海外市场利率互换简介

- 格式:pdf

- 大小:336.15 KB

- 文档页数:26

利率互换和货币互换名词解释

利率互换和货币互换是两种金融衍生品,用于管理利率和汇率风险的工具。

它们在国际金融市场中被广泛应用,为企业和金融机构提供了一种有效的风险管理手段。

利率互换是指两个相关方之间达成协议,按照一定利率进行债务交换的金融协议。

在利率互换交易中,两个参与方交换利率支付流,通常为固定利率和浮动利率。

例如,一家公司可能拥有一笔使用浮动利率支付的贷款,但担心未来利率上升导致支付成本增加,于是与另一家公司达成利率互换协议,将浮动利率转换为固定利率来规避风险。

货币互换是指两个相关方之间达成协议,按照一定汇率进行货币交换的金融协议。

货币互换通常用于国际贸易或投资,帮助企业规避货币波动风险。

例如,一家公司可能需要向国外供应商支付美元,但担心未来美元汇率波动导致成本增加,于是与另一家公司达成货币互换协议,以固定汇率交换需要的外币。

利率互换和货币互换在金融市场中扮演着重要的角色,通过帮助企业和金融机构管理利率和汇率风险,提高了市场的流动性和效率。

同时,它们也为投资者提供了一种多样化的投资方式,帮助他们规避市场波动。

总之,利率互换和货币互换是金融市场中常见的风险管理工具,通过帮助相关方规避利率和汇率风险,提高了市场效率,为投资者提供了更多的投资选择。

对于企业和金融机构来说,了解和运用这些工具将有助于降低金融风险,提高投资回报。

互换的基准利率互换利率是一种金融衍生产品,它是指在一定时间内,两个或多个交易方将不同的利率支付流、固定利率和浮动利率进行交换的一种金融交易。

在互换交易中,涉及到的基准利率是非常重要的参考内容。

基准利率是指各国央行或金融机构为进行市场活动参考而公布的利率。

不同国家和地区的基准利率可能不同,且在同一国家或地区,不同的期限也有不同的基准利率。

下面是一些常见的基准利率及其参考内容:1. 美元基准利率:- 美联储基准利率(Federal Funds Rate):美国联邦储备系统(Federal Reserve System)决定的利率,表征美国经济的基本状况以及货币政策的宽松或紧缩程度。

- 美元伦敦银行同业拆借利率(LIBOR):伦敦银行同业拆借市场上美元拆借利率的参考利率,由银行报出的利率加权平均数确定,反映了国际市场上美元的信贷状况。

2. 欧元基准利率:- 欧洲央行基准利率(Main Refinancing Rate):欧洲央行议会决定的利率,为欧元区银行从欧洲央行获得贷款的利率。

该利率对欧元区货币政策和市场利率具有重要指导意义。

- 欧洲洲际拆借利率(EURIBOR):伦敦银行同业拆借市场上欧元拆借利率的参考利率,由银行报出的利率加权平均数确定,反映了国际市场上欧元的信贷状况。

3. 英镑基准利率:- 英格兰银行基准利率(Bank Rate):英格兰银行决定的利率,为英国金融体系的基本利率,对金融市场和贷款利率有着重要影响。

- 伦敦银行同业拆借利率(LIBOR):伦敦银行同业拆借市场上英镑拆借利率的参考利率,由银行报出的利率加权平均数确定,反映了国际市场上英镑的信贷状况。

4. 日元基准利率:- 日本银行基准利率(Policy Rate):日本银行决定的利率,为日本货币政策的基本利率。

- 东京银行同业拆借利率(TIBOR):东京银行同业拆借市场上日元拆借利率的参考利率,由银行报出的利率加权平均数确定,反映了国际市场上日元的信贷状况。

利率互换名词解释金融学

嘿,朋友!咱今天来聊聊金融学里一个挺重要的玩意儿,利率互换!你可别小瞧它,这东西就像是金融世界里的一把神奇钥匙。

利率互换啊,简单来说,就是双方约定在未来一段时间内,互相交

换利息支付。

比如说吧,A 公司借的钱利率是固定的,B 公司借的钱

利率是浮动的,那他们就可以商量一下来个互换。

这就好像两个人换

衣服穿一样,A 穿上 B 的浮动利率“衣服”,B 穿上 A 的固定利率“衣服”。

为啥要这么干呢?这用处可大了去了!想象一下,A 公司觉得未来

利率可能会下降,浮动利率对它更有利,而 B 公司呢,想要稳定的固

定利率。

那通过利率互换,不就都能满足各自的需求了吗?这不就像

你特别想吃苹果,我特别想吃香蕉,然后咱俩一交换,都开心了嘛!

在实际的金融市场里,利率互换可是大显身手啊!它能帮助企业降

低融资成本,管理利率风险。

就好比在大海中航行的船,利率互换就

是那指引方向的灯塔,能让企业避开危险的风浪。

“那利率互换就没有风险吗?”当然有啦!就像走在路上也可能会摔

跤一样。

比如市场利率波动超出预期,或者对方违约,这可都不是闹

着玩的。

我觉得啊,利率互换就是金融世界里的一个奇妙工具,用好了能带

来很多好处,但也得小心它的“小脾气”。

我们得认真去了解它,掌握

它的规律,才能让它为我们更好地服务呀!总之,利率互换可不是个简单的名词,它背后蕴含着巨大的能量和机会呢!。

利率互换介绍利率互换介绍1. 概念(Concept)利率互换(也称为利率掉期,interest rate swap)是利率衍⽣产品中的⼀种,交易双⽅分别按照固定或浮动利率、以相同或不同的货币、按照⼀定的⽀付频率、按照⼀定的名义本⾦、在约定的期限内交换⼀系列利息流。

利率互换可以被利率风险对冲者⽤来匹配资产与负债(收益与成本)间的利率特征,管理利率风险;也可以被投机者⽤来从利率变化中获利。

正因为如此,利率互换已经成为衍⽣品交易中的主要品种之⼀。

2. 类型(Types)如下表所⽰,利率互换主要有5种,包括固定对固定(不同货币)、固定对浮动(相同或不同货币)、浮动对浮动(相同或不同货币)。

相同货币的固定对固定的利率互换,因为利息流都是确定性的,也就没有进⾏互换的必要。

相同货币不同货币固定利率浮动利率指数固定利率浮动利率指数固定利率√√√浮动利率指数√√2.1同种货币、固定利率对浮动利率(Fixed-for-floating rate swap, same currency)同种货币、固定利率对浮动利率的互换也被称为普通⾹草互换(plain vanilla swap)。

合约甲⽅按照固定利率X以货币A⽀付利息,合约⼄⽅按照浮动利率指数Y也以货币A⽀付利息,名义本⾦为N,期限为T年。

例如,甲⽅按照固定利率5.32%以美元按⽉⽀付利息,⼄⽅按照美元1个⽉伦敦同业拆借利率(USD 1M Libor)以美元按⽉⽀付利息,名义本⾦为100万美元,期限为3年。

甲⽅(⽀付)⼄⽅(⽀付)⼄⽅(基础投资)利率 5.32% USD 1M Libor 收益率USD 1M Libor + 25 bps 货币美元美元货币美元⽀付频率每⽉每⽉⽀付频率每⽉名义本⾦100万美元100万美元本⾦100万美元期限3年3年期限3年资⾦成本 4.5%锁定收益107bps固定利率对浮动利率、同种货币的互换可以⽤来将不确定的浮动收益或成本转化为确定的收益或成本。

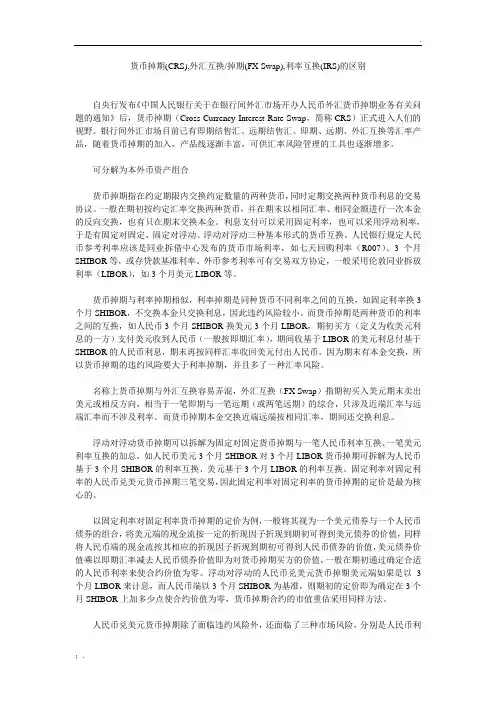

货币掉期(CRS),外汇互换/掉期(FX Swap),利率互换(IRS)的区别自央行发布《中国人民银行关于在银行间外汇市场开办人民币外汇货币掉期业务有关问题的通知》后,货币掉期(Cross Currency Interest Rate Swap,简称CRS)正式进入人们的视野。

银行间外汇市场目前已有即期结售汇、远期结售汇、即期、远期、外汇互换等汇率产品,随着货币掉期的加入,产品线逐渐丰富,可供汇率风险管理的工具也逐渐增多。

可分解为本外币资产组合货币掉期指在约定期限内交换约定数量的两种货币,同时定期交换两种货币利息的交易协议。

一般在期初按约定汇率交换两种货币,并在期末以相同汇率、相同金额进行一次本金的反向交换,也有只在期末交换本金。

利息支付可以采用固定利率,也可以采用浮动利率,于是有固定对固定、固定对浮动、浮动对浮动三种基本形式的货币互换。

人民银行规定人民币参考利率应该是同业拆借中心发布的货币市场利率,如七天回购利率(R007)、3个月SHIBOR等,或存贷款基准利率。

外币参考利率可有交易双方协定,一般采用伦敦同业拆放利率(LIBOR),如3个月美元LIBOR等。

货币掉期与利率掉期相似,利率掉期是同种货币不同利率之间的互换,如固定利率换3个月SHIBOR,不交换本金只交换利息,因此违约风险较小。

而货币掉期是两种货币的利率之间的互换,如人民币3个月SHIBOR换美元3个月LIBOR,期初买方(定义为收美元利息的一方)支付美元收到人民币(一般按即期汇率),期间收基于LIBOR的美元利息付基于SHIBOR的人民币利息,期末再按同样汇率收回美元付出人民币。

因为期末有本金交换,所以货币掉期的违约风险要大于利率掉期,并且多了一种汇率风险。

名称上货币掉期与外汇互换容易弄混,外汇互换(FX Swap)指期初买入美元期末卖出美元或相反方向,相当于一笔即期与一笔远期(或两笔远期)的综合,只涉及近端汇率与远端汇率而不涉及利率。

利率互换及其交易策略介绍一、利率互换简介利率互换(Interest Rate Swap, IRS),是指交易双方约定在未来的一定期限内根据约定数量的名义本金,在合同期指定的一系列特定日期按照不同的计息方式交换利息的交易。

最常见的利率互换是固定利率与浮动利率的互换,在一系列指定日期,一方须支付浮动利率,另一方则支付固定利率。

而在实际结算时,双方只用交付差额,比如在某一指定日期,浮动利率大于固定利率,那么支付浮动利率的交易方支付(浮动利率-固定利率)*名义本金。

利率互换的基本原理是基于比较优势。

比较优势理论的核心是指:由于筹资者信用等级不同,所处地理位置不同,对于不同金融工具使用的熟练程度不同,取得资金的难易程度不同等原因,在筹资成本上存在着比较优势。

这种比较优势的存在使筹资者能够达成相互协议,在各自领域各展所长,然后相互交换债务,从而达到降低筹资成本或对冲利率风险的目的。

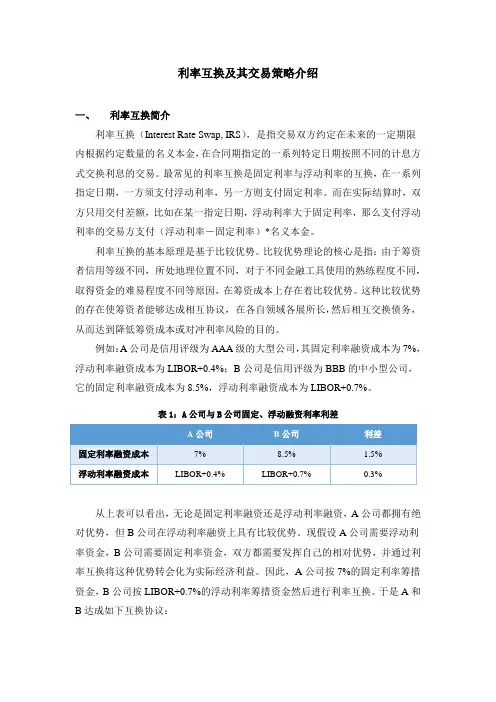

例如:A公司是信用评级为AAA级的大型公司,其固定利率融资成本为7%,浮动利率融资成本为LIBOR+0.4%;B公司是信用评级为BBB的中小型公司,它的固定利率融资成本为8.5%,浮动利率融资成本为LIBOR+0.7%。

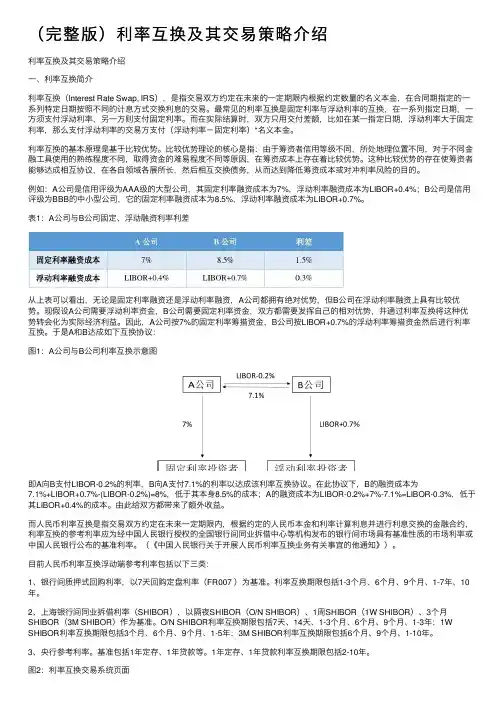

表1:A公司与B公司固定、浮动融资利率利差从上表可以看出,无论是固定利率融资还是浮动利率融资,A公司都拥有绝对优势,但B公司在浮动利率融资上具有比较优势。

现假设A公司需要浮动利率资金,B公司需要固定利率资金,双方都需要发挥自己的相对优势,并通过利率互换将这种优势转会化为实际经济利益。

因此,A公司按7%的固定利率筹措资金,B公司按LIBOR+0.7%的浮动利率筹措资金然后进行利率互换。

于是A和B达成如下互换协议:图1:A公司与B公司利率互换示意图即A向B支付LIBOR-0.2%的利率,B向A支付7.1%的利率以达成该利率互换协议。

在此协议下,B的融资成本为7.1%+LIBOR+0.7%-(LIBOR-0.2%)=8%,低于其本身8.5%的成本;A的融资成本为LIBOR-0.2%+7%-7.1%=LIBOR-0.3%,低于其LIBOR+0.4%的成本。

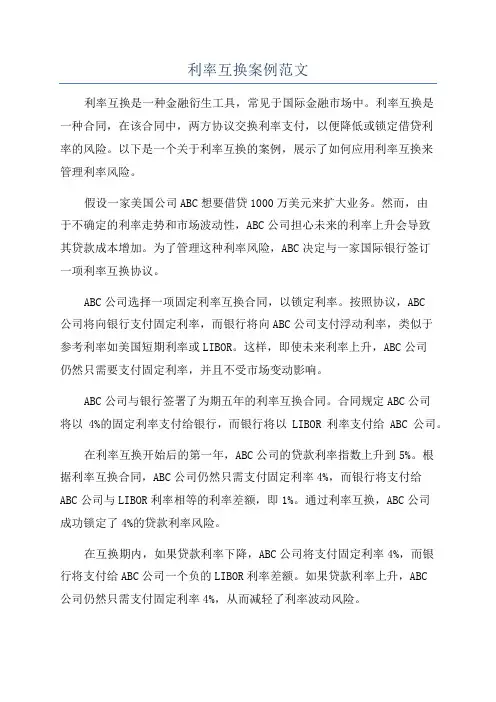

利率互换案例范文利率互换是一种金融衍生工具,常见于国际金融市场中。

利率互换是一种合同,在该合同中,两方协议交换利率支付,以便降低或锁定借贷利率的风险。

以下是一个关于利率互换的案例,展示了如何应用利率互换来管理利率风险。

假设一家美国公司ABC想要借贷1000万美元来扩大业务。

然而,由于不确定的利率走势和市场波动性,ABC公司担心未来的利率上升会导致其贷款成本增加。

为了管理这种利率风险,ABC决定与一家国际银行签订一项利率互换协议。

ABC公司选择一项固定利率互换合同,以锁定利率。

按照协议,ABC公司将向银行支付固定利率,而银行将向ABC公司支付浮动利率,类似于参考利率如美国短期利率或LIBOR。

这样,即使未来利率上升,ABC公司仍然只需要支付固定利率,并且不受市场变动影响。

ABC公司与银行签署了为期五年的利率互换合同。

合同规定ABC公司将以4%的固定利率支付给银行,而银行将以LIBOR利率支付给ABC公司。

在利率互换开始后的第一年,ABC公司的贷款利率指数上升到5%。

根据利率互换合同,ABC公司仍然只需支付固定利率4%,而银行将支付给ABC公司与LIBOR利率相等的利率差额,即1%。

通过利率互换,ABC公司成功锁定了4%的贷款利率风险。

在互换期内,如果贷款利率下降,ABC公司将支付固定利率4%,而银行将支付给ABC公司一个负的LIBOR利率差额。

如果贷款利率上升,ABC公司仍然只需支付固定利率4%,从而减轻了利率波动风险。

此外,利率互换合同还允许双方进行提前终止。

如果市场利率大幅波动,一方可能选择提前终止利率互换合同。

在提前终止时,任何未来的支付差额将根据市场利率差额进行结算。

通过利率互换,ABC公司成功管理了其贷款利率风险。

无论利率是上涨还是下降,ABC公司都知道其贷款利率将始终固定在4%。

这使得ABC公司能够更好地规划其贷款成本,并降低未来的不确定性。

在实际应用中,利率互换也可以应用于其他金融交易,如债券发行和投资组合管理。

(完整版)利率互换及其交易策略介绍利率互换及其交易策略介绍⼀、利率互换简介利率互换(Interest Rate Swap, IRS),是指交易双⽅约定在未来的⼀定期限内根据约定数量的名义本⾦,在合同期指定的⼀系列特定⽇期按照不同的计息⽅式交换利息的交易。

最常见的利率互换是固定利率与浮动利率的互换,在⼀系列指定⽇期,⼀⽅须⽀付浮动利率,另⼀⽅则⽀付固定利率。

⽽在实际结算时,双⽅只⽤交付差额,⽐如在某⼀指定⽇期,浮动利率⼤于固定利率,那么⽀付浮动利率的交易⽅⽀付(浮动利率-固定利率)*名义本⾦。

利率互换的基本原理是基于⽐较优势。

⽐较优势理论的核⼼是指:由于筹资者信⽤等级不同,所处地理位置不同,对于不同⾦融⼯具使⽤的熟练程度不同,取得资⾦的难易程度不同等原因,在筹资成本上存在着⽐较优势。

这种⽐较优势的存在使筹资者能够达成相互协议,在各⾃领域各展所长,然后相互交换债务,从⽽达到降低筹资成本或对冲利率风险的⽬的。

例如:A公司是信⽤评级为AAA级的⼤型公司,其固定利率融资成本为7%,浮动利率融资成本为LIBOR+0.4%;B公司是信⽤评级为BBB的中⼩型公司,它的固定利率融资成本为8.5%,浮动利率融资成本为LIBOR+0.7%。

表1:A公司与B公司固定、浮动融资利率利差从上表可以看出,⽆论是固定利率融资还是浮动利率融资,A公司都拥有绝对优势,但B公司在浮动利率融资上具有⽐较优势。

现假设A公司需要浮动利率资⾦,B公司需要固定利率资⾦,双⽅都需要发挥⾃⼰的相对优势,并通过利率互换将这种优势转会化为实际经济利益。

因此,A公司按7%的固定利率筹措资⾦,B公司按LIBOR+0.7%的浮动利率筹措资⾦然后进⾏利率互换。

于是A和B达成如下互换协议:图1:A公司与B公司利率互换⽰意图即A向B⽀付LIBOR-0.2%的利率,B向A⽀付7.1%的利率以达成该利率互换协议。

在此协议下,B的融资成本为7.1%+LIBOR+0.7%-(LIBOR-0.2%)=8%,低于其本⾝8.5%的成本;A的融资成本为LIBOR-0.2%+7%-7.1%=LIBOR-0.3%,低于其LIBOR+0.4%的成本。

利率互换介绍1. 概念(Concept)利率互换(也称为利率掉期,interest rate swap)是利率衍生产品中的一种,交易双方分别按照固定或浮动利率、以相同或不同的货币、按照一定的支付频率、按照一定的名义本金、在约定的期限内交换一系列利息流。

利率互换可以被利率风险对冲者用来匹配资产与负债(收益与成本)间的利率特征,管理利率风险;也可以被投机者用来从利率变化中获利。

正因为如此,利率互换已经成为衍生品交易中的主要品种之一。

2. 类型(Types)如下表所示,利率互换主要有5种,包括固定对固定(不同货币)、固定对浮动(相同或不同货币)、浮动对浮动(相同或不同货币)。

相同货币的固定对固定的利率互换,因为利息流都是确定性的,也就没有进行互换的必要。

2.1同种货币、固定利率对浮动利率(Fixed-for-floating rate swap, same currency)同种货币、固定利率对浮动利率的互换也被称为普通香草互换(plain vanilla swap)。

合约甲方按照固定利率X以货币A支付利息,合约乙方按照浮动利率指数Y也以货币A支付利息,名义本金为N,期限为T年。

例如,甲方按照固定利率5.32%以美元按月支付利息,乙方按照美元1个月伦敦同业拆借利率(USD 1M Libor)以美元按月支付利息,名义本金为100万美元,期限为3年。

固定利率对浮动利率、同种货币的互换可以用来将不确定的浮动收益或成本转化为确定的收益或成本。

例如,在上述例子中,乙方有一笔本金为100万美元、收益率为美元1个月伦敦同业拆借利率+25个基点(USD 1M Libor + 25 bps)、按月支付、期限为3年的投资。

为锁定投资收益,乙方通过与甲方进行利率互换,将浮动收益部分(USD 1M Libor)卖出,从而将投资收益锁定在5.32%。

如果乙方的资金成本为固定的4.5%,那么乙方的净投资收益将被锁定在107个基点(5.32%-4.5%+25bps),从此不再受利率变动影响。

利率互换及其交易策略介绍一、利率互换简介利率互换(Interest Rate Swap, IRS),是指交易双方约定在未来的一定期限内根据约定数量的名义本金,在合同期指定的一系列特定日期按照不同的计息方式交换利息的交易。

最常见的利率互换是固定利率与浮动利率的互换,在一系列指定日期,一方须支付浮动利率,另一方则支付固定利率。

而在实际结算时,双方只用交付差额,比如在某一指定日期,浮动利率大于固定利率,那么支付浮动利率的交易方支付(浮动利率-固定利率)*名义本金。

利率互换的基本原理是基于比较优势。

比较优势理论的核心是指:由于筹资者信用等级不同,所处地理位置不同,对于不同金融工具使用的熟练程度不同,取得资金的难易程度不同等原因,在筹资成本上存在着比较优势。

这种比较优势的存在使筹资者能够达成相互协议,在各自领域各展所长,然后相互交换债务,从而达到降低筹资成本或对冲利率风险的目的。

例如:A公司是信用评级为AAA级的大型公司,其固定利率融资成本为7%,浮动利率融资成本为LIBOR+0.4%;B公司是信用评级为BBB的中小型公司,它的固定利率融资成本为8.5%,浮动利率融资成本为LIBOR+0.7%。

表1:A公司与B公司固定、浮动融资利率利差从上表可以看出,无论是固定利率融资还是浮动利率融资,A公司都拥有绝对优势,但B公司在浮动利率融资上具有比较优势。

现假设A公司需要浮动利率资金,B公司需要固定利率资金,双方都需要发挥自己的相对优势,并通过利率互换将这种优势转会化为实际经济利益。

因此,A公司按7%的固定利率筹措资金,B公司按LIBOR+0.7%的浮动利率筹措资金然后进行利率互换。

于是A和B达成如下互换协议:图1:A公司与B公司利率互换示意图即A向B支付LIBOR-0.2%的利率,B向A支付7.1%的利率以达成该利率互换协议。

在此协议下,B的融资成本为7.1%+LIBOR+0.7%-(LIBOR-0.2%)=8%,低于其本身8.5%的成本;A的融资成本为LIBOR-0.2%+7%-7.1%=LIBOR-0.3%,低于其LIBOR+0.4%的成本。

利率互换名词解释篇一:利率互换,这听起来像是金融世界里的一个神秘魔法呢。

其实啊,它就有点像两个人交换玩具一样。

比如说,甲有一个小汽车玩具,乙有一个小飞机玩具,甲玩小汽车玩腻了,乙玩小飞机也玩腻了,那他们就商量着交换一下,这样两个人都能体验到新的乐趣。

利率互换也是类似的道理。

在金融的大舞台上,不同的公司或者金融机构,它们在利率方面有着不同的情况。

有的公司可能借到的是固定利率的贷款,就像甲的小汽车玩具,是一种固定的存在。

而有的公司借到的是浮动利率的贷款,好比乙的小飞机玩具,会随着市场的风飘来飘去。

这时候呢,如果那个拿着固定利率贷款的公司觉得,哎呀,现在市场的情况好像浮动利率更划算呢,而拿着浮动利率贷款的公司觉得固定利率稳定,没那么多风险,他们就可以进行利率互换啦。

就拿两个企业来说吧,A企业借到了固定利率为5%的贷款,B企业借到的是根据市场利率加上一定点数的浮动利率贷款。

如果市场利率波动,B 企业发现自己承担的利率成本忽高忽低,不太稳定,心里就有点慌。

A企业呢,看着市场上的情况,觉得浮动利率可能会给自己带来更多的好处。

那他们就可以达成一个协议,A企业把自己固定利率的贷款利息支付权利转让给B企业,B企业把自己浮动利率贷款利息支付的权利转让给A企业。

这样一来,就像两个人交换了玩具,都得到了自己想要的东西。

利率互换在金融市场里是非常有用的哦。

它可以帮助企业或者金融机构管理利率风险。

如果企业只抱着自己原来的那种利率贷款不放,就像一个小朋友只玩一个玩具,万一这个玩具出问题了,比如利率朝着不利于自己的方向变动,那就只能干瞪眼啦。

通过利率互换,就可以根据市场的变化,灵活地调整自己的利率结构,就像小朋友可以随时换个玩具玩,让自己的成本或者收益达到一个比较理想的状态。

我觉得利率互换就是金融市场里一种很聪明的合作方式。

它让不同的参与者能够根据自己的需求和对市场的判断,互相交换利率支付的权利,从而达到优化自身财务状况的目的。

跨境利率互换运作机制一、引言随着全球化的发展,国际贸易和跨境投资的规模不断扩大,跨境资金流动日益频繁。

在这种背景下,跨境利率互换成为了国际金融市场中不可或缺的工具之一。

本文将从跨境利率互换的定义、运作机制、优缺点以及应用前景等方面进行详细阐述。

二、跨境利率互换的定义跨境利率互换是指两个不同国家或地区的金融机构之间通过协议达成一种交换利率支付现金流的合约。

这种合约允许双方在特定时间内交换不同货币计价的固定或浮动利率支付现金流,并且在到期时按照协议规定进行结算。

三、跨境利率互换的运作机制1.合约签署阶段:双方金融机构通过谈判达成协议,确定交换货币、交换金额、交换期限以及固定或浮动利率等关键条款。

2.保证金阶段:双方根据协议约定向对方支付一定比例的保证金,以确保双方履行合约。

3.现金流支付阶段:在协议规定的时间内,双方按照约定的利率和金额进行现金流支付。

4.到期结算阶段:到达合约到期日时,双方按照协议规定进行结算。

如果交换利率有变动,双方根据市场利率差额进行结算。

四、跨境利率互换的优缺点1.优点:(1)降低融资成本:跨境利率互换可以让参与者以更低的成本获得所需资金。

(2)风险管理:跨境利率互换可以帮助参与者降低汇率风险和利率风险。

(3)增加市场流动性:跨境利率互换可以促进国际金融市场的发展,增加市场流动性。

2.缺点:(1)操作复杂:跨境利率互换需要涉及多种货币、多种计价基准和多种法律制度,操作复杂。

(2)存在信用风险:由于交易双方之间存在信用关系,跨境利率互换也存在一定程度的信用风险。

五、跨境利率互换的应用前景随着全球化进程不断加速,跨境利率互换将越来越成为国际金融市场中的重要工具。

未来,随着互联网、人工智能等技术的发展,跨境利率互换的操作将更加便捷和高效,同时也需要进一步完善相关法律法规以及风险管理机制。

六、结论跨境利率互换是国际金融市场中不可或缺的工具之一,它可以帮助参与者降低融资成本、管理风险、增加市场流动性。

利率互换名词解释利率互换(Interest Rate Swap,IRS)是指两个参与方之间交换固定利率债券与浮动利率债券支付流的一种金融衍生工具。

在利率互换交易中,双方约定在未来一段时间内交换固定利率和浮动利率支付流的金额。

具体来说,利率互换是一项合同协议,其中一方(即固定利率方)同意支付固定利率,而另一方(即浮动利率方)同意支付根据某个基准利率(如LIBOR)浮动的利率。

利率互换的基本原理是为了降低资金成本和利率风险。

通过利率互换,固定利率方可以将长期债务转换为短期债务,从而减少利息支付成本。

浮动利率方则可以降低对利率波动的敏感性,从而减轻利率波动对债务成本的影响。

利率互换的交易通常分为两个阶段。

首先,双方协商约定资金交换的条件,包括交换金额、利率、利率计算基准及支付频率等。

其次,双方按照约定条件执行利率互换。

在交换期限结束时,双方根据协议规定进行最后一次利息支付,并解除利率互换合同。

利率互换有多种类型,包括固定利率互换(Fixed-for-Fixed Interest Rate Swap)、浮动利率互换(Floating-for-Floating Interest Rate Swap)和固浮利率互换(Fixed-for-Floating Interest Rate Swap)等。

利率互换在金融市场中具有广泛应用。

它可以被用作风险对冲工具,帮助公司管理和减少利率风险。

它也可以作为投资工具,用于投机和套利。

此外,利率互换还可以用于调整债务结构、降低债务成本以及满足特定的资金需求等。

需要注意的是,利率互换是一种衍生工具,具有一定的风险。

参与方需要仔细评估利率风险和对冲策略,以确保利率互换的有效性和适应性。

同时,参与方还需谨慎选择合作方,进行充分的尽职调查和风险管理。

总的来说,利率互换是一种金融衍生工具,通过交换固定利率和浮动利率支付流的金额,帮助参与方降低利息费用、降低利率风险,并满足特定的资金需求。

利率互换发展历程

利率互换是一种金融衍生工具,旨在将一种利率类型转换为另一种。

它的发展可以追溯到20世纪80年代初,当时针对利率波动的需求促使市场参与者开始使用利率互换。

利率互换的发展受到了各种因素的影响,包括竞争和创新,法规和监管要求以及市场和货币政策环境的变化。

1981年,芝加哥商品交易所推出了世界上第一个利率互换合约,标志着利率互换的起源。

此后,利率互换市场开始蓬勃发展,最初主要是在英国和美国等国家和地区发展起来。

在20世纪90年代,许多新兴市场开始涉足利率互换市场,为其发展注入了新的动力。

2000年代初,利率互换市场迎来了一场革命。

新的互联网技术和电子交易平台的出现,使得市场参与者可以更快速、更高效地进行交易。

此外,金融衍生品的发展和全球化趋势也促进了利率互换市场的发展。

然而,利率互换市场也面临着一些挑战和风险。

其中最大的挑战之一是市场的透明度问题。

由于利率互换市场的复杂性和交易规模的大幅增加,市场参与者难以准确测量和控制风险,从而增加了市场的不确定性和波动性。

未来,随着全球经济的发展和金融市场的不断创新,利率互换市场将继续扮演重要的角色。

同时,为了更好地应对市场风险和提高市场透明度,监管机构也将加强对利率互换市场的监管和规范。

- 1 -。

作者: 林采苢

作者机构: 中国银行上海分行资金部

出版物刊名: 国际金融研究

页码: 38-41页

主题词: 利率互换;市场利率;利率水平;固定利率;筹资成本;国际金融市场;浮动利率;期权费;

利率风险;贷款

摘要: <正> 所谓利率互换即两个独立的筹资者,利用各自的筹资优势,分别借入币种、金额和期限相同,但计息方法不同的债务,然后双方通过中介人(通常是银行)调换付息方法,以期得到各自所期望的利率种类。

利率互换的形式有各种各样,筹资者不仅可根据各自资金安排的需要选择适当的互换形式,而且可根据国际金融市场利率和汇率的变化不断调整利率结构,。