中级宏观经济学(英文)19-Money Supply

- 格式:ppt

- 大小:256.00 KB

- 文档页数:23

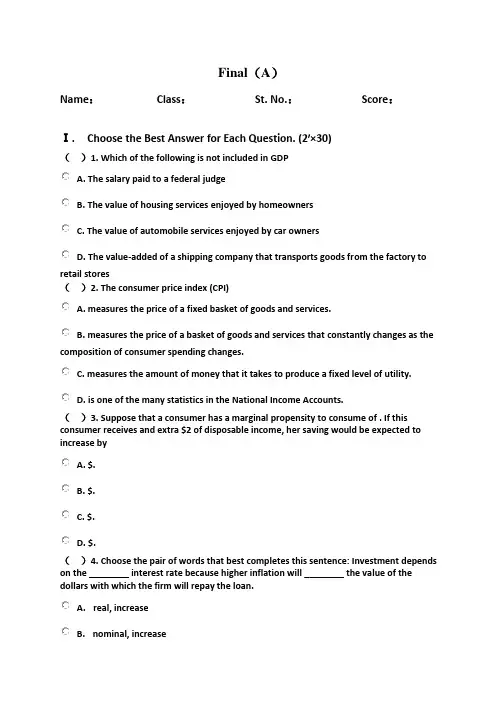

Final(A)Name:Class:St. No.:Score:Ⅰ. Choose the Best Answer for Each Q uestion. (2′×30)()1. Which of the following is not included in GDPA. The salary paid to a federal judgeB. The value of housing services enjoyed by homeownersC. The value of automobile services enjoyed by car ownersD. The value-added of a shipping company that transports goods from the factory to retail stores()2. The consumer price index (CPI)A. measures the price of a fixed basket of goods and services.B. measures the price of a basket of goods and services that constantly changes as the composition of consumer spending changes.C. measures the amount of money that it takes to produce a fixed level of utility.D. is one of the many statistics in the National Income Accounts.()3. Suppose that a consumer has a marginal propensity to consume of . If this consumer receives and extra $2 of disposable income, her saving would be expected to increase byA. $.B. $.C. $.D. $.()4. Choose the pair of words that best completes this sentence: Investment depends on the ________ interest rate because higher inflation will ________ the value of the dollars with which the firm will repay the loan.A. real, increaseB. nominal, increaseC. real, decreaseD. nominal, decrease()5. Consider an economy where the only goods traded are coconuts and pineapples. Last year, 100 coconuts were sold at $1 a piece, and 200 pineapples were sold at $2.50 a piece. If the money supply was $100, what was velocityA. 30B. 15C. 6D. 5()6. When the government raises revenue by printing money, it imposes an "inflation tax" because theA. real value of money holdings falls.B. interest rate falls.C. difference between nominal and real interest rates becomes smaller.D. nominal value of money holdings falls.()7. In a small open economy, which interest rate equals the world interest rateA. The real interest rateB. The nominal interest rateC. Both the real and the nominal interest ratesD. It depends on whether the exchange rate is fixed or floating.()8. If a country's real exchange rate falls (depreciates), thenA. net exports rise.B. net exports fall.C. exports and imports rise by the same amount.D. exports and imports fall by the same amount.()9. Suppose that 2 percent of the employed lose their jobs each month (s = and 38 percent of the unemployed find a job each month (f = . Then, the steady-state rate of unemployment isA. 2 percent.B. 5 percent.C. 16 percent.D. 36 percent.()10. Structural unemployment results whenA. the minimum wage is set to increase in the near future.B. there is generous unemployment insurance.C. workers are temporarily laid off due to weather conditions.D. the real wage is above its market-clearing level.()11. Suppose that the capital stock is 100, the depreciation rate is 10 percent per year, and output is 25. What must the saving rate be to keep the capital stock constantA. 2.5 percentB. 10 percentC. 25 percentD. 40 percent()12. If two economies are identical except for their rates of population growth, then if both economies are in steady state, the economy with the higher rate of population growth will have aA. lower rate of growth of total output.B. higher rate of growth of total output.C. lower rate of growth of output per person.D. higher rate of growth of output per person.()13. In the Solow growth model with population growth (n) and technological progress (g), the steady-state growth rate of total output isA. 0.B. n.C. g.D. n + g.()14. Advocates of the Y=AK model interpret capital asA. consisting solely of the stock of plants and equipment.B. being inversely related to technological progress.C. including knowledge.D. being determined by exogenous forces.()15. The model of aggregate supply and aggregate demand that assumes sticky pricesA. does not explain economic fluctuations.B. shows that output depends on demand as well as supply.C. shows that monetary and fiscal policy are always destabilizing influences on theeconomy.D. shows that monetary policy is neutral.()16. The AS/AD model with sticky prices predicts that, in the long run, a reduction of the money supply results inA. lower prices and lower output.B. lower prices and no change in output.C. no change in prices and lower output.D. no change in prices or output.()17. If investment becomes less sensitive to the interest rate, then theA. LM curve becomes steeper.B. LM curve becomes flatter.C. IS curve becomes steeper.D. IS curve becomes flatter.()18. According to the IS-LM model, if the central bank increases the money supply, then the interest rateA. falls and income falls.B. falls and income rises.C. rises and income falls.D. rises and income rises.()19. The slowdown in the U.S. economy in 2001 can be explained byA. negative shocks to the IS curve resulting in a fall in aggregate demand.B. negative shocks to the LM curve resulting in a fall in aggregate demand.C. negative shocks to the IS curve resulting in a fall in aggregate supply.D. negative shocks to the LM curve resulting in a fall in aggregate supply.()20. The Mundell-Fleming model predicts that, in Y - e space, an appreciation of the exchange rate will cause the IS* curve toA. shift to the left.B. shift to the right.C. become steeper.D. remain unchanged.()21. According to the Mundell-Fleming model, in a small country with a floating exchange rate, a tax cut will cause the exchange rate toA. rise.B. rise in the same proportion as inflation.C. remain constant.D. fall.()22. In the sticky-wage model, output deviates from the natural rate throughA. unexpected changes in the nominal wage.B. expected changes in the price level.C. unexpected changes in the price level.D. expected changes in the real wage.()23. The Lucas critique is based onA. the inside lag of economic policy.B. the Phillips curve.C. automatic stabilizers.D. the fact that people's expectations are rational.()24. If Ricardian equivalence holds and the government cuts taxes without any plans to reduce government spending, then a forward-looking consumer wouldA. increase consumption by the same amount as the tax cut.B. increase consumption by the tax cut times the marginal propensity to consume.C. leave consumption unchanged in order to save for future taxes.D. decrease consumption in order to save for future taxes.()25. In a two-period consumption model, a rise in the income of the second period would cause consumption in the first period toA. rise because of the income effect.B. fall because of the substitution effect.C. remain constant because the income and substitution effects cancel each other.D. be undetermined without more information about sizes of the income andsubstitution effects.()26. Friedman's permanent-income hypothesis asserts that the marginal propensity to consume out of income isA. one.B. zero.C. higher for permanent income than it is for temporary income.D. lower for permanent income than it is for temporary income.()27. The cost of capital does not depend on theA. interest rate.B. rate at which the overall price level is changing.C. depreciation rate.D. rate at which capital prices are changing.()28. If the currency-deposit ratio (cr) is 5 percent and the reserve-deposit ratio (rr) is 30 percent then the money multiplier (m) isA. 1.3.B. 3.C. 4.D. 20.()29. In the Baumol-Tobin model of cash management, if the nominal interest rate rises, individuals would be expected to holdA. less money and make fewer trips to the bank.B. less money and make more trips to the bank.C. more money and make fewer trips to the bank.D. more money and make more trips to the bank.()30. Interest rates are an important part of real-business-cycle theory because theyA. are monetary policy instruments.B. affect the intertemporal substitution of labor.C. affect only real variables.D. link nominal and real variables.II (10′)In U.S.A., the capital share of GDP is about 30 percent; the average growth in output is about 3 percent per year; the depreciation rate is about 4 percent per year; and the capital-output ratio is about . Suppose that the production function is CD, so that the capital share in output is constant, and that the United States has been in a steady state.a. What must the saving rate be in the initial steady stateb. What is the marginal product of capital in the initial steady statec. What will the marginal product of capital be at the Golden Rule steady stated. What will the capital-output ratio be at the Golden Rule steady statee. What must the saving rate be to reach the Golden Rule steady stateIII. (10′) Suppose that investment depends on both income and the interest rate, ., the=+-, where a is a constant between 0 and 1 which investment function is I I aY brmeasures the influence of national income on investment, and b is a constant greater than 0 which measures the influence of the interest rate on investment. Use the IS-LM model to consider the short-run impact of an increase in government purchases on national income Y, the interest rate r, consumption C, and investment I. How might this investment function alter the conclusions implied by the basic IS-LM modelIV . (10′) Suppose that an economy has the Phillips curve 105()n u u ππ--=-.and that the natural rate of unemployment is given by an average of the past two years’ unemploy ment: 120.5n u u u --=(+). Suppose that the Fed follows a policy to reduce permanently the inflation rate by 1 percentage point. What effect will that policy have on the unemployment rate over time What is the sacrifice ratio in this economy What do these equations imply about the short-run and long-run tradeoffs between inflation and unemploymentV. (10′) Suppose that the price level relevant for money demand includes the price of imported goods and that the price of imported goods depends on the exchange rate, ., themoney market is described by /(,)M P L r Y = where (1)/d f P P P e λλ=+-. The parameter is the share domestic goods in the price index P . Assume that the price of domestic goods d P and the price of foreign goods measured in foreign currency f P are fixed. What is the effect of expansionary fiscal policy under floating exchange rates in this model Suppose that political instability increases the country risk premium and, thereby, the interest rate. What is the effect on the exchange rate, the price level, and aggregate income in this model。

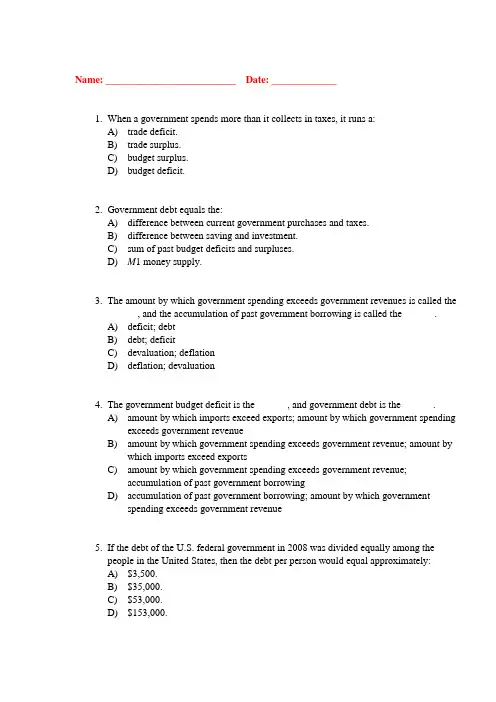

Name: __________________________ Date: _____________1. When a government spends more than it collects in taxes, it runs a:A) trade deficit.B) trade surplus.C) budget surplus.D) budget deficit.2. Government debt equals the:A) difference between current government purchases and taxes.B) difference between saving and investment.C) sum of past budget deficits and surpluses.D) M1 money supply.3. The amount by which government spending exceeds government revenues is called the______, and the accumulation of past government borrowing is called the ______.A) deficit; debtB) debt; deficitC) devaluation; deflationD) deflation; devaluation4. The government budget deficit is the ______, and government debt is the ______.A) amount by which imports exceed exports; amount by which government spendingexceeds government revenueB) amount by which government spending exceeds government revenue; amount bywhich imports exceed exportsC) amount by which government spending exceeds government revenue;accumulation of past government borrowingD) accumulation of past government borrowing; amount by which governmentspending exceeds government revenue5. If the debt of the U.S. federal government in 2008 was divided equally among thepeople in the United States, then the debt per person would equal approximately:A) $3,500.B) $35,000.C) $53,000.D) $153,000.6. Compared to the size of government debt as a percentage of GDP in other majorindustrial countries, the federal government of the United States:A) is one of the most heavily indebted governments.B) has accumulated a relatively small debt.C) has accumulated somewhat greater than average debt.D) is one of the least indebted governments.7. Historically, the primary cause of increases in government debt is:A) printing too much money.B) cutting taxes.C) increasing interest rates.D) financing wars.8. The large increase in U.S. government debt between 1980 and 1995 was unusualbecause it occurred:A) during peacetime.B) during an extended recessionary period.C) without increased government spending.D) without tax cuts.9. Relative to the size of GDP, the U.S. federal government debt was at its maximum:A) at the end of the Revolutionary War.B) at the end of the Civil War.C) at the end of World War II.D) following the 9/11 terrorist attacks in 2001.10. Holding other factors constant, the ratio of government debt to GDP can decrease as aresult of any of the following changes except:A) decreases in government spending.B) increases in GDP.C) decreases in tax revenues.D) decreases in transfer payments.11. If government debt is not changing, then:A) the economy is at long-run equilibrium.B) the government's budget must be balanced.C) GDP must equal the natural rate of output.D) capital per worker is constant.12. The factors most responsible for forecasts of the U.S. government debt spiraling out ofcontrol in the next half century are the projected:A) slowdowns in the rates of technological change and human capital growth.B) decrease in high-skilled domestic workers and the increase in immigration oflow-skilled workers into the United States.C) aging of the U.S. population and rising health care costs.D) increase in international competition and the outsourcing of U.S. jobs.13. An increase in the elderly population of a country affects fiscal policy most directlybecause:A) the elderly generally are not required to pay taxes.B) governments provide pensions and health care for the elderly.C) the elderly favor high interest rates on their savings.D) governments spend more on education as the proportion of the elderly increases.14. Which of the following is the most likely explanation of the August 2011 decision byStandard and Poor's to reduce its credit rating on U.S. government bonds?A) A U.S. government debt default was not a likely outcome, but was a possibility tooccur in the short term.B) The U.S. government budget deficit was too large.C) Strategies to reduce predicted U.S. government future budget deficits did notappear likely, making default a possibility.D) Foreign governments were no longer willing to lend to the U.S. government.15. In a time of inflation when the government budget is balanced in the conventional sense,the real (i.e., deflated) value of the government debt is:A) growing at the rate of inflation.B) growing, but at a rate less than the rate of inflation.C) constant.D) decreasing at the rate of inflation.16. In a time of inflation when the real (i.e., deflated) value of the government debt isconstant, then the conventionally:A) reported government budget will show a deficit equal to the inflation rate times theoutstanding debt.B) reported government budget will show a deficit equal to less than the inflation ratetimes the outstanding debt.C) reported government budget will be balanced.D) measured government budget will show a surplus equal to the inflation rate timesthe outstanding debt.17. Assume that the nominal interest rate is 11 percent, the inflation rate is 8 percent, andgovernment debt at the beginning of the year equals $4 trillion. By how much is the government budget deficit overstated as a result of inflation?A) $0.12 trillionB) $0.32 trillionC) $0.44 trillionD) $0.80 trillion18. A deficit adjusted for inflation should include only government spending used to make_____ interest payments.A) realB) nominalC) foreignD) domestic19. If the government debt, D, equals $5 trillion, the nominal interest rate is 7 percent, andthe real interest rate is 3 percent, then nominal budget deficit overstates the real deficit by $ ___ trillion.A) 0.35B) 0.20C) 0.15D) 0.0720. Current measures of the U.S. federal government's budget deficit account for all of thefollowing except:A) government expenditures.B) government revenues.C) changes in government indebtedness.D) changes in government capital assets.21. If capital budgeting procedures were employed, then a budget deficit would bemeasured as:A) the sum of government debt.B) the change in government debt.C) the change in government debt minus the change in government capital assets.D) the change in government capital assets.22. When the federal government incurs additional debt to acquire an asset, under currentbudgeting procedures the deficit ______, while under capital budgeting procedures the deficit ______.A) does not change; increasesB) increases; does not changeC) does not change; decreasesD) decreases; does not change23. Capital budgeting is a procedure that:A) adjusts the deficit for inflation.B) estimates what the deficit would be if the economy were operating at the naturalrate of output.C) accounts for assets as well as liabilities.D) measures the impact of fiscal policy on the lifetime incomes of individuals ofdifferent ages.24. Under capital budgeting, all of the following transactions would affect the federalbudget deficit except the federal government's:A) sending a check to a welfare recipient.B) sending a check to the state of Massachusetts.C) selling a highway to the state of New York and using the proceeds to retire federaldebt.D) selling an office building.25. The amount the government would owe if a borrower were to default on agovernment-guaranteed loan is an example of:A) capital budgeting.B) a contingent liability.C) a cyclically adjusted liability.D) Ricardian equivalence.26. One item that is considered part of the federal debt is:A) Treasury bills.B) future Social Security benefits.C) student loans, which may go into default.D) potential liabilities of savings and loan associations.27. The debt of the United States government is underreported in the view of manyeconomists because all of the following liabilities are excluded except:A) future pensions of government employees.B) debt owed to foreigners.C) future Social Security benefits.D) government guarantees of student loans.28. The cyclically adjusted budget deficit:A) adjusts the deficit for inflation.B) estimates what the deficit would be if the economy were operating at the naturalrate of output.C) accounts for assets as well as liabilities.D) measures the impact of fiscal policy on the lifetime incomes of individuals ofdifferent ages.29. An estimate of what government spending and tax revenue would be if the economywere operating at its natural rate of output and employment is called the ______ budget.A) cyclically adjustedB) inflation-adjustedC) capital-assetD) generational accounting30. Cyclically adjusted budgets are useful because they:A) systematically account for changes in government assets and liabilities.B) reflect policy changes, but not current economic conditions.C) account for tax burdens on different generations of taxpayers.D) correctly account for the impact of inflation on government indebtedness.31. Assume that a government has a balanced budget when the economy is at fullemployment. If the economy then enters a recession, with no change in tax or spending laws, then the budget of the government is most likely to:A) remain balanced.B) be in deficit.C) be in surplus.D) be in either deficit or surplus, depending on the severity of the recession.32. Each of the following changes would allow the measured budget deficit to provide atruer picture of fiscal policy except:A) correcting for the effects of inflation.B) offsetting changes in government liabilities with changes in government assets.C) excluding some liabilities altogether.D) correcting for the effects of the business cycle.33. Measuring the size of government debt is complicated by all of the following factorsexcept:A) inflation.B) uncounted liabilities.C) capital assets of the government.D) failure of the Office of Management and Budget to disclose figures on capitalexpenditures and credit programs.34. According to the traditional view of government debt, if taxes are cut without cuttinggovernment spending, then the long-run effects will be ______ steady-state capital and ______ consumption.A) higher; higherB) lower; lowerC) higher; lowerD) lower; higher35. According to the traditional view of government debt, if taxes are cut without cuttinggovernment spending, then the short-run effects will be:A) higher output and lower unemployment.B) higher output and higher unemployment.C) no change in output or unemployment.D) no change in output and higher unemployment.36. According to the traditional view of government debt, if taxes are cut without cuttinggovernment spending, then the international effect initially will be a capital ______ anda trade ______.A) inflow; deficitB) inflow; surplusC) outflow; deficitD) outflow; surplus37. According to the traditional view of government debt, if taxes are cut without a cut ingovernment spending, then in the United States this situation will lead to ______ net indebtedness on the part of the United States to foreign countries and ______ netexports.A) more; moreB) more; fewerC) less; fewerD) less; more38. The international impacts of a debt-financed tax cut, according to the traditional view ofgovernment debt, are a(n) ______ in net exports and a domestic currency _____.A) increase; appreciationB) increase; depreciationC) decrease; depreciationD) decrease; appreciation39. According to the traditional viewpoint of government debt, a tax cut without a cut ingovernment spending:A) stimulates consumer spending in the short run and reduces national saving.B) stimulates consumer spending in the short run and reduces private saving.C) has no effect on consumer spending but reduces national saving.D) has no effect on consumer spending but reduces private saving.40. According to the traditional viewpoint of government debt, a tax cut without a cut ingovernment spending:A) raises consumption in both the short run and the long run.B) lowers consumption in both the short run and the long run.C) raises consumption in the short run but lowers it in the long run.D) lowers consumption in the short run but raises it in the long run.41. According to the traditional view of government debt (as in the Mundell–Flemingmodel), if taxes are cut without cutting government spending, then the short-run effects are a(n) ______ of the dollar and a(n) ______ in net exports.A) appreciation; increaseB) appreciation; decreaseC) depreciation; increaseD) depreciation; decrease42. According to the traditional view of government debt (as in the IS–LM model), if taxesare cut without cutting government spending, then in the short run interest rates will ______ and investment will ______.A) increase; increaseB) increase; decreaseC) decrease; decreaseD) decrease; increase43. According to supply siders, tax cuts can raise total tax revenue if the tax cuts generatelarge enough:A) decrease in aggregate supply.B) increase in aggregate supply.C) decrease in the money supply.D) increase in the money supply.44. Government tax policy can affect aggregate supply as well as aggregate demand,because changes in taxes change the:A) supply of money in the economy.B) length of the inside lag of fiscal policy.C) incentives to work and invest.D) tradeoff between inflation and unemployment.45. Ricardian equivalence refers to the same impact of financing government:A) whether by printing money or raising taxes.B) in the long run as in the short run.C) whether by debt or taxes.D) in an open economy as in a closed economy.46. The logic of Ricardian equivalence implies that:A) tax cuts do not influence consumer spending but changes in government spendingdo.B) neither tax cuts nor changes in government spending affect consumer spending.C) tax cuts combined with future decreases in government spending will decreaseconsumer spending.D) if the government cuts taxes and increases current government spending, consumerspending will increase.47. According to the theory of Ricardian equivalence, if consumers are forward-looking,they will view a tax cut combined with no plans to reduce government spending as______, so their consumption will ______.A) additional disposable income; increase.B) additional disposable income; remain unchanged.C) a rescheduling of taxes into the future; increase.D) a rescheduling of taxes into the future; remain unchanged.48. According to the theory of Ricardian equivalence, tax cuts combined with no plans toreduce government spending ______ public saving and ______ private saving.A) reduce; reduceB) reduce; increaseC) increase; increaseD) increase; reduce49. A debt-financed tax cut will ______ saving in the traditional view and ______ saving inthe view of Ricardian equivalence.A) increase; increaseB) decrease; decreaseC) decrease; increaseD) decrease; not change50. A debt-financed tax cut will ______ current consumption in the traditional view and______ current consumption in the view of Ricardian equivalence.A) increase; increaseB) increase; decreaseC) increase; not changeD) decrease; decrease51. All of the following are arguments against Ricardian equivalence except:A) consumers make consumption decisions myopically.B) consumers are rational and forward-looking in consumption decision-making.C) consumers are borrowing-constrained.D) consumers do not expect future taxes to fall on them.52. Suppose a household considers only current income in making consumption decisions.This is an example of:A) Ricardian equivalence.B) the permanent-income hypothesis.C) myopia.D) the life-cycle model.53. The Ricardian view on fiscal policy makes less sense if people are:A) rational and practice foresight.B) shortsighted and not fully rational.C) able to plan for the future.D) able to borrow without constraint.54. In response to a tax cut, the consumption of a consumer who is borrowing-constrained______, whereas the consumption of a forward-looking, unconstrained consumer acting in accord with Ricardian equivalence ______.A) increases; increasesB) increases; remains unchangedC) remains unchanged; remains unchangedD) remains unchanged; increases55. When President George H. W. Bush lowered tax withholding in 1992 without loweringthe amount of taxes owed, surveys showed that:A) almost everyone spent the higher take-home pay.B) almost everyone saved the higher take-home pay.C) a majority of respondents said they would spend the higher take-home pay, but asignificant minority said they would save it.D) a majority of respondents said they would save the higher take-home pay, but asignificant minority said they would spend it.56. Given a reduction in income tax withheld, but no change in income tax owed,households that act according to Ricardian equivalence would ______ the extratake-home pay, while those facing binding borrowing constraints would ______ the extra-take home pay.A) spend; spendB) spend; saveC) save; saveD) save; spend57. Proponents of Ricardian equivalence argue that the relevant decision-making unit is the:A) individual.B) household.C) infinitely lived family.D) community.58. Proponents of Ricardian equivalence argue that if taxes are cut without cuttinggovernment spending and taxes are not expected to increase in the future until after an individual expects to be dead, then the individual will:A) spend all of the increase in income.B) spend some of the increase in income and save the rest.C) use the increase in income to buy government bonds to help finance the deficit.D) save all of the increase in income and leave it as a bequest to his or her children.59. From the Ricardian point of view, a consumer should not raise his or her consumptionwhen taxes are cut but government spending is not cut because:A) the government is going to raise taxes by exactly as much as the cut in the nextyear.B) the government is going to raise taxes by exactly as much as the cut plus interest inthe next year.C) the government is sure to raise taxes by an amount equal in present value to thedebt incurred this year, sometime in the taxpayer's lifetime.D) even if the government does not raise enough extra taxes during the taxpayer'slifetime to pay off, in present value, the debt incurred this year, the taxpayer shouldmake provision for the taxes that will be levied on his or her heirs.60. Assume that nobody cares about the economic well-being of future generations. Thenthe Ricardian equivalence view of the effect of debt-financed tax cuts is:A) totally invalid.B) still fully valid because the government has the option to levy taxes to pay off thefull debt in just a few years.C) still fully valid as long as the government cuts spending also.D) still partially valid because most of the taxpayers will live and pay taxes for asubstantial number of years after the tax cut.61. The strategic bequest motive hypothesizes that parents:A) leave bequests to children because they care about their children's well-being.B) leave bequests to children who are borrowing-constrained.C) make larger bequests the larger the quantity of taxes that will be shifted to theirchildren.D) use the threat of disinheritance to control their children's behavior.62. The experience of the 1980s:A) clearly contradicted the Ricardian equivalence view because national saving wasvery low.B) clearly supported the Ricardian equivalence view, for people saved little onlybecause they were optimistic, as confirmed by the stock market.C) will provide a clear answer on the validity of Ricardian equivalence as soon aseconomists are able to analyze it with their computers.D) may be used to argue both in favor of and against the Ricardian equivalence viewof the tax cuts.63. In the United States, having a balanced budget is currently enforced for:A) the federal government.B) no state governments.C) all state governments.D) many state governments.64. One reason for not requiring a balanced federal budget at all times is that with abalanced-budget rule:A) expenditures are not limited because, if the government wants to raiseexpenditures, it just raises taxes.B) in a recession even the automatic stabilizing powers of our system of taxes andtransfers could not work.C) the distorting features of the tax system are minimized.D) it is possible to shift the burden of a war from current to future generations.65. Tax smoothing is a desirable policy because it:A) reduces the distortions of incentives caused by taxes.B) reduces budget deficits in periods of recession.C) eliminates the impact of automatic stabilizers.D) is consistent with a balanced budget.66. One way to shift the tax burden from the current generation to future generations is tofinance a war:A) by raising taxes.B) by printing money.C) by running a budget surplus.D) by running a budget deficit.67. To minimize the disincentives of very high taxes, a policy of tax smoothing requires abudget ______ in years of unusually low government revenue and a budget ______ in years of unusually high government expenditures.A) surplus; deficitB) deficit; surplusC) surplus; surplusD) deficit; deficit68. Using fiscal policy, including automatic stabilizers, to stabilize output over a businesscycle is not consistent with:A) rational expectations.B) inflation targeting.C) the natural-rate hypothesis.D) a strict balanced-budget rule.69. A strict balanced-budget rule would:A) permit the use of fiscal policy for stabilization.B) allow the use of tax smoothing to reduce tax distortions.C) redistribute tax burdens across generations.D) restrain political incompetence and opportunism.70. Monetary policy is linked to fiscal policy when government spending is financed by:A) taxes.B) borrowing from banks.C) borrowing from foreigners.D) printing money.71. The real value of government debt is reduced by:A) expected inflation.B) expected deflation.C) unexpected inflation.D) unexpected deflation.72. Financing a budget deficit by ______ leads to inflation, and inflation ______ the realvalue of government debt.A) issuing debt; increasesB) issuing debt; decreasesC) printing money; increasesD) printing money; decreases73. Hyperinflations typically occur when governments:A) attempt to keep the unemployment rate below the natural rate.B) finance spending with the inflation tax.C) set inflation targets too high.D) use discretionary monetary policy to stabilize output.74. To force politicians to judge whether government spending is worth the costs, someeconomists have argued for:A) a balanced-budget rule for fiscal policy.B) a constant money-growth rule for monetary policy.C) avoiding the assumption of any contingent liabilities.D) the application of Ricardian equivalence.75. The possibility of capital flight is likely to be greater at higher levels of governmentdebt because there is a greater:A) temptation to default on the debt.B) likelihood that the government will begin issuing indexed bonds.C) probability that a balanced budget will be adopted by the government.D) potential for tax smoothing policies to be eliminated.76. High levels of government debt that raise investors' fear of a government default on debtwill result in capital ______ and a(n) ______ of the country's exchange rate.A) outflows; depreciationB) outflows; appreciationC) inflows; depreciationD) inflows; appreciation77. Indexed bonds produce all of the following benefits except:A) less inflation risk.B) more financial innovation.C) better government incentives.D) lower rates of inflation.78. A measure of the expected rate of inflation can be found by the:A) yield on nominal bonds plus the yield on index bonds.B) yield on nominal bonds minus the yield on index bonds.C) observed rate of inflation minus the yield on real bonds.D) observed rate of inflation minus the yield on nominal bonds.79. Inflation-indexed government bonds have all of the following benefits except:A) eliminating inflation.B) reducing the government's incentive to produce surprise inflation.C) encouraging financial innovation.D) eliminating inflation risk.80. If the government levies a one-time temporary tax on the young and gives the proceedsto the elderly, and both generations follow the life-cycle consumption pattern but are not altruistically linked:A) both the young and the old will consume more.B) there will be a net increase in overall consumption.C) there will be a net decrease in overall consumption.D) there will be no change in overall consumption.81. If the government levies a one-time temporary tax on the young and gives the proceedsto the elderly, and both generations follow the life-cycle consumption pattern and arealtruistically linked:A) both the young and the old will consume more.B) there will be a net increase in overall consumption.C) there will be a net decrease in overall consumption.D) there will be no change in overall consumption.82. If an individual should subtract the present value of future tax obligations due to thegovernment deficit from his or her disposable income, this situation suggests that, inaggregate analysis, the government deficit should be subtracted from disposable income.That is, instead of C = a + b(Y –T), we should use: C = a + b((Y –T – (G –T)), or = a + b(Y –G).a. Using this consumption function and the further relations:I = IG = GT = TY = C + I + Gwrite the equilibrium equation determining Y as a function of a, I, G, and T.b. If b equals 0.5, what are the numerical values of the multipliers for I, G, and T, respectiv83. Compare the traditional view versus the view of Ricardian equivalence of the effects ofa debt-financed tax cut on:a. national saving,b. current consumption, andc. the real interest rate.84. Many people are concerned about the budget deficit of the U.S. federal government.Suggest at least three possible negative economic effects of a budget deficit and threepossible economic benefits of a budget deficit.85. The U.S. Treasury reports the budget deficit or surplus of the federal government. Giveat least one reason why the measured budget deficit might overstate the “true” deficitand at least one reason the measured figure might understate the “true” deficit.86. Explain how tax cuts can affect both aggregate demand and aggregate supply.87. What is Ricardian equivalence? Give at least three reasons why Ricardian equivalencemight not correctly describe an economy.88. Countries seeking to adopt the euro as their currency must meet certain criteria,including the requirements to keep their government budget deficit equal to 3 percent or less of GDP, and to hold government debt levels below 60 percent of GDP. Discuss why there are fiscal policy criteria for joining a monetary union.89. Graphically illustrate the traditional view of the short-run impacts of a debt-financed taxcut on:a. interest rates and output in a closed economy in the short run, using the IS–LM model.b. exchange rates and output in a small open economy with a flexible exchange rate in therun, using the Mundell–Fleming model.90. Graphically illustrate the traditional view of the long-run impacts of a debt-financed taxcut on :a. saving, investment, and real interest rate using the classical model (Chapter 3).b. steady state capital per worker and output per worker using the Solow growth model.91. Using the model of aggregate demand–aggregate supply to illustrate the traditionalview, graphically compare the short-run and long-run impact of debt-financed tax cuts on:a. output,b. prices.92. War is the generator of debt burden for countries. How does war generate debt for acountry?。

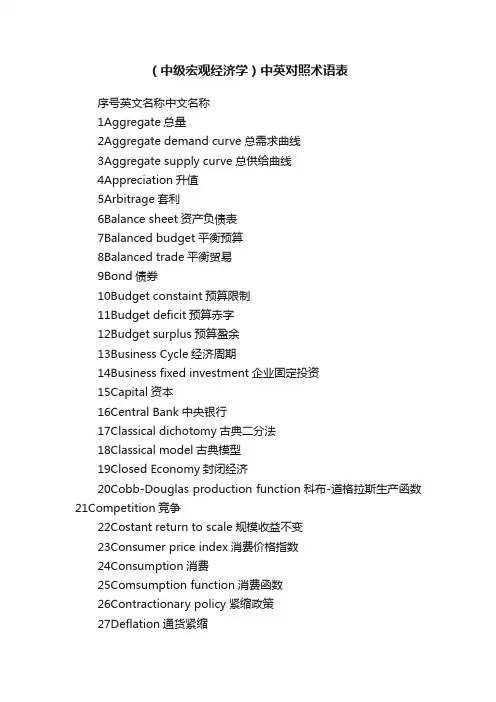

(中级宏观经济学)中英对照术语表序号英文名称中文名称1Aggregate总量2Aggregate demand curve总需求曲线3Aggregate supply curve总供给曲线4Appreciation升值5Arbitrage套利6Balance sheet资产负债表7Balanced budget平衡预算8Balanced trade平衡贸易9Bond债券10Budget constaint预算限制11Budget deficit预算赤字12Budget surplus预算盈余13Business Cycle经济周期14Business fixed investment企业固定投资15Capital资本16Central Bank中央银行17Classical dichotomy古典二分法18Classical model古典模型19Closed Economy封闭经济20Cobb-Douglas production function科布-道格拉斯生产函数21Competition竞争22Costant return to scale规模收益不变23Consumer price index消费价格指数24Consumption消费25Comsumption function消费函数26Contractionary policy紧缩政策27Deflation通货紧缩28Demand deposits活期存款29Demand-shocks需求冲击30Depreciation折旧,贬值31Depression萧条32Diminishing marginal product边际产品递减33Discount rate贴现率34Discounting贴现35Elasticity弹性36Endogenous variable内生变量37Equlibrium均衡38Excess reserves超额准备金39Exogenous variable外生变量40Expansinary policy扩张性政策41Exports出口42Factor of production生产要素43Factor price要素价格44Factor share要素份额45Federal Reserve美联储46Fiat money法定货币47Financial intermediation金融中介48Fiscal policy财政政策49Fixed exchange rate固定汇率50Flexible prices伸缩性价格51Floating exchange rate浮动汇率52Flow流量53GDP国内生产总值54GDP deflator GDP平减指数55General equilibrium一般均衡56Government purchases政府购买57GNP国民生产总值58Hyperinflation超速通货膨胀59Imports进口60Inffierence curve无差异曲线61Inflation通货膨胀62Interest rate利率63Inventory investment存货投资64Investment投资65Labor force劳动力66Labor-force participation rate劳动参与率67Large open economy大型开放经济68Liquidity流动性69Liquidity constraint流动性限制70Loanable funds可贷资金71Marginal product of capital资本边际产量72Marginal product of labor,MPL劳动的边际产量73Marginal propencity to consume,MPC边际消费倾向74Marginal rate of substitution,MRS边际替代率75Market-clearing model市场出清模型76Medium of exchange交换媒介77Menu cost菜单成本78Model模型79Monetary base基础货币80Monetary neutrality货币中性81Monetary policy货币政策82Money货币83Money demand function货币需求函数84National income accounting国民收入核算85National income accounts identity国民收入核算恒等式86National saving国民储蓄87Natural rate of unemployment自然失业率88Net capital outflow资本净流出89Net exports净出口90Net foreign investment国外净投资91Net investment净投资92Nominal名义的93Nominal exchange rate名义汇率94Nominal interest rate名义利率95Open economy开放经济96Open-market operations公开市场业务97Phillips curve菲利普斯曲线98Present value现值99Private saving私人储蓄100Production function生产函数101Profit利润102Public saving公共储蓄103Quota配额104Real实际的105Real exchange rate实际汇率106Real interest rate实际利率107Real money balances实际货币余额108Recession衰退109Rental price of capital资本的租赁价格110Reserve requirements法定准备金率111Reserves准备金112Residental investment居住投资113Saving储蓄114Seigniorage金(银)币铸造税115Shock冲击116Shoe-leather cost鞋底成本117Small open economy小型开放经济118Stabilization policy稳定政策119Stagflation滞胀120Steady state稳定状态121Sticky prices黏性价格122Stock存量,股票123Stock market股票市场124Supply shocks供给冲击125Tariff关税126Trade balance贸易余额127Transfer payments转移支付128Underground economy地下经济129Unemployment insurance失业保障130Unemployment rate失业率131Unit of account计价单位132Value added增加值133Velocity of money货币流通速度134Wage工资135Wage rigidity工资刚性。

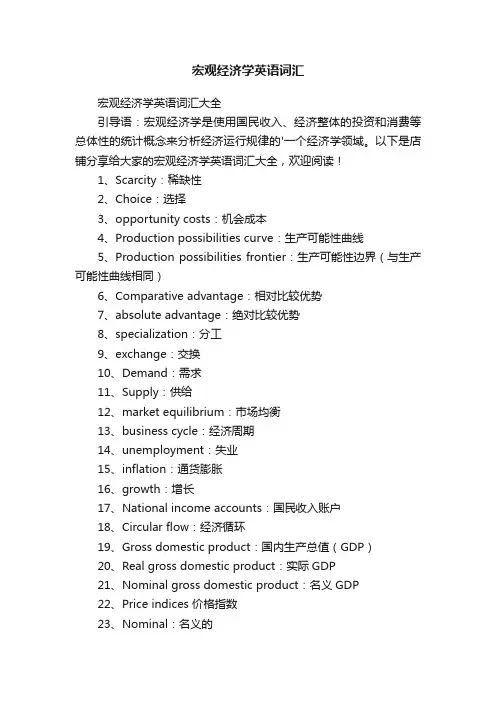

宏观经济学英语词汇宏观经济学英语词汇大全引导语:宏观经济学是使用国民收入、经济整体的投资和消费等总体性的统计概念来分析经济运行规律的'一个经济学领域。

以下是店铺分享给大家的宏观经济学英语词汇大全,欢迎阅读!1、Scarcity:稀缺性2、Choice:选择3、opportunity costs:机会成本4、Production possibilities curve:生产可能性曲线5、Production possibilities frontier:生产可能性边界(与生产可能性曲线相同)6、Comparative advantage:相对比较优势7、absolute advantage:绝对比较优势8、specialization:分工9、exchange:交换10、Demand:需求11、Supply:供给12、market equilibrium:市场均衡13、business cycle:经济周期14、unemployment:失业15、inflation:通货膨胀16、growth:增长17、National income accounts:国民收入账户18、Circular flow:经济循环19、Gross domestic product:国内生产总值(GDP)20、Real gross domestic product:实际GDP21、Nominal gross domestic product:名义GDP22、Price indices 价格指数23、Nominal:名义的24、real:实际的25、Natural rate of unemployment:自然失业率26、Aggregate demand:总需求27、Multiplier:乘数效应28、crowding—out effects:挤出效应29、Aggregate supply:总供给30、Short—run:短期31、long—run:长期32、Sticky:黏性33、Flexible:自由伸缩性34、Stagflation:滞胀35、Actual output:实际产出36、full—employment:充分就业产出37、Economic fluctuations:经济波动38、Money:货币39、stock:股票40、bond:债券41、Bank:银行42、financial markets:金融市场43、Time value of money:货币的时间价值44、money supply:货币供给45、Money demand:货币需求46、creation of money:货币的创造47、Money market:货币市场48、Loanable funds market 可贷资金市场49、Policy:政策工具50、Quantity theory of money:货币数量论51、Real interest rate:实际利率52、nominal rate:名义利率53、Fiscal policy:财政政策54、Monetary policy:货币政策55、Government deficits:财政赤字56、Government debt:政府债务57、Demand—pull inflation:需求拉动型通货膨胀58、Cost—push inflation:成本推动型通货膨胀59、The Phillips curve:菲利普斯曲线60、Expectations:期望(预期)61、human capital:人力资本投资62、Investment in human capital:人力资本投资63、Investment in physical capital:物质资本投资64、Research and development:研发65、technological progress:技术进步66、Balance of payments accounts:收支账户平衡67、Balance of trade:贸易平衡68、Current account:经常账户69、Capital account:资本账户70、Foreign exchange market:外汇市场71、Exchange rate:汇率72、Currency appreciation:货币升值73、Currency depreciation:货币贬值74、Net export:净出口75、capital flows:资本流动下载文档。

CHAPTER 19BIG EVENTS: THE ECONOMICS OF DEPRESSION,HYPERINFLATION, AND DEFICITSChapter Outline•The Great Depression and its impact on macroeconomics•Money and inflation•Monetarism and the rational expectations approach•The effects of hyperinflation•Disinflation and the sacrifice ratio•Credibility•The Fed's dilemma•Deficits, money growth, and seigniorage•The inflation tax•Federal government outlays and revenues•The primary deficit•The debt-to-income ratio•The burden of the debt•Financing Social SecurityChanges from the Previous EditionThe material in this chapter was in Chapter 18 in the previous edition. It has been updated, Boxes 19-2 and 19-5 have been added, and other boxes have been renumbered accordingly. Introduction to the MaterialThe Great Depression in the 1930s presented an economic crisis of enormous proportions. Between 1929 and 1933, real GDP in the U.S. fell by almost 30% and unemployment reached an all-time high of almost 25%. While the economy grew fairly rapidly from 1933-37, unemployment remained in the double digit range. In 1937/38, there was another major recession and the unemployment rate remained above 5% until 1942. In the 1930s unemployment averaged 18.8%, but by 1939 real GDP had recovered to its 1929 level.The classical economists of the time were not equipped to explain the existence of such substantial and persistent unemployment or to prescribe policies to deal with it. Only in 1936, in John Maynard Keynes’book The General Theory of Employment, Interest and Money, was a macroeconomic theory introduced upon which policies to keep the economy out of future recessions could be based. Keynes’ theory provided an explanation of what had happened during the Great Depression and suggested policies that might have prevented it.The stock market crash of 1929 is often seen as the catalyst for the Great Depression but, in fact, economic activity actually started to decline even before the crash. What might well have393been an average recession turned into a very severe depression due to the inept economic policies employed at the time. The Fed failed to provide needed liquidity to banks and did little to prevent the collapse of the financial system. The huge contraction in money supply due to the large numbers of bank failures caused the economic downturn. Fiscal policy was weak at best. Politicians concerned with balancing the budget raised taxes to match increases in government spending, so the decline in aggregate demand was not counteracted.Many other countries also suffered during the same period, mainly as a result of the collapse of the international financial system and the enactment of high tariffs worldwide. These policies were designed to protect domestic producers in an attempt to improve each country’s domestic trade balance at the expense of foreign trading partners. However, the attempts to "export" unemployment ultimately resulted in an overall decline in world trade and production.In the U.S., many institutional changes and administrative actions, collectively known as the New Deal, were implemented in the 1930s. The Fed was reorganized and new institutions were created, including the FDIC, the SEC, and the Social Security Administration. Public works programs and a program to establish orderly competition among firms were also implemented.The experience of the Great Depression led to the belief that the economy is inherently unstable and active stabilization policy is needed to maintain full employment. Keynes was an advocate of active government policy. In his work, he explained what had happened in the Great Depression and what could be done to avoid a recurrence. Many years later, Milton Friedman and Anna Schwartz offered a different explanation. In their book A Monetary History of the United States, Friedman and Schwartz argued that the severe decline in money supply, caused by the Fed’s failure to prevent banks from failing, was the reason for the severity of the Great Depression. They claimed that monetary policy is very powerful and that fluctuations in money supply can explain most of the fluctuations in GDP over the last century. This argument provided the impetus for new research on the effects of fiscal and monetary stabilization policies. While economists are still debating these issues, we can conclude that monetary policy can affect the behavior of output in the short and medium run, but not in the long run. In the long run, increases in the growth rate of money supply will simply lead to increases in the rate of inflation. Box 19-3 gives an overview of the monetarist positions on the importance of money for the economy, while Box 19-2 quotes Fed Chairman Ben Bernanke, who admits that the magnitude of the Great Depression was indeed the result of the Fed’s action—or, more accurately, inaction.The link between inflation and monetary growth can easily be derived from the quantity theory of money equation:MV = PY ==> %∆M + %∆V = %∆P + %∆Y ==> m + v = π + y ==> π = m - y + v In other words, the rate of inflation (%∆P = π) is determined by the difference between the growth rate of nominal money supply (%∆M = m) and the growth rate of real output (%∆Y = y), adjusted for the percentage change in the income velocity of money (%∆V = v).Figure 19-1 shows that trends in the rate of inflation and the growth of money supply (M2) have been somewhat similar over the last four decades. There is plenty of evidence to support the notion that in the long run, inflation is a monetary phenomenon here in the U.S. as well as in other countries. However, there are short-run variations, indicating that changes in velocity and output growth have also affected the inflation rate. By the mid 1990s, the relationship between394M2 growth and inflation had largely broken down, even for the long run. It is still true, however, that there has never been inflation in the long run without rapid growth of money supply, and the faster money grew the higher the rate of inflation.Although there is no exact definition, countries are said to experience hyperinflation when the inflation rate reaches 1,000% annually. Countries that have experienced hyperinflation have all had huge budget deficits which, in many cases, originated from increased government spending during wartime. A classical example is the German hyperinflation of 1922/23. In an economy experiencing hyperinflation, there is often widespread indexing, most likely to foreign exchange rates rather than to the price level, since prices are changing so fast. Eventually, hyperinflation becomes too much to bear and the government is forced to take harsh measures, including fiscal reform and the introduction of a new monetary unit pegging the new money to a foreign currency. Box 19-4 on the situation in Bolivia in the 1980s provides a good example of how hyperinflation can be stopped. It also points out that the costs are great in terms of decreasing per-capita income. In 1985, Bolivia stopped external debt service, raised taxes, reduced money creation, and stabilized the exchange rate. Inflation came down quickly, but per-capita income in 1989 was 35 percent less than it had been a decade earlier.In its fight against hyperinflation, Israel tried to keep unemployment rates low by instituting wage and price controls while also sharply cutting budget deficits and rationing credit. These measures reduced the rate of inflation significantly. In the late 1980s, the governments of Argentina and Brazil imposed wage-price controls but failed to supplement them with fiscal austerity, so the result was much less satisfactory, although they, like many South American countries eventually succeeded in lowering their inflation rates. In the early 1990s, countries in Eastern Europe experienced brief periods of high inflation during their adjustments from centrally planned economies to more market based economies (as shown in Table 19-6). There is no guarantee that periods of hyperinflation will not surface again. New Box 19-5 describes the situation in Zimbabwe where the decision made in 2006 to print more money to finance higher government spending led to inflation rates in excess of 1,000%.When inflation is high, policy makers must focus on reducing it without causing a major economic downturn. This is fairly difficult to accomplish, however, since labor contracts tend to reflect past expectations and new contract negotiations take time. In addition, it may be difficult for a central bank to gain credibility in its fight against inflation because of its behavior in the past. Credibility is important, since inflationary expectations adjust down faster if people believe that a government is serious in its attempt to reduce inflation. If this is the case, the expectations-adjusted Phillips curve shifts to the left sooner and the economy adjusts more quickly to the full-employment level of output at a lower inflation rate. But some increase in unemployment is almost always needed to reduce inflation, since real wages need to adjust down to their full-employment level. The costs to society are often measured in terms of the sacrifice ratio, that is, the ratio of the cumulative percentage loss of GDP to the achieved reduction in the inflation rate.Probably all economists now agree with the monetarist propositions that rapid money growth tends to be inflationary and inflation cannot be kept low unless money growth is kept low. We also know that monetary policy has long and variable lags. But other monetarist positions remain more controversial, including those that suggest that the economy is inherently stable and that monetary targets are better than interest rate targets. The rational expectations approach can be seen as an extension of the monetarist approach, with a strong belief that markets clear rapidly395and people use all information available to them. This is why they advocate policy rules rather than discretion and place emphasis on the credibility of policy makers. Box 19-6 highlights the rational expectations approach.Any government that is unwilling to show fiscal restraint will ultimately be faced with excessive money growth and an increase in the inflation rate. Continued large government budget deficits create a policy dilemma for a central bank, which must decide whether to monetize the debt. If the central bank decides not to finance the debt, the increased borrowing needs of the government may drive interest rates up, leading to the crowding out of private spending. The central bank may then be blamed for slowing down economic growth. But if the central bank is worried about high interest rates and monetizes the debt in order to keep interest rates low, inflation may increase with the central bank taking the blame.The financing of government spending through the creation of high-powered money is an alternative to explicit taxation. Inflation acts like a tax since the government can spend more by printing money while people can spend less, since some of their income must be used to increase their nominal money holdings. The inflation tax revenue is defined as:inflation tax revenue = (inflation rate)*(the real money base).The ability of the government to raise additional tax revenue through the creation of money (and therefore inflation) is called seigniorage, and Table 19-7 shows some empirical evidence of the inflation tax revenue raised as percentage of GDP for some Latin American countries. However, there is a limit to how much revenue a government can raise through an inflation tax. As inflation increases, people reduce their currency holdings and banks reduce their excess reserves, since holding money becomes more costly. Eventually the real monetary base falls so much that the government's inflation tax revenue decreases. Figure 19-3 shows this graphically.While higher deficits can cause higher inflation if they are financed through money creation, higher inflation may also contribute to deficits, since inflation reduces the real value of tax payments. In addition, high nominal interest rates (caused by high inflation) raise the nominal interest payments the government must make on the national debt. The inflation-adjusted deficit corrects for that and is defined in the following way:inflation-adjusted deficit = total deficit - (inflation rate)*(national debt).Large government budget deficits and rapid monetary expansion seem to be inevitable parts of hyperinflation. The high rate of monetary expansion originates in the government's desire to raise its inflation tax revenue. However, the government can only be successful if it prints money faster than the public anticipates. Eventually, the process will break down, as the real money base becomes smaller and smaller.During the 1980s, the U.S. experienced very large budget deficits, which were temporarily brought under control in the late 1990s, only to increase sharply again in 2002. Figure 19-4 shows the trend in U.S. budget deficits as percentage of GDP, while Tables 19-8 and 19-9 give an overview of trends in the U.S. government's outlays and revenues. It is interesting to note that entitlements and interest payments on the national debt have increased significantly over the last396four decades. On the revenue side, corporate income taxes as a share of GDP have declined, while social insurance taxes have increased substantially.To highlight the role of the national debt in the budget, it is useful to distinguish between the actual budget deficit and the primary (non-interest) budget deficit. The U.S. budget deficits in the 1990s were actually more a result of high interest payments on the previously incurred debt than of government spending exceeding tax revenues. This is the legacy of past deficits. As the national debt accumulates, its interest costs accelerate, contributing even more to the budget deficit. The national debt is the result of all past and present budget deficits, and the process by which the Treasury finances the debt is called debt management. As old government securities mature, the Treasury issues new securities to make the payments on old ones.Robert Eisner has argued that it is important to recognize that the government has assets and not just debts. Any spending on infrastructure should be treated as accumulation of real capital and offset by the debt issued to pay for it. In other words, just like private spending, government expenditures should be separated into government “consumption” and government “investment.”With the U.S. gross national debt now exceeding $8.5 trillion (or over $28,000 per capita), it becomes important to consider its real burden. If individuals who hold government bonds consider an increase in government debt as an increase in their personal wealth, they will consume more and a lower share of GDP will be invested. This will lead to a lower rate of capital accumulation and slower future economic growth. Another concern is that foreigners hold a large part of the debt. Since the burden of future tax payments on this part of the debt (plus interest) will fall on U.S. taxpayers while the recipients of these payments will be foreigners, there will be a reduction in U.S. net wealth.High deficits cannot be sustained indefinitely, but as long as national income is growing faster than the national debt (implying a declining debt-income ratio), the potential for instability is fairly low. In the 1990s, there was widespread sentiment that government had grown too big and that sound fiscal policy had to be implemented. The fiscal restriction finally succeeded in turning the large budget deficits of the 1980s into budget surpluses in 1998. A debate quickly began among politicians about the best ways to put the surplus to use. Was it better to cut taxes, increase spending, or gradually pay off the national debt? The path chosen by the Bush administration was a massive tax cut, leading to renewed budget deficits in 2002.Another debate revolves around Social Security reform. There is increasing concern about the financial difficulties that the Social Security system will face in the near future. The system is financed to a large extent on a pay-as-you-go basis, with most of the earmarked taxes paid by current workers being used immediately to finance the Social Security benefits of current retirees. Such a transfer of resources from the young to the old can be accomplished if:• A growing population increases the ratio of workers to retirees. If population growth slows, however, then contributions have to be increased or benefits have to be cut.•High-income growth allows retirement benefits to be higher than past contributions, since the source of the benefits is the higher income of the younger generations. If income growth slows, however, then the system may face financing difficulties.•The political situation is favorable. A larger percentage of older people than younger people vote so the elderly can enforce the intergenerational transfer through the political system. But at some point, the young, who expect to receive lower benefits than their parents relative to their contributions, may refuse to support the system through their taxes.397While the Social Security system is often seen as a “forced savings system,” which makes sure that everyone accumulates some wealth for retirement, there is strong empirical evidence that the system actually reduces national saving due to its pay-as-you-go financing. The decline in saving reduces the rate of capital accumulation, which lowers productivity and future living standards.The Social Security trust fund actually has been growing as a result of the Social Security Reform of 1983, but current predictions are that the system will be bankrupt after 2045 when most of the baby-boomer generation will have retired. While most people do not wish to see the Social Security system totally abandoned, additional reforms are very likely in the near future. The central question is how to earn higher returns on the funds invested to prevent the system from insolvency and how to preserve equity for those who have already paid into the system. Suggestions for LecturingStudents who follow the news see stock prices fluctuate daily and they probably heard about past stock market bubbles and crashes. These students will be curious about the impact of major swings in stock market activity on the economy. Most people assume that the stock market crash of October, 1929 marked the beginning of the Great Depression and are not aware that economic activity had actually begun to decline earlier. A good way to introduce the material in this chapter is to ask: “Could a Great Depression happen again?” or “Do stock market crashes cause economic downturns?” Either will lead to a lively class discussion that can help to highlight several of the issues raised in the chapter. In this discussion the major stock market crash of October, 1987 and the decline in (especially high-tech) stock values that started in March, 2000 will undoubtedly come up. They are reminders that stock market bubbles will always eventually burst and that there is considerable risk associated with buying stocks.Most economists now agree that the magnitude of the Great Depression was exacerbated by inadequate fiscal and monetary policy responses. The Fed’s failure to inject e nough liquidity into the banking system to prevent failures led to a severe contraction in the supply of money and an economic downturn, and. Policy makers also did little initially to stimulate economic activity through fiscal policy. The severity of the economic situation in the 1930’s is not surprising to economists today, as no well-developed economic theory existed at the time that could deal with a disturbance of this magnitude. It was not until John Maynard Keynes offered an explanation of what had happened during the Great Depression and suggested ways to prevent future recessions that macroeconomists began to ponder the values of fiscal and monetary stabilization policies. It is no wonder that Keynes is seen by many as the “father of all macroeconomists.”Economic theories are generally pro ducts of their time and, as mentioned above, Keynes’macroeconomic theory was developed as a result of the Great Depression. His explanation and prescription for preventing future depressions were widely accepted, but did not have much impact on policy making in the U.S. until the 1960s, when the government followed (mostly fiscal) activist policies to ensure full employment.The handling of the major stock market crash of 1987 appears to indicate that policy makers have learned from past mistakes. Stock values dropped by more than 24% in October of 1987, but we did we not see a severe downturn in economic activity. Why not? For one, Alan398Greenspan, who had been appointed as chair of the Board of Governors of the Fed only a few months earlier, was conscious of what had happened in 1929 and immediately assured financial markets that the Fed would provide the liquidity needed to prevent a financial collapse. The Fed quickly started to undertake open market purchases in an effort to drive interest rates down. In addition, as a result of institutional changes implemented after the Great Depression, government now has a much larger role in the economy. Students should be aware that the Great Depression not only shaped modern macroeconomic thinking and approaches to stabilization policy, but also shaped the structure of many U.S. institutions. Instructors may want to spend some time talking about these institutions and their importance to our economy.It also should be noted that the economy was in much better shape when the stock market crashed in 1987 than it was in 1929. While we can only speculate on what would have happened had the economy been in worse shape, the existence of programs such as Social Security and unemployment insurance would have dampened the severity of a downturn by providing some automatic stability. In addition, the existence of the FDIC, which insures all bank deposits up to $100,000, now serves to avoid panic in financial markets and runs on banks.The recession in 1981/82, which was the most severe recession since the Great Depression and brought the unemployment level close to 11%, provides another good example that policy makers now react much more swiftly to major economic upheavals. Even though the recession was fairly severe, it did not last for an extended period, since expansionary policies were implemented almost immediately after the magnitude of the downturn became clear.There are still disagreements about the primary causes for the Great Depression and these should be clarified. The Keynesian explanation concentrates on spending behavior, that is, the reduction in consumption and the collapse of investment. The decrease in aggregate demand was exacerbated by the restrictive fiscal policy implemented by the government trying to balance the budget. The monetarist explanation concentrates on the behavior of money and asserts that the Fed failed to prevent the collapse of the banking system. The large number of bank failures led to a loss of confidence in the banking system, an enormous increase in the currency-deposit ratio, and therefore a huge decrease in the money multiplier. Monetarists see the resulting severe decline in money supply as the cause of the Great Depression. Both explanations fit the facts and it is important for instructors to point out that there is no inherent conflict between them; in fact, they complement one another.While the programs of the New Deal are largely credited with revitalizing the economy in the mid-1930s, probably one of the most important factors was the sharp increase in money supply, starting in 1933. This is often a forgotten fact. It should be noted that while unemployment remained high, the deflation of prices and wages stopped after 1933, and output began to rebound. In addition, some of the programs implemented by the government after the Great Depression helped to keep wages from falling further.The fact that unemployment’s downward pressure on wages tends to weaken if high unemployment is persistent should also be mentioned at this point. The possibility that the behavior of nominal wages affects the rate of inflation should be discussed with reference to the situation in some European countries, where the unemployment rate has been above the levels experienced in the U.S. for quite some time.The German hyperinflation of 1922-23, when the inflation rate averaged 322% per month, provides another example of a major economic event that shaped macroeconomic thinking. But399students will probably prefer to discuss more recent examples, such as the Bolivian experience of the 1980s highlighted in Box 19-4 or the situation in Zimbabwe starting in 2006. Both cases make clear that the cost of stopping hyperinflation can be extremely high in terms of a decreased standard of living. The discussion should make it clear that large budget deficits and rapid monetary growth are always prevalent in times of hyperinflation, and only draconian measures can ensure a reduction in inflationary expectations. Without such measures the economy will collapse and has to be completely restructured, with the introduction of a new monetary unit that may be pegged to a foreign exchange rate.There is no exact definition of hyperinflation, but it is said to exist when the inflation rate reaches 1,000% on an annual basis. Students will always remember the following definition of inflation in general: “inflation is nothing more than too much money chasing too few goods.” But is inflation “always and everywhere a monetary phenomenon,” as Milton Friedman put it? Figure 19-1 indicates that the rate of inflation and the growth rate of M2 show somewhat similar long-run trends (at least until about 1993), but there are large variations in the short run. In other words, the link between monetary growth and the inflation rate is by no means precise. For one, growth in output affects the inflation rate and real money holdings. Interest rate changes and financial innovations also affect desired money holdings and therefore the income velocity of money. Empirical evidence indicates that the velocity of M2 has shown a fairly constant long-run trend from the 1960s to the 1990s, while the velocity of M1 has fluctuated significantly over the last few decades. Considering the enormous changes that took place in the U.S. banking system in the 1980s, it is surprising that the income velocity of M2 actually stayed as stable as it did. By the late 1990s, the link between M2 growth and the inflation rate had largely broken down; the possible causes and any monetary policy implications should be discussed.By now, students should be familiar with the quantity theory of money equation and should be able to derive the equation that shows the long-run relationship between money growth, output growth, velocity changes, and the rate of inflation. We can thus derive the following:MV = PY ==> %∆M + %∆V = %∆P + %∆Y ==> %∆P = %∆M - %∆Y + %∆V==> π = m - y + v.This equation indicates that higher growth rates of money (%∆M = m) adjusted for growth in output (%∆Y = y) and changes in velocity (%∆V = v) are associated with higher inflation rates (%∆P = π). The strict monetary growth rule is based on this equation and suggests that a zero inflation rate can be achieved if money supply is only allowed to grow at the same rate as the long-run trend of output, assuming that velocity remains stable. It should be made clear, that this equation shows only a long-run relationship and that output growth and velocity can be highly variable in the short run, causing great variations in the inflation rate.Besides looking at the role of monetary growth in determining the inflation rate, instructors may also want to spend some time looking at the role of nominal wages and labor productivity. Just by recalling the simple equationw = W/P,400。

宏观经济学MEASUREING A NATION’S INCOME一国收入的衡量Microeconomics the study of how households and firms make decisions and how they interact in markets.微观经济学:研究家庭和企业如何做出决策,以及他们如何在市场上相互交易。

Macroeconomics the study of economy-wide phenomena,including inflation,unemployment,and economic growth宏观经济学:研究整体经济现象,包括通货膨胀、失业和经济增长。

GDP is the market value of final goods and services produced within a country in a given period of time.国内生产总值GDP:给定时期的一个经济体内生产的所有最终产品和服务的市场价值Consumption is spending by households on goods and services, with the exception of purchased of new housing.消费:除了购买新住房,家庭用于物品与劳务的支出。

Investment is spending on capital equipment inventories, and structures, including household purchases of new housing.投资:用于资本设备、存货和建筑物的支出,包括家庭用于购买新住房的支出。

Government purchases are spending on goods and services by local, state, and federal government.政府支出:地方、州和联邦政府用于物品和与劳务的支出。

经济学专业术语(中英文对照)目录1. 经济学原理 (2)2. 像经济学家一样思考 (2)3. 相互依存性与贸易的好处 (3)4. 供给与需求的市场力量 (3)5. 弹性及其应用 (4)6. 供给需求与政策 (4)7. 消费者、生产者与市场效率 (4)8. 赋税的应用 (4)9. 国际贸易 (5)10. 外部性 (5)11. 公共物品和公共资源 (5)12. 税制设计 (5)13. 生产成本 (6)14. 竞争市场上的企业 (7)15. 垄断 (7)16. 垄断竞争 (7)17. 寡头 (7)18. 生产要素市场 (8)19. 收入与歧视 (8)20. 收入不平等与贫困 (8)21. 消费者选择理论 (9)22. 微观经济学前沿 (9)23. 一国收入的衡量 (10)24. 生活费用的衡量 (10)25. 生产与增长 (10)26. 储蓄、投资和金融体系 (11)27. 金融学的基本工具 (11)28. 失业 (12)29. 货币制度 (12)30. 货币增长与通货膨胀 (13)31. 开放经济的宏观经济学 (14)32. 开放经济的宏观经济理论 (14)33. 总需求与总供给 (14)34. 货币政策和财政政策对总需求影响 (15)35. 通胀与失业之间的短期权衡取舍 (15)1.经济学原理经济:(economy)稀缺性:(scarcity)经济学:(economics)效率:(efficiency)平等:(equality)机会成本:(opporyunity cost)理性人:(rational people)边际变动:(marginal change)边际收益:(marginal benefit)边际成本:(marginal cost)激励:(incentive)市场经济:(market economy)产权:(property rights)市场失灵:(market failure)外部性:(externality)市场势力:(market power)生产率:(productivity)通货膨胀:(inflation)经济周期:(business cycle)2.像经济学家一样思考循环流量图:(circular-flow diagram)生产可能性边界:(production possibilities)微观经济学:(microeconomics)宏观经济学:(macroeconomics)实证表述:(positive statements)规范表述:(normative statements)有序数对:(ordered pair)3.相互依存性与贸易的好处绝对优势:(absolute advantage)机会成本:(apportunity cost)比较优势:(comparative advantage)进口品:(imports)出口品:(exports)4.供给与需求的市场力量市场:(market)竞争市场:(competitive market)需求量:(quantity demand)需求定理:(law of demand)需求表:(demand schedule)需求曲线:(demand curve)正常物品:(normal good)低档物品:(inferior good)替代品:(substitutes)互补品:(complements)供给量:(quantity supplied)供给定理:(law of supply)供给表:(supply schedule)供给曲线:(supply curve)均衡:(equilibrium)均衡价格:(equilibrium price)均衡数量:(equilibrium quantity)过剩:(surplus)短缺:(shortage)供求定理:(law of supply and demand)5.弹性及其应用弹性:(elasticity)需求价格弹性:(price elasticity of demand)总收益:(total revenue)需求收入弹性:(income elasticity)需求的交叉价格弹性:(cross-price elasticity)供给价格弹性:(price elasticity of supply)6.供给需求与政策价格上限:(price ceiling)价格下限:(price floor)税收归宿:(tax incidence)7.消费者、生产者与市场效率福利经济学:(welfare economics)支付意愿:(willingness to pay)消费者剩余:(consumer surplus)成本:(cost)生产者剩余:(producer surplus)效率:(efficiency)平等:(equality)8.赋税的应用无谓损失:(deadweight loss)9.国际贸易世界价格:(world price)关税:(tariff)10.外部性外部性:(externality)外部性内在化:(internalizing the externality)矫正税:(corrective taxes)科斯定理:(coase theorem)交易成本:(transaction cost)11.公共物品和公共资源排他性:(excludability)消费中的竞争性:(rivalry in consumption)私人物品:(private goods)公共物品:(public goods)公共资源:(common resources)俱乐部物品:(club goods)搭便车者:(free rider)成本-收益分析:(cost-benefit analysis)公地悲剧:(tragedy of commons)12.税制设计纳税义务:(tax lianility)预算赤字:(budget defict)预算盈余:(budget surplus)平均税率:(average tax rate)边际税率:(marginal tax rate)定额税:(lump-sum tax)受益原则:(benefits principle)支付能力原则:(ability-to-pay principle)纵向平等:(vertical equity)横向平等:(horizontal equity)比例税:(proportional tax)累退税:(regressive tax)累进税:(progressive tax)13.生产成本总收益:(total revenue)总成本:(total cost)利润:(profit)显性成本:(explicit costs)隐性成本:(implicit costs)经济利润:(economic profit)会计利润:(counting profit)生产函数:(production function)边际产量:(marginal product)边际产量递减:(diminishing marginal product)固定成本:(fixed costs)可变成本:(variable costs)平均总成本:(average total cost)平均固定成本:(average fixed costs)平均可变成本:(average variable costs)边际成本:(marginal cost)有效规模:(efficient scale)规模经济:(economies of scale)规模不经济:(diseconomies of scale)规模收益不变:(constant returns to scale) 14.竞争市场上的企业竞争市场:(competitive market)平均收益:(average revenue)边际收益:(marginal revenue)沉没成本:(sunk revenue)15.垄断垄断企业:(monopoly)自然垄断:(natural monopoly)价格歧视:(price discrimination)16.垄断竞争寡头:(oligopoly)垄断竞争:(monopolistic competition) 17.寡头博弈论:(game theory)勾结:(collusion)卡特尔:(cartel)纳什均衡:(Nash equilibrium)囚徒困境:(prisoners’ dilemma)占优策略:(dominant strategy)18.生产要素市场生产要素:(factors of production)生产函数:(production function)劳动的边际产量:(marginal product of labor)边际产量递减:(diminishing marginal product)边际产量值:(value of the marginal product)资本:(capital)19.收入与歧视补偿性工资差别:(compensating differential)人力资本:(human capital)工会:(union)罢工:(strike)效率工资:(efficiency)歧视:(discrimination)20.收入不平等与贫困贫困率:(poverty rate)贫困率:(poverty line)实物转移支付:(in-kind transfers)生命周期:(life cycle)持久收入:(permanent income)功利主义:(utilitariansm)效用:(utilitariansm)自由主义:(liberalism)最大最小准则:(maximin criterion)负所得税:(negative income tax)福利:(welfare)社会保险:(social insurance)自由至上主义:(libertarianism)21.消费者选择理论预算约束线:(budget constraint)无差异曲线:(indiffernnce curve)边际替代率:(marginal rate of subtitution)完全替代品:(perfect substitudes)完全互补品:(perfect complements)正常物品:(normal good)低档物品:(inferior good)收入效应:(income effect)替代效应:(substitution effect)吉芬物品:(Giffen good)22.微观经济学前沿道德风险:(moral hazard)代理人:(agent)委托人:(principal)逆向选择:(adverse selection)发信号:(signaling)筛选:(screening)政治经济学:(political economy)康多塞悖论:(condorcet paradox)阿罗不可能性定理:(Arrow’s impossibility)中值选民定理:(median vater theorem)行为经济学:(behavioral economics)23.一国收入的衡量微观经济学:(microeconomics)宏观经济学:(macroeconomics)国内生产总值:(gross domestic product,GDP)消费:(consumption)投资:(investment)政府购买:(government purchase)净出口:(net export)名义GDP:(nominal GDP)真实GDP:(real GDP)GDP平减指数:(GDP deflator)24.生活费用的衡量消费物价指数:(consumer price index,CPI)通货膨胀率:(inflation rate)生产物价指数:(produer price index,PPI)指数化:(indexation)生活费用津贴:(cost-of-living allowance,COLA)名义利率:(nominal interest rate)25.生产与增长生产率:(productivity)物质资本:(physical capital)人力资本:(human capital)自然资源:(natural resources)技术知识:(technological knoeledge)收益递减:(diminishing returns)追赶效应:(catch-up effect)26.储蓄、投资和金融体系金融体系:(financial system)金融市场:(financial markets)债券:(bond)股票:(stock)金融中介机构:(financial intermediaries)共同基金:(mutual fund)国民储蓄:(national saving)私人储蓄:(private saving)公共储蓄:(public saving)预算盈余:(budget surplus)预算赤字:(budget deficit)可贷资金市场:(market for loanable funds)挤出:(crowding out)27.金融学的基本工具金融学:(finance)现值:(present value)终值:(future value)复利:(compounding)风险厌恶:(risk aversion)多元化:(diversification)企业特有风险:(firm-specific risk)市场风险:(market risk)基本面风险:(fundamental analysis)有效市场假说:(efficient markets by pothesis)信息有效:(informational efficiency)随机游走:(random walk)28.失业劳动力:(laborforce)失业率:(unemployment rate)劳动力参与率:(labor-force participation rate)自然失业率:(natural rate of unemployment)周期性失业:(cyclical unemployment)失去信心的工人:(discouraged workers)摩擦性失业:(frictional unemployment)结构性失业:(structural unemployment)寻找工作:(job search)失业保险:(unemployment insurance)工会:(union)集体谈判:(collective bargaining)罢工:(strike)效率工资:(essiciency wages)29.货币制度货币:(money)交换媒介:(medium of exchange)计价单位:(unit of account)价值储藏手段:(store of value)流动性:(liquidity)商品货币:(commodity money)法定货币:(fiat money)通货:(currency)活期存款:(demand deposits)联邦储备局:(Federal Reserve)中央银行:(central bank)货币供给:(money supply)货币政策:(monetary policy)准备金:(reserves)部分准备金银行:(fractional-reserve banking)准备金率:(reserve ratio)货币乘数:(money multiplier)银行资本:(bank capital)杠杆:(leverage)杠杆率:(leverage ratio)资本需要量:(capital requirement)公开市场操作:(open-market operations)贴现率:(discount rate)法定准备金:(reserve requirements)补充金融计划:(supplementary financing program)联邦基金利率:(federal funds rate)30.货币增长与通货膨胀铲除通胀:(whip Inflation Now)货币数量论:(quantity theory of money)名义变量:(nominal variables)真实变量:(real variables)古典二分法:(classiacl dichotomy)货币中性:(monetary neutrality)货币流通速度:(velocity of money)数量方程式:(quantity equation)通货膨胀税:(inflation tax)费雪效应:(Fisher effect)皮鞋成本:(shoeleather cost)菜单成本:(menu costs)31.开放经济的宏观经济学封闭经济:(closed economy)开放经济:(open economy)出口:(exports)净出口:(net exports)贸易余额:(trade balance)贸易盈余:(trade surplus)贸易平衡:(balanced trade)贸易赤字:(trade deficit)资本净流出:(net capital outflow)名义汇率:(nominal exchange rate)升值:(appreciation)贬值:(depreciation)真实汇率:(real exchange rate)购买力平价:(purchasing-power parity)32.开放经济的宏观经济理论贸易政策:(trade policy)资本外逃:(capital flight)33.总需求与总供给衰退:(recession)萧条:(depression)总需求与总供给模型:(model of aggregate demand and aggregate supply)总需求曲线:(aggregate-demand curve)总供给曲线:(aggregate-supply curve)自然产出水平:(natural level of output)滞胀:(stagflation)34.货币政策和财政政策对总需求影响流动性偏好理论:(theory of liquidity)财政政策:(fisical policy)乘数效应:(multiplier effect)挤出效应:(crowding-out effect)自动稳定器:(automatic stabilizers)35.通胀与失业之间的短期权衡取舍菲利普斯曲线:(phillips curve)自然率假说:(natural-rate hypothesis)供给冲击:(supply shock)牺牲率:(sacrifice ratio)理性预期:(rational expectations)。

西方经济学名词解释英文版第一章Macroeconomics 宏观经济学The study of the overall aspects and workings of a national economy, such as income, output, and the interrelationship among diverse economic sectors. 研究国民收入的各方面。

Microeconomics 微观经济学The study of the operations of the components of a national economy, such as individual firms, households, and consumers.研究经济中单个因素行为的分析。

GDP 国内生产总值 (Gross Domestic Product)The total market value of all final goods and services producedwithin the borders of a nation during a specified period.一国国民在各行业中一年内生产的最终产品和最终服务价值总和。