安永-财务管理最佳实践-管理报告24

- 格式:ppt

- 大小:962.59 KB

- 文档页数:18

安永监督管理措施安永(Ernst & Young)是全球领先的专业服务机构之一,提供审计、税务、咨询和交易咨询等服务。

作为一家具有全球影响力的公司,安永非常重视监督管理措施,以确保其业务运作的合规性和可持续发展。

安永建立了完善的内部控制体系,以监督和管理公司的各项业务活动。

该体系包括内部审计、风险管理和合规等方面的措施。

内部审计部门负责对公司的各项业务进行独立的审计和评估,以确保其运作符合相关法规和标准。

风险管理部门负责识别和评估公司可能面临的风险,并制定相应的控制措施和监督机制。

合规部门负责确保公司遵守各项法规和行业准则,防范和应对潜在的违规行为。

安永注重员工的职业道德和行为规范,通过培训和内部沟通等方式强调员工的合规意识。

公司制定了严格的职业道德准则,要求员工始终保持高尚的道德品质和职业操守。

同时,安永鼓励员工积极参与专业组织和行业协会,加强对职业规范和行业最佳实践的了解和遵守。

公司还建立了举报机制,鼓励员工积极报告违规行为,以加强对违规行为的监督和管理。

安永与客户建立了良好的合作关系,并严格遵守保密协议和法律法规,确保客户信息的安全和机密性。

公司采用先进的信息技术和数据管理系统,加密和备份客户数据,并采取物理和逻辑措施保障数据的安全性。

同时,安永定期对员工进行数据隐私和信息安全培训,加强他们对客户数据保护的认识和责任意识。

安永还积极参与行业自律和监管机构的工作,推动行业规范和最佳实践的制定和执行。

公司与各类监管机构保持密切合作,及时了解最新的法规和政策动态,并积极配合监管部门的监督和检查工作。

安永还参与行业协会和专业组织的工作,共同推动行业的发展和规范。

安永作为一家全球领先的专业服务机构,高度重视监督管理措施,以确保其业务运作的合规性和可持续发展。

公司通过建立完善的内部控制体系、强化员工的合规意识、保护客户信息安全和积极参与行业监管等方式,加强对业务的监督和管理。

安永将继续致力于提升监督管理水平,为客户提供高质量的专业服务。

安永会计师事务所宣传语全文共四篇示例,供您参考第一篇示例:1. 专业的财务顾问,为您提供全方位的服务。

2. 提供高效、可靠的审计、会计和咨询服务。

3. 为您的业务增值,助您成就更大的成功。

4. 解决财务问题,助您实现未来的目标。

5. 为您量身定制的可持续发展解决方案。

6. 专业团队,倾力助您实现商业愿景。

7. 无忧财务,专业护航您的企业发展。

8. 丰富经验,卓越解决方案,为您的企业保驾护航。

9. 您值得最专业的财务合作伙伴。

10. 与您携手,共同开创成功之路。

11. 我们的使命是成为您的可信赖的财务伙伴。

12. 为您的财务业绩提供强大的支持和引导。

13. 结合专业知识和行业洞察力,为您提供优质服务。

14. 专注为您的企业提供高品质的财务服务。

15. 您的成功,是我们不懈追求的目标。

16. 我们努力,为您的企业带来更多的价值。

17. 一流的团队,为您的企业保驾护航。

18. 智慧、创新,为您解决财务难题。

19. 我们关心您的企业,为您提供全方位的支持。

20. 专业精湛,为您的企业提供最佳的财务方案。

21. 责任感和专业精神,为您的企业保驾护航。

22. 我们致力于助您实现财务和业务目标。

23. 细致入微,助您寻找财务增长点。

24. 智慧、责任,为您的企业创造更大成功。

25. 丰富经验,为您提供专业财务咨询。

26. 我们愿意与您一起成就商业辉煌。

27. 倾听您的需求,为您量身定制财务解决方案。

28. 为您的企业保驾护航,助您抓住商机。

29. 我们立志成为您最值得信赖的财务合作伙伴。

30. 专业精神,严谨态度,为您提供一流的财务支持。

第二篇示例:1. 提供卓越财务解决方案,助您开创更美好的未来。

2. 专业的财务团队,为您的业务保驾护航。

3. 为企业提供最佳的财务咨询服务,助您实现商业目标。

4. 高效的财务管理,助您实现财务自由。

5. 我们致力于成为您最值得信赖的财务合作伙伴。

6. 丰富的行业经验,为您量身打造个性化的财务方案。

安永咨询企业风险分析报告1. 简介本报告为安永咨询针对XXX公司进行的企业风险分析报告,旨在帮助公司全面了解和评估当前面临的各种风险,并提出相应的风险管理和控制建议,以确保公司可持续发展。

2. 风险评估2.1 市场风险目前,XXX公司所处市场竞争激烈,市场份额失去了一部分,竞争对手推出了一系列类似产品并以更低的价格吸引了部分客户。

此外,行业监管政策的变化也给公司的运营带来了一定压力。

建议:1. 加强市场调研,了解市场需求并快速反应;2. 提升产品研发能力,不断创新,提供符合市场需求的产品;3. 加强与政府监管部门的合作,了解和遵守相关政策,降低运营风险。

2.2 经营风险目前,公司内部管理不规范,存在组织结构不明确、员工流失率高等问题。

此外,公司对外部环境的变化反应较慢,无法及时调整业务策略,导致经营效率低下。

建议:1. 完善组织结构,明确各部门的职责和权限;2. 加强人力资源管理,提升员工福利待遇和培训机会,降低员工流失率;3. 建立灵活的经营机制,及时调整业务策略以适应市场变化。

2.3 操作风险XXX公司目前存在操作风险较高的问题,生产流程不规范,存在设备故障率高、原材料供应不稳定等问题;同时,安全管理不到位,存在安全事故的隐患。

建议:1. 提升生产流程规范性,加强设备维护和管理,降低故障率;2. 寻求多元化供应商,建立稳定的原材料供应链;3. 建立健全的安全管理制度,加强对员工的安全教育和培训。

2.4 财务风险公司财务状况不稳定,流动资金不足,经营现金流压力较大。

同时,存在对外担保过多的情况,承担了较高的财务风险。

建议:1. 加强财务管理,提高财务数据分析和预测能力;2. 优化资金结构,降低债务压力,提升流动资金状况;3. 合理控制担保风险,谨慎承担对外担保。

3. 总结通过对XXX公司的风险评估,我们发现公司目前面临的市场风险、经营风险、操作风险和财务风险均存在一定的挑战。

为了确保公司的可持续发展,我们提出了相应的风险管理和控制建议,如加强市场调研与产品研发、完善组织架构与人力资源管理、提升操作规范与安全管理、优化财务管理与资金结构等。

财务管理实验报告总结免费范文21世纪人类社会已步入信息时代。

仅靠书本的理论知识已不能满足成为一名高标准财务管理人员的要求,所以,为了提高实际操作能力,财务管理实验是必不可少的,财务管理实验报告有什么心得体会吗?来看看下面店铺为你带来的财务管理实验报告总结吧,这其中也许就有你需要的。

财务管理实验报告总结1财务管理模拟实验报告一、实验目的随着公司之间的竞争力日益增强,企业对财务管理人才的综合素质要求也逐渐提高,那么,在这个国际化进程迅速发展的时代,仅靠书本的理论知识已不能满足成为一名高标准财务管理人员的要求,所以,为了提高实际操作能力,在大四这一学年,我们开设了《财务管理模拟实验》课程。

在大三时期,我们已经学习了《财务管理》的相关理论知识,虽然这次的实验课仅有四周时间,但也在一定程度上巩固了我们所学的基本知识和理论,加强了我们对财务管理的理解和掌握。

通过模拟经营公司的方式,将我们的理论知识与实践相结合,用所学的财务管理基本方法和理论知识来解决生活和工作中的实际问题,这不仅仅锻炼了我们的实际操作能力,还为未来能够尽快适应财务工作奠定了良好的基础。

二、实验成员角色分配此次财务管理模拟实验的课程是将大学所学的所有学科的与企业经营管理相关知识点融合一体,对相关知识点提出了综合性的应用,其实,这个课程与我们每年参加的ERP沙盘模拟大赛很相似。

团队中的四个人必须有很强的团队意识和强大的凝聚力,这项工作本身就是一项相互配合与在相互帮助中完成的工作,每个人都负有别人不可替代的任务。

如果四个人当中有一个人缺少团队意识,那只会有一种结果:必输无疑,无论其它人的个人业务水平有多高,因为每个人的工作都是紧密的相互关联、密不可分的。

三、实验过程及分析(一)生产计划与实行第一年,我们公司主要是生产低端产品,所以安装了三条生产线分别是两条低端L1,一条在建的中端M1,之所以我们在选择生产线时选择的都是最贵的,是因为我们小组坚信,只要能生产出多的产品,就一定能盈利。

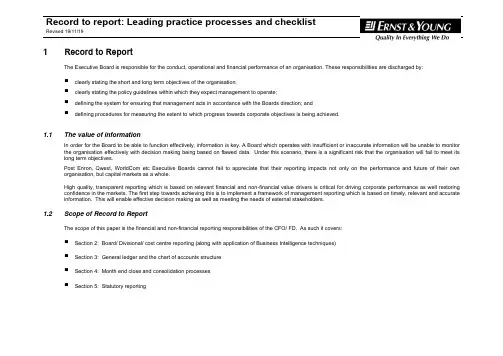

1 Record to ReportThe Executive Board is responsible for the conduct, operational and financial performance of an organisation. These responsibilities are discharged by:▪clearly stating the short and long term objectives of the organisation;▪clearly stating the policy guidelines within which they expect management to operate;▪defining the system for ensuring that management acts in accordance with the Boards direction; and▪defining procedures for measuring the extent to which progress towards corporate objectives is being achieved.1.1 The value of informationIn order for the Board to be able to function effectively, information is key. A Board which operates with insufficient or inaccurate information will be unable to monitor the organisation effectively with decision making being based on flawed data. Under this scenario, there is a significant risk that the organisation will fail to meet its long term objectives.Post Enron, Qwest, WorldCom etc Executive Boards cannot fail to appreciate that their reporting impacts not only on the performance and future of their own organisation, but capital markets as a whole.High quality, transparent reporting which is based on relevant financial and non-financial value drivers is critical for driving corporate performance as well restoring confidence in the markets. The first step towards achieving this is to implement a framework of management reporting which is based on timely, relevant and accurate information. This will enable effective decision making as well as meeting the needs of external stakeholders.1.2 Scope of Record to ReportThe scope of this paper is the financial and non-financial reporting responsibilities of the CFO/ FD. As such it covers:▪Section 2: Board/ Divisional/ cost centre reporting (along with application of Business Intelligence techniques)▪Section 3: General ledger and the chart of accounts structure▪Section 4: Month end close and consolidation processes▪Section 5: Statutory reportingThe paper does not cover the reporting responsibilities of other Operational Executives (eg. Sales, Logistics, CRM, Marketing, HR etc).2 Management reporting2.1 The purpose of management informationThe purpose of management information is to:▪monitor progress against corporate objectives and plans▪identify actions required where actual performance is at variance with expectationThe Board Report is a key component in the management reporting hierarchy, collating information across an organisation. The Board Report combines the various operational activities through the common and objective medium of finance (be it sterling, dollars etc). A good Board Report will ultimately drive decision making and actions, assisting the organisation to achieve its short-term and long term objectives.As such the Board Report should provide all the necessary information to support the Board in fulfilling its responsibilities. In doing so it should be:▪Externally focused-Market opportunities-Threats-Competition▪Forward looking-Driving vision-Aligning operations to strategy-Refining strategy as required▪Challenging to the management team-Driving performance-Questioning the status quo-Understanding and managing risks2.2 Management reporting & operational reportingManagement reporting is a broad term which may mean different things to different people. It is, therefore, necessary to understand the distinction between:▪management reporting as used by key Executives and senior management. These reports are used to drive decision making and measure whether or not corporate objectives are being met. This type of reporting needs to be salient, relevant, covering both financial and non financial criteria▪management reporting as used for day to day operational purposes. Examples include cost centre reports, headcount analysis, call centre performance etc.These reports are data driven and enable managers to review delivery of their current responsibilities. These reports should be standard in their presentation and delivered within minimal intervention or overhead. This type of reporting is described as “operational reporting”The focus of this paper is the Executive style management reporting2.3 Design principles in Management ReportingIt is recognised that every company will have differing information needs for running that corporation. As such every company will have different management reporting needs. It is, however, necessary when reviewing or developing report content to have in place core design principles. These should include:▪delivery of information which meets the needs of key decision makers within the organisation▪delivery of timely, relevant and accurate information which meets the needs of the Business as well as Finance▪delivery of information not data, based on the philosophy of “less is more” (salient, concise reporting of information vs delivery of significant volumes of numeric and other data)▪“one version of the truth” which delivers consistency of information across the whole organisation (see Section 2.4 below)▪use of lead as well as lag indicators (eg. for customer satisfaction, service downtime may be a lead indicator, customer churn a lag indicator)▪incorporation of operational KPIs as well as core financial measures▪application of a balance score card approach, ensuring consideration is given to financial, operational, people/staff and customer perspectives.▪application of exception reporting techniques, with significant variances being highlighted▪action orientated reporting, in terms of commentary and reviewdynamic in nature. The content and format of reports needs to be reviewed and refreshed to ensure they keep pace with changes in the Business2.4Overview of the cascade of informationThe management reporting strategy should be based on a cascade of information from the Board down (ie. from Board to Divisions to Business Units and ultimately cost centres). This is represented below:In delivering this cascade of information it is necessary to ensure consistency of information from the Board through to the cost centres. This is based on the principle of “one version of the truth”. It ensures, for example, that the results of Division X as presented to the Division X MD are the same as those being reviewed by the Group CFO. As well as consistency in content there should also be consistency in the look and feel of reports to ensure Executives and management can negotiate them with ease.Group ReportDivisional Management ReportsBusiness Unit ReportsOperational/ Cost Centre ReportsDefinition of content needs to be “top down”. The CFO/ Board should define the Board Report content such that it meets thei r needs. It also needs to be consistent with corporate strategy and subsequently used to monitor performance and drive business performance. The needs of the Board should then be cascaded down to Divisions, Business Units and ultimately cost centres. This ensur es corporate strategy is translated into operational delivery. This can be contrasted with the “bottom up” content driven approach, where cost centre reporting cascades up to bespoke Business Unit and Division reports. When agg regated at the Board level this is usually characterised by excel consolidations, significant data volumes and the need to refer to inconsistent Division reports.2.5 The use of Key Performance Indicators (KPIs)Management reports should contain performance information relating to the key operational issues as well as financial measures. This is important as changes in operational measures tend to be lead indicators on future financial performance (eg. network build is behind schedule – cash flow savings in the short term, slower sales growth in the longer term).The CFO/ Board should agree on the KPIs presented in the report. General principles on KPIs are:-▪availability: frequency & accuracy▪relevance: alignment to critical success factors▪acceptance: level of use in the organisation/ industry▪topical: relevance to specific strategic initiativesWhen establishing financial and operational measures for inclusion in management reports, this needs to be done with an understanding of remuneration and reward structures. The two need to be consistent. Failure to do so will deliver conflicting messages. It is noted reward based measures will have the most powerful influence on day to day behaviours.2.6 Example contentAs noted above, each and very organisation will have their own needs a nd opinions, driving the look, feel and content of the management reports. A “leading practice” management report (Board Report, Division Report and cost centre report) is given, however, in Appendix 1. This report demo nstrates the leading practice principles highlighted above and is to be used for reference purposes only.In terms of content it includes:▪[Executive summary –A synopsis of performance is provided by KPIs accompanied by appropriate action orientated commentary. Use of data is limited to core data only▪Action plan –corrective actions specified with contingencies and sensitivity analysis showing best and worst case scenarios(usually in the form of commentary)▪Profit and Loss statement –P&L account showing period and cumulative positions with highlighted variances against budget. Any major variances should behighlighted and adequately explained. Trend analysis should be shown graphically and full year projections shown▪Projected outturn incorporated in P&L –Projected outturns recalculated each month on the basis of actual performance and action plans▪Cashflow –Actual and projected receipts and payments up to the year end▪Balance Sheet - position of working capital, assets and long term investments / debt.]2.7 Leading practice checklist2.8 Management reporting – process overviewManagement reporting - detailed process: production of management reports3 General ledger and chart of accounts3.1 Purpose of the General LedgerThe General Ledger is used capture financial data at transactional level with standard accounts in a standard record structure that accommodates multidimensional reporting.The general ledger should allow for the following;▪Consistent and accurate classification of accounting data▪Ease of transfer of financial data throughout the company▪Clear flow of financial data from source systems through multiple levels of consolidation▪Latitude for additional data elements3.2 Chart of accountsThe core structure underlying the general ledger is contained in the Chart of Accounts. Characteristics of a good chart of accounts are as follows:▪application of a common chart of accounts where possible,which facilitates consolidation and reconciliation across large organisations.▪well defined segments and group values for ease of reporting▪keep it simple – elimination of unnecessary segments, elimination of unnecessary detail within segments▪use of a thin general ledger structure with detailed data being held in the sub ledgers, data warehouse environments for analytical purposes▪ a structure consistent with the organisational structure (management and legal)▪ a structure which reflects appropriate levels of accountability within the organisation (ie cost centre structure cascades down to a decision making managerial positions and not beyond)Appendix 2 provides a detailed chart of accounts assessment and the application of “leading practice ”. In doin g so it reviews the structure of chart of accounts as well as the application of a common chart of accounts for a pan European company.3.3 General ledger overviewAn outline of the general ledger is summarised below. Figure [ ]: Outline of the General Ledger structureGeneral LedgerINVENTORY CONTROLFinancial and management reports are generated - drill down queries are performedCapital assets3.4 General ledger leading practice checklistThe following section provides a leading practice checklist for the general ledger. It should be used in conjunction with Appendix 2.4 Month end close4.1 What is Fast close?For a reporting environment to be effective there needs to be delivery of timely and relevant information. The longer the delay between operational transactions and report production, the less relevant the report will be from an information and decision making perspective. Consequently, month end close procedures are critical in the delivery of effective management reporting.Fast Close is an approach to deliver quicker management and financial reporting by improving month end close processes and enhancing the quality and relevance of the information provided.The first quartile benchmark for the production and distribution of management reports is 5 working days post month end. This can be achieved by:▪ensuring a focus is maintained on providing key decision makers with relevant information and setting materiality levels from a Group perspective▪ensuring all possible activities and postings are performed in advance of the month end close (eg. inter-company reconciliations)▪applying standard processes across the organisation and automating these as much as possibleIn doing so the timeliness of reporting improves, reducing the resources tied up in the month end cycle.4.2 To be processA high level process map for “leading practice” month end close is outlined below.4.3 Month end leading practice checklistThe following section provides a leading practice checklist for the month end close process.4.4 Group consolidation & reporting featuresThe key features of a group consolidation system are summarised below.Figure [ ]: Consolidation system4.5 Consolidation leading practice checklistThe following section provides a leading practice checklist for the consolidation process.5 Statutory reporting5.1 Statutory reporting requirementsNot surprisingly, given the diversity of development of business practices across Europe, statutory reporting requirements vary considerably country by country. The statutory requirements within a particular country will dictate:▪The topics of information to be disclosed (e.g. P&L, balance sheet, cash flow, fixed assets, director emoluments, pension liabilities)▪The accounting standards to be used in deriving the figures (e.g. UK GAAP, IAS)▪The timetable for publication (e.g. x months after year-end close in the UK)▪The language for publication of documents.In addition, in certain countries the business transactions must be reportable against a national standard chart of accounts. In some countries, this principle is extended to the insistence that all transactions are coded at source against a national standard chart of accounts.For multinational groups, subsidiaries will have a responsibility to provide statutory results within the country of registration (typically the country they are operating in), as well as having their results consolidated into the group results. In some cases, the multiple reporting requirements can cause significant complications in the preparation of statutory reports. For example, the Italian subsidiary of a joint UK-France owned group will need to have results prepared in all three formats, GAAPs and charts of accounts.This area of design leading practice, including full details of statutory design requirements by country, can be found in the ROI Chart of Accounts paper.Within an individual country, it is common for the organisation to consist of multiple legal entities, and for historic reasons or tax purposes the legal structure often does not match with the management reporting structure. In leading practice situations, transactional data is tagged with the relevant legal entity, to allow simple collation of results by legal entity for statutory reporting purposes. This ideal may not be practical in some cases, requiring the coding of AR / AP / payroll etc to both legal entity and management cost centre. There are also likely to be large single transactions, such as rent, insurance etc. that will need to be allocated across legal entities. As a result, the preparation of statutory reports will often require a significant amount of allocation of balances to legal entities before the consolidation process can begin.5.2 Leading practice timetableThe top quartile timetable from a recent survey of 250 European companies is shown in the figure below:5.3 Statutory reporting leading practice checklistThe following section provides a leading practice checklist for the statutory reporting process.。

安永财务报告范文安永财务报告范文1这次实训在期末进行,时间为从6月17号至6月24号,共10个课时,大概持续一个星期。

这次实训的目的是为了进一步巩固我们按模块教学所掌握的《财务管理》操作技能知识,全面检验我们财务会计核算综合运用技能,加强我们动手能力和实践操作能力,并为今后从事财务管理打下良好基础,而特开展的。

这次实训要求我们能以企业的财务报表等核算资料为基础,对企业财务活动的过程和结果进行研究和评价,以分析企业在生产经营过程中的利弊得失、财务状况及发展趋势,并能为评价和改进财务财务管理工作及为未来进行经济决策提供重要的财务信息。

实训内容分为三大块:一初步分析,二财务指标分析,三综合分析。

实训开始的第一步骤是公式计算。

根据企业资产负债表以及利润表上的数据信息,再通过特定的公式把各项指标的结构比率、增长额和增长率等项目计算出来。

这个工作的技术含量相对比较低,最要是考察我们对公式的理解程度以及运用程度,只要你熟悉公式,懂得运用公式,然后对号入座,几乎上就没什么大问题了,但是要计算的数据比较多,相对就变得繁琐,毕竟是一环扣一环的公式计算,这要求核算人员工作态度仔细严谨。

由于实训要求书面书写清洁整齐、规范、严禁挖乱、涂改和使用涂改液,所以我做的时候先在草稿上做一次,确认无误后,再填入实训资料。

我平时是属于比较认真学习的那一类,所以这个公式计算没到四个课时,我就完成了,进展得相对比较顺利。

可是进行第二步骤运用公式分析就遇到相当大的困难。

第二步骤公式分析、评价,也就是这次实训过程中最为关键、最为重要、最精髓的一步,也是这次实训的主要内容以及主要目的。

第一步是对资产负债表以及利润表作初步分析。

资产负债表总体分为三大块:资产、负债及所有者权益,而其中资产又分为流动资产和非流动资产,负债又分为流动负债和非流动负债。

每一大块到每一小块,再到每一小块的细分都要进行分析小结,这点对初学者来说要求不低难度不少,或许是老师对我们期望值相当高,希望通过高要求打好我们基础,所以才安排大题量并细分析。

优秀审计案例

审计是一种重要的财务管理工具,可以帮助企业或组织发现潜在的风险和问题,提高财务稳定性和透明度。

以下是一些历史上的优秀审计案例:

1. 安然公司审计案例

安然公司是一家美国能源公司,因为财务造假和管理失误导致公司破产。

安然公司的审计师安永会计师事务所也因此受到了严厉的批评。

这个案例揭示了审计师在审计过程中需要更加严格的审查和监督,以确保财务报告的准确性和透明度。

2. 马达加斯加共和国审计案例

2002年,国际货币基金组织(IMF)对马达加斯加共和国进行了审计,发现了该国政府在财务管理方面存在严重问题。

审计报告揭示了政府在预算编制、财务报告和资金管理方面的不当行为,促使政府采取了一系列措施改进财务管理和监督。

3. 英国国家健康服务审计案例

英国国家健康服务(NHS)是一个庞大的公共医疗系统,每年花费数十亿英镑。

审计师对NHS进行了审计,发现了一些问题,如医疗设备的管理和维护、医疗

服务的质量和效率等。

审计报告促使NHS采取了一系列改进措施,提高了医疗服务的质量和效率。

4. 美国纽约证券交易所审计案例

纽约证券交易所(NYSE)是全球最大的证券交易所之一,每年交易额达数万亿美元。

审计师对NYSE进行了审计,发现了一些问题,如交易系统的安全性和透明度、交易员的行为规范等。

审计报告促使NYSE采取了一系列改进措施,提高了交易系统的安全性和透明度。

以上案例表明,审计是一种重要的财务管理工具,可以帮助企业或组织发现潜在的风险和问题,提高财务稳定性和透明度。

审计师需要在审计过程中严格审查和监督,确保财务报告的准确性和透明度。

经典的财务管理宣传广告词篇一:最经典的财务管理方案(策划)伊吉康附件4:财务管理:第一部分规范财务管理制度:财务是公司的命脉,财务部门的建设分为岗位设置、岗位职责、业务流程三个方面。

根据公司管理需要,制订如下:(一)岗位设置:出纳一名。

往来会计一名。

资金预算会计一名。

总帐会计一名。

(二)岗位职责:各会计岗位除了完成如下相关岗位工作外,还要及时完成公司及财务主管交办的工作。

1. 出纳(1)责任范围:①日常零用现金的提取及其它现金收付。

②银行日常收付款业务的办理。

③月初核对上月总账中的银行存款账目,并编制余额调节表④每周末进行现金盘点,编制现金盘点表。

⑤应收及应付账款以外收付款业务的账务处理。

⑥应付及应收票据台账的登记。

⑦根据审核后的送货单及合同开据销售发票。

⑧会计凭证的及时打印。

⑨核对现金、银行存款、应付票据、其它应收款账目。

⑩工资的发放。

(2)工作要点:①出纳一般在收到主管审核传递的会计凭证后再收付款项,凭证附件不齐、审批签字不全的,应拒付。

②每月10日前上报银行存款余额调节电子表,每周末17:00上报本周现金盘点电子表。

③及时打印银行对账单、取回银行单据,交相关会计入账。

④根据主管审核的付款凭证支付货款,付款时收验收款方收据、对账单(经我方核签)、送货单、委托书、收款人身份证复印件,证件齐全方可付款。

⑤及时登记的应付票据台账电子档放入共享文件夹,供本部门主管和资金预算会计查询。

⑥发票的开据应以往来会计复核的送货单、对账单、合同以及经批准的开票申请表为依据,开具的发票经主管复核后方能交给业务人员寄出。

⑦超过500元的付款,要经主管点数后方可支付。

2. 往来会计(1)责任范围:①应收、应付账款的核对、挂帐。

②应收及应付账款收付款计划、应收账款追踪表的填报。

③复核市场部报表。

④月未抽盘仓库的资产盘点表。

⑤报价。

⑥核对应收账款、应付账款、原材料等账目。

(2)工作要点:①每月10日前根据采购送来的应付对账单,在总账中挂应付账款,挂账前核查对账单、发票、验收单、送货单、订单等单证齐全;审批签字手续完备;复核单证之间单价、数量、金额是否相符且计算无误。

致谢主题专家||||本报告作者|| 技术变革驱动共享升级目录第一部分6第二部分282015安永财务共享服务调查报告| 1今年在与企业持续的沟通以及观察中,我们发现越来越多的企业开始关注财务共享服务中心在中国境内的发展情况,而企业财务共享服务中心的管理团队对于最佳运营管理实践、技术革新的关注也提升到了新的高度。

在此背景之下,安永咨询进行了“2015年中国境内企业财务共享服务中心发展情况”调查,针对中国境内企业财务共享服务中心的总体情况、选址、业务分布、人员管理、运营管理、技术革新等方面展开了调研。

本报告《技术变革驱动共享升级——2015安永财务共享服务调查报告》在上述调研结果的基础上进行了分析总结,分为“中国境内企业财务共享服务行业发展现状”和“技术变革推动财务共享服务时代到来”两个部分,针对以下核心领域进行探讨:►揭示中国境内企业财务共享服务中心的发展现状►对财务共享服务中心管理者提出创新思维的要求►展望技术革新的未来2 | 技术变革驱动共享升级前言财务共享服务在中国已经度过了概念导入时期,进入到了快速发展阶段。

从最初对概念的浅显理解,到现在的积极推动和繁荣建设,这十多年的蓬勃发展我们有目共睹。

与此同时,伴随信息技术的快速发展与变革,企业也经历了从会计电算化到财务信息化的转变。

越来越多的企业已经从信息化中受益。

财务共享服务中心的发展与信息化紧密相连,网络报账、影像系统、资金交易处理平台已经成为今天财务共享服务中心的标配工具。

绩效管理、质量管理、客户服务也越来越多地依靠系统来支持。

可以说,信息技术成就了中国式财务共享服务时代的辉煌。

而今天,技术的发展没有止步,技术的革新让人眼花缭乱,移动互联网的全面覆盖,云计算的落地应用,大数据的积极尝试。

财务共享服务中心的管理者们在思考这个问题,技术的革新将带来怎样的改变。

安永咨询作为财务共享服务领域综合解决方案的积极推动者,针对中国境内企业2015年财务共享服务中心的情况进行了调查,本文将依托调查结果以及笔者的研究,洞悉中国境内企业财务共享服务行业的发展现状,以及技术革新对财务共享服务带来的影响。

安永报告:监管与合规仍是企业面临最大风险李莎【摘要】@@ <全球企业风险报告>是安永邀请来自14个行业的70多名主要管理人士和分析师进行深入访谈,随后按照行业归类汇总后完成的.这14个行业分别是资产管理、汽车制造业、银行业、消费品行业、政府和公共部门、保险业、生命科学行业、媒体及娱乐业、采矿及金属业、石油天然气,能源及公共事业,房地产、科技,以及通信业.【期刊名称】《国际融资》【年(卷),期】2010(000)009【总页数】3页(P26-28)【作者】李莎【作者单位】【正文语种】中文2010年8月4日,安永发布第三期《全球企业风险报告》,报告强调,尽管金融危机所带来的第一波冲击已经消退,但是,随着全球经济走出衰退,企业仍面临诸多的风险和挑战《全球企业风险报告》是安永邀请来自14个行业的70多名主要管理人士和分析师进行深入访谈,随后按照行业归类汇总后完成的。

这14个行业分别是资产管理、汽车制造业、银行业、消费品行业、政府和公共部门、保险业、生命科学行业、媒体及娱乐业、采矿及金属业、石油天然气、能源及公共事业、房地产、科技,以及通信业。

调查结果显示,全球十大风险依次为监管与合规、获取信贷、经济复苏放缓或二次探底衰退、人才管理、新兴市场、成本削减、非传统市场进入者、严厉的环保措施、社会认同风险及企业社会责任,以及进行联盟与并购交易。

对比2009年的报告,可以看出,新一期报告中所列示的十大风险基本相同,但是在排序上却变化较大,这反映了在全球经济的复苏的背景下,企业面临的风险是不断变化的,因此,企业需要用动态的视角面对不断变化翻新的挑战。

值得注意的是,社会认同风险及企业社会责任首次跻身前十。

安永大中华风险咨询主管合伙人谢明和安永风险咨询合伙人梅放对该报告的十大风险分析进行了解释。

监管与合规继2008年排名第一之后,监管与合规风险今年再次列为全球企业风险第一。

随着全球经济的不断复苏,对于流动性的担忧不再成为企业关注的核心,今年列为第二。

2024安永财务共享服务调查报告一、本文概述1、背景介绍 a. 财务共享服务的定义与发展 b. 安永对财务共享服务的关注a. 财务共享服务的定义与发展财务共享服务是一种新型的财务管理模式,它将企业分散在各个地区的财务部门整合在一起,通过信息技术和标准化流程来提高财务管理的效率和准确性。

这种模式起源于20世纪90年代的欧美国家,随着全球化的发展和信息技术的发展而逐渐普及。

财务共享服务能够降低企业的成本,提高企业的服务质量,从而为企业创造更多的价值。

b. 安永对财务共享服务的关注安永作为全球领先的专业服务公司,一直关注着财务共享服务的发展。

为了深入了解财务共享服务的现状和未来趋势,安永连续多年开展财务共享服务调查。

通过收集和分析全球范围内的大量数据,了解企业在实施财务共享服务过程中的挑战和成果,为企业在财务共享服务建设方面提供参考和建议。

2、报告目的与结构 a. 目的:探讨财务共享服务的发展趋势、挑战和机遇 b. 结构:调查结果概述、详细分析、结论与建议a. 目的:本报告旨在探讨财务共享服务的发展趋势、挑战和机遇。

通过对全球范围内的财务共享服务实践进行调查,我们希望了解当前的最佳实践、发展趋势以及面临的挑战,为企业提供有关财务共享服务的洞察和建议。

b. 结构:本报告分为以下几个部分:1、调查结果概述:我们将简要介绍调查的基本结果,包括财务共享服务的现状、业务流程的外包情况、技术的发展趋势等。

2、详细分析:我们将深入分析各个领域的调查结果,包括人员配置、业务流程、技术应用和创新实践等。

通过详细分析,我们可以更好地了解财务共享服务的优势和挑战。

3、结论与建议:我们将总结调查结果,提出针对企业的建议,包括如何优化财务共享服务、如何应对挑战以及如何利用机遇等。

通过以上结构,我们可以全面了解财务共享服务的现状和发展趋势,为企业提供实用的建议和指导。

二、财务共享服务的现状与趋势1、全球财务共享服务分布情况 a. 地区分布 b. 行业分布a. 地区分布根据2024安永财务共享服务调查报告,全球范围内的财务共享服务(Financial Shared Services,FSS)主要分布在以下几个地区:首先,亚洲地区已经成为全球财务共享服务的重要中心。

安永暑期实习自我评价我在安永的暑期实习中收获良多,通过这次实习,我深刻意识到了自己在专业知识与实践能力上的不足之处,也更加清晰地认识到了自己未来发展的方向和目标。

在实习期间,我主要参与了公司的人力资源管理和财务管理方面的工作,以下是我对自己在实习期间的评价。

首先是专业知识。

作为一名管理类专业的学生,我在学校学习了很多关于人力资源和财务管理方面的理论知识,但是在实际工作中,我发现自己的知识储备还远远不足以胜任实习工作中的各种任务。

尤其是在财务管理方面,我对于财务报表的编制和分析还不够熟练,导致在实习中需要花费更多的时间和精力去理解和处理相关工作。

因此,在未来的学习和工作中,我需要更加深入地学习相关知识,提升自己的专业能力。

其次是实践能力。

在实习期间,我发现自己在实际工作中的处理问题的能力还不够强。

在人力资源管理方面,我遇到了一些员工关系问题,由于我对于相关的法律法规和公司政策还不够熟悉,导致我在处理问题时不够果断,也没有找到最合适的解决方案。

在财务管理方面,我在财务报表的编制和分析方面还存在一些不足,需要经过更多的实际操作和案例分析来提升自己的实践能力。

因此,在未来的学习和工作中,我需要更加注重实践能力的培养,多参与到实际工作中去,不断积累经验,提升自己的处理问题的能力和分析能力。

再次是团队合作能力。

在实习期间,我与同事和领导一起合作完成了很多任务,我深刻体会到了在团队合作中相互沟通、相互协助的重要性。

在对一些任务的完成中,我发现自己在沟通和协作方面还不够出色,导致任务完成的效率不高,也耽误了其他同事的工作进度。

在未来的工作中,我需要更加注重团队合作能力的培养,主动与同事沟通,积极参与团队合作,共同完成任务,提升自己的团队合作能力。

最后是自我管理能力。

在实习期间,我发现自己在时间管理和任务分配上还存在一些问题,导致工作效率不够高,也影响了自己的工作质量。

在未来的学习和工作中,我需要更加注重自我管理能力的培养,合理安排时间,合理分配任务,提升自己的工作效率,也提升自己的自我管理能力。