对外经济贸易大学国际经济贸易学院固定收益证券部分答案

- 格式:docx

- 大小:30.70 KB

- 文档页数:7

第一单元选择题1 投资者持有证券是为了取得收益,但持有证券也要冒得不到收益甚至损失的风险。

所以,收益是对风险的补偿,风险与收益成()关系。

A. 正比B. 反比C. 不相关D. 线性2 很多情况下人们往往把能够带来报酬的支出行为称为()。

A. 支出B. 储蓄C. 投资D. 消费3 证券按其性质不同,可以分为()A. 凭证证券和有价证券B. 资本证券和货券C. 商品证券和无价证券D. 虚拟证券和有价证券4 证券投资通过投资于证券将资金转移到企业部门,因此通常又被称为()。

A. 间接投资B. 直接投资C. 实物投资D. 以上都不正确5 直接投融资的中介机构是()A. 商业银行B. 信托投资公司C. 投资咨询公司D. 证券经营机构6 由于()的作用,投资者不再满足投资品种的单一性,而希望建立多样化的资产组合。

A. 边际收入递减规律B. 边际风险递增规律C. 边际效用递减规律D. 边际成本递减规律7 广义的有价证券包括()、货币证券和资本证券。

A. 商品证券B. 凭证证券C. 权益证券D. 债务证券8 有价证券是()的一种形式。

A. 商品证券B. 权益资本C. 虚拟资本D. 债务资本9 证券按发行主体不同,可分为公司证券、()、政府证券和国际证券。

A. 银行证券B. 保险公司证券C. 投资公司证券D. 金融机构证券1 0证券持有者可以获得一定数额的收益,这是投资者转让资金使用权的报酬。

此收益的最终源泉是()B. 利息或红利C. 生产经营过程中的价值增值D. 虚拟资本价值第一单元是非题1 证券的最基本特征是法律特征和书面特征。

√2 有价证券是指无票面金额,证明持券人有权按期取得一定收入并可自由转让和买卖的所有权或债权证券货币证券是指本身能使持券人或第三者取得货币索取权的有价证券。

有价证券是虚拟资本的一种形式,能给持有者带来收益。

有价证券本身没有价值,所以没有价格。

×3 √4 √5 ×6 持有有价证券可以获得一定数额的收益,这种收益只有通过转让有价证券才能获得。

第一章概览1、如何理解固定收益证券?固定收益证券是指其发行人未来向其持有人支付的货币流量将符合某种合约规定的证券。

(1)代表了其持有人的一种权利;(2)发行人未来要支付一定的货币流量;(3)发行人未来支付的货币流量要符合某种合约约定;(4)发行人未来支付的货币流量并不一定是固定不变的。

2、固定收益证券有哪些种类?(1)债务证券类;(2)股权证券类的优先股;(3)资产证券化类。

3、债券的特征体现在哪些方面?(1)偿还性;(2)收益性;(3)安全性;(4)流动性。

4、说明债券与股票的联系与区别。

(1)联系:债券与股票都属于有价证券、债券与股票都是筹措资金的手段、债券和股票的收益率互相影响;(2)区别:债券与股票的权利体现不同的关系、债券与股票的发行目的不完全相同、债券与股票的期限有着不同的属性、债券与股票的债息或股息收益情况存在差异、债券与股票的风险水平不同。

5、说明债券的完整过程。

6、债券可以如何分类?第二章债券发行和偿还1、说明债券发行方式的种类。

(1)直接发行是指债券发行人不依靠中介机构,自己直接向债券认购人出售债券。

间接发行是指债券发行人依靠中介机构的帮助,由中介机构来代理完成债券发行事宜。

(2)公开募集是指债券向全社会公开发行,一般不具体指定债券发行对象或者对债券发行对象做过多的限制。

私下募集是指债券不向全社会公开发行,而是只允许特定类别的投资者承购债券。

(3)竞价发行是指由代表债券认购人方面的竞价人通过一定的竞价程序来决定债券发行价格的方式。

定价发行是指由债券发行人单方面确定债券发行价格、而后由债券认购人认购的方式。

2、债券主要的发行方式有哪些?(1)承购包销法,是指债券发行人与债券承销人签订承购包销合同,由债券承销人负责其所承受的债券发行的销售任务。

(2)招标发行法,是指债券发行人先不规定债券发行价格(或其他某一债券发行条件),由投标人直接竞价,然后发行人根据投标所产生的结果来发行债券。

对外经济贸易大学国际经济贸易学院固定收益证券部分答案Company number:【0089WT-8898YT-W8CCB-BUUT-202108】国际经济贸易学院研究生课程班《固定收益证券》试题1)Explain why you agree or disagree with the following statement: “The price of a floater will always trade at its par value.”Answer:I disagree with the statement: “The price of a floater will always trade at its par value.” First, the coupon rate of a floating-rate security (or floater) is equal to a reference rate plus some spread or margin. For example, the coupon rate of a floater can reset at the rate on a three-month Treasury bill (the reference rate) plus 50 basis points (the spread). Next, the price of a floater depends on two factors: (1) the spread over the reference rate and (2) any restrictions that may be imposed on the resetting of the coupon rate. For example, a floater may have a maximum coupon rate called a cap or a minimum coupon rate called a floor. The price of a floater will trade close to its par value as long as (1) the spread above the reference rate that the market requires is unchanged and (2) neither the cap nor the floor is reached. However, if the market requires a larger (smaller) spread, the price of a floater will trade below (above) par. If the coupon rate is restricted from changing to the reference rate plus the spread because of the cap, then the price of a floater will trade below par.2) A portfolio manager is considering buying two bonds. Bond A matures in three years and has a coupon rate of 10% payable semiannually. Bond B, of the same credit quality, matures in 10 years and has a coupon rate of 12% payable semiannually. Both bonds are priced at par.(a) Suppose that the portfolio manager plans to hold the bond that is purchased for three years. Which would be the best bond for the portfolio manager to purchaseAnswer:The shorter term bond will pay a lower coupon rate but it will likely cost less for a given market the bonds are of equal risk in terms of creit quality (The maturity premium for the longer term bond should be greater),the question when comparing the two bond investments is:What investment will be expecte to give the highest cash flow per dollar investedIn other words,which investment will be expected to give the highest effective annual rate of general,holding the longer term bond should compensate the investor in the form of a maturity premium and a higher expected ,as seen in the discussion below,the actual realized return for either investment is not known with certainty.To begin with,an investor who purchases a bond can expect to receive a dollar return from(i)the periodic coupon interest payments made be the issuer,(ii)an capital gain when the bond matures,is called,or is sold;and (iii)interest income generated from reinvestment of the periodic cash last component of the potential dollar return is referred to as reinvestment a standard bond(our situation)that makes only coupon payments and no periodic principal payments prior to the maturity date,the interim cash flows are simply the coupon ,for such bonds the reinvestment income is simply interest earned from reinvesting the coupon interest these bonds,the third component of the potential source of dollar return is referred to as the interest-on-interest components.If we are going to coupute a potential yield to make a decision,we should be aware of the fact that any measure of a bond’s potential yield should take into consideration each of the three components described current yield considers only the coupon interest consideration is given to any capital gain or interest on yield to maturity takes into account coupon interest and any capital also considers the interest-on-interest ,implicit in the yield-to-maturity computation is the assumption that the coupon payments can be reinvested at the computed yield to yield to maturity is a promised yield and will be realized only if the bond is held to maturity and the coupon interest payments are reinvested at the yield to the bond is not held to maturity and the coupon payments are reinvested at the yield to maturity,then the actual yield realized by an investor can be greater than or less than the yield to maturity.Given the facts that(i)one bond,if bought,will not be held to maturity,and(ii)the coupon interest payments will be reinvested at an unknown rate,we cannot determine which bond might give the highest actual realized ,we cannot compare them based upon this ,if the portfolio manager is risk inverse in the sense that she or he doesn’t want to buy a longer term bond,which will likel have more variability in its return,then the manager might prefer the shorter term bond(bondA) of thres bond also matures when the manager wants to cash in the ,the manager would not have to worry about any potential capital loss in selling the longer term bond(bondB).The manager would know with certainty what the cash flowsThese cash flows are spent when received,the manager would know exactly how much money could be spent at certain points in time.Finally,a manager can try to project the total return performance of a bond on the basis of the panned investment horizon and expectations concerning reinvestment rates and future market ermits the portfolio manager to evaluate thich of several potential bonds considered for acquisition will perform best over the planned investment we just rgued,this cannot be done using the yield to maturity as a measure of relative total return to assess performance over some investment horizon is called horizon a total return is calculated oven an investment horizon,it is referred to as a horizon horizon analysis framwor enabled the portfolio manager to analyze the performance of a bond under different interest-rate scenarios for reinvestment rates and future market by investigating multiple scenarios can the portfolio manager see how sensitive the bond’s performance will be to each can help the manager choose between the two bond choices.(b) Suppose that the portfolio manager plans to hold the bond that is purchased for six years instead of three years. In this case, which would be the best bond for the portfolio manager to purchaseAnswer:Similear to our discussion in part(a),we do not know which investment would give the highest actual relized return in six years when we consider reinvesting all cash the manager buys a three-year bond,then there would be the additional uncertainty of now knowing what three-year bond rates would be in three purchase of the ten-year bond would be held longer than previously(six years compared to three years)and render coupon payments for a six-year period that are these cash flows are spent when received,the manager will know exactly how much money could be spent at certain points in timeNot knowing which bond investment would give the highest realized return,the portfolio manager would choose the bond that fits the firm’s goals in terms of maturity.3) Answer the below questions for bonds A and B.Bond A Bond BCoupon8%9%8%8%Yield tomaturityMaturity25(years)Par$$Price$$(a) Calculate the actual price of the bonds for a 100-basis-point increase in interest rates. Answer:For Bond A, we get a bond quote of $100 for our initial price if we have an 8% coupon rate and an 8% yield. If we change the yield 100 basis point so the yield is 9%, then the value of the bond (P) is the present value of the coupon payments plus the present value of the par value. We have C = $40, y = %, n = 4, and M = $1,000. Inserting these numbers into our present value of coupon bond formula, we get:The present value of the par or maturity value of $1,000 is:Thus, the value of bond A with a yield of 9%, a coupon rate of 8%, and a maturity of 2 years is: P = $ + $ = $. Thus, we get a bond quote of $. We already know that bond B will give a bond value of $1,000 and a bond quote of $100 since a change of 100 basis points will make the yield and coupon rate the same, For example, inserting Thus, the value of bond A with a yield of 9%, a coupon rate of 8%, and a maturity of 2 years is: P = $ + $ = $. Thus, we get a bond quote of $. We already know that bond B will give a bond value of $1,000 and a bond quote of $100 since a change of 100 basis points will make the yield and coupon rate the same, For example, inserting(b) Using duration, estimate the price of the bonds for a 100-basis-point increase in interest rates.Answer:To estimate the price of bond A, we begin by first computing the modified duration. We can use an alternative formula that does not require the extensive calculations required by the Macaulay procedure. The formula is:Putting all applicable variables in terms of $100, we have C = $4, n = 4, y = , and P = $. Inserting these values, in the modified duration formula gives:($1,[] + $ / $ = ($ + $ / $ = $ / $ = or about . Converting to annual number by dividing by two gives a modified duration of (before the increase in 100 basis points it was . We next solve for the change in price using the modified duration of and dy = 100 basis points = . We have: We can now solve for the new price of bond A as shown below:This is slightly less than the actual price of $. The difference is $ – $ = $. To estimate the price of bond B, we follow the same procedure just shown for bond A. Using the alternative formula for modified duration that does not require the extensive calculations required by the Macaulay procedure and noting that C = $45, n = 10, y = , and P = $100, we get:($ + $0) / $100 = or about (before the increase in 100 basis points it was or about . Converting to an annual number by dividing by two gives a modified duration of (before the increase in 100 basis points it was . We will now estimate the price of bond B using the modified duration measure. With 100 basis points giving dy = and an approximate duration of , we have:Thus, the new price is(1 – $1, = $1, = $.This is slightly less than the actual price of $1,000. The difference is $1,000 – $ = $.(c) Using both duration and convexity measures, estimate the price of the bonds for a 100-basis-point increase in interest rates.Answer:For bond A, we use the duration and convexity measures as given below. First, we use the duration measure. We add 100 basis points and get a yield of 9%. We now have C = $40, y = %, n = 4, and M = $1,000. NOTE. In part (a) we computed the actual bond price and got P = $. Prior to that, the price sold at par (P = $1,000) since the coupon rate and yield were then equal. The actual change in price is: ($ – $1,000) = $ and the actual percentage change in price is: $ / $1,000 = %. We will now estimate the price by first approximating the dollar price change. With 100 basis points giving dy = and a modified duration computed in part (b) of , we have:This is slightly more negative than the actual percentage decrease in price of %. The difference is % – (%) = % + % = %. Using the % just given by the duration measure, the new price for bond A is:This is slightly less than the actual price of $. The difference is $ – $ = $. Next, we use the convexity measure to see if we can account for the difference of %. We have: convexity measure (half years) =2232121212(1)(100/)11(1)(1)(1)n n n d P C Cn n n C y dy P y y y y y P ++⎡⎤⎡⎤+-⎡⎤=--+⎢⎥⎢⎥⎢⎥+++⎣⎦⎣⎦⎣⎦ For bond A, we add 100 basis points and get a yield of 9%. We now have C = $40, y = %, n = 4, and M = $1,000. NOTE. In part (a) we computed the actual bond price and got P = $. Prior to that, the price sold at par (P = $1,000) since the coupon rate and yield were then equal. Expressing numbers in terms of a $100 bond quote, we have: C = $4, y = , n = 4, and P = $. Inserting these numbers into our convexity measure formula gives: convexity measure (half years) =342562$412($4)44(5)(100$4/0.045)1116.93250.045(1.045)0.045(1.045)(1.045)$98.2062y ⎡⎤⎡⎤-=⎡⎤--+=⎢⎥⎢⎥⎢⎥⎣⎦⎣⎦⎣⎦ Adding the duration measure and the convexity measure, we get % + % = %. Recall the actual change in price is: ($ – $1,000) = $ and the actual percentage change in price is: $ / $1,000 = or approximately %. Using the % resulting from both the duration and convexity measures, we can estimate the new price for bond A. We have:Adding the duration measure and the convexity measure, we get % + % = %. Recall the actual change in price is: ($ – $1,000) = $ and the actual percentage change in price is: $ / $1,000 = or approximately %. Using the % resulting from both the duration and convexity measures, we can estimate the new price for bond A. We have:This is slightly more negative than the actual percentage decrease in price of %. The difference is %)-%)=%Using the %just given by the duration measure, the new price for Bond B is:This is slightly less than the actual price of $1,000. This difference is $1,000-$=$We use the convexity measure to see if we can account for the difference of 00594%. We have: For Bond B, 100 basis points are added and get a yield of 9%. We now have C=$45, y=%, n=10, and M=$1,000. Note in part (a), we computed the actual bond price and got P=$1,000 since the coupon rate and yield were then equal. Prior to that, the price sold at P=$1,. Expressing numbers in terms of a $100 bond quote, we have C=$, , n=10 and P=$100.Inserting these numbers into our convexity measure formula gives:The convexity measure (in years)=Note. Dollar Convexity Measure=Convexity Measure (years) times P=($100)=$1,. The percentage price change due to convexity is 21()2dP convexity measure dy P = Inserting in the values, we get 21(77.8103)(0.01)0.000974632dP P == Thus, we have % increase in price when we adjust for convexity measure.Adding the duration measure and convexity measure, we get %+% equals %. Recall the actual change in price is ($1,000-$1,=-$ and the actual new price isFor Bond A. This is about the same as the actual price of $1,000. The difference is $1,$1,000=$. Thus, using the convexity measure along with the duration measure has narrowed the estimated price from a difference of -$ to $.(d) Comment on the accuracy of your results in parts b and c, and state why one approximation is closer to the actual price than the other.Answer:For bond A, the actual price is $. When we use the duration measure, we get a bond price of $ that is $ less than the actual price. When we use duration and convex measures together, we get a bond price of $. This is slightly more than the actual price of $. The difference is $ – $ = $. Thus, using the convexity measure along with the duration measure has narrowed the estimated price from a difference of $ to $. For bond B, the actual price is $1,000. When we use the duration measure, we get a bond price of $ that is $ less than the actual price. When we use duration and convex measures together, we get a bond price of $1,. This is slightly more than the actual price of $1,000. The difference is $1, – $1,000 = $. Thus, using the convexity measure along with the duration measure has narrowed the estimated price from a difference of $ to $As we see, using the duration and convexity measures together is more accurate. The reason is that adding the convexity measure to our estimate enables us to include the second derivative that corrects for the convexity of the price-yield relationship. More details are offered below. Duration (modified or dollar) attempts to estimate a convex relationship with a straight line (the tangent line). We can specify a mathematical relationship that provides a better approximation to the price change of the bond if the required yield changes. We do this by using the first two terms of a Taylor series to approximate the price change as follows: Dividing both sides of this equation by P to get the percentage price change gives us:The first term on the right-hand side of equation (1) is equation for the dollar price change based on dollar duration and is our approximation of the price change based on duration. In equation (2), the first term on the right-hand side is the approximate percentage change in price based on modified duration. The second term in equations (1) and (2) includes the second derivative of the price function for computing the value of a bond. It is the second derivative that is used as a proxy measure to correct for the convexity of the price-yield relationship. Market participants refer to the second derivative of bond price function as the dollar convexity measure of the bond. The second derivative divided by price is a measure of the percentage change in the price of the bond due to convexity and is referred to simply as the convexitymeasure.(e) Without working through calculations, indicate whether the duration of the two bonds would be higher or lower if the yield to maturity is 10% rather than 8%.Answer: Like term to maturity and coupon rate, the yield to maturity is a factor that influences price volatility. Ceteris paribus, the higher the yield level, the lower the price volatility. The same property holds for modified duration. Thus, a 10% yield to maturity will have both less volatility than an 8% yield to maturity and also a smaller duration. There is consistency between the properties of bond price volatility and the properties of modified duration. When all other factors are constant, a bond with a longer maturity will have greater price volatility. A property of modified duration is that when all other factors are constant, a bond with a longer maturity will have a greater modified duration. Also, all other factors being constant, a bond with a lower coupon rate will have greater bond price volatility. Also, generally, a bond with a lower coupon rate will have a greater modified duration. Thus, bonds with greater durations will greater price volatilities.4)Suppose a client observes the following two benchmark spreads for two bonds:Bond issue U rated A: 150 basis pointsBond issue V rated BBB: 135 basis pointsYour client is confused because he thought the lower-rated bond (bond V) should offer a higher benchmark spread than the higher-rated bond (bond U). Explain why the benchmark spread may be lower for bond U.5)The bid and ask yields for a Treasury bill were quoted by a dealer as % and %, respectively. Shouldn’t the bid yield be less than the ask yield, because the bid yield indicates how much the dealer is willing to pay and the ask yield is what the dealer is willing to sell the Treasury bill forAnswer:The higher bid means a lower price. So the dealer is willing to pay less than would be paid for the lower ask price. We illustrate this below. Given the yield on a bank discount basis (Yd), the price of a Treasury bill is found by first solving the formula for the dollar discount (D), as follows:The price is then Price = F-DFor the 100-day Treasury bill with a face value (F) of $100,000, if the yield on a bank discount basis (Yd) is quoted as %, D is equal to:Therefore, price = $100,000 – $1, = $98,. For the 100-day Treasury bill with a face value (F) of $100,000, if the yield on a bank discount basis (Yd) is quoted as %, D is equal to:Therefore, price is: P = F – D = $100,000 – $1, = $98,.Thus, the higher bid quote of % (compared to lower ask quote %) gives a lower selling price of $98, (compared to $98,. The % higher yield translates into a selling price that is $ lower. In general, the quoted yield on a bank discount basis is not a meaningful measure of the return from holding a Treasury bill, for two reasons. First, the measure is based on a face-value investment rather than on the actual dollar amount invested. Second, the yield is annualized according to a 360-day rather than a 365-day year, making it difficult to compare Treasury bill yields with Treasury notes and bonds, which pay interest on a 365-day basis. The use of 360 days for a year is a money market convention for some money market instruments, however. Despite its shortcomings as a measure of return, this is the method that dealers have adopted toquote Treasury bills. Many dealer quote sheets, and some reporting services, provide two other yield measures that attempt to make the quoted yield comparable to that for a coupon bond and other money market instruments.6)What is the difference between a cash-out refinancing and a rate-and-term refinancingAnswer:When a lender is evaluating an application from a borrower who is refinancing, the loan-to-value ratio (LTV) is dependent upon the requested amount of the new loan and the market value of the property as determined by an appraisal. When the loan amount requested exceeds the original loan amount, the transaction is referred to as a cash-out-refinancing. If instead, there is financing where the loan balance remains unchanged, the transaction is said to be a rate-and-term refinancing or no-cash refinancing. That is, the purpose of refinancing the loan is to either obtain a better note rate or change the term of the loan.7) Describe the cash flow of a mortgage pass-through security.Answer:The cash flow of a mortgage pass-through security depends on the cash flow of the underlying cash flow consists of monthly mortgage payments representing interest,the scheduled repayment of principal,and any prepayments.Payments are made to security holders each theamount nor the timing,however,of the cash flow from the pool of mortgages is identical to that of the cash flow passed through to investors. The monthly cash flow for a pass-through is less than the monthly cash flow of the underlying mortgages by an amount equal to servicing and other other fees are those charged by the issuer or guarantor of the pass-through for guaranteeing the coupon rage on a pass-through,called the pass-through coupon rate,is less than the mortgage rage on the underlying pool of mortgage loans by an amount equal to the servicing and guaranteeing feesThe timing of the cash flow,like the amount of the cash flow,is also monthly mortgage payment is due from each mortgagor on the first day of each month,but there is a delay in passing through the corresponding monthly cash flow to the length of the delay varies by the type of pass-through security.Because of prepayments,the cash flow of a pass-through is also not known with certainty.。

投资学_对外经济贸易大学中国大学mooc课后章节答案期末考试题库2023年1.APT假设证券回报率是由因素模型生成,而且能够具体确定因素。

参考答案:错误2.根据指数模型,两个证券之间的协方差是______。

参考答案:由同一个因素,即市场指数的收益率对它们的影响决定的3.根据套利定价理论,一只股票的均衡收益与_____相关。

参考答案:承担的系统风险4.一个成功的公司(如苹果公司)长期获得巨额利润,这与有效市场假说是相违背的。

参考答案:错误5.对于公平赌博:参考答案:严格风险厌恶者不会参与_严格风险喜好的投资者会参与6.根据套利定价理论,对于充分分散化的组合,从风险-收益关系的角度____。

参考答案:为使市场达到均衡,只有因素风险需要风险溢价_均衡时只有系统风险与期望收益有关_只有套利者存在并充分套利,才能实现该组合的风险-收益均衡关系7.假设证券的收益率有一个单因素模型生成,某投资者拥有一个组合的具体特征如下:证券A,B,C的期望收益分别为0.2,0.1和0.05;因素敏感度分别为2.0,3.5和0.5;初始投资比列分别为0.2,0.4和0.4。

根据上述特征,该投资者发现能够用证券A,B,C构成套利组合,于是决定通过“增加原有组合中A的持有比例,并相应的减少B和C的持有比例的方法来进行套利。

假定该投资者原有组合中A的持有比例增加0.2,计算B和C的投资比例将如何调整?参考答案:将A的持股比例提高到0.4;将B和C的持股比例都减少到0.3_三种证券的权重调整之和为08.考虑多因素APT模型,有两个独立的经济因素,F1和F2,无风险利率为6%。

A、B是充分分散风险的两个资产组合,A组合对F1和F2的因素敏感度分别为1.0和2.0;B组合对F1和F2的因素敏感度分别为2.0和0.0;它们的期望收益分别为0.19和0.12。

假设市场不存在套利机会,则F1的因素组合的风险溢价和F2的因素组合的风险溢价应为下面哪两个答案____。

第1章固定收益证券概述1.固定收益证券与债券之间是什么关系?解答:债券是固定收益证券的一种,固定收益证券涵盖权益类证券和债券类产品,通俗的讲,只要一种金融产品的未来现金流可预期,我们就可以将其简单的归为固定收益产品。

2.举例说明,当一只附息债券进入最后一个票息周期后,会否演变成一个零息债券?解答:可视为类同于一个零息债券。

3.为什么说一个正常的附息债券可以分拆为若干个零息债券?并给出论证的理由。

解答:在不存在债券违约风险或违约风险可控的前提下,可以将附息债券不同时间点的票面利息视为零息债券。

4.为什么说国债收益率是一国重要的基础利率之一。

解答:一是国债的违约率较低;二是国债产品的流动性在债券类产品中最好;三是国债利率能在一定程度上反映国家货币政策的走向,是衡量一国金融市场资金成本的重要参照。

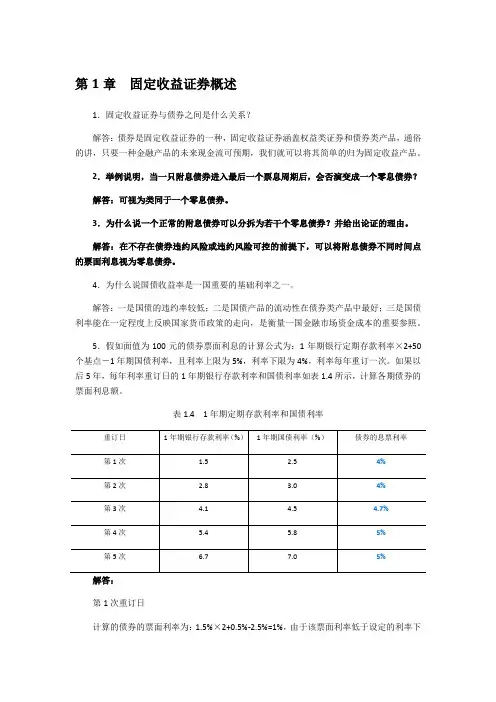

5.假如面值为100元的债券票面利息的计算公式为:1年期银行定期存款利率×2+50个基点-1年期国债利率,且利率上限为5%,利率下限为4%,利率每年重订一次。

如果以后5年,每年利率重订日的1年期银行存款利率和国债利率如表1.4所示,计算各期债券的票面利息额。

表1.4 1年期定期存款利率和国债利率解答:第1次重订日计算的债券的票面利率为:1.5%×2+0.5%-2.5%=1%,由于该票面利率低于设定的利率下限,所以票面利率按利率下限4%支付。

此时,该债券在1年期末的票面利息额为100×4%=4元第2次重订日计算的债券的票面利率为:2.8%×2+0.5%-3%=3.1%,由于该票面利率低于设定的利率下限,所以票面利率仍按利率下限4%支付。

此时,该债券在2年期末的票面利息额为100×4%=4元第3次重订日计算的债券的票面利率为:4.1%×2+0.5%-4.5%=4.2%,由于该票面利率介于设定的利率下限和利率上限之间,所以票面利率按4.7%支付。

此时,该债券在3年期末的票面利息额为100×4.2%=4.2元第4次重订日计算的债券的票面利率为:5.4%×2+0.5%-5.8%=5.5%,由于该票面利率高于设定的利率上限,所以票面利率按利率上限5%支付。

公司金融(对外经济贸易大学)智慧树知到课后章节答案2023年下对外经济贸易大学对外经济贸易大学第一章测试1.以下哪个选项是被定义为对公司长期投资的管理()答案:资本预算2.发行额外股份的决定与以下哪个选项最相关?()答案:资本结构的相关决定3.以下哪个选项表示现金流出企业?(1). 证券发行(2). 支付股利(3). 新的贷款收益(4). 支付税款(2)和(4)4.由两人或以上的个人成立公司,并且成立人对公司所有的债务承担无限责任,这种企业组织形式被称为:()答案:普通合伙制企业5.以下哪个选项是正确的()答案:独资企业和合伙制企业都是按照个人所得的征税标准征税第二章测试1.今天你在你的本地银行的存款账户中存入了100美元。

以下哪个选项表示你的这项投资从现在开始,一年之后的价值?()答案:终值2.terry正在计算一项他下一年将要收到的奖金的现值。

这一计算的过程称为()折现3.这个下午,你往退休存款账户中存入1000美元。

这一账户能够获得的利息以6%的利率复合增长。

在你退休之前的40年里,你将不会取出任何本金或利息。

以下哪个选项是正确的?()答案:这项投资的现值是10004.在9.25%的年化利率下,时限23年,复利计算,6200美金的投资的终值是多少?()答案:47433.475.你从奶奶那儿收到了3000现金作为礼物。

你决定将这笔钱存入银行,从而能够在50年后为你的孙子发送礼物。

在8.5%的利率条件下,你最终可以得到的金额,比8%的利率条件下多多少?()答案:36554.11第三章测试1. Mary买了一份债券,每年她可以获得60美元的利息收入。

这60美元对应的公司金融的概念是什么?答案:利息2.发行人可以自主决定是否提前进行偿还的债券称之为:答案:可赎回债券3.债券的市场售价大于其票面价值。

那么这种债券有以下哪些特点?(1)折价债券(2)溢价债券(3)到期收益率大于票面利率(4)到期收益率小于票面利率答案:(2)和(4)4.以下哪个选项是正确的答案:其他条件保持不变,仅仅缩短债券的期限,零息债券的市场价格将上升5.Green Roof Inns正准备发行债券,拟定的利率是6%,半年付一次息,面值1000美元。

投资学(对外经济贸易大学)知到章节测试答案智慧树2023年最新第一章测试1.现代金融理论的发展是以()为标志。

参考答案:马科维茨的投资组合理论的出现2.资本资产定价模型是()参考答案:威廉夏普提出的3.套利定价模型是()参考答案:利用相对定价法定价的4. ______是金融资产。

参考答案:A和C5._____是基本证券的一个例子参考答案:长虹公司的普通股票6.购买房产是一定是实物投资。

参考答案:错7.金融市场和金融机构能够提供金融产品、金融工具和投资机制,使得资源能够跨期配置。

参考答案:对8.有效市场假说是尤金.法玛于1952年提出的。

参考答案:错9.投资学是学习如何进行资产配置的学科。

参考答案:对10.威廉夏普认为投资具有两个属性:时间和风险。

参考答案:对第二章测试1.公平赌博是:参考答案:A和C均正确2.假设参与者对消费计划a,b和c有如下的偏好关系:请问这与偏好关系的相违背?参考答案:传递性3.某投资者的效用函数为,如果这位投资者为严格风险厌恶的投资者,则参考答案:α<2βy, β<04.某人的效用函数是U(w)=-1/w。

那么他是相对风险厌恶型投资者。

参考答案:递减5.假设图中的所有组合都是公平定价的。

1、股票A,B,C的贝塔因子是多少?参考答案:0 ;1;1.6第三章测试1.马克维茨提出的有效边界理论中,风险的测度是通过_____进行的。

参考答案:收益的标准差2.用来测度两项风险资产的收益是否同向变动的的统计量是____参考答案:c和d3.有关资产组合分散化,下面哪个论断是正确?参考答案:一般来说,当更多的股票加入资产组合中时,整体风险降低的速度会越来越慢4.加入了无风险证券后的最优资产组合____参考答案:是无差异曲线和资本配置线的切点5.现代金融投资理论的开创者是。

参考答案:马柯维兹6.在均值-标准差坐标系中,当资产收益率服从正态分布时,严格风险厌恶型投资者无差异曲线的斜率是参考答案:正7.公平赌博:参考答案:a和b均正确8.按照马克维茨的描述,下面的资产组合中哪个不会落在有效边界上?资产组合期望收益率(%)标准差(%)W 4 2X 6 8Y 5 9Z 8 10参考答案:资产组合Y不会落在有效边界上9.考虑两种完全负相关的风险证券A和B。

第一章测试1.下列属于现金等价物的产品有:()A:资产支持商业票据B:货币基金C:可转债D:10年期国债答案:AB2.以下哪些产品属于固定收益类()A:优先股B:资产支持证券C:普通股D:浮息债答案:ABD3.权益类资产与固定收益类资产在产品结构上的核心结构差别在于()A:固定收益产品约定了未来现金流,股票没有约定未来现金流B:固定收益产品有固定的票面利率,股票没有固定利率C:固定收益产品的本金偿还期限是有限的,股票没有还本的概念D:其他三项都对答案:A4.以下套利策略里哪些策略不涉及股票?()A:可转债套利B:信用基差套利C:国债期货套利D:资本结构套利答案:BC5.信用基差套利策略主要关注的是哪些市场间的价格偏差()A:信用债与股票B:不同期限的CDSC:信用债与CDSD:信用债与国债答案:C6.以下套利策略里哪些策略经常关注同一公司的债券与股票之间的定价差异?()A:可转债套利B:资本结构套利C:并购套利D:信用基差套利答案:AB7.关于危困资产投资时机,以下说法哪些是正确的()A:危困资产的投资机会往往出现在经济繁荣期间B:危困资产的退出机会往往出现在经济低迷期间C:危困资产的退出机会往往出现在经济繁荣期间D:危困资产的投资机会往往出现在经济低迷期间答案:CD8.从全球角度看,企业信用评级分布和结构化融资信用评级分布分别最接近于哪种分布?()A:企业信用评级分布接近于以A和BBB为中心的近似对称分布;结构化融资信用评级分布接近于以A和BBB为主的左偏态分布。

B:企业信用评级分布接近于以A和BBB为中心的近似对称分布;结构化融资信用评级分布接近于以AAA为主的左偏态分布。

C:企业信用评级分布接近于以A和BBB为中心的近似对称分布;结构化融资信用评级分布接近于以A和BBB为中心的近似对称分布。

D:企业信用评级分布接近于以AAA为主的左偏态分布;结构化融资信用评级分布接近于以AAA为主的左偏态分布。

《固定收益证券》课后习题参考答案陈蓉 郑振龙北京大学出版社Copyright © 2011 Chen, Rong & Zheng, Zhenlong第一章固定收益证券概述1.如何理解投资固定收益证券所面临的风险?虽然相比股票、期权等投资品,固定收益证券能够提供相对稳定的现金流回报,但投资固定收益证券同样面临一系列潜在风险,包括利率风险、再投资风险、信用风险、流动性风险、通货膨胀风险等。

(一)利率风险利率风险是固定收益证券最重要的风险之一,久期、凸性等指标都是描述利率变化百分比与固定收益证券价格变化百分比之间关系的,这意味着利率的变化能够对固定收益证券价格带来不确定性,这就是利率风险。

(二)再投资风险对于固定收益证券在存续期所收到的现金流,投资者面临着所收现金流的再投资问题,如果市场利率上升或者下降,投资者的收益必定会面临不确定性,这就是再投资风险。

(三)信用风险投资者面临的信用风险分为两类:一类是发行者丧失偿债能力导致的无法按期还本付息和发行者信用等级下降导致的固定收益投资品价格下降;另二类是固定收益衍生品交易对手不履约带来的风险。

(四)流动性风险固定收益证券面临着变现能力强弱的问题,即变现能力强,即投资品的流动性强;变现能力弱,即投资品的流动性弱。

(五)通货膨胀风险固定收益证券的收益率往往是指的名义收益率,所以在固定收益证券的存续期产生的现金流还面临着同期相对购买力变化的不确定性,即通货膨胀风险。

2.“国债是无风险债券。

”这种说法对吗?请以具体案例说明你的观点。

这句话是指国债没有信用风险,其基本含义是说国债到期能保证偿付。

但这并不意味着国债没有市场风险和流动性风险;同时,有时国债也可能有信用风险,例如欧债危机下的希腊国债。

3.如何理解回购交易的融资功能?为什么说回购交易为市场提供了卖空债券的手段?回购就是按约定价格卖出某一证券的同时,约定在未来特定时刻按约定价格将该证券买回。

一.名词解释一般责任债券:指地方政府以其信用承诺支付本息而发行的债券。

一般责任债券并无特定的还款来源,地方政府必须利用税收来偿还本息.金融债券:银行等金融机构作为筹资主体为筹措资金而面向个人发行的一种有价证券,是表明债务、债权关系的一种凭证。

债券按法定发行手续,承诺按约定利率定期支付利息并到期偿还本金.它属于银行等金融机构的主动负债。

资产抵押债券:是以资产(通常是房地产)的组合作为抵押担保而发行的债券,是以特定“资产池(Asset Pool)”所产生的可预期的稳定现金流为支撑,在资本市场上发行的债券工具. 零息债券:零息债券是指以贴现方式发行,不附息票,而于到期日时按面值一次性支付本利的债券。

零息债券发行时按低于票面金额的价格发行,而在兑付时按照票面金额兑付,其利息隐含在发行价格和兑付价格之间。

零息债券的最大特点是避免了投资者所获得利息的再投资风险。

连续复利:如果利率是按年复利,那么投资终值为:A(1+R)N ,如果利率对应一年复利m 次。

则投资终值为::A(1+R/m)Nm,当m趋于无穷大时所对应的利率称为连续复利,在连续复利下,可以证明数量为A的资金投资N年时,投资终值为Aern收益债券:指规定无论利息的支付或是本金的偿还均只能自债券发行公司的所得或利润中拔出的公司债券。

公司若无盈余则累积至有盈余年度始发放,这种债券大多于公司改组或重整时才发生,一般不公开发行.这种债券的利息并不固定,发期有无利润和利润大小而定,如无利润则不付息。

因此,这种债券与优先股类似。

所不同的是优先股无到期日,而它需到期归还本金。

扬基债券:在美国债券市场上发行的外国债券,即美国以外的政府、金融机构、工商企业和国际组织在美国国内市场发行的、以美元为计值货币的债券。

即期利率:借贷交易达成后立即贷款形成的利率称为即期利率。

即期利率是指债券票面所标明的利率或购买债券时所获得的折价收益与债券当前价格的比率。

它是某一给定时点上无息证券的到期收益率。

固定收益证券课后习题答案固定收益证券课后习题答案一、单选题1、【正确答案】 B 【答案解析】固定收益证券是指能够提供固定收益的证券,如债券和存款等。

2、【正确答案】 D 【答案解析】利率风险是指市场利率变动引起固定收益证券价格下降的风险。

3、【正确答案】 A 【答案解析】债券的久期是指债券的利率敏感性程度,用于衡量利率变动对债券价格的影响程度。

二、多选题1、【正确答案】 A、B、C、D 【答案解析】以上选项均为固定收益证券的特点。

2、【正确答案】 A、C 【答案解析】债券的利率风险包括市场风险和信用风险,而市场风险又包括价格风险和利率风险。

3、【正确答案】 A、B、C 【答案解析】债券的到期收益率是指投资者在债券到期前每年能获得的最低收益率,因此,只有在债券按年付息的情况下,债券的到期收益率才能反映投资者的真实收益率。

三、判断题1、【正确答案】错【答案解析】固定收益证券的价格变动与市场利率变动呈反方向变动,即市场利率上升,固定收益证券的价格下降;市场利率下降,固定收益证券的价格上涨。

2、【正确答案】对【答案解析】债券的久期越长,对利率变动的敏感性越强,当市场利率变动时,债券价格变动的幅度也越大。

3、【正确答案】对【答案解析】债券的到期收益率是指投资者在债券到期前每年能获得的最低收益率,因此,只有在债券按年付息的情况下,债券的到期收益率才能反映投资者的真实收益率。

固定收益类理财产品话术引入:在投资理财的领域里,固定收益类理财产品一直备受投资者青睐。

这类产品通常以低风险、稳定收益的特点著称,为投资者提供了一个安全、可靠的资产增值途径。

本文将详细介绍固定收益类理财产品的特点、市场分析、比较优势、投资策略、适用人群以及注意事项,帮助大家更好地了解这类理财产品的魅力。

产品概述:固定收益类理财产品是一种以利率和期限为主要特征的理财工具。

投资者通过购买固定收益类产品,在约定期限内,可以获得固定利率的收益。

这类产品通常包括国债、企业债券、银行定期存款等,风险较低,收益稳定。

固定收益证券 第一章作业 1 解:()22.746%)51/(100031.751%101/100063=+==+=p p 半年复利:年复利:85.740)365/%101/(100074.741)12/%101/(100065.743%)5.21/(100010953612=+==+==+=p p p 天复利:月复利:季复利:82.740/1000)/%101/(10003.03==+=e n p n 连续复利:2解:0885.02000)2/110000905.02000)1(1000168=⇒=+=⇒=+r r r r (半年复利:年复利:0866.02)/1(0867.02365/10870.0212/10876.024/1829209632=⇒=+=⇒=+=⇒=+=⇒=+r n r r r r r r r n 连续利率:)天利率:()月利率:()季复利:(3解:1823.02.1ln %201%200392.004.1ln %41%,4==⇒=+==⇒=+r e r e r r ,年计息:复利年计息:复利1984.0)12/%201ln(12/%201%201952.005.1ln 4/%201%20121244=+=⇒=+==⇒=+r e r e r r )(,月计息:复利)(,季计息:复利4解:应计利息净价全价全价应计利息净价+=⨯++=⨯⨯==+=1841051)2/09125.01(100184/792/09125.010071875.10132/231012x解得: 029911851.0=x 故买入收益率为0.029911851同理 卖出收益率为0.027782327 5解:答:(1)设逆浮动利率债券的利率公式为X 5000*9%=3000*(LIBOR+3%)+2000X 解得X=18%-1.5LIBOR逆浮动利率债券的利率确定公式为18%-1.5 month LIBOR (2)因为0<LIBOR<=12%浮动利率债券的利率=1month LIBOR+3%,故顶为15%,底为3%逆浮动利率债券的利率=18%-1.5monthLIBOR ,故顶为18%,底为0 6 解:5000/100*98.25 =4912.5元所以投资者购买该债券需支付的金额 4912.5元 7 解:浮动利率= LIBOR+1.25%=6.5%+1.25%=7.725%半年支付的利率水平=7.725%/2=3.875%第二章作业1. 设债券的面值是P ,到期收益率为5%时的债券价格为1P ,到期收益率为6%时的债券价格为2P .则123223126%6%6%(15%)(15%)(15%)6%6%6%(16%)(16%)(16%)0.027P P P PP P P P P P P P P +=++++++=+++++-= 即价格下降2.72% 2.54321003%(13%)1003%(13%)1003%(13%)1003%(13%)1003%(13%)1003%100119.4FV =⨯⨯++⨯⨯++⨯⨯++⨯⨯++⨯⨯++⨯+=3、假定某债券面值为100元,期限为3年,票面利率为年6%,一年支付2次利息,投资者购买价格为103元,请计算在再投资收益率为年4%的情况下投资者的年收益率。

第一章固定收益证券简介三、计算题1.如果债券的面值为1000美元,年息票利率为5%,则年息票额为答案:年息票额为5%*1000=50美元。

四、问答题1.试结合产品分析金融风险的基本特征。

答案:金融风险是以货币信用经营为特征的风险,它不同于普通意义上的风险,具有以下特征:客观性. 社会性.扩散性. 隐蔽性2.分析欧洲债券比外国债券更受市场投资者欢迎的原因。

答案:欧洲债券具有吸引力的原因来自以下六方面:1)欧洲债券市场部属于任何一个国家,因此债券发行者不需要向任何监督机关登记注册,可以回避许多限制,因此增加了其债券种类创新的自由度与吸引力。

2)欧洲债券市场是一个完全自由的市场,无利率管制,无发行额限制。

3)债券的发行常是又几家大的跨国银行或国际银团组成的承销辛迪加负责办理,有时也可能组织一个庞大的认购集团,因此发行面广4)欧洲债券的利息收入通常免缴所得税,或不预先扣除借款国的税款。

5)欧洲债券市场是一个极富活力的二级市场。

6)欧洲债券的发行者主要是各国政府、国际组织或一些大公司,他们的信用等级很高,因此安全可靠,而且收益率又较高。

3.请判断浮动利率债券是否具有利率风险,并说明理由。

答案:浮动利率债券具有利率风险。

虽然浮动利率债券的息票利率会定期重订,但由于重订周期的长短不同、风险贴水变化及利率上、下限规定等,仍然会导致债券收益率与市场利率之间的差异,这种差异也必然导致债券价格的波动。

正常情况下,债券息票利率的重订周期越长,其价格的波动性就越大。

三、简答题1.简述预期假说理论的基本命题、前提假设、以及对收益率曲线形状的解释。

答案:预期收益理论的基本命题预期假说理论提出了一个常识性的命题:长期债券的到期收益率等于长期债券到期之前人们短期利率预期的平均值。

例如,如果人们预期在未来5年里,短期利率的平均值为10%,那么5年期限的债券的到期收益率为10%。

如果5年后,短期利率预期上升,从而未来20年内短期利率的平均值为11%,则20年期限的债券的到期收益率就将等于11%,从而高于5年期限债券的到期首。

《固定收益证券》章节练习题第一章固定收益证券简介1、某8年期债券,第1~3年息票利率为6.5%,第4~5年为7%,第6~7年为7.5%,第8年升为8%,该债券就属于()。

A 多级步高债券B 递延债券C 区间债券D 棘轮债券2、风险具有以下基本特征()。

A风险是对事物发展未来状态的看法B风险产生的根源在于事物发展未来状态所具有的不确定性C风险和不确定性在很大程度上都受到经济主体对相关信息的掌握D风险使得事物发展的未来状态必然包含不利状态的成分3、固定收益产品所面临的最大风险是()。

A 信用风险B 利率风险C 收益曲线风险D 流动性风险4、如果债券的面值为1000美元,年息票利率为5%,则年息票额为?5、固定收益市场上,有时也将()称为深度折扣债券。

A 零息债券 B步高债券 C递延债券 D浮动利率债券6、试结合产品分析金融风险的基本特征。

7、分析欧洲债券比外国债券更受市场投资者欢迎的原因。

8、金融债券按发行条件分为()。

A普通金融债券 B 累进利息金融债券 C贴现金融债券 D 付息金融债券9、目前我国最安全和最具流动性的投资品种是()A 金融债B 国债C 企业债D 公司债10、请判断浮动利率债券是否具有利率风险,并说明理由。

第二章债券的收益率1.债券到期收益率计算的原理是()。

A.到期收益率是购买债券后一直持有到期的内含报酬率B.到期收益率是能使债券每年利息收入的现值等于债券买入价格的折现率C.到期收益率是债券利息收益率与资本利得收益率之和D.到期收益率的计算要以债券每年末计算并支付利息、到期一次还本为前提2.下列哪种情况,零波动利差为零?A.如果收益率曲线为平B.对零息债券来说C.对正在流通的财政债券来说D.对任何债券来说3.在纯预期理论的条件下,下凸的的收益率曲线表示:A.对长期限的债券的需求下降B.短期利率在未来被认为可能下降C.投资者对流动性的需求很小D.投资者有特殊的偏好4.债券的收益来源包括哪些?A.利息B.再投资收入C.资本利得D.资本损失。

国际经济贸易学院研究生课程班《固定收益证券》试题1)Explain why you agree or disagree with the following statement: “The price of a floater will always trade at its par value.”Answer:I disagree with the statement: “The price of a floater will always trade at its par value.” First, the coupon rate of a floating-rate security (or floater) is equal to a reference rate plus some spread or margin. For example, the coupon rate of a floater can reset at the rate on a three-month Treasury bill (the reference rate) plus 50 basis points (the spread). Next, the price of a floater depends on two factors: (1) the spread over the reference rate and (2) any restrictions that may be imposed on the resetting of the coupon rate. For example, a floater may have a maximum coupon rate called a cap or a minimum coupon rate called a floor. The price of a floater will trade close to its par value as long as (1) the spread above the reference rate that the market requires is unchanged and (2) neither the cap nor the floor is reached. However, if the market requires a larger (smaller) spread, the price of a floater will trade below (above) par. If the coupon rate is restricted from changing to the reference rate plus the spread because of the cap, then the price of a floater will trade below par.2)A portfolio manager is considering buying two bonds. Bond A matures in three years and has a coupon rate of 10% payable semiannually. Bond B, of the same credit quality, matures in 10 years and has a coupon rate of 12% payable semiannually. Both bonds are priced at par.(a) Suppose that the portfolio manager plans to hold the bond that is purchased for three years. Which would be the best bond for the portfolio manager to purchase?Answer:The shorter term bond will pay a lower coupon rate but it will likely cost less for a given market rate.Since the bonds are of equal risk in terms of creit quality (The maturity premium for the longer term bond should be greater),the question when comparing the two bond investments is:What investment will be expecte to give the highest cash flow per dollar invested?In other words,which investment will be expected to give the highest effective annual rate of return.In general,holding the longer term bond should compensate the investor in the form of a maturity premium and a higher expected return.However,as seen in the discussion below,the actual realized return for either investment is not known with certainty.To begin with,an investor who purchases a bond can expect to receive a dollar return from(i)the periodic coupon interest payments made be the issuer,(ii)an capital gain when the bond matures,is called,or is sold;and (iii)interest income generated from reinvestment of the periodic cash flows.The last component of the potential dollar return is referred to as reinvestment income.For a standard bond(our situation)that makes only coupon payments and no periodic principal payments prior to the maturity date,the interim cash flows are simply the coupon payments.Consequently,for such bonds the reinvestment income is simply interest earned from reinvesting the coupon interest payments.For these bonds,the third component of the potential source of dollar return is referred to as the interest-on-interest components.If we are going to coupute a potential yield to make a decision,we should be aware of the fact that any measure of a bond’s potential yield should take into consideration each of the three components described above.The current yield considers only the coupon interest payments.No consideration is given to any capital gain or interest on interest.The yield to maturity takes into account couponinterest and any capital gain.It also considers the interest-on-interest component.Additionally,implicit in the yield-to-maturity computation is the assumption that the coupon payments can be reinvested at the computed yield to maturity.The yield to maturity is a promised yield and will be realized only if the bond is held to maturity and the coupon interest payments are reinvested at the yield to maturity.If the bond is not held to maturity and the coupon payments are reinvested at the yield to maturity,then the actual yield realized by an investor can be greater than or less than the yield to maturity.Given the facts that(i)one bond,if bought,will not be held to maturity,and(ii)the coupon interest payments will be reinvested at an unknown rate,we cannot determine which bond might give the highest actual realized rate.Thus,we cannot compare them based upon this criterion.However,if the portfolio manager is risk inverse in the sense that she or he doesn’t want to buy a longer term bond,which will likel have more variability in its return,then the manager might prefer the shorter term bond(bondA) of thres years.This bond also matures when the manager wants to cash in the bond.Thus,the manager would not have to worry about any potential capital loss in selling the longer term bond(bondB).The manager would know with certainty what the cash flows are.If These cash flows are spent when received,the manager would know exactly how much money could be spent at certain points in time.Finally,a manager can try to project the total return performance of a bond on the basis of the panned investment horizon and expectations concerning reinvestment rates and future market yields.This ermits the portfolio manager to evaluate thich of several potential bonds considered for acquisition will perform best over the planned investment horizon.As we just rgued,this cannot be done using the yield to maturity as a measure of relative ing total return to assess performance over some investment horizon is called horizon analysis.When a total return is calculated oven an investment horizon,it is referred to as a horizon return.The horizon analysis framwor enabled the portfolio manager to analyze the performance of a bond under different interest-rate scenarios for reinvestment rates and future market yields.Only by investigating multiple scenarios can the portfolio manager see how sensitive the bond’s performance will be to each scenario.This can help the manager choose between the two bond choices.(b) Suppose that the portfolio manager plans to hold the bond that is purchased for six years instead of three years. In this case, which would be the best bond for the portfolio manager to purchase?Answer:Similear to our discussion in part(a),we do not know which investment would give the highest actual relized return in six years when we consider reinvesting all cash flows.If the manager buys a three-year bond,then there would be the additional uncertainty of now knowing what three-year bond rates would be in three years.The purchase of the ten-year bond would be held longer than previously(six years compared to three years)and render coupon payments for a six-year period that are known.If these cash flows are spent when received,the manager will know exactly how much money could be spent at certain points in timeNot knowing which bond investment would give the highest realized return,the portfolio manager would choose the bond that fits the firm’s goals in terms of maturity.3)Answer the below questions for bonds A and B.Bond A Bond BCoupon 8% 9%Yield to maturity 8% 8%Maturity (years) 2 5Par $100.00 $100.00Price $100.00 $104.055(a) Calculate the actual price of the bonds for a 100-basis-point increase in interest rates. Answer:For Bond A, we get a bond quote of $100 for our initial price if we have an 8% coupon rate and an 8% yield. If we change the yield 100 basis point so the yield is 9%, then the value of the bond (P) is the present value of the coupon payments plus the present value of the par value. We have C = $40, y = 4.5%, n = 4, and M = $1,000. Inserting these numbers into our present value of coupon bond formula, we get:The present value of the par or maturity value of $1,000 is:Thus, the value of bond A with a yield of 9%, a coupon rate of 8%, and a maturity of 2 years is: P = $143.501 + $838.561 = $982.062. Thus, we get a bond quote of $98.2062. We already know that bond B will give a bond value of $1,000 and a bond quote of $100 since a change of 100 basis points will make the yield and coupon rate the same, For example, inserting Thus, the value of bond A with a yield of 9%, a coupon rate of 8%, and a maturity of 2 years is: P = $143.501 + $838.561 = $982.062. Thus, we get a bond quote of $98.2062. We already know that bond B will give a bond value of $1,000 and a bond quote of $100 since a change of 100 basis points will make the yield and coupon rate the same, For example, inserting(b) Using duration, estimate the price of the bonds for a 100-basis-point increase in interest rates.Answer:To estimate the price of bond A, we begin by first computing the modified duration. We can use an alternative formula that does not require the extensive calculations required by the Macaulay procedure. The formula is:Putting all applicable variables in terms of $100, we have C = $4, n = 4, y = 0.045, and P = $98.2062. Inserting these values, in the modified duration formula gives:($1,975.308642[0.161439] + $35.664491) / $98.2062 = ($318.89117 + $35.664491) / $98.2062 = $354.555664 / $98.2062 = 3.6103185 or about 3.61. Converting to annual number by dividing by two gives a modified duration of 1.805159 (before the increase in 100 basis points it was 1.814948). We next solve for the change in price using the modified duration of 1.805159 and dy = 100 basis points = 0.01. We have:We can now solve for the new price of bond A as shown below:This is slightly less than the actual price of $982.062. The difference is $982.062 –$981.948 = $0.114. To estimate the price of bond B, we follow the same procedure just shown for bond A. Using the alternative formula for modified duration that does not require the extensive calculations required by the Macaulay procedure and noting that C = $45, n = 10, y = 0.045, and P = $100, we get:($791.27182 + $0) / $100 = 7.912718 or about 7.91 (before the increase in 100 basis points it was 7.988834 or about 7.99). Converting to an annual number by dividing by two gives a modified duration of 3.956359 (before the increase in 100 basis points it was 3.994417). We will now estimate the price of bond B using the modified duration measure. With 100 basis points giving dy = 0.01 and an approximate duration of 3.956359, we have:Thus, the new price is(1 – 0.0395635)$1,040.55 = (0.9604364)$1,040.55 = $999.382.This is slightly less than the actual price of $1,000. The difference is $1,000 – $999.382 = $0.618.(c) Using both duration and convexity measures, estimate the price of the bonds for a 100-basis-point increase in interest rates.Answer:For bond A, we use the duration and convexity measures as given below. First, we use the duration measure. We add 100 basis points and get a yield of 9%. We now have C = $40, y = 4.5%, n = 4, and M = $1,000. NOTE. In part (a) we computed the actual bond price and got P =$982.062. Prior to that, the price sold at par (P = $1,000) since the coupon rate and yield were then equal. The actual change in price is: ($982.062 – $1,000) = $17.938 and the actual percentage change in price is: $17.938 / $1,000 = 0.017938%. We will now estimate the price by first approximating the dollar price change. With 100 basis points giving dy = 0.01 and a modified duration computed in part (b) of 1.805159, we have:This is slightly more negative than the actual percentage decrease in price of 1.7938%. The difference is 1.7938% – ( 1.805159%) = 1.7938% + 1.805159% = 0.011359%. Using the1.805159% just given by the duration measure, the new price for bond A is:This is slightly less than the actual price of $982.062. The difference is $982.062 – $981.948 = $0.114. Next, we use the convexity measure to see if we can account for the difference of 0.011359%. We have: convexity measure (half years) =2232121212(1)(100/)11(1)(1)(1)n n n d P C Cn n n C y dy P y y y y y P ++⎡⎤⎡⎤+-⎡⎤=--+⎢⎥⎢⎥⎢⎥+++⎣⎦⎣⎦⎣⎦ For bond A, we add 100 basis points and get a yield of 9%. We now have C = $40, y = 4.5%, n = 4, and M = $1,000. NOTE. In part (a) we computed the actual bond price and got P = $982.062. Prior to that, the price sold at par (P = $1,000) since the coupon rate and yield were then equal. Expressing numbers in terms of a $100 bond quote, we have: C = $4, y = 0.045, n = 4, and P = $98.2062. Inserting these numbers into our convexity measure formula gives:convexity measure (half years) =342562$412($4)44(5)(100$4/0.045)1116.93250.045(1.045)0.045(1.045)(1.045)$98.2062y ⎡⎤⎡⎤-=⎡⎤--+=⎢⎥⎢⎥⎢⎥⎣⎦⎣⎦⎣⎦ Adding the duration measure and the convexity measure, we get 1.805159% + 0.021166% =1.783994%. Recall the actual change in price is: ($982.062 – $1,000) = $17.938 and the actual percentage change in price is: $17.938 / $1,000 = −0.017938 or approximately 1.7938%. Using the 1.783994% resulting from both the duration and convexity measures, we can estimate the new price for bond A. We have:Adding the duration measure and the convexity measure, we get 1.805159% + 0.021166% =1.783994%. Recall the actual change in price is: ($982.062 – $1,000) = $17.938 and the actual percentage change in price is: $17.938 / $1,000 = −0.017938 or approximately 1.7938%. Using the 1.783994% resulting from both the duration and convexity measures, we can estimate the new price for bond A. We have:This is slightly more negative than the actual percentage decrease in price of -3.896978%. The difference is (-3.896978%)-(-3.95635%)=0.059382%Using the -3.95635%just given by the duration measure, the new price for Bond B is:This is slightly less than the actual price of $1,000. This difference is $1,000-$999.382=$0.618 We use the convexity measure to see if we can account for the difference of 00594%. We have: For Bond B, 100 basis points are added and get a yield of 9%. We now have C=$45, y=4.5%, n=10, and M=$1,000. Note in part (a), we computed the actual bond price and got P=$1,000 since the coupon rate and yield were then equal. Prior to that, the price sold at P=$1,040.55. Expressing numbers in terms of a $100 bond quote, we have C=$4.5, y-0.045, n=10 and P=$100. Inserting these numbers into our convexity measure formula gives:The convexity measure (in years)=Note. Dollar Convexity Measure=Convexity Measure (years) times P=19.452564($100)=$1,945.2564.The percentage price change due to convexity is 21()2dP convexity measure dy P = Inserting in the values, we get 21(77.8103)(0.01)0.000974632dP P == Thus, we have 0.097463% increase in price when we adjust for convexity measure.Adding the duration measure and convexity measure, we get -3.9563659%+0.097263% equals -3.859096%. Recall the actual change in price is ($1,000-$1,040.55)=-$40.55 and the actual new price isFor Bond A. This is about the same as the actual price of $1,000. The difference is $1,000.394-$1,000=$0.394. Thus, using the convexity measure along with the duration measure has narrowed the estimated price from a difference of -$0.618 to $0.394.(d) Comment on the accuracy of your results in parts b and c, and state why one approximation is closer to the actual price than the other.Answer:For bond A, the actual price is $982.062. When we use the duration measure, we get a bond price of $981.948 that is $0.114 less than the actual price. When we use duration and convex measures together, we get a bond price of $982.160. This is slightly more than the actual price of $982.062. The difference is $982.160 – $982.062 = $0.098. Thus, using the convexity measure along with the duration measure has narrowed the estimated price from a difference of $0.114 to $0.0981. For bond B, the actual price is $1,000. When we use the duration measure, we get a bond price of $999.382 that is $0.618 less than the actual price. When we use duration and convex measures together, we get a bond price of $1,000.394. This is slightly more than the actual price of $1,000. The difference is $1,000.394 – $1,000 = $0.394. Thus, using the convexity measure along with the duration measure has narr owed the estimated price from a difference of −$0.618 to $0.394 As we see, using the duration and convexity measures together is more accurate. The reason is that adding the convexity measure to our estimate enables us to include the second derivative that corrects for the convexity of the price-yield relationship. More details are offered below. Duration (modified or dollar) attempts to estimate a convex relationship with a straight line (the tangent line). We can specify a mathematical relationship that provides a better approximation to the price change of the bond if the required yield changes. We do this by using the first two terms of a Taylor series to approximate the price change as follows:Dividing both sides of this equation by P to get the percentage price change gives us:The first term on the right-hand side of equation (1) is equation for the dollar price change based on dollar duration and is our approximation of the price change based on duration. In equation (2), the first term on the right-hand side is the approximate percentage change in price based on modified duration. The second term in equations (1) and (2) includes the second derivative of the price function for computing the value of a bond. It is the second derivative that is used as a proxy measure to correct for the convexity of the price-yield relationship. Market participants refer to the second derivative of bond price function as the dollar convexity measure of the bond. The second derivative divided by price is a measure of the percentage change in the price of the bond due to convexity and is referred to simply as the convexity measure.(e) Without working through calculations, indicate whether the duration of the two bonds would be higher or lower if the yield to maturity is 10% rather than 8%.Answer: Like term to maturity and coupon rate, the yield to maturity is a factor that influences price volatility. Ceteris paribus, the higher the yield level, the lower the price volatility. The sameproperty holds for modified duration. Thus, a 10% yield to maturity will have both less volatility than an 8% yield to maturity and also a smaller duration. There is consistency between the properties of bond price volatility and the properties of modified duration. When all other factors are constant, a bond with a longer maturity will have greater price volatility. A property of modified duration is that when all other factors are constant, a bond with a longer maturity will have a greater modified duration. Also, all other factors being constant, a bond with a lower coupon rate will have greater bond price volatility. Also, generally, a bond with a lower coupon rate will have a greater modified duration. Thus, bonds with greater durations will greater price volatilities.4)Suppose a client observes the following two benchmark spreads for two bonds:Bond issue U rated A: 150 basis pointsBond issue V rated BBB: 135 basis pointsYour client is confused because he thought the lower-rated bond (bond V) should offer a higher benchmark spread than the higher-rated bond (bond U). Explain why the benchmark spread may be lower for bond U.5)The bid and ask yields for a Treasury bill were quoted by a dealer as 5.91% and 5.89%, respectively. Shouldn’t the bid yield be less than the ask yield, because the bid yield indicates how much the dealer is willing to pay and the ask yield is what the dealer is willing to sell the Treasury bill for?Answer:The higher bid means a lower price. So the dealer is willing to pay less than would be paid for the lower ask price. We illustrate this below. Given the yield on a bank discount basis (Yd), the price of a Treasury bill is found by first solving the formula for the dollar discount (D), as follows:The price is then Price = F-DFor the 100-day Treasury bill with a face value (F) of $100,000, if the yield on a bank discount basis (Yd) is quoted as 5.91%, D is equal to:Therefore, price = $100,000 – $1,641.67 = $98,358.33. For the 100-day Treasury bill with a face value (F) of $100,000, if the yield on a bank discount basis (Yd) is quoted as 5.89%, D is equal to: Therefore, price is: P = F – D = $100,000 – $1,636.11 = $98,363.89.Thus, the higher bid quote of 5.91% (compared to lower ask quote 5.89%) gives a lower selling price of $98,358.33 (compared to $98,363.89). The 0.02% higher yield translates into a selling price that is $5.56 lower. In general, the quoted yield on a bank discount basis is not a meaningful measure of the return from holding a Treasury bill, for two reasons. First, the measure is based on a face-value investment rather than on the actual dollar amount invested. Second, the yield is annualized according to a 360-day rather than a 365-day year, making it difficult to compare Treasury bill yields with Treasury notes and bonds, which pay interest on a 365-day basis. The use of 360 days for a year is a money market convention for some money market instruments, however. Despite its shortcomings as a measure of return, this is the method that dealers have adopted to quote Treasury bills. Many dealer quote sheets, and some reporting services, provide two other yield measures that attempt to make the quoted yield comparable to that for a coupon bond and other money market instruments.6)What is the difference between a cash-out refinancing and a rate-and-term refinancing? Answer:When a lender is evaluating an application from a borrower who is refinancing, the loan-to-value ratio (LTV) is dependent upon the requested amount of the new loan and the market value of the property as determined by an appraisal. When the loan amount requested exceeds the original loan amount, the transaction is referred to as a cash-out-refinancing. If instead, there is financing where the loan balance remains unchanged, the transaction is said to be a rate-and-termrefinancing or no-cash refinancing. That is, the purpose of refinancing the loan is to either obtain a better note rate or change the term of the loan.7)Describe the cash flow of a mortgage pass-through security.Answer:The cash flow of a mortgage pass-through security depends on the cash flow of the underlying mortgage.The cash flow consists of monthly mortgage payments representing interest,the scheduled repayment of principal,and any prepayments.Payments are made to security holders each month.Neither theamount nor the timing,however,of the cash flow from the pool of mortgages is identical to that of the cash flow passed through to investors.The monthly cash flow for a pass-through is less than the monthly cash flow of the underlying mortgages by an amount equal to servicing and other fees.The other fees are those charged by the issuer or guarantor of the pass-through for guaranteeing the issue.The coupon rage on a pass-through,called the pass-through coupon rate,is less than the mortgage rage on the underlying pool of mortgage loans by an amount equal to the servicing and guaranteeing feesThe timing of the cash flow,like the amount of the cash flow,is also different.The monthly mortgage payment is due from each mortgagor on the first day of each month,but there is a delay in passing through the corresponding monthly cash flow to the securityholders.The length of the delay varies by the type of pass-through security.Because of prepayments,the cash flow of a pass-through is also not known with certainty.。