金融专业英语阅读(答案)

- 格式:doc

- 大小:119.93 KB

- 文档页数:22

金融专业英语阅读(答案)Chapter OneMonetary Policy(货币政策) …………………………………Chapter TwoForeign Exchange Risk andWhy It Should Be Managed(外汇风险和进行外汇管理的原因)………………………………………Chapter ThreeTools and Techniques forThe Management of Foreign Exchange Risk(控制外汇风险的工具和方法) …………………………………Chapter FourU.S. Foreign ExchangeIntervention(美国对外汇交易的干预) …………………………………Chapter FiveHistory of Accounting(会计的历史起源) …………………………………Chapter SixAccounting and Bookkeeping(会计和簿记) …………………………………Chapter SevenFinancial Markets and Intermediaries(金融市场和中间业务) …………………………………Chapter EightHistory of Insurance(保险的历史起源) …………………………………Chapter NineInsurance Policy(保险单) …………………………………Chapter TenBank for International Settlements(国际清算银行) …………………………………Chapter ElevenCommercial Bank Lending(商业银行借贷) …………………………………Chapter TwelveCredit Analysis(信贷分析) …………………………………Chapter ThirteenWhat Kind of Mortgage Loan Should You Get?(何种抵押贷款更适合你?) …………………………………Chapter FourteenMutual Fund(共同基金) …………………………………Chapter FifteenBonds(债券) …………………………………Chapter SixteenOptions(期权) …………………………………Chapter OneMonetary Policy货币政策Answers:Multiple choices1.D2.B3.C4.C5.ATrue or False1.F2.T3.F4.T5.F6.TRead the following text and choose the best sentences for A to E below to fill in each of the gaps in text1. E2. B3. D4. A5. CCloseEmployment, demand, fiscal policy tools, monetary policy, central bank, interest rates, "stable" prices, inflation, "federal funds" rate, open market operationsTranslation:Translate the following passage into Chinese1.紧缩性货币政策和扩张性货币政策都涉及到改变一个国家的货币供应量水平。

考研英语经济类阅读理解及原文翻译考研英语经济类阅读理解及原文翻译:OPTIONS AHOYWhy investors like Korean blue chipsDESPITE the world economic downturn, South Koreas stockmarket has this year outperformed those of all other countries bar Russia. Its composite stock price index (Kospi) has risen by more than 25% since January 1st. The rally, which has been driven by foreign buying, is expected to continue next year, for two reasons: encouraging economic fundamentals, and the introduction of derivatives so beloved of the worlds hedge funds.On January 28th next year the Korea Stock Exchange is due to introduce option contracts on the shares of seven listed companies: SK Telecom, Korea Electric Power, Korea Telecom, Samsung Electronics, Hyundai Motor, Pohang Iron Steel and Kookmin Bank. And as early as July, the Financial Supervisory Commission is expected to allow investment banks to sell over-the-counter derivatives, such as equity or interest-rate swaps. Trading volume on the exchange will increase accordingly, says Lee Wonki at Merrill Lynch. Foreigners hold nearly 90 trillion won ($70 billion) of Korean shares, 37% of the market. Their slice of the trading of Kospi 200 index futures and options rose to 10% this year, from about 5% a year ago. But the Kospi index, covering 200 companies, is not the best way to hedge foreign portfolios, which are invested mainly in the seven blue-chipshares. Yet derivatives alone will not sustain Korean equities unless the economy turns around. There are signs that it has reached bottom, with real GDP estimated to have grown by at least 2.8% this year (slower than last year but higher than earlier forecasts of 2% or less). Jin Nyum, the finance minister, predicts that, although exports may suffer next year if the Japanese yen continues to fall, domestic demand and public spending will help real GDP to grow near to the countrys full potential of 5%.Some analysts argue that the recent market rise has been caused by investors blind faith in bank and technology shares. The latter rallied last month, but then hesitated as Micron, an American memory-chip maker, blew hot and cold on taking a stake in or allying with Hynix, Koreas debt-laden maker of memory chips.Nevertheless, the rally is likely to continue, says Koh Wonjong, of SG Securities in Seoul. That is because South Koreas industries are more diversified--into information technology, cars, shipbuilding, steel and services--than those of other Asian countries. In Taiwan, telecoms, media and technology shares account for 80% of the market.The restructuring of some big companies, such as Hynix and Daewoo Motor, remains incomplete, as does bank reform. But the past four years of financial and corporate change may soon pay off. For many companies, balance-sheet problems have turned into the need to measure profits, a far more welcome task.Economist; 12/22/2001, Vol. 361 Issue 8253, p86, 1/2p, 1 graph词汇注释bar prep. 除…之外rally n. 重整;(市场价格) 回升,跌后复升;恢复健康; 振作精神;集会, 大会;汽车赛会over-the-counter【证券】 (不通过交易所)买卖双方直接交易的,场外交易的(每位买者或卖者都是经过协议与议价来达成股票的买卖)option n. 选择权, [经]买卖的特权interest-rate swap 利率掉期;利率调期won [wCn] n. [sing., pl. ]圆(南北朝鲜的货币单位)index futures 指数期货hedge n. [经]对冲blow hot and cold (on, about) 出尔反尔;三心二意; 反复无常; 拿不定主意stake [steIk] n. (木头或金属的)柱,桩;股份;利害关系have [take] a stake in sth. 与某事有利害关系,与…休戚相关debt-laden 债台高筑的pay off 还清;偿清;报复;偿还;结清工资解雇(某人);成功参考译文选择权在招手为什么投资者对韩国蓝筹股情有独钟?尽管世界经济不景气, 但今年南韩的股市行情却比除俄国以外其他国家的股市都好。

金融考研英语二真题答案一、阅读理解Passage 11. C2. B3. APassage 24. D5. A6. CPassage 37. A 8. D 9. B二、完形填空10. C 11. D 12. B 13. B 14. C15. A 16. D 17. B 18. C 19. A20. D 21. C 22. A 23. B 24. D25. A 26. B 27. C 28. D 29. C30. B三、综合阅读填空31. F 32. G 33. D 34. E 35. C36. A 37. H 38. B 39. C 40. F41. G 42. H 43. E 44. D 45. A四、翻译46. 参加这个考试的人数远远超过了预期。

47. 因为她的资历和经验,她被任命为部门经理。

48. 金融市场的波动可能会导致投资者的损失。

49. 这个项目在规定的时间内完成了,这是我们的重要成绩之一。

50. 自从经济危机以来,许多公司都采取了削减开支的措施。

五、作文题目:中国金融市场的发展与挑战随着中国经济的迅速崛起,中国金融市场也经历了快速发展。

然而,在这一过程中,金融市场也面临着一些挑战。

本文将探讨中国金融市场的发展现状以及所面临的主要挑战。

首先,中国金融市场的发展取得了显著的成就。

中国已成为全球第二大经济体,具有庞大的消费市场和潜力巨大的投资机会。

在金融领域,中国的股票市场、债券市场和期货市场迅速增长,并与国际市场融合。

同时,中国还积极推动金融创新,包括在线支付、数字货币等,为经济发展提供了新的动力。

然而,中国金融市场也面临着一些挑战。

首先,金融风险是发展中国金融市场的主要威胁之一。

目前,中国金融市场对外开放程度的提高使得外部冲击因素增加,金融市场波动性加大。

其次,市场监管和风险防范体系仍然不完善,监管能力、监管水平等需要进一步提升。

此外,金融市场的不均衡发展也是一个问题,一些地区和行业相对较弱,与一线城市相比,发展水平还有差距。

金融英语考试试题金融英语考试试题金融英语考试是衡量金融从业人员英语水平的重要指标之一。

这种考试旨在测试考生在金融领域的专业英语知识和技能。

下面将介绍一些常见的金融英语考试试题,以帮助考生更好地准备考试。

一、阅读理解阅读理解是金融英语考试中常见的题型之一。

考生需要阅读一篇关于金融领域的文章,并回答相关问题。

以下是一个例子:文章:The Role of Central Banks in the EconomyCentral banks play a crucial role in the economy by controlling the money supply and interest rates. They are responsible for maintaining price stability and promoting economic growth. Central banks achieve this through various monetary policy tools, such as open market operations and reserve requirements.Question: What is the role of central banks in the economy?答案:The role of central banks in the economy is to control the money supply and interest rates, maintain price stability, and promote economic growth.二、词汇选择词汇选择题是考察考生对金融领域词汇的理解和应用能力。

以下是一个例子:Question: The process of converting an asset into cash is called _______.a) liquidityb) inflationc) diversificationd) leverage答案:a) liquidity三、填空题填空题是考察考生对金融英语词汇和术语的掌握程度。

金融硕士英语阅读理解习题及答案North China's Tianjin Municipality(直辖市)has started a “Blue Sky Project” to control the air pollution. Under the project requirements, the air quality in Tianjin is expected to measure up to the national standard by 2007, when two thirds of days in the year will enjoy fairly good or excellent air quality. In order to achieve the goal, Tianjin will take a series of measures such as controlling the use of coal, reducing the dust floating from construction sites, planting trees along the major streets, and replacing petrol with liquid natural gas as the fuel for vehicles. Since people paid little attention to the environmental protection, the air quality in Tianjin has worsened during the past decade. The project has received wide praise and support from the natives. *The newly-discovered “Great Wall” in south China's Hunan ProvincNE-HEe will open to visitors in the near future. “We will try to make it an internationally famous attraction for tourists, ” said Yuan Xinhua, director of the Hunan Provincial Tourism Administration(管理局)。

Chapter One Functions of Financial Markets 一.Translate the following sentences into Chinese.1.China’s banking industry is now supervised by the PBC and CBRC. In addition, the MOFis in charge of financial accounting and taxation part of banking regulation and management.目前中国银行业主要由中国人民银行和银监会进行监管。

此外,财政部负责银行业监管的财务会计及税收方面。

2.Currently Chinese fund management companies are engaged in the following business:securities investment fund, entrusted asset management, investment consultancy, management of national social security funds, enterprise pension funds and QDII businesses.目前中国的基金管理公司主要从事以下业务:证券投资基金业务、受托资产管理业务、投资咨询业务、社保基金管理业务、企业年金管理业务和合格境内机构投资者业务等。

3.China's economy had 10% growth rate in the years before the world financial crisisof 2008. That economic expansion resulted from big trade surpluses and full investment.Now China is seeking to move away from that growth model. The country is working to balance exports with demand at home.在2008年世界经济危机之前的那些年,中国经济增长速度曾达到10%。

“高职高专商务英语专业规划教材”Unit 1 Financial Market Research练习参考答案I.Read through the text and answer the following questions.1.A financial market is a mechanism that allows people to easily buy andsell (trade) financial securities (such as stocks and bonds), commodities (such as precious metals or agricultural goods), and other fungible items of value at low transaction costs and at prices that reflect the efficient-market hypothesis.2.The raising of capital ;the transfer of risk and international trade3.Capital markets,commodity markets,money markets, derivative markets,insurance markets and foreign exchange markets .4.Financial markets fit in the relationship between lenders andborrowers.5.Individuals, companies, governments, municipalities and publiccorporations.II. Paraphrase the following expressions or abbreviations and translate them into ChineseCheck the answers from the Special Term Lists.III. Fill in the blanks with the proper wordsThe global financial crisis, brewing for a while, really started to show its effects in the middle of 2007 and into 2008. Around the world stock markets have fallen, large financial institutions have collapsed or been bought out, and governments in even the wealthiest nations have had to come up with rescue packages to bail out their financial systems.On the one hand many people are concerned that those responsible for the financial problems are the ones being bailed out, while on the other hand, a global financial meltdown will affect the livelihoods of almost everyone in an increasingly inter-connected world. The problem could have been avoided, if ideologues supporting the current economics models weren’t so vocal, influential and inconsiderate of others’ viewpoints and concerns.IV.Translation.1.金融市场包括很多方面,包括资本市场,华尔街,甚至是市场本身。

Part One1. What are the main roles of banks?答:Although banks share many common features with other profit-seeking business,they play a unique role in the economy through mobilizing savings,allocating capital funds to fiance productive investment,transmitting monetary policy,providinga payment system and transforming risks.3. According to the revised edition of the Law of the People's Republic of China on the People's Bank of China ,what functions does the PBC perform?答:The PBC 's key functions are to conduct monetary policy, prevent and dissolve financial risks, and maintain financial stability under the leadership of the State Council.4. Can you give some examples of indirect instruments for implementing monetary policy?答:Indirect instruments as required reserve ratio, interest rate adjustment and open market operations.9. What is your definition of share and bond?答:Shares are certificates or book entries representing ownership in a corporation or similar entity.Bonds are written evidences of debts.13. What is your definition of “securities”?答:Securities are paper certificates (definitive securities) or electronic records (book-entry securities) evidencing ownership of equity (stock) or debt obligations (bonds).Part Two2. What are the objectives of banking supervision?First, the key objective of supervision is to maintain stability and public confidence in financial system.The second goal of bank supervisions to ensure that bank operate in a safe and sound manner and that they hold capital and reserve sufficient to cover the risks that may arise in their business.Third, a related goal is to protect depositors’ funds and , if any bank should fail, to minimize the losses to be absorbed by the deposit insurance fund.The fourth goal of bank supervision is to foster an efficient and competition banking system that is responsive to the public need for high quality financial services at reasonable cost.The fifth and final goal of bank supervision is to ensure compliance with banking laws and regulations.3. What risks might the commercial banks have to face?(1)credit risk (2)market risk (3)liquidity risk (4)operational risk (5)legal risk (6)reputation risk4. What are the implication of credit risk, market risk, liquidity risk and operational risk?Credit risk: A major type of risk that banks face is credit risk or the failure of a counterpart to perform according to a contractual arrangement.Market risk: Two specific elements of market risk are foreign exchange risk and interest risk. Banks face a risk of losses in on- and off-balance sheet positions arising from movement in exchange rates. Interest rate risk prefers to the exposure of a bank’s financial condition to adverse movements in interest rates.Liquidity risk: Liquidity risk arises from the inability of a bank to accommodate decreases in liabilities or to fund increases in assets.Operational risk: The most important types of operational risk involve breakdowns in internal controls and corporate governance..5.At what levels does the Basel Accord set the minimum capital ratio requirements for internationally active banks?The Accord sets minimum capital ratio requirements for internationally active banks of 4% tier one capita and 8% total capital (tier one plus tier two) in relation to risk-weighted assets.Part Three1. What does foreign exchange include ?答:Foreign exchange includes the following means of payments and assets denominated in a foreign currency that can be used for international settlement:●Foreign currencies, including banknotes and coins;●Payment vouchers denominated in foreign currency, including negotiableinstruments, bank certificates of deposit and certificates of postal savings;●Securities denominated in foreign currency, including government bonds,corporate bonds and stocks;●Super-national currencies such as Special Drawing Rights and the Euro; and●Other assets denominated in foreign currency.3. What are the requirements for domestic institutions for opening foreign exchange accounts abroad?答:Domestic entities which meet one of the following requirements may apply for opening a foreign exchange account abroad:●Expecting small amount income during a certain period of time abroad;●Expecting small amount ex penditure during a certain period of time abroad;●Undertaking overseas construction projects;and issuing securities denominated in foreign currency abroad.6. Give the definition of foreign exchange?答:Foreign exchange , or forex , is foreign money. All foreign currency, consisting of founds held with banks abroad, or bills or cheques, again in foreign currency and payable abroad , are termed foreign exchange.9. Give the definition of spot and forward transaction?答:Spot transactions involve today’s p rices of currency and delivery of the currency within two business days, except for Canadian dollar (CAD), which must be delivered in one day.10. Tell the difference between forward and futures transactions?答:(1) Forward transactions involve today’s pr ices of currency and delivery on a stipulated future date.(2) Futures transactions are always traded on exchanges. In order to be marketable on exchanges, futures contracts are standardized in terms of quantity, settlement datesand quotation.Part Four14. How could a bank earn interest income?答:The principal source of income for the majority of banks is still the interest received on the funds that the institution has at its disposal and is able to lend out in some form.Whenever a bank lends out money it will generally charge interest to the customer.21. Why should a bank keep sufficient liquid assets?答:It is important for a bank to hold sufficient liquid assets to meet the demands of depositors who may seek to withdraw their funds. However,maintenance of too high a level of liquid assets could be expensive. Cash balances in particular yield no income,yet will cost the same as any other asset to fund.25. What are the three major activities included in a bank's Statement of Cash Flows?答:The statement of cash flows reports cash flows relating to operating,investing and financing activities of a bank.Part five4. What are negotiable instruments? list some examples.答:From a functional perspective, negotiable instruments are documents used in commerce to secure the payment of money. Paying large sums of money in cash is both inconvenient and, unfortunately, risky. In all cases, negotiable instruments represent a right to payment. A right is, by definition, a promise and not a tangible piece of property. So, negotiable instruments are classified as choses in action. The three main types of them are the following: Bills of Exchange, Cheques, Promissory Notes.7. What’s the difference between capital lease and operating lease?答:1: Whether the ownership of property is to be transferred by the end of lease term.2: Whether the lease has an operation to purchase the leased property at a bargain price.3: The lease term is long to or short in according to the estimated economic life of the leased property.4: Whether the lease is a cancelable lease.5: Whether the lease is full-payout lease.9. What’s the meaning of Account Receivable Financing?答:Accounts Receivable represents a promise from customers to pay for a goods sold or services rendered. Account Receivable Financing is a form of collateralized lending in which accounts receivables are the collateral.12. What are basic characteristics of money mark securities?答:Money-mark securities, which are discussed in details later in this chapter, have three basic characteristics in common:They are usually sold in large denominations.They have low default risk.They mature in one year or less from their original issue date. Most money marker instruments mature in less than 120 days.Why teasury bills are attractive to investors?答:Teasury bills are attractive to investors because they are backed by the government and therefore are virtually free of default risk .Even if the government ran out of money, it could simply print more to pay them off when they mature.The risk of unexpected changes in inflation is also low because of their short-termmaturity. 15. What are the features of inter-bank markets?答:Inter-bank markets are money markets in which short-term funds transferred (lent or borrowed) between financial institutions, usually for one day, that is , they are usually overnight investment . The interest rate for borrowing these funds is close to ,but always slightly higher than ,the rate that is available from the central bank. 17.How have NCDs become the second most popular money market instruments?答:Negotiable CDs are in large denominations .Although NCDs denominations are too large for individual investors , they are sometimes purchased by money market funds that have pooled individua l investor’s funds. Thus , the existence of money market funds allows individuals to be indirect investors in NCDs ,marking a more active NCD market.19.What products does the on-line banking provide?答:basic products and services, intermediate products and services ,advanced products and services.Part Six1,What categories can the loan be divided according to their risk?答:The five-category system classifies bank loans according to their inherent risks as pass(normal),special-mention,substandard,doubtful and loss.What are the commonly used methods of credit analysis?答:Tranditionally,key risk factors have been classified according to the five CS of credit:character,capital,capacity,conditions,and collateral. Golden and Walker identify the five CS of bad credit,representing things to guard against to help prevent problems.These include complacency,carelessness,communication breakdown,contingencies,and competition.A useful framework for sorting out the facts and opinions in credit analysis is the 5Ps approach:people,purpose,payment,protection,and perspective.How can a bank take security for an advance?答:A bank has different kinds of security as cover for advance to his customers.There are several ways in which a bank may take security for an advance by lien,pledge,mortgage and hypothecation.。

金融英语阅读教程课后练习题含答案学习金融英语是一个不断提高自己的过程,需要我们不断阅读、理解并练习。

本文将为大家提供几道关于金融英语阅读的课后练习题,希望大家可以通过这些题目进一步掌握金融英语的核心概念。

练习题1.Which of the following describes a bear market in finance?• A. High stock prices• B. Low stock prices• C. Consistently steady stock prices2.What is the definition of a bond?• A. A type of stock• B. An investment that represents a loan made by an investor to a borrower• C. A type of currency3.What is the role of a stockbroker?• A. They lend money to individuals or businesses• B. They help investors buy and sell stocks and other securities• C. They are responsible for printing and distributing financial statements to investors4.What is the difference between a stock and a mutual fund?• A. A stock represents ownership in a single company; a mutual fund is a collection of stocks and other investments• B. A stock is a type of bond; a mutual fund is a type of stock• C. A stock is a type of currency; a mutual fund is a type of commodity5.What is the purpose of the Department of the Treasury?• A. To regulate the stock market• B. To collect taxes and manage government finances• C. To oversee the Federal Reserve答案1.B. A bear market is characterized by a drop in stock pricesover a sustned period of time.2.B. A bond is a debt security that represents a loan made byan investor to a borrower, typically a corporate or government entity.3.B. Stockbrokers help investors buy and sell stocks, bonds,and other securities. They also provide advice and research to help clients make informed investment decisions.4.A. Stocks represent ownership of a single company, whilemutual funds are a collection of investments, including stocks.5.B. The Department of the Treasury is responsible forcollecting taxes and managing the finances of the federalgovernment. They also oversee the production of currency andmanage the national debt.总结以上是几道关于金融英语阅读的练习题及其答案。

金融英语阅读教程第四版课后练习答案1、The relationship between employers and employees has been studied(). [单选题] *A. originallyB. extremelyC. violentlyD. intensively(正确答案)2、64.Would you like to drink ________?[单选题] *A.something else(正确答案)B.anything elseC.else somethingD.else anything3、A brown bear escaped from the zoo, which was a()to everyone in the town. [单选题] *A. HarmB. violenceC. hurtD. threat(正确答案)4、—Is this ______ football, boy? —No, it is not ______.()[单选题] *A. yours; myB. your; mine(正确答案)C. your; meD. yours; mine5、Don’t _______. He is OK. [单选题] *A. worry(正确答案)B. worried aboutC. worry aboutD. worried6、I arrived _____ the city _____ 9:00 am _______ April [单选题] *A. at, in, atB. to, on, atC. in, or, atD. in, at, on(正确答案)7、Mary _____ be in Paris. I saw her just now on campus. [单选题] *A. mustn'tB. can't(正确答案)C. need notD. may not8、We haven't heard from him so far. [单选题] *A. 到目前为止(正确答案)B. 一直C. 这么远D. 这么久9、Mr. White likes to live in a _______ place. [单选题] *A. quiteB. quiet(正确答案)C. quickD. quietly10、—What were you doing when the rainstorm came?—I ______ in the library with Jane. ()[单选题] *A. readB. am readingC. will readD. was reading(正确答案)11、24.Kitty’s father ______ a policeman since 2 He loves helping people. [单选题] *A.isB.wasC.has been (正确答案)D.have been12、Every year Carl _______ most of his time swimming, camping and traveling with his parents. [单选题] *A. is spendingB. spentC. will spendD. spends(正确答案)13、I am so excited to receive a _______ from my husband on my birthday. [单选题] *A. present(正确答案)B. percentC. parentD. peace14、He _______ getting up early. [单选题] *A. used toB. is used to(正确答案)C. is usedD. is used for15、Yesterday I _______ a book.It was very interesting. [单选题] *A. lookedB. read(正确答案)C. watchedD. saw16、The green shorts are _______ sale for $[单选题] *A. forB. on(正确答案)C. atD. with17、25.A watch is important in our life. It is used for ______ the time. [单选题] * A.telling (正确答案)C.speakingD.holding18、76.AC Milan has confirmed that the England star David Beckham ()the team soon. [单选题] *A. has rejoinedB. was going to rejoinC. rejoinedD. is to rejoin(正确答案)19、Your homework must_______ tomorrow. [单选题] *A. hand inB. is handed inC. hands inD. be handed in(正确答案)20、The children ______ visiting the museum. [单选题] *A. look overB. look forward to(正确答案)C. look for21、These plastics flowers look so_____that many people think they are real. [单选题] *A.beautifulB.artificialC.natural(正确答案)D.similar22、41.—________ do you take?—Small, please. [单选题] *A.What size(正确答案)B.What colourC.How manyD.How much23、Just use this room for the time being ,and we’ll offer you a larger one _______it becomes available [单选题] *A. as soon as(正确答案)B unless .C as far asD until24、Mrs. Green has given us some _______ on how to study English well. [单选题] *A. practiceB. newsC. messagesD. suggestions(正确答案)25、Jim, we have _______ important to tell you right now . [单选题] *A. someB. something(正确答案)C. anyD. anything26、I think _______ is nothing wrong with my car. [单选题] *A. thatB. hereC. there(正确答案)D. where27、Which animal do you like _______, a cat, a dog or a bird? [单选题] *A. very muchB. best(正确答案)C. betterD. well28、Nuclear science should be developed to benefit the people_____harm them. [单选题] *A.more thanB.other thanC.rather than(正确答案)D.better than29、Many children have to _______ their parents. [单选题] *A. divide intoB. put onC. depend on(正确答案)D. take on30、The commander said that two _____ would be sent to the Iraqi front line the next day. [单选题] *A. women's doctorB. women doctorsC. women's doctorsD. women doctor(正确答案)。

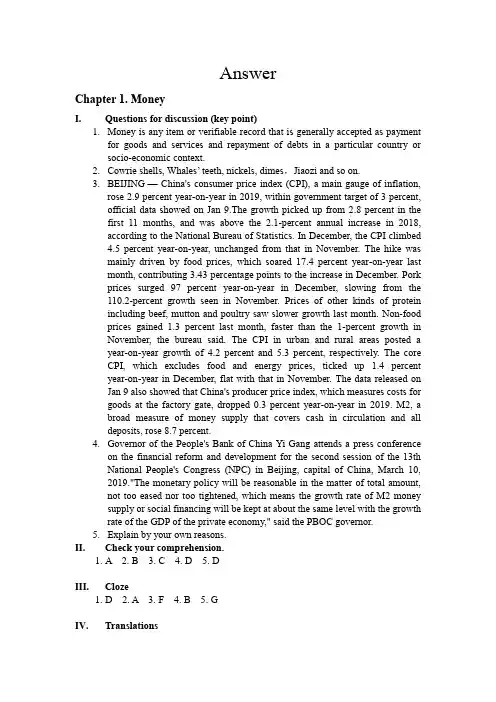

AnswerChapter 1. MoneyI.Questions for discussion (key point)1.Money is any item or verifiable record that is generally accepted as paymentfor goods and services and repayment of debts in a particular country or socio-economic context.2.Cowrie shells, Whales’ teeth, nickels, dimes,Jiaozi and so on.3.BEIJING— China's consumer price index (CPI), a main gauge of inflation,rose 2.9 percent year-on-year in 2019, within government target of 3 percent, official data showed on Jan 9.The growth picked up from 2.8 percent in the first 11 months, and was above the 2.1-percent annual increase in 2018, according to the National Bureau of Statistics. In December, the CPI climbed4.5 percent year-on-year, unchanged from that in November. The hike wasmainly driven by food prices, which soared 17.4 percent year-on-year last month, contributing 3.43 percentage points to the increase in December. Pork prices surged 97 percent year-on-year in December, slowing from the 110.2-percent growth seen in November. Prices of other kinds of protein including beef, mutton and poultry saw slower growth last month. Non-food prices gained 1.3 percent last month, faster than the 1-percent growth in November, the bureau said. The CPI in urban and rural areas posted a year-on-year growth of 4.2 percent and 5.3 percent, respectively. The core CPI, which excludes food and energy prices, ticked up 1.4 percent year-on-year in December, flat with that in November. The data released on Jan 9 also showed that China's producer price index, which measures costs for goods at the factory gate, dropped 0.3 percent year-on-year in 2019. M2, a broad measure of money supply that covers cash in circulation and all deposits, rose 8.7 percent.ernor of the People's Bank of China Yi Gang attends a press conferenceon the financial reform and development for the second session of the 13th National People's Congress (NPC) in Beijing, capital of China, March 10, 2019."The monetary policy will be reasonable in the matter of total amount, not too eased nor too tightened, which means the growth rate of M2 money supply or social financing will be kept at about the same level with the growth rate of the GDP of the private economy," said the PBOC governor.5.Explain by your own reasons.II.Check your comprehension.1.A2. B3. C4. D5. DIII.Cloze1.D2. A3. F4. B5. GIV.Translations1.Translate the English to Chinese(1)In the days of the gold standard, the volume of money and credit in circulationwas tied to the amount of gold in a country’s vaults.在金本位时代,流通中的货币和信贷量与一个国家的金库中的黄金数量是挂钩的。

PartⅠ.Decide whether each of the following statements is true or false (10%)每题1分, 答错不扣分1.I.perfec.market.existed.resource.woul.b.mor.mobil.an.coul.therefor.b.transferre.t.thos.countrie.mor.willin.t.pa..hig.pric.fo.them.. .. .2.Th.forwar.contrac.ca.hedg.futur.receivable.o.payable.i.foreig.currencie.t.insulat.th.fir.agains.exchang.rat.risk ... . )3.Th.primar.objectiv.o.th.multinationa.corporatio.i.stil.th.sam.primar.objectiv.o.an.firm.i.e..t.maximiz.sharehol de.wealth.. .. )4..lo.inflatio.rat.tend.t.increas.import.an.decreas.exports.thereb.decreasin.th.curren.accoun.deficit.othe.thing.e qual......5..capita.accoun.defici.reflect..ne.sal.o.th.hom.currenc.i.exchang.fo.othe.currencies.Thi.place.upwar.pressur.o.tha.hom.currency’.value.. .. )parativ.advantag.implie.tha.countrie.shoul.specializ.i.production.thereb.relyin.o.othe.countrie .fo.som.products.. .. .7.Covere.interes.arbitrag.i.plausibl.whe.th.forwar.premiu.reflec.th.interes.rat.differentia.betwee.tw.countrie.sp ecifie.b.th.interes.rat.parit.formula. .. . )8.Th.tota.impac.o.transactio.exposur.i.o.th.overal.valu.o.th.firm.. .. .9. .pu.optio.i.a.optio.t.sell-b.th.buye.o.th.option-.state.numbe.o.unit.o.th.underlyin.instrumen.a..specifie.pric.pe.uni.durin..specifie.period... . )10.Future.mus.b.marked-to-market.Option.ar.not.....)PartⅡ:Cloze (20%)每题2分, 答错不扣分1.I.inflatio.i..foreig.countr.differ.fro.inflatio.i.th.hom.country.th.exchang.rat.wil.adjus.t.maintai.equal.. purchasin.powe... )2.Speculator.wh.expec..currenc.t..appreciat..... .coul.purchas.currenc.future.contract.fo.tha.currency.3.Covere.interes.arbitrag.involve.th.short-ter.investmen.i..foreig.currenc.tha.i.covere.b.....forwar.contrac...... .t. sel.tha.currenc.whe.th.investmen.matures.4.. Appreciation.Revalu....)petitio.i.increased.5.....PP... .suggest..relationshi.betwee.th.inflatio.differentia.o.tw.countrie.an.th.percentag.chang.i.th.spo.exchang.ra t.ove.time.6.IF.i.base.o.nomina.interes.rat....differential....).whic.ar.influence.b.expecte.inflation.7.Transactio.exposur.i..subse.o.economi.exposure.Economi.exposur.include.an.for.b.whic.th.firm’... valu... .wil.b.affected.modit.a..state.pric.i..... pu..optio..i.exercised9.Ther.ar.thre.type.o.long-ter.internationa.bonds.The.ar.Globa.bond. .. eurobond.....an....foreig.bond...).10.An.goo.secondar.marke.fo.financ.instrument.mus.hav.a.efficien.clearin.system.Mos.Eurobond.ar.cleare.thr oug.eithe...Euroclea... ..o.Cedel.PartⅢ:Questions and Calculations (60%)过程正确结果计算错误扣2分rmation:A BankB BankBid price of Canadian dollar $0.802 $0.796Ask price of Canadian dollar $0.808 $0.800rmation.i.locationa.arbitrag.possible?put.t h.profi.fro.thi.arbitrag.i.yo.ha.$1,000,e.(5%)ANSWER:Yes! One could purchase New Zealand dollars at Y Bank for $.80 and sell them to X Bank for $.802. With $1 million available, 1.25 million New Zealand dollars could be purchased at Y Bank. These New Zealand dollars could then be sold to X Bank for $1,002,500, thereby generating a profit of $2,500.2.Assum.tha.th.spo.exchang.rat.o.th.Britis.poun.i.$1.90..Ho.wil.thi.spo.rat.adjus.i.tw.year.i.th.Unite.Kingdo.experience.a.inflatio.rat.o..percen.pe.yea.whil.th.Unite.State.experience.a.inflatio.rat.o..perc en. pe.year?(10%)ANSWER:According to PPP, forward rate/spot=indexdom/indexforth.exchang.rat.o.th.poun.wil.depreciat.b.4..percent.Therefore.th.spo.rat.woul.adjus.t.$1.9..[..(–.047)..$1.81073.Assum.tha.th.spo.exchang.rat.o.th.Singapor.dolla.i.$0.70..Th.one-yea.interes.rat.i.1.percen.i.th.Unite.State.a n..percen.i.Singapore..Wha.wil.th.spo.rat.b.i.on.yea.accordin.t.th.IFE?.(5%)ANSWER: according to the IFE,St+1/St=(1+Rh)/(1+Rf)$.70 × (1 + .04) = $0.7284.Assum.tha.XY.Co.ha.ne.receivable.o.100,00.Singapor.dollar.i.9.days..Th.spo.rat.o.th.S.i.$0.50.an.th.Singap or.interes.rat.i.2.ove.9.days..Sugges.ho.th.U.S.fir.coul.implemen..mone.marke.hedge..B.precis. .(10%)ANSWER: The firm could borrow the amount of Singapore dollars so that the 100,000 Singapore dollars to be received could be used to pay off the loan. This amounts to (100,000/1.02) = about S$98,039, which could be converted to about $49,020 and invested. The borrowing of Singapore dollars has offset the transaction exposure due to the future receivables in Singapore dollars.pan.ordere..Jagua.sedan.I..month..i.wil.pa.£30,00.fo.th.car.I.worrie.tha.poun.ster1in.migh.ris.sharpl.fro.th.curren.rate($1.90)pan.bough...mont.poun.cal.(suppose.contrac.siz..£35,000.wit..strik.pric.o.$1.9.fo..premiu.o.2..cents/£.(1)Is hedging in the options market better if the £ rose to $1.92 in 6 months?(2)what did the exchange rate have to be for the company to break even?(15%)Solution:(1)I.th..ros.t.$pan.woul. exercis.th.poun.cal.option.Th.su.o.th.strik.pric.an.premiu..i.$1.90 + $0.023 = $1.9230/£Thi.i.bigge.tha.$1.92.So hedging in the options market is not better.(2.whe.w.sa.th. compan.ca.brea.even.w.mea.tha.hedgin.o.no.hedgin.doesn’. matter.An.onl.whe.(strik.pric..premiu.).th.exchang.rat.,hedging or not doesn’t matter.So, the exchange rate =$1.923/£.6.Discus.th.advantage.an.disadvantage.o.fixe.exchang.rat.system.(15%)textbook page50 答案以教材第50 页为准PART Ⅳ: Diagram(10%)Th.strik.pric.fo..cal.i.$1.67/£.Th.premiu.quote.a.th.Exchang.i.$0.022.pe.Britis.pound.Diagram the profit and loss potential, and the break-even price for this call optionSolution:Following diagram shows the profit and loss potential, and the break-even price of this put option:PART Ⅴa) b) Calculate the expected value of the hedge.c) How could you replicate this hedge in the money market?Yo.ar.expectin.revenue.o.Y100,00.i.on.mont.tha.yo.wil.nee.t.cover.t.dollars.Yo.coul.hedg.thi.i.forwar.market.b.takin.lon.position.i.U.dollar.(shor.position.i.Japanes.Yen).B.lockin.i.you.pric.a.$..Y105.you.dolla.revenue.ar.guarantee.t.b.Y100,000/ 105 = $952You could replicate this hedge by using the following:a) Borrow in Japanb) Convert the Yen to dollarsc) Invest the dollars in the USd) Pay back the loan when you receive the Y100,000。

金融专业英语第二版课后答案1、During the Spring Festival, people in Northern China usually eat _______ as a traditional Chinese food. [单选题] *A. pizzaB. dumplings(正确答案)C. hamburgersD. noodles2、The plane arrived at London airport _______ Wednesday morning. [单选题] *A. on(正确答案)B. atC. inD. for3、The little girl held _____ in her hand. [单选题] *A. five breadsB. five piece of breadsC. five piece of breadD. five pieces of bread(正确答案)4、Many people prefer the bowls made of steel to the _____ made of plastic. [单选题] *A. itB. ones(正确答案)C. oneD. them5、You have been sitting on my hat and now it is badly out of(). [单选题] *A. dateB. shape(正确答案)C. orderD. balance6、You cannot see the doctor _____ you have made an appointment with him. [单选题] *A. exceptB.evenC. howeverD.unless(正确答案)7、There are trees on both sides of the broad street. [单选题] *A. 干净的B. 狭窄的C. 宽阔的(正确答案)D. 宁静的8、One effective()of learning a foreign language is to study the language in its cultural context. [单选题] *A. approach(正确答案)B. wayC. mannerD. road9、62.--There is? ? ? ? ? sale on in the shop today. Let’s go together.--Please wait? ? ? ? ? ?minute. I’ll finish my homework first. [单选题] *A.a; theB.a; a(正确答案)C.the; aD.the; the10、We sent our children to school to prepare them for the time _____ they will have to work for themselves. [单选题] *A. thatB. when(正确答案)C. whileD. as11、We have ______ homework today. ()[单选题] *A. too manyB. too much(正确答案)C. much tooD. very much12、My English teacher has given us some _______ on how to study English well. [单选题] *A. storiesB. suggestions(正确答案)C. messagesD. practice13、31.That's ______ interesting football game. We are all excited. [单选题] *A.aB.an(正确答案)C.theD./14、( )Keep quiet, please. It’s ________ noisy here. [单选题] *A. many tooB. too manyC. too muchD. much too(正确答案)15、—Look at those purple gloves! Are they ______, Mary?—No, they aren’t. ______ are pink. ()[单选题] *A. you; IB. your; MyC. yours; Mine(正确答案)D. you; Me16、The twins _______ us something about their country. [单选题] *A. told(正确答案)B. saidC. talkedD. spoke17、Neither she nor her friends ______ been to Haikou. [单选题] *A. have(正确答案)B. hasC. hadD. having18、I often _______ music from the Internet. [单选题] *A. download(正确答案)B. spendC. saveD. read19、It is reported()three people were badly injured in the traffic accident. [单选题] *A. whichB. that(正确答案)C.whileD.what20、Everyone here is _______ to me. [单选题] *A. happyB. wellC. kind(正确答案)D. glad21、His mother’s _______ was a great blow to him. [单选题] *A. diedB. deadC. death(正确答案)D. die22、Grandpa pointed to the hospital and said, “That’s _______ I was born?”[单选题] *A. whenB. howC. whyD. where(正确答案)23、45.—Let's make a cake ________ our mother ________ Mother's Day.—Good idea. [单选题] *A.with; forB.for; on(正确答案)C.to; onD.for; in24、69.Online shopping is easy, but ________ in the supermarket usually ________ a lot of time. [单选题] *A.shop; takesB.shopping; takeC.shop; takeD.shopping; takes(正确答案)25、80.Thousands of ________ from other countries visit the village every year. [单选题] *A.robotsB.postcardsC.tourists(正确答案)D.bridges26、Chinese people spend _____ money on travelling today as they did ten years ago. [单选题] *A. more than twiceB. as twice muchC. twice as much(正确答案)D. twice more than27、How beautiful the flowers are! Let’s take some _______. [单选题] *A. photos(正确答案)B. potatoesC. paintingsD. tomatoes28、Don’t ______. He is OK. [单选题] *A. worriedB. worry(正确答案)C. worried aboutD. worry about29、His father always _______ by subway. [单选题] *A. go to workB. go to schoolC. goes to bedD. goes to work(正确答案)30、____ is standing at the corner of the street. [单选题] *A. A policeB. The policeC. PoliceD. A policeman(正确答案)。

《金融专业英语》习题答案第一篇:《金融专业英语》习题答案《金融专业英语》习题答案Chapter OneFunctions of Financial Markets 一. Translate the following sentences into Chinese.1.China’s banking industry is now supervised by the PBC and CBRC.In addition, the MOF is in charge of financial accounting and taxation part of banking regulation and management.目前中国银行业主要由中国人民银行和银监会进行监管。

此外,财政部负责银行业监管的财务会计及税收方面。

2.Currently Chinese fund management companies are engaged in the following business: securities investment fund, entrusted asset management, investment consultancy, management of national social security funds, enterprise pension funds and QDII businesses.目前中国的基金管理公司主要从事以下业务:证券投资基金业务、受托资产管理业务、投资咨询业务、社保基金管理业务、企业年金管理业务和合格境内机构投资者业务等。

3.China's economy had 10% growth rate in the years before the world financial crisis of 2008.That economic expansion resulted from big trade surpluses and full investment.Now China is seeking to move away from that growth model.The country is working to balance exports with demand at home.在2008年世界经济危机之前的那些年,中国经济增长速度曾达到10%。

《金融英语阅读教程第三版》课后答案

《金融英语阅读教程第三版》课后答案

第一部分参考译文

TopicOne:Introduction

引言

1.政治与经济

2.金融部门的经济角色

3.金融危机

TopicTwo:FinancialSystem

金融体系

4.金融体系

5.国际货币体系和国际收支

6.世界银行

7.国际货币基金组织

8.中国的银行业

9.银团贷款的历史与发展

TopicThree:MoneyandEconomies

货币与经济

10.货币

11.国际货币的宏观经济学

12.布雷顿森林协议与金汇兑本位制

13.洗钱

14.世界经济全球化

TopicFour:InvestmentSystem

投资体系

15.投资系统评估

16.期货与期权

17.为什么进行全球投资TopicFive:Accounting

会计

18.金融工具会计

19.应收款项估值会计

20.公司融资策略概观

TopicSix:Insurance

保险

21.面向家庭的保单

22.保险商提供的`投资产品与服务TopicSeven:Law

法律

23.招标广告

24.合同法

25.宾夕法尼亚公平银行

26.为什么税务法规影响投资决策

TopicEight:OptionalReading 补充阅读

27.微观经济学

28.国际收支平衡

29.为什么财务管理如此重要

30.统计学的基本概念

31.管理会计的整体性。

Part11.Multiple Choice(Part1 单选DDDAD ADABD 阅读CDDA CDBBD)(1) The People's Bank of China has been divided into ________district banks since 1999.A. 6B. 7C. 8D. 9(2) The PBC has operated as the central bank since________.A. 1987B. 1986C. 1985D. 1984(3)China formally lifted all remaining current account restrictions in _________.A. 1993B. 1994C. 1995D. 1996(4) ________remains the principle foreign exchange bank.A. The Bank of ChinaB. The Commercial and Industrial BankC. The Construction BankD. The Agricultural Bank(5) The indirect instruments such as ________have emerged as major monetary policy tools that the PBC relies on.A. required reserve ratioB. interest rate adjustmentC. open market operationsD. all of the above(6) With China's entry into WTO, China has decided to implement a phased reform of________.A. the wholly state-owned commercial banksB. the policy banksC. joint-equity commercial banksD. the non-bank financial sector(7) Banks play a unique role in the economy through ________.A. mobilizing savingsB. transmitting monetary policyC. providing a payment systemD. all of above(8) The evolution of the Chinese banking system can be broadly divided into ________phases.A. 3B.4C. 2D. 5(9) Although capital market development is expected to speed up, banks in China currently provide about________percent of aggregate financing in the economy.A. 65B. 75C. 50D. 80(10) Apart from traditional deposit taking and lending business, commercial banks now offer a broad range of intermediary services such as________.A. international settlementB. bank cardsC. private bankingD. all of the above2.True or False(1)Since the enactment of the Law of the People's Bank of China in March 1995, the PBC has no longer played the role of financing fiscal deficits in national budgetary.(2) The People's Bank of China was made as a central bank in 1948.(3) The indirect policy instruments include required reserve ratio, interest rate adjustment, and credit ceiling.(4) Before 1979 the foreign exchange control was strictly enforced.(5) The wholly state-owned commercial banks in China today used to be known as state-owned specialized banks.(6) One of the important goals of liberalizing the banking sector is to give foreign banks nationaltreatment.(7) The increase of the presence of foreign banks in China is likely to introduce new products and expertise.(8) Now China still remains some current account restrictions.(9) In recent years, there has been a great improvement in the conduct of monetary policy with great reliance on direct policy instruments.(10) Now China is an Article Ⅷ member of the International Monetary Fund.3.ClozeDirections: Read the following paragraphs and then put the suitable words or phrases into the blanks.The banking sector has played an important role in ________the implementation of the stabilization and structural measures as well as sustaining strong economic growth. The macroeconomic stability and ________improvement in turn have enabled the banking sector to________vigorously. Although capital market development is expected to speed up, banks in China, which currently provide about 75 percent of aggregate financing in the economy, are likely to continue playing a ________role in financing economic and technological development as well as the economic________ in the foreseeable future.1.facilitating2.reform3.structural4.develop5.dominantIn recent years, there has been a significant improvement in the ________of monetary policy with greater reliance on ________policy instruments. The central bank used to rely on credit ceilings for commercial banks as a major tool for monetary policy. This direct instrument has been abolished while such indirect instruments as required reserve ratio, interest rate adjustment and open market operations have ________as major monetary policy tools. The required reserve account and excess reserve account of the commercial banks with the central bank have been ________and the consolidated required reserve ratio has been reduced from 13 percent to 8 percent. Since 1996, the central bank has________ interest rates on many occasions to reflect the weakening domestic and global demand. These policy measures have helped sustain strong economic growth 1.emerged 2.conduct 3.lowered 4.indirect 5.mergedThe reform efforts have resulted in greater openness of the banking sector, integrated financial markets, increased diversification of banking institutions, strengthened competition and improved efficiency of ________allocation. Despite these achievements, the banking sector in China is faced with ________challenges, including the high level of ________loans and the need to prepare for greater competition from foreign banks, as China becomes a member of the World Trade Organization. These challenges call for ________efforts on the part of the authorities in institutional building to facilitate greater enforceability of bank claims, faster market infrastructure development and better ownership structure. These efforts have to be accompanied by parallel actions of the banks to improve corporate governance, particularly ________structure and internal controls.1.incentive2.non_performing3.resource4.formidable5.intensifying4. Translation(1) Although banks share many common features with other profit-seeking businesses, they play a unique role in the economy through mobilizing savings, allocating capital funds to finance productive investment,transmitting monetary policy, providing a payment system and transforming risks.尽管银行与其他以盈利为目的的企业具有许多共同的特征,但它在国民经济中还发挥着特殊的作用。

考研英语经济类阅读理解及答案解析考研,除了做教育类的英语阅读理解之外,还可以做做经济类型的。

下面是店铺给大家整理的考研英语经济类阅读理解及答案,供大家参阅!考研英语经济类阅读理解及答案:SALLIE KRAWCHECK CEO of Citigroup's new Smith Barney unitAS A TRACK STAR in high school, Sallie Krawcheck ranked among her state's best at the high jump. But she hasn't jumped for anyone since, and her unshakable independence has propelled her career on Wall Street to heights unimaginable to a girl coming of age in Charleston, S.C., in the 1970s. Then, Krawcheck--always an outstanding student--thought mostly of cheerleading and "dating the coolest boy," she acknowledges. "She was in danger of becoming terminally cute," recalls her high school guidance counselor, Nancy Wise, who recognized Krawcheck's potential early and stoked her business ambitions. Today Krawcheck, 37, is one of the most powerful women in the corporate world and a rising star.How far she climbs depends on how well she meets her latest challenge: closing the credibility gap at financial-services giant Citigroup, after government inquiries put a cloud over the firm's reputation--and its stock. Krawcheck was hired in October from the independent stock-research firm Sanford C. Bernstein (where she was CEO) to be Citi's designated savior. Citigroup's proud CEO, Sanford Weill, personally wooed her, reorganizing a large chunk of Citi around her. Krawcheck is now CEO of a reconstituted Smith Barney, which encompasses Citi's stock-research and retail-brokerage operations.This large stage leaves Krawcheck outwardly undaunted.She's relaxed and confident, with a self-deprecating sense of humor. She says she's "incredibly insecure," and has had nightmares in which she fails to win the respect of her new colleagues. But this soft-spoken humility belies a toughness present from the start. Daughter of a lawyer and sister of three more, Krawcheck learned early on to substantiate her assertions--or keep quiet."It used to get quite interesting around the dinner table," says her father Lenny, who practices law in Charleston. "Politics, relationships--you name it. It was every man for himself and awful tough to make your point." Jokes Sallie: "None of us could get a friend to come over for dinner."Krawcheck earned a journalism degree from the University of North Carolina and an M.B.A. from Columbia University. She went to work at Salomon Brothers but soon moved to Donaldson, Lufkin & Jenrette, where she met her husband Gary Appel. In 1994 Krawcheck moved to Bernstein and dived into stock research. She began covering financial-services firms in 1997 and immediately became the most influential analyst in that field. During those years, Krawcheck earned Weill's ire--and respect when she was later proved correct--by dwelling on the pitfalls of Weill's acquisition of Salomon~~~~~~~~By Daniel Kadlec Time; 12/2/2002, Vol. 160 Issue 23, p52, 1/2p, 1c注(1):本文选自Time; 12/2/2002, p52, 1/2p, 1c;注(2):本文习题命题模仿对象2003年真题Text 2;1. The author begins his article by __________.[A]making a comparison[B]posing a contrast[C]justifying an assumption[D]explaining a phenomenon2. Krawcheck was chosen the CEO of the Smith Barney because ___________.[A]the CEO of the Citigroup trusted her[B]she was thought to be able to save Citigroup out of trouble[C]she has wonderful experience in this field[D]she is the new rising star3. Krawcheck’s success depends on ___________.[A]how well she can regain the firm’s reputation[B]how well she can save the firm’s credibility crisis[C]how well she can raise the firm’s stock[D]how well she can fulfill her own plan and aim4. The previous days Krawcheck spent at home are mentioned to show that __________.[A] Krawcheck knows well how to prove her ideas[B] family members are always on different sides.[C]there is an air of freed om at Krawcheck’s home[D]they have a variety of topics at dinner5.From the text we learn that Krawcheck is ___________.[A]humorous[B]soft-hearted[C]sensitive[D]strong-minded答案:ABBAD篇章剖析本文记述了萨利•克劳切克成功的职业生涯。

金融专业英语阅读(答案)Chapter OneMonetary Policy(货币政策) …………………………………Chapter TwoForeign Exchange Risk andWhy It Should Be Managed(外汇风险和进行外汇管理的原因)………………………………………Chapter ThreeTools and Techniques forThe Management of Foreign Exchange Risk(控制外汇风险的工具和方法) …………………………………Chapter FourU.S. Foreign ExchangeIntervention(美国对外汇交易的干预) …………………………………Chapter FiveHistory of Accounting(会计的历史起源) …………………………………Chapter SixAccounting and Bookkeeping(会计和簿记) …………………………………Chapter SevenFinancial Markets and Intermediaries(金融市场和中间业务) …………………………………Chapter EightHistory of Insurance(保险的历史起源) …………………………………Chapter NineInsurance Policy(保险单) …………………………………Chapter TenBank for International Settlements(国际清算银行) …………………………………Chapter ElevenCommercial Bank Lending(商业银行借贷) …………………………………Chapter TwelveCredit Analysis(信贷分析) …………………………………Chapter ThirteenWhat Kind of Mortgage Loan Should You Get?(何种抵押贷款更适合你?) …………………………………Chapter FourteenMutual Fund(共同基金) …………………………………Chapter FifteenBonds(债券) …………………………………Chapter SixteenOptions(期权) …………………………………Chapter OneMonetary Policy货币政策Answers:Multiple choices1.D2.B3.C4.C5.ATrue or False1.F2.T3.F4.T5.F6.TRead the following text and choose the best sentences for A to E below to fill in each of the gaps in text1. E2. B3. D4. A5. CCloseEmployment, demand, fiscal policy tools, monetary policy, central bank, interest rates, "stable" prices, inflation, "federal funds" rate, open market operationsTranslation:Translate the following passage into Chinese1.紧缩性货币政策和扩张性货币政策都涉及到改变一个国家的货币供应量水平。

扩张性货币政策增加货币供应量,而紧缩性货币政策会减少货币供应量。

2.当联邦储备体系在公开市场上购买有价证券,会引起证券价格上涨。

债券价格和利率成反比关系。

联邦贴现率就是一种利率,因此降低联邦利率实际上就是降低利率。

如果联邦储备系统决定降低法定储备要求,那么银行能够进行投资的资金会增加。

这会引起投资比如债券价格的上涨,因此利率会降低。

无论联邦储备体系用何种方法来增加货币供应量,利率都会降低,债券价格会上涨。

Translate the following sentences into English1. China would maintain a stable currency and prudent monetary policy, and expected to stay within its growth and inflation targets this year2.China would also maintain a prudent monetary policy to support economic development while preventing inflationary pressure and financial risks3. China’s economy continued to grow steadily and rapidly in the first quarter,with investment in fixed assets slowing and domestic consumption accelerating.4.because of China’s large increase in its trade surplus and foreign exchange reserves in the first quarter, the effectiveness of its monetary policy — used to help control inflation — was facing “serious challenges.”5. The central bank would seek to further streamline its foreign exchange system to facilitate the orderly outflow of funds. At the same time, it would tighten the management of foreign exchange inflows and settlement.Chapter TwoForeign Exchange Risk and Why It Should Be Managed外汇风险和进行外汇管理的原因Answers:Multiple choices1 d, 2,d 3, b 4, d 5,cTrue or False1.T 2,F 3,T 4,F 5,FRead the following text and the best sentences for A to E to fill in each of the gaps in text 1,E 2,C 3,B 4,A 5,DCloseHowever perform for to the extent face expensive patterns devise hedging only nominal reference currency.Translate the following passage into Chinese1.第四,他们说企业没有任何外汇风险,因为企业用美元或日元(所在国的货币)做业务。

但是有一点很清楚,即使你用美元支付德国客户,当马克贬值,你的价格必须作调整,否则你的价格就会比当地的竞争者低。

2.再说,股票持有者持有不同的债券,认为一个企业的外汇汇率变化的负面作用可以用其他企业的盈利挽回。

换句话说,汇率风险是可变化的,如果是这样,可能它就不是风险。

Translate the following sentences into English1. exchange risk is simple in concept: a potential gain or loss that occurs as a result of an exchange rate change.2. risk is not a risk if it is anticipated. In most currencies there are futures or forward exchange contracts whose prices give firm an indication of where the market expects currencies to go.3. It is generally agreed that leverage shields the firm from taxes, because interest is tax deductible whereas dividends are not.4. They consider any use of risk management tools, such as forwards, futures and options, as speculative. Or they argue that such financial manipulations lie outside the firm’s field of expertise.They say that thee firm is hedged. All transactions such as imports and exports are covered, and foreign subsidiaries fiancé in local currencies.Chapter ThreeTools and Techniques for the Management of Foreign Exchange Risk控制外汇交易风险的工具和方法Answers:Multiple choices1. D2. C.3. A.4. D.5. C.True or False1. T2. F3. F4. T5. F.6. TRead the following text and choose the best sentences for A to E below to fill in each of the gaps in text1. C2. D3. E4. A5. BClosehedge, interest differential, futures, denominating, debt, exposed, logical, ends up, costly, advantageousTranslation:Translate the following passage into Chinese外汇交易当然是指两种不用货币之间的交易了。