英文版国际金融试题和答案[1]

- 格式:doc

- 大小:59.00 KB

- 文档页数:3

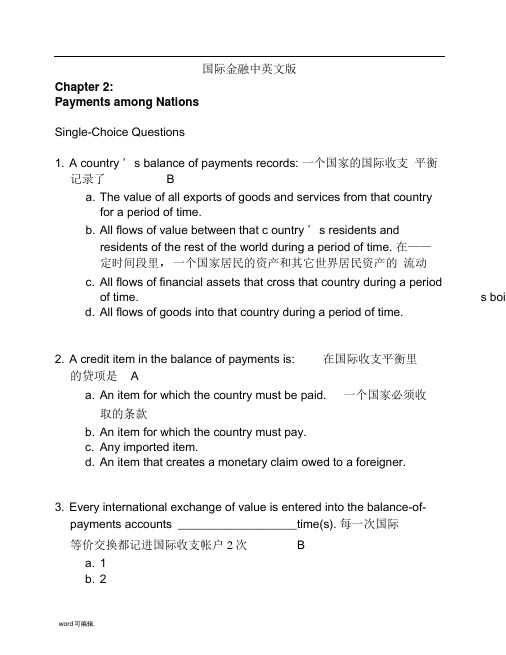

国际金融中英文版Chapter 2:Payments among NationsSingle-Choice Questions1. A country ' s balance of payments records: 一个国家的国际收支平衡记录了 Ba. The value of all exports of goods and services from that countryfor a period of time.b. All flows of value between that c ountry ' s residents andresidents of the rest of the world during a period of time. 在——定时间段里,一个国家居民的资产和其它世界居民资产的流动c. All flows of financial assets that cross that country during a periodof time.s boid. All flows of goods into that country during a period of time.2. A credit item in the balance of payments is: 在国际收支平衡里的贷项是Aa. An item for which the country must be paid. 一个国家必须收取的条款b. An item for which the country must pay.c. Any imported item.d. An item that creates a monetary claim owed to a foreigner.3. Every international exchange of value is entered into the balance-of-payments accounts __________________ t ime(s). 每一次国际等价交换都记进国际收支帐户2次 Ba. 1b. 2c. 3d. 44. A debit item in the balance of payments is: 在国际收支平衡中的借项是Ba. An item for which the country must be paid.b. An item for which the country must pay. 一个国家必须支付的条款c. Any exported item.d. An item that creates a monetary claim on a foreigner.5. In a nation's balance of payments, which one of the following items isalways recorded as a positive entry? D 在国际收支中,下列哪个项目总被视为有利条项a. Changes in foreign currency reserves.b. Imports of goods and services.c. Military foreign aid supplied to allied nations.d. Purchases by foreign travelers visiting the country. 国外游客在本国发生的购买6. The sum of all of the debit items in the balance of payments: 在收支平衡中,所有贷项的总和Ba. Equals the overall balance.b. Equals the sum of all credit items.等于所有借项的总和c. Equals ‘ compensating ' transactions.d. Equals the sum of credit items minus errors and omissions.7. Which of the following capital transactions are entered as debits in theU.S. balance of payments? 下列哪个资本交易在美国的收支平衡中当作借项?Ba. A U.S. resident transfers $100 from his account at Credit Suissein Basel (Switzerland) to his account at a San Francisco branchof Wells Fargo Bank.b. A French resident transfers $100 from his account at WellsFargo Bank in San Francisco to his Credit Suisse account inBasel. 一个法国居民在旧金山的Fargo Bank用其帐户转帐100美金到位于巴塞尔的瑞士信贷户口c. A U.S. resident sells his IBM stock to a French resident.d. A U.S. resident sells his Credit Suisse stock to a French resident.8. An increase in a nation's financial liabilities to foreign residents is a: 一个国家对另一个国家金融负债的增加是一种 Ca. Reserve inflow.b. Reserve outflow.c. Capital inflow.资本流入d. Capital outflow.9. A ______ are money-like assets that are held by governmentsand that are recognized by governments as fully acceptable forpayments between them.官方国际储备资产是一种类似于钱的资产,这种资产由政府掌握并作为政府间的一种支付手段得到充分认可.a. Official international reserve assets 官方国际储备资产b. Unofficial international reserve assetsc. Official domestic reserve assetsd. Unofficial domestic reserve assetslO.Which of the following is considered a capital inflow ? 下列哪项被视为资本流入 Aa. A sale of U.S. financial assets to a foreign buyer. 美国一金融资产卖给一外国买家b. A loan from a U.S. bank to a foreign borrower.c. A purchase of foreign financial assets by a U.S. buyer.d. A U.S. citizen ' s repayment of a loan from a foreign bank.11.In a country ' s balance of payments, which of the following transactions are debits? 一个国家的收支平衡表中,哪个交易属于借项?Aa. Domestic bank balances owned by foreigners are decreased. 外国人拥有的国内银行资产的下降b. Foreign bank balances owned by domestic residents aredecreased.c. Assets owned by domestic residents are sold to nonresidents.d. Securities are sold by domestic residents to nonresidents.12. ___________ The role of D is to direct one nation savings intoanother nation ' s investm资金流的作用是指导一个国家的储蓄进入到另一个国家的投资a. Merchandise trade flowsb. Services flowsc. Current account flowsd. Capital flows 资金流13. The net value of flows of goods, services, income, and unilateral transfers is called the: 商品,服务,收入和单方面转让等现金流的净收益叫经常账目(户)Ba. Capital account.b. Current account.经常账目(户)c. Trade balance.d. Official reserve balance.14. The netvalue of flows of financial assets and similar claims (excluding official international reserve asset flows) is called the: 金融资产和类似的资产(官方国际储备资产流除外)的净值流叫Aa. Financial account.金融帐b. Current account.c. Trade balance.d. Official reserve balance.15. The financial accountin the U.S. balance of payments includes: 美国国家收支表中的金融帐包括: Ba. Everything in the current account.b. U.S. government payments to other countries for the use ofmilitary bases.美政府采用其它国家军事基地所需支付款项c. Profits that Nissan of America sends back to Japan.d. New U.S. investments in foreign countries.16. A U.S. resident increasing her holdings of a foreign financial assetcauses a: 一个美国居民增持一外国金融资产会引起 Da. Credit in the U.S. current account.b. Debit in the U.S. current account.c. Credit in the U.S. capital account.d. Debit in the U.S. capital account. 美国资本帐的借帐17. A foreign resident increasing her holdings of a U.S. financial assetcauses a: 一个美国居民增持本国一金融资产会引起Ca. Credit in the U.S. current account.b. Debit in the U.S. current account.c. Credit in the U.S. capital account.美国资本帐的贷帐d. Debit in the U.S. capital account.18. A deficit in the current account: 经常帐户中的赤字Aa. Tends to cause a surplus in the financial account.会导致金融帐中的盈余b. Tends to cause a deficit in the financial account.c. Has no relationship to the financial account.d. Is the result of increasing exports and decreasing imports.19.ln September, 2005, exports of goods from the U.S. decreased $3.3billion to $73.4 billion, and imports of goods increased $3.8 billion to $144.5 billion. This increased the deficit in:2005 年8 月,美国商品出口降低了33亿美元,共734亿美元;商品进口上升到1145亿美元, 上长了38亿.这样增加了哪个方面的赤字? Ca. The balance of payments.b. The financial account.c. The current account. 经常帐户d. Unilateral transfers.20. Which of thefollowing would contribute to a U.S. current account surplus?以下哪项有助于美国现金帐的盈余? Ba. The United States makes a unilateral tariff reduction on importedgoods.b. The United States cuts back on American military personnelstationed in Japan.美国削减在日本的军事人员c. U.S. tourists travel in large numbers to Asia.d. Russian vodka becomes increasingly popular in the UnitedStates.21. Which of the followingtransactions is recorded in the financial account ?以下哪个交易会被当作金融帐 Aa. Ford motor company builds a new plant in China 福特摩托公司在中国设立车间b. A Chinese businessman imports Ford automobiles from theUnited States.c. A U.S. tourist spends money on a trip to China.d. The New York Yankees are paid $10 million by the Chinese toplay an exhibition game in Beijing, China.22.lf a British business buys U.S. government securities, how will this beentered in the balance of payments? 女口果一英国商人购买了美国政府的债券,那么这个交易在收支平衡表中会被当作是?b. It will appear in the trade account as an export.c. It will appear in the financial account as an increase in U.S.assets held by foreigners会被当作是外国人所有的美国资产增长d. It will appear in the financial account as a decrease in U.S. assetsheld by foreigners.23.ln the balance of payments, the statistical discrepancy or error term is used to: 在收支平衡表中,统计差异与错误项目会用来确保借帐总和跟贷帐总和一致Aa. Ensure that the sum of all debits matches the sum of all credits.b. Ensure that imports equal the value of exports.c. Obtain an accurate account of a balance-of-payments deficit.d. Obtain an accurate account of a balance-of-payments surplus.24.0fficial reserve assets are: 官方储备资产是 Ba. The gold holdings in the nation ' s central bank.b. Money like assets that are held by governments and that arerecognized by governments as fully acceptable for paymentsbetween them.官方国际储备资产是一种类似于钱的资产,这种资产由政府掌握并作为政府间的一种支付手段得到充分认可c. Government T-bills and T-bonds.d. Government holdings of SDR ' s25. Which of the following constitutesthe largest component of the world ' s international reserve assets? 下列哪项构成了世界国际储备资产的大部份?Da. Gold.b. Special Drawing Rights.c. IMF Reserve Positions.d. Foreign Currencies. 夕卜汇(币)26. The net accumulation of foreignassets minus foreign liabilities is: 海外净资产的积累减去外债等于Ca. Net official reserves.b. Net domestic investment.c. Net foreign investment.国外投资净值d. Net foreign deficit.27. A countryexperiencing a current account surplus: 一个国家经历经常帐户的盈余Ba. Needs to borrow internationally.b. Is able to lend internationally.就有能力向外放贷c. Must also have had a surplus in its "overall" balance.d. Spent more than it earned on its merchandise and service trade,international income payments and receipts and internationaltransfers.28. ______ The ____ C measures the sum of the current account balanceplus the private capital account balance. 官方结算差额是指经常帐户余额的总和加上私人资本帐(B=CA+FA,FA:为非官方投资和储备)a. Official capital balanceb. Unofficial capital balancec. Official settlements balance 官方结算差额d. Unofficial settlements balance29.If the overall balance is in Al ________ , there is an accumulation ofofficial reserve assets by the country or a decrease in foreign official reserve holdings of the country's assets.女口果综合差额处于盈余,那么会出现本国官方储备资产的积累或者国外官方储备的减少(B=CA+FA,B+OR=0 ,OR:官方储备金额)a. Surplus 盈余b. Deficitc. Balanced. Foreign hands3O.Which of the following is the current account balance NOT equal to?以下哪项不等同于现金帐 Da. The difference between domestic product and domesticexpenditure.b. The difference between national saving and domestic investment.c. Net foreign investment.d. The difference between government saving and governmentinvestment.政府储蓄与政府投资的差值True/False Questions31. Capit al inflows are debits and capital outflows are credits. 资金流入是借项,资金外流是贷项32. The net value ofthe flow of goods, services, income, and gifts is the current account balance. (T) 商品,服务,收入和单方面转让等现金流的净收益叫经常账目余额33. The net flow offinancial assets and similar claims is the private current accountbalance.金融资产和类似的资产的净值叫经常帐目余额34. The majority of countries' official reserves assets are now foreignexchange assets, financial assets denominated in a foreign currency that is readily acceptable in international transactions. (T) 大部份官方储备资产作为以外汇资产和金融资产为命名的外币在世界上交易与流通.35. A country's financial account balance equals the country's net foreigninvestment. 一个国家的金融帐差额相当于一个国家的净国外投资36. A country has a current account deficit if it is saving more than it isinvesting domestically.一个国家如果在国内的储蓄比投资要大,那么会出现经常账目赤字37. The official settlements balance measures the sum of the capitalaccount balance plus the public current account balance. 官方结算差额是资金帐户余额的总额加上公共经常帐户余额38. A nation's international investment position shows its stock ofinternational assets and liabilities at a moment in time. (T) 一个国家的国际投资状况反映出它在特定时间里的国际资产股份以及债务情况.39. A nation is a borrower if its current account is in deficit during a timeperiod. (T)在一段时间内,如果一个国家的经常帐出现赤字,那么它就是借方.40. A nation is a debtor if its net stock of foreign assets is positive. 如果一个国家的国外资产净储备是正数,那么它是借方(债务方)41. A transaction leading to a foreign resident increasing her holdings of aU.S. financial asset will be recorded as a debit on the U.S. financialaccount.如果一项交易引起一外国居民增持美国金融资产的股份,那么这项交易在美国金融帐中会被当作借项42. A credit item is an item for which a country must pay. 贷项是指个国家必须还款的条项43. Gold is a major reserve asset that is currently often used in officialreserve transactions.黄金作为主要的储备资产,常被用在官方储备交易当中.44. The current account balance is equal to the difference betweendomestic product and national expenditure.(T) 经常项目余额等于国民生产与国民支出的差额45.ln 2007 U.S. households, businesses and government were buyingmore goods and services than they were producing.(T) 2 0 0 7 年,美国家庭,商业,政府购买的商品和服务比他们生产(商品和服务)的要多.46。

International Finance 国际金融Notes to the ans wers:1、All the terms can be found in the text.2、The discussions can be attained by reading the original text.Chapter 1Answers:II. T T F F F T TIII. 1. reserve currency 2. appreciate 3. was pegged to 4. deficit 5. fixed exchange rates 6. floating exchange rates 7. depreciate 8. market forcesIV. 1. Confidence in the ability of the U.S. to redeem dollars for gold began to fall as potential claims against the dollar increased and U.S. gold reserves fell.2.Under the fixed exchange rate system, the value of the dollar was tied to gold through itsconvertibility in to gold at the U.S. Treasury, and other nations’ currencies were tied to the dollar by the maintenance of a fixed rate of exchange.3.IMF has adjusted its role in the exchange rate system in view of the development of thesituation.4.After the collapse of the Bretton Woods System, the task of ―rigorous monitoring‖theexchange rate policy of member countries fell on the shoulder of IMF.5.Under normal conditions the stabilizing operations were sufficient to contain short-runfluctuations in a currency’s price within the required bounds of 1% of par value and thereby maintain a system of fixed exchange rates.Chapter 2Answers:I. liquid, turnover, due to, hedge, cross trading, electronic broking, outright forwards,Over-the-counter, futures and options, derivatives, remainder.II.. 1. The fundamental changes occurred in post-war world economy. The international flow of commodities, capital and labor is intensifying, thus leading to integration of international markets.1.Often referred to as ―financial institutions with a soul‖, credit unions are member-ownedcooperatives that offer checking accounts, savings accounts, credit cards, and consumer loans.2.If you think the price of gold will rise, you can buy a most simple kind of financial derivativewhich is called ―futures‖. If by that time the price really goes up, then you make a gain. But if you make a wrong guess and the price declines, then you suffer a loss.3.Financial derivatives are financial commodities deriving from such spot market products asinterest rate or bond, foreign exchange or foreign exchange rate and sto ck or stock indexes.There are mainly three types of derivatives: futures, options and swaps, each of which involves a mix of financial contracts.panies and investment funds are using basic currency futures and currency options, onesthat are regarded as traditional hedging products for investors who want to protect their international assets from sharp gains and declines in currency prices.Chapter 3Answers:II. 1. deposit accounts 2. securitization 3. Deregulation 4. consolidation 5. portfolio 6. thrift institutions 7. listing 8. liquidity 9. banking supervision 10. Credit riskIII. 1. Depository institutions 2. commercial banks 3. credit analysis 4. working capital 5. consolidation 6. financing 7. moral hazard 8. Bank supervision and regulation 9. Credit risk 10. Liquidity riskIV. 1. If a bank’s base rate was below money market rates, a customer could borrow from a bank and lend these funds to the money market, thus making a profit on the deal.2.Financing of international trade is one of the basic functions of a commercial bank. Not onlydoes it father deposits (demand, time and savings accounts), but it also grants loans.3.If you have a credit card, you buy a car, eat a dinner, take a trip,a nd even get a haircut bycharging the cost to your account.4.As the central bank and under the leadership of the State Council, the People’s Bank ofChina will formulate and implement monetary policies, execute supervision and control power over the banking industry.5.One of major function of the central bank is the supervision of the clearing mechanis m. Areliable clearing mechanis m which can settle inter-bank transaction with high efficiency is crucial to a well-operated financial system.Chapter 4 Ans wers:II. 1.integrity 2. pretext 3. released 4. produce 5. facilities 6. obliged 7. alleging 8. Claims 9. cleared 10. deliveryIII. 1. in favor of 2. consignment 3. undertaking, terms and conditions 4. cleared 5. regardless of 6. obliged to 7. undervalue arrangement 8. on the pretext of 9. refrain from 10. hinges onIV. 1. The objective of documentary credits is to facilitate international payment by making use of the financial expertise and credit worthiness of one or more banks.2.In compliance with your request, we have effected insurance on your behalf and debited youraccount with the premium in the amount of $1000.3.When an exporter is trading regularly with an importer, he will offer open account terms.4.Exporters usually insist on payment by cash in advance when they are trading with oldcustomers.5.Cash in advance means that the exporter is paid either when the importer places his order orwhen the goods are ready for shipment.Chapter 5.II.1. b 2. c 3. c 4. a 5. b 6. b 7. a 8. cIII. 1. guaranteed 2. without recourse 3. defaults 4. on the buyer’s account 5. is equivalent to 6. in question 7. devaluation 8. validity 9. discrepancy 10. inconsistent withChapter 6Answers:II. 1. open account, creditworthiness 2. demand 3. draw on, creditor 4. protest 5. schedule, discrepancies 6. acceptance 7. drawee 8. guranteedIII. 1. collecting bank 2. tenor 3. the proceeds 4. protest 5. deferred payment 6. presentation 7. the maturity date 8. a document of title 9. the shipping documents 10. transshipmentIV. 1. Documentary collection is a method by which the exporter authorizes the bank to collect money from the importer.2.When a draft is duly presented for acceptance or payment but the acceptance or paymentis refused, the draft is said to be dishonored.3.In the international money market, draft is a circulative and transferable instrument.Endorsement serves to transfer the title of a draft to the transferee.4.A clean bill of lading is favored by the buyer and the banks for financial settlementpurposes.5.Parcel post receipt is issued by the post office for goods sent by parcel post. It is both areceipt and evidence of dispatch and also the basis for claim and adjustment if there is any damage to or loss of parcels.Chapter 7II. financing, discounting, factoring, forfaiting, without recourse, accounts receivable, factor, trade obligations, promissory notes, trade receivables, specialized.III. 1. a cash flow disadvantage 2. without recourse 3. negotiable instruments 4. promissory notes 5. profit margin 6. at a discount, maturity, credit risk 7. A bill of exchange, A promissory noteIV. 1. When a bill is dishonored by non-acceptance or by non-payment, the holder then has an immediate right of recourse against the drawer and the endorsers.2.If a bill of lading is made out to bearer, it can be legally transferred without endorsement.3.The presenting bank should endeavor to ascertain the reasons non-payment ornon-acceptance and advise accordingly to the collecting bank.4.Any charges and expenses incurred by banks in connection with any action for protection o fthe goods will be for the account of the principal.5.Anyone who has a current account at a bank can use a cheque.Chapter EightStructure of the Foreign Exchange Market外汇市场的构成1. Key Terms1)foreign exchange:―Foreign exchange‖ refers t o money denominated in the currency of another nation or group of nations.2)payment“payment”is the transmission of an instruction to transfer value that results from a transaction in the economy.3)settlement―settlement‖ is the final and uncondit ional transfer of the value specified in a payment instruction.2. True or False1) true 2) true 3) true 4) true1)Tell the reasons why the dollar is the market's most widely tradedcurrency?key points: U.S.A economic background; the leadership of USD in the world economy ; the role it plays in investment , trade, etc.2)What kind of market is the foreign exchange market?Make reference to the following parts:(8.7 The Market Is Made Up of An International Network of Dealers)Chapter 9Instruments交易工具1. Key Terms1) spot transactionA spot transaction is a straightforward (or ―outright‖) exchange of one currency for another. The spot rate is the current market price, the benchmark price.Spot transactions do not require immediate settlement, or payment ―on the spot.‖ By convention, the settlement date, or ―value date,‖is the second business day after the ―deal date‖ (or ―trade date‖) on which the transaction is agreed to by the two traders. The two-day period provides ample time for the two parties to confirm the agreement and arrange the clearing and necessary debiting and crediting of bank accounts in various international locations.2) American termsThe phrase ―American terms‖means a direct quote from the point of view of someone located in the United States. For the dollar, that means that the rate is quoted in variable amounts of U.S. dollars and cents per one unit of foreign currency (e.g., $1.2270 per Euro).3) outright forward transactionAn outright forward transaction, like a spot transaction, is a straightforward single purchase/ sale of one currency for another. The only difference is that spot is settled, or delivered, on a value date no later than two business days after the deal date, while outright forward is settled on any pre-agreed date three or more business days after the deal date. Dealers use the term ―outright forward‖ to make clear that it is a single purchase or sale on a future date, and not part of an ―FX swap‖.4) FX swapAn FX swap has two separate legs settling on two different value dates, even though it is arranged as a single transaction and is recorded in the turnover statistics as a single transaction. The two counterparties agree to exchange two currencies at a particular rate on one date (the ―near date‖) and to reverse payments, almost always at a different rate, on a specified sub sequent date (the ―far date‖). Effectively, it is a spot transaction and an outright forward transaction going in opposite directions, or else two outright forwards with different settlement dates, and going in opposite directions. If both dates are less than one month from the deal date, it is a ―short-dated swap‖; if one or both dates are one month or more from the deal date, it is a ―forward swap.‖5) put-call parity―Put-call parity‖says that the price of a European put (or call) option can be deduced from the price of a European call (or put) option on the same currency, with the same strike price and expiration. When the strike price is the same as the forward rate (an ―at-the-money‖forward), the put and the call will be equal in value. When the strike price is not the same as the forward price, the difference between the value of the put and the value of the call will equal the difference in the present values of the two currencies.2. True or False1) true 2) true 3) true3. Cloze1) Traders in the market thus know that for any currency pair, if the basecurrency earns a higher interest rate than the terms currency, the currency will trade at a forward discount, or below the spot rate; and if the base currency earns a lower interest rate than the terms currency, the base currency will trade at a forward premium, or above the spot rate. Whichever side of the transaction the trader is on, the trader won't gain (or lose) from both the interest rate differential and the forward premium/discount. A trader who loses on the interest rate will earn the forward premium, and vice versa.2) A call option is the right, but not the obligation, to buy the underlyingcurrency, and a put option is the right, but not the obligation, to sellthe underlying currency. All currency option trades involve two sides—the purchase of one currency and the sale of another—so that a put to sell pounds sterling for dollars at a certain price is also a call to buy dollars for pounds sterling at that price. The purchased currency is the call side of the trade, and the sold currency is the put side of the trade. The party who purchases the option is the holder or buyer, and the party who creates the option is the seller or writer. The price at which the underlying currency may be bought or sold is the exercise , or strike, price. The option premium is the price of the option that the buyer pays to the writer. In exchange for paying the option premium up front, the buyer gains insurance against adverse movements in the underlying spot exchange rate while retaining the opportunity to benefit from favorable movements. The option writer, on the other hand, is exposed to unbounded risk—although the writer can (and typically does) seek to protect himself through hedging or offsetting transactions.4. Discussions1)What is a derivate financial instrument? Why is traded?2)Discuss the differences between forward and futures markets in foreigncurrency.3)What advantages do foreign currency futures have over foreigncurrency options?4)What is meant if an option is ―in the money‖, ―out of the money‖,or ―atthe money‖?5)What major international contracts are traded on the ChicagoMercantile Exchange ? Philadelphia Stock Exchange?Chapter 10Managing Risk in Foreign Exchange Trading外汇市场交易的风险管理1. Key Terms1) Market riskMarket risk, in simplest terms, is price risk, or ―exposure to (adverse)price change.‖ For a dealer in foreign exchange, two major elements of market risk are exchange rate risk and interest rate risk—that is, risks of adverse change in a currency rate or in an interest rate.2) VARVAR estimates the potential loss from market risk across an entire portfolio, using probability concepts. It seeks to identify the fundamental risks that the portfolio contains, so that the portfolio can be decomposed into underlying risk factors that can be quantified and managed. Employing standard statistical techniques widely used in other fields, and based in part on past experience, VAR can be used to estimate the daily statistical variance, or standard deviation, or volatility, of the entire portfolio. On the basis of that estimate of variance, it is possible to estimate the expected loss from adverse price movements with a specified probability over a particular period of time (usually a day).3) credit riskCredit risk, inherent in all banking activities, arises from the possibility that the counterparty to a contract cannot or will not make the agreed payment at maturity. When an institution provides credit, whatever the form, it expects to be repaid. When a bank or other dealing institution enters a foreign exchange contract, it faces a risk that the counterparty will not perform according to the provisions of the contract. Between the time of the deal and the time of thesettlement, be it a matter of hours, days, or months, there is an extension of credit by both parties and an acceptance of credit risk by the banks or other financial institutions involved. As in the case of market risk, credit risk is one of the fundamental risks to be monitored and controlled in foreign exchange trading.4) legal risksThere are legal risks, or the risk of loss that a contract cannot be enforced, which may occur, for example, because the counterparty is not legally capable of making the binding agreement, or because of insufficient documentation or a contract in conflict with statutes or regulatory policy.2. True or False1)True 2) true3. Translation1) Broadly speaking, the risks in trading foreign exchange are the same asthose in marketing other financial products. These risks can be categorized and subdivided in any number of ways, depending on the particular focus desired and the degree of detail sought. Here, the focus is on two of the basic categories of risk—market risk and credit risk (including settlement risk and sovereign risk)—as they apply to foreign exchange trading. Note is also taken of some other important risks in foreign exchange trading—liquidity risk, legal risk, and operational risk2) It was noted that foreign exchange trading is subject to a particular form ofcredit risk known as settlement risk or Herstatt risk, which stems in part from the fact that the two legs of a foreign exchange transaction are often settled in two different time zones, with different business hours. Also noted was the fact that market participants and central banks have undertaken considerable initiatives in recent years to reduce Herstatt risk.4. Discussions2)Discuss the way how V AR works in measuring and managing marketrisk?3)Why are banks so interested in political or country risk?4)Discuss other forms of risks which you know in foreign exchange. Chapter 11The Determination of Exchange Rates汇率的决定1. Key Terms1) PPPPurchasing Power Parity (PPP) theory holds that in the long run, exchange rates will adjust to equalize the relative purchasing power of currencies. This concept follows from the law of one price, which holds that in competitive markets, identical goods will sell for identical prices when valued in the same currency.2) the law of one priceThe law of one price relates to an individual product. A generalization of that law is the absolute version of PPP, the proposition that exchange rates will equate nations' overall price levels.3) FEER―fundamental equilibrium exchange rate,‖ or FEER,envisaged as the equilibrium exchange rate that would reconcile a nation's internal and external balance. In that system, each country would commit itself to a macroeconomicstrategy designed to lead, in the medium term, to ―internal balance‖—defined as unemployment at the natural rate and minimal inflation—and to ―external balance‖—defined as achieving the targeted current account balance. Each country would be committed to holding its exchange rate within a band or target zone around the FEER, or the level needed to reconcile internal and external balance during the intervening adjustment period.4) monetary approachThe monetary approach to exchange rate determination is based on the proposition that exchange rates are established through the process of balancing the total supply of, and the total demand for, the national money in each nation. The premise is that the supply of money can be controlled by the nation's monetary authorities, and that the demand for money has a stable and predictable linkage to a few key variables, including an inverse relationship to the interest rate—that is, the higher the interest rate, the smaller the demand for money.5) portfolio balance approachThe portfolio balance approach takes a shorter-term view of exchange rates and broadens the focus from the demand and supply conditions for money to take account of the demand and supply conditions for other financial assets as well. Unlike the monetary approach, the portfolio balance approach assumes that domestic and foreign bonds are not perfect substitutes. According to the portfolio balance theory in its simplest form, firms and individuals balance their portfolios among domestic money, domestic bonds, and foreign currency bonds, and they modify their portfolios as conditions change. It is the process of equilibrating the total demand for, and supply of, financial assets in each country that determines the exchange rate.2. True or False1) true 2) true3. Cloze1)PPP is based in part on some unrealistic assumptions: that goods are identical; that all goods are tradable; that there are no transportationcosts, information gaps, taxes, tariffs, or restrictions of trade; and—implicitly and importantly—that exchange rates are influenced only byrelative inflation rates. But contrary to the implicit PPP assumption,exchange rates also can change for reasons other than differences ininflation rates. Real exchange rates can and do change significantly overtime, because of such things as major shifts in productivitygrowth, advances in technology, shifts in factor supplies, changes inmarket structure, commodity shocks, shortage, and booms.2)Each individual and firm chooses a portfolio to suit its needs, based on a variety of considerations—the holder's wealth and tastes, the level ofdomestic and foreign interest rates, expectations of future inflation,interest rates, and so on. Any significant change in the underlying factorswill cause the holder to adjust his portfolio and seek a new equilibrium.These actions to balance portfolios will influence exchange rates.4. Discussions1)How does the purchasing power parity work?2)Describe and discuss one model for forecasting foreign exchange rates.3)Make commends on how good are the various approaches mentioned in the chapter.4)Central banks occasionally intervene in foreign exchange markets. Discuss the purpose of such intervention. How effective is intervention?Chapter 12The Financial Markets金融市场1. Key Terms1)money marketThe money market is really a market for short-term credit, or the option to use someone else's money for a period of time in return for the payment of interest. The money market helps the participants in the economic process cope with routine financial uncertainties. It assists in bridging the differences in the timing of payments and receipts that arise in a market economy.2)capital marketMarkets dealing in instruments with maturities that exceed one year are often referred to as capital markets.3)primary marketThe term ―primary market‖ applies to the original issuance of a credit market instrument. There are a variety of techniques for such sales, including auctions, posting of rates, direct placement, and active customer contacts by a salesperson specializing in the instrument4) secondary marketOnce a debt instrument has been issued, the purchaser may be able to resell it before maturity in a ―secondary market.‖ Again, a number of techniques are available for bringing together potential buyers and sellers of existing debt instruments. They include various types of formal exchanges, informal telephone dealer markets, and electronic trading through bids and offers on computer screens. Often, the same firms that provide primary marketing services help to create or ―make‖ secondary markets.5)RPsIn addition to making outright purchases and sales in the secondary market, entities with money to invest for a brief period can acquire a security temporarily, and holders of debt instruments can borrow short term by selling securities temporarily. These two types of transactions are repurchase agree-ments (RPs) and reverse RPs,respectively. In the wholesale market, banks and government securities dealers offer RPs at competitive rates of return by selling securities under contracts providing for their repurchase from one day to several months later6)BAs 7)CDs (reference to 13.1)8) EurodollarEurodollars are U.S. dollar deposits at banking offices in a country other than the United States.9) EurobankEurobanks—banks dealing in Eurodollar or some other nonlocal currency deposits, including foreign branches of U.S. banks— originally held deposits almost exclusively in Europe, primarily London. While most such deposits are still held in Europe, they are also held in such places as the Bahamas, Bahrain, Canada, the Cayman Islands, Hong Kong, Singapore, and Tokyo, as well as other parts of the world.10)LIBOR (reference to 13.2.2 Certificates of Deposit)London inter-bank offer rate11)mortgage-backed securities12)Eurobond market (details make reference to13.3.3 )The Eurobond market, centered in London, is an offshore market in intermediate- and long-term debt issues. It serves as a source of capital for multinational corporations and for foreign governments. It developed after the United States instituted the interest equalization tax in 1963 to stem capital outflows inspired by relatively low U.S. interest rates.2. True or False1) true 2) true 3) true3. Discussions1) Describe the characteristics of Interest Rate Swap and the role of it in thebank-related financial market.2) What risks are encountered in the swaps markets?3) Discuss one or two specific examples of derivative products and their use.4. Translations1) Markets dealing in instruments with maturities that exceed one year are often referred to as capital markets, since credit to finance investments in new capital would generally be needed for more than one year. The time division is arbitrary. A long-term project can be started with short-term credit, with additional instruments may need to be renewed before a project is completed. Debt instruments that differ in maturity share other characteristics. Hence, the term ―capital market‖ could be –and occasionally is applied to some shorter maturity transactions.2) The secondary market for Treasure securities consists of a network of dealers, brokers, and investors who effect transactions either by telephone or electronically. Telephone trades are generally between dealers and their customers. Electronics trading is arranged through screen-based systems provided by some of the dealers to their customers. It allows selected trades to take place without a conversation. When dealers trade with each other, they generally use brokers. Brokers provide information on screen, but the final trades are made bytelephone.Chapter 13Concepts of Financial Assets Value金融资产价值的概念1. Key Terms1) absolute measure of valueAn absolute measure of value is used when one must compare it to a nominal amount: purchase price, amount to invest, target sum of money to raise2) relative measure of valueA relative measure of rate of return is more convenient to use when one wishes to compare one financial asset to a set of numerous alternative assets. A rate of return is the most commonly used relative measure of value.3) discountingFuture benefits must be discounted (or converted) to their present (or today's) value, before they are summed. Discounting is part of the study of time value of money, or actuarial mathematics, and a complete treatment of it can be found in specialized textbook.4) time value of moneyTime value of money studies how amounts of money are made equivalent over time. Converting amounts today into their future equivalent consists in adding interest to principal, i.e. compounding. Converting amounts in the future into today's equivalent consists of charging an interest, i.e. discounting. Thus, discounting is the exact inverse of compounding.5) FV 6) PV 7) annuity8) short term securitiesShort term securities (i.e. securities with maturity less than one year) are sold at a discount (i.e. nominal value less the interest to be earned over the remaining number of days to maturity). There is no coupon, and no additional benefits such as conversion right, but there may be a penalty for early redemption in the case of some bank certificates of deposit.9) P/E ratio (make reference to 15.5.3 --Earnings Multiple or P/E Ratio)Another approach which is used as a short-cut by a large number of investors, is the earnings multiple. It is sometimes referred to as earningsmultiplier, and it is most commonly known as price-to-earnings or P/E ratio. In many instances, the approach, rather than being an oversimplification, can be an improvement over the previous format. In its most common presentation, the idea is that the price P of a share should be a multiple m of its earnings per share E. The multiple m is an industry average because it is assumed that all companies in an industry face similar marketing, technological and resource challenges, and thus, should have similar organizational and production patterns.10) intrinsic valueintrinsic value, or difference between market price of the underlying stock and strike price (which is also known as exercise price because it is the price at which an option holder can buy from or sell to the option writer the underlying stock through the options exchange)。

国际金融英语试题及答案1. 以下哪个选项不是国际货币基金组织(IMF)的主要职能?A. 提供技术援助B. 监督成员国的经济政策C. 促进国际贸易D. 提供紧急财政援助答案:C2. 世界银行的主要目标是什么?A. 促进全球贸易B. 减少全球贫困C. 维护国际货币稳定D. 促进全球金融市场发展答案:B3. 什么是外汇储备?A. 一个国家持有的外国货币和黄金B. 一个国家持有的国内货币和黄金C. 一个国家持有的外国货币和证券D. 一个国家持有的国内货币和证券答案:A4. 根据国际收支平衡表,以下哪项交易不属于经常账户?A. 商品出口B. 服务进口C. 外国直接投资D. 工人汇款回国答案:C5. 什么是货币贬值?A. 一个国家的货币价值相对于其他国家货币的减少B. 一个国家的货币价值相对于黄金的减少C. 一个国家的货币价值相对于商品和服务的减少D. 一个国家的货币价值相对于外国投资的减少答案:A6. 什么是浮动汇率制度?A. 货币价值由市场供求关系决定B. 货币价值由政府固定C. 货币价值由国际货币基金组织决定D. 货币价值由中央银行决定答案:A7. 什么是国际金融市场?A. 跨国公司进行商品和服务交易的市场B. 跨国公司进行货币和金融资产交易的市场C. 跨国公司进行商品和金融资产交易的市场D. 跨国公司进行服务和金融资产交易的市场答案:B8. 什么是国际货币体系?A. 国际货币的发行和流通体系B. 国际货币的监管和管理体系C. 国际货币的交换和结算体系D. 国际货币的发行、监管和管理体系答案:D9. 什么是外汇交易?A. 一种货币兑换成另一种货币的交易B. 一种商品兑换成另一种商品的交易C. 一种服务兑换成另一种服务的交易D. 一种资产兑换成另一种资产的交易答案:A10. 什么是国际金融危机?A. 一个国家内部的金融体系崩溃B. 一个国家内部的货币体系崩溃C. 多个国家金融体系的崩溃D. 多个国家货币体系的崩溃答案:C。

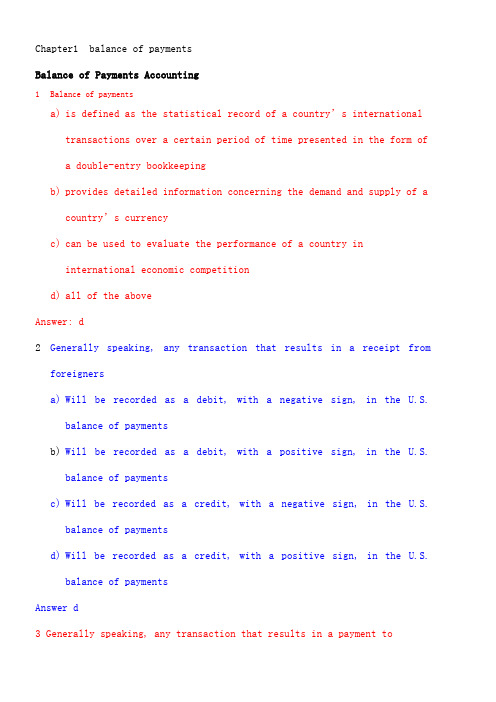

Chapter1 balance of paymentsBalance of Payments Accounting1Balance of paymentsa)is defined as the statistical record of a country’s internationaltransactions over a certain period of time presented in the form ofa double-entry bookkeepingb)provides detailed information concerning the demand and supply of acountry’s currencyc)can be used to evaluate the performance of a country ininternational economic competitiond)all of the aboveAnswer: d2Generally speaking, any transaction that results in a receipt from foreignersa)Will be recorded as a debit, with a negative sign, in the U.S.balance of paymentsb)Will be recorded as a debit, with a positive sign, in the U.S.balance of paymentsc)Will be recorded as a credit, with a negative sign, in the U.S.balance of paymentsd)Will be recorded as a credit, with a positive sign, in the U.S.balance of paymentsAnswer d3 Generally speaking, any transaction that results in a payment toforeignerse)Will be recorded as a debit, with a negative sign, in the U.S.balance of paymentsf)Will be recorded as a debit, with a positive sign, in the U.S.balance of paymentsg)Will be recorded as a credit, with a negative sign, in the U.S.balance of paymentsh)Will be recorded as a credit, with a positive sign, in the U.S.balance of paymentsAnswer a)4 Suppose the McDonalds Corporation imports 100 tons of Canadian beef, paying for it by transferring the funds to a New York bank account kept by the Canadian Beef Conglomerate.i)Payment by McDonalds will be recorded as a debitj)The deposit of the funds by the seller will be recorded as a debit k)Payment by McDonalds will be recorded as a creditl)The deposit of the funds by the buyer will be creditAnswer: a5Since the balance of payments is presented as a system of double-entry bookkeeping,a)Every credit in the account is balanced by a matching debitb)Every debit in the account is balanced by a matching creditc)a) and b) are both true6 A country’s international transactions can be grouped into thefollowing three main types:a)current account, medium term account, and long term capitalaccountb)current account, long term capital account, and officialreserve accountc)current account, capital account, and official reserve accountd)capital account, official reserve account, trade account Answer: c7Invisible trade refers to:a)services that avoid tax paymentsb)underground economyc)legal, consulting, and engineering servicesd)tourist expenditures, onlyAnswer: c8The current account is divided into four finer categories:a)Merchandise trade, services, income, and statisticaldiscrepancy.b)Merchandise trade, services, income, and unilateral transfersc)Merchandise trade, services, portfolio investment, andunilateral transfersd)Merchandise trade, services, factor income, and direct9Factor incomea)Consists largely of interest, dividends, and other income onforeign investments.b)Is a theoretical construct of the factors of production, land,labor, capital, and entrepreneurial ability.c)Is generally a very minor part of national income accounting,smaller than the statistical discrepancy.d)None of the aboveAnswer: aUSE THE FOLLOWING INFORMATION TO ANSWER THE NEXT TWO QUESTIONS10 The entries in the “current account” and the “capital account”, combined together, can be outlined (in alphabetic order) as:(i)- direct investment(ii)- factor income(iii)- merchandise (iv)- official transfer (v)- other capital (vi)- portfolio investment(vii)- private transfer(viii)- services11Current account includesa)(i), (ii), and (iii)b)(ii), (iii), and (vii)c)(iv), (v), and (vii)d)(i), (v), and (vi) Answer: ba)(i), (ii), and (iii)b)(ii), (iii), and (vii)c)(iv), (v), and (vii)d)(i), (v), and (vi)Answer: d13The difference between Foreign Direct Investment and Portfolio Investment is that:a)Portfolio Investment mostly represents the sale and purchase offoreign financial assets such as stocks and bonds that do notinvolve a transfer of control.b)Foreign Direct Investment mostly represents the sale and purchaseof foreign financial assets such as stocks whereas PortfolioInvestment mostly involves the sales and purchase of foreign bonds.c)Foreign direct investment is about buying land and buildingfactories, whereas portfolio investment is about buying stocks andbonds.d)All of the aboveAnswer: a14In the latter half of the 1980s, with a strong yen, Japanese firmsa)Faced difficulty exportingb)Could better afford to acquire U.S. assets that had become lessexpensive in terms of yen.c)Financed a sharp increase in Japanese FDI in the United StatesAnswer: d15International portfolio investments have boomed in recent years, as a result ofa)A depreciating U.S. dollarb)Increased gasoline and other commodity prices.c)The general relaxation of capital controls and regulation in manycountriesd)None of the aboveAnswer: cAnswer: c)16The capital account measuresa)The sum of U.S. sales of assets to foreigners and U.S. purchases offoreign assets.b)The difference between U.S. sales of assets to foreigners and U.S.purchases of foreign assets.c)The difference between U.S. sales of manufactured goods toforeigners and U.S. purchases of foreign products.d)None of the aboveAnswer: b) page 6417When Honda, a Japanese auto maker, built a factory in Ohio,a)It was engaged in foreign direct investmentb)It was engaged in portfolio investmentc)It was engaged in a cross-border acquisitionAnswer: a) page 64.18The capital account may be divided into three categories:a)Cross-border mergers and acquisitions, portfolio investment, andother investmentb)Direct investment, portfolio investment, and Cross-border mergersand acquisitionsc)Direct investment, mergers and acquisitions, and other investmentd)Direct investment, portfolio investment, and other investment Answer: d)19When Nestlé, a Swiss firm, bought the American firm Carnation, it was engaged in foreign direct investment. If Nestlé had only bought a non-controlling number of shares of the firma)Nestlé would have been engaged in portfolio investmentb)Nestlé would have been engaged in a cross-border acquisitionc)It would depend if they bought the shares from an American or aCanadiand)None of the above.Answer: a)20Foreign direct investment (FDI) occursa)when an investor acquires a measure of control of a foreignbusinessb)when there is an acquisition, by a foreign entity in the U.S., of10 percent or more of the voting shares of a businessinvolve a transfer of controld)a and bAnswer: d21Statistical discrepancy, which by definition represents errors and omissionsa)Cannot be calculated directlyb)Is calculated by taking into account the balance-of-paymentsidentityc)Probably has some elements that are honest mistakes, it can’t allbe money laundering and drugs.d)All of the aboveAnswer: d)22The statistical discrepancy in the balance-of-payments accountsa)Arise since recordings of payments and receipts are done atdifferent times, in different places, possibly using differentmethods.b)Arise since some transactions (illegal transactio ns?) occur “offthe books”.c)Represents omitted and misrecorded transactions.d)All of the aboveAnswer: d)23Regarding the statistical discrepancy in the balance-of-payments accountsresponsible for the discrepancy.b)The sum of the balance on the capital account and the statisticaldiscrepancy is very close to the balance of the current account in magnitude.c)It tends to be positive one year and negative in others, so it’ssafe to ignore itd)a) and b)Answer: d)24When a country must make a net payment to foreigners because of a balance-of-payments deficit, the central bank of the countrya)Should do nothingb)Should run down its official reserve assets (e.g. gold, foreignexchanges, and SDRs)c)Should borrow anew from foreign central banks.d)b) or c) will workAnswer: d)25Continued U.S. trade deficits coupled with foreigners’ desire to diversify their currency holdings away from U.S. dollarsa)could further diminish the position of the dollar as the dominantreserve currencyb)could affect the value of U.S. dollar (e.g. through the currencydiversification decisions of Asian central banks)c)Could lend steam to the emergence of the euro as a credible reserved)All of the aboveAnswer: d26Currently, international reserve assets are comprised ofa)gold, platinum, foreign exchanges, and special drawing rights (SDRs)b)gold, foreign exchanges, special drawing rights (SDRs), and reservepositions in the International Monetary Fund (IMF)c)gold, diamonds, foreign exchanges, and special drawing rights (SDRs)d)reserve positions in the International Monetary Fund (IMF), only Answer: b27International reserve assets include “foreign exchanges”. These area)Special Drawing Rights (SDRs) at the IMFb)reserve positions in the International Monetary Fund (IMF)c)Foreign currency held by a country’s central bankd)None of the aboveAnswer: c28The most important international reserve asset, comprising 94 percent of the total reserve assets held by IMF member countries isa)Goldb)Foreign exchangesc)Special Drawing Rights (SDRs)d)Reserve positions in the International Monetary Fund (IMF)Answer: b29The vast majority of the foreign-exchange reserves held by centrala)Local currenciesb)U.S. dollarsc)Yend)EuroAnswer: b30The U.S. Trade Deficita)Is a capital account surplusb)Is a current account deficitc)Is both a capital account surplus and a current account deficitd)None of the aboveAnswer: c31Over the last several years the U.S. has run persistenta)Balance-of-payments deficitsb)Balance-of-payments surplusesc)Current Account deficitsd)Capital Account deficitsAnswer: c32More important than he absolute size of a country’s balance-of-payments disequilibriuma)is the nature and cause of the disequilibriumb)is whether it is a trade surplus or deficitc)is whether the local government is mercantilist or notd)Nothing is more important than he absolute size of a country’sAnswer: aThe Relationship between Balance of Payments and National Income Accounting For questions in this section, the notation isY = GNP = national incomeC = consumptionI = private investmentG = government spendingX = exportsM = imports33National income, or Gross National Product is given by:a)GNP = Y = C + I + G + X + Mb)GNP = Y = C + I + G + X – Mc)GNP = I = C + Y + G + X – Md)GNP = Y = C + I + X + M – GAnswer: b)34Which of the following is a true statement?a)BCA ≡ X – Mb)BKA ≡ X – Mc)BKA –BCA ≡ X – Md)BKA ≡ X – MAnswer a)35There is an intimate relationship between a country’s BCA and how the country finances its domestic investment and pays for government+ (T – G). Given this, which of the following is a true statement?a)If (S –I) < 0, it implies that a country’s domestic savings isinsufficient to finance domestic investment.b) If (T –G) < 0, it implies that a country’s tax revenue isinsufficient to finance government spendingc)both a) and b) are trued)none of the aboveAnswer c)36There is an intimate relationship between a country’s B CA and how the country finances its domestic investment and pays for governmentexpenditures. This relationship is given by BCA ≡ X –M ≡ (S – I) + (T – G). Given this, which of the following is a true statement?a)If (S –I) < 0, it implies that a country’s domestic savings isinsufficient to finance domestic investment.b) If (T –G) < 0, it implies that a country’s tax revenue isinsufficient to finance government spendingc)when BCA is negative, it implies that government budget deficitsan/or part of domestic investment are being finance with foreign-controlled capitald)all of the above are trueAnswer d)37There is an intimate relationship between a country’s BCA and how the country finances its domestic investment and pays for government+ (T – G). Given this, in order for a country to reduce a BCA deficit, which of the following must occur?a)For a given level of S and I, the government budget deficit (T – G)must be reducedb)For a given level of I and (T – G), S must be increasedc)For a given level of S and (T – G), I must falld)All of the above would work to reduce a BCA deficitAnswer d)Explain how each of the following transactions will be classified and recorded in the debit and credit of the U.S. balance of payments:(1) A Japanese insurance company purchases U.S. Treasury bonds and paysout of its bank account kept in New York City.(2) A U.S. citizen consumes a meal at a restaurant in Paris and payswith her American Express card.(3) A Indian immigrant living in Los Angeles sends a check drawn on hisL.A. bank account as a gift to his parents living in Bombay.(4) A U.S. computer programmer is hired by a British company for consulting andgets paid from the U.S. bank account maintained by the British company.In contrast to the U.S., Japan has realized continuous current account surpluses. What could be the main causes for these surpluses? Is it desirable to have continuous current account surpluses?。

![国际金融中英文版答案解析]](https://img.taocdn.com/s1/m/4c94fb34b52acfc789ebc98d.png)

国际金融中英文版Chapter 2:Payments among NationsSingle-Choice Questions1.A country’s balance of payments records:一个国家的国际收支平衡记录了 Ba.The value of all exports of goods and services from thatcountry for a period of time.b.All flows of value between that c ountry’s residentsand residents of the rest of the world during a periodof time. 在一定时间段里, 一个国家居民的资产和其它世界居民资产的流动c.All flows of financial assets that cross thatcountry’s borders during a period of time.d.All flows of goods into that country during a periodof time.2.A credit item in the balance of payments is: 在国际收支平衡里的贷项是 Aa.An item for which the country must be paid. 一个国家必须收取的条款b.An item for which the country must pay.c.Any imported item.d.An item that creates a monetary claim owed to aforeigner.3.Every international exchange of value is entered into thebalance-of-payments accounts __________ time(s). 每一次国际等价交换都记进国际收支帐户2次 Ba.1b.2c.3d.44.A debit item in the balance of payments is: 在国际收支平衡中的借项是 Ba.An item for which the country must be paid.b.An item for which the country must pay. 一个国家必须支付的条款c.Any exported item.d.An item that creates a monetary claim on a foreigner.5.In a nation's balance of payments, which one of the followingitems is always recorded as a positive entry? D 在国际收支中, 下列哪个项目总被视为有利条项a.Changes in foreign currency reserves.b.Imports of goods and services.itary foreign aid supplied to allied nations.d.Purchases by foreign travelers visiting the country.国外游客在本国发生的购买6.The sum of all of the debit items in the balance of payments:在收支平衡中,所有贷项的总和 Ba.Equals the overall balance.b.Equals the sum of all credit items.等于所有借项的总和c.Equals ‘compensating’ transactions.d.Equals the sum of credit items minus errors andomissions.7.Which of the following capital transactions are entered asdebits in the U.S. balance of payments? 下列哪个资本交易在美国的收支平衡中当作借项?Ba.A U.S. resident transfers $100 from his account atCredit Suisse in Basel (Switzerland) to his account ata San Francisco branch of Wells Fargo Bank.b.A French resident transfers $100 from his account atWells Fargo Bank in San Francisco to his Credit Suisseaccount in Basel. 一个法国居民在旧金山的Fargo Bank用其帐户转帐100美金到位于巴塞尔的瑞士信贷户口c.A U.S. resident sells his IBM stock to a Frenchresident.d.A U.S. resident sells his Credit Suisse stock to aFrench resident.8.An increase in a nation's financial liabilities to foreignresidents is a: 一个国家对另一个国家金融负债的增加是一种Ca.Reserve inflow.b.Reserve outflow.c.Capital inflow.资本流入d.Capital outflow.9.___A_______ are money-like assets that are held bygovernments and that are recognized by governments as fully acceptable for payments between them. 官方国际储备资产是一种类似于钱的资产,这种资产由政府掌握并作为政府间的一种支付手段得到充分认可.a.Official international reserve assets 官方国际储备资产b.Unofficial international reserve assetsc.Official domestic reserve assetsd.Unofficial domestic reserve assets10.Which of the following is considered a capital inflow?下列哪项被视为资本流入 Aa.A sale of U.S. financial assets to a foreign buyer.美国一金融资产卖给一外国买家b.A loan from a U.S. bank to a foreign borrower.c.A purchase of foreign financial assets by a U.S. buyer.d.A U.S. citizen’s repayment of a loan from a foreignbank.11.In a country’s balance of payments, which of thefollowing transactions are debits?一个国家的收支平衡表中,哪个交易属于借项? Aa.Domestic bank balances owned by foreigners aredecreased. 外国人拥有的国内银行资产的下降b.Foreign bank balances owned by domestic residents aredecreased.c.Assets owned by domestic residents are sold tononresidents.d.Securities are sold by domestic residents tononresidents.12.The role of ___D_______ is to direct one nation’ssavings into another nation’s investments: 资金流的作用是指导一个国家的储蓄进入到另一个国家的投资a.Merchandise trade flowsb.Services flowsc.Current account flowsd.Capital flows 资金流13.The net value of flows of goods, services, income, andunilateral transfers is called the: 商品,服务,收入和单方面转让等现金流的净收益叫经常账目(户)Ba.Capital account.b.Current account.经常账目(户)c.Trade balance.d.Official reserve balance.14.The net value of flows of financial assets and similarclaims (excluding official international reserve asset flows) is called the: 金融资产和类似的资产(官方国际储备资产流除外)的净值流叫 Aa.Financial account.金融帐b.Current account.c.Trade balance.d.Official reserve balance.15.The financial account in the U.S. balance of paymentsincludes: 美国国家收支表中的金融帐包括: Ba.Everything in the current account.b.U.S. government payments to other countries for the useof military bases.美政府采用其它国家军事基地所需支付款项c.Profits that Nissan of America sends back to Japan.d.New U.S. investments in foreign countries.16.A U.S. resident increasing her holdings of a foreignfinancial asset causes a: 一个美国居民增持一外国金融资产会引起Da.Credit in the U.S. current account.b.Debit in the U.S. current account.c.Credit in the U.S. capital account.d.Debit in the U.S. capital account. 美国资本帐的借帐17. A foreign resident increasing her holdings of a U.S.financial asset causes a: 一个美国居民增持本国一金融资产会引起 Ca.Credit in the U.S. current account.b.Debit in the U.S. current account.c.Credit in the U.S. capital account.美国资本帐的贷帐d.Debit in the U.S. capital account.18. A deficit in the current account: 经常帐户中的赤字 Aa.Tends to cause a surplus in the financial account.会导致金融帐中的盈余b.Tends to cause a deficit in the financial account.c.Has no relationship to the financial account.d.Is the result of increasing exports and decreasingimports.19.In September, 2005, exports of goods from the U.S.decreased $3.3 billion to $73.4 billion, and imports of goods increased $3.8 billion to $144.5 billion. Thisincreased the deficit in:2005年8月,美国商品出口降低了33亿美元,共734亿美元;商品进口上升到1145亿美元,上长了38亿.这样增加了哪个方面的赤字?Ca.The balance of payments.b.The financial account.c.The current account. 经常帐户d.Unilateral transfers.20.Which of the following would contribute to a U.S. currentaccount surplus? 以下哪项有助于美国现金帐的盈余? Ba.The United States makes a unilateral tariff reductionon imported goods.b.The United States cuts back on American militarypersonnel stationed in Japan.美国削减在日本的军事人员c.U.S. tourists travel in large numbers to Asia.d.Russian vodka becomes increasingly popular in theUnited States.21.Which of the following transactions is recorded in thefinancial account?以下哪个交易会被当作金融帐Aa.Ford motor company builds a new plant in China 福特摩托公司在中国设立车间b.A Chinese businessman imports Ford automobiles from theUnited States.c.A U.S. tourist spends money on a trip to China.d.The New York Yankees are paid $10 million by the Chineseto play an exhibition game in Beijing, China.22.If a British business buys U.S. government securities,how will this be entered in the balance of payments? 如果一英国商人购买了美国政府的债券,那么这个交易在收支平衡表中会被当作是? Ca.It will appear in the trade account as an import.b.It will appear in the trade account as an export.c.It will appear in the financial account as an increasein U.S. assets held by foreigners.会被当作是外国人所有的美国资产增长d.It will appear in the financial account as a decreasein U.S. assets held by foreigners.23.In the balance of payments, the statistical discrepancyor error term is used to: 在收支平衡表中, 统计差异与错误项目会用来确保借帐总和跟贷帐总和一致 Aa.Ensure that the sum of all debits matches the sum ofall credits.b.Ensure that imports equal the value of exports.c.Obtain an accurate account of a balance-of-paymentsdeficit.d.Obtain an accurate account of a balance-of-paymentssurplus.24.Official reserve assets are: 官方储备资产是Ba.The gold holdings in the nation’s central bank.b.Money like assets that are held by governments and thatare recognized by governments as fully acceptable forpayments between them. 官方国际储备资产是一种类似于钱的资产,这种资产由政府掌握并作为政府间的一种支付手段得到充分认可ernment T-bills and T-bonds.ernment holdings of SDR’s25.Which of the following constitutes the largest componentof the world’s international reserve assets?下列哪项构成了世界国际储备资产的大部份? Da.Gold.b.Special Drawing Rights.c.IMF Reserve Positions.d.Foreign Currencies. 外汇(币)26.The net accumulation of foreign assets minus foreignliabilities is: 海外净资产的积累减去外债等于C official reserves. domestic investment. foreign investment. 国外投资净值 foreign deficit.27. A country experiencing a current account surplus: 一个国家经历经常帐户的盈余 Ba.Needs to borrow internationally.b.Is able to lend internationally.就有能力向外放贷c.Must also have had a surplus in its "overall" balance.d.Spent more than it earned on its merchandise and servicetrade, international income payments and receipts andinternational transfers.28.The ___C_______ measures the sum of the current accountbalance plus the private capital account balance. 官方结算差额是指经常帐户余额的总和加上私人资本帐(B=CA+FA,FA:为非官方投资和储备)a.Official capital balanceb.Unofficial capital balancec.Official settlements balance官方结算差额d.Unofficial settlements balance29.If the overall balance is in __A________, there is anaccumulation of official reserve assets by the country ora decrease in foreign official reserve holdings of thecountry's assets. 如果综合差额处于盈余,那么会出现本国官方储备资产的积累或者国外官方储备的减少(B=CA+FA,B+OR=0,OR:官方储备金额)a.Surplus盈余b.Deficitc.Balanced.Foreign hands30.Which of the following is the current account balance NOTequal to? 以下哪项不等同于现金帐 Da.The difference between domestic product and domesticexpenditure.b.The difference between national saving and domesticinvestment. foreign investment.d.The difference between government saving andgovernment investment. 政府储蓄与政府投资的差值True/False Questions31.Capital inflows are debits and capital outflows arecredits. 资金流入是借项,资金外流是贷项32.The net value of the flow of goods, services, income, andgifts is the current account balance. (T) 商品,服务,收入和单方面转让等现金流的净收益叫经常账目余额33.The net flow of financial assets and similar claims isthe private current account balance. 金融资产和类似的资产的净值叫经常帐目余额34.The majority of countries' official reserves assets arenow foreign exchange assets, financial assets denominated in a foreign currency that is readily acceptable ininternational transactions. (T) 大部份官方储备资产作为以外汇资产和金融资产为命名的外币在世界上交易与流通.35. A country's financial account balance equals thecountry's net foreign investment.一个国家的金融帐差额相当于一个国家的净国外投资36. A country has a current account deficit if it is savingmore than it is investing domestically.一个国家如果在国内的储蓄比投资要大,那么会出现经常账目赤字37.The official settlements balance measures the sum of thecapital account balance plus the public current account balance. 官方结算差额是资金帐户余额的总额加上公共经常帐户余额38. A nation's international investment position shows itsstock of international assets and liabilities at a moment in time. (T) 一个国家的国际投资状况反映出它在特定时间里的国际资产股份以及债务情况.39. A nation is a borrower if its current account is indeficit during a time period. (T)在一段时间内,如果一个国家的经常帐出现赤字,那么它就是借方.40. A nation is a debtor if its net stock of foreign assetsis positive. 如果一个国家的国外资产净储备是正数,那么它是借方(债务方)41. A transaction leading to a foreign resident increasingher holdings of a U.S. financial asset will be recorded asa debit on the U.S. financial account. 如果一项交易引起一外国居民增持美国金融资产的股份,那么这项交易在美国金融帐中会被当作借项42. A credit item is an item for which a country must pay.贷项是指一个国家必须还款的条项43.Gold is a major reserve asset that is currently often usedin official reserve transactions. 黄金作为主要的储备资产,常被用在官方储备交易当中.44.The current account balance is equal to the differencebetween domestic product and national expenditure.(T) 经常项目余额等于国民生产与国民支出的差额45.In 2007 U.S. households, businesses and government werebuying more goods and services than they were producing.(T)2007年,美国家庭,商业,政府购买的商品和服务比他们生产(商品和服务)的要多.46。

INTERNATIONAL FINANCEAssignment Problems (3) Name: Student#:I. Choose the correct answer for the following questions (only ONE correct answer) (2 credits for each question, total credits 2 x 25 = 50)1. Interbank quotations that include the United States dollars are conventionally given in, which state the foreign currency price of one U.S. dollar, such as a bid price of SFr 0.85/$.A. indirect quoteB. direct quoteC. American quoteD. European quote2. The spot exchange rate published in financial newspapers is usually the .A. nominal exchange rateB. real exchange rateC. effective exchange rateD. equilibrium exchange rate3. The foreign exchange refers to the .A. foreign bank notes and coinsB. demand deposits in foreign banksC. foreign securities that can be easily cashedD. all of the above4. The functions of the foreign exchange market come down to .A. converting the currency of one country into the currency of anotherB. providing some insurance against the foreign exchange riskC. making the foreign exchange speculation easyD. Only A and B are true.5. Which of the following is NOT true regarding the foreign exchange market.A. It is the place through which people exchange one currency for another.B. The exchange rate nowadays is mainly determined by the market forces.C. Most foreign exchange transactions are physically completed in this market.D. All of the above are true.6. The world largest foreign exchange markets are respectively.A. London, New York and TokyoB. London, Paris and FrankfurtC. London, Hong Kong and SingaporeD. London, Zurich and Bahrain7. The foreign exchange market is NOT efficient because .A. monetary authorities dominate the foreign exchange market and everybody knows that by definition, central banks are inefficientB. commercial banks and other participants of the market do not compete with one another due to the fact that transaction takes place around the world and not in a single centralized locationC. foreign exchange dealers have different prices such as bid and ask pricesD. None of the reasons listed are correct because the foreign exchange market is an efficient market8. earn a profit by a bid-ask spread on currencies they buy and sell.on the other hand, earn a profit by bringing together buyers and sellers of foreign exchanges and earning a commission on each sale and purchase.A. Foreign exchange brokers; foreign exchange dealersB. Foreign exchange dealers; foreign exchange brokersC. arbitragers; speculatorsD. commercial banks; central banks9. Most foreign exchange transactions are through the U.S. dollars. If the transaction is expressed as the currencies per dollar, this is known as whereas are expressed as dollars per currency.A. direct quote; indirect quoteB. indirect quote; direct quoteC. European quote; American quoteD. American quote, European quote10. From the viewpoint of a Japanese investor, which of the following would be a direct quote..B. .C. ¥110/.D. . ¥11. Which of the following is true about the foreign exchange market.A. It is a global network of banks, brokers, and foreign exchange dealers connected by electronic communications system.B. The foreign exchange market is usually located in a particular place.C. The foreign exchangerates are usually determined by the related monetary authorities.D. The main participants in this market are currency speculatorsfrom different countries.12. The extent to which the income from individual transactions is affected by fluctuations in foreign exchange values is considered to be .A. Translation exposureB. economic exposureC. transaction exposureD. accounting exposure13. Which of the following exchange rates is adjusted for price changes.A. nominal exchange rateB. real exchange rateC. effective exchange rateD. equilibrium exchange rate14. Suppose the exchange rate of the RMB versus U.S. dollar is ¥6.8523/$ n RMB were to undergo a 10% depreciation, the new exchange rate in terms ofbe:A. B. C. D.15. At least in a U.S. MNC’s financial accounting statement, if the value of the euro depreciatesrapidly againstthat of the dollar over a year, this would reducethe dollarvalue of the euro profit made by the European subsidiary. This is a typical .A. transaction exposureB. translation exposureC. economic exposureD. operating exposure16. A Japanese-based firm expects to receive pound-payment in 6 months. The companyhas a (an) .A. economic exposureB. accounting exposureC. long position in sterlingD. short position in sterling17 The exposure to foreign exchangerisk known as Translation Exposure may bedefined as .A. change in reported owne’r s equity in consolidated financial statements caused bya change in exchange ratesB. the impact of settling outstanding obligations entered into before change in exchange rates but to be settled after change in exchange ratesC. the changein expectedfuture cashflows arisingfrom an unexpectedchangein exchange ratesD. All of the above18 When a firm deals with foreign trade or investment, it usually has foreignexchange risk exposure. So if an American firm expects to receive a dollar-payment from a Chinese company in the next 30 days, the U.S. firm has the possible .A. economic exposureB. transaction exposureC. translation exposureD. none of the above19. In order to avoid the possible loss because of the exchange rate fluctuations, a firm that has a position in foreign exchanges can that position in the forward market.A. short; sellB. long; sellC. long; buyD. none of the above20. A forward contract to deliver Japaneseyens for Swissfrancs could be describedeither as or ,A. selling yens forward; buying francs forwardB. buying francs forward; buying yens forwardC. selling yens forward; selling francs forwardD. selling francs forward; buying yens forwardSFr/$21. Dollars are trading at S0=SFr0.7465/$ in the spot market. The 90-dayforwardSFr/$rate is F1=SFr0.7432/$. So the forward on the dollar in basis points is :A. discount,B. discount, 33C. premium,D. premium, 3322. If the spot rate is /. , 3-month forward rate is6./, which of the following is NOT true.A. euro is at forward premium by 100 points.B. dollar is at forward discount by 100 points.C. dollar is at forward discount by 55 points.D. euro is at forward premium by 2.96% p.a.23. If the spot C$/$ rate is 1.0305/15, forward dollar is 25/30 premium, the outright forward quote in American term should be .A. –B. –C. ––24. If the spot C$/$ rate is 1.0305/15, forward dollar is 25/30 premium, the $/C$ forward quote in terms of points should be .A. 30/25B. 25/30C. –(23/28)D. –(28/23)25. The current U.S. dollar exchange rate is¥85/$. If the 90-day forward dollar rate is ¥90/$, then the yen is selling at a per annum of .A. premium; 5.88%B. discount; 5.56%C. premium; 23.52%D. discount; 22.23%II. ProblemsQuestions1through10are based on the information presented in Table 3.1(2.credits for each question, total credits 2 x 10 = 20)TableCountry Exchange rate(2021) Exchange rate CPI Volume of Volume ofimports from U.S.(2021) (2021)Germany Mexico U.S.. 0.75/$Mex$11.8/$. 0.70/$Mex$12.20/$$200m$120m$350m$240m1. The real exchange rate of the dollar against the euro in 2021 was .2. The real exchange rate of the dollar against the peso in 2021 was .3. The dollar was against the euro in nominal term by .A. appreciated; 6.67%B. depreciated; 6.67%C. appreciated; 7.14%D depreciated; 7.14%4. The Mexican peso was against the dollar in nominal term by.A. appreciated; 3.39%B. depreciated; 3.39%C. appreciated; 3.28%D. depreciated; 3.28%5. The volume of the German foreign trade with the U.S. was .6. The volume of the Mexican foreign trade with the U.S. was .7. Assume the U.S. trades only with the Germany and Mexico. Now if we want to calculate the dollar effective exchange rate in 2021 against a basket of currencies of euroand Mexican peso, the weight assigned to the euro should be .8. The weight assigned to the peso should be .9. Assumethe 2021 is the baseyear. The dollar effective exchangerate in 2021 was.10. Was the dollar generally stronger or weaker in 2021 according to your calculation.11. The following exchange rates are available to you.Fuji Bank ¥80.00/$United Bank of Switzerland SFr0.8900/$Deutsche Bank ¥Assume you have an initial SFr10 million. Can you make a profit via triangular arbitrage. If so, show steps and calculate the amount of profit in Swiss fra n8cs c.r e(dit s)12. If the dollar appreciates 1000% against the ruble, by what percentage does the ruble depreciate against the dolla(r5. credits)13. As a percentage of an arbitrary starting amount, about how large would transactions costs have to be to make arbitrage between the exchange rat e S s Fr/$S= SFr1.7223/$, S$/¥¥/SFr= ¥, and S = ¥unprofitable. Explain(.7 credits14. You are given the following exchange rates:¥/A$S = 67.05 –£/A$S –¥/ £Calculate the bid and ask rate of S : (5 credits)15.Suppose the spot quotation on the Swiss franc (CHF) in New York is4–42–68. Compute the percentage bid-ask spreads on the CHF/EUR quo t(e5. credits)Answers to Assignment Problems (3)Part I1. D2. A3. D4. D5. D6. A7. D8. B9. C 10. C11. A 12. A 13. B 14. D 15. B16. C 17. A 18. D 19. B 20. A21. B 22. B 23. C 24. C 25. D Part II1. 0.70 x (105.3/102.5) = 0.7 x 1.0273 =2. 12.2 x (105.3/110.5) = 12.2 x .9529 =3. B (0.7 /.75)–1 = -6.67%4. D (1/12.2)/(1/11.8) –1 = -3.28%5. 5506. 3607. 550/910 = 60.44%8. 360/910 =9. (0.70/0.75)(60.44%) + (12.2/11.8)(39.56%) = .5641 + 0.4090 = .9731 = 97.31%10. weaker, because dollar depreciated by 2.69%.¥/$ $/SFr SFr/ ¥11. Since S S S = 0.946186< 1, there is an arbitrage opportunity.Steps: ①Buy ¥from Deutsche Bank, SFr10 million x =¥950million② m③ mProfit (ignoring transaction fees):–SFr10 = 0.56875 million = 568,75012. (x–1) = 1000%; 1/11 –1 = 90.9%13. S SFr/$ S$/ ¥S¥/SFr = SFr1.7223/$ x x¥¥F=rIf transaction costs exceed $0.0326 (3.26%), the arbitrage is unprofitable.¥/A$14. Given: S = –£/A$S –¥/.(bid)£/.(ask)15. Given: –52/SFr–68/SFrSo, S SRr/ . (bid)S SFr/ . (ask)Bid-ask margin = –1.424) / 1.4264 = 0.1683%。

国际金融中英文版Chapter 2:Payments among NationsSingle-Choice Questions1. A country’s balance of payments records:一个国家的国际收支平衡记录了 Ba.The value of all exports of goods and services from that country for a periodof time.b.All flows of value between that c ountry’s residents and residents of the restof the world during a period of time。

在一定时间段里,一个国家居民的资产和其它世界居民资产的流动c.All flows of financial assets that cross that country’s borders during a periodof time.d.All flows of goods into that country during a period of time。

2.3. A credit item in the balance of payments is: 在国际收支平衡里的贷项是 Aa.An item for which the country must be paid。

一个国家必须收取的条款b.An item for which the country must pay。

c.Any imported item。

d.An item that creates a monetary claim owed to a foreigner。

4.Every international exchange of value is entered into the balance—of—paymentsaccounts __________ time(s)。