8麦肯锡三层面分析:企业设计战略规划、开拓增长的有效工具

- 格式:doc

- 大小:103.00 KB

- 文档页数:5

国开【形考】《企业战略分析》形考任务1-3答案平时作业一一、判断题。

题目1产业成熟期的企业通常会采取市场领先型战略。

(错)题目2战略是对企业竞争的整体性、长远性、基本性谋划。

(对)题目3“三察三看”,即通过察环境侧看发展大势,察需求侧看市场变化,察供给侧看竞争格局。

(对)题目4“想做”、“可做”、“能做”是企业战略定位的交集。

(对)题目5矛盾推演任务是将企业内外环境联系起来,识别新形势下企业面临的所有矛盾。

(错)题目7机会洞察主要解决的是“路线行动配资源”的问题。

(错)题目8公司级战略的主攻方向可以用波士顿矩阵来进行指导,业务级战略的主攻方向可以用麦肯锡三层面理论来指导.(错)题目9知己知彼是战略推演的前提。

(对)题目10环境侧推演由于关注的是宏观层面,对所有企业一样重要.(错)题目11战略推演就是战略规划。

(错)题目12 战略定位确定企业发展方位,主题明确企业发展基调,主线明晰企业发展主轴,主攻方向则是锚定企业重点发展领域,而着力点聚焦着手之处。

(对)题目1、战略定位是战略推演的逻辑起点,旨在帮助企业识别市场机会,明确发展方向。

(错)。

题目2、企业的内部不协调矛盾推演主要通过横向对标发现内部短板。

(错)。

题目6、总体路线设计针对的是业务层战略,标定企业的发展方位、奋斗目标,绘就战略蓝图。

(错)。

题目11、适应型战略思维逻辑是“目标—差距—补短”。

(对)题目12、业务路线设计核心解决的是具体战略举措问题,是路线设计的着力点。

(错)。

题目12、在确定中心任务时,一种是针对发现的主要矛盾,运用塑造型思维,把瓶颈突破作为中心任务。

(错)。

题目3、不少企业出现上下战略不同调、内部各行其是的现象,问题就出在企业内部没有建立起共同的战略语言。

(对)题目4、通过能力分析,我们可以查找内部的短板,发现产生内部不协调的矛盾根源.(对)题目12、战略的本质是驱动价值创造。

(对)二、填空题。

题目13战略心法是“知己知彼明方向,()配资源”。

麦肯锡模型及其详解麦肯锡模型(McKinsey model)是一种管理工具,用于分析和解决复杂的商业问题。

它由全球领先的管理咨询公司麦肯锡公司(McKinsey & Company)开发并广泛应用。

在本篇文章中,我们将详细解释麦肯锡模型的各个方面,包括其定义、应用场景、步骤和示例。

一、什么是麦肯锡模型麦肯锡模型是一种商业问题解决框架,旨在提供结构化的方法来分析和解决各种商业挑战。

该模型由麦肯锡公司的顾问们根据多年的实践经验开发而成,并在全球范围内得到广泛应用。

其核心思想是将问题分解为不同的要素,并通过相互关联的分析来提供解决方案。

二、麦肯锡模型的应用场景麦肯锡模型适用于各种商业问题解决和战略制定的场景。

无论是市场分析、竞争对手研究、产品定位、供应链优化还是企业规模扩张,麦肯锡模型都可以提供有力的解决方案。

该模型被广泛应用于各行各业,包括制造业、金融业、咨询业等。

三、麦肯锡模型的步骤麦肯锡模型的应用通常包括以下几个步骤:1. 定义问题:明确要解决的具体问题,并确保所有相关方都对问题的定义达成一致。

2. 数据收集:收集必要的数据和信息,包括市场数据、竞争信息等,以支持后续的分析和决策。

3. 分析框架:选择适当的分析框架,将问题分解为不同的要素,并建立它们之间的关联。

4. 数据分析:在分析框架的指导下,对收集到的数据进行分析,识别关键问题和机会。

5. 解决方案:基于数据分析的结果,提出切实可行的解决方案,并进行评估和优化。

6. 实施计划:将解决方案转化为可执行的计划,并明确责任和时间表。

7. 监控和调整:跟踪解决方案的实施情况,定期评估并进行必要的调整。

四、麦肯锡模型的示例为了更好地理解麦肯锡模型的应用,以下是一个实际案例的示例:假设一个新兴的科技公司面临市场份额下降的问题。

他们希望通过使用麦肯锡模型来找到解决方案。

遵循麦肯锡模型的步骤,他们首先明确问题为市场份额下降,并与团队成员一致对问题进行定义。

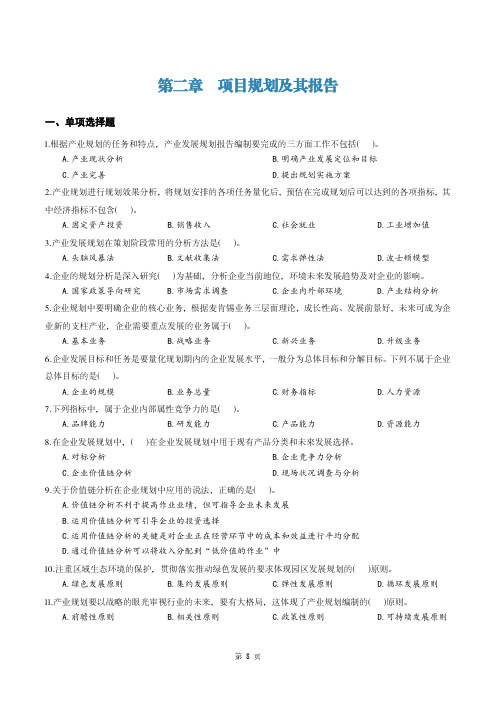

第二章项目规划及其报告一、单项选择题1.根据产业规划的任务和特点,产业发展规划报告编制要完成的三方面工作不包括()。

A.产业现状分析B.明确产业发展定位和目标C.产业完善D.提出规划实施方案2.产业规划进行规划效果分析,将规划安排的各项任务量化后,预估在完成规划后可以达到的各项指标,其中经济指标不包含()。

A.固定资产投资B.销售收入C.社会就业D.工业增加值3.产业发展规划在策划阶段常用的分析方法是()。

A.头脑风暴法B.文献收集法C.需求弹性法D.波士顿模型4.企业的规划分析是深入研究()为基础,分析企业当前地位,环境未来发展趋势及对企业的影响。

A.国家政策导向研究B.市场需求调查C.企业内外部环境D.产业结构分析5.企业规划中要明确企业的核心业务,根据麦肯锡业务三层面理论,成长性高、发展前景好,未来可成为企业新的支柱产业,企业需要重点发展的业务属于()。

A.基本业务B.战略业务C.新兴业务D.升级业务6.企业发展目标和任务是要量化规划期内的企业发展水平,一般分为总体目标和分解目标。

下列不属于企业总体目标的是()。

A.企业的规模B.业务总量C.财务指标D.人力资源7.下列指标中,属于企业内部属性竞争力的是()。

A.品牌能力B.研发能力C.产品能力D.资源能力8.在企业发展规划中,()在企业发展规划中用于现有产品分类和未來发展选择。

A.对标分析B.企业竞争力分析C.企业价值链分析D.现场状况调查与分析9.关于价值链分析在企业规划中应用的说法,正确的是()。

A.价值链分析不利于提高作业业绩,但可指导企业未来发展B.运用价值链分析可引导企业的投资选择C.运用价值链分析的关键是对企业正在经营环节中的成本和效益进行平均分配D.通过价值链分析可以将收入分配到“低价值的作业”中10.注重区域生态环境的保护,贯彻落实推动绿色发展的要求体现园区发展规划的()原则。

A.绿色发展原则B.集约发展原则C.弹性发展原则D.循环发展原则11.产业规划要以战略的眼光审视行业的未来,要有大格局,这体现了产业规划编制的()原则。

麦肯锡战略分析的工具:解决问题的基本方法(之一)麦肯锡是国际顶级战略管理咨询公司,它有一系列独特的管理理念、方法和工具。

这里介绍他们的一个分析问题的方法。

原文是PPT文档,现在还无法上传,只好这样转贴了。

这里先贴到步骤一。

余下部门,有空时我尽快编好贴出。

有关解决问题常见的迷思迷思―解决问题的高手是天生的,而不是培养出来的。

有的人生来就有这个天赋,而有的人却没有,这是一种天生的创造能力...是教不出来的。

‖事实―善于解决问题的能力通常是缜密而系统化思维的产物,任何一个有才之士都能获得这种能力。

有序的思维工作方式并不会扼杀灵感及创造力,反而会助长灵感及创造力的产生。

‖解决问题的七个步骤1、陈述问题> 2、分解问题(问题树) > 3、去掉所有非关键问题(漏斗法) > 4、制定详细的工作计划 > 5、进行关键分析 > 6、综合调查结果,并建构论证 > 7、讲述来龙去脉:在沟通文件中将数据及论证联系起来第一步-陈述问题清晰地陈述要解决的问题清晰陈述问题的特点:1) 一个主导性的问题或坚定的假设2) 具体,不笼统3) 有内容的(而非事实的罗列或一种无可争议的主张)4) 可行动的5) 以决策者下一步所需的行动为重点首要之务是对问题的准确了解陈述问题的实例-公共图书馆问题评价公共图书馆面临着大家抱怨它不能事实的陈述提供信息服务的问题图书馆是否应努力改善对会员的服务?无可争议能否采取不同的图书馆管理方法以改太空泛善对会员的服务?图书馆有哪些改善会员服务的可能?具体,可行动的是通过延长时间,更好地选择书刊,还是在现有的预算内改善编辑目录使借阅更加容易?其他方面-问题的背景情况1.决策者哪些是你的听众?2.影响决策者的主要因素哪些是他们比较关心的问题?你如何解决互相冲突的问题?3.解决问题的时间多快需要找出解答?4.成功的标准决策者如何判断是否成功地解决了问题?他/她所关心的是什么?5.主要衡量标准哪些是衡量成功的主要变数?6.所需的准确度需要何种准确度?问题背景情况的实例-公共图书馆1.决策者• 图书馆馆长• 理事会• 市长2.影响决策者的主要因素图书馆馆长• 12个月後需再由市长续聘并由理事会批准• 已任职7年市长• 将在9个月后重新选举,并面临着需增加赋税但没有提供足够服务的压力3.解决问题的时间安排必须在6个月内进行改善,所以必须在2月内解决问题4.成功的标准改革必须同图书馆的使命一致• 改革计划必须可在6个月内实施• 改善成果必须在6个月内可以衡量并有所显现• 因为图书馆的工作人员是主要的改革实施者,所以他们必须支持改革5.主要衡量标准不超出预算• 客户满意度调查结果有所改善• 发给市长、报纸或图书馆长的表扬信6.所需的准确度对所需变革种类的强有力的指导比细节的精确度更为重要• 但不能超出预算关心听众所急一定要考虑到决策者的主要标准注意多快需要答案麦肯锡战略分析的工具:解决问题的基本方法(之二)步骤2-分解问题问题陈述:逻辑树问题/假设1分支问题分支问题问题/假设2分支问题分支问题问题/假设3分支问题分支问题为什么使用逻辑树?1.将问题分成几个部分使• 解决问题的工作可以分成智力上能够解决的几个部分• 不同部分可按轻重缓急区分• 工作责任能分派到各人2.保证问题获得完整地解决• 将问题的各个部分解决好,即可解决整个问题• 所分问题的各个部分各不相同,而且包括了各个方面(即没有重叠没有遗漏)3.使项目小组共同了解解决问题的框架4.协助重点使用组织框架及理论步骤3-淘汰非关键的问题• 经常反复推敲过程中的第一步–假设/理论及数据之间的来回穿梭–使用80/20的思考方式• 重点努力解决最重要的问题• 不仅要常问―那又会怎样‖...而且还要问你忘了什么• 进行一项较困难的研究分析时淘汰非关键性问题是掌握合理生活方式的关键步骤4-制定详细的工作计划问题• 从逻辑树中最後一点(或「叶」)开始• 「重要议题」和「未解决议题」定义不同。

麦肯锡1。

麦肯锡7S模型 (1)2. 麦肯锡七步分析法 (4)3. 麦肯锡三层面理论 (5)4. 麦肯锡逻辑树分析法 (6)5。

麦肯锡七步成诗法 (8)6。

麦肯锡客户盈利性矩阵 (12)注1: 新7S原则 (14)麦肯锡咨询公司(Mckinsey & Company)是世界级领先的全球管理咨询公司。

自1926年成立以来,公司的使命就是帮助领先的企业机构实现显著、持久的经营业绩改善,打造能够吸引、培育和激励杰出人才的优秀组织机构。

麦肯锡采取“公司一体”的合作伙伴关系制度,在全球44个国家有80多个分公司,共拥有6500多名咨询顾问。

麦肯锡大中华分公司包括北京、香港、上海与台北四家分公司,共有40多位董事和250多位咨询顾问。

在过去十年中,麦肯锡在大中华区完成了800多个项目,涉及公司整体与业务单元战略、企业金融、营销/销售与渠道、组织架构、制造/采购/供应链、技术、产品研发等领域。

1.麦肯锡7S模型目录1 麦肯锡7S模型简介二十世纪七、八十年代,美国人饱受了经济不景气、失业的苦恼,同时听够了有关日本企业成功经营的艺术等各种说法,也在努力寻找着适合于本国企业发展振兴的法宝。

托马斯·J·彼得斯(Thomas J.Peters)和小罗伯特·H·沃特曼(Robert H.Waterman),这两位斯坦福大学的管理硕士、长期服务于美国著名的麦肯锡管理顾问公司的学者,访问了美国历史悠久、最优秀的62家大公司,又以获利能力和成长的速度为准则,挑出了43家杰出的模范公司,其中包括IBM、德州仪器、惠普、麦当劳、柯达、杜邦等各行业中的翘楚.他们对这些企业进行了深入调查、并与商学院的教授进行讨论,以麦肯锡顾问公司研究中心设计的企业组织七要素(简称7S模型)为研究的框架,总结了这些成功企业的一些共同特点,写出了《追求卓越——美国企业成功的秘诀》一书,使众多的美国企业重新找回了失落的信心.7—S模型指出了企业在发展过程中必须全面地考虑各方面的情况,包括结构(Structure)、制度(Systems)、风格(Style)、员工(Staff)、技能(Skills)、战略(Strategy)、共同价值观(Shared Valueds)。

最全麦肯锡战略分析工具BU Strategic Plan Template Book STRATEGYPLANNING INSTRUCTIONS TABLE OF CONTENTS BU STRATEGIC PLAN DEVELOPMENT IEXECUTIVE SUMMARY IIA INDUSTRY DYNAMICS AND IMPLICATIONS – SUMMARY IIAINDUSTRY DYNAMICS AND IMPLICATIONS – BACK-UP 1 IIA INDUSTRY DYNAMICS-UP 2 IIA INDUSTRY DYNAMICS AND IMPLICATIONS – AND IMPLICATIONS –BACKBACK-UP 3 IIA INDUSTRY DYNAMICS AND IMPLICATIONS – BACK-UP 4 IIB COMPETITIVE ASSESSMENT – SUMMARY IIB COMPETITIVE ASSESSMENT –BACK-UP1 IIB COMPETITIVE ASSESSMENT – BACK-UP2 IIC INTERNAL ASSESSMENT –BACK-UP 1 IIC INTERNAL ASSESSMENT SUMMARY IIC INTERNAL ASSESSMENT –– BACK-UP 2 IIC INTERNAL ASSESSMENT – BACK-UP 3 IIIA STRATEGY ARTICULATION – SUMMARY IIIA STRATEGY ARTICULATION – BACK-UP 1 IIIA STRATEGY ARTICULATION – BACK-UP 2 IIIA STRATEGY ARTICULATION –BACK-UP3 IIIA STRATEGY ARTICULATION – BACK-UP4 IIIB STRATEGICINITIATIVES – SUMMARY IIIB STRATEGIC INITIATIVES – BACK-UP 1 IIIB STRATEGIC INITIATIVES – BACK-UP 2 IIIB STRATEGIC INITIATIVES – BACK-UP 3 IIIBSTRATEGIC INITIATIVES – BACK-UP 4 IIIC FINANCIAL PROJECTIONS –SUMMARYIIIC FINANCIAL PROJECTIONS – BACK-UP 1 IIIC FINANCIAL PROJECTIONS –BACK-UP 2 IIIC FINANCIAL PROJECTIONS – BACK-UP 3 IIIC FINANCIAL PROJECTIONS – BACK-UP 4 IIID RISKSCONTINGENCIES STRATEGIC ALTERNATIVES– SUMMARY IIID RISKSCONTINGENCIES STRATEGIC ALTERNATIVES –BACK-UP 1 IIID RISKSCONTINGENCIES STRATEGIC ALTERNATIVES – BACK-UP2 IIID RISKSCONTINGENCIES STRATEGIC ALTERNATIVES – BACK-UP3 SEGMENTANALYSIS STRUCTURE-CONDUCT-PERFORMANCE SCP MODEL SWOT ANALYSISCAPABILITY PLATFORM ASSESSMENT OF SOURCES OFCOMPETITIVE ADVANTAGE 12 CAPABILITY PLATFORM ASSESSMENT OF SOURCES OF COMPETITIVE ADVANTAGE 22 COMPETITOR CAPABILITY COMPARISON BENCHMARK PERFORMANCE AGAINST RELEVANT INDUSTRY KPIs SEGMENT ANALYSIS TREND ANALYSIS – RETURN ON CAPITAL EMPLOYED ROCE TREND ANALYSIS – CASH INTANGIBLE ASSET CHECKLIST WHERE TO COMPETE VALUE PROPOSITION BUSINESS MODEL STRATEGIC INITIATIVES SOURCES OF VALUE STRATEGIC INITIATIVES VALUE QUANTIFICATION STRATEGIC INITIATIVES RESOURCING REQUIREMENTS DEFINITION OF RISKS C1 What are the key assumptions Profit and loss eg revenues costs margin Balance sheet Corporate center directives Corporate center assumptions BASE CASE Business unit assumptions Revenues Market size Market share Price Costs Input costs Production costs Other costs eg SGA Margins Gross margin Operatingmargin Capital Planned investments divestments Changes in workingcapital 2002 KEY FORECAST ASSUMPTIONS 2003 2004 Growth rate Corporate center assumptions 2002 20032004 Key economic indicators GDP growth Consumer price indexExchange rate PhP USD 91-day T-bill rate Corporate tax rateInstructionsThese are the minimum required assumptions Feel free to add other assumptions relevant to your BU C2 What is your projected net income in the next few years Income statement forecast BASE CASE Historical Sales Cost of goods sold Gross profit Operating expenses Operating profit Other expenses Taxes Net profit 1999 FORECASTED INCOME STATEMENT 2000 In PhP million Forecast 2001 2002 2003 2004 CAGR 1999-2004 Growth analysis SalesGross profit Operating profit Net profit Margin analysis Gross margin Operating margin Net margin Key assumptions not listed earlier should be detailed at the bottom of the chart The impact of planned initiatives on the revenues and costs should be established clearly with additional attachments if required Best estimates on possible actual results InstructionsThese are the minimum required income statement accounts and analyses Feel free to add other accounts and analyses relevant to your BU C3What is your expected cash generation ability over the medium term Cash flow forecast InstructionsThese are the minimum required cash flow statement accounts Feelfree to add other accounts relevant to your BU BASE CASE Operatingprofit Depreciation and amortization Other non-cash operating expenses Net operating cash flow Increasedecrease in working capital Other operating cash flow Total operating cash flow FORECASTED CASH FLOW STATEMENT Historical 1999 2000 Forecast 2001 2002 2003 2004 CAGR 1999-2004 Capital expenditure Other investing cash flow items Total investing cash flow Increasedecrease in debt Dividends Other financing cash flow Total financing cash flow In PhP million Key assumptions not listed earlier should be detailed at the bottom of the chart The impact of planned initiatives on the fixed and working capital investments should beestablished clearly with additional attachments if required Best estimates on possible actual results C4 What is your expected capital productivity Balance sheet forecast ROCE computation ROCE Operating income x 1- tax rate All interest bearing debtshort and long minority interest stockholders equityInstructionsThese are the minimum required balance sheet accounts and analyses Feel free to add other accounts and analyses relevant to your BU BASE CASE Cash Accounts receivables Inventories Other current assets Total current assets Net fixed assets Other assets Total assets FORECASTED BALANCE SHEET Historical 1999 2000 Forecast 2001 2002 2003 2004 CAGR1999-2004 Accounts payable Other current liabilities Total current liabilities Shortans Long-term loans Other liabilities Total -term lo liabilities Minority interest Total stockholders equity In PhPmillion Capital employed ROCE Total liab stockholders equity Ratio analysis Working capital turnover Debt-equity ratio Best estimates on possible actual results D What strategic alternatives have you considered D1What are the associated risks to your chosen strategy D2Re-examining industry opportunities and industrycompetitive threats what alternatives exist to your chosen strategy InstructionsThe answer to thisoverarching questionrequires a recapitulationof the sections mainfindings D3 Beyond the 3-year time frame what breakthrough strategic options may be possible InstructionsThese subsectionscontain a 1-2 sentencesummary of the relevantfindings D1 What are the associated risks to your chosen strategy Identification of significant potential risks and plans to mitigate Sensitivityscenario financial analysis Potential risks Business risk Regulatory risk Technology risk Integrity risk Macroeconomic risk Impact Likelihood Contingency Other D2 Re-examining industry opportunities andindustrycompetitive threats what alternatives exist to your chosen strategy Where to compete Value proposition Business model Alignment with external realities Where to compete Alternative value proposition Alternative business model Alignment with external realities InstructionsBased on a review of the section on Environmental and Internal Assessment Strategy Articulation and the frameworks used Exhibit 2-4 13-15 determine other potential strategic alternatives D3 Beyond the 3-year time frame what breakthrough strategic options may be possible Out-of-the-box ideasInstructionsThink radical Think out-of-the-box IV EXHIBITS Instructions Please include all relevant supporting documentation in this section Exhibit 1 ILLUSTRATIVE Industry boundaries Segments Industry segments Relatively distinct sub-groupings within the industry Market is relatively similar within the segment but different across segments Different industry dynamics may vary in importance in different segments Producers Industry S Technology breakthroughs Changes in government policyregulations Domestic International Economics of demand Availability of substitutes Differentiability of products Rate of growth Volatilitycyclicality Economics of supply Concentration of producers Import competition Diversity of producers Fixedvariable coststructureCapacity utilization Entryexit barriers Industry chain economics Bargaining power of input suppliers Bargaining power of customers Marketing Pricing Volume Advertisingpromotion New productsRDDistribution Capacity change Expansioncontraction Entryexit Acquisitionmerger divestiture Vertical integration Forwardbackward integration Vertical joint ventures Long-term contracts Internal efficiency Cost control Logistics Process RD Organization effectiveness Finance Profitability Value creation Technological progress Employment objectives External shocks Feedback tructure C onduct P erformance Exhibit 2 Exhibit 3 1 Determinants of supplier power Differentiation of inputs Switching costs of suppliers and firms in the industry Presence of substitute inputs Supplier concentration Importance of volume to supplier Cost relative to total purchases in the industry Impact of inputs on cost or differentiation Threat of forward integration relative tothreat of backward integration by firms in the industry 2Determinants of barriers to entry Economies of scale Proprietary product differences Brand identity Switching costs Capital requirements Access to distribution Absolute cost advantages Proprietary learning curve Access to necessary inputs Proprietary low-cost product design Government policy Expected retaliation 5 Rivalry determinantsIndustry growth Fixed or storage costvalue added Intermittentovercapacity Product differences Brand identity Switching costsConcentration and balance Informational complexity Diversity of competitors Corporate stakes Exit barriers 3 Determinants of buying power Bargaining leverage Buyer concentration vs firm concentration Buyer volume Buyer switching costs relative to firm switching costs Buyerinformation Ability to backward integrate Substitute productsPull-through 4 Determinants ofsubstitution threat Relative price performance of substitutes Switchingcosts Buyer propensity to substitute 2 New entrants 3 Buyers 4Substitutes Intensity of rivalry 1 Suppliers Price sensitivity Pricetotal purchases Product differences Brand Identity Impact on qualityperception Buyer profits Decision makers incentives 5 Industry competitors "FORCES AT WORK" FRAMEWORK OpportunitiesThreats How are and supply expected to evolve How do you expect the industry chain demandeconomics to evolve What are the potential major industry discontinuitiesWhat competitor actions do you expect YOUR BU Exhibit 4 CONVERT OPPORTUNITIES BUILD ON STRENGTHS NEUTRALIZE THREATS ADDRESS WEAK-NESSES Strengths Weaknesses What are your BUs assetscompetencies that solidify your competitive position What are your BUs assetscompetencies that weaken your competitive position Can be used as a thought starter forcompetitive analysis and internal assessment Surfaces potential opportunitiesthreats arising from factors external to the BU Physical asset Location"space"Distributionsales network Brandreputation Patent Relationship with "license" allocator BHPs low-cost mines Telecommmedia company with rightsradio spectrum Avons representatives Coca-Cola Pharmaceutical company with a "wonder drug "Favored nation" status with a key minister in liberalizing economy Innovation Cross-functional coordination Market positioning Costefficiency management Talent development 3M with new products McDonalds with QSCV JJ with branded consumer health products Emerson Electrics Best Cost Producer program PG brand management program Privileged assets Distinctive competencies Necessary capabilities in order to succeed in the industry Example Exhibit 5 ILLUSTRATIVE Step 1 Ensure that these are the capabilities required to succeed in the industry Use this list as a thought starter add anddelete as you see appropriate BU Overall Segments A B C Step 2 Assess your overall position relative to the capabilities required to succeedin the industry Also determine if these capabilities are relevant to the segments you serve Physical asset Location"space"Distributionsales network Brandreputation Patent Relationship with "license" allocator Innovation Cross-functional coordination Market positioning Costefficiency management Talent development Privileged assets Distinctive competencies Necessary capabilities in order tosucceed in the industry Exhibit 6 Extremely relevant Somewhat relevant Irrelevant BU Overall Competitors A B C Step 3 Compare the strengths and weaknesses of your competitive position vs the necessary skills Physical asset Location"space"Distributionsales network Brandreputation Patent Relationship with "license" allocator Innovation Cross-functional coordination Market positioning Costefficiency management Talent development Privileged assets Distinctive competencies Necessary capabilities in order to succeed in the industry Exhibit 7 ILLUSTRATIVE Exhibit 8ILLUSTRATIVE KPIs examples Financial indicators Margin Net income ROCEOperating indicators Advertising effectiveness Utilization rate Strategic indicators Market share Percent of revenue from new products Working capital trend External indicators Market prices of raw materials BU Competitor A Competitor B Competitor C Revenue Gross profit Operating profit Assets employed People employed Operatingprofit margin Gross profitmargin ROCE Step 1 Identify the relevant segments Step 2 Provide a segment analysis based on the following minimum financial metrics revenue gross profit and margin operating profit and margin Step 3 Tothe extent assets and people can be disaggregated by segment deployment of assets against returns can be analyzed PhP of total Segment 1 PhP of total Segment 2 PhP of total Segment 3 PhP of totalSegment 4 PhP of total Total Exhibit 9Segment 1 Segment 2 Segment 3 Segment 4 Total NOT EXHAUSTIVE The ROCE tree can be disaggregated to show the other relevant KPIs of a BU ROCE Percent Operating income x 1 - tax rate PhP million Capital employed PhP million ? Revenue PhP million Operating margin Percent x 1 - tax ratePercent x Market share Percent Industry sales PhP million x Exhibit 10 NOT EXHAUSTIVE The cash flow tree can be disaggregated to show the other relevant KPIs of a BU Exhibit 11 Cash flow generated PhP million Operating cash flow PhP million Investing cash flow PhP million Net income PhP million Non-cash expenses PhP million Change in working capital PhP million Financing cash flow PhP million Exhibit 12Intangible assets Ways to extract near-term value Talent Highly motivated and competent workforce leveraging specific skill sets to Generate growth Improveincrease company intangibles Intellectual property Patents generating licensing fees Understanding of customer behavior Risk management Software ILLUSTRATIVE Network Interconnected webs of parties Non-exclusive Additional member lowers costs increases benefits Brandimage Inherent image or brand built upon excellent service and product offerings Lower search costs forcustomers Exhibit 13 Customers Channels Productsmarkets Target customers and segments Which customers are you Geographictrying to target or attract Which are you willing to serve but will not spend resources to attract Which would you prefer not to serve Howdoes the entity reach its target customers Which distribution channels will you use What customer segments can they reach Geographical scope of business activities Geographic limits to the business Local regional multi-local national international or global player If local which localities Quality and breadth of the product line Breadth of the product line Quality of the product line Product bundles or a series of unrelated products A companys specific promise to its target customers of the benefits it will provide at an explicit price It answer the following questions Who is your target customer What are the explicit benefits you provide to your customer What perceived value do you provide to the customer better than competition How much value do your customers attach to the benefits you provide Exhibit 14 Exhibit 15 Understand value desires Select target Chose the value Value proposition Design product process Procure manu- facture Distri- bute Provide the value Service PriceDefine benefitsprice Sales message Communicate the value Business model Integrated set of actions to provide and communicate the value proposition to customers Segmentation Value proposition Adver- tising Promo- tionalPR Value delivery system VDS Each BU must address these 2 issues to define their business model Illustration of how the value proposition will be provided and communicated Identification of existing strengths that can be leveraged and required capabilities that need tobe built to be distinctive in chosen value delivery system 1 2Categories of initiatives 1 Capture greater market share Volume increase EBIT impact via Price increase Cost reduction Other Invest-ment Capital employed impact via Divest-ment Capitalefficiency Other ü 2 Cost reduction eg effective channel management3Obtain higher prices 4 Create new market demand 5 Form strategic alliances partnerships ü ü ü ü ü ü ü ü ü ü ü Eg improvedworking capital employment increased asset utilization changes to assetownership Specific actionable initiatives Exhibit 16 ILLUSTRATIVE Exhibit 17 ILLUSTRATIVE Estimate of totalongoing operating income andcapital employed impact fromsuccessful implementation ofstrategic initiatives Operating income ongoing impact 2001-2004 PhP millions Capital employed ongoing impact 2001-2004 PhP billions Present operating income Volume increase Price increase Cost reduction benefit Additional costs Total ongoing operating income Present capital employed Improved capital efficiency Divestments Investments capexacquisitionsTotal ongoing capital employed one-time operating income impact one-time costs ––– Exhibit 18 ILLUSTRATIVE Categories of initiatives Specific actionable initiatives Peopleskills Resourcerequirements Funding Ex-Com involvement 1 Capture greater market share 2 Cost reduction 3 Achieve higher prices4 Create new market demand5 Form strategicalliancespartnerships Exhibit 19 Definition Risk of loss due to changes in industry and competitive environment as well as shifts in customer preferences Business risk Risk due to changes in regulatory environment eg deregulation Regulatory risk Risk due to major changes in technology Technology risk Risk of failures due to business processes and operations or peoples behavior either intentional eg fraud or unintentional eg errors Integrity risk Risk of loss due to changes in the political social oreconomic environments Macroeconomic risk Unit of measureFootnote Source Source CONFIDENTIAL Document Date This report is solely for the use of client personnel No part of it may be circulated quoted or reproduced for distribution outside the client organization without prior written approval from McKinsey Company This material was used by McKinsey Company during an oral presentation it is not a complete record of the discussion CONFIDENTIAL Training materials 8 June 2001 This report is solely for the use of client personnel No part of it may be circulated quoted or reproduced for distribution outside the client organization without prior written approval from McKinsey Company This material was used by McKinsey Company during an oral presentation it isnot a complete record of the discussion Jim Ayala – PHO MelissaGil –PHO Regina Manzano – PHO Suresh Mustapha – PHO Steve Shaw – HKO ShellyYeh – PHO Choon-Gin Tan – SIO The objective of these templates is toprovide completeness and consistency of BU strategic plan submissions These templates are not intended to replace or constrain BU strategic thinking and should be adapted to reflect a particular BUs sectoral context as required Each section begins with a summary that is based on a synthesis of questions and analyses that follow The suggested approach would be to first complete the relevant back-up analyses and then worktowards the overall synthesis I Executive summary IIEnvironmental and internal assessment A Industry dynamics and its implications B Competitive assessment C Internal assessment III Strategic definition and implications A Strategy articulation BStrategic initiatives C Financial projection DRiskscontingencies and strategic alternatives IV Exhibits Industry dynamics and implications Environmental and internal assessment Competitive assessment Internal assessment What are the major changes in industry dynamics and resulting opportunities and risks What are your competitive strengths and weaknesses How does your current business emphasis fit with industry opportunity and competitive landscapeStrategy articulation Strategic definition and implications Strategic initiatives Financial projections What strategy will your BU pursue over the next 3 years What will be the impact of major strategic initiatives What are the expected financial returns of your strategy Riskcontingen-cies strategic alternatives What strategic alternatives have you consideredInstructions The Executive Summaryprovides a synthesis of theEnvironmental and InternalAssessments and theresultant BU Strategic Plans II ENVIRONMENTAL AND INTERNAL ASSESSMENT A What are the major changes in industry dynamics and the resulting opportunities and risks A2 How is industry structure changing demand supply and industry chain economics What are the resulting opportunities and risks A3 What is the expected competitor conduct What are the resulting opportunities and risks A4 What are the present and future external factors that could present new opportunities and risks A1What industry are you competing in What are the various segments in the industry InstructionsThe answer to thisoverarching questionrequires a recapitulationof the sections mainfindings InstructionsThese subsectionscontain a 1-2 sentencesummary of the relevantfindings A1 What industry are you competing in What are the various segments in the industry Industry definition Industry segmentation Definition Sizing InstructionsExhibit 1 could providea useful framework foranswering this question Industry definition Industry segmentation A2 How is industry structure changing with respect to demand supply and industry chain economics What are the resulting opportunities and risks Economics of demand By segment Substitutes ability to differentiate Volatility cyclicality Economics of supply Producer concentration and diversity Import competition Capacity utilization Entryexit barriers Cost structure fixed and variable Industry chain economics Customer and supplier bargaining power InstructionsExhibit 23 or 4 could providea useful framework foranswering this question A3 What is the expected competitor conduct What are the resulting opportunities and risks Major industry competitor movesMarketing initiatives Industry capacity changes MAs divestitures Vertical integrationdisaggregation Alliances and partnerships Costcontrol and efficiency improvements InstructionsExhibit 23 or 4 could providea useful framework foranswering this question A4 What are the present and future external factors that could present new opportunities and risks Impact and likelihood of major industry discontinuities Changes in regulationgovernment policy Technological breakthroughs Instructions Exhibit 23 or 4 could providea useful framework foranswering this question B What are your competitive strengths and weaknesses B1 What are the capabilities required to succeed in this industry B2 How do you compare against these necessary capabilities InstructionsThe answer to thisoverarching questionrequires a recapitulationof the sections mainfindings InstructionsThese subsectionscontain a 1-2 sentencesummary of the relevantfindings B1 What are the capabilities required to succeed in this industry Privileged assets that create competitive advantage eg physical assets locationspace distributionsales network intangible assetsintellectual capital network brands talents Distinctive skillscompetencies that create competitive advantage eginnovation talent development InstructionsExhibit 5 could providea useful framework foranswering this question B2 How do you compare against thesenecessary capabilities Strengths and weaknesses of your competitive position vs necessary capabilities Benchmark performance against the industrys relevant key performance indicators KPIs with margin andmarket share as the required minimum Strengths and weaknesses of your competitive position vs necessary capabilities Benchmark performance against therelevant industrys KPIs InstructionsExhibits 6 and 7 couldprovide a useful frameworkfor answering this question InstructionsExhibit 8 could providea useful framework foranswering this question KPIs are a handful of levers that drive the value of the industrybusiness C How does your current business emphasis。

8、麦肯锡三层面分析:企业设计战略规划、开拓增长的有效工具

麦肯锡三层面理论

麦肯锡三层面理论(Three aspect theories)

麦肯锡三层面理论简介

麦肯锡资深顾问梅尔达德·巴格海(Mehrdad Baghai)、斯蒂芬·科利(Stephen coley)与戴维-怀特(David white)通过对世界上不同行业的40个处于高速增长的公司进行研究,在《增长炼金术——持续增长之秘诀》中提出所有不断保持增长的大公司的共同特点是保持三层面业务的平衡发展:第一层面是拓展和守卫核心业务;第二层面是建立新兴业务;第三层面是创造有生命力的候选业务。

他们能够源源不断地建立新业务,它们能够从内部革新其核心业务,而又同时开创新业务,它们所掌握的技巧在于保持新旧更替的管道畅通,一旦出现减退势头便不失时机地以新替旧。

这就是著名的三层面理论。

三层面增长理论认为健康的企业增长要综合平衡管理企业的三个层面的业务:第一层面是守卫和拓展核心业务,第二层面是建立即将涌现增长动力的业务,第三层面是创造有生命力的未来业务。

这一理论给正在寻求增长的中国企业带来了四个启示:突出核心业务,为营造今后的主业而实施多元化;企业发展必须有利可图,兼顾行业整体要求,竞争与合作并行;中国企业应着力于满足现有国内需求,同时通过创新适当超前,塑造市场;中国企业应学会在不景气中寻求发展机遇。

[编辑]

与增长三层面有关的一些因素

[编辑]

三层面增长理论的主要观点

麦肯锡公司根据他们对于世界上不同行业的40个处于高速增长的公司进行的研究,提出了增长阶梯的概念。

他们认为高速增长的公司每一段时间都会前进一步,每一步都会带来新行动和新能力;成功的增长公司强调针对近期和远期的远景和策略;真正伟大的公司是能维持增长同时追求增长的公司。

他们提出增长有3个层面:第一层面是守卫和拓展核心业务,第二层面是建立即将涌现增长动力的业务,第三层面是创造有生命力的未来业务,公司实现增长就必须同时管好增长3层面。

对于企业来说要成功的进行3层面的增长,一个宏伟的远景目标加上有效结合长、中、短3个时间层面的发展战略规划是企业增长的关键。

要达到领先,企业必须对3个发展层面进行均衡管理,对于不同层面的业务应该采用不同的战略与管理。

第一层面是公司当前的核心业务,这一业务实实在在地为公司带来大部分的营业收入、利润和现金流,并且公司在这一业务中所培育的经验和技能可以现金流,并且公司在这一业务中所培育的经验和技能可以长业务,这种业务已经经历了最初的经营概念和经营模式的探索,基本确立了经营概念和经营模式,并且具有高成长

性,已经产生了收入或利润,而且公司也期望在不久的将来第二层面的业务也会像第一层面的业务那样带来盈利。

第三层面是处于探索阶段的未来业务,它们不仅是领导人的一些想法,而且是具有实质性运作或投资的一些小的项目,这些项目在将来有的能发展成为第二层面的业务,甚至成为第一层面业务。

对于寻求发展的企业来说要成功的启动3层面的增长必须首先取得增长的资格。

所谓增长的资格第一要以优良的运营业绩力图成为领先市场的强竞争力企业。

这样为建立增长的基础提供必要的资源保证的同时使管理者能领导并有足够的财务和相关能力支持增长。

第二要剥离对企业未来无关紧要的业务,将关注的重心放在企业现在和企业未来无关紧要的业务,将关注的重心放在企业现在和第三是使投资者确信增长举措是好的投资,这样在投资者的支持下可以确保足够的资金以实现增长。

其次,企业希望增长必须做出增长的决心。

由高层主管做出增长的承诺,统一领导层对于增长的认识,选出能够领导增长并且具有相关能力的关键管理人员。

提出更高的目标对于做出增长的决心也很重要,这样可以推动员工采用新思维,也使得企业活动和投入要有重点。

做出增长的决心必须要去除组织结构中的障碍,确保企业文化、个人偏见、管理系统和激励机制不会对启动增长产生负面影响。

再次,因为持续增长是一个能力的吐旧纳新、使业务阶梯式上升的演进过程,要启动增长就一定要为增长建立起能力平台,取得增长的动力。

获得成功增长的企业往往需要组合所需的能力,以良好的状态战胜竞争对手。

它们还应该能迅速判断在已有的能力中哪些是新的能力平台所需要的,它们还能用切实的、一步一步的努力和脚踏实地的工作获取尚没有的能力,以充实能力平台。

成功的企业的能力平台随不同层面业务的不同而不同,并能在增长阶梯的每一步,都能在原有基础上进行充实,以形成竞争者难以模仿的能力。

企业3层面的可持续发展还要求有一种独特的企业文化,要针对长、中、短3个时间层面不同的发展战略用不同的方式对长、中、短3个时间层面的业务、人才和业绩进行系统管理。

[编辑]

三层面理论对企业增长的启示

一般来说我国很多企业在寻求增长和发展过程中,面临一一系列的战略选择和困惑,往往可持续性不强。

在搞好主业还是寻求多元化上我国很多企业盲目发展多元化,失败例子很多,如著名的巨人集团。

我国企业很多情况下搞不清增长和利润是否有矛盾,不知道哪个更重要。

造成了过分追求规模与量的扩张,而忽视利润与价值创造,在许多行业造成恶性竞争、重复投资、市场高度不规范。

在技术创新理论上我国企业认识很多也知道其中的重要性,但是实践成功还不多。

不少企业仍缺乏真正的创新能力,同时也有不少企业觉得国内需求本身就与先进技术发展有脱节。

因此,是赶超世界先进趋势还是满足现有国内需求常常让中国企业迷惑不解。

自从1998年金融风暴和2OO1年互联网泡沫破灭以来全球的整体宏观经济环境动荡不安,中国人世后市场竞争环境日趋激烈,这些外部环境的变化使不少我国企业放弃了或至少延缓了本来宏伟的发展目标尤其是第二、三层面业务的开拓,使企业缺乏自身寻找新的经济增长点和启动市场的能力。

第一个启示:突出核心业务,为营造今后的主业而实施多元化。

首先必须明确核心技能与核心业务,可以有几个,但总体上宜少不宜多,通过节支、增收与技术创新,来创造最大的价值,取得发展的权利。

同时必须清楚地认识到,任何现有业务都会有一个成熟、利润率逐步下降的过程,因而必须及时考虑多元化;但多元化不是为了今天的规模扩张,也不是为了多元化而多元化。

多元化是为了不断寻找并发展未来两、三年来可以成为新的经济增长点的新的核心业务,也就是说,核心业务是动态的概念,应该不断凋整,它永远是企业的中心任务和最主要的利润源泉。

多元业务之间应该是有一定的联系的。

中国企业管理者因此必须同时具备今天和未来若干年的眼光,而不是局限于短期考虑,争上项目,扩大短期规模与知名度。

第二个启示:企业发展必须有利可图,兼顾行业整体要求,竞争与合作并行。

首先是第一层面的业务必须能产生足够利润以支持其他层面,第一层面的业务的发展必须基于增加盈利能力的基础。

在中国特殊的环境中,这在相当程度上意味着改善行业整体行为积极促使行业结构调整,而不是依靠恶性循环的不良竞争。

第二层面的业务可以以销售收入快速增长为主要目标,但也必须充分认识今后盈利的可能性,确保净现值最大化。

既要有远见敢于投资,又必须确保投资的总效益,必要时考虑适当的投资组合,减少风险,增大效益。

比较远的第三层面的业务则应以少量投资,增大选择的可能性与灵活性为主。

可以多做一些基础工作,考虑与行业内外企业的多种形式的广泛合作,既规避风险,也有利于促发市场朝某一有利方向发展。

第三个启示:中国企业应着力于满足现有国内需求,同时通过创新适当超前,塑造市场。

企业首先要能做到至少在某几个领域能比其他所有竞争对手都能满足现有需求。

这也是取得发展的资格的重要因素。

根据我国的现实条件,加强主业经营以取得增长的资格,与启动增长可以同步,不一定要分先后。

优秀的企业应该考虑如何主导市场,塑造顾客需求,发掘潜在的需求。

在许多行业,中国顾客通常需求特征细分不明显区别,无从取舍者数量不小。

有效的塑造这些需求,既可产生第二层面业务的创意,也能在第一层面业务上加强顾客忠诚度技术创新就是开拓新产品新业务的重要途径,必须与适当超前的塑造挖掘顾客潜在需求结合起来,注重产业化与市场化。

创新的第一个问题应该是“我们将给用户带来怎样的额外价值?”,而不是“我们新产品的指标如何先进?”具备能够给用户带来实际的巨大额外价值的技术创新才能开创新的业务与新的经济增长点。

第四个启示:中国企业应学会在不景气中寻求发展机遇。

许多中国企业在一段时间内的超高速的发展往往得助于有利于其发展的宏观大环境甚或某些特殊政策。

但是,在中国人世后许多政策的放宽,企业面临的内外战略环境的变化使得在竞争日益激烈及不可避免的受到全球经济动荡的影响下,不少企业适应能力不强,持续性增长能力不强。

要保持增长发展,就要学会在不景气中寻找机会。

通常至少有几类发展机会。

一是加大市场投资,利用其他企业松缓下滑时机,迅速取得更大的市场主导权,使市场占有率取得跳跃式增长(如2O世纪9O年代初美国康柏等)。

二是利用行业不景气的现实,加速行业结构调整重组(如民航、化工等)。

三是加速发展第二层面业务,反过来刺激支持第一层面业务,形成良性循环(如在美国大萧条时期成立的CE金融事业部,中国的信贷消费,与农村市场的启动等)。

四是剥离部分业务,敢于有所不为,取得发展资金。

在不景气下成长发展的企业必将具有独特竞争力,并形成持久发展的能力与动力。