金融市场学第三章习题答案

- 格式:doc

- 大小:28.50 KB

- 文档页数:2

第三章习题:1.X股票目前的市价为每股20元,你卖空1 000股该股票。

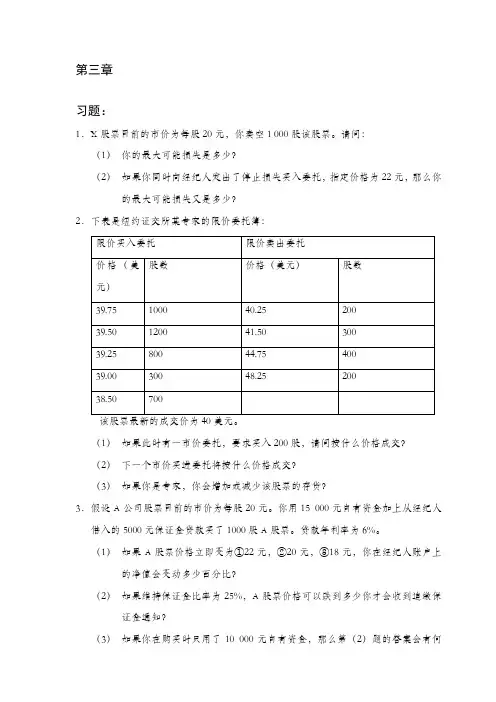

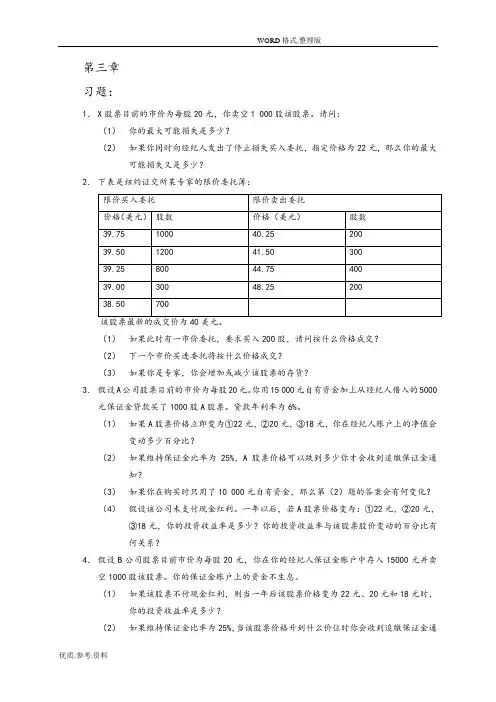

请问:(1)你的最大可能损失是多少?(2)如果你同时向经纪人发出了停止损失买入委托,指定价格为22元,那么你的最大可能损失又是多少?2.下表是纽约证交所某专家的限价委托簿:(1)如果此时有一市价委托,要求买入200股,请问按什么价格成交?(2)下一个市价买进委托将按什么价格成交?(3)如果你是专家,你会增加或减少该股票的存货?3.假设A公司股票目前的市价为每股20元。

你用15 000元自有资金加上从经纪人借入的5000元保证金贷款买了1000股A股票。

贷款年利率为6%。

(1)如果A股票价格立即变为①22元,②20元,③18元,你在经纪人账户上的净值会变动多少百分比?(2)如果维持保证金比率为25%,A股票价格可以跌到多少你才会收到追缴保证金通知?(3)如果你在购买时只用了10 000元自有资金,那么第(2)题的答案会有何变化?(4)假设该公司未支付现金红利。

一年以后,若A股票价格变为:①22元,②20元,③18元,你的投资收益率是多少?你的投资收益率与该股票股价变动的百分比有何关系?4.假设B公司股票目前市价为每股20元,你在你的经纪人保证金账户中存入15000元并卖空1000股该股票。

你的保证金账户上的资金不生息。

(1)如果该股票不付现金红利,则当一年后该股票价格变为22元、20元和18元时,你的投资收益率是多少?(2)如果维持保证金比率为25%,当该股票价格升到什么价位时你会收到追缴保证金通知?(3)若该公司在一年内每股支付了0.5元现金红利,(1)和(2)题的答案会有什么变化?5.下表是2002年7月5日某时刻上海证券交易所厦门建发的委托情况:问能否成交,成交价多少?(2)此时你输入一笔限价买进委托,要求按13.24元买进10000股,请问能成交多少股,成交价多少?未成交部分怎么办?6.3月1日,你按每股16元的价格卖空1000股Z股票。

第三章资本市场复习思考题1.答:(1)普通股股东享有公司的经营参与权,而优先股股东一般不享有公司的经营参与;(2)普通股股东的收益要视公司的赢利状况而定,而优先股的收益是固定的;(3)普通股股东不能退股,只能在二级市场上变现,而优先股股东可依照优先股股票上所附的赎回条款要求公司将股票赎回;(4)优先股票是特殊股票中最主要的一种,在公司赢利和剩余财产的分配上享有优先权。

2.答:股票的发行方式有:(1)公募是指面向市场上大量的非特定的投资者公开发行股票。

(2)私募是指股票发行只面向少数特定的投资者和投资机构,前者如使用发行公司产品的用户或本公司的职工,后者如大的金融机构或与发行者有密切业务往来关系的公司。

(3)配股是指给予现有股东以低于市场价值的价格优先购买一部分新发行的股票的权利,以保证原有股东权益比例不变。

股票的承销方式有:(1)包销。

包销是指承销商以低于发行定价的价格把公司发行的股票全部买进,再转卖给投资者,承销商所得到的买卖差价是对承销商所提供的咨询服务以及承担包销风险的报偿,也称为承销折扣。

(2)代销。

代销指承销商许诺尽可能多地销售股票,但不保证能够完成预定销售额,任何没有出售的股票可退给发行公司。

这样。

承销商不承担风险。

(3)备用包销。

通过认股权来发行股票并不需要投资银行的承销服务,但发行公司可与投资银行协商签订备用包销合同,该合同要求投资银行作为备用认购者买下未能售出的剩余股票,而发行公司为此支付备用费。

3.答:(1)发行主体不同。

作为筹资手段,无论是国家、地方公共团体还是企业,都可以发行债券,而股票则只能是股份制企业才可以发行。

(2)收益稳定性不同。

从收益方面看,债券在购买之前,利率已定,到期就可以获得固定利息,而不管发行债券的公司经营获利与否。

股票一般在购买之前不定股息率,股息收入随股份公司的盈利情况变动而变动,盈利多就多得,盈利少就少得,无盈利不得。

(3)保本能力不同。

从本金方面看,债券到期可回收本金,也就是说连本带利都能得到,如同放债一样。

高教版《金融市场学》课后习题答案(3)第三章习题:1.X股票目前的市价为每股20元,你卖空1 000股该股票。

请问:(1)你的最大可能损失是多少?(2)如果你同时向经纪人发出了停止损失买入委托,指定价格为22元,那么你的最大可能损失又是多少?2.下表是纽约证交所某专家的限价委托簿:限价买入委托限价卖出委托价格(美元)股数价格(美元)股数39.75 1000 40.25 20039.50 1200 41.50 30039.25 800 44.75 40039.00 300 48.25 20038.50 700该股票最新的成交价为40美元。

(1)如果此时有一市价委托,要求买入200股,请问按什么价格成交?(2)下一个市价买进委托将按什么价格成交?(3)如果你是专家,你会增加或减少该股票的存货?3.假设A公司股票目前的市价为每股20元。

你用15 000元自有资金加上从经纪人借入的5000元保证金贷款买了1000股A股票。

贷款年利率为6%。

(1)如果A股票价格立即变为①22元,②20元,③18元,你在经纪人账户上的净值会变动多少百分比?(2)如果维持保证金比率为25%,A股票价格可以跌到多少你才会收到追缴保证金通知?(3)如果你在购买时只用了10 000元自有资金,那么第(2)题的答案会有何变化?(4)假设该公司未支付现金红利。

一年以后,若A股票价格变为:①22元,②20元,③18元,你的投资收益率是多少?你的投资收益率与该股票股价变动的百分比有何关系?4.假设B公司股票目前市价为每股20元,你在你的经纪人保证金账户中存入15000元并卖空1000股该股票。

你的保证金账户上的资金不生息。

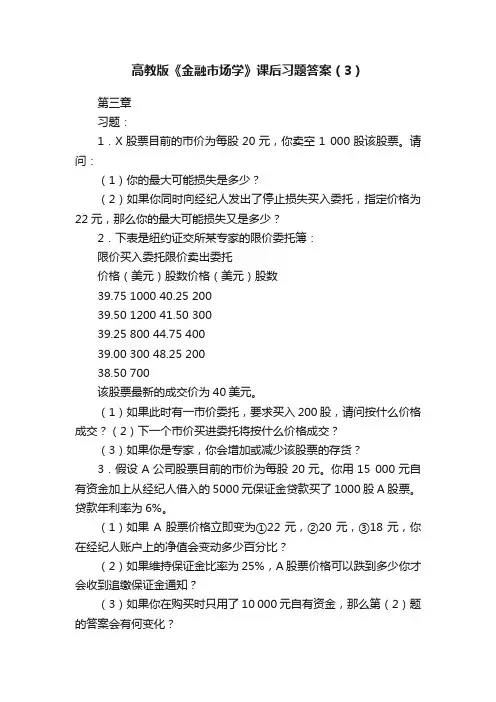

(1)如果该股票不付现金红利,则当一年后该股票价格变为22元、20元和18元时,你的投资收益率是多少?(2)如果维持保证金比率为25%,当该股票价格升到什么价位时你会收到追缴保证金通知?(3)若该公司在一年内每股支付了0.5元现金红利,(1)和(2)题的答案会有什么变化?5.下表是20XX年7月5日某时刻上海证券交易所厦门建发的委托情况:限价买入委托限价卖出委托价格(元)股数价格(元)股数13.21 6600 13.22 20013.20 3900 13.23 320013.19 1800 13.24 2400(1)此时你输入一笔限价卖出委托,要求按13.18元的价格卖出1000股,请问能否成交,成交价多少?(2)此时你输入一笔限价买进委托,要求按13.24元买进10000股,请问能成交多少股,成交价多少?未成交部分怎么办?6.3月1日,你按每股16元的价格卖空1000股Z股票。

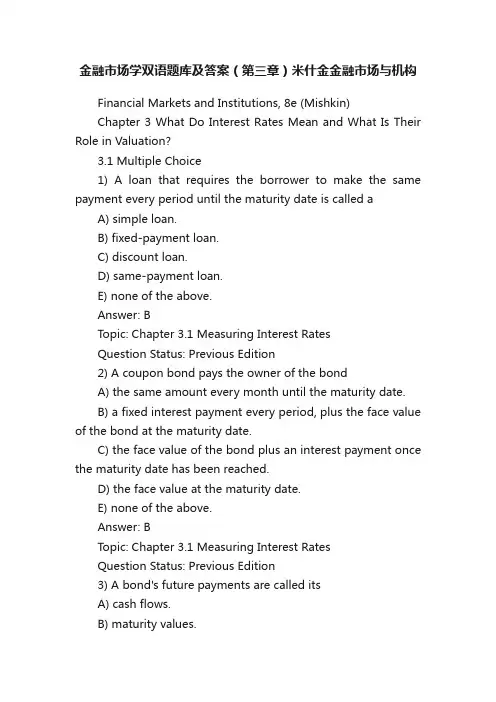

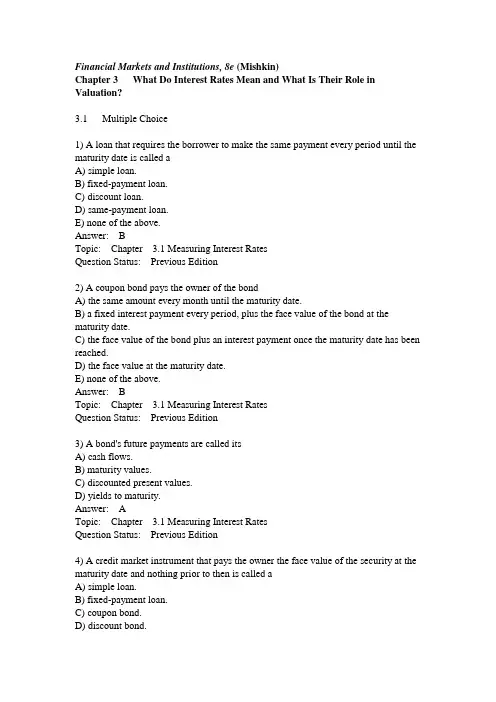

金融市场学双语题库及答案(第三章)米什金金融市场与机构Financial Markets and Institutions, 8e (Mishkin)Chapter 3 What Do Interest Rates Mean and What Is Their Role in Valuation?3.1 Multiple Choice1) A loan that requires the borrower to make the same payment every period until the maturity date is called aA) simple loan.B) fixed-payment loan.C) discount loan.D) same-payment loan.E) none of the above.Answer: BTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition2) A coupon bond pays the owner of the bondA) the same amount every month until the maturity date.B) a fixed interest payment every period, plus the face value of the bond at the maturity date.C) the face value of the bond plus an interest payment once the maturity date has been reached.D) the face value at the maturity date.E) none of the above.Answer: BTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition3) A bond's future payments are called itsA) cash flows.B) maturity values.C) discounted present values.D) yields to maturity.Answer: ATopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition4) A credit market instrument that pays the owner the face value of the security at the maturity date and nothing prior to then is called aA) simple loan.B) fixed-payment loan.C) coupon bond.D) discount bond.Answer: DTopic: Chapter 3.1 Measuring Interest Rates Question Status: Previous Edition5) (I) A simple loan requires the borrower to repay the principal at the maturity date along with an interest payment.(II) A discount bond is bought at a price below its face value, and the face value is repaid at the maturity date.A) (I) is true, (II) false.B) (I) is false, (II) true.C) Both are true.D) Both are false.Answer: CTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition6) Which of the following are true of coupon bonds?A) The owner of a coupon bond receives a fixed interest payment every year until the maturity date, when the face or par value is repaid.B) U.S. Treasury bonds and notes are examples of coupon bonds.C) Corporate bonds are examples of coupon bonds.D) All of the above.E) Only A and B of the above.Answer: DTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition7) Which of the following are generally true of all bonds?A) The longer a bond's maturity, the lower is the rate of return that occurs as a result of the increase in the interest rate.B) Even though a bond has a substantial initial interest rate, its return can turn out to be negative if interest rates rise.C) Prices and returns for long-term bonds are more volatile than those forshorter-term bonds.D) All of the above are true.E) Only A and B of the above are true.Answer: DTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition8) (I) A discount bond requires the borrower to repay the principal at the maturity date plus an interest payment.(II) A coupon bond pays the lender a fixed interest payment every year until the maturity date, when a specified final amount (face or par value) is repaid.A) (I) is true, (II) false.B) (I) is false, (II) true.C) Both are true.D) Both are false.Answer: BTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition9) If a $5,000 coupon bond has a coupon rate of 13 percent, then the coupon payment every year isA) $650.B) $1,300.C) $130.D) $13.E) None of the above.Answer: ATopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition10) An $8,000 coupon bond with a $400 annual coupon payment has a coupon rate ofA) 5 percent.B) 8 percent.C) 10 percent.D) 40 percent.Answer: ATopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition11) The concept of ________ is based on the notion that a dollar paid to you in the future is less valuable to you than a dollar today.A) present valueB) future valueC) interestD) deflationAnswer: ATopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition12) Dollars received in the future are worth ________ than dollars received today. The process of calculating what dollars received in the future are worth today is called ________.A) more; discountingB) less; discountingC) more; inflatingD) less; inflatingAnswer: BTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition13) The process of calculating what dollars received in the future are worth today is calledA) calculating the yield to maturity.B) discounting the future.C) compounding the future.D) compounding the present.Answer: BTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition14) With an interest rate of 5 percent, the present value of $100 received one year from now is approximatelyA) $100.B) $105.C) $95.D) $90.Answer: CTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition15) With an interest rate of 10 percent, the present value ofa security that pays $1,100 next year and $1,460 four years from now is approximatelyA) $1,000.B) $2,000.C) $2,560.D) $3,000.Answer: BTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition16) With an interest rate of 8 percent, the present value of $100 received one year from now is approximatelyA) $93.B) $96.C) $100.D) $108.Answer: ATopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition17) With an interest rate of 6 percent, the present value of $100 received one year from now is approximatelyA) $106.B) $100.C) $94.D) $92.Answer: CTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition18) The interest rate that equates the present value of the cash flow received from a debt instrument with its market pricetoday is theA) simple interest rate.B) discount rate.C) yield to maturity.D) real interest rate.Answer: CTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition19) The interest rate that financial economists consider to be the most accurate measure is theA) current yield.B) yield to maturity.C) yield on a discount basis.D) coupon rate.Answer: BTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition20) Financial economists consider the ________ to be the most accurate measure of interest rates.A) simple interest rateB) discount rateC) yield to maturityD) real interest rateAnswer: CTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition21) For a simple loan, the simple interest rate equals theA) real interest rate.B) nominal interest rate.C) current yield.D) yield to maturity.Answer: DTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition22) For simple loans, the simple interest rate is ________ the yield to maturity.A) greater thanB) less thanC) equal toD) not comparable toAnswer: CTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition23) The yield to maturity of a one-year, simple loan of $500 that requires an interest payment of $40 isA) 5 percent.B) 8 percent.C) 12 percent.D) 12.5 percent.Answer: BTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition24) The yield to maturity of a one-year, simple loan of $400 that requires an interest payment of $50 isA) 5 percent.B) 8 percent.C) 12 percent.D) 12.5 percent.Answer: DTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition25) A $10,000, 8 percent coupon bond that sells for $10,000 has a yield to maturity ofA) 8 percent.B) 10 percent.C) 12 percent.D) 14 percent.Answer: ATopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition26) A $10,000, 8 percent coupon bond that sells for $10,100 has a yield to maturity ________.A) equal to 8 percentB) greater than 8 percentC) less than 8 perfectD) that cannot be calculatedAnswer: CTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: New Question27) Which of the following $1,000 face value securities has the highest yield to maturity?A) A 5 percent coupon bond selling for $1,000B) A 10 percent coupon bond selling for $1,000C) A 12 percent coupon bond selling for $1,000D) A 12 percent coupon bond selling for $1,100Answer: CTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition28) Which of the following $1,000 face value securities has the highest yield to maturity?A) A 5 percent coupon bond selling for $1,000B) A 10 percent coupon bond selling for $1,000C) A 15 percent coupon bond selling for $1,000D) A 15 percent coupon bond selling for $900Answer: DTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition29) Which of the following $1,000 face value securities has the lowest yield to maturity?A) A 5 percent coupon bond selling for $1,000B) A 7 percent coupon bond selling for $1,100C) A 15 percent coupon bond selling for $1,000D) A 15 percent coupon bond selling for $900Answer: BTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: New Question30) Which of the following are true for a coupon bond?A) When the coupon bond is priced at its face value, the yield to maturity equals the coupon rate.B) The price of a coupon bond and the yield to maturity are negatively related.C) The yield to maturity is greater than the coupon rate when the bond price is below the par value.D) All of the above are true.E) Only A and B of the above are true.Answer: DTopic: Chapter 3.1 Measuring Interest Rates Question Status: Previous Edition31) Which of the following are true for a coupon bond?A) When the coupon bond is priced at its face value, the yieldto maturity equals the coupon rate.B) The price of a coupon bond and the yield to maturity are negatively related.C) The yield to maturity is greater than the coupon rate when the bond price is above the par value.D) All of the above are true.E) Only A and B of the above are true.Answer: ETopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition32) Which of the following are true for a coupon bond?A) When the coupon bond is priced at its face value, the yield to maturity equals the coupon rate.B) The price of a coupon bond and the yield to maturity are positively related.C) The yield to maturity is greater than the coupon rate when the bond price is above the par value.D) All of the above are true.E) Only A and B of the above are true.Answer: ATopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition33) A consol bond is a bond thatA) pays interest annually and its face value at maturity.B) pays interest in perpetuity and never matures.C) pays no interest but pays its face value at maturity.D) rises in value as its yield to maturity rises.Answer: BTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition34) The yield to maturity on a consol bond that pays $100 yearly and sells for $500 isA) 5 percent.B) 10 percent.C) 12.5 percent.D) 20 percent.E) 25 percent.Answer: DTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition35) The yield to maturity on a consol bond that pays $200 yearly and sells for $1000 isA) 5 percent.B) 10 percent.C) 20 percent.D) 25 percent.Answer: CTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition36) A frequently used approximation for the yield to maturity on a long-term bond is theA) coupon rate.B) current yield.C) cash flow interest rate.D) real interest rate.Answer: BTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition37) The current yield on a coupon bond is the bond's ________ divided by its________.A) annual coupon payment; priceB) annual coupon payment; face valueC) annual return; priceD) annual return; face valueAnswer: ATopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition38) When a bond's price falls, its yield to maturity ________ and its current yield________.A) falls; fallsB) rises; risesC) falls; risesD) rises; fallsAnswer: BTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition39) The yield to maturity for a one-year discount bond equalsA) the increase in price over the year, divided by the initial price.B) the increase in price over the year, divided by the face value.C) the increase in price over the year, divided by the interest rate.D) none of the above.Answer: ATopic: Chapter 3.1 Measuring Interest Rates Question Status: Previous Edition40) If a $10,000 face value discount bond maturing in oneyear is selling for $8,000, then its yield to maturity isA) 10 percent.B) 20 percent.C) 25 percent.D) 40 percent.Answer: CTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition41) If a $10,000 face value discount bond maturing in one year is selling for $9,000, then its yield to maturity is approximatelyA) 9 percent.B) 10 percent.C) 11 percent.D) 12 percent.Answer: CTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition42) If a $10,000 face value discount bond maturing in one year is selling for $5,000, then its yield to maturity isA) 5 percent.B) 10 percent.C) 50 percent.D) 100 percent.Answer: DTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition43) If a $5,000 face value discount bond maturing in one year is selling for $5,000, then its yield to maturity isA) 0 percent.B) 5 percent.C) 10 percent.D) 20 percent.Answer: ATopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition44) The Fisher equation states thatA) the nominal interest rate equals the real interest rate plus the expected rate of inflation.B) the real interest rate equals the nominal interest rate less the expected rate of inflation.C) the nominal interest rate equals the real interest rate less the expected rate of inflation.D) both A and B of the above are true.E) both A and C of the above are true.Answer: DTopic: Chapter 3.2 Distinction Between Real and Nominal Interest Rates Question Status: Previous Edition45) If you expect the inflation rate to be 15 percent next year and a one-year bond hasa yield to maturity of 7 percent, then the real interest rate on this bond isA) 7 percent.B) 22 percent.C) -15 percent.D) -8 percent.E) none of the above.Answer: DTopic: Chapter 3.2 Distinction Between Real and Nominal Interest Rates Question Status: Previous Edition46) If you expect the inflation rate to be 5 percent next year and a one-year bond has a yield to maturity of 7 percent, then the real interest rate on this bond isA) -12 percent.B) -2 percent.C) 2 percent.D) 12 percent.Answer: CTopic: Chapter 3.2 Distinction Between Real and Nominal Interest Rates Question Status: Previous Edition47) The nominal interest rate minus the expected rate of inflationA) defines the real interest rate.B) is a better measure of the incentives to borrow and lend than the nominal interest rate.C) is a more accurate indicator of the tightness of credit market conditions than the nominal interest rate.D) all of the above.E) only A and B of the above.Answer: DTopic: Chapter 3.2 Distinction Between Real and Nominal Interest RatesQuestion Status: Previous Edition48) The nominal interest rate minus the expected rate of inflationA) defines the real interest rate.B) is a less accurate measure of the incentives to borrow and lend than is the nominal interest rate.C) is a less accurate indicator of the tightness of credit market conditions than is the nominal interest rate.D) defines the discount rate.Answer: ATopic: Chapter 3.2 Distinction Between Real and Nominal Interest Rates Question Status: Previous Edition49) In which of the following situations would you prefer to be making a loan?A) The interest rate is 9 percent and the expected inflation rate is 7 percent.B) The interest rate is 4 percent and the expected inflation rate is 1 percent.C) The interest rate is 13 percent and the expected inflation rate is 15 percent.D) The interest rate is 25 percent and the expected inflation rate is 50 percent. Answer: BTopic: Chapter 3.2 Distinction Between Real and Nominal Interest Rates Question Status: Previous Edition50) In which of the following situations would you prefer to be borrowing?A) The interest rate is 9 percent and the expected inflation rate is 7 percent.B) The interest rate is 4 percent and the expected inflation rate is 1 percent.C) The interest rate is 13 percent and the expected inflation rate is 15 percent.D) The interest rate is 25 percent and the expected inflation rate is 50 percent. Answer: DTopic: Chapter 3.2 Distinction Between Real and Nominal Interest Rates Question Status: Previous Edition51) What is the return on a 5 percent coupon bond that initially sells for $1,000 and sells for $1,200 one year later?A) 5 percentB) 10 percentC) -5 percentD) 25 percentE) None of the aboveAnswer: DTopic: Chapter 3.3 Distinction Between Interest Rates and ReturnsQuestion Status: Previous Edition52) What is the return on a 5 percent coupon bond that initially sells for $1,000 and sells for $900 one year later?A) 5 percentB) 10 percentC) -5 percentD) -10 percentE) None of the aboveAnswer: CTopic: Chapter 3.3 Distinction Between Interest Rates and ReturnsQuestion Status: Previous Edition53) The return on a 5 percent coupon bond that initially sells for $1,000 and sells for $1,100 one year later isA) 5 percent.B) 10 percent.C) 14 percent.D) 15 percent.Answer: DTopic: Chapter 3.3 Distinction Between Interest Rates and ReturnsQuestion Status: Previous Edition54) The return on a 10 percent coupon bond that initially sells for $1,000 and sells for $900 one year later isA) -10 percent.B) -5 percent.C) 0 percent.D) 5 percent.Answer: CTopic: Chapter 3.3 Distinction Between Interest Rates and ReturnsQuestion Status: Previous Edition55) Which of the following are generally true of all bonds?A) The only bond whose return equals the initial yield to maturity is one whose time to maturity is the same as the holding period.B) A rise in interest rates is associated with a fall in bond prices, resulting in capital losses on bonds whose term to maturities are longer than the holding period.C) The longer a bond's maturity, the greater is the price change associated with a given interest rate change.D) All of the above are true.E) Only A and B of the above are true.Answer: DTopic: Chapter 3.3 Distinction Between Interest Rates and ReturnsQuestion Status: Previous Edition56) Which of the following are true concerning the distinction between interest rates and return?A) The rate of return on a bond will not necessarily equal the interest rate on that bond.B) The return can be expressed as the sum of the current yieldand the rate of capital gains.C) The rate of return will be greater than the interest rate when the price of the bond falls between time t and time t + 1.D) All of the above are true.E) Only A and B of the above are true.Answer: ETopic: Chapter 3.3 Distinction Between Interest Rates and ReturnsQuestion Status: Previous Edition57) If the interest rates on all bonds rise from 5 to 6 percent over the course of the year, which bond would you prefer to have been holding?A) A bond with one year to maturityB) A bond with five years to maturityC) A bond with ten years to maturityD) A bond with twenty years to maturityAnswer: ATopic: Chapter 3.3 Distinction Between Interest Rates and ReturnsQuestion Status: Previous Edition58) Suppose you are holding a 5 percent coupon bond maturing in one year with a yield to maturity of 15 percent. If the interest rate on one-year bonds rises from 15 percent to 20 percent over the course of the year, what is the yearly return on the bond you are holding?A) 5 percentB) 10 percentC) 15 percentD) 20 percentAnswer: CTopic: Chapter 3.3 Distinction Between Interest Rates and ReturnsQuestion Status: Previous Edition59) (I) Prices of longer-maturity bonds respond more dramatically to changes in interest rates.(II) Prices and returns for long-term bonds are less volatile than those for short-term bonds.A) (I) is true, (II) false.B) (I) is false, (II) true.C) Both are true.D) Both are false.Answer: A。

第三章习题:1.X股票目前的市价为每股20元,你卖空1 000股该股票。

请问:(1)你的最大可能损失是多少?(2)如果你同时向经纪人发出了停止损失买入委托,指定价格为22元,那么你的最大可能损失又是多少?2.下表是纽约证交所某专家的限价委托簿:(1)如果此时有一市价委托,要求买入200股,请问按什么价格成交?(2)下一个市价买进委托将按什么价格成交?(3)如果你是专家,你会增加或减少该股票的存货?3.假设A公司股票目前的市价为每股20元。

你用15 000元自有资金加上从经纪人借入的5000元保证金贷款买了1000股A股票。

贷款年利率为6%。

(1)如果A股票价格立即变为①22元,②20元,③18元,你在经纪人账户上的净值会变动多少百分比?(2)如果维持保证金比率为25%,A股票价格可以跌到多少你才会收到追缴保证金通知?(3)如果你在购买时只用了10 000元自有资金,那么第(2)题的答案会有何变化?(4)假设该公司未支付现金红利。

一年以后,若A股票价格变为:①22元,②20元,③18元,你的投资收益率是多少?你的投资收益率与该股票股价变动的百分比有何关系?4.假设B公司股票目前市价为每股20元,你在你的经纪人保证金账户中存入15000元并卖空1000股该股票。

你的保证金账户上的资金不生息。

(1)如果该股票不付现金红利,则当一年后该股票价格变为22元、20元和18元时,你的投资收益率是多少?(2)如果维持保证金比率为25%,当该股票价格升到什么价位时你会收到追缴保证金通知?(3)若该公司在一年内每股支付了0.5元现金红利,(1)和(2)题的答案会有什么变化?5.下表是2002年7月5日某时刻上海证券交易所厦门建发的委托情况:成交,成交价多少?(2)此时你输入一笔限价买进委托,要求按13.24元买进10000股,请问能成交多少股,成交价多少?未成交部分怎么办?6.3月1日,你按每股16元的价格卖空1000股Z股票。

第一章本章小结1.金融市场是指以金融资产为交易对象而形成的供求关系及其机制的总和。

2.金融市场可以按多种方式进行分类,其中最常用的是按交易的标的物划分为货币市场、资本市场、外汇市场和黄金市场。

3.金融市场的主体有筹资者、投资者(投机者)、套期保值者、套利者和监管者。

4.金融市场在经济系统中具有聚敛功能、配置功能、调节功能和反映功能。

5.资产证券化、金融全球化、金融自由化和金融工程化是金融市场的发展趋势。

本章重要概念金融市场金融资产金融工具套期保值者套利者投资者投机者货币市场资本市场外汇市场直接金融市场间接金融市场初级市场二级市场第三市场第四市场公开市场议价市场有形市场无形市场现货市场衍生市场资产证券化金融全球化金融自由化金融工程化思考题:1.什么是金融市场,其含义可包括几个层次?2.从金融市场在储蓄一投资转化机制中的重要作用这一角度理解“金融是现代经济的核心”。

3.金融市场有哪些分类,哪些主体?4.理解金融市场的经济功能,其聚敛功能、配置功能、调节功能和反映功能各表现在哪些方面?5.结合实际经济生活把握金融市场的四大发展趋势:资产证券化、金融全球化、金融自由化和金融工程化。

第二章本章重要概念同业拆借市场回购协议逆回购协议商业票据银行承兑票据大额可转让定期存单政府债券货币市场共同基金思考题:1.货币市场的界定标准是什么?它包括哪些子市场?2.同业拆借市场的主要参与者、交易对象及利率形成机制?3.回购市场的交易原理,及其与同业拆借市场的区别?4.商业票据市场和银行承兑票据市场的联系和区别?5.大额存单市场是如何产生的,有哪些特征?6.为什么国库券市场具有明显的投资特征?7.了解货币市场共同基金的动作及其特征。

第三章简短小结1.资本市场通常由股票市场、债券市场和投资基金三个子市场构成。

2.股票是投资者向公司提供资金的权益合同,是公司的所有权凭证,按剩余索取权和剩余控制权的不同有不同种类的股票,最基本的分类是普通股和优先股。

金融市场学试题及答案第一章金融市场概论名词解释1.货币市场:指以期限在1年以内的金融工具为交易对象的短期金融市场。

其主要功能是保持金融工具的流动性,以便随时将金融工具转换成现实的货币。

2.资本市场:是指以期限在1年以上的金融工具为交易对象的中长期金融市场。

一般来说,资本市场包括两个部分:一是银行中长期存贷款市场,二是有价证券市场。

但人们通常将资本市场等同于证券市场。

3.保险市场:是指从事因意外灾害事故所造成的财产和人身损失的补偿,以保险单和年金单的发行和转让为交易对象的、一种特殊形式的金融市场。

4.金融衍生工具:是在原生金融工具基础上派生出来的金融工具,包括金融期货、金融期权、金融互换、金融远期等。

衍生金融工具的价格以原生金融工具的价格为基础,主要功能在于管理与原生金融工具紧密相关的金融风险。

5.完美市场:是指在这个市场上进行交易的成本接近或等于零,所有的市场参与者都是价格的接受者。

在这个市场上,任何力量都不对金融工具的交易及其价格进行干预和控制,任由交易双方通过自由竞争决定交易的所有条件。

单项选择题1.金融市场被称为国民经济的“晴雨表”,这实际上指的就是金融市场的(D)。

A•分配功能B•财富功能C•流动性功能D.反映功能2.金融市场的宏观经济功能不包括(B)。

A•分配功能B•财富功能C•调节功能D.反映功能3.金融市场的配置功能不表现在(C)方面。

A.资源的配置B.财富的再分配C.信息的再分配D.风险的再分配4.金融工具的收益有两种形式,其中下列哪项收益形式与其他几项不同(D)。

A.利息B.股息C.红利D.资本利得5.一般来说,(B)不影响金融工具的安全性。

A.发行人的信用状况B.金融工具的收益大小C.发行人的经营状况D.金融工具本身的设计6.金融市场按(D)划分为货币市场、资本市场、外汇市场、保险市场、衍生金融市场。

A.交易范围B.交易方式C.定价方式D.交易对象7.(B)是货币市场区别于其他市场的重要特征之一。

1. 假设你发现一只装有100万元的宝箱。

(答:A、这是金融资产B、整个社会的实物资产不会因为这个发现而增加C、因为得到这笔资金我会变得更富有D、金融资产代表了实物资产的要求权,当宝箱的发现者要求获得更多实物资产时,社会上其他人能获得的实物资产就变少了)2. 与产品市场及其他要素市场比较,金融市场有哪些主要特点?(答:(1)商品特殊性:以货币和资本为交易对象(2)交易活动集中性:通常在交易所集中进行(3)主体角色的可变性:参与主体在金融市场上可以既是资金供给者又是资金需求者(4)金融市场可以是有形市场,也可以是无形市场)3. 什么是金融工具的流动性?它对金融市场有何重要意义?(答:金融工具的流动性是指金融资产能够以一个合理的价格顺利变现的能力流动性对金融市场的意义:与一般商品不同,金融资产往往不具备特定的物质属性。

金融资产持有者主要关心持有期间所能获得的收益及其面临的风险,因而金融资产的流动性(转手买卖的难易度)成为投资者关心的重点。

流动性好的市场通常被认为是能够提供交易而且对价格影响较小的市场,除了能够增强交易者的信心,而且还能够抵御外部冲击,从而降低系统风险。

市场流动性的增强不仅保证了金融市场的正常运转,也促进了资源有效配置和经济增长。

)4. 什么是资产证券化?如何理解资产证券化对金融市场的影响?(答:资产证券化是以特定资产组合或特定现金流为支持,发行可交易证券的一种融资形式。

其对金融市场的影响主要表现在以下几个方面:(1)增强资产流动性(2)降低融资成本(3)减少风险资产,提高资产质量(4)资产担保类证券提供了比政府担保债券更高的收益(5)资产证券化为投资者提供了多样化的投资品种)5. 结合实际分析:金融全球化对中国的积极与消极影响。

(答:积极影响:(1)金融全球化有利于中国从国际市场引入外资(2)金融全球化有利于中国学习发达国家金融运作的先进经验(3)金融全球化有利于中国金融机构参与世界竞争消极影响:(1)金融全球化使中国本土金融机构的生存面临巨大压力(2)金融全球化为国际游资攻击中国金融市场提供了条件(3)金融全球化加剧了中国经济的泡沫化程度(4)金融全球化给中国的金融监管和调控带来挑战)6. 简述金融机构在金融市场上的特殊地位。

金融市场学课程作业答案1(第一章至第三章)一、名词解释1.所谓衍生金融工具:是在原生金融工具基础上派生出来的金融工具,包括金融期货、金融期权、金融互换、金融远期等。

衍生金融工具的价格以原生金融工具的价格为基础,主要功能在于管理与原生金融工具紧密相关的金融风险。

2.所谓完美市场:是指在这个市场上进行交易的成本接近或等于零,所有的市场参与者都是价格的接受者。

在这个市场上,任何力量都不对金融工具的交易及其价格进行干预煳控制,任由交易双方通过自由竞争决定交易的所有条件。

3.货币经纪人:又称货币市场经纪人,即在货币市场社翡当交易双方中介并收取佣金的中间商人。

货币市场经纪人具体包括货币中间商、票据经纪人煳短期证券经纪人。

4.票据:是指出票人自己承诺或委托付款人,在指定日期或见票时,无条件支付一定金额并可流通转让的有价证券。

票据是国际通用的信用煳结算工具,它由苴体现债权债务关系并具有流动性,是货币市场的交易工具。

5.债券:是债务人在筹集资金时,依照法律手续发行,向债权人承诺按约 利率煳日期支付利息,并在特定日期偿还本金,从而明确债权债务关系的有价证券。

它是资本市场上主要的交易工具。

面值、利率煳偿还期限是债券的要素。

6.基金证券:又称投资基金证券,是指由投资基金发起人向社会公众公开发行,证明持有人按其所持份额享有资产所有权、资产收益权煳剩余财产分配权的有价证券。

二、单项选择题1.D2.B3.B4.A5.C6.B7.B8.D9.A 10.C 11.C 12.B 13.A 14.C 15.B三、多项选择题1.ACD2.ABCE3.ABCD4.ABCD5.ABD6.BCD7.ABCD8.ACD9.ABCD 10.BCD 11.ACD 12.DE 13.ABC 14.ABCDE 15.ABCDE四、判断题1.Χ(价格机制) 2.Χ(反映功能)3.√ 4.Χ(资本市场) 5.Χ(交割) 6.Χ(不需要) 7.Χ(初极市场)8.√ 9.Χ(互为消长)10.√ 11.Χ(居间经纪人) 12.Χ(商业票据煳银行票据) 13.Χ(本票无需承兑) 14.Χ(股票除外) 15.Χ(普通股)五、简答题1.金融市场通常是指以市场方式买卖金融工具的场所。

1. 假设你发现一只装有100万元的宝箱。

(答:A、这是金融资产B、整个社会的实物资产不会因为这个发现而增加C、因为得到这笔资金我会变得更富有D、金融资产代表了实物资产的要求权,当宝箱的发现者要求获得更多实物资产时,社会上其他人能获得的实物资产就变少了)2. 与产品市场及其他要素市场比较,金融市场有哪些主要特点?(答:(1)商品特殊性:以货币和资本为交易对象(2)交易活动集中性:通常在交易所集中进行(3)主体角色的可变性:参与主体在金融市场上可以既是资金供给者又是资金需求者(4)金融市场可以是有形市场,也可以是无形市场)3. 什么是金融工具的流动性?它对金融市场有何重要意义?(答:金融工具的流动性是指金融资产能够以一个合理的价格顺利变现的能力流动性对金融市场的意义:与一般商品不同,金融资产往往不具备特定的物质属性。

金融资产持有者主要关心持有期间所能获得的收益及其面临的风险,因而金融资产的流动性(转手买卖的难易度)成为投资者关心的重点。

流动性好的市场通常被认为是能够提供交易而且对价格影响较小的市场,除了能够增强交易者的信心,而且还能够抵御外部冲击,从而降低系统风险。

市场流动性的增强不仅保证了金融市场的正常运转,也促进了资源有效配置和经济增长。

)4. 什么是资产证券化?如何理解资产证券化对金融市场的影响?(答:资产证券化是以特定资产组合或特定现金流为支持,发行可交易证券的一种融资形式。

其对金融市场的影响主要表现在以下几个方面:(1)增强资产流动性(2)降低融资成本(3)减少风险资产,提高资产质量(4)资产担保类证券提供了比政府担保债券更高的收益(5)资产证券化为投资者提供了多样化的投资品种)5. 结合实际分析:金融全球化对中国的积极与消极影响。

(答:积极影响:(1)金融全球化有利于中国从国际市场引入外资(2)金融全球化有利于中国学习发达国家金融运作的先进经验(3)金融全球化有利于中国金融机构参与世界竞争消极影响:(1)金融全球化使中国本土金融机构的生存面临巨大压力(2)金融全球化为国际游资攻击中国金融市场提供了条件(3)金融全球化加剧了中国经济的泡沫化程度(4)金融全球化给中国的金融监管和调控带来挑战)6. 简述金融机构在金融市场上的特殊地位。

《金融市场学》作业参考答案第一章基本训练三、单项选择题1、金融市场的客体是指金融市场的( A )。

A.金融工具B.金融中介机构C.金融市场的交易者D.金融市场价格2、现货市场的实际交割一般在成交后( A )内进行。

A.2日B.5日C.1周D.1月3、下列属于所有权凭证的金融工具是( C )。

A.商业票据B.企业债券C.股票D.可转让大额定期存单4、在金融市场发达国家,许多未上市的证券或者不足一个成交批量的证券,也可以在市场进行交易,人们习惯于把这种市场称之为( A )。

A.店头市场B.议价市场C.公开市场D.第四市场5、企业是经济活动的中心,因此也是金融市场运行的( B )。

A.中心B.基础C.枢纽D.核心6、世界上最早的证券交易所是( A )。

A.荷兰阿姆斯特丹证券交易所B.英国伦敦证券交易所C.德国法兰克福证券交易所D.美国纽约证券交易所7、专门融通一年以内短期资金的场所称之为( A )。

A.货币市场B.资本市场C.现货市场D.期货市场8、旧证券流通的市场称之为( B )。

A.初级市场B.次级市场C.公开市场D.议价市场四、多项选择题1、下面( BCD )属于金融衍生工具的交易种类。

A.现货交易B.期货交易C.期权交易D.股票指数交易E.贴现交易2、金融市场的参与者包括( ABCDE )。

A.居民个人B.商业性金融机构C.中央银行D.企业E.政府3、下列金融工具中,没有偿还期的有( AE )。

A.永久性债券B.银行定期存款C.商业票据D.CD单E.股票4、机构投资者一般主要包括( ABCDE )。

A.共同基金B.保险公司C.信托投资公司D.养老金基金E.投资银行5、货币市场具有( ACD )的特点。

A.交易期限短B.资金借贷量大C.流动性强D.风险相对较低E.交易工具收益较高而流动性差6、资本市场的特点是( ABD )。

A.金融工具期限长 B.资金借贷量大C.流动性强D.为解决长期投资性资金的供求需要E.交易工具有一定的风险性和投机性7、金融工具一般具有的特征:( BCDE )。

金融市场基础知识第三章证券市场主体第一节证券发行人1 [单选题] 下列属于直接融资方式的是()。

A.抵押贷款B. 发行债券C. 银团贷款D. 银行贷款正确答案:B公司直接融资活动主要由股票融资和债券融资两种方式2 [单选题] 中国人民银行于()年开始发行中央银行票据。

A. 2001B. 2003C. 2005D. 2007正确答案:B中国人民银行于2003年开始发行中央银行票据。

3 [单选题] 在上市公司增资发行的方式中,()是股份公司向不特定对象公开募集股份的增资方式。

A.公开增发B.定向增发C.发行可转换公司债券D.配股正确答案: A在上市公司增资发行的方式中,公开增发是股份公司向不特定对象公开募集股份的增资方式。

4 [单选题] 增发是股份公司向不特定对象公开募集股份的增资方式,其目的主要有()。

Ⅰ向社会公众募集资金Ⅱ扩大股东人数Ⅲ增加股票的流动性Ⅳ分散股权,避免股份过分集中A.Ⅰ、Ⅱ、ⅣB.Ⅱ、ⅢC.Ⅰ、Ⅲ、ⅣD.Ⅰ、Ⅱ、Ⅲ、Ⅳ正确答案: D向不特定对象公开募集股份,简称增发,是股份公司向不特定对象公开募集股份的增资方式。

增发的目的是向社会公众募集资金,扩大股东人数,分散股权,增强股票的流通性,并可避免股份过分集中。

第Ⅰ、Ⅱ、Ⅲ、Ⅳ均正确,故选D。

5 [单选题] 与直接融资相比,间接融资的优势有()。

Ⅰ受公平原则的约束,有助于市场竞争,资源优化配置Ⅱ通过发行长期债券和发行股票,有利于筹集稳定的、可以长期使用的投资资金Ⅲ有利于降低信息成本和合约成本Ⅳ保密性较强A.Ⅱ、ⅣB.Ⅲ、ⅣC.Ⅱ、ⅢD.Ⅰ、Ⅲ、Ⅳ正确答案: B间接融资的优势有:Ⅰ银行等金融机构网点多,吸收存款的起点低,能够广泛筹集社会各方面闲散资金,积少成多,形成巨额资金,容易实现资金供求期限和数量的匹配;Ⅱ有利于降低信息成本和合约成本;Ⅲ由于金融机构的资产、负债是多样化的,融资风险便可由多样化的资产和负债结构分散承担,有利于通过分散化来降低金融风险;Ⅳ间接融资(银行体系)具有货币创造功能,对经济增长有切实的促进作用;Ⅴ授信额度可以使企业的流动资金需要及时方便地获得解决;Ⅵ保密性较强。

金融市场学第三章选择题您的姓名: [填空题] *_________________________________1. 商业银行向中央银行所作的票据转让行为是()。

[单选题] *A.贴现B.承兑C.转贴现D.再贴现(正确答案)答案解析:再贴现是指在中央银行开立账户的银行在需要资金时,将其持有的贴现收进的未到期的票据转让给中央银行以进行资金融通的行为。

2. 下列属于票据市场的基本功能是()。

[单选题] *A.实现债权流通B.反映市场利率C.融通短期资金(正确答案)D.传导货币政策答案解析:票据市场是以票据为交易媒介进行资金融通、资源配置的市场,其具有融通短期资金、实现债权流通、反映市场利率信息及中央银行通过票据再贴现政策传导货币政策等多种功能。

其基本功能是融通短期资金。

3. 银行承兑汇票特征的有()。

*A.安全性强(正确答案)B.流动性强(正确答案)C.流动性弱D.无追索权E.有追索权(正确答案)答案解析:银行承兑汇票的特征:安全性强、流动性大、灵活性好、有追索权。

4. 投资者以97美元的折扣价格购买期限为180天,面值为100美元的商业票据,其贴现率为()。

[单选题] *A.1%B.2%C.6%(正确答案)D.4%答案解析:贴现利息=面额-发行价格=100-97=3美元,贴现率=(贴现利息/面额)×360/期限×100%=(3/100)×360/180×100%=6%。

5. 下列选项中属于短期融资券融资优势的是()。

*A.融资成本低(正确答案)B.融资成本高C.融资方式灵活(正确答案)D.发行便利(正确答案)E.可以持续融资(正确答案)答案解析:短期融资券的融资优势有:(1)融资成本低;(2)融资方式灵活;(3)发行便利且可以持续融资。

6. 根据《票据法》规定,票据分为()。

[单选题] *A.汇票和本票B.汇票和支票C.支票和本票D.汇票、本票和支票(正确答案)答案解析:根据《票据法》规定,票据分为汇票、本票和支票。

第三章资本市场习题解答:1.(1)从理论上说,可能的损失是无限的,损失的金额随着X股票价格的上升而增加。

(2)当股价上升超过22元时,停止损失买进委托就会变成市价买进委托,因此最大损失就是2 000元左右。

2.(1)该委托将按最有利的限价卖出委托价格,即40.25美元成交。

(2)下一个市价买进委托将按41.50美元成交。

(3)我将增加该股票的存货。

因为该股票在40美元以下有较多的买盘,意味着下跌风险较小。

相反,卖压较轻。

3.你原来在账户上的净值为15 000元。

(1)若股价升到22元,则净值增加2000元,上升了13.33%;若股价维持在20元,则净值不变;若股价跌到18元,则净值减少2000元,下降了13.33%。

(2)令经纪人发出追缴保证金通知时的价位为X,则X满足下式:(1000X-5000)/1000X=25%所以X=6.67元。

(3)此时X要满足下式:(1000X-10000)/1000X=25%所以X=13.33元。

(4)一年以后保证金贷款的本息和为5000×1.06=5300元。

若股价升到22元,则投资收益率为:(1000×22-5300-15000)/15000=11.33%若股价维持在20元,则投资收益率为:(1000×20-5300-15000)/15000=-2%若股价跌到18元,则投资收益率为:(1000×18-5300-15000)/15000=-15.33%投资收益率与股价变动的百分比的关系如下:投资收益率=股价变动率×投资总额/投资者原有净值-利率×所借资金/投资者原有净值4.你原来在账户上的净值为15 000元。

(1)若股价升到22元,则净值减少2000元,投资收益率为-13.33%;若股价维持在20元,则净值不变,投资收益率为0;若股价跌到18元,则净值增加2000元,投资收益率为13.33%。

(2)令经纪人发出追缴保证金通知时的价位为Y,则Y满足下式:(15000+20000-1000X)/1000X=25%所以Y=28元。

习题三答案

1.(1)从理论上说,可能的损失是无限的,损失的金额随着X股票价格的上升而增加。

(2)当股价上升超过22元时,停止损失买进委托就会变成市价买进委托,因此最大损失就是2 000元左右。

2.(1)该委托将按最有利的限价卖出委托价格,即40.25美元成交。

(2)下一个市价买进委托将按41.50美元成交。

(3)我将增加该股票的存货。

因为该股票在40美元以下有较多的买盘,意味着下跌风险较小。

相反,卖压较轻。

3.你原来在账户上的净值为15 000元。

若股价升到22元,则净值增加2000元,上升了13.33%;

若股价维持在20元,则净值不变;

若股价跌到18元,则净值减少2000元,下降了13.33%。

令经纪人发出追缴保证金通知时的价位为X,则X满足下式:

(1000X-5000)/1000X=25%

所以X=6.67元。

此时X要满足下式:

(1000X-10000)/1000X=25%

所以X=13.33元。

一年以后保证金贷款的本息和为5000×1.06=5300元。

若股价升到22元,则投资收益率为:

(1000×22-5300-15000)/15000=11.33%

若股价维持在20元,则投资收益率为:

(1000×20-5300-15000)/15000=-2%

若股价跌到18元,则投资收益率为:

(1000×18-5300-15000)/15000=-15.33%

投资收益率与股价变动的百分比的关系如下:

投资收益率=股价变动率×投资总额/投资者原有净值-利率×所借资金/投资者原有净值

4.你原来在账户上的净值为15 000元。

(1)若股价升到22元,则净值减少2000元,投资收益率为-13.33%;

若股价维持在20元,则净值不变,投资收益率为0;

若股价跌到18元,则净值增加2000元,投资收益率为13.33%。

(2)令经纪人发出追缴保证金通知时的价位为Y,则Y满足下式:

(15000+20000-1000X)/1000X=25%

所以Y=28元。

(3)当每股现金红利为0.5元时,你要支付500元给股票的所有者。

这样第(1)题的收益率分别变为-16.67%、-3.33%和10.00%。

Y则要满足下式:

(15000+20000-1000X-500)/1000X=25%

所以Y=27.60元。

5.(1)可以成交,成交价为13.21元。

(2)能成交5800股,其中200股成交价为13.22元,3200股成交价为13.23元,2400股成交价格为13.24元。

其余4200股未成交部分按13.24元的价格作为限价买进委托排队等待新的委托。

6.你卖空的净所得为16×1000-0.3×1000=15700元,支付现金红利1000元,买回股票花了

12×1000+0.3×1000=12300元。

所以你赚了15700-1000-12300=2400元。

7.令3个月和6个月国库券的年收益率分别为r3和r6,则

1+r3=(100/97.64)4=1.1002

1+r6=(100/95.39)2=1.0990

求得r3=10.02%,r6=9.90%。

所以3个月国库券的年收益率较高。

8.(1)0时刻股价平均数为(18+10+20)/3=16,1时刻为(19+9+22)/3=16.67,股价平均数上升了4.17%。

(2)若没有分割,则C股票价格将是22元,股价平均数将是16.67元。

分割后,3只股票的股价总额为(19+9+11)=39,因此除数应等于39/16.67=2.34。

(3)变动率为0。

9.(1)拉斯拜尔指数=(19×1000+9×2000+11×2000)/(19×1000+9×2000+22×2000)=0.7284 因此该指数跌了27.16%。

(2)派许指数=(19×1000+9×2000+11×4000)/(19×1000+9×2000+22×4000)=0.648

因此该指数变动率为35.2%。

10. (1)息票率高的国债;

(2)贴现率低的国库券。