《财务管理学》第七章作业及答案

- 格式:doc

- 大小:43.50 KB

- 文档页数:5

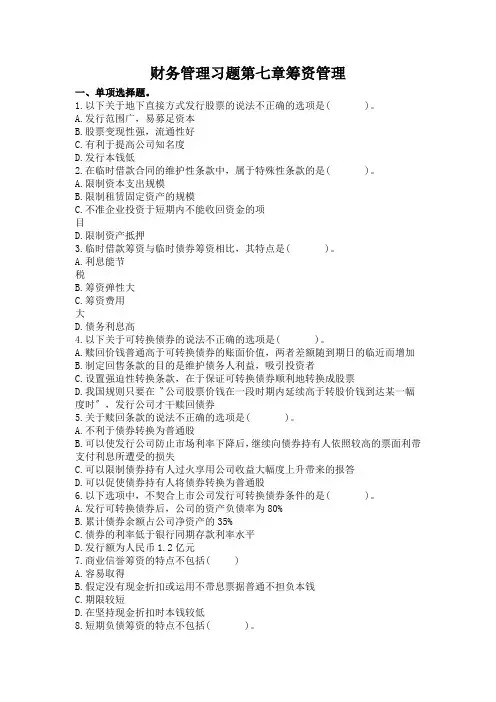

财务管理习题第七章筹资管理一、单项选择题。

1.以下关于地下直接方式发行股票的说法不正确的选项是( )。

A.发行范围广,易募足资本B.股票变现性强,流通性好C.有利于提高公司知名度D.发行本钱低2.在临时借款合同的维护性条款中,属于特殊性条款的是( )。

A.限制资本支出规模B.限制租赁固定资产的规模C.不准企业投资于短期内不能收回资金的项目D.限制资产抵押3.临时借款筹资与临时债券筹资相比,其特点是( )。

A.利息能节税B.筹资弹性大C.筹资费用大D.债务利息高4.以下关于可转换债券的说法不正确的选项是( )。

A.赎回价钱普通高于可转换债券的账面价值,两者差额随到期日的临近而增加B.制定回售条款的目的是维护债务人利益,吸引投资者C.设置强迫性转换条款,在于保证可转换债券顺利地转换成股票D.我国规则只要在〝公司股票价钱在一段时期内延续高于转股价钱到达某一幅度时〞,发行公司才干赎回债券5.关于赎回条款的说法不正确的选项是( )。

A.不利于债券转换为普通股B.可以使发行公司防止市场利率下降后,继续向债券持有人依照较高的票面利带支付利息所遭受的损失C.可以限制债券持有人过火享用公司收益大幅度上升带来的报答D.可以促使债券持有人将债券转换为普通股6.以下选项中,不契合上市公司发行可转换债券条件的是( )。

A.发行可转换债券后,公司的资产负债率为80%B.累计债券余额占公司净资产的35%C.债券的利率低于银行同期存款利率水平D.发行额为人民币1.2亿元7.商业信誉筹资的特点不包括( )A.容易取得B.假定没有现金折扣或运用不带息票据普通不担负本钱C.期限较短D.在坚持现金折扣时本钱较低8.短期负债筹资的特点不包括( )。

A.筹资速度快,容易取得B.筹资富有弹性C.筹资本钱较低D.筹资风险较低9.企业从银行借入短期借款,不会招致实践利率高于名义利率的利息支付方式是( )。

A.收款法B.贴现法C.加息法D.分期等额归还本利和的方法10.以下有关抵押借款和无抵押借款的说法不正确的选项是( )。

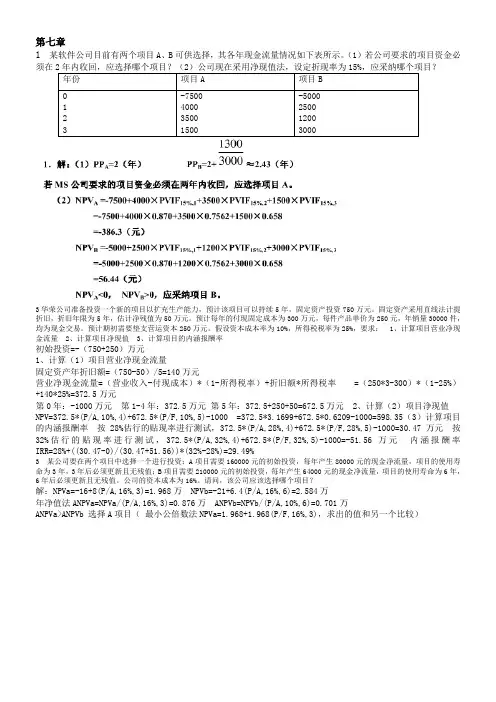

第七章1某软件公司目前有两个项目A、B可供选择,其各年现金流量情况如下表所示。

(1)若公司要求的项目资金必须在2年内收回,应选择哪个项目?(2)公司现在采用净现值法,设定折现率为15%,应采纳哪个项目?年份项目A 项目B0 1 2 3 -7500400035001500-50002500120030003华荣公司准备投资一个新的项目以扩充生产能力,预计该项目可以持续5年,固定资产投资750万元。

固定资产采用直线法计提折旧,折旧年限为5年,估计净残值为50万元。

预计每年的付现固定成本为300万元,每件产品单价为250元,年销量30000件,均为现金交易。

预计期初需要垫支营运资本250万元。

假设资本成本率为10%,所得税税率为25%,要求:1、计算项目营业净现金流量2、计算项目净现值3、计算项目的内涵报酬率初始投资=-(750+250)万元1、计算(1)项目营业净现金流量固定资产年折旧额=(750-50)/5=140万元营业净现金流量=(营业收入-付现成本)*(1-所得税率)+折旧额*所得税率=(250*3-300)*(1-25%)+140*25%=372.5万元第0年:-1000万元第1-4年:372.5万元第5年:372.5+250+50=672.5万元2、计算(2)项目净现值NPV=372.5*(P/A,10%,4)+672.5*(P/F,10%,5)-1000 =372.5*3.1699+672.5*0.6209-1000=598.35(3)计算项目的内涵报酬率按28%估行的贴现率进行测试,372.5*(P/A,28%,4)+672.5*(P/F,28%,5)-1000=30.47万元按32%估行的贴现率进行测试,372.5*(P/A,32%,4)+672.5*(P/F,32%,5)-1000=-51.56万元内涵报酬率IRR=28%+((30.47-0)/(30.47+51.56))*(32%-28%)=29.49%3 某公司要在两个项目中选择一个进行投资:A项目需要160000元的初始投资,每年产生80000元的现金净流量,项目的使用寿命为3年,3年后必须更新且无残值;B项目需要210000元的初始投资,每年产生64000元的现金净流量,项目的使用寿命为6年,6年后必须更新且无残值。

财务管理学(第8版)习题答案财务管理学(第8版)习题答案第一章:基础概念1. (a) 财务管理学是研究如何在资源有限的情况下,对企业的资金进行规划、筹集和运用的学科。

(b) 财务管理学的目标是最大化股东财富。

(c) 公司治理是确保公司管理层合理行使职权,保护股东利益的一系列制度和实践。

(d) 资本预算决策是指对长期投资项目进行评估和选择的过程。

2. (a) 法人:指具有法人地位的企业和组织,可以独立承担各种权利和义务。

(b) 市场:指供给和需求的相互作用下形成的商品和服务的交换场所。

(c) 证券:代表资金或债权的一种金融工具,可以在市场上进行买卖。

(d) 资本市场:指进行证券交易的场所,包括股票市场和债券市场。

第二章:财务报表分析1. (a) 资产负债表是反映企业在某一特定日期上的财务状况的报表。

(b) 利润表是反映企业在一定时期内盈利情况的报表。

(c) 资金流量表是反映企业在一定时期内资金进出情况的报表。

(d) 所有者权益变动表是反映企业在一定时期内所有者权益变动情况的报表。

2. (a) 流动比率 = 流动资产 / 流动负债,衡量企业短期偿债能力。

(b) 速动比率 = (流动资产 - 存货) / 流动负债,衡量企业除存货外的短期偿债能力。

(c) 资产负债率 = 总负债 / 总资产,衡量企业负债占总资产的比例。

(d) 资产收益率 = 净利润 / 总资产,衡量企业利用资产创造利润的能力。

第三章:财务规划与预测1. (a) 财务规划是根据预定的目标,制定财务活动方案和计划的过程。

(b) 财务预测是对未来一定时期内的财务状况和结果进行预测和估计。

(c) 资本预算决策是指对长期投资项目进行评估和选择的过程。

(d) 周期预算是指按一定时间周期制定的预算,如年度预算。

2. (a) 现金收入预测是根据企业的销售计划和市场环境等因素,预测未来一定时期内的现金收入情况。

(b) 资金需求预测是根据企业的财务计划和经营活动,预测未来一定时期内的资金需求量。

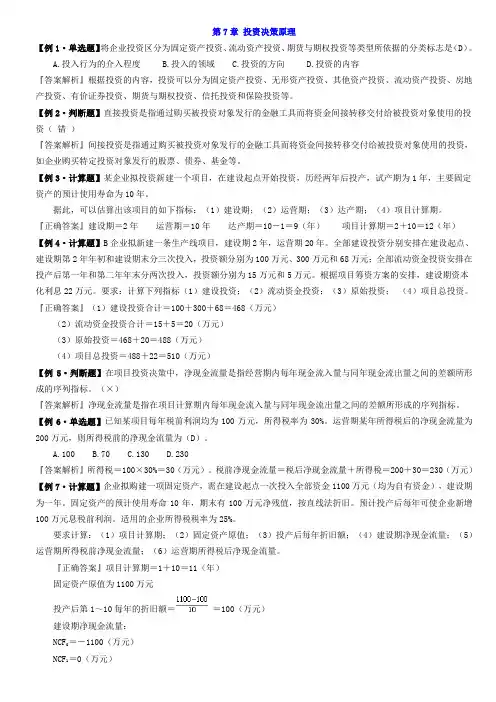

第7章投资决策原理【例1·单选题】将企业投资区分为固定资产投资、流动资产投资、期货与期权投资等类型所依据的分类标志是(D)。

A.投入行为的介入程度B.投入的领域C.投资的方向D.投资的内容『答案解析』根据投资的内容,投资可以分为固定资产投资、无形资产投资、其他资产投资、流动资产投资、房地产投资、有价证券投资、期货与期权投资、信托投资和保险投资等。

【例2·判断题】直接投资是指通过购买被投资对象发行的金融工具而将资金间接转移交付给被投资对象使用的投资(错)『答案解析』间接投资是指通过购买被投资对象发行的金融工具而将资金间接转移交付给被投资对象使用的投资,如企业购买特定投资对象发行的股票、债券、基金等。

【例3·计算题】某企业拟投资新建一个项目,在建设起点开始投资,历经两年后投产,试产期为1年,主要固定资产的预计使用寿命为10年。

据此,可以估算出该项目的如下指标:(1)建设期;(2)运营期;(3)达产期;(4)项目计算期。

『正确答案』建设期=2年运营期=10年达产期=10-1=9(年)项目计算期=2+10=12(年)【例4·计算题】B企业拟新建一条生产线项目,建设期2年,运营期20年。

全部建设投资分别安排在建设起点、建设期第2年年初和建设期末分三次投入,投资额分别为100万元、300万元和68万元;全部流动资金投资安排在投产后第一年和第二年年末分两次投入,投资额分别为15万元和5万元。

根据项目筹资方案的安排,建设期资本化利息22万元。

要求:计算下列指标(1)建设投资;(2)流动资金投资;(3)原始投资;(4)项目总投资。

『正确答案』(1)建设投资合计=100+300+68=468(万元)(2)流动资金投资合计=15+5=20(万元)(3)原始投资=468+20=488(万元)(4)项目总投资=488+22=510(万元)【例5·判断题】在项目投资决策中,净现金流量是指经营期内每年现金流入量与同年现金流出量之间的差额所形成的序列指标。

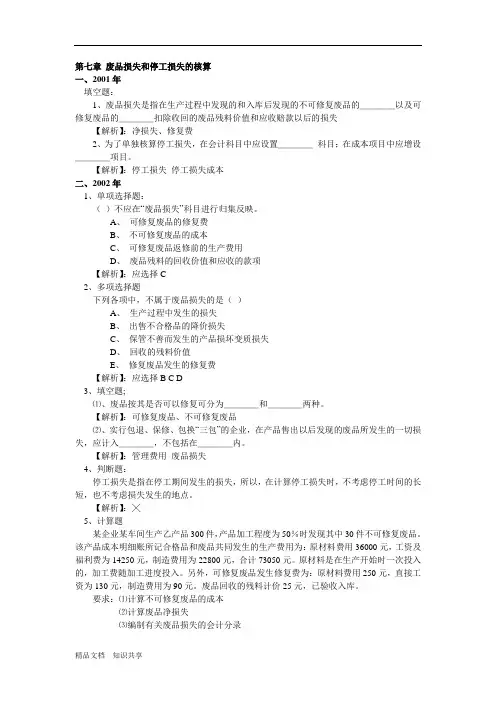

第七章废品损失和停工损失的核算一、2001年填空题:1、废品损失是指在生产过程中发现的和入库后发现的不可修复废品的____以及可修复废品的____扣除收回的废品残料价值和应收赔款以后的损失【解析】:净损失、修复费2、为了单独核算停工损失,在会计科目中应设置____科目;在成本项目中应增设____项目。

【解析】:停工损失停工损失成本二、2002年1、单项选择题:()不应在“废品损失”科目进行归集反映。

A、可修复废品的修复费B、不可修复废品的成本C、可修复废品返修前的生产费用D、废品残料的回收价值和应收的款项【解析】:应选择C2、多项选择题下列各项中,不属于废品损失的是()A、生产过程中发生的损失B、出售不合格品的降价损失C、保管不善而发生的产品损坏变质损失D、回收的残料价值E、修复废品发生的修复费【解析】:应选择B C D3、填空题;⑴、废品按其是否可以修复可分为____和____两种。

【解析】:可修复废品、不可修复废品⑵、实行包退、保修、包换“三包”的企业,在产品售出以后发现的废品所发生的一切损失,应计入____,不包括在____内。

【解析】:管理费用废品损失4、判断题:停工损失是指在停工期间发生的损失,所以,在计算停工损失时,不考虑停工时间的长短,也不考虑损失发生的地点。

【解析】:╳5、计算题某企业某车间生产乙产品300件,产品加工程度为50%时发现其中30件不可修复废品。

该产品成本明细账所记合格品和废品共同发生的生产费用为:原材料费用36000元,工资及福利费为14250元,制造费用为22800元,合计73050元。

原材料是在生产开始时一次投入的,加工费随加工进度投入。

另外,可修复废品发生修复费为:原材料费用250元,直接工资为130元,制造费用为90元。

废品回收的残料计价25元,已验收入库。

要求:⑴计算不可修复废品的成本⑵计算废品净损失⑶编制有关废品损失的会计分录【解析】:⑴计算不可修复废品成本原材料费用分配:分配率=36000/300=120(原材料一次投入每件的材料费相同)废品材料成本=30×120=3600工资及福利费用分配:(产品加工到50%时发生废品,应折合成约当产量)分配率=14250/(300-30)+30×50%=14250/285=50废品工资及福利费成本=30×50%×50=750制造费用分配:分配率=22800/(300-30)+30×50%=22800/285=80废品制造费用成本=30×50%×80=1200废品损失总成本=3600+750+1200=5550⑶编制有关的会计分录①结转废品实际成本的会计分录借:废品损失5550贷:基本生产成本5550②收回残值的会计分录借:原材料25贷:废品损失25废品净损失=5550-25+(250+130+90)=5995③结转废品净损失的会计分录借:基本生产成本5995贷:废品损失5995三、2003年1、单项选择题不可修复废品的成本扣除回收的废品残值后的净额称为()A、废品损失B、废品净损失C、废品报废损失D、废品总损失【解析】:应选择B2、多项选择题发生停工损失时,可能借记的科目有()A、停工损失B、制造费用C、管理费用D、营业外支出E、基本生产成本【解析】:应选择A B D3、填空题对于发生的废品净损失,应从“废品损失”科目的贷方转入____科目的借方,在所属有关产品成本明细账中,记入____成本项目。

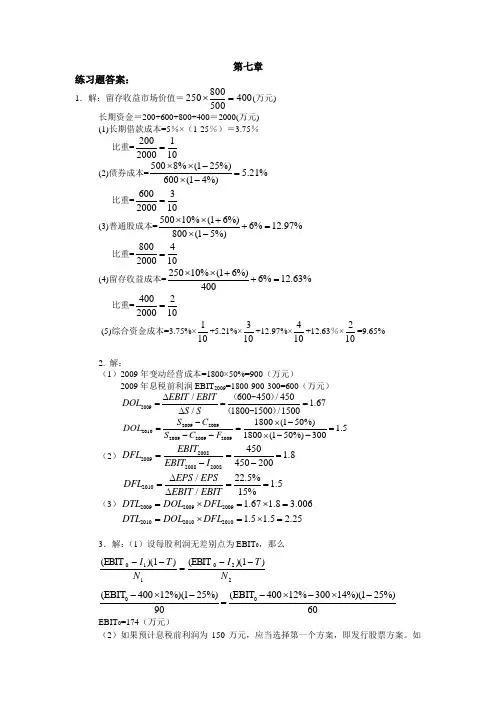

第七章练习题答案:1.解:留存收益市场价值=400500800250=⨯(万元) 长期资金=200+600+800+400=2000(万元)(1)长期借款成本=5%×(1-25%)=3.75%比重=2001200010= (2)债券成本=5008%(125%) 5.21%600(14%)⨯⨯-=⨯- 比重=6003200010= (3)普通股成本=50010%(16%)6%12.97%800(15%)⨯⨯++=⨯- 比重=8004200010= (4)留存收益成本=25010%(16%)6%12.63%400⨯⨯++= 比重=4002200010= (5)综合资金成本=3.75%×110+5.21%×310+12.97%×410+12.63%×210=9.65%2. 解:(1)2009年变动经营成本=1800×50%=900(万元)2009年息税前利润EBIT 2009=1800-900-300=600(万元)2009/600450/450 1.67/18001500/1500EBIT EBIT DOL S S ∆===∆(-)(-) 2009200920102009200920091800(150%) 1.51800(150%)300S C DOL S C F -⨯-===--⨯-- (2)2008200920082008450 1.8450200EBIT DFL EBIT I ===-- 2010/22.5% 1.5/15%EPS EPS DFL EBIT EBIT ∆===∆ (3)200920092009 1.67 1.8 3.006DTL DOL DFL =⨯=⨯=201020102010 1.5 1.5 2.25DTL DOL DFL =⨯=⨯=3.解:(1)设每股利润无差别点为EBIT 0,那么220110)1)((EBIT )1)((EBIT N T I N T I --=-- 00(EBIT 40012%)(125%)(EBIT 40012%30014%)(125%)9060-⨯--⨯-⨯-= EBIT 0=174(万元)(2)如果预计息税前利润为150万元,应当选择第一个方案,即发行股票方案。

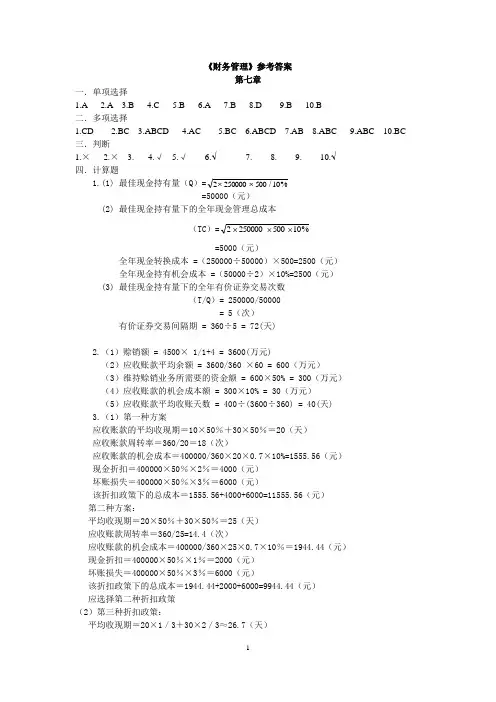

《财务管理》参考答案第七章一.单项选择1.A2.A3.B4.C5.B6.A7.B8.D9.B 10.B二.多项选择1.CD2.BC3.ABCD4.AC5.BC6.ABCD7.AB8.ABC9.ABC 10.BC 三.判断1.×2.×3.×4.√5.√6.√7.×8.×9.×10.√四.计算题1.(1) 最佳现金持有量(Q)=%2500002⨯⨯500/10=50000(元)(2) 最佳现金持有量下的全年现金管理总成本(TC)=%⨯2⨯⨯10250000500=5000(元)全年现金转换成本 =(250000÷50000)×500=2500(元)全年现金持有机会成本 =(50000÷2)×10%=2500(元)(3) 最佳现金持有量下的全年有价证券交易次数(T/Q)= 250000/50000= 5(次)有价证券交易间隔期 = 360÷5 = 72(天)2.(1)赊销额 = 4500× 1/1+4 = 3600(万元)(2)应收账款平均余额 = 3600/360 ×60 = 600(万元)(3)维持赊销业务所需要的资金额 = 600×50% = 300(万元)(4)应收账款的机会成本额 = 300×10% = 30(万元)(5)应收账款平均收账天数 = 400÷(3600÷360) = 40(天)3.(1)第一种方案应收账款的平均收现期=10×50%+30×50%=20(天)应收账款周转率=360/20=18(次)应收账款的机会成本=400000/360×20×0.7×10%=1555.56(元)现金折扣=400000×50%×2%=4000(元)坏账损失=400000×50%×3%=6000(元)该折扣政策下的总成本=1555.56+4000+6000=11555.56(元)第二种方案:平均收现期=20×50%+30×50%=25(天)应收账款周转率=360/25=14.4(次)应收账款的机会成本=400000/360×25×0.7×10%=1944.44(元)现金折扣=400000×50%×1%=2000(元)坏账损失=400000×50%×3%=6000(元)该折扣政策下的总成本=1944.44+2000+6000=9944.44(元)应选择第二种折扣政策(2)第三种折扣政策:平均收现期=20×1/3+30×2/3≈26.7(天)应收账款周转率=360/26.7=13.48(次)应收账款的机会成本=400000/360×26.7×0.7×10%=2076.67(元)现金折扣=400000×1/3×1%≈1333.33(元)坏账损失=400000×2/3×3%≈8000(元)该折扣政策下的总成本=2076.67+1333.33+8000=11410(元)所以应选择第二种折扣政策。

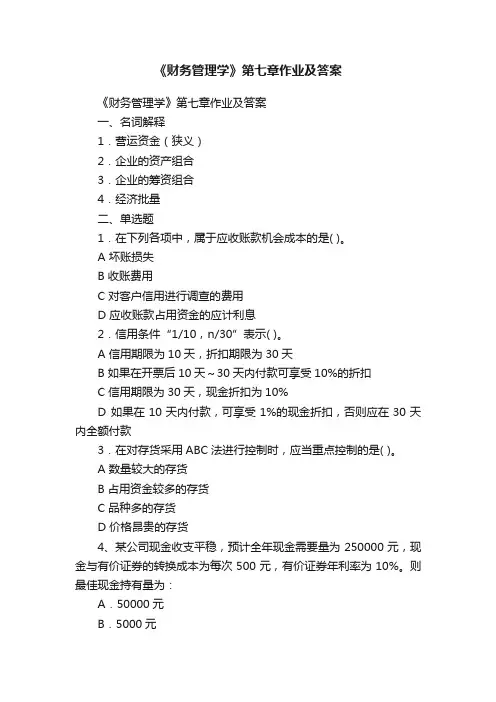

《财务管理学》第七章作业及答案《财务管理学》第七章作业及答案一、名词解释1.营运资金(狭义)2.企业的资产组合3.企业的筹资组合4.经济批量二、单选题1.在下列各项中,属于应收账款机会成本的是( )。

A 坏账损失B 收账费用C 对客户信用进行调查的费用D 应收账款占用资金的应计利息2.信用条件“1/10,n/30”表示( )。

A 信用期限为10天,折扣期限为30天B 如果在开票后10天~30天内付款可享受10%的折扣C 信用期限为30天,现金折扣为10%D 如果在10天内付款,可享受1%的现金折扣,否则应在30天内全额付款3.在对存货采用ABC法进行控制时,应当重点控制的是( )。

A 数量较大的存货B 占用资金较多的存货C 品种多的存货D 价格昂贵的存货4、某公司现金收支平稳,预计全年现金需要量为250000元,现金与有价证券的转换成本为每次500元,有价证券年利率为10%。

则最佳现金持有量为:A.50000元B.5000元C.2500元D.500元三、多选题1.不同的资产组合对企业报酬和风险的影响主要有( )。

A 较多地投资于流动资产可以降低企业的风险,但会减少企业的盈利B 流动资产投资过多,而固定资产又相对不足,会使企业生产能力减少C 如果企业的固定资产增加,会造成企业的风险增加,盈利减少D 如果企业的固定资产减少,会造成企业的风险增加,盈利减少E 企业采用比较冒险的资产组合,会使企业的投资报酬率上升2.为了评价两个可选择的信用标准孰优孰劣,必须计算两个方案各自带来的利润和成本,为此应测试的项目有( )。

A 信用条件的变化情况B 销售量变化对利润销售的影响C 应收账款投资及其机会成本的变化D 坏账成本的变化E 管理成本的变化3.利息率状况对企业筹资组合的影响是( )。

A 一般来说,由于长期资金的利息率高,因此企业较少使用长期资金,较多使用短期资金B 当长期资金的利息率和短期资金的利息率相差较少时,企业一般较多地利用长期资金,较少使用流动负债C 短期资金和长期资金利息率的波动都很大,不易确定D 当长期资金利息率远远高于短期资金利息率时,会促使企业较多地利用流动负债,以降低资金成本E 利息率对企业的筹资组合没有影响4.下列关于商业信用的叙述中正确的是( )。

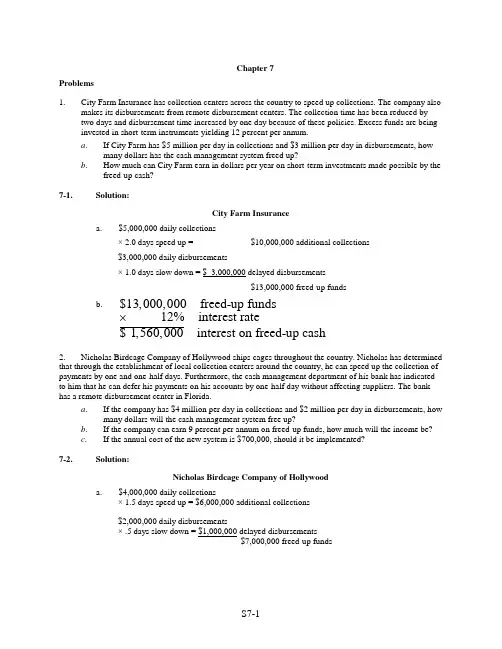

Chapter 7Problems1. City Farm Insurance has collection centers across the country to speed up collections. The company alsomakes its disbursements from remote disbursement centers. The collection time has been reduced by two days and disbursement time increased by one day because of these policies. Excess funds are being invested in short-term instruments yielding 12 percent per annum.a. If City Farm has $5 million per day in collections and $3 million per day in disbursements, howmany dollars has the cash management system freed up?b. How much can City Farm earn in dollars per year on short-term investments made possible by thefreed-up cash?7-1. Solution:City Farm Insurancea. $5,000,000 daily collections× 2.0 days speed up = $10,000,000 additional collections$3,000,000 daily disbursements× 1.0 days slow down = $ 3,000,000 delayed disbursements$13,000,000 freed-up fundsb. $13,000,000 freed-up funds12% interest rate$1,560,000 interest on freed-up cash2. Nicholas Birdcage Company of Hollywood ships cages throughout the country. Nicholas has determined that through the establishment of local collection centers around the country, he can speed up the collection of payments by one and one-half days. Furthermore, the cash management department of his bank has indicated to him that he can defer his payments on his accounts by one-half day without affecting suppliers. The bank has a remote disbursement center in Florida.a. If the company has $4 million per day in collections and $2 million per day in disbursements, howmany dollars will the cash management system free up?b. If the company can earn 9 percent per annum on freed-up funds, how much will the income be?c. If the annual cost of the new system is $700,000, should it be implemented?7-2. Solution:Nicholas Birdcage Company of Hollywooda. $4,000,000 daily collections× 1.5 days speed up = $6,000,000 additional collections$2,000,000 daily disbursements× .5 days slow down = $1,000,000 delayed disbursements$7,000,000 freed-up fundsb.$7,000,000 freed-up funds9% interest rate$630,000 interest on freed-up cash⨯ c.No. The annual income of $630,000 is $70,000 less than the annual cost of $700,000 for the new system.3. Megahurtz International Car Rentals has rent-a-car outlets throughout the world. It also keeps funds for transactions purposes in many foreign countries. Assume in 2003, it held 100,000 reals in Brazil worth 35,000 dollars. It drew 12 percent interest, but the Brazilian real declined 20 percent against the dollar. a . What is the value of its holdings, based on U.S. dollars, at year-end (Hint: multiply $35,000 times 1.12 and then multiply the resulting value by 80 percent.)b .What is the value of its holdings, based on U.S. dollars, at year-end if it drew 9 percent interest and the real went up by 10 percent against the dollar? 7-3.Solution:Megahurtz International Car Rentala.$35,000 × 1.12 = $39,200$39,200 × 80% = $31,360 dollar value of real holdings b.$35,000 × 1.09 = $38,150$38,150 × 110% = $41,965 dollar value of real holdings4. Thompson Wood Products has credit sales of $2,160,000 and accounts receivable of $288,000. Computethe value of the average collection period. 7-4.Solution:Thompson Wood ProductsAccounts ReceivableAverage collection period Average daily credit sales$288,000$2,160,000/360$288,00048days $6,000====5. Lone Star Petroleum Co. has annual credit sales of $2,880,000 and accounts receivable of $272,000. Compute the value of the average collection period. 7-5.Solution:Lone Star Petroleum Co.Accounts ReceivableAverage collection period Average daily credit sales$272,000$2,288,000/360$272,0008,00034days====6. Knight Roundtable Co. has annual credit sales of $1,080,000 and an average collection period of 32 days in 2008. Assume a 360-day year. What is the company ’s average accounts receivable balance? Accounts receivable are equal to the average daily credit sales times the average collection period. 7-6.Solution:Knight Roundtable Co.$1,080,000annual credit sales$3,000credit sales a day 360days per year=$3,000 average 32 average $96,000 average accounts daily credit sales collection period receivable balance=⨯ 7. Darla ’s Cosmetics has annual credit sales of $1,440,000 and an average collection period of 45 days in 2008. Assume a 360-day year.What is the company ’s average accounts receivable balance? Accounts receivable are equal to the average daily credit sales times the average collection period. 7-7.Solution:Darla ’s Cosmetic Company$1,440,000 annual credit sales/360 = $4,000 per day credit sales$4,000 credit sales × 45 average collection period = $180,000 average accounts receivable balance8. In Problem 7, if accounts receivable change to $200,000 in the year 2009, while credit sales are$1,800,000, should we assume the firm has a more or a less lenient credit policy? 7-8.Solution:Darla ’s Cosmetics (Continued)To determine if there is a more lenient credit policy, compute the average collection period.Accounts ReceivableAverage collection period Average daily credit sales$200,000$1,800,000/360$200,00040 days $5,000====Since the firm has a shorter average collection period, it appears that the firm does not have a more lenient credit policy.9. Hubbell Electronic Wiring Company has an average collection period of 35 days. The accounts receivable balance is $105,000. What is the value of its credit sales? 7-9.Solution:Hubbell Electronic Wiring CompanyAccounts receivable Average collection period Average daily credit sales$105,00035 days credit sales 360$105,000Credit sales/36035 daysCredit sales/360$3,000 credit sales per dayCredit sales $3,==⎛⎫ ⎪⎝⎭===000360$1,080,000⨯=10.Marv ’s Women ’s Wear has the following schedule for aging of accounts receivable.Age of Receivables, April 30, 2004(1) (2)(3) (4)Month of SalesAge of AccountAmounts Percent of AmountDue April ....................................... 0–30 $ 88,000 ____ March .....................................31–6044,000____February ................................. 61–90 33,000 ____January ................................... 91–120 55,000 ____Total receivables ................. $220,000 100%a. Fill in column (4) for each month.b. If the firm had $960,000 in credit sales over the four-month period, compute the averagecollection period. Average daily sales should be based on a 120-day period.c. If the firm likes to see its bills collected in 30 days, should it be satisfied with the averagecollection period?d. Disregarding your answer to part c and considering the aging schedule for accounts receivable,should the company be satisfied?e. What additional information does the aging schedule bring to the company that the averagecollection period may not show?7-10. Solution:Marv’s Women’s WearAge of Receivables, April 30, 2004a.(1)(2)(3)(4)Month of Sales Age of Account Amounts Percent of AmountDueApril 0-30 $ 88,000 40% March 31-60 44,000 20% February 61-90 33,000 15% January 91-120 55,000 25% Total receivables $220,000 100%b.Accounts receivable Average Collection PeriodAverage daily credit sales$220,000$960,000/120$220,000$8,00027.5 days====c. Yes, the average collection of 27.5 days is less than 30 days.d. No. The aging schedule provides additional insight that 60 percent of the accounts receivableare over 30 days old.e. It goes beyond showing how many days of credit sales accounts receivables represent, toindicate the distribution of accounts receivable between various time frames.11. Nowlin Pipe & Steel has projected sales of 72,000 pipes this year, an ordering cost of $6 per order, and carrying costs of $2.40 per pipe. a . What is the economic ordering quantity?b . How many orders will be placed during the year?c .What will the average inventory be? 7-11.Solution:Nowlin Pipe and Steel Companya.EOQ 600 units=====b. 72,000 units/600 units = 120 ordersc.EOQ/2 = 600/2 = 300 units (average inventory)12.Howe Corporation is trying to improve its inventory control system and has installed an online computer at its retail stores. Howe anticipates sales of 126,000 units per year, an ordering cost of $4 per order, and carrying costs of $1.008 per unit. a . What is the economic ordering quantity?b . How many orders will be placed during the year?c . What will the average inventory be?d .What is the total cost of inventory expected to be? 7-12.Solution:Howe Corp.a.EOQ 1,000 units ===b.126,000 units/1,000 units = 126 orders7-12. (Continued)c. EOQ/2 = 1,000/2 = 500 units (average inventory)d.126 orders × $4 ordering cost = $ 504 500 units × $1.008 carrying cost per unit = 504 Total costs= $1,00813. (See Problem 12 for basic data.) In the second year, Howe Corporation finds it can reduce ordering costs to $1 per order but that carrying costs will stay the same at $1.008 per unit. a . Recompute a, b, c , and d in Problem 12 for the second year. b .Now compare years one and two and explain what happened. 7-13.Solution:Howe Corp. (Continued)a.EOQ 500 units=====126,000 units/500 units = 252 ordersEOQ/2 = 500/2 = 250 units (average inventory) 252 orders × $1 ordering cost = $252 250 units × $1.008 carrying cost per unit = 252 Total costs = $504b.The number of units ordered declines 50%, while the number of orders doubles. The average inventory and total costs both decline by one-half. Notice that the total cost did not decline in equal percentage to the decline in ordering costs. This is because the change in EOQ and other variables (½) is proportional to the square root of the change in ordering costs (¼).14. Higgins Athletic Wear has expected sales of 22,500 units a year, carrying costs of $1.50 per unit, and an ordering cost of $3 per order. a . What is the economic order quantity?b . What will be the average inventory? The total carrying cost?c .Assume an additional 30 units of inventory will be required as safety stock. What will the new average inventory be? What will the new total carrying cost be? 7-14.Solution:Higgins Athletic Weara. EOQ==300 units ===b. EOQ/2 = 300/2 = 150 units (average inventory)150 units × $1.50 carrying cost/unit = $225 total carrying costc.EOQAverage inventory Safety Stock230030150301802=+=+=+=180 inventory × $1.50 carrying cost per year= $270 total carrying cost15. Dimaggio Sports Equipment, Inc., is considering a switch to level production. Cost efficiencies would occur under level production, and aftertax costs would decline by $35,000, but inventory would increase by $400,000. Dimaggio would have to finance the extra inventory at a cost of 10.5 percent.a. Should the company go ahead and switch to level production?b. How low would interest rates need to fall before level production would be feasible?7-15. Solution:Dimaggio Sports Equipment, Inc.a. Inventory increases by $400,000× interest expense 10.5%Increased costs $ 42,000Less: Savings 35,000Loss ($ 7,000)Don’t switch to level production. Increased ROI is less than the interest cost of moreinventory.b. If interest rates fall to 8.75% or less, the switch would be feasible.$35,000 Savings8.75%$400,000 increased inventory=16. Johnson Electronics is considering extending trade credit to some customers previously considered poorrisks. Sales will increase by $100,000 if credit is extended to these new customers. Of the new accounts receivable generated, 10 percent will prove to be uncollectible. Additional collection costs will be 3 percent of sales, and production and selling costs will be 79 percent of sales. The firm is in the 40percent tax bracket.a. Compute the incremental income after taxes.b. What will Johnson’s incremental return on sales be if these new credit customers are accepted?c. If the receivable turnover ratio is 6 to 1, and no other asset buildup is needed to serve the newcustomers, what will Johnson’s incremental return on new average investment be?7-16. Solution:Johnson Electronicsa. Additional sales ............................................................................................ $100,000Accounts uncollectible (10% of new sales) .................................................. – 10,000Annual incremental revenue ......................................................................... $ 90,000Collection costs (3% of new sales) ............................................................... – 3,000Production and selling costs (79% of new sales) .......................................... – 79,000Annual income before taxes ......................................................................... $ 8,000Taxes (40%) .................................................................................................. – 3,200Incremental income after taxes ..................................................................... $ 4,800b.Incremental income Incremental return on salesIncremental sales$4,800/$100,000 4.8%===c. Receivable turnover = Sales/Receivable turnover = 6xReceivables = Sales/Receivable turnover= $100,000/6= $16,666.67Incremental return on new average investment = $4,800/$16,666.67 = 28.80%17. Collins Office Supplies is considering a more liberal credit policy to increase sales, but expects that 9 percent of the new accounts will be uncollectible. Collection costs are 5 percent of new sales, production and selling costs are 78 percent, and accounts receivable turnover is five times. Assume income taxes of 30 percent and an increase in sales of $80,000. No other asset buildup will be required to service the new accounts.a. What is the level of accounts receivable to support this sales expansion?b. What would be Collins’s incremental aftertax return on investment?c. Should Collins liberalize credit if a 15 percent aftertax return on investment is required?Assume Collins also needs to increase its level of inventory to support new sales and that inventory turnover is four times.d. What would be the total incremental investment in accounts receivable and inventory to support a$80,000 increase in sales?e. Given the income determined in part b and the investment determined in part d, should Collinsextend more liberal credit terms?7-17. Solution:Collins Office Suppliesa.$80,000 Investment in accounts receivable$16,0005==b. Added sales .................................................................................................. $ 80,000Accounts uncollectible (9% of new sales) .................................................... – 7,200Annual incremental revenue ......................................................................... $ 72,800Collection costs (5% of new sales) ............................................................... – 4,000Production and selling costs (78% of new sales) – 62,400Annual income before taxes ......................................................................... $ 6,400Taxes (30%) .................................................................................................. – 1,920Incremental income after taxes ..................................................................... $ 4,480Return on incremental investment = $4,480/$16,000 = 28%c. Yes! 28% exceeds the required return of 15%.7-17. (Continued)d.$80,000 Investment in inventory =$20,0004=Total incremental investmentInventory $20,000Accounts receivable 16,000Incremental investment $36,000 $4,480/$36,000 = 12.44% return on investmente. No! 12.44% is less than the required return of 15%.18. Curtis Toy Manufacturing Company is evaluating the extension of credit to a new group of customers.Although these customers will provide $240,000 in additional credit sales, 12 percent are likely to be uncollectible. The company will also incur $21,000 in additional collection expense. Production and marketing costs represent 72 percent of sales. The company is in a 30 percent tax bracket and has a receivables turnover of six times. No other asset buildup will be required to service the new customers.The firm has a 10 percent desired return on investment.a. Should Curtis extend credit to these customers?b. Should credit be extended if 14 percent of the new sales prove uncollectible?c .Should credit be extended if the receivables turnover drops to 1.5 and 12 percent of the accounts are uncollectible (as was the case in part a ). 7-18.Solution:Curtis Toy Manufacturing Companya.Added sales ...................................................................................................... $240,000 Accounts uncollectible (12% of new sales) ...................................................... 28,800 Annual incremental revenue ............................................................................. 211,200 Collection costs ................................................................................................ 21,000 Production and selling costs (72% of new sales) .............................................. 172,800 Annual income before taxes ............................................................................. 17,400 Taxes (30%) ...................................................................................................... 5,220 Incremental income after taxes .........................................................................$ 12,180$240,000Receivable turnover 6.0x6.040,000 in new receivables==$12,180Return on incremental investment 30.45%$40,000==b.Added sales .................................................................................................. $240,000 Accounts uncollectible (14% of new sales) .................................................. – 33,600 Annual incremental revenue ......................................................................... $206,400 Collection costs ............................................................................................ – 21,000 Production and selling costs (72% of new sales) .......................................... –172,800 Annual income before taxes ......................................................................... $ 12,600 Taxes (30%) .................................................................................................. – 3,780 Incremental income after taxes .....................................................................$ 8,820$8,820Return on incremental investment 22.05%$40,000==Yes, extend credit.7-18. (Continued)c.If receivable turnover drops to 1.5x, the investment in accounts receivable would equal $240,000/1.5 = $160,000. The return on incremental investment, assuming a 12% uncollectible rate, is 7.61%.$12,180==Return on incremental investment7.61%$160,000The credit should not be extended. 7.61% is less than the desired 10%.19. Reconsider problem 18. Assume the average collection period is 120 days. All other factors are the same(including 12 percent uncollectibles). Should credit be extended?7-19. Solution:Curtis Toy Manufacturing Company (Continued)First compute the new accounts receivable balance.Accounts receivable = average collection period × average daily sales240,000⨯=⨯=120 days120$667$80,040360 daysorAccounts receivable = sales/accounts receivable turnover360 days==Accounts receivable turnover3x120 days=$240,000/3$80,000Then compute return on incremental investment.$12,18015.23%=$80,000Yes, extend credit. 15.23% is greater than 10%.20. Apollo Data Systems is considering a promotional campaign that will increase annual credit sales by $600,000. The company will require investments in accounts receivable, inventory, and plant and equipment. The turnover for each is as follows:Accounts receivable (5x)Inventory (8x)Plant and equipment (2x)All $600,000 of the sales will be collectible. However, collection costs will be 3 percent of sales, and production and selling costs will be 77 percent of sales. The cost to carry inventory will be 6 percent of inventory. Depreciation expense on plant and equipment will be 7 percent of plant and equipment. The tax rate is 30 percent.a. Compute the investments in accounts receivable, inventory, and plant and equipment based on theturnover ratios. Add the three together.b. Compute the accounts receivable collection costs and production and selling costs and add thetwo figures together.c. Compute the costs of carrying inventory.d. Compute the depreciation expense on new plant and equipment.e. Add together all the costs in parts b, c, and d.f. Subtract the answer from part e from the sales figure of $600,000 to arrive at income before taxes.Subtract taxes at a rate of 30 percent to arrive at income after taxes.g. Divide the aftertax return figure in part f by the total investment figure in part a. If the firm has arequired return on investment of 12 percent, should it undertake the promotional campaigndescribed throughout this problem.7-20. Solution:Apollo Data Systemsa. Accounts receivable = sales/accounts receivable turnover=$120,000$600,000/5Inventory = sales/inventory turnover=$75,000$600,000/8Plant and equipment = sales/(plant and equipment turnover)=$600,000/2$300,000Total investment$495,0007-20. (Continued)b. Collection cost = 3% × $600,000 $ 18,000Production and selling costs = 77% × $600,000 = 462,000Total costs related to accounts receivable $480,000c. Cost of carrying inventory6% × inventory6% × $75,000 $4,500d. Depreciation expense7% × Plant and Equipment7% × $300,000 $21,000e. Total costs related to accounts receivable $480,000Cost of carrying inventory 4,500Depreciation expense 21,000Total costs $505,500f. Sales $600,000– total costs 505,500 Income before taxes 94,500 Taxes (30%) 28,350 Income after taxes $ 66,150g. Income after taxes$66,15013.36%Total investment495,000==Yes, it should undertake the campaignThe aftertax return of 13.36% exceeds the required rate of return of 12%21. In Problem 20, if inventory turnover had only been 4 times:a. What would be the new value for inventory investment?b. What would be the return on investment? You need to recompute the total investment and thetotal costs of the campaign to work toward computing income after taxes. Should the campaign beundertaken?7-21. Solution:Apollo Data Systems (Continued)a. Inventory = sales/inventory turnover$150,000 = $600,000/4b. New Total InvestmentAccounts receivable $120,000Inventory 150,000Plant and equipment 300,000$570,000Total Cost of the CampaignCost of carrying inventory6% × $150,000 = $9,000 ($4,500 more than previously)New Income After TaxesSales $600,000– total costs 510,000 ($505,500 + 4,500)Income before taxes 90,000Taxes (30%) 27,000Income after taxes $ 63,000Income after taxes$63,00011.05%Total investment570,000==No, the campaign should not be undertakenThe aftertax return of 11.05% is less than the required rate of return of 12%(Problems 22–25 are a series and should be taken in order.)22. Maddox Resources has credit sales of $180,000 yearly with credit terms of net 30 days, which is also theaverage collection period. Maddox does not offer a discount for early payment, so its customers take the full 30 days to pay.What is the average receivables balance? What is the receivables turnover?7-22. Solution:Maddox ResourcesSales/360 days = average daily sales$180,000/360 = $500Accounts receivable balance = $500 × 30 days = $15,000Receivable turnover =Sales$180,00012x Receivables$15,000==or360 days/30 = 12x23. If Maddox were to offer a 2 percent discount for payment in 10 days and every customer took advantageof the new terms, what would the new average receivables balance be? Use the full sales of $180,000 for your calculation of receivables.7-23. Solution:Maddox Resources (Continued)$500 × 10 days = $5,000 new receivable balance24. If Maddox reduces its bank loans, which cost 12 percent, by the cash generated from its reducedreceivables, what will be the net gain or loss to the firm?7-24. Solution:Maddox Resources (Continued)Old receivables – new receivables with discount = Funds freed by discount$15,000 – $5,000 .................................................................... = $10,000Savings on loan = 12% × $10,000 ............................................ = $ 1,200Discount on sales = 2% × $180,000 ......................................... = (3,600)Net change in income from discount ........................................ $(2,400) No! Don’t offer the discount since the income from reduced bank loans does not offset the loss onthe discount.25. Assume that the new trade terms of 2/10, net 30 will increase sales by 20 percent because the discountmakes the Maddox price competitive. If Maddox earns 16 percent on sales before discounts, should it offer the discount? (Consider the same variables as you did for problems 22 through 24.)7-25. Solution:Maddox Resources (Continued)New sales = $180,000 × 1.20 = $216,000 Sales per day = $216,000/360 = $600 Average receivables balance = $600 × 10 = $6,000 Savings in interest cost ($15,000 – $6,000) × 12% = 1,080Increase profit on new sales = 16% × $36,000* = $5,760Reduced profit because of discount = 2% × $216,000 = (4,320) Net change in income ................................................................................... $2,520 Yes, offer the discount because total profit increases.*New Sales $36,000 = $216,000 – $180,000COMPREHENSIVE PROBLEMBailey Distributing Company sells small appliances to hardware stores in the southern California area. Michael Bailey, the president of the company, is thinking about changing the credit policies offered by the firm to attract customers away from competitors. The current policy calls for a 1/10, net 30, and the new policy would call for a 3/10, net 50. Currently 40 percent of Bailey customers are taking the discount, and it is anticipated that this number would go up to 50 percent with the new discount policy. It is further anticipated that annual sales would increase from a level of $200,000 to $250,000 as a result of the change in the cash discount policy.The increased sales would also affect the inventory level. The average inventory carried by Bailey is based on a determination of an EOQ. Assume unit sales of small appliances will increase from 20,000 to 25,000 units. The ordering cost for each order is $100 and the carrying cost per unit is $1 (these values will not change with the discount). The average inventory is based on EOQ/2. Each unit in inventory has an average cost of $6.50.Cost of goods sold is equal to 65 percent of net sales; general and administrative expenses are 10 percentof net sales; and interest payments of 12 percent will be necessary only for the increase in the accounts receivable and inventory balances. Taxes will equal 25 percent of before-tax income.a. Compute the accounts receivable balance before and after the change in the cash discount policy.Use the net sales (Total sales – Cash discounts) to determine the average daily sales and theaccounts receivable balances.b. Determine EOQ before and after the change in the cash discount policy. Translate this intoaverage inventory (in units and dollars) before and after the change in the cash discount policy.c. Complete the income statement.Before Policy Change After Policy ChangeNet sales (Sales – Cash discounts)Cost of goods soldGross profitGeneral and administrativeexpenseOperating profitInterest on increase in accountsreceivable and inventory (12%)Income before taxesTaxesIncome after taxesd. Should the new cash discount policy be utilized? Briefly comment.CP 7-1. Solution:Bailey Distributing Companya. Accounts receivable = average collection × averageperiod daily sales Before Policy ChangeAverage collection period.40 × 10 days = 4.60 × 30 days = 1822 daysAverage daily sales。

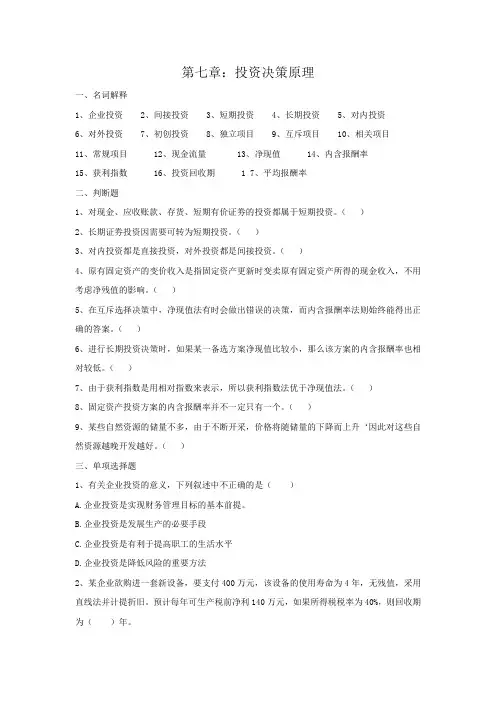

第七章:投资决策原理一、名词解释1、企业投资2、间接投资3、短期投资4、长期投资5、对内投资6、对外投资7、初创投资8、独立项目9、互斥项目 10、相关项目11、常规项目 12、现金流量 13、净现值 14、内含报酬率15、获利指数 16、投资回收期 1 7、平均报酬率二、判断题1、对现金、应收账款、存货、短期有价证劵的投资都属于短期投资。

()2、长期证劵投资因需要可转为短期投资。

()3、对内投资都是直接投资,对外投资都是间接投资。

()4、原有固定资产的变价收入是指固定资产更新时变卖原有固定资产所得的现金收入,不用考虑净残值的影响。

()5、在互斥选择决策中,净现值法有时会做出错误的决策,而内含报酬率法则始终能得出正确的答案。

()6、进行长期投资决策时,如果某一备选方案净现值比较小,那么该方案的内含报酬率也相对较低。

()7、由于获利指数是用相对指数来表示,所以获利指数法优于净现值法。

()8、固定资产投资方案的内含报酬率并不一定只有一个。

()9、某些自然资源的储量不多,由于不断开采,价格将随储量的下降而上升‘因此对这些自然资源越晚开发越好。

()三、单项选择题1、有关企业投资的意义,下列叙述中不正确的是()A.企业投资是实现财务管理目标的基本前提。

B.企业投资是发展生产的必要手段C.企业投资是有利于提高职工的生活水平D.企业投资是降低风险的重要方法2、某企业欲购进一套新设备,要支付400万元,该设备的使用寿命为4年,无残值,采用直线法并计提折旧。

预计每年可生产税前净利140万元,如果所得税税率为40%,则回收期为()年。

A、4.5B、2.9C、2.2 D3.23、当贴现率与内含报酬率相等时()A、净现值小于零B、净现值等于零C、净现值大于零D、净现值不一定4、某企业准备新建一条生产线,预计各项支出如下:投资前费用2000元,设备购置费用8000元,设备安装费用1000元,建筑工程费用6000元,投产时需垫支营运资金3000元,不可预见费按总支出的5%计算,则该生产线的投资总额为()元。

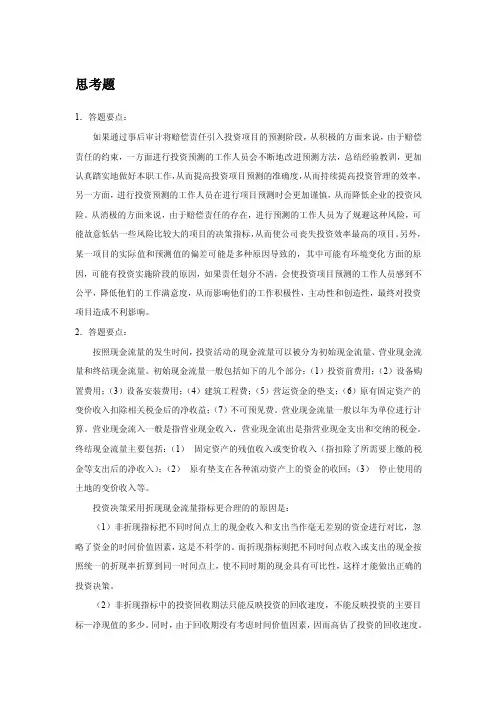

思考题1.答题要点:如果通过事后审计将赔偿责任引入投资项目的预测阶段,从积极的方面来说,由于赔偿责任的约束,一方面进行投资预测的工作人员会不断地改进预测方法,总结经验教训,更加认真踏实地做好本职工作,从而提高投资项目预测的准确度,从而持续提高投资管理的效率。

另一方面,进行投资预测的工作人员在进行项目预测时会更加谨慎,从而降低企业的投资风险。

从消极的方面来说,由于赔偿责任的存在,进行预测的工作人员为了规避这种风险,可能故意低估一些风险比较大的项目的决策指标,从而使公司丧失投资效率最高的项目。

另外,某一项目的实际值和预测值的偏差可能是多种原因导致的,其中可能有环境变化方面的原因,可能有投资实施阶段的原因,如果责任划分不清,会使投资项目预测的工作人员感到不公平,降低他们的工作满意度,从而影响他们的工作积极性,主动性和创造性,最终对投资项目造成不利影响。

2.答题要点:按照现金流量的发生时间,投资活动的现金流量可以被分为初始现金流量、营业现金流量和终结现金流量。

初始现金流量一般包括如下的几个部分:(1)投资前费用;(2)设备购置费用;(3)设备安装费用;(4)建筑工程费;(5)营运资金的垫支;(6)原有固定资产的变价收入扣除相关税金后的净收益;(7)不可预见费。

营业现金流量一般以年为单位进行计算。

营业现金流入一般是指营业现金收入,营业现金流出是指营业现金支出和交纳的税金。

终结现金流量主要包括:(1)固定资产的残值收入或变价收入(指扣除了所需要上缴的税金等支出后的净收入);(2)原有垫支在各种流动资产上的资金的收回;(3)停止使用的土地的变价收入等。

投资决策采用折现现金流量指标更合理的的原因是:(1)非折现指标把不同时间点上的现金收入和支出当作毫无差别的资金进行对比,忽略了资金的时间价值因素,这是不科学的。

而折现指标则把不同时间点收入或支出的现金按照统一的折现率折算到同一时间点上,使不同时期的现金具有可比性,这样才能做出正确的投资决策。

财务管理第九版第七章课后题答案1、下列项目中,应计入营业外收入的有()。

[单选题] *A.处置交易性金融资产的收益B.固定资产盘盈C.接受捐赠(正确答案)D.无法收到的应收账款2、税金及附加核算的内容不包括()。

[单选题] *A.增值税(正确答案)B.消费税C. 资源税D.资源税3、小规模纳税企业购入原材料取得的增值税专用发票上注明:货款20 000元。

增值税2 600元,在购入材料的过程中另支付包装费500元。

则该企业原材料的入账价值为()元。

[单选题] *A.19 500B.20 500C.22 600D.23 100(正确答案)4、用盈余公积弥补亏损时,应借记“盈余公积”,贷记()。

[单选题] *A.“利润分配——未分配利润”B.“利润分配——提取盈余公积”C.“本年利润”D.“利润分配——盈余公积补亏”(正确答案)5、固定资产报废清理后发生的净损失,应计入()。

[单选题] *A.投资收益B.管理费用C.营业外支出(正确答案)D.其他业务成本6、.(年浙江省第三次联考)下列项目中不需要进行会计核算的是()[单选题] *A签订销售合同(正确答案)B宣告发放现金股利C提现备发工资D结转本年亏损7、企业自创的专利权与非专利技术,其研究开发过程中发生的支出,应当区分研究阶段支出与开发阶段支出分别处理。

无法区分研究阶段支出和开发阶段支出,应当将其所发生的研发支出全部费用化,计入当期损益中的()。

[单选题] *A.管理费用(正确答案)B.财务费用C.营业外支出D.销售费用8、A企业2014年12月购入一项固定资产,原价为600万元,采用年限平均法计提折旧,使用寿命为10年,预计净残值为零,2018年1月该企业对该项固定资产的某一主要部件进行更换,发生支出合计400万元,符合固定资产确认条件,被更换的部件的原价为300万元。

则对该项固定资产进行更换后的原价为( )万元。

[单选题] *A.210B.1 000C.820D.610(正确答案)9、.(年浙江省第三次联考)下列属于事前核算职能的是()[单选题] *A记账B分析C考核D预测(正确答案)10、企业对应付的商业承兑汇票,如果到期不能足额付款,在会计处理上应将其转作()。

财务管理第七章习题与答案筹资方式一、单项选择题1.某企业按“2/10,n/50”的条件购进一批商品。

若企业放弃现金折扣,在信用期内付款,则其放弃现金折扣的机会成本为()。

A.16.18% B.20% C.14% D.18.37%2.下列关于企业筹资的基本原则的说法,不正确的是()A.规模适当 B.筹措的资金充足 C.来源合理 D.方式经济3.公司增发的普通股的发行价为20元/股,筹资费用为发行价的5%,最近刚发放的股利为每股2元,已知该股票的资金成本为12%,则该股票的股利年增长率为()。

A.2% B.1.33% C.4% D.5%4.关于留存收益的成本,下列说法不正确的是()A.留存收益是企业资金的一种重要来源B.它实际上是股东对企业进行追加投资,股东对这部分投资也要求有一定的报酬C.由于是自有资金,所以没有成本D.在没有筹资费用的情况下,留存收益的成本计算与普通股是一样的5.某企业用贴现的方式按年利率12%从银行借入款项1000万元,银行要求企业按贷款额的8%保留补偿性余额,该借款的实际年利率为()。

A.15% B.10% C.12% D.12.5%6.在财务管理中,依据财务比率与资金需求量之间的关系预测资金需求量的方法称为()。

A.定性预测法 B.比率预测法 C.基本分析法 D.资金习性预测法7.留存收益的来源渠道()。

A.只有盈余公积 B.只有未分配利润 C.包括盈余公积和未分配利润 D.指的是分配的股利二、多项选择题1.某企业拥有流动资产100万元(其中永久性流动资产为30万元),负债和权益资本共计400万元(其中权益资本150万元,长期负债100万元,自发性流动负债60万元),则以下说法正确的有()。

A.该企业采取的是激进型组合策略B.该企业采取的是平稳型组合策略C.该企业的临时性流动负债为90万元D.该企业目前没有处于经营性低谷2.按有无特定的财产担保,可将债券分为()。

A.信用债券B.有担保债券C.抵押债券D.无担保债券3.甲公司用贴现法以10%的年利率从银行贷款1000万元,期限为1年,则以下说法正确的有()A.甲公司应付利息是90万元B.甲公司实际可用的资金为900万元C.甲公司的实际利率要比10%高D.甲公司的应付利息是100万元4.在短期借款的利息计算和偿还方法中,企业实际负担利率高于名义利率的有()。

第七章营运资金管理思考练习一、单项选择题1.C2.B3.D4.C5.B6.B7.C8.C9.B 10.B 11.A 12.D 13.C 14.D 15.C二、多项选择题1.ACD 2.AB 3.BCD 4.ABC 5.ABCD 6.BC 7.AB 8.AC9.AB 10.BC 11.AC 12.ABCD 13.BC 14.BD 15.BD三、判断题1-5.×√×√× 6-10.√×××× 11-15 √×√×√四、计算题1.(1)最佳现金持有量=(2×400000×400/20%)1/2=40000元(2)转换成本=400000/40000×400=4000元机会成本=40000/2×20%=4000元(3)有价证券交易间隔期=360/(400000÷40000)=36天2.(1)收益增加=800×5%×20%=8(万元)(2)信用政策调整后的平均收现期=20×30%+30×40%+40×30%=30(天)收入增加使资金平均占用变动=800×(1+5%)×80%/360×30-800×80%/360×25=11.56(万元)(3)应计利息变动=11.56×10%=1.156(万元)(4)增加的收账费用=800×5%×1%=0.4(万元)(5)增加坏账损失=800×(1+5%)×1.2%-800×1%=2.08(万元)(6)增加的现金折扣=800×(1+5%)×30%×2%+800×(1+5%)×40%×1%=8.4(万元)(7)增加的各项费用合计=1.156+0.4+2.08+8.4=12.036(万元)(8)改变信用期的净损益=8-12.036=-4.036(万元),小于0。

中国人民大学会计系列教材·第四版《财务管理学》章后练习参考答案第一章总论二、案例题答:(1)(一)以总产值最大化为目标缺点:1. 只讲产值,不讲效益;2. 只求数量,不求质量;3. 只抓生产,不抓销售;4. 只重投入,不重挖潜。

(二)以利润最大化为目标优点:企业追求利润最大化,就必须讲求经济核算,加强管理,改进技术,提高劳动生产率,降低产品成本。

这些措施都有利于资源的合理配置,有利于经济效益的提高。

缺点:1. 它没有考虑利润实现的时间,没有考虑资金时间价值;2. 它没能有效地考虑风险问题,这可能会使财务人员不顾风险的大小去追求最多的利润;3. 它往往会使企业财务决策带有短期行为的倾向,即只顾实现目前的最大利润,而不顾企业的长远发展。

(三)以股东财富最大化为目标优点:1. 它考虑了风险因素,因为风险的高低,会对股票价格产生重要影响;2. 它在一定程度上能够克服企业在追求利润上的短期行为,因为不仅目前的利润会影响股票价格,预期未来的利润也会对企业股票价格产生重要影响;3. 它比较容易量化,便于考核和奖惩。

缺点:1. 它只适用于上市公司,对非上市公司则很难适用;2. 它只强调股东的利益,而对企业其他关系人的利益重视不够;3. 股票价格受多种因素影响,并非都是公司所能控制的,把不可控因素引入理财目标是不合理的。

(四)以企业价值最大化为目标优点:1. 它考虑了取得报酬的时间,并用时间价值的原理进行了计量;2. 它科学地考虑了风险与报酬的关系;3. 它能克服企业在追求利润上的短期行为,因为不仅目前的利润会影响企业的价值,预期未来的利润对企业价值的影响所起的作用更大。

缺点:很难计量。

进行企业财务管理,就是要正确权衡报酬增加与风险增加的得与失,努力实现二者之间的最佳平衡,使企业价值达到最大化。

因此,企业价值最大化的观点,体现了对经济效益的深层次认识,它是现代企业财务管理目标的最优目标。

(2)青鸟天桥的财务管理目标是追求控股股东利益最大化。

财务管理第七章习题一、单项选择题1. 企业将资金占用在应收账款上而放弃其他方面投资可获得的收益是应收账款的( A )。

A.管理成本B.坏账成本C.资金成本D.机会成本2.经济批量是指( D )。

A.采购成本最低的采购批量B.订货成本最低的采购批量C.储存成本最低的采购批量D.存货总成本最低的采购批量3.在对存货采用ABC法进行控制时,应当重点控制的是( B )。

A.数量较大的存货B.占用资金较多的存货C.品种多的存货D.价格昂贵的存货4.信用标准常见的表示指标是( A )。

A.信用条件B.预期的坏账损失率C.现金折扣D.信用期 5.企业置存现金,主要是为了满足( D )。

A.交易性、预防性、盈利性需要B.交易性、预防性、投机性需要C.支付性、预防性、盈利性需要D.交易性、预防性、流通性需要 6.企业评价客户登记,决定给予或拒绝客户信用的依据是( A )。

A.信用标准B.收账政策C.信用条件D.信用政策7.下列各项属于应收账款机会成本的是( C )。

A.坏账损失B.收账费用C.应收账款占用资金的应计利息D.对客户信用进行调查的费用8.现金作为一种资产,它的( A )。

A.流动性强,盈利性差B.流动性强,盈利性强C.流动性差,盈利性强D.流动性差,盈利性强9.在存货ABC分类控制法中,对存货的最基本的分类标准为(A )。

A.金额标准B.品质标准C.品种数量标准D.质量成容积标准二、多项选择题1.控制现金支出的有效措施包括( ABCD )A.推迟支付应付款B.采用汇票付款C.加速收款D.合理利用“浮游量”260 2.最佳现金持有量的模式包括( ABC )A.现金周转模式B.存货模式C.成本分析模式D.因素分析模式3.企业持有现金的动机包括( ABC )A.交易动机B.预防动机C.投机动机D.满足未来偿债要求建立偿债4.下列各项中,属于信用政策的有( BCD )A.现销政策B.信用标准C.收账政策D.信用条件5.存货成本包括( ABCD )A.缺货成本B.订货成本C.储存成本D.购置成本三、判断题1.根据存货经济订货量模型,经济订货量是能使订货总成本与储存总成本相等的订货批量(×)。

第七章1某软件公司目前有两个项目A、B可供选择,其各年现金流量情况如下表所示。

(1)若公司要求的项目资金必须在3 1500 30003华荣公司准备投资一个新的项目以扩充生产能力,预计该项目可以持续5年,固定资产投资750万元。

固定资产采用直线法计提折旧,折旧年限为5年,估计净残值为50万元。

预计每年的付现固定成本为300万元,每件产品单价为250元,年销量30000件,均为现金交易。

预计期初需要垫支营运资本250万元。

假设资本成本率为10%,所得税税率为25%,要求:1、计算项目营业净现金流量2、计算项目净现值3、计算项目的内涵报酬率初始投资=-(750+250)万元1、计算(1)项目营业净现金流量固定资产年折旧额=(750-50)/5=140万元营业净现金流量=(营业收入-付现成本)*(1-所得税率)+折旧额*所得税率=(250*3-300)*(1-25%)+140*25%=372.5万元第0年:-1000万元第1-4年:372.5万元第5年:372.5+250+50=672.5万元2、计算(2)项目净现值NPV=372.5*(P/A,10%,4)+672.5*(P/F,10%,5)-1000 =372.5*3.1699+672.5*0.6209-1000=598.35(3)计算项目的内涵报酬率按28%估行的贴现率进行测试,372.5*(P/A,28%,4)+672.5*(P/F,28%,5)-1000=30.47万元按32%估行的贴现率进行测试,372.5*(P/A,32%,4)+672.5*(P/F,32%,5)-1000=-51.56万元内涵报酬率IRR=28%+((30.47-0)/(30.47+51.56))*(32%-28%)=29.49%3 某公司要在两个项目中选择一个进行投资:A项目需要160000元的初始投资,每年产生80000元的现金净流量,项目的使用寿命为3年,3年后必须更新且无残值;B项目需要210000元的初始投资,每年产生64000元的现金净流量,项目的使用寿命为6年,6年后必须更新且无残值。

《财务管理学》第七章作业及答案

一、名词解释

1.营运资金(狭义)

2.企业的资产组合

3.企业的筹资组合

4.经济批量

二、单选题

1.在下列各项中,属于应收账款机会成本的是( )。

A 坏账损失

B 收账费用

C 对客户信用进行调查的费用

D 应收账款占用资金的应计利息

2.信用条件“1/10,n/30”表示( )。

A 信用期限为10天,折扣期限为30天

B 如果在开票后10天~30天内付款可享受10%的折扣

C 信用期限为30天,现金折扣为10%

D 如果在10天内付款,可享受1%的现金折扣,否则应在30天内全额付款

3.在对存货采用ABC法进行控制时,应当重点控制的是( )。

A 数量较大的存货

B 占用资金较多的存货

C 品种多的存货

D 价格昂贵的存货

4、某公司现金收支平稳,预计全年现金需要量为250000元,现金与有价证券的转换成本为每次500元,有价证券年利率为10%。

则最佳现金持有量为:

A.50000元

B.5000元

C.2500元

D.500元

三、多选题

1.不同的资产组合对企业报酬和风险的影响主要有( )。

A 较多地投资于流动资产可以降低企业的风险,但会减少企业的盈利

B 流动资产投资过多,而固定资产又相对不足,会使企业生产能力减少

C 如果企业的固定资产增加,会造成企业的风险增加,盈利减少

D 如果企业的固定资产减少,会造成企业的风险增加,盈利减少

E 企业采用比较冒险的资产组合,会使企业的投资报酬率上升

2.为了评价两个可选择的信用标准孰优孰劣,必须计算两个方案各自带来的利润和成本,为此应测试的项目有( )。

A 信用条件的变化情况

B 销售量变化对利润销售的影响

C 应收账款投资及其机会成本的变化

D 坏账成本的变化

E 管理成本的变化

3.利息率状况对企业筹资组合的影响是( )。

A 一般来说,由于长期资金的利息率高,因此企业较少使用长期资金,较多使用短期

资金

B 当长期资金的利息率和短期资金的利息率相差较少时,企业一般较多地利用长期资金,

较少使用流动负债

C 短期资金和长期资金利息率的波动都很大,不易确定

D 当长期资金利息率远远高于短期资金利息率时,会促使企业较多地利用流动负债,

以降低资金成本

E 利息率对企业的筹资组合没有影响

4.下列关于商业信用的叙述中正确的是( )。

A 商业信用有赊购商品和预收货款两种形式

B 商业信用与商品买卖同时进行,属自然性融资

C 无论企业是否放弃现金折扣,商业信用的资金成本都较低

D 商业信用是企业之间的一种间接信用关系

E 信用条件“1/10,n/30”表明企业如在10天内付款,则可享受到10%的现金折扣

四、计算题:

1、某公司材料年需要量8000千克,进货单价为25元/千克,单位年储存成本为6元,每次订货成本为160元,一定订货在2000千克以上可获得现金折扣3%,求最佳经济批量。

2、东方公司1998年计划销售收入为7200万元,预计有60%为赊销,应收账款的平均收现期为60天。

求1998年度该公司应收账款平均占用资金的数额。

一、名词解释

1.营运资金(狭义) : 营运资金是指在企业生产经营活动中占用在流动资产上的资金。

狭义的营运资金又称净营运资金,是指流动资产减流动负债后的余额。

2.企业的资产组合 :企业资产总额中流动资产和非流动资产各自占有的比例。

3.企业的筹资组合 :企业资金总额中短期资金和长期资金各自占有的比例。

4.经济批量:一定时期储存成本和订货成本总和最低的采购批量。

二、单选题

1.在下列各项中,属于应收账款机会成本的是( D)。

A 坏账损失

B 收账费用

C 对客户信用进行调查的费用

D 应收账款占用资金的应计利息

2.信用条件“1/10,n/30”表示( D)。

A 信用期限为10天,折扣期限为30天

B 如果在开票后10天~30天内付款可享受10%的折扣

C 信用期限为30天,现金折扣为10%

D 如果在10天内付款,可享受1%的现金折扣,否则应在30天内全额付款

3.在对存货采用ABC法进行控制时,应当重点控制的是( B)。

A 数量较大的存货

B 占用资金较多的存货

C 品种多的存货

D 价格昂贵的存货

4、某公司现金收支平稳,预计全年现金需要量为250000元,现金与有价证券的转换成本为每次500元,有价证券年利率为10%。

则最佳现金持有量为: A

A.50000元

B.5000元

C.2500元

D.500元

三、多选题

1.不同的资产组合对企业报酬和风险的影响主要有(ABE )。

A 较多地投资于流动资产可以降低企业的风险,但会减少企业的盈利

B 流动资产投资过多,而固定资产又相对不足,会使企业生产能力减少

C 如果企业的固定资产增加,会造成企业的风险增加,盈利减少

D 如果企业的固定资产减少,会造成企业的风险增加,盈利减少

E 企业采用比较冒险的资产组合,会使企业的投资报酬率上升

2.为了评价两个可选择的信用标准孰优孰劣,必须计算两个方案各自带来的利润和成本,为此应测试的项目有(BCDE )。

A 信用条件的变化情况

B 销售量变化对利润销售的影响

C 应收账款投资及其机会成本的变化

D 坏账成本的变化

E 管理成本的变化

3.利息率状况对企业筹资组合的影响是( BD)。

A 一般来说,由于长期资金的利息率高,因此企业较少使用长期资金,较多使用短期资金

B 当长期资金的利息率和短期资金的利息率相差较少时,企业一般较多地利用长期资金,较少使用流动负债

C 短期资金和长期资金利息率的波动都很大,不易确定

D 当长期资金利息率远远高于短期资金利息率时,会促使企业较多地利用流动负债,以降低资金成本

E 利息率对企业的筹资组合没有影响

4.下列关于商业信用的叙述中正确的是( AB)。

A 商业信用有赊购商品和预收货款两种形式

B 商业信用与商品买卖同时进行,属自然性融资

C 无论企业是否放弃现金折扣,商业信用的资金成本都较低

D 商业信用是企业之间的一种间接信用关系

E 信用条件“1/10,n/30”表明企业如在10天内付款,则可享受到10%的现金折扣

四、计算题:

1、某公司材料年需要量8000千克,进货单价为25元/千克,单位年储存成本为6元,每次订货成本为160元,一定订货在2000千克以上可获得现金折扣3%,求最佳经济批量。

按存货模式计算得到存货经济批量为:

件。

综上,最佳经济批量为件,若一次订货件。

所以,经济批量为(元)(次)时,订货次数为:当(元)(次)时,订货次数为:当(千克)每件年储存成本每次订货成本全年需要量20000640203%)-(12580001602000

8000622000TC 20006532040422580001601362

654TC 136548000654N 2040392580001601362

653TC 136538000653N 2.6536

160*8000*2**2C AF 2*=⨯⨯+⨯+⨯==⨯+⨯+⨯==⎥⎦

⎤⎢⎣⎡==⨯+⨯+⨯==⎥⎦

⎤⎢⎣⎡=====N

2、东方公司1998年计划销售收入为7200万元,预计有60%为赊销,应收账款的平均收现期为60天。

求1998年度该公司应收账款平均占用资金的数额。

应收账款平均资金占用额为:

(元)或者(元)72060360

%60720072060

360

%607200=⨯⨯=⨯。