Chapter 6 Exchange Rates, Interest Rates, and Interest Parity

- 格式:ppt

- 大小:919.00 KB

- 文档页数:26

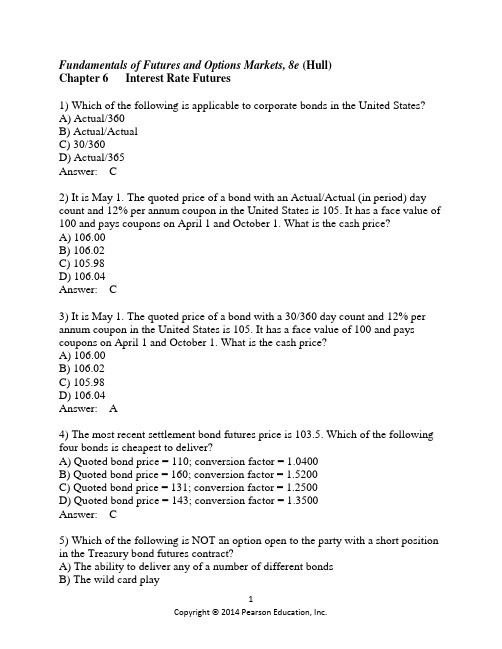

Fundamentals of Futures and Options Markets, 8e (Hull)Chapter 6 Interest Rate Futures1) Which of the following is applicable to corporate bonds in the United States?A) Actual/360B) Actual/ActualC) 30/360D) Actual/365Answer: C2) It is May 1. The quoted price of a bond with an Actual/Actual (in period) day count and 12% per annum coupon in the United States is 105. It has a face value of 100 and pays coupons on April 1 and October 1. What is the cash price?A) 106.00B) 106.02C) 105.98D) 106.04Answer: C3) It is May 1. The quoted price of a bond with a 30/360 day count and 12% per annum coupon in the United States is 105. It has a face value of 100 and pays coupons on April 1 and October 1. What is the cash price?A) 106.00B) 106.02C) 105.98D) 106.04Answer: A4) The most recent settlement bond futures price is 103.5. Which of the following four bonds is cheapest to deliver?A) Quoted bond price = 110; conversion factor = 1.0400B) Quoted bond price = 160; conversion factor = 1.5200C) Quoted bond price = 131; conversion factor = 1.2500D) Quoted bond price = 143; conversion factor = 1.3500Answer: C5) Which of the following is NOT an option open to the party with a short position in the Treasury bond futures contract?A) The ability to deliver any of a number of different bondsB) The wild card playC) The fact that delivery can be made any time during the delivery monthD) The interest rate used in the calculation of the conversion factorAnswer: D6) A trader enters into a long position in one Eurodollar futures contract. How much does the trader gain when the futures price quote increases by 6 basis points?A) $6B) $150C) $60D) $600Answer: B7) A company invests $1,000 in a five-year zero-coupon bond and $4,000 in aten-year zero-coupon bond. What is the duration of the portfolio?A) 6 yearsB) 7 yearsC) 8 yearsD) 9 yearsAnswer: D8) The modified duration of a bond portfolio worth $1 million is 5 years. By approximately how much does the value of the portfolio change if all yields increase by 5 basis points?A) Increase of $2,500B) Decrease of $2,500C) Increase of $25,000D) Decrease of $25,000Answer: B9) A portfolio is worth $24,000,000. The futures price for a Treasury note futures contract is 110 and each contract is for the delivery of bonds with a face value of $100,000. On the delivery date the duration of the bond that is expected to be cheapest to deliver is 6 years and the duration of the portfolio will be 5.5 years. How many contracts are necessary for hedging the portfolio?A) 100B) 200C) 300D) 400Answer: B10) Which of the following is true?A) The futures rates calculated from a Eurodollar futures quote are always less than the corresponding forward rateB) The futures rates calculated from a Eurodollar futures quote are always greater than the corresponding forward rateC) The futures rates calculated from a Eurodollar futures quote should equal the corresponding forward rateD) The futures rates calculated from a Eurodollar futures quote are sometimes greater than and sometimes less than the corresponding forward rateAnswer: B11) How much is a basis point?A) 1.0%B) 0.1%C) 0.01%D) 0.001%Answer: C12) Which of the following day count conventions applies to a US Treasury bond?A) Actual/360B) Actual/Actual (in period)C) 30/360D) Actual/365Answer: B13) What is the quoted discount rate on a money market instrument?A) The interest rate earned as a percentage of the final face value of a bondB) The interest rate earned as a percentage of the initial price of a bondC) The interest rate earned as a percentage of the average price of a bondD) The risk-free rate used to calculate the present value of future cash flows from a bondAnswer: A14) Which of the following is closest to the duration of a 2-year bond that pays a coupon of 8% per annum semiannually? The yield on the bond is 10% per annum with continuous compounding.A) 1.82B) 1.85C) 1.88D) 1.92Answer: C15) Which of the following is NOT true about duration?A) It equals the years-to-maturity for a zero coupon bondB) It equals the weighted average of payment times for a bond, where weights are proportional to the present value of paymentsC) Equals the weighted average of individual bond durations for a portfolio, where weights are proportional to the present value of bond pricesD) The prices of two bonds with the same duration change by the same percentage amount when interest rate move up by 100 basis pointsAnswer: D16) The conversion factor for a bond is approximatelyA) The price it would have if all cash flows were discounted at 6% per annumB) The price it would have if it paid coupons at 6% per annumC) The price it would have if all cash flows were discounted at 8% per annumD) The price it would have if it paid coupons at 8% per annumAnswer: A17) The time-to-maturity of a Eurodollars futures contract is 4 years, and thetime-to-maturity of the rate underlying the futures contract is 4.25 years. The standard deviation of the change in the short term interest rate, σ = 0.011. What is the difference between the futures and the forward interest rate?A) 0.105%B) 0.103%C) 0.098%D) 0.093%Answer: B18) A trader uses 3-month Eurodollar futures to lock in a rate on $5 million for six months. How many contracts are required?A) 5B) 10C) 15D) 20Answer: B19) In the U.S. what is the longest maturity for 3-month Eurodollar futures contracts?A) 2 yearsB) 5 yearsC) 10 yearsD) 20 yearsAnswer: C20) Duration matching immunizes a portfolio againstA) Any parallel shift in the yield curveB) All shifts in the yield curveC) Changes in the steepness of the yield curveD) Small parallel shifts in the yield curve Answer: D。

金融英语第六章答案Chapter 6The Foreign Exchange MarketExercisesⅠ. Answer the following questions in English.1. How many common methods to express a foreign exchange rate?Answer:There are two common methods to express a foreign exchange rate.2. What is usefulness of settling account?Answer:Business people will pay and recieive different currencies.Therefore, they must convert the currencies that they received into the currencies thatthey could buy commodities.3. How does stop order work?Answer: Stop orders can be used to enter the market on momentuma or to limit the potential loss of a position.4. What do you think about single currency system? Is it possible to establishsingle currency system in the world now?Answer:I think a single currency system,it means no foreign exchange market,no foreign exchange rates,no foreign exchange.It is no possible to establish single currency system in the world now. Because in our world of mainly national currencies,the foreign exchange market plays the indispensable role of providing the essential machinery for making payments across borders,transferring funds and purchasing powerfrom one currency to another,and determining thatsingularly important price,the exchange rate.5. What is limit order?Answer: A limit is an order to buy or sell a currency at a specified price or better.6. How to make money for many traders through foreign exchange market?Answer:(一)You should have trading currencies with a strategy.(1) Currency Trading is Only For Part of Your Investment Money(2)You Must Limit Your Losses in Currency Trading(3)Know the Trends of the Foreign Currency Market Before Trading(二)Decide What Type of Currency Trader You Will be.(1)Trade currendes in multiple lots(2)Lose the urge to trade currencies every day(3)Stick to your trading planⅡ.Fill in the each blank with an appropriate word or expression.l. The currency trader should also decide the time __frame__ that he will be using to trade in order to determine which trend will be the most important. 2. The bid is the price at which dealers are willing to __buy__ dollars (basecurrency) in terms of yen (quote currency) and users of our trading platform can __sell__ dollars in terms of yen.3. The order remains active until the end of the trading day (5:00 PM EST),unless it is __executed__ or canceled by the trader.4. A GTC order remains active until it is canceled by the currency trader or untilthe order is executed. It is the __trade’s__ responsibility to __cancel__ aGTC order.5. The Foreign Exchange Market is where the majority of buying and selling ofworld __currencies__ takes place.6. When placing a limit order, the trader also specifies the__duration__ for whichthe order is to remain active while it is not executed.Ⅲ.Translate the following sentences into English.1.外汇交易市场,也称为“Forex”或“FX”市场,是世界上最大的金融市场,平均每天超过1兆美元的资金在当中周转——相当于美国所有证券市场交易额总和的30倍。