投资学题库

- 格式:doc

- 大小:63.00 KB

- 文档页数:21

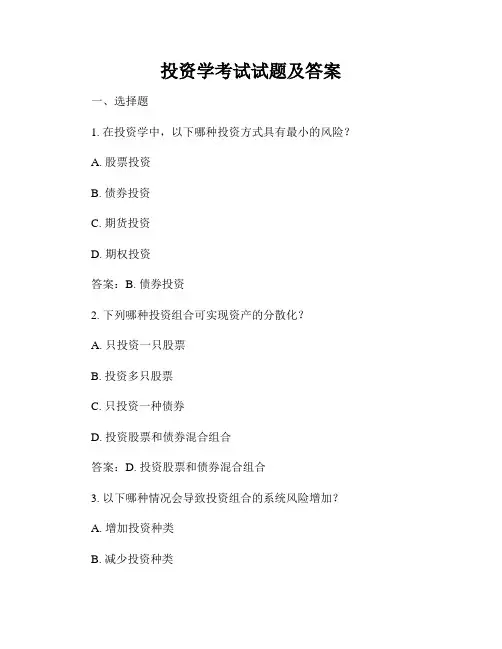

投资学考试试题及答案一、选择题1. 在投资学中,以下哪种投资方式具有最小的风险?A. 股票投资B. 债券投资C. 期货投资D. 期权投资答案:B. 债券投资2. 下列哪种投资组合可实现资产的分散化?A. 只投资一只股票B. 投资多只股票C. 只投资一种债券D. 投资股票和债券混合组合答案:D. 投资股票和债券混合组合3. 以下哪种情况会导致投资组合的系统风险增加?A. 增加投资种类B. 减少投资种类C. 提高资产流动性D. 降低资产回报率答案:B. 减少投资种类二、简答题1. 请简要解释什么是资产配置,以及它对投资组合的重要性。

答:资产配置是指根据个体的风险偏好和投资目标,合理分配资金到不同类型的资产中,以达到最佳的风险与回报平衡。

资产配置可以帮助投资者实现分散化,降低整体风险,并在长期内获得更好的投资回报。

2. 请解释什么是夏普比率,以及它对投资业绩评估的意义。

答:夏普比率是一种衡量投资组合风险和回报比率的指标,它计算方式为投资组合的年化收益率减去无风险利率后,再除以投资组合收益的标准差。

夏普比率越高,代表单位风险下获得的回报越高,是评估投资业绩优劣的重要指标之一。

三、计算题1. 投资者A的投资组合有60%是股票,40%是债券。

如果股票的年化收益率为10%,债券的年化收益率为5%,则该投资组合的年化收益率是多少?答案:(60% * 10%)+(40% * 5%)= 6% + 2% = 8%2. 投资者B的投资组合中,有30%是美国股票,40%是中国股票,30%是英国股票。

如果美国股票的夏普比率为1.2,中国股票的夏普比率为1.5,英国股票的夏普比率为0.8,则整个投资组合的夏普比率是多少?答案:(30% * 1.2)+(40% * 1.5)+(30% * 0.8)= 0.36 + 0.6 + 0.24 = 1.2以上是投资学考试的试题及答案,希望对您的学习有所帮助。

祝您考试顺利!。

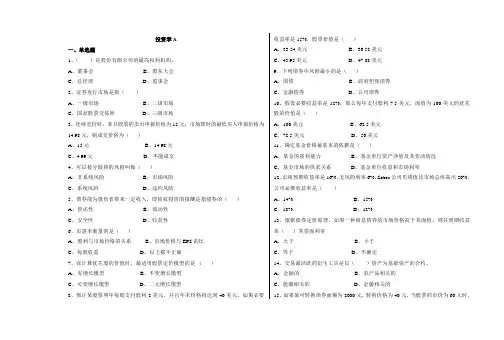

投资学A一、单选题1、()是股份有限公司的最高权利机构。

A、董事会B、股东大会C、总经理D、监事会2、证券发行市场是指()A、一级市场B、二级市场C、国家股票交易所D、三级市场3、连续竞价时,某只股票的卖出申报价格为15元,市场即时的最低买入申报价格为14.98元,则成交价格为()A、15元B、14.98元C、4.99元D、不能成交4、可以被分散掉的风险叫做()A、非系统风险B、市场风险C、系统风险D、违约风险5、债券能为投资者带来一定收入,即债权投资的报酬是指债券的()A、偿还性B、流动性C、安全性D、收益性6、市盈率衡量的是()A、股利与市场价格的关系B、市场价格与EPS的比C、每股收益D、以上都不正确7、在计算优先股的价值时,最适用股票定价模型的是()A、零增长模型B、不变增长模型C、可变增长模型D、二元增长模型8、预计某股票明年每股支付股利2美元,并且年末价格将达到40美元。

如果必要收益率是15%,股票价值是()A、33.54美元B、36.52美元C、43.95美元D、47.88美元9、下列债券中风险最小的是()A、国债B、政府担保债券C、金融债券D、公司债券10、假设必要收益率是12%,那么每年支付股利7.5美元,面值为100美元的优先股的价值是()A、100美元B、62.5美元C、72.5美元D、50美元11、确定基金价格最基本的依据是()A、基金的盈利能力B、基金单位资产净值及其变动情况C、基金市场的供求关系D、基金单位收益和市场利率12、市场预期收益率是16%,无风险利率6%,Zebra公司贝塔值比市场总体高出20%,公司必要收益率是()A、14%B、15%C、18%D、12%13、根据债券定价原理,如果一种附息债券的市场价格高于其面值,则其到期收益率()其票面利率A、大于B、小于C、等于D、不确定14、交易最活跃的衍生工具是以()资产为基础资产的合约。

A、金融的B、农产品相关的C、能源相关的D、金融相关的15、如果某可转换债券面额为2000元,转换价格为40元,当股票的市价为60元时,则该债券当前的转换价值为( )元。

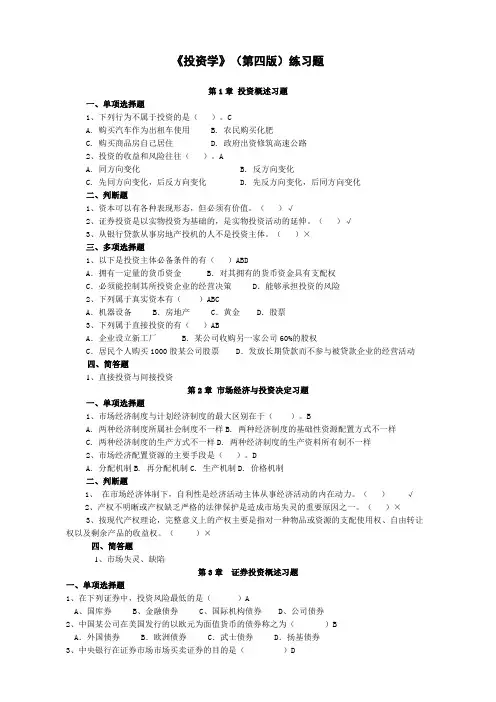

《投资学》(第四版)练习题第1章投资概述习题一、单项选择题1、下列行为不属于投资的是()。

CA. 购买汽车作为出租车使用B. 农民购买化肥C. 购买商品房自己居住D. 政府出资修筑高速公路2、投资的收益和风险往往()。

AA. 同方向变化B. 反方向变化C. 先同方向变化,后反方向变化D. 先反方向变化,后同方向变化二、判断题1、资本可以有各种表现形态,但必须有价值。

()√2、证券投资是以实物投资为基础的,是实物投资活动的延伸。

()√3、从银行贷款从事房地产投机的人不是投资主体。

()×三、多项选择题1、以下是投资主体必备条件的有()ABDA.拥有一定量的货币资金 B.对其拥有的货币资金具有支配权C.必须能控制其所投资企业的经营决策 D.能够承担投资的风险2、下列属于真实资本有()ABCA.机器设备 B.房地产 C.黄金 D.股票3、下列属于直接投资的有()ABA.企业设立新工厂 B.某公司收购另一家公司60%的股权C.居民个人购买1000股某公司股票 D.发放长期贷款而不参与被贷款企业的经营活动四、简答题1、直接投资与间接投资第2章市场经济与投资决定习题一、单项选择题1、市场经济制度与计划经济制度的最大区别在于()。

BA. 两种经济制度所属社会制度不一样B. 两种经济制度的基础性资源配置方式不一样C. 两种经济制度的生产方式不一样D. 两种经济制度的生产资料所有制不一样2、市场经济配置资源的主要手段是()。

DA. 分配机制B. 再分配机制C. 生产机制D. 价格机制二、判断题1、在市场经济体制下,自利性是经济活动主体从事经济活动的内在动力。

()√2、产权不明晰或产权缺乏严格的法律保护是造成市场失灵的重要原因之一。

()×3、按现代产权理论,完整意义上的产权主要是指对一种物品或资源的支配使用权、自由转让权以及剩余产品的收益权。

()×四、简答题1、市场失灵、缺陷第3章证券投资概述习题一、单项选择题1、在下列证券中,投资风险最低的是()AA、国库券B、金融债券C、国际机构债券D、公司债券2、中国某公司在美国发行的以欧元为面值货币的债券称之为()BA.外国债券 B.欧洲债券 C.武士债券 D.扬基债券3、中央银行在证券市场市场买卖证券的目的是()DA、赚取利润B、控制股份C、分散风险D、宏观调控4、资本证券主要包括()。

《投资学》考试题库及答案投资学考试题库及答案1. 什么是投资学?投资学是研究投资行为和投资决策的学科。

它涉及到资金的配置和管理,以及分析市场和资产的风险与回报。

2. 请列举投资学中常见的投资工具和资产类别。

- 投资工具:股票、债券、期货合约、期权合约等。

- 资产类别:股票、债券、商品、房地产等。

3. 什么是现金流量?为什么它在投资决策中很重要?- 现金流量指的是某一时间段内产生或支出的现金金额。

- 它在投资决策中很重要,因为投资决策的目的是为了获得更多现金流入。

分析现金流量可以帮助投资者评估投资项目的盈利能力和风险。

4. 请解释什么是投资回报率(ROI)?如何计算ROI?- 投资回报率是用于衡量投资项目的收益率的指标。

- 计算ROI的公式是(投资收益 - 投资成本)/ 投资成本 ×100%。

5. 什么是资本资产定价模型(CAPM)?它有什么作用?- 资本资产定价模型是一种用于估计资产预期回报的模型。

- 它的作用是帮助投资者确定资产的合理价格,并衡量资产的系统风险。

6. 请解释什么是分散投资?为什么分散投资可以降低投资风险?- 分散投资指的是将投资分散到不同的资产或资产类别中。

- 分散投资可以降低投资风险,因为不同资产之间的回报通常是不相关的。

当一个资产表现不佳时,其他资产的回报可能会抵消这种损失。

7. 请说明什么是投资组合?如何构建一个优化的投资组合?- 投资组合是指将多个不同的资产组合在一起形成的投资策略。

- 构建一个优化的投资组合需要考虑资产的回报和风险,以及投资者的目标和偏好。

通过有效的资产分配和风险调整,可以最大化投资组合的回报并降低风险。

8. 请解释什么是市场效率假设?它对投资者有什么影响?- 市场效率假设认为市场价格已经反映了所有可获得的信息,投资者无法通过分析市场信息获得超额收益。

- 对投资者而言,市场效率假设表明他们需要依赖其他策略来获取超越市场平均水平的收益,如选择合适的资产配置和分散投资。

《投资学》习题及其参考答案第1章投资概述一、填空题1、投资所形成的资本可分为和。

2、资本是具有保值或增值功能的。

3、按照资本存在形态不同,可将资本分为、、、等四类。

4、根据投资所形成资产的形态不同,可以将投资分为、、三类。

5、按研究问题的目的不同,可将投资分成不同的类别。

按照投资主体不同,投资可分为、、、四类。

6、从生产性投资的每一次循环来,一个投资运动周期要经历、、、等四个阶段。

一、填空题1、真实资本、金融资本2、持久性经济要素3、实物资本、无形资本、金融资本、人力资本4、实物资本投资、金融资本投资、人力资本投资5、个人投资、企业投资、政府投资、外国投资6、试比较主要西方投资流派理论的异同?7、资金筹集、分配、运用、回收与增值第2章市场经济与投资决定四、问答题1、一定的经济主体如何才能成为真正的投资主体?2、计划经济和市场经济下的投资决定有何不同?3、结合新制度经济学的有关知识,谈谈你对中国投融资制度改革的看法或建议。

四、问答题1、答:投资主体是指从事投资活动的法人和自然人。

投资主体是投资权利体、投资责任体和投资利益体的内在统一。

一定的经济主体要成为真正的投资主体必须具有三个特征:(1)拥有投资权利,能相对独立地作出投资决策,包括投资目标的确定、投资方式的选择等方面的自主决策。

(2)投资主体必须承担相应的投资风险和责任,包括承担的政治风险、经济风险、法律风险和社会道德风险。

(3)投资主体必须享有一定的投资收益,不能享受投资收益的法人或自然人不是真正的投资主体。

2、答:计划经济和市场经济下投资决定的不同表现在四个方面:(1)计划经济下的投资决定。

计划经济下的投资制度是政府主导型的投资制度。

这种投资制度的典型是改革前的前苏联、东欧、和中国等国家。

①投资主体。

政府是主要、甚至是唯一的投资主体。

政府投资主体以中央政府为主,包揽了各行各业的几乎所有投资。

企业不是投资主体,只是政府部门的附属和政府投资的实施者。

投资学练习题及答案doc

一、选择题

1.投资学主要解决的是()

A.投资资产配置

B.资产定价

C.证券定价

D.投资产生的风险分析

答案:A

2.以下属于基本投资理论的是()

A.市场超额收益理论

B.理性投资者理论

C.技术分析理论

D.约束最优投资决策理论

答案:B

3.投资组合中各资产之间的相关系数越小,表明投资组合的()

A.风险性

B.收益率

C.可靠性

D.稳定性

答案:A

4.投资学的主要内容是()

A.证券投资

B.资产定价

C.投资策略研究

D.资产配置

答案:D

二、填空题

5.投资学的基本原理是,投资者应尽可能通过正确的投资组合减少投资风险与保证投资收益,以实现____________的最大化。

答案:投资收益

6.用投资学的思想来构建投资组合,则是基于____________的理论支撑。

答案:多元化

7.投资策略的设计应充分考虑市场的____________,科学分析投资风险以达到投资的最优选择。

大一投资学考试题及答案一、单项选择题(每题2分,共20分)1. 投资学中,投资组合的风险主要来源于()。

A. 系统性风险B. 非系统性风险C. 市场风险D. 利率风险答案:B2. 根据资本资产定价模型(CAPM),下列哪项不是决定资产预期收益率的因素?()A. 无风险利率B. 市场风险溢价C. 资产的贝塔系数D. 资产的流动性答案:D3. 在现代投资理论中,下列哪项不是有效市场假说(EMH)的类型?()A. 弱式有效市场B. 半强式有效市场C. 强式有效市场D. 完全有效市场答案:D4. 以下哪项不是投资学中的风险度量指标?()A. 方差B. 标准差C. 夏普比率D. 收益率答案:D5. 投资组合理论中,投资者通过分散投资可以降低的是()。

A. 系统性风险B. 非系统性风险C. 市场风险D. 利率风险答案:B6. 根据债券定价理论,下列哪项不是影响债券价格的因素?()A. 利率水平B. 债券的信用等级C. 债券的到期时间D. 债券的面值答案:D7. 股票的股息贴现模型(DDM)中,下列哪项不是决定股票内在价值的因素?()A. 预期股息B. 贴现率C. 股票的面值D. 股息增长率答案:C8. 在投资中,下列哪项不是财务杠杆的作用?()A. 增加收益B. 增加风险C. 减少收益D. 增加风险和收益的潜力答案:C9. 投资学中,下列哪项不是投资决策的基本原则?()A. 风险与回报的权衡B. 多元化投资C. 市场时机选择D. 长期投资答案:C10. 投资学中,下列哪项不是投资分析的主要方法?()A. 基本分析B. 技术分析C. 宏观经济分析D. 行为分析答案:D二、多项选择题(每题3分,共15分)11. 投资学中,下列哪些因素会影响股票价格?()A. 公司的盈利能力B. 利率水平C. 通货膨胀率D. 投资者情绪答案:ABCD12. 投资组合管理中,下列哪些是风险管理策略?()A. 资产配置B. 风险预算C. 衍生品对冲D. 市场时机选择答案:ABC13. 根据资本资产定价模型(CAPM),下列哪些因素会影响资产的预期收益率?()A. 无风险利率B. 市场风险溢价C. 资产的贝塔系数D. 资产的流动性答案:ABC14. 投资学中,下列哪些是影响债券价格的主要因素?()A. 利率水平B. 债券的信用等级C. 债券的到期时间D. 债券的面值答案:ABC15. 投资学中,下列哪些是投资分析的主要方法?()A. 基本分析B. 技术分析C. 宏观经济分析D. 行为分析答案:ABC三、判断题(每题2分,共10分)16. 投资组合理论认为,通过分散投资可以消除所有风险。

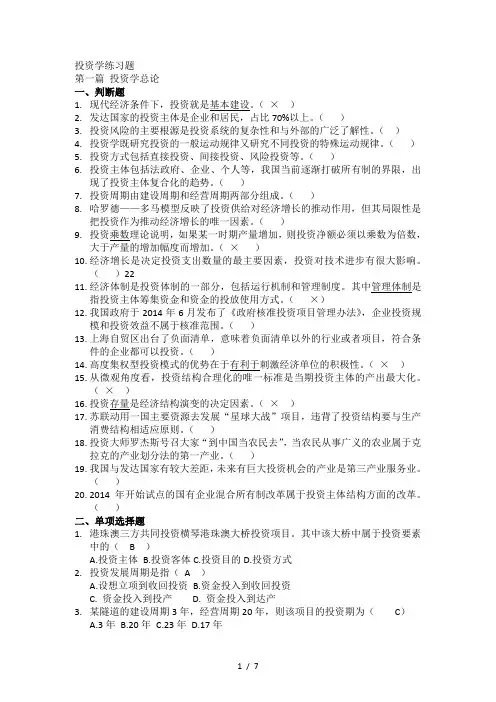

投资学练习题第一篇投资学总论一、判断题1.现代经济条件下,投资就是基本建设。

(×)2.发达国家的投资主体是企业和居民,占比70%以上。

()3.投资风险的主要根源是投资系统的复杂性和与外部的广泛了解性。

()4.投资学既研究投资的一般运动规律又研究不同投资的特殊运动规律。

()5.投资方式包括直接投资、间接投资、风险投资等。

()6.投资主体包括法政府、企业、个人等,我国当前逐渐打破所有制的界限,出现了投资主体复合化的趋势。

()7.投资周期由建设周期和经营周期两部分组成。

()8.哈罗德——多马模型反映了投资供给对经济增长的推动作用,但其局限性是把投资作为推动经济增长的唯一因素。

()9.投资乘数理论说明,如果某一时期产量增加,则投资净额必须以乘数为倍数,大于产量的增加幅度而增加。

(×)10.经济增长是决定投资支出数量的最主要因素,投资对技术进步有很大影响。

()2211.经济体制是投资体制的一部分,包括运行机制和管理制度。

其中管理体制是指投资主体筹集资金和资金的投放使用方式。

(×)12.我国政府于2014年6月发布了《政府核准投资项目管理办法》,企业投资规模和投资效益不属于核准范围。

()13.上海自贸区出台了负面清单,意味着负面清单以外的行业或者项目,符合条件的企业都可以投资。

()14.高度集权型投资模式的优势在于有利于刺激经济单位的积极性。

(×)15.从微观角度看,投资结构合理化的唯一标准是当期投资主体的产出最大化。

(×)16.投资存量是经济结构演变的决定因素。

(×)17.苏联动用一国主要资源去发展“星球大战”项目,违背了投资结构要与生产消费结构相适应原则。

()18.投资大师罗杰斯号召大家“到中国当农民去”,当农民从事广义的农业属于克拉克的产业划分法的第一产业。

()19.我国与发达国家有较大差距,未来有巨大投资机会的产业是第三产业服务业。

()20.2014年开始试点的国有企业混合所有制改革属于投资主体结构方面的改革。

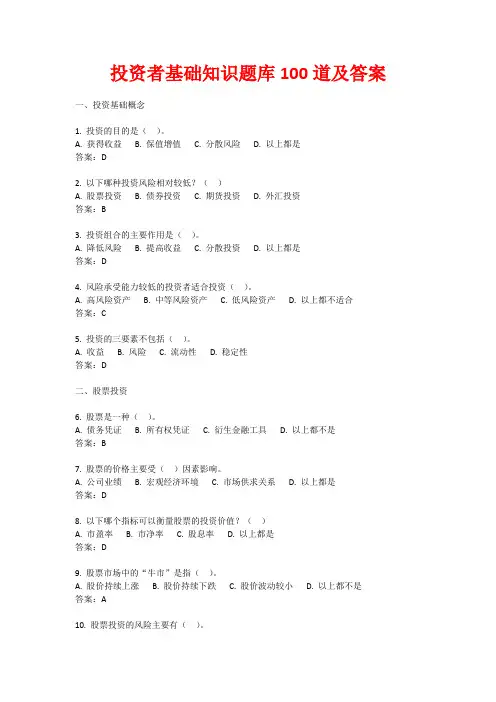

投资者基础知识题库100道及答案一、投资基础概念1. 投资的目的是()。

A. 获得收益B. 保值增值C. 分散风险D. 以上都是答案:D2. 以下哪种投资风险相对较低?()A. 股票投资B. 债券投资C. 期货投资D. 外汇投资答案:B3. 投资组合的主要作用是()。

A. 降低风险B. 提高收益C. 分散投资D. 以上都是答案:D4. 风险承受能力较低的投资者适合投资()。

A. 高风险资产B. 中等风险资产C. 低风险资产D. 以上都不适合答案:C5. 投资的三要素不包括()。

A. 收益B. 风险C. 流动性D. 稳定性答案:D二、股票投资6. 股票是一种()。

A. 债务凭证B. 所有权凭证C. 衍生金融工具D. 以上都不是答案:B7. 股票的价格主要受()因素影响。

A. 公司业绩B. 宏观经济环境C. 市场供求关系D. 以上都是答案:D8. 以下哪个指标可以衡量股票的投资价值?()A. 市盈率B. 市净率C. 股息率D. 以上都是答案:D9. 股票市场中的“牛市”是指()。

A. 股价持续上涨B. 股价持续下跌C. 股价波动较小D. 以上都不是答案:A10. 股票投资的风险主要有()。

A. 市场风险B. 公司风险C. 行业风险D. 以上都是答案:D11. 投资者购买股票的收益主要来自()。

A. 股息收入B. 资本利得C. 红利分配D. 以上都是答案:D12. 股票的交易方式主要有()。

A. 现货交易B. 期货交易C. 期权交易D. 以上都是答案:A(主要是现货交易,期货和期权交易属于衍生交易方式)13. 股票的发行方式主要有()。

A. 公开发行B. 非公开发行C. 配股D. 以上都是答案:D14. 以下哪个是股票市场的主要指数?()A. 上证指数B. 深证成指C. 沪深300 指数D. 以上都是答案:D15. 股票投资的分析方法主要有()。

A. 基本面分析B. 技术分析C. 量化分析D. 以上都是答案:D三、债券投资16. 债券是一种()。

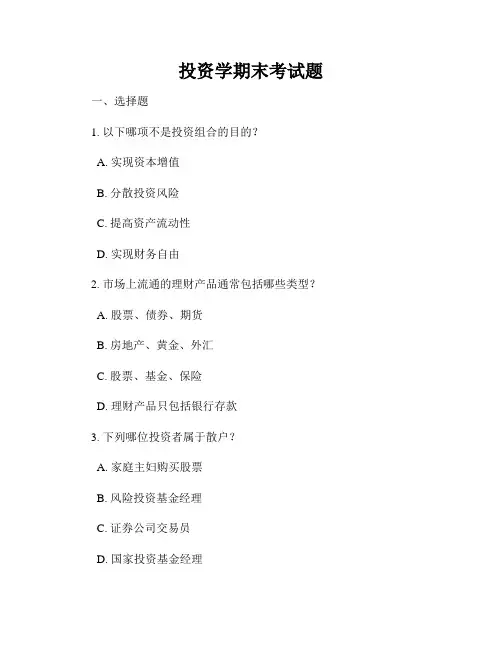

投资学期末考试题一、选择题1. 以下哪项不是投资组合的目的?A. 实现资本增值B. 分散投资风险C. 提高资产流动性D. 实现财务自由2. 市场上流通的理财产品通常包括哪些类型?A. 股票、债券、期货B. 房地产、黄金、外汇C. 股票、基金、保险D. 理财产品只包括银行存款3. 下列哪位投资者属于散户?A. 家庭主妇购买股票B. 风险投资基金经理C. 证券公司交易员D. 国家投资基金经理4. 以下哪种投资工具属于固定收益类投资?A. 股票B. 债券C. 期货D. 房地产5. 市场风险是指A. 投资的损失B. 政策风险C. 经济波动D. 市场潜规则二、简答题1. 请简要说明投资组合的优点和不足之间的平衡关系。

投资组合的优点在于可以实现资本增值、分散投资风险以及提高资产流动性。

通过将资金分散投资于不同的资产,可以降低个别资产的风险对整个投资组合的影响,从而达到降低总体风险的目的。

资本增值是投资者的首要目标,通过选择具有良好增长潜力的投资品种,可以增加资本的回报。

另外,不同种类的投资工具具有不同的流动性,投资组合可以根据投资者的流动性需求进行调整,提高资产的流动性。

然而,投资组合也存在不足之处。

例如,投资组合需要对不同的资产进行定期调整和重新配置,需要消耗一定的时间和精力。

此外,由于市场环境的变化,投资组合的风险也存在无法完全避免的情况。

投资者需要密切关注市场和经济动态,及时做出调整,以降低投资组合的风险。

2. 请简要说明风险和收益之间的关系。

风险和收益通常呈正相关关系,即收益越高,风险也越高;收益越低,风险也越低。

投资中的风险来自市场风险、信用风险、流动性风险等多个方面,不同的投资品种和投资策略会有不同的风险水平。

投资者在选择投资品种时,需要根据个人的风险承受能力和投资目标来进行判断和选择。

如果投资者追求高回报,通常需要承担相应的风险。

然而,风险并不意味着必然获得高回报,投资者需要根据自身情况仔细评估风险和收益之间的平衡,制定适合自己的投资策略。

投资学考试试题及答案一、选择题(每题4分,共40分)1. 投资学是研究什么问题的学科?A. 资金的筹集和分配B. 资产的收益和风险C. 经济发展和社会进步D. 企业管理和决策2. 股票的收益主要由以下哪些因素决定?A. 利润收益B. 股息收益C. 股价上涨收益D. 所有选项都正确3. 以下哪种投资组合可以实现风险分散?A. 只投资一种股票B. 只投资一种债券C. 投资多种不同类型的资产D. 所有选项都无法实现风险分散4. 在现金流折现决策中,下列哪个指标可用来评估投资项目的收益性?A. 净现值B. 内部收益率C. 投资回收期D. 所有选项都正确5. 风险资产的预期收益率和风险程度之间的关系是:A. 收益率越高,风险越低B. 收益率越低,风险越低C. 收益率越高,风险越高D. 收益率与风险无关6. 以下哪个指标用于评估投资组合的风险和收益之间的关系?A. 夏普比率B. 贝塔系数C. 布朗修正系数D. 所有选项都正确7. 在股票市场上,以下哪个指标用于衡量股票价格波动的大小?A. 均值B. 方差C. 标准差D. 所有选项都正确8. 资产组合的有效前沿是指:A. 所有可行的资产组合构成的曲线B. 高收益率资产构成的曲线C. 低风险资产构成的曲线D. 所有选项都不正确9. 什么是资本资产定价模型(CAPM)?A. 一种基于资产收益率和市场风险的定价模型B. 一种用于计算股票价格的模型C. 一种用于计算债券收益率的模型D. 所有选项都不正确10. 标准差衡量的是:A. 资产的期望收益B. 资产的风险敞口C. 资产的现金流D. 所有选项都不正确二、判断题(每题4分,共20分)1. 长期债券的价格波动较大,风险相对较高。

( )2. 投资组合的风险可以通过对冲来降低。

( )3. 投资组合的效用函数反映了投资者对风险和收益的偏好。

( )4. 若两个资产间的相关系数为-1,则它们的收益率具有正相关关系。

( )5. 在投资组合理论中,有效前沿上的资产组合都具有最大效用。

投资学期末试题及答案一、选择题(每题2分,共20分)1. 投资组合理论是由哪位经济学家提出的?A. 亚当·斯密B. 哈里·马科维茨C. 约翰·梅纳德·凯恩斯D. 米尔顿·弗里德曼2. 以下哪项不是投资风险的类型?A. 市场风险B. 信用风险C. 流动性风险D. 收益风险3. 股票的贝塔系数衡量的是:A. 股票价格波动性B. 股票与市场的关系C. 股票的收益潜力D. 股票的流动性4. 债券的到期收益率与市场利率的关系是:A. 正相关B. 负相关C. 无关系D. 有时正相关,有时负相关5. 以下哪种投资策略不是基于市场效率假说?A. 被动投资B. 技术分析C. 基本面分析D. 指数基金投资二、简答题(每题10分,共30分)1. 请简述资本资产定价模型(CAPM)的基本假设和公式。

2. 什么是有效市场假说(EMH)?它对投资者的决策有何影响?3. 请解释什么是杠杆收购(LBO)以及它在投资中的作用。

三、计算题(每题25分,共50分)1. 假设你拥有一个包含两种股票的投资组合,股票A和股票B。

股票A的预期收益率为12%,股票B的预期收益率为15%。

如果股票A占投资组合的60%,股票B占40%,计算投资组合的预期收益率。

2. 某公司发行了一张面值为1000美元,期限为10年,年利率为5%的债券。

如果市场利率为6%,计算该债券的当前价格。

四、论述题(共30分)1. 论述私募股权投资与公开市场投资的主要区别,并分析它们各自的优点和局限性。

2. 请结合当前市场环境,讨论投资者如何平衡风险与回报。

答案:一、选择题1. B2. D3. B4. A5. B二、简答题1. 资本资产定价模型(CAPM)的基本假设包括:市场是有效的,投资者是理性的,不存在交易成本和税收,投资者可以无限制地借贷资金等。

CAPM的公式为:E(Ri) = Rf + βi * (E(Rm) - Rf),其中E(Ri)是资产i的预期收益率,Rf是无风险利率,βi是资产i的贝塔系数,E(Rm)是市场组合的预期收益率。

投资学题库与参考答案一、单选题(共30题,每题1分,共30分)1、对于股票有一种描述“人在江湖漂,哪有不挨刀”表明( )。

A、承担股票风险是获得收益的前提B、股市风险不可预料C、投资收益与风险成正比D、股票具有高风险特征正确答案:D2、根据预期假设理论,收益率曲线向上倾斜,则说明市场预期未来短期利率( )。

A、会上升B、会下降C、会保持平稳D、趋势变化不明确正确答案:A3、期货交易中最可能采取实物交割的是( )。

A、投机客B、套利交易者C、套期保值者D、期货空头正确答案:C4、“中央决定,加快股票发行注册制推出步伐”,这条信息是( )。

A、微观信息B、宏观信息C、中观信息D、行业信息正确答案:B5、开放基金的发行价格一般( )。

A、由于超额需求,高于净资产价格B、由于费用和佣金,低于净资产价格C、由于费用和佣金,高于净资产价格D、由于有限的需求,低于净资产价格正确答案:C6、未来同等数额现金流的价值( )现在同等数额的现金流。

A、小于B、等于C、不等于D、大于正确答案:A7、投资的收益和风险往往( )。

A、先同方向变化,后反方向变化B、反方向变化C、先反方向变化,后同方向变化D、同方向变化正确答案:D8、“如果你爱他,把他送到股市,因为那儿是天堂;如果你恨他,把他送到股市,因为那儿是地狱”。

这句话最能说明的基本原理是( )。

A、牛熊市周而复始B、投资收益和投资风险形影相随C、尊重市场、适应市场D、分散投资降低风险正确答案:B9、股票除权过程中,上市公司对外宣告一个日期,这个日期被称为( ),当天收市后持有公司股票的投资者享有公司宣称的各种权益。

()A、股票除权日B、社会公告日C、对外宣告日D、股权登记日正确答案:D10、期货具有多种功能,其中不包括( )。

A、投资功能B、价格发现功能C、避险功能D、投机功能正确答案:A11、公司债券的信誉要( )政府债券和金融债券,风险较大,因而利率一般也比较( )。

金融投资学考试试题一、选择题(每题 3 分,共 30 分)1、以下哪种投资工具风险相对较低?()A 股票B 债券C 期货D 外汇2、投资组合能够降低风险的主要原因是()A 分散化B 集中化C 长期投资D 短期投资3、当经济处于衰退期时,以下哪种行业可能表现较好?()A 房地产B 汽车C 食品D 奢侈品4、有效市场假说中,弱式有效市场认为()A 技术分析无效B 基本面分析无效C 内幕消息有用D 所有分析都无效5、以下哪个指标可以衡量投资的系统性风险?()A 方差B 标准差C 贝塔系数D 阿尔法系数6、债券的票面利率是指()A 市场利率B 实际利率C 名义利率D 到期收益率7、股票的市盈率是指()A 股价除以每股收益B 每股收益除以股价C 股价除以每股净资产D 每股净资产除以股价8、基金的单位净值是指()A 基金资产总值除以基金份额总数B 基金资产净值除以基金份额总数C 基金份额总数除以基金资产总值D 基金份额总数除以基金资产净值9、以下哪种投资策略属于被动投资?()A 价值投资B 成长投资C 指数投资D 波段操作10、金融衍生品的基本功能包括()A 套期保值B 价格发现C 投机D 以上都是二、判断题(每题 2 分,共 20 分)1、投资的风险越大,收益一定越高。

()2、股票是一种债权凭证。

()3、债券的价格与市场利率呈正相关关系。

()4、基金的风险低于股票。

()5、期货交易实行保证金制度。

()6、金融市场是有效的,投资者不可能获得超额收益。

()7、系统性风险可以通过分散投资来消除。

()8、投资组合的方差越大,风险越高。

()9、优先股的股东具有优先认股权。

()10、开放式基金的规模是固定的。

()三、简答题(每题 10 分,共 30 分)1、简述资本资产定价模型的基本内容。

资本资产定价模型(CAPM)是一种用于描述资产预期收益率与风险之间关系的模型。

它的核心观点是,在均衡市场中,资产的预期收益率等于无风险利率加上资产的贝塔系数乘以市场风险溢价。

二、单项选择题1.很多情况下人们往往把能够带来报酬的支出行为称为______。

A 支出B 储蓄C 投资D 消费答案: C2.证券投资通过投资于证券将资金转移到企业部门, 因此通常又被称为______。

A 间接投资B 直接投资C 实物投资D 以上都不正确答案: B3.直接投融资的中介机构是______。

A 商业银行B 信托投资公司C 投资咨询公司D 证券经营机构答案: D三、多项选择题1.投资的特点有_______。

A 投资是现在投入一定价值量的经济活动B 投资具有时间性C 投资的目的在于得到报酬D 投资具有风险性答案: ABCD2.证券投资在投资活动中占有突出的地位, 其作用表现在______促进经济增长等方面。

A 使社会的闲散货币转化为投资资金B 使储蓄转化为投资C 促进资金合理流动D 促进资源有效配置答案: ABCD3.间接投资的优点有______。

A 积少成多B 续短为长C 化分散为集中D 分散风险答案: ABCD1.进入证券市场进行证券买卖的各类投资者即是证券投资的______。

A 主体B 客体C 工具D 对象答案: A2.由于______的作用, 投资者不再满足投资品种的单一性, 而希望建立多样化的资产组合。

A 边际收入递减规律B 边际风险递增规律C 边际效用递减规律D 边际成本递减规律答案: C3.通常, 机构投资者在证券市场上属于______型投资者。

A 激进B 稳定C 稳健D 保守答案: C4.商业银行通常将______作为第二准备金, 这些证券䠠??______为主。

A 长期证券长期国债B 短期证券短期国债C 长期证券公司债D 短期证券公司债答案: B5.购买股票旨在长期参股并可能谋求进入公司决策管理层的投资者被称为______。

A 投机者B 机构投资者C QFIID 战略投资者答案: D6.有价证券所代表的经济权利是______。

A 财产所有权B 债权C 剩余请求权D 所有权或债权答案: D7、按规定, 股份有限公司破产或解散时的清偿顺序是______。

《投资学》复习题一、单项选择题1、如果你相信市场是()有效市场的形式,你会觉得股价反映了所有相关信息,包括那些只提供给内幕人士的信息。

a. 半强式b. 强式c. 弱式d. a、b和c2.很多情况下人们往往把能够带来报酬的支出行为称为______。

A 支出B 储蓄C 投资D 消费3、当其他条件相同,分散化投资在那种情况下最有效?( )a. 组成证券的收益不相关b. 组成证券的收益正相关c. 组成证券的收益很高d. 组成证券的收益负相关4.如果强式有效市场假定成立,下列哪一种说法是正确的?()A、未来事件能够被准确地预测。

B、价格能够反映所有可得到的信息。

C、证券价格由于不可辨别的原因而变化。

D、价格不起伏。

5. 市场风险也可解释为()。

a. 系统风险,可分散化的风险b. 系统风险,不可分散化的风险c. 个别风险,不可分散化的风险d. 个别风险,可分散化的风险6.半强式有效市场假定认为股票价格()A、反映了已往的全部价格信息。

B、反映了全部的公开可得信息。

C、反映了包括内幕信息在内的全部相关信息。

D、是可以预测的。

7.对已经进行贴现,尚未到期的票据转做一次贴现的行为称为( )A.再贴现 B.承兑 C.转贴现 D.多次贴现8、其他条件不变,债券的价格与收益率()。

a. 正相关b. 反相关c. 有时正相关,有时反相关d. 无关9.在红利贴现模型中,不影响贴现率k的因素是()。

A、真实无风险回报率B、股票风险溢价C、资产回报率D、预期通胀率。

10.我国现行的证券交易制度规定,在一个交易日内,除首日上市证券外,每只股票或基金的交易价格相对上一个交易日收市价的涨跌幅度不得超过______。

A 5%B 10%C 15%D 20%11、在合约到期前,交易者除了进行实物交割,还可以通过______来结束交易。

A 投机B 对冲C 交收D 主动放弃12、以包销或代销方式帮助发行人发行证券的商号或机构叫做( )A.证券承销人 B.证券交易经纪人 C.证券交易所 D.证券结算公司13、期权交易是对______的买卖。

Chapter 11The Efficient Market HypothesisMultiple Choice Questions1. If you believe in the ________ form of the EMH, you believe that stock prices reflect all relevant information including historical stock prices and current public information about the firm, but not information that is available only to insiders.A.Semistrong2. When Maurice Kendall examined the patterns of stock returns in 1953 he concluded that the stock market was __________. Now, these random price movements are believed to be _________.A.inefficient; the effect of a well-functioning market3. The stock market follows a __________.B.Submartingale4. A hybrid strategy is one where the investorD.maintains a passive core and augments the position with an actively managed portfolio.5. The difference between a random walk and a submartingale is the expected price change in a random walk is ______ and the expected price change for a submartingale is ______.D.zero; positive6.6. The difference between a random walk and a submartingale is the expected price change in a random walk is ______ and the expected price change for asubmartingale is ______.D.zero; positive7. Proponents of the EMH typically advocateB.investing in an index fund.C. a passive investment strategy.E. B and C8. Proponents of the EMH typically advocateC. a passive investment strategy.9. If you believe in the _______ form of the EMH, you believe that stock prices reflect all information that can be derived by examining market trading data such as the history of past stock prices, trading volume or short interest.C.Weak10. If you believe in the _________ form of the EMH, you believe that stock prices reflect all available information, including information that is available only to insiders.B.strong11. If you believe in the reversal effect, you shouldC.buy stocks this period that performed poorly last period.12. __________ focus more on past price movements of a firm's stock than on the underlying determinants of future profitability.D.Technical analysts13. _________ above which it is difficult for the market to rise.B.Resistance level is a value14. _________ below which it is difficult for the market to fall.C.Support level is a value15. ___________ the return on a stock beyond what would be predicted from market movements alone.A.An excess economic return isC.An abnormal return isE. A and C16. The debate over whether markets are efficient will probably never be resolved because of ________.A.the lucky event issue.B.the magnitude issue.C.the selection bias issue.D.all of the above.17. A common strategy for passive management is ____________.A.creating an index fund18. Arbel (1985) found thatA.the January effect was highest for neglected firms.19. Researchers have found that most of the small firm effect occursD.in January.20. Basu (1977, 1983) found that firms with low P/E ratiosA.earned higher average returns than firms with high P/E ratios.21. Jaffe (1974) found that stock prices _________ after insiders intensively bought shares.C.increased22. Banz (1981) found that, on average, the risk-adjusted returns of small firmsA.were higher than the risk-adjusted returns of large firms.23. Proponents of the EMH think technical analystsE.are wasting their time.24. Studies of positive earnings surprises have shown that there isA. a positive abnormal return on the day positive earnings surprises are announced.B. a positive drift in the stock price on the days following the earnings surprise announcement.D.both A and B are true.25. Studies of negative earnings surprises have shown that there isA. a negative abnormal return on the day negative earnings surprises are announced.B. a positive drift in the stock price on the days following the earnings surprise announcement.D.both A and B are true.26. Studies of stock price reactions to news are calledB.event studies.27. On November 22, 2005 the stock price of Walmart was $ and the retailer stock index was . On November 25, 2005 the stock price of Walmart was $ and the retailer stock index was . Consider the ratio of Walmart to the retailer index on November 22 and November 25. Walmart is _______ the retail industry and technical analysts who follow relative strength would advise _______ the stock.A.outperforming, buying28. Work by Amihud and Mendelson (1986,1991)A.argues that investors will demand a rate of return premium to invest in less liquid stocks.B.may help explain the small firm effect.C.may be related to the neglected firm effect.E.A, B, and C.29. Fama and French (1992) found that the stocks of firms within the highest decile of market/book ratios had average monthly returns of _______ while the stocks of firms within the lowest decile of market/book ratios had average monthly returns of ________.C.less than 1%, greater than 1%30. A market decline of 23% on a day when there is no significant macroeconomic event ______ consistent with the EMH because ________.D.would not be, it was not a clear response to macroeconomic news.31. In an efficient market, __________.A.security prices react quickly to new informationB.security prices are seldom far above or below their justified levelsC.security analysts will not enable investors to realize superior returns consistentlyE.A, B, and C32. The weak form of the efficient market hypothesis asserts thatB.future changes in stock prices cannot be predicted from past prices.C.technicians cannot expect to outperform the market.E. B and C33. A support level is the price range at which a technical analyst would expect theC.demand for a stock to increase substantially.34. A finding that _________ would provide evidence against the semistrong form of the efficient market theory.A.low P/E stocks tend to have positive abnormal returnsC.one can consistently outperform the market by adopting the contrarian approach exemplified by the reversals phenomenonE. A and C35. The weak form of the efficient market hypothesis contradictsD.technical analysis, but is silent on the possibility of successful fundamental analysis. 36. Two basic assumptions of technical analysis are that security prices adjustC.gradually to new information and market prices are determined by the interaction of supply and demand.37. Cumulative abnormal returns (CAR)A.are used in event studies.B.are better measures of security returns due to firm-specific events than are abnormal returns (AR).D. A and B.38. Studies of mutual fund performanceA.indicate that one should not randomly select a mutual fund.B.indicate that historical performance is not necessarily indicative of future performance.D. A and B.39. The likelihood of an investment newsletter's successfully predicting the direction of the market for three consecutive years by chance should beC.between 10% and 25%.40. In an efficient market the correlation coefficient between stock returns for two non-overlapping time periods should beC.zero.41. The weather report says that a devastating and unexpected freeze is expected to hit Florida tonight, during the peak of the citrus harvest. In an efficient market one would expect the price of Florida Orange's stock toA.drop immediately.42. Matthews Corporation has a beta of . The annualized market return yesterday was 13%, and the risk-free rate is currently 5%. You observe that Matthews had an annualized return yesterday of 17%. Assuming that markets are efficient, this suggests thatB.good news about Matthews was announced yesterday.43. Nicholas Manufacturing just announced yesterday that its 4th quarter earnings will be 10% higher than last year's 4th quarter. You observe that Nicholas had an abnormal return of % yesterday. This suggests thatC.investors expected the earnings increase to be larger than what was actually announced.44. When Maurice Kendall first examined stock price patterns in 1953, he found thatB.there were no predictable patterns in stock prices.45. If stock prices follow a random walkD.price changes are random.46. The main difference between the three forms of market efficiency is thatD.the definition of information differs.47. Chartists practiceA.technical analysis.48. Which of the following are used by fundamental analysts to determine proper stock pricesI) trendlinesII) earningsIII) dividend prospectsIV) expectations of future interest ratesV) resistance levelsC.II, III, and IV49. According to proponents of the efficient market hypothesis, the best strategy for a small investor with a portfolio worth $40,000 is probably to E.invest in mutual funds.50. Which of the following are investment superstars who have consistently shown superior performanceI) Warren BuffetII) Phoebe BuffetIII) Peter LynchIV) Merrill LynchV) Jimmy BuffetC.I and III51. Google has a beta of . The annualized market return yesterday was 11%, and the risk-free rate is currently 5%. You observe that Google had an annualized return yesterday of 14%. Assuming that markets are efficient, this suggests thatB.good news about Google was announced yesterday.52. Music Doctors has a beta of . The annualized market return yesterday was 12%, and the risk-free rate is currently 4%. You observe that Music Doctors had an annualized return yesterday of 15%. Assuming that markets are efficient, this suggests thatA.bad news about Music Doctors was announced yesterday.53. QQAG has a beta of . The annualized market return yesterday was 13%, and the risk-free rate is currently 3%. You observe that QQAG had an annualized return yesterday of 20%. Assuming that markets are efficient, this suggests that C.no significant news about QQAG was announced yesterday.54. QQAG just announced yesterday that its 4th quarter earnings will be 35% higher than last year's 4th quarter. You observe that QQAG had an abnormal return of % yesterday. This suggests thatC.investors expected the earnings increase to be larger than what was actually announced.55. LJP Corporation just announced yesterday that it would undertake an international joint venture. You observe that LJP had an abnormal return of 3% yesterday. This suggests thatD.investors view the international joint venture as good news.56. Music Doctors just announced yesterday that its 1st quarter sales were 35% higher than last year's 1st quarter. You observe that Music Doctors had an abnormal return of -2% yesterday. This suggests thatC.investors expected the sales increase to be larger than what was actually announced.57. The Food and Drug Administration (FDA) just announced yesterday that they would approve a new cancer-fighting drug from King. You observe that King had an abnormal return of 0% yesterday. This suggests thatD.the approval was already anticipated by the market58. Your professor finds a stock-trading rule that generates excessrisk-adjusted returns. Instead of publishing the results, she keeps the trading rule to herself. This is most closely associated with ________.B.selection bias59. At freshman orientation, 1,500 students are asked to flip a coin 20 times. One student is crowned the winner (tossed 20 heads). This is most closely associated with ________.D.the lucky event issue60. Sehun (1986) finds that the practice of monitoring insider trade disclosures, and trading on that information, would be ________.E.not sufficiently profitable to cover trading costs61. If you believe in the reversal effect, you shouldC.sell stocks this period that performed well last period.62. Patell and Woflson (1984) report that most of the stock price response to corporate dividend or earnings announcements occurs within ____________ of the announcement.C. 2 hoursShort Answer Questions63. Discuss the various forms of market efficiency. Include in your discussion the information sets involved in each form and the relationships across information sets and across forms of market efficiency. Also discuss the implications for the various forms of market efficiency for the various types of securities' analysts.The weak form of the efficient markets hypothesis (EMH) states that stock prices immediately reflect market data. Market data refers to stock prices and trading volume. Technicians attempt to predict future stock prices based on historic stock price movements. Thus, if the weak form of the EMH holds, the work of the technician is of no value.The semistrong form of the EMH states that stock prices include all public information. This public information includes market data and all other publicly available information, such as financial statements, and all information reported in the press relevant to the firm. Thus, market information is a subset of all public information. As a result, if the semistrong form of the EMH holds, the weak form must hold also. If the semistrong form holds, then the fundamentalist, who attempts to identify undervalued securities by analyzing public information, is unlikely to do so consistently over time. In fact, the work of the fundamentalist may make the markets even more efficient!The strong form of the EMH states that all information (public and private) is immediately reflected in stock prices. Public information is a subset of all information, thus if the strong form of the EMH holds, the semistrong form must hold also. The strong form of EMH states that even with inside (legal or illegal) information, one cannot expect to outperform the market consistently over time. Studies have shown the weak form to hold, when transactions costs are considered. Studies have shown the semistrong form to hold in general, although some anomalies have been observed. Studies have shown that some insiders (specialists, major shareholders, major corporate officers) do outperform the market. Feedback: The purpose of this question is to assure that the student understands the interrelationships across different forms of the EMH, across the informationsets, and the implications of each form for different types of analysts.64. What is an event study It is a test of what form of market efficiency Discuss the process of conducting an event study, including the best variable(s) to observe as tests of market efficiency.A event study is an empirical test which allows the researcher to assess the impact of a particular event on a firm's stock price. To do so, one often uses the index model and estimates e, the residual term which measures thetfirm-specific component of the stock's return. This variable is the difference between the return the stock would ordinarily earn for a given level of market performance and the actual rate of return on the stock. This measure is often referred to as the abnormal return of the stock. However, it is very difficult to identify the exact point in time that an event becomes public information; thus, the better measure is the cumulative abnormal return, which is the sum of abnormal returns over a period of time (a window around the event date). This technique may be used to study the effect of any public event on a firm's stock price; thus, this technique is a test of the semistrong form of the EMH. Feedback: The rationale for this question is to ascertain if the student understands the methodology most commonly used as a test of the semistrong form of market efficiency.65. Discuss the small firm effect, the neglected firm effect, and the January effect, the tax effect and how the four effects may be related.Studies have shown that small firms earn a risk-adjusted rate of return greater than that of larger firms. Additional studies have shown that firms that are not followed by analysts (neglected firms) also have a risk-adjusted return greater than that of larger firms. However, the neglected firms tend to be small firms; thus, the neglected firm effect may be a manifestation of the small firm effect. Finally, studies have shown that returns in January tend to be higher than in other months of the year. This effect has been shown to persist consistently over the years. However, the January effect may be the tax effect, as investors may have sold stocks with losses in December for tax purposes and reinvested in January. Small firms (and neglected firms) would tend to be more affected by this increased buying than larger firms, as small firms tend to sell for lower prices.Feedback: The purpose of this question is to reinforce the interrelationships, that "effects" may not always be independent and thus readily identifiable. Also these effects are widely discussed in the financial press, and the January effect appears to be quite persistent.66. Why might the degree of market efficiency differ across various markets State three reasons why this might occur and explain each reason briefly.1. Market efficiency depends on information being essentially free and costless to market participants. In the . markets this is the case to a large extent. The . markets are well developed and professional analysts often follow securities. Information is available on television, in the press, and on the Internet. The opposite may be true in other markets, such as those of developing countries, where there are fewer or no analysts and few market participants with these resources.2. Accounting disclosure requirements are different across markets. In the . firms must meet SEC requirements to be publicly traded. In other countries the requirements may be different or nonexistent. This has implications about the ease with which analysts can evaluate the company to determine its proper value.3. Markets for "neglected" stocks may be less efficient than markets for stocks that are heavily followed by analysts. If analysts feel that it is not worthwhile to give their attention to particular stocks then ample information about these stocks will not be readily available to investors.Feedback: This question leads the student to look at some of the fundamental reasons for market efficiency and why there may be differences among markets with regard to the reasons. Alternative answers are possible.67. With regard to market efficiency, what is meant by the term "anomaly" Give three examples of market anomalies and explain why each is considered to be an anomaly.Anomalies are patterns that should not exist if the market is truly efficient. Investors might be able to make abnormal profits by exploiting the anomalies, which doesn't make sense in an efficient market.Possible examples include, but are not limited to, the following.the small-firm effect - average annual returns are consistently higher for small-firm portfolios, even when adjusted for risk by using the CAPM.January effect - the small-firm effect occurs virtually entirely in January. neglected-firm effect - small firms tend to be ignored by large institutional traders and stock analysts. This lack of monitoring makes them riskier and they earn higher risk-adjusted returns. The January effect is largest for neglected firms.the liquidity effect - investors demand a return premium to invest in less-liquid stocks. This is related to the small-firm effect and the neglected-firm effect. These stocks tend to earn high risk-adjusted rates of return.ratios - firms with the higher book-to-market-value ratios have higherrisk-adjusted returns, suggesting that they are underpriced. When combined with the firm-size factor, this ratio explained returns better than systematic risk as measured by beta.the reversal effect - stocks that have performed best in the recent past seem to underperform the rest of the market in the following periods, and vice versa. Other studies indicated that this effect might be an illusion. These studies used portfolios formed mid-year rather than in December and considered the liquidity effect.Investors should not be able to earn excess returns by taking advantage of anyof these. The market should adjust prices to their proper levels. But these things have been documented to occur repeatedly.Feedback: This question tests whether the student grasps the basic concept of anomalies and allows some choice in explaining some of them.。