公司理财第八章

- 格式:ppt

- 大小:842.50 KB

- 文档页数:34

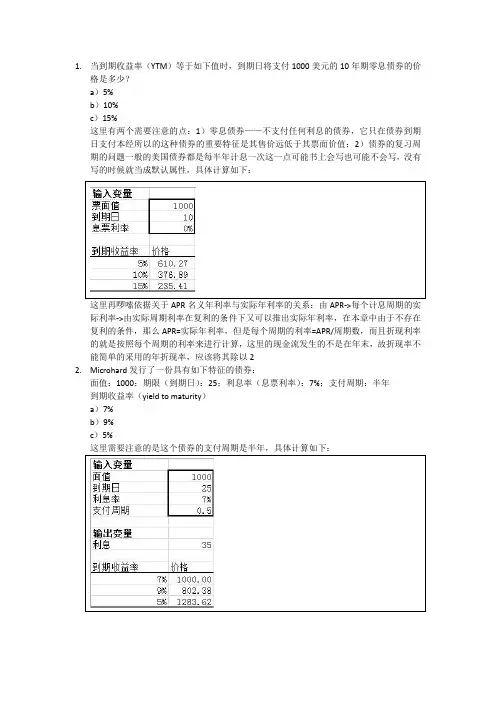

1. 当到期收益率(YTM )等于如下值时,到期日将支付1000美元的10年期零息债券的价格是多少?a )5%b )10%c )15%这里有两个需要注意的点:1)零息债券——不支付任何利息的债券,它只在债券到期日支付本经所以的这种债券的重要特征是其售价远低于其票面价值;2)债券的复习周期的问题一般的美国债券都是每半年计息一次这一点可能书上会写也可能不会写,没有写的时候就当成默认属性,具体计算如下:这里再啰嗦依据关于APR 名义年利率与实际年利率的关系:由APR->每个计息周期的实际利率->由实际周期利率在复利的条件下又可以推出实际年利率,在本章中由于不存在复利的条件,那么APR=实际年利率,但是每个周期的利率=APR/周期数,而且折现利率的就是按照每个周期的利率来进行计算,这里的现金流发生的不是在年末,故折现率不能简单的采用的年折现率,应该将其除以22. Microhard 发行了一份具有如下特征的债券:面值:1000;期限(到期日):25;利息率(息票利率):7%;支付周期:半年到期收益率(yield to maturity )a )7%b )9%c )5%3.Watters雨伞集团公司2年前发型了12年期的债券,票面利率为7.8%,该债券每半年支付一次利息。

如果债券当前售价面值为105%,那么到期收益收益率(YTM)会是多少?答:这道题就没有什么好说的了就是考察一个逼近法和一个2年前,因为售价是面值的105%所以他的期望收益率会低于票面利率,剩下的就只能通过试错来确定了(但也可以千万要注意一般会先算出来3.45%这个数但是这个是一个计息周期的折现率,要将他转换成一年的折现率,由于这里不会存在复利的情况故这里的年折现率只需将半年计的折现率乘以2即可4.公司发行在外的债券期限为13.5年,到期收益率为7.6%,当前价格为1175美元,该债券每半年支付一次利息问该债券的当前价格是多少?这道题漏了一个条件那就是该债券的票面价值是1000,需要记住的是债券的票面值一般5.公司发行了一份面值为1000欧元的债券,期限为15年,票面利率为8.4%,每年支付一6.真实利率=(1+名义利率)/(1+通货膨胀率)-18.根据公式:名义利率=(1+实际利率)*(1+通货膨胀率)-1故本题的答案=7.32%9.略:同样是根据真实利率=(1+名义利率)/(1+通货膨胀率)-1来做10.略11.这个要求了解国债报价表的组成其实就是考英语单词coupon:利息bid:购入价格asked:卖出价格chg:卖出价的变动情况asded yield:到期收益率购买价格是面值的1000(119+19/32)%其一天的卖出价格是面值的1000(120+6/32)%,美国债券市场上的债券面值一般为100012.这道题出现了一个新名词叫做当前收益率,对它的解释是:利息/卖出价格,注意不要和息票利率混淆了,默认面值=100013.这道题需要的注意的是在一道题中使用的折现率与折现周期要统一,不能前半部分是按照年14.这道题有一个隐含条件:在题目中没有明确指出债券价格的时候就将它默认为是1000美元,这里只给出敏感性分析的计算结果:由图可知期限较长的债券对利率风险较为敏感,原因是期限较长的债券的面值的现值较低,相较于期限较短的债券的它的利息年金的现值在价格所占的比重增加说实话从这幅图还真的不好判别到底谁的更加敏感,从斜率来看甚至我觉得高票面利率的债券甚至反应要稍微强一点,到底是不是这样呢?我们来看一下变化的百分比(当到期收益率改变时的价格变化/没有变化前的百分比较少,它的价格中的一大部分的比重来自与面值的现值,如果到期收益率变换那么对它将造成比较大的影响16.说实话这道题让我有点迷糊了,这里的到期收益率YTM和当前收益率都出现过了,但是这里居然冒出来一个实际收益率EAR也就是计算复利复息的那种,债券真的还会支付利息的利息吗??这点我有很大的疑问,不过答案是这么写的,知道的同学可以的话发个17.这道题参考了英文原版答案,发现题中漏了一个条件那就是票面利率=10%,这道题没有什么特点就是考察当以面值出售时,票面利率=期望收益率所以读者自作吧,只是简单的计算题18.这道题也是,首先发票价上的1090包含了四个月的利息,所以半年利息的2/3即可,具体计算留作读者自作19.同18题20.结果如下图所示21.这道题值得注意的是它的最新报价应为871.55美元,还有就是再一次提醒所有的率都是22.根据题目创建了excel电子表格模型,发现当到期收益率=票面利率时,无论期限为多少债券价格都等于票面价值,这可以单过一个定理来进行记忆,也可以通过公示推导得到,具体数学公式推导,读者自作23.本题有一个公式需要了解:资本利得=卖出价格-买入价格,不要考虑折现问题英文原版答案:24.题目比较简单,就是注意一下它的哪一个持有期收益率就是在你持有过程之中所实际得25.这道题比较简单,就是计算量大,注意求完终值再来求现值即可26.这是一道比较好的题,它让我们分清以前的实际年利率和实际利率的差别,虽然只是差了一个字,但是在这道题中却很明显的体现了出来,显示名义年利率(与计息周期有关)->名义利率(与通货膨胀率有关)->除去通货膨胀的名义年利率->周利率,在来使用年金现值计算公式,这里体现了一个重要的思想那就是以年金发生时间间隔来算年金现值27.这是一道非常好的题,具体的思路与26题相似,都是通过实际年利率->出去通货膨胀的实际年利率->除去通货膨胀的名义年利率->除去通货膨胀的名义月利率这里为什么要求出除去通货膨胀的月利率,因为现金流量的发生时间不是在年末,而是在每个月,而这一题的最后一问确是一道更好的题,它求最后一年的名义现金流量,也就是考虑通货膨胀的情况,但我们从一开始计算这道题时就去除了通货膨胀,所以通货膨胀年应该是30+25年,而且因为只是求一个时间点的现金流量,而且不存在求和的情况,故用年度通货膨胀率。

第八章:利率和债券估值1. a. P = $1,000/(1 + .05/2)⌒20 = $610.27b. P = $1,000/(1 + .10/2)⌒20 = $376.89c. P = $1,000/(1 + .15/2)⌒20 = $235.412.a. P = $35({1 – [1/(1 + .035)]⌒50 } / .035) + $1,000[1 / (1 + .035)⌒50]= $1,000.00When the YTM and the coupon rate are equal, the bond will sell at par.b. P = $35({1 – [1/(1 + .045)]⌒50 } / .045) + $1,000[1 / (1 + .045)⌒50]= $802.38When the YTM is greater than the coupon rate, the bond will sell at a discount.c. P = $35({1 – [1/(1 + .025)]⌒50 } / .025) + $1,000[1 / (1 + .025)⌒50]= $1,283.62When the YTM is less than the coupon rate, the bond will sell at a premium.3. P = $1,050 = $39(PVIFAR%,20) + $1,000(PVIFR%,20) R = 3.547%YTM = 2 *3.547% = 7.09%4. P = $1,175 = C(PVIFA3.8%,27) + $1,000(PVIF3.8%,27) C = $48.48年收益:2 × $48.48 = $96.96则票面利率:Coupon rate = $96.96 / $1,000 = .09696 or 9.70%5. P = €84({1 – [1/(1 + .076)]⌒15 } / .076) + €1,000[1 / (1 + .076)⌒15] = €1,070.186. P = ¥87,000 = ¥5,400(PVIFAR%,21) + ¥100,000(PVIFR%,21) R = 6.56%7. 近似利率为:R = r + h= .05 –.039 =.011 or 1.10%根据公式(1 + R) = (1 + r)(1 + h)→(1 + .05) = (1 + r)(1 + .039)实际利率= [(1 + .05) / (1 + .039)] – 1 = .0106 or 1.06%8. (1 + R) = (1 + r)(1 + h)→R = (1 + .025)(1 + .047) – 1 = .0732 or 7.32%9. (1 + R) = (1 + r)(1 + h)→h = [(1 + .17) / (1 + .11)] – 1 = .0541 or 5.41%10. (1 + R) = (1 + r)(1 + h)→r = [(1 + .141) / (1.068)] – 1 = .0684 or 6.84%11. The coupon rate is 6.125%. The bid price is:买入价= 119:19 = 119 19/32 = 119.59375%⨯ $1,000 = $1,195.9375The previous day‘s ask price is found by:pr evious day‘s ask price = Today‘s asked price – Change = 119 21/32 – (–17/32) = 120 6/32 前一天的卖出价= 120.1875% ⨯ $1,000 = $1,201.87512.premium bond当前收益率= Annual coupon payment / Asked price = $75/$1,347.1875 = .0557 or 5.57% The YTM is located under the ―Asked yield‖column, so the YTM is 4.4817%.Bid-Ask spread = 134:23 – 134:22 = 1/3213.P = C(PVIFAR%,t) + $1,000(PVIFR%,t)票面利率为9%:P0 = $45(PVIFA3.5%,26) + $1,000(PVIF3.5%,26) = $1,168.90P1 = $45(PVIFA3.5%,24) + $1,000(PVIF3.5%,24) = $1,160.58P3 = $45(PVIFA3.5%,20) + $1,000(PVIF3.5%,20) = $1,142.12P8 = $45(PVIFA3.5%,10) + $1,000(PVIF3.5%,10) = $1,083.17P12 = $45(PVIFA3.5%,2) + $1,000(PVIF3.5%,2) = $1,019.00P13 = $1,000票面利率为7%:P0 = $35(PVIFA4.5%,26) + $1,000(PVIF4.5%,26) = $848.53P1 = $35(PVIFA4.5%,24) + $1,000(PVIF4.5%,24) = $855.05P3 = $35(PVIFA4.5%,20) + $1,000(PVIF4.5%,20) = $869.92P8 = $35(PVIFA4.5%,10) + $1,000(PVIF4.5%,10) = $920.87P12 = $35(PVIFA4.5%,2) + $1,000(PVIF4.5%,2) = $981.27P13 = $1,00014.PLaurel = $40(PVIFA5%,4) + $1,000(PVIF5%,4) = $964.54PHardy = $40(PVIFA5%,30) + $1,000(PVIF5%,30) = $846.28Percentage change in price = (New price -Original price) / Original price△PLaurel% = ($964.54 -1,000) / $1,000 = -0.0355 or -3.55%△PHardy% = ($846.28 -1,000) / $1,000 = -0.1537 or -15.37%If the YTM suddenly falls to 6 percentPLaurel = $40(PVIFA3%,4) + $1,000(PVIF3%,4) = $1,037.17PHardy = $40(PVIFA3%,30) + $1,000(PVIF3%,30) = $1,196.00△PLaurel% = ($1,037.17 -1,000) / $1,000 = +0.0372 or 3.72%△PHardy% = ($1,196.002 -1,000) / $1,000 = +0.1960 or 19.60%15. Initially, at a YTM of 10 percent, the prices of the two bonds are:P Faulk = $30(PVIFA5%,16) + $1,000(PVIF5%,16) = $783.24P Gonas = $70(PVIFA5%,16) + $1,000(PVIF5%,16) = $1,216.76If the YTM rises from 10 percent to 12 percent:P Faulk = $30(PVIFA6%,16) + $1,000(PVIF6%,16) = $696.82P Gonas = $70(PVIFA6%,16) + $1,000(PVIF6%,16) = $1,101.06Percentage change in price = (New price – Original price) / Original price△PFaulk% = ($696.82 -783.24) / $783.24 = -0.1103 or -11.03%△PGonas% = ($1,101.06 -1,216.76) / $1,216.76 = -0.0951 or -9.51%If the YTM declines from 10 percent to 8 percent:PFaulk = $30(PVIFA4%,16) + $1,000(PVIF4%,16) = $883.48PGonas = $70(PVIFA4%,16) + $1,000(PVIF4%,16) = $1,349.57△PFaulk% = ($883.48 -783.24) / $783.24 = +0.1280 or 12.80%△PGonas% = ($1,349.57 -1,216.76) / $1,216.76 = +0.1092 or 10.92%16.P0 = $960 = $37(PVIFAR%,18) + $1,000(PVIFR%,18) R = 4.016% YTM = 2 *4.016% = 8.03%Current yield = Annual coupon payment / Price = $74 / $960 = .0771 or 7.71% Effective annual yield = (1 + 0.04016)⌒2 – 1 = .0819 or 8.19%17.P = $1,063 = $50(PVIFA R%,40) + $1,000(PVIF R%,40) R = 4.650% YTM = 2 *4.650% = 9.30%18.Accrued interest = $84/2 × 4/6 = $28Clean price = Dirty price – Accrued interest = $1,090 – 28 = $1,06219.Accrued interest = $72/2 × 2/6 = $12.00Dirty price = Clean price + Accrued interest = $904 + 12 = $916.0020.Current yield = .0842 = $90/P0→P0 = $90/.0842 = $1,068.88P = $1,068.88 = $90{[(1 – (1/1.0781)⌒t ] / .0781} + $1,000/1.0781⌒t $1,068.88 (1.0781)⌒t = $1,152.37 (1.0781)⌒t – 1,152.37 + 1,000t = log 1.8251 / log 1.0781 = 8.0004 ≈8 years21.P = $871.55 = $41.25(PVIFA R%,20) + $1,000(PVIF R%,20) R = 5.171% YTM = 2 *5.171% = 10.34%Current yield = $82.50 / $871.55 = .0947 or 9.47%22.略23.P: P0 = $90(PVIFA7%,5) + $1,000(PVIF7%,5) = $1,082.00P1 = $90(PVIFA7%,4) + $1,000(PVIF7%,4) = $1,067.74Current yield = $90 / $1,082.00 = .0832 or 8.32%Capital gains yield = (New price – Original price) / Original priceCapital gains yield = ($1,067.74 – 1,082.00) / $1,082.00 = –0.0132 or –1.32%D: P0 = $50(PVIFA7%,5) + $1,000(PVIF7%,5) = $918.00P1 = $50(PVIFA7%,4) + $1,000(PVIF7%,4) = $932.26Current yield = $50 / $918.00 = 0.0545 or 5.45%Capital gains yield = ($932.26 – 918.00) / $918.00 = 0.0155 or 1.55%24. a.P0 = $1,140 = $90(PVIFA R%,10) + $1,000(PVIF R%,10) R = YTM = 7.01%b.P2 = $90(PVIFA6.01%,8) + $1,000(PVIF6.01%,8) = $1,185.87P0 = $1,140 = $90(PVIFA R%,2) + $1,185.87(PVIF R%,2)R = HPY = 9.81%The realized HPY is greater than the expected YTM when the bond was bought because interest rates dropped by 1 percent; bond prices rise when yields fall.25.PM = $800(PVIFA4%,16)(PVIF4%,12)+$1,000(PVIFA4%,12)(PVIF4%,28)+ $20,000(PVIF4%,40) PM = $13,117.88Notice that for the coupon payments of $800, we found the PV A for the coupon payments, and then discounted the lump sum back to todayBond N is a zero coupon bond with a $20,000 par value; therefore, the price of the bond is the PV of the par, or:PN = $20,000(PVIF4%,40) = $4,165.7826.(1 + R) = (1 + r)(1 + h)1 + .107 = (1 + r)(1 + .035)→r = .0696 or 6.96%EAR = {[1 + (APR / m)]⌒m }– 1APR = m[(1 + EAR)⌒1/m – 1] = 52[(1 + .0696)⌒1/52 – 1] = .0673 or 6.73%Weekly rate = APR / 52= .0673 / 52= .0013 or 0.13%PVA = C({1 – [1/(1 + r)]⌒t } / r)= $8({1 – [1/(1 + .0013)]30(52)} / .0013)= $5,359.6427.Stock account:(1 + R) = (1 + r)(1 + h) →1 + .12 = (1 + r)(1 + .04) →r = .0769 or 7.69%APR = m[(1 + EAR)1/⌒1/m– 1]= 12[(1 + .0769)⌒1/12– 1]= .0743 or 7.43%Monthly rate = APR / 12= .0743 / 12= .0062 or 0.62%Bond account:(1 + R) = (1 + r)(1 + h)→1 + .07 = (1 + r)(1 + .04)→r = .0288 or 2.88%APR = m[(1 + EAR)⌒1/m– 1]= 12[(1 + .0288)⌒1/12– 1]= .0285 or 2.85%Monthly rate = APR / 12= .0285 / 12= .0024 or 0.24%Stock account:FVA = C {(1 + r )⌒t– 1] / r}= $800{[(1 + .0062)360 – 1] / .0062]}= $1,063,761.75Bond account:FVA = C {(1 + r )⌒t– 1] / r}= $400{[(1 + .0024)360 – 1] / .0024]}= $227,089.04Account value = $1,063,761.75 + 227,089.04= $1,290,850.79(1 + R) = (1 + r)(1 + h)→1 + .08 = (1 + r)(1 + .04) →r = .0385 or 3.85%APR = m[(1 + EAR)1/m– 1]= 12[(1 + .0385)1/12– 1]= .0378 or 3.78%Monthly rate = APR / 12= .0378 / 12= .0031 or 0.31%PVA = C({1 – [1/(1 + r)]t } / r )$1,290,850.79 = C({1 – [1/(1 + .0031)]⌒300 } / .0031)C = $6,657.74FV = PV(1 + r)⌒t= $6,657.74(1 + .04)(30 + 25)= $57,565.30。

公司理财学原理第八章习题答案二、单选题1、关于企业筹资方式,下面说法中错误的是( C )A、间接筹资的优点是,筹资要求不如直接筹资高,取得相对容易,筹资效率高;缺点是,金融中介机构要获取一定的利益,筹资成本较高,另外,间接筹资方式单一,选择面狭窄,难以进行优选B、筹集国内资金的优点是,筹资相对容易,筹资成本较低;缺点是,筹资量可能因资金市场的限制,而无法扩大,以及难以引进国际上最先进的技术C、直接筹资的优点是,筹资面狭窄,筹资方式和筹资对象的选择余地小,筹资成本较低;缺点是,社会对直接筹资的公司要求较高,达不到规定的公司无法进行直接筹资,无中介机构参与,所有风险均由筹资公司承担,风险较大。

D、筹集国际资金的优点是,筹资量大,可以在筹资的同时引入先进的技术;缺点是,筹资难度大,成本高,风险大。

2、下列( B )可以为企业筹集短期资金。

A、融资租赁B、商业信用C、内部积累D、发行股票3、下列各项中( D )不属于吸收直接投资的优点。

A、筹资面广B、有利于尽快形成生产能力C、资金成本较低D、有利于降低财务风险4、按照资金是否通过金融机构划分为( B )。

A、内部筹资和外部筹资B、直接筹资和间接筹资C、权益筹资和负债筹资D、国内筹资和国际筹资5、下列( A )属于企业内部筹资A、利润留存B、融资租赁C、发行债券D、发行普通股6、下列各项中不属于利用商业信用筹资形式的是( C )。

A、赊购商品B、预收货款C、短期借款D、商业汇票7、长江公司现有总资产100万元,全部来源于股权筹资,总资产收益率保持10%不变,先准备借入长期借款50万元,借款利息率12%,不考虑所得税影响,长江公司筹资后的净资产收益率为( C ),是否应该借入长期借款( C )?A、10% 应当借入B、6.3% 不应当借入C、9% 不应当借入D、11% 应当借入8、假设上题中总资产收益率10%为税前收益率,借款利息率12%为税前利息率,所得税税率为30%。