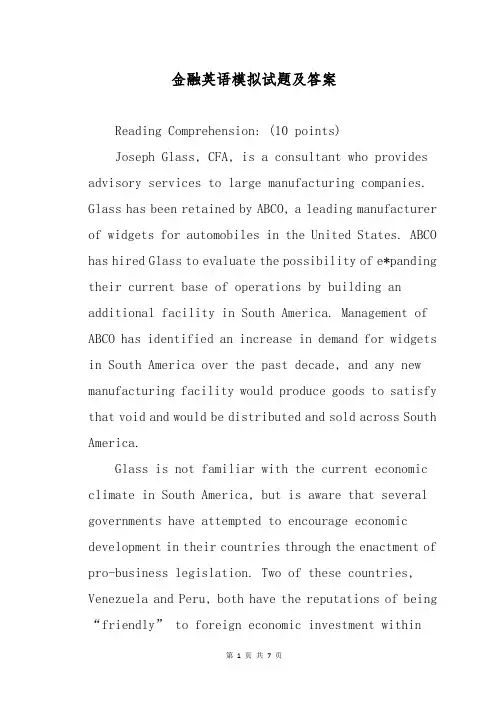

金融英语模拟试题及答案Reading Comprehension: (10 points)Joseph Glass, CFA, is a consultant who provides advisory services to large manufacturing companies. Glass has been retained by ABCO, a leading manufacturer of widgets for automobiles in the United States. ABCO has hired Glass to evaluate the possibility of e*panding their current base of operations by building an additional facility in South America. Management of ABCO has identified an increase in demand for widgets in South America over the past decade, and any new manufacturing facility would produce goods to satisfy that void and would be distributed and sold across South America.Glass is not familiar with the current economic climate in South America, but is aware that several governments have attempted to encourage economic development in their countries through the enactment of pro-business legislation. Two of these countries, Venezuela and Peru, both have the reputations of being “friendly” to foreign economic investment withintheir borders. The two countries share some similarities: both, until the past twenty years, were primarily agricultural economies with little industrial development. Also, both countries can offer a relatively low-cost labor force, although their workers in general, are not highly skilled.The government of Peru has declared that protecting the country’s environment is of utmost importance, and has established a regulatory body that oversees any environmental concerns that may arise as the country becomes more industrialized. Fairly stringent regulations have already been put into place in order to ensure that going forward, the operating practices of manufacturers within their country’s borders will be in balance with the government’s concern for their county’s natural resources. Regulations cover areas of concern such as air emissions, water conservation and the use of sustainable resources. Glass advised ABCO that a cost-benefit analysis must be performed to accurately determine both the direct and indirect costs of compliance with the regulations.The Venezuelan government has taken steps to ensurethat it can carefully manage the development of its country’s emerging economy, and to ensure that a competitive market is maintained. A regulatory agency was established five years ago to provide guidance for any new manufacturing concern seeking to operate in Venezuela. The head of the agency is Juan Santos, the former CEO of one of the first modernized manufacturing facilities in the country. During his tenure as head of the agency, he has demonstrated his ability to render decisions that attempt to simultaneously satisfy legislators, industry participants, and consumers. Glass is impressed by Santos’ work so far, but realizes that over the past five years, Venezuela has e*perienced a period of relatively slow economic development. Glass believes that Santos’ skills will truly be put to the test in the upcoming years of the anticipated economic e*pansion.Glass acknowledges the need for governmental regulation of industry, but recognizes that there always are offsetting costs, both short-term and long-term of such controls. Based upon his knowledge of events that have occurred in the United States over thepast thirty years, Glass recommends that ABCO continue to carefully monitor economic developments in both countries even after a site for a new manufacturing facility is selected.Part 1)Should ABCO build a new facility in either of the two countries, it is almost a certainty that they would be the low-cost producer of widgets, with the capacity to satisfy nearly all demand in the region. A natural monopolist operating in an unregulated industry will produce at the point where:A. Marginal costs equal marginal revenue.B. Average costs equal marginal revenue.C. Average costs equal average revenue.D. The marginal cost curve intersects the demand schedule.Part 2)The social regulation policies enacted by the government of Peru would least likely to cause which of the following outcomes? ()A. Higher costs of production.B. A disproportionately higher compliance e*pensefor larger firms rather than smaller firms.C. Higher prices for the end consumer.D. Attempts by industry participants to avoid compliance through creative response.Part 3)If ABCO were to build its new facility in Peru, compliance with the country’s regulatory policies will increase the price of their product by appro*imately ten percent. Some consumers may respond by not replacing the widgets in their automobiles as frequently as before, which will cause decreased fuel efficiency. This unintended effect of regulation is an e*ample of: ()A. The capture hypothesis.B. A creative response.C. A feedback effect.D. The share-the-gains, share-the-pains theory.Part 4)The appointment of Santos, an industry “insider”, to head the regulatory agency in Venezuela has the potential to cause a reaction predicted by which of the following theories of regulatory behavior? ()A. Rate-of-return regulation.B. Share-the-gains, share-the-pains theory.C. The capture hypothesis.D. Cost-of-service regulation.Part 5)Santos, as the head of the main regulatory body in Venezuela, must decide how to manage the effects of an unanticipated sharp increase in the cost of electricity. Santos proposed regulation that will allow manufacturers to pass on the increased costs at scheduled intervals over a five year period. This approach is an e*ample of: ()A. Rate of return regulation.B. Cost-of-service regulation.C. Share-the-gains, share-the-pains theory.D. Social regulation.E*planations of terms:(10 points)1. Liquidity2. Cost-push inflation3. Surveillance4. E*ternal debt5. Foreign reserveQuestion3: How many factors to e*plain the reserveholdings?Question4: What is The Monetary Policy Instruments of the Central Bank?Question5: What is Concept of Trust Market?And what the composition of it is?Question6: What is the Money Laundering?。

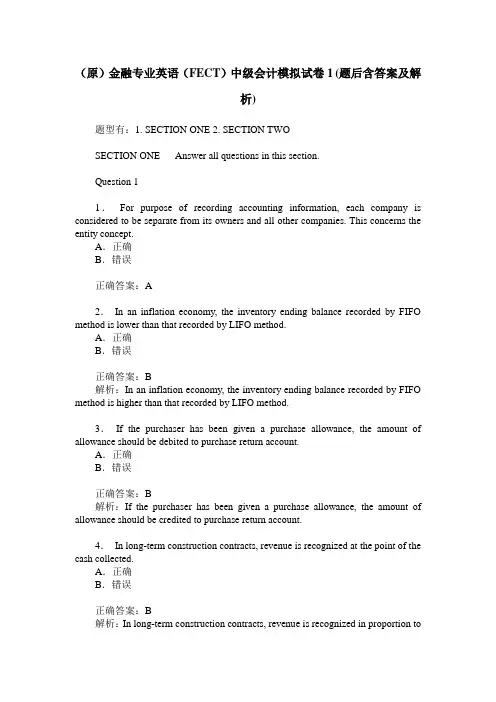

(原)金融专业英语(FECT)中级会计模拟试卷1(题后含答案及解析)题型有:1. SECTION ONE 2. SECTION TWOSECTION ONE Answer all questions in this section.Question 11.For purpose of recording accounting information, each company is considered to be separate from its owners and all other companies. This concerns the entity concept.A.正确B.错误正确答案:A2.In an inflation economy, the inventory ending balance recorded by FIFO method is lower than that recorded by LIFO method.A.正确B.错误正确答案:B解析:In an inflation economy, the inventory ending balance recorded by FIFO method is higher than that recorded by LIFO method.3.If the purchaser has been given a purchase allowance, the amount of allowance should be debited to purchase return account.A.正确B.错误正确答案:B解析:If the purchaser has been given a purchase allowance, the amount of allowance should be credited to purchase return account.4.In long-term construction contracts, revenue is recognized at the point of the cash collected.A.正确B.错误正确答案:B解析:In long-term construction contracts, revenue is recognized in proportion tothe contract work performed each year.5.In business charges depreciation in accounts, the accounting concept to be considered is the materiality concept.A.正确B.错误正确答案:B解析:In business charges depreciation in accounts, the accounting concept to be considered is the going concern concept.6.Cumulative preference shares have the right to accumulate dividends in a given year if they are in arrears.A.正确B.错误正确答案:AQuestion 27.If retained earnings were understated and liabilities were overstated, which of the following errors could have been the cause?A.Making the adjustment entry for depreciation expenses twice.B.Failure to record interest accrued on a note payable.C.Failure to make the adjusting entry to record revenue which had been earned but not yet billed to clients.D.Failure to record the earned portion of fees received in advance.正确答案:D8.The selected data pertain to a company at 31 December 2003 as the following:Quick Assets $208,000Quick ratio 2.6 to 1Current ratio 3.5 to 1Net sales for 2003 $1,800,000Cost of good sold for 2003 $990,000Average total assets for 2003 $1,200,000The company’s inventory balance at 31 December 2003 is ______.A.$72,000.B.$186,990.C.$231,111.D.$68,000.正确答案:A9.An accrued expense can best be described as an amount ______.A.paid and currently matched with earnings.B.paid and not currently matched with earnings.C.not paid but currently matched with earnings.D.None of the above.正确答案:C10.Mr. Wong paid $3,000 in advance for insurance on 1 December 2001 and debited it to Insurance Expense. No entries were made subsequently in 2001 or in 200The accounting period ends on December 3As a result of this error ______.A.2001 income was understated $2,000.B.2002 income was understated $2,000.C.2001 income was understated $3,000.D.2002 income was understated $3,000.正确答案:A11.Mr. Ting’s net cash inflow from operating activities for the year ending 30 June is$123,000. The following adjustments were included in the supplementary schedule reconciling cash flow from operating activities with net income:Depreciation $38,000Increase in net accounts receivable 31,000Decrease inventory 27,000Increase in accounts payable 48,000Increase in interest payable 12,000Net income is ______.A.$29,000.B.$41,000.C.$79,000.D.$217,000.正确答案:A12.Which of the following is not a characteristic of the accounting for non-trading organizations?A.They normally provide Receipts and Payments Accounts.B.They have Accumulated Fund, which is more or less the same as capital.C.It is more common to keep all records on a single entry basis.D.They must keep books on a double-entry system.正确答案:D13.Mr. Wong is a small company. And it failed to record every transaction. Now you are provided with the following information: capital at 1 January 2003 is $30,000, capital at 31 December 2003 is $31,000. During 2003, drawings are $2,000. Then the net profit for the year 2003 is ______.A.$3,000.B.$-1,000.C.$1,000.D.$-3,000.正确答案:A14.At the beginning of a given period, Mr. Ting’s inventory was all finished goods. The volume is 600. At file end of this period, 2,000 are completed units and 600 are partly completed. The partly completed units were deemed to be 50% complete. The manufacturing cost is $30,000. Then cost per unit is ______.A.$17.64B.$13.04C.$10.34D.$15正确答案:A15.Basic accounting assumptions include the following except ______.A.going concern.B.monetary unit.C.consistency.D.business entity.正确答案:C16.At 1 January 2003, the balance of Billy Company’s Provision for Bad Debts is $5,000. At 31 December 2003, the balance of trade debtors is $45,000. Billy Company’s provision for bad debts equals to 10% of trade debtors. During the year 2003, the bad debt written off is$2,000. Then Bad Debt expenses of Billy Company this year must be ______.A.$2,500.B.$1,500.C.$-1,500.D.$-2,500.正确答案:BQuestion 317.As at 31 December Year 8, Sam Ltd’s cash book showed a debit balance of $1,055, although he had an overdraft of $3,511. The discrepancy is due to the following:—Bank interest of $10 had been included in the bank statement, but was not recorded in the cash book.—A cheque for $2,300 was banked on 28 December and correctly entered in the cash book. Unfortunately the customer had forgotten to sign the cheque and it was subsequently dishonored and returned by the bank on 31 December. The book-keeper recorded the return in the cash book on 3 January Year 9.—The bank had incorrectly deducted $907 from Sam’s account for a cheque drawn by May.—A refund of $85 received from a supplier and banked on 2 October had been recorded in the cash book as a receipt of $58.—A cheque for $450 issued on 29 December as a refund to a customer had been recorded as a receipt in the cash book. It has not been presented for payment by 31 December.—The book-keeper had intended to desposit $2,750 in the bank on 31 December and therefore recorded it as a receipt in the cash book on that date. Due to a delay, the amount was not banked until 3 January Year 9.—An amount of $350 paid directly into the bank by a customer had not been recorded in the cash book.—The cash book receipts had been undercast by $800.Required:(a)Calculate the corrected cash book balance on 31 December Year 8.(b)Prepare a bank reconciliation statement for Sam showing the bank overdraft which appeared on his bank statement on that date.正确答案:(a)Corrected Cash Book Balance:$$Original balance 1,055Add: Refund wrongly entered 27Direct banking 350Undercasting 800 1,1772,232Less: Bank interest 10Dishonored cheque 2,300Entered on wrong side 950Not deposited 2,750 6,0103,778 O/D(b)Bank Reconciliation Statement as at 31 December Year 8:$$Balance per bank statement 3,511 O/DLess: Unpresented chequesNovember 190December 450 6402,871 O/DAdd: Error by bank 9073,778 O/DQuestion 418.1. Ming’s Company produces CD appliances. The following is the cost information for the year ended 31 December 2003.1. Material put into production was valued at $360,000 and $80,000 of which was used as supplies.2. The payroll records showed that total labor cost was $350,000, $68,000 of which was the costs of foremen and storekeeping men.3. Factory power and utilities were at a total cost of $90,000.4. Selling and administration expenses totaled $100,000.5. There was no opening and closing work-in-progress. The production records indicated that 20,000 units were completed in the year.Required:Calculate the following:(a)Prime cost(b)Conversion cost(c)Cost of goods manufactured(d)Unit production cost正确答案:(a)Prime cost =$(360,000-80,000)+$(350,000-68,000) =$562,000(b)Conversion cost =$(350,000-68,000)+$80,000+$68,000+$90,000=$520,000(c)Cost of goods manufactured =$(360,000-80,000)+$520,000 =$800,000(d)Unit production cost = Cost of goods manufactured / completed units= $800,000 / 20,000 = $40 per unitQuestion 519.Mr. Wong is a small manufacturer of bicycles in Hong Kong. His business incurred the following costs for the year ended 31 December 2003.$Materials (100% variable) 300,000Labor (25% variable) 200,000Selling & distribution cost (20% variable) 50,000Other costs (fixed) 170,000 720,000Normally, the business sells3,000 units at $300 each:Required:(a)Calculate the breakeven point in units and dollar sales.(b)Calculate the contribution to sales ratio.(c)Calculate the margin of safety in percentage.正确答案:(a) Total variable costs:$Materials 300,000Labor ($200,000×25%) 50,000Selling & distribution cost ($50,000×20% ) 10,000360,000Variable cost per unit =$360,000 / 3,000 =$120Contribution per unit =Selling price - Variable cost =$300 -$120 =$180Breakeven point (in units) = Fixed cost / Contribution per unit= ($200,000×75% +$50,000×80% +$170,000)/$180= $360,000/$180= 2,000 unitsBreakeven point (dollars sales) = Breakeven units ×Selling price per unit= 2,000×$300= $600,000(b) the contribution to sales ratio = $180 / $300×100% = 60%(c) the margin of safety = (Current sales - breakeven sales) / Current sales×100%= (3,000×$300-$600,000)/$900,000×100%= 33.3%Question 620.If a company had 120,000, 4% preference shares of $1 each and 250,000 ordinary shares of $1 each, then the dividends would be payable as follows:Year 1 Year 2 Year 3 Year 4 Year 5$$$$$Total Profits appropriated for dividends 7,000 3,000 20,000 4,000 5,000Required:(a)If the preference shares are cumulative, non-participating, calculate the preference dividends and ordinary dividends in each year.(b)If the preference shares are cumulative, participating, calculate the preference dividends and ordinary dividends in each year.正确答案:(a)If the preference shares are cumulative, non-participatingYear 1 Year 2 Year 3 Year 4 Year 5$$$$$Preference Dividends (4%) 4,800 3,000 6,600 4,000 5,000Ordinary Dividends 2,200 —13,400 ——(b)If the preference shares is cumulative, participatingYear 1 Year 2 Year 3 Year 4 Year 5$$$$$Preference Dividends (4%) 4,800 3,000 1,800 4,000 200(4%) (2.5%) (in arrears) (3.33%) (in arrears)4,800 4,800(4%) (4%)1,103 —(0.92%) 5,0005,903Ordinary Dividends 2,200 —10,000 ——(0.88%) (4%)2,297(0.92%)12,297SECTION TWO Answer any two questions in this section.Question 721.After the first year of trading, Mr. Wong provided you the following list of ledger balances as at 31 December 2003:$Stock, 1 January 2003 3,300Stock, 31 December 2003 25,200Sales 160,000Purchases 100,000Premises 142,600Fixtures & Fittings 45,200Motor Vehicles 42,500Returns Inwards 1,500Returns Outwards 2,600Carriage Inwards 1,000Carriage Outwards 250Debtors 30,500Creditors 41,500Wages 17,495Rent and Rates 3,900Lighting & Heating 18,455Insurance 10,600Motor Vehicle Expenses 2,400Cash at Bank 4,700Bank Loan 29,000LoanInterest 2,300Drawing 6,400You are further given the following information:1.Wages owing are $550.2.Prepaid rent is $600.3.Depreciation of Fixtures & Fittings is 10% per annum on cost.4.Depreciation of Premises is based on a 10-year lease.5.Depreciation of Motor Vehicles is 50% life using the reducing balance method.6.Stock taken for Mr. Wong’s own use is $1,100. Such a transaction has not yet been recorded.7.It is estimated that one-third of the driving time is for private purposes.8.5% of the outstanding accounts at the year end is thought to be uncollectible.9.There was no error made in the recording of business transactions for the year.Required:(a)Prepare a Trading and Profit and Loss Account for the year ended 31 December 2003.(b)Prepare a Balance Sheet as at 31 December 2003.(c)Explain the meaning and the significance of Working Capital.正确答案:(a) Mr. Wong’s BusinessTrading and Profit and Loss Account for the year ended 31 December 2003$$$Sales 160,000Less: Returns inwards 1,500Net sales 158,500Less: Cost of goods soldOpening stock 3,300Purchases 100,000Carriage inwards 1,000101,000Less: Returns outwards 2,60098,400Less: Stock drawing 1,100 97,300100,600Less: Closing stock 25,200 75,400Gross Profit 83,100Less: ExpensesWages (17,495 + 550) 18,045Rent and Rates (3,900-600) 3,300Lighting & Heating 18,455Insurance 10,600Motor Vehicle Expenses (2,400×2/3) 1,600Loan Interest 2,300Carriage Outwards 250Bad debts 1,525Depreciation:—Premises (142,600×1/10) 14,260—Fixtures & Fittings (45,200×10%) 4,520—Motor Vehicle (42,500×50%) 21,250 96,105(13,005)(b) Mr. Wong’s BusinessBalance Sheet as at 31 December 2003$$$Cost Dep NBVFixed AssetsPremises 142,600 14,260 128,340Fixtures & Fittings 45,200 4,520 40,680Motor vehicles 42,500 21,250 21,250230,300 40,030 190,270Current AssetsStock 25,200Debtors 30,500Less: Provision for bad debts 1,525 28,975Prepaid rent 600Cash at bank 4,70059,475Less: Current LiabilitiesCreditors 41,500Accrued wages 550 42,050Net Current Assets 17,425Total Net Assets 207,695Represented ByCapital (Workings 1) 200,000Less: Net Loss 13,005186,995Less: Drawings (6,400+1,100+1/3×2,400) 8,300178,695Bank loan 29,000207,695Workings 1: The initial capital contributed by Mr. Wong is determined by drawing up the following trial balance:Dr Cr$$Stock 3,300Sales 160,000Purchases 100,000Premises 142,600Fixtures & Fittings 45,200Motor Vehicles 42,500Returns Inwards 1,500Returns Outwards 2,600Carriage Inwards 1,000Carriage Outwards 250Debtors 30,500Creditors 41,500Wages 17,495Rent and Rates 3,900Lighting & Heating 18,455Insurance 10,600Motor Vehicle Expenses 2,400Cash at Bank 4,700Bank Loan 29,000Loan Interest 2,300Drawings 6,400Capital (Balance Figure) _____ 200,000433,100 433,100(c) Working capital is defined as the excess of current assets over current liabilities. It is one of the important financial indicators of the liquidity position of a business entity. A positive working capital position means that a business is able to manage its affairs to such a state that current assets are sufficiently ready to meet the requirement of settling the debts which are to be due within one year. In other words, a business is to be solvent in the short term if there is a positive working capital. This indicates that the liquidity position of a business is financially sound.However, a positive working capital does not necessarily indicate that the business is solvent in the long term or in a forced liquidation.Question 822.The following are the summarized financial statements of Mr. Wong’s business for the years ended 31 December 2002 and 2003 respectively.Balance Sheets as at 31 December2002 2003$$Fixed Assets (net book value) 22,500 18,000Current Assets:Stock 10,500 27,000Debtors 18,000 54,000Bank 1,500 —Current liabilities:Creditors (9,000) (22,500)Bank overdraft —(15,000) 43,500 61,500Capital at 1 January 18,000 43,500Net Profit for the year 45,000 52,500Drawings (19,500) (34,500) 43,500 61,500Profit and Loss AccountSales 180,000 300,000Cost of sales 120,000 225,000Gross profit 60,000 75,000Operating expenses 15,000 22,500Net profit 45,000 52,500Additional information is given as follows:1. All sales were on credit basis.2. There were no purchase or disposals of fixed assets during the year.3. The stock value and debtor balance as at 31 December 2001 were $15,000 and $30,000 respectively.Required:(a)Calculate the following financial ratios for years both 2002 and 2003:(i)Gross profit margin(ii)Net profit margin(iii)Return on capital employed(iv)Current ratio(v)Acid test ratio(vi)Stock turnover period (days)(vii)Debtors collection period (days)(viii)Gearing ratio(b)Why is the gearing ratio important to a banker in making a lending decision?(c)Based on the financial ratios in (a), comment on the profitability, liquidity and management efficiency of Mr. Wong’s business.正确答案:(a) (i) Gross profit margin = Gross profit / Sales×100%year 2002: = 60,000/180,000×100% = 33.3%year 2003: = 75,000/300,000×100% = 25%(ii) Net profit margin = Net profit/Sales×100%year 2002: = 45,000/180,000×100% = 25%year 2003: = 52,500/300,000×100% = 17.5%(iii) Return on capital employed = Net profit / Capital employed×100%year 2002: = 45,000/43,500×100% = 103.4%year 2003: = 52,500/61,500×100% = 85.4%(iv) Current ratio = Current assets / Current liabilitiesyear 2002: = 30,000/9,000 = 3.33 to 1year 2003: = 81,000/37,500 = 2.16 to 1(v) Acid test ratio = (Current assets- Stocks) / Current liabilitiesyear 2002: = 19,500/9,000 = 2.17 to 1year 2003: = 54,000/37,500 = 1.44 to 1(vi) Stock turnover period (days) = 365×Average Stock / Cost of salesyear 2002: = 365×0.5×(15,000+10,500)/120,000 = 39 daysyear 2003: = 365×0.5×(10,500+27,000)/225,000 = 30 days(vii) Debtors collection period (days) = 365×Average debtors/Salesyear 2002: = 365×0.5×(30,000+18,000)/180,000 = 49 daysyear 2003: = 365×0.5×(18,000+54,000)/300,000 = 44 days(viii) Gearing ratio = Long-term loan/(Long-term loan + Shareholders’ fund)×100%year 2002: = 0year 2003: = 0(b) Gearing ratio is an expression of the way companies are financed and the proportion of capital provided by risk taking shareholders and by lenders to the company.This ratio assists the bankers in their loan lending decisions. Basically, gearing ratio is an indication of the risk to be undertaken by the ordinary shareholders because of the interest obligation of the long-term financial position, particularly thecash flows. A company’s borrowing power will be correspondingly lower when there is an increase in the geared ratio.(c) The following points should be noted:Profitability —Decrease in gross profit margin, net profit margin and return on capital employed.—Although turnover is improved, profit margins am decreased. This may be due to inefficient control on operating expenses and/or less effective marketing strategy.Liquidity—Both current ratio and acid test ratio indicate that the liquidity position is worsening.—It may be due to piling up of inventory and substantial outstanding debtors amounts.Management Efficiency—The credit control policy has been tightened up as the debtors’ collection period has been reduced by 5 days.—The stock control has also been improved as the stock turnover becomes faster.Question 923.The following ledger balances are extracted from the books of White Trading Company as at 31 December 2003:$Bad debts 750Bank overdraft 1,650Capital 100,000Carriage inwards 3,500Carriage outwards 1,400Creditors 18,500Debenture interest 900Debtors 12,500Discounts allowed 1,300Discounts received 1,500Drawings 24,900Equipment (at cost) 150,000Insurance 1,000Lighting 5,000Motor Van 40,000Provision for bad debts 1,100Provision for depreciation—Equipment 90,000—Motor Van 18,000Purchases 1,000,000Rent & rates 110,000Salaries and wages 210,000Sales 1,400,000Stock 1 January 2003 90,000Returns inwards 13,000Returns outwards 13,5009% 1998-2008 10-year Debenture 20,000Additional information relevant to the year ended 31 December 2003 is as follows:1. Closing stock at 31 December 2003 $115,0002. Accrued wages $20,0003. Prepaid insurance $2004. Outstanding telephone bill $2005. Outstanding rent $10,0006. Removal expenses of $950 are still outstanding because of dispute and they have not yet been entered into the accounting records.7. The depreciation policy is:(a)Equipment reducing balance method at 5% p.a(b)Motor Van: 25% p.a on cost8. It is a policy to make a provision for bad debts at 4% of outstanding debtors on the balance sheet date.Required:Prepare the Trading and Profit and Loss Account for the year ended 31 December 2003.正确答案:White Trading CompanyTrading and Profit and Loss Account for the year ended 31 December 2003$$$Sales 1,400,000Less: Returns inwards 13,000 1,387,000Less: Cost of goods soldOpening stock 90,000Purchases 1,000,000Add: Carriage inwards 3,500Less: Returns outwards (13,500) 990,0001,080,000Less: Closing stock 115,000 965,000Gross Profit 422,000Other revenues:Discounts received 1,500Bad debts recovery 950424,450Less: ExpensesSalaries and wages 230,000(210,000 + 20,000)Rent & rates 120,000(110,000 + 10,000)Lighting 5,000Insurance (1,000 - 200) 800Removal expenses 950Bank services charges 160Telephone 200Discount allowed 1,300Carriage outwards 1,400Bad debts (750 + 25,000 ×650- 1,100)Debenture interest 2,700(900 + 20,000 ×9%)Depreciation-equipment 3,000 366,160(150,000 - 90,000)×5%Net Profit 58,290。

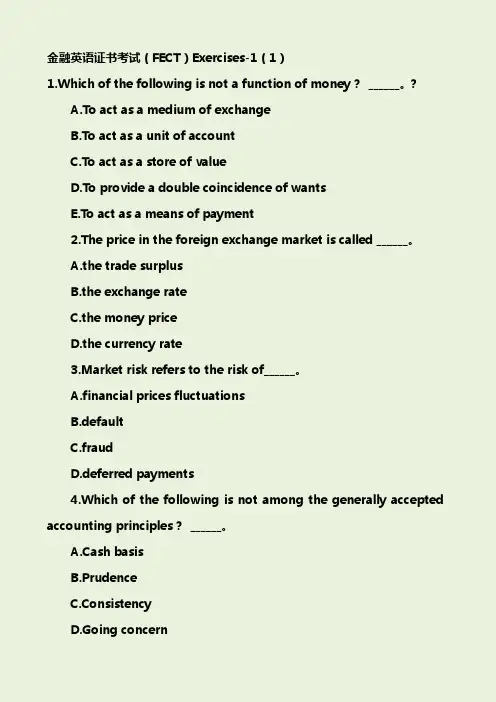

金融英语证书考试(FECT)Exercises-1(1)1.Which of the following is not a function of money?______。

?A.To act as a medium of exchangeB.To act as a unit of accountC.To act as a store of valueD.To provide a double coincidence of wantsE.To act as a means of payment2.The price in the foreign exchange market is called ______。

A.the trade surplusB.the exchange rateC.the money priceD.the currency rate3.Market risk refers to the risk of______。

A.financial prices fluctuationsB.defaultC.fraudD.deferred payments4.Which of the following is not among the generally accepted accounting principles?______。

A.Cash basisB.PrudenceC.ConsistencyD.Going concernE.Money measurement。

5.What is a documentary letter of credit?______。

A.A conditional bank undertaking to pay an exporter on production of stipulated documentationB.A method of lending against documentary securityC.An international trade settlement system biased in favour of importersD.All of the above6.Holding a group of assets reduces risk as long as the assets ______。

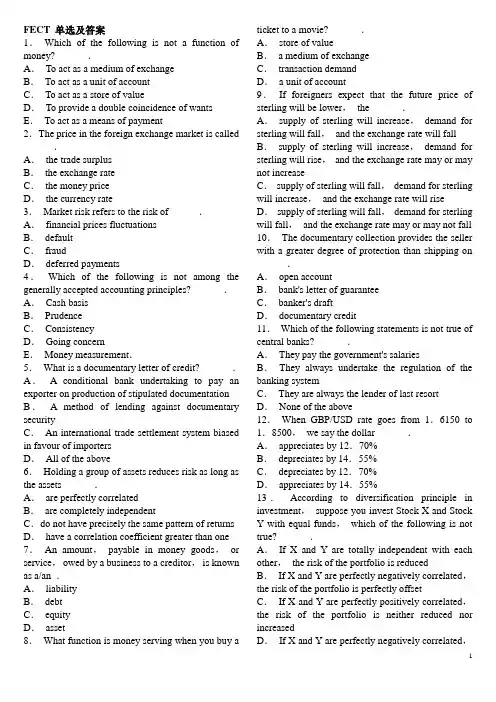

FECT 单选及答案1.Which of the following is not a function of money? ______.A.To act as a medium of exchangeB.To act as a unit of accountC.To act as a store of valueD.To provide a double coincidence of wants E.To act as a means of payment2.The price in the foreign exchange market is called ______.A.the trade surplusB.the exchange rateC.the money priceD.the currency rate3.Market risk refers to the risk of______.A.financial prices fluctuationsB.defaultC.fraudD.deferred payments4.Which of the following is not among the generally accepted accounting principles? ______.A.Cash basisB.PrudenceC.ConsistencyD.Going concernE.Money measurement.5.What is a documentary letter of credit? ______.A. A conditional bank undertaking to pay an exporter on production of stipulated documentation B. A method of lending against documentary securityC.An international trade settlement system biased in favour of importersD.All of the above6.Holding a group of assets reduces risk as long as the assets ______.A.are perfectly correlatedB.are completely independentC.do not have precisely the same pattern of returns D.have a correlation coefficient greater than one 7.An amount,payable in money goods,or service,owed by a business to a creditor,is known as a/an .A.liabilityB.debtC.equityD.asset8.What function is money serving when you buy a ticket to a movie? ______.A.store of valueB.a medium of exchangeC.transaction demandD.a unit of account9.If foreigners expect that the future price of sterling will be lower,the ______.A.supply of sterling will increase,demand for sterling will fall,and the exchange rate will fall B.supply of sterling will increase,demand for sterling will rise,and the exchange rate may or may not increaseC.supply of sterling will fall,demand for sterling will increase,and the exchange rate will rise D.supply of sterling will fall,demand for sterling will fall,and the exchange rate may or may not fall 10.The documentary collection provides the seller with a greater degree of protection than shipping on ______.A.open accountB.bank's letter of guaranteeC.banker's draftD.documentary credit11.Which of the following statements is not true of central banks? ______.A.They pay the government's salariesB.They always undertake the regulation of the banking systemC.They are always the lender of last resort D.None of the above12.When GBP/USD rate goes from 1.6150 to 1.8500,we say the dollar ______.A.appreciates by 12.70%B.depreciates by 14.55%C.depreciates by 12.70%D.appreciates by 14.55%13.According to diversification principle in investment,suppose you invest Stock X and Stock Y with equal funds,which of the following is not true? ______.A.If X and Y are totally independent with each other,the risk of the portfolio is reducedB.If X and Y are perfectly negatively correlated,the risk of the portfolio is perfectly offsetC.If X and Y are perfectly positively correlated,the risk of the portfolio is neither reduced nor increasedD.If X and Y are perfectly negatively correlated,the risk of the portfolio is neither reduced nor increased14.These are four main methods of securing payment in international trade:(1)payment under documentary credit(2)open account(3)collection,that is document against payment or acceptance of a bill of exchange(4)payment in advanceFrom an exporter's point of view,the order of preference is ______.A.(4),(2),(3),(1)B.(4),(1),(3),(2)C.(4),(3),(1),(2)D.(2),(4),(1),(3)15.The main liability on a bank balance sheet is ______.A.depositsB.capital and reservesC.loans and overdraftsD.cash16.______ shows that net income for a specified period of time and how it was calculated.A.The income statementB.The capital statementC.The accounting statementD.The statement of financial condition 17.Why must the liabilities and assets of a bank be actively managed? ______.A.Because assets and liabilities are not evenly matched on the same time scaleB.Because assets and liabilities are evenly matched C.Because the interbank market uses LIBOR D.Because assets and liabilities can be underwritten 18.If the expected returns of two risky assets have a perfect negative correlation,then risk .A.is increasedB.falls to zeroC.is unaffectedD.is reduced by one-half19.A possible disadvantage of freely fluctuating exchange rates with no official intervention is that .A.some nations would experience continual deficits B.the exchange rates may experience wide and frequent fluctuationsC.nations would no longer be able to undertake domestic policies designed to achieve and maintain full employment D.nations would need a larger supply of international reserves than otherwise20.What are your GBP/USD position and the average rate if you sell £4m at 1.6350 buy £5m at 1.6340 and sell $5m at 1.6348?A.Short £2 058 478.10 long $3 370 000 at 1.6371 B.Long £5 941 521.90 short $9710 000 at 1.6342 C.Short £5 941 521.90 long $9 710 000 at 1.6342 D.Long £4 058 478.10 short $6 630 000 at 1.6336 1.D 2.B 3.A 4.A 5.A 6.C 7.A 8.B 9.A 10.A11.B 12.B 13.D 14.B 15.A 16.A 17.A 18.B 19.B 20.D1.When a country runs a foreign trade deficit under a flexible foreign exchange rate system,its .A.imports automatically increaseB.currency automatically depreciates C.exports automatically declineD.currency automatically appreciates2.Which of the following statements is not true of accounting? ______.A.Accounting is language of businessB.The user of accounting includes business,government,nonprofit organizations and individuals.C.Accounting is useful for decision making D.Accounting is an end rather than a means to an end3.The term foreign exchange is best defined by the following statement:it is ______.A.the rate of exchange between two currencies B.synonymous with currency exchangeC.the place in which foreign currencies are exchangedD.an instrument such as paper currency,note,and check used to make payments between countries 4.What is Asset Allocation? ______.A.Buying assets of different types,risks,and potential returnsB.Buying assets with more than one brokerage accountC.The ability to buy mutual fundsD.Buying stocks for the long term5.External users of financial accounting information include all of the following except .A.suppliersB.line managersC.general publicD.creditors6.CAPM is short for .A.Capital Asset Pricing ModelB.Cash Added Price MatrixC.Capital Asset Pricing MatrixD.Cost and Price Model7.Liquidity measures the ______.A.value of an assetB.ease with which an asset can be exchanged C.usefulness of an assetD.economic and monetary reliability of an asset compared with other assets8.In a letter of credit transaction,the bank pays the seller against ______ which agree(s)with______.A.documents...the credit B.merchandise...the contract C.documents...the contract D.merchandise...the buyer ordered9.A barter economy is one that does not possess _______.A.any wealthB.printed currencyC.a medium of exchangeD.gold10.Which of the following is not true of airway bill? ______.A.When goods are delivered to the airline,the airway bill is signed by them or their agents as a receipt of the goodsB.Airway bill is a document of title to the goods C.Airway bill may also provide evidence of despatch of the goods where it has been stamped indicating details of the relevant flightD.None of the above11.The value of money varies _____.A.directly with the unemployment rate B.directly with the price levelC.inversely with the unemployment D.inversely with the price level12.The economics news on the television reports that the dollar has strengthened relative to the Japanese yen.This means that ______.A.the dollar has depreciated relative to the yen B.the dollar can now purchase more yenC.the yen can now purchase more dollarsD.the US trade balance with the Japanese economy has improved13.The theory of international exchange that holds that exchange rates are set so that the price of similar goods in different countries is the same is the ______.A.price feedback theoryB.trade feedback theoryC.purchasing power parity theoryD.J-curve theory14.According to the optimal portfolio theory,where should portfolios lie? ______.A.On the efficient frontierB.Above the efficient frontierC.Under the efficient frontierD.Anywhere,as long as the portfolio is diversified 15.Which of the following is not a user of management accounting information? ______.A.Store managerB.CreditorC.CEOD.CFO16.Based on the scenarios below,what is the expected return for a portfolio with the following return profile? ______.Market Conditionbear Normal BullProbability 02 0.3 05Rate of return ??25% 10% 24%A.4%B.10%C.20%D.25%Use the following expectations on Stocks X and Y to answer questions 17 through 19 (round to the nearest percent).Bear Market Normal Market Bull Market Probability 0.2 0.5 0.3Stock X_ -20% 18% 50%Stock Y -15% 20% 10%17.Financial markets serve to channel funds from ______.A.the government to contractorsB.investors to consumersC.consumers to producersD.savers to investors18.The agreements that were reached at the Bretton Woods conference in 1944 established a system .A.of essentially fixed exchange rates under whicheach country agreed to intervene in the foreign exchange market when necessary to maintain the agreed-upon value of its currencyB.of floating exchange rates determined by the supply and demand of one nation's currency relative to the currency of other nationsC.that prohibited governments from intervening in the foreign exchange marketsD.in which the values of currencies were fixed in terms of a specific number of ounces of gold,which in turn determined their values in international trading19.Which of the following statements is not consistent with generally accepted accounting principles relating to asset valuation? .A.Assets are originally recorded in accounting records at their cost to the business entity B.Accountants prefer to base the valuation of assets upon objective,verifiable evidence rather than upon appraisals or personal opinionC.Accountants assume that assets such as office supplies,land and buildings will be used in business operations rather than sold at current market prices D.Subtracting total liabilities from total assets indicates what the owner's equity in the business is worth under current market conditions20.A fiscal expansion in the UK ______ the pound sterling.A.tends to appreciateB.tends to depreciateC.does not affect the price ofD.has no predictable effect on the price of1.B 2.D 3.D 4.A 5.B 6.A 7.B 8.A 9.C 10.B11.D 12.B 13.C 14.A 15.B 16.B 17.A 18.A 19.D 20.A1.When a country runs a foreign trade deficit under a flexible foreign exchange rate system,its .A.imports automatically increaseB.currency automatically depreciatesC.exports automatically declineD.currency automatically appreciates2.Which of the following statements is not true of accounting? ______.A.Accounting is language of businessB.The user of accounting includes business,government,nonprofit organizations and individuals.C.Accounting is useful for decision makingD.Accounting is an end rather than a means to an end3.The term foreign exchange is best defined by the following statement:it is ______.A.the rate of exchange between two currencies B.synonymous with currency exchangeC.the place in which foreign currencies are exchangedD.an instrument such as paper currency,note,and check used to make payments between countries4.What is Asset Allocation? ______.A.Buying assets of different types,risks,and potential returnsB.Buying assets with more than one brokerage accountC.The ability to buy mutual fundsD.Buying stocks for the long term5.External users of financial accounting information include all of the following except .A.suppliersB.line managersC.general publicD.creditors6.CAPM is short for .A.Capital Asset Pricing ModelB.Cash Added Price MatrixC.Capital Asset Pricing MatrixD.Cost and Price Model7.Liquidity measures the ______.A.value of an assetB.ease with which an asset can be exchangedC.usefulness of an assetD.economic and monetary reliability of an asset compared with other assets8.In a letter of credit transaction,the bank pays the seller against ______ which agree(s)with______.A.documents...the creditB.merchandise...the contractC.documents...the contractD.merchandise...the buyer ordered9. A barter economy is one that does not possess _______.A.any wealthB.printed currencyC.a medium of exchangeD.gold10.Which of the following is not true of airway bill? ______.A.When goods are delivered to the airline,the airway bill is signed by them or their agents as a receipt of the goodsB.Airway bill is a document of title to the goodsC.Airway bill may also provide evidence of despatch of the goods where it has been stamped indicating details of the relevant flightD.None of the above1B 2.D 3.D 4.A 5.B 6.A 7.B 8A 9C 10B 1.Under which one of the following circumstances would it be wise for your customer to arrange a forward foreign exchange contract? ______.A.Import of goods priced in a foreign currency B.Import of goods priced in RMBC.Export of goods priced in RMBD.Export of goods priced in a foreign currency where the rate of exchange has been agreed in the sales contract2.Incoterms address ______.A.the risks of loss between the partiesB.breaches of contractC.ownership rightsD.type of ship used3.Which of the following is or was an example of representative full-bodied money? ______.A.Debt moneyB.ATS accountC.Gold certificateD.Demand deposit4.Risks associated with investing in foreign countries are the following except ______.A.voting riskB.exchange rate riskC.country riskD.political risk5.An exporter sells goods to a customer abroad on FOB and on CIF term.Who is responsible for the freight charges in each? ______.A.Exporter;ExporterB.Exporter;ImporterC.Importer;ImporterD.Importer;Exporter6.Default risk refers to the possibility that a borrower may ______.A.be unable to repay the principal on his loan B.be unable to make the interest payments on his loanC.go bankruptD.all of the above7.What is the reserve requirement? ______.A.The requirement of a bank to deposit a percentage of moneyB.The requirement for deposits in cashC.The percentage of a bank's deposits in the form of cash reservesD.The requirement for cash reserves8.A draft is like a check that can be endorsed but it isn't a title to goods,like ______.A.a bill of ladingB.an inspection certificateC.a certificate of originD.an insurance certificate9.Arbitrage ______.A.is a general economic term for buying something where it is cheap and selling it where it is dearB.keeps exchange rates consistent across marketsC.has been outlawed by the International Monetary FundD.cannot occur where there is a forward exchange marketE.both A and B10.What is the purpose of comparing the ledger entries with the documents? ______.A.To prove that all the transactions have made for the right amountsB.To prove that all the accounts have been posted correctlyC.To check the number of all the debits and creditsD.To post the right accounts答案:1.A 2.A 3.C 4.A 5.D 6.D 7.A 8.A 9.E 10.B1.What are the expected returns for Stocks X and Y respectively? ______.A.20% and 10%B.18% and 12%C.20% and 11%D.18% and 5%2.Which of the following payment terms eliminates the exchange risk,assuming the exporter invoices in foreign currency? ______.A.Confirmed irrevocable documentary creditB.Open accountC.Documentary collection D/AD.None of the above3.ABC Co.Ltd.purchased a car for $ 12 000,making a down payment of $5 000 cash and signing a $7 000 note payable due in 60 days.Which of the following is not correct? ______.A.From the viewpoint of a short-term creditor,this transaction makes the business less solventB.Total liabilities increased by $7 000C.Total assets increased by $12 000D.This transaction had no immediate effect on the owner's equity in the business4.Which of the following terms of payment will entirely eliminate country risk? ______.A.Revocable documentary creditsB.Confirmed Irrevocable documentary credits C.Documentary collection D/PD.Documentary collection D/A5.The expiry date of a documentary credit is Sunday,24 February,and documents have to be A presented to you.Which of the following is an acceptable presentation? (Assume there is no latest stated date for shipment stipulated.)______.A.Presentation to you on Monday 25 February with the bill of lading dated 25 FebruaryB.Presentation on Monday 25 February with the bill of lading dated Sunday 24 FebruaryC.Presentation on Tuesday 26 February with the bill of lading dated Sunday 24 FebruaryD.Presentation on Friday 22 February with the bill of lading dated Sunday 29 January6.What are the standard deviations of returns on Stocks X and Y respectively? ______.A.15% and 26%B.24% and 13%C.20% and 4%D.28% and 8%7.Who makes the first presentation of documents under a transferable credit? ______.A.ApplicantB.First beneficiaryC.Second beneficiaryD.None of the above8.A transaction caused a $10 000 decrease in both total assets and total liabilities.This transaction could have been ______.A.repayment of a $ 10 000 bank loanB.an asset with a cost of $10000 was destroyed by fireC.purchase of a delivery truck for $10 000 cashD.collection of a $10 000 account receivable9.Money ceases to serve as an effective store of value when ______.A.the government runs large deficitsB.the unemployment rate is very highC.productivity in the economy declinesD.rapid inflation occurs10.An indication that the money supply is greater than the desirable amount would be .A.insufficient spending and excessive savingB.deflationC.inadequate spending and rising unemploymentD.rising wages and prices答案:1.A 2.D 3.C 4.B 5.B 6.B 7.C 8.A 9.D 10.D。

2010年金融英语(FECT)考试模拟试题(英语学习)1. Usually the low interest rate currency trades at a ______ to the high interest rate currency in the forward market.A. premiumB. parC. discountD. bar2. Which of the following statements about standby letters of credit is true?______.A. They can serve as a guarantee to a buyer against a seller defaultingB. They are contrary to the general rule that letters of credit may only be used for the actual movement of goodsC. They are unlike a tender (or other)bond in their legal standing and method of operationD. They are unlike a tender bond with its fixed expiry date3. The most liquid of all assets is ______.A. the stock of commercial banksB. M 1C. intelligenceD. the debt of major corporations4. Beta and standard deviation differ as risk measures in that beta measures ______.A. only unsystematic risk,while standard deviation measures total riskB. only systematic risk,while standard deviation measures total riskC. both systematic and unsystematic risk,while standard deviation measures only unsystematic riskD. both systematic and unsystematic risk,while standard deviation measures only systematic risk5. What information would you find in a statement of cash flows that you would not be able to get from the other two primary financial statements?______.A. Cash provided by or used in financing activitiesB. Cash balance at the end of the periodC. Total liabilities due to creditors at the end of the periodD. Net income6. An analyst estimates that a stock has the following probabilities of return depending on the state of the economy:State of economyProbabilityReturnGood0.115%Normal0.613%Poor0.37%The expected return of the stock is ______.A. 7.8%B. 11.4%C. 11.7%D. 13.0%7. According to the rules of debit and credit for balance sheet accounts ______.A. increases in asset,liability,and owner‘s equity accounts are recorded by debitsB. decreases in asset and liability accounts are recorded by creditsC. increases in asset and owner’s equity accounts are recorded by debitsD. decreases in liability and owner‘s equity accounts are recorded by debits8. Inpiduals will accept the medium of exchange in return for goods and services only if they are confident that ______.A. the inflation rate is zeroB. it possesses intrinsic valueC. they can pass it on to othersD. they can exchange it for gold9. When a country’s currency appreciates,the country‘s goods abroad become ______ and foreign goods in that country become ______.A. cheaper.。

金融专业英语证书考试FECT模拟试题-4(总分100, 考试时间90分钟)SECTION ONE (Compulsory):Answer all ten questions in this section. Each question carries 1 mark.1. Multiple-choice questions: from the following four options, selecta correct and fill in its labeling the brackets.1.Suppose the demand for tea is very price-elastic. To increase revenue, the tea supplier should ___ the price level.A IncreaseB DecreaseC Not changeD Uncertain该题您未回答:х该问题分值: 2答案:B2.Which of the following would NOT cause a shift upward of the consumption schedule? ()A An increase in household wealth.B An expectation of rising incomes in the future.C A reduction in income taxes.D An increase in household disposable income.该题您未回答:х该问题分值: 2答案:D3.An increase of $1,000 in bank deposits will: ()A Result in a higher level of inflation.B Mean proportionately increased bank profits.C Facilitate the credit creation process.D Bring about government intervention in the working of the bankingsystem.该题您未回答:х该问题分值: 2答案:C4.A rising foreign exchange rate for country X will: ()A Result in a rise in X’s RPI.B Be likely to raise the employment level in X.C Favor those holidaying in X from abroad.D Ease inflationary pressures with X.该题您未回答:х该问题分值: 2答案:D5.Cutting taxes can lower investment through its impact on interest rates. This is an example of the: ()A Income effect.B Accelerator effect.C Crowding out effect.D Multiplier effect.该题您未回答:х该问题分值: 2答案:B6.Which one of the following is the most widely used measure of inflation? ()A The Consumer Price Index.B The Index of Leading Economic Indicators.C The prime rate.D The Federal Funds rate.该题您未回答:х该问题分值: 2答案:A7.You have just won the lottery (congratulations!) and are given the option of receiving $2,000,000 now or an annuity of 200,000 at the end of each year for thirty years. Which of the following is correct? () (assume you are making the decision based on present values)A You cannot choose between the two without first computing future values.B You will always choose the lump sum regardless of interest rates.C Comparing the future value of each will lead to the same decision as comparing present values.D You will always choose the annuity.E You will choose the lump sum if interest rates are 7%.该题您未回答:х该问题分值: 2答案:C8.A company buys 10 items at a price of £200 each, all on 14 days free credit. It then sells on the next day 5 units for £350 each. One item was sold for cash, the remainder on 21 days free credit. What effect do these transactions have on the firm’s cash fl ow on the day of the sale? ()A Gains £750B Gains £1,750C Loses £2,000D Gains £350.该题您未回答:х该问题分值: 2答案:D9.A firm has fixed costs of £100,000 per month and variable costs of £25 for item. It sells them for £50 each. If it sells 5,000 units each month, what is the firm’s Margin of Safety? ()A 1,000 units per monthB £50,000C 1,000 unitsD 25%.该题您未回答:х该问题分值: 2答案:A10.Fred Perry, CFA, purchased $100,000 of a newly issued Treasury inflation protection security based on the following characteristics and information.The coupon payment at the end of one year is closest to: ()A $2,000.B $2,100.C $5,000.D $7,000该题您未回答:х该问题分值: 2答案:BSECTION TWO(Compulsory):Answer the questions in this section.Reading Comprehension:Arnold Barker is an analyst at BAYCON Investments. He has been asked to revise BAYCON’s credit analysis process for corporate fixe d-income securities. This credit analysis process is the basis for the selection of individual bonds for BAYCON’s fixed-income portfolios. Hank Su, Barker’s supervisor, comments that one limitation of the current credit analysis process at BAYCON is that it only provides an estimate of a bond’s default risk. He asks Barker to expand the credit analysis processto provide an estimate of a bond’s credit spread risk. Su defines credit spread risk as follows:"Credit spread risk is the risk that the issuer will fail to satisfy the terms of the bond with respect to payments.”In addition, Su believes that the current credit analysis process focuses too much on character, collateral, and covenants, and not enough on capacity. In response to Su’s observations, Barker develops a quantitative debt-capacity model to assess the capacity of an issuer to meet its obligations. His debt-capacity model is based on the issuer’s profitability, debt coverage, and cash flow analysis. Barker decides to use the model to evaluate Haynes Industries, a recent investment-grade bond issuer. To calculate the inputs to the debt-capacity model, Barker gathered selected financial data, displayed in Exhibit 1, on Haynes Industries.Exhibit 1Selected Financial Data for Haynes Industries(In millions)Barker also decides to look at several key ratios used by Standard & Poor’s and other credit analysts, including coverage ratios, solvency ratios, and "funds from operations / total debt."Ed Dawson, a fixed-income research manager at BAYCON, has reviewed Barker’s debt-capacity model and makes the following statements about the model’s applicability to high-yield bonds, asset-backed securities, and municipal bonds:1. For the model to be useful for high-yield issues, it must consider the entire debt structure of the issuer. For example, high-yield issuers rely to a greater extent on bank debt than investment-grade issuers.2. While the model has limited applicability in the assessment of the credit of asset-backed securities, it can be used to evaluate the quality of the service. However, it cannot be used to assess the underlying collateral’s ability to generate cash flows.3. The credit analysis of municipal tax-backed bonds should involve assessing the issuer’s:debt structure,ability and political discipline to maintain sound budgetary policy, local tax base and intergovernmental revenues available, andflow of funds structure.11.Su’s definition of credit spread risk is: ()A Correct.B Incorrect, be cause credit spread risk is the risk that a bond’sprice will fall when the bond’s risk premium increases while the yield on a similar maturity Treasury bond falls.C Incorrect, because credit spread risk is the risk t hat a bond’sprice will fall when the bond’s risk premium decreases while the yield on a similar maturity Treasury bond rises.D Incorrect, because credit spread risk is the risk that a bond’sprice will fall when the bond’s risk premium remains constant while the yield on a similar maturity Treasury bond rises.该题您未回答:х该问题分值: 2答案:ADistinguish among default risk, credit spread risk, and downgrade risk.Credit spread risk is the risk an issuer’s debt obligation will relatively decline due to an increase in the credit spread. In this case the credit spread is increasing and the bond’s price will fall.12.The "funds from operations / total debt" ratio for Haynes Industries for 2004 was closest to: ()A 50.5%.B 52.1%.C 52.1%.D 63.5%.该题您未回答:х该问题分值: 2答案:CCalculate, critique, and interpret the key financial ratios used by credit analysts.Funds from operations / total debt = 7,672 / 14,147 = 54.23%. Funds from operations is defined as (Net Income + Depreciation & Amortization + Other non-cash charges) = (5,186 + 1,703 + 783) = 7,672. Total debt is defined as (Current Maturity of LTD + Long-Term Debt + Lease Debt Equivalent) = (2,172 + 11,475 + 500) = 14,147.13.For 2004, compared with 2003, did Haynes Industries have an increase or decrease in: ()A Answer A.B Answer B.C Answer C.D Answer D.该题您未回答:х该问题分值: 2答案:BCalculate, critique, and interpret the key financial ratios used by credit analysts.The interest coverage ratio [(EBIT (EBITDA)) / interest expense] increased from 8.97 (9.89) in 2003 to 10.40 (11.38) in 2004, and short-term solvency decreased from 1.358 in 2003 to 1.128 in 2004 where:*Current Liabilities = Current Assets - Working Capital 2004: Current Liabilities = 8,668 - 984 = 7,6842003: Current Liabilities = 8,232 - 2,168 = 6,06414.Given the debt structure described in Dawson’s first statement, the factor that is least likely to affect the creditworthiness of the high-yield issuer is the: ()A Ability to refinance.B Impact of sale of assets.C Presence of senior bonds in the debt structure.D Impact of changes in short-term interest rates.该题您未回答:х该问题分值: 2答案:CIdentify, explain, and interpret the typical elements of the corporate structure and debt structure of a high-yield issuer and the impact of these elements on the risk position of the lender. Bank loans have a priority over other debt issues; therefore the presence of senior bonds in the debtstructure will have little impact on the credit analysis of high-yield issuers.15.Regarding Dawson’s second stat ement that refers to asset-backed securities is he correct or incorrect in describing the model’s ability to: ()A Answer A.B Answer BC Answer CD Answer D该题您未回答:х该问题分值: 2答案:CDiscuss the factors considered by rating agencies in rating asset-backed securities.In the case of an asset-backed security, the quality of the service is evaluated using factors such as servicing history, underwriting standards for loan origination, servicing capabilities, business environment, and financial condition. The model will only address financial condition. Dawson is correct in stating that the model cannot be used to determine the ability of the underlying collateral to generate cash flows.Explanations of terms16.Liquidity trap该题您未回答:х该问题分值: 6答案:As the money supply increases the supply-of-money curve intersects the demand-for-money curve at flat part of the latter where an increase in the money supply no longer reduce the interest rate. This flat portion of the demand-for-money is called liquidity trap, which illustrates that the interest rate is insensitive to the increase of the money supply andpeople’s demand for money becomes infinitely large at the flat portion of the demand-for-money.17.Recognition lag该题您未回答:х该问题分值: 6答案:The recognition lag is the period that elapses between the time at which economic situation changes and the time at which the policymaking officials become aware of the need for action. This time lag could be negative if the disturbance can be predicted and appropriate policy actions considered before it even occurs.18.Group of Seven (G-7)该题您未回答:х该问题分值: 6答案:Seven of the world’s leading countries that meet periodically to achieve a cooperative effort on international economic and monetary issues。

2012年金融专业英语证书考试FECT模拟试题-5(总分100,考试时间90分钟)SECTION ONE (Compulsory):Single-choice questions Multiple-choice questions: from the following four options, select a correct and fill in its labeling the brackets.1. Tom cannot tell the difference between Coke and Pepsi. For Tom, these goods are: ()A. Perfect substitutes.B. **plements.C. Necessities.D. None of the above.2. Suppose the economy is running at the level of potential GDP, an increase in government spending in the long run will ___ the price level and ___ the output level,A. Increase, not changeB. Increase, increaseC. Increase, decreaseD. Decrease, increase3. For a natural monopoly, the optimal policy for a regulator to set is a price such that: ()A. The price level equals marginal cost.B. The price level equals average variable cost.C. The price level equals average total cost but higher than marginal cost.D. The price level is lower than marginal cost but higher than average total cost.4. If AD shifts to the right to adapt to oil shocks from OPEC, then: ()A. P and GDP will remain normal automatically.B. GDP may be unchanged although P will rise.C. GDP will rise and P will drop.D. The domestic P of oil will drop.5. School students paying a lower fare than adults on the MTR trains, or cheaper tickets to the theatre, is an example of: ()A. The suppliers making less profit because some customers pay a lower price.B. Consumers obtaining more consumer surplus.C. Price discrimination allowing the suppliers to make more profit from charging a higher price to customers whose demand is more elastic.D. Price discrimination allowing the suppliers to make more profit from charging a lower price to customers whose demand is more elastic.6. When the nominal interest rate rises, ()A. Economic activity is encouraged.B. The real interest rate rises and the price of bonds rises.C. Inflation rises and the real interest rate falls.D. The real interest rate rises and the price of bonds falls.7. A firm has fixed costs of £100,000 per month and variable costs of £25 for item. It proposes to sell these items for £50 each. What is the break-even output for this firm? ()A. 4,000 unitsB. 4,000 units in a month.C. Cannot be worked out from the information.D. 2,000 units per month.8. For an A- rated corporate bond that has deteriorating fundamentals, but is expected to remain investment grade, the greatest risk is most likely: ()A. Event risk.B. Default risk.C. Liquidity risk.D. Credit spread risk.9. An investor currently has a portfolio valued at $700,000. The investor’s objective is long-term growth, but the investor will need $30,000 by the end of the year to pay her so n’s college tuition and another $10,000 by year-end for her annual vacation. The investor is considering four alternative portfolios: Portfolio Expected Return Standard Deviation of Returns 1.8% 10% 2.10% 13% 3.14% 22% 4.18% 35% Using Roy’s safet y-first criterion, which of the alternative portfolios minimizes the probability that the investor’s portfolio will have a value lower than $700,000 at year-end? ()A. Portfolio 1.B. Portfolio 2.C. Portfolio 3.D. Portfolio 4.10. A futures trader must deposit an additional amount of money into a margin account at the clearinghouse if the margin account ending balance is below the: ()A. Initial margin requirement.B. Variation margin requirement.C. Maintenance margin requirement.D. Amount of the loan borrowed from the clearinghouse.SECTION TWO(Compulsory):Reading ComprehensionJason Johnson, CFA, is a principal of a large private equity firm in New York. One of the associates in his firm has identified a potential investment opportunity for the firm. Gasline, Inc. is a major producer of pipeline used in the production of natural gas in the Southwest United States. Last year, Gasline had approximately $150 million in sales, and sales are expected to increase as a result of increasing demand for their product. **pany was founded over twenty-five years ago, and has been publically traded for the last ten years. The founder of **pany, along with other members of the family, holds the majority of **mon stock, and the group is amenable to liquidating their collective position at this time. Johnson’s associate believes there is significant opportunity in the industry, based upon new technology that allows for the extraction of natural gas from locations and depths that previously were too cost-prohibitive. This new technology should translate into increased demand for the industry, both domestically and abroad. Johnson concurs with this forecast for the industry, but believes further in-depth analysis must be performed beforeany investment decision can be made. Of particular concern to Johnson is Gasline’s numerous, complicated transactions related to **pany’s various stock-**pensation plans. Over the past decade, **pany has participated in varying degrees in programs involving stock option grants, an employee stock purchase plan, and performance-based awards. Johnson believes that thorough analysis of each program will determine whether or not the programs were properly accounted for in Gasline’s financial statements. The CEO of Gasline was awarded a stock option package at the beginning of 2006, which could ultimately have a significant impact on **pany’s future earnings. Details of the CEO’s stock option grant are outlined below. **pany established an employee stock purchase plan in 2004. Under the existing plan guidelines, full-time employees of Gasline that **pleted 3 years of service are eligible to purchase up to 1,000 Gasline shares per year at a 15% discount. Since inception of the program, employees of **pany have purchased approximately 75,000 shares. In the footnotes to **pany’s financial statements, it states th at Gasline’s management has determined that the plan is noncompensatory and therefore no compensation expense has been recognized in association with the plan. Part of the **pensation package for Gasline **es through participation in a service-based stock awards grant program. Under this program, all full-time employees are awarded 100 shares of **mon stock on July 1st of each year. Employees vest at the rate of 20% each year, and are fully vested after **pletion of five years of service. Employees that leave **pany or retire prior to being fully vested forfeit all interest in the stock. Johnson questions whether or not Gasline’s accounting treatment of this program is fully in accordance with FASB standards. CEO Options (grant date January 1, 2006)11. For the valuation of the CEO’s stock options granted on January 1, 2006, Gasline estimated a fair value of $100,000 by using Monte Carlo simulation. In accordance with SFAS No. 123(R), which of the following statements is most accurate? Gasline’s accounting treatment of the options is: ()A. In compliance because a Monte Carlo simulation is an acceptable method of valuing options in the absence of a market-based instrument.B. Not in compliance because the fair value must be established by using the Black-Scholes option pricing model.C. Not in compliance because the options had no intrinsic value as of the grant date.D. In compliance because the firm can elect to use either the intrinsic value model or the fair value model in the valuation of stock option plans.12. Assume that the CEO of Gasline exercises 25,000 of his options on December 31, 2006, andthe market price of the stock on that date is $39.50. Calculate the **pensation expense for the year ending 2006 that Gasline should recognize in association with the CEO option grant. ()A. $62,500.B. $25,000.C. $100,000D. $0.13. In accordance with SFAS No. 123(R), which of the following statements regarding Gasline’s employee stock purchase plan is most accurate? ()A. The plan cannot be considered noncompensatory because the discount exceeds the per share transaction cost of a public offering.B. The plan can be considered noncompensatory because it is offered equally to all full-time employees, not just upper management.C. The plan cannot be considered noncompensatory because participation is voluntary on the part of the employees.D. The plan can be considered noncompensatory because of the existence of the service-based stock awards grant program.14. If an employee stock purchase plan is considered noncompensatory in accordance with SFAS No. 123(R): ()A. Compensation expense is recognized over the projected remaining service life of each employee.B. Compensation expense is deferred until the shares are sold.C. No compensation expense is recognized.D. Compensation expense is limited to the amount of the discount.15. SFAS No. 123(R) gives specific guidelines as to what date is to be used to establish the fair value of the stock awarded through a service-based award program, and whether or not any adjustment for awards that did not vest must be made to compensation expense at the end of the vesting period. Which of the follo wing guidelines is most applicable to Gasline’s program? () Date that fair value is established "True-up" adjustment necessary?A. Grant date NoB. Last day of grant year YesC. Grant date YesD. Last day of grant year NoSECTION THREE(Compulsory):Explanations of terms16. Speculative demand for money17. Time lag18. Floating exchange rate19. Present value20. The OTC MarketSECTION FOUR(Compulsory):Answer questions21. What is Common Stock?22. What is the Controllability?23. What is the monetary base?24. List the Counter-measures of Inflation as more as possible.。