对外经贸大学金融英语考试试题附答案

- 格式:pdf

- 大小:305.35 KB

- 文档页数:20

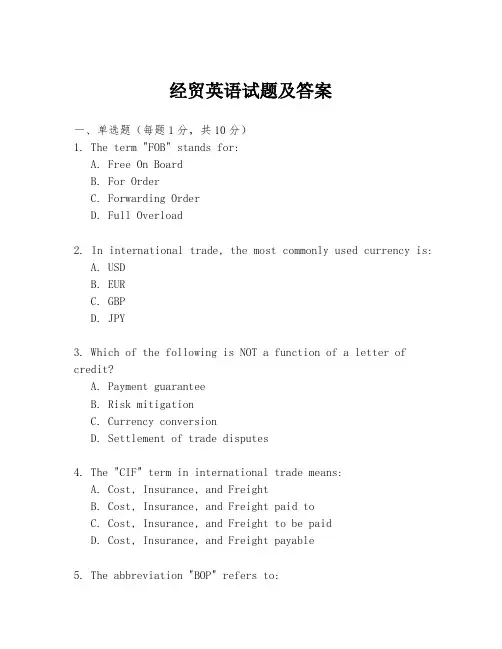

经贸英语试题及答案一、单选题(每题1分,共10分)1. The term "FOB" stands for:A. Free On BoardB. For OrderC. Forwarding OrderD. Full Overload2. In international trade, the most commonly used currency is:A. USDB. EURC. GBPD. JPY3. Which of the following is NOT a function of a letter of credit?A. Payment guaranteeB. Risk mitigationC. Currency conversionD. Settlement of trade disputes4. The "CIF" term in international trade means:A. Cost, Insurance, and FreightB. Cost, Insurance, and Freight paid toC. Cost, Insurance, and Freight to be paidD. Cost, Insurance, and Freight payable5. The abbreviation "BOP" refers to:A. Balance of PaymentsB. Business Operating PlanC. Bureau of PersonnelD. Board of Professionals6. The "T/T" payment method stands for:A. Telegraphic TransferB. Trade TransferC. Total TransferD. Time Transfer7. Which of the following is a non-tariff barrier to trade?A. Import quotaB. Customs dutyC. SubsidyD. Trade embargo8. The term "GATT" is associated with:A. General Agreement on Tariffs and TradeB. Global Alliance for Trade and TechnologyC. Global Association of Trade and TransportD. Global Agreement on Trade Terms9. The "D/P" term in trade documents refers to:A. Documents against PaymentB. Documents against PresentationC. Documents against PerformanceD. Documents against Promise10. The "L/C" is commonly understood to mean:A. Letter of CreditB. Letter of ComplaintC. Letter of ConfirmationD. Letter of Commitment答案:1-5 A A D A A6-10 A D A A A二、填空题(每题1分,共10分)1. The abbreviation "GDP" stands for ________, which is a measure of the economic performance of a country.2. In international trade, the term "EXW" means ________, indicating that the seller delivers the goods to the buyer's premises.3. A "proforma invoice" is a ________ document that outlines the details of a transaction but is not a legally binding contract.4. The "BOP" consists of two parts: the current account and the ________ account.5. The term "DAP" stands for Delivered At Place, which means the seller has fulfilled their obligations once the goods are ________ at the agreed place.6. The "UNCTAD" is an abbreviation for the United Nations Conference on Trade and Development, which focuses on promoting ________ and development.7. The "FCA" term in Incoterms means Free Carrier, where the risk of loss or damage to the goods passes from the seller to the buyer when the goods are ________ to the carrier.8. The "H.S. Code" refers to the Harmonized Commodity Description and Coding System, which is used for ________ purposes.9. The "CFR" term stands for Cost and Freight, where the seller pays for the cost and freight necessary to bring the goods to the named port of ________.10. The "TIR" system is an international customs transit system for road transport, which facilitates the movement of goods under cover of a single, internationally recognized________.答案:1. Gross Domestic Product2. Ex Works3. preliminary or non-contractual4. capital5. ready and available6. trade7. handed over8. customs classification9. destination10. customs guarantee三、简答题(每题5分,共20分)1. What are the main differences between a documentary collection and a documentary credit?2. Explain the concept of "Most Favored Nation" (MFN) in international trade.3. What are the key components of a sales contract in international trade?4. Describe the role of the International Chamber of Commerce (ICC) in the context of international trade.答案:1. A documentary collection is a method of payment where the bank acts as an intermediary to collect payment on behalf of the seller. A documentary credit, on the other hand, is a commitment by a bank at the request of the buyer to pay a specified amount to the seller under specific terms and conditions.2. The Most Favored Nation (MFN) treatment is a principle in international trade where a country grants another country the。

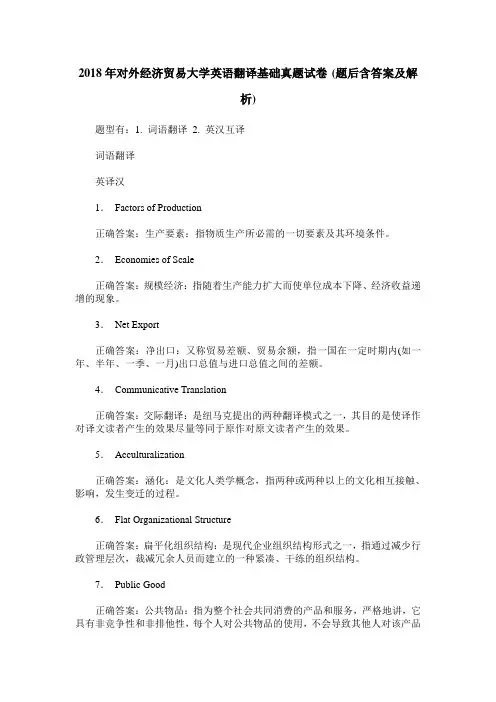

2018年对外经济贸易大学英语翻译基础真题试卷(题后含答案及解析)题型有:1. 词语翻译 2. 英汉互译词语翻译英译汉1.Factors of Production正确答案:生产要素:指物质生产所必需的一切要素及其环境条件。

2.Economies of Scale正确答案:规模经济:指随着生产能力扩大而使单位成本下降、经济收益递增的现象。

3.Net Export正确答案:净出口:又称贸易差额、贸易余额,指一国在一定时期内(如一年、半年、一季、一月)出口总值与进口总值之间的差额。

4.Communicative Translation正确答案:交际翻译:是纽马克提出的两种翻译模式之一,其目的是使译作对译文读者产生的效果尽量等同于原作对原文读者产生的效果。

5.Acculturalization正确答案:涵化:是文化人类学概念,指两种或两种以上的文化相互接触、影响,发生变迁的过程。

6.Flat Organizational Structure正确答案:扁平化组织结构:是现代企业组织结构形式之一,指通过减少行政管理层次,裁减冗余人员而建立的一种紧凑、干练的组织结构。

7.Public Good正确答案:公共物品:指为整个社会共同消费的产品和服务,严格地讲,它具有非竞争性和非排他性,每个人对公共物品的使用,不会导致其他人对该产品消费的减少。

8.the Butterfly Effect正确答案:蝴蝶效应:指在长时间和大范围内,微小的空气系统变化可能导致连锁反应,并最终导致其他系统产生极大变化。

汉译英9.定位正确答案:positioning: it is a marketing strategy that aims to make a brand occupy a distinct position, relative to competing brands, in the mind of the customer.10.海上丝绸之路正确答案:Maritime Silk Road: it started from China’s south-east coastal regions, traversing a vast expanse of oceans and seas to countries in Southeast Asia, Africa and Europe. This trading route that connects the East and the West, had enhanced the exchanges of commodities, people and culture among countries situated on the road.11.平行文本正确答案:parallel text: it is a corresponding original text in different languages.12.先发优势正确答案:first-mover advantage: in marketing strategy, it is the advantage gained by the initial significant occupant of a market segment.13.小康社会正确答案:moderately prosperous society: it is a Chinese term used to refer to China’s development goals. Achieving a “moderately prosperous society” includes not only a target for income and consumption but also development of education, health, environmental improvement and other strategic factors.14.人种学研究正确答案:ethnology study: it refers to the study of ethnology, which is the branch of anthropology that compares and analyzes the characteristics of different peoples and the relationships between them.15.再生家庭正确答案:family of procreation; it refers to the family that is formed through marriage and by having or a-dopting children.16.特许商品正确答案:licensed product: it is a product whose development, manufacturing, marketing, and sales has been licensed by the brand owner to others who want to use the brand in association with a product, for an agreed period of time, within an agreed territory.英汉互译英译汉17.Once conform, once do what other people do finer than they do it, and a lethargy steals over all the finer nerves and faculties of the soul. He becomes all outer show and inward emptiness; dull, callous, and indifferent.正确答案:一旦循规蹈矩,一旦人为亦为、有过之而无不及,呆滞就会渐渐控制灵魂中一切灵敏的神经和官能。

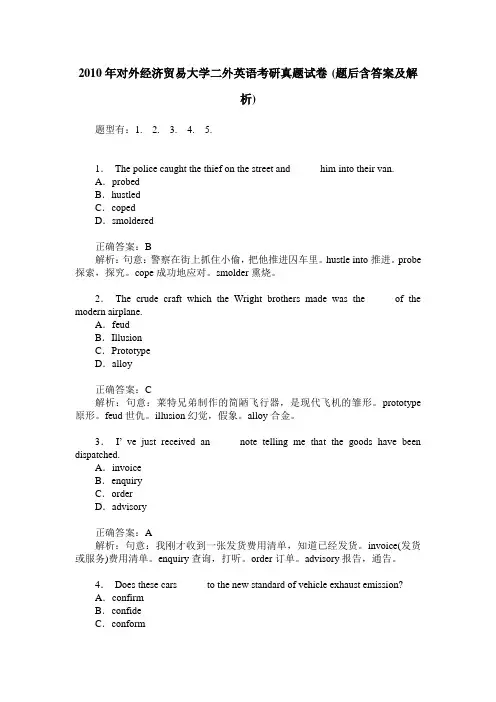

2010年对外经济贸易大学二外英语考研真题试卷(题后含答案及解析)题型有:1. 2. 3. 4. 5.1.The police caught the thief on the street and______him into their van.A.probedB.hustledC.copedD.smoldered正确答案:B解析:句意:警察在街上抓住小偷,把他推进囚车里。

hustle into推进。

probe 探索,探究。

cope成功地应对。

smolder熏烧。

2.The crude craft which the Wright brothers made was the______of the modern airplane.A.feudB.IllusionC.PrototypeD.alloy正确答案:C解析:句意:莱特兄弟制作的简陋飞行器,是现代飞机的雏形。

prototype 原形。

feud世仇。

illusion幻觉,假象。

alloy合金。

3.I’ve just received an______note telling me that the goods have been dispatched.A.invoiceB.enquiryC.orderD.advisory正确答案:A解析:句意:我刚才收到一张发货费用清单,知道已经发货。

invoice(发货或服务)费用清单。

enquiry查询,打听。

order订单。

advisory报告,通告。

4.Does these cars______to the new standard of vehicle exhaust emission?A.confirmB.confideC.conformD.complement正确答案:C解析:句意:这些汽车符合汽车废气排放的新标准吗?conform to符合,遵从。

confirm批准,确认。

confide(向某人)吐露(秘密、隐私等)。

经贸英语——考试题库及答案.docxThe cost of packing is the mode of packing, distance of tr ansportation and the price terms.收藏A.responsible forB.subject toC.available toD.paid by回答错误!正确答案:BWe d like to a sole agency agreement with you yo ur cotton goods for a period of three years.收藏A.assign ??- forB.sign ??- onC.come to ??- inD.reach ??- at回答错误!正确答案:BWe have the pleasure to inform you that the shipment has gone for ward per s.s. East Wind and hope that it will arrive at the in perfect condition.收藏A. aimB.destinationC.purposeD.goal回答错误!正确答案:BWe have numerous connections throughout the country and there a re good of a very profitable market for your manufactures.收藏A.illusionsB.prospectsC.wishesD.aspectsPlease that we would do what we can to support you as f ar as your sales territory is concerned.收藏A.assureB.be assuredC.assure usD.be sure回答错误!正确答案:BOur best offer is given below to our final confirmation.收藏A.to subjectB.subjectC.subjectingD.subjectedWe hope you will double your efforts to build a large turnover s to a closer arrangement like sole agency.收藏A.allowB.grantC.modifyD.justify回答错误!正确答案:DPlease let us have details of your machine tools, your est delivery.收藏A.give usB.giving usC.given usD.to give us so a earliAs the time for shipment is now considerably , we should be obliged if you would inform us, by return of post, of the reason for the delay.收藏A.overdueB.overdoneC.overchargedD.due回答错误!正确答案:AWe offer you the following items your reply reaching here by 3 p.m. April 12, our time.收藏A.subjects toB.subject toC.subjecting toD.to subject to回答错误!正确答案:BWe have come to learn your name through the US Embassyin Beiji ng importers of plastic products.收藏A.withB.inC.forD.as回答错误!正确答案:DA survey report is enclosed and your early settlement is re quested.收藏A.in your referenceB.in your contrastC.in your comparisonD.。

对外经济贸易大学考博英语模拟试卷1(题后含答案及解析)题型有:1. Structure and V ocabulary 2. Error Identification 3. Cloze 4. Proofreading 5. Chinese-English TranslationStructure and V ocabulary1.Everyone must have liked the cake because there wasn’t even a ______left.A.crutchB.chipC.chopD.clip正确答案:B解析:本题是一道词义辨析题,crutch含义为“支柱,叉柱”;chip含义为“碎片,碎屑”;chop含义为“一块排骨”;clip含义为“夹钳”。

根据句意,本题应该选B。

2.Mary ______when she found her husband drunk again.A.blew her topB.became abnormalC.was affectedD.in opposition正确答案:A解析:本题是一道词义辨析题,blow one’s top含义为“发脾气”;become abnormal含义为“变得反常”;be affected含义为“被影响”;in opposition含义为“反对”。

根据句意,A最适合。

3.During the famine many people ______eating grass and leaves.A.felt inclined toB.were confronted withC.got accustomed toD.were reduced to正确答案:D解析:本题是一道词义辨析题,come on含义为“跟着来”;come off含义为“离开”;come out含义为“出来”;come up含义为“偶然获得”。

根据句意,D 最合适。

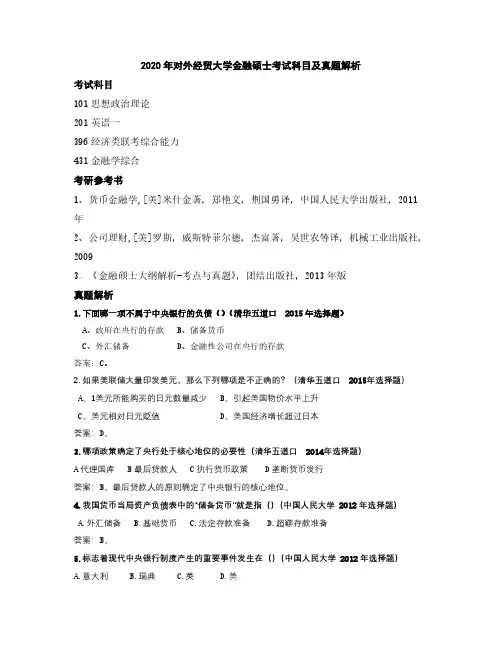

超详细!2021对外经济贸易大学MTI真题+答案211翻译硕士英语一、单选20题近义词辨析untacheduntachable unequal unequable固定搭配poverty alleviation(脱贫)depreciationvolatile “v”开头的很多词意辨析consultancy和 redundancy 区别很多题都是,一道题两个空,一般只清楚一个空,另一个空单词不认识,很难选二、文体改错10题comma price, run on, fragment 比较多,也有correct,choppy比较少,没有stringy三、阅读,2篇常规阅读,1篇5选5,1篇判断正误第一篇2017年12月六级真(第一套),判断正误Our world now moves so fast that we seldom stop tosee just how far we have come in just a few years. The latest iPhone 6s, forexample, has a dual-core processor and fits nicely into your pocket. comparison,you would expect to find a technological specification like this on yourstandard laptop in an office anywhere in the world.It's no wonder that new applications for theInternet of Things are moving ahead fast when almost every new device we buy hasa plug on the end of it or a wireless connection to the internet. Soon, our currentsmartphone lifestyle will expand to create our own smart home lifestyle too.All researches agree that close to 25 billiondevices, things and sensors will be connected 2020 which incidentally isalso the moment that Millennials (千禧一代) are expected to make up 75 percent of our overallworkforce, and the fully connected home will become a reality for large numbersof people worldwide.However, this is just the tip of the proverbialiceberg as smart buildings and even cities increasingly become the norm asleaders and business owners begin to wake up to the massive savings thattechnology can deliver through connected sensors and new forms of automationcoupled with intelligent energy and facilities management.Online security cameras, intelligent lighting and awealth of sensors that control both temperature and air quality are offering anunprecedented level of control, efficiency, and improvements to what were onceclassed necessary costs when running a business or managing a large building.We can expect that the ever-growing list ofdevices, systems and environments remain connected, always online and talkingto each other. The big benefit will not only be in the housing of this enormousand rapidly growing amount of data, but will also be in the ability torun realtime data analytics to extract actionable and ongoing knowledge.The biggest and most exciting challenge of thistechnology is how to creatively leverage this ever-growing amount of data todeliver cost savings, improvements and tangible benefits to both businesses andcitizens of these smart cities.The good news is that most of this technology isalready invented. Let's face it, it wasn't too long ago that the idea ofworking from anywhere and at anytime was some form of a distant Utopian (乌托邦式的) dream, and yet now we can perform almost anyoffice-based task from any location in the world as long as we have access tothe internet.It's time to wake up to the fact that making smartbuildings, cities and homes will dramatically improve our quality of life inthe years ahead.第二篇,选自2019年5月一篇经济学人文章Sleepless in Silicon ValleyWhy the techie obsession with sleep technologymakes perfect senseFirst, close the blackout blinds in your bedroom.Eat dinner at 4pm, and do not eat or drink anything after 6pm. Put on yourblue-light blocking glasses at 8pm. Set your bedroom temperature to 67oF{19.4C) and your electric blanket to 69.8oF {21 C). At 8.45pm, meditate forfive to ten minutes. Switch on your deep- wave sound machine. Put on yourQurasleep tracking ring. You are now, finally, ready for slumber. This may allsound a bit over the top. But this is the "sleep hygiene" routinedescribed in a recent blog post Bryan Johnson, who sold his previous companyto eBay for $800m and is now chief executive of Kernel, a startup developingbrain-computer interfaces. He admits that his sleep routine has "decimatedmy social life”, and that his partner sleeps in a different room, but says allthis troubleis worth it, because it has boosted his level of "deepsleep" as much as 157%. He has bought Oura rings for all his employees.Mr Johnson does not expect other people to copy hisroutine, but made it public to encourage the sharing of sleep habits and tips.Like many other techies, he regards sleep hygiene as an effective way tomaintain mental health, boost cognition and enhance productivity. In its mostrecent funding round, backers of Oura, the Finnish maker of the high-tech ring,included the co- founders of YouTube and Twitch, along with alumni ofFacebook,Skype and . The ring's most famous user is Jack Dorsey, the boss ofTwitter, whose unusual wellness regime-which also incorporates near-infraredsaunas, radiation blocking Faraday tents, fasting and cryotherapy- prompted theNew York Times this month to dub him “Gwyneth Paltrow for Silicon Valley”. Fortech tycoons, it seems, sleep is the new fitness.Those who want to monitor and improve their sleephaveno shortage of gadgets to choose from. As well as electric blankets andmattress- chillers, sound machines and "decimated my social life” smartrings, there are also smart pillows, sleep-tracking watches and bracelets,intelligentsleep masks, brain-stimulating headbands, bedside sleep sensors andcountless sleep- monitoring apps. The market for sleep technology was worth$58bn in 2014 and is expected to grow to $81bn 2020, according toPersistence, a market-research firm. Big companies in the field includehousehold names such as Apple, Bose, Nokia and Philips. After Mr Dorsey'senthusiastic endorsement, the Oura rings are back- ordered four to sixweeks.The mania for sleep technology makes perfect sensefor the tech industry, combining as it does several existing trends. For astart, it fits with the industry's metrics -driven worldview. Techies obsessabout OKRs {objectives and key results), KPIs {key performance indicators) anddigital-analytics dashboards showing the performance of specific products andfeatures. Applying similar techniques to sleep and other aspects of theirpersonal lives, an approach known as the "quantified self" seems alogical step. As those in the startup world like to say, channeling Peter Drucker,a management guru, "what's measured improves."Sleep- tracking also aligns neatly with Silicon Valley'scult of productivity, and the constant search for "life hacks" thatwill make entrepreneurs more effective, efficient and successful. This ranges fromwearing the same clothes every day, Steve Jobs-style (thus avoiding wastingtime deciding what to put on), to fastidious fitness routines and complicateddiets. Elaborate sleep regimes slot right in, because they promise clarity ofthought and improved cognitive performance. They also let people extend theirquantified· self and life- -hacking efforts into the one part of the day that waspreviously untouched: shut-eye.Relentlessly pursuing productivity only whileyou are awake is for wimps. Sleep -tracking means you can do it round theclock. Oura describes its sensor packed ring as a "secret weapon forpersonal improvement"- -another way to get ahead.1.下列说法符合文章标题的是?A how to?B how to achieve self-improvementC how to monitor your sleepingD seeping hyhegnie and technology that can improveefciency2.What dose "Iife hacks "mean?A life tipsB?C?D privacy monitoring3. What does the sentence mean "decimated m ysocial life”4. What does the sentence mean "the Oura ringsare back- ordered four to six weeks."?5.搞科技的为啥喜欢这个?选项为D.以上全部第三篇: Cosco CiscoIntel 这些公司预见未来,制定未来发展计划的情况,哪些公司可以紧跟时代潮流。

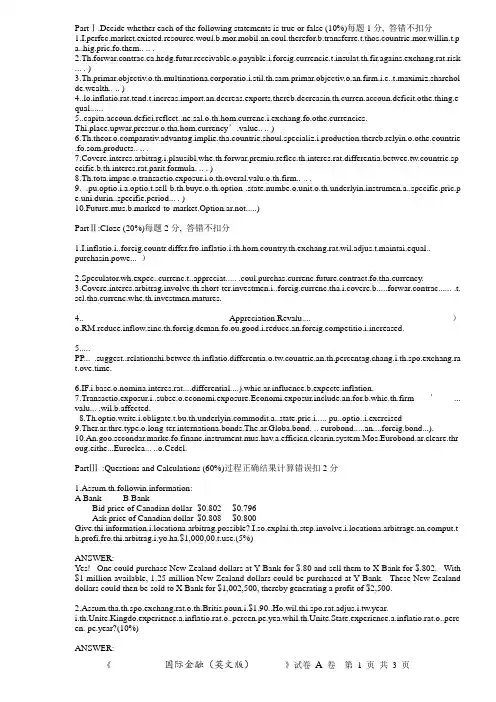

PartⅠ.Decide whether each of the following statements is true or false (10%)每题1分, 答错不扣分1.I.perfec.market.existed.resource.woul.b.mor.mobil.an.coul.therefor.b.transferre.t.thos.countrie.mor.willin.t.pa..hig.pric.fo.them.. .. .2.Th.forwar.contrac.ca.hedg.futur.receivable.o.payable.i.foreig.currencie.t.insulat.th.fir.agains.exchang.rat.risk ... . )3.Th.primar.objectiv.o.th.multinationa.corporatio.i.stil.th.sam.primar.objectiv.o.an.firm.i.e..t.maximiz.sharehol de.wealth.. .. )4..lo.inflatio.rat.tend.t.increas.import.an.decreas.exports.thereb.decreasin.th.curren.accoun.deficit.othe.thing.e qual......5..capita.accoun.defici.reflect..ne.sal.o.th.hom.currenc.i.exchang.fo.othe.currencies.Thi.place.upwar.pressur.o.tha.hom.currency’.value.. .. )parativ.advantag.implie.tha.countrie.shoul.specializ.i.production.thereb.relyin.o.othe.countrie .fo.som.products.. .. .7.Covere.interes.arbitrag.i.plausibl.whe.th.forwar.premiu.reflec.th.interes.rat.differentia.betwee.tw.countrie.sp ecifie.b.th.interes.rat.parit.formula. .. . )8.Th.tota.impac.o.transactio.exposur.i.o.th.overal.valu.o.th.firm.. .. .9. .pu.optio.i.a.optio.t.sell-b.th.buye.o.th.option-.state.numbe.o.unit.o.th.underlyin.instrumen.a..specifie.pric.pe.uni.durin..specifie.period... . )10.Future.mus.b.marked-to-market.Option.ar.not.....)PartⅡ:Cloze (20%)每题2分, 答错不扣分1.I.inflatio.i..foreig.countr.differ.fro.inflatio.i.th.hom.country.th.exchang.rat.wil.adjus.t.maintai.equal.. purchasin.powe... )2.Speculator.wh.expec..currenc.t..appreciat..... .coul.purchas.currenc.future.contract.fo.tha.currency.3.Covere.interes.arbitrag.involve.th.short-ter.investmen.i..foreig.currenc.tha.i.covere.b.....forwar.contrac...... .t. sel.tha.currenc.whe.th.investmen.matures.4.. Appreciation.Revalu....)petitio.i.increased.5.....PP... .suggest..relationshi.betwee.th.inflatio.differentia.o.tw.countrie.an.th.percentag.chang.i.th.spo.exchang.ra t.ove.time.6.IF.i.base.o.nomina.interes.rat....differential....).whic.ar.influence.b.expecte.inflation.7.Transactio.exposur.i..subse.o.economi.exposure.Economi.exposur.include.an.for.b.whic.th.firm’... valu... .wil.b.affected.modit.a..state.pric.i..... pu..optio..i.exercised9.Ther.ar.thre.type.o.long-ter.internationa.bonds.The.ar.Globa.bond. .. eurobond.....an....foreig.bond...).10.An.goo.secondar.marke.fo.financ.instrument.mus.hav.a.efficien.clearin.system.Mos.Eurobond.ar.cleare.thr oug.eithe...Euroclea... ..o.Cedel.PartⅢ:Questions and Calculations (60%)过程正确结果计算错误扣2分rmation:A BankB BankBid price of Canadian dollar $0.802 $0.796Ask price of Canadian dollar $0.808 $0.800rmation.i.locationa.arbitrag.possible?put.t h.profi.fro.thi.arbitrag.i.yo.ha.$1,000,e.(5%)ANSWER:Yes! One could purchase New Zealand dollars at Y Bank for $.80 and sell them to X Bank for $.802. With $1 million available, 1.25 million New Zealand dollars could be purchased at Y Bank. These New Zealand dollars could then be sold to X Bank for $1,002,500, thereby generating a profit of $2,500.2.Assum.tha.th.spo.exchang.rat.o.th.Britis.poun.i.$1.90..Ho.wil.thi.spo.rat.adjus.i.tw.year.i.th.Unite.Kingdo.experience.a.inflatio.rat.o..percen.pe.yea.whil.th.Unite.State.experience.a.inflatio.rat.o..perc en. pe.year?(10%)ANSWER:According to PPP, forward rate/spot=indexdom/indexforth.exchang.rat.o.th.poun.wil.depreciat.b.4..percent.Therefore.th.spo.rat.woul.adjus.t.$1.9..[..(–.047)..$1.81073.Assum.tha.th.spo.exchang.rat.o.th.Singapor.dolla.i.$0.70..Th.one-yea.interes.rat.i.1.percen.i.th.Unite.State.a n..percen.i.Singapore..Wha.wil.th.spo.rat.b.i.on.yea.accordin.t.th.IFE?.(5%)ANSWER: according to the IFE,St+1/St=(1+Rh)/(1+Rf)$.70 × (1 + .04) = $0.7284.Assum.tha.XY.Co.ha.ne.receivable.o.100,00.Singapor.dollar.i.9.days..Th.spo.rat.o.th.S.i.$0.50.an.th.Singap or.interes.rat.i.2.ove.9.days..Sugges.ho.th.U.S.fir.coul.implemen..mone.marke.hedge..B.precis. .(10%)ANSWER: The firm could borrow the amount of Singapore dollars so that the 100,000 Singapore dollars to be received could be used to pay off the loan. This amounts to (100,000/1.02) = about S$98,039, which could be converted to about $49,020 and invested. The borrowing of Singapore dollars has offset the transaction exposure due to the future receivables in Singapore dollars.pan.ordere..Jagua.sedan.I..month..i.wil.pa.£30,00.fo.th.car.I.worrie.tha.poun.ster1in.migh.ris.sharpl.fro.th.curren.rate($1.90)pan.bough...mont.poun.cal.(suppose.contrac.siz..£35,000.wit..strik.pric.o.$1.9.fo..premiu.o.2..cents/£.(1)Is hedging in the options market better if the £ rose to $1.92 in 6 months?(2)what did the exchange rate have to be for the company to break even?(15%)Solution:(1)I.th..ros.t.$pan.woul. exercis.th.poun.cal.option.Th.su.o.th.strik.pric.an.premiu..i.$1.90 + $0.023 = $1.9230/£Thi.i.bigge.tha.$1.92.So hedging in the options market is not better.(2.whe.w.sa.th. compan.ca.brea.even.w.mea.tha.hedgin.o.no.hedgin.doesn’. matter.An.onl.whe.(strik.pric..premiu.).th.exchang.rat.,hedging or not doesn’t matter.So, the exchange rate =$1.923/£.6.Discus.th.advantage.an.disadvantage.o.fixe.exchang.rat.system.(15%)textbook page50 答案以教材第50 页为准PART Ⅳ: Diagram(10%)Th.strik.pric.fo..cal.i.$1.67/£.Th.premiu.quote.a.th.Exchang.i.$0.022.pe.Britis.pound.Diagram the profit and loss potential, and the break-even price for this call optionSolution:Following diagram shows the profit and loss potential, and the break-even price of this put option:PART Ⅴa) b) Calculate the expected value of the hedge.c) How could you replicate this hedge in the money market?Yo.ar.expectin.revenue.o.Y100,00.i.on.mont.tha.yo.wil.nee.t.cover.t.dollars.Yo.coul.hedg.thi.i.forwar.market.b.takin.lon.position.i.U.dollar.(shor.position.i.Japanes.Yen).B.lockin.i.you.pric.a.$..Y105.you.dolla.revenue.ar.guarantee.t.b.Y100,000/ 105 = $952You could replicate this hedge by using the following:a) Borrow in Japanb) Convert the Yen to dollarsc) Invest the dollars in the USd) Pay back the loan when you receive the Y100,000。

金融英语考试试题及答案金融英语是金融领域中不可或缺的一部分,对于从事金融行业的人士来说,掌握金融英语的知识非常重要。

为了帮助大家更好地备考金融英语考试,本文将为大家提供一些常见的金融英语考试试题及答案。

一、选择题1. What is the meaning of IPO?a) Initial Public Offeringb) International Purchase Orderc) Investment Portfolio Optimizationd) International Partnership Organization答案:a) Initial Public Offering2. What does the term "capital market" refer to?a) The market for physical capitalb) The market for financial assets with a maturity of less than a yearc) The market for financial assets with a maturity of more than a yeard) The market for real estate properties答案:c) The market for financial assets with a maturity of more than a year3. Which of the following is an example of a derivative?a) Stockb) Bondc) Optiond) Certificate of Deposit答案:c) Option4. What is the opposite of a deficit?a) Surplusb) Debtc) Liabilityd) Equity答案:a) Surplus5. What is the term for a loan that is secured by collateral?a) Unsecured loanb) Subordinated loanc) Secured loand) Revolving loan答案:c) Secured loan二、填空题1. The study of how individuals and institutions make financial decisions and how these decisions affect the allocation of resources is known as__________.答案:finance2. When a company issues shares for the first time and offers them to the public, it is called an ____________.答案:IPO (Initial Public Offering)3. The interest rate that a commercial bank charges its most creditworthy customers is known as the _________.答案:prime rate4. A financial instrument that represents ownership in a corporation is called a ___________.答案:stock5. The basic economic problem of having seemingly unlimited human wants in a world of limited resources is known as ________.答案:scarcity三、解答题1. Explain the concept of time value of money.答案:The time value of money refers to the idea that a dollar today is worth more than a dollar in the future. This is because money can be invested and earn interest over time. Therefore, receiving a dollar today ismore desirable than receiving the same amount in the future. The time value of money is an important concept in finance and is used to calculate the present value of future cash flows.2. What are the main functions of a central bank?答案:The main functions of a central bank include:- Monetary policy: Central banks are responsible for formulating and implementing monetary policy to control the money supply and interest rates in an economy. This is done to achieve specific macroeconomic objectives, such as price stability and economic growth.- Banker to the government: Central banks act as the government's bank and provide services such as managing the government's accounts, issuing government securities, and acting as a lender of last resort.- Banker to commercial banks: Central banks also provide banking services to commercial banks, including maintaining accounts, providing short-term loans, and overseeing the stability of the banking system.- Currency issuance: Central banks are responsible for issuing and circulating the national currency.- Financial stability: Central banks play a crucial role in maintaining financial stability and monitoring risks in the banking system.总结:本文为大家提供了一些常见的金融英语考试试题及答案。

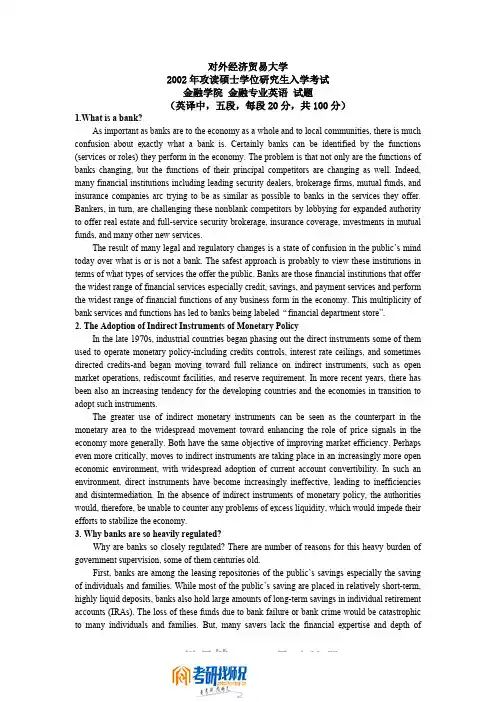

对外经济贸易大学2002年攻读硕士学位研究生入学考试金融学院金融专业英语试题(英译中,五段,每段20分,共100分)1.What is a bank?As important as banks are to the economy as a whole and to local communities, there is much confusion about exactly what a bank is. Certainly banks can be identified by the functions (services or roles) they perform in the economy. The problem is that not only are the functions of banks changing, but the functions of their principal competitors are changing as well. Indeed, many financial institutions including leading security dealers, brokerage firms, mutual funds, and insurance companies arc trying to be as similar as possible to banks in the services they offer. Bankers, in turn, are challenging these nonblank competitors by lobbying for expanded authority to offer real estate and full-service security brokerage, insurance coverage, investments in mutual funds, and many other new services.The result of many legal and regulatory changes is a state of confusion in the public’s mind today over what is or is not a bank. The safest approach is probably to view these institutions in terms of what types of services the offer the public. Banks are those financial institutions that offer the widest range of financial services especially credit, savings, and payment services and perform the widest range of financial functions of any business form in the economy. This multiplicity of bank services and functions has led to banks being labeled“financial department store”.2. The Adoption of Indirect Instruments of Monetary PolicyIn the late 1970s, industrial countries began phasing out the direct instruments some of them used to operate monetary policy-including credits controls, interest rate ceilings, and sometimes directed credits-and began moving toward full reliance on indirect instruments, such as open market operations, rediscount facilities, and reserve requirement. In more recent years, there has been also an increasing tendency for the developing countries and the economies in transition to adopt such instruments.The greater use of indirect monetary instruments can be seen as the counterpart in the monetary area to the widespread movement toward enhancing the role of price signals in the economy more generally. Both have the same objective of improving market efficiency. Perhaps even more critically, moves to indirect instruments are taking place in an increasingly more open economic environment, with widespread adoption of current account convertibility. In such an environment, direct instruments have become increasingly ineffective, leading to inefficiencies and disintermediation. In the absence of indirect instruments of monetary policy, the authorities would, therefore, be unable to counter any problems of excess liquidity, which would impede their efforts to stabilize the economy.3. Why banks are so heavily regulated?Why are banks so closely regulated? There are number of reasons for this heavy burden of government supervision, some of them centuries old.First, banks are among the leasing repositories of the public’s savings especially the saving of individuals and families. While most of the public’s saving are placed in relatively short-term, highly liquid deposits, banks also hold large amounts of long-term savings in individual retirement accounts (IRAs). The loss of these funds due to bank failure or bank crime would be catastrophic to many individuals and families. But, many savers lack the financial expertise and depth of。

2013年对外经济贸易大学英语专业(基础英语)真题试卷(总分:88.00,做题时间:90分钟)一、翻译(总题数:2,分数:4.00)1.Paraphrase each of the following passages. Try not to copy the original sentences. Write your answer on the ANSWER SHEET(10% , 5 points each)."The Antarctic is the vast source of cold on our planet, just as the sun is the source of our heat, and it exerts tremendous control on our climate, "[Jacques]Cousteau told the camera. " The cold ocean water around Antarctica flows north to mix with warmer water from the tropics, and its upwelling helps to cool both the surface water and our atmosphere. Yet the fragility of this regulating system is now threatened by human activity. "(From "Captain Cousteau")(分数:2.00)填空项1:__________________2."While the Sears Tower is arguably the greatest achievement in skyscraper engineering so far, it"s unlikely that architects and engineers have abandoned the quest for the world"s tallest building. The question is: Just how high can a building go? Structural engineer William LeMessurier has designed a skyscraper nearly one-half mile high, twice as tall as the Sears Tower. And architect Robert Sobel claims that existing technology could produce a 500-story building. "(From Ron Bachman)(分数:2.00)填空项1:__________________二、阅读理解(总题数:2,分数:20.00)Mayor Tom Bradley calls Los Angeles " the most ethnically diverse city in the world, " and he"s surely right. Los Angeles is the new Ellis Island, the place futurists tout as the America of tomorrow. The demographic changes that are beginning to transform the rest of the country are here already. Just a decade ago, Los Angeles was largely white and homogeneous. Today there are no majorities. The 1990 census says the city is 40 percent Latino, 37 percent Anglo and 23 percent black and Asian. Thanks to immigration—legal and illegal—greater Los Angeles has nearly as many Mexicans as Monterrey, more Salvadorans than any city but San Salvador and the largest Korean, Taiwanese, Chinese and Philippine populations in the country. Nearly 100 languages are spoken in the city"s schools. More than 300, 000 newcomers flood in each year, pitting blacks against Hispanics and Asians for jobs and housing in a city where both are scarce. Los Angeles has not been a triumph for the melting pot, at least not yet. Even before the riots, it sometimes resembled a city under siege. Los Angeles is a town where merchants pack guns, where inner-city neighborhoods are divided into precincts with names like " Little Beirut" or " the Kill Zone, " where wealthy neighborhoods are fenced off and posted with warnings Of ARMED RESPONSE. "This is a bunker mentality, " says the head of one of L. A. " s 3, 500 private security firms. Lacking any center, barricaded into nervous camps, Los Angeles has little common ground upon which its diverse citizenry can meet. Nowhere in the country is the gap between rich and poor so evident; nowhere are racial or ethnic relations so complex. Mexicans mistrust Central Americans. Hispanics and Asians coexist uneasily in many neighborhoods. Black looters who torched Asian markets justified themselves as avenging perceived racism. Amid the social fragmentation, blacks are especially isolated. Once southern California"s ascendant minority, African-Americans represent only 13 percent of the city"s population, and that percentage is shrinking. L. A. "s Latinos, by contrast, doubled over the past decade, all but displacing blacks in Watts, home of the 1965 riots, and encroaching on African-American neighborhoods throughout the city. There are no quick fixes to such profound social changes. Politicians will cobble together emergency economic and social programs. Ultimately, though, the solution to L. A. " s crisis will be the very diversity that now poses such challenges. Drive down Melrose Avenue and you are struck by the city"s tremendous ethnic vitality—and its potential. Iranian and Russian restaurants vie with Jewish markets. Armenian exporters jostle Japanese importers. Thai Town gives way to Koreatown which gives way to Little Central America. This is more than a festival of international cuisine. These are thriving businesses with spreading links to greater Los Angeles and beyond. " L. A. is America"s first true world city, " says Safi Qureshey, a Pakistani immigrant whose company, AST Research, Inc. , has become the third largest U. S. computer exporter. You hear a lot of talk these days about Pacific Rim-ism, and how ethnic diversity is the key to the 21st century. In L. A. , much of thattalk is true. Malaysian or Thai businessmen in Los Angeles keep their links to their homelands. Commerce often follows. "This is the modern version of the traditional melting pot, " says Phil Burgess at the Center for the New West. "These new Americans learn English. They plug into the system. But they " assimilate" us as much as we " assimilate" them. " Many of these successes are in neighborhoods that today seem so troubled. Asian communities are quickly vaulting into the middle class. If some Hispanic neighborhoods seem overrun with impoverished newcomers, others are becoming established centers of enterprise. Significantly, Hispanic neighborhoods were largely spared from rioting and looting. The reason is part economics, part ethnicity. Latinos and Asians have a stake in the city in a way that most blacks have not, explains L. A. sociologist Joel Kotkin. "They start more businesses and buy their homes. You don"t torch what you own. " What"s more, Asians and Latinos generally stay put once they make it, spreading their wealth to their neighbors. Blacks, by contrast, tend to behave like many whites. They head for the suburbs, leaving behind a black "community" of predominantly young poor. That isolation must end if Los Angeles is to recover and prosper—and it may well end sooner rather than later. The wealth generated by thriving ethnic businesses will raise the communities around them. That day may be too far off for the rioters, but what"s encouraging is that so many Angelenos still managed to see that vision through the smoke of L. A. "s fires.(分数:10.00)(1).Which of the following is NOT true about Los Angeles?(分数:2.00)A.Immigration makes it the most ethnically diverse city in the world.B.There are not enough jobs and houses for the immigrants.tino accounts for the largest percentage of the population.D.Some people came to settle down in L.A.through illegal means.(2).Which of the following can best describe the city according to the author?(分数:2.00)A.People of many different cultures mingle well in the city.B.Among different ethnic groups there are constant conflicts.C.Little communication takes place because of language barriers.D.Rich people are a threat to the rest of the people in the city.(3).Among all the groups of people, the population of______is shrinking and its people are isolated.(分数:2.00)A.MexicansB.HispanicsnsD.African-Americans(4).To adapt to the social changes, the way out for L.A.may be______.(分数:2.00)A.what causes the problems—diversityB.some effective economic and social programsC.a festival of international cuisineD.getting people to move out of the city(5)."You don"t torch what you own" means______.(分数:2.00)A.You don"t give what you have created to others.B.You don"t want others to destroy your property.C.You don"t want to destroy your own property.D.You are not satisfied with what you have.South Korea wallows in existential angst The phenomenal success of Gangnam Style, a video by Korean rap artist Psy that has been viewed 280m times, is a quirky(and rather catchy)indication of South Korea"s rising fortunes. The dance video gently sends up the nouveau-riche, plastic surgery-enhanced lifestyle that has been made possible by an economic transformation so extraordinary it is known as " the miracle on the Han River". But something curious is happening. Just as South Korea is growing more confident on the world stage—culturally, economically and diplomatically—it is going through something of an existential crisis at home. Suicides are drastically higher, fertility is perilously low and the electorate is flirting with the idea of jettisoning traditional presidential candidates in favour of an untested IT entrepreneur. It seems an odd moment to be having a national nervous breakdown. Samsung and Hyundai have established themselves as premier consumer brands from Canberra to Cupertino. Korea"s per capita income of $30, 000 is fast closing in on the EU average of $33, 000. And whether it is winning $ 20bn nuclear contracts in Abu Dhabi, pouring money into emerging markets such as India, China and Brazil, or vying with Japan to be Washington"s best friend in Asia, Seoul is having a global impact as never before. That is not how it feels at home. The more that theresidents of the fashionable Gangnam district live it up, the more Koreans feel their economic model is skewed towards a privileged elite. Some statistics suggest Korea is among the most unequal of advanced countries. Chaebol conglomerates, the pride of the nation abroad, are considered by many to be economic bullies at home, blamed for squeezing suppliers and pushing small businesses into bankruptcy. Whatever the impressive macroeconomic data suggest, more Koreans feel poor, overworked and weighed down by social pressures. Chief among their concerns is the stress and expense of putting their children through "exam hell" , even in the knowledge that there are too many graduates chasing too few well-paid jobs. No wonder Korea"s birth rate has plummeted—to 1. 23, well below the 2. 2 replacement rate and lower even than Japan, at 1.4. The outgoing conservative government of Lee Myung-bak was good at putting on an international show. It hosted the G20 summit with aplomb. It attracted attention with its "green growth" agenda. But John Delury, assistant professor at Yonsei university, says it neglected domestic social and economic issues. Suicide rates have doubled over the past decade and are now the main cause of death for people under 40. The position of women has advanced at a much slower pace than the economy. Nowhere is the sense of dissatisfaction more apparent than in the campaign for December"s presidential election. The surprise package has been Ahn Chul-soo, a university professor and founder of Ahnlab, an antivirus company, who has gained a cult following especially among Korean youth. The 50-year-old independent—a sort of "anti-politician"—is polling above 40 per cent even though he only declared his presidential ambition this month. Mr. Ahn is funning against two establishment figures. Park Geun-hye is a conservative from the same party as the presidential incumbent. On the liberal establishment side, the Democratic United party has selected Moon Jae-in, aide to a former president. It is a measure of how much Koreans want a break from the past that Ms. Park saw fit this week to apologize for the human rights abuses of her father, the dictator Park Chung-hee, who ran the country for 18 years until he was assassinated in 1979.(On hearing of his fate, his pragmatic daughter"s first words were said to have been "Is the border secure?")Ms. Park has felt it necessary to ditch her impeccably conservative credentials by moving towards the centre. She has taken to talking about " economic democratisation" , a buzz phrase that embraces the idea of weakening the stranglehold of chaebol and fostering a more even distribution of wealth. Mr. Ahn, whose supporters compare him with Barack Obama—the promising 2008 vintage, not the corked 2012 version—represents a rejection of old-style polities. "Moon is the man of the past, Park is a relic of the past, Ahn is the man of the future, " is how Jang Sung-min, a former parliamentarian puts it. The three-way race makes the election result highly unpredictable. Many expect Mr. Ahn and Mr. Moon to come to some sort of last-minute pact. If they do not, they risk splitting the liberal vote and handing victory to Ms. Park, a result that would appear to be at odds with the anti-establishment mood. One possible interpretation of the political mess in general and the popularity of the political novice Mr. Ahn in particular is that Korea is going through a crisis of democratic legitimacy. That would be quite the wrong conclusion. The country that threw off dictatorship in 1987 is now as robust, if imperfect, a democracy as any in Asia, a rebuke to those who argue that Confucian societies or "Asian values" are somehow incompatible with the ballot box. Far from suggesting that democracy is failing Korea, the noisy tussle around the presidency shows a system adapting to the popular will. That, at least, should brighten the national mood.(分数:10.00)(1).What does the author mean by "South Korea wallows in existential angst"?(分数:2.00)A.South Korea is currently experiencing the existential anxiety.B.South Korea now indulges in the existential anger.C.South Korea ties itself with the existential logic.D.South Korea is seeking a new way out of existential crisis.(2).Of the following, what is NOT true about Korea"s "existential crises at home"?(分数:2.00)A.Koreans in general are having a nervous breakdown nationally.B.Fertility is perilously low.C.Suicides are drastically higher.D.South Korea becomes ever more unconfident economically.(3).Which of the following statements is TRUE about Chaebol conglomerates?(分数:2.00)A.They are not considered economic bullies at home.B.They are regarded as pride of the nation abroad.C.They have nothing to do with pushing small businesses to bankruptcy.D.All of above.(4).Compared with Barack Obama, what is the image of Mr. Ahn in his supporters" eyes?(分数:2.00)A.He is an establishment figure.B.He is from a minority group that represents the past.C.He has working experience in an enterprise as Obama does.D.He represents a rejection of old-style and man of the future.(5).According to the passage, which of the following is TRUE on Korea"s democracy?(分数:2.00)A.It has a bright future.B.The democracy is faring in South Korea.C.Korea is going through a crisis of democratic legitimacy.D.Confucian societies or "Asian values" are incompatible with the democracy.三、选词填空(总题数:2,分数:20.00)Choose the correct headings for each of the following paragraphs marked with B to F. Write your answer on the ANSWER SHEET(15 points, 3 points each). List of Headings i. Read all about it ii. It"s easier than ever to buy culture. iii. culture wars iv. Fueling the explosion v. Cultural abundance unlike a building boom vi. We"ve reached a tipping point, or at least turned a corner. vii. Informal relations viii. Anyone can be a maker of culture. ix. Whatever happened to the television test pattern? Example Answer Paragraph A ix A No more than 20 years ago, most TV stations routinely signed off the air for at least a few hours a day. At the end of their broadcast period, stations would slap a test pattern up on the screen until the next morning"s programming began. The test pattern—occasionally an absurd drawing of a Native American but more often a simple geometric shape adorned with call letters—was a great symbol of cultural dead space, of a moment when nothing was happening, when nothing was being transmitted, save perhaps for a monotonous electronic hum. While some stations still do sign off, they are increasingly rare in a hyperkinetic, always-open America that has shifted fully into 24-7 mode. If the test pattern symbolized a moment of silence in the cultural process, then it"s only fitting that its long run has effectively been canceled. B Similar developments range far beyond the small screen. During the past few decades, we have been experiencing what can aptly be called a "culture boom" : a massive and prolonged increase in art, music, literature, video, and other forms of creative expression. Everywhere we look, the cultural marketplace is open and ready for business: The number of places where you can buy books has more than doubled during the past 20 years, while the number of libraries has increased by about 17 percent. More than 25, 000 video rental stores are scattered across the United States, effectively functioning as second-run theaters and art houses even in the most remote backwaters. More than 110 symphony orchestras have been founded since 1980, reports The Wall Street Journal, which also notes that the national 1997 -98 theatrical season "raked in a record $1.3 billion in ticket sales. " About 3 , 500 commercial radio stations and 670 commercial television stations have come on the air since 1970; during the same period, cable viewership has quadrupled. C The increasingly important World Wide Web has provided space for all sorts of commercial and noncommercial culture, ranging from authorized sites to a reader-compiled database of more than 180, 000 movies to translations of Dante"s sonnets to fan-generated art. In video and music production, where equipment costs were once prohibitive enough to seriously limit access, there is a flourishing, self-conscious "do-it-yourself" movement that has taken great advantage of cheaper technology and distribution methods. In a world of $ 100 VCRs, bargain-basement PCs, CD-rewritable drives, and other technologies that allow users to copy and manipulate images, words, and sound in ever-new and seamless ways, even the sharp distinction between producer and consumer seems increasingly blurred. D Gone for good are the days when serious cultural critics, whether on the right or the left, could nod toward Tocqueville and Mrs. Trollope and bemoan a scarcity of "culture" in America. Instead, the contemporary descendants of such folks are more likely to make the sort of claim Slate"s Jacob Weisberg did recently in a review of economist Tyler Cowen"s In Praise of Commercial Culture. After granting that the United States does in fact offer a dizzying array of cultural opportunities, Weisberg complains: "What we lack is a flourishing common, or national, culture. Contemporary classical music goes unperformed, foreign films have no audience, and hardly anyone reads contemporary poetry. Meanwhile, pap abounds. " There are, in fact, healthy, if small, markets for the fare Weisberg prefers. The problem isn"t a lack of choice in cultural matters: You want Mozart, Mingus, and Marilyn Manson ? No problem—they"re all available(and probably at a discount). Rather, the issue is precisely a profusion of choice in cultural matters; You want Mozart, Mingus—and Marilyn Manson? E By virtually any measure, cultural activity has been enjoying an expansion that stacks up to Wall Street"s long-running bull market. Interestingly, the culture boom has, for the most part, seen older art forms supplemented and preserved, rather than paved over. The past 30 years have seen a number of developments that have greatly increased the amount and variety of TV-related culture available. The average home now has 2. 3 sets,compared to 1. 4 sets in 1970. Cable is now in 65. 3 percent of all households with TVs(compared to 6.7 percent in 1970). The average subscriber receives 30 to 60 channels, typically including several devoted not merely to shopping but to new and old feature films, reruns of old shows, documentaries, and other sorts of specialized programming. Omnipresent video rental stores give virtually everyone access to a film library that a few decades ago even a millionaire wouldn"t have been able to afford. F The culture boom is similarly reshaping book publishing. While an enormous amount of ink has been spilled over the demise of print culture, the death of so-called mid-list authors, and the threat to diversity posed by mega-mergers among publishers, actual book sales and related figures suggest a very different picture. Between 1975 and 1996, the number of books sold increased by 817 million units annually. Fifty years ago, Tyler Cowen points out in In Praise of Commercial Culture, there were only 85, 000 titles in print in the United States. Today, that figure stands at about 1. 3 million. The increase in the number of books available has been matched by an increase in places to get books. Between 1985 and 1993, for instance, the number of "ultimate companies"—outlets selling books in some form or another—rose from 9, 200 to almost 20, 000. Such staggering numbers have, of course, been eclipsed by Web sellers such as Amazon, com and Barnes & Noble"s onlineoutfit(barnesandnoble. com). Boasting sites that include several million titles, Amazon and Barnes & Noble have been joined in cyberspace by used-book sites that combine lists from hundreds of used-hook stores nationwide. The Web retailers are also leading the way in increasing access to foreign tides that have traditionally been very difficult to find in the States.(分数:10.00)(1).Paragraph B 1(分数:2.00)填空项1:__________________(2).Paragraph C 1(分数:2.00)填空项1:__________________(3).Paragraph D 1(分数:2.00)填空项1:__________________(4).Paragraph E 1(分数:2.00)填空项1:__________________(5).Paragraph F 1(分数:2.00)填空项1:__________________The backlash against the rich has gone global 1Defending the French government"s recent decision to raise the top rate of income tax to 75 per cent, Pierre Moscovici, the country"s finance minister, told Le Monde: " This is not a punitive measure, but a patriotic measure. " The rich, he explained, are being given an opportunity to make "an exceptional contribution" to solving France"s financial problems. I am sure they are very grateful. France is clearly taking a big risk by raising its tax rates so much higher than those of its neighbours, 2The truth is that the new French government is at the extreme end of a new global trend: an international backlash against the wealthy that is reshaping politics from Europe to the U. S. to China. David Cameron, the British prime minister, has offered to roll out the red carpet for French tax exiles. But even in Britain, where the top tax rate is 45 per cent, there is a new mood of antagonism towards the rich. 3 In the U. S. , meanwhile, Barack Obama is campaigning to increase taxes on "millionaires and billionaires". It is true that the tax rises that the U. S. president wants would be laughably small by French standards. Mr Obama merely wants to raise the top rate from 35 per cent to 39. 6 per cent, as well as increasing taxes on capital gains and dividends. 4 The French socialists made great play of Nicolas Sarkozy"s allegedly " bling" lifestyle and friendships with the super-rich. In similar vein, the Obama campaign has attacked Mitt Romney as a tax-dodging representative of "the 1 per cent"—and mocked his wife"s ownership of a dressage horse. These tactics sound risky because Americans are traditionally said to admire the wealthy , rather than to envy them. But the Obama camp can read polls. By a margin of 64 per cent to 33 per cent, Americans are in favour of higher taxes on those earning more than $250, 000. Political sensitivities about the gap between the wealthy and the rest are not confined to the west. The lifestyles of the rich and powerful is now the most sensitive and dangerous topic in Chinese polities. The website of Bloomberg News was recently shut down in China, apparently as punishment for the publication of an article on the family wealth of a high rank official in China. Why is all this happening? As Zanny Minton Beddoes of The Economist writes in a recent essay, " a majority of the world"s citizens now live in countries where the gap between the rich and the rest is a lot bigger than it was a generation ago". 5As Ms. Minton Beddoes points out, in the U. S. "the portion of national income going to the richest 1 per cent tripled from 8 per cent in the 1970s to 24 per cent in 2007". Eventually that kind of shift is liable tospark a political backlash. The trigger for that reaction has been the Great Recession, which has increased the pressure on the living standards of ordinary people, while exposing misbehaviour at the top. Western politicians, from Barack Obama to Francois Hollande are seeking to capture and channel this new mood. In Asia, where the Great Recession has hit less hard, other factors may be at work. The internet and the rise of microblogging have made it easier to spread information and to whip up indignation about the gap between the hard-pressed worker and the super-rich. Choose the following sentences marked A to E to complete the above article. Write your answer on the ANSWER SHEET. A. The trend has been most extreme in the west. B. It is never a great sign when politicians start appealing to taxpayers" patriotism. C. Even conservative politicians dare not defend bankers" pay. D. But it is a mistake to portray the Hollande administration as Socialist dinosaurs. E. But some of the president"s rhetoric has distinct echoes of the successful Hollande campaign in France.(分数:10.00)填空项1:__________________填空项1:__________________填空项1:__________________填空项1:__________________填空项1:__________________四、选择题(总题数:20,分数:40.00)4.The man at the wheel is the fastest athlete in the world today, who has just taken delivery of his new car, thelatest______of the Toyota Supra.(分数:2.00)unchB.versionC.ventureD.mode5.As policymakers rush to implement reforms in response to one financial calamity, they are ______create distortions that pave the way for the next disaster.(分数:2.00)A.apt toB.apt atC.risk toD.risk in6.As everyone understands, struggling______ economies must find a way to boost their net exports.(分数:2.00)A.surroundingB.minorC.ambientD.peripheral7.I seem to hear the lyrics with his humming: ______what may, I"ll love you until my dying day.(分数:2.00)esB.Will comeinge8.Apart from the budget office and other disinterested parties that study the law, each side in the debate uses research sponsored by interest groups, often______, to support its case.(分数:2.00)A.slopedB.sloppyC.tippedD.slanted9.All the doors were of stainless steel and the whole was kept______by the cleaning squad.(分数:2.00)A.right on the noseB.spick and spanC.under the wireD.safe and sound10.It is an irony of fate that I myself have been the recipient of excessive admiration and______ from my fellow-being, through no fault, and no merit, of my own.(分数:2.00)A.curtsyB.contemptC.reverenceD.courtesy11.The system, furthermore, helps the company in accessing up-to-date publishing information and sales analysis, which have become______of the retail business.(分数:2.00)A.part and partakeB.odds and endsC.part and parcelD.facts and figures12.For Japan, with a large share of its exports destined for Europe, a deeper crisis there would ______growth.(分数:2.00)A.take its toll onB.send away forC.bring a charge home toD.put a check on13.The 15 "recommended goods" have photos and resumes with their "starting prices" , ______ their expected monthly pay, ranging from RMB2000 -3000.(分数:2.00)A.e. g.B.viz.C.n. b.D.vs.14."Let us go forth to lead the land we love. "(分数:2.00)A.simileB.metaphorC.alliterationD.assonance15.A city that is set on a hill cannot be hid.(分数:2.00)A.zeugmaB.assonanceC.aporiaD.euphony16.A notorious annual feast, the picnic was well attended.(分数:2.00)A.litotesB.appositiveC.parodyD.antithesis。

1对外经济贸易大学2004年攻读硕士学位研究生入学考试金融学院金融学专业基础试题 科目代码:421所有答题(包括英语的判断题和选择题)均做在答卷纸上,并在每题答案前标明各级题号。

答在本试题卷上无效。

本试题卷共5页。

一、True-False Questions (1×15=15 points. Please write “T ” for true statements or “F ” for false statements following every question number on your answer sheet)1. An American tourist visiting Germany and spending money there (for lodging, food, etc.) will reduce the U.S. current account deficit and reduce Germany’s current account balance.2. A weakening of the U.S. dollar with respect to the British pound would likely reduce the U.S. exports to Britain and increase U.S. imports from Britain.3. Among the agencies providing loans to foreign governments are the International Monetary Fund, the World Bank, and the International financial Corporation.4. According to the “J curve effect”, a weakening of the U.S. dollar relative to its trading partners’ currencies would result in an initial increase in the current account balance. followed by a subsequent decrease in the current account balance.5. A bank will buy a foreign currency at the ask quote and will sell a foreign currency at the did quote.6. U.S. dollar deposits placed in banks located in Europe and other continents are known as eurodollars.7. If the forward rate were the same as the spot rate, and interest rates of the two countries differed, it would be possible for astute investors to engage in arbitrage to earn virtually riskless profits.8. A cross exchange rate between two foreign currencies can easily be obtained with the two currencies’ exchange rates relative to the dollar.9. If the British government desires an appreciation in its currency with respect to the U.S. dollar, it would consider intervening in the foreign exchange market by buying dollars with pounds.10. If the current spot rate exceeds the exercise price of a put option, that option is classified as being out of the money.11. A European option can only be exercised at maturity, while an American option can be exercised any time prior to maturity.12. A corporation wishing to hedge payables using options would likely purchase call options: a corporation wishing to hedge receivables would likely purchase put options.13. An advantage of a fixed exchange rate system is that governments are not required to constantly intervene in the foreign exchange market to maintain exchange rates within specified boundaries.14. The absolute form of Purchasing Power Parity (PPP) states that the rate of change in the prices of products should be similar when measured in a common currency.15. Since the balance of payments simply reflects the result of international accounting, all transactions are measured using double-entrybookkeeping.。

对外经济贸易大学2005年攻读硕士学位研究生入学考试421金融专业基础试题所有答题(包括英语的判断题和选择题)均做在答题纸上,并在每题答案前标明各级题号。

在本试卷上答题无效。

一、True-False Questions(1 x 15=i5 points).Indicate whether each of the following statements is true or false by writing“T”Or“F”on your answer sheet.1.In a freely floating exchange rate system,exchange rates are determined solely by the forces of supply and demand which,in turn,are influenced by fundamental economic variables.2.According to the price·specie-flow mechanism,prices are equalized across countries,and the international payments are brought into equilibrium automatically.3.According to the theory of the optimum currency area,the trade-off becomes favorable as the size of the economic unit shrinks.4.The balance of payments is an accounting statement which measures all financial and economic transactions between domestic residents and non-residents over a specified period of time.5.A currency is said to be selling at a premium if the forward rate expressed in dollars is less than the spot rate.6.If the first forward quote(bid rate)is smaller than the second forward quote (offer rate),then the forward rate is at a discount and the points are subtracted from the spot rate 7.If exchange rate inconsistencies exist in different money centers,exchange traders will take advantage of currency arbitrage opportunities.8.An out-of-the-money option is worthful on its maturity date.9.Purchasing power parity says that the currency with the higher rate of inflation is expected to depreciate relative to the currency with the lower rate of inflation.10.If the forward rate is unbiased,then it should reflect the expected future spot rate at maturity.11.Transaction risk can not be eliminated by pricing all contracts in the home currency.12.The Eurobond market exists because investors are able to avoid government regulation and taxes.13.Although interest rate swaps can be used to hedge interest rate risk,they may not be used to reduce costs.14.The Brady plan called on Less Developed Countries(LDCs)to undertake growth-oriented structural reforms,while the Baker plan emphasized debt relief through forgiveness instead of new lending.15.The foreign exchange market is similar to the OTC market in securities,whereby trading is done over the telephone or through telex。

When a(n)_____is made,a foreign trade transaction is concluded.得分/总分A.offerB.counter-offerC.acceptanceD.inquiry正确答案:C你没选择任何选项2单选(5分)When making an inquiry,it is improper to include in your letter____.得分/总分A.the way of payment for the goodsB.the bargaining over the pricesC.the product nameD.the packing of the goods正确答案:B你没选择任何选项3单选(5分)The above prices are on a CIF San Francisco____.得分/总分A.offerB.basisC.counterofferD.request正确答案:B你没选择任何选项4单选(5分)Our payment terms are_____,irrevocable letter of credit for the full invoice value.得分/总分A.confirmedB.combinedC.D.completed正确答案:A你没选择任何选项5单选(5分)The main document adopted by the insured to make claims against the insurer is______.得分/总分A.Bill of ladingB.transportation documentsC.insurance certificateD.insurance document正确答案:C你没选择任何选项6单选(5分)All delicate parts are to be in soft material and firmly packed in cardboard boxes.得分/总分A.packedB.placedC.putD.wrapped正确答案:D你没选择任何选项7单选(5分)We have lodged a claim the seller for the shortage of shipments.s DONGFENG.得分/总分A.against;exB.with;inC.on;as perD.with;to正确答案:A你没选择任何选项8单选(5分)You go to dinner with your boss and he offers to pay,what should you do?得分/总分A.Insist that you should pay.B.Consider that by rank he should pay.C.Never offer to pay.It is considered impolite.D.Nothing.正确答案:A你没选择任何选项9单选(5分)甲方应尽快在协议生效后,或最迟在本协议生效后六十天内,按上述乙方地址交给乙方有关特许产品的全部技术与销售情报。

金融英语试题及答案一、选择题(每题2分,共20分)1. Which of the following is NOT a type of financial instrument?A. StocksB. BondsC. DerivativesD. Real estate答案:D2. What is the term used to describe the process of converting interest into capital?A. AmortizationB. CompoundingC. DiscountingD. Accrual答案:D3. In finance, what is the term for the risk that an investor faces due to changes in interest rates?A. Credit riskB. Market riskC. Interest rate riskD. Operational risk答案:C4. Which of the following is NOT a function of a central bank?A. Monetary policy implementationB. Financial regulationC. Currency issuanceD. Stock trading答案:D5. What is the term for the practice of borrowing in a foreign currency to take advantage of lower interest rates?A. ArbitrageB. HedgingD. Carry trade答案:D6. What is the term for a financial contract that obligates the buyer to purchase an asset or the seller to sell an asset at a predetermined future date and price?A. Forward contractB. Futures contractC. Options contractD. Swap contract答案:A7. What is the term used to describe the process of evaluating an investment based on its risk and potential return?A. Portfolio managementB. Risk assessmentC. Due diligenceD. Valuation8. What is the term for the difference between the bid and ask prices of a financial instrument?A. SpreadB. YieldC. DiscountD. Margin答案:A9. In finance, what is the term for the risk that a borrower will default on a loan?A. Liquidity riskB. Credit riskC. Market riskD. Interest rate risk答案:B10. What is the term for a financial institution that provides loans and other financial services to individuals and businesses?A. Investment bankB. Commercial bankC. Insurance companyD. Hedge fund答案:B二、填空题(每题2分,共20分)11. The process of converting future cash flows into their present value is known as ________.答案:Discounting12. A ________ is a financial institution that accepts deposits and channels those deposits into lending activities.答案:Bank13. The ________ is the risk that an asset's value will decrease due to a change in the market or economic conditions.答案:Market risk14. A ________ is a financial instrument that represents an ownership position in a corporation.答案:Stock15. The ________ is the process of determining the value of an asset or security by using financial models.答案:Valuation16. A ________ is a financial instrument that represents a creditor relationship with a financial organization.答案:Bond17. The ________ is the risk that a financial institution will not be able to meet its short-term obligations.答案:Liquidity risk18. A ________ is a financial instrument that gives the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified price.答案:Option19. The ________ is the risk that a financial institution will not be able to meet its long-term obligations.答案:Solvency risk20. A ________ is a financial institution that provides services such as underwriting or acting as a client's agent in the issuance of securities.答案:Investment bank三、简答题(每题10分,共40分)21. Explain the concept of "leverage" in finance.答案:Leverage in finance refers to the use of borrowed funds to increase the potential return of an investment. It is the process of using various financial instruments or borrowed capital to increase the potential return of an investment. However, leverage also increases the risk of loss if the investment's value declines.22. What are the main differences between a commercial bank and an investment bank?答案:A commercial bank primarily deals with retail banking services such as accepting deposits, providing loans, and offering basic financial services to individuals and businesses. An investment bank, on the other hand, focuses on services like securities underwriting, mergers and acquisitions advice, and other capital market activities. Investment banks are typically involved in more complex financial transactions and services related to corporate finance.23. Describe the role of a central bank in an economy.答案:A central bank plays a crucial role in an economy by implementing monetary policy, regulating financial institutions, issuing currency, and maintaining the stability of the financial system. It also acts as a lender of last resort to banks and other financial institutions, and it oversees the payment systems within the country.24. What is the purpose of financial regulation, and why is it important?答案:The purpose of financial regulation is to ensure the stability, integrity, and efficiency of financial markets while protectingconsumers and investors. It is important because it helps to prevent financial crises, maintain confidence in the financial system, and promote economic growth by reducing the risk of fraud, market manipulation, and other unethical practices.四、论述题(每题20分,共20分)25. Discuss the importance of risk management in financial institutions and how it can be implemented.答案:Risk management is crucial in financial institutions as it helps to identify, assess, and mitigate potential risks that could lead to financial losses. It involves the use of various tools and strategies such as diversification, hedging, and stress testing to manage risks effectively. Implementing risk management involves setting up a robust framework that includes risk identification, risk assessment, risk control, and monitoring and reporting. This ensures that financial institutions can operate within acceptable risk parameters and maintain their financial health and stability.。

《国际金融》期末考试试题(一)一、填空题(10分)1、某银行美元兑日元的汇率报价是105.90-00,则客户卖出日元应使用的汇率是( )。

2、汇率超调模型对商品市场价格的假设是( )。

3、在国际外汇市场上,银行间远期外汇交易通常采用的形式是( )。

4、买方以向卖方支付一笔费用为代价,获得在一定期限内由卖方支付参考利率高于协定利率差额的合约是()。

5、集贸易融资、商业资信调查、应收账款管理及信用风险担保于一体的新兴综合性金融服务是()。

6、折算风险是指经济主体对资产负债表进行会计处理中,在将功能货币转换为记账货币时,因汇率变动而呈现( )损失的可能性。

7、在国际收支局部差额中,反映实际资源跨国转移状况的是()。

8、实行钉住汇率制度的国家,其货币与被钉住货币之间一般规定平价,并且汇率对平价的波动幅度限于一个很小的范围,一般不超过( )。

9、我国1996年接受了国际货币基金组织第八条款的义务,实现了人民币( )可兑换。

10、一般认为,国际储备至少应该能够满足( )个月的进口需要。

二、判断题(10分)1、美元对日元升值50%,也就是说日元对美元贬值50%。

2、外汇市场是以造市商为核心的市场。

3、欧洲货币期货是一种利率期货。

4、信用证结算是以银行信用取代商业信用。

5、在外汇风险中,折算风险和经济风险都是一次性的,而交易风险的影响则是长期的。

6、一公司卖给其海外子公司价值100万美元的原材料,则该交易不应记入国际收支。

7、根据汇率制度选择的经济论,经济开放度高的国家应该实行弹性较小的汇率制度。

8、对内可兑换的目的和实质是消除外汇管制。

9、在第一代投机性冲击模型中,投机性冲击来自对政府政策不一致的预期。

10、国际货币基金组织的最高权力机构是国际货币与金融委员会。

三、单选题(15分)1、除了外汇汇率外,银行外汇牌价还标出现钞汇率。

这两者之间的关系是( )。

A.现钞买入价等于外汇买入价,现钞卖出价低于外汇卖出价B.现钞买入价低于外汇买入价,现钞卖出价等于外汇卖出价C.现钞买入价和卖出价均低于外汇买入价和卖出价D.现钞买入价和卖出价均高于外汇买入价和卖出价2、某银行在报出英镑兑美元即期汇率的同时,报出3个月远期英镑汇率为20-30。

对外经济贸易大学2000-2001学年第一学期ENG353《金融英语阅读》期末考试试卷(A)本试卷适用于:全校三年级各专业的学生(99级)学号:姓名:班级:成绩:1.Translate the following financial terms.(20%)1)IDA2)SDR3)IFC4)OECD5)Clipping6)Laissez-faire7)Debasement8)MIGA9)Convertible paper money10)in arrears1)扶贫(工作)2)"大一统"银行系统3)垂直管理体制4)霸权5)金本位制崩溃6)互惠主义7)银根紧缩8)差别价格9)收益差10)空头交易2.Paraphrase the underlined words in English according to the text. (15%)1)The IFC's policy is to favor joint ventures that have some local capital committed at the outset, or at least the probability of local capital involvement in the foreseeable future.2)To date, there have been no defaults on loans made by the World Bank.3)Rugged individualistic liberalism based upon Anglo-Saxon roots knew, rendering their liberal ideology rigid and dogmatic.4)The value of a commodity or token used as money also fluctuates, and when there is inflation, its value persistently falls.5)They put their reputation on the line when they endorse a company's report.3.Please translate the following sentences into either Chinese or English (20%) 1)The "whole earth" approach to political economy--a world view--remains theexception and not the rule. Economists note that their discipline was traditionally called "political economy," the queen of the social sciences dating back at least to Adam Smith's Wealth of Nations, published in 1776.2)Barter can take place only when there is a double coincidence of wants. A doublecoincidence of wants is a situation that occurs when person A wants to buy what person B is selling and person B wants to buy what person A is selling.3)政府对国际贸易中的小汽车和多数其它商品进行调控。

他们对进口征收税款,称为关税,同时建立配额制,以对可能进口的数量进行限制。

4)货币是为人们广为接受的,作为商品和服务支付手段的任何商品或辅币,货币有四种职能:交换媒介、价值尺度、储藏手段、延期支付手段。