第十一讲 二元选择模型(高级计量经济学课件-对外经济贸易大学 潘红宇)

- 格式:ppt

- 大小:146.50 KB

- 文档页数:27

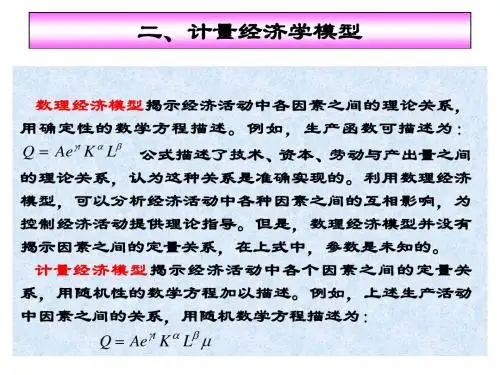

第11章二值选择模型11.1 二值选择模型如果被解释变量y离散,称为“离散选择模型”(discrete choice model)或“定性反应模型”(qualitative response model)。

最常见的离散选择模型是二值选择行为(binary choices)。

比如:考研或不考研;就业或待业;买房或不买房;买保险或不买保险;贷款申请被批准或拒绝;出国或不出国;回国或不回12国;战争或和平;生或死。

假设个体只有两种选择,比如1y =(考研)或0y =(不考研)。

最简单的建模方法为“线性概率模型”(Linear Probability Model ,LPM):1122(1,,)i i i K iK i i i y x x x i n βββεε'=+=+= +++x β (11.1)其中,解释变量12()i i i iK x x x '≡ x ,而参数12()K βββ'≡ β。

LPM 的优点是,计算方便,容易得到边际效应(即回归系数)。

3LPM 的缺点是,虽然y 的取值非0即1,但根据线性概率模型所作的预测值却可能出现ˆ1y>或ˆ0y <的不现实情形。

图11.1 线性概率模型4为使y 的预测值介于[0,1]之间,在给定x 的情况下,考虑y 的两点分布概率:P(1|)(,)P(0|)1(,)y F y F ==⎧⎨==-⎩x x x x ββ (11.2)函数(,)F x β称为“连接函数”(link function) ,因为它将x 与y 连接起来。

y 的取值要么为0,要么为1,故y 肯定服从两点分布。

连接函数的选择具有一定灵活性。

通过选择合适的连接函数(,)F x β(比如,某随机变量的累积分布函数),可保证ˆ01y≤≤,并将ˆy 理解为“1y =”发生的概率,因为5E(|)1P(1|)0P(0|)P(1|)y y y y =⋅=+⋅===x x x x (11.3)如果(,)F x β为标准正态的累积分布函数,则P(1|)(,)()()y F t dt φ'-∞'===Φ≡⎰x x x x βββ (11.4)()φ⋅与()Φ⋅分别为标准正态的密度与累积分布函数;此模型称为“Probit ”。

WEEK 10: MACROECONOMETRICS Introduction1.The concept of stationarity2.Spurious regressions3.Testing for unit roots4.Cointegration analysis1. S TATIONARITYConditions for t y to be a stationary time series process i. t E y constant t ii. t Var y constant tiii. ,t t k Cov y y constant t and all k≠0 Autoregressive time series1t t t y y- Notice no constant and t is a white noise error term.- AR(1) model – time series behaviour of t y is largely explained by its value in the previous period.- Necessary condition for stationarity 1 , if , 1 series is explosive and if 1 have a unit root.Example 1 – Stationary AR(1) ModelSTATA codeset obs 500 /*set number of observations*/gen time=_n /*create time trend*/gen y=0 if time==1 /* first observation set y=0*/gen e=rnormal(0, 1) /*create a random number*/replace y=(0.67*y[_n-1])+e if time~=1 /*AR(1) model =0.67*/ twoway (line y time) /*line plot*/Example 2 – Explosive AR(1) ModelSTATA codeset obs 500 /*set number of observations*/gen time=_n /*create time trend*/gen y=0 if time==1 /* first observation set y=0*/gen e=rnormal(0, 1) /*create a random number*/replace y=(1.16*y[_n-1])+e if time~=1 /*AR(1) model =1.16*/ twoway (line y time) /*line plot*/Example 3 – Non-stationary AR(1) ModelSTATA codeset obs 500 /*set number of observations*/gen time=_n /*create time trend*/gen y=0 if time==1 /* first observation set y=0*/ gen e=rnormal(0, 1) /*create a random number*/ replace y=y[_n-1]+e if time~=1 /*AR(1) model =1*/ twoway (line x time) /*line plot*/ Noticety is not mean reverting. Random walk =1In the model:1t t t y yif 1 then t y is said to contain a UNIT ROOT i.e. is non-stationarySo 1t t t y y subtract 1t y from the LHS and RHS:111t t t t t y y y yt t y and because t is white noise t y is a stationary series.Example 3 (continued) – Non-stationary AR(1) Model and First Difference- A series t y is integrated of order one, i.e. t y I (1), and contains a unit root if t y is non-stationary but t y is a stationary series.- Possible that the series t y needs to be differenced more than once to achieve a stationary process.- A series t y is integrated of order d , i.e. t y I (d) if t y is non-stationary but d t y is a stationary series: Note: 211t t t t t t t y y y y y y y2.S PURIOUS REGRESSIONWhy worry whether t y is stationary?Most macroeconomic time series are trended and in most cases non-stationary processes.Using OLS to model non-stationary data can lead to problems and incorrect conclusions.a.high R squared often >0.95b.high t valuesc.theoretically variables in the analysis have no interrelationship Why does non-stationarity arise in macro data?Economic time series e.g. GDP, money supply, employment, all tend to grow at an annual rate.Such series non-stationary as the mean is continually rising. Even after differencing the series cannot be made stationary.So, usually take logarithms of time series data before undertaking econometric analysis.Take logarithm of a series which exhibits an average growth rate it will follow a linear trend and become an integrated series, i.e. one which is stationarity after differencing.Consider t y which grows by 10% per period, thus11.1t t y yTake the log of both the LHS and RHS, then1log log 1.1log t t y yThe lagged dependent variable has a unit coefficient and log 1.1 is a constant. The series would now be I(1), see example 3.Consider the model01t t t y xCLRM assumptions require that both variables have zero mean and constant variance (i.e. stationary, see (1i and 1ii)).If these assumption are violated and the series are non-stationary Granger and Newbold (1974) proved that results obtained are totally spurious. Granger, C. and P. Newbold (1974) Spurious regressions in econometrics. Journal of Econometrics, 2, 111-120.‘Rule of thumb’ for detecting a spurious regression:or,a.2R DWRb.12Logic behind spurious regression.Consider two unrelated series that are non-stationary, then:– both either together, or one will whilst the other .– Either way likely to find a +ve or –ve significant relationship.PROFESSOR KARL TAYLOR ECN6540 2017-18 Example 4 – Spurious Regression: Artificial DataSource | SS df MS Number of obs = 500-------------+------------------------------ F( 1, 498) = 143.04Model | 9096.19185 1 9096.19185 Prob > F = 0.0000Residual | 31668.4706 498 63.5913065 R-squared = 0.2231-------------+------------------------------ Adj R-squared = 0.2216Total | 40764.6625 499 81.6927104 Root MSE = 7.9744------------------------------------------------------------------------------y | Coef. Std. Err. t P>|t| [95% Conf. Interval]-------------+----------------------------------------------------------------x | .9443085 .0789556 11.96 0.000 .7891813 1.099436_cons | 3.505432 .4156699 8.43 0.000 2.688749 4.322114------------------------------------------------------------------------------ Durbin-Watson d-statistic (2, 500) = 0.0316917Example 5 – Spurious Regression: Economic DataRegress by OLS the logarithm of GDP against the logarithm of M2. Quarterly time series data over the period 1975Q1 until 1997Q4.01log log tt t gdp muse "C:\Karl's files\2016-17\ECN6540\LECTURES\spurious1.dta", cleargen date=q(1975q1)+_n-1format date %tq tsset dategen lgdp=log(gdp) gen lm=log(m) reg lgdp lm estat dwatsonSource | SS df MS Number of obs = 92 -------------+------------------------------ F( 1, 90) = 547.56 Model | 1.78659606 1 1.78659606 Prob > F = 0.0000 Residual | .29365627 90 .003262847 R-squared = 0.8588 -------------+------------------------------ Adj R-squared = 0.8573 Total | 2.08025233 91 .022859916 Root MSE = .05712 ------------------------------------------------------------------------------ lgdp | Coef. Std. Err. t P>|t| [95% Conf. Interval] -------------+---------------------------------------------------------------- lm | .219892 .0093971 23.40 0.000 .201223 .2385611 _cons | 3.075618 .0571457 53.82 0.000 2.962088 3.189147 ------------------------------------------------------------------------------ Durbin-Watson d-statistic( 2, 92) = 0.032836Regression fits the data well – both variables trended.Why is this regression spurious?In the model 01t t t y x there are four possible scenarios:a. Both t y and t x are stationary processes and so the CLRM is appropriate and OLS is BLUE;b. t y and t x are integrated of difference orders, e.g. I(0) and I(1), – the regression is now meaningless, since t y has a constant mean and t x drifts over time;c. t y and t x are integrated of the same order, e.g. I(1), and t contains a stochastic trend, i.e. I(1). This is the case of a spurious regression. Could re-estimate the model in first differences.d. t y and t x are integrated of the same order,e.g. I(1), and t is a stationary process, i.e. I(0). In this special case t y and t x are said to be cointegrated .Hence testing for non-stationarity is extremely important.3. T ESTING FOR UNIT ROOTSTesting the order of integration is a test for the number of unit roots.i. Test t y to see if stationary. If stationary then t y I (0); if not stationary then t y I (d); d >0.ii. Take first differences of t y i.e. 1t t t y y y then test t y to see ifstationary. If stationary then t y I (1); if not stationary then t y I (d); d >0.iii. Take the second difference of t y i.e. 21t t t t y y y y then test 2t yto see if stationary. If stationary then t y I (2); if not stationary then t y I (d); d >0.Continue process until stationary.Dickey-Fuller Test for Unit RootsDickey and Fuller (1979) Distribution of the estimators for autoregressive time series with a unit root. Journal of the American Statistical Association , 74, 427-431.Dickey and Fuller (1981) Likelihood ratio statistics for autoregressive time series with a unit root. Econometrica , 49, 1057-1072.Test based on testing for the existence of a unit root.Start with an AR(1) model:1t t t y yTo test for a unit root 0:1H 1:1HCan re-write the above model by subtracting 1t y from both sides:111111t t t t t tt t t t y y y y y y y(1)1To test for a unit root the null and alternative hypotheses are 0:0H 1:0HDickey and Fuller proposed two alternative regression equations which can be used for testing the presence of a unit root:1t t t y y (2)Testing for a unit root based upon eq. (1) is only valid if the d.g.p has a zero mean and no trend. So eq. (2) includes a constant in the random walk process.1t t t y t y (3)Allows for a non zero mean and trend component in the series.The DF test for a unit root is based upon a conventional t test on from one of the three models.Critical values (based upon Mackinnon, 1991): MODEL 1% 5% 10% 1t t t y y 1t t t y y -3.43 -2.86 -2.57 1t t t y t y -3.96 -3.41 -3.13 Standard critical values -2.33 -1.65 -1.28If t statistic is greater than the critical value then the null hypothesis of a unit root is rejected and can conclude that t y is a stationary process.3.1 Augmented Dickey-Fuller Test for Unit RootsUnlikely that the error term t in eqs. (1) to (3) is white noise – auto/serial correlation.Dickey and Fuller proposed augmenting the DF test by including extra lagged terms of the dependent variable to eliminate the presence of autocorrelation.11p k t k k t t t y y y (4)11p k t k k t t t y y y (5)11p k t k k t t t y y y t (6)Again the difference between eqs. (4) to (6) concerns the inclusion of a constant and trend.An important consideration is the optimal lag length p.-If p is too small then the remaining autocorrelation will bias the test.-If p is too large then the power of the test will suffer.Ng and Perron (1995) suggest firstly, set an upper bound for p i.e. p . Then estimate the ADF test based on the p lag length.If the absolute value of the t-statistic for testing the significance of the last lagged difference is greater than 1.6 then set p=p and perform the unit root test. Otherwise, reduce the lag length by one and repeat the process.Rule of thumb (Schwert, 1989),0.25int12100Tp3.2 Kwiatkowski-Phillips-Schmidt-Shin (1992)Testing the null hypothesis of stationarity against the alternative of a unit root. How sure are we that economic time series have a unit root? Journal of Econometrics , 54, 159-178.KPSS test differs to the DF and ADF null hypothesis is stationarity. Model decomposed into trend, random walk (t r ) and a stationary error term:21,0u t tt t tt t IID u u r r r t yThe initial value of t r is fixed and serves the role of the intercept 0r . Thestationary null hypothesis is that 20u since tis stationary, hence under the null hypothesis t y is trend stationary.To undertake the test:i. Regress t y of on an intercept and time trend, i.e. t t y t ;ii. Save the OLS residuals from (i) ˆt t eand compute the partial sum process, i.e. 1t s t s S e ;iii. Test statistic is LM, given by:221ˆT tt KPSS S .2ˆis an estimate of the error variance RSS/T (may be corrected for autocorrelation);iv. Critical value at 5% level 0.145. If trend omitted from (i) then the criticalvalue at the 5% level is 0.463.Example 6 – Unit Root Tests – ADF test: Nelson & Plosser U.S. Data Nelson, C.R. and Plosser, C.I. (1982), Trends and Random Walks in Macroeconomic Time Series, Journal of Monetary Economics, 10, 139–162.clear all /*clear memory*/use /ec-p/data/macro/nelsonplosser.dta /*load data*/ keep year lip lsp500 /*keep a subset of Nelson and Plosser variables*/drop if lip==. | lsp500==. /*drop any missing observation*/tsset year /*set year as time identifier*/twoway (line lip year) (line lsp500 year, yaxis(2)) /*plot data over time*//*ADF tests on industrial production*/dfuller lip, regress noconstant lags(3) /*ADF test no constant or trend eq.(4) */ dfuller lip, regress lags(3) /*ADF test constant no trend eq.(5) */dfuller lip, regress trend lags(3) /*ADF test constant and trend eq.(6) *//*ADF tests on S&P 500 index*/dfuller lsp500, regress noconstant lags(3) /*ADF test no constant or trend eq.(4) */ dfuller lsp500, regress lags(3) /*ADF test constant no trend eq.(5) */dfuller lsp500, regress trend lags(3) /*ADF test constant and trend eq.(6) *//*ADF tests on industrial production*/dfuller lip, regress noconstant lags(3) /*ADF test no constant or trend eq.(4) */ Augmented Dickey-Fuller test for unit root Number of obs = 96---------- Interpolated Dickey-Fuller ---------Test 1% Critical 5% Critical 10% CriticalStatistic Value Value Value------------------------------------------------------------------------------Z(t) 2.640 -2.602 -1.950 -1.610------------------------------------------------------------------------------D.lip | Coef. Std. Err. t P>|t| [95% Conf. Interval]-------------+----------------------------------------------------------------lip |L1. | .0121854 .0046149 2.64 0.010 .0030198 .0213511LD. | .0855473 .1060297 0.81 0.422 -.1250368 .2961313L2D. | -.0727104 .1059196 -0.69 0.494 -.2830758 .1376551L3D. | .0177574 .1045445 0.17 0.865 -.189877 .2253918------------------------------------------------------------------------------dfuller lip, regress lags(3) /*ADF test constant no trend eq.(5) */Augmented Dickey-Fuller test for unit root Number of obs = 96 ---------- Interpolated Dickey-Fuller --------- Test 1% Critical 5% Critical 10% Critical Statistic Value Value Value ------------------------------------------------------------------------------ Z(t) -0.687 -3.516 -2.893 -2.582 ------------------------------------------------------------------------------------------------------------------------------------------------------------ D.lip | Coef. Std. Err. t P>|t| [95% Conf. Interval] -------------+---------------------------------------------------------------- lip |L1. | -.006546 .0095294 -0.69 0.494 -.025475 .0123831 LD. | .05638 .1046247 0.54 0.591 -.1514442 .2642041 L2D. | -.0932085 .1041037 -0.90 0.373 -.2999977 .1135807 L3D. | -.0161771 .1034743 -0.16 0.876 -.2217161 .1893618 _cons | .0627725 .0281174 2.23 0.028 .0069208 .1186242 ------------------------------------------------------------------------------dfuller lip, regress trend lags(3) /*ADF test constant and trend eq.(6) */Augmented Dickey-Fuller test for unit root Number of obs = 96---------- Interpolated Dickey-Fuller --------- Test 1% Critical 5% Critical 10% Critical Statistic Value Value Value ------------------------------------------------------------------------------ Z(t) -3.298 -4.049 -3.454 -3.152 ------------------------------------------------------------------------------------------------------------------------------------------------------------ D.lip | Coef. Std. Err. t P>|t| [95% Conf. Interval] -------------+---------------------------------------------------------------- lip |L1. | -.2207902 .0669447 -3.30 0.001 -.3537874 -.0877929 LD. | .168619 .1054778 1.60 0.113 -.040931 .378169 L2D. | .0151678 .10462 0.14 0.885 -.1926782 .2230138 L3D. | .0831198 .1031807 0.81 0.423 -.1218666 .2881062 _trend | .0088867 .0027512 3.23 0.002 .0034209 .0143524 _cons | .1611592 .0405474 3.97 0.000 .0806046 .2417137 ------------------------------------------------------------------------------Note can find given 10.220810.220810.7792/*ADF tests on S&P 500 index*/dfuller lsp500, regress noconstant lags(3) /*ADF test no constant & trend eq.(4) */ Augmented Dickey-Fuller test for unit root Number of obs = 96---------- Interpolated Dickey-Fuller ---------Test 1% Critical 5% Critical 10% CriticalStatistic Value Value Value------------------------------------------------------------------------------Z(t) 1.567 -2.602 -1.950 -1.610------------------------------------------------------------------------------D.lsp500 | Coef. Std. Err. t P>|t| [95% Conf. Interval]-------------+----------------------------------------------------------------lsp500 |L1. | .0106279 .0067804 1.57 0.120 -.0028386 .0240944LD. | .2531512 .1064478 2.38 0.019 .0417367 .4645658L2D. | -.1932357 .107425 -1.80 0.075 -.406591 .0201196L3D. | -.017031 .1064838 -0.16 0.873 -.228517 .194455------------------------------------------------------------------------------dfuller lsp500, regress lags(3) /*ADF test constant no trend eq.(5) */ Augmented Dickey-Fuller test for unit root Number of obs = 96 ---------- Interpolated Dickey-Fuller --------- Test 1% Critical 5% Critical 10% Critical Statistic Value Value Value ------------------------------------------------------------------------------ Z(t) 0.059 -3.516 -2.893 -2.582 ------------------------------------------------------------------------------------------------------------------------------------------------------------ D.lsp500 | Coef. Std. Err. t P>|t| [95% Conf. Interval] -------------+---------------------------------------------------------------- lsp500 |L1. | .0011734 .0200279 0.06 0.953 -.0386096 .0409564 LD. | .2612615 .1080976 2.42 0.018 .046539 .475984 L2D. | -.1856923 .1089062 -1.71 0.092 -.4020212 .0306366 L3D. | -.0079754 .1084307 -0.07 0.942 -.2233596 .2074089 _cons | .0252099 .0502234 0.50 0.617 -.0745527 .1249725 ------------------------------------------------------------------------------dfuller lsp500, regress trend lags(3) /*ADF test constant and trend eq.(6) */ Augmented Dickey-Fuller test for unit root Number of obs = 96---------- Interpolated Dickey-Fuller ---------Test 1% Critical 5% Critical 10% CriticalStatistic Value Value Value------------------------------------------------------------------------------Z(t) -2.121 -4.049 -3.454 -3.152------------------------------------------------------------------------------------------------------------------------------------------------------------D.lsp500 | Coef. Std. Err. t P>|t| [95% Conf. Interval]-------------+----------------------------------------------------------------lsp500 |L1. | -.0969978 .0457218 -2.12 0.037 -.1878321 -.0061635LD. | .3015991 .1068021 2.82 0.006 .0894181 .5137802L2D. | -.1405117 .1079217 -1.30 0.196 -.3549171 .0738936L3D. | .0396776 .1076543 0.37 0.713 -.1741965 .2535517_trend | .0032803 .0013813 2.37 0.020 .0005362 .0060245_cons | .0942689 .0569704 1.65 0.101 -.0189127 .2074505------------------------------------------------------------------------------So both industrial production and the S&P 500 index definitely not stationary over the period, i.e. not I(0).Order of integration?Take first difference then undertake test again.In STATA the first difference operator is D, second difference operator is D2 /*ADF tests on industrial production first differenced*/dfuller D.lip, lags(3) /*ADF test constant no trend eq.(5) */dfuller D.lip, trend lags(3) /*ADF test constant and trend eq.(6) *//*ADF tests on S&P 500 index first differenced*/dfuller D.lsp500, lags(3) /*ADF test constant no trend eq.(5) */dfuller D.lsp500, trend lags(3) /*ADF test constant and trend eq.(6) *//*ADF tests on industrial production first differenced*/dfuller D.lip, lags(3) /*ADF test constant no trend eq.(5) */Augmented Dickey-Fuller test for unit root Number of obs = 95 ---------- Interpolated Dickey-Fuller --------- Test 1% Critical 5% Critical 10% Critical Statistic Value Value Value ------------------------------------------------------------------------------ Z(t) -5.624 -3.517 -2.894 -2.582 ------------------------------------------------------------------------------dfuller D.lip, trend lags(3) /*ADF test constant and trend eq.(6) */ Augmented Dickey-Fuller test for unit root Number of obs = 95---------- Interpolated Dickey-Fuller --------- Test 1% Critical 5% Critical 10% Critical Statistic Value Value Value ------------------------------------------------------------------------------ Z(t) -5.600 -4.051 -3.455 -3.153 ------------------------------------------------------------------------------/*ADF tests on S&P 500 index first differenced*/dfuller D.lsp500, lags(3) /*ADF test constant no trend eq.(5) */Augmented Dickey-Fuller test for unit root Number of obs = 95 ---------- Interpolated Dickey-Fuller --------- Test 1% Critical 5% Critical 10% Critical Statistic Value Value Value ------------------------------------------------------------------------------ Z(t) -5.996 -3.517 -2.894 -2.582 ------------------------------------------------------------------------------dfuller D.lsp500, trend lags(3) /*ADF test constant and trend eq.(6) */ Augmented Dickey-Fuller test for unit root Number of obs = 95---------- Interpolated Dickey-Fuller --------- Test 1% Critical 5% Critical 10% Critical Statistic Value Value Value ------------------------------------------------------------------------------ Z(t) -6.149 -4.051 -3.455 -3.153 ------------------------------------------------------------------------------Hence both industrial production and the S&P 500 index are I(1).4.C OINTEGRATION-Trended data can create problems due to spurious regressions.-Most macro variables are trended and hence non-stationary.-Hence the problem of spurious regressions is likely in macro models. Solution?Difference the data until it becomes stationary.Problemsi.If the model is correctly specified in both y and x then differencing bothvariables means the error process is also differenced non-invertibleMA process, estimation difficulties;ii.Once the model is differenced it can no longer have a unique long run solution.4.1 Cointegration DefinitionsWhere the regression of one non-stationary variable y on one or more non-stationary variables ,,,12k x x x results in a non spurious regression.Then a long run equilibrium relationship exists between the variables.Hence cointegration should only occur where there is a relationship linking the variables.We will only consider the case of two variables t y and t x i.e. not multivariate cointegration.If there is a long run equilibrium relationship between t y and t x , despite them both rising over time (trended), then a linear combination of the two variables must be I(0).A linear combination can be taken from the model:01t t t y xConsider the residuals:01ˆˆˆt t t t e y xIf t e I (0) then t y and t x are said to be cointegrated.10, is known as the cointegrating vector.Definitions:i. Time series t y and t x cointegrated of order d , b where d ≥b ≥0, which canbe written as t t x y , CI (d,b ), if both series are I(d ) and a linear combinationexists between the variables integrated of order I(d-b ). Then ,12 is the cointegrating vector (there is only one).ii. Generalisation, multivariate cointegration: let t Z denote an n×1 vector ofthe series ,,,,123nt t t t Z Z Z Z , if each it Z is I(d ) and an n×1 vector exists such that ' t Z I (d-b ) then it Z CI (d,b ). Can be more than one cointegrating vector.4.2Testing for Cointegration in single equationsEngle, R. and C. Granger (1987) Cointegration and error correction: Representation, estimation and testing. Econometrica, 35, 251-276.Step 1-By definition cointegration requires that the variables are integrated of the same order I(d).-So apply ADF tests to infer the number of unit roots in each variable.i.If both t y and t x are I(0) then OLS and appropriate.ii.If t y and t x are integrated to different orders, e.g. I(0) and I(1), then they can-not be cointegrated.iii.If both t y and t x are integrated to the same order, e.g. I(1), then go to step 2.Step 2- If both t y and t x are integrated to the same order, in macro data usually I(1), then estimate the long run equilibrium relationship:01t t t y x- Obtain the residuals from the model, t e .- If there is no cointegration then the results will be spurious (see section 2).- If the variables are cointegrated then OLS yields super-consistent estimatesfor the cointegrating parameter 1ˆ .Step 3- Test the residuals from step 2 for stationarity using the ADF test:11p k t k k t t t u e e e- If t e I (0) then t y and t x are cointegrated.- Note critical value differ to those standard ADF tests:Critical values (based upon Engle-Granger, 1987): MODEL 1% 5% 10%Lags (ADF) -3.73 -3.17-2.91Example 7 – Engle Granger Cointegration Use King et al. data for the U.S.:King, R. G., C. I. Plosser, J. H. Stock, and M. W. Watson. 1991. Stochastic trends and economic fluctuations. American Economic Review , 81, 819–840.Model logarithm of consumption (c) as a function of the logarithm of gdp (y).01log log t t t c yclear all /*clear memory*/use /data/r11/balance2 /*load data*/ tsset time /*set year as time identifier*/ twoway (line y time) (line c time, yaxis(2))/*STEP 1 - order of integration*//*ADF tests on real gdp*/dfuller y, regress trend lags(4) /*ADF test constant and trend eq.(6)*/ /*ADF tests on consumption*/dfuller c, regress trend lags(4) /*ADF test constant and trend eq.(6)*/ /*STEP 2 - estimate long run relationship*/regress c ypredict e, resid /*gain residuals*/estat dwatson /*durbin watson statistic*//*STEP 3 - test residuals for stationarity*/dfuller e, regress noconstant lags(4) /*ADF test on residual*//*step 1 - order of integration*//*ADF tests on real gdp*/Dfuller y, regress trend lags(4) /*ADF test constant and trend eq.(6)*/Augmented Dickey-Fuller test for unit root Number of obs = 91---------- Interpolated Dickey-Fuller --------- Test 1% Critical 5% Critical 10% Critical Statistic Value Value Value ------------------------------------------------------------------------------ Z(t) -2.133 -4.060 -3.459 -3.155 ------------------------------------------------------------------------------------------------------------------------------------------------------------ D.y | Coef. Std. Err. t P>|t| [95% Conf. Interval] -------------+---------------------------------------------------------------- y |L1. | -.0089805 .0042109 -2.13 0.036 -.0173543 -.0006067 LD. | .6394239 .1096428 5.83 0.000 .4213873 .8574606 L2D. | -.0055359 .1296175 -0.04 0.966 -.2632945 .2522227 L3D. | .0906288 .1302257 0.70 0.488 -.1683393 .3495969 L4D. | .0008952 .1130575 0.01 0.994 -.2239321 .2257225 _trend | .0001668 .0000632 2.64 0.010 .0000411 .0002926 _cons | .0260383 .0118528 2.20 0.031 .0024678 .0496088 ------------------------------------------------------------------------------/*ADF tests on consumption*/dfuller c, regress trend lags(4) /*ADF test constant and trend eq.(6)*/ Augmented Dickey-Fuller test for unit root Number of obs = 91 ---------- Interpolated Dickey-Fuller --------- Test 1% Critical 5% Critical 10% Critical Statistic Value Value Value ------------------------------------------------------------------------------ Z(t) -1.622 -4.060 -3.459 -3.155 ------------------------------------------------------------------------------------------------------------------------------------------------------------ D.c | Coef. Std. Err. t P>|t| [95% Conf. Interval] -------------+---------------------------------------------------------------- c |L1. | -.0063104 .0038897 -1.62 0.108 -.0140456 .0014248 LD. | .6579478 .1068026 6.16 0.000 .4455591 .8703365 L2D. | .1038069 .1289307 0.81 0.423 -.152586 .3601998 L3D. | .2031445 .1317853 1.54 0.127 -.0589249 .465214 L4D. | -.2282238 .1125153 -2.03 0.046 -.4519729 -.0044747 _trend | .0001326 .0000526 2.52 0.014 .0000279 .0002372 _cons | .0180606 .0109068 1.66 0.101 -.0036288 .0397499 ------------------------------------------------------------------------------。