最新我国外汇储备币种结构研究

- 格式:docx

- 大小:17.34 KB

- 文档页数:4

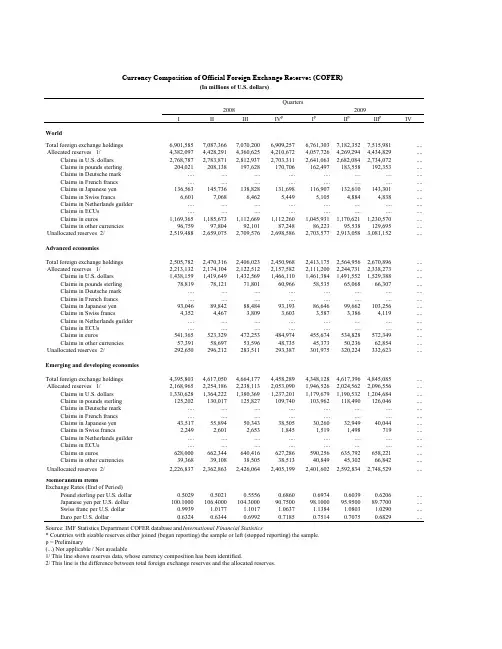

IIIIIIIVpIpIIpIII pIVWorldTotal foreign exchange holdings 6,901,5857,087,3667,070,2006,909,2576,761,3037,182,3527,515,981.... Allocated reserves 1/4,382,0974,428,2914,360,6254,210,6724,057,7264,269,2944,434,829.... Claims in U.S. dollars 2,768,7872,783,8712,812,9372,703,3112,641,0632,682,0842,734,072.... Claims in pounds sterling 204,021208,138197,628170,706162,497183,558192,353.... Claims in Deutsche mark ................................ Claims in French francs ................................ Claims in Japanese yen 136,563145,736138,828131,698116,907132,610143,301.... Claims in Swiss francs6,6017,0686,4625,4495,1054,8844,838.... Claims in Netherlands guilder ................................ Claims in ECUs ................................ Claims in euros1,169,3651,185,6731,112,6691,112,2601,045,9311,170,6211,230,570.... Claims in other currencies 96,75997,80492,10187,24886,22395,538129,695.... Unallocated reserves 2/2,519,4882,659,0752,709,5762,698,5862,703,5772,913,0583,081,152....Advanced economiesTotal foreign exchange holdings 2,505,7822,470,3162,406,0232,450,9682,413,1752,564,9562,670,896.... Allocated reserves 1/2,213,1322,174,1042,122,5122,157,5822,111,2002,244,7312,338,273.... Claims in U.S. dollars 1,438,1591,419,6491,432,5691,466,1101,461,3841,491,5521,529,388.... Claims in pounds sterling 78,81978,12171,80160,96658,53565,06866,307.... Claims in Deutsche mark ................................ Claims in French francs ................................ Claims in Japanese yen 93,04689,84288,48493,19386,64699,662103,256.... Claims in Swiss francs4,3524,4673,8093,6033,5873,3864,119.... Claims in Netherlands guilder ................................ Claims in ECUs ................................ Claims in euros541,365523,329472,253484,974455,674534,828572,349.... Claims in other currencies 57,39158,69753,59648,73545,37350,23662,854.... Unallocated reserves 2/292,650296,212283,511293,387301,975320,224332,623....Emerging and developing economies Total foreign exchange holdings 4,395,8034,617,0504,664,1774,458,2894,348,1284,617,3964,845,085.... Allocated reserves 1/2,168,9652,254,1862,238,1132,053,0901,946,5262,024,5622,096,556.... Claims in U.S. dollars 1,330,6281,364,2221,380,3691,237,2011,179,6791,190,5321,204,684.... Claims in pounds sterling 125,202130,017125,827109,740103,962118,490126,046.... Claims in Deutsche mark ................................ Claims in French francs ................................ Claims in Japanese yen 43,51755,89450,34338,50530,26032,94940,044.... Claims in Swiss francs2,2492,6012,6531,8451,5191,498719.... Claims in Netherlands guilder ................................ Claims in ECUs ................................ Claims in euros628,000662,344640,416627,286590,256635,792658,221.... Claims in other currencies 39,36839,10838,50538,51340,84945,30266,842.... Unallocated reserves 2/2,226,8372,362,8632,426,0642,405,1992,401,6022,592,8342,748,529....Memorandum ItemsExchange Rates (End of Period) Pound sterling per U.S. dollar 0.50290.50210.55560.68600.69740.60390.6206.... Japanese yen per U.S. dollar 100.1000106.4000104.300090.750098.100095.950089.7700.... Swiss franc per U.S. dollar 0.9939 1.0177 1.1017 1.0637 1.1384 1.0803 1.0290.... Euro per U.S. dollar0.63240.63440.69920.71850.75140.70750.6829....Source: IMF Statistics Department COFER database and International Financial Statistics* Countries with sizable reserves either joined (began reporting) the sample or left (stopped reporting) the sample.p = Preliminary(...) Not applicable / Not available1/ This line shows reserves data, whose currency composition has been identified.2/ This line is the difference between total foreign exchange reserves and the allocated reserves.2008Currency Composition of Official Foreign Exchange Reserves (COFER)(In millions of U.S. dollars)Quarters2009IIIIIIIVIII IIIIVWorldTotal foreign exchange holdings 4,357,7294,586,3244,749,3535,036,9255,359,3755,722,7146,048,4866,411,087 Allocated reserves 1/2,936,9363,033,9033,137,4583,315,4833,511,6843,717,9523,895,2834,119,190 Claims in U.S. dollars 1,953,0912,006,2462,087,0752,171,0752,294,7622,423,5162,499,5852,641,645 Claims in pounds sterling 115,857126,907132,305145,205156,439171,610183,111192,663Claims in Deutsche mark ................................ Claims in French francs ................................ Claims in Japanese yen 97,36394,44293,646102,051101,429102,724104,487120,480 Claims in Swiss francs4,7104,4564,9335,6856,0085,7146,2536,395 Claims in Netherlands guilder ................................ Claims in ECUs ................................Claims in euros720,154750,313765,656831,947883,881940,8761,018,3971,082,276 Claims in other currencies 45,76151,53953,84359,52069,16473,51183,45075,731 Unallocated reserves 2/1,420,7931,552,4211,611,8941,721,4421,847,6912,004,7622,153,2032,291,897Advanced economiesTotal foreign exchange holdings 2,067,4792,116,4452,147,6532,218,9082,257,2342,290,4532,346,1032,394,712 Allocated reserves 1/1,807,0701,850,8521,882,1591,948,4291,985,9782,019,9462,078,1882,119,372 Claims in U.S. dollars 1,256,0221,280,1931,309,4321,336,6731,365,0401,375,7751,390,9821,408,823 Claims in pounds sterling 52,98057,18859,11364,71865,76970,96877,34176,020Claims in Deutsche mark ................................ Claims in French francs ................................ Claims in Japanese yen 84,76881,21281,11784,19479,97881,07481,10085,213 Claims in Swiss francs4,0424,0704,1884,5784,7844,7025,1354,720 Claims in Netherlands guilder ................................ Claims in ECUs ................................ Claims in euros379,893394,576393,224420,278430,790444,617475,054499,098 Claims in other currencies 29,36433,61335,08537,98839,61842,80948,57745,497 Unallocated reserves 2/260,409265,593265,494270,479271,256270,508267,914275,340Emerging and developing economies Total foreign exchange holdings 2,290,2502,469,8792,601,7002,818,0173,102,1413,432,2613,702,3834,016,375 Allocated reserves 1/1,129,8661,183,0511,255,3001,367,0541,525,7061,698,0071,817,0951,999,817 Claims in U.S. dollars 697,069726,053777,644834,402929,7221,047,7421,108,6021,232,822 Claims in pounds sterling 62,87669,71973,19380,48790,671100,642105,770116,643Claims in Deutsche mark ................................ Claims in French francs ................................ Claims in Japanese yen 12,59513,23112,52917,85721,45221,65023,38835,267 Claims in Swiss francs6683867451,1071,2231,0121,1181,675 Claims in Netherlands guilder ................................ Claims in ECUs ................................ Claims in euros340,260355,737372,432411,669453,092496,259543,344583,177 Claims in other currencies 16,39717,92518,75721,53229,54630,70234,87330,234 Unallocated reserves 2/1,160,3841,286,8281,346,4001,450,9631,576,4351,734,2541,885,2892,016,558Memorandum ItemsExchange Rates (End of Period) Pound sterling per U.S. dollar 0.57640.54510.53470.50940.51070.49880.49230.4992 Japanese yen per U.S. dollar 117.4000114.9500117.8000118.9500117.6500123.2300115.0500114.0000 Swiss franc per U.S. dollar 1.3057 1.2329 1.2537 1.2203 1.2212 1.2266 1.1700 1.1255 Euro per U.S. dollar0.82620.78660.78990.75930.75090.74050.70530.67932006Currency Composition of Official Foreign Exchange Reserves (COFER) (continued)(In millions of U.S. dollars)Quarters2007IIIIIIIVIII IIIIVWorldTotal foreign exchange holdings 3,295,8943,340,7573,440,0633,748,4003,857,3123,947,3964,054,8514,174,556 Allocated reserves 1/2,428,9402,428,0962,477,2502,655,0702,692,5372,727,4372,761,0782,843,541 Claims in U.S. dollars 1,640,7181,647,7711,668,4951,751,0121,763,4511,805,0071,833,9471,902,535 Claims in pounds sterling 65,53466,20875,96889,45795,73894,76899,278102,243Claims in Deutsche mark ................................ Claims in French francs ................................ Claims in Japanese yen 97,04993,55388,872101,787104,864102,500104,498101,769 Claims in Swiss francs5,4645,7114,1784,4194,5783,6333,9884,143 Claims in Netherlands guilder ................................ Claims in ECUs ................................ Claims in euros572,645569,096592,089658,531675,432674,908670,782683,809 Claims in other currencies 47,53045,75847,64849,86548,47346,62048,58549,041 Unallocated reserves 2/866,954912,660962,8131,093,3301,164,7751,219,9591,293,7731,331,015Advanced economiesTotal foreign exchange holdings 1,929,4581,920,0561,942,9512,041,1292,044,8822,038,5072,031,6502,047,627 Allocated reserves 1/1,701,6811,688,4681,708,1911,796,1471,791,7821,782,1881,775,1811,790,518 Claims in U.S. dollars 1,196,3101,192,4641,197,5021,218,1841,218,8521,238,8671,231,1561,248,630 Claims in pounds sterling 37,70038,31343,49848,42050,20048,57249,14249,826Claims in Deutsche mark ................................ Claims in French francs ................................ Claims in Japanese yen 82,41279,13875,03987,32386,00485,18586,13383,885 Claims in Swiss francs4,3684,5753,0243,2463,5222,8753,2483,427 Claims in Netherlands guilder ................................ Claims in ECUs ................................ Claims in euros346,555341,246355,400400,666396,971373,506370,329370,818 Claims in other currencies 34,33732,73133,72938,30936,23333,18235,17333,933 Unallocated reserves 2/227,777231,588234,760244,981253,099256,319256,469257,109Emerging and developing economies Total foreign exchange holdings 1,366,4361,420,7011,497,1121,707,2721,812,4311,908,8892,023,2012,126,929 Allocated reserves 1/727,258739,629769,058858,923900,755945,249985,8971,053,023 Claims in U.S. dollars 444,408455,306470,992532,828544,599566,140602,792653,906 Claims in pounds sterling 27,83427,89532,46941,03745,53846,19650,13652,417Claims in Deutsche mark ................................ Claims in French francs ................................ Claims in Japanese yen 14,63714,41513,83314,46418,86017,31518,36617,885 Claims in Swiss francs1,0961,1361,1551,1721,0577******** Claims in Netherlands guilder ................................ Claims in ECUs ................................ Claims in euros226,090227,850236,690257,866278,461301,402300,453312,991 Claims in other currencies 13,19313,02713,91911,55612,24013,43813,41115,108 Unallocated reserves 2/639,178681,072728,053848,349911,676963,6401,037,3041,073,906Memorandum ItemsExchange Rates (End of Period) Pound sterling per U.S. dollar 0.54510.55200.55590.51780.53120.55760.56620.5808 Japanese yen per U.S. dollar 104.3000108.3800111.0000104.1200107.3500110.4000113.1500117.9700 Swiss franc per U.S. dollar 1.2759 1.2538 1.2595 1.1316 1.1952 1.2849 1.2902 1.3143 Euro per U.S. dollar0.81810.82270.80590.73420.77140.82700.83040.8477Currency Composition of Official Foreign Exchange Reserves (COFER) (continued)(In millions of U.S. dollars)2004Quarters2005IIIIIIIVIII IIIIVWorldTotal foreign exchange holdings 2,081,7272,237,0062,307,4652,408,1092,501,5712,668,7062,831,9863,025,110 Allocated reserves 1/1,576,5651,690,5481,741,7501,795,9151,845,4841,962,9982,060,4282,223,110 Claims in U.S. dollars 1,129,0991,168,2661,185,5191,204,6731,236,5851,310,6661,383,8141,465,752 Claims in pounds sterling 42,13346,14048,65950,53746,67849,72449,97461,655Claims in Deutsche mark ................................ Claims in French francs ................................ Claims in Japanese yen 69,12579,84779,49878,14571,97670,58879,01287,608 Claims in Swiss francs5,3625,6225,9987,3144,4374,0804,6695,016 Claims in Netherlands guilder ................................ Claims in ECUs ................................ Claims in euros310,064364,280393,034427,327455,218492,816506,361559,246 Claims in other currencies 20,78126,39329,04227,91930,59035,12436,59843,833 Unallocated reserves 2/505,162546,458565,715612,194656,087705,708771,558802,000Advanced economiesTotal foreign exchange holdings 1,242,4181,339,4131,383,4061,419,0441,441,3421,529,9741,619,0751,739,279 Allocated reserves 1/1,112,9231,189,3581,225,2011,254,8611,272,0781,351,2971,426,6031,529,481 Claims in U.S. dollars 791,095814,241834,736844,294862,758912,601977,3621,036,696 Claims in pounds sterling 29,77232,84534,77236,08831,28232,67732,02436,338Claims in Deutsche mark ................................ Claims in French francs ................................ Claims in Japanese yen 59,25370,01770,21966,30362,89962,07773,01076,631 Claims in Swiss francs4,4014,6535,0266,6163,6743,3793,9454,157 Claims in Netherlands guilder ................................ Claims in ECUs ................................ Claims in euros212,580246,762258,425281,546289,206315,311314,783343,638 Claims in other currencies 15,82220,84022,02220,01422,25925,25225,47932,022 Unallocated reserves 2/129,495150,055158,205164,183169,264178,677192,472209,798Emerging and developing economies Total foreign exchange holdings 839,309897,593924,059989,0651,060,2291,138,7321,212,9111,285,831 Allocated reserves 1/463,642501,190516,549541,054573,406611,702633,825693,629 Claims in U.S. dollars 338,004354,025350,783360,379373,826398,064406,453429,056 Claims in pounds sterling 12,36213,29513,88714,44915,39617,04817,95025,317Claims in Deutsche mark ................................ Claims in French francs ................................ Claims in Japanese yen 9,8729,8309,27811,8429,0778,5116,00210,977 Claims in Swiss francs960970972698764701724858 Claims in Netherlands guilder ................................ Claims in ECUs ................................ Claims in euros97,484117,518134,609145,781166,012177,505191,577215,608 Claims in other currencies 4,9605,5537,0217,9058,3329,87211,11911,812 Unallocated reserves 2/375,667396,403407,510448,011486,823527,031579,086592,202Memorandum ItemsExchange Rates (End of Period) Pound sterling per U.S. dollar 0.70260.65060.63950.62040.63300.60600.59750.5603 Japanese yen per U.S. dollar 133.2000119.4500121.5500119.9000120.1500119.8500111.2000107.1000 Swiss franc per U.S. dollar 1.6829 1.4752 1.4832 1.3868 1.3537 1.3581 1.3155 1.2369 Euro per U.S. dollar1.1463 1.0025 1.01420.95360.91790.87510.85820.791820022003QuartersCurrency Composition of Official Foreign Exchange Reserves (COFER) (continued)(In millions of U.S. dollars)Currency Composition of Official Foreign Exchange Reserves (COFER) (continued)(In millions of U.S. dollars)Quarters20002001I II III IV I II III IV WorldTotal foreign exchange holdings1,808,7061,852,8971,874,0891,936,2821,931,7971,934,1642,027,8182,049,630 Allocated reserves 1/1,400,5901,441,9151,465,5501,518,2441,507,6351,510,6271,581,7101,569,488 Claims in U.S. dollars1,000,8591,038,4791,059,5741,079,9161,090,1191,098,2351,129,2991,122,431 Claims in pounds sterling40,92339,78939,99941,79841,84940,01341,59042,401 Claims in Deutsche mark................................ Claims in French francs................................ Claims in Japanese yen88,75986,46794,18092,07883,11080,91385,44779,190 Claims in Swiss francs3,5902,9253,2794,0874,1313,9674,1504,372 Claims in Netherlands guilder................................ Claims in ECUs................................ Claims in euros245,173252,549248,757277,693266,965266,335298,986301,026 Claims in other currencies21,28521,70519,76022,67221,46121,16522,23920,069 Unallocated reserves 2/408,116410,983408,540418,039424,161423,536446,108480,142 Advanced economiesTotal foreign exchange holdings1,118,8961,163,9431,172,3511,203,2981,186,2971,174,0971,229,3241,231,557 Allocated reserves 1/1,005,2151,049,9531,060,4091,093,9471,075,3651,062,7771,113,2701,108,111 Claims in U.S. dollars716,068754,940760,650768,827771,636766,173785,781787,963 Claims in pounds sterling29,74328,95429,81231,01030,83928,86230,05630,034 Claims in Deutsche mark................................ Claims in French francs................................ Claims in Japanese yen73,37173,60881,27380,62773,43471,19574,63868,356 Claims in Swiss francs2,6152,0332,4413,1843,3303,3173,8433,391 Claims in Netherlands guilder................................ Claims in ECUs................................ Claims in euros166,719174,051172,475193,979180,448178,421202,642202,984 Claims in other currencies16,70016,36813,75716,32015,67714,80916,31015,384 Unallocated reserves 2/113,681113,990111,942109,351110,932111,320116,054123,446 Emerging and developing economiesTotal foreign exchange holdings689,810688,954701,739732,984745,499760,067798,494818,073 Allocated reserves 1/395,374391,961405,141424,296432,270447,850468,440461,377 Claims in U.S. dollars284,791283,539298,924311,089318,483332,062343,518334,468 Claims in pounds sterling11,18010,83510,18710,78811,01011,15111,53312,367 Claims in Deutsche mark................................ Claims in French francs................................ Claims in Japanese yen15,38912,85912,90811,4519,6769,71810,80910,834 Claims in Swiss francs975892838903801650307981 Claims in Netherlands guilder................................ Claims in ECUs................................ Claims in euros78,45478,49876,28283,71386,51787,91496,34498,043 Claims in other currencies4,5855,3376,0026,3525,7846,3565,9294,685 Unallocated reserves 2/294,435296,993296,598308,688313,229312,217330,053356,696 Memorandum ItemsExchange Rates (End of Period)Pound sterling per U.S. dollar0.62690.66130.68020.67020.70150.71220.68020.6895 Japanese yen per U.S. dollar105.8500105.4000107.8500114.9000124.6000124.0500119.3000131.8000 Swiss franc per U.S. dollar 1.6688 1.6263 1.7359 1.6365 1.7317 1.7954 1.6117 1.6773 Euro per U.S. dollar 1.0468 1.0465 1.1409 1.0747 1.1322 1.1792 1.0952 1.1347Currency Composition of Official Foreign Exchange Reserves (COFER) (continued)(In millions of U.S. dollars)Quarters1999I II III IV WorldTotal foreign exchange holdings1,605,9131,646,1921,713,5751,781,947 Allocated reserves 1/1,239,4151,273,7251,324,2451,379,705 Claims in U.S. dollars882,325918,685936,039979,783 Claims in pounds sterling34,01535,57437,02939,827 Claims in Deutsche mark................ Claims in French francs................ Claims in Japanese yen74,77371,67482,72687,939 Claims in Swiss francs3,5713,0923,1933,172 Claims in Netherlands guilder................ Claims in ECUs................ Claims in euros224,936223,854242,702246,950 Claims in other currencies19,79520,84622,55522,034 Unallocated reserves 2/366,497372,467389,331402,242 Advanced economiesTotal foreign exchange holdings980,3881,005,7081,057,7211,108,128 Allocated reserves 1/886,574906,664953,928997,111 Claims in U.S. dollars623,772643,834663,107701,693 Claims in pounds sterling26,11527,52229,05130,391 Claims in Deutsche mark................ Claims in French francs................ Claims in Japanese yen59,85058,16568,35072,801 Claims in Swiss francs1,7221,2841,3611,337 Claims in Netherlands guilder................ Claims in ECUs................ Claims in euros160,257159,908174,251174,242 Claims in other currencies14,85815,95117,80816,647 Unallocated reserves 2/93,81499,044103,793111,017 Emerging and developing economiesTotal foreign exchange holdings625,525640,484655,854673,819 Allocated reserves 1/352,842367,061370,317382,594 Claims in U.S. dollars258,553274,852272,932278,090 Claims in pounds sterling7,9008,0527,9789,436 Claims in Deutsche mark................ Claims in French francs................ Claims in Japanese yen14,92413,50914,37615,138 Claims in Swiss francs1,8491,8081,8321,835 Claims in Netherlands guilder................ Claims in ECUs................ Claims in euros64,67863,94568,45172,708 Claims in other currencies4,9384,8954,7475,387 Unallocated reserves 2/272,683273,423285,538291,225 Memorandum ItemsExchange Rates (End of Period)Pound sterling per U.S. dollar0.62050.63500.60730.6187 Japanese yen per U.S. dollar120.4000121.1000106.8500102.2000 Swiss franc per U.S. dollar 1.4872 1.5525 1.4975 1.5996 Euro per U.S. dollar0.93090.96820.93760.9954Currency Composition of Official Foreign Exchange Reserves (COFER) (continued)(In millions of U.S. dollars)Annual20012002200320042005200620072008pWorldTotal foreign exchange holdings2,049,6302,408,1093,025,1103,748,4004,174,5565,036,9256,411,0876,909,257 Allocated reserves 1/1,569,4881,795,9152,223,1102,655,0702,843,5413,315,4834,119,1904,210,672 Claims in U.S. dollars1,122,4311,204,6731,465,7521,751,0121,902,5352,171,0752,641,6452,703,311 Claims in pounds sterling42,40150,53761,65589,457102,243145,205192,663170,706 Claims in Deutsche mark................................ Claims in French francs................................ Claims in Japanese yen79,19078,14587,608101,787101,769102,051120,480131,698 Claims in Swiss francs4,3727,3145,0164,4194,1435,6856,3955,449 Claims in Netherlands guilder................................ Claims in ECUs................................ Claims in euros301,026427,327559,246658,531683,809831,9471,082,2761,112,260 Claims in other currencies20,06927,91943,83349,86549,04159,52075,73187,248 Unallocated reserves 2/480,142612,194802,0001,093,3301,331,0151,721,4422,291,8972,698,586 Advanced economiesTotal foreign exchange holdings1,231,5571,419,0441,739,2792,041,1292,047,6272,218,9082,394,7122,450,968 Allocated reserves 1/1,108,1111,254,8611,529,4811,796,1471,790,5181,948,4292,119,3722,157,582 Claims in U.S. dollars787,963844,2941,036,6961,218,1841,248,6301,336,6731,408,8231,466,110 Claims in pounds sterling30,03436,08836,33848,42049,82664,71876,02060,966 Claims in Deutsche mark................................ Claims in French francs................................ Claims in Japanese yen68,35666,30376,63187,32383,88584,19485,21393,193 Claims in Swiss francs3,3916,6164,1573,2463,4274,5784,7203,603 Claims in Netherlands guilder................................ Claims in ECUs................................ Claims in euros202,984281,546343,638400,666370,818420,278499,098484,974 Claims in other currencies15,38420,01432,02238,30933,93337,98845,49748,735 Unallocated reserves 2/123,446164,183209,798244,981257,109270,479275,340293,387 Emerging and developing economiesTotal foreign exchange holdings818,073989,0651,285,8311,707,2722,126,9292,818,0174,016,3754,458,289 Allocated reserves 1/461,377541,054693,629858,9231,053,0231,367,0541,999,8172,053,090 Claims in U.S. dollars334,468360,379429,056532,828653,906834,4021,232,8221,237,201 Claims in pounds sterling12,36714,44925,31741,03752,41780,487116,643109,740 Claims in Deutsche mark................................ Claims in French francs................................ Claims in Japanese yen10,83411,84210,97714,46417,88517,85735,26738,505 Claims in Swiss francs9816988581,1727161,1071,6751,845 Claims in Netherlands guilder................................ Claims in ECUs................................ Claims in euros98,043145,781215,608257,866312,991411,669583,177627,286 Claims in other currencies4,6857,90511,81211,55615,10821,53230,23438,513 Unallocated reserves 2/356,696448,011592,202848,3491,073,9061,450,9632,016,5582,405,199 Memorandum ItemsExchange Rates (End of Period)Pound sterling per U.S. dollar0.68950.62040.56030.51780.58080.50940.49920.6860 Japanese yen per U.S. dollar131.8000119.9000107.1000104.1200117.9700118.9500114.000090.7500 Swiss franc per U.S. dollar 1.6773 1.3868 1.2369 1.1316 1.3143 1.2203 1.1255 1.0637 Euro per U.S. dollar 1.13470.95360.79180.73420.84770.75930.67930.7185Currency Composition of Official Foreign Exchange Reserves (COFER) (concluded)(In millions of U.S. dollars)Annual19951996*1997*199819992000WorldTotal foreign exchange holdings1,389,8011,566,2681,616,2481,643,8031,781,9471,936,282 Allocated reserves 1/1,034,1751,224,4641,271,9821,282,4061,379,7051,518,244 Claims in U.S. dollars610,337760,071828,887888,724979,7831,079,916 Claims in pounds sterling21,87432,88332,85634,14239,82741,798 Claims in Deutsche mark163,088179,916184,349176,951........ Claims in French francs24,36122,63818,31420,814........ Claims in Japanese yen70,07182,30773,48780,02987,93992,078 Claims in Swiss francs3,4643,7054,4354,2373,1724,087 Claims in Netherlands guilder3,3062,9354,4613,489........ Claims in ECUs88,28886,83777,32216,637........ Claims in euros................246,950277,693 Claims in other currencies49,38753,17247,87157,38322,03422,672 Unallocated reserves 2/355,626341,805344,266361,397402,242418,039 Advanced economiesTotal foreign exchange holdings917,7351,003,397999,5171,009,0831,108,1281,203,298 Allocated reserves 1/752,519898,527901,778911,763997,1111,093,947 Claims in U.S. dollars407,735521,031553,701615,679701,693768,827 Claims in pounds sterling15,96625,89224,55025,96830,39131,010 Claims in Deutsche mark121,361133,572133,034125,185........ Claims in French francs17,30014,97110,66612,898........ Claims in Japanese yen54,02064,85156,29863,90772,80180,627 Claims in Swiss francs1,4281,4512,2592,2121,3373,184 Claims in Netherlands guilder2,4022,4563,2452,903........ Claims in ECUs88,11686,65576,93115,333........ Claims in euros................174,242193,979 Claims in other currencies44,19347,64741,09447,67716,64716,320 Unallocated reserves 2/165,216104,87097,73997,320111,017109,351 Emerging and developing economiesTotal foreign exchange holdings472,066562,872616,731634,720673,819732,984 Allocated reserves 1/281,656325,937370,204370,643382,594424,296 Claims in U.S. dollars202,602239,040275,186273,045278,090311,089 Claims in pounds sterling5,9086,9918,3068,1759,43610,788 Claims in Deutsche mark41,72746,34451,31551,765........ Claims in French francs7,0617,6677,6487,916........ Claims in Japanese yen16,05117,45617,18916,12215,13811,451 Claims in Swiss francs2,0362,2542,1752,0241,835903 Claims in Netherlands guilder9044791,216586........ Claims in ECUs1721823911,304........ Claims in euros................72,70883,713 Claims in other currencies5,1945,5246,7779,7065,3876,352 Unallocated reserves 2/190,410236,935246,527264,077291,225308,688 Memorandum ItemsExchange Rates (End of Period)Pound sterling per U.S. dollar0.64520.58890.60470.60110.61870.6702 Japanese yen per U.S. dollar102.8300116.0000129.9500115.6000102.2000114.9000 Swiss franc per U.S. dollar 1.1505 1.3464 1.4553 1.3765 1.5996 1.6365 Euro per U.S. dollar................0.9954 1.0747。

外汇储备结构分析截止2021年底,我国外汇储备余额为8189亿美元,如果再加上香港的1243亿美元,实际上我国已经以9432亿美元的外汇储备位居世界榜首。

随着我国外汇储备规模地不断扩大,对其适度规模的研究也越来越多,相比较而言对我国外汇储备结构是否合理的研究则乏善可陈。

外汇储备的结构研究可以分为四个方面:外汇储备在全部储备中所占比例的控制;外汇储备的结构安排;储备资产的投资决策;债务管理。

本文拟从这四个方面分析我国外汇储备的结构特征。

国际储备由黄金储备、外汇储备、在基金组织的储备头寸和特别提款权四个部分构成。

国际储备这四个组成部分各自的流动性、安全性和盈利性都是不同的,它们各自在国际储备总额中所占的比重不同,会导致整个国际储备总体呈现出不同的流动性、安全性和盈利性。

我国国际储备四个组成部分各自所占的比重是很不平衡的,大部分是外汇储备。

我国的黄金储备占国际储备的百分比是1.6%,2001年,我国拥有的特别提款权配额为63.692亿特别提款权约合83亿美元,只占当年国际储备的3.9%。

储备头寸占国际储备的比例也很低。

我国的黄金储备、特别提款权和在基金组织的储备头寸偏低受到了整个国际储备体系的影响。

1976年“黄金非货币化”后,黄金的储备货币职能在继续退化,只是作为一种最后支付手段保留在国家中央银行。

自20世纪90年代以来,与IMF有关的储备资产即储备头寸和特别提款权所占的比重在最高时也不过5%左右,并呈不断下降的趋势。

而按市场价格计算,黄金储备所占的比重虽然稍高,但也呈下跌走势。

至于外汇储备则不仅所占比重一直最高,且表现为不可逆转的上升势头。

在国际储备体系中外汇储备成为了最主要的储备资产。

我国的国际储备格局与世界的国际储备格局变换是相一致的。

这种相一致性并不能说明我国的国际储备格局就是合理的,它恰恰说明我国的经济实力还不强大,我国的人民币还不是世界可自由兑换的货币,我国的金融地位在世界金融领域中还处于劣势。

浅谈对我国外汇储备现状的研究和管理政策建议前言外汇储备是我国对外经济活动中的一种重要的货币资产,是维护国家金融安全和经济发展的重要保障。

近年来,随着我国外贸和国际金融市场的变化,我国外汇储备规模和结构也发生了较大的变化。

本文旨在通过对我国外汇储备现状的研究,提出相应的管理政策建议,以促进我国外汇储备的稳步增长和优化。

我国外汇储备现状自改革开放以来,我国外汇储备规模始终呈现出稳步增长的态势。

截止2021年5月,我国外汇储备总额为3.22万亿美元,稳居全球第一。

分析其结构可以发现,外汇储备主要由外汇、金融衍生品和其他投资组成。

其中,外汇占据外汇储备的主要部分,约占80%以上,金融衍生品占比约为10%,其他投资占比较小。

近年来,我国外汇储备的规模和结构发生了一些变化。

首先,我国外贸结构发生了变化,疫情和贸易摩擦等因素导致我国外贸形势不断发生变化,这给我国外汇储备带来了一定的压力。

其次,国际金融市场波动加大,金融风险也在逐步增加,这对我国外汇储备的安全和管理提出了更高的要求。

因此,我们需要对我国外汇储备的现状进行深入分析,并提出相应的管理政策建议。

我国外汇储备研究影响我国外汇储备的因素国内生产总值(GDP)、国际收支、金融市场等因素都会影响我国外汇储备的规模和结构。

其中,GDP是影响我国外汇储备规模的最主要因素,它反映了一个国家的经济实力和国际竞争力。

国际收支和金融市场对外汇储备也有不可忽视的影响。

稳定国际收支和金融市场有助于促进外汇储备的增长,反之则会对外汇储备产生负面影响。

潜在风险虽然外汇储备是我国货币资产中的重要组成部分,但是外汇储备管理也面临着潜在的风险。

其中,政治风险、市场风险和信用风险是主要的三种风险。

政治风险包括国家政策和国际政治因素;市场风险包括金融市场变化和利率风险等;信用风险是对外汇储备所投资的相关方信用状况的评估。

外汇储备管理政策建议为了保护我国外汇储备的安全和合理增长,我们提出一些管理政策建议:1.加强外汇储备管理制度的建设。

2024年我国外汇储备管理与经营研究论文一、引言外汇储备是一国政府持有的国际间普遍接受的外国货币,主要用于平衡国际收支、稳定汇率以及维护国家经济安全。

随着我国经济的持续发展和对外开放程度的不断提高,外汇储备规模逐渐扩大,如何有效管理和经营外汇储备成为了一个重要议题。

本文旨在探讨我国外汇储备的管理与经营策略,分析当前面临的挑战,并提出相应的政策建议。

二、我国外汇储备的演变与现状我国外汇储备自改革开放以来经历了显著的增长。

随着贸易顺差的积累、外资的流入以及国际市场的投资收益,我国外汇储备规模不断攀升。

这种增长在一定程度上增强了我国的国际清偿能力,为维护国家经济安全提供了有力支撑。

然而,外汇储备的过快增长也带来了一系列问题,如货币政策的独立性受限、外汇储备资产的风险管理等。

三、外汇储备管理的目标与原则外汇储备管理的核心目标是在保证国际支付能力的基础上,实现外汇储备资产的安全性、流动性和增值性。

为实现这一目标,外汇储备管理应遵循以下原则:一是安全性原则,确保外汇储备资产不受损失;二是流动性原则,保证外汇储备能够随时满足国际支付需求;三是增值性原则,通过合理的投资运营实现外汇储备资产的增值。

四、我国外汇储备管理与经营的策略多元化投资策略:为降低外汇储备资产的风险,我国应采取多元化投资策略,将外汇储备分散投资于不同国家、不同币种和不同资产类别的金融产品。

这不仅可以降低单一资产的风险,还能提高整体投资组合的收益。

加强风险管理:建立健全的风险管理体系是外汇储备管理与经营的关键。

我国应加强对外汇储备资产的风险评估、监测和预警,及时发现并应对潜在风险。

同时,还应加强内部控制和审计监督,确保外汇储备资产的安全。

优化外汇储备结构:我国应根据国际经济形势的变化和国内经济发展的需要,适时调整外汇储备的币种和资产结构。

这不仅可以降低汇率风险,还能提高外汇储备资产的收益。

推动外汇储备运用的创新:随着我国经济的不断发展和对外开放程度的提高,我国可以积极探索外汇储备运用的新模式、新途径。

中国外汇储备币种结构估计、优化及调整研究的开题报告一、研究背景中国外汇储备规模为世界第一,因此其外汇储备管理对国际金融体系稳定起着至关重要的作用。

外汇储备中的币种结构是一项关键的管理策略,直接关系到外汇储备风险和效率的把握。

近年来,随着全球经济形势的变化和外汇市场波动的加剧,中国的外汇储备困境日益加重,需要进一步加强对外汇储备币种的结构估计、优化及调整研究,以提高储备管理的有效性和可靠性。

二、研究目标本研究旨在从政策角度和经济角度入手,探讨中国外汇储备币种结构的现状、风险、效率和优化方向,从而为制订更科学、更合理的外汇储备管理策略提供理论与实践支持。

三、研究内容与思路1.外汇储备币种结构现状分析通过收集、整理和分析相关数据资料,深入研究中国外汇储备的币种分布情况,探讨影响外汇储备币种结构的因素。

具体包括储备货币的种类、比重、分布地区和发达程度等。

2.外汇储备币种结构的风险评估从风险角度出发,对外汇储备币种结构的风险进行评估。

分析外汇储备币种结构可能面临的风险类型,如汇率风险、政治风险、流动性风险等,同时考虑外汇储备的分散程度、安全性和稳定性等指标,从而为外汇储备币种优化提供决策依据。

3.外汇储备币种结构的效率评估研究外汇储备币种结构对储备管理效率的影响,通过分析外汇储备币种结构的收益和成本比较,在效益最大化的前提下,调整外汇储备币种结构。

4.外汇储备币种结构优化方向分析综合考虑外汇储备币种结构的现状、风险和效益,提出外汇储备币种结构优化的方向和思路,建议调整储备货币种类、比重、分配方向和地区。

四、研究意义本研究可为中国政府制订更科学和更有效的外汇储备管理策略提供理论基础和决策支持。

同时,对于探讨全球外汇储备管理和理论研究也具有一定的参考意义。

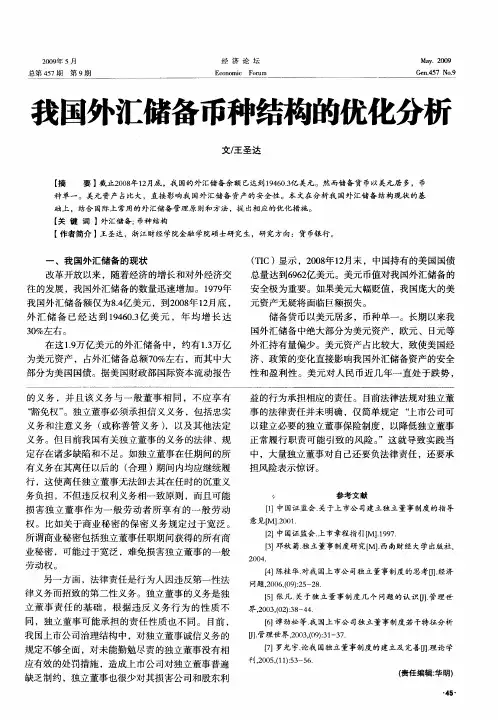

中国外汇储备币种结构目前,国际金融市场动荡不安,我国规模不断扩大的外汇储备面临巨大风险,外汇储备管理尤其是外汇储备币种的选择已显得尤为重要。

虽然国家外汇管理局和中国人民银行定期发布外汇储备余额的数据,但外汇储备的就具体构成却是没有披露的。

本文以Heller—Knight模型和Dooley模型为指导,利用影响外汇储备相关因素的分析,合理探究我国目前外汇币种构建情况。

最后,结合国际金融市场局势和中国外汇储备现状,提出我国外汇储备币种结构的调整思路,认为我国外汇储备应适当降低美元持有比例,保持日元现有持有水平,并适当增持欧元资产。

标签:Heller—Knight模型Dooley模型外汇储备币种结构2006年2 月底,中国外汇储备规模首次超过日本,跃居世界首位,总体规模达8527亿美元。

截止至2007年末,中国外汇储备余额达1.53万亿美元,增长速度高达43.3%。

巨额的外汇储备规模及惊人的增长速度,一方面表明我国经济实力的不断增强,另一方面也对我国的外汇储备管理,尤其是外汇币种结构的管理提出了更高的要求。

当前我国外汇储备以美元为主,但从2007年7月起,至2008年2月,美元实际有效汇率由88.73点跌至83.61点,8个月的贬值幅度为5.77%。

与此同时,欧元却持续升值。

历史数据显示:过去两年里,欧元兑美元升值17%,兑日元升值20.4%。

面对当今世界经济形势的明显变化,如何合理安排我国外汇储备的币种结构已经成为摆在我们面前的重要课题之一。

本文以Heller—Knight模型和Dooley模型为基础,并根据中国实际情况对模型做出适当修正,引入相关数据,试图从影响外汇储备的相关因素出发,探究我国目前外汇储备币种构建情况。

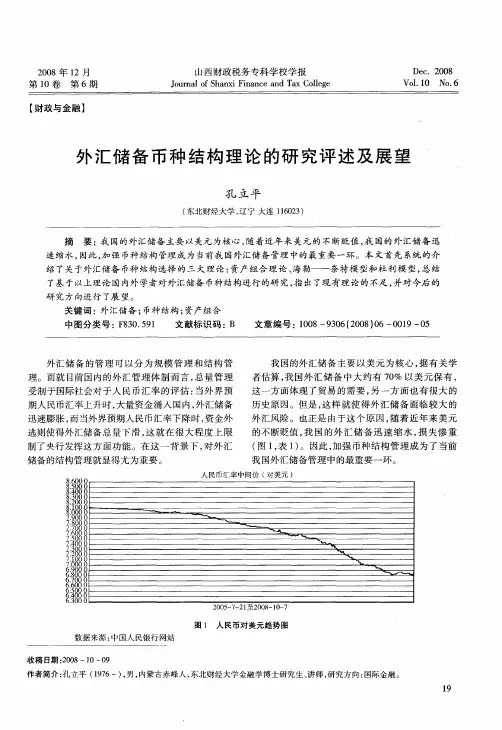

一、中国外汇储备的币种结构历史发展情况国际货币储备体系的演变经历了三次明显的变化。

在金本位时期,黄金充当世界货币,加上英国的经济实力,形成了黄金—英镑的国际储备体系。

1994年布雷顿森林体系建立,确立了以美元为中心的国际货币体系,即美元—黄金国际储备体系。

中国外汇储备构成中国外汇储备构成1、币种构成中国外汇储备的结构没有对外明确公布过,目前属于国家金融机密。

据估计,美元资产占70%左右,日元约为10%,欧元和英镑约为20%,依据来自于国际清算银行的报告、路透社报道以及中国外贸收支中各币种的比例。

2、具体形式政府在国外的短期存款或其他可以在国外兑现的支付手段,如外国有价证券,外国银行的支票、期票、外币汇票等。

主要用于清偿国际收支逆差,以及干预外汇市场以维持本国货币的汇率。

外汇掉期和货币互换的区别区别一、交易期限外汇掉期:一般为1年以内的交易,也有1年以上的交易。

货币互换:一般为1年以上的交易。

区别二、本金外汇掉期:通常前后交换的本金金额不变,换算成相应的外汇金额不一致,由约定汇率决定。

货币互换:期初、期末各交换一次本金,金额不变。

区别三、交换本金金额外汇掉期:前期交换和后期收回的本金金额通常不一致。

货币互换:前期交换和后期收回的本金金额通常一致。

区别四、汇率外汇掉期:前后交换货币通常使用不同汇率。

货币互换:前后交换货币通常使用相同汇率。

区别五、利息外汇掉期:不进行利息交换。

货币互换:通常进行利息互换,交易双方需向对方支付换进货币的利息。

什么叫做外汇的亏损点外汇的亏损点:亏损点是指投资者在交易中价格反向移动时出现的亏损程度。

例如,如果一个投资者在某个货币对上买入并持有头寸,但市场价格下跌,那么当价格下跌到投资者所持头寸的买入价以下时,就会产生亏损点。

亏损点的数量取决于头寸的大小和价格的变动。

外汇当天买的能卖出吗可以外汇买进后,就可以立即卖出的。

外汇是T+0制度,即时买进卖出。

开户建议选择有监管资质,且成立时间10年以上的老牌经纪商,以保障资金的安全。

在外汇当中,货币对的投资门槛都比较低,像欧美,一手的保证金291美金,黄金一手的保证金为945美金,最低做单0.01手,相当于几美金就可以做黄金这些热门品种了。

外汇开户只需准备身份证,银行卡,手机,邮箱,登陆平台官网,填写资料即可办理外汇交易中买入价,卖出价和中间价有什么区别卖出价(Sellprice)就是卖出基础货币,同时买入结算货币的价格。

[我国外汇储备的现状]我国外汇储备第一篇我国外汇储备:有关外汇储备的论文从经济危机和我国外汇储备管理的现状出发,分析了外汇储备管理中存在的安全问题,针对问题进行了思考,提出了“一控二调三转变”的加强安全管理的措施,一是要控制外汇储备规模,二是要调整外汇储备结构,三是要转变人民币在国际货币体系中的角色。

一、我国外汇储备的现状近年来我国外汇储备总量不断攀升,2022年2月,中国外汇储备首次超过日本成为世界第一,2022年全球金融危机爆发,经济形势不景气,但我国外汇储备仍然保持高速增长,年增加量均超过4千亿美元。

根据国家统计局公布的统计数据,截至今年6月末,我国外汇储备余额达21316亿美元。

近来外汇储备的快速增长,与中国经济基本面转好有密切关系,说明国际投资者对中国经济发展充满信心。

同时巨额的外汇储备也带了一系列的安全问题。

一是增大了外汇储备安全的风险,汇率风险、利率风险是外汇储备无法规避的两种风险。

由于金融危机对美国的冲击最为严重,美元资产最容易遭受金融危机的直接冲击。

美国央行为克服金融危机的影响连续10次降低利率。

美国国债的收益率也一路走低,自2022年10月全球金融危机爆发以来,美国1年期国库券利率持续走低,截至2022年12月22日,收益率降到0。

39%。

截至2022年10月,美元对人民币已贬值高达9。

5%,当时我国外汇储备额大约是1。

9万亿美元,仅此汇率风险一项损失就已高达1300亿美元。

我国的外汇储备高度集中于美元资产,不论是美国国债价值下跌抑或是美元汇率大幅贬值,都会导致我国外汇储备大幅缩水。

二是加大了外汇储备成本。

超额外汇储备的存在增加了外汇储备管理的成本,有研究表明,向国外进行国债投资比向国内发放贷款所获得利息要少,向国外商业银行借款的利率又比一般的存款利率要高,要多支付利息。

超额外汇的巨额存在所造成的少收的利息和多付的利息也不是一个小数字。

二、推行“一控二调三转变”以加强我国外汇储备的安全管理当前情况下,我国外汇储备要加强安全管理,必须要积极推行“一控二调三转变”的措施。

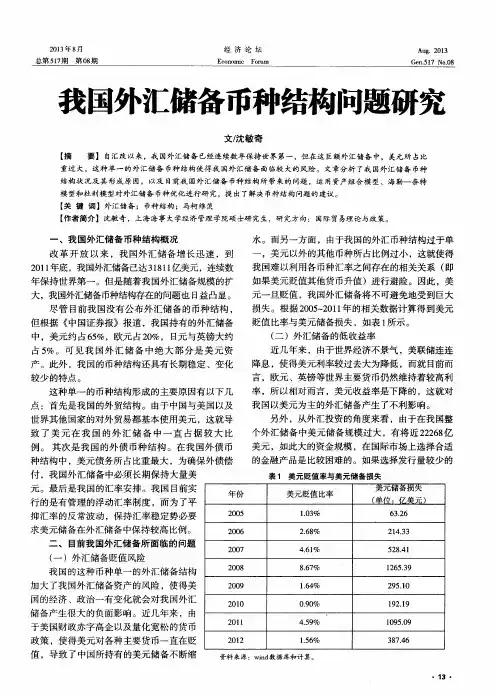

我国外汇储备币种结构研究

【摘要】国际储备是一国政府所持有的备用于弥补国际收支赤字,维持本国货币汇率的国际间可以接收的一切资产。

国际储备的主要功能有保证国际支付能力;调节国际收支失衡;稳定本国货币汇率;保证本国的国际信誉。

在国际储备的构成中,外汇储备是国际储备的主体。

【关键词】外汇储备;储备币种结构;财富功能

外汇储备又称储备性货币,它是指由一国官方掌握的国外可兑换货币的存款和其他可变现的金融资产。

一国的外汇储备资产包括外币存款、债券、债券回购、同业拆放等各项外汇资产。

外汇储备作为国际储备的重要组成部分,是一国国际清偿能力的主要体现。

外汇储备作为一国官方掌握的国外可兑换货币的存款和其他可变现的金融资产,其主要的功能在于融通国际收支逆差,干预外汇市场和维持本国汇率稳定。

布雷顿森林体系崩溃后,各国货币兑换可以自由浮动,这就为国际贸易和投资带来了汇率风险,世界各国为减少汇率波动,保证外汇市场的干预能力,减小资本流动对经济的负面影响,大大增加了对外汇储备的需求。

世界各国开始努力实现储备货币的多元化,国际货币体系进入了一个多元化的货币储备体系。

目前,美元、欧元、日元、英镑、瑞士法郎(在亚洲包括港币)等货币共同成为国际储备货币,但美元仍是最主要的储备货币。

从国际储备体系来看,全球约有160多个国家和地区的货币与美元有着直接联系。

当然欧元和日元也在成为重要的储备货币,其作用不断加强。

一、外汇储备币种结构管理重心应向财富功能转移

亚洲金融危机之后,我国外汇储备呈持续增长态势。

我国外汇储备的高速增长是由多种因素造成的:国际收支平衡表显示,经常项目中的商品贸易顺差(主要来源于美国)与资本金融项目中的直接投资流入是推动我国外汇储备增长的主要成因。

此外,基于人民币升值预期的国际投机资本非法流入和国内居民资产调整,对我国外汇储备增长也构成了不容忽视的影响。

从我国经济特点和国际经济环境看,我国外汇储备持续增长的局面在相当长时期内还将延续。

一方面,我国目前拥有稳定的政治环境、廉价高效的劳动力和广阔的市场前景,并且这些决定国际直接投资流入的主导因素在短期内不易发生重大变化。

另一方面,我国经常项目持续顺差是全球经济失衡格局的重要组成部分;东亚(包括我国)与美国在储蓄率和贸易重组步调方面的差异是全球经济失衡的主要背景,而储蓄率和贸易重组步调在短期内难以有大的改变,由此可以判断,在汇率水平不做大幅调整的情况下,我国贸易顺差将会长期存在。

从全局角度看,我国外汇储备增长符合外汇储备管理保持信心的新精神,也符合我国经济改革和发展的需要。

首先,我国金融体系存在严重脆弱性,居民和企业对人民币的信心并非牢不可破;外汇储备增长可以增强人民币信心,防止某种形式的货币替代发生。

其次,人民币汇率制度正在进行渐进式弹性化改革;外汇储备增长可以增强我国中央银行干预汇率的信誉,为人民币汇率制度改革护航。

在保持较大规模外汇储备的背景下,我国外汇储备管理重心必然要更加重视财富功能;与此同时,我国外汇储备币种构成也应向促进财富增长方向转移。

二、根据分档管理确定币种构成的不同基准和计值标准

目前,国内学者对外汇储备采用分档管理已达成共识。

通常认为,我国外汇储备可分为流动性部分和投资性部分两档。

其中,流动性部分主要用以维持汇率稳

定及金融安全,主要以流动性较高的资产形式持有,不对其提出收益性要求。

对于投资性部分,则应提出保值增值的目标,积累一定经验后,也可以考虑引进全球性的基金管理机构参与这部分外汇资产的管理。

对不同部分的外汇储备币种结构管理,应当采用不同的货币构成基准和计值标准。

流动性部分主要是用以维持汇率稳定及金融安全,其应从货币干预视角来设定货币构成基准和计值标准,即强调外汇储备在外汇市场干预或为资本项目融资的作用。

从这一思路看,我国流动性外汇储备价值衡量应主要参考货币当局汇率安排中的目标货币―――重点考虑美元。

投资部分以保值增值为目标,它应从真实进口购买力视角来设定货币构成基准和计值标准。

三、渐进地调整外汇储备币种结构

我国目前的外汇储备数量较大,这意味着我国外汇储备币种结构的调整将会影响市场价格。

这一特点决定了我国外汇储备币种结构调整应当采用渐进方式,这不仅有利于全球经济稳定,也有利于我国外汇储备价值的稳定。

在当前全球经济失衡格局下,一个关键问题是,美国的资本流入是否能为美国经常项目失衡充分融资,并以此支撑美元对其他主要货币的信心。

从美国国际收支情况看,亚洲金融危机以来,美国的资本金融项目总体呈顺差不断增长态势,其中,证券融资起到了主导作用。

外汇储备币种结构渐进调整还有利于我国外汇储备价值的稳定。

例如,如果我国迅速将美元国债储备转换成欧元储备,则大量抛售很有可能会使得美元国债收益率迅速上升,这将导致我国继续持有的美元储备的贴现值下降。

即使假设美元跌势短期内还将持续,欧元储备增加导致的外汇储备账面价值增长能否抵消继续持有的美元储备账面价值减少就会成为疑问。