金融学专业英语

- 格式:pdf

- 大小:150.55 KB

- 文档页数:10

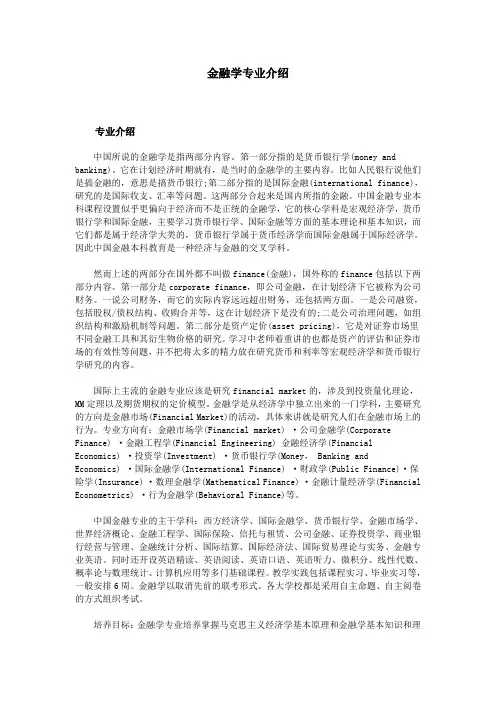

金融学专业介绍专业介绍中国所说的金融学是指两部分内容。

第一部分指的是货币银行学(money and banking)。

它在计划经济时期就有,是当时的金融学的主要内容。

比如人民银行说他们是搞金融的,意思是搞货币银行;第二部分指的是国际金融(international finance),研究的是国际收支、汇率等问题。

这两部分合起来是国内所指的金融。

中国金融专业本科课程设置似乎更偏向于经济而不是正统的金融学,它的核心学科是宏观经济学,货币银行学和国际金融,主要学习货币银行学、国际金融等方面的基本理论和基本知识,而它们都是属于经济学大类的,货币银行学属于货币经济学而国际金融属于国际经济学。

因此中国金融本科教育是一种经济与金融的交叉学科。

然而上述的两部分在国外都不叫做finance(金融),国外称的finance包括以下两部分内容。

第一部分是corporate finance,即公司金融,在计划经济下它被称为公司财务。

一说公司财务,而它的实际内容远远超出财务,还包括两方面。

一是公司融资,包括股权/债权结构、收购合并等,这在计划经济下是没有的;二是公司治理问题,如组织结构和激励机制等问题。

第二部分是资产定价(asset pricing),它是对证券市场里不同金融工具和其衍生物价格的研究。

学习中老师着重讲的也都是资产的评估和证券市场的有效性等问题,并不把将太多的精力放在研究货币和利率等宏观经济学和货币银行学研究的内容。

国际上主流的金融专业应该是研究financial market的,涉及到投资量化理论,MM定理以及期货期权的定价模型。

金融学是从经济学中独立出来的一门学科,主要研究的方向是金融市场(Financial Market)的活动,具体来讲就是研究人们在金融市场上的行为。

专业方向有:金融市场学(Financial market) ·公司金融学(Corporate Finance) ·金融工程学(Financial Engineering) 金融经济学(Financial Economics) ·投资学(Investment) ·货币银行学(Money, Banking and Economics) ·国际金融学(International Finance) ·财政学(Public Finance)·保险学(Insurance) ·数理金融学(Mathematical Finance) ·金融计量经济学(Financial Econometrics) ·行为金融学(Behavioral Finance)等。

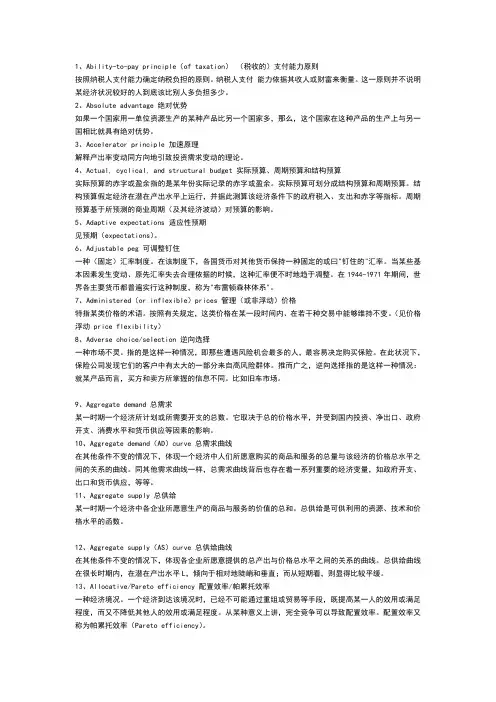

1、Ability-to-pay principle(of taxation)(税收的)支付能力原则按照纳税人支付能力确定纳税负担的原则。

纳税人支付能力依据其收人或财富来衡量。

这一原则并不说明某经济状况较好的人到底该比别人多负担多少。

2、Absolute advantage 绝对优势如果一个国家用一单位资源生产的某种产品比另一个国家多,那么,这个国家在这种产品的生产上与另一国相比就具有绝对优势。

3、Accelerator principle 加速原理解释产出率变动同方向地引致投资需求变动的理论。

4、Actual, cyclical, and structural budget 实际预算、周期预算和结构预算实际预算的赤字或盈余指的是某年份实际记录的赤字或盈余。

实际预算可划分成结构预算和周期预算。

结构预算假定经济在潜在产出水平上运行,并据此测算该经济条件下的政府税入、支出和赤字等指标。

周期预算基于所预测的商业周期(及其经济波动)对预算的影响。

5、Adaptive expectations 适应性预期见预期(expectations)。

6、Adjustable peg 可调整钉住一种(固定)汇率制度。

在该制度下,各国货币对其他货币保持一种固定的或曰"钉住的"汇率。

当某些基本因素发生变动、原先汇率失去合理依据的时候,这种汇率便不时地趋于凋整。

在1944-1971年期间,世界各主要货币都普遍实行这种制度,称为"布雷顿森林体系"。

7、Administered(or inflexible)prices 管理(或非浮动)价格特指某类价格的术语。

按照有关规定,这类价格在某一段时间内、在若干种交易中能够维持不变。

(见价格浮动 price flexibility)8、Adverse choice/selection 逆向选择一种市场不灵。

指的是这样一种情况,即那些遭遇风险机会最多的人,最容易决定购买保险。

对外经济贸易大学2002年攻读硕士学位研究生入学考试金融学院金融专业英语试题(英译中,五段,每段20分,共100分)1.What is a bank?As important as banks are to the economy as a whole and to local communities, there is much confusion about exactly what a bank is. Certainly banks can be identified by the functions (services or roles) they perform in the economy. The problem is that not only are the functions of banks changing, but the functions of their principal competitors are changing as well. Indeed, many financial institutions including leading security dealers, brokerage firms, mutual funds, and insurance companies arc trying to be as similar as possible to banks in the services they offer. Bankers, in turn, are challenging these nonblank competitors by lobbying for expanded authority to offer real estate and full-service security brokerage, insurance coverage, investments in mutual funds, and many other new services.As important as banks are to the economy as a whole and to local communities, there is much confusion about exactly what a bank is. Certainly banks can be identified by the functions (services or roles) they perform in the economy. The problem is that not only are the functions of banks changing, but the functions of their principal competitors are changing as well. Indeed, many financial institutions including leading security dealers, brokerage firms, mutual funds, and insurance companies arc trying to be as similar as possible to banks in the services they offer. Bankers, in turn, are challenging these nonblank competitors by lobbying for expanded authority to offer real estate and full-service security brokerage, insurance coverage, investments in mutual funds, and many other new services.The result of many legal and regulatory changes is a state of confusion in the public’s mind today over what is or is not a bank. The safest approach is probably to view these institutions in terms of what types of services the offer the public. Banks are those financial institutions that offer the widest range of financial services especially credit, savings, and payment services and perform the widest range of financial functions of any business form in the economy. This multiplicity of bank services and functions has led to banks being labeled“financial department store”.2. The Adoption of Indirect Instruments of Monetary PolicyIn the late 1970s, industrial countries began phasing out the direct instruments some of them used to operate monetary policy-including credits controls, interest rate ceilings, and sometimes directed credits-and began moving toward full reliance on indirect instruments, such as open market operations, rediscount facilities, and reserve requirement. In more recent years, there has been also an increasing tendency for the developing countries and the economies in transition to adopt such instruments.The greater use of indirect monetary instruments can be seen as the counterpart in the monetary area to the widespread movement toward enhancing the role of price signals in the economy more generally. Both have the same objective of improving market efficiency. Perhaps even more critically, moves to indirect instruments are taking place in an increasingly more open economic environment, with widespread adoption of current account convertibility. In such an environment, direct instruments have become increasingly ineffective, leading to inefficiencies and disintermediation. In the absence of indirect instruments of monetary policy, the authoritieswould, therefore, be unable to counter any problems of excess liquidity, which would impede their efforts to stabilize the economy.3. Why banks are so heavily regulated?Why are banks so closely regulated? There are number of reasons for this heavy burden of government supervision, some of them centuries old.First, banks are among the leasing repositories of the public’s savings especially the saving of individuals and families. While most of the public’s saving are placed in relatively short-term, highly liquid deposits, banks also hold large amounts of long-term savings in individual retirement accounts (IRAs). The loss of these funds due to bank failure or bank crime would be catastrophic to many individuals and families. But, many savers lack the financial expertise and depth of information needed to correctly evaluate the riskiness of a bank. Therefore, regulatory agencies are charged with the responsibility of gathering and evaluating the information needed to assess the true financial condition of banks in order to protect the public against loss.Banks are also closely watched because of their power to create money in the form of readily spendable deposits by making loans and investments. Changes in the volume of money created by banks appear to be closely correlated with economic conditions, especially the growth of jobs and the presence or absence of inflation.Banks are also regulated because they provide individuals and businesses with loans that support consumption and investment spending. Regulatory authorities argue that the public has a keen interest in an adequate supply of loans flowing from the banking system. Moreover, where discrimination in the granting of credit is present, those individuals who are discriminated against face a significant obstacle to their personal well-being and an improved standard of living. This is especially true if access to credit is denied because of age, sex, race, national origin, or similar factors.Finally, banks have a long history of involvement with government federal, state, and local. Early in the history of the industry governments relied upon cheap bank credit and the taxation of banks to finance armies and to supply the funds they were unwilling to raise through direct taxation of their citizens. More recently, governments have relied upon banks to assist in conducting economic policy, in collecting taxes, and in dispensing government payments.4. Financial FuturesA financial futures contract is an agreement between buyer and a seller reached today that calls for the delivery of particular security in exchange for cash at some future date . The market value of a futures contract changes daily as the market price of the security to be exchanged moves over time. As a result, futures contracts are “marked to marker”each day to reflect the current value of the assets subject to eventual delivery under each futures contract, and a cash payment may have to be made (usually to a broker) by one or the other party to the contract in order to protect against possible loss.The financial futures markets are designed to shift the risk of interest rate fluctuations from risk-averse investors, such as commercial banks, to speculators willing to accept and possibly profit from such risks. Futures contracts are traded on organized exchanges (such as the Chicago Board of Trade or the London Futures Exchange), where floor brokers execute orders received from the public to buy or sell these contracts at the best prices available. Then a bank contacts an exchange broker and offers to sell futures contracts (I, e., the bank wishers to “go short”in futures), this means it is promising to deliver securities of a certain kind and quality to the buyerof those contracts on a stipulated date at a predetermined price. Conversely, a bank may enter the futures market as buyer of futures contracts (i.e., the bank chooses to “go long”in futures), agreeing to accept delivery of the particular securities named in each contract and to pay cash to the exchange clearinghouse the day the contracts mature, based on their price at that time.5. Offshore Financial Center (OFC)An offshore financial center (OFC) may be defined as jurisdiction in which transactions with non-residents far outweigh transactions related to the domestic economy. They have developed by offering an attractive tax, legal and/or regulatory environment. In particular, the absence of inheritance, wealth, withholding or capital gains taxes can make the environment in OFCs very favorable to, for example, internationally mobile individuals. Zero or low direct taxes can make it attractive for companies conducting business with non-residents to incorporate in OFCs. Ina similar vein, the corporate legal environment may facilitate speedy adoption of new financial products or allow greater flexibility in restructuring and refinancing options. Political and economic stability and the presence of high quality professional (eg legal and accounting) and supporting services are also important in attracting business from other major financial centers.A number of important OFCs are small island states, with few domestically owned financial institutions, a large number of “brass-plate” institutions and little non-financial economic activity. The Cayman Islands and the British Virgin Islands are obvious examples. But the distinction between OFCs and other financial centers is not clear-out. Some economies. Such as Hong Kong and Singapore have a significant volume of entrepot business alongside domestically orientated financial intermediation. The term “OTC”is , furthermore, sometimes also used in connection with special tax and/or regulation zones that are established within the borders of a country to attract non-resident business (for example Labuan in Malaysia, or the International Financial Services Center in Dublin).1.银行是什么?无论是对于整个经济还是对于某一地区的经济而言,银行都是很重要的,同样地,人们对银行的准确含义也充满了困惑。

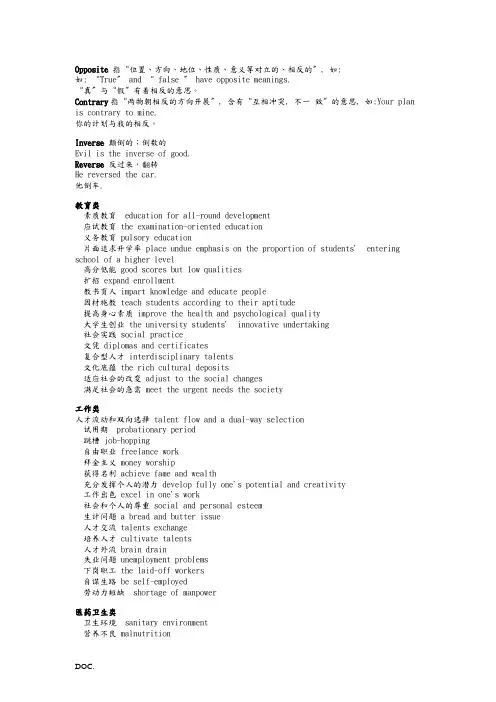

Opposite指“位置、方向、地位、性质、意义等对立的、相反的〞, 如:如: “True〞and “ false 〞 have opposite meanings.“真〞与“假〞有着相反的意思。

Contrary指“两物朝相反的方向开展〞, 含有“互相冲突, 不一致〞的意思, 如:Your plan is contrary to mine.你的计划与我的相反。

Inverse 颠倒的;倒数的Evil is the inverse of good.Reverse 反过来,翻转He reversed the car.他倒车.教育类素质教育 education for all-round development应试教育 the examination-oriented education义务教育 pulsory education片面追求升学率 place undue emphasis on the proportion of students' entering school of a higher level高分低能 good scores but low qualities扩招 expand enrollment教书育人 impart knowledge and educate people因材施教 teach students according to their aptitude提高身心素质 improve the health and psychological quality大学生创业 the university students' innovative undertaking社会实践 social practice文凭 diplomas and certificates复合型人才 interdisciplinary talents文化底蕴 the rich cultural deposits适应社会的改变 adjust to the social changes满足社会的急需 meet the urgent needs the society工作类人才流动和双向选择 talent flow and a dual-way selection试用期 probationary period跳槽 job-hopping自由职业 freelance work拜金主义 money worship获得名利 achieve fame and wealth充分发挥个人的潜力 develop fully one's potential and creativity工作出色 excel in one's work社会和个人的尊重 social and personal esteem生计问题 a bread and butter issue人才交流 talents exchange培养人才 cultivate talents人才外流 brain drain失业问题 unemployment problems下岗职工 the laid-off workers自谋生路 be self-employed劳动力短缺 shortage of manpower医药卫生类卫生环境 sanitary environment营养不良 malnutrition杀虫剂 pesticide传染病 infectious disease呼吸疾病 respiratory disease商业类假冒伪劣 forged and fake modities物美价廉 goods with high qualities low price售后服务 after-sale service家用电器 household electrical appliances旺季 during peak selling seasons促销 promote sales提高购置力 raise the purchasing power刺激购物欲 stimulate the desire to buy超前消费 premature consumption国有企业 state-owned enterprise私人企业 private enterprise偷税漏税 tax evasion保持时常良好的秩序 keep market in good order垄断市场 monopolize the market社会道德类遵守公德 ply with public morality物质和精神文明建设 material and ideological progress守法 observe/obey the law遵守交规 observe traffic regulations改良社会风气 improve public morals## offend against the law侵犯个人隐私 invasion of privacy违反公共规章 break/violate public regulations扰乱治安 disturb the social order要求索赔 claim pensation应该受法律严惩 deserve to be punished heavily by the law环保类生态系统 ecosystem环保意识 environmental awareness生态失衡 disruption of ecological balance全球变暖 global warming温室效应 greenhouse effect沙尘暴 sand/dust storms淡水资源短缺 shortage of fresh waterdownsizing减员**streamline精简**on the job/in-service在职**disposable一次性**think tank智囊团**round the clock service全天候服务**(free) convertibility〔自由〕兑换**find a sugar daddy傍大款**Nordic北欧**non-renewable不可再生**out and out彻头彻尾**deadlock僵局**tertiary industry第三产业**fair (market) value市值**refund退款**axis-of-evil邪恶轴心**(nuclear) nonproliferation核不扩散**holistic整体的**one-off一次性〔解决〕的;一揽子的**turnkey总承包的;现成可使用的**in-house自有的;〔in-house finance pany) **round-up汇总?**overseas returnee海归**framework accord框架协议**WTO accession参加WTO**non-exclusive license非专用特许**royalty free无费的**sublicense转授权;转发许可证**creature forts衣食**recapitalization资产重组**RPI〔Retail Price Index〕零售物价指数**overriding concern高于一切的考虑**Lanyard系索**copyright著作权**royalty**pliance合规性**extension展期**co-lead underwriter副主承销商**Advisory Board咨询委员会**Board of Councillors理事会**entrepreneur创业者**upmarket高端的**attorney general首席检察官**upscale高端的**clientele客户群**self starter白手起家人**down round筹资首轮**mass market vs. submarket总的市场/次级市场〔比如根据某个标准分的客户群〕**letter/power of attorney委任书**market clout市场影响〔?〕**rehaul (a business)重组;**sell-back (与buy-out相对〕**monograph专题〔论述〕**verbatim逐字逐句的说法〔比如销售“定式〞用语〕**Liquidity Trap流动性陷阱〔宁愿把资金存放于银行拿取零利息的回报,也不愿再投资赔了〕**many a little makes a mickle集腋成裘**reservist后备兵**at eleventh hours关键时刻**misnomer用词不当**payoff收益**outperform超过**bailout解决;救援〔for instance, the bailout from IMF for South Korea and other SE Asian countries after financial crisis)**honor of N/R (notes receivable)/dishonor到期兑现**political cronies政府人员办的关联企业**value-based pricing价值导向定价法〔区别于cost-based pricing,指能为客户带来多少价值来确定价格,而不是消耗了多少本钱,比如飞机票)**clearinghouse like exchange〔交换场所〕**value of synergy企业兼并之后带来的利益**post-investment values〔注意post的用法〕**techie做技术的人〔与salesman相对〕**on-target专注于最终目标的**optimum最适宜的**overhead还有一个意思是“投影〞,类似powerpoint**in line与预期相符的**YTD (year-to-date)从Jan 1到目前的时间**scorched earth焦土政策**economies of scopeX围经济〔与economies of scale相比〕**toehold小支点,起点**industry observer行业观察家**networking商业构建私人关系网**conference backdrop会议背景幕**trade-up升级**ease of maintenance/repair维修的容易度**cap〔金额〕最高限度;upper limit**lifetime〔债券等的〕存期**double dip recession二次萧条〔特指本次美国经济泡沫破灭后,还将面临的进一步衰退〕**fringe benefits附加福利〔除国家规定外的〕**annual leave年假**call to order宣布开会;要求遵守秩序**second the motion附议**motion carried动议通过**window dressing粉饰**end-state最终状态**scrap废品〔与rework相对〕**disagrregate分解**solidity可*性**MIS (management information system) 管理信息系统**in due course稍后**7-11便利店**numerator/denominator分子/分母**winding-up结算;停业**subsidiary/member panies下属公司**coach大客车**OEM/aftermarket parts汽车业的前/后配件**assembly plant汽车整车厂**elevated rail轻轨**honorary名誉**deputy magistrate副区长〔虹口〕**size up估计**offer .. Advancement over比。

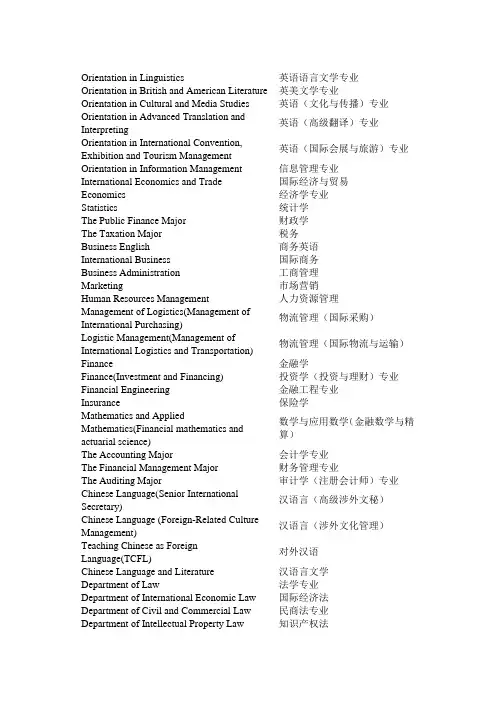

Orientation in Linguistics 英语语言文学专业Orientation in British and American Literature 英美文学专业Orientation in Cultural and Media Studies 英语(文化与传播)专业Orientation in Advanced Translation andInterpreting英语(高级翻译)专业Orientation in International Convention,Exhibition and Tourism Management英语(国际会展与旅游)专业Orientation in Information Management 信息管理专业International Economics and Trade 国际经济与贸易Economics 经济学专业Statistics 统计学The Public Finance Major 财政学The Taxation Major 税务Business English 商务英语International Business 国际商务Business Administration 工商管理Marketing 市场营销Human Resources Management 人力资源管理Management of Logistics(Management ofInternational Purchasing)物流管理(国际采购)Logistic Management(Management ofInternational Logistics and Transportation)物流管理(国际物流与运输)Finance 金融学Finance(Investment and Financing) 投资学(投资与理财)专业Financial Engineering 金融工程专业Insurance 保险学Mathematics and Applied Mathematics(Financial mathematics and actuarial science) 数学与应用数学(金融数学与精算)The Accounting Major 会计学专业The Financial Management Major 财务管理专业The Auditing Major 审计学(注册会计师)专业Chinese Language(Senior InternationalSecretary)汉语言(高级涉外文秘)Chinese Language (Foreign-Related CultureManagement)汉语言(涉外文化管理)Teaching Chinese as ForeignLanguage(TCFL)对外汉语Chinese Language and Literature 汉语言文学Department of Law 法学专业Department of International Economic Law 国际经济法Department of Civil and Commercial Law 民商法专业Department of Intellectual Property Law 知识产权法Department of Diplomacy 外交学专业Department of International Politics 国际政治专业Computer Science and Technology 计算机科学与技术Software Engineering 软件工程专业Information Management & InformationSystem信息管理与信息系统Electronic Commerce 电子商务Public Affairs and Administration 公共事业管理Administration Management 行政管理Applied Psychology (majoring in ManagementPsychology)应用心理学Social Work (majoring in Urban SocialAdministration)社会工作专业BA in Journalism(International Journalism) 新闻学(国际新闻)BA in Advertising 广告学BA in the Art of Broadcasting and Hosting 播音与主持艺术专业Music Performance(Vocal Music) 音乐表演专业(声乐)Art Design (Visual Transmission Design)(Photoshop)Major 艺术设计(视觉传达设计)(数字影像设计)专业。

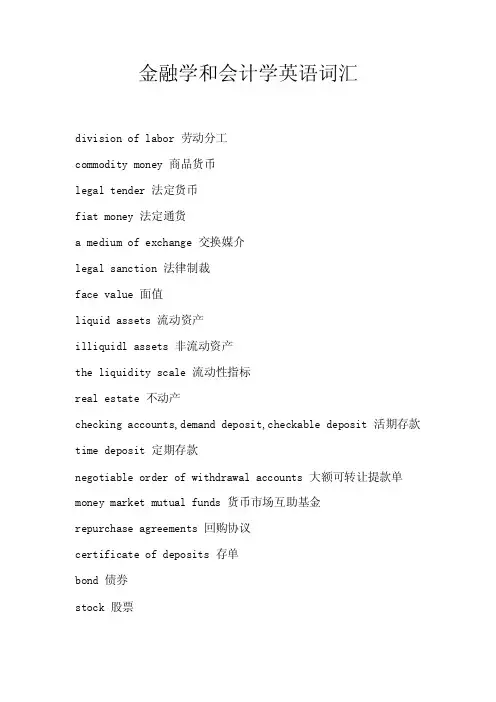

金融学和会计学英语词汇division of labor 劳动分工commodity money 商品货币legal tender 法定货币fiat money 法定通货a medium of exchange 交换媒介legal sanction 法律制裁face value 面值liquid assets 流动资产illiquidl assets 非流动资产the liquidity scale 流动性指标real estate 不动产checking accounts,demand deposit,checkable deposit 活期存款time deposit 定期存款negotiable order of withdrawal accounts 大额可转让提款单money market mutual funds 货币市场互助基金repurchase agreements 回购协议certificate of deposits 存单bond 债券stock 股票travelers'checks 旅行支票small-denomination time deposits 小额定期存款large-denomination time deposits 大额定期存款bank overnight repurchase agreements 银行隔夜回购协议bank long-term repurchase agreements 银行长期回购协议thrift institutions 存款机构financial institution 金融机构commercial banks 商业银行a means of payment 支付手段a store of value 储藏手段a standard of value 价值标准reserve 储备note 票据discount 贴现circulate 流通central bank 中央银行the Federal Reserve System 联邦储备系统credit union 信用合作社paper currency 纸币credit creation 信用创造branch banking 银行分行制unit banking 单一银行制out of circulation 退出流通capital stock 股本at par 以票面价值计electronic banking 电子银行banking holding company 公司银行the gold standard 金本位the Federal Reserve Board 联邦储备委员会the stock market crash 股市风暴reserve ratio 准备金比率deficit 亏损roll 展期wholesale 批发default 不履约auction 拍卖collateralize 担保markup 价格的涨幅dealer 交易员broker 经纪人pension funds 养老基金face amount 面值commerical paper 商业票据banker's acceptance 银行承兑汇票Fed fund 联邦基金eurodollar 欧洲美元treasury bills 国库券floating-rate 浮动比率fixed-rate 固定比率default risk 拖欠风险credit rating 信誉级别tax collection 税收money market 货币市场capital market 资本市场original maturity 原始到期期限surplus funds 过剩基金宏观经济的 macroeconomic通货膨胀 inflation破产 insolvency有偿还债务能力的 solvent合同 contract汇率 exchange rate紧缩信贷 tighten credit creation 私营部门 private sector财政管理机构 fiscal authorities宽松的财政政策 slack fiscal policy税法 tax bill财政 public finance财政部 the Ministry of Finance平衡预算 balanced budget继承税 inheritance tax货币主义者 monetariest增值税 VAT (value added tax)收入 revenue总需求 aggregate demand货币化 monetization赤字 deficit经济不景气 recession经济好转 turnabout复苏 recovery成本推进型 cost push货币供应 money supply生产率 productivity劳动力 labor force实际工资 real wages成本推进式通货膨胀 cost-push inflation 需求拉动式通货膨胀 demand-pull inflation 双位数通货膨胀 double- digit inflation极度通货膨胀 hyperinflation长期通货膨胀 chronic inflation治理通货膨胀 to fight inflation最终目标 ultimate goal坏的影响 adverse effect担保 ensure贴现 discount萧条的 sluggish认购 subscribe to支票帐户 checking account货币控制工具 instruments of monetry control 借据 IOUs(I owe you)本票 promissory notes货币总监 controller of the currency拖收系统 collection system支票清算或结算 check clearing资金划拨 transfer of funds可以相信的证明 credentials改革 fashion被缠住 entangled货币联盟 Monetary Union再购协议 repo精明的讨价还价交易 horse-trading欧元 euro公共债务 membership criteria汇率机制 REM储备货币 reserve currency劳动密集型 labor-intensive股票交易所 bourse竞争领先 frontrun牛市 bull market非凡的牛市 a raging bull规模经济 scale economcies买方出价与卖方要价之间的差价 bid-ask spreads 期货(股票) futures经济商行 brokerage firm回报率 rate of return股票 equities违约 default现金外流 cash drains经济人佣金 brokerage fee存款单 CD(certificate of deposit)营业额 turnover资本市场 capital market布雷顿森林体系 The Bretton Woods System经常帐户 current account套利者 arbitrager远期汇率 forward exchange rate即期汇率 spot rate实际利率 real interest rates货币政策工具 tools of monetary policy银行倒闭 bank failures跨国公司 MNC ( Multi-National Corporation) 商业银行 commercial bank商业票据 comercial paper利润 profit本票,期票 promissory notes监督 to monitor佣金(经济人) commission brokers套期保值 hedge有价证券平衡理论 portfolio balance theory 外汇储备 foreign exchange reserves固定汇率 fixed exchange rate浮动汇率 floating/flexible exchange rate 货币选择权(期货) currency option套利 arbitrage合约价 exercise price远期升水 forward premium多头买升 buying long空头卖跌 selling short按市价订购股票 market order股票经纪人 stockbroker国际货币基金 the IMF七国集团 the G-7监督 surveillance同业拆借市场 interbank market可兑换性 convertibility软通货 soft currency限制 restriction交易 transaction充分需求 adequate demand短期外债 short term external debt汇率机制 exchange rate regime直接标价 direct quotes资本流动性 mobility of capital赤字 deficit本国货币 domestic currency外汇交易市场 foreign exchange market国际储备 international reserve利率 interest rate资产 assets国际收支 balance of payments贸易差额 balance of trade繁荣 boom债券 bond资本 captial资本支出 captial expenditures商品 commodities商品交易所 commodity exchange期货合同 commodity futures contract普通股票 common stock联合大企业 conglomerate货币贬值 currency devaluation通货紧缩 deflation折旧 depreciation贴现率 discount rate归个人支配的收入 disposable personal income 从业人员 employed person汇率 exchange rate财政年度fiscal year自由企业 free enterprise国民生产总值 gross antional product 库存 inventory劳动力人数 labor force债务 liabilities市场经济 market economy合并 merger货币收入 money income跨国公司 Multinational Corproation 个人收入 personal income优先股票 preferred stock价格收益比率 price-earning ratio优惠贷款利率 prime rate利润 profit回报 return on investment使货币升值 revaluation薪水 salary季节性调整 seasonal adjustment关税 tariff失业人员 unemployed person效用 utility价值 value工资 wages工资价格螺旋上升 wage-price spiral收益 yield补偿贸易 compensatory trade, compensated deal 储蓄银行 saving banks欧洲联盟 the European Union单一的实体 a single entity抵押贷款 mortgage lending业主产权 owner's equity普通股 common stock无形资产 intangible assets收益表 income statement营业开支 operating expenses行政开支 administrative expenses现金收支一览表 statement of cash flow贸易中的存货 inventory收益 proceeds投资银行 investment bank机构投资者 institutional investor垄断兼并委员会 MMC招标发行 issue by tender定向发行 introduction代销 offer for sale直销 placing公开发行 public issue信贷额度 credit line国际债券 international bonds欧洲货币Eurocurrency利差 interest margin以所借的钱作抵押所获之贷款 leveraged loan 权利股发行 rights issues净收入比例结合 net income gearing常用的经济学金融学中英文词汇及解释Equilibrium,competitive 竞争均衡见竟争均衡(competitive equilibrium)。

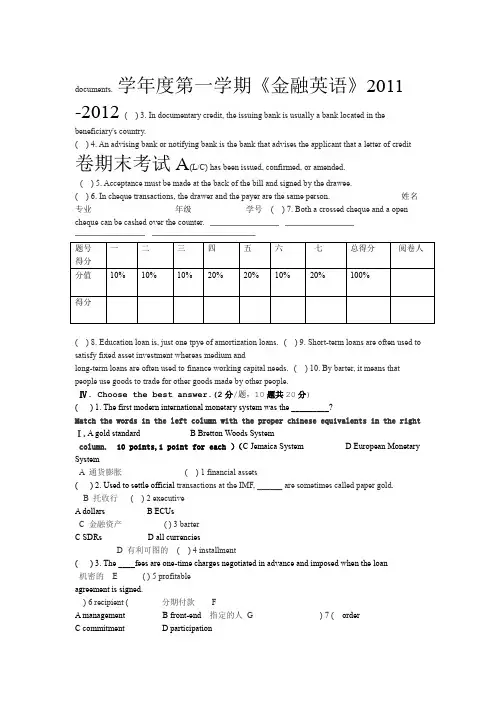

documents.学年度第一学期《金融英语》2011 -2012 ( ) 3. In documentary credit, the issuing bank is usually a bank located in the beneficiary's country.( ) 4. An advising bank or notifying bank is the bank that advises the applicant that a letter of credit 卷期末考试A(L/C) has been issued, confirmed, or amended.( ) 5. Acceptance must be made at the back of the bill and signed by the drawee.( ) 6. In cheque transactions, the drawer and the payer are the same person. 姓名专业年级学号( ) 7. Both a crossed cheque and a open cheque can be cashed over the counter.( ) 8. Education loan is, just one tpye of amortization loans.( ) 9. Short-term loans are often used to satisfy fixed asset investment whereas medium andlong-term loans are often used to finance working capital needs.( ) 10. By barter, it means that people use goods to trade for other goods made by other people.Ⅳ. Choose the best answer.(2分/题,10题共20分)( ) 1. The first modern international monetary system was the _________?Match the words in the left column with the proper chinese equivalents in the right Ⅰ.A gold standard B Bretton Woods Systemcolumn.10 points,1 point for each )(C Jemaica System D European Monetary SystemA 通货膨胀( ) 1 financial assets( ) 2. Used to settle official transactions at the IMF, ______ are sometimes called paper gold.B 托收行( ) 2 executiveA dollarsB ECUsC 金融资产( ) 3 barterC SDRsD all currenciesD 有利可图的( ) 4 installment( ) 3. The ____fees are one-time charges negotiated in advance and imposed when the loan机密的 E ( ) 5 profitableagreement is signed.) 6 recipient ( 分期付款 FA managementB front-end 指定的人G ) 7 ( orderC commitmentD participation( 行政人员H ) 8 inflation( ) 4. The person paying the money is _______ of a cheque.I 物物交换) 9 confidental (A the draweeB the endorser ( 收信人J ) 10 remitting bankC the payeeD the endorsee( ) 5. The documents will not be delivered to the buyer until ________.分)105题,(II.Give the full name to the following words.2分/ 题共A the buyer has cleared goods B the goods have arrived ______________________________ ECU .1C the bill is paid or accepted D both A and B______________________________ IMF .2( ) 6. If it is not stated as D/P or D/A, the documents can be released_________.______________________________ SDRs 3.A against acceptance pour avalB against acceptance 4. D/A_______________________________C against paymentD in either way.5CPA ________________________________ ( ) 7. Under_____, no draft is drawn. It is also used as a means of avoiding the stamp duty(10分). Decide whether each of the following statements is true(T) or false(F). Ⅲpayable on drafts.the ( personal with be not should transactions Business 1. ) confused Similarly, transactions.A the acceptance creditB the derferred payment credit transactions of different entities should not be accounted for together.D the negotiated creditC the payment credit ) 2. A usance credit means a credit which stipulates the immediate payment on presentation of(( ) 8. ________is the bank to which the pricipal has entrusting the collection.“We needed furniture(家具) for our living room.”Says John Ross, “and we just didn't have enough money to buy it. So we decided to try making a few tables and chairs.”B The collecting bank John got married six A The remitting bankmonths ago, and like many young people these days, they are struggling to make a home at a time when D Both A and BC The presenting bankthe cost of living is very high. The Rosses took a 2-week course for $ 280 at a night school. Nowthey ) 9. Which principle has the assumption that the business will continue in operation?(build all their furniture and make repairs around the house.B The going-concern concept A The cost principleJim Hatfield has three boys and his wife died. He has a full-time job at home as well as in a shoe C The matching principle D Both A and Bmaking factory. Last month, he received a car repair bill for $ 420. “I was deeply upset about it. Now I ( ) 10. _______ is the most important part of a bank letter.have finished a car repair course, I should be able to fix the car by myself.” B Body ASubjectJohn and Jim are not unusual people. Most families in the country are doing everything they can to D SignatureC Complimentary closesave money so they can fight the high cost of living. If you want to become a “)do-it-yourself”, you can Ⅴ. Translate the following sentences. (20分go to DIY classes. And for those who do not have time to take a course, there are books that tell you 1. The usual way wordor by writing stamping the the drawee accepts a draft iss authorized signature and the ACCEPTED” on the face of the draft, plus the drawee'“how you can do things yourself.1. We can learn from the text that many newly married people _______. date accepted.that theA. find it hard to pay for what they need verify reasonable good 2. Banks wiil act in faith and exercise care and mustdocuments received appear to ba as listed in the collection order. B. have to learn to make their own furniture.C. take DIY courses run by the government. hospitals, as churches, most government agencies, andsuch 3. Nonprofit organizationscolleges use accounting information in much the same way that profit oriented businesses D. seldom go to a department store to buy things2. John and his wife went to evening classes to learn how to _____ do.4. 用货币作为交换媒介是货币的主要职能之一。

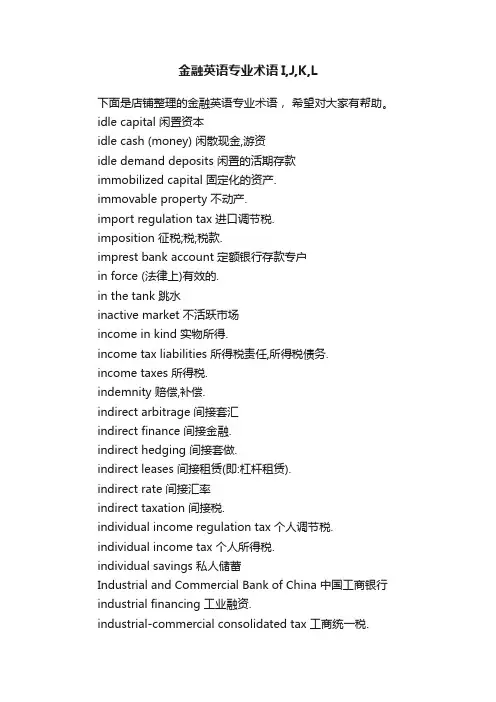

金融英语专业术语I,J,K,L下面是店铺整理的金融英语专业术语,希望对大家有帮助。

idle capital 闲置资本idle cash (money) 闲散现金,游资idle demand deposits 闲置的活期存款immobilized capital 固定化的资产.immovable property 不动产.import regulation tax 进口调节税.imposition 征税;税;税款.imprest bank account 定额银行存款专户in force (法律上)有效的.in the tank 跳水inactive market 不活跃市场income in kind 实物所得.income tax liabilities 所得税责任,所得税债务.income taxes 所得税.indemnity 赔偿,补偿.indirect arbitrage 间接套汇indirect finance 间接金融.indirect hedging 间接套做.indirect leases 间接租赁(即:杠杆租赁).indirect rate 间接汇率indirect taxation 间接税.individual income regulation tax 个人调节税. individual income tax 个人所得税.individual savings 私人储蓄Industrial and Commercial Bank of China 中国工商银行industrial financing 工业融资.industrial-commercial consolidated tax 工商统一税.industrial-commercial income tax 工商所得税. industrial-commercial tax 工商税.inflation 通货膨胀inflation 通货膨胀inflation 通货膨胀inflation rate 通货膨胀率inflation rate 通货膨胀率inflation rate 通货膨胀率inflationary spiral 螺旋式上升的通货膨胀inflationary spiral 螺旋式上升的通货膨胀inflationary spiral 螺旋式上升的通货膨胀inflationary trends 通货膨胀趋势inflationary trends 通货膨胀趋势inflationary trends 通货膨胀趋势infrastructure bank 基本建设投资银行initial margin 初始保证金.initial margin 期初保证权.initial margins 初始保证金.initial reserve 初期准备金initial reserve 初期准备金initial reserve 初期准备金insider 内幕人installment savings 零存整取储蓄institution 机构投资者insurance appraiser 保险损失评价人. insurance broker 保险经纪人.insurance contract 保险契约,保险合同. insurance saleman 保险外勤.insurance services 保险业务insure against fire 保火险.insured 被保险人.interbank market 银行同业市场inter-business credit 同行放帐.interest on deposit 存款利息interest per annum 年息interest per month 月息interest rate futures contract 利率期货合约.interest rate policy 利率政策interest rate policy 利率政策interest rate policy 利率政策interest rate position 利率头寸.interest rate risk 利率风险.interest restriction 利息限制interest subsidy 利息补贴interest-rate risk 利息率风险.interim finance 中间金融.intermediary bank 中间银行intermediate account 中间帐户internal reserves 内部准备金internal reserves 内部准备金internal reserves 内部准备金international banking services 国际银行业务International Investment Bank (IIB) 国际投资银行international leasing 国际租赁.in-the-money 有内在价值的期权.intraday 日内intrinsic utility 内在效用.intrinsic value 实际价值,内部价值.inward documentary bill for collection 进口跟单汇票,进口押汇(汇票)isolation of risk 风险隔离.issue bank 发行银行JCB card JCB卡.joint financing 共同贷款.key risk 关键风险.kill a bet 终止赌博.land use tax 土地使用税.large deposit 大额存款large leases 大型租赁.latent inflation 潜在的通货膨胀latent inflation 潜在的通货膨胀latent inflation 潜在的通货膨胀lease agreement 租约.lease and release 租借和停租.lease broker 租赁经纪人.lease financing 租赁筹租.lease immovable 租借的不动产. lease in perpetuity 永租权.lease insurance 租赁保险.lease interest insurance 租赁权益保险. lease land 租赁土地.lease mortgage 租借抵押.lease out 租出.lease property 租赁财产.lease purchase 租借购买.lease rental 租赁费.lease territory 租借地.leaseback 回租.leasebroker 租赁经纪人.leased immovable 租借的不动产.leasehold 租赁土地.leasehold 租借期,租赁营业,租赁权. leasehold property 租赁财产. leasehold property 租赁财产. leaseholder 租赁人. leaseholder 承租人,租借人. leases agent 租赁代理.leases arrangement 租赁安排. leases company 租赁公司. leases structure 租赁结构. leasing 出租.leasing agreement 租赁协议. leasing amount 租赁金额. leasing asset 出租财产,租赁财产. leasing clauses 租赁条款. leasing consultant 租赁顾问. leasing contract 租赁合同. leasing cost 租赁成本.leasing country 承租国. leasing division 租赁部. leasing equipment 租赁设备. leasing industry 租赁业. leasing industry (trade) 租赁业. leasing money 租赁资金. leasing period 租赁期.leasing regulations 租赁条例. legal interest 法定利息legal tender 法定货币legal tender 本位货币,法定货币lessee 承租人,租户.lessor 出租人.letter of confirmation 确认书.letter transfer 信汇leveraged leases 杠杆租赁.lien 扣押权,抵押权.life insurance 人寿保险.life of assets 资产寿命.limit order 限价指令limited floating rate 有限浮动汇率line of business 行业,营业范围,经营种类. liquidation 清仓liquidity 流动性liquidity of bank 银行资产流动性liquidity of bank 银行资产流动性liquidity of bank 银行资产流动性listed stock 上市股票livestock transaction tax 牲畜交易税. loan account 贷款帐户loan amount 贷款额.loan at call 拆放.loan bank 放款银行loan volume 贷款额.loan-deposit ratio 存放款比率loan-deposit ratio 存放款比率loan-deposit ratio 存放款比率loans to financial institutions 金融机构贷款loans to government 政府贷款local bank 地方银行local income tax (local surtax) 地方所得税. local surtax 地方附加税.local tax 地方税.long arbitrage 多头套利.long position 多头头寸long position 多头寸;买进的期货合同. long-term certificate of deposit 长期存款单long-term credit bank 长期信用银行long-term finance 长期资金融通.loss leader 特价商品,亏损大项loss of profits insurance 收益损失保险. loss on exchange 汇兑损失low-currency dumping 低汇倾销low-currency dumping 低汇倾销.。

广东商学院各院及其专业(中英文翻译)(GUANG DONG UNIVERSITY OF BUSINESS STUDIES)一、工商管理学院:The College of Business Administration1、物流管理:Logistics Management2、人力资源:Human Resources3、市场营销专业:Marketing Program4、工商管理专业:Business Administration Program二、会计学院: the College of Accounting1、审计学:Auditing2、会计学专业:Accounting Professional3、财务管理专业: Financial Management Major4、审计学(注册会计师)Auditing(Certified Public Accountant (CPA))三、财税学院:the College of Taxation1、财政学:Public Finance2、税务:Financial Affairs3、资产评估专业:MSc Property Appraisal and Management四、公共管理学院:School of Public Administration1、行政管理专业:General Administration Program2、劳动与社会保障:Labor and Social Security3、文化产业管理: Culture Industry Management4、公共事业管理(城市管理):City Management五、金融学院:College of Finance1、金融学:Finance2、国际金融:International Finance3、金融工程:Financial Engineering4、保险:Insurance5、投资学:Investment Principles六、经济贸易与统计学院:the College of Economic and Statistics1、经济学:Economics2、国际经济与贸易:International Economics And Trade3、统计学:Statistics4、国际商务:International Business七、法学院:The College of Law1、法学(国际法):The International Law2、法学(民商法):Civil and Commercial Law3、法学:Science of Law4、治安学:Science of Public Order八、旅游学院:College of Tourism1、酒店管理:Hotel Management2、旅游管理:Tourism Management3、会展经济与管理:Exhibition Economy and Management九、资源与环境学院:College of Resource and Environment1、土地资源管理:Land Resources Management2、资源环境与城乡规划管理:Resources-Environment and Urban-Rural Planning Management3、房地产经营管理:Administration and Management of Real Estate十、外国语学院:College of Foreign Language1、英语(国际商务管理):International Business Management2、英语(国际商务翻译):International Business English Translation3、日语(国际商务管理):nternational Business Management十一、人文与传播学院: College of Humanities and Communications1、汉语言文学:Chinese Language and Literature2、新闻学:Advocacy Journalism3、新闻学(编辑出版方向)News Editing4、社会工作:Social work5、社会学:Sociology6、播音与主持艺术:Techniques of Broadcasting and Anchoring7、广播电视编导:Radio and Television Editing and Directing十二、艺术学院:Academy of Fine Arts1、广告学(广告策划与经营管理方向):Advertisement2、艺术设计(广告设计方向):Art and Design(Advertising Design)3、艺术设计(玩具与游戏设计方向):Art and Design4、艺术设计(商业空间设计方向):Commercial Space Design5、艺术设计(展示设计):Display Design6、动画专业:Science of Animated Cartoon Program十三、信息学院:College of Information1、信息管理与信息系统:Information Management and Information System2、计算机科学与技术:Computer Science and Technology3、电子商务:Electronic Commerce4、软件工程:Software Engineering十四、数学与计算科学学院:Collegeof Mathematics and Computer Science1、信息与计算科学:Information and Computing Science2、数学与应用数学:Mathematics and Applied Mathematics十五、人文与传播学院:College of Humanities and Communications1、应用心理学: Applied Psychology2、商务文秘:Business secretary3、对外汉语:Teaching Chinese as a Foreign Language。

各个学科名字的英文单词各个学科名字的英文单词每一门学科的名字都有属于它的英文单词,为此店铺为大家带来各个学科名字的英文单词。

学科名的英文单词Chinese 语文English 英语Japanese 日语history 历史mathematics 数学physical education 体育algebra 代数geometry 几何geography 地理biology 生物chemistry 化学physics 物理literature 文学psychology 心理学sociology 社会学philosophy 哲学engineering 工程学mechanical engineering 机械工程学electronics 电子学medicine 医学social science 社会学agriculture 农学astronomy 天文学economics 经济学politics 政治学biochemistry 生物化学anthropology 人类学linguistics 语言学accounting 会计学law 法学metallurgy 冶金学finance 财政学,金融学journalism 新闻学civil engineering 土木工程学architecture 建筑学business administration 工商管理学chemical engineering 化学工程学botany 植物学学科的英文例句计算机科学目前已是一门成熟的.学科。

Computer science is now a fully-fledged academic subject.他熟悉这一学科。

He is at home with this subject.她已全面掌握了这一学科。

She has a comprehensive grasp of the subject.但愿我能精通这门学科就好了。

大学生专业英语词汇总结随着全球化时代的到来,跨国公司、国际组织以及各种国际活动的频繁出现,英语作为国际交流的基本语言,成为了每一个大学生必备的技能之一。

作为大学英语的学习者,熟练掌握专业英语词汇不仅是提升英语水平的必要条件,也是迈向专业领域的重要基础。

下面是本文为大家总结的大学生专业英语词汇:一、商务英语1. revenue –收入\n2. profit –利润\n3. sales –销售额\n4. market –市场\n5. brand –品牌\n6. strategy –策略\n7. investment –投资\n8. competition –竞争\n9. target market –目标市场\n10. advertising –广告二、计算机科学1. algorithm –算法\n2. database –数据库\n3. programming –编程\n4. software –软件\n5. hardware –硬件\n6. network –网络\n7. code –代码\n8. operating system –操作系统\n9. debugging –调试\n10. user interface –用户界面三、金融学1. interest rate –利率\n2. stock –股票\n3. bond –债券\n4. investment –投资\n5. risk –风险\n6. liquidity –流动性\n7. asset –资产\n8. liability –负债\n9. hedge fund –对冲基金\n10. derivatives –衍生品四、法律1. contract –合同\n2. litigation –诉讼\n3. liability –责任\n4. precedent –先例\n5. intellectual property –知识产权\n6. arbitration –仲裁\n7. legal system –法律体系\n8. judgment –判决\n9. plaintiff –原告\n10. defendant –被告五、医学1. diagnosis –诊断\n2. treatment –治疗\n3. surgery –手术\n4. medication –药物\n5. patient –病人\n6. symptom –症状\n7. disease –疾病\n8. surgery –外科学\n9. anatomy –解剖学\n10. physiology –生理学六、教育学1. curriculum –课程\n2. pedagogy –教学法\n3. assessment –评估\n4. classroom management –课堂管理\n5. educational psychology –教育心理学\n6. learning outcomes –学习成果\n7. special education –特殊教育\n8. differentiated instruction –差异化教学\n9. educational research –教育研究\n10. teaching strategies –教学策略七、国际关系1. sovereignty –主权\n2. diplomacy –外交\n3. globalization –全球化\n4. non-governmental organization (NGO) –非政府组织\n5. international law –国际法\n6. foreign policy –外交政策\n7. human rights –人权\n8. conflict resolution –冲突解决\n9. international trade –国际贸易\n10. international governance –国际治理八、建筑设计1. blueprint –蓝图\n2. architecture –建筑学\n3. building materials –建筑材料\n4. interior design –室内设计\n5.construction –建筑工程\n6. sustainable design –可持续设计\n7. building code –建筑规范\n8. structural engineering –结构工程\n9. landscape architecture –景观设计\n10. urban planning –城市规划以上是本文总结的大学生专业英语词汇,涵盖了商务、计算机科学、金融学、法律、医学、教育学、国际关系、建筑设计等多个专业领域。

分享返回分享首页»分享经济学专业英语词汇整理来源:金相彬S.K.的日志1、Ability-to-pay principle(of taxation)(税收的)支付能力原则按照纳税人支付能力确定纳税负担的原则。

纳税人支付能力依据其收人或财富来衡量。

这一原则并不说明某经济状况较好的人到底该比别人多负担多少。

2、Absolute advantage 绝对优势如果一个国家用一单位资源生产的某种产品比另一个国家多,那么,这个国家在这种产品的生产上与另一国相比就具有绝对优势。

3、Accelerator principle 加速原理解释产出率变动同方向地引致投资需求变动的理论。

4、Actual, cyclical, and structural budget 实际预算、周期预算和结构预算实际预算的赤字或盈余指的是某年份实际记录的赤字或盈余。

实际预算可划分成结构预算和周期预算。

结构预算假定经济在潜在产出水平上运行,并据此测算该经济条件下的政府税入、支出和赤字等指标。

周期预算基于所预测的商业周期(及其经济波动)对预算的影响。

5、Adaptive expectations 适应性预期见预期(expectations)。

6、Adjustable peg 可调整钉住一种(固定)汇率制度。

在该制度下,各国货币对其他货币保持一种固定的或曰"钉住的"汇率。

当某些基本因素发生变动、原先汇率失去合理依据的时候,这种汇率便不时地趋于凋整。

在1944-1971年期间,世界各主要货币都普遍实行这种制度,称为"布雷顿森林体系"。

7、Administered(or inflexible)prices 管理(或非浮动)价格特指某类价格的术语。

按照有关规定,这类价格在某一段时间内、在若干种交易中能够维持不变。

(见价格浮动 price flexibility)8、Adverse choice/selection 逆向选择一种市场不灵。

金融专业英语词汇大全一、基本金融术语1. 金融(Finance):指货币的筹集、分配和管理活动。

2. 银行(Bank):提供存款、贷款、支付结算等金融服务的机构。

3. 证券(Securities):代表财产所有权或债权的凭证,如股票、债券等。

4. 投资(Investment):将资金投入到某个项目或资产,以获取收益的行为。

5. 债务(Debt):借款人向债权人承诺在一定期限内偿还本息的义务。

6. 股票(Stock):股份有限公司发行的,代表股东对公司所有权和收益分配权的凭证。

7. 债券(Bond):债务人向债权人发行的,承诺按一定利率支付利息并在到期日偿还本金的债务凭证。

8. 利率(Interest Rate):资金的价格,反映资金借贷的成本。

9. 汇率(Exchange Rate):一种货币兑换另一种货币的比率。

10. 通货膨胀(Inflation):货币购买力下降,物价普遍持续上涨的现象。

二、金融衍生品词汇1. 金融衍生品(Financial Derivatives):基于现货金融工具派生出来的新型金融工具。

2. 期货(Futures):双方约定在未来某一时间、按约定的价格买卖某种标的物的合约。

3. 期权(Options):买卖双方在未来一定期限内,按约定价格买入或卖出某种标的物的权利。

4. 掉期(Swap):双方约定在未来某一时间,相互交换一系列现金流的合约。

5. 远期合约(Forward Contract):双方约定在未来某一时间、按约定的价格买卖某种标的物的合约。

三、金融机构及监管部门词汇1. 中央银行(Central Bank):国家金融政策制定和执行的机构,如中国人民银行。

2. 商业银行(Commercial Bank):以盈利为目的,提供存款、贷款、支付结算等金融服务的银行。

3. 证券公司(Securities Company):从事证券经纪、投资咨询、资产管理等业务的金融机构。

学位专业名称中英文翻译对照表序号专业学位名称英文名称1金融硕士Master of Finance2应用统计硕士Master of Applied Statistics3税务硕士Master of Taxation4国际商务硕士Master of International Business5保险硕士Master of Insurance6资产评估硕士Master of Valuation7审计硕士Master of Auditing8法律硕士Juris Master9社会工作硕士Master of Social Work10汉语国际教育硕士Master of Teaching Chinese to Speakers of Other Languages 11应用心理硕士Master of Applied Psychology12翻译硕士Master of Translation and Interpreting13新闻与传播硕士Master of Journalism and Communication14出版硕士Master of Publishing15文物与博物馆硕士Master of Cultural Heritage and Museology16工程硕士Master of Engineering17临床医学硕士Master of Medicine18工商管理硕士Master of Business Administration19公共管理硕士Master of Public Administration20会计硕士Master of Professional Accounting21旅游管理硕士Master of Tourism Administration22图书情报硕士Master of Library and Information Studies23工程管理硕士Master of Engineering Management24高级工商管理硕士Executive Master Of Business Administration25艺术硕士Master of Fine Arts26口腔医学硕士Master of Stomatological Medicine序号工程硕士领域名称英文名称1光学工程Optical Engineering2材料工程Material Engineering3电子与通信工程Electronics and Communication Engineering 4控制工程Control Engineering5计算机技术Computer Technology6软件工程Software Engineering7化学工程Chemical Engineering8环境工程Environmental Engineering9生物工程Biotechnology Engineering10制药工程Pharmaceutical Engineering11项目管理Project Management12物流工程Logistics Engineering13生物医学工程Biomedical Engineering备注序号代码门类、一级学科及专业名称英文翻译101哲学 PHILOSOPHY 20101哲学 PHILOSOPHY 4010102中国哲学 CHINESE PHILOSOPHY 5010103外国哲学FOREIGN PHILOSOPHIES 6010104逻辑学 LOGIC 7010105伦理学 ETHICS 8010106美学 AESTHETICS 9010107宗教学 RELIGIOUS STUDIES 10010108科学技术哲学 PHILOSOPHY OF SCIENCE AND TECHNOLOGY 1102经济学 ECONOMICS 120201理论经济学 THEORETICAL ECONOMICS 13020101政治经济学 POLITICAL ECONOMICS 14020102经济思想史 HISTORY OF ECONOMIC THOUGHTS 15020103经济史 ECONOMIC HISTORY 16020104西方经济学ECONOMICS 17020105世界经济WORLD ECONOMY 18020106人口、资源与环境经济学ECONOMICS OF POPULATION, RESOURCES AND ENVIRONMENT 190202应用经济学 APPLIED ECONOMICS 20020202区域经济学 REGIONAL ECONOMICS 21020203财政学 PUBLIC FINANCE 22020204金融学 FINANCE 23020205产业经济学 INDUSTRIAL ECONOMICS 24020206国际贸易学 INTERNATIONAL TRADE 25020207劳动经济学 LABOR ECONOMICS 26020208统计学 STATISTICS 27020209数量经济学 QUANTITATIVE ECONOMICS 280202Z1保险学INSURANCE 290202Z2金融工程FINANCE ENGINEERING 300202Z3精算学ACTUARIAL SCIENCES 310202Z4城市经济学URBAN ECONOMICS 320202Z6物流学LOGISTICS 33020224计算金融学COMPUTIONAL FINANCE 3403法学 LAW 350301法学 LAW 36030101法学理论 JURISPRUDENCE 37030102法律史LEGAL HISTORY 38030103宪法学与行政法学C ONSTITUTIONAL AND ADMINISTRATIVE LAW 学科专业名称中英文翻译对照表代码为2位的是学位授予门类,代码为4位的是一级学科名称,代码为6位的是二级学科即专业名称。

经济学专业英语术语表专业简介: 经济学主要研究经济学、金融学、投资学、精算学等方面的基本知识和技能,在银行、证券、信托等金融机构进行经济分析、预测、规划、管理以及各类金融服务。

例如:债券、基金的投资前景分析,股票、投资的风险评估,汽车、房子的抵押贷款,企业破产时的资产清算等。

开设课程: 经济学主要课程:政治经济学、《资本论》、西方经济学、统计学、国际经济学、货币银行学、财政学、经济学说史、发展经济学、企业管理、市场营销、国际金融、国际贸易等1. 政治经济学 (Political Economy)术语术语术语术语术语生产力 (Productivity)生产关系 (ProductionRelations)经济制度 (EconomicSystem)社会主义市场经济(Socialist MarketEconomy)资本主义市场经济(Capitalist MarketEconomy)劳动价值论 (Labor Theory of Value)剩余价值 (SurplusValue)利润率 (Profit Rate)资本积累 (CapitalAccumulation)资本有机构成 (OrganicComposition of Capital)经济危机 (EconomicCrisis)货币 (Money)信用 (Credit)利息 (Interest)货币政策 (MonetaryPolicy)财政 (Fiscal)税收 (Taxation)政府支出 (GovernmentExpenditure)财政政策 (Fiscal Policy)公共债务 (Public Debt)国民收入 (NationalIncome)国内生产总值 (GrossDomestic Product,GDP)国民生产总值 (GrossNational Product, GNP)经济增长率 (EconomicGrowth Rate)经济发展水平 (EconomicDevelopment Level)2. 《资本论》(Capital)术语术语术语术语术语商品 (Commodity)使用价值 (Use Value)交换价值 (ExchangeValue)商品拜物教(CommodityFetishism)商品流通形式 (Forms ofCommodity Circulation)简单商品流通 (Simple Commodity Circulation)货币商品流通 (MoneyCommodityCirculation)货币转化为资本(Money Transformedinto Capital)资本循环过程(Circuit of Capital)资本周转时间 (TurnoverTime of Capital)不变资本 (ConstantCapital)变动资本 (VariableCapital)剩余价值率 (Rate ofSurplus Value)剥削率 (Rate ofExploitation)绝对剩余价值生产方式(Absolute Surplus ValueProduction Method)相对剩余价值生产方式(Relative Surplus Value Production Method)简单再生产(SimpleReproduction)扩大再生产(ExpandedReproduction)生产部门(Department ofProduction)消费部门(Department ofConsumption)资本主义生产方式(Capitalist Mode of Production)资本主义生产关系(Capitalist ProductionRelations)资本主义经济规律(Capitalist EconomicLaws)资本主义经济危机(Capitalist EconomicCrisis)资本主义的历史趋势(Historical Trend ofCapitalism)3. 西方经济学 (Western Economics)术语术语术语术语术语微观经济学(Microeconomics)宏观经济学(Macroeconomics)经济学方法论(EconomicMethodology)经济学思想史 (Historyof Economic Thought)经济学流派 (Schools ofEconomics)边际分析 (MarginalAnalysis)需求 (Demand)供给 (Supply)市场均衡 (MarketEquilibrium)弹性 (Elasticity)消费者行为(Consumer Behavior)效用 (Utility)预算约束 (BudgetConstraint)消费者选择(Consumer Choice)消费者剩余 (ConsumerSurplus)生产者行为 (ProducerBehavior)生产函数 (ProductionFunction)成本函数 (CostFunction)收益函数 (RevenueFunction)利润最大化 (ProfitMaximization)市场结构 (Market Structure)完全竞争市场 (PerfectCompetition Market)垄断市场 (MonopolyMarket)寡头垄断市场(Oligopoly Market)竞争性垄断市场(Monopolistic CompetitionMarket)4. 统计学 (Statistics)术语术语术语术语术语统计数据 (Statistical Data)数据来源 (DataSources)数据类型 (DataTypes)数据收集方法(DataCollection Methods)数据整理方法(DataProcessing Methods)频数分布表(Frequency Distribution Table)直方图(Histogram)频率多边形(Frequency Polygon)分位数(Quantile)箱线图(Boxplot)中心趋势度量(Measures of Central Tendency)平均数(Mean)中位数(Median)众数(Mode)几何平均数(GeometricMean)离散趋势度量(Measures ofDispersion)极差(Range)方差(Variance)标准差(StandardDeviation)变异系数(Coefficient ofVariation)相关分析(CorrelationAnalysis)散点图(ScatterPlot)相关系数(CorrelationCoefficient)回归分析(RegressionAnalysis)回归方程(RegressionEquation)5. 国际经济学(International Economics)术语术语术语术语术语国际贸易(InternationalTrade)国际收支(Balance ofPayments)汇率(Exchange Rate)国际金融(InternationalFinance)国际货币体系(International MonetarySystem)比较优势(Comparative Advantage)贸易政策(TradePolicy)关税(Tariff)非关税壁垒(Non-TariffBarrier)自由贸易区(Free TradeArea)关税同盟(CustomsUnion)共同市场(CommonMarket)经济一体化(EconomicIntegration)区域贸易协定(RegionalTrade Agreement)世界贸易组织(WorldTrade Organization)汇率制度(Exchange Rate Regime)固定汇率(FixedExchange Rate)浮动汇率(FloatingExchange Rate)管理浮动汇率(ManagedFloating Exchange Rate)汇率决定理论(ExchangeRate DeterminationTheory)汇率风险(Exchange Rate Risk)避险(Hedging)套利(Arbitrage)规模经济(Economies ofScale)产品差异化(ProductDifferentiation)贸易多样化(Trade Diversification)贸易创造(TradeCreation)贸易转移(TradeDiversion)贸易保护主义(TradeProtectionism)贸易自由化(TradeLiberalization)国际金融市场(International FinancialMarket)国际债券市场(International BondMarket)国际股票市场(International StockMarket)国际外汇市场(International ForeignExchange Market)国际金融危机(International FinancialCrisis)金本位制(Gold Standard System)布雷顿森林体系(Bretton WoodsSystem)特别提款权(SpecialDrawing Rights,SDRs)欧洲货币体系(EuropeanMonetary System, EMS)欧元(Euro)6. 货币银行学 (Money and Banking)货币的本质(Nature ofMoney)货币的功能(Functionof Money)货币的种类(Types ofMoney)货币供给(MoneySupply)货币需求(Money Demand)货币创造(Money Creation)存款准备金率(ReserveRequirement Ratio)存款货币乘数(DepositMoney Multiplier)银行的资产负债表(Bank's Balance Sheet)银行的盈亏表(Bank'sIncome Statement)银行的风险管理(Risk Management of Bank)银行的监管(Regulation of Bank)银行的稳健性(Soundnessof Bank)银行的效率(Efficiencyof Bank)银行的竞争力(Competitiveness of Bank)中央银行(CentralBank)中央银行的职能(Function of CentralBank)中央银行的独立性(Independence of CentralBank)中央银行的货币政策(Monetary Policy ofCentral Bank)中央银行的政策工具(PolicyTools of Central Bank)存款利率(Deposit Interest Rate)贷款利率(LoanInterest Rate)基准利率(BenchmarkInterest Rate)政策利率(PolicyInterest Rate)市场利率(Market InterestRate)7. 财政学 (Public Finance)术语术语术语术语术语公共部门(PublicSector)公共财政(Public Finance)公共财政的功能(Function of PublicFinance)公共财政的目标(Objective of PublicFinance)公共财政的原则(Principleof Public Finance)公共支出(Public Expenditure)公共支出的结构(Structure of PublicExpenditure)公共支出的效果(Effect ofPublic Expenditure)公共支出的决策(Decisionof Public Expenditure)公共支出的评价(Evaluation of PublicExpenditure)公共收入(Public Revenue)税收(Tax)税收的分类(Classification of Tax)税收的效果(Effect of Tax)税收的原则(Principle ofTax)税制(Tax System)税率(Tax Rate)税基(Tax Base)税负(Tax Burden)税收弹性(Tax Elasticity)财政赤字(FiscalDeficit)财政平衡(Fiscal Balance)财政盈余(Fiscal Surplus)财政政策(Fiscal Policy)财政乘数(FiscalMultiplier)8. 经济学说史 (History of Economic Thought)术语术语术语术语术语经济思想(EconomicThought)经济思想家(EconomicThinker)经济思潮(EconomicTrend)经济范式(EconomicParadigm)经济方法论(EconomicMethodology)古典经济学(Classical Economics)亚当·斯密(Adam Smith)大卫·李嘉图(DavidRicardo)托马斯·罗伯特·马尔萨斯(Thomas Robert Malthus)约翰·斯图亚特·穆勒(John Stuart Mill)新古典经济学(Neoclassical Economics)威廉·斯坦利·杰文斯(William StanleyJevons)卡尔·门格尔(CarlMenger)列昂·瓦尔拉斯(LeonWalras)阿尔弗雷德·马歇尔(Alfred Marshall)凯恩斯主义(Keynesianism)约翰·梅纳德·凯恩斯(John Maynard Keynes)总需求(TotalDemand)总供给(Total Supply)有效需求(EffectiveDemand)马克思主义(Marxism)卡尔·马克思(Karl Marx)弗里德里希·恩格斯(Friedrich Engels)剩余价值(Surplus Value)剩余价值理论(Theory ofSurplus Value)9. 发展经济学 (Development Economics)术语术语术语术语术语发展(Development)经济发展(EconomicDevelopment)社会发展(SocialDevelopment)人类发展(HumanDevelopment)可持续发展(SustainableDevelopment)发展中国家(Developing Countries)发达国家(DevelopedCountries)最不发达国家(LeastDeveloped Countries)新兴市场国家(Emerging MarketCountries)发展中欧洲和中亚国家(Europeand Central Asia DevelopingCountries)发展指标(Development Indicator)经济增长率(EconomicGrowth Rate)人均国民收入(PerCapita NationalIncome)贫困率(Poverty Rate)不平等系数(InequalityCoefficient)发展理论(Development Theory)进化论(Evolutionism)扩散论(Diffusionism)追赶论(Catch-upTheory)结构主义(Structuralism)发展战略(Development Strategy)进口替代战略(ImportSubstitution Strategy)出口导向战略(Export-oriented Strategy)自力更生战略(Self-reliance Strategy)开放型战略(Open Strategy)10. 企业管理 (Business Management)术语术语术语术语术语企业(Business)企业的目标(Objective ofBusiness)企业的环境(Environment ofBusiness)企业的组织(Organization ofBusiness)企业的管理(Management ofBusiness)管理的定义(Definition of Management)管理的功能(Function ofManagement)管理的原则(Principle ofManagement)管理的过程(Process ofManagement)管理的效果(Effect ofManagement)计划(Planning)计划的类型(Type ofPlanning)计划的步骤(Step ofPlanning)计划的工具(Tool ofPlanning)计划的评价(Evaluationof Planning)组织(Organizing)组织的类型(Type ofOrganizing)组织的结构(Structure ofOrganizing)组织的设计(Design ofOrganizing)组织的变革(Change ofOrganizing)领导(Leading)领导的类型(Type ofLeading)领导的风格(Style ofLeading)领导的技能(Skill ofLeading)领导的效果(Effect ofLeading)11. 市场营销 (Marketing)术语术语术语术语术语市场(Market)市场营销(Marketing)市场营销的概念(Conceptof Marketing)市场营销的目标(Objective ofMarketing)市场营销的原则(Principle ofMarketing)市场营销环境(Marketing Environment)微观环境(Microenvironment)宏观环境(Macroenvironment)竞争环境(CompetitiveEnvironment)法律环境(LegalEnvironment)市场营销信息系统(Marketing InformationSystem)市场调查(MarketResearch)市场分析(Market Analysis)市场预测(MarketForecast)市场控制(MarketControl)市场细分(Market Segmentation)目标市场(TargetMarket)市场定位(MarketPositioning)市场选择(MarketSelection)市场组合(Market Mix)产品(Product)产品生命周期(ProductLife Cycle)产品策略(ProductStrategy)产品创新(ProductInnovation)产品品牌(ProductBrand)12. 国际金融 (International Finance)术语术语术语术语术语国际金融(InternationalFinance)国际金融市场(International FinancialMarket)国际金融机构(International FinancialInstitution)国际金融体系(International FinancialSystem)国际金融秩序(International FinancialOrder)国际收支(Balance of Payments)经常账户(CurrentAccount)资本账户(Capital Account)官方储备账户(OfficialReserve Account)国际收支平衡(Balanceof Payment Equilibrium)汇率(Exchange Rate)汇率制度(ExchangeRate Regime)汇率决定理论(ExchangeRate DeterminationTheory)汇率风险(ExchangeRate Risk)汇率政策(ExchangeRate Policy)国际债务(InternationalDebt)外债(Foreign Debt)内债(Domestic Debt)多边债务(MultilateralDebt)双边债务(Bilateral Debt)国际金融危机(International FinancialCrisis)金融全球化(FinancialGlobalization)金融自由化(FinancialLiberalization)金融监管(FinancialRegulation)金融稳定(FinancialStability)13. 国际贸易国际贸易是指不同国家或地区之间进行的商品和服务的交换活动。