资产组合理论2

- 格式:pptx

- 大小:459.67 KB

- 文档页数:55

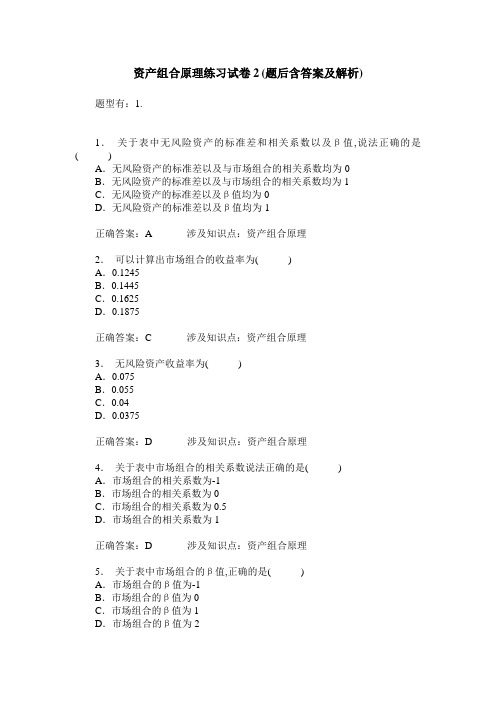

资产组合原理练习试卷2(题后含答案及解析) 题型有:1.1.关于表中无风险资产的标准差和相关系数以及β值,说法正确的是( )A.无风险资产的标准差以及与市场组合的相关系数均为0B.无风险资产的标准差以及与市场组合的相关系数均为1C.无风险资产的标准差以及β值均为0D.无风险资产的标准差以及β值均为1正确答案:A 涉及知识点:资产组合原理2.可以计算出市场组合的收益率为( )A.0.1245B.0.1445C.0.1625D.0.1875正确答案:C 涉及知识点:资产组合原理3.无风险资产收益率为( )A.0.075B.0.055C.0.04D.0.0375正确答案:D 涉及知识点:资产组合原理4.关于表中市场组合的相关系数说法正确的是( )A.市场组合的相关系数为-1B.市场组合的相关系数为0C.市场组合的相关系数为0.5D.市场组合的相关系数为1正确答案:D 涉及知识点:资产组合原理5.关于表中市场组合的β值,正确的是( )A.市场组合的β值为-1B.市场组合的β值为0C.市场组合的β值为1D.市场组合的β值为2正确答案:C 涉及知识点:资产组合原理6.利用β的定值公式,可以得到A股票的标准差为( )A.0.1B.0.2C.0.3D.0.4正确答案:B 涉及知识点:资产组合原理7.计算出B股票与市场组合的相关系数为( )A.0.3B.0.4C.0.6D.0.8正确答案:C 涉及知识点:资产组合原理8.C股票的β值和标准差分别为( )A.0.1B.0.2C.0.25D.0.5正确答案:D 涉及知识点:资产组合原理9.C股票的标准差为( )A.0.1B.0.25C.0.5D.0.75正确答案:B 涉及知识点:资产组合原理10.下列关于证券的风险分散能力,说法错误的是( )A.两个证券之间ρ值的绝对值越大,组合的风险分散能力越差B.两个证券之间ρ值为-1时,组合的风险分散能力越大C.两个证券之间ρ值为1时,组合的风险分散能力越大D.两个证券之间ρ值为0时,两证券之间不存在线性相关性正确答案:C 涉及知识点:资产组合原理11.在资产组合和资产定价理论中,通常用β值和标准差来衡量风险。

投资学中的资产组合理论投资学是研究投资行为和投资决策的学科,而资产组合理论是投资学中的重要理论之一。

资产组合理论旨在通过合理配置不同资产,以达到最佳的投资组合,实现风险和收益的平衡。

一、资产组合理论的基本原理资产组合理论的核心思想是通过将资金分散投资于不同的资产类别,降低投资风险,提高收益。

这是因为不同的资产类别具有不同的风险和收益特征,通过组合投资可以平衡不同资产的风险和收益,降低整体投资风险。

资产组合理论的基本原理包括以下几点:1. 分散投资:将资金分散投资于不同的资产类别,如股票、债券、房地产等,以降低投资风险。

当某一资产表现不佳时,其他资产可能表现良好,从而实现风险的分散。

2. 风险与收益的权衡:投资者在选择资产组合时,需权衡风险和收益。

通常情况下,高风险资产具有高收益潜力,而低风险资产则收益相对较低。

投资者需根据自身风险承受能力和投资目标来确定合适的资产配置比例。

3. 投资者偏好:资产组合理论认为投资者有不同的风险偏好和收益要求。

有些投资者偏好高收益高风险的资产,而有些投资者则更倾向于低风险低收益的资产。

因此,投资者的风险偏好是资产组合构建的重要考量因素。

二、资产组合构建的方法资产组合构建的方法有多种,常见的方法包括:1. 最小方差组合:这是资产组合理论中最经典的方法之一。

最小方差组合是指在给定风险水平下,使投资组合的方差最小化。

通过对不同资产的权重进行调整,可以找到最佳的投资组合,以实现风险和收益的平衡。

2. 马科维茨均值方差模型:这是一种基于投资组合风险与收益之间的权衡关系的建模方法。

该模型将投资组合的收益率和方差作为评价指标,通过优化模型中的参数,找到最佳的投资组合。

3. 市场组合理论:市场组合理论认为,市场上的投资组合是最佳的组合,因为市场上的投资者都是理性的,他们会选择最佳的资产配置比例。

因此,投资者可以通过购买市场上的指数基金等方式,间接获得市场组合的收益。

三、资产组合理论的应用资产组合理论在实际投资中具有广泛的应用。

资产组合管理(二)(总分54,考试时间90分钟)单项选择题1. Stock A has a standard deviation of O. 5 and Stock B has a standard deviation of 0.3. Stock A and Stock B are perfectly positively correlated. According to Markowitz portfolio theory how much should be invested in each stock to minimize the portfolio"s standard deviation?A. 100% in StockA. B. 50% in Stock A and 50% in Stock B.B. 100% in StockC.2. Adding a stock to a portfolio will reduce the risk of the portfolio if the correlation coefficient is less than which of the following?A. +0.50.B. 0.00.C. +1.00.3. An analyst believes that EFG will pay a $1 dividend a year from now, and will be priced at $23 per share immediately following the dividend. The risk-free rate is 4%, and the analyst forecasts an expected market return of 12%. EFG has a beta of 0.75 and a current price of $ 22.Based on this information:A. EFG is overvalued.B. EFG is undervalued.C. EFG is fairly priced.4. Consider a stock selling for $ 23 that is expected to increase in price to $ 27 by the end of the year and pay a $ 0.50 dividend. If the risk-free rate is 4 percent, the expected return on the market is 8.5 percent, and the stock"s beta is 1.9, what is the current valuation of the stock?The stock:A. is overvalued.B. is undervalued.C. is correctly valued.5. With respect to the security market line, if two risky assets have the same covariance with the market portfolio but have different estimated rates of return, the most accurate conclusion is that the two risky assets have:A. the same amount of systematic risk, and both assets are properly valued.B. different amount of systematic risk, and both assets are properly valued.C. The same amount of systematic risk, and at least one of the assets is either overvalued or undervalued.6. The risk-free rate is 5% and the expected market risk premium is 10%. A portfolio manager is projecting a return of 20% on a portfolio with a beta of 1.5. After adjusting for risk, this portfolio is expected to:A. equal the market"s performance.B. outperform the market.C. underperform the market.7. The statistics for three stocks A, B, and C are shown below. Based only on the information provided, and given a choice between portfolios of equal amounts of stock A and B or B and C, Correlation of ReturnsStock A B CA 1.00 0.90 0.50B 1.00 0.10C 1.00Standard Deviation of ReturnsStock A BS"dev 0.40 0.20 0.40which portfolio you would recommend?A. AB.B. BC.C. AC.8. An investor is evaluating the following possible portfolios. Which of the following portfolios would not lie on the efficient frontier? PortfolioExpected Return Standard DeviationA 26% 28%B 23% 34%C 14% 23%D 18% 14%E 11% 8%F 18% 16%A. C, D, and E.B. A, E, and F.C. B, C, and F.9. Which of the following types of risk are essentially the same?A. Market risk and unsystematic risk.B. Total risk and the variance of returns.C. Undiversifiable risk and unsystematic risk.10. Which of the following assumptions associated with the capital asset pricing model (CAPM), when relaxed, will be least likely to result in turning the security market line (SML) into a band rather than a line?A. No transaction costs.B. Equal borrowing and lending rates.C. Homogeneous expectations.11. The particular portfolio on the efficient frontier that best suits an individual investor is determined by:A. the individual"s asset allocation plan.B. the beta of the market at that particular time.C. the individual"s utility curve.12. Rank, from highest to lowest, the following investors by their most likely capacity to tolerate risk. Age Marital StatusChildren Net Worth Annual IncomeInvestor A 50 Widowed 0 $4 million $ 50000Investor B 30 Married 1 $4 million $ 100000Investor C 70 Married 0 $1 million $ 30000Investor D 50 Married 2 $1 million $ 50000A. C, D,A,B. B. B, D,A,B.C. B, A, D, C.13. Empirical evidence suggests that the security market line (SML) does not maintain a constant slope or intercept across time, creating valuation issues for securities analysts and portfolio managers. Which of the following will cause the slope of the SML to change or cause a shift in the SML?Change in Slope Shift in SML①A. An increase in expected inflation A decrease in real growth②B. A decrease in real growth An increase in the market risk premium③C. An increase in the market risk premium Unexpected growth of the money supplyA. ①B. ②C. ③14. The Objectives part of the investment policy statement serves to:A. set out what the invested money will be used for.B. establish the benchmarks to be used in evaluating performance of the investments.C. express the expected risk and return for the invested capital.15. An investor has identified the following possible portfolios. Which portfolio lies to the right of the efficient frontier? Portfolio Expected Return Standard DeviationA 18% 35%B 14% 20%C 13% 24%A. A.B. C.C. B.16. The market portfolio in the Capital Market Theory contains which types of investments?A. All risky assets in existence.B. All risky and risk-free assets in existence.C. All stocks and bonds in existence.17. According to the Markowitz model of portfolio risk, any portfolio with 10 securities would require estimation of a total of:A. 10 variance and 45 unique covariance statistics.B. 100 unique variance or covariance statistics.C. 50 unique variance or covariance statistics.18. Using the Markowitz model, calculation of the portfolio standard deviation does not require the:A. Expected rate of return on the market portfolio.B. Variance of each individual asset in the portfolio.C. Weight of each individual asset in the portfolio, where the weight is determined by the portfolio value.19. An analyst gathered the following information about stock A and the market index: Estimated future rate of retum for stock A 16%Covariance of stock Awith the market index 600.0standard deviation of the market index 20.0Risk-free rate of retum 5%Yield of zero coupon Treasury bond 6%Expected future rate of return for the market index 13%Based only on the information above, the analyst"s most appropriate conclusion is that the stock is:A. overvalued because the required rate of return for the stock is 15.5%.B. overvalued because the required rate of return for the stock is 17.0%.C. undervalued because the required rate of return for the stock is 15.5%.20. An investor in a high tax bracket would typically:A. invests in income producing securities.B. prefers capital gains to income.C. has a lower tolerance for risk.21. Generally speaking, the factor that best explains a portfolio"s level of return and variation in return over time can be explained by:A. target asset allocation decision.B. investment manager"s skill with respect to market timing.C. investment manager"s skill with respect to security selection.22. What are the added types of risks involved with global investing?A. currency risk and inflation riskB. currency risk and country riskC. country risk and political risk23. Securities A and B have forecasted returns of 14% and 18% over the next 12 months. During the same period, the market (M) is expected to generate returns of 16%. The risk-free rate is 6% , and β = 1.1. The forecasted price for next year for security A is $ 60. According to the CAPM, what should A sell for today?A. $51.72.B. $54.05.C. $51.28.24. Which of the following is not a characteristic of a portfolio located on the efficient frontier?A. the portfolio offers the highest possible return for its level of standard deviation.B. the portfolio offers the highest possible risk for its level of return.C. the portfolio offers the lowest possible risk for its level of return.25. Which of the following statements about the importance of risk and return in the investment objective is least accurate?A. The investor"s risk tolerance is likely to determine what level of return will be feasible.B. Expressing investment goals in terms of risk is more appropriate than expressing goals in terms of return.C. Expressing investment objectives only in terms of return can lead to inappropriate investments.26. An analyst gathered the following data on Stock A and Stock B: ScenarioProbability Stock A"s returnStock B"s return1 0.5 0.30 0.1502 0.5 0.15 0.075What is the covariance between the returns of Stock A and Stock B?A. 0.0076.B. 0.0028.C. 0.0876.27. Portfolio managers at Goodwin & Associates believe they can significantly alter the risk/return profile of their risky portfolios by allocating a portion of available funds to the risk-free asset. Which of the following statements correctly assesses the effect of combining the risk-free asset with a risky portfolio? Adding the risk-free asset will:A. decrease portfolio standard deviation due to its positive correlation with risky assets.B. decrease portfolio standard deviation because it is uncorrelated with risky assets.C. decrease portfolio standard deviation due to its negative correlation with risky assets.28. An analyst gathers the following data about the returns for three stocks.Stock A Stock B Stock C E(R) 0.04 0.09 0.11σ 2 0.0025 0.00640.0081CovAB = 0.001, ρBC = 0.60The correlation coefficient between the returns of Stock A and Stock B ( ρAB ) and the covariance between the returns of Stock B and C (CovBC) are closest to:ρAB CovBC①A. 0.01 0.002②B. 0.01 0.004③C. 0.25 0.004A. ①B. ②C. ③29. Both Portfolio X and Portfolio Y are well-diversified. The risk-free rate is 8 percent, and the return for the marker is 16 percent, that is:Portfolio Expected Return BetaX 16% 1.00Y 12% 0.25In this situation, which of the following Correlation of Returns about Portfolio X and Portfolio Y is true?Portfolio X Portfolio Y①A. overvalued properly valued②B. properly valued undervalued③C. undervalued properly valuedA. ①B. ②C. ③30. While assessing an investor"s risk tolerance, a financial adviser is least likely to ask which of the following questions?A. "How old are you?"B. "What rate of investment return do you expect?"C. "How much insurance coverage do you have?"31. Which of the following statements concerning the security market line (SML) and the capital market line (CML) is true?A. All portfolios are expected to lie on the CML.B. All securities are expected to lie on the CML.C. All securities are expected to lie on the SML.32. In the policy statement for a young person, which of the following characterizations might be most appropriate?A. high risk.B. high liquidity.C. high cash payout.33. When an investor can borrow and invest at the risk-free rate, which of the following statements is least likely valid?A. The capital market line (CML) is straight.B. Investors who borrow the risk-free asset to lever their portfolio will move their portfolios to the right of the market portfolio on the CML.C. The x-axis measurement of risk is the standardized covariance.34. Which one of the following is least likely one of the assumptions of capital market theory?A. Investors have heterogeneous expectations.B. Markets are in equilibrium.C. There are no taxes or transaction costs involved in buying or selling assets.35. Which type of risk is positively related to expected excess returns according to the CAPM?A. Unique.B. Systematic.C. Diversifiable.36. The risk-free rate is 5% and the expected market return is 15%. A portfolio manager isprojecting a return of 20% on a portfolio with a beta of 1.5. After adjusting for risk, this portfolio"s return will:A. he equal to the market.B. outperform the market.C. underperform the market.37. Which of the following should NOT be included as a constraint in an investment policy statement (IPS)?A. How funds are spent after being withdrawn from the portfolio.B. Tax implications on the returns generated by the portfolio.C. Constraints put on investment activities by regulatory agencies.38. Given the following data what is the correlation coefficient between the two stocks and the Beta of stock A?standard deviation of returns of Stock A is 10.04 percentstandard deviation of returns of Stock B is 2.05 percentstandard deviation of the market is 3.01 percentcovariance between the two stocks is 0.00109covariance between the market and stock A is 0.002Correlation Coefficient Beta ( stock A)①A. 0.6556 0.06②B. 0.5296 0.06③C. O.5296 2.2A. ①B. ②C. ③39. Which of the following statements about investment constraints is FALSE?A. Diversification efforts can increase tax liability.B. Investors concerned about time horizon are not likely to worry about liquidity.C. Tax deferral usually makes more sense for the young than for the old.40. The manager of the Fullen Balanced Fund is putting together a report that breaks out the percentage of portfolio return that is explained by the target asset allocation, security selection, and tactical variations from the target, respectively. Which of the following sets of numbers was the most likely conclusion for the report?A. 90%, 6%,4%.B. 50%,25%,25%.C. 33%, 33%, 33%.41. Which of the following statements about the security market line (SML) and capital market line (CML) is most accurate?A. The SML is a straight line, but the CML is a curve.B. The SML involves the concept of a risk-free asset, but the CML does not.C. The SML uses beta, but the CML uses standard deviation as the risk measure.42. An analyst gathered the following return information over a lO-year period for two funds, Fund X and Fund Y:Correlation (RX, RY) = 0.34Based on this information, the population covariance of the returns between the two funds is closest to:A. 4.35.B. 7.42.C. 31.61.43. An investor holds a portfolio of two stocks, ABC Inc. , and XYZ Corp, and is considering adding the stock of New Company to her portfolio. For diversification purposes, the most important factor for her considers where making this decision is:A. new Company"s expected return relative to the of ABC and XYZ.B. the average covariance of New Company"s returns with the returns of ABC and XYZ.C. the total variance of New Company"s returns relative to the variance of returns for ABC and XYZ.44. As time goes on, we expect the SML:A. to change slope to reflect different investment opportunities in the markets.B. to change level to reflect changes in risk aversion among investors.C. to change level and slope depending on the economic conditions prevailing.45. An investor owns the following portfolio today. Stock Market Value Expected Annual ReturnR $ 2000 17%S $ 3200 8%T $ 2800 13%The investor"s expected total rate of return( increase in market value) after three years is closest to:A. 12.0%.B. 36.0%.C. 40.5%.46. All of the following are part of the portfolio-management process EXCEPT:A. limiting the portfolio"s tax liability.B. allocating assets for the portfolio and rebalancing the portfolio.C. identifying the investor"s goals and constraints.47. Which of the following statements about return objectives is TRUE?A. To achieve the capital appreciation objective, the nominal rate of return must exceed the rate of inflation.B. The total return objective considers returns from both capital gains and current income, net of expected inflation.C. The current income objective is usually appropriate when an investor requires the purchasing power of the initial investment to increase over time.48. Robert Johnson, CFA, is considering the purchase of two stocks from different industry. Each stock has an expected return of 12.5 percent and an expected standard deviation of returns of 16 percent. Which of the following statements Johnson said about the two stocks is most accurate?A. Regardless of the weights selected or the correlation between the returns of the two stocks, the expected standard deviation of a **posed of the two stocks will be less than 16%.B. Rational investor should not invest in the two stocks because their returns obviously exhibit positive correlation.C. Regardless of the weights selected or the correlation between the returns of the two stocks, the expected return of a **posed of the two stocks will be 12.5 %.49. If the standard deviation of stock A is 7.2 percent, the standard deviation of stock B is 5.4 percent, and the covariance between the two is - 0. 0031, what is the correlation coefficient?A. -0.64.B. -0.80.C. -0.19.50. Mason Snow, CFA, is an analyst with Polari Investments. Snow"s manager has instructed him to put only securities that are undervalued on the buy list. Today, Snow is to make a recommendation on the following two stocks: Bahre (with an expected return of 10 percent and a beta of 1.4) and Cubb (with an expected return of 15 percent and a beta of 2.0). The risk-free rate is at 7 percent and the market premium is 4 percent. Snow places:A. neither security on the list.B. only Bahre on the list.C. only Cubb on the list.51. Which of the following statement best described the efficient frontier? It is the set of portfolios that has :A. the minimum risk for every level of return.B. the maximum return for each level of beta based on the capital asset pricing model.C. the maximum excess rate of return for every given level of risk.52. Which of the following statements about risk and return is FALSE?A. Return objectives should be considered in conjunction with risk preferences.B. Return objectives may be stated in dollar amounts or in percentages.C. Return-only objectives provide a more concise and efficient way to measure performance for investment managers.53. Which of the following statements about risk is least likely correct?A. The security market line plots expected return against systematic risk.B. The capital market line plots expected return against total risk.C. The efficient frontier plots expected return against unsystematic risk.54. Joe Finn is a highly paid corporate executive who will retire in two years. Over 25 years ago, Finn bought a large portfolio of growth stocks that has performed quite well. Finn has asked his financial adviser to consider switching from stocks to high-yielding bonds. The investment issue of greatest concern in implementing this strategy will be:A. liquidity needs.B. time horizon.C. tax considerations.。

资产组合理论投资组合理论⼀、资产组合理论简介资产组合理论是与投资问题紧密联系在⼀起的,所以也被称为投资组合理论。

该理论产⽣于上世纪50年代,是财务学家们在探索如何定量风险、选择最佳资产组合以分散和控制风险的道路上逐步发展起来的。

资产组合理论学派的代表⼈物包括马克维兹、威廉·夏普、斯蒂芬·罗斯等。

其中马克维兹分别于1952和1959年发表了《资产组合选择》的论⽂和《组合选择》的专著,论述了投资收益率的⽅差确定⽅法和风险资产组合模型,成为资产组合理论学派的创始⼈。

威廉·夏普在马克维兹理论的基础上于1964年建⽴了著名的CAPM模型,并与1990年与马克维兹分享了第22界诺贝尔经济学奖。

斯蒂芬·罗斯于1976发表了题为《资本资产定价套利理论》的论⽂,对CAPM模型提出极⼤的挑战。

另外,该学派的理论还包括了单指数模型和多因素模型。

⼆、⼏个前提性概念1、风险厌恶和效⽤价值由于⼈们对风险的偏好程度不同,可以将投资者分为三类,即风险厌恶者、风险中性者和风险爱好者。

我们可以使⽤效⽤函数度量投资者对收益和风险的偏好:U =E(r)-0.005Aσ2其中E(r)为期望收益,σ2为收益⽅差,A为风险厌恶系数,其取值区间为(-∞,+∞)数值越⼤,投资者的风险厌恶程度越⾼,当A=0时,即为风险中性者。

在资产组合理论中,假设所有投资者都为风险厌恶者,因此投资者的效⽤值与期望收益呈正向变化,与风险和风险厌恶系数呈反向变化,所以其效⽤函数可以⽤下图表⽰:2、资本配置线和酬报与波动性⽐率在包括了⼀个风险资产和⼀个⽆风险资产的资产组合中,其期望收益和标准差可以⽤下式表⽰:E (r c )=wpE (r p )+(1-w p )r f =r f +w p (E (r p )-r f )σc=w pσp其中w p 为风险资产在组合中所占的⽐例,将以上两式结合可以得到: E (r c )=rf+σσpc (E (r p )-r f )⽤图形表⽰如下:图中的直线就是资本配置线(CAL ),表⽰了投资者的所有的可⾏的风险收益组合。

第20讲:投资组合理论(二)风险资产和无风险资产的组合先发放上一讲的答案。

第1题:C。

如果向左弯曲的程度较大,最小方差组合下方的点无效,所以A错误;此时,最小方差组合以下的点的收益率都低于最小方差组合,所以B也错误。

弯曲程度和相关系数有关,和证券各自的标准差无关,所以D错误。

第2题:ABC。

相关系数为1时,组合的标准差刚好是证券标准差的加权平均,D错误;相关系数小于1时,组合的标准差小于证券标准差的加权平均,ABC 正确。

上一讲我们讨论的是风险资产的组合,即单项资产的标准差都大于零。

后来人们想,能不能引入无风险资产,和风险资产组合再组合呢?当然可以。

假设:风险资产组合的平均收益率和标准差分别为r风险组合和σ风险组合无风险资产的平均收益率和标准差分别为R f和σf这两者组合的平均收益率和标准差分别为r p和σp投资于风险资产组合的比重为Q,则投资于无风险资产的比重为1-Q那么:r p = Qr风险组合+ (1-Q) R fσ2p = Q2σ2风险组合+ (1-Q)2σ2f + 2Qσ风险组合(1-Q)σf r风险组合,f这两个式子看不懂的回去看上一讲!接下来开始变魔术。

首先,人家都叫无风险资产了,风险为零,所以σf=0;其次,无风险资产都是我行我素的,和任何人没有关系,所以r风险组合,f=0。

因此,σ2p = Q2σ2风险组合,即σp = Qσ风险组合,再加上r p = Qr风险组合+ (1-Q) R f,不难发现,r p和σp呈线性关系(不明白的回去看上一讲的虚线框,思路是一样的,这里还简单很多)。

既然如此,两点确定一直线,说明无风险资产(假设R f =8%,而σf = 0,所以是纵轴上的点)和机会集中的任何一点都可以连起来。

这就有无数条直线了,到底选哪条呢?看下图:随便画垂直线(黄色虚线),和三条直线的交点风险相同,但收益1最高、2其次,3最低,所以3排除,而1又达不到(和机会集没有交集),那只能是2了。