管理经济学12

- 格式:ppt

- 大小:171.00 KB

- 文档页数:37

Chapter 12: Answers to Questions and Problems1.a. The expected value of option 1 is()()()()()300100161200164500166200164100161=++++. The expected value of option 2 is ()()()()()11111801701,0001708030055555++++=. b. The variance of option 1 is()()()()().000,2530010016130020016430050016630020016430010016122222=−+−+−+−+−Similarly, the variance of option 2 is 124,120. The standard deviation of option 1 is 158.11. The standard deviation of option 2 is 352.31.c. Option 2 is the most risky.2.a. Risk loving.b. Risk averse.c. Risk neutral.3.a.$5. b.She will purchase, since your price is less than her reservation price. c.$6. d. She will continue to search, since the price exceeds her reservation price.4.a. ()().6$100.4$200$140Ep =+=.b. Set Ep = MC to get 140 = 1 + 4Q . Solve for Q to find your profit-maximizing output, Q = 34.75 units.c. Your expected profits are (Ep)Q – C(Q) = $140(34.75) – (34.75 +2(34.75)2)=$2,415.13.5.a. The expected value, which is $25.b. The maximum value, which is $50.6.a. With only two bidders, n = 2. The lowest possible valuation is L = $1,000, and your own valuation is v = $2,500. Thus, your optimal sealed bid is$2,500$1,000$2,500$1,7502v L b v n −−=−=−=. b. With ten bidders, n =10. The lowest possible valuation is L = $1,000, and your own valuation is v = $2,500. Thus, your optimal sealed bid is$2,500$1,000$2,500$2,35010v L b v n −−=−=−=. c. With one hundred bidders, n =100. The lowest possible valuation is L = $1,000, and your own valuation is v = $2,500. Thus, your optimal sealed bid is$2,500$1,000$2,500$2,485100v L b v n −−=−=−=.7.a. With 5 bidders, n = 5. The lowest possible valuation is L = $50,000, and your own valuation is v = $75,000. Thus, your optimal sealed bid is$75,000$50,000$75,000$70,0005v L b v n −−=−=−=. b. A Dutch auction is strategically equivalent to a first-price sealed bid auction (see part (a)). Thus, you should let the auctioneer continue to lower the price until it reaches $70,000, and then yell “Mine!”c. $75,000, since it is a dominant strategy to bid your true valuation in a second-price, sealed-bid auction.d. Remain active until the price exceeds $75,000; then drop out.8.a. Hidden actions lead to moral hazard; hidden characteristics lead to adverse selection.b. Incentive contracts can solve moral hazard problems; screening and sorting can solve adverse selection problems.9. Since this is a common value auction, bidders will not bid their own private estimates because doing so would lead to the winner’s curse. Thus, there will be an additional incentive for bidders to shade their bids below their estimated valuations. The English auction format provides bidders the most information (therefore allowing them to pool information to some extent), mitigating this problem. For this reason, the English auction would generate the highest expected revenues in this case.10.Your expected inverse demand is E(P) = .5(200,000 – 250Q ) + .5(400,000 – 250Q ) = 300,000 – 250Q. Therefore, your expected marginal revenue is E(MR) = 300,000 – 500Q . Your marginal cost is MC = $200,000. Setting E(MR) = MC yields300,000500200,000Q −=. Solving, Q = 200. The price you expect is thus E(P) = 300,000 – 250(200) = $250,000. Your profits are thus ($250,000 -$200,000)(200) - $110,000 = $9,890,000.11. One would expect higher premiums on credit life, thanks to adverse selection. Peoplewho cannot pass physicals will select toward this type of insurance, resulting in higher premiums. Furthermore, people who are healthy and can pass a physical will be unwilling to pay the higher premiums, thus exacerbating this effect.12. The expected benefit from an additional search are 0.05($110,000 - $60,000) = $2,500, while the cost of another search is $5,000. Therefore, make her an offer. 13. In the absence of "guaranteed issue," an insurance company could choose to insure only those employees with a very low risk structure. In this case they offer lower rates because they experience fewer claims. But this leaves those workers with greater risk factors without insurance. By requiring insurers to offer coverage to all employees, the insurance company must take on employees that are less healthy and a greater risk. Why the controversy? By insuring those with greater health risks, the expected number of claims rises, thus increasing the cost of coverage. The workers with existing health problems benefit at the expense of healthy workers, who pay higher prices with "guaranteed issue." If the price rises high enough and healthy workers are free to drop coverage, this can result in adverse selection: The only people willing to pay the higher premiums are those in poor health.14. Brownstown Steel has better information about its financial situation than does its lenders, and is attempting to use this information advantage to enhance its bargaining position. If lenders gained full information about the financial situation of Brownstown Steel Corp., they would be in a position to squeeze the maximum amount from Brownstown Steel without fear of pushing it into bankruptcy. Absent the information, lenders will be more generous, since taking too much would increase the risk that Brownstown Steel goes bankrupt.15. The 30-day warranty and 10-point inspection. This not only reduces buyer risk from being duped by a used car dealer, but provides a costly signal about the quality of the used cars sold. An unscrupulous dealer would find it costly to mimic this strategy. Recognizing both of these facts, rational buyers will be more willing to purchase cars from the dealer.16. Offer two plans for customers with more than $1 million in assets. One plan (perhaps called the “Free Trade” Account) has an annual maintenance fee of $10,000 good for up to 400 “free” transactions (computed as $10,000/$25) per year (each additional transaction is priced at $25 each). The other plan (perhaps called the “Free Service” Account) has no annual maintenance fee but charges $100 per transaction. Given these two options, investors will sort themselves into the plans based on their individual characteristics.17.With 5 other bidders, n = 6. The lowest possible valuation is L = $5,000, and your own valuation is v = $12,000. Thus, your optimal first-price, sealed-bid is$12,000$5,000$12,000$10,833.336v L b v n −−=−=−=.18. A risk-neutral Oracle’s bid of $7 billion is low since the expected value of the presentvalue of the stream of profits is $7.6 billion. The public bidding process described most resembles an independent, private value English auction (each company places a different probability assessment on the value of the company that depends onpotential realized synergies). SAP’s expected value of the present value of the stream of profits is $8.4 billion. Since this is greater than Oracle’s expected value, SAP will win the “auction” and acquire PeopleSoft. SAP will pay just over $7.6 billion for PeopleSoft.19.The expected value of aggregate ten-year profits of a McDonald’s franchise is ()()()75.4$1$25.5$50.10$25.=−++million. Similarly, the expected value of a Penn Station East Coast Subs’ franchise is ()()75.4$)30$(025.5$95.30$025.=−++million. The variance and standard deviation of owning a McDonald’s franchise is()()()1875.1575.4125.75.4550.75.41025.2222'=−−+−+−=s McDonald σand 8971.31875.152''===s McDonald s McDonald σσ, respectively. Similarly, the variance and standard deviation for Penn Station East Coast Subs’ is()()()1875.4675.430025.75.4595.75.430025.2222=−−+−+−=Penn σand7961.61875.462===Penn Penn σσ, respectively. Since the expected values are thesame we can compare the standard deviations to determine the most risky investment. Since s McDonald Penn 'σσ>there is more risk associated with a Penn Station East Coast Subs’ franchise.20. There are several things for a student to consider in deciding to enroll in a traditionalMBA program or an online MBA program. It is likely that students with a spouse and family may be more attracted to online MBA programs, since these individuals are value stability and have others relying on them for income. In contrast, traditional MBA programs are more likely to attract singles who are willing to bear theopportunity cost associated with this form of education. Thus, there is an adverse selection issue. The individual who selects the traditional MBA program is likely to have a stronger signaling value regarding underlying characteristics.21.Market collapse is likely since “outsiders” will be unwilling to participate in equity (or other) markets since they know “insiders” will only sell a stock when they know the price is too high. Similarly, insiders will only buy when the price of a stock is known to be low. This is a losing proposition for outsiders, who would rationally choose not to participate in the market. This is an example of a moral hazard and is one of the primary reasons the SEC exists.。

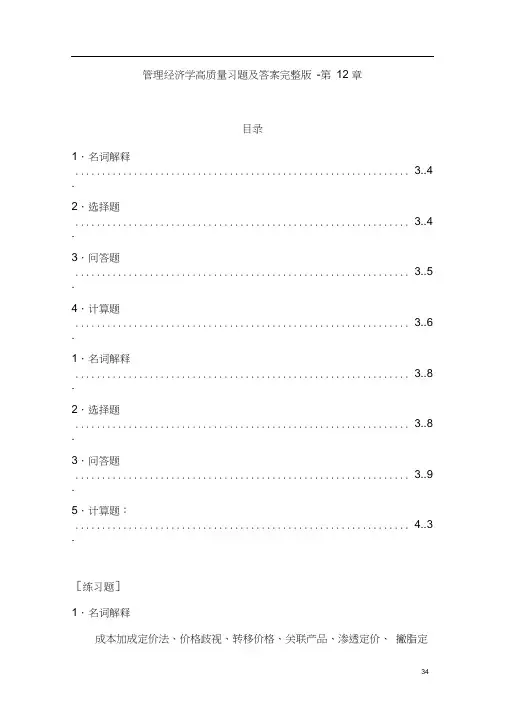

管理经济学高质量习题及答案完整版-第12 章目录1.名词解释............................................................... 3..4 .2.选择题............................................................... 3..4 .3.问答题............................................................... 3..5 .4.计算题............................................................... 3..6 .1.名词解释............................................................... 3..8 .2.选择题............................................................... 3..8 .3.问答题............................................................... 3..9 .5.计算题:............................................................... 4..3 .[练习题]1.名词解释成本加成定价法、价格歧视、转移价格、关联产品、渗透定价、撇脂定价2.选择题(1)依据成本加成法定价时,为使利润最大化,其产品需求价格弹性越大,则成本加成率:A. 越大B.越小C.没有影响D.无法确定(2)当产品需求价格弹性为-1.5 时,成本加成率为:A.0.4B.2.5C.2.0D.0.5 (3)一级价格歧视是指:A.按每个消费者支付愿望来确定产品价格B. 根据消费者购买数量的不同来定价C. 根据不同市场的消费者的弹性来定价D. 以上都不对(4)对于以下有效实行价格歧视的条件中,哪一条不是必须的:A. 市场上对同种产品的需求价格弹性是不同的B.能区分消费者的支付意愿C.无弹性的总需求D. 能有效分割市场(5)对于需求上存在关联关系的互补商品,相比于不存在关联关系的独立商品其每种产品的产量应该:A.更大B.更小C.相等D.无法确定(6)对于纵向一体化的企业,当其中间产品不存在外部市场时,中间产品的转移价格应该是:A. 按全部成本定价B. 按平均成本定价C.按边际成本定价D.按边际收益定价(7)渗透定价是指企业产品A. 以较高价格进入市场B.以较低价格进入市场C.与竞争者一样的价格进入市场D.随着市场需求的变化调整价格3.问答题(1)在何种情况下,企业实行成本加成定价会实现最大利润?(2)举出两个价格歧视的例子,并分别解释垄断者采取该价格政策的原因。

管理经济学第十二版教学设计前言管理经济学作为管理学和经济学的结合体,是管理专业核心课程之一。

本次教学设计基于《管理经济学》第十二版教材,旨在为学生提供全面深入的管理经济学知识体系,强化学生在领域理论、框架工具和实践技能方面的素养。

教学目标•理解经济学基本概念和原理,掌握管理经济学基础知识。

•熟悉管理经济学的三个经典分析框架:微观经济学分析、宏观经济学分析和博弈论分析。

•运用管理经济学分析工具,识别和解决管理实践中的问题和挑战。

•提高学生对全球经济动态和趋势的敏感度和洞察力,拓展视野。

教学内容第一章:管理经济学概述•管理经济学的起源和发展。

•管理经济学的基本理论和方法。

•管理经济学的应用领域。

第二章:需求和供给分析•需求和供给分析的基本概念。

•需求和供给曲线的画法。

•需求、供给和价格的关系。

•市场的均衡和失衡。

•市场价格和产品选择的最优点。

第三章:微观经济学分析•经济学的基本原则和分析方法。

•生产和成本的基本概念。

•生产函数和长期和短期的生产成本分析。

•供应曲线和市场结构的影响因素分析。

第四章:利润和利润率•利润的概念和含义。

•利润的来源和测算。

•利润率与生产率的关系。

•利润率与生产规模的关系。

第五章:管理经济学中的价格和市场结构•不同市场结构的基本概念。

•垄断和垄断竞争的区别和特点。

•小型企业和大型企业的比较。

•市场竞争和压力中的价格和量的关系。

第六章:宏观经济学分析•宏观经济学的基本概念和方法。

•GDP、通货膨胀率、失业率和利率的测算。

•货币、外汇、财政政策的实施和效果。

•市场价格、通货膨胀和利率的关系。

第七章:管理经济学中的企业组织•企业组织的基础概念和设计。

•企业组织的战略、结构和过程的关系。

•管理体系和信息流的设计和管理。

•组织中的变革与创新。

第八章:企业管理的财务和会计分析•财务和会计基本概念和原则。

•财务管理的职能和目标。

•账目分析、报表分析和资产负债表的应用。

•利润、投资回报和现金流的计算和分析。

管理经济学名词解释1、需求价格弹性:指需求量对价格变动的反应程度,是需求量变化的百分比除以价格变化的百分比。

2、需求收入弹性:当消费者的收入水平变化1%时,对某种商品需求量变化的百分数。

它测度的是某种商品的需求量对收入水平的变化作出反应的敏感程度。

3、交叉价格弹性:当X商品的价格变动时,会引起Y商品需求量的变动。

称Y商品需求量的相对变化率与X商品价格的相对变化率之比为Y商品的需求交叉价格弹性。

4、机会成本是指为了得到某种东西而所要放弃另一些东西的最大价值;也可以理解为在面临多方案择一决策时,被舍弃的选项中的最高价值者是本次决策的机会成本;会计成本:是指企业在经营过程中所实际发生的一切成本。

包括工资、利息、土地和房屋的租金、原材料费用、折旧等。

5、显性成本:是指厂商为了购买或雇佣供生产所需的生产要素所支付的费用。

例如支付的生产费用、工资费用、市场营销费用等,因而它是有形的成本。

隐性成本:是厂商本身自己所拥有的且被用于企业生产过程的那些生产要素的总价格。

是一种隐藏于企业总成本之中、游离于财务审计监督之外的成本。

如管理层决策失误带来的巨额成本增加、领导的权威失灵造成的上下不一致、信息和指令失真、效率低下等。

相对于显性成本来说,这些成本隐蔽性大,难以避免、不易量化。

6、社会成本VS私人成本社会成本是在生产的过程中,整个社会承受的代价。

包括生产厂商在内。

私人成本也称为私人费用。

指厂商生产过程中投入的所有生产要素的价格。

厂商的私人成本仅仅按照生产要素价格和正常利润来进行计算,因此,在外部经济下产生的环境污染、生态破坏、给别人和社会带来的损失都没有计入私人成本,从而使得私人成本会低于社会成本。

7、固定成本VS变动成本固定成本是指成本总额在一定时期和一定业务量范围内,不受业务量增减变动影响而能保持不变的成本。

变动成本是指那些成本的总发生额在相关范围内随着业务量的变动而呈线性变动的成本。

8、增量成本VS沉淀成本增量成本是由产量增量而导致的总成本的变化量,等于生产增量之后的总成本减去生产增量前的总成本。

管理经济学第十二版课程设计课程简介本课程的目的是培养学生能够理解和应用管理经济学的基本理论和方法,掌握企业经济决策的基本模型和工具,以及解决企业经济问题所需要的分析技能和实践经验。

在本课程中,我们将深入探讨企业经济决策的主要内容和方法,包括市场供求分析、成本分析、价格决策、财务管理、投资决策等。

课程设计本课程的设计主要分为三个部分:理论学习、案例研究和实践操作。

理论学习本部分将在课堂上进行,主要涉及以下内容:1.市场供求分析:介绍市场概念和行为,分析市场供求、弹性和均衡。

2.成本分析:介绍企业成本的概念和组成,深入了解成本的相关概念和理论,并掌握成本的计算方法。

3.价格决策:介绍企业价格决策的基本原则,掌握定价策略的突破性思维。

4.财务管理:介绍企业财务管理的基本原理和方法,包括企业财务结构、财务指标、财务分析等。

5.投资决策:深入了解投资决策的基本概念和流程,掌握基本的投资分析和评估方法。

案例研究本部分将通过案例研究的方式深入理解和应用所学的理论知识。

我们将会为学生提供一些实际案例,让学生在团队中对其进行深入的分析和研究,并根据分析结果进行案例策略的制定和实施。

案例研究旨在培养学生的实际经验和分析能力,让学生能够深度思考并解决实际企业经济问题。

实践操作本部分将通过实践操作的方式让学生了解和掌握各种经济决策模型和工具,并在实际操作中加深对其理论知识的理解和应用。

我们将为学生提供一些模拟实验和实际企业决策模拟,让学生在实际操作中体会实际企业经济决策的复杂性和挑战性,进一步提升其实践经验和决策能力。

课程收获通过学习,学生将会获得以下收获:1.了解和掌握企业经济决策的基本理论和方法,能够分析和解决企业经济问题。

2.培养实践经验和分析能力,加强团队合作和沟通协作能力,提高团队决策水平。

3.培养自主学习和自我提高能力,为学生的未来职业发展打下坚实的基础。

总结管理经济学是企业经济决策中的重要组成部分,也是管理学的重要学科。