企业会计准则08 号--资产减值(中英文对照)

- 格式:doc

- 大小:40.84 KB

- 文档页数:14

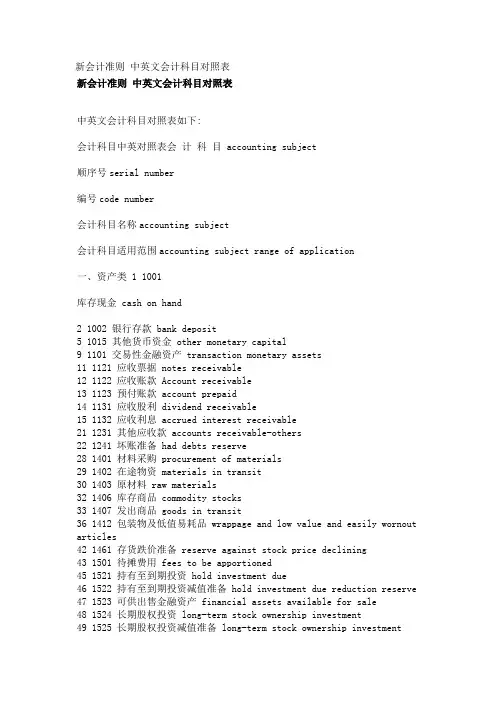

新会计准则中英文会计科目对照表新会计准则中英文会计科目对照表中英文会计科目对照表如下:会计科目中英对照表会计科目 accounting subject顺序号serial number编号code number会计科目名称accounting subject会计科目适用范围accounting subject range of application一、资产类 1 1001库存现金 cash on hand2 1002 银行存款 bank deposit5 1015 其他货币资金 other monetary capital9 1101 交易性金融资产 transaction monetary assets11 1121 应收票据 notes receivable12 1122 应收账款 Account receivable13 1123 预付账款 account prepaid14 1131 应收股利 dividend receivable15 1132 应收利息 accrued interest receivable21 1231 其他应收款 accounts receivable-others22 1241 坏账准备 had debts reserve28 1401 材料采购 procurement of materials29 1402 在途物资 materials in transit30 1403 原材料 raw materials32 1406 库存商品 commodity stocks33 1407 发出商品 goods in transit36 1412 包装物及低值易耗品 wrappage and low value and easily wornout articles42 1461 存货跌价准备 reserve against stock price declining43 1501 待摊费用 fees to be apportioned45 1521 持有至到期投资 hold investment due46 1522 持有至到期投资减值准备 hold investment due reduction reserve47 1523 可供出售金融资产 financial assets available for sale48 1524 长期股权投资 long-term stock ownership investment49 1525 长期股权投资减值准备 long-term stock ownership investmentreduction reserve50 1526 投资性房地产 investment real eastate51 1531 长期应收款 long-term account receivable52 1541 未实现融资收益 unrealized financing income54 1601 固定资产 permanent assets55 1602 累计折旧 accumulated depreciation56 1603 固定资产减值准备permanent assets reduction reserve57 1604 在建工程 construction in process58 1605 工程物资 engineer material59 1606 固定资产清理 disposal of fixed assets60 1611 融资租赁资产租赁专用 financial leasing assets exclusively for leasing61 1612 未担保余值租赁专用 unguaranteed residual value exclusively for leasing62 1621 生产性生物资产农业专用 productive living assets exclusively for agriculture63 1622 生产性生物资产累计折旧农业专用 productive living assets accumulated depreciation exclusively for agriculture64 1623 公益性生物资产农业专用 non-profit living assets exclusively for agriculture65 1631 油气资产石油天然气开采专用 oil and gas assets exclusively for oil and gas exploitation66 1632 累计折耗石油天然气开采专用 accumulated depletion exclusively for oil and gas exploitation67 1701 无形资产 intangible assets68 1702 累计摊销 accumulated amortization69 1703 无形资产减值准备 intangible assets reduction reserve70 1711 商誉 business reputation71 1801 长期待摊费用 long-term deferred expenses72 1811 递延所得税资产 deferred income tax assets73 1901 待处理财产损溢 waiting assets profit and loss二、负债类 debt group74 2001 短期借款 short-term loan81 2101 交易性金融负债 transaction financial liabilities83 2201 应付票据 notes payable84 2202 应付账款 account payable85 2205 预收账款 item received in advance86 2211 应付职工薪酬 employee pay payable87 2221 应交税费 tax payable88 2231 应付股利 dividend payable89 2232 应付利息 interest payable90 2241 其他应付款 other account payable97 2401 预提费用 withholding expenses98 2411 预计负债 estimated liabilities99 2501 递延收益 deferred income100 2601 长期借款 money borrowed for long term101 2602 长期债券 long-term bond106 2801 长期应付款 long-term account payable107 2802 未确认融资费用 unacknowledged financial charges108 2811 专项应付款 special accounts payable109 2901 递延所得税负债 deferred income tax liabilities三、共同类112 3101 衍生工具 derivative tool113 3201 套期工具 arbitrage tool114 3202 被套期项目 arbitrage project四、所有者权益类115 4001 实收资本 paid-up capital116 4002 资本公积 contributed surplus117 4101 盈余公积 earned surplus119 4103 本年利润 profit for the current year120 4104 利润分配 allocation of profits121 4201 库存股 treasury stock五、成本类122 5001 生产成本 production cost123 5101 制造费用 cost of production124 5201 劳务成本 service cost125 5301 研发支出 research and development expenditures126 5401 工程施工建造承包商专用 engineering construction exclusively for construction contractor127 5402 工程结算建造承包商专用 engineering settlement exclusively for construction contractor128 5403 机械作业建造承包商专用 mechanical operation exclusively for construction contractor六、损益类129 6001 主营业务收入main business income130 6011 利息收入金融共用 interest income financial sharing135 6051 其他业务收入 other business income136 6061 汇兑损益金融专用 exchange gain or loss exclusively for finance137 6101 公允价值变动损益 sound value flexible loss and profit138 6111 投资收益 income on investment142 6301 营业外收入 nonrevenue receipt143 6401 主营业务成本 main business cost144 6402 其他业务支出 other business expense145 6405 营业税金及附加 business tariff and annex146 6411 利息支出金融共用 interest expense financial sharing155 6601 销售费用 marketing cost 156 6602 管理费用 managing cost157 6603 财务费用 financial cost 158 6604 勘探费用 exploration expense 159 6701 资产减值损失 loss from asset devaluation160 6711 营业外支出 nonoperating expense 161 6801 所得税 income tax 162 6901 以前年度损益调整prior year profit and loss adjustmentAccounting StandardsAuthoritative & interpretive literature. FASB, AICPA, SEC &more 新会计准则英汉对照目录Effective 2007 for Listed Companies1. 企业会计准则————————-基本准则(Accounting Standard for Business Enterprises - Basic Standard)2. 企业会计准则第1 号————————-存货(Accounting Standard for Business Enterprises No. 1 - Inventories)3. 企业会计准则第2 号————————-长期股权投资(Accounting Standard for Business Enterprises No. 2 - Long-term equity investments)4. 企业会计准则第3 号————————-投资性房地产(Accounting Standard for Business Enterprises No. 3 - Investment properties)5. 企业会计准则第4 号————————-固定资产(Accounting Standard for Business Enterprises No. 4 - Fixed assets)6. 企业会计准则第5 号————————-生物资产(Accounting Standard for Business Enterprises No. 5 - Biological assets)7. 企业会计准则第6 号————————-无形资产(Accounting Standard for Business Enterprises No. 6 - Intangible assets)8. 企业会计准则第7 号————————-非货币性资产:)(Accounting Standard for Business Enterprises No. 7 - Exchange of non-monetary assets)9. 企业会计准则第8 号————————-资产减值(Accounting Standard for Business Enterprises No. 8 - Impairment of assets)10. 企业会计准则第9 号————————-职工薪酬(Accounting Standard for Business Enterprises No. 9 –Employee compensation )11. 企业会计准则第10 号————————企业年金基金(Accounting Standard for Business Enterprises No. 10 - Enterprise annuity fund)12. 企业会计准则第11 号————————股份支付(Accounting Standard for Business Enterprises No. 11 - Share-based payment)13. 企业会计准则第12 号————————债务重组(Accounting Standard for Business Enterprises No. 12 - Debt restructurings)14. 企业会计准则第13 号————————或有事项(Accounting Standard for Business Enterprises No. 13 - Contingencies)15. 企业会计准则第14 号————————收入(Accounting Standard for Business Enterprises No. 14 - Revenue)16. 企业会计准则第15 号————————建造合同(Accounting Standard for Business Enterprises No. 15 - Construction contracts)17. 企业会计准则第16 号————————政府补助(Accounting Standard for Business Enterprises No. 16 - Government grants)18. 企业会计准则第17 号————————借款费用(Accounting Standard for Business Enterprises No. 17 - Borrowing costs)19. 企业会计准则第18 号————————所得税(Accounting Standard for Business Enterprises No. 18 - Income taxes)20. 企业会计准则第19 号————————外币折算(Accounting Standard for Business Enterprises No. 19 - Foreign currency translation)21. 企业会计准则第20 号————————企业合并(Accounting Standard for Business Enterprises No. 20 - Business Combinations)22. 企业会计准则第21 号————————租赁(Accounting Standard for Business Enterprises No. 21 - Leases)23. 企业会计准则第22 号————————金融工具确认和计量(Accounting Standard for Business Enterprises No. 22 - Recognition and measurement of financial instruments)24. 企业会计准则第23 号————————金融资产转移(Accounting Standard for Business Enterprises No. 23 - Transfer of financial assets)25. 企业会计准则第24 号————————套期保值(Accounting Standard for Business Enterprises No. 24 - Hedging)26. 企业会计准则第25 号————————原保险合同(Accounting Standard for Business Enterprises No. 25 - Direct insurance contracts)27. 企业会计准则第26 号————————再保险合同(Accounting Standard for Business Enterprises No. 26 -Re-insurance contracts)28. 企业会计准则第27 号————————石油天然气开采(Accounting Standard for Business Enterprises No. 27 - Extraction of petroleum and natural gas)29. 企业会计准则第28 号————————会计政策、会计估计变更和差错更正(Accounting Standard for Business Enterprises No. 28 - Changes in accounting policie and estimates, and correction of errors)30. 企业会计准则第29 号————————资产负债表日后事项(Accounting Standard for Business Enterprises No. 29 - Events occurring after the balance sheet date)31. 企业会计准则第30 号————————财务报表列报(Accounting Standard for Business Enterprises No. 30 - Presentation of financial statements)32. 企业会计准则第31 号————————现金流量表(Accounting Standard for Business Enterprises No. 31 - Cashflow statements)33. 企业会计准则第32 号————————中期财务报告(Accounting Standard for Business Enterprises No. 32 - Interim financial reporting)34. 企业会计准则第33 号————————合并财务报表(Accounting Standard for Business Enterprises No. 33 - Consolidated financial statements)35. 企业会计准则第34 号————————每股收益(Accounting Standard for Business Enterprises No. 34 - Earnings per share)36. 企业会计准则第35 号————————分部报告(Accounting Standard for Business Enterprises No. 35 - Segment reporting)37. 企业会计准则第36 号————————关联方披露(Accounting Standard for Business Enterprises No. 36 - Related party disclosure)38. 企业会计准则第37 号————————金融工具列报(Accounting Standard for Business Enterprises No. 37 - Presentation of financial instruments)39. 企业会计准则第38 号————————首次执行企业会计准则(Accounting Standard for Business Enterprises No.38 - First time adoption of Accounting Standards for Business Enterprises)审计法Audit Law, Audit Act审计法实施条例the Implementary Rules of the Audit law审计标准audit criteria,audit standard审计准则auditing standard审计原则auditing principles审计手册audit manual公认审计准则Generally Accepted Auditing Standards审计法律规范audit laws and regulations审计体制audit system审计权限audit purview;audit jurisdiction;audit mandate 审计职责audit responsibility审计监督audit supervision;supervision through auditing 审计管辖权audit jurisdiction审计执法implementation of audit laws and regulations审计处理audit sanction审计处罚audit penalty依法审计conduct auditing in accordance with laws审计意见audit opinion审计决定audit decision审计建议audit suggestion, audit recommendation复核意见conclusion of audit review审计复议audit appeal审计听证audit hearing审计复核audit review审计战略audit strategy审计计划audit plan审计方案auditing program 审计目标auditing objective 审计范围audit scope审计内容audit coverage审计结论audit conclusion审计任务audit assignments 审计结果audit finding审计报告audit report审计方法audit method审计过程auditing process审计证据audit evidence审计测试audit test审计风险audit risk审计抽样audit sampling审计软件audit software审计程序auditing procedures 审计调查audit investigation 审计小组audit team审计线索audit trail工作底稿working paper绕过计算机审计auditing around the computer通过计算机审计auditing through the computer计算机辅助审计computer-assited audit信息技术审计IT audit合法性审计compliance audit, regularity audit合规性审计compliance audit综合审计comprehensive audit效益审计value for money audit (VFM audit)绩效审计performance audit财务审计financial audit财务报表审计financial statement audit财务收支审计audit of financial revenues and expenditures 决算审计final account audit经济责任审计accountability audit任中经济责任审计middle term accountability audit离任经济责任审计term-end accountability audit管理审计management audit项目审计project audit外部审计external audit内部审计internal audit政府审计government audit联合审计joint audit实地审计field audit期末审计final audit期中审计interim audit定期审计periodic audit初次审计initial audit初步审计preliminary audit事后审计post-audit事前审计pre-audit事中审计concurrent audit专项审计special audit法定审计statutory audit后续审计successive audit跟踪审计follow up audit全过程审计whole process auditing 突击审计surprise audit审计报告audit report标准报告standard report长式报告long-form report短式报告short-form report审计工作报告audit working report审计结果公告Announcement of Audit Findings审计长Auditor General副审计长Deputy Auditor General审计主任chief auditor资深审计师senior auditor审计师(员)auditor注册内部审计师certified internal auditor(CIA)注册信息系统审计师certified information systems auditor(CISA)注册公共会计师certified public accountant(CPA)特许会计师chartered accountant(CA)审计经费audit funds审计业务费audit operating expense审计专项经费special funds for auditing无保留意见:unqualified opinion保留意见qualified opinion无法表示意见: disclaimer of opinion否定意见:adverse opinion。

《企业会计准则第8号——资产减值》解释为了便于本准则的应用和操作,现就以下问题作出解释:(1)估计资产可收回金额应当遵循重要性原则;(2)预计资产未来现金流量的方法及考虑因素;(3)折现率的确定方法;(4)资产预计未来现金流量现值的计算;(5)资产组的认定;(6)存在少数股东权益情况下的减值测试。

一、估计资产可收回金额应当遵循重要性原则企业应当在资产负债表日判断资产是否存在减值的迹象。

有确凿证据表明资产存在减值迹象的,应当进行减值测试,估计资产的可收回金额。

在估计资产可收回金额时,应当遵循重要性原则。

根据这一原则,资产存在下列情况的,可以不估计其可收回金额:(一)以前报告期间的计算结果表明,资产可收回金额远高于其账面价值,之后又没有消除这一差异的交易或者事项,资产负债表日可以不重新估计该资产的可收回金额。

(二)以前报告期间的计算与分析表明,资产可收回金额相对于本准则列示的减值迹象反应不敏感,在本报告期间又发生了该减值迹象的,比如,当期市场利率或市场投资报酬率上升,该上升对计算资产未来现金流量现值采用的折现率影响不大的,可以不因上述减值迹象的出现而重新估计该资产的可收回金额。

二、预计资产未来现金流量的方法及其应当考虑的因素(一)预计资产未来现金流量的方法预计资产未来现金流量,通常应当根据资产未来每期最有可能产生的现金流量进行预测。

采用期望现金流量法更为合理的,应当采用期望现金流量法预计资产未来现金流量。

采用期望现金流量法,资产未来现金流量应当根据每期现金流量期望值进行预计,每期现金流量期望值,按照各种可能情况下的现金流量乘以相应的发生概率加总计算。

(二)预计资产未来现金流量应当考虑的因素1. 预计未来现金流量和折现率,应当在一致的基础上考虑因一般通货膨胀而导致物价上涨因素的影响。

如果折现率考虑了这一影响因素,资产预计未来现金流量也应当考虑;折现率没有考虑这一影响因素的,预计未来现金流量也不应考虑。

浅谈资产减值的会计处理摘要:新企业会计准则详细地规范了资产减值损失的确认、计量和相关信息的披露,明确规定资产减值损失一经确认,以后期间不得转回。

在实际工作中,对于不同性质的资产由于受企业内部和外部因素的影响,在计提减值准备确认后,分以后期间允许转回、不得转回两种情况进行账务处理,故在实际操作中难免会产生混淆。

本文通过举例对不同性质的资产减值账务处理进行系统归纳总结,指出其对利润的影响,避免利用减值准备调节利润,确保利润的准确性和可比性。

关键词:资产减值;会计处理引言《企业会计准则第8 号———资产减值》详细地规范了资产减值损失的确认、计量和相关信息的披露,力求真实地反映企业资产的质量,提高了会计信息的有用性,也使一些原本比较抽象的概念易于理解,便于实务操作。

计提资产减值准备,体现了会计谨慎性原则,可以保证企业利润和会计信息的准确性和可比性。

新会计准则规定,流动资产的减值损失允许转回,但必须以历史成本为上限进行调整;非流动资产的减值损失,即使以后该资产的价值回升,其减值准备在持有期间一律不得转回。

一、减值损失经确认后不得转回的资产项目(一)固定资产减值准备资产负债表日,企业应对固定资产进行逐项检查和测试,若确认固定资产发生了减值,企业应计提固定资产减值准备,按照固定资产账面价值高于可收回金额差额部分,借记“资产减值损失”科目,贷记“固定资产减值准备”科目。

若以后期间判断原已计提的减值损失的影响因素全部或部分消除,按照新会计准则规定,固定资产减值损失一经确认,以后会计期间不得转回。

期末,应将计提的固定资产减值损失转入本年利润。

例如,2013 年12 月31 日,某公司某机器设备账面价值320000 元,对该机器设备进行测试发现有减值迹象,根据市场行情该机器设备可收回金额300000 元。

会计处理如下:2013 年年末,该机器设备发生减值时借:资产减值损失20000贷:固定资产减值准备200002013 年年末,将计提的减值准备转入本年利润借:本年利润20000贷:资产减值损失20000若该机器设备在2014年年末可收回金额为350000元,此时已高于账面价值320000 元,按照规定,企业2013年年末计提的资产减值准备20000 元,不能冲减或转回。

企业会计准则第8号资产减值应用指南一、估计资产可收回金额应当遵循重要性要求企业应当在资产负债表日判断资产是否存在可能发生减值的迹象。

资产存在减值迹象的,应当进行减值测试,估计资产的可收回金额。

在估计资产可收回金额时,应当遵循重要性要求。

(一)以前报告期间的计算结果表明,资产可收回金额显著高于其账面价值,之后又没有发生消除这一差异的交易或者事项的,资产负债表日可以不重新估计该资产的可收回金额。

(二)以前报告期间的计算与分析表明,资产可收回金额相对于某种减值迹象反应不敏感,在本报告期间又发生了该减值迹象的,可以不因该减值迹象的出现而重新估计该资产的可收回金额。

比如,当期市场利率或市场投资报酬率上升,对计算资产未来现金流量现值采用的折现率影响不大的,可以不重新估计资产的可收回金额。

二、预计资产未来现金流量应当考虑的因素和采用的方法(一)预计资产未来现金流量应当考虑的主要因素1.预计资产未来现金流量和折现率,应当在一致的基础上考虑因一般通货膨胀而导致物价上涨等因素的影响。

如果折现率考虑了这一影响因素,资产预计未来现金流量也应当考虑;折现率没有考虑这一影响因素的,预计未来现金流量则不予考虑。

2.预计资产未来现金流量,应当分析以前期间现金流量预计数与实际数的差异情况,以评判预计当期现金流量所依据的假设的合理性。

通常应当确保当期预计现金流量所依据假设与前期实际结果相一致。

3.预计资产未来现金流量应当以资产的当前状况为基础,不应包括与将来可能会发生的、尚未作出承诺的重组事项有关或者与资产改良有关的预计未来现金流量。

未来发生的现金流出是为了维持资产正常运转或者原定正常产出水平所必需的,预计资产未来现金流量时应当将其考虑在内。

4.预计在建工程、开发过程中的无形资产等的未来现金流量,应当包括预期为使该资产达到预定可使用或可销售状态而发生的全部现金流出。

5.资产的未来现金流量受内部转移价格影响的,应当采用在公平交易前提下企业管理层能够达成的最佳价格估计数进行预计。

企业会计准则8号摘要:一、企业会计准则第8号概述二、资产减值的定义和计算方法三、资产减值测试的过程四、资产减值的应用案例五、与国际会计准则的比较与趋同正文:一、企业会计准则第8号概述企业会计准则第8号(以下简称“准则8号”)是我国于2006年2月15日发布的一项关于资产减值的会计准则。

该准则旨在规范资产减值的确认、计量和相关信息的披露,自2007年1月1日起施行。

准则8号借鉴了国际会计准则第36号《资产减值》,并结合我国实际情况进行了修改,实现了与国际会计准则的趋同。

二、资产减值的定义和计算方法资产减值是指资产的可收回金额低于其账面价值。

可收回金额是指资产销售净值(资产的公允价值减去处置费用后的净额)与使用价值(资产预计未来现金流量的现值)二者中的较高者。

在计算资产减值时,需要根据资产预计的未来现金流量和折现率在资产剩余使用寿命内予以折现后的金额确定。

三、资产减值测试的过程在进行资产减值测试时,首先需要确定资产的账面价值,然后计算其可收回金额。

如果可收回金额低于账面价值,就需要确认资产减值损失。

此外,还需要对相关资产组(或者资产组组合)进行减值测试,并调整资产组的账面价值。

四、资产减值的应用案例假设一家公司拥有一项固定资产,其账面价值为100万元,预计未来现金流量为80万元,但处置费用为20万元。

在这种情况下,可收回金额为60万元(80万元- 20万元),低于账面价值。

该公司需要确认减值损失40万元,并在财务报表中反映这一事项。

五、与国际会计准则的比较与趋同准则8号与国际会计准则第36号在资产减值的定义、计算方法和测试过程等方面基本一致,但结合我国实际情况进行了调整。

例如,在确定资产未来现金流量的现值时,准则8号要求采用企业自身折现率,而国际会计准则则允许采用市场折现率或其他可靠的数据来源。

这使得准则8号在遵循国际会计准则的基础上,更具可操作性和实用性。

总之,企业会计准则第8号对资产减值的确认、计量和信息披露进行了规范,有助于提高企业财务报表的真实性和可靠性。

资产减值会计准则在会计准则中,资产减值是一个重要的概念。

它指的是企业需要根据相关规定对其资产进行评估,并在必要时进行减值处理。

资产减值是一种预见未来的风险和损失的会计方法,旨在准确反映企业的财务状况和经营结果。

资产减值的原则是,当资产的账面价值高于其预期收益时,企业需要考虑将其减值。

这主要涉及到两个方面,即资产的价值和未来的收益。

资产的价值可以通过内外部市场价格、资产的使用寿命以及资产的可替代性等因素来确定。

未来的收益可以通过市场需求、竞争环境以及技术进步等因素来预测。

在进行资产减值评估时,企业需要根据会计准则的要求,以公允价值为基准进行评估。

公允价值是指在市场上进行交易时,交易双方自愿达成的价格。

企业需要比较资产的账面价值和其公允价值,如果账面价值高于公允价值,则需要进行减值处理。

资产减值的处理方式有多种,一般可以分为暂时性减值和永久性减值。

暂时性减值是指资产的价值暂时下降,但在未来可能恢复的情况。

在这种情况下,企业可以选择暂时性减值的处理方式,即将减值金额计入资产减值准备账户,待资产价值恢复时进行恢复。

永久性减值是指资产的价值永久下降,不能恢复的情况。

在这种情况下,企业需要将减值金额直接计入损益表,减少企业的利润。

资产减值的评估需要基于充分的信息和合理的假设。

企业需要对市场环境、行业竞争、技术进步等因素进行全面分析,并结合自身的经营情况和财务状况,对资产减值进行合理的估计。

同时,企业需要及时调整减值准备的金额,以反映最新的情况。

资产减值对企业的财务状况和经营结果有重要影响。

一方面,资产减值减少了企业的资产价值,降低了企业的净资产。

另一方面,资产减值增加了企业的损失,减少了企业的利润。

因此,企业需要谨慎评估资产减值的影响,合理处理减值问题,以保证财务报告的准确性和可靠性。

资产减值是会计准则中一个重要的概念,旨在准确反映企业的财务状况和经营结果。

企业需要根据相关规定对其资产进行评估,并在必要时进行减值处理。

企业会计准则8号

摘要:

1.企业会计准则第8 号的背景和意义

2.资产减值的定义和计算方法

3.资产减值准则对企业财务管理的影响

4.企业会计准则第8 号的实施和规范对象

5.企业会计准则第8 号与国际会计准则的趋同

正文:

企业会计准则第8 号是我国财政部于2006 年颁布的一项会计准则,旨在规范资产减值的确认、计量和相关信息的披露。

资产减值是指资产的可收回金额低于其账面价值,这种情况在企业经营过程中经常出现,如果不及时处理,可能会对企业的财务状况和经营业绩产生重大影响。

根据企业会计准则第8 号,资产减值的计算方法主要包括两种:一是资产销售净值,即资产的公允价值减去处置费用后的净额;二是资产预计未来现金流量的现值。

这两种计算方法中,取较高者作为资产的可收回金额。

企业会计准则第8 号的实施对企业的财务管理产生了深远的影响。

首先,它提高了企业财务报告的透明度,使投资者和其他利益相关者能够更加准确地了解企业的财务状况和经营风险。

其次,它有助于企业及时发现和处理资产减值,避免因资产减值而导致的财务损失。

企业会计准则第8 号主要适用于企业资产减值的确认、计量和相关信息的披露。

规范的对象包括单项资产和资产组。

其中,资产组是指企业可以认定的

最小资产组合,其产生的现金流入应当基本上独立于其他资产或者资产组产生的现金流入。

总体来说,企业会计准则第8 号在借鉴国际会计准则的基础上,结合我国的实际情况,对资产减值进行了全面、系统的规定。

企业会计准则第8号——资产减值第一章总则第一条 为了规范企业资产减值的会计处理和相关信息的披露,根据《企业会计准则——基本准则》,制定本准则。

第二条 资产减值,是指资产的可收回金额低于其账面价值。

本准则中的资产,除了特别规定外,包括单项资产和资产组。

资产组是指企业可以认定的最小资产组合,其产生的现金流入应当基本上独立于其他资产或者资产组产生的现金流入。

第三条 列各项适用其他相关会计准则:㈠存货的减值,适用《企业会计准则第1号――存货》。

㈡采用公允价值计量模式计量的投资性房地产的减值,适用《企业会计准则第3号――投资性房地产》。

㈢消耗性生物资产的减值,适用《企业会计准则第5号――生物资产》。

㈣建造合同形成的资产的减值,适用《企业会计准则第15号――建造合同》。

㈤递延所得税资产的减值,适用《企业会计准则第18号――所得税》。

㈥融资租赁中出租人未担保余值的减值,适用《企业会计准则第21号――租赁》。

㈦《企业会计准则第22号――金融工具确认和计量》规范的金融资产的减值,适用《企业会计准则第22号――金融工具确认和计量》。

㈧未探明矿区权益的减值,适用《企业会计准则第27号――石油天然气开采》。

第二章 可能发生减值资产的认定第四条 企业应当在会计期末判断资产是否存在可能发生减值的迹象。

因企业合并所形成的商誉和使用寿命不确定的无形资产,无论是否存在减值迹象,每年都应当进行减值测试。

第五条 存在下列迹象的,表明资产可能发生了减值:(一)资产的市价当期大幅度下跌,其跌幅明显高于因时间的推移或者正常使用而预计的下跌。

(二)企业经营所处的经济、技术或法律等环境以及资产所处的市场在当期或将在近期发生重大变化,从而对企业产生不利影响。

(三)市场利率或者其他市场投资回报率在当期已经提高,从而影响企业计算资产预计未来现金流量现值的折现率,导致资产可收回金额大幅度降低。

(四)有证据表明资产已经陈旧过时或其实体已经损坏。

(五)资产已经或者将被闲置、终止使用或者计划提前处置。

第28卷湖北师范学院学报(自然科学版)Vol 128第3期Journa l of Hube i Nor m al University (Na t ural Science)No 13,2008解读《企业会计准则第8号-资产减值》李红湘1,周汉萍2(1.湖北师范学院数学与统计学院,湖北黄石 435002;2.中国建设银行黄石分行,湖北黄石 435002)摘要:在充分借鉴《国际会计准则第36号-资产减值》的基础上,结合我国的实际情况,财政部于2006年先后发布了《企业会计准则第8号-资产减值》(以下简称新准则)、《企业会计准则第8号-资产减值》应用指南。

对新准则及其应用指南中相关概念、实务等问题进行剖析,以期为更好地理解、运用新准则提供一些参考。

关键词:资产;资产组;减值测试;会计处理中图分类号:F235199 文献标识码:A 文章编号:100922714(2008)0320030206 资产的主要特征之一是它必须能够为企业带来经济利益的流入,如果资产不能够为企业带来经济利益或者带来的经济利益低于账面价值,那么,该资产就不能再予确认或者不能再以原账面价值予以确认,否则不符合资产的定义,也无法反映资产的实际价值,其结果会导致企业资产虚增和利润虚增。

因此,当企业资产的可收回金额低于其账面价值时,即表明资产发生了减值,企业应当确认资产减值损失,并把资产的原账面价值减记至可收回金额,这就是本新准则及其应用指南所要规范的内容。

1 新准则的适用范围 新准则适用于固定资产、无形资产及其他未做特别规定的其他资产(如对子公司、联营企业和合营企业的长期股权投资;采用成本模式进行后续计量的投资性房地产;生产性生物资产;商誉;探明石油天然气矿区权益和井及相关设施)。

已做特别规定的存货、采用公允价值模式计量的投资性房地产、消耗性生物资产、建造合同形成的资产、递延所得税资产、融资租赁中出租人未担保余值、金融资产、未探明储量的石油天然气矿区权益等资产的减值,由相应的具体会计准则进行规范,不在本准则规范的范围内。

作者: 陈香茹

作者机构: 河南省组织机构代码中心,郑州450008

出版物刊名: 经济研究导刊

页码: 157-158页

主题词: 企业会计准则;资产减值;计提

摘要:2006年2月15日,财政部文件财会【2006】3号发布了【财政部关于印发《企业会计准则第1号——存货》等38项具体准则的通知】,《资产减值准则》作为第8号准则写入其中。

为了更好的理解和运用《资产减值准则》(以下简称新准则),对资产减值的相关问题进行了探讨,以期对资产减值会计进行更加准确的操作,使资产负债表上的资产项目更符合资产的定义。

企业会计准则第8 号——资产减值Accounting Standard for Business Enterprises No. 8 - Impairment of Assets第一章总则Chapter I General Provisions第一条为了规范资产减值的确认、计量和相关信息的披露,根据《企业会计准则——基本准则》,制定本准则。

Article 1 To standardize the confirmation and measurement of the impairment of assets, and the disclosure of relevant information, these Standards are formulated according to the Accounting Standard for Business Enterprises – Basic Standards.第二条资产减值,是指资产的可收回金额低于其账面价值。

Article 2 The term "impairment of assets" refers to that the recoverable amount of assets is lower than its carrying value.本准则中的资产,除了特别规定外,包括单项资产和资产组。

The assets as mentioned in these standards shall include single item assets and group assets.资产组,是指企业可以认定的最小资产组合,其产生的现金流入应当基本上独立于其他资产或者资产组产生的现金流入。

The term "group assets " refers to a minimum combination of assets that may be recognized by an enterprise, by which the flow-in cash generated shall be generally independent of those by other assets or group assets.第三条下列各项适用其他相关会计准则:Article 3 The following items shall be subject to other relevant accounting standards:(一)存货的减值,适用《企业会计准则第1 号——存货》。

(1) The impairment of inventories shall be subject to the Accounting Standard for Business Enterprises No. 1 - Inventories;(二)采用公允价值模式计量的投资性房地产的减值,适用《企业会计准则第 3 号——投资性房地产》。

(2) The impairment of investment properties measured through the fair value method shall be g subject to the Accounting Standard for Business Enterprises No.3 - Investment Properties;(三)消耗性生物资产的减值,适用《企业会计准则第5 号——生物资产》。

(3) The impairment of consumptive biological assets shall be subject to the Accounting Standard for Business Enterprises No. 5 - Biological Assets;(四)建造合同形成的资产的减值,适用《企业会计准则第15号——建造合同》。

(4) The impairment of assets formed by construction contracts shall be subject to the Accounting Standard for Business Enterprises No. 15 – Construction Contracts;(五)递延所得税资产的减值,适用《企业会计准则第18 号——所得税》。

(5) The impairment of deferred income tax assets shall be subject to the Accounting Standard for Business Enterprises No. 18 - Income Taxes;(六)融资租赁中出租人未担保余值的减值,适用《企业会计准则第21 号——租赁》。

(6) The impairment of the unsecured residual value of the lessor in a financial leasing shall be subject to the Accounting Standard for Business Enterprises No.21 - Leases;(七)《企业会计准则第22 号——金融工具确认和计量》规范的金融资产的减值,适用《企业会计准则第22 号——金融工具确认和计量》。

(7) The impairment of financial assets regulated by the Accounting Standard for Business Enterprises No. 22 - Recognition and Measurement of Financial Instruments shall be subject to the Accounting Standard for Business Enterprises No. 22 - Recognition and Measurement of Financial Instruments; and(八)未探明石油天然气矿区权益的减值,适用《企业会计准则第27 号——石油天然气开采》。

(8) The impairment of the rights and interests of unverified petroleum and natural gas mining areas shall be subject to the Accounting Standard for Business Enterprises No. 27 -Extraction of Petroleum and Natural Gas.第二章可能发生减值资产的认定Chapter II Recognition of Assets with Potential Impairment第四条企业应当在资产负债表日判断资产是否存在可能发生减值的迹象。

因企业合并所形成的商誉和使用寿命不确定的无形资产,无论是否存在减值迹象,每年都应当进行减值测试。

Article 4 An enterprise shall, on the day of balance sheet, make a judgment on whether there is any sign of possible assets impairment. No matter whether there is any sign of possible assets impairment, the business reputation formed by the merger of enterprises and intangible assets with uncertain service lives shall be subject to impairment test every year.第五条存在下列迹象的,表明资产可能发生了减值:Article 5 There may be an impairment of assets when one of the following signs occurs:(一)资产的市价当期大幅度下跌,其跌幅明显高于因时间的推移或者正常使用而预计的下跌。

(1) The current market price of assets falls, and its decrease is obviously higher than the expected drop over time or due to the normal use;(二)企业经营所处的经济、技术或者法律等环境以及资产所处的市场在当期或者将在近期发生重大变化,从而对企业产生不利影响。

(2) The economic, technological or legal environment in which the enterprise operates, or the market where the assets is situated will have any significant change in the current period or in the near future, which will cause adverse impact on the enterprise;(三)市场利率或者其他市场投资报酬率在当期已经提高,从而影响企业计算资产预计未来现金流量现值的折现率,导致资产可收回金额大幅度降低。

(3) The market interest rate or any other market investment return rate has risen in the current period, and thus the discount rate of the enterprise for calculating the expected future cash flow of the assets will be affected, which will result in great decline of the recoverable amount of the assets;(四)有证据表明资产已经陈旧过时或者其实体已经损坏。

(4) Any evidence shows that the assets have become obsolete or have been damaged substantially; (五)资产已经或者将被闲置、终止使用或者计划提前处置。