第二章商业银行资本管理习题

- 格式:doc

- 大小:32.00 KB

- 文档页数:4

《商业银行管理学》课后习题答案及解析《商业银行管理学》课后习题及题解第一章商业银行管理学导论习题一、判断题1. 《金融服务现代化法案》的核心内容之一就是废除《格拉斯-斯蒂格尔法》。

2. 政府放松金融管制与加强金融监管是相互矛盾的。

3. 商业银行管理的最终目标是追求利润最大化。

4. 在金融市场上,商业银行等金融中介起着类似于中介经纪人的角色。

5. 商业银行具有明显的企业性质,所以常用于企业管理的最优化原理如边际分享原理、投入要素最优组合原理、规模经济原理也适用于商业银行。

6. 金融市场的交易成本和信息不对称决定了商业银行在金融市场中的主体地位。

7. 企业价值最大化是商业银行管理的基本目标。

8. 商业银行管理学研究的主要对象是围绕稀缺资源信用资金的优化配置所展开的各种业务及相关的组织管理问题。

9. 商业银行资金的安全性指的是银行投入的信用资金在不受损失的情况下能如期收回。

二、简答题1. 试述商业银行的性质与功能。

2. 如何理解商业银行管理的目标?3. 现代商业银行经营的特点有哪些?4. 商业银行管理学的研究对象和内容是什么?5. 如何看待“三性”平衡之间的关系?三、论述题1. 论述商业银行的三性目标是什么,如何处理三者之间的关系。

2. 试结合我国实际论述商业银行在金融体系中的作用。

第一章习题参考答案一、判断题1.√2.×3.×4.√5.×6.√7.×8.√9.√二、略;三、略。

第二章商业银行资本金管理习题一、判断题1. 新巴塞尔资本协议规定,商业银行的核心资本充足率仍为4%。

2. 巴塞尔协议规定,银行附属资本的合计金额不得超过其核心资本的50%。

3. 新巴塞尔资本协议对银行信用风险提供了两种方法:标准法和内部模型法。

4. 资本充足率反映了商业银行抵御风险的能力。

5. 我国国有商业银行目前只能通过财政增资的方式增加资本金。

6. 商业银行计算信用风险加权资产的标准法中的风险权重由监管机关规定。

《商业银行业务与经营》综合练习题第一章商业银行导论第一部分选择题1、最早进入中国的外国银行是()A、浙江兴业银行B、交通银行C、东方银行D、通商银行2、()是商业银行最基本,也是最能反映其经营活动特征的职能。

A、信用中介B、信用创造C、支付中介D、金融服务3、我国的商业银行实行的是(),而世界上大部分国家都实行此种组织形式。

A、单一银行制B、分行制C、银行控股公司制D、非银行控股公司制4、股份制商业银行的组织形式中,()是商业银行的最高权力机构。

A、董事会B、监事会C、总稽核D、股东大会5、现代股份制商业银行的内部组织结构可以分为()A、决策机构B、执行机构C、监管机构D、监督机构6、商业银行的管理系统由()方面组成。

A、全面管理B、财务管理C、人事管理D、经营管理E、市场营销管理7、世界各国在对银行业进行监管时,主要内容包括()A、银行业的准入B、银行资本的充足性C、银行的清偿能力D、银行业务活动的范围E、贷款的集中程度第二部分填空题1、在英国,早期的银行业是由发展而来的。

2、1694年,英国建立了历史上第一家资本主义股份制商业银行——,它的出现宣告了高利贷性质的银行业在社会信用领域垄断地位的结束。

3、商业银行的信用创造职能是在与职能的基础上产生的。

4、从全球商业银行来看,商业银行的外部组织形式主要有三种类型,即、和。

5、政府对银行监管的“CAMEL(骆驼)原则”具体指、、、和。

6、目前各国存款保险制度的组织形式主要有三种,即、和。

7、1894年我国的成立以后,开始正式行使对商业银行的监管职能。

而2003年12月27日,《中华人民共和国银行业监督管理法》,明确是银行业的监督管理机构。

第三部分名词解释1、信用创造2、银行控股公司制3、商业银行的外部组织形式4、商业银行的内部组织形式5、存款保险制度第四部分问答题1、商业银行在一国经济发展过程中发挥了什么样的作用?2、商业银行单一银行制有哪些优缺点?商业银行分行制有哪些优缺点?3、政府为什么要对银行业实施监管?我国政府如何对银行业实施监管?第二章商业银行的资本管理第一部分选择题1、一家银行在发展过程中,会遇到各种各样的风险,例如()A、信用风险B、利率风险C、汇率风险D、经营风险E、流动性风险2、(),国际清算银行通过了《关于统一国际银行资本衡量和资本标准的协议》(即《巴塞尔协议》),规定12个参加国应以国际可比性及一致性为基础制定各自银行资本标准。

商业银行经营管理习题第二章商业银行的资本管理一、名词解释1、银行资本(会计资本、经济资本、监管资本)2、核心资本3、附属资本4、普通股5、公开储备6、混合资本工具7、次级债务8、银行资本充足率标准9、风险加权资产10、持续增长率二、填空1、《巴塞尔协议》将银行资本分成两级:和。

2、《巴塞尔协议》中体现的思想是商业银行的最低资本由银行资产结构形成的所决定的。

3、商业银行的核心资本包括和。

4、银行资本充足率是和的比率。

5、《巴塞尔协议》对商业银行表内风险资产规定了不同的风险权数,分为五个档次:、、、、。

6、银行的最佳资本量是指银行资本既不能,又不能。

7、商业银行的资本来源于两大渠道:和。

8、优先股的主要类型有:、和。

三、不定项选择1、按照巴塞尔协议的要求,商业银行的资本充足率至少要达到()。

A6% B7% C8% D10%2、下列各项中属于商业银行核心资本的是()。

A长期金融债券B未分配利润C混合资本工具D未公开储备3、下列属于商业银行附属资本的是()。

A股票发行溢价B未分配利润C公积金D未公开储备4、巴塞尔协议对核心资本的要求是其与风险资产的比率不得低于()。

A4% B6% C8% D10%5、巴塞尔协议对衍生金融工具的资本要求作出规定,要求银行将其转换成相应的信用对等额的是()。

A期货合同B期权合同C利率合同D货币合同6、对于银行的外汇加权综合头寸,巴塞尔协议规定要求持有其()的资本用以防范外汇风险。

A4% B6% C8% D10%7、影响商业银行资本的需要量的因素有()。

A法律规定B宏观经济形势C银行资产负债结构D银行的信誉8、银行内部融资的优点是()。

A成本低B不会削弱控制权C无银行自身限制D不受净利润规模限制9、以下属于银行资本的外部融资方法的是()A发行普通股B发行优先股C发行资本性工具D出售资产与租赁设备E股票与债券的互换10、下列属于混合资本工具的是()。

A资本票据B债券C可转换债券D股票11、我国商业银行的核心资本包括()A实收资本B资本公积C盈余公积D未分配利润四、判断并说明理由1、商业银行长期附属债务的债权人与银行一般存款人具有相同的本息要求权。

第二章 商业银行的资本商业银行资本管理是资产负债管理的重要基础。

银行必须在法律允许的范围内,综合考虑各种资本供给渠道的可能性及其成本,解决资本的供给问题。

2.1学习要求(1)熟练掌握商业银行资本的构成(2)掌握商业银行资本充足度的测量(3)熟练掌握商业银行资本管理的方法(4)了解我国商业银行的资本状况2.2 内容简述2.2.1银行资本金的构成商业银行的资本金除了包括股本、资本盈余、留存收益在内的所有者权益外,还包括一定比例的债务资本,如资本票据、债券等。

商业银行的资本具有双重特点,根据《巴塞尔协议》,常将所有者权益称为一级资本和核心资本,而将长期债务称为二级资本和附属资本。

核心资本包括股本和公开储备。

股本包括已经发行并全额缴付的普通股和永久性非累积的优先股;公开储备指以公开的形式,通过保留盈余和其他盈余,例如股票发行溢价、保留利润(凭国家自行处理,包括在整个过程中用当年保持利润向储备分配或储备提取)、普通准备金和法定准备金的增值而创造和增加的反映在资产负债表上的储备。

附属资本包括非公开储备、重估储备、普通准备金、混合资本工具和长期附属债务。

1)非公开储备。

该储备不公开在资产负债表上标明,但却反映在损益表内,并为银行的监管机构所接受。

2)资产重估储备。

包括物业重估储备和证券重估储备。

3)普通准备金。

指用于防备目前尚不能确定的损失的准备金或呆账准备金。

4)混合资本工具。

指既有股本性质又有债务性质的混合工具。

5)长期附属债务。

包括普通的、无担保的、初次所定期限最少五年以上的次级债务资本工具和不许购回的优先股。

另外,《巴塞尔协议》还规定,在核定银行资本实力时应从核心资本中扣除商誉;从核心资本与附属资本之和中扣除对不合并报表的附属银行和财务附属公司的投资,扣除对其他银行和金融机构资本部分的投资。

2.2.2资本充足性及其测定资本充足性是银行安全经营的要求。

存款人、社会公众、银行自身均对此有要求。

银行持有充分的资本是风险管理的要求,也是在安全经营基础上追求更多利润的保障。

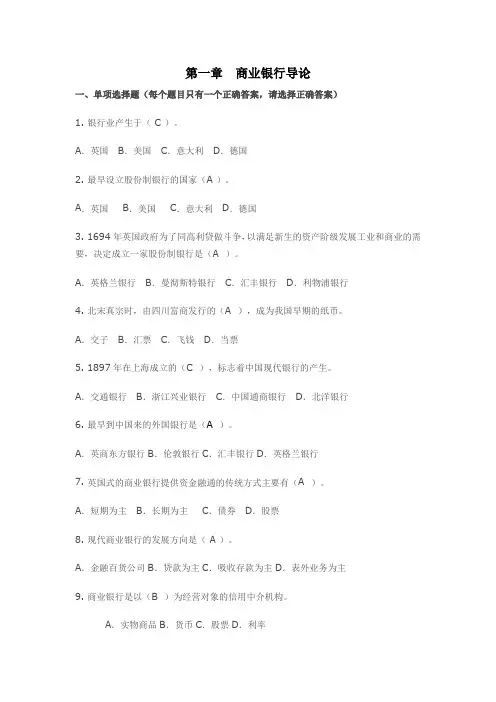

第一章商业银行导论一、单项选择题(每个题目只有一个正确答案,请选择正确答案)1.银行业产生于(C)。

A.英国B.美国C.意大利D.德国2.最早设立股份制银行的国家(A)。

A.英国B.美国C.意大利D.德国3.1694年英国政府为了同高利贷做斗争,以满足新生的资产阶级发展工业和商业的需要,决定成立一家股份制银行是(A)。

A.英格兰银行B.曼彻斯特银行C.汇丰银行D.利物浦银行4.北宋真宗时,由四川富商发行的(A),成为我国早期的纸币。

A.交子B.汇票C.飞钱D.当票5.1897年在上海成立的(C),标志着中国现代银行的产生。

A.交通银行B.浙江兴业银行C.中国通商银行D.北洋银行6.最早到中国来的外国银行是(A)。

A.英商东方银行B.伦敦银行C.汇丰银行D.英格兰银行7.英国式的商业银行提供资金融通的传统方式主要有(A)。

A.短期为主B.长期为主C.债券D.股票8.现代商业银行的发展方向是(A)。

A.金融百货公司B.贷款为主C.吸收存款为主D.表外业务为主9.商业银行是以(B)为经营对象的信用中介机构。

A.实物商品B.货币C.股票D.利率10.商业银行的(D)被称为第一级准备。

A.贷款资产B.证券资产C.股票资产D.现金资产11.商业银行的性质主要归纳为以追求(B)为目标。

A.追求最大贷款额B.追求最大利润C.追求最大资产D.追求最大存款12.(C)是国家的金融管理当局和金融体系的核心,具有较高的独立性,它不对客户办理具体的信贷业务,不以营利为目的。

A.工商银行B.股份制银行C.中央银行D.专业银行13.(A)是商业银行最基本也最能反映其经营活动特征的的职能。

A.信用中介B.支付中介C.清算中介D.调节经济的职能14.金融市场上利率的变动使经济体在筹集或运用资金时可能遭受到的损失是指(A)。

A.国家风险B.利率风险C.信用风险D.流动性风险15.借贷双方产生借贷行为后,借款方不能按时归还贷款方的本息而使贷款方遭受损失的可能性是指(C)。

第2章 商业银行的资本管理1.银行资本对银行的经营有什么意义?答:银行资本对银行经营的意义主要是指吸收意外损失和消除银行的不稳定因素:(1)资本可以吸收银行的经营亏损,保护银行的正常经营,以使银行的管理者能有一定的时间解决存在的问题,为银行避免破产提供了缓冲的余地。

因此,资本金又被称为旨在保护债权人,使债权人在面对风险时免遭损失的“缓冲器”。

(2)资本为银行的注册、组织营业以及存款进入前的经营提供启动资金,诸如土地获得及建设办公楼或租用、安装设备等。

(3)银行资本有助于树立公众对银行的信心,它向银行的债权人显示了银行的实力。

对于高负债经营的银行业,市场信心是决定银行经营稳定性的直接因素。

充足的资本令银行即使在紧缩时期也能满足市场的信贷需求,在客户看来。

这是一种有力的保证。

在市场经济条件下,银行资本在维持市场信心方面发挥了关键作用。

(4)银行资本为银行的扩张,银行新业务、新计划的开拓与发展提供资金。

许多银行的增长超出其开业时设施的承受能力,追加资本的注入允许银行增加办公设备、增设分行,以便同市场的扩大保持同步发展。

(5)银行资本作为银行增长的监测者,有助于保证单个银行增长的长期可持续性。

因为监管当局与市场都要求银行的贷款及其他风险资产的增长与银行的资本保持一致。

随着银行风险的暴露,银行吸收亏损的缓冲装置也必须相应扩大。

相对资本而言,贷款与存款业务增长过快的银行会从市场和监管部门接受到降低增长速度或增加资本的信号。

监管部门的资本监管已经成为限制银行风险暴露程度的越来越重要的政策工具。

这也同时有利于提高公众对银行的信心。

2.《巴塞尔协议》对银行资本的构成是怎样规定的?答:《巴塞尔协议》明确规定银行资本的构成包括两类:一类是核心资本,另一类是附属资本。

(1)核心资本。

银行的核心资本由股本和公开储备两部分构成。

①股本。

股本可为两部分,普通股和永久非累积优先股。

其中,普通股是商业银行发增加资本的重要手段,通过发行普通股可以广泛吸收社会资金,使银行资本足够雄厚,以保护存款人和其他债权人不受损失,激励公众信心。

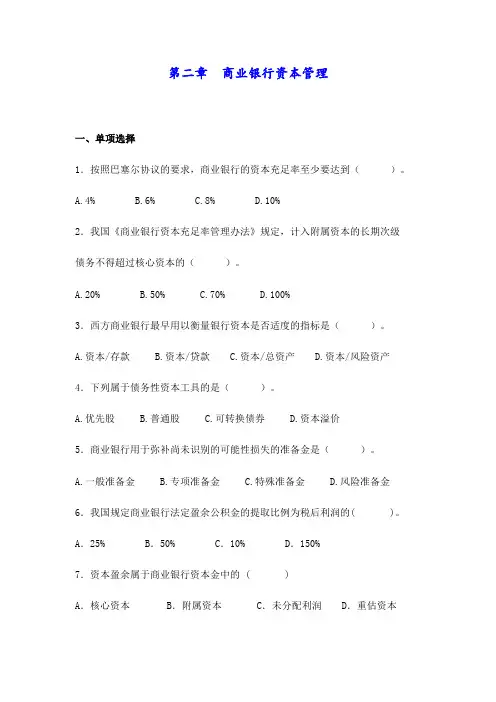

第二章商业银行资本管理一、单项选择1.按照巴塞尔协议的要求,商业银行的资本充足率至少要达到()。

A.4%B.6%C.8%D.10%2.我国《商业银行资本充足率管理办法》规定,计入附属资本的长期次级债务不得超过核心资本的()。

A.20%B.50%C.70%D.100%3.西方商业银行最早用以衡量银行资本是否适度的指标是()。

A.资本/存款B.资本/贷款C.资本/总资产D.资本/风险资产4.下列属于债务性资本工具的是()。

A.优先股B.普通股C.可转换债券D.资本溢价5.商业银行用于弥补尚未识别的可能性损失的准备金是()。

A.一般准备金B.专项准备金C.特殊准备金D.风险准备金6.我国规定商业银行法定盈余公积金的提取比例为税后利润的( )。

A.25% B.50% C.10% D.150%7.资本盈余属于商业银行资本金中的 ( )A.核心资本 B.附属资本 C.未分配利润 D.重估资本8.《巴塞尔协议》规定商业银行的核心资本与风险加权资产的比例关系是( )。

A.≥8% B.≤8% C.≤4% D.≥4%9.票据贴现的期限最长不超过 ( )。

A.6个月 B.9个月 C.3个月 D.1个月10.下列哪一个不属于银行的权益资本 ( )。

A.普通股 B.优先股 C.权益承诺票据 D.盈余公积金二、多项选择1.下列各项中属于商业银行核心资本的是()。

A.实收资本B.资本公积C.未分配利润D.重估储备E.公开储备2.下列各项中属于商业银行附属资本的是()。

A.一般准备B.优先股C.盈余公积D.可转换债券E.永久性非累计优先股3.根据巴塞尔《新资本协议》,银行可以采用的信用风险计量方法有()。

A.标准法B.内部评级初级法C.内部评级高级法D.基本指标法E.内部模型法4.巴塞尔《新资本协议》对商业银行的()提出了资本拨备要求。

A.流动性风险B.信用风险C.市场风险D.操作风险E.道德风险5.次级债券是商业银行发行的、本金和利息的清偿顺序列于()的债券。

Chapter 2Analyzing Bank PerformanceChapter Objectives1.Introduce bank financial statements, including the basic balance sheet and income statement, and discuss theinterrelationship between them.2.Provide a framework for analyzing bank performance over time and relative to peer banks. Introduce key financial ratios that can be used to evaluate profitability and the different types of risks faced by banks. Focus on the trade-off between bank profitability and risk.3.Identify performance measures that differentiate between small, independent banks (specialty banks) and largerbanks that are part of multibank holding companies or financial holding companies.4. Distinguish between types of bank risk; credit, liquidity, interest rate, capital, operational, and reputational.5. Describe the nature of and meaning of regulatory CAMELS ratings for banks.6.Provide applications of data analysis to sample banks’ financial information.7.Describe performance characteristics of different-sized banks.8. Describe how banks can manipulate financial information to ‘window-dress’ performance.Key Concepts1. Bank managers must balance banking risks and returns because there is a fundamental trade-off between profitability, liquidity, asset quality, market risk and solvency. Decisions that increase banking risk must offer above average profits. The more liquid a bank is and the more equity capital used to fund operations, the less profitable is a bank, ceteris paribus.2. Banks face five basic types of risk in day-to-day operations: credit risk, liquidity risk, market risk, capital/solvency risk, and operational risk. Market risk encompasses interest rate risk, foreign exchange risk and price risk. Each type of risk refers to the potential variation in a ba nk's net income or market value of stockholders’ equity resulting from problems that affect that part of the bank's activities.3. Banks also face risks in the areas of country risk associated with loans or other activity with foreign government units and off-balance sheet activities, which create contingent liabilities. More recently, banks have focused on reputation risk. For example, from 2002-2005 Citigroup, JP Morgan Chase, and Bank of America found that even though they continued to report strong pro fits, they experienced strong criticism for 1) their roles in facilitating strategies to disguise Enron’s true financial status, 2) problems in sub-prime lending programs via the Associates Corp. and their own internal finance company activities, 3) problems with underwriting subsidiaries with analyst conflicts between stock reports and the firm’s investment banking relationships; facilitating market timing of stock trades to their detriment of their own mutual fund holders, 4) lack of supervision of trading groups, and 5) facilitating improper borrowing at Parmalat.4. A bank's return on equity (ROE) can be decomposed in terms of the duPont system of financial ratio analysis. This examination of historical balance sheet and income statement data enables an analyst to evaluate the comparative strengths and weaknesses of performance over time and versus peer banks. The Uniform Bank Performance Report (UBPR) data reflect the basic ratios from this return on equity model.5. Different-sized commercial banks exhibit different operating characteristics and thus performance measures. Small banks typically report a higher return on assets (ROA) than large banks because they earn higher gross yields on assets and pay less interest on liabilities.6. High performance banks generally benefit from lower interest and non-interest expense and limit credit risk so that loan losses are relatively low. They also operate with above average stockholders' equity.7. Many banks can successfully "window-dress" performance by manipulating the reporting of financial data. They may accelerate revenue recognition and defer expenses or selectively alter when they take securities gains or losses and time when to charge off loans or report loans as non-performing. As such, they may inappropriately smooth earnings with provisions for loan losses or by other means. Analysts must be careful when evaluating extraordinary transactions that have one-time gain or loss features.Answers to End of Chapter Questions1. For a large bank, assets consist approximately of marketable securities (20%), loans (70%), and other assets (10%). Liabilities consist of core deposits (40%-60%), noncore, purchased liabilities (20%-40%), and other liabilities (5 %-10%) as a fraction of assets. Small banks typically obtain more funds in the form of core deposits and less in the form of noncore, purchased liabilities. Small banks often invest more in securities as well. Of course, the actual percentages for any bank depend on that bank’s business strategy, mark et competition, and ownership.2. A bank's interest income consists of interest earned on loans and securities while noninterest income includes revenues from deposit service charges, trust department fees, fees from nonbank subsidiaries, etc. Interest expense consists of interest paid on interest-bearing core deposits and noncore liabilities while noninterest expense is comprised of overhead costs, personnel costs, and other costs. A bank’s net interest income equals its interest income minus interest expense. Note that interest income may be calculated on a tax-equivalent basis in which tax-exempt interest is converted to its pre-tax equivalent. A bank’s burden is defined as its noninterest expense minus noninterest income. This is often quoted as a fract ion of total assets. A bank’s efficiency ratio is calculated as noninterest expense divided by the sum of net interest income and noninterest income. The denominator effectively measures net operating revenue after subtracting interest expense. The efficiency ratio measure the noninterest cost per $1of operating revenue generated. Analysts often interpret the efficiency ratio as a measure of a bank’s ability to control overhead relative to its ability to generate noninterest income (and overall revenue). A lower number is presumably better because it reflects better cost control compared with revenue generation.3. Balance sheet accounts:a. Increase liability: money market deposit account (+$5,000)Increase asset: federal funds sold (+$5,000)b. Decrease asset: real estate loanIncrease asset: mortgage loanc. Increase equity: common stock (common and preferred capital)Increase asset: commercial loans4. Income statementInterest on U.S. Treasury & agency securities $44,500Interest on municipal bonds 60,000Interest and fees on loans 189,700Interest income = $294,200Interest paid on interest-checking accounts $33,500Interest paid on time deposits 100,000Interest paid on jumbo CDs 101,000Interest expense = $234,500Net interest income = $59,700Provisions for loan losses = $ 18,000Net interest income after provisions = $41,700Fees received on mortgage originations $23,000Service charge receipts 41,000Trust department income 15,000Non-interest income = $79,000Employee salaries and benefits $145,000Occupancy expense 22,000Non-interest expense = $167,000Income before income taxes -$46,300Income taxes 15,742Net income = -$30,558Cash dividends declared 2,500Retained earnings = -$33,058This assumes that expenses associated with the purchase of the new computer are included in occupancy expense. If not, the computer expense (depreciation) will increase the loss for the period. Also, the bank can receive a tax refund from prior tax payments if the bank made a taxable profit within recent years.5. The primary risks faced by banks are credit risk, liquidity risk, interest rate risk, foreign exchange risk (the latter two represent market risk), operational risk, reputational risk, and capital solvency. In general, promised, or expected, returns should be higher for banks that assume increased risk. There should also be greater volatility in returns over time.a. Credit risk: Net loan charge-offs/LoansHigh risk - high ratio; Low risk - low ratioHigh risk manifests itself in occasional high charge-offs, which requires above average provisions for loan lossses to replenish the loan loss reserve. Thus, net income is volatile over time.b. Liquidity risk: Core deposits/AssetsHigh risk - low ratio; Low risk - high ratioHigh risk manifests itself in less stable funding as a bank relies more on noncore, purchased liabilities thatfluctuate over time. These noncore liabilities are also higher cost, which raises interest expense.c. Interest rate risk: (|Repriceable assets-repriceable liabilities|)/AssetsHigh risk - high ratio; Low risk - low ratioHigh risk banks do not closely match the amount of repriceable assets and repriceable liabilities. Largedifferences suggest that net interest income may vary sharply over time as the level of interest rates changes.d. Foreign exchange risk: Assets denominated in a foreign currency minus liabilities denominated in the same foreign currency.High risk – a large difference; Low risk – a small differenceHigh risk manifests itself when exchange rates change adversely and the value of the bank’s net position of assets versus liabilities denominated in a currency changes sharply.e. Operational risk: total assets/number of employeesHigh risk – low ratio; Low risk – high ratioHigh risk manifests itself when the bank operates at low productivity measured by more employees per amount of assetsf. Capital/solvency risk: Stockholders’ equity/AssetsHigh risk - low ratio; Low risk - high ratioHigh risk manifests itself because fewer assets must go into default before a bank is insolvent and can be closed down by regulators.g. Reputational risk is difficult to measure ex ante. It is more observable by announced problems and issues.6. Equity multiplierBank L: Equity/Assets = 0.06 indicates Assets/Equity = 16.67XBank S: Equity/Assets = 0.10 indicates Assets/Equity = 10XIf each bank earns 1.5% on assets (ROA = 0.015), then the ROEs will equal 25% (Bank L) and 15% (Bank S). If, instead, each bank reports a loss with ROA = -0.012, then the ROEs will equal -20% (Bank L) and -15% (Bank S). When banksare profitable, financial leverage has the positive effect of increasing ROE; when banks report losses, financial leverage increases the magnitude of loss in terms of a negative ROE.7. ROE= net income/stockholders' equityROA = net income/total assetsEM = total assets/stockholders' equityER = total operating expense/total assetsAU = total revenue/total assetsBalance sheet figures should be measured as averages over the period of time the income number is generated.ROE = ROA x EM ROA = AU – ER – TAXwhere TAX = applicable income tax/total assets.8. Profitability ratios differ across banks of different size as measured by assets. The primary reasons are that different size banks have different asset and liability compositions and engage in different amounts of off-balance sheet activities. Typically, small banks report higher net interest margins because their average asset yields are relatively high while their average cost of funds is relatively low. This reflects loans to higher risk borrowers, on average, and proportionately more funding from lower cost core deposits. ROEs, in turn, are often lower because small banks operate with more capital relative to assets, that is with lower equity multipliers, so that even with comparable ROAs the ROEs are lower. Large banks ROAs are increasing faster over time because large banks operate with lower efficiency ratios as they have been more successful in generating fee income.9. CAMELSa. C =capital adequacy: equity/assetsb. A = asset quality: nonperforming loans/loans; loan charge-offs/loansc. M = management: no single ratio is good, although all ratios indicate overall strategyd. E = earnings: aggregate profit ratios; ROE, ROA, net interest margin, burden, efficiencye. L = liquidity: core deposits/assets; noncore, purchased liabilities/assets; marketable securities/assetsf. S = sensitivity to market risk; |repriceable assets-repriceable liabilities|/assets; difference in assets and liabilitiesdenominated in the same currency; size of trading positions in commodities, equities and other tradeable assets.10. Lowest to highest liquidity risk: 3-month T-bills, 5-year Treasury bond, 5-year municipal bond (if high quality and from a known issuer), 4-year car loan with monthly payments (receive some principal monthly, may be saleable), 1-year construction loan, 1-year loan to individual, pledged 3-month T-bill. As stated, the 3-month T-bill that is pledged as collateral is illiquid unless the bank can change its collateral status.11. Comparative credit riska. loan to a comer grocery store representing a little known borrower with uncertain financialsb. loan collateralized with inventory (work in process) because the collateral is less liquid and more difficult to value;this assumes that the receivables are still viable and not too aged.c. normally the Ba-rated municipal bond, unless the agency bond is an "exotic" mortgage backed security, because theagency bond carries an implied guarantee in that Freddie Mac is a quasi-public borrower.d. 1-year car loan because the student loan is typically government guaranteed12. For the balance sheet: high core deposits/assets; high equity/assets; low noncore, purchased liabilities/assets; high investment securities/assets; high agriculture loans/assets (the value refers to that for small banks); For the income statement: net interest margin (high); burden/assets (high), efficiency ratio (high); (the descriptor in parentheses refers to the relationship for small banks versus larger banks).13. Extending a loana. the new loan is typically not classified as nonperforming because no payments are past dueb. often a bank recognizes that the loan is in the problem stage and the borrower renegotiates the terms in its favor;rationale is that the borrower may default if the loan is not restructured. Note that this restructuring gives theappearance that asset quality is higher.c. the primary risk is that the bank is throwing more money down a sink hole and will never recover any of its loan.14. Dividend payment: For: the loss is temporary and stockholders expect the dividend payment. Failure to make the payment will sharply lower the stock price because stockholders will be alienated. Against: the bank has not generated sufficient cash to make the payment from normal operations. By paying the cash dividend, the bank is self-liquidating. The cash dividend will lower the bank’s capital. What normally decides the issue is whether the loss is truly temporary or more permanent. Management typically errs by assuming that losses are temporary, and thus continues to make dividend payments when it should be reducing or eliminating them.15.Liquidity risk:a.Securities classified as held-to-maturity cannot be sold unless there has been an unusual change in the underlyingcredit quality of the security issuer. A high fraction indicates low liquidity because few securities (just 5% of the total) can be sold.b. A low core deposit base indicates a bank that relies proportionately more on noncore, volatile liabilities that are lessstable and more likely to leave the bank if rates change. This makes a bank’s funding sources less reliable and the bank subject to greater liquidity risk.c. A bank that holds long-term securities (8 years is long term) has assumed significant price risk even if the securitiescan be readily sold because they are classified as available-for-sale. Such securities will fall in value if interest rates rise. This indicates high liquidity risk.d.Assuming that $10 million in securities is sufficient, the fact that none are pledged makes them more liquid and isindicative of lower liquidity risk than if any securities were pledged.Problems1. Community National Bank (CNB)1. Profitability analysis for 2004 using UBPR figures:RATIO Community National Bank Peer BanksROE 8.67% 11.72%ROA 0.63 1.09EM 13.97X 10.67XAU 5.91 6.23ER 4.94 4.73TAX 0.34 0.41a.Aggregate profitability for CNB is substantially lower measured both by both ROE and ROA. Because CNB has less equity relative to assets, it has greater financial leverage. Thus, the greater financial leverage increases CNB’s ROE relative to peer banks. The fact that its ROE is lower, despite the greater leverage, indicates that the higher risk does not produce higher overall profitability. CNB has assumed a riskier profile with its greater financial leverage in that fewer assets can default before the bank is insolvent. CNB’s ROA is lower because it earns a lower average yield on assets (AU), pays more in operating expense (ER), offset somewhat by the fact that it pays less in taxes (TAX).b.Risk ComparisonCredit risk: same net charge-offs, much lower nonperforming (more than 90 days past due) and nonaccrual loans, higher provisions for loan losses (.30% versus 0.18%); loan loss reserve is a greater fraction of total loans and leases and a much greater fraction of noncurrent loans. Overall, the ratios indicate below-average risk. Of course, these figures represent only one year of data.Liquidity risk: lower equity to assets suggests higher liquidity risk from a funding perspective, higher available for sale securities and lower pledged securities suggests lower liquidity risk from the asset sale perspective; very high core deposits, low noncore funding (liabilities), low loans and leases and high ST securities suggest lowerliquidity risk. Overall, liquidity risk appears lower because the bank has a strong core deposit base, fewer loans and more securities can be readily sold. Still, the bank might have difficulty borrowing if loans exhibit low qualityand deposit outflows arise. Conclusion: below-average liquidity risk.Capital Risk: low capital to asset ratios; low equity to assets indicate above average capital risk; bank pays less out in dividends and its growth rate in equity capital is lower. Overall, the bank exhibits greater capital risk. Thissituation is offset by the bank’s apparent higher quality assets.Operational risk: low assets to employees ratio, high personnel expense to employees and high efficiency ratio indicate high operational risk. Of course, these data do not capture the likelihood of fraud and other potentialoperational problems.c.Recommendations:1)Impro ve the bank’s capital position; slow asset growth and pursue greater profits.2)Evaluate credit risk carefully; ensure that loans are adequately diversified and that any default of a single loan ortype of loans cannot place the bank’s capital at risk to where regulators will restrict the bank’s activities. Slow loan growth until capital base is at target. Implement a formal credit risk review process.3)Improve operating efficiency. Review noninterest expense sources and cut costs where possible.4)The first t wo suggestions will have the impact of lowering the bank’s earnings, ceteris paribus. Therefore,management should focus on growing sources of noninterest income that currently are not being pursued.2.Citibank UBPRa.In 2004, Citibank’s ROE equaled 15.26% while its ROA equaled 1.49% versus peers’ figures of 14.58% and 1.31%,respectively. Citibank’s equity multiplier (EM = ROE/ROA) equaled approximately 10.24X versus 11.13X for peers. Citibank’s AU is higher at 8.83% (5.25% + 3.58%) versus 7.69% (4.46% + 3.23%) at peers. Citibank clearly generated higher gross revenues from both interest and noninterest sources. Citibank’s expense ratio (ER), in turn, equaled 6.27% while ER for peers was much lower for each type of expense and in total at 4.23%. Based on the profit figures alone, Citibank appears to be a high performance bank and achieves that by generating greater relative revenues.b.Citibank’s credit risk (as evidenced only by the ratios provided) appears high as net losses to loans is higher thanPeers (1.58% versus 0.25%), as is noncurrent loans and leases as a fraction of loans (1.78% versus 0.59%). The loss allowance (reserve) is a higher fraction of loans, but a much smaller fraction of net losses (charge-offs) andnoncurrent loans indicating that more reserves might be appropriate.c.Citibank’s liquidity risk appears high as the bank has a lower equity to asset (tier 1 leverage capital) ratio and reliesmuch more on noncore liabilities (noncore fund dependence). With its greater credit risk, you might expect it to operate with greater equity capital. Similarly, the bank is growing at a fast pace which generally increases overall risk because management cannot easily control risk from growth.d.Recommendations:Carefully assess credit risk; realign portfolio where appropriate.Increase the loan loss reserve.Slow loan growth and/or shift loans to less risky classes.Line up additional sources of liquidity.Review pricing of loans and deposits; identify sources of fees/noninterest income to see if they are sustainable.。

第二章商业银行资本管理一、单项选择题二、多项选择题三、填空题四、名词解释操作风险:指由于不正确的或错误的内部操作过程、人员、系统或外部事件导致直接或间接损失的风险。

分母对策:减少资产膨胀,优化资产结构,尽量降低风险权重高的资产在总资产中的比重,从而使资产所要求的资本量较小,以满足金融监管的要求。

次级债务:指对于债务人资产的要求权次于其他债权人的债务。

五、计算题六、简答题七、论述题八、案例分析题1、假设某银行在2010年年末需要制定2011-2015年的资本计划。

根据银行的总体财务预测,该银行在2011-2015年的资产收益率分别为0.45%,0.60%,0.65%,0.68%和0.70%。

已知2010年该银行的资产收益率为0.45%,过去几年资产一直以10%的速度增长,并且每年坚持发放25万美元的红利。

当年的总资本与总资产的比值仅为6.25%,远低于监管部门要求的8%,鉴于该银行资本不足的情况,监管部门限期银行5年将资本比率提高到8%。

为此银行制定了5年内的资本计划。

根据银行的资产规模、股利分配政策以及融资渠道的不同,银行可以制定出以下四种资本计划:要求:对以下四种资本计划进行分析评述。

1、计划一:银行不愿意压缩当前的增长势头,并且仍然坚持每年25万美元稳定的股利分配政策,这种情况下,尽管银行的资本数量也在不断的增加,但增长幅度始终赶不上资产每年10℅的增长速度,因此直到2015年末,该银行都无法达到8℅的增长速度,因此计划一是不现实的选择,如果一意孤行,将面临清算或被接管的危险。

计划二:既然内部积累的速度远抵不上资产的扩张速度,那么为何不节制一些,减少或放慢银行的资产发展速度以此来换取资本比率的上升呢?计划二中银行选择的是以每年1百万美元的速度缩小银行的规模,仍然发放25万美元的红利。

从表中的数据可以看到银行不断趋近资本比率目标,并在最后1年达到了监管部门的要求。

但这个过程对银行简直就像一种折磨,谁也不愿意看到经营规模的缩小。

商业银行练习题及答案(2)第一章导论(一)不定项选择题:1.中国通商银行是清政府于————在上海成立的。

A 1901年B 1897年1902年 D 1898年2.下列金融机构中,不是商业银行的是————A 中国农业银行B 交通银行C 农村信用合作社D 江阴市农村商业银行3.我国商业银行机构设置的原则是:A 竞争效率原则B 安全稳健原则C 规模适度原则D 利润最大原则4.历史上最早的银行威尼斯银行成立于————A 1593年B 1619年C 1580年D 1609年5.商业银行最基本的职能是————A 信用中介B 信用中介信用创造C 信用中介支付中介D 支付中介金融服务6.商业银行的职能包括:A 支付中介B 信用中介C 信用创造D 金融服务E 调节经济7.商业银行的组织形式有:A 单一银行制B 持股公司制C 连锁银行制D 总分行制E 全能银行制8.我国国有商业银行内部组织的层次结构可分为:A 总决策层B 执行管理层C 检查监督层D 执行操作层9.我国国有商业银行部门结构中由计划、信贷、存款、会计、出纳、国际业务等部门构成了——A 信息调研机构B 综合管理机构C 业务经营机构D 决策指挥机构10.我国国有商业银行部门结构中由人事、教育、科技、办公室、总务等部门构成了——A 决策指挥机构B 综合管理机构C 信息调研机构D 检查监督机构11.股份制商业银行的最高权力机构是:A 董事会B 理事会C 监事会D 股东大会12.总经理是商业银行的行政首脑,是在——直接领导下开展工作。

A 股东大会B 董事会C 监事会D 理事会13.商业银行经营的最基本的目标是:A 经营的安全性B 经营的流动性C 追求利润的最大化D 追求资产的最大化14.当今国际金融领域商业银行扩大资产规模和业务范围的主要途径是:A 大银行兼并小银行B 资产重组C 强强联合D 收购股权15.历史上最早的银行是:A 威尼斯银行B 米兰银行C 阿姆斯特丹银行D 汉堡银行16.1999年11月美国国会通过了意在取消金融业分业经营的法案是:A 《格拉斯-斯蒂格尔法》B 《美国联邦储备银行法》C 《美国商业银行法》D 《金融服务现代化法案》17.世界上第一家网络银行是:A 美国花旗银行B 美国信浮银行C 日本第一劝业银行D 美国安全第一网络银行18.商业银行信用中介的职能主要充当的是:A 买卖资本商品的所有权B 买卖资本商品的使用权C 充当资金交换的媒介D 办理货币的收付和兑换19.商业银行信用创造的限制条件有:A 存款额B 准备金率C 贷款的有效需求D 存款付现率20.商业银行经营的流动性方针是指:A 保持资产的流动性B 保持负债的流动性C 所持资产的变现能力D 是获得资金的负债能力(二)复习思考题:1.名词解释:商业银行信用创造支付中介流动性效益性基础货币全能化经营信用中介单一银行制2.简述现代商业银行的发展趋势。

商业银行经营管理计算题集团文件发布号:(9816-UATWW-MWUB-WUNN-INNUL-DQQTY-第二章商业银行资本管理1.假设某银行遵循巴塞尔协议Ⅰ的资本要求,目前自有资本40亿元,资产的风险权数为50%,问该银行的资本能支撑多大的资产规模2.某商业银行资产负债表显示,现金为100万元,对企业的贷款为80万元,对企业的长期信贷承诺为200万元,请问根据这三项数据计算风险资产为多少3.假设我国某股份制商业银行遵循巴塞尔协议Ⅰ的资本要求,目前资产余额为2000亿元,资产的风险权数为50%,这家银行的最低资本限额为多少第三章商业银行负债管理加权平均资本成本1.假设某银行开办了某种新的存款种类,由此使存款平均余额增加了9000万元,这些资金的利息成本为270万元,其它成本为135万元,新增资金的20%用于非盈利资产,则该银行的边际成本计算如下:资金边际成本=(270+135)/9000=4.5%新增可用资金边际成本=(270+135)/9000×(1-20%)=5.625%2.某商业银行共筹集5亿元资金,其中以8%的资金成本率可以筹集支票存款1亿元,以12%的资金成本率可以筹集定期存款、储蓄存款等3亿元,资本性债券1亿元,其成本率为16%。

如果存款运用于非盈利资产比重分别为:支票存款为15%,定期和储蓄存款5%。

资本性债券全部用于盈利性资产上。

该行的加权平均成本率为:第五章商业银行贷款管理成本加成定价法1.一笔贷款额100万元,如果银行为了筹集该笔资金以2.65%的利率发行存单,;银行发放和管理这笔资金的经营成本为1.80%,预计违约风险补偿费用需要2.50%,银行预期的利润水平为1.00%,按成本加成定价法,这一笔贷款的利率应该为多少2.某客户申请500万元的信用额度,实际使用400万元,利率20%(合同)。

顾客对其未使用部分支付1%承诺费。

银行要求客户必须有相当于实际贷款额的20%和未使用额的5%的存款作为补偿余额。

第二章商业银行资本管理

一、单项选择

1.按照巴塞尔协议的要求,商业银行的资本充足率至少要达到()。

A.4%

B.6%

C.8%

D.10%

2.我国《商业银行资本充足率管理办法》规定,计入附属资本的长期次级债务不得超过核心资本的()。

A.20%

B.50%

C.70%

D.100%

3.西方商业银行最早用以衡量银行资本是否适度的指标是()。

A.资本/存款

B.资本/贷款

C.资本/总资产

D.资本/风险资产4.下列属于债务性资本工具的是()。

A.优先股

B.普通股

C.可转换债券

D.资本溢价

5.商业银行用于弥补尚未识别的可能性损失的准备金是()。

A.一般准备金

B.专项准备金

C.特殊准备金

D.风险准备金6.我国规定商业银行法定盈余公积金的提取比例为税后利润的( )。

A.25% B.50% C.10% D.150%

7.资本盈余属于商业银行资本金中的 ( )

A.核心资本 B.附属资本 C.未分配利润 D.重估资本

8.《巴塞尔协议》规定商业银行的核心资本与风险加权资产的比例关系是

( )。

A.≥8% B.≤8% C.≤4% D.≥4%

9.票据贴现的期限最长不超过 ( )。

A.6个月 B.9个月 C.3个月 D.1个月

10.下列哪一个不属于银行的权益资本 ( )。

A.普通股 B.优先股 C.权益承诺票据 D.盈余公积金二、多项选择

1.下列各项中属于商业银行核心资本的是()。

A.实收资本

B.资本公积

C.未分配利润

D.重估储备

E.公开储备

2.下列各项中属于商业银行附属资本的是()。

A.一般准备

B.优先股

C.盈余公积

D.可转换债券

E.永久性非累计优先股

3.根据巴塞尔《新资本协议》,银行可以采用的信用风险计量方法有()。

A.标准法

B.内部评级初级法

C.内部评级高级法

D.基本指标法

E.内部模型法

4.巴塞尔《新资本协议》对商业银行的()提出了资本拨备要求。

A.流动性风险

B.信用风险

C.市场风险

D.操作风险

E.道德风险

5.次级债券是商业银行发行的、本金和利息的清偿顺序列于()的债券。

A.银行其他负债之后

B.银行股权资本之前

C.银行股权资本之后

D.银行其他负债之前

E.银行劣后股之前

6.商业银行资本金的筹集主要有哪些途径()

A.内部筹集 B.分子对策 C.分母对策

D.外部对策 E.再贴现

7.银行资本按其来源划分有()

A.账面资本 B.债务资本 C.权益资本

D.补充性资本 E.监管资本

8.影响银行资本金需求量的主要因素有()

A.监管法规的要求 B.资产质量 C.信用规模

D.信用等级 E.营业机构规模

三、判断题

1.为了降低成本增加利润,商业银行的资本越少越好。

2.商业银行长期次级债务的债权人与银行一般存款人具有相同的本息要求权。

3.根据《巴塞尔新资本协议》的要求,商业银行信息披露是指商业银行将其财务会计报告以年度报告的形式向公众公开。

4.从数量上来看,经济资本等与商业银行的非预期损失。

5.风险资本值是银行在一定容忍度下吸收潜在损失所需的资本数额

四、名词解释

1.监管资本

2.公开储备

3.次级债券

4.资本充足率

5.风险资本

五、问答题

1.说明商业银行资本金的作用,并解释为什么长期次级债务可以作为资本的一部分。

2.分析普通股、优先股和可转换债券的利弊。

3.巴塞尔《新资本协议》的主要内容是什么?

4.我国对资本充足率管理的主要内容有哪些?

5.试析风险资本和监管资本风险定价的异同?。