➢ Investing directly in PE funds can be difficult for individual investors and small institutions

➢ Relatively high investment minimums may disqualify some of the small investors

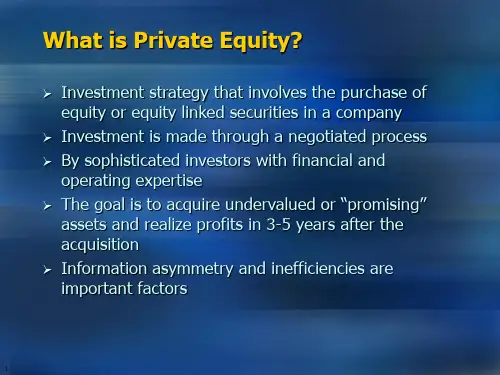

assets and realize profits in 3-5 years after the acquisition ➢ Information asymmetry and inefficiencies are important factors

2

Alternative Investments

10

How are PE Funds Structured?

➢ Private limited partnerships ➢ Individual managers are the General Partner (GP) ➢ Providers of capital (pensions, insurance companies,

for LPs ➢ LPs need to fund within 2-3 weeks of “capital call” ➢ Penalties for failure to fund by LPs ➢ IRRs depend on when money is transferred by LPs

manufacturing industries ➢ Typically have assets to borrow against and

access to bank loans ➢ Seek private equity to effect a change in