斯托克《计量经济学》Ch4

- 格式:ppt

- 大小:238.50 KB

- 文档页数:12

计量经济学斯托克第四版实证答案十一章1、企业开出的商业汇票为银行承兑汇票,其无力支付票款时,应将应付票据的票面金额转作()。

[单选题] *A.应付账款B.其他应付款C.预付账款D.短期借款(正确答案)2、某公司为一般纳税人,2019年6月购入商品并取得增值税专用发票,价款100万元,增值税率13%;支付运费取得增值税专用发票,运费不含税价款为30万元,增值税率9%,则该批商品的入账成本为()。

[单选题] *A.130万元(正确答案)B.7万元C.3万元D.113万元3、企业生产车间发生的固定资产的修理费应计入()科目。

[单选题] *A.制造费用B.生产成本C.长期待摊费用D.管理费用(正确答案)4、企业因解除与职工的劳动关系给予职工补偿而发生的职工薪酬,应借记的会计科目是()。

[单选题] *A.管理费用(正确答案)B.计入存货成本或劳务成本C.营业外支出D.计入销售费用5、长期借款利息及外币折算差额,均应记入()科目。

[单选题] *A.其他业务支出B.长期借款(正确答案)C.投资收益D.其他应付款6、固定资产报废清理后发生的净损失,应计入()。

[单选题] *A.投资收益B.管理费用C.营业外支出(正确答案)D.其他业务成本7、下列各项税金中不影响企业损益的是()。

[单选题] *A.消费税B.资源税C.增值税(正确答案)D.企业所得税8、股份有限公司为核算投资者投入的资本应当设置()科目。

[单选题] *A.“实收资本”B.“股东权益”C.“股本”(正确答案)D.“所有者权益”9、.(年预测)下列属于货币资金转换为生产资金的经济活动的是()[单选题] * A购买原材料B生产领用原材料C支付工资费用(正确答案)D销售产品10、企业生产经营期间发生的长期借款利息应计入()科目。

[单选题] *A.在建工程B.财务费用(正确答案)C.开办费D.长期待摊费用11、某企业上年末“利润分配——未分配利润”科目贷方余额为50 000元,本年度实现利润总额为1 000 000元,所得税税率为25%,无纳税调整项目,本年按照10%提取法定盈余公积,应为()元。

第四章 经典单方程计量经济学模型:放宽基本假定的模型一、内容提要本章主要介绍计量经济模型的二级检验问题,即计量经济检验。

主要讨论对回归模型的若干基本经典假定是否成立进行检验、当检验发现不成立时继续采用OLS 估计模型所带来的不良后果以及如何修正等问题。

包括:异方差性问题、序列相关性问题、多重共线性问题。

1.异方差:含义:随机扰动项的方差随样本点而不同。

后果:OLS 估计是线性、无偏、一致的但不有效;由于随机项异方差的存在而导致的参数估计值的标准差的偏误,通常的假设检验t 检验和F 检验失效;模型的预测变得无效。

检验:图示法、Goldfeld-Quandt 检验法以及White 检验法等。

修正:而当检测出模型确实存在异方差性时,通过采用加权最小二乘法进行修正的估计。

序列相关性也是模型随机扰动项出现序列相关时产生的一类现象。

与异方差的情形相类似,在序列相关存在的情况下,OLS 估计量仍具无偏性与一致性,但通常的假设检验不再可靠,预测也变得无效。

序列相关性的检测方法也有若干种,如图示法、回归检验法、Durbin-Watson 检验法以及Lagrange 乘子检验法等。

存在序列相关性时,修正的估计方法有广义最小二乘法(GLS )以及广义差分法。

多重共线性是多元回归模型可能存在的一类现象,分为完全共线与近似共线两类。

模型的多个解释变量间出现完全共线性时,模型的参数无法估计。

更多的情况则是近似共线性,这时,由于并不违背所有的基本假定,模型参数的估计仍是无偏、一致且有效的,但估计的参数的标准差往往较大,从而使得t-统计值减小,参数的显著性下降,导致某些本应存在于模型中的变量被排除,甚至出现参数正负号方面的一些混乱。

显然,近似多重共线性使得模型偏回归系数的特征不再明显,从而很难对单个系数的经济含义进行解释。

多重共线性的检验包括检验多重共线性是否存在以及估计多重共线性的范围两层递进的检验。

而解决多重共线性的办法通常有逐步回归法、差分法以及使用额外信息、增大样本容量等方法。

《计量经济学》第四章知识第四章古典线性回归模型在引论中,我们推出了满足凯恩斯条件的消费函数与收入有关的一个最普通模型:C=α+βX+ε,其中α>0,0<β<1ε是一个随机扰动。

这是一个标准的古典线性回归模型。

假如我们得到如下例1的数据例1 可支配个人收入和个人消费支出年份可支配收入个人消费1970 751.6 672.11971 779.2 696.81972 810.3 737.11973 864.7 767.91974 857.5 762.81975 847.9 779.41976 906.8 823.11977 942.9 864.31978 988.8 903.21979 1015.7 927.6 来源:数据来自总统经济报告,美国政府印刷局,华盛顿特区,1984。

(收入和支出全为1972年的十亿美元)一、线性回归模型及其假定一般地,被估计模型具有如下形式:y i=α+βx i+εi,i=1,…,n,其中y是因变量或称为被解释变量,x是自变量或称为解释变量,i标志n个样本观测值中的一个。

这个形式一般被称作y对x的总体线性回归模型。

在此背景下,y称为被回归量,x称为回归量。

构成古典线性回归模型的一组基本假设为:1. 函数形式:y i=α+βx i+εi,i=1,…,n,2. 干扰项的零均值:对所有i,有:E[εi]=0。

σ是一个常数。

3. 同方差性:对所有i,有:Var[εi]=σ2,且24. 无自相关:对所有i ≠j ,则Cov[εi ,εj ]=0。

5. 回归量和干扰项的非相关:对所有i 和j 有Cov[x i ,εj ]=0。

6. 正态性:对所有i ,εi 满足正态分布N (0,2σ)。

模型假定的几点说明:1、函数形式及其线性模型的转换具有一般形式i i i x g y f εβα++=)()(对任何形式的g(x)都符合我们关于线性模型的定义。

[例] 一个常用的函数形式是对数线性模型:βAx y =。

Chapter 2. Review of Probability2.1 Random Variables and Probability Distributions概率Probability:在大量重复实验下,事件发生的频率趋向的某个稳定值。

例如,记事件“下雨”为A,其发生的概率为P()A。

条件概率Conditional Probability :例:已知明天会出太阳,下雨的概率有多大?记事件“出太阳”为B 。

则在出太阳的前提条件下降雨的“条件概率”(conditional probability )为,P()P()P()A B A B B ∩≡其中,“∩”表示事件的交集(intersection ),故P()A B ∩为“太阳雨”的概率,参见图2.1。

条件概率是计量经济学的重要概念之一。

图2.1、条件概率示意图独立事件Independence :如果条件概率等于无条件概率,即P()P()A B A =,即B 是否发生不影响A 的发生,则称,A B 为相互独立的随机事件。

此时,P()P()P()P()A B A B A B ∩≡=,故P()P()P()A B A B ∩=也可以将此式作为独立事件的定义。

全概公式如果事件组{}12,,,(2)n B B B n ≥ 两两互不相容,()0(1,,)i P B i n >∀= ,且12n B B B ∪∪∪ 为必然事件(即在12,,,n B B B 中必然有某个i B 发生,“∪”表示事件的并集,union ),则对任何事件A 都有(无论A 与{}12,,,n B B B 是否有任何关系),1P()P()P()ni i i A B A B ==∑全概公式把世界分成了n 个可能的情形,再把每种情况下的条件概率“加权平均”而汇总成无条件概率(权重为每种情形发生的概率)。

该公式有助于理解后面的迭代期望定律。

离散型随机变量Discrete Random Variable :假设随机变量X 的可能取值为{}12,,,,k x x x ,其对应的概率为{}12,,,,k p p p ,即(P )k k p X x ≡=,则称X 为离散型随机变量,其分布律可以表示为,1212k k X x x x pp p p其中,0k p ≥,1kkp=∑。

计量经济学斯托克答案【篇一:计量经济学教材推荐】txt>【计量经济学的内容体系】古扎拉蒂《计量经济学基础》白砂堤津耶《通过例题学习计量经济学》伍德里奇《计量经济学导论:现代观点》斯托克、沃森《计量经济学导论》林文夫(fumio hayashi)《计量经济学》雨宫健(takeshi amemiya )《高级计量经济学》李子奈、潘文卿编著《计量经济学》【计量经济学的内容体系】狭义的计量经济学以揭示经济现象中的因果关系为目的,主要应用回归分析方法。

广义的计量经济学是利用经济理论、统计学和数学定量研究经济现象的经济计量方法,除了回归分析方法,还包括投入产出分析法、时间序列分析方法等。

把计量经济学分为初级、中级、高级三个层次,初级计量经济学一般包括计量经济学所必须的基础数理统计只是和矩阵代数只是、经典的线性计量经济学模型理论与方法(以单一方程模型为主)、单方程模型的应用等内容;中级计量经济学以经典的线性计量经济学模型理论与方法及其应用为主要内容,包括单一方程模型和联立方程模型。

在应用方面,主要讨论计量经济学模型在生产、需求、消费、投资、货币需求和宏观经济系统等传统领域的应用,注重于应用过程中实际问题的处理。

在描述方法上普遍运用矩阵描述;高级计量经济学以扩展的线性模型理论与方法、非线性模型理论与方法和动态模型理论与方法,以及它们的应用为主要内容。

从研究对象和侧重点的角度讲,理论计量经济学侧重于理论与方法的数学证明与推导,与数理统计联系极为密切;应用计量经济学则以建立与应用计量经济学模型为主要内容,强调应用模型的经济学和统计学基础,侧重于建立与应用模型过程中实际问题的处理。

纵观计量经济学发展史,20世纪70年代之前发展并广泛应用的计量经济学称为经典计量经济学,其理论特征是:以经济理论为导向建立因果分析的随机模型,模型具有明确的形式和参数,模型变量之间的关系多表现为线性关系,或者可以化为线性关系,以时间序列数据或者截面数据为样本,采用最小二乘方法或者极大似然方法估计模型。

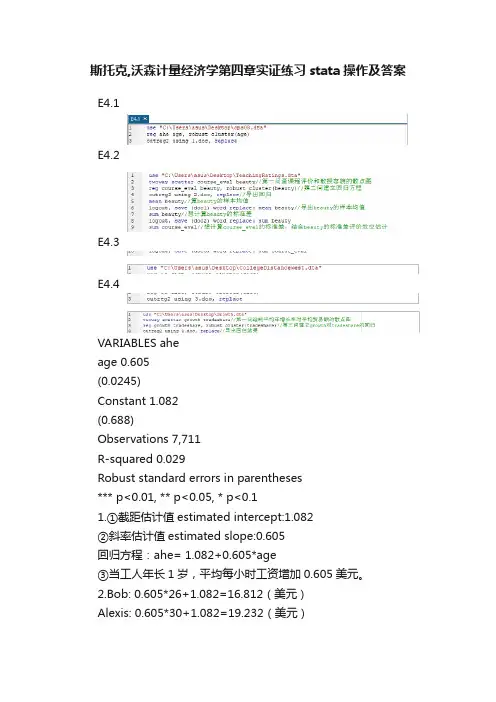

斯托克,沃森计量经济学第四章实证练习stata操作及答案E4.1E4.2E4.3E4.4VARIABLES aheage 0.605(0.0245)Constant 1.082(0.688)Observations 7,711R-squared 0.029Robust standard errors in parentheses*** p<0.01, ** p<0.05, * p<0.11.①截距估计值estimated intercept:1.082②斜率估计值estimated slope:0.605回归方程:ahe= 1.082+0.605*age③当工人年长1岁,平均每小时工资增加0.605美元。

2.Bob: 0.605*26+1.082=16.812(美元)Alexis: 0.605*30+1.082=19.232(美元)答:预测Bob的收入为每小时16.812美元,Alexis为19.232美元。

3.年龄不能解释不同个体收入变化的大部分。

因为R-squared反映了因变量的全部变化能通过回归关系被自变量充分解释的比例,而分析得R-squared的值为0.029,解释度低,说明年龄不能解释不同个体收入变化的大部分。

1.答:两者看上去有微弱的正相关关系2.VARIABLES course_evalbeauty 0.133(0.0550)Constant 3.998(0.0449)Observations 463R-squared 0.036Robust standard errors in parentheses*** p<0.01, ** p<0.05, * p<0.1①截距估计值:3.998斜率估计值:0.133回归方程:Course_Eval=3.998+0.133*beauty//mean beautyMean estimation Number of obs = 463Mean Std.Err. 95% Conf. Interval beauty 4.75e-08 0.0367 -0.0720 0.0720②截距的估计值=Course_Eval的样本均值-斜率估计值*Beauty 的样本均值计算得Beauty的样本均值趋近于零,所以截距的估计值等于Course_Eval的样本均值。

斯托克计量经济学教材全文共四篇示例,供读者参考第一篇示例:斯托克计量经济学教材是一本经典的经济学教材,被广泛应用于大学本科和研究生阶段的经济学专业课程中。

该教材由文字严谨,内容深入浅出,涵盖了计量经济学的各个方面,为学生提供了全面的理论知识和实践技能。

一、教材内容《斯托克计量经济学》是由詹姆斯·斯托克(James Stock)和马克·沃森(Mark Watson)合著的一本经典教材,在经济学界享有盛誉。

该教材涵盖了计量经济学的基本理论、方法和实证研究,内容涉及回归分析、时间序列分析、面板数据分析、因果推断等多个方面,旨在帮助学生建立起对经济现象的客观量化分析能力。

二、教材特点1. 理论与实践相结合:《斯托克计量经济学》教材注重理论与实践相结合,既强调了基本的计量经济学理论框架,又通过大量实证案例展示了如何将理论运用到实际数据分析中。

2. 清晰易懂的讲解方式:该教材在文字表达上十分严谨清晰,避免了学术术语的过度使用,让学生更容易理解和掌握复杂的计量经济学理论。

3. 大量练习题和案例分析:为了帮助学生更好地掌握知识点,教材中设置了大量的练习题和案例分析,让学生通过实际操作来巩固所学知识。

4. 近年最新研究成果:《斯托克计量经济学》不仅汇总了经典的计量经济学研究成果,还尽可能地涵盖了最新的研究进展和方法,使学生对计量经济学领域的发展趋势有所了解。

三、教材在教学中的应用斯托克计量经济学教材以其深入浅出的讲解方式、丰富实例和案例、以及严谨的理论基础,成为了经济学领域不可或缺的经典教材,为学生们打开了通往计量经济学世界的大门,引导他们更好地理解和应用计量经济学知识,为未来的学习和研究提供了坚实的基础。

希望更多的学生能通过学习《斯托克计量经济学》,在经济学领域取得更为出色的成就。

第二篇示例:斯托克(Stock)是计量经济学领域内享有盛誉的学者,他的著作《计量经济学》(Introduction to Econometrics)广泛应用于全球各大高校的计量经济学课程中。

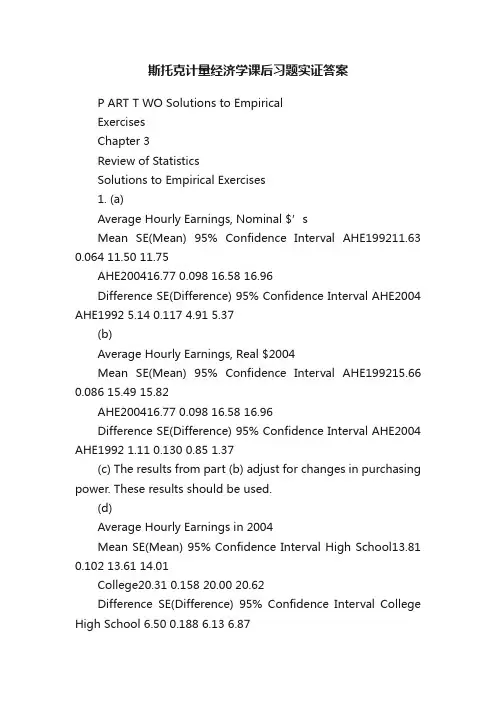

斯托克计量经济学课后习题实证答案P ART T WO Solutions to EmpiricalExercisesChapter 3Review of StatisticsSolutions to Empirical Exercises1. (a)Average Hourly Earnings, Nominal $’sMean SE(Mean) 95% Confidence Interval AHE199211.63 0.064 11.50 11.75AHE200416.77 0.098 16.58 16.96Difference SE(Difference) 95% Confidence Interval AHE2004 AHE1992 5.14 0.117 4.91 5.37(b)Average Hourly Earnings, Real $2004Mean SE(Mean) 95% Confidence Interval AHE199215.66 0.086 15.49 15.82AHE200416.77 0.098 16.58 16.96Difference SE(Difference) 95% Confidence Interval AHE2004 AHE1992 1.11 0.130 0.85 1.37(c) The results from part (b) adjust for changes in purchasing power. These results should be used.(d)Average Hourly Earnings in 2004Mean SE(Mean) 95% Confidence Interval High School13.81 0.102 13.61 14.01College20.31 0.158 20.00 20.62Difference SE(Difference) 95% Confidence Interval College High School 6.50 0.188 6.13 6.87Solutions to Empirical Exercises in Chapter 3 109(e)Average Hourly Earnings in 1992 (in $2004)Mean SE(Mean) 95% Confidence Interval High School13.48 0.091 13.30 13.65 College19.07 0.148 18.78 19.36Difference SE(Difference) 95% Confidence Interval College High School5.59 0.173 5.25 5.93(f) Average Hourly Earnings in 2004Mean SE(Mean) 95% Confidence Interval AHE HS ,2004AHE HS ,19920.33 0.137 0.06 0.60 AHE Col ,2004AHE Col ,19921.24 0.217 0.82 1.66Col–HS Gap (1992)5.59 0.173 5.25 5.93 Col–HS Gap (2004)6.50 0.188 6.13 6.87Difference SE(Difference) 95% Confidence Interval Gap 2004 Gap 1992 0.91 0.256 0.41 1.41Wages of high school graduates increased by an estimated 0.33 dollars per hour (with a 95%confidence interval of 0.06 0.60); Wages of college graduates increased by an estimated 1.24dollars per hour (with a 95% confidence interval of 0.82 1.66). The College High School gap increased by an estimated 0.91 dollars per hour.(g) Gender Gap in Earnings for High School Graduates Yearm Y s m n m w Y s w n w m Y w Y SE (m Y w Y )95% CI 199214.57 6.55 2770 11.86 5.21 1870 2.71 0.173 2.37 3.05 200414.88 7.16 2772 11.92 5.39 1574 2.96 0.192 2.59 3.34There is a large and statistically significant gender gap in earnings for high school graduates.In 2004 the estimated gap was $2.96 per hour; in 1992 the estimated gap was $2.71 per hour(in $2004). The increase in the gender gap is somewhat smaller for high school graduates thanit is for college graduates.Chapter 4Linear Regression with One RegressorSolutions to Empirical Exercises1. (a) ·AHE 3.32 0.45 u AgeEarnings increase, on average, by 0.45 dollars per hour when workers age by 1 year.(b) Bob’s predicted earnings 3.32 0.45 u 26 $11.70Alexis’s predicted earnings 3.32 0.45 u 30 $13.70(c) The R2 is 0.02.This mean that age explains a small fraction of the variability in earnings acrossindividuals.2. (a)There appears to be a weak positive relationship between course evaluation and the beauty index.Course Eval 4.00 0.133 u Beauty. The variable Beauty has a mean that is equal to 0; the(b) ·_estimated intercept is the mean of the dependent variable (Course_Eval) minus the estimatedslope (0.133) times the mean of the regressor (Beauty). Thus, the estimated intercept is equalto the mean of Course_Eval.(c) The standard deviation of Beauty is 0.789. ThusProfessor Watson’s predicted course evaluations 4.00 0.133 u 0 u 0.789 4.00Professor Stock’s predicted course evaluations 4.00 0.133 u 1 u 0.789 4.105Solutions to Empirical Exercises in Chapter 4 111(d) The standard deviation of course evaluations is 0.55 and the standard deviation of beauty is0.789. A one standard deviation increase in beauty is expected to increase course evaluation by0.133 u 0.789 0.105, or 1/5 of a standard deviation of course evaluations. The effect is small.(e) The regression R2 is 0.036, so that Beauty explains only3.6% of the variance in courseevaluations.3. (a) ?Ed 13.96 0.073 u Dist. The regression predicts that if colleges are built 10 miles closerto where students go to high school, average years of college will increase by 0.073 years.(b) Bob’s predicted years of completed education 13.960.073 u 2 13.81Bob’s predicted years of completed education if he was 10 miles from college 13.96 0.073 u1 13.89(c) The regression R2 is 0.0074, so that distance explains only a very small fraction of years ofcompleted education.(d) SER 1.8074 years.4. (a)Yes, there appears to be a weak positive relationship.(b) Malta is the “outlying” observation with a trade share of 2.(c) ·Growth 0.64 2.31 u TradesharePredicted growth 0.64 2.31 u 1 2.95(d) ·Growth 0.96 1.68 u TradesharePredicted growth 0.96 1.68 u 1 2.74(e) Malta is an island nation in the Mediterranean Sea, south of Sicily. Malta is a freight transportsite, which explains its larg e “trade share”. Many goods coming into Malta (imports into Malta)and immediately transported to other countries (as exports from Malta). Thus, Malta’s importsand exports and unlike the imports and exports of most other countries. Malta should not beincluded in the analysis.Chapter 5Regression with a Single Regressor:Hypothesis Tests and Confidence IntervalsSolutions to Empirical Exercises1. (a) ·AHE 3.32 0.45 u Age(0.97) (0.03)The t -statistic is 0.45/0.03 13.71, which has a p -value of 0.000, so the null hypothesis can berejected at the 1% level (and thus, also at the 10% and 5% levels).(b) 0.45 r 1.96 u 0.03 0.387 to 0.517(c) ·AHE 6.20 0.26 u Age(1.02) (0.03)The t -statistic is 0.26/0.03 7.43, which has a p -value of 0.000, so the null hypothesis can berejected at the 1% level (and thus, also at the 10% and 5% levels).(d) ·AHE 0.23 0.69 u Age(1.54) (0.05)The t -statistic is 0.69/0.05 13.06, which has a p -value of 0.000, so the null hypothesis can berejected at the 1% level (and thus, also at the 10% and 5% levels).(e) The difference in the estimated E 1 coefficients is 1,1,??College HighScool E E 0.69 0.26 0.43. Thestandard error of for the estimated difference is SE 1,1,??()College HighScoolE E (0.032 0.052)1/2 0.06, so that a 95% confidence interval for the difference is 0.43 r 1.96 u 0.06 0.32 to 0.54(dollars per hour).2. ·_ 4.000.13CourseEval Beauty u (0.03) (0.03)The t -statistic is 0.13/0.03 4.12, which has a p -value of 0.000, so the null hypothesis can be rejectedat the 1% level (and thus, also at the 10% and 5% levels).3. (a) ?Ed13.96 0.073 u Dist (0.04) (0.013)The t -statistic is 0.073/0.013 5.46, which has a p -value of 0.000, so the null hypothesis can be rejected at the 1% level (and thus, also at the 10% and 5% levels).(b) The 95% confidence interval is 0.073 r 1.96 u 0.013 or0.100 to 0.047.(c) ?Ed13.94 0.064 u Dist (0.05) (0.018)Solutions to Empirical Exercises in Chapter 5 113(d) ?Ed13.98 0.084 u Dist (0.06) (0.013)(e) The difference in the estimated E 1 coefficients is 1,1,??Female Male E E 0.064 ( 0.084) 0.020.The standard error of for the estimated difference is SE 1,1,??()Female Male E E (0.0182 0.0132)1/20.022, so that a 95% confidence interval for the difference is 0.020 r 1.96 u 0.022 or 0.022 to0.064. The difference is not statistically different.Chapter 6Linear Regression with Multiple RegressorsSolutions to Empirical Exercises1. Regressions used in (a) and (b)Regressor a bBeauty 0.133 0.166Intro 0.011OneCredit 0.634Female 0.173Minority 0.167NNEnglish 0.244Intercept 4.00 4.07SER 0.545 0.513R2 0.036 0.155(a) The estimated slope is 0.133(b) The estimated slope is 0.166. The coefficient does not change by an large amount. Thus, theredoes not appear to be large omitted variable bias.(c) Professor Smith’s predicted course evaluation (0.166 u 0)0.011 u 0) (0.634 u 0) (0.173 u0) (0.167 u 1) (0.244 u 0) 4.068 3.9012. Estimated regressions used in questionModelRegressor a bdist 0.073 0.032bytest 0.093female 0.145black 0.367hispanic 0.398incomehi 0.395ownhome 0.152dadcoll 0.696cue80 0.023stwmfg80 0.051intercept 13.956 8.827SER 1.81 1.84R2 0.007 0.279R0.007 0.277Solutions to Empirical Exercises in Chapter 6 115(a) 0.073(b) 0.032(c) The coefficient has fallen by more than 50%. Thus, it seems that result in (a) did suffer fromomitted variable bias.(d) The regression in (b) fits the data much better as indicated by the R2, 2,R and SER. The R2 and R are similar because the number of observations is large (n 3796).(e) Students with a “dadcoll 1” (so that the student’s father went to college) complete 0.696 moreyears of education, on average, than students with “dadcoll 0” (so that the student’s father didnot go to college).(f) These terms capture the opportunity cost of attending college. As STWMFG increases, forgonewages increase, so that, on average, college attendance declines. The negative sign on thecoefficient is consistent with this. As CUE80 increases, it is more difficult to find a job, whichlowers the opportunity cost of attending college, so that college attendance increases. Thepositive sign on the coefficient is consistent with this.(g) Bob’s predicted years of education 0.0315 u 2 0.093 u58 0.145 u 0 0.367 u 1 0.398 u0 0.395 u 1 0.152 u 1 0.696 u 0 0.023 u 7.5 0.051 u 9.75 8.82714.75(h) Jim’s expected years of education is 2 u 0.0315 0.0630 less than Bob’s. Thus, Jim’s expectedyears of education is 14.75 0.063 14.69.3.Variable Mean StandardDeviation Unitsgrowth 1.86 1.82 Percentage Pointsrgdp60 3131 2523 $1960tradeshare 0.542 0.229 unit freeyearsschool 3.95 2.55 yearsrev_coups 0.170 0.225 coups per yearassasinations 0.281 0.494 assasinations per yearoil 0 0 0–1 indicator variable (b) Estimated Regression (in table format):Regressor Coefficienttradeshare 1.34(0.88)yearsschool 0.56**(0.13)rev_coups 2.15*(0.87)assasinations 0.32(0.38)rgdp60 0.00046**(0.00012)intercept 0.626(0.869)SER 1.59R2 0.29R0.23116 Stock/Watson - Introduction to Econometrics - Second EditionThe coefficient on Rev_Coups is í2.15. An additional coup in a five year period, reduces theaverage year growth rate by (2.15/5) = 0.43% over this 25 year period. This means the GPD in 1995 is expected to be approximately .43×25 = 10.75% lower. This is a larg e effect.(c) The 95% confidence interval is 1.34 r 1.96 u 0.88 or 0.42 to 3.10. The coefficient is notstatistically significant at the 5% level.(d) The F-statistic is 8.18 which is larger than 1% critical value of 3.32.Chapter 7Hypothesis Tests and Confidence Intervals in Multiple RegressionSolutions to Empirical Exercises1. Estimated RegressionsModelRegressor a bAge 0.45(0.03)0.44 (0.03)Female 3.17(0.18)Bachelor 6.87(0.19)Intercept 3.32(0.97)SER 8.66 7.88R20.023 0.1902R0.022 0.190(a) The estimated slope is 0.45(b) The estimated marginal effect of Age on AHE is 0.44 dollars per year. The 95% confidenceinterval is 0.44 r 1.96 u 0.03 or 0.38 to 0.50.(c) The results are quite similar. Evidently the regression in (a) does not suffer from importantomitted variable bias.(d) Bob’s predicted average hourly earnings 0.44 u 26 3.17 u 0 6.87 u 0 3.32 $11.44Alexis’s predicted average hourly earnings 0.44 u 30 3.17 u 1 6.87 u 1 3.32 $20.22 (e) The regression in (b) fits the data much better. Gender and education are important predictors of earnings. The R2 and R are similar because the sample size is large (n 7986).(f) Gender and education are important. The F-statistic is 752, which is (much) larger than the 1%critical value of 4.61.(g) The omitted variables must have non-zero coefficients and must correlated with the includedregressor. From (f) Female and Bachelor have non-zero coefficients; yet there does not seem to be important omittedvariable bias, suggesting that the correlation of Age and Female and Age and Bachelor is small. (The sample correlations are ·Cor(Age, Female) 0.03 and·Cor(Age,Bachelor) 0.00).118 Stock/Watson - Introduction to Econometrics - Second Edition2.ModelRegressor a b cBeauty 0.13**(0.03) 0.17**(0.03)0.17(0.03)Intro 0.01(0.06)OneCredit 0.63**(0.11) 0.64** (0.10)Female 0.17**(0.05) 0.17** (0.05)Minority 0.17**(0.07) 0.16** (0.07)NNEnglish 0.24**(0.09) 0.25** (0.09)Intercept 4.00**(0.03) 4.07**(0.04)4.07**(0.04)SER 0.545 0.513 0.513R2 0.036 0.155 0.1552R0.034 0.144 0.145(a) 0.13 r 0.03 u 1.96 or 0.07 to 0.20(b) See the table above. Intro is not significant in (b), but the other variables are significant.A reasonable 95% confidence interval is 0.17 r 1.96 u 0.03 or0.11 to 0.23.Solutions to Empirical Exercises in Chapter 7 119 3.ModelRegressor (a) (b) (c)dist 0.073**(0.013) 0.031**(0.012)0.033**(0.013)bytest 0.092**(0.003) 0.093** (.003)female 0.143**(0.050) 0.144** (0.050)black 0.354**(0.067) 0.338** (0.069)hispanic 0.402**(0.074) 0.349** (0.077)incomehi 0.367**(0.062) 0.374** (0.062)ownhome 0.146*(0.065) 0.143* (0.065)dadcoll 0.570**(0.076) 0.574** (0.076)momcoll 0.379**(0.084) 0.379** (0.084)cue80 0.024**(0.009) 0.028** (0.010)stwmfg80 0.050*(0.020) 0.043* (0.020)urban 0.0652(0.063) tuition 0.184(0.099)intercept 13.956**(0.038) 8.861**(0.241)8.893**(0.243)F-statitisticfor urban and tuitionSER 1.81 1.54 1.54R2 0.007 0.282 0.284R0.007 0.281 0.281(a) The group’s claim is that the coefficien t on Dist is 0.075 ( 0.15/2). The 95% confidence forE Dist from column (a) is 0.073 r 1.96 u 0.013 or 0.099 to 0.046. The group’s claim is includedin the 95% confidence interval so that it is consistent with the estimated regression.120 Stock/Watson - Introduction to Econometrics - Second Edition(b) Column (b) shows the base specification controlling for other important factors. Here thecoefficient on Dist is 0.031, much different than the resultsfrom the simple regression in (a);when additional variables are added (column (c)), the coefficient on Dist changes little from the result in (b). From the base specification (b), the 95% confidence interval for E Dist is0.031 r1.96 u 0.012 or 0.055 to 0.008. Similar results are obtained from the regression in (c).(c) Yes, the estimated coefficients E Black and E Hispanic are positive, large, and statistically significant.Chapter 8Nonlinear Regression FunctionsSolutions to Empirical Exercises1. This table contains the results from seven regressions that are referenced in these answers.Data from 2004(1) (2) (3) (4) (5) (6) (7) (8)Dependent VariableAHE ln(AHE) ln(AHE) ln(AHE) ln(AHE) ln(AHE) ln(AHE) ln(AHE) Age 0.439**(0.030) 0.024**(0.002)0.147**(0.042)0.146**(0.042)0.190**(0.056)0.117*(0.056)0.160Age2 0.0021**(0.0007) 0.0021** (0.0007)0.0027**(0.0009)0.0017(0.0009)0.0023(0.0011)ln(Age) 0.725**(0.052)Female u Age 0.097 (0.084) 0.123 (0.084) Female u Age2 0.0015 (0.0014)0.0019 (0.0014) Bachelor u Age 0.064 (0.083)0.091 (0.084) Bachelor u Age2 0.0009 (0.0014) 0.0013 (0.0014) Female 3.158**(0.176) 0.180**(0.010)0.180**(0.010)0.180**(0.010)(0.014)1.358*(1.230)0.210**(0.014)1.764(1.239)Bachelor 6.865**(0.185) 0.405**(0.010)0.405**(0.010)0.405**(0.010)0.378**(0.014)0.378**(0.014)0.769(1.228)1.186(1.239)Female u Bachelor 0.064** (0.021) 0.063**(0.021)0.066**(0.021)0.066**(0.021)Intercept 1.884(0.897) 1.856**(0.053)0.128(0.177)0.059(0.613)0.078(0.612)0.633(0.819)0.604(0.819)0.095(0.945)F-statistic and p-values on joint hypotheses(a) F-statistic on terms involving Age 98.54(0.00)100.30(0.00)51.42(0.00)53.04(0.00)36.72(0.00)(b) Interaction termswithAge24.12(0.02)7.15(0.00)6.43(0.00)SER 7.884 0.457 0.457 0.457 0.457 0.456 0.456 0.456 R0.1897 0.1921 0.1924 0.1929 0.1937 0.1943 0.1950 0.1959 Significant at the *5% and **1% significance level.122 Stock/Watson - Introduction to Econometrics - Second Edition(a) The regression results for this question are shown in column (1) of the table. If Age increasesfrom 25 to 26, earnings are predicted to increase by $0.439 per hour. If Age increases from33 to 34, earnings are predicted to increase by $0.439 per hour. These values are the samebecause the regression is a linear function relating AHE and Age .(b) The regression results for this question are shown in column (2) of the table. If Age increasesfrom 25 to 26, ln(AHE ) is predicted to increase by 0.024. This means that earnings are predicted to increase by 2.4%. If Age increases from 34 to 35, ln(AHE ) is predicted to increase by 0.024.This means that earnings are predicted to increase by 2.4%. These values, in percentage terms,are the same because the regression is a linear function relating ln(AHE ) and Age .(c) The regression results for this question are shown in column (3) of the table. If Age increasesfrom 25 to 26, then ln(Age ) has increased by ln(26) ln(25) 0.0392 (or 3.92%). The predictedincrease in ln(AHE ) is 0.725 u (.0392) 0.0284. This means that earnings are predicted toincrease by 2.8%. If Age increases from 34 to 35, then ln(Age ) has increased by ln(35) ln(34) .0290 (or 2.90%). The predicted increase in ln(AHE ) is 0.725 u (0.0290) 0.0210. This means that earnings are predicted to increase by 2.10%.(d) When Age increases from 25 to 26, the predicted change in ln(AHE ) is(0.147 u 26 0.0021 u 262) (0.147 u 25 0.0021 u 252) 0.0399.This means that earnings are predicted to increase by 3.99%.When Age increases from 34 to 35, the predicted change in ln(AHE ) is(0. 147 u 35 0.0021 u 352) (0. 147 u 34 0.0021 u 342) 0.0063.This means that earnings are predicted to increase by 0.63%.(e) The regressions differ in their choice of one of the regressors. They can be compared on the basis of the .R The regression in (3) has a (marginally) higher 2,R so it is preferred.(f) The regression in (4) adds the variable Age 2 to regression(2). The coefficient on Age 2 isstatistically significant ( t 2.91), and this suggests that the addition of Age 2 is important. Thus,(4) is preferred to (2).(g) The regressions differ in their choice of one of the regressors. They can be compared on the basis of the .R The regression in (4) has a (marginally) higher 2,R so it is preferred.(h)Solutions to Empirical Exercises in Chapter 8 123 The regression functions using Age (2) and ln(Age) (3) are similar. The quadratic regression (4) is different. It shows a decreasing effect of Age on ln(AHE) as workers age.The regression functions for a female with a high school diploma will look just like these, but they will be shifted by the amount of the coefficient on the binary regressor Female. The regression functions for workers with a bachelor’s degree will also look just like these, but they would be shifted by the amount of the coefficient on the binary variable Bachelor.(i) This regression is shown in column (5). The coefficient on the interaction term Female uBachelor shows the “extra effect” of Bachelor on ln(AHE) for women relative the effect for men.Predicted values of ln(AHE):Alexis: 0.146 u 30 0.0021 u 302 0.180 u 1 0.405 u 1 0.064 u 1 0.078 4.504Jane: 0.146 u 30 0.0021 u 302 0.180 u 1 0.405 u 0 0.064 u 0 0.078 4.063Bob: 0.146 u 30 0.0021 u 302 0.180 u 0 0.405 u 1 0.064 u 0 0.078 4.651Jim: 0.146 u 30 0.0021 u 302 0.180 u 0 0.405 u 0 0.064 u 0 0.078 4.273Difference in ln(AHE): Alexis Jane 4.504 4.063 0.441Difference in ln(AHE): Bob Jim 4.651 4.273 0.378Notice that the difference in the difference predicted effects is 0.441 0.378 0.063, which is the value of the coefficient on the interaction term.(j) This regression is shown in (6), which includes two additional regressors: the interactions of Female and the age variables, Age and Age2. The F-statistic testing the restriction that the coefficients on these interaction terms is equal to zero is F 4.12 with a p-value of 0.02. This implies that there is statistically significant evidence (at the 5% level) that there is a different effect of Age on ln(AHE) for men and women.(k) This regression is shown in (7), which includes two additional regressors that are interactions of Bachelor and the age variables, Age and Age2. The F-statistic testing the restriction that the coefficients on these interaction terms is zero is 7.15 with a p-value of 0.00. This implies that there is statistically significant evidence (at the 1% level) that there is a different effect of Age on ln(AHE) for high school and college graduates.(l) Regression (8) includes Age and Age2 and interactions terms involving Female and Bachelor.The figure below shows the regressions predicted value of ln(AHE) for male and females with high school and college degrees.124 Stock/Watson - Introduction to Econometrics - Second EditionThe estimated regressions suggest that earnings increase as workers age from 25–35, the rangeof age studied in this sample. There is evidence that the quadratic term Age2 belongs in theregression. Curvature in the regression functions in particularly important for men.Gender and education are significant predictors of earnings, and there are statistically significant interaction effects between age and gender and age and education. The table below summarizes the regressions predictions for increases in earnings as a person ages from 25 to 32 and 32 to 35Gender, Education Predicted ln(AHE) at Age(Percent per year)25 32 35 25 to 32 32 to 35Males, High School 2.46 2.65 2.67 2.8% 0.5%Females, BA 2.68 2.89 2.93 3.0% 1.3%Males, BA 2.74 3.06 3.09 4.6% 1.0%Earnings for those with a college education are higher than those with a high school degree, andearnings of the college educated increase more rapidly early in their careers (age 25–32). Earnings for men are higher than those of women, and earnings of men increase more rapidly early in theircareers (age 25–32). For all categories of workers (men/women, high school/college) earningsincrease more rapidly from age 25–32 than from 32–35.。

‘FinancialEconometrics’ Lectured by Dr Jin Hongfei 1第4章古典线性回归模型的进一步探讨‘Financial Econometrics’ Lectured byDr Jin Hongfei 2拟合优度(Goodness of Fit)•我们希望用某种方式来测定一个回归模型拟合数据的优劣程度.i Y 可分解为‘FinancialEconometrics’ Lectured by Dr Jin Hongfei 6作为拟合优度测量的R 2所存在的问题•这里有一些问题:1. R 2是由y 均值的变异来定义,所以如果一个模型再参数化(重新排列)并且应变量改变,R 2也会改变。

2. 如果有更多的回归自变量加入到回归方程中去,R 2的值永远不会下降, 例如考虑两个模型:回归方程1: y t = β1+ β2x 2t + β3x 3t + u t回归方程2: y t = β1+ β2x 2t + β3x 3t + β4x 4t + u t对于回归方程2来讲,其R 2至少和回归方程1的R 2一样大。

3. 对于时间序列回归,R 2常常取0.9或更高的值‘Financial Econometrics’ Lectured byDr Jin Hongfei 8违反CLRM 假设•回忆我们假定CLRM 残差项:1. E(u t ) = 02. Var(u t ) = σ2< ∞3. Cov (u i ,u j ) = 04. X 矩阵是非随机的或者在重复样本中是固定的5. u t ∼N (0,σ2)j i ≠‘Financial Econometrics’ Lectured byDr Jin Hongfei 9违反CLRM 假设的调查•进一步研究这些假设,尤其从以下几个方面:-怎么才能检验违背了假定-原因-结论概括得讲,将遇到下面三个问题中的一个或多个:-系数估计值是错误的-相关的标准误是错误的-检验统计量分布的假定是不正确的-解决方法-使假设不再被违反-避开这些问题,以便其他可供选择的技术仍然能有效得使用‘FinancialEconometrics’ Lectured by Dr Jin Hongfei 11假定1: E(u t ) = 0•假设误差项的均值等于0.•对于诊断检验,我们不能观察其分布,所以只能检验残差项•残差的均值总是为零意味着在回归方程中有常数项‘Financial Econometrics’ Lectured by Dr Jin Hongfei 13异方差(Heteroscedasticity )的检测•图示法•正式的方法:异方差检验最好的一种方法是怀特一般性检验(White’s general test )如何进行这种检验:1. 假设待估计的回归模型采取以下的形式:y t = β1+ β2x 2t + β3x 3t + u t为了检验Var(u t ) = σ2. 估计这个模型,获得残差项。

Chapter 8. Nonlinear Regression Functions8.1 A General Strategy for Modeling Nonlinear Regression Functions•Everything so far has been linear in the X’s•The approximation that the regression function is linearmight be good for some variables, but not for others.•The multiple regression framework can be extended to handle regression functions that are nonlinear in one or more X.The TestScore – STR relation looks approximately linear…But the TestScore – average district income relation looks like it is nonlinear.If a relation between Y and X is nonlinear:•The effect on Y of a change in X depends on the value of X – that is, the marginal effect of X is not constant•A linear regression is mis-specified – the functional form is wrong•The estimator of the effect on Y of X is biased – it needn’t even be right on average. 遗漏高次项会带来遗漏变量偏差。

计量经济学概述一、计量经济学定义1. 定义有几个比较权威的定义:(1) 计量经济学是一门发展迅速的经济学分支,其目标是给出经济关系的经验内容。

(2) 计量经济学科定义为实际经济现象的定量分析,这种分析根据的是由适当的推断方法联系在一起的理论和观测的即时发展。

计量经济学运用数理统计知识分析经济数据,对构建与数理经济学基础上的数学模型提供经验支持,并得出数量结果。

(3) 计量经济学是将经济理论、数学和统计推断等工具应用于经济现象分析的社会科学。

综上所述,计量经济学是一门有关经济关系的经验估计的经济学分支。

计量经济学依据经济理论,使用数学和统计推断等工具,用观测数据对经济和商务活动进行实证研究,测度和检验经济变量间的经验关系,从而给出经济理论的经验内容,在经济理论的抽象世界和人类活动的具体世界之间搭建桥梁。

经济理论、数学和统计学知识在计量经济学这一领域进行研究的必要前提,这三者中的每一个对于真正理解现代经济生活中的数量关系是必要的,但不是充分的,只有结合在一起才行。

因此,一个优秀的计量经济学家必须是合格的数学家和统计学家,还应该是一个经过系统经济学训练的经济学家。

2. 要素经济理论、数学和统计方法3. 目标计量经济学从根本上说,是对经验规律的认识以及将这些规律推广为经济学定律的系统努力,这些定律被用来进行预测,即关于什么可能发生或者什么将会发生的预测。

因此,广义上说,计量经济学可以成为预测的科学。

因为使用统计学的分析方法,所以计量经济学有别于像数学那样的传统的科学,具体在以后我们会涉及到。

4. 发展历程最早是在W.Petty在1690年写的《政治算术》中出现计量经济学。

其观点是尽可能地排除主观因素,强调比较那些用于数据分析的数量,重量以及衡量尺度的重要性。

1911年H.L.Moore在他所著的《工资的法则》中,开始用统计的手法对工资的边界生产力进行了验证。

20世纪20年代末期资本主义世界发生了严重的经济危机,原有的经济理论失灵,产生了所谓的凯恩斯革命。

YY Y Y YYY Y Y E Y d F Fq Y E Y E Yi i u X YE Y E Y W X V Y E VE Y E Y E WE X E X W X VY X Y WV X Y XYW V W VX Y Y X Y X Y X Y X X Y X Y CM F C M F C M F M FC M F M F M F M F M F M F C M F M FC C e e e eC e CX X Y E YE YYE Y E YIntroduction to Econometrics,Y XYE Y XE Y XYY XE XYX Y E XY E X E YX Y X YX YY Y FY Z Z N Y ZE Y Y E W WY WY WE Y YY YWX S WE S X E S X E S X E S XE S X E S X E S X E S XE S E S X E S X XE S E S X E S X XE S E S X E S X XE S E S X E S X XS E S S E SE S S S E S E S S E S E SZNn Zn ZnZnY YP YP YZ nnIntroduction to Econometrics,l j i j ilj i ii Y y X x Y y Y y X x X x i i i k k lj j j j i i jj i k lj j i j il i E Y y Y y y Y y X x X x y Y y X x X x E Y X x X x X Yi j i jX x Y y X x Yy XY l k i j ij lk i j i j E XX x Y y x X x Yy l kiX i j Y j i j X Y x X x y Y y E X XE X E XE X X X X X E XE X E X E X E X E X E X E X E X E XE X E X EX E X E XX X E XX X X X X E XE X E X E X E XE X E X E X E X E X E X E X E X E XX Z X Z X Z XZ X Z Z z X x Z z E Z XE Z E Y X E X Z X E X X E Z X X X X X E XY Z E X Z E X E XYE X ZX E X E ZX E X X Z ZX E ZX E XY E X E ZXX Y X YXY E X E X E XY X E XYE X X Y n n i n n i i i ax ax ax ax ax a x x x x a x n i i n n i nn n n i i ii x y xy x y x y x x x y y y x y nia a a aa na n n i i i i ii i i i i n n n n n i i i i i ii i i i i a bx cy a b x c y abx acy bcx y na b x c y abx ac y bc x y E W E E W Z E E X X Z E E X ZE X Z E WZ E E WZ Z E ZE W Z E ZV W h Z E VE W E h Z E W h Z E W h ZE V E W E h Z E h Z h zznY N Yn YYn Ynn Ynn YnY Y YY Y p Y p Y p p ppptacttnp H p H pactp tp H p H pactp tpt ptH p H pp tppp pppp pIntroduction to Econometrics,t ttp nn pp p p p pnpp tt p p p n pn p t-ppY YY nYYYYH HYYtactacttYn Y nn YE YYnYYs YYYYnsnYsYYIntroduction to Econometrics,H H tactY Ytpact p tpY YapaYbp bYYap a p aYbp b p bapbpapbpapbpa bp papbpapbpapbpYpm mYYwwY Yi Y Y i j YE Y E Y Y i ji j YY YYY Y nYYnn m n wnm wY YwSE YTestScoreTestScoreTestScore CSSSRn SER RTSSY s nYs AgeAWEAWESER Y AWE SERRX Y X AWEu iu iX iu iE u iuX E u i X i E uiYi XiiE EXE u E u iE XE EXXEYiY Y RRiY Y iiiYX iY Y iX iiX iin iiX n i iiY b X bib X niiX n iiXIntroduction to Econometrics,X i X u i ii iX i X u itacttp H Hactp tptacttp H Hactp tpt act t pt p pIntroduction to Econometrics,Y Xn nY Y Y X Y Y Y nE Y i XX nX inXmY w m YY mY mwmwmwmmwwmwmw。