会计文献中英文对照

- 格式:doc

- 大小:42.50 KB

- 文档页数:4

会计内部控制中英文对照外文翻译文献(文档含英文原文和中文翻译)内部控制系统披露—一种可替代的管理机制根据代理理论,各种治理机制减少了投资者和管理者之间的代理问题(Jensen and Meckling,1976; Gillan,2006)。

传统上,治理机制已经被认定为内部或外部的。

内部机制包括董事会及其作用、结构和组成(Fama,1980;Fama and Jensen,1983),管理股权(Jensen and Meckling,1976)和激励措施,起监督作用的大股东(Demsetz and Lehn,1985),内部控制系统(Bushman and Smith,2001),规章制度和章程条款(反收购措施)和使用的债务融资(杰森,1993)。

外部控制是由公司控制权市场(Grossman and Hart,1980)、劳动力管理市场(Fama,1980)和产品市场(哈特,1983)施加的控制。

各种各样的金融丑闻,动摇了世界各地的投资者,公司治理最佳实践方式特别强调了内部控制系统在公司治理中起到的重要作用。

内部控制有助于通过提供保证可靠性的财务报告,和临时议会对可能会损害公司经营目标的事项进行评估和风险管理来保护投资者的利益。

这些功能已被的广泛普及内部控制系统架构设计的广泛认可,并指出了内部控制是用以促进效率,减少资产损失风险,帮助保证财务报告的可靠性和对法律法规的遵从(COSO,1992)。

尽管有其相关性,但投资者不能直接观察,因此也无法得到内部控制系统设计和发挥功能的信息,因为它们都是组织内的内在机制、活动和过程(Deumes and Knechel,2008)。

由于投资者考虑到成本维持监控管理其声称的(Jensen and Meckling,1976),内部控制系统在管理激励信息沟通上的特性,以告知投资者内部控制系统的有效性,是当其他监控机制(该公司的股权结构和董事会)比较薄弱,从而为其提供便捷的监控(Leftwich et等, 1981)。

A V AT Revenue Simulation Model for Tax ReformIn Developing CountriesGlenn P .Jenkins[Abstract]: In this paper, we develop a model to simulate policies and revenues for a value added tax (V AT) system in countries that have an indirect tax system containing sales, excise taxes, and tariffs. An application of the model is carried out for Nepal, which has recently introduced the V AT to replace its sales tax system and rationalize its excise and tariff systems. The study shows that, in a developing country, tax policies that might seem very realistic and politically noncontroversial are likely to yield a very narrow tax base. If a government of a developing country wants to rely more on the V AT over time, it must move aggressively to broaden the base and enhance compliance.[Key words]: V AT revenue, Tax reform, model, NepalⅠ. INTRODUCTIONImport tariffs and excise taxes often constitute the most important revenue sources in developing countries. Because of growing concerns in recent years about economic efficiency and tax simplicity in a competitive and integrated world economy, many countries are lowering trade taxes and replacing distorted excise taxes with consumption-type V AT. With respect to the latter, one of the most important questions is the revenue potential of alternative designs of this new tax as governments attempt to replace or enhance the level of revenues generated by their current tax system.The potential revenue which can be raised from the V AT depends on a number of factors, such as how broad the tax base will be and the extent to which businesses will comply with the tax. This issue has not been widely discussed in the public finance literature. The main purpose of this paper is to provide an analytical framework which can be used to estimate the potential tax base and associated revenues for a V AT in a typical developing country. The model developed for this purpose should be detailed enough to facilitate the estimation of the potentialrevenues for alternative tax options. Such a model can then be used to assist decision makers in setting their tax policies. To illustrate, the model is applied to the economy of Nepal. We chose Nepal because it is typical of many developing countries, having very limited statistical data and moving from a highly distorted indirect tax system to a V AT.Ⅱ. ALTERNATIVE APPROACHES TO THE ESTIMATION OF A V AT BASEThe potential tax revenue of a V AT is greatly dependent on the number and level of tax rates, the scope of the tax base, and the degree of tax compliance. The proposed V AT is assumed to be a multistage consumption tax based on the destination principle, similar to a European-style V AT. The tax is applied to the sales of goods and services at all stages of the production and distribution chain. At each stage, vendors are able to claim tax credits to recover the tax they paid on their business inputs. As a result, the tax system is in effect applying the tax only to the value added by each vendor. Since the only tax that does not get refunded is the tax imposed on final consumption, the tax is equivalent to the retail sales tax on final consumption. While imposing a tax at a destination principle, imports are taxed in the same way as domestically produced goods, and exports are not subject to tax. Therefore, the tax essentially applies to goods and services consumed domestically.A common feature of the tax base in most V AT countries is to not tax a number of important goods or services because of political and socioeconomic considerations, technical difficulties, or administrative complexity. These goods and services generally fall into two major categories, zero-rated and tax exempt. For zero-rated commodities, the V AT is not levied on the selling price of these items. The vendor, however, receives full credit for the V AT paid on inputs used in production. If zero-rated sales occur at an intermediate stage, purchasers would not have a credit to deduct against any subsequent tax due. This would, in fact, provide a cash flow cost and benefit to the vendor and purchaser, respectively. The net revenue implications for the government would nevertheless be nil. By comparison, if zero-rated sales occur at the retail stage, it would effectively remove all the tax burden from consumers and the government would lose all the tax revenue from the sales of these goods and services.For conceptual and technical difficulties, countries employing a V AT generally exempt the domestic sales of financial intermediation and insurance services. For administrative and compliance simplicity, most V AT countries also exempt small businesses from the tax. When these goods and services are exempted, the V AT is not applied to these sales. Unlike zero-rated goods and services, vendors of exempt products are not eligible to receive any credit for the taxes paid on the inputs used to produce that good or service. The denial of input tax credits increases the production cost for the vendor, although the value added of the vendor escapes tax.Like zero-rated sales, tax exemption can occur at either an intermediate or the retail stage. Consider the tax exemption at the retail stage where goods are sold directly to consumers. Only the value added at the retail stage will not be subject to tax. In contrast, if tax exempt sales operate at the intermediate stages of the production-distribution chain, sales by the subsequent businesses acquiring the goods are effectively overtaxed to the extent that the inputs prior the exempt stage are not creditable. As a result, the tax base is not reduced, but is augmented by the cascading effect.The government could ultimately collect a greater amount of tax revenue than it would otherwise.Multiple tax rates are a common feature of some V AT systems in the developing countries. It is not uncommon to observe that a lower rate is applied to goods or services which are regarded as the necessities of life. At the same time, there are luxury goods which may be subjected to a higher rate of V AT or alternatively, a non-increditable excise tax.Three alternative approaches can be used to estimate the tax base and associated revenues, for which input-output tables, national accounts and family expenditure survey data are often required. The first approach is simply to construct an aggregate tax base. It begins with the Gross Domestic Product (GDP) of the economy, which is the sum of the value added in the domestic production of all goods and services. Because we are considering a destination principle V AT, we need to subtract exports and add imports to the GDP. For a consumption type V AT, the base is also reduced by the gross capital formation of the private sector. The base is further reduced by zero-rated or exempted consumption expenditures. Since vendors of exempted goods and services are unable to claim any credits for taxes paid on the inputs acquired to produce that good or service, the tax base will have to be upward adjusted. The second approach computes the base by summing the value added of each industrial sector in the economy. The base has to beadjusted for the fact that the V AT is a destination type tax and, as such, would tax imports on entry into the country and zero-rate exports. Further adjustments would have to be made for changes in inventories and for commodities which are either zero-rated or exempted. Making these adjustments by sector is usually difficult since the values of exports and imports are not readily available on an industry basis. Although an aggregate adjustment for the whole economy may be possible, detailed information by sector would be lost. The third approach is to estimate the value of goods and services purchased by consumers which would automatically capture the destination principle of the V AT since it excludes exports while imports are included. The V AT base by commodity can then be calculated using the commodity sales values at the final consumer level. The approach would also facilitate an analysis of incidence or price impact of the V AT on consumers, issues which are usually important in the political debate over sales tax reform.Ⅲ. GENERAL METHODOLOGY FOR ESTIMATING THE V AT BASEThis section explores the detailed methodology of the third approach described above. This approach depends heavily upon input-output tables. Input-output models are static in nature and, as such, do not allow for behavioral responses to policy changes. Thus, the V AT base estimation discussed in this paper does not take into account behavioral responses due to the replacement of the current sales tax system with the V AT.As was mentioned earlier, the V AT base can be estimated using the final expenditures made by various economic entities. Construction of the base can, therefore, begin with the data for domestic expenditures contained in the final demand matrix of the I-O tables. The final demand matrix generally contains a transaction matrix of a number of commodities by a number of final demand categories. The final demand categories may include many categories under each of the headings such as personal consumption, government expenditures, investment, imports, and exports. Personal consumption refers to those individuals/households or entities who acquire goods and services for their own consumption and who do not produce supplies of a commercial nature. Government expenditures include the current and capital spending by all levels ofgovernment. This would be treated in a fashion similar to personal consumption under a V AT system except that the V AT paid by the same level of government sector will not necessarily increase net government collections. Investment, however, is excluded from the base calculation since the V AT allows for an input tax credit for any business purchases including capital investment. Exports are also excluded because of the destination type V AT. Imports are ignored because purchases made by other final demand categories are inclusive of imports.The starting point in calculating the V AT base is with the amount of personal and government expenditures. This amount is equivalent to the total expenditures shown in the I-O tables. Adjustments must however, be made for several factors in order to arrive at the V AT base. What follows is a description of the relevant deductions and adjustments.Calculation of the current sales taxesSuppose that a country has a manufacturer sales tax system and the government proposes to replace it with a V AT. The gross expenditures contained in the I-O tables, expressed at purchasers' price, include the current sales taxes to be replaced. These taxes are imposed on the manufacturer's sale price of goods produced in the country and on the duty paid value of imported goods. Wholesale and retail trade margins are excluded from the tax base. Usually, these sales taxes apply also to a range of intermediate inputs and capital goods used in the production and distribution of goods and services.In order to remove the current sales taxes paid directly by personal and government sectors from each category of expenditures, one has to first construct the current sales tax base. This is accomplished by removing the retail and wholesale trade margins from purchasers' expenditures on each good or service, inclusive of sales tax.The expected current sales tax revenue from each commodity, say, the ith commodity( Ri), can be calculated by multiplying the derived tax base by the applicable tax rate and by the taxable proportion:where is the sales tax-inclusive base of the ith commodity, is the taxable proportion of theith commodity, and is the sales tax rate of the ith commodity. The magnitude of the taxableproportions depends upon the proportion of the legally taxable sales to the total sales of the items contained in each commodity category.A further calculation must be made for the hidden (or indirect) sales taxes embedded in personal and government expenditures. This represents the sales taxes which are levied on business inputs. These inputs are used in turn to produce goods and services which are ultimately sold to final consumers and governments. If sales taxes are assumed to be fully shifted forward, the taxes will be transformed into a higher price of the final goods and services. The I-O tables can be used to measure the indirect sales tax content in the goods and services purchased by final consumers and governments.The total of the above expected direct and indirect sales tax revenues over all commodities and all entities usually is not the same as the actual tax collections. This is a result of a number of factors, such as bad debt allowances, tax free allowances for small importation, tax evasion, small suppliers exemption. After adjusting for the factors which are known, the expected tax revenues are made equal to the actual tax collections by applying a calculated compliance rate. This rate is simply the ratio of the actual revenue to the expected revenue. Of course, the compliance rate may vary by commodity, depending upon market conditions and other factors.Introduction of the value-added taxThe potential revenue of the V AT extended to the retail level can be calculated by summing domestic personal and government expenditures at retail prices. This does not include expenditures made by businesses since the taxes paid on business purchases are creditable. Thus, the starting point for calculating the V AT base is with the value of all goods and services (shown in the I-O tables) purchased by personal and government sectors, net of all current sales taxes.This is the total potential tax base, which is then multiplied by the taxable proportions for each corresponding commodity in order to arrive at the V AT base. At this point, the taxable proportions are determined by the tax policies and laws under consideration. For example, the proposed V AT may zero-rate or exempt certain goods or services. In such cases, the full value of zero-rated or exempted goods and services purchased by individuals or governments has to be removed from the potential base. For exempt items, however, taxes paid on business inputs used to produce the exempt goods or services are not creditable. Therefore, an additional adjustment to the tax base is needed to account for the extent to which the vendors cannot claim input tax credit for taxes paid on business expenditures. In summary, the total potential V AT base can beexpressed as follows:Where is the percentage wholesale margin for the ith commodity, is the percentage retail margin for the ith commodity, is the total business inputs used in the production of the jthexempt sector under the proposed V AT, is the ratio of taxable inputs to the total inputs usedin the production of the jth exempt sector under the proposed V AT, and Bi ,ai and pi are defined as eqn..Special attention should be paid to long-term residential rent paid by tenants to landlords and imputed rent arising from the consumption flow by owner-occupied housing, which is normally presented as part of personal expenditures in the I-O tables or national accounts. This rent is often tax exempt and should be excluded from the tax base in order to avoid double taxation, since as an alternative, the V AT is sometimes levied on the purchase price of newly constructed dwellings. A portion of gross cash rent and imputed rent, however, would still be subject to V AT as a result of taxable expenditures made for repairs, property insurance, and certain utilities. It should be noted that the value of land is excluded in both the I-O tables and national accounts because it does not represent value added. For our purpose, the value of land is usually included as part of the purchase price of a new home. Thus, when new houses are taxable under the V AT, the personal expenditures must be adjusted upward to account for the full price of new homes. Some adjustments must be also made to gross expenditures in the government sector. For the most part, the production from this sector is usually exempt under a V AT and the associated value added would not attract the tax. On the other hand, the intermediate inputs used to produce government goods and services are usually taxable and, as a consequence, remain in the tax base of the government sector.Finally, to arrive at a benchmark estimate of revenue yield, the tax base for each commodity item is then multiplied by the compliance ratio under the current sales tax system. This adjustment implies that the compliance rate for each commodity under the proposed V AT would not be different from that being subject to the current system. The compliance rate may be adjusted upward however if one believes that the V AT system would enhance taxpayercompliance, or if the government can increase the level of administrative enforcement. On the contrary, the compliance rate may be adjusted downward if tax evasion is expected to spread with the introduction of a V AT. The total expected V AT revenues for the economy will then be equal to the summation of all adjusted tax bases across goods and services purchased by both the personal and government sectors, times the proposed V AT rates.Accrual versus actual revenue collectionsThe model developed so far provides an annual estimate of the V AT paid by final consumers and governments. These estimates are presented on an accrual basis rather than the actual revenues received by the government due to the payment lags built into the V AT system. For example, the V AT may be designed to provide a great deal of flexibility in filing requirements, depending on the size of the business. For large firms, filing may be required on a monthly basis. For smaller firms, filing may be allowed on a quarterly or annual return. Certain types of businesses such as exporters are likely to choose to file their returns on a monthly basis in order to claim input tax credits earlier. Furthermore, all taxpayers are likely to have until the end of the month following the reporting period to file their returns.From a government’s perspective, it is necessary to transform the V AT estimates from an accrual to a collection basis. One can first segregate the above annual estimate of the V AT base into the individual ``value-added'' components for primary producers, manufacturers, wholesalers, retailers, and other service sectors. Each of these components is then converted to a monthly basis using sales and other relevant data. For example, the retail component is distributed to each month based on monthly retail sales data. This should reflect the seasonal patterns in production and distribution channels. The appropriate collection lags should also be incorporated for each type of tax filer. The resulting revenues can then be transformed to a collection basis. This consideration will be particularly important when the V AT is first introduced into a country.Ⅳ. AN APPLICATION TO A CASE FOR NEPALThe current sales tax collected in Nepal in fiscal year 1994-95 was about 6,032 million rupees which accounts for approximately one-third of the total tax revenues. It is the single mostimportant revenue source. Like many other countries, the sales tax is imposed on the manufacturer's sale price of goods produced for domestic consumption, and on the duty paid value of imported goods. As a result, the tax applies to a range of inter-mediate inputs and capital goods used in the production and distribution channels. This tax has become not only administratively complex, but also economically inefficient. The Minister of State for Finance in Nepal announced in the July 1993 budget that the government would focus on gradually transforming the sales tax into a value-added tax. Since then, subsequent governments have had to make a series of tax policies and set tax rates in order to ensure the new sales tax system is fair, simple, efficient and produces revenue in a stable fashion.In the July 1993 budget, it was announced that the number of sales tax rates would be reduced from five to two rates, 10% and 20%. The same tax rates are applied equally to domestically produced goods and to imports in order to streamline the sales tax operation. In addition, there has been a substantial amount of government revenues collected from a number of selective excises on cigarettes, liquor, beer, soft drinks, edible oils, cement and so on. The main objective of this section is to apply the above model to the estimation of potential revenues for a V AT to be implemented in Nepal.Preparation of the basic dataThe data are quite limited in Nepal. In order to present the most up-to-date economic structure for the country, we developed a complete set of data for the FY 1994-95 since this is the latest year that data are available on the expenditure side from national accounts in Nepal.The data are arranged into three major categories-personal, business, and government. First, the detailed personal expenditure data are only available from a Household Budget Survey for 1985. These data also are separated into urban and rural for each class of commodity expenditure. Due to their different expenditure patterns and the recent massive migration from rural to urban areas, the current detailed household expenditures by commodities for the country as a whole are constructed by increasing the proportion of the total national household expenditures made in urban areas from 7% in 1985 to 12% in 1994. Using the FY 1994-95 aggregate private consumption shown in national accounts as a control total, the detailed personal expenditures by commodities are estimated.Second, the information concerning business expenditures on capital investment and intermediate inputs is very limited. The national accounts only provide an aggregate figure on private capital formation which can be further separated into machinery and equipment and construction. Using import information, the totals for machinery and equipment are further allocated among tractors, motor vehicles and parts, aircraft, telecommunications, medical equipment, and other machinery equipment. This is done in anticipation that certain goods or sectors are likely to be either zero-rated or exempted under the proposed V AT. The split between residential and nonresidential construction is also important because of their differences in the composition of mixed construction materials. For nonresidential construction, about one-third is sponsored by international organizations and is classified as expenditures of the government sector. For each construction category, detailed requirements of construction materials, labor cost, as well as profits and contract tax are provided by the Nepal Engineers' Association. In addition, the detailed intermediate inputs demanded by each of the industrial sectors are developed using the 1987 I-O tables.Third, government expenditures are separated into Regular and Development Expenditures. The latter are mostly funded by international organizations such as the World Bank, the Asian Development Bank, and bilateral donors which do not pay tariffs or other commodity taxes on their purchases. Each of the Regular and Development Expenditures can be further broken down into current and capital expenditures by commodity items or economic functions.After the basic detailed expenditures data for FY 1994-95 are constructed, the wholesale and retail margins for each commodity are removed from purchasers' expenditures on each good or service derived above .This would form the manufacturers' or importers' sales totals, inclusive of taxes, by commodity and by entity. The expected sales tax revenue for each commodity can then be calculated based on eqn (1).Simulation of the V AT revenuesThe proposed V AT will be imposed on goods and services consumed in the Kingdom of Nepal except for those specified in Schedules 1 and 2 of the V AT Act. The V AT Act will replace the Sales Tax Act, Hotel Act, Contract Tax Act, and Entertainment Act. This implies that, for revenue-neutral, at least a total of 6,857 million rupees should have been generated in FY 1994-95 if the proposed V AT was implemented.The following basic tax policies are incorporated in the model simulations for illustrative purposes:(ⅰ) impose a single rate of V AT which is extended to the retail level under the destination principle. Most personal and government expenditures are taxed, including government expenditures financed through international organizations.(ⅱ) zero-rate exported goods and services.(ⅲ)exempt unprocessed food, drug and medical services, books and newspapers, water and transportation services.(ⅳ) exempt newly constructed dwellings, residential rents, and financial services.(ⅴ) adjust the excise levies on alcoholic beverages and tobacco products to maintain their current consumer prices.Before turning to the empirical results, it is useful to recall the equivalency of the V AT to that of retail sales tax levied on the final selling price of all goods and services.The data on the latter were derived earlier in the form of gross expenditures by commodities under the personal, business, and government category. These gross expenditures represent the sum of all the expenditures on the various commodities and primary inputs contained in each category. Adjustments must be made for factors such as removal of the current sales taxes, zero-rated and exempt goods and services, and realistic tax compliance by taxpayers in order to arrive at the V AT base and the associated revenues.First, the above gross expenditures by commodities and by entities contain the amounts of the current sales taxes, directly paid by individuals and by governments, which must be deducted in calculating the V AT base. Since sales taxes are assumed to be fully shifted forward to final consumers, a further deduction must be made for the indirect sales taxes embedded in the price of personal and government expenditures. One can observe from Columns (2) and (3) of Table 1 that more than half of the current sales taxes are imposed on intermediate inputs and capital goods in Nepal. These input taxes are now embodied in the form of higher prices of goods and services sold to final consumers and governments.Second, the excise tax on alcoholic beverages and tobacco products are adjusted upward in order to maintain the same level of retail prices for consumers. The excise adjustment (DE) must equal the diff erence between the manufacturers’ sales prices of the excisable good under the newversus the current sales tax systems. That is:where is the single V AT rate, is the V AT compliance rate, is the current sales tax rateof the ith excisable good, and is the compliance rate of the current sales tax systems. is defined as eqn. (1), namely, the current sales tax-inclusive base of the ith excisable good. Hence, the adjustments shown in Column (5) of Table 1 refer to the case if the V AT rate is set at 12% and the tax compliance remains the same as the current tax system.Third, the full value of zero-rated goods or services purchased by final consumers and governments must be removed from gross expenditures. The simulation will only apply to exports, not to the goods and services paid for with foreign exchange but consumeddomestically.Fourth, for exempt goods and services that operate at the retail stage, the V AT is not levied on their selling prices nor are vendors entitled to the input tax credit. As a result, the associated input taxes that are not creditable form part of the V AT base. It should be noted that while not only unprocessed basic groceries but also basic agricultural inputs such as fertilizer seeds and pesticides are exempt. Another interesting case in Nepal is the practical difficulty of imposing a V AT on newly constructed houses because no such market prevails. New houses are normally self-constructed with assistance from relatives or friends. Therefore, new houses are treated as tax exempt and the purchases of construction materials are made subject to tax the business inputs associated with the denied input tax credits are all shown by sector in the second panel of Table 1 to form part of the V AT in Nepal.Fifth, the government is treated in the same fashion as final consumers. In other words, expenditures incurred by the government are taxed.Each of these tax policy measures presented in the V AT Act might appear reasonable and politically prudent, in the context of the economy of Nepal. But the results in Column (7) of Table 1 show that the V AT base, with the current tax compliance, has been reduced to approximately 20% gross domestic expenditure. It is also unrealistic to expect a substantial increase in compliance of the tax in a near term. If significant additional revenues are to be collected, tougher tax policies to broaden the tax base will have to be implemented. Because the share of the formal economy is relatively small in such a developing country, the potential tax base for a V AT is rather narrow. Hence, substantial political will is needed in developing countries to impose taxes on goods and services that might be exempted due to political or social considerations in developed countries.A V AT generally requires a higher level of administrative expenditures than a single stage sales tax system because of the greater number of taxpayers and the initial start up costs. This will reduce the net collection of tax revenues. There is a question of whether the V AT would lead to either greater tax enforcement or greater revenue leakage. One can argue that invoices issued by vendor registrants are proof of tax paid and, thus, constitute the basis for input tax credit claims by purchaser registrants. The invoice system may be considered by some economists or tax practitioners as a mechanism that provides an audit trail and an incentive to record。

IMPLEMENTING ENVIRONMENTAL COSTACCOUNTING IN SMALL AND MEDIUM-SIZEDCOMPANIES1.ENVIRONMENTAL COST ACCOUNTING IN SMESSince its inception some 30 years ago, Environmental Cost Accounting (ECA) has reached a stage of development where individual ECA systems are separated from the core accounting system based an assessment of environmental costs with (see Fichter et al., 1997, Letmathe and Wagner , 2002).As environmental costs are commonly assessed as overhead costs, neither the older concepts of full costs accounting nor the relatively recent one of direct costing appear to represent an appropriate basis for the implementation of ECA. Similar to developments in conventional accounting, the theoretical and conceptual sphere of ECA has focused on process-based accounting since the 1990s (see Hallay and Pfriem, 1992, Fischer and Blasius, 1995, BMU/UBA, 1996, Heller et al., 1995, Letmathe, 1998, Spengler and H.hre, 1998).Taking available concepts of ECA into consideration, process-based concepts seem the best option regarding the establishment of ECA (see Heupel and Wendisch , 2002). These concepts, however, have to be continuously revised to ensure that they work well when applied in small and medium-sized companies.Based on the framework for Environmental Management Accounting presented in Burritt et al. (2002), our concept of ECA focuses on two main groups of environmentally related impacts. These are environmentally induced financial effects and company-related effects on environmental systems (see Burritt and Schaltegger, 2000, p.58). Each of these impacts relate to specific categories of financial and environmental information. The environmentally induced financial effects are represented by monetary environmental information and the effects on environmental systems are represented by physical environmental information. Conventional accounting deals with both – monetary as well as physical units – but does not focus on environmental impact as such. To arrive at a practical solution to the implementation of E CA in a company’s existing accounting system, and to comply with the problem of distinguishing between monetary and physical aspects, an integrated concept is required. As physical information is often the basis for the monetary information (e.g. kilograms of a raw material are the basis for the monetary valuation of raw material consumption), the integration of this information into the accounting system database is essential. From there, the generation of physical environmental and monetary (environmental) information would in many cases be feasible. For many companies, the priority would be monetary (environmental) information for use in for instance decisions regarding resource consumptions and investments. The use of ECA in small andmedium-sized enterprises (SME) is still relatively rare, so practical examples available in the literature are few and far between. One problem is that the definitions of SMEs vary between countries (see Kosmider, 1993 and Reinemann, 1999). In our work the criteria shown in Table 1 are used to describe small and medium-sized enterprises.Table 1. Criteria of small and medium-sized enterprisesNumber of employees TurnoverUp to 500employees Turnover up to EUR 50mManagement Organization- Owner-cum-entrepreneur -Divisional organization is rare- Varies from a patriarchal management -Short flow of information style in traditional companies and teamwork -Strong personal commitmentin start-up companies -Instruction and controlling with- Top-down planning in old companies direct personal contact- Delegation is rare- Low level of formality- High flexibilityFinance Personnel- family company -easy to survey number of employees- limited possibilities of financing -wide expertise-high satisfaction of employeesSupply chain Innovation-closely involved in local -high potential of innovationeconomic cycles in special fields- intense relationship with customersand suppliersKeeping these characteristics in mind, the chosen ECA approach should be easy to apply, should facilitate the handling of complex structures and at the same time be suited to the special needs of SMEs.Despite their size SMEs are increasingly implementing Enterprise Resource Planning (ERP) systems like SAP R/3, Oracle and Peoplesoft. ERP systems support business processes across organizational, temporal and geographical boundaries using one integrated database. The primary use of ERP systems is for planning and controlling production and administration processes of an enterprise. In SMEs however, they are often individually designed and thus not standardized making the integration of for instance software that supports ECA implementation problematic. Examples could be tools like the “eco-efficiency” approach of IMU (2003) or Umberto (2003) because these solutions work with the database of more comprehensive software solutions like SAP, Oracle, Navision or others. Umberto software for example (see Umberto, 2003) would require large investments and great background knowledge of ECA – which is not available in most SMEs.The ECA approach suggested in this chapter is based on an integrative solution –meaning that an individually developed database is used, and the ECA solution adopted draws on the existing cost accounting procedures in the company. In contrast to other ECA approaches, the aim was to create an accounting system that enables the companies to individually obtain the relevant cost information. The aim of the research was thus to find out what cost information is relevant for the company’s decision on environmental issues and how to obtain it.2.METHOD FOR IMPLEMENTING ECASetting up an ECA system requires a systematic procedure. The project thus developed a method for implementing ECA in the companies that participated in the project; this is shown in Figure 1. During the implementation of the project it proved convenient to form a core team assigned with corresponding tasks drawing on employees in various departments. Such a team should consist of one or two persons from the production department as well as two from accounting and corporate environmental issues, if available. Depending on the stage of the project and kind of inquiry being considered, additional corporate members may be added to the project team to respond to issues such as IT, logistics, warehousing etc.Phase 1: Production Process VisualizationAt the beginning, the project team must be briefed thoroughly on the current corporate situation and on the accounting situation. To this end, the existing corporate accounting structure and the related corporate information transfer should be analyzed thoroughly. Following the concept of an input/output analysis, how materials find their ways into and out of the company is assessed. The next step is to present the flow of material and goods discovered and assessed in a flow model. To ensure the completeness and integrity of such a systematic analysis, any input and output is to be taken into consideration. Only a detailed analysis of material and energy flows from the point they enter the company until they leave it as products, waste, waste water or emissions enables the company to detect cost-saving potentials that at later stages of the project may involve more efficient material use, advanced process reliability and overview, improved capacity loads, reduced waste disposal costs, better transparency of costs and more reliable assessment of legal issues. As a first approach, simplified corporate flow models, standardizedstand-alone models for supplier(s), warehouse and isolated production segments were established and only combined after completion. With such standard elements and prototypes defined, a company can readily develop an integrated flow model with production process(es), production lines or a production process as a whole. From the view of later adoption of the existing corporate accounting to ECA, such visualization helps detect, determine, assess and then separate primary from secondary processes. Phase 2: Modification of AccountingIn addition to the visualization of material and energy flows, modeling principal and peripheral corporate processes helps prevent problems involving too high shares of overhead costs on the net product result. The flow model allows processes to be determined directly or at least partially identified as cost drivers. This allows identifying and separating repetitive processing activity with comparably few options from those with more likely ones for potential improvement.By focusing on principal issues of corporate cost priorities and on those costs that have been assessed and assigned to their causes least appropriately so far, corporate procedures such as preparing bids, setting up production machinery, ordering (raw) material and related process parameters such as order positions, setting up cycles of machinery, and order items can be defined accurately. Putting several partial processes with their isolated costs into context allows principal processes to emerge; these form the basis of process-oriented accounting. Ultimately, the cost drivers of the processes assessed are the actual reference points for assigning and accounting overhead costs. The percentage surcharges on costs such as labor costs are replaced by process parameters measuring efficiency (see Foster and Gupta, 1990).Some corporate processes such as management, controlling and personnel remain inadequately assessed with cost drivers assigned to product-related cost accounting. Therefore, costs of the processes mentioned, irrelevant to the measure of production activity, have to be assessed and surcharged with a conventional percentage.At manufacturing companies participating in the project,computer-integrated manufacturing systems allow a more flexible and scope-oriented production (eco-monies of scope), whereas before only homogenous quantities (of products) could be produced under reasonable economic conditions (economies of scale). ECA inevitably prevents effects of allocation, complexity and digression and becomes a valuable controlling instrument where classical/conventional accounting arrangements systematically fail to facilitate proper decisions. Thus, individually adopted process-based accounting produces potentially valuable information for any kind of decision about internal processing or external sourcing (e.g. make-or-buy decisions).Phase 3: Harmonization of Corporate Data – Compiling and Acquisition On the way to a transparent and systematic information system, it is convenient to check core corporate information systems of procurement and logistics, production planning, and waste disposal with reference to their capability to provide the necessary precise figures for the determined material/energy flow model and for previously identified principal and peripheral processes. During the course of the project, a few modifications within existing information systems were, in most cases, sufficient to comply with these requirements; otherwise, a completely new softwaremodule would have had to be installed without prior analysis to satisfy the data requirements.Phase 4: Database conceptsWithin the concept of a transparent accounting system, process-based accounting can provide comprehensive and systematic information both on corporate material/ energy flows and so-called overhead costs. To deliver reliable figures over time, it is essential to integrate a permanent integration of the algorithms discussed above into the corporate information system(s). Such permanent integration and its practical use may be achieved by applying one of three software solutions (see Figure 2).For small companies with specific production processes, an integrated concept is best suited, i.e. conventional andenvironmental/process-oriented accounting merge together in one common system solution.For medium-sized companies, with already existing integrated production/ accounting platforms, an interface solution to such a system might be suitable. ECA, then, is set up as an independent software module outside the existing corporate ERP system and needs to be fed data continuously. By using identical conventions for inventory-data definitions within the ECA software, misinterpretation of data can be avoided.Phase 5: Training and CoachingFor the permanent use of ECA, continuous training of employees on all matters discussed remains essential. To achieve a long-term potential of improved efficiency, the users of ECA applications and systems must be able to continuously detect and integrate corporate process modifications and changes in order to integrate them into ECA and, later, to process them properly.。

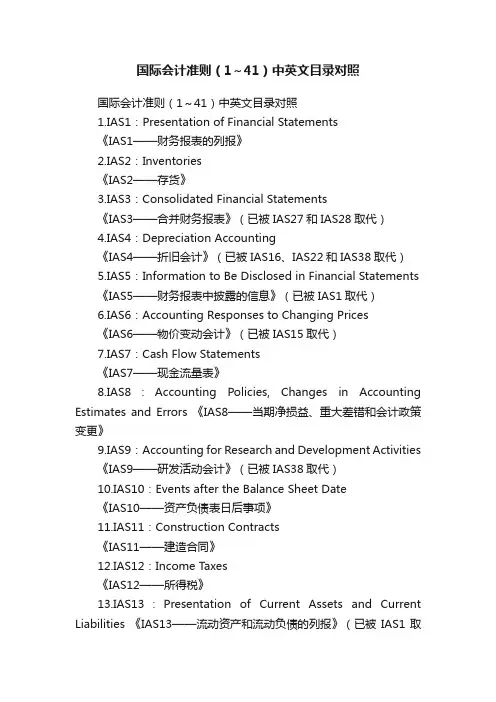

国际会计准则(1~41)中英文目录对照国际会计准则(1~41)中英文目录对照1.IAS1:Presentation of Financial Statements《IAS1——财务报表的列报》2.IAS2:Inventories《IAS2——存货》3.IAS3:Consolidated Financial Statements《IAS3——合并财务报表》(已被IAS27和IAS28取代)4.IAS4:Depreciation Accounting《IAS4——折旧会计》(已被IAS16、IAS22和IAS38取代)5.IAS5:Information to Be Disclosed in Financial Statements《IAS5——财务报表中披露的信息》(已被IAS1取代)6.IAS6:Accounting Responses to Changing Prices《IAS6——物价变动会计》(已被IAS15取代)7.IAS7:Cash Flow Statements《IAS7——现金流量表》8.IAS8:Accounting Policies, Changes in Accounting Estimates and Errors 《IAS8——当期净损益、重大差错和会计政策变更》9.IAS9:Accounting for Research and Development Activities《IAS9——研发活动会计》(已被IAS38取代)10.IAS10:Events after the Balance Sheet Date《IAS10——资产负债表日后事项》11.IAS11:Construction Contracts《IAS11——建造合同》12.IAS12:Income Taxes《IAS12——所得税》13.IAS13:Presentation of Current Assets and Current Liabilities 《IAS13——流动资产和流动负债的列报》(已被IAS1取代)14.IAS14:Segment Reporting《IAS14——分部报告》15.IAS15:Information Reflecting the Effects of Changing Prices《IAS15——反映物价变动影响的信息》(2003年已被撤销)16.IAS16:Property, Plant and Equipment《IAS16——不动产、厂场和设备》17.IAS17:Leases《IAS17——租赁》18.IAS18:Revenue《IAS18——收入》19.IAS19:Employee Benefits《IAS19——雇员福利》20.IAS20:Accounting for Government Grants and Disclosure of Government Assistance《IAS20——政府补助会计和政府援助的披露》21.IAS21:The Effects of Changes in Foreign Exchange Rates《IAS21——汇率变动的影响》22.IAS22:Business Combinations《IAS22——企业合并》(已被IFRS3取代)23.IAS23:Borrowing Costs《IAS23——借款费用》24.IAS24:Related Party Disclosures《IAS24——关联方披露》25.IAS25:Accounting for Investments《IAS25——投资会计》(已被IAS39 和IAS40取代)26.IAS26:Accounting and Reporting by Retirement Benefit Plans《IAS26——退休福利计划的会计和报告》27.IAS27:Consolidated and Separate Financial Statements《IAS27——合并财务报表及对子公司投资会计》28.IAS28:Investments in Associates《IAS28——对联合企业投资会计》29.IAS29:Financial Reporting in Hyperinflationary Economies《IAS29——恶性通货膨胀经济中的财务报告》30.IAS30:Disclosures in the Financial Statements of Banks and Similar Financial Institutions《IAS30——银行和类似金融机构财务报表中的披露》31.IAS31:Interests in Joint Ventures《IAS31——合营中权益的财务报告》32.IAS32:Financial Instruments: Disclosure and Presentation《IAS32——金融工具:披露和列报》33.IAS33:Earnings per Share《IAS33——每股收益》34.IAS34:Interim Financial Reporting《IAS34——中期财务报告》35.IAS35:Discontinuing Operations《IAS35——终止经营》(已被IFRS5取代)36.IAS36:Impairment of Assets《IAS36——资产减值》37.IAS37:Provisions, Contingent Liabilities and Contingent Assets 《IAS37——准备、或有负债和或有资产》38.IAS38:Intangible Assets《IAS38——无形资产》39.IAS39:Financial Instruments: Recognition and Measurement《IAS39——金融工具:确认和计量》40.IAS40:Investment Property《IAS40——投资性房地产》41.IAS41:Agriculture《IAS41——农业》国际会计准则中文版文件格式:Pdf可复制性:可复制TAG标签:会计学点击次数:更新时间:2010-03-30 15:23介绍国际会计准则中文版,国际会计准则在2008年做了更新,中文版不知道是否同步更新,这个对于会计从业人员的帮助很大,在网上找了很久中文版都是2003的老版本,不知道楼主上传的版本对我是否有用。

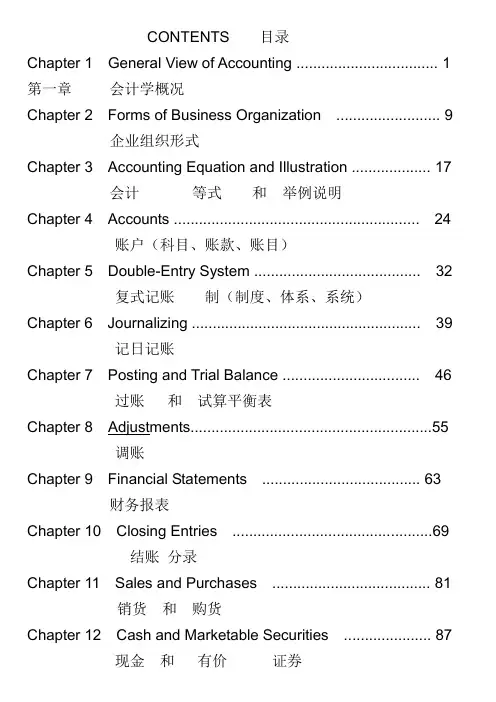

CONTENTS 目录Chapter 1 General View of Accounting (1)第一章会计学概况Chapter 2 Forms of Business Organization (9)企业组织形式Chapter 3 Accounting Equation and Illustration (17)会计等式和举例说明Chapter 4 Accounts (24)账户(科目、账款、账目)Chapter 5 Double-Entry System (32)复式记账制(制度、体系、系统)Chapter 6 Journalizing (39)记日记账Chapter 7 Posting and Trial Balance (46)过账和试算平衡表Chapter 8 Adjustments (55)调账Chapter 9 Financial Statements (63)财务报表Chapter 10 Closing Entries (69)结账分录Chapter 11 Sales and Purchases (81)销货和购货Chapter 12 Cash and Marketable Securities (87)现金和有价证券Chapter 13 Accounts Receivable (92)应收账款Chapter 14 Notes Receivable (97)应收票据Chapter 15 Inventories (103)存货盘点to take inventories at the end of accounting period在会计期末盘点存货Chapter 16 Plant Assets (109)厂房设备资产Chapter 17 Bonds Payable (117)应付债券Chapter 18 Capital Stocks (122)股本Reference Answer (127)参考答案General View of AccountingCHAPTER 1Chapter 1General View of Accounting会计学概况As one of the oldest professions,作为历史最古老的职业之一,accounting is as old as the civilization of human.会计和人类文明一样历史悠久。

会计舞弊财务舞弊外文翻译文献(文档含中英文对照即英文原文和中文翻译)原文:Global Corporate Accounting Frauds and Action for Reforms1、IntroductionDuring the recent series of corporate fraudulent financial reporting incidents in the U.S., similar corporate scandals were disclosed in several other countries. Almost all cases of foreign corporate accounting frauds were committed by entities that conduct their businesses in more than one country, and most of these entities are also listed on U.S. stock exchanges. Following the legislative and regulatory reforms of corporate America, resulting from the SarbanesOxley Act of 2002, reforms were also initiated worldwide. The primary purpose of this paper is twofold: (1) to identify the prominent American and foreign companies involved in fraudulent financial reporting and the nature of accounting irregularities they committed; and (2) to highlight the global reaction for corporate reforms which are aimed at restoring investor confidence in financial reporting, the public accounting profession and global capital markets.2、Cases of Global Corporate Accounting FraudsThe list of corporate financial accounting scandals in the U.S. is extensive, and each one was the result of one or more creative accounting irregularities. Exhibit 1 identifies a sample of U.S. companies that committed such fraud and the nature of their fraudulent financial reporting activities.EXHIBIT 1. A SAMPLE OF CASES OF CORPORATE ACCOUNTING3、Global Regulatory Action for Corporate and Accounting ReformsI. U.S. Sarbanes-Oxley Act of 2002 (SOA 2002)In response to corporate and accounting scandals, the effects of which are still being felt throughout the U.S. economy, and in order to protect public interest and to restore investor confidence in the capital market, U.S. lawmakers, in a compromise by the House and Senate, passed the Sarbanes-Oxley Act of 2002. President Bush signed this Act into law (Public Law 107-204) on July 30, 2002. The Act resulted in major changes to compliance practices of large U.S. and non-U.S. companies whose securities are listed or traded on U.S. stock exchanges, requiring executives, boards of directors and external auditors to undertake measures to implement greater accountability, responsibility and transparency of financial reporting. The statutes of the act, and the new SEC initiatives that followed, are considered the most significant legislation and regulations affecting the corporate community and the accounting profession since 1933. Other U.S. regulatory bodies such as the New York StockExchange (NYSE), the National Association of Securities Dealers Automated Quotation (NASDAQ) and the State Societies of CPAs have also passed new regulations which place additional burdens on publicly traded companies and their external auditors.The Sarbanes-Oxley Act (SOA) is expressly applicable to any non-U.S. company registered on U.S. exchanges under either the Securities Act of 1933 or the Security Exchange Act of 1934, regardless of country of incorporation or corporate domicile. Furthermore, external auditors of such registrants, regardless of their nationality or place of business, are subject to the oversight of the Public Company Accounting Oversight Board (PCAOB) and to the statutory requirements of the SOA .The United States' SOA has reverberated around the globe through the corporate and accounting reforms addressed by the International Federation of Accountants (IFAC); the Organization for Economic Cooperation and Development (OECD); the European Commission (UC); and authoritative bodies within individual European countries.II. International Federation of Accountants (IFAC)The International Federation of Accountants (IFAC) is a private governance organization whose members are the national professional associations of accountants. It formally describes itself as the global representative of the accounting profession, with the objective of serving the public interest, strengthening the worldwide accountancy profession and contributing to the development of strong international economies by establishing and promoting adherence to high quality standards. The Federation represents accountancy groups worldwide and has served as a reminder that restoring public confidence in financial reporting and the accounting profession should be considered a global mission. It is also considered a key player in the global auditing arena which, among other things, constructs international standards on auditing and has laid down an international ethical code for professional accountants. The IFAC has recently secured a degree of support for its endeavors from some of the world's most influential international organizations in economic and financial spheres, including global Financial Stability Forum (FSF), the International Organization ofSecurities Commissions (IOSCO), the World Bank and, most significantly, the European Communities(EC).In October 2002, IFAC commissioned a Task Force on Rebuilding Public Confidence in Financial Reporting to use a global perspective to consider how to restore the credibility of financial reporting and corporate disclosure. Its report, "Rebuilding Public Confidence in Financial Reporting: An International Perspective," includes recommendations for strengthening corporate governance, and raising the regulating standards of issuers. Among its conclusions and recommendations related to audit committees are :1. All public interest entities should have an independent audit committee or similar body .2. The audit committee should regularly report to the board and should address concerns about financial information, internal controls or the audit .3. The audit committee must meet regularly and have sufficient time to perform its role effectively .4. Audit committees should have core responsibilities, including monitoring and reviewing the integrity of financial reporting, financial controls, the internal audit function, as well as for recommending, working with and monitoring the external auditors.5. Audit committee members should be financially literate and a majority should have "substantial financial experience." They should receive further training as necessary on their responsibilities and on the company.6. Audit committees should have regular private "executive sessions" with the outside auditors and the head of the internal audit department. These executive sessions should not include members of management. There should be similar meetings with the chief financial officer (CFO) and other key financial executives, but without other members of management.7. Audit committee members should be independent of management .8. There should be a principles-based approach to defining independence on an international level. Companies should disclose committee members' credentials,remuneration and shareholdings.9. Reinforcing the role of the audit committee should improve the relationship between the auditor and the company. The audit committee should recommend the hiring and firing of auditors and approve their fees, as well as review the audit plan.10. The IFAC Code of Ethics should be the foundation for individual national independence rules. It should be relied on in making decisions on whether auditors should provide non-audit services. Non-audit services performed by the auditor should be approved by the audit committee.11. All fees, for audit and non-audit services, should be disclosed to shareholders.12. Key audit team members, including the engagement and independent review partners, should serve no longer than seven years on the audit .13. Two years should pass before a key audit team member can take a position at the company as a director or any other important management position .III. Organization for Economic Cooperation and Development (OECD)The Organization for Economic Cooperation and Development (OECD) is a quasi-think tank made up of 30 member countries, including the United States (U.S.) and the United Kingdom (UK), and it has working relationships with more than 70 other countries. In 2004, the OECD unveiled the updated revision of its "Principles of Corporate Governance" that had originally been adopted by its member governments (including the U.S. and UK) in 1999. Although they are non-binding, the principles provide a reference for national legislation and regulation, as well as guidance for stock exchanges, investors, corporations and other parties .The principles have long become an international benchmark for policy makers, investors, corporations and other stakeholders worldwide. They have advanced the corporate governance agenda and provided specific guidance for legislative and regulatory initiatives in both the OECD and non-OECD countries.The 2004 updated version of "Principles of Corporate Governance" includes recommendations on accounting and auditing standards, the independence of board members and the need for boards to act in the interest of the company and theshareholders. The updated version also sets more demanding standards in a number of areas that impact corporate executive compensation and finance, such as :1. Granting investors the right to nominate company directors, as well as a more forceful role in electing them.2. Providing shareholders with a voice in the compensation policy for board members and executives, and giving these stockholders the ability to submit questions to auditors.3. Mandating that institutional investors disclose their overall voting policies and how they manage material conflicts of interest that may affect the way the investors exercise key ownership functions, such as voting .4. Identifying the need for effective protection of creditor rights and an efficient system for dealing with corporate insolvency .5. Directing rating agencies, brokers and other providers of information that could influence investor decisions to disclose conflicts of interest, and how those conflicts are being managed .6. Mandating board members to be more rigorous in disclosing related party transactions, and protecting so-called "whistle blowers" by providing the employees with confidential access to a board-level contact .4、ConclusionThe Sarbanes-Oxley Act of 2002 was the U.S. government's response to the wave of fraudulent corporate financial reporting experienced during the 1990s and early 2000s an represented a significant step in regaining investors' confidence in the global financial reporting process. The SOA created new and stricter statutes to avoid a repeat of previous corporate financial disasters. The Act not only applies to U.S. entities but also covers primarily large non-U.S. companies whose securities are listed or traded on U.S. stock exchanges, as well as their non-U.S. external auditors, regardless of their nationality or place of business. Foreign entities have to comply with the SOA by June 2005 .Across the Atlantic, the IFAC, OECD and EU have recognize the recent eruption of corporate scandals in Europe and affirmed the inevitable need forcorporate governance reforms and regulation of the public accounting profession worldwide. The International Federation of Accountants (IFAC) has passed the Code of Professional Ethics for international accounting firms. The Organization for Economic Cooperation and Development (OECD) has passed guidelines for improving corporate governance. The European Union (EU) has proposed a code of conduct for independent auditors, which include a five-year auditor rotation requirement. European countries are also individually involved in improving their corporate laws through governance codes of practice.Sourse: Badawi, Ibrahim M. Review of Business; Spring2005, Vol. 26 Issue 2, p8-14, 7p译文:全球公司会计舞弊和改革行为一、前言随着最近一系列公司虚假财务报告事件在美国发生,类似丑闻也在其他国家被曝光。

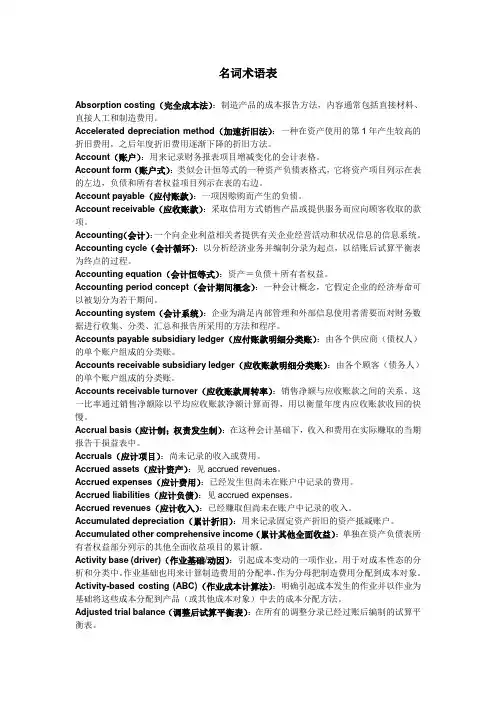

名词术语表Absorption costing(完全成本法):制造产品的成本报告方法,内容通常包括直接材料、直接人工和制造费用。

Accelerated depreciation method(加速折旧法):一种在资产使用的第1年产生较高的折旧费用,之后年度折旧费用逐渐下降的折旧方法。

Account(账户):用来记录财务报表项目增减变化的会计表格。

Account form(账户式):类似会计恒等式的一种资产负债表格式,它将资产项目列示在表的左边,负债和所有者权益项目列示在表的右边。

Account payable(应付账款):一项因赊购而产生的负债。

Account receivable(应收账款):采取信用方式销售产品或提供服务而应向顾客收取的款项。

Accounting(会计):一个向企业利益相关者提供有关企业经营活动和状况信息的信息系统。

Accounting cycle(会计循环):以分析经济业务并编制分录为起点,以结账后试算平衡表为终点的过程。

Accounting equation(会计恒等式):资产=负债+所有者权益。

Accounting period concept(会计期间概念):一种会计概念,它假定企业的经济寿命可以被划分为若干期间。

Accounting system(会计系统):企业为满足内部管理和外部信息使用者需要而对财务数据进行收集、分类、汇总和报告所采用的方法和程序。

Accounts payable subsidiary ledger(应付账款明细分类账):由各个供应商(债权人)的单个账户组成的分类账。

Accounts receivable subsidiary ledger(应收账款明细分类账):由各个顾客(债务人)的单个账户组成的分类账。

Accounts receivable turnover(应收账款周转率):销售净额与应收账款之间的关系。

这一比率通过销售净额除以平均应收账款净额计算而得,用以衡量年度内应收账款收回的快慢。

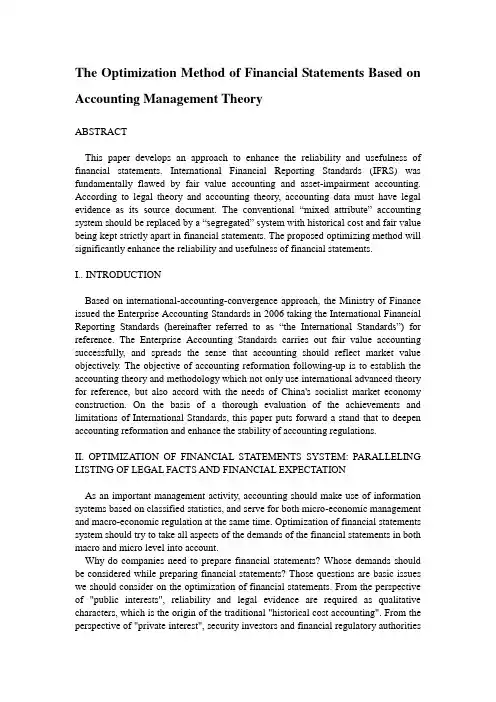

The Optimization Method of Financial Statements Based on Accounting Management TheoryABSTRACTThis paper develops an approach to enhance the reliability and usefulness of financial statements. International Financial Reporting Standards (IFRS) was fundamentally flawed by fair value accounting and asset-impairment accounting. According to legal theory and accounting theory, accounting data must have legal evidence as its source document. The conventional “mixed attribute” accounting system should be re placed by a “segregated” system with historical cost and fair value being kept strictly apart in financial statements. The proposed optimizing method will significantly enhance the reliability and usefulness of financial statements.I.. INTRODUCTIONBased on international-accounting-convergence approach, the Ministry of Finance issued the Enterprise Accounting Standards in 2006 taking the International Financial Reporting Standards (hereinafter referred to as “the International Standards”) for reference. The Enterprise Accounting Standards carries out fair value accounting successfully, and spreads the sense that accounting should reflect market value objectively. The objective of accounting reformation following-up is to establish the accounting theory and methodology which not only use international advanced theory for reference, but also accord with the needs of China's socialist market economy construction. On the basis of a thorough evaluation of the achievements and limitations of International Standards, this paper puts forward a stand that to deepen accounting reformation and enhance the stability of accounting regulations.II. OPTIMIZA TION OF FINANCIAL STATEMENTS SYSTEM: PARALLELING LISTING OF LEGAL FACTS AND FINANCIAL EXPECTA TIONAs an important management activity, accounting should make use of information systems based on classified statistics, and serve for both micro-economic management and macro-economic regulation at the same time. Optimization of financial statements system should try to take all aspects of the demands of the financial statements in both macro and micro level into account.Why do companies need to prepare financial statements? Whose demands should be considered while preparing financial statements? Those questions are basic issues we should consider on the optimization of financial statements. From the perspective of "public interests", reliability and legal evidence are required as qualitative characters, which is the origin of the traditional "historical cost accounting". From the perspective of "private interest", security investors and financial regulatory authoritieshope that financial statements reflect changes of market prices timely recording "objective" market conditions. This is the origin of "fair value accounting". Whether one set of financial statements can be compatible with these two different views and balance the public interest and private interest? To solve this problem, we design a new balance sheet and an income statement.From 1992 to 2006, a lot of new ideas and new perspectives are introduced into China's accounting practices from international accounting standards in a gradual manner during the accounting reform in China. These ideas and perspectives enriched the understanding of the financial statements in China. These achievements deserve our full assessment and should be fully affirmed. However, academia and standard-setters are also aware that International Standards are still in the process of developing .The purpose of proposing new formats of financial statements in this paper is to push forward the accounting reform into a deeper level on the basis of international convergence.III. THE PRACTICABILITY OF IMPROVING THE FINANCIAL STATEMENTS SYSTEMWhether the financial statements are able to maintain their stability? It is necessary to mobilize the initiatives of both supply-side and demand-side at the same time. We should consider whether financial statements could meet the demands of the macro-economic regulation and business administration, and whether they are popular with millions of accountants.Accountants are responsible for preparing financial statements and auditors are responsible for auditing. They will benefit from the implementation of the new financial statements.Firstly, for the accountants, under the isolated design of historical cost accounting and fair value accounting, their daily accounting practice is greatly simplified. Accounting process will not need assets impairment and fair value any longer. Accounting books will not record impairment and appreciation of assets any longer, for the historical cost accounting is comprehensively implemented. Fair value information will be recorded in accordance with assessment only at the balance sheet date and only in the annual financial statements. Historical cost accounting is more likely to be recognized by the tax authorities, which saves heavy workload of the tax adjustment. Accountants will not need to calculate the deferred income tax expense any longer, and the profit-after-tax in the solid line table is acknowledged by the Company Law, which solves the problem of determining the profit available for distribution.Accountants do not need to record the fair value information needed by security investors in the accounting books; instead, they only need to list the fair value information at the balance sheet date. In addition, because the data in the solid line table has legal credibility, so the legal risks of accountants can be well controlled. Secondly, the arbitrariness of the accounting process will be reduced, and the auditors’ review process will be greatly simplified. The independent auditors will not have to bear the considerable legal risk for the dotted-line table they audit, because the risk of fair value information has been prompted as "not supported by legalevidences". Accountants and auditors can quickly adapt to this financial statements system, without the need of training. In this way, they can save a lot of time to help companies to improve management efficiency. Surveys show that the above design of financial statements is popular with accountants and auditors. Since the workloads of accounting and auditing have been substantially reduced, therefore, the total expenses for auditing and evaluation will not exceed current level as well.In short, from the perspectives of both supply-side and demand-side, the improved financial statements are expected to enhance the usefulness of financial statements, without increase the burden of the supply-side.IV. CONCLUSIONS AND POLICY RECOMMENDATIONSThe current rule of mixed presentation of fair value data and historical cost data could be improved. The core concept of fair value is to make financial statements reflect the fair value of assets and liabilities, so that we can subtract the fair value of liabilities from assets to obtain the net fair value.However, the current International Standards do not implement this concept, but try to partly transform the historical cost accounting, which leads to mixed using of impairment accounting and fair value accounting. China's accounting academic research has followed up step by step since 1980s, and now has already introduced a mixed-attributes model into corporate financial statements.By distinguishing legal facts from financial expectations, we can balance public interests and private interests and can redesign the financial statements system with enhancing management efficiency and implementing higher-level laws as main objective. By presenting fair value and historical cost in one set of financial statements at the same time, the statements will not only meet the needs of keeping books according to domestic laws, but also meet the demand from financial regulatory authorities and security investorsWe hope that practitioners and theorists offer advices and suggestions on the problem of improving the financial statements to build a financial statements system which not only meets the domestic needs, but also converges with the International Standards.基于会计管理理论的财务报表的优化方法摘要本文提供了一个方法,以提高财务报表的可靠性和实用性。

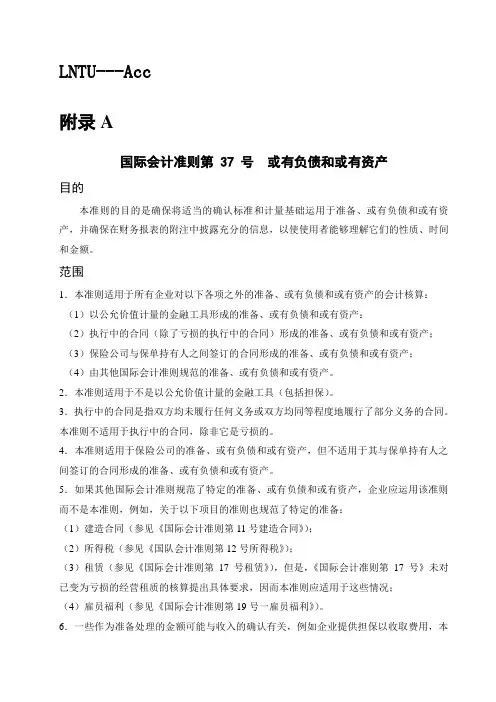

LNTU---Acc附录A国际会计准则第 37 号或有负债和或有资产目的本准则的目的是确保将适当的确认标准和计量基础运用于准备、或有负债和或有资产,并确保在财务报表的附注中披露充分的信息,以使使用者能够理解它们的性质、时间和金额。

范围1.本准则适用于所有企业对以下各项之外的准备、或有负债和或有资产的会计核算:(1)以公允价值计量的金融工具形成的准备、或有负债和或有资产:(2)执行中的合同(除了亏损的执行中的合同)形成的准备、或有负债和或有资产;(3)保险公司与保单持有人之间签订的合同形成的准备、或有负债和或有资产;(4)由其他国际会计准则规范的准备、或有负债和或有资产。

2.本准则适用于不是以公允价值计量的金融工具(包括担保)。

3.执行中的合同是指双方均未履行任何义务或双方均同等程度地履行了部分义务的合同。

本准则不适用于执行中的合同,除非它是亏损的。

4.本准则适用于保险公司的准备、或有负债和或有资产,但不适用于其与保单持有人之间签订的合同形成的准备、或有负债和或有资产。

5.如果其他国际会计准则规范了特定的准备、或有负债和或有资产,企业应运用该准则而不是本准则,例如,关于以下项目的准则也规范了特定的准备:(1)建造合同(参见《国际会计准则第11号建造合同》);(2)所得税(参见《国队会计准则第12号所得税》);(3)租赁(参见《国际会计准则第17 号租赁》),但是,《国际会计准则第17 号》未对已变为亏损的经营租质的核算提出具体要求,因而本准则应适用于这些情况;(4)雇员福利(参见《国际会计准则第19号一雇员福利》)。

6.一些作为准备处理的金额可能与收入的确认有关,例如企业提供担保以收取费用,本准则不涉及收入确认,《国际会计准则第18 号收入》明确了收入确认标准,并就确认标准的应用提供了实务指南,本准则不改变《国际会计准则第18 号》的规定。

7.本准则将准备定义为时间或金额不确定的负债,在某些国家,“准备”也与一些项目相联系使用,例如折旧,资产减值和坏账:这些是对资产账面金额的调整,本准则不涉及。

会计学财务报表中英文对照外文翻译文献(文档含英文原文和中文翻译)译文:中美财务报表的区别(1)财务报告内容构成上的区别1)美国的财务报告包括三个基本的财务报表,除此之外,典型的美国大公司财务报告还包括以下成分:股东权益、收益与综合收益、管理报告、独立审计报告、选取的5-10年数据的管理讨论与分析以及选取的季度数据。

2)我国财务报告不注重其解释,而美国在财务报告的内容、方法、多样性上都比较充分。

中国的评价部分包括会计报表和财务报表,财务报表是最主要的报表,它包括前述各项与账面不符的描述、财会政策与变化、财会评估的变化、会计差错等问题,资产负债表日期,关联方关系和交易活动等等,揭示方法是注意底部和旁注。

美国的财务范围在内容上比财务报表更加丰富,包括会计政策、技巧、添加特定项目的报告, 报告格式很难反映内容和商业环境等等,对违反一致性、可比性原则问题,评论也需要披露的,但也揭示了许多方面,比如旁注、底注、括号内、补充声明、时间表和信息分析报告。

(2)财务报表格式上的比较1)从资产负债表的格式来看,美国的资产负债表有账户类型和报告样式两项描述,而我国是使用固定的账户类型。

另外,我们的资产负债表在项目的使用上过于标准化,不能够很好的反映出特殊的商业项目或者不适用于特殊类型的企业。

而美国的资产负债表项目是多样化的,除此之外,财务会计准则也是建立在资产负债表中资产所有者投资和支出两项要素基础上的,这一点也是中国的财会准则中没有的。

2)从损益表格式的角度来看,美国采用的是多步式,损益表项目分为两部分,营业利润和非营业利润,但是意义不同。

我国的营业利润在范围上比美国的小,例如投资收益在美国是归类为营业利润的而在我国则不属于营业利润。

另外,我国的损益表项目较美国的更加规范和严格,美国校准损益表仅仅依赖于类别和项目。

报告收可以与销售收入及其他收入相联系,也可以和利息收益、租赁收入和单项投资收益相联系;在成本方面,并不是严格的划分为管理成本、财务成本、和市场成本,并且经常性销售费用、综合管理费用以及利息费用、净利息收益都要分别折旧。

中英文对照外文翻译文献(文档含英文原文和中文翻译)译文:译文(一)世界贸易的飞速发展和国际资本的快速流动将世界经济带入了全球化时代。

在这个时代, 任何一个国家要脱离世界贸易市场和资本市场谋求自身发展是非常困难的。

会计作为国际通用的商业语言, 在经济全球化过程中扮演着越来越重要的角色, 市场参与者也对其提出越来越高的要求。

随着市场经济体制的逐步建立和完善,有些国家加入世贸组织后国际化进程的加快,市场开放程度的进一步增强,市场经济发育过程中不可避免的各种财务问题的出现,迫切需要完善的会计准则加以规范。

然而,在会计准则制定过程中,有必要认真思考理清会计准则的概念,使制定的会计准则规范准确、方便操作、经济实用。

由于各国家的历史、环境、经济发展等方面的不同,导致目前世界所使用的会计准则在很多方面都存在着差异,这使得各国家之间的会计信息缺乏可比性,本国信息为外国家信息使用者所理解的成本较高,在很大程度上阻碍了世界国家间资本的自由流动。

近年来,许多国家的会计管理部门和国家性的会计、经济组织都致力于会计准则的思考和研究,力求制定出一套适于各个不同国家和经济环境下的规范一致的会计准则,以增强会计信息的可比性,减少国家各之间经济交往中信息转换的成本。

译文(二)会计准则就是会计管理活动所依据的原则, 会计准则总是以一定的社会经济背景为其存在基础, 也总是反映不同社会经济制度、法律制度以及人们习惯的某些特征, 因而不同国家的会计准则各有不同特点。

但是会计准则毕竟是经济发展对会计规范提出的客观要求。

它与社会经济发展水平和会计管理的基本要求是相适应的,因而,每个国家的会计准则必然具有某些共性:1. 规范性每个企业有着变化多端的经济业务,而不同行业的企业又有各自的特殊性。

而有了会计准则,会计人员在进行会计核算时就有了一个共同遵循的标准,各行各业的会计工作可在同一标准的基础上进行,从而使会计行为达到规范化,使得会计人员提供的会计信息具有广泛的一致性和可比性,大大提高了会计信息的质量。