罗斯公司理财PPT第18章

- 格式:ppt

- 大小:505.50 KB

- 文档页数:33

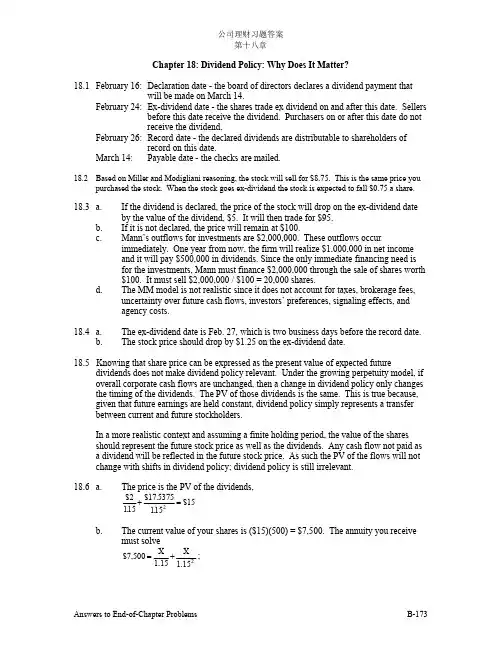

公司理财习题答案第十八章Chapter 18: Dividend Policy: Why Does It Matter?18.1February 16:Declaration date - the board of directors declares a dividend payment thatwill be made on March 14.February 24:Ex-dividend date - the shares trade ex dividend on and after this date. Sellersbefore this date receive the dividend. Purchasers on or after this date do notreceive the dividend.February 26:Record date - the declared dividends are distributable to shareholders ofrecord on this date.March 14:Payable date - the checks are mailed.18.2Based on Miller and Modigliani reasoning, the stock will sell for $8.75. This is the same price youpurchased the stock. When the stock goes ex-dividend the stock is expected to fall $0.75 a share.18.3 a.If the dividend is declared, the price of the stock will drop on the ex-dividend dateby the value of the dividend, $5. It will then trade for $95.b. If it is not declared, the price will remain at $100.c. Mann’s outflows for investments are $2,000,000. These outflows occurimmediately. One year from now, the firm will realize $1,000,000 in net incomeand it will pay $500,000 in dividends. Since the only immediate financing need isfor the investments, Mann must finance $2,000,000 through the sale of shares worth$100. It must sell $2,000,000 / $100 = 20,000 shares.d. The MM model is not realistic since it does not account for taxes, brokerage fees,uncertainty over future cash flows, investors’ preferences, signaling effects, andagency costs.18.4 a. The ex-dividend date is Feb. 27, which is two business days before the record date.b. The stock price should drop by $1.25 on the ex-dividend date.18.5 Knowing that share price can be expressed as the present value of expected futuredividends does not make dividend policy relevant. Under the growing perpetuity model, if overall corporate cash flows are unchanged, then a change in dividend policy only changes the timing of the dividends. The PV of those dividends is the same. This is true because, given that future earnings are held constant, dividend policy simply represents a transfer between current and future stockholders.In a more realistic context and assuming a finite holding period, the value of the shares should represent the future stock price as well as the dividends. Any cash flow not paid as a dividend will be reflected in the future stock price. As such the PV of the flows will not change with shifts in dividend policy; dividend policy is still irrelevant.18.6 a. The price is the PV of the dividends,$2.$17..$1511553751152+=b. The current value of your shares is ($15)(500) = $7,500. The annuity you receivemust solve ;$7,500X 1.15X 1.152=+You desire $4,613.3721 each year. You will receive $1,000 in dividends in the firstyear, so you must sell enough shares to generate $3,613.3721. The end-of-yearprice at which you will sell your shares is the PV of the liquidating dividend,$17.5375 / 1.15 = $15.25, so you must sell 236.942 shares. The remaining shareswill each earn the liquidating dividend. At the end of the second year, you willreceive $4,613.38 [= (500 - 236.942) x $17.5375]. (Rounding causes thediscrepancies).18.7 a. The value is the PV of the cash flows.Value = $32,000 + $1,545,600 / 1.12 = $1,412,000b. The current price of $141.20 per share will fall by the value of the dividend to $138.c. i. According to MM, it cannot be true that the low dividend is depressing the price.Since dividend policy is irrelevant, the level of the dividend should not matter.Any funds not distributed as dividends add to the value of the firm hence thestock price. These directors merely want to change the timing of the dividends(more now, less in the future). As the calculations below indicate, the value ofthe firm is unchanged by their proposal. Therefore, share price will beunchanged.To pay the $4.25 dividend, new shares, which total $10,500 (-$42,500 - $32,000)in value, must be sold. Those shares must also earn 12% so the value of the oldshareholders’ interest one year hence will fall $11,760 (=10,500 x 1.12). Underthis scenario, the current value of the firm is Value = $42,500 + $1,533,840 /1.12 = $1,412,000ii. The new shareholders are not entitled to receive the current dividend. They will receive only the value of the equity one year hence. The PV of those flows is$1,533,840 / 1.12 = $1,369,500, so the share price will be $136.95 and 76.67shares will be sold.18.8 a. (1.2 + 15) / 1 = $16.2Expected share price is $16.2.b. He can invest the dividends into the Gibson stock.Dividends that he gets = $1.2 million x 50% x 1,000 / 1,000,000 = $600Expected share price after dividend = (0.6 + 15) / 1 =$15.6Number of shares that Jeff needs to buy = 600 / 15.6 = 3818.9Alternative 1: Dividends are paid out to the shareholders now.2 (1-31%) (1+7% (1-31%))3 = $1.59 millionAlternative 2: NBM invests cash in the financial assets:i. T-bill2 (1+7% (1-35%))3 (1-31%) = $1.58 millionii. Preferred stock2 {1+11% [1-(1-30%) x 35%]3} (1-31%) = $1.75 millionThe after-tax cash flow for the shareholders is maximized when the firm invests the cash in the preferred stocks.公司理财习题答案第十八章18.10 You should not expect to find either low dividend, high growth stocks or tax-free municipalbonds in the University of Pennsylvania’s portfolio. Since the university does not pay taxes on investment income, it will want to invest in securities, which provide the highest pre-tax return. Since tax-free municipal bonds generally provide lower returns than taxablesecurities, there is no reason for the university to hold municipal bonds.The Litzenberger-Ramaswamy research (discussed in the section on empirical evidence) found that high dividend stocks pay higher pre-tax returns than risk comparable lowdividend stocks because of the taxes on dividend income. Since the University ofPennsylvania does not pay taxes, it would be wise to invest in high dividend stocks rather than low dividend stocks in the same risk class.18.11 a. If T C = T0 then (P e - P b) / D =1. The stock price will fall by the amount of thedividend.b. If T C = 0 and T0 0 then (P e - P b) / D =1 - T0. The stock price will fall by the after-tax proceeds from the dividend.c. In a, there was no tax disadvantage to dividends. Thus, investors are indifferentbetween buying the stock at P b and receiving the dividend or waiting, buying thestock at P e and receiving a subsequent capital gain. When only the dividend istaxed, after-tax proceeds must be equated for investors to be indifferent. Since theafter-tax proceeds from the dividend are D (1 - T0), the price will fall by thatamount.d. No, Elton and Gruber’s paper is not a prescription for dividend policy. In a worldwith taxes, a firm should never issue stock to pay a dividend, but the presence oftaxes does not imply that firms should not pay dividends from excess cash. Theprudent firm, when faced with other financial considerations and legal constraintsmay choose to pay dividends.18.12 a. Let x be the ordinary income tax rate. The individual receives an after-tax dividendof $1,000(1-x) which she invests in Treasury bonds. The T-bond will generateafter-tax cash flows to the investor of $1,000 (1 - x)[1+0.08(1-x)].If the firm invests the money, its proceeds are $1,000 [1 + 0.08 (1-0.35)]To be indifferent, the investor’s proceeds must be the same whether she invests theafter-tax dividend or receives the proceeds from the firm’s investment and paystaxes on that amount.1,000 (1 - x) [1 + 0.08 (1 - x)] = (1 - x) {1,000 [1 + 0.08 (1 - 0.35)]}x = 0.35Note: This argument does not depend upon the length of time the investment is held.b.Yes, this is a reasonable answer. She is only indifferent if the after-tax proceedsfrom the $1,000 investment in identical securities are identical; that occurs onlywhen the tax rates are identical.c. Since both investors will receive the same pre-tax return, you would expect the sameanswer as in part a. Yet, because Carlson enjoys a tax benefit from investing instock, the tax rate on ordinary income, which induces indifference, is much lower.1,000 (1 - x) [1 + 0.12(1 - x)] = (1 - x) {1,000 [1 + 0.12 (1 – 0.3) (0.35)]}x = 24.5%d. It is a compelling argument, but there are legal constraints, which deter firms frominvesting large sums in stock of other companies.18.13 The fallacy behind both groups’ arguments is that they are considering dividends the onlyreturn on a stock. They ignored capital gains. If dividends are controlled, firms are likely to decrease their dividends. When dividends are reduced, the companies retain moreincome, which causes share price to increase. That increase in share price will add to the investors’ capital gains. Since dividends and capital gains are both ways of compensating investors, if transaction costs are negligible and there are no taxes, investors will beindifferent between the two forms of compensation.18.14 a. The after-tax expected return on Grebe stock is 4 / 20 = 0.2. Since Deaton stock isin the same risk class, it will be priced to yield the same after-tax expected return.0.2(20P)(1T g)4(0.75)P;T g0P$19.170=--+= =b. If T g = 25%, the after-tax expected return on Grebe stock is (4) (1-0.25) / 20 = 0.15.Deaton’s price will be0.15(20P)(0.75)4(0.75)PP$200=-+ =c. In this MM world, when the tax rates are identical, there is no tax disadvantage tothe dividend. Investors are indifferent between $1 in capital gains and $1 individends. Hence, Deaton’s price will also be $20.18.15 P (Payall) = [100 + 25 (1-25%)] / (1 + 25%) = $95P (Payless) = [100 + 25 (50%) + 25 (50%) (1 - 25%)] / (1 + 25%) = $97.5P (Paynone) = $10018.16 a. Dividend yield: 4.5 / 50.50 = 0.0891b. The pricing of bonds was discussed in an earlier chapter. Whenever a bond isselling at par, the yield to maturity is the coupon rate. So, the yield on the DuPontbonds is 11%.c. After-tax shield = (Pre-tax yield) (1 - T)Preferred stock Debti. GM’s pension fund; T=08.91%11.00%ii. GM; T=.348.00%7.26%iii Roger Smith; T = 0.28 6.42%7.92% *GM is exempt from 70% of taxes on dividend income, therefore, its effective taxrate is (0.3) (0.34) = 0.102.d. Corporations, which are exempt from 70% of taxes on dividend income, would holdthe preferred stock.18.17 The bird-in-the-hand argument is based upon the erroneous assumption that increaseddividends make a firm less risky. If capital spending and investment spending areunchanged, the firm’s overall cash flows are not affected by the dividend policy.18.18 This argument is theoretically correct. In the real world with transaction costs of securitytrading, home-made dividends can be more expensive than dividends directly paid out by公司理财习题答案第十八章the firms. However, the existence of financial intermediaries such as mutual funds reduces the transaction costs for individuals greatly. Thus, as a whole, the desire for current income shouldn’t be a major factor favoring high-current-dividend policy.18.19 To minimize her tax burden, your aunt should divest herself of high dividend yield stocksand invest in low dividend yield stock. Or, if possible, she should keep her high dividend stocks, borrow an equivalent amount of money and invest that money in a tax deferredaccount.18.20 This is not evidence on investor preferences. A rise in stock price when the currentdividend is increased may reflect expectations that future earnings, cash flows, etc. willrise. The better performance of the 115 companies, which raised their payouts, may also reflect a signal by management through the dividends that the firms were expected to do well in the future.18.21 Virginia Power’s investors probably were not aware of the cash flow crunch. Thus, theprice drop was due to the negative information about the cost overruns. Even if they were suspicious that there were overruns, the announcement would still cause a drop in pricebecause it removed all uncertainty about overruns and indicated their magnitude.18.22 As the firm has been paying out regular dividends for more than 10 years, the currentsevere cut in dividends can cause the shareholders to lower their expectations on currentand future cash flows of the firm. It then results in the drop in the stock price.18.23 a. Cap’s past behavior suggests a preference for capital gains while Widow Jonesexhibits a preference for current income.b. Cap could show the widow how to construct homemade dividends through the saleof stock. Of course, Cap will also have to convince her that she lives in an MMworld. Remember that homemade dividends can only be constructed under the MMassumptions.c.Widow Jones may still not invest in Neotech because of the transaction costsinvolved in constructing homemade dividends. Also the Widow may desire theuncertainty resolution which comes with high dividend stocks.18.24 The capital investment needs of small, growing companies are very high. Therefore,payment of dividends could curtail their investment opportunities. Their other option is to issue stock to pay the dividend thereby incurring issuance costs. In either case, thecompanies and thus their investors are better off with a zero dividend policy during thefirms’ rapid growth phases. This fact makes these firms attractive only to low dividendclienteles.This example demonstrates that dividend policy is relevant when there are issuance costs.Indeed, it may be relevant whenever the assumptions behind the MM model are not met. 18.25 Unless there is an unsatisfied high dividend clientele, a firm cannot improve its share priceby switching policies. If the market is in equilibrium, the number of people who desirehigh dividend payout stocks should exactly equal the number of such stocks available. The supplies and demands of each clientele will be exactly met in equilibrium. If the market is not in equilibrium, the supply of high dividend payout stocks may be less than the demand.Only in such a situation could a firm benefit from a policy shift.18.26 a. Div1 = Div0 + s (t EPS1 - Div0)= 1.25 + 0.3 (0.4 x 4.5 -1.25)= 1.415b. Div1 = Div0 + s (t EPS1 - Div0)= 1.25 + 0.6 (0.4 x 4.5 - 1.25)= 1.58Note: Part “a” is more conservative since the adjustment rate is lower.18.27 This finding implies that firms use initial dividends to “signal” their potentialgrowth and positive NPV prospects to the stock market. The initiation of regularcash dividends also serves to convince the market that their high current earningsare not temporary.。

罗斯《公司理财》重点知识整理上课讲义罗斯《公司理财》重点知识整理第一章导论1. 公司目标:为所有者创造价值公司价值在于其产生现金流能力。

2. 财务管理的目标:最大化现有股票的每股现值。

3. 公司理财可以看做对一下几个问题进行研究:1. 资本预算:公司应该投资什么样的长期资产。

2. 资本结构:公司如何筹集所需要的资金。

3. 净运营资本管理:如何管理短期经营活动产生的现金流。

4. 公司制度的优点:有限责任,易于转让所有权,永续经营。

缺点:公司税对股东的双重课税。

第二章会计报表与现金流量资产 = 负债 + 所有者权益(非现金项目有折旧、递延税款)EBIT(经营性净利润) = 净销售额 - 产品成本 - 折旧EBITDA = EBIT + 折旧及摊销现金流量总额CF(A) = 经营性现金流量 - 资本性支出- 净运营资本增加额 = CF(B) + CF(S)经营性现金流量OCF = 息税前利润 + 折旧 - 税资本性输出 = 固定资产增加额 + 折旧净运营资本 = 流动资产 - 流动负债第三章财务报表分析与财务模型1. 短期偿债能力指标(流动性指标)流动比率 = 流动资产/流动负债(一般情况大于一)速动比率 = (流动资产 - 存货)/流动负债(酸性实验比率)现金比率 = 现金/流动负债流动性比率是短期债权人关心的,越高越好;但对公司而言,高流动性比率意味着流动性好,或者现金等短期资产运用效率低下。

对于一家拥有强大借款能力的公司,看似较低的流动性比率可能并非坏的信号2. 长期偿债能力指标(财务杠杆指标)负债比率 = (总资产 - 总权益)/总资产 or (长期负债 + 流动负债)/总资产权益乘数 = 总资产/总权益 = 1 + 负债权益比利息倍数 = EBIT/利息现金对利息的保障倍数(Cash coverage radio) = EBITDA/利息3. 资产管理或资金周转指标存货周转率 = 产品销售成本/存货存货周转天数 = 365天/存货周转率应收账款周转率 = (赊)销售额/应收账款总资产周转率 = 销售额/总资产 = 1/资本密集度4. 盈利性指标销售利润率 = 净利润/销售额资产收益率ROA = 净利润/总资产权益收益率ROE = 净利润/总权益5. 市场价值度量指标市盈率 = 每股价格/每股收益EPS 其中EPS = 净利润/发行股票数市值面值比 = 每股市场价值/每股账面价值企业价值EV = 公司市值+ 有息负债市值- 现金EV乘数= EV/EBITDA6. 杜邦恒等式ROE = 销售利润率(经营效率)x总资产周转率(资产运用效率)x权益乘数(财杠)ROA = 销售利润率x总资产周转率7. 销售百分比法假设项目随销售额变动而成比例变动,目的在于提出一个生成预测财务报表的快速实用方法。

公司理财罗斯1. 引言在现代商业环境中,公司理财是确保企业长期稳定发展的重要一环。

公司理财的目标是通过合理的资金管理和投资决策,最大化股东权益和企业价值。

本文将介绍一种常见的公司理财方法——罗斯(Return on Sales)指标,以及该指标的计算和应用。

2. 罗斯指标介绍罗斯指标是一种衡量公司盈利能力的指标,也被称为利润率。

它用于评估公司销售收入所产生的净利润的能力。

罗斯指标可以帮助企业管理层了解公司的利润情况,并作出相应的战略决策。

通常,罗斯指标是以百分比形式表示的,计算公式如下:罗斯 = 净利润 / 销售收入 * 100%3. 罗斯指标的计算要计算公司的罗斯指标,首先需要确定公司的净利润和销售收入。

净利润是指企业在扣除各种费用和税后,所获得的利润。

销售收入是指企业在一定时期内通过销售产品或提供服务而实现的收入。

下面是一个简单的示例来说明如何计算罗斯指标:项目金额(单位:万元)销售收入100营业成本60营业税金及附加5销售费用10管理费用10财务费用5净利润10根据上表中的数据,我们可以计算出罗斯指标:罗斯 = 10 / 100 * 100% = 10%这意味着该公司实现的销售收入中,有10%转化为净利润。

4. 罗斯指标的应用罗斯指标的应用范围广泛,可以用于评估公司的盈利水平和盈利能力。

通过比较不同时间段内的罗斯指标,可以判断企业的经营状况是否有所改善或恶化。

此外,与其他公司进行罗斯指标的比较也是一种常见的应用。

同行业内的公司之间的比较可以帮助企业了解自己的竞争力和市场地位。

在实际运营中,管理层可以借助罗斯指标来制定公司的财务目标和经营策略。

比如,如果罗斯指标较低,可能意味着成本控制不当或销售策略有问题,管理层可以采取相应的措施来提高罗斯指标。

此外,罗斯指标还可以作为公司与投资者和潜在合作伙伴进行沟通的工具。

公司可以通过展示其良好的罗斯指标来吸引潜在投资者的关注,进而获得更多的融资机会。

5. 结论罗斯指标是一种重要的公司理财工具,通过衡量公司销售收入所产生的净利润能力,提供了一个评估和比较企业盈利能力的指标。

罗斯《公司理财》(第9版)课后习题第16章资本结构:基本概念一、概念题1.馅饼模型(pie model)答:馅饼模型是一种分析公司资本结构的模型,用来讨论公司应如何选择负债权益比的问题。

该理论将公司的筹资要求权之和比作一个馅饼,并且将公司的价值定义为负债和所有者权益之和。

该理论认为,债权人和股东将分别得到不同大小的馅饼块,但是整个馅饼的大小,也就是公司的实际价值,却完全不会受到馅饼分割方式的影响。

也就是说,公司的融资结构只影响公司利润的分配方式,即这个利润馅饼如何被分割以及由谁承担公司的风险,不会对公司的价值造成任何影响。

2.MM命题Ⅰ(MM Proposition I)答:不考虑公司所得税情况下的MM命题Ⅰ指的是,公司的价值取决于未来经营活动净收益的资本化程度,资本化率与公司的风险相一致。

这一命题有两个直接推论:a.公司的平均资本成本与公司资本结构无关;b.公司的平均资本成本等于与之风险相同的零举债公司的资本化率。

3.MM命题Ⅱ(MM Proposition II)答:不考虑公司所得税情况下的MM命题Ⅱ指的是,举债经营公司的权益资本成本等于零举债经营公司的权益资本成本加上风险报酬率。

风险报酬率的多少取决于公司举债经营的程度。

命题二表明,随着公司负债的增加,公司的权益资本成本也将提高。

4.MM命题Ⅰ(公司税)[MM Proposition I(corporate taxes)]答:MM命题一,零举债经营公司的价值是公司税后经营收益除以公司权益资本成本所得的结果,而举债经营公司的价值等于同类风险的零举债经营公司的价值加上税款节余额。

根据这一结论,当公司负债增加时,举债经营公司价值增加较快。

特别地,当公司负债筹资的比重为100%时,公司的价值最大。

5.MM命题Ⅱ(公司税)[MM Proposition II(corporate taxes)]答:MM命题二,举债公司的权益资本成本等于同类风险零举债经营公司的权益资本成本加上风险报酬率,而风险报酬率又取决于公司资本结构和公司所得税税率。

第18章杠杆企业的估价与资本预算一、选择题H 汽车公司有1000万元资产,其中200万元通过债务筹集,800万元通过权益筹集,目前β系数为1.2,所得税率为40%,无杠杆β系数为()。

A.1.3254B.0.9856C.1.0435D.1.2134【答案】C 【解析】将有杠杆的β系数转化为无杠杆β系数,计算公式为:()=11c t ββ⎡⎤+⨯-⎢⎥⎣⎦权益无杠杆负债权益代入数据,可得无杠杆β系数为1.0435。

二、论述题1.试述对公司价值评估三种主要方法进行比较。

答:有杠杆企业的三种资本预算方法:调整净现值法(APV),权益现金流量法(FTE)和加权平均资本成本法(WACC)。

(1)调整净现值法调整净现值法(APV)可用下面的式子描述,即APV=NPV+NPVF。

一个项目为杠杆企业创造的价值(APV)等于一个无杠杆企业的项目净现值(NPV)加上筹资方式的副效应的净现值。

这种效应一般包括以下四个方面(即负债的连带效应的四种)影响:①债务融资的节税效应;②发行成本;③破产成本;④非市场利率融资的收益。

计算公式为:()101t t t UCF R ∞=+-+∑负债的连带效应初始投资额(2)权益现金流量法权益现金流量法是资本预算的另一种方法,这种方法只对杠杆企业项目所产生的属于权益所有者的现金流量进行折现,折现率为权益资本成本R S 。

对于一项永续性的现金流入,计算公式为:有杠杆企业项目的权益现金流量/R S权益现金流量法的计算分三个步骤进行:第一步:计算有杠杆现金流量(LCF)。

另外,也可以直接由无杠杆现金流量(UCF)计算有杠杆现金流量(LCF)。

权益所有者的现金流量在无杠杆和有杠杆这两种情况下的差异关键在于税后的利息支付。

用代数式表达如下:UCF-LCF=(1-T C )R B B第二步:计算R S接着要计算的是折现率R S 。

计算R S 的公式:R S =R 0+B/S(1-T C )(R 0-R B )第三步:估价有杠杆现金流量LCF 的现值=LCF/R S 。