第十一章奇异期权课后习题及答案

- 格式:docx

- 大小:20.73 KB

- 文档页数:3

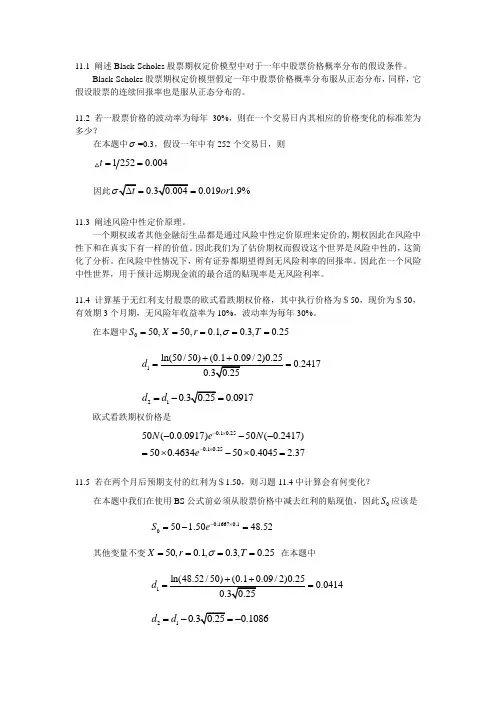

11.1 阐述Black-Scholes 股票期权定价模型中对于一年中股票价格概率分布的假设条件。

Black-Scholes 股票期权定价模型假定一年中股票价格概率分布服从正态分布,同样,它假设股票的连续回报率也是服从正态分布的。

11.2 若一股票价格的波动率为每年30%,则在一个交易日内其相应的价格变化的标准差为多少?在本题中σ=0.3,假设一年中有252个交易日,则 12520.004t ==因此0.019 1.9%or ==11.3 阐述风险中性定价原理。

一个期权或者其他金融衍生品都是通过风险中性定价原理来定价的,期权因此在风险中性下和在真实下有一样的价值。

因此我们为了估价期权而假设这个世界是风险中性的,这简化了分析。

在风险中性情况下,所有证券都期望得到无风险利率的回报率。

因此在一个风险中性世界,用于预计远期现金流的最合适的贴现率是无风险利率。

11.4 计算基于无红利支付股票的欧式看跌期权价格,其中执行价格为$50,现价为$50,有效期3个月期,无风险年收益率为10%,波动率为每年30%。

在本题中050,50,0.1,0.3,0.25S X r T σ=====10.2417d ==210.0917d d =-=欧式看跌期权价格是0.10.250.10.2550(0.0.0917)50(0.2417)500.4634500.4045 2.37N e N e -⨯-⨯---=⨯-⨯=11.5 若在两个月后预期支付的红利为$1.50,则习题11.4中计算会有何变化?在本题中我们在使用BS 公式前必须从股票价格中减去红利的贴现值,因此0S 应该是0.16670.1050 1.5048.52S e-⨯=-= 其他变量不变50,0.1,0.3,0.25X r T σ==== 在本题中10.0414d ==210.1086d d =-=-欧式看跌期权价格是0.10.250.10.2550(0.1086)48.52(0.0414)500.543248.520.4045 3.03N e N e -⨯-⨯---=⨯-⨯=11.6 什么是隐含波动率?如何计算?隐含波动率是使一个期权的Black-Scholes 价格等于它的市场价格的波动率,它用互换程序计算。

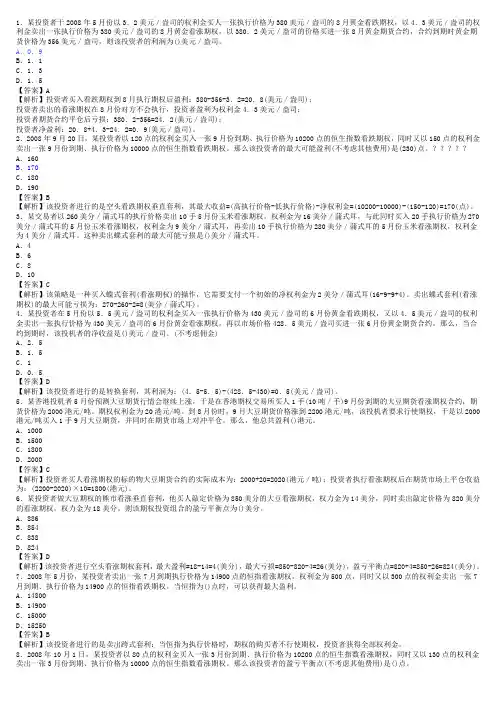

1.某投资者于2008年5月份以3.2美元/盎司的权利金买人一张执行价格为380美元/盎司的8月黄金看跌期权,以4.3美元/盎司的权利金卖出一张执行价格为380美元/盎司的8月黄金看涨期权,以380.2美元/盎司的价格买进一张8月黄金期货合约,合约到期时黄金期货价格为356美元/盎司,则该投资者的利润为()美元/盎司。

A.0.9B.1.1C.1.3D.1.5【答案】A【解析】投资者买入看跌期权到8月执行期权后盈利:380-356-3.2=20.8(美元/盎司);投资者卖出的看涨期权在8月份对方不会执行,投资者盈利为权利金4.3美元/盎司;投资者期货合约平仓后亏损:380.2-356=24.2(美元/盎司);投资者净盈利:20.8+4.3-24.2=0.9(美元/盎司)。

2.2008年9月20日,某投资者以120点的权利金买入一张9月份到期、执行价格为10200点的恒生指数看跌期权,同时又以150点的权利金卖出一张9月份到期、执行价格为10000点的恒生指数看跌期权。

那么该投资者的最大可能盈利(不考虑其他费用)是(230)点。

A.160B.170C.180D.190【答案】B【解析】该投资者进行的是空头看跌期权垂直套利,其最大收益=(高执行价格-低执行价格)-净权利金=(10200-10000)-(150-120)=170(点)。

3.某交易者以260美分/蒲式耳的执行价格卖出10手5月份玉米看涨期权,权利金为16美分/蒲式耳,与此同时买入20手执行价格为270美分/蒲式耳的5月份玉米看涨期权,权利金为9美分/蒲式耳,再卖出10手执行价格为280美分/蒲式耳的5月份玉米看涨期权,权利金为4美分/蒲式耳。

这种卖出蝶式套利的最大可能亏损是()美分/蒲式耳。

A.4B.6C.8D.10【答案】C【解析】该策略是一种买入蝶式套利(看涨期权)的操作,它需要支付一个初始的净权利金为2美分/蒲式耳(16-9-9+4)。

第一章1.1请解释远期多头与远期空头的区别。

答:远期多头指交易者协定将来以某一确定价格购入某种资产;远期空头指交易者协定将来以某一确定价格售出某种资产。

1.2请详细解释套期保值、投机与套利的区别。

答:套期保值指交易者采取一定的措施补偿资产的风险暴露;投机不对风险暴露进行补偿,是一种“赌博行为”;套利是采取两种或更多方式锁定利润。

1.3请解释签订购买远期价格为$50的远期合同与持有执行价格为$50的看涨期权的区别。

答:第一种情况下交易者有义务以50$购买某项资产(交易者没有选择),第二种情况下有权利以50$购买某项资产(交易者可以不执行该权利)。

1.4一位投资者出售了一个棉花期货合约,期货价格为每磅50美分,每个合约交易量为50,000磅。

请问期货合约结束时,当合约到期时棉花价格分别为(a)每磅48.20美分;(b)每磅51.30美分时,这位投资者的收益或损失为多少?答:(a)合约到期时棉花价格为每磅$0.4820时,交易者收入:($0.5000-$0.4820)×50,000=$900;(b)合约到期时棉花价格为每磅$0.5130时,交易者损失:($0.5130-$0.5000) ×50,000=$6501.5假设你出售了一个看跌期权,以$120执行价格出售100股IBM的股票,有效期为3个月。

IBM股票的当前价格为$121。

你是怎么考虑的?你的收益或损失如何?答:当股票价格低于$120时,该期权将不被执行。

当股票价格高于$120美元时,该期权买主执行该期权,我将损失100(st-x)。

1.6你认为某种股票的价格将要上升。

现在该股票价格为$29,3个月期的执行价格为$30的看跌期权的价格为$2.90.你有$5,800资金可以投资。

现有两种策略:直接购买股票或投资于期权,请问各自潜在的收益或损失为多少?答:股票价格低于$29时,购买股票和期权都将损失,前者损失为$5,800$29×(29-p),后者损失为$5,800;当股票价格为(29,30),购买股票收益为$5,800$29×(p-29),购买期权损失为$5,800;当股票价格高于$30时,购买股票收益为$5,800$29×(p-29),购买期权收益为$$5,800$29×(p-30)-5,800。

1.试着找出一些本章没有讨论到的奇异期权或者自己设计几类奇异期权。

答:巴拉期权/巴黎期权/重置期权/可参见专著:《奇异期权》张光平(Peter G.Zhang)著这里可以介绍几张近年创新出来的奇异期权。

奇异期权是在常规期权(标准的欧式或美式期权)基础上,通过改变合约条款,满足私人定制收益结构或者路径依赖的场外期权产品。

比如2016年,我国券商推出的结构化收益凭证,同时嵌套了挂钩特定指数的敲入和敲出期权组合,敲入和敲出的观察时间不一致,敲入为每天观察日,敲出为每月特定一个观察日。

另外,当标的指数走势表现出趋势后,还设计了阶梯障碍的敲出期权。

这类“理财产品”受到高净值人群的追捧。

看似高票息的背后,潜藏的市场风险也非常大。

2.为什么奇异期权主要在场外交易?它们可能在交易所交易吗?答:场内交易的期权通常是标准化的金融期权。

而大多数的奇异期权条款都是定制化,挂钩的标的和收益结构都没有统一的标准,往往是金融机构根据客户的具体需求开发出来的,其灵活性和多样性是常规期权所不能比拟的,因此多只能在场外交易的。

相应地,奇异期权流动性也比较差,定价和保值往往也更加困难,奇异期权对模型设定正确与否的依赖性常常很强,合约中潜在的风险通常比较模糊,很容易导致非预期的损失,无论是用标的资产进行保值还是用相应的期权进行保值,都需要很小心。

当然,也有很少的一些流行的(参与这多了,就可以标准)奇异期权在交易所交易。

3.有一类定义在两个资产S(t)和Ŝ(t)上的奇异期权,在到期日T该期权持有者的收益是min[S(T),Ŝ(t)]。

请问该期权应该如何定价?答:这个属于支付两资产中最优或者最差回报的奇异期权。

大致的定价思路为,在S(t)和Ŝ(t)构成的相图以及45度线S(t)=Ŝ(t),利用双变量正态分布密度函数,可以表示出期权价格的积分表达式。

定价推导可参见专著:《奇异期权》张光平(Peter G.Zhang)著,第14章,第26章。

第十一章:收益和风险:资本资产定价模型1.系统性风险通常是不可分散的,而非系统性风险是可分散的。

但是,系统风险是可以控制的,这需要很大的降低投资者的期望收益。

2.(1)系统性风险(2)非系统性风险(3)都有,但大多数是系统性风险(4)非系统性风险(5)非系统性风险(6)系统性风险3.否,应在两者之间4.错误,单个资产的方差是对总风险的衡量。

5.是的,组合标准差会比组合中各种资产的标准差小,但是投资组合的贝塔系数不会小于最小的贝塔值。

6. 可能为0,因为当贝塔值为0 时,贝塔值为0 的风险资产收益=无风险资产的收益,也可能存在负的贝塔值,此时风险资产收益小于无风险资产收益。

7.因为协方差可以衡量一种证券与组合中其他证券方差之间的关系。

8. 如果我们假设,在过去3 年市场并没有停留不变,那么南方公司的股价价格缺乏变化表明该股票要么有一个标准差或贝塔值非常接近零。

德州仪器的股票价格变动大并不意味着该公司的贝塔值高,只能说德州仪器总风险很高。

9. 石油股票价格的大幅度波动并不表明这些股票是一个很差的投资。

如果购买的石油股票是作为一个充分多元化的产品组合的一部分,它仅仅对整个投资组合做出了贡献。

这种贡献是系统风险或β来衡量的。

所以,是不恰当的。

10. The statement is false. If a security has a negative beta, investors would want to hold the asset to reduce the variability of their portfolios. Those assets will have expected returns that are lower than the risk-free rate. To see this, examine the Capital Asset Pricing Model:E(R S) = R f + S[E(R M) – R f] If S < 0, then the E(R S) < R f11. Total value = 95($53) + 120($29) = $8,515The portfolio weight for each stock is:WeightA = 95($53)/$8,515 = .5913 WeightB = 120($29)/$8,515 = .4087 12.Total value = $1,900 + 2,300 = $4,200So, the expected return of this portfolio is:E(R p) = ($1,900/$4,200)(0.10) + ($2,300/$4,200)(0.15) = .1274 or 12.74%13. E(R p) = .40(.11) + .35(.17) + .25(.14) = .1385 or 13.85%14. Here we are given the expected return of the portfolio and the expected return of each asset in the portfolio and are asked to find the weight of each asset. We can use the equation for the expected return of a portfolio to solve this problem. Since the total weight of a portfolio must equal 1 (100%), the weight of Stock Y must be one minus the weight of Stock X. Mathematically speaking, this means:E(R p) = .129 = .16w X + .10(1 –w X)We can now solve this equation for the weight of Stock X as:.129 = .16w X + .10 – .10w X w X = 0.4833So, the dollar amount invested in Stock X is the weight of Stock X times the total portfolio value, or: Investment in X = 0.4833($10,000) = $4,833.33And the dollar amount invested in Stock Y is:Investment in Y = (1 – 0.4833)($10,000) = $5,166.6715. E(R) = .2(–.09) + .5(.11) + .3(.23) = .1060 or 10.60%16. E(RA) = .15(.06) + .65(.07) + .20(.11) = .0765 or 7.65%E(RB) = .15(–.2) + .65(.13) + .20(.33) = .1205 or 12.05%17. E(R A) = .10(–.045) + .25 (.044) + .45(.12) + .20(.207) = .1019 or 10.19%方差=.10(–.045 – .1019)⌒2 + .25(.044 – .1019)⌒2 + .45(.12 – .1019)⌒2 + .20(.207 – .1019)⌒2 = .00535标准差= (.00535)1/2 = .0732 or 7.32%18. E(R p) = .15(.08) + .65(.15) + .20(.24) = .1575 or 15.75%If we own this portfolio, we would expect to get a return of 15.75 percent.19. a.Boom: E(R p) = (.07 + .15 + .33)/3 = .1833 or 18.33%Bust: E(R p) = (.13 + .03 .06)/3 = .0333 or 3.33%E(Rp) = .80(.1833) + .20(.0333) = .1533 or 15.33%b. Boom: E(R p)=.20(.07) +.20(.15) + .60(.33) =.2420 or 24.20%Bust: E(R p) =.20(.13) +.20(.03) + .60( .06) = –.0040 or –0.40%E(R p) = .80(.2420) + .20( .004) = .1928 or 19.28%P的方差= .80(.2420 – .1928)⌒2 + .20( .0040 – .1928)⌒2 = .0096820.a.Boom: E(R p) = .30(.3) + .40(.45) + .30(.33) = .3690 or 36.90%Good: E(R p) = .30(.12) + .40(.10) + .30(.15) = .1210 or 12.10%Poor: E(R p) = .30(.01) + .40(–.15) + .30(–.05) = –.0720 or –7.20%Bust: E(R p) = .30(–.06) + .40(–.30) + .30(–.09) = –.1650 or –16.50%E(R p) = .20(.3690) + .35(.1210) + .30(–.0720) + .15(–.1650) = .0698 or 6.98%b. p⌒2 = .20(.3690 – .0698)⌒2 + .35(.1210 – .0698)⌒2 + .30(–.0720 – .0698)⌒2 + .15(–.1650 – .0698)⌒2 = .03312p的标准差= (.03312)⌒1/2 = .1820 or 18.20%21. β= .25(.75) + .20(1.90) + .15(1.38) + .40(1.16) = 1.2422.βp = 1.0 = 1/3(0) + 1/3(1.85) + 1/3(βX) βX = 1.1523.E(R i) = R f + [E(R M) – R f] ×βiE(R i) = .05 + (.12 – .05)(1.25) = .1375 or 13.75%24. We are given the values for the CAPM except for the of the stock. We need to substitute these values into the CAPM, and solve for the of the stock. One important thing we need to realize is that we are given the market risk premium. The market risk premium is the expected return of the market minus the risk-free rate. We must be careful not to use this value as the expected return of the market. Using the CAPM, we find:E(R i) = .142 = .04 + .07βi 则βi = 1.4625. E(R i) = .105 = .055 + [E(R M) – .055](.73) 则E(R M) = .1235 or 12.35%26. E(R i) = .162 = R f + (.11 – R f)(1.75).162 = R f + .1925 – 1.75R f则R f = .0407 or 4.07%27. a. E(R p) = (.103 + .05)/2 = .0765 or 7.65%b. We need to find the portfolio weights that result in a portfolio with a of 0.50. We know the 贝塔of the risk-free asset is zero. We also know the weight of the risk-free asset is one minus the weight of the stock since the portfolio weights must sum to one, or 100 percent. So:c. We need to find the portfolio weights that result in a portfolio with an expected return of 9 percent. We also know the weight of the risk-free asset is one minus the weight of the stock since the portfolio weights must sum to one, or 100 percent. So:d. Solving for the of the portfolio as we did in part a, we find:18. ßp = w W(1.3) + (1 –w W)(0) = 1.3w WSo, to find the βof the portfolio for any weight of the stock, we simply multiply the weight of the stock times its β.Even though we are solving for the and expected return of a portfolio of one stock and the risk-free asset for different portfolio weights, we are really solving for the SML. Any combination of this stock and the risk-free asset will fall on the SML. For that matter, a portfolio of any stock and the risk-free asset, or any portfolio of stocks, will fall on the SML. We know the slope of the SML line is the market risk premium, so using the CAPM and the information concerning this stock, the market risk premium is:E(R W) = .138 = .05 + MRP(1.30)MRP = .088/1.3 = .0677 or 6.77%So, now we know the CAPM equation for any stock is:E(R p) = .05 + .0677*贝塔p29. E(R Y) = .055 + .068(1.35) = .1468 or 14.68%E(R Z) = .055 + .068(0.85) = .1128 or 11.28%Reward-to-risk ratio Y = (.14 – .055) / 1.35 = .0630Reward-to-risk ratio Z = (.115 – .055) / .85 = .070630. (.14 – R f)/1.35 = (.115 – R f)/0.85We can cross multiply to get: 0.85(.14 – R f) = 1.35(.115 – R f)Solving for the risk-free rate, we find:0.119 – 0.85R f = 0.15525 – 1.35R f R f = .0725 or 7.25%31.32. [E(R A) – R f]/ A = [E(R B) – R f]/ßBRP A/β A = RP B/β B βB/βA = RP B/RP A33. Boom: E(R p) = .4(.20) + .4(.35) + .2(.60) = .3400 or 34.00%Normal: E(R p) = .4(.15) + .4(.12) + .2(.05) = .1180 or 11.80%Bust: E(R p) = .4(.01) + .4(–.25) + .2(–.50) = –.1960 or –19.60%E(R p) = .35(.34) + .40(.118) + .25(–.196) = .1172 or 11.72%σp⌒2= .35(.34 – .1172)2 + .40(.118 – .1172)2 + .25(–.196 – .1172)2 = .04190σp= (.04190)1/2 = .2047 or 20.47%b. RP i = E(R p) – R f = .1172 – .038 = .0792 or 7.92%c.Approximate expected real return = .1172 – .035 = .0822 or 8.22%1 + E(R i) = (1 + h)[1 + e(r i)]1.1172 = (1.0350)[1 + e(r i)]e(r i) = (1.1172/1.035) – 1 = .0794 or 7.94%Approximate expected real risk premium = .0792 – .035 = .0442 or 4.42%Exact expected real risk premium = (1.0792/1.035) – 1 = .0427 or 4.27%34. w A = $180,000 / $1,000,000 = .18 w B = $290,000/$1,000,000 = .29βp = 1.0 = w A(.75) + w B(1.30) + w C(1.45) + w Rf(0) w C = .33655172Invest in Stock C = .33655172($1,000,000) = $336,551.721 = w A + w B + w C + w Rf 1 = .18 + .29 + .33655172 + w Rf w Rf = .19344828Invest in risk-free asset = .19344828($1,000,000) = $193,448.28w X(.172) + w Y(.0875) + (1 –w X –w Y)(.055)35. E(R p) = .1070 =βp = .8 = w X(1.8) + w Y(0.50) + (1 –w X – w Y)(0)w X = –0.11111 w Y = 2.00000 w Rf = –0.88889Investment in stock X = –0.11111($100,000) = –$11,111.1136. E(R A) = .33(.082) + .33(.095) + .33(.063) = .0800 or 8.00%E(R B) = .33(–.065) + .33(.124) + .33(.185) = .0813 or 8.13%股票A:方差=.33(.082 – .0800)⌒2 + .33(.095 – .0800)⌒2 + .33(.063 – .0800)⌒2 = .00017 标准差=(.00017)⌒1/2 = .0131 or 1.31%股票B:方差=.33(–.065 – .0813)⌒2 + .33(.124 – .0813)⌒2 + .33(.185 – .0813)⌒2 = .01133 标准差= (.01133)1/2 = .1064 or 1064%Cov(A,B) = .33(.092 – .0800)(–.065 – .0813) + .33(.095 – .0800)(.124 – .0813) + .33(.063– .0800)(.185 – .0813) = –.000472ρA,B = Cov(A,B) / (标准差A 标准差B)= –.000472 / (.0131)(.1064) = –.337337. E(R A) = .30(–.020) + .50(.138) + .20(.218) = .1066 or 10.66%E(R B) = .30(.034) + .50(.062) + .20(.092) = .0596 or 5.96%A的方差 =.30(–.020 – .1066)⌒2 + .50(.138 – .1066)⌒2 + .20(.218 – .1066)⌒2 = .00778 2 A的标准差= (.00778)⌒1/2 = .0882 or 8.82%B的方差=.30(.034 – .0596)⌒2 + .50(.062 – .0596)⌒2 + .20(.092 – .0596)⌒2 = .00041B的标准差= (.00041)⌒1/2 = .0202 or 2.02%Cov(A,B) = .30(–.020 – .1066)(.034 – .0596) + .50(.138 – .1066)(.062 – .0596)+ .20(.218 – .1066)(.092 – .0596) = .001732ρA,B = Cov(A,B) / A的标准差*B的标准差= .001732 / (.0882)(.0202) = .970138. a. E(R P) = w F E(R F) + w G E(R G)E(R P) = .30(.10) + .70(.17) = .1490 or 14.90%b. The variance of a portfolio of two assets can be expressed as:标准差= (.18675)⌒1/2 = .4322 or 43.22%39. a. The expected return of the portfolio is the sum of the weight of each asset times the expected return of each asset, so:E(R P) = w A E(R A) + w B E(R B) = .45(.13) + .55(.19) = .1630 or 16.30%c. As Stock A and Stock B become less correlated, or more negatively correlated, the standard deviation of the portfolio decreases.40.(iv) The market has a correlation of 1 with itself.(v) The beta of the market is 1.(vi) The risk-free asset has zero standard deviation.(vii) The risk-free asset has zero correlation with the market portfolio.(viii) The beta of the risk-free asset is 0.b. Firm A: E(R A) = R f + βA[E(R M) – R f]E(R A) = 0.05 + 0.85(0.12 – 0.05) = .1095 or 10.95%Firm B: E(R B) = R f +βB[E(R M) – R f]E(R B) = 0.05 + 1.5(0.12 – 0.05) = .1550 or 15.50%Firm C: E(R C) = R f + βC[E(R M) – R f]E(R C) = 0.05 + 1.23(0.12 – 0.05) = .1358 or 13.58%According to the CAPM, the expected return on Firm C‘s stock should be 13.58 percent. However, the expected return on Firm C‘s stock given in the table is 17 percent. Therefor e, Firm C‘s stock is underpriced, and you should buy it.43. First, we need to find the standard deviation of the market and the portfolio, which are:M的标准差= (.0429)⌒1/2 = .2071 or 20.71%Z 的标准差= (.1783)⌒1/2 = .4223 or 42.23%Now we can use the equation for beta to find the beta of the portfolio, which is:βZ = (相关系数Z,M)*(标准差Z) / 标准差M = (.39)(.4223) / .2071 = .80Now, we can use the CAPM to find the expected return of the portfolio, which is:E(R Z) = R f + βZ[E(R M) – R f] = .048 + .80(.114 – .048) = .1005 or 10.05%。

郑振龙《金融工程》第2版课后习题第十六章奇异期权1.奇异期权的主要类型有哪些?答:奇异期权的基本类型包括分拆与组合、弱式路径依赖、强式路径依赖、时间依赖、维数和阶数。

(1)分拆与组合:最基本的奇异期权是对常规期权和其他一些金融资产的分拆和组合,以得到所需要的回报。

(2)路径依赖:期权的价值会受到标的变量所遵循路径的影响,它又分为弱式路径依赖和强式路径依赖两种。

强式路径依赖奇异期权必须增加独立路径依赖变量;弱式路径依赖奇异期权则无需增加这样的变量。

(3)时间依赖:在期权特征中加入时间依赖,使期权的一些变量随时间而变化。

(4)多维期权:该类期权存在多个独立变量。

(5)高阶期权:该类期权的损益和价值取决于另一个(些)期权的价值。

2.分别为弱式路径依赖期权、强式路径依赖期权、多维期权、高阶期权举出几例。

答:(1)弱式路径依赖弱式路径依赖期权的价值会受到路径变量的影响,但无需增加独立路径依赖变量。

美式期权、障碍期权都是弱式路径依赖期权。

(2)强式路径依赖强式路径依赖期权的损益除了取决于标的资产的目前价格和时间外,还取决于资产价格路径的一些特征,需增加独立路径依赖变量。

亚式期权、回溯期权都是强式路径依赖期权。

(3)多维期权该类期权存在多个独立变量。

彩虹期权、资产交换期权都是多维期权。

(4)高阶期权高阶期权的损益和价值取决于另一个(些)期权的价值。

复合期权、选择者期权都是高阶期权。

3.分析障碍期权的性质。

答:障碍期权的回报以及它们的价值要受到资产到期前遵循路径的影响,因而属于路径依赖期权。

但是,障碍期权的路径依赖性质是较弱的。

因为该期权只需知道障碍是否被触发,而不需要关于路径的其他任何信息,关于路径的信息也不会成为其定价模型中的一个新增独立变量。

如果障碍水平没有被触发,障碍期权到期时的损益情况仍然和常规期权是相同的。

因此,障碍期权是属于弱式路径依赖。

4.基于某个资产价格的欧式向下敲出期权的价值与基于该资产期货价格的欧式向下敲出期权价值相等吗(该期货合约到期日与期权到期日相同)?答:不相等,因为两者被敲出的可能性大小不同。

奇异期权期权市场是世界上最具有活力和变化的市场之一,盈利和避险的需要不断推动新工具的产生。

本章我们将介绍其中一些常见的新型期权本章我们将介绍其中一些常见的新型期权,,分析其定价和保值机制分析其定价和保值机制。

这些思路和方法将有助于我们理解市场中不断创新的期权工具助于我们理解市场中不断创新的期权工具。

概述到目前为止,我们所涉及的主要是标准的欧式或美式期权,比这些常规期权更复杂的衍生证券常常被叫做奇异期权(Exotic Options),比如执行价格不是一个确定的数,而是一段时间内的平均资产价格的期权,或是在期权有效期内如果资产价格超过一定界限,期权就作废,等等。

大多数的奇异期权都是在场外交易的,往往是金融机构根据客户的具体需求开发出来的,其灵活性和多样性是常规期权所不能比拟的。

但是相应地,奇异期权的定价和保值往往也更加困难,奇异期权对模型设定正确与否的依赖性常常很强,合约中潜在的风险通常比较模糊,很容易导致非预期的损失,无论是用标的资产进行保值还是用相应的期权进行保值(在后面我们将会看到,这种保值方法被称为静态保值),都需要很小心。

由于奇异期权的多样性,要对它们进行完全的描述是不可能的,我们只能介绍一些常见的奇异期权,阐述相关的定价和保值技术,为读者提供一个借鉴,当遇到性质相同的问题时,可以加以利用。

本节的主要内容是:对奇异期权的主要类型进行大致的区分,以帮助读者更好地理解奇异期权。

这些类型包括:分拆与组合;弱路径依赖;强路径依赖;时间依赖、维数和阶数。

必须注意的是,因为奇异期权变化很多,本节内容并不能包括奇异期权的所有特点。

一、分拆与组合最基本的奇异期权是对常规期权和其他一些金融资产的分拆和组合,从而得到我们所需要的回报。

这一方法是金融工程的核心之一。

分拆和组合的思想还可以用在为奇异期权定价上。

通过对奇异期权到期时回报的数学整理,常常可以把期权分成常规期权、简单期权和其他金融资产的组合,从而大大简化期权定价过程。

SOLUTIONS TO TEXT PROBLEMS:Quick Quizzes1. Public goods are goods that are neither excludable nor rival. Examples include national defense,knowledge, and uncongested nontoll roads. Common resources are goods that are rival but not excludable. Examples include fish in the ocean, the environment, and congested nontoll roads. 2. The free-rider problem occurs when people receive the benefits of a good but avoid paying for it.The free-rider problem induces the government to provide public goods because if the government uses tax revenue to provide the good, everyone pays for it and everyone enjoys its benefits. The government should decide whether to provide a public good by comparing the good’s costs to its benefits; if the benefits exceed the costs, society is better off.3. Governments try to limit the use of common resources because one person’s use of the resourcediminishes others’ use of it, so there is a negative externality which leads people to use common resources excessively.Questions for Review1. An excludable good is one that people can be prevented from using. A rival good is one for whichone person's use of it diminishes another person's enjoyment of it. Pizza is both excludable, sincea pizza producer can prevent someone from ea ting it who doesn't pay for it, and rival, since whenone person eats it, no one else can eat it.2. A public good is a good that is neither excludable nor rival. An example is national defense, whichprotects the entire nation. No one can be prevented from enjoying the benefits of it, so it is not excludable, and an additional person who benefits from it does not diminish the value of it to others, so it is not rival. The private market will not supply the good, since no one would pay for itbecause they cannot be excluded from enjoying it if they don't pay for it.3. Cost-benefit analysis is a study that compares the costs and benefits to society of providing a publicgood. It is important because the government needs to know which public goods people value most highly and which have benefits that exceed the costs of supplying them. It is hard to dobecause quantifying the benefits is difficult to do from a questionnaire and because respondents have little incentive to tell the truth.4. A common resource is a good that is rival but not excludable. An example is fish in the ocean. Ifsomeone catches a fish, that leaves fewer fish for everyone else, so it's a rival good. But theocean is so vast, you cannot charge people for the right to fish, or prevent them from fishing, so it is not excludable. Thus, without government intervention, people will use the good too much,since they don't account for the costs they impose on others when they use the good.Problems and Applicat ions1. a. The externalities associated with public goods are positive. Since the benefits from thepublic good received by one person don't reduce the benefits received by anyone else, thesocial value of public goods is substantially greater than the private value. Examplesinclude national defense, knowledge, uncongested non-toll roads, and uncongested parks.Since public goods aren't excludable, the free-market quantity is zero, so it is less than the215efficient quantity.b. The externalities associated with common resources are generally negative. Sincecommon resources are rival but not excludable (so not priced) the use of the commonresources by one person reduces the amount available for others. Since commonresources are not priced, people tend to overuse them their private cost of using theresources is less than the social cost. Examples include fish in the ocean, theenvironment, congested non-toll roads, the Town Commons, and congested parks.2. a. (1) Police protection is a natural monopoly, since it is excludable (the police may ignoresome neighborhoods) and not rival (unless the police force is overworked, they're availablewhenever a crime arises). You could make an argument that police protection is rival, ifthe police are too busy to respond to all crimes, so that one person's use of the policereduces the amount available for others; in that case, police protection is a private good.(2) Snow plowing is most likely a common resource. Once a street is plowed, it isn'texcludable. But it is rival, especially right after a big snowfall, since plowing one streetmeans not plowing another street.(3) Education is a private good (with a positive externality). It is excludable, sincesomeone who doesn't pay can be prevented from taking classes. It is rival, since thepresence of an additional student in a class reduces the benefits to others.(4) Rural roads are public goods. They aren't excludable and they aren't rival sincethey're uncongested.(5) City streets are common resources when congested. They aren't excludable, sinceanyone can drive on them. But they are rival, since congestion means every additionaldriver slows down the progress of other drivers. When they aren't congested, city streetsare public goods, since they're no longer rival.b. The government may provide goods that aren't public goods, such as education, becauseof the externalities associated with them.3. a. Charlie is a free rider.b. The government could solve the problem by sponsoring the show and paying for it with taxrevenue collected from everyone.c. The private market could also solve the problem by making people watch commercials thatare incorporated into the program. The existence of cable TV makes the good excludable,so it would no longer be a public good.4. a. Since knowledge is a public good, the benefits of basic scientific research are available tomany people. The private firm doesn't take this into account when choosing how muchresearch to undertake; it only takes into account what it will earn.b. The United States has tried to give private firms incentives to provide basic research bysubsidizing it through organizations like the National Institute of Health and the NationalScience Foundation.c. If it's basic research that adds to knowledge, it isn't excludable at all, unless people in othercountries can be prevented somehow from sharing that knowledge. So perhaps U.S.firms get a slight advantage because they hear about technological advances first, butknowledge tends to diffuse rapidly.5. When a person litters along a highway, others bear the negative externality, so the private costsare low. Littering in your own yard imposes costs on you, so it has a higher private cost and is thus rare.6. When the system is congested, each additional rider imposes costs on other riders. For example,when all seats are taken, some people must stand. Or if there isn't any room to stand, somepeople must wait for a train that isn't as crowded. Increasing the fare during rush hourinternalizes this externality.7. On privately owned land, the amount of logging is likely to be efficient. Loggers have incentives todo the right amount of logging, since they care that the trees replenish themselves and the forest can be logged in the future. Publicly owned land, however, is a common resource, and is likely to be overlogged, since loggers won't worry about the future value of the land.Since public lands tend to be overlogged, the government can improve things by restricting thequantity of logging to its efficient level. Selling permits to log, or taxing logging, could be used to reach the appropriate quantity by internalizing the externality. Such restrictions are unnecessary on privately owned lands, since there is no externality.8. a. Overfishing is rational for fishermen since they're using a common resource. They don'tbear the costs of reducing the number of fish available to others, so it's rational for them tooverfish. The free-market quantity of fishing exceeds the efficient amount.b. A solution to the problem could come from regulating the amount of fishing, taxing fishingto internalize the externality, or auctioning off fishing permits. But these solutionswouldn't be easy to implement, since many nations have access to ocea ns, so internationalcooperation would be necessary, and enforcement would be difficult, because the sea is solarge that it is hard to police.c. By giving property rights to countries, the scope of the problem is reduced, since eachcountry has a greater incentive to find a solution. Each country can impose a tax or issuepermits, and monitor a smaller area for compliance.d. Since government agencies (like the Coast Guard in the United States) protect fishermenand rescue them when they need help, the fishermen aren't bearing the full costs of theirfishing. Thus they fish more than they should.e. The statement, "Only when fishermen believe they are assured a long-term and exclusiveright to a fishery are they likely to manage it in the same far-sighted way as good farmersmanage they land," is sensible. If fishermen owned the fishery, they would be sure not tooverfish, because they would bear the costs of overfishing. This is a case in whichproperty rights help prevent the overuse of a common resource.f. Alternatives include regulating the amount of fishing, taxing fishermen, auctioning offfishing permits, or taxing fish sold in stores. All would tend to reduce the amount offishing from the free-market amount toward the efficient amount.9. The private market provides information about the quality or function of goods and services inseveral different ways. First, producers advertise, providing people information about the product and its quality. Second, private firms provide information to consumers with independent reportson quality; an example is the magazine Consumer Reports. The government plays a role as well, by regulating advertising, thus preventing firms from exaggerating claims about their products,regulating certain goods like gasoline and food to be sure they are measured properly and provided without disease, and not allowing dangerous products on the market.10. To be a public good, a good must be neither rival nor excludable. When the Internet isn’tcongested, it is n ot rival, since one person’s use of it does not affect anyone else. However, at times traffic on the Internet is so great that everything slows down at such times, the Internet is rival. Is the Internet excludable? Since anyone operating a Web site can charge a customer for visiting the site by requiring a password, the Internet is excludable. Thus the Internet is notstrictly a public good. Since the Internet is usually not rival, it is more like a natural monopolythan a public good. However, since most people’s Web sites contain information and exclude no one, the majority of the Internet is a public good (when it is not congested).11. Recognizing that there are opportunity costs that are relevant for cost-benefit analysis is the key toanswering this question. A richer community can afford to place a higher value on life and safety.So the richer community is willing to pay more for a traffic light, and that should be considered in cost-benefit analysis.。

第1章引言1.3远期合约多头与远期合约空头的区别是什么?答:持有远期合约多头的交易者同意在未来某一确定的时间以某一确定的价格购买一定数量的标的资产;而持有远期合约空头的交易者则同意在未来某一确定的时间以某一确定的价格出售一定数量的标的资产。

1.6某交易员进入期货价格每磅50美分的棉花远期合约空头方。

合约的规模是50000磅棉花。

当合约结束时棉花的价格分别为(a)每磅48.20美分,(b)每磅51.30美分,对应以上价格交易员的盈亏为多少?答:(a)此时交易员将价值48.20美分/磅的棉花以50美分/磅的价格出售,收益=(0.50 00-0.482)×50000=900(美元)。

(b)此时交易员将价值51.30美分/磅的棉花以50美分/磅的价格出售,损失=(0.513 -0.500)×50000=650(美元)。

1.9你认为某股票价格将要上升,股票的当前价格为29美元,而3个月期限,执行价格为30美元的看涨期权价格为2.90美元,你总共有5800美元的资金。

说明两种投资方式:一种是利用股票,另一种是利用期权。

每种方式的潜在盈亏是什么?答:在目前的资金规模条件下,一种方式为买入200只股票,另一种方式是买入2000个期权(即20份合约)。

如果股票价格走势良好,第二种方式将带来更多收益。

例如,如果股票价格上升到40美元,将从第二种方式获得2000×(40-30)-5800=14200(美元),而从第一种方式中仅能获得200×(40-29)=2200(美元)。

然而,当股票价格下跌时,第二种方式将导致更大的损失。

例如,如果股票价格下跌至25美元,第一种方式的损失为200×(29-25)=800(美元),而第二种方式的损失为全部5800美元的投资。

这个例子说明了期权交易的杠杆作用。

1.12解释为什么期货合约既可以用于投机也可以用于对冲。

答:如果一个交易员对一资产的价格变动有风险敞口,他可以用一个期货合约来进行对冲。

10.2课后习题详解一、问答题1.某投资者以3美元的价格买入欧式看跌期权,股票价格为42美元,执行价格为40美元,在什么情况下投资者会盈利?在什么情况下期权会被行使?画出在到期时投资者盈利与股票价格之间的关系图。

答:如果到期日股票价格低于37美元,投资者执行将获得利润。

在这种情况下执行期权获得的收益高于3美元。

如果到期日股票价格低于40美元,期权就会被执行。

图10-1显示了投资者的利润随股票价格变化的情况。

2.某投资者以4美元的价格卖出1份欧式看涨期权,股票价格为47美元,执行价格为50美元,在什么情况下投资者会盈利?在什么情况下期权会被行使?画出在到期时投资者盈利与股票价格之间的关系图。

图10-1投资者的利润图10-2投资者的利润答:如果到期日股票价格低于54美元,投资者将获得利润;如果到期日股票价格低于50美元,期权将不被执行,投资者将获得利润4美元;如果到期日股票价格介于50美元与54美元之间,期权将被执行,投资者的利润介于0到4美元之间。

图10-2显示了投资者的利润随股票价格变化而变化的情况。

3.某投资者卖出1份欧式看涨期权并同时买入1份欧式看跌期权,看涨及看跌期权的执行价格均为K,到期日均为T,描述投资者的头寸。

答:投资者的收益为:-max(ST-K,0)+max(K-ST,0),即在任何情况下投资者的收益均为K-ST。

投资者的头寸与执行价格为K的远期合约短头寸相同。

4.解释经纪人为什么向期权的承约方(而不是买方)收取保证金。

答:当投资者买入期权时,必须先行支付现金,此时不可能存在未来的负债,因而无须缴纳任何保证金。

当投资者出售期权时,未来可能会有负债发生。

为避免违约风险,经纪人需要其缴纳保证金。

5.一股票期权的循环期为2月份、5月份、8月份和11月份,在以下日期有哪种期权在进行交易?(a)4月1日,(b)5月30日。

答:在4月1日,交易的期权的到期月份包括4月、5月、8月和11月。

在5月30日,交易的期权的到期月份包括6月、7月、8月和11月。

注会考试《财务管理》习题及解析(第

十一章)

第十一章期权估价

本章重点:期权的到期日价值的确定;期权投资策略;影响期权价值的因素;期权定价模

型的原理;单期二叉树期权定价模型;扩张期权、时机选择期权。

【典型例题】

1.()假设影响期权价值的其他因素不变,股票价格上升时以该股票为标的资产欧式看跌

期权价值下降,股票价格下降时以该股票为标的资产的美式看跌期权价值上升()

【答案】正确

【解析】假设影响期权价值的其他因素不变,则股票价格与看跌期权(包括欧式和美式)

的价值反向变化。

2.()对于未到期的看涨期权来说,当其标的资产的现行市价低于执行价格时,该期权

处于虚值状态,其当前价值为零。

()

【答案】错误

【解析】期权价值=内在价值+时间溢价,对于未到期的看涨期权来说,时间溢加大于零,当其标的资产的现行市价低于执行价格时,该期权处于虚值状态,不会被执行,此时内在

价值为零,但期权价值不为零。

对于期权的讲解,这是安通学校老师反复要求掌握的知识点。

3.某公司的股票现在的市价是60元,有1股以该股票为标的资产的看涨期权,执行价格

为63元,到期时间为6个月。

6个月以后股价有两种可能:上升25%或者降低20%,则套

期保值比率为()

A.0.5

B.0.44

C.0.4

D.1

【答案】 B

【解析】上行股价=60×(1+25%)=75(元),下行股价=60×(1-20%)=48;股

价上行时期权到期日价值=75-63=(元),股价下行时期权到期日价值=0;套期保值

比率=(-0)/(75-48)=0.44。

4.()资料:。

赫尔《期权、期货及其他衍生产品》(第9版)笔记和课后习题详解完整版>精研学习䋞>无偿试用20%资料全国547所院校视频及题库全收集考研全套>视频资料>课后答案>往年真题>职称考试第1章引言1.1复习笔记1.2课后习题详解第2章期货市场的运作机制2.1复习笔记2.2课后习题详解第3章利用期货的对冲策略3.1复习笔记3.2课后习题详解第4章利率4.1复习笔记4.2课后习题详解第5章如何确定远期和期货价格5.1复习笔记5.2课后习题详解第6章利率期货6.1复习笔记6.2课后习题详解第7章互换7.1复习笔记7.2课后习题详解第8章证券化与2007年信用危机8.1复习笔记8.2课后习题详解第9章OIS贴现、信用以及资金费用9.1复习笔记9.2课后习题详解第10章期权市场机制10.1复习笔记10.2课后习题详解第11章股票期权的性质11.1复习笔记11.2课后习题详解第12章期权交易策略12.1复习笔记12.2课后习题详解第13章二叉树13.1复习笔记13.2课后习题详解第14章维纳过程和伊藤引理14.1复习笔记14.2课后习题详解第15章布莱克-斯科尔斯-默顿模型15.1复习笔记15.2课后习题详解第16章雇员股票期权16.1复习笔记16.2课后习题详解第17章股指期权与货币期权17.1复习笔记17.2课后习题详解第18章期货期权18.1复习笔记18.2课后习题详解第19章希腊值19.1复习笔记19.2课后习题详解第20章波动率微笑20.1复习笔记20.2课后习题详解第21章基本数值方法21.1复习笔记21.2课后习题详解第22章风险价值度22.1复习笔记22.2课后习题详解第23章估计波动率和相关系数23.1复习笔记23.2课后习题详解第24章信用风险24.1复习笔记24.2课后习题详解第25章信用衍生产品25.1复习笔记25.2课后习题详解第26章特种期权26.1复习笔记26.2课后习题详解第27章再谈模型和数值算法27.1复习笔记27.2课后习题详解第28章鞅与测度28.1复习笔记28.2课后习题详解第29章利率衍生产品:标准市场模型29.1复习笔记29.2课后习题详解第30章曲率、时间与Quanto调整30.1复习笔记30.2课后习题详解第31章利率衍生产品:短期利率模型31.1复习笔记31.2课后习题详解第32章HJM,LMM模型以及多种零息曲线32.1复习笔记32.2课后习题详解第33章再谈互换33.1复习笔记33.2课后习题详解第34章能源与商品衍生产品34.1复习笔记34.2课后习题详解第35章章实物期权35.1复习笔记35.2课后习题详解第36章重大金融损失与借鉴36.1复习笔记36.2课后习题详解。

第十一章衍生金融工具市场参考答案一、单项选择题(本大题共20小题,每小题1分,共20分。

在每小题列出的四个备选答案中只有一个是最符合题目要求的,请将其代码分别填写在下列表格中。

错选、多选、漏选或未选记-1分)。

1.B2.A3.D4.B5.C6.B7.B8.A9.D 10.A11.A 12.C 13.A 14.C 15.D 16.D 17.B 18.C 19.A 20.B二、多项选择题(本大题共10小题,每小题2分,共20分。

在每小题列出的五个备选答案中有二至五个是符合题目要求的,请将其代码分别填写在下列表格中。

错选、多选、未选均记-2分。

)1.BCD2.ACDE3.ABCD4.ABDE5.ABCD6.ABC7.DE8.AD9.ABCDE 10.ABCE三、简述题(本大题共5小题,每小题8分,共40分。

)简述要点并作相应的解释或说明。

1.金融远期合约有哪些特点?答:金融远期合约具有的特点:(1)非标准化合约。

远期合约通常是由金融融机构之间或者金融机构与其客户之间通过谈判后签订,在签订远期合约时,根据交易者各方的具体情况和要求,一般是交易双方经过协商来决定合约的具体交易规模、交割时间和其他条件。

(2)多数采用实物或现金交割。

大部分远期合约最后均以实物或现金方式交割,只有很少情况下以平仓来代替实物交割的。

(3)流动性较差。

由于每份远期合约差异很大,适应对象的要求特殊,这给远期合约的流通造成较大不便。

(4)信用风险大。

远期合约不在交易所内进行交易,没有统一的结算机构,加之签订合约时,双方不需交纳保证金。

当价格变动对一方有利时,双方有可能无力或无诚意履行合约,因此,远期合约信用风险较高。

2.金融期货合约有哪些主要类型?答:金融期货合约是二十世纪70年代后逐渐发展起来的。

它的具体品种很多,主要可分为四类:外汇期货合约、利率期货合约、股票指数期货合约、股票期货合约。

(1)外汇期货合约是一种交易所制定以某种货币为标的的标准化的法律契约。

第十一章 期权估价(二)影响期权价值的因素 期权价值是指期权的现值,不同于期权的到期日价值。

影响期权价值的主要因素有股票市价、执行价格、到期期限、股价波动率、无风险利率和预期红利。

一个变量增加(其他变量不变)对期权价格的影响变量 欧式看涨期权欧式看跌期权美式看涨期权美式看跌期权股票价格 + - + - 执行价格 - + - + 到期期限 不一定 不一定 + + 股价波动率 + + + + 无风险利率 + - + - 红利-+-+【例题4】假设影响期权价值的其他因素不变,股票价格上升时以该股票为标的资产的欧式看跌期权价值下降,股票价格下降时以该股票为标的资产的美式看跌期权价值上升。

()(2007年)【答案】√【解析】假设影响期权价值的其他因素不变,则股票价格与看跌期权(包括欧式和美式)的价值反向变化,所以,原题说法正确。

第二节期权价值评估的方法一、估价原理(一)复制原理:(借钱买若干股股票,令其组合收益能与每份期权收入相同)1、投资一份看涨期权收益:股价上涨:收入=(市价-执行价格)=a股价下跌:收入=02、借钱买若干股股票收益:H×每股股票售价-借款本利和股价上涨:若干股上行市价-借款本利和=a股价下跌:若干股下行市价-借款本利和=03、所以:每份期权价格(买价)=借钱买若干股股票的投资支出=H×每股买价-借款额【教材例11-9】假设ABC公司的股票现在的市价为50元。

有1股以该股票为标的资产的看涨期权,执行价格为52.08元,到期时间是6个月。

6个月以后股价有两种可能:上升33.33%,或者降低25%。

无风险利率为每年4%。

拟建立一个投资组合,包括购进适量的股票以及借入必要的款项,使得该组合6个月后的价值与购进该看涨期权相等。

购买0.5股的股票,同时以2%的利息借入18.38元。

这个组合的收入同样也依赖于年末股票的价值。

表10-7 投资组合的收入 单位:元 股票到期日价格 66.6637.5组合中股票到期日收入 66.66×0.5=33.33 37.5×0.5=18.75 -组合中借款本利和偿还 18.38×1.02=18.75 18.75 到期日收入合计14.58(二)关键指标确定:1、H (套期保值比率)的确定(1)原理:要建立一个对冲,使得无论股价上涨还是下跌,净流量恒定(表11-8) 即:股价上行时净现金流量=股价下行时的净现金流量H ×上行股价-上行时期权到期价值=H ×下行股价-下行时期权到期价值 (2)计算公式:股价变化期权价值变化H2、借款额的确定因为期望:股价下跌:若干股下行市价-借款本利和 =0 所以:H ×每股下行市价-借款数额×(1+每期利率)=0 借款额=+每期利率下行股价1 H3、计算步骤:P322(1)确定可能的到期日股票价格 上行股价u S =股票现价S ×上行乘数u 下行股价d S =股票现价S ×下行乘数d (2)根据执行价格计算确定到期日期权价值: 股价上行时期权到期日价值u C =上行股价-执行价格 股价下行时期权到期日价值d C =0(3)计算套期保值率:套期保值比率H=期权价值变化/股价变化 (4)计算投资组合的成本(期权价值) 购买股票支出=套期保值率×股票现价 借款数额=价格下行时股票收入的现值=(到期日下行股价×套期保值率)/(1+r )期权价值=投资组合成本=购买股票支出-借款数额【例题1】假设甲公司的股票现在的市价为20元。

第十一章奇异期权

复习思考题

11.1.在到期日的支付依附于标的资产有效期至少一段时间内的平均价格的期权是哪种?()

A、亚式期权

B、障碍期权

C、远期开始期权

D、两值期权

11.2.关于下列期权品种交易场所,说法正确的是:()

A、普通期权主要在场外交易

B、利率期权全部在交易所场内交易

C、奇异期权主要在场外交易

D、奇异期权主要在交易所场内交易

11.3.以下哪种期权可用来对冲标的资产波动率变化带来的风险()

A、后定期权

B、障碍期权

C、一篮子期权

D、叫停期权

11.4.下列说法中错误的是()

A、投资者为了规避金融资产远期波动率带来的风险,可以购买在未来某个时刻生效的期权,即远期开始期权

B、复合期权简单的理解就是期权的期权

C、回望期权给予投资者最优的收益函数

D、一篮子期权的标的资产是单一的

11.5.奇异期权包括()

A、任选期权

B、百慕大期权

C、障碍期权

D、美式期权

11.6.以下属于障碍期权的是()

A、平均价格期权

B、下跌敲入看涨期权

C、平均执行价格期权

D、下跌敲出看涨期权

11.7.常见的非标准美式期权有()

A、固定回报期权

B、远期开始期权

C、百慕大期权

D、加纳利期权

11.8.以下交易所推出了两值期权的产品的是()

A、美国证券交易所

B、芝加哥期权交易所

C、上海证券交易所

D、北美衍生品交易所

11.9.二叉树通常可用于哪些期权的定价()

A、叫停期权

B、一篮子期权

C、美式期权

D、欧式期权

11.10.平均价格期权A的执行价格基于算术平均值,下列数据反映了至今这些期权标的资产的市场价格:100元,102元,105元,104元,106元,这种期权的当期执行价格是多少?

11.11.现有一个新发行的基于不付红利股票的回望看跌期权,执行价格为50,有限期限为3个月,无风险收益率为10%,股票价格波动率是年利率40%,该期权的价值为多少?

11.12.当6个月后的S&P500指数大于1000时,一个衍生品提供的收益为100美元,否则提供的收益为0.设估值的当前水平为960,股指的股息收益率为3%,股指波动率为每年20%,无风险收益率为每年8%,这一衍生品的价格是多少?

讨论题

11.1.奇异型期权与标准化的交易所交易期权存在哪些差异?

11.2.具有同样到期期限的一个回望看涨期权和一个回望看跌期权组合的收益情况是什么样?

11.3.假设在期权开始时,执行价格比股票价格高10%,如何对这样的远期开始看跌期权定价?设标的资产为无息股票。

11.4.静态复制的基本思想是什么?

复习思考题答案

11.1.A

11.2.C

11.3.A

11.4.D

11.5.ABC

11.6.BD

11.7.CD

11.8.ABD

11.9.ACD

11.10. A:100+102+105+104+106

5

=103.40(元)11.11.

由欧式回望看跌期权的价值公式

S max e−rT[N(b1)−

σ

2

2(r−q)

e Y2N(−b3)]+S0e−qT

σ

2

2(r−q)

N(−b2)−S0e−qT N(b2)

其中

b1=ln(S max S0

⁄)+(−r+q+σ

2

2

⁄)T

σ√T

b2=b1−σ√T

b3=ln(S max S0

⁄)+(r−q−σ

2

2

⁄)T

σ√T

Y2=2(r−q+σ

2

2

⁄)ln(S max

S0

⁄)

σ

2

可得,该回望看跌期权的价值为7.79。

11.12.

这是一个现金或空手看涨期权。

该期权的价格为100N(d2)e−0.08∗0.5,其中d2= ln(9601000

⁄)+(0.08−0.03−0.222⁄)∗0.5

0.2∗√0.5

=−0.1826。

因为N(d2)=0.4276,所以该衍生品的价格为41.08美元。

讨论题答案

11.1.奇异期权与标准化的交易所交易期权存在哪些差异?

答:奇异期权通常在选择权性质、基础资产以及期权有效期等内容上与标准期权存在差异,他们是为了满足交易者的特定需求在标准化期权的基础上改变相关属性和条件得到的。

11.2. 具有同样到期期限的一个回望看涨期权和一个回望看跌期权组合的收益情况是什么样?

答:一个浮动回望看涨期权提供的收益为S T−S min;一个回望看跌期权提供的收益为S max−S T;因而,一个回望看涨期权和一个回望看跌期权组合的收益为S max−S min

11.3. 假设在期权开始时,执行价格比股票价格高10%,如何对这样的远期开始看跌期权定价?设标的资产为无息股票。

答:当一个无息股票上的期权执行价格比股票价格高10%时,期权的价格与股票价格成

比例。

与书中给出的远期开始期权定价相似,若t1是期权开始的时间,t2为期权结束的时间,则该期权的价格等于另一个在此刻开始、期限为t2−t1、执行价为1.1倍当前股票价格的期权价格。

11.4. 静态复制的基本思想是什么?

答:静态复制的基本思想是通过市场上的其他资产来构造与资产P具有相同收益函数的资产P‘。

显而易见,如果视P和P‘为时间轴和资产价格轴构成的坐标系中的收益函数,且P 和P‘满足相同的价格方程,那么P和P‘的价格应该是相同的,不然就会存在无风险套利的机会。