国际结算第十章复习课程

- 格式:ppt

- 大小:54.50 KB

- 文档页数:16

国际结算Translation1.无追索权的 without recourse2.投标保函Tender Guarantee3.备用信用证 stand-by credit4.托收出口押汇collection bill purchased5.善意持票人 bona-fide holder6.信托收据Trust receipt7.承兑交单documents against acceptance8.拒付通知notice of dishonor9.循环信用证Revolving Credit10.空白背书 blank endorsement1.Acceptance for honor 参加承兑2.After sight 见票即付3.Short form bill of lading 简式提单4.Mail remittance 信汇5.Countermand of payment 止付6.Clearing bank 清算银行7.Proforma invoice 形式发票8.Subsequent holder 后手9.Disclosed factoring 公开保理10.Shipping mark 唛头1.CIF 到岸价2.Advance payment 预付款3.Correspondent bank 代理银行4.Test key 密押5.Confirmed letter of credit 保兑信用证6.Subsequent endorser 后手7.Direct guarantee 直接担保8.Deferred credit 延期付款信用证9.Insurance certificate 保险证书,小保单10.Clean bill of lading 清洁提单1.原产地证书 certificate of original2.经常账户 current account3.金融单据 financial document4.参加承兑人 acceptor for honor5.商业发票 commercial invoice6.承兑交单 documents against acceptance7.账户关系8.贷记通知 credit advice9.电汇 telegraphic transfer10.银行信用 the reputation of the bankMultiple Choice1.If bank of china instructs bank of America to pay a sum of USD1,000,000.00 to Midland,its nostro account will beA.creditedB. debitedC. increasedD. decreasedNostro account 往账,我行在他行开立的存款账户2.if a bill is payable “60 days after date”, the date of payment id decided according toA.the date of acceptanceB.the date of presentationC.the date of the billD.the date of maturityAt days/month(s) after date出票后若干天、月付款3.A(n)______ is a financial document.A.bill of exchangeB.bill of ladingC.insurance policymercial invoice“Financial Documents” means bills of exchange, promissory notes, cheques, or other similar instruments used for obtaining the payment of money.“Commercial Documents” means invoices, transport documents of title or other similar documents, or any other documents whatsoever, not being financial documents.4.The party to whom the bill is addressed is called the ______A.drawerB.draweeC.payeeD.drawer5.To the importer, the fastest and safest method of settlement isA.letter of creditB.cash in advanceC.open accountD.collectionOpen account business 赊账业务Payment after Arrival of the Goods which is adopted in international trade is usually effected by remittance too, and is advantageous to importer6.Which of the following is based on commercial credit?A.letter of creditB.bank letter of guaranteeC.collectionD.insurance7.Which type of collection offers greatest security to the exporter?A.Documents against acceptanceB.Documents against paymentC.Clean collectionD.Acceptance D/P8.The principal is generally the customer of a bank who prepares documentation andsubmits them to the_____ bank with a collection order for payment from the buyer (drawee).A.remittingB.collectingC.presentingD.correspondent9. A letter of credit is_______A. a formal guarantee of paymentB. a conditional undertaking to make paymentC.an unconditional undertaking to make paymentD. a two bank guarantee of paymentThe documentary credit跟单信用证 or letter of credit is an undertaking(保证) issued by a bank for the account of the buyer (the applicant) or for its own account, to pay the beneficiary the value of the draft and/or documents provided that the terms and conditions of the documentary credit are complied with完全符合.10.From the point of view of a Chinese,_____is our bank’s account in the books of anoverseas bank,denominated in foreign currency.A. a vostro accountB. a nostro accountC. a mirror accountD. a record account11. If a bill is payable “120 days after date”, the date of payment id decided according toA.the date of acceptanceB.the date of presentationC.the date of the billD.the date of maturity12. A(n)_____is a commercial document.A.bill of exchangeB.bill of ladingC.promissory checkD.check“Financial Documents” means bills of exchange, promissory notes, cheques, or other similar instruments used for obtaining the payment of money.“Commercial Documents” means in voices, transport documents of title or other similar documents, or any other documents whatsoever, not being financial documents.13.The party to whom the bill is addressed is called the_____A.drawerB.draweeC.payeeD.payer14. Which of the following is based on banker’s credit?A.Letter of creditB.D/PC.D/AD.T/T15._____is a compromised method between open account and cash in advance.A. Letter of guaranteeB. remittanceC. treasury billsD. Documentary collection16.The various methods of settlement all involve the same book keeping记账. The onlyDifference isA.the method by which the overseas bank is advised about the transferB.the method by which the beneficiary is advised about the transferC.the speedD.the beneficiary17.If a London Bank makes a payment to a correspondent abroad,_____A.it will remit the sum abroadB.the foreign bank’s vostro account will be creditedC.the London bank’s nostro account will be creditedD.either A or B18.Which type of collection offers the greatest security to the importer?A.Documents against acceptanceB.Documents against paymentC.Clean collectionD.Acceptance D/P19. The principal is generally the customer of a bank who preparesdocumentation and submits them to the_____ bank with a collection order for payment from the buyer (drawee).A. remittingB. collectingC. presentingD. correspondent20. If the credit stipulates shipment on or about December 18,2012,then the date ofon board bill of lading may be_____A. December 28, 2012B. December 12, 2012C. December 18, 2012D. B or C1. Please state the simplified remittance diagram2. Please state the difference between documents against payment and documentsagainst acceptance3. Please state the simplified D/A diagram4. Please illustrates the documents against payment transaction flow.5. Compare with the back-to-back L/C and transferable L/C, explain their similarityand differenceSimilarities:1. Both of them have middle men and second beneficiaries. And middle mancan get price difference by keeping business secrets.2. Middle men bear the cost.3. The amount, unit cost, shipment date on letters of credit can be amended bymiddle men.Differences:1. Transferable L/C involves an applicant, a issuing bank, a letter of creditwhile back-to-back L/C involves two applicants, two issuing banks, twoletters of credit.2. Transferable credit: the original issuing bank takes responsibility for the creditBack-to-back credit: the original issuing bank doesn’t take responsibility forthe new credit.3. Transferable credit: the credit can’t be transferred without the expresscontent ofissuing bank.Back-to-back credit: the new credit can be opened by middle men withoutthe original bank’s consent and even w ithout prior notice to the originalbank4. Transferable credit: the middle man becomes the first beneficiary from the beneficiaryBack-to-back credit: the middle man becomes the applicant from thebeneficiary.6. Explain the role of commercial invoices1.The commercial invoice is the key accounting document describing the commercial transaction between the buyer and the seller. It is a document giving details of goods, service, price, quantity, settlement terms and shipment.2.It make it is convenient for importers to check whether the delivered goods iscorresponded to the contract.3. It can be viewed as accounting basis for importers and exporters.4. It can be basis of calculating customs duty for export place and import place.mercial invoice can be used to be the basis of payment to take the place ofdraft.(1)商业发票是全部单据的中心,是出口商装运货物并表明是否履约的总说明。

国际结算课程复习资料国际结算课程复习资料⼀、重点词汇英汉互译:第⼀章国际结算的介绍Correspondent Bank 代理⾏ Control Documents 控制⽂件Test key 密押 Terms and conditions 费率表Specimen of authorized signature 印鉴 SWIFT 环球银⾏⾦融电讯协会Debit (for bank) 借记Credit (for bank) 贷记Nostro account 往户账 Vostro account 来户账IMF 国际货币基⾦组织 ICC 国际商会 WBG 世界银⾏组织CHIPS 英国同业银⾏⾃动⽀付系统 CHAPS 纽约银⾏同业电⼦清算系统URC522 《跟单托收统⼀规则》 UCP 600《跟单信⽤证统⼀惯例》国际结算 International Settlement预付货款 Payment in advance 赊账 Open Account(O/A)汇款(汇付)Remittance 托收 Collection跟单信⽤证Documentary L/C 银⾏保函 Bank Guarantee第⼆章票据Recourse 追索Non-causation ⽆因性流通⼯具 Negotiable Instrument汇票 Bill of Exchange/Draft本票 Promissory Note⽀票 Check/Chequedrawer 出票⼈payer/drawee 付款⼈payee 收款⼈endorser 背书⼈acceptor 承兑⼈Holder 持票⼈Holder for value 对价持票⼈Holder in due course/Bona fide holder 正当持票⼈/善意的持票⼈汇票出票Issue 背书Endorsement)提⽰(Presentation 承兑(Acceptance保证Guarantee 付款Payment 拒付Dishonor 追索Recourse拒绝证书Protest Tenor 付款期限 Usance bill 远期汇票Blank endorsement 空⽩背书Acceptance/payment for honor参加承兑和参加付款⽀票Crossed check 划线⽀票 Uncrossed check ⾮划线⽀票 Open check 现⾦⽀票Rubber check/bad check 空头⽀票Collecting bank 托收⾏out of date 过期第三章Remittance 汇付,顺汇 Reverse remittance 逆汇Remitter 汇款⼈ Remitting bank 汇出⾏Paying bank 汇⼊⾏,解付⾏Beneficiary or payee 收款⼈,受益⼈Reimbursement of remittance cover 拨头⼨T/T 电汇 M/T 信汇 D/D 票汇 Payment in advance 预付货款Open account / payment after goods arrival 赊销 Consignment 寄售第四章Documentary collection 跟单托收Clean collection 光票托收Direct collection 直接托收 D/P at sight 即期付款交单D/P after sight 远期付款交单 D/A 承兑交单D/P.T/R/ 付款交单凭信托收据借单 Outward bills/出⼝押汇Inward bills /进⼝押汇 Principal/委托⼈Remitting Bank/托收⾏ Collecting Bank/代收⾏Drawee/付款⼈Principal’s representative in case of need/需要时的代理第五章Applicant 申请⼈ Beneficiary 受益⼈ Issuing Bank 开证⾏Advising Bank通知⾏ Confirming Bank 保兑⾏ Paying Bank 付款⾏承兑⾏Accepting Bank 议付⾏Negotiating Bank 偿付⾏Reimbursing Bank 索偿⾏Claiming Bank 寄单⾏Remitting Bankin duplicate ⼀式两份 in triplicate ⼀式三份in quadruplicate ⼀式四份 in quintuplicate ⼀式五份Confirm 保兑 Negotiate 议付 undertaking 承诺Primary liability forpayment of the Issuing Bank 开证⾏承担第⼀性付款责任Documentary Credit Nominated Bank指定银⾏soft clause软条款跟单与光票信⽤证 Documentary and clean L/C不可撤销与可撤销信⽤证 Irrevocable and revocable L/C保兑与不保兑信⽤证 Confirmed and unconfirmed L/C即期付款、延期付款、承兑和议付信⽤证,假远期信⽤证Sight、 Usance、 Acceptance and Negotiation L/C可转让与不可转让信⽤证 Transferable and Untransferable L/C循环信⽤证 Revolving L/C 对开信⽤证 Reciprocale L/C背对背信⽤证 Back to back L/C 预⽀(红条款)信⽤证)Anticipantory L/C 备⽤信⽤证 Standby L/C⼆、知识重点:第⼀章国际结算的介绍⼀、国际结算定义:(Definition)1、是指处于两个处于不同国家的当事⼈通过银⾏办理的两国间货币收付业务。

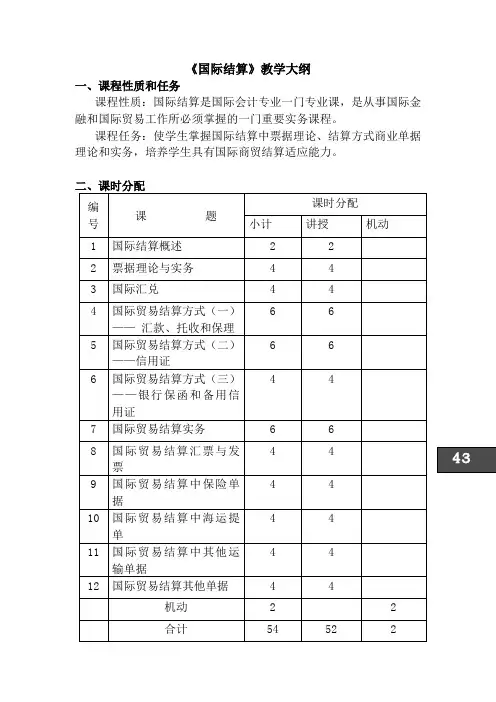

《国际结算》教学大纲一、课程性质和任务课程性质:国际结算是国际会计专业一门专业课,是从事国际金融和国际贸易工作所必须掌握的一门重要实务课程。

课程任务:使学生掌握国际结算中票据理论、结算方式商业单据理论和实务,培养学生具有国际商贸结算适应能力。

三、课程教学内容第一章国际结算概述国际结算基本概念,当代国际贸易结算特点,凭单付款,非现金结算,国际结算体系。

第二章票据理论与实务票据概述,汇票定义和内容,票据行为及汇票的使用,本票及常见的本票形式,支票及其使用。

重点:汇票的使用。

难点:票据实务。

第三章国际汇兑代理银行关系,银行汇兑,国际银行间帐户汇兑方式。

重点:中心汇票难点:国际银行间帐户汇兑方式。

第四章国际贸易结算方式(一)汇款、托收和保理汇款当事人,汇款方式,汇款在国际贸易中的应用,汇款退汇,托收当事人,跟单托收种类,托收当事人的责任,跟单托收中汇票与单据,跟单托收方式下进出口押汇,保理商可以提供的服务,保理业重点:汇款、托收、保理实务难点:进出口押汇,保理业务的一般做法。

第五章国际贸易结算方式(二)——信用证信用证一般业务程序,信用证当事人,信用证的内容,信用证类型,跟单信用证统一惯例。

重点:信用证应用。

难点:跟单信用证统一惯例。

第六章国际贸易结算方式(三)——银行保函和备用信用证银行保函,直接担保,保函内容,银行保函种类,保函实务,银行保函和跟单信用证区别,备用信用证含义。

重点:银行保函主要内容。

难点:银行保函和跟单信用证区别。

第七章国际贸易结算实务国际贸易术语的国际惯例,向承运人交货的3种贸易术语,其他贸易术语,信用卡证实务,结算融资,出口结算融资,进口结算融资,国际贸易结算中的风险及防范。

重点:进出口融资。

难点:信用卡证实务。

第八章国际贸易结算汇票与发票单据作用,种类,汇票,商业发票的内容及编制掌握的原则。

重点:发票编制。

难点:编制掌握的原则。

第九章国际贸易结算中保险单据海上运输保险承保范围,保险单据及种类,保险单内容及作用。

第二章国际储备第三章第四章外汇实务第五章第六章第七章第八章国际结算第九章第十章第十一章重点重点重难点重点难点重点重难点第一章国际收支本章重难点分析第一节国际收支与国际收支平衡表一、国际收支1(1(2(3第一节国际收支与国际收支平衡表一、国际收支广义的国际收支是指一个经济体居民与非居民之间发生的所有经济交易活动的汇总。

它以交易为基础,不仅包括贸易收支和非贸易收支,也包括资本的输入和输出;不仅包括已实现的外汇收支交易,也包括未实现的外汇收支交易。

国际货币基金组织建议采用广义的国际收支概念。

一、国际收支2(1(2一、国际收支2(3二、国际收支平衡表二、国际收支平衡表1二、国际收支平衡表二、国际收支平衡表23二、国际收支平衡表4第一节国际收支与国际收支平衡表三、国际收支平衡表的结构(1)经常账户,包括货物、服务、初次收入和二次收入四个子账户。

(2)资本与金融账户,包括资本账户和金融账户两个子账户。

(3)误差与遗漏净额是作为残差项推算的,于轧平账户时使用。

四、国际收支平衡表的内容四、国际收支平衡表的内容1.(1(212个四、国际收支平衡表的内容2.3.四、国际收支平衡表的内容四、国际收支平衡表的内容1.(1(2四、国际收支平衡表的内容2.(1(2(3四、国际收支平衡表的内容(4(5四、国际收支平衡表的内容讲解归纳与举例)A. B./处置C. D.【正确答案:B】/谢谢第二节国际收支平衡表的分析一、分析国际收支平衡表的意义(1(2(3一、分析国际收支平衡表的意义(1(2(3二、国际收支平衡表分析方法(三种)二、国际收支平衡表分析方法(三种)1.二、国际收支平衡表分析方法(三种)2.二、国际收支平衡表分析方法(三种)3./ 4.二、国际收支平衡表分析方法(三种)二、国际收支平衡表分析方法(三种)三、国际投资头寸表三、国际投资头寸表三、国际投资头寸表1.2.三、国际投资头寸表3.4.三、国际投资头寸表5.(1(2(3(4讲解归纳与举例A. B.C. D.【正确答案:B】谢谢第三节国际收支的调节一、国际收支平衡表的平衡与失衡一、国际收支平衡表的平衡与失衡二、国际收支失衡的原因二、国际收支失衡的原因三、国际收支失衡的经济影响(1(2(3(4(1(2四、国际收支调节方法四、国际收支调节方法1.四、国际收支调节方法2.。

《国际结算》课程知识复习学习材料试题与参考答案一、单选题1.属于汇款活动当事人的是(B)A.委托人B.汇出行C.代收行D.索偿付2.计算汇票付款具体时间时,必须包括(D)A.见票日B.出票日C.提单日D.付款日3.属于顺汇方法的支付方式是(A)A.汇款B.托收C.信用证D.银行保函4.通过汇出行开立的银行汇票的转移实现货款支付的汇付方式是(C)A.电汇B.信汇C.票汇D.银行转帐5.承兑交单方式下开立的汇票是(B)A.即期汇票B.远期汇票C.银行汇票D.银行承兑汇票6.持票人将汇票提交付款人的行为是(A)A.提示B.承兑C.背书D.退票7.信用证支付方式实际上把进口人履行的付款责任,转移给(B)A.出口人B.银行C.供货商D.最终用户8.当受益人审证时发现信用证与合同不符时,可要求(B)。

A.开征行改证B.开证人改证C.通知行改证D.付款行改证9.保理业务支付的手续费一般是发票金额(B)A.0B.0.01C.0.01D.0.0110.在我国实际出口业务中,出口公司开出的汇票在信用证结算方式下出票原因栏应填写(D)A.合同号码及签订日期B.提单号码及签发日期C.发票号码及签发日期D.信用证号码及出证日11.D/P·T/R意指(C)A.合同号码及签订日期B.提单号码及签发日期C.发票号码及签发日期D.信用证号码及出证日12.L/C上如未明确付款人,则制作汇票时,受票人应为(B)A.开证申请人B.开证行C.议付行D.通知行13.保兑行对保兑信用证承担的付款责任是(B)A.第一性的B.第二性的C.第三性的D.第四性的14.(A)贸易方式采购大型机器设备需要开立保函,还要开立延期付款信用证,是一种最复杂的结算方式。

A.投标B.补偿贸易C.易货贸易D.寄售15.承兑人对出票人的指示不加限制地同意确认,这是(A)A.一般承兑B.特别承兑C.普通承兑D.限制承兑16.合同中规定采用D/A 30天的托收方式付款,托收日为9月l日,如寄单邮程为10天,则此业务的提示日承兑日、付款日、交单日为(B)A.9月11日/9月11日/10月11日B.9月11日/10月11日/9月11日C.9月1日/9月11日/10月11日D.9月1日/10月11日/9月11日17.按照《跟单信用证统一惯例》的规定,受益人最后向银行交单议付的期限是不迟于提单签发日(C)A.11天B.15天C.21天D.25天18.最简单的结算方式为(A)A.汇款B.托收C.信用证D.银行保函19.背书人在汇票背面只有签名,不写被背书人,这是(D)A.限定性背书B.特别背书C.记名背书D.空白背书20.接受汇出行的委托将款项解付给收款人的银行是(B)A.托收银行B.汇入行C.代收行D.转递行21.在汇款方式中,能为收款人提供融资便利的方式是(B)A.信汇B.票汇C.电汇D.远期汇款22.在托收结算方式下,一旦货款被买方拒付,在进口地承担货物的提货、报关、存仓、转售等责任的当事人是(A)A.委托人B.托收行C.代收银行D.付款人23.易货贸易方式采用(D)方式,比普通信用证复杂一些。

国际结算实训教案第一章:国际结算概述一、教学目标1. 了解国际结算的定义、功能和基本流程。

2. 掌握国际结算的工具和方式。

3. 理解国际结算在国际贸易中的重要性。

二、教学内容1. 国际结算的定义与功能2. 国际结算的基本流程3. 国际结算的工具和方式4. 国际结算在国际贸易中的应用三、教学方法1. 讲授法:讲解国际结算的基本概念、流程和工具。

2. 案例分析法:分析实际案例,让学生更好地理解国际结算的应用。

四、教学评估1. 课堂问答:检查学生对国际结算基本概念的理解。

2. 案例分析报告:评估学生对国际结算应用能力的掌握。

第二章:汇付结算方式一、教学目标1. 掌握汇付结算的定义和特点。

2. 了解汇付结算的流程和操作要点。

3. 熟悉汇付结算在国际贸易中的应用。

1. 汇付结算的定义和特点2. 汇付结算的流程和操作要点3. 汇付结算在国际贸易中的应用三、教学方法1. 讲授法:讲解汇付结算的基本概念和流程。

2. 模拟操作法:让学生参与模拟汇付结算操作,提高实际操作能力。

四、教学评估1. 课堂问答:检查学生对汇付结算基本概念的理解。

2. 模拟操作报告:评估学生对汇付结算操作能力的掌握。

第三章:托收结算方式一、教学目标1. 掌握托收结算的定义和特点。

2. 了解托收结算的流程和操作要点。

3. 熟悉托收结算在国际贸易中的应用。

二、教学内容1. 托收结算的定义和特点2. 托收结算的流程和操作要点3. 托收结算在国际贸易中的应用三、教学方法1. 讲授法:讲解托收结算的基本概念和流程。

2. 模拟操作法:让学生参与模拟托收结算操作,提高实际操作能力。

1. 课堂问答:检查学生对托收结算基本概念的理解。

2. 模拟操作报告:评估学生对托收结算操作能力的掌握。

第四章:信用证结算方式一、教学目标1. 掌握信用证结算的定义和特点。

2. 了解信用证结算的流程和操作要点。

3. 熟悉信用证结算在国际贸易中的应用。

二、教学内容1. 信用证结算的定义和特点2. 信用证结算的流程和操作要点3. 信用证结算在国际贸易中的应用三、教学方法1. 讲授法:讲解信用证结算的基本概念和流程。

国际结算课程教案第一章:国际结算概述1.1 教学目标了解国际结算的定义、功能和作用掌握国际结算的基本程序和流程熟悉国际结算的工具和方式1.2 教学内容国际结算的定义和重要性国际结算的基本程序和流程国际结算的工具:汇票、本票、支票、汇款、信用证等国际结算的方式:电汇、信汇、票汇等1.3 教学方法讲授法:讲解国际结算的定义、功能和作用,以及基本程序和流程案例分析法:分析实际案例,加深对国际结算工具和方式的理解1.4 教学评估课堂讨论:让学生参与讨论国际结算的流程和工具第二章:国际结算工具2.1 教学目标掌握国际结算中常用的工具,如汇票、本票、支票、汇款、信用证等了解各种工具的特点、优缺点和适用场景2.2 教学内容汇票的定义、种类和特点本票的定义、种类和特点支票的定义、种类和特点汇款的定义、流程和特点信用证的定义、种类和特点2.3 教学方法讲授法:讲解各种国际结算工具的定义、特点和适用场景案例分析法:分析实际案例,加深对各种工具的理解和应用2.4 教学评估课堂讨论:让学生参与讨论各种国际结算工具的特点和适用场景第三章:国际结算方式3.1 教学目标掌握国际结算中常用的方式,如电汇、信汇、票汇等了解各种方式的优缺点和适用场景3.2 教学内容电汇的定义、流程和特点信汇的定义、流程和特点票汇的定义、流程和特点3.3 教学方法讲授法:讲解各种国际结算方式的定义、流程和特点案例分析法:分析实际案例,加深对各种方式的理解和应用3.4 教学评估课堂讨论:让学生参与讨论各种国际结算方式的优缺点和适用场景第四章:国际结算风险与管理4.1 教学目标了解国际结算中可能出现的风险,如信用风险、操作风险、法律风险等掌握国际结算风险的管理方法和策略4.2 教学内容国际结算风险的种类和来源国际结算风险的管理方法和策略国际结算风险控制的工具和技术4.3 教学方法讲授法:讲解国际结算风险的种类、来源和管理方法案例分析法:分析实际案例,加深对国际结算风险管理的理解和应用4.4 教学评估课堂讨论:让学生参与讨论国际结算风险的种类和管理方法第五章:国际结算实务操作5.1 教学目标掌握国际结算实务的基本操作流程熟悉国际结算实务中的关键环节和注意事项5.2 教学内容国际结算实务操作的基本流程国际结算实务中的关键环节,如汇票审核、结算金额确认、支付指令发出等国际结算实务中的注意事项,如合规性、安全性、及时性等5.3 教学方法讲授法:讲解国际结算实务操作的基本流程和关键环节角色扮演法:模拟国际结算实务操作,让学生参与实际操作过程5.4 教学评估课堂讨论:让学生参与讨论国际结算实务操作中的关键环节和注意事项第六章:国际结算中的货币与汇率6.1 教学目标理解国际货币体系的基本概念掌握汇率的定义、种类及影响因素分析汇率变动对国际结算的影响6.2 教学内容国际货币体系的发展与现状汇率的种类:现汇汇率、现钞汇率、买入汇率、卖出汇率等影响汇率变动的因素:供求关系、通货膨胀、利率、政府政策等汇率变动对国际结算的影响6.3 教学方法讲授法:讲解国际货币体系的基本概念和汇率的相关知识案例分析法:分析汇率变动对国际结算的具体案例6.4 教学评估课堂讨论:让学生参与讨论汇率变动对国际结算的影响第七章:国际结算支付方式——信用证7.1 教学目标理解信用证的基本概念和作用掌握信用证的种类、条款及操作流程分析信用证的风险与防范措施7.2 教学内容信用证的定义、作用及基本条款信用证的种类:光票信用证、跟单信用证、备用信用证等信用证的操作流程:开证、议付、偿付等信用证的风险与防范措施7.3 教学方法讲授法:讲解信用证的基本概念、种类、条款及操作流程案例分析法:分析信用证的风险与防范措施的具体案例7.4 教学评估课堂讨论:让学生参与讨论信用证的风险与防范措施第八章:国际结算支付方式——托收8.1 教学目标理解托收的基本概念和作用掌握托收的种类、条款及操作流程分析托收的风险与防范措施8.2 教学内容托收的定义、作用及基本条款托收的种类:光票托收、跟单托收等托收的操作流程:托收申请、托收通知、托收执行等托收的风险与防范措施8.3 教学方法讲授法:讲解托收的基本概念、种类、条款及操作流程案例分析法:分析托收的风险与防范措施的具体案例8.4 教学评估课堂讨论:让学生参与讨论托收的风险与防范措施第九章:国际结算支付方式——汇款9.1 教学目标理解汇款的基本概念和作用掌握汇款的种类、条款及操作流程分析汇款的风险与防范措施9.2 教学内容汇款的定义、作用及基本条款汇款的种类:电汇、信汇、票汇等汇款的操作流程:汇款申请、汇款执行、收款确认等汇款的风险与防范措施9.3 教学方法讲授法:讲解汇款的基本概念、种类、条款及操作流程案例分析法:分析汇款的风险与防范措施的具体案例9.4 教学评估课堂讨论:让学生参与讨论汇款的风险与防范措施第十章:国际结算的未来发展10.1 教学目标了解国际结算的发展趋势掌握新兴结算工具和支付系统分析未来国际结算面临的挑战与机遇10.2 教学内容国际结算的发展趋势:电子化、数字化、网络化等新兴结算工具:数字货币、电子支付、移动支付等新兴支付系统:SWIFT、、支付等未来国际结算面临的挑战与机遇10.3 教学方法讲授法:讲解国际结算的发展趋势、新兴结算工具和支付系统案例分析法:分析未来国际结算面临的挑战与机遇的具体案例10.4 教学评估课堂讨论:让学生参与讨论国际结算的未来发展重点和难点解析1. 国际结算概述:理解国际结算的定义、功能和作用,以及基本程序和流程。

《国际结算》教学大纲一、课程性质和任务课程性质:国际结算是国际会计专业一门专业课,是从事国际金 融和国际贸易工作所必须掌握的一门重要实务课程。

课程任务:使学生掌握国际结算中票据理论、结算方式商业单据 理论和实务,培养学生具有国际商贸结算适应能力。

二、课时分配43三、课程教学内容第一章国际结算概述国际结算基本概念,当代国际贸易结算特点,凭单付款,非现金结算,国际结算体系。

第二章票据理论与实务票据概述,汇票定义和内容,票据行为及汇票的使用,本票及常见的本票形式,支票及其使用。

重点:汇票的使用。

难点:票据实务。

第三章国际汇兑代理银行关系,银行汇兑,国际银行间帐户汇兑方式重点:中心汇票难点:国际银行间帐户汇兑方式。

第四章国际贸易结算方式(一)汇款、托收和保理汇款当事人,汇款方式,汇款在国际贸易中的应用,汇款退汇,托收当事人,跟单托收种类,托收当事人的责任,跟单托收中汇票与单据,跟单托收方式下进出口押汇,保理商可以提供的服务,保理业务当事人,保重点:汇款、托收、保理实务难点:进出口押汇,保理业务的一般做法。

第五章国际贸易结算方式(二)--- 信用证信用证一般业务程序,信用证当事人,信用证的内容,信用证类型,跟单信用证统一惯例。

重点:信用证应用。

难点:跟单信用证统一惯例。

第六章国际贸易结算方式(三)――银行保函和备用信用证银行保函,直接担保,保函内容,银行保函种类,保函实务,银行保函和跟单信用证区别,备用信用证含义。

重点:银行保函主要内容。

难点:银行保函和跟单信用证区别。

第七章国际贸易结算实务国际贸易术语的国际惯例,向承运人交货的3种贸易术语,其他贸易术语,信用卡证实务,结算融资,出口结算融资,进口结算融资,国际贸易结算中的风险及防范。

重点:进出口融资。

难点:信用卡证实务。

第八章国际贸易结算汇票与发票单据作用,种类,汇票,商业发票的内容及编制掌握的原则。

重点:发票编制。

难点:编制掌握的原则。

第九章国际贸易结算中保险单据海上运输保险承保范围,保险单据及种类,保险单内容及作用。

《国际结算》课程笔记第一章票据概述票据是商业交易中不可或缺的金融工具,具有特定的概念、特性和作用。

本章将详细介绍票据的基本知识,包括票据的概念、特性和作用,票据的当事人、票据权利和票据关系,票据的起源和票据法系,以及票据风险与防范。

第一节票据的概念、特性和作用1. 票据的概念票据是一种书面的、具有一定格式和内容的凭证,由出票人签发,载明支付一定金额的文义,并指定付款人支付给特定收款人或持票人的有价证券。

票据是一种无条件的支付承诺,具有高度的流动性和可转让性。

2. 票据的特性(1) 无条件支付:票据是无条件支付的有价证券,出票人向收款人支付一定金额,无需附加任何条件。

(2) 可转让性:票据可以通过背书或交付的方式转让给他人,实现支付功能的传递。

(3) 有序性:票据具有明确的付款人和收款人,按照一定的顺序进行支付。

(4) 确定性:票据的金额、付款人和收款人是确定的,具有明确的支付义务。

(5) 有价证券:票据是一种有价证券,代表着一定的财产权益。

(6)要式性:票据的格式和内容通常由法律或行业惯例规定,必须按照一定的格式和要求填写。

(7)期限性:票据通常有一定的期限,如汇票、本票和支票等,超过期限则无法兑现。

3. 票据的作用(1) 支付工具:票据作为一种支付工具,可以方便地进行交易结算。

(2) 信用工具:票据可以作为信用工具,为商业活动提供融资和担保。

(3) 流通手段:票据可以通过背书和转让,实现资金的流通和支付功能的传递。

(4) 投资工具:票据可以作为一种短期投资工具,为投资者提供收益。

(5) 融资工具:票据可以帮助企业筹集资金,满足短期资金需求。

第二节票据的当事人、票据权利和票据关系1. 票据的当事人票据的当事人主要包括出票人、付款人和收款人。

出票人是签发票据并承担支付义务的人,付款人是根据票据的指示支付金额的人,收款人是享有票据权利并接受支付的人。

(1) 出票人(Drawer):出票人是指在票据上签名并发出票据的人,对票据的付款承担责任。