香港2016贸易公司财务报表(资产债表、利润表、利得税计算表)

- 格式:xls

- 大小:38.50 KB

- 文档页数:1

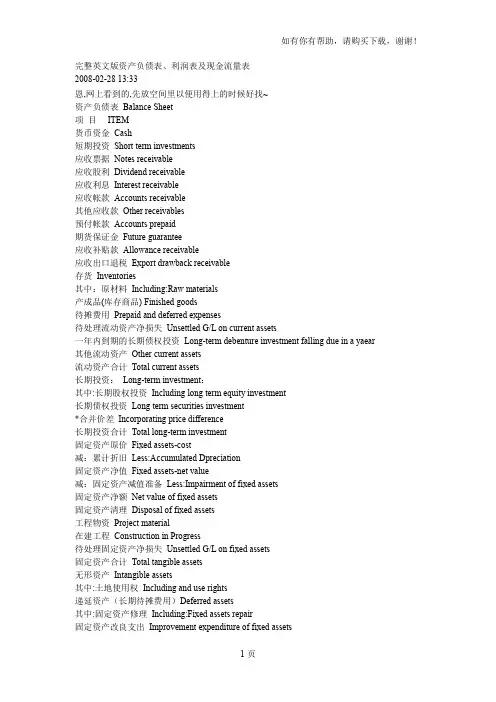

完整英文版资产负债表、利润表及现金流量表2008-02-28 13:33恩,网上看到的,先放空间里以便用得上的时候好找~资产负债表Balance Sheet项目ITEM货币资金Cash短期投资Short term investments应收票据Notes receivable应收股利Dividend receivable应收利息Interest receivable应收帐款Accounts receivable其他应收款Other receivables预付帐款Accounts prepaid期货保证金Future guarantee应收补贴款Allowance receivable应收出口退税Export drawback receivable存货Inventories其中:原材料Including:Raw materials产成品(库存商品) Finished goods待摊费用Prepaid and deferred expenses待处理流动资产净损失Unsettled G/L on current assets一年内到期的长期债权投资Long-term debenture investment falling due in a yaear 其他流动资产Other current assets流动资产合计Total current assets长期投资:Long-term investment:其中:长期股权投资Including long term equity investment长期债权投资Long term securities investment*合并价差Incorporating price difference长期投资合计Total long-term investment固定资产原价Fixed assets-cost减:累计折旧Less:Accumulated Dpreciation固定资产净值Fixed assets-net value减:固定资产减值准备Less:Impairment of fixed assets固定资产净额Net value of fixed assets固定资产清理Disposal of fixed assets工程物资Project material在建工程Construction in Progress待处理固定资产净损失Unsettled G/L on fixed assets固定资产合计Total tangible assets无形资产Intangible assets其中:土地使用权Including and use rights递延资产(长期待摊费用)Deferred assets其中:固定资产修理Including:Fixed assets repair固定资产改良支出Improvement expenditure of fixed assets其他长期资产Other long term assets其中:特准储备物资Among it:Specially approved reserving materials 无形及其他资产合计Total intangible assets and other assets递延税款借项Deferred assets debits资产总计Total Assets资产负债表(续表) Balance Sheet项目ITEM短期借款Short-term loans应付票款Notes payable应付帐款Accounts payab1e预收帐款Advances from customers应付工资Accrued payro1l应付福利费Welfare payable应付利润(股利) Profits payab1e应交税金Taxes payable其他应交款Other payable to government其他应付款Other creditors预提费用Provision for expenses预计负债Accrued liabilities一年内到期的长期负债Long term liabilities due within one year其他流动负债Other current liabilities流动负债合计Total current liabilities长期借款Long-term loans payable应付债券Bonds payable长期应付款long-term accounts payable专项应付款Special accounts payable其他长期负债Other long-term liabilities其中:特准储备资金Including:Special reserve fund长期负债合计Total long term liabilities递延税款贷项Deferred taxation credit负债合计Total liabilities* 少数股东权益Minority interests实收资本(股本) Subscribed Capital国家资本National capital集体资本Collective capital法人资本Legal person"s capital其中:国有法人资本Including:State-owned legal person"s capital集体法人资本Collective legal person"s capital个人资本Personal capital外商资本Foreign businessmen"s capital资本公积Capital surplus盈余公积surplus reserve其中:法定盈余公积Including:statutory surplus reserve公益金public welfare fund补充流动资本Supplermentary current capital* 未确认的投资损失(以“-”号填列)Unaffirmed investment loss未分配利润Retained earnings外币报表折算差额Converted difference in Foreign Currency Statements所有者权益合计Total shareholder"s equity负债及所有者权益总计Total Liabilities & Equity利润表INCOME STA TEMENT项目ITEMS产品销售收入Sales of products其中:出口产品销售收入Including:Export sales减:销售折扣与折让Less:Sales discount and allowances产品销售净额Net sales of products减:产品销售税金Less:Sales tax产品销售成本Cost of sales其中:出口产品销售成本Including:Cost of export sales产品销售毛利Gross profit on sales减:销售费用Less:Selling expenses管理费用General and administrative expenses财务费用Financial expenses其中:利息支出(减利息收入) Including:Interest expenses (minusinterest ihcome) 汇兑损失(减汇兑收益)Exchange losses(minus exchange gains)产品销售利润Profit on sales加:其他业务利润Add:profit from other operations营业利润Operating profit加:投资收益Add:Income on investment加:营业外收入Add:Non-operating income减:营业外支出Less:Non-operating expenses加:以前年度损益调整Add:adjustment of loss and gain for previous years利润总额Total profit减:所得税Less:Income tax净利润Net profit现金流量表Cash Flows StatementPrepared by:Period: Unit:Items1.Cash Flows from Operating Activities:01)Cash received from sales of goods or rendering of services02)Rental receivedValue added tax on sales received and refunds of value03)added tax paid04)Refund of other taxes and levy other than value added tax07)Other cash received relating to operating activities08)Sub-total of cash inflows09)Cash paid for goods and services10)Cash paid for operating leases11)Cash paid to and on behalf of employees12)Value added tax on purchases paid13)Income tax paid14)Taxes paid other than value added tax and income tax17)Other cash paid relating to operating activities18)Sub-total of cash outflows19)Net cash flows from operating activities2.Cash Flows from Investing Activities:20)Cash received from return of investments21)Cash received from distribution of dividends or profits22)Cash received from bond interest incomeNet cash received from disposal of fixed assets,intangible 23)assets and other long-term assets26)Other cash received relating to investing activities27)Sub-total of cash inflowsCash paid to acquire fixed assets,intangible assets28)and other long-term assets29)Cash paid to acquire equity investments30)Cash paid to acquire debt investments33)Other cash paid relating to investing activities34)Sub-total of cash outflows35)Net cash flows from investing activities3.Cash Flows from Financing Activities:36)Proceeds from issuing shares37)Proceeds from issuing bonds38)Proceeds from borrowings41)Other proceeds relating to financing activities42)Sub-total of cash inflows43)Cash repayments of amounts borrowed44)Cash payments of expenses on any financing activities45)Cash payments for distribution of dividends or profits46)Cash payments of interest expenses47)Cash payments for finance leases48)Cash payments for reduction of registered capital51)Other cash payments relating to financing activities52)Sub-total of cash outflows53)Net cash flows from financing activities4.Effect of Foreign Exchange Rate Changes on Cash Increase in Cash and Cash EquivalentsSupplemental Information1.Investing and Financing Activities that do not Involve in Cash Receipts and Payments56)Repayment of debts by the transfer of fixed assets57)Repayment of debts by the transfer of investments58)Investments in the form of fixed assets59)Repayments of debts by the transfer of investories2.Reconciliation of Net Profit to Cash Flows from Operating Activities62)Net profit63)Add provision for bad debt or bad debt written off64)Depreciation of fixed assets65)Amortization of intangible assetsLosses on disposal of fixed assets,intangible assets66)and other long-term assets (or deduct:gains)67)Losses on scrapping of fixed assets68)Financial expenses69)Losses arising from investments (or deduct:gains)70)Defered tax credit (or deduct:debit)71)Decrease in inventories (or deduct:increase)72)Decrease in operating receivables (or deduct:increase)73)Increase in operating payables (or deduct:decrease)74)Net payment on value added tax (or deduct:net receipts75)Net cash flows from operating activities Increase in Cash and Cash Equivalents76)cash at the end of the period77)Less:cash at the beginning of the period78)Plus:cash equivalents at the end of the period79)Less:cash equivalents at the beginning of the period80)Net increase in cash and cash equivalents现金流量表Cash Flows StatementPrepared by:Period: Unit:Items1.Cash Flows from Operating Activities:01)Cash received from sales of goods or rendering of services02)Rental receivedValue added tax on sales received and refunds of value03)added tax paid04)Refund of other taxes and levy other than value added tax07)Other cash received relating to operating activities08)Sub-total of cash inflows09)Cash paid for goods and services10)Cash paid for operating leases11)Cash paid to and on behalf of employees12)V alue added tax on purchases paid13)Income tax paid14)Taxes paid other than value added tax and income tax17)Other cash paid relating to operating activities18)Sub-total of cash outflows19)Net cash flows from operating activities2.Cash Flows from Investing Activities:20)Cash received from return of investments21)Cash received from distribution of dividends or profits22)Cash received from bond interest incomeNet cash received from disposal of fixed assets,intangible 23)assets and other long-term assets26)Other cash received relating to investing activities27)Sub-total of cash inflowsCash paid to acquire fixed assets,intangible assets28)and other long-term assets29)Cash paid to acquire equity investments30)Cash paid to acquire debt investments33)Other cash paid relating to investing activities34)Sub-total of cash outflows35)Net cash flows from investing activities3.Cash Flows from Financing Activities:36)Proceeds from issuing shares37)Proceeds from issuing bonds38)Proceeds from borrowings41)Other proceeds relating to financing activities42)Sub-total of cash inflows43)Cash repayments of amounts borrowed44)Cash payments of expenses on any financing activities45)Cash payments for distribution of dividends or profits46)Cash payments of interest expenses47)Cash payments for finance leases48)Cash payments for reduction of registered capital51)Other cash payments relating to financing activities52)Sub-total of cash outflows53)Net cash flows from financing activities4.Effect of Foreign Exchange Rate Changes on Cash Increase in Cash and Cash EquivalentsSupplemental Information1.Investing and Financing Activities that do not Involve in Cash Receipts and Payments56)Repayment of debts by the transfer of fixed assets57)Repayment of debts by the transfer of investments58)Investments in the form of fixed assets59)Repayments of debts by the transfer of investories2.Reconciliation of Net Profit to Cash Flows from OperatingActivities62)Net profit63)Add provision for bad debt or bad debt written off64)Depreciation of fixed assets65)Amortization of intangible assetsLosses on disposal of fixed assets,intangible assets66)and other long-term assets (or deduct:gains)67)Losses on scrapping of fixed assets68)Financial expenses69)Losses arising from investments (or deduct:gains)70)Defered tax credit (or deduct:debit)71)Decrease in inventories (or deduct:increase)72)Decrease in operating receivables (or deduct:increase)73)Increase in operating payables (or deduct:decrease)74)Net payment on value added tax (or deduct:net receipts75)Net cash flows from operating activities Increase in Cash and Cash Equivalents76)cash at the end of the period77)Less:cash at the beginning of the period78)Plus:cash equivalents at the end of the period79)Less:cash equivalents at the beginning of the period80)Net increase in cash and cash equivalents现金流量表的现金流量声明拟制人:时间:单位:项目1.cash流量从经营活动:01 )所收到的现金从销售货物或提供劳务02 )收到的租金增值税销售额收到退款的价值03 )增值税缴纳04 )退回的其他税收和征费以外的增值税07 )其他现金收到有关经营活动08 )分,总现金流入量09 )用现金支付的商品和服务10 )用现金支付经营租赁11 )用现金支付,并代表员工12 )增值税购货支付13 )所得税的缴纳14 )支付的税款以外的增值税和所得税17 )其他现金支付有关的经营活动18 )分,总的现金流出19 )净经营活动的现金流量2.cash流向与投资活动:20 )所收到的现金收回投资21 )所收到的现金从分配股利,利润22 )所收到的现金从国债利息收入现金净额收到的处置固定资产,无形资产23 )资产和其他长期资产26 )其他收到的现金与投资活动27 )小计的现金流入量用现金支付购建固定资产,无形资产28 )和其他长期资产29 )用现金支付,以获取股权投资30 )用现金支付收购债权投资33 )其他现金支付的有关投资活动34 )分,总的现金流出35 )的净现金流量,投资活动产生3.cash流量筹资活动:36 )的收益,从发行股票37 )的收益,由发行债券38 )的收益,由借款41 )其他收益有关的融资活动42 ),小计的现金流入量43 )的现金偿还债务所支付的44 )现金支付的费用,对任何融资活动45 )支付现金,分配股利或利润46 )以现金支付的利息费用47 )以现金支付,融资租赁48 )以现金支付,减少注册资本51 )其他现金收支有关的融资活动52 )分,总的现金流出53 )的净现金流量从融资活动4.effect的外汇汇率变动对现金增加现金和现金等价物补充资料1.investing活动和筹资活动,不参与现金收款和付款56 )偿还债务的转让固定资产57 )偿还债务的转移投资58 )投资在形成固定资产59 )偿还债务的转移库存量2.reconciliation净利润现金流量从经营活动62 )净利润63 )补充规定的坏帐或不良债务注销64 )固定资产折旧65 )无形资产摊销损失处置固定资产,无形资产66 )和其他长期资产(或减:收益)67 )损失固定资产报废68 )财务费用69 )引起的损失由投资管理(或减:收益)70 )defered税收抵免(或减:借记卡)71 )减少存货(或减:增加)72 )减少经营性应收(或减:增加)73 )增加的经营应付账款(或减:减少)74 )净支付的增值税(或减:收益净额75 )净经营活动的现金流量增加现金和现金等价物76 )的现金,在此期限结束77 )减:现金期开始78 )加:现金等价物在此期限结束79 )减:现金等价物期开始80 ),净增加现金和现金等价物项目项目货币资金现金短期投资短期投资应收票据应收票据应收股利应收股息应收利息应收利息应收帐款应收账款其他应收款其他应收款预付帐款预付帐户期货保证金未来的保证应收补贴款免税额应收款应收出口退税出口退税应收款存货清单其中:原材料包括:原料产成品(库存商品),产成品待摊费用,预付及待摊费用待处理流动资产净损失不了了之g / L的对流动资产一年内到期的长期债权投资长期债券投资下降,是由于在一个yaear 其他流动资产其他流动资产流动资产合计流动资产总额长期投资:长期投资:其中:长期股权投资包括长期股权投资长期债权投资长期证券投资*合并价差把差价长期投资合计总长期投资固定资产原价固定资产成本减:累计折旧减:累计dpreciation固定资产净值固定资产-净值减:固定资产减值准备减:减值的固定资产固定资产净额固定资产净值固定资产清理处置固定资产工程物资工程材料在建工程建设进度待处理固定资产净损失不了了之g / L的固定资产固定资产合计总有形资产无形资产无形资产其中:土地使用权包括使用权递延资产(长期待摊费用)递延资产其中:固定资产修理,其中包括:固定资产修理固定资产改良支出改善的开支,固定资产其他长期资产其他长期资产其中:特准储备物资中,它:特别批准保留的材料无形及其他资产合计总无形资产及其他资产递延税款借项递延借项资产资产总计资产总额资产负债表(续表)资产负债表项目项目短期借款,短期贷款应付票款应付票据应付帐款帐户payab1e预收帐款进步,从顾客应付工资累积payro1l应付福利费支付的福利应付利润(股利)利润payab1e应交税金应缴税项其他应交款其他支付给政府其他应付款其他债权人预提费用提供开支预计负债累计负债一年内到期的长期负债长期负债一年内到期其他流动负债其他流动负债流动负债合计流动负债总额长期借款长期借款,应付应付债券应付债券长期应付款长期应付帐款专项应付款特别应付帐款其他长期负债其他长期负债其中:特准储备资金,其中包括:特别储备基金长期负债合计总额长期负债递延税款贷项递延税项抵免负债合计负债总额*少数股东权益少数股东权益实收资本(股本),资本认购国家资本民族资本集体资本,集体资本法人资本法人"的建设工程其中:国有法人资本,包括:国有法人"的建设工程集体法人资本集体法人"的建设工程个人资本个人资本外商资本外商的" S资本资本公积资本公积盈余公积盈余公积其中:法定盈余公积包括:法定盈余公积公益金公益基金补充流动资本supplermentary目前的资本*未确认的投资损失(以" -"号填列)u naffirmed投资损失未分配利润留存收益外币报表折算差额改建差异外币报表所有者权益合计股东总的" S股权负债及所有者权益总计负债总额与股本利润表收入报表项目项目产品销售收入为产品销售其中:出口产品销售收入,包括:出口销售减:销售折扣与折让减:销售折扣及免税额产品销售净额销售净额的产品减:产品销售税金减:销售税产品销售成本,销售成本其中:出口产品销售成本包括:成本的出口销售报告产品销售毛利利润总额,销售收入减:销售费用减:销售费用管理费用一般及行政开支财务费用财务费用其中:利息支出(减利息收入),其中包括:利息支出(minusinterest ihcome )汇兑损失(减汇兑收益),汇兑损失(减汇兑收益)产品销售利润的利润,销售额加:其他业务利润地址:利润来自其他业务营业利润经营利润加:投资收益地址:收入对投资加:营业外收入加:非经营性收入减:营业外支出减:非经营性开支加:以前年度损益调整地址:调整损益,为往年利润总额利润总额减:所得税减:所得税净利润净利润。

3.2Correspondence address in Hong Kong if different from 3.1 above:—IN ANY COMMUNICATION PLEASE QUOTE THE FILE NUMBER BELOW FILE NO.TOYou are required under section 51(1) of the Inland Revenue Ordinance (Cap. 112) to make on this form a true and correct return of the Assessable Profits (or Adjusted Loss) (See Note 1) arising during the basis period (See Note 2) for the year of assessment ended 31 March .All sections/boxes of the form is not acceptable. You should read the attached Notes and Instructions before completion.You MUST prepare the following documents (collectively called “Supporting Documents”):(a) a certified copy of your Balance Sheet, Auditor’s Report where required by Hong Kong or foreign law or if one has otherwise been prepared, and Profitand Loss Account in respect of the basis period;(b) a tax computation with supporting schedules showing how the amount of Assessable Profits (or Adjusted Loss) has been arrived at;(c)the attached Supplementary Form (I.R.51S); and(d)other documents and information as specified in the attached Notes and Instructions.If you are NOT If you are a SMALL other items of the Supporting Documents You may choose to prepare the I.R.51S by downloading it from the Department's web site for completion. (See Note 4)Date:3.DETAILS OF THE CORPORATION If different from that previously reported, “1.STATEMENT OF ASSESSABLE PROFITS OR ADJUSTED LOSS2.TAX LIABILITY OR REPAYMENT2.12.2Tax PayableTax Repayable3.1Main business address in Hong Kong:—............................................................................................................................................................................................................................................1.1Assessable Profits (before loss brought forward):1.2Adjusted Loss (before loss brought forward):S1.GENERAL MATTERS (See Note S1)S1.1Are you aIf yes, complete boxes S1.1.1, S1.1.2 and S1.1.3.S1.1.1S1.1.2S1.1.3S1.2State your basis period:Is the accounting date for this year different from that of last year?S1.3Did you commence business within the basis period?If yes, state the date of commencement: ................................................................................................................. S1.4Did you cease business within the basis period?If yes, complete boxes S1.4.1, S1.4.2 and S1.4.3.S1.4.1S1.4.2S1.4.3S1.5Are your financial statements prepared in a foreign currency?If yes, state the currency and the conversion rate used to convert to HKCurrency ...............................................................S1.6Are you a private company?If yes, complete box S1.6.1.S1.6.1S1.7Did you purchase any property during the basis period on which industrial building or commercial building allowance is claimed?S1.8Within the basis period did you accept any orders, sell any goods, provide any services or accept any payment using the Internet?If yes, complete boxes S1.8.1, S1.8.2 and S1.8.3.S1.8.1S1.8.2S1.8.3S2.TRANSACTIONS FOR / WITH NON-RESIDENTS (See Note S2)During the basis period did you:S2.1sell any goods or provide any services in Hong Kong on behalf of a non-resident person?S2.2receive, as agent, on behalf of a non-resident person any other trade or business income arising in or derived from Hong Kong?S2.3pay or accrue to a non-resident person any sum for the use of intellectual property specified in section 15(1)(If yes, complete box S2.3.1.S2.3.1。

香港公司利得税应税所得范围根据香港税例,在考虑任何人士的纳税义务时,先确定其盈利来源是在香港,还是在外地。

买卖货物盈利,按税局指引规定,如果购货及销货合约均在外地达成,其盈利方可免税。

如果生产工序迁往内地,如果其实际生产活动在国内进行,但其他的管理、设计、生产技术等皆由香港提供,50%的盈利应视为在香港生产而缴纳利得税。

内地企业所得税应税所得,既包括纳税人来源于中国境内所得,也包括来源于境外的所得。

纳税年度香港政府无硬性规定纳税年度,纳税人可采用公历上年4月1日起至下年3月31日止,亦可采用公历1月1日起至12月31日止,或阴历年底。

多数有限公司纳税年度是采用公历3月31日或12月31日。

内地企业所得税的纳税年度统一规定为公历1月1日起至12月31日止。

缴税方法与纳税期限香港公司计算利得税采取暂缴税方式。

暂缴税通常是根据上一年度之盈利计算,属于估计性质,须持当年评税基期内盈利确定后,再予以调整。

香港公司纳税期较长,利得税申报表是一年填报一次,而且,不管会计年度是采用公历3月31日或12月31日,其开始申报时间均定于每年4月份,并可根据公司的具体情况申请延期。

如会计年度是12月31日的,最后申报期为8月,如会计年度为3月31日的,则最后申报期为11月。

一般情况下,交第一期利得税款的时间约为会计年度后10-11月。

内地企业所得税是实行按年计算,分月或分季预缴,年终汇算清缴,多退少补的征缴办法。

纳税在月份或季度终15天内,填报预缴所得税申报表,并在规定期限内缴纳税款。

年终汇算清缴在年终后4个月内进行,纳税人在年度终了后45日内,向其所在地主管税务机关报送会计报表和所得税申报表,办理年终汇算。

坏账损失的处理香港公司对应收未收账款是否作坏账损失处理,由公司董事会决定,不用上报税务部门批准。

当然,也要取得债务人有关无法偿还债务的证明,如债务人已破产、清盘、失踪等资料。

内地企业对应收账款作坏账损失处理,该费用支出在计算企业所得税额时能否与收益抵消,取决于企业所属税务机关对该笔坏账的审批结论。

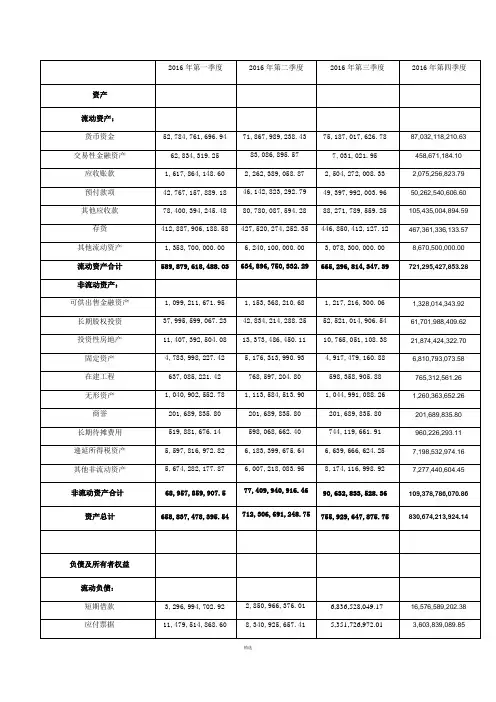

目录1前言 (2)2 公司背景分析 (2)3新华锦集团的财务状况分析 (2)3.1资产负债表分析 (2)3.2 利润表分析 (9)3.3 现金流量分析 (10)3.4 财务比率分析 (13)3.5新华锦集团的杜邦分析 (20)结论 (21)参考文献 (21)2016年新华锦财务报表分析1前言面对国内外复杂严峻的经济形势,我国不断加强和改善宏观调控,以积极的财政政策和稳健的货币政策,努力促进经济增长,以求实现政策刺激向自主增长的有序转变。

2016年我国经济持续稳定发展,GDP逐年上升,增长速度较为平稳。

虽然世界经济形势表现出的状况并不乐观,但中国有很大的调控空间。

从反映一个国家的经济表现以及国力与财富的国内生产总值(GDP)的主要组成来看,目前居民消费、投资、出口均出现积极迹象。

目前我国消费情况比较平稳。

从收入增长情况来看,今年上半年城乡居民收入增长幅度高于GDP涨幅,再加上物价回落,居民实质性消费会有所提升。

在投资方面,政府已有很多行动,主要是基建项目审批步伐加快,数量增加,通过投资拉动经济增长。

下面我们对2016年经济环境作具体分析如下。

2 公司背景分析新华锦集团是按照山东省政府“推进省属外贸企业改革重组”的战略部署,由新华锦集团有限公司联合省纺织、工艺、特艺、基地、包装五家省级外贸企业共同组建的,成立于2002年6月。

之后,集团又托管了省对外贸易集团。

目前集团拥有直属和控股企业132家,员工17900余人,经营领域涉及国际贸易、金融投资、星级酒店、文化收藏、房地产开发和国际物流等产业。

集团自2002年成立至今,累计完成进出口额超过120亿美元,连续五年居山东省进出口企业首位,在中国最大的500家进出口企业中居第58位。

在中国500强企业中居第353位,2013年中国服务业企业500强第114位。

3新华锦集团的财务状况分析3.1资产负债表分析资产负债表是体现企业在特定时点的报表。

通过对资产负债表表格各要素项目及相应报表附注进行分析和对比,我们可以得到以下几类信息:一是企业所掌握的经济资源及这些资源的分布和结构,二是企业的资产、负债的流动性与短期偿债能力,三是企业的资本结构与长期偿债能力,四是企业的财务实力和财务弹性能力。

**有限公司 **年度财务报表附注1. 公司简介及报表使用权限 ** 有限公司(以下简称本公司)是由 ** 有限公司(以下简称“** 公司” ) 投资设立的外商独资企业, **年 **月 **日于中华人民共和国 ** 市注册设立。

本公司的经营期限为 **年,其经营范围为生产、加工 ** 电机及电子零件产 品。

产品内外销售。

本公司的注册地和主要经营场所位于中国 ** 市 ** 经济开发区。

本报告中的财务报表是根据《香港财务报告准则》编制,仅作内部管 理之用。

《香港财务报告准则》下的会计处理方式与公司的法定财务报告的 会计处理方法存在差异,本财务报表是在本公司法定财务报表的基础上通 过恰当的调整(未对公司原有会计记录进行调整)编制而成,并非取代公 司原有的财务会计记录。

本公司以人民币作为记账本位币。

2.应用新准则和修订准则 在本财务报表授权签署日,新香港会计准则( HKASs), 香港财务报告准则 (HKFRSs) 和香港财务报告解释委员会[HK(IFRIC)] 释义已发布。

列示如下: 香港会计准则第 8 号 香港会计准则第 1 号(修订本) 香港会计准则第 23 号(修订本) 香港会计准则第 27 号(修订本) 香港财务报告准则第 2 号 香港财务报告准则第 7 号 香港会计准则第 32 号及香港会计准则 第 1 号(修订本) 香港(国际财务报告诠释委员会)-诠释 第 9 号及香港会计准则第 39 号(修订本) 香港(国际财务报告诠释委员会)-诠释 第 13 号-7-会计政策、会计估计更改及 错误更正 呈报财务报表 借贷成本 综合及独立财务报表 股份基础给付 金融工具:披露 金融工具:表达 嵌入式衍生工具 客户忠诚计划香港(国际财务报告诠释委员会)-诠释 第 15 号 香港(国际财务报告诠释委员会)-诠释 第 16 号 香港(国际财务报告诠释委员会)-诠释 第 18 号房地产建议协议 对冲于海外业务的投资净额 客户转让资产本公司认为釆用以上新准则及修订准则不会对本公司于本会计及前期期间 的财务报表造成重大影响。

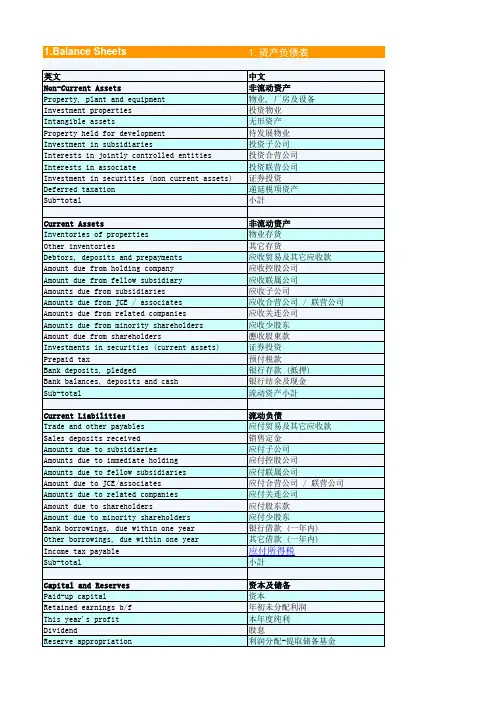

⾹港会计科⽬、财务报表(中英对照)⾹港会计科⽬(中英⽂对照)编码科⽬名称(简体)科⽬名称(繁体)科⽬名称(英⽂)1资产資產Assets110现⾦現⾦Cash1101库存现⾦庫存現⾦Cash on hand11011库存现⾦-港币庫存現⾦-港幣Cash on hand-HKD11012库存现⾦-美元庫存現⾦-美元Cash on hand-USD1102银⾏存款銀⾏存款Cash in banks11021汇丰银⾏存款匯豐銀⾏存款HSBC110211汇丰银⾏存款-港币匯豐銀⾏存款-港幣HSBC-HKD110212汇丰银⾏存款-美元匯豐銀⾏存款-美元HSBC-USD11022中国银⾏存款中國銀⾏存款BOC110221中国银⾏存款-港币中國銀⾏存款-港幣BOC-HKD110222中国银⾏存款-美元中國銀⾏存款-美元BOC-USD1103定期存款定期存款Time deposits11031汇丰银⾏定期存款-港币匯豐銀⾏定期存款-港幣Time deposits of HSBC-HKD11032汇丰银⾏定期存款-美元匯豐銀⾏定期存款-美元Time deposits of HSBC-USD1104零⽤⾦零⽤⾦Petty cash11041零⽤⾦-港币零⽤⾦-港幣Petty cash-HKD11042零⽤⾦-美元零⽤⾦-美元Petty cash-USD113短期投资短期投資Short-term investments1131有价证券有價證券Marketable securities1132备抵有价证券跌价损失備抵有價證券跌價損失Allowance for market decline marketable securities 1141应收票据應收票據Notes receivable11411应收票据-港币應收票據-港幣Notes receivable-HKD11412应收票据-美元應收票據-美元Notes receivable-USD1142贴现应收票据貼現應收票據Notes receivable discounted1143备抵坏帐-应收票据備抵壞帳-應收票據Allowance for bad debts-notes receivable1144应收帐款應收帳款Accounts receivable11441应收帐款-港币應收帳款-港幣Accounts receivable-HKD11442应收帐款-美元應收帳款-美元Accounts receivable-USD1145备低坏帐-应收帐款備低壞帳-應收帳款Allowance for bad debts-accounts receivable 1148应收退税款應收退稅款Tax refunds receivable1149留抵税额留抵稅額Tax retained1150应收收益應收收益Accrued income1159其他应收款其他應收款Other receivables11591其他应收款-港币其他應收款-港幣Other receivables-HKD11592其他应收款-美元其他應收款-美元Other receivables-USD1160备抵坏帐-其他应收款備抵壞帳-其他應收款Allowance for bad debts-other receivable1201商品存货商品存貨Merchandise inventory12011商品存货(永续盘存)商品存貨(永續盤存)Merchandise inventory12012商品存货(定期盘存)商品存貨(定期盤存)Merchandise inventory(Stock Closing)1202制成品製成品Finished goods1203在制品在製品Goods in process1204原料原料Raw materials1205物料物料Supplies1206在途材料在途材料Material & supplies in transit1207回收料回收料Reproduced materials1208借出原料借出原料Lend materials1209瑕疵品瑕疵品Defective work1215备抵存货跌价损失備抵存貨跌價損失Allowance for market decline-inventory124预付款项預付款項Prepayments1241预付货款預付貨款Advance payments to suppliers1242⽤品盘存⽤品盤存Office supplies on hand1243预付费⽤預付費⽤Prepaid expenses1244预付税款預付稅款Prepaid taxes1245其他预付款其他預付款Other prepayments1250应收关系企业款應收關係企業款Accounts receivable-relationship126其他流动资产其他流動資產Other current assets1261进项税额進項稅額Input tax1262其他流动资产其他流動資產Other current assets13长期投资⾧期投資Long-term investments1301长期投资⾧期投資Investments in stocks1302备抵长期投资损失備抵⾧期投資損失Allowance for loss on long-term investments14固定资产固定資產Fixed assets or Plant assets140⼟地⼟地Land1401⼟地⼟地Land1402累计折旧-⼟地累計折舊-⼟地Accumulated depreciation-Land141房屋及建筑房屋及建築Buildings and structures1411房屋及建筑房屋及建築Buildings and structures1412累计折旧-房屋及建筑累計折舊-房屋及建築Accumulated depreciation-Buildings and structures 142机器设备機器設備Machinery & equipment1421机器设备機器設備Machinery & equipment1422累计折旧-机器设备累計折舊-機器設備Accumulated depreciation-Machinery & equipment 143⽔电设备⽔電設備Power equipment1431⽔电设备⽔電設備Power equipment1432累计折旧-⽔电设备累計折舊-⽔電設備Accumulated depreciation-Power equipment144交通设备交通設備Transportation facilities1441交通设备交通設備Transportation facilities1442累计折旧-交通设备累計折舊-交通設備Accumulated depreciations-Transportation facilitie 145⽣财器具⽣財器具Furniture and fixtures1451⽣财器具⽣財器具Furniture and fixtures1452累计折旧-⽣财器具累計折舊-⽣財器具Accumulated depreciation-furniture and fixtures146⼯具设备⼯具設備Tools & equipment1461⼯具设备⼯具設備Tools & equipment1462累计折旧-⼯具设备累計折舊-⼯具設備Accumulated depreciation-Tools & equipment148杂项设备雜項設備Miscellaneous equipment1481杂项设备雜項設備Miscellaneous equipment1482累计折旧-杂项设备累計折舊-雜項設備Accumulated depreciation-Miscellaneous equipment 149未完⼯程及预付⼯程及设备款未完⼯程及預付⼯程及設備款Construction work in progress and advance payments 1491未完⼯程未完⼯程Construction work in progress1492预付⼯程及设备款預付⼯程及設備款Advance payments on construction and equipment 15其他资产其他資產Other assets151递延费⽤遞延費⽤Deferred charges1511开办费開辦費Organization costs1512递延权利⾦遞延權利⾦Deferred royalties1521存出保证⾦存出保證⾦Guarantee deposits paid1531催收款项催收款項Accounts receivable overdue1532备抵坏帐-催收款项備抵壞帳-催收款項Allowance for bad debts1541闲置资产閒置資產Idle assets1542累计折旧-闲置资产累計折舊-閒置資產Accumulated depreciation-idle assets1601应收保证票据應收保證票據Guarantee notes1602存出保证票据存出保證票據Certified notes2负债負債Liabilities210短期借款短期借款Short-term loans2101银⾏透⽀銀⾏透⽀Bank overdrafts2102银⾏借款銀⾏借款Bank loans2103购料贷款購料貸款Purchases loans2109其他短期借款其他短期借款Other short-term loans2110应付商业本票應付商業本票Commercial papers payable2111应付商业本票折价應付商業本票折價Discount on commercial papers payable2141应付票据應付票據Notes payable2142其他应付票据其他應付票據Other notes payable2143应付帐款應付帳款Accounts payable21431应付帐款-港币應付帳款-港幣Accounts payable-HKD21432应付帐款-美元應付帳款-美元Accounts payable-USD2146应付费⽤應付費⽤Accrued expenses2147应付股利應付股利Dividends payable2148应付税捐應付稅捐Other taxes payable2151销项税额銷項稅額Other notes payable2159其他应付款其他應付款Other payables2160应付所得税應付所得稅Income taxes payable225预收款项預收款項Accounts collected in advance2251预收货款預收貨款Advances from customers2254其他预收款其他預收款Other accounts collected in advance 2255代收款代收款Collection for others2270其他流动负债其他流動負債Other current liabilities24长期负债⾧期負債Long-term liabilities240长期债务⾧期債務Long-term loans payable2401长期借款⾧期借款Long-term loans payable2402长期应付款⾧期應付款Long-term payables2405其他长期负债其他⾧期負債Other long-term liabilities25其他负责其他負責Other liabilities2501存⼊保证⾦存⼊保證⾦Guarantee deposits received26信托代理及保证负债信託代理及保證負債Trust collection and guarantee liabilities 2601存⼊保证票据存⼊保證票據Guarantee notes received2602应付保证票据應付保證票據Commitments on guarantee notes3股东权益股東權益Stockholders' equity31投⼊资本投⼊資本Paid-in capital3101股本股本Capital stock3109预收股本預收股本Capital received in advance3201增资准备增資準備Additional capital surplus3301资本公积資本公積Capital surplus34保留盈馀保留盈餘Retained earnings340已指拨保留盈馀已指撥保留盈餘Appropriated retained earnings3401法定公积法定公積Legal surplus341未指拨保留盈馀未指撥保留盈餘Unappropriated retained earnings 3411保留盈馀(累积亏损)保留盈餘(累積虧損)Retained earnings or Accumulated loss 3412本期损益本期損益Profit or loss-current periods4营业收⼊營業收⼊Operating revenues41营业收⼊營業收⼊Operating revenues410销货收⼊銷貨收⼊Sales revenues4101销货收⼊銷貨收⼊Sales4102销货退回銷貨退回Sales returns4104销货折让銷貨折讓Sales allowances420劳务收⼊勞務收⼊Service revenues4201加⼯收⼊加⼯收⼊Revenue form reprocessing4209其他营业收⼊其他營業收⼊Other operating revenues5营业成本營業成本Operating costs510销货成本銷貨成本Cost of goods sold5101销货成本銷貨成本Cost of goods sold5401直接⼈⼯直接⼈⼯Direct labor5500制造费⽤製造費⽤Manufacturing overhead56劳务成本勞務成本Service costs560劳务成本勞務成本Service costs5601劳务成本勞務成本Service costs5901其他营业成本其他營業成本Other operating costs6营业费⽤營業費⽤Operating expenses61营业费⽤營業費⽤Operating expenses6101⽔费⽔費Water6102电费電費ELECTRICITY6103电话费電話費TELEPHONE6104⽂具及印刷⽂具及印刷STATIONERY6105租⾦租⾦RENT6106娱乐交际费娛樂交際費ENTERTAINMENT & GIFT6107维修保养费維修保養費GENERAL REPAIR & MAINTENANCE 6108交通费交通費TRAVELLING6109保险费保險費INSURANCE6110⼴告费廣告費ADVERTISING6111管理费管理費MANAGEMENT FEES6112邮费郵費POSTAGE6113出⼝运费出⼝運費CARRIAGE OUTWARDS6118⼊⼝运费⼊⼝運費CARRIAGE INWARDS6119核数费核數費AUDIT FEES6120佣⾦⽀出佣⾦⽀出COMMISSION6121专业法律费專業法律費PROFESSIONAL & LEGAL CHARGES6122杂费雜費SUNDRY62折旧费折舊費Depreciation Expenses6201⼟地折旧费⼟地折舊費Land Depreciation Expenses6202房屋及建筑折旧费房屋及建築折舊費Buildings and structures Depreciation Expenses 6203机器设备折旧费機器設備折舊費Machinery & equipment Depreciation Expenses 6204⽔电设备折旧费⽔電設備折舊費Power equipment Depreciation Expenses6205交通设备折旧费交通設備折舊費Transportation facilities Depreciation Expenses 6206⽣财器具折旧费⽣財器具折舊費Furniture and fixtures Depreciation Expenses 6207⼯具设备折旧费⼯具設備折舊費Tools & equipment Depreciation Expenses 6208杂项设备折旧费雜項設備折舊費Miscellaneous equipment Depreciation Expenses 7营业外收⼊及⽀出營業外收⼊及⽀出Non-operating income and expenses71营业外收⼊營業外收⼊Non-operating income710营业外收⼊營業外收⼊Non-operating income7101利息收⼊利息收⼊Interest income7102财产交易增益財產交易增益Gain on disposal of assets7103租赁收⼊租賃收⼊Rent income7104佣⾦收⼊佣⾦收⼊Commission income7105商品盘盈商品盤盈Gains on physical inventory7106兑换收⼊兌換收⼊Exchange gains7107退税收⼊退稅收⼊Tax refunds income7108投资收⼊投資收⼊Gain on investments7109其他收⼊其他收⼊Other non-operating income72营业外⽀出營業外⽀出Non-operating expenses720营业外⽀出營業外⽀出Non-operating expenses7201利息⽀出利息⽀出Interest expenses7202财产交易损失財產交易損失Loss on disposal of assets7203灾害损失災害損失Loss on calamity7204存货跌价损失存貨跌價損失Loss on market decline of inventory7205盘存损失盤存損失Loss on physical inventory7206兑换损失兌換損失Exchange losses7208投资损失投資損失Loss on investments7209其他营业外⽀出及损失其他營業外⽀出及損失Other non-operating expenses & losses8⾮常损益及会计原则变更累积影响数⾮常損益及會計原則變更累積影響數Extraordinary items and cumulative effect81⾮常损益⾮常損益Extraordinary items8101⾮常损益⾮常損益Extraordinary items8202会计原则变更累积影响数會計原則變更累積影響數Cumulative effect of changes in accounting princip 9所得税所得稅Income taxes91所得税所得稅Income taxes910所得税所得稅Income taxes9101预计所得税預計所得稅Income taxes⾹港会计报表(中英⽂对照)1.Balance Sheets 1.资产负债表英⽂中⽂Non-Current Assets⾮流动资产Property, plant and equipment物业, ⼚房及设备Investment properties投资物业Intangible assets⽆形资产Property held for development待发展物业Investment in subsidiaries投资⼦公司Interests in jointly controlled entities投资合营公司Interests in associate投资联营公司Investment in securities (non current assets)证券投资Deferred taxation递延税项资产Sub-total⼩計Current Assets⾮流动资产Inventories of properties物业存货Other inventories其它存货Debtors, deposits and prepayments应收贸易及其它应收款Amount due from holding company应收控股公司Amount due from fellow subsidiary应收联属公司Amounts due from subsidiaries应收⼦公司Amounts due from JCE / associates应收合营公司 / 联营公司Amounts due from related companies应收关连公司Amounts due from minority shareholders应收少股东Amount due from shareholders應收股東款Investments in securities (current assets)证券投资Prepaid tax预付税款Bank deposits, pledged银⾏存款 (抵押)Bank balances, deposits and cash银⾏结余及现⾦Sub-total流动资产⼩計Current Liabilities流动负债Trade and other payables应付贸易及其它应收款Sales deposits received销售定⾦Amounts due to subsidiaries应付⼦公司Amounts due to immediate holding应付控股公司Amounts due to fellow subsidiaries应付联属公司Amount due to JCE/associates应付合营公司 / 联营公司Amounts due to related companies应付关连公司Amount due to shareholders应付股东款Amount due to minority shareholders应付少股东Bank borrowings, due within one year银⾏借款 (⼀年内) Other borrowings, due within one year其它借款 (⼀年内) Income tax payable应付所得税Sub-total⼩計Capital and Reserves资本及储备Paid-up capital资本Retained earnings b/f年初未分配利润This year's profit本年度纯利Dividend股息Reserve appropriation利润分配-提取储备基⾦Statutory reserve法定储备Capital reserves资本公积-股权投资准备Property revaluation reserve投资物业重估储备Sub-total所有者权益⼩計Minority interests少股东权益Non-Current Liabilities⾮流动负债Bank borrowings, due after one year银⾏借款 (⼀年以上)Other borrowings, due after one year其它借款 (⼀年以上)Long term payables长期应付款Deferred taxation递延税款Sub-total⼩計2.INCOME STATEMENT 2.英⽂中⽂Turnover营业收⼊Business Tax主营业务税⾦及附加Cost of sales营业成本Gross Margin 经营⽑利Other operating income其它业务收⼊Interest Income利息收⼊Gain from investment in securites投资收益Change in fair value of investment properties投资物业公平价值之溢利Other operating expenses其它业务⽀出Selling expenses营业费⽤Administrative expenses管理费⽤Provision on investment in securities持有作买卖之投资公平价值之溢利Finance costs财务费⽤Share of results of jointly controlled entities应占合营公司业绩Taxation税项Minority interests少股东损益This year's (profit) loss本年度利纯3.CASH-FLOWSTATEMENT 3.现⾦流量表英⽂中⽂Operating activities:经营活动Profit before tax稅前經營溢利Adjustment:-調整:-Share of result of jointly controlled entities应占共同控制公司业绩Depreciation折舊Allowance for doubtful debts(补贴拨回),呆坏帐补贴Change in fair value of investment properties投资物业公平价值之溢利Change in fair value of investments held for trading持有作买卖之投资之公平价值溢利interest received利息收⼊Finance costs财务费⽤Impairment loss on goodwill of JCE共同控制公司之商誉减值损失Impairment loss on goodwill arising on acquisition of增持予附属公司之权益导致商誉减值损失additional interest in subsidiaries出售物业、⼚房及设备之亏损(收益)Loss on disposal of PPE持有作买卖之投资之亏损(收益)Gain on disposal of jointly controlled entities出售⼀间共同控制公司之收益Write-back of trade payables应付贸易账款拨回 未計流動資⾦變動前之經營業務及現⾦流量Increase in inventories of properties物业存货之减少(增加)Increase in other inventories其它存货之减少(增加)Increase in trade and other receivables应收贸易及其它款项之增加Increase in investments held for trading持有作买卖之投资的减少(增加)Increase in trade and other payables应付贸易及其它账款之增加(减少)Increase in sales deposits received销售定⾦之增加(减少)Cash generated from operation經營業務產⽣之現⾦Dividend received已收股息Tax paid- income tax已付所得稅Tax paid- land value added tax已付⼟地增值稅Refund of tax所得稅退回Net cash inflow generated from operation經營業務之現⾦流量淨額 投资业务Interest received利息收⼊Purchase of property, plant and equipment购置物业,⼚房及设备Proceeds from disposal of property, plant and equipment出售物业,⼚房及设备之收⼊ 附属公司收购Acquisition of additional interest in sub增持予附属公司之权益Net cash from disposal of a subsidiary出售⼀间附属公司之净现⾦收⼊Cash received on disposal of a JCE出售⼀间共同控制公司之实收现⾦Dividend received from a JCE收到⼀间共同控制公司的股息Repayment from related companies来⾃关联公司的(预付款)还款Advances to JCE向共同控制公司⽀付的预付款Capital contributions to JCE向共同控制公司出资Net cash from investing activities源⾃投资之现⾦净值Financing activities融資業務Capital contribution from minority shareholders⼩股东投⼊资本Decrease in amounts due to related companies应付关联公司款额之减少Increase in amounts due to shareholders应付股东款项之增加Increase in amounts due to JCE应付共同控制公司款项之增加(减少)New bank loans raised新筹集银⾏贷款Repayment of bank loans偿还银⾏贷款Repayment of other borrowings偿还其它借款Interest paid已付股息Dividend paid已付利息Net cash from financing activities融資業務⼩计Net increase/ (decrease) in cash & cash equivalent現⾦及等同現⾦項⽬之變動Net increase/ (decrease) in cash & cash equivalents現⾦及等同現⾦項⽬之變動Cash & cash equivalent at 1 January現⾦及等同現⾦項⽬承上年度Cash & cash equivalent at 30 November結轉現⾦及等同現⾦項⽬Analysis of the balance of cash and cash equivalents 現⾦及等同現⾦項⽬的分析Bank balances and cash銀⾏結存及現⾦。

一、资产负债表物业, 厂房及设备Investment properties 投资物业Intangible assets 无形资产Property held for development 待发展物业Investment in subsidiaries 投资子公司Interests in jointly controlled entities 投资合营公司Interests in associate 投资联营公司Investment in securities (non current assets) 证券投资Deferred taxation 递延税项资产Sub-total 小计Current Assets 非流动资产Inventories of properties 物业存货Other inventories 其它存货Debtors, deposits and prepayments 应收贸易及其它应收款Amount due from holding company 应收控股公司Amount due from fellow subsidiary 应收联属公司Amounts due from subsidiaries 应收子公司Amounts due from JCE / associates 应收合营公司/ 联营公司Amounts due from related companies 应收关连公司Amounts due from minority shareholders 应收少股东Amount due from shareholders 应收股东款Investments in securities (current assets) 证券投资Prepaid tax 预付税款Bank deposits, pledged 银行存款(抵押)Bank balances, deposits and cash 银行结余及现金Sub-total 流动资产小计Current Liabilities 流动负债Trade and other payables 应付贸易及其它应收款Sales deposits received 销售定金Amounts due to subsidiaries 应付子公司Amounts due to immediate holding 应付控股公司Amounts due to fellow subsidiaries 应付联属公司Amount due to JCE/associates 应付合营公司/ 联营公司Amounts due to related companies 应付关连公司Amount due to shareholders 应付股东款Amount due to minority shareholders 应付少股东Bank borrowings, due within one year 银行借款(一年内) Other borrowings, due within one year 其它借款(一年内) Income tax payable 应付所得税Sub-total 小计1. 2二、损益表英文中文Turnover 营业收入Business Tax 主营业务税金及附加Cost of sales 营业成本Gross Margin 经营毛利Other operating income 其它业务收入Interest Income 利息收入Gain from investment in securites 投资收益Change in fair value of investment properties 投资物业公平价值之溢利Other operating expenses 其它业务支出Selling expenses 营业费用Administrative expenses 管理费用Provision on investment in securities 持有作买卖之投资公平价值之溢利Finance costs 财务费用Share of results of jointly controlled entities 应占合营公司业绩Taxation 税项Minority interests 少股东损益This year's (profit) loss 本年度利纯2. 3三、现金流量表英文中文Operating activities: 经营活动Profit before tax 税前经营溢利Adjustment:- 调整:-Share of result of jointly controlled entities 应占共同控制公司业绩Depreciation 折旧Allowance for doubtful debts (补贴拨回),呆坏帐补贴Change in fair value of investment properties 投资物业公平价值之溢利Change in fair value of investments held for trading 持有作买卖之投资之公平价值溢利interest received 利息收入Finance costs 财务费用Impairment loss on goodwill of JCE 共同控制公司之商誉减值损失Impairment loss on goodwill arising on acquisition of 增持予附属公司之权益导致商誉减值损失additional interest in subsidiaries 出售物业、厂房及设备之亏损(收益)Loss on disposal of PPE 持有作买卖之投资之亏损(收益)Gain on disposal of jointly controlled entities 出售一间共同控制公司之收益Write-back of trade payables 应付贸易账款拨回未计流动资金变动前之经营业务及现金流量Increase in inventories of properties 物业存货之减少(增加)Increase in other inventories 其它存货之减少(增加)Increase in trade and other receivables 应收贸易及其它款项之增加Increase in investments held for trading 持有作买卖之投资的减少(增加)Increase in trade and other payables 应付贸易及其它账款之增加(减少)Increase in sales deposits received 销售定金之增加(减少)Cash generated from operation 经营业务产生之现金。

香港会计报表香港会计报表2011-04-04 14:41:02| 分类:会计知识 | 标签: |字号大中小订阅香港会计报表1.Balance Sheets 1.资产负债表英文中文Non-Current Assets 非流动资产Property, plant and物业, 厂房及设备equipmentInvestment properties 投资物业Intangible assets 无形资产Property held for待发展物业developmentInvestment in subsidiaries 投资子公司Interests in jointly投资合营公司controlled entitiesInterests in associate 投资联营公司Investment in securities证券投资(non current assets)Deferred taxation 递延税项资产Sub-total 小計Current Assets 非流动资产Inventories of properties 物业存货Other inventories 其它存货Debtors, deposits and应收贸易及其它应收款prepaymentsAmount due from holding应收控股公司companyAmount due from fellow应收联属公司subsidiaryAmounts due from应收子公司subsidiariesAmounts due from JCE /应收合营公司 / 联营公司associatesAmounts due from related应收关连公司companiesAmounts due from minority应收少股东shareholdersAmount due from shareholders 應收股東款Investments in securities证券投资(current assets)Prepaid tax 预付税款Bank deposits, pledged 银行存款 (抵押)Bank balances, deposits and银行结余及现金cashSub-total 流动资产小計Current Liabilities 流动负债Trade and other payables 应付贸易及其它应收款Sales deposits received 销售定金Amounts due to subsidiaries 应付子公司Amounts due to immediate应付控股公司holdingAmounts due to fellow应付联属公司subsidiariesAmount due to JCE/associates 应付合营公司 / 联营公司Amounts due to related应付关连公司companiesAmount due to shareholders 应付股东款Amount due to minority应付少股东shareholdersBank borrowings, due within银行借款 (一年内)one yearOther borrowings, due within其它借款 (一年内)one yearIncome tax payable 应付所得税Sub-total 小計Capital and Reserves 资本及储备Paid-up capital 资本Retained earnings b/f 年初未分配利润This year's profit 本年度纯利Dividend 股息Reserve appropriation 利润分配-提取储备基金Statutory reserve 法定储备Capital reserves 资本公积-股权投资准备Property revaluation reserve 投资物业重估储备Sub-total 所有者权益小計Minority interests 少股东权益Non-Current Liabilities 非流动负债Bank borrowings, due after银行借款 (一年以上)one yearOther borrowings, due after其它借款 (一年以上)one yearLong term payables 长期应付款Deferred taxation 递延税款Sub-total 小計2.INCOME STATEMENT 2.损益表英文中文Turnover 营业收入Business Tax 主营业务税金及附加Cost of sales 营业成本经营毛利Gross MarginOther operating income 其它业务收入Interest Income 利息收入Gain from investment in投资收益securitesChange in fair value of投资物业公平价值之溢利investment propertiesOther operating expenses 其它业务支出Selling expenses 营业费用Administrative expenses 管理费用Provision on investment in持有作买卖之投资公平价值之溢利securitiesFinance costs 财务费用Share of results of jointly应占合营公司业绩controlled entitiesTaxation 税项Minority interests 少股东损益This year's (profit) loss 本年度利纯3.CASH-FLOWSTATEMENT 3.现金流量表英文中文Operating activities: 经营活动Profit before tax 稅前經營溢利Adjustment:- 調整:-Share of result of jointly应占共同控制公司业绩controlled entitiesDepreciation 折舊Allowance for doubtful debts (补贴拨回),呆坏帐补贴Change in fair value of投资物业公平价值之溢利investment propertiesChange in fair value of持有作买卖之投资之公平价值溢利investments held for tradinginterest received 利息收入Finance costs 财务费用Impairment loss on goodwill共同控制公司之商誉减值损失of JCEImpairment loss on goodwill增持予附属公司之权益导致商誉减值损失arising on acquisition ofadditional interest in出售物业、厂房及设备之亏损(收益)subsidiariesLoss on disposal of PPE 持有作买卖之投资之亏损(收益)Gain on disposal of jointly出售一间共同控制公司之收益controlled entitiesWrite-back of trade payables 应付贸易账款拨回未計流動資金變動前之經營業務及現金流量Increase in inventories of物业存货之减少(增加)propertiesIncrease in other其它存货之减少(增加)inventoriesIncrease in trade and other应收贸易及其它款项之增加receivablesIncrease in investments held持有作买卖之投资的减少(增加)for tradingIncrease in trade and other应付贸易及其它账款之增加(减少)payablesIncrease in sales deposits销售定金之增加(减少)receivedCash generated from經營業務產生之現金operationDividend received 已收股息Tax paid- income tax 已付所得稅Tax paid- land value added已付土地增值稅taxRefund of tax 所得稅退回Net cash inflow generated from operation經營業務之現金流量淨額 投资业务Interest received 利息收入Purchase of property, plant and equipment购置物业,厂房及设备 Proceeds from disposal ofproperty, plant and equipment出售物业,厂房及设备之收入附属公司收购[size=+0]Acquisition of additional interest in sub增持予附属公司之权益 Net cash from disposal of a subsidiary 出售一间附属公司之净现金收入[size=+0]Cash received on disposal of a JCE出售一间共同控制公司之实收现金 Dividend received from a JCE 收到一间共同控制公司的股息Repayment from related companies来自关联公司的(预付款)还款 Advances to JCE 向共同控制公司支付的预付款Capital contributions to JCE 向共同控制公司出资Net cash from investing activities源自投资之现金净值Financing activities 融資業務Capital contribution from minority shareholders小股东投入资本 Decrease in amounts due to related companies应付关联公司款额之减少 Increase in amounts due to shareholders应付股东款项之增加 Increase in amounts due to JCE应付共同控制公司款项之增加(减少) New bank loans raised 新筹集银行贷款Repayment of bank loans 偿还银行贷款Repayment of other borrowings偿还其它借款 Interest paid 已付股息Dividend paid 已付利息Net cash from financingactivities融資業務小计Net increase/ (decrease) incash & cash equivalent現金及等同現金項目之變動Net increase/ (decrease) incash & cash equivalents現金及等同現金項目之變動Cash & cash equivalent at 1January現金及等同現金項目承上年度Cash & cash equivalent at 30November結轉現金及等同現金項目Analysis of the balance ofcash and cash equivalents現金及等同現金項目的分析Bank balances and cash 銀行結存及現金会计科目中英对照表1001 现金Cash on hand1002 银行存款Cash in bank1009 其他货币资金Other monetary fund100901 外埠存款Deposit in other cities 100902 银行本票Cashier's cheque100903 银行汇票Bank draft100904 信用卡Credit card100905 信用保证金Deposit to creditor100906 存出投资款Cash in investing account 1101 短期投资Short-term investments 110101 股票Short-term stock investments 110102 债券Short-term bond investments 110203 基金Short-term fund investments 110110 其他Other short-term investments1102 短期投资跌价准备Provision for loss on decline in value of short-term investments1111 应收票据Notes receivable 1121 应收股利Dividends receivable 1131 应收账款Accounts receivable 1133 其他应收款Other receivable1141 坏账准备Provision for bad debts1151 预付账款Advance to suppliers1161 应收补贴款Subsidy receivable1201 物资采购Materials purchased1211 原材料Raw materials1221 包装物Containers1231 低值易耗品Low cost and short lived articles1232 材料成本差异Cost variances of material1241 自制半成品Semi-finished products 1243 库存商品Merchandise inventory1244 商品进销差价Margin between selling and purchasing price onmerchandise1251 委托加工物资Material on consignment for further processing1261 委托代销商品Goods on consignment- out1271 受托代销商品Goods on consignment-in1281 存货跌价准备Provision for impairment of inventories1291 分期收款发出商品Goods on installment sales1301 待摊费用Prepaid expense1401 长期股权投资Long-term equity investments140101 股票投资Long-term stock investments140102 其他股权投资Other long-term equity investments1402 长期债权投资Long-term debt investments140201 债券投资Long-term bond investments140202 其他债权投资Other long-term debt investments1421 长期投资减值准备Provision for impairment of long-term investments1431 委托贷款Entrusted loan143101 本金Principal of entrusted loan143102 利息Interest of entrusted loan143103 减值准备Provision for impairment of entrusted loan 1501 固定资产Fixed assets-cost1502 累计折旧 Accumulated depreciation1505 固定资产减值准备Provision for impairment of fixed assets 1601 工程物资 Construction material160101 专用材料 Specific purpose materials160102 专用设备 Specific purpose equipments160103 预付大型设备款Prepayments for major equipments 160104 为生产准备的工具及器具Tools and instruments prepared for production1603 在建工程 Construction in process1605 在建工程减值准备 Provision for impairment of construction in process1701 固定资产清理Disposal of fixed assets 1801 无形资产 Intangible assets1815 未确认融资费用Unrecognized financing charges 1901 长期待摊费用Long-term deferred expenses 1911 待处理财产损溢Profit & loss of assets pending disposal 191101 待处理流动资产损溢Profit & loss of current-assets pending disposal 191102 待处理固定资产损溢Profit & loss of fixed assets pending disposal 2101 短期借款 Short-term loans2111 应付票据 Notes payable2121 应付账款 Accounts payable2131 预收账款 Advance from customers2141 代销商品款 Accounts of consigned goods2151 应付工资 Wages payable2153 应付福利费 Welfare payable2161 应付股利 Dividends payable2171 应交税金 Taxes payable217101 应交增值税 Value added tax payable21710101 进项税额 Input VAT21710102 已交税金 Payment of VAT21710103 转出未交增值税Outgoing of unpaid VAT21710104 减免税款 VAT relief21710105 销项税额 Output VAT21710106 出口退税 Refund of VAT for export21710107 进项税额转出Outgoing of input VAT 21710108 出口抵减内销产品应纳税额Merchandise VAT from expert to domestic sale21710109 转出多交增值税Outgoing of over-paid VAT 217102 未交增值税 Unpaid VAT217103 应交营业税 Business tax payable217104 应交消费税 Consumer tax payable217105 应交资源税 Tax on natural resources payable217106 应交所得税 Income tax payable217107 应交土地增值税Land appreciation tax payable 217108 应交城市维护建设税Urban maintenance and construction tax payable 217109 应交房产税 Real estate tax payable217110 应交土地使用税Land use tax payable 217111 应交车船使用税Vehicle and vessel usage tax payable 217112 应交个人所得税Personal income tax payable 2176 其他应交款 Other fund payable2181 其他应付款 Other payables2191 预提费用 Accrued expenses2201 待转资产价值Pending transfer value of assets 2211 预计负债 Estimable liabilities2301 长期借款 Long-term loans2311 应付债券 Bonds payable231101 债券面值 Par value of bond231102 债券溢价 Bond premium231103 债券折价 Bond discount231104 应计利息 Accrued bond interest2321 长期应付款 Long-term payable2331 专项应付款 Specific account payable2341 递延税款 Deferred tax3101 实收资本(或股本)Paid-in capital(or share capital)3103 已归还投资Retired capital 3111 资本公积Capital reserve311101 资本(或股本)溢价Capital (or share capital) premium311102 接受捐赠非现金资产准备Restricted capital reserve of non-cash assetsdonation received311103 接受现金捐赠Reserve of cash donation received311104 股权投资准备Restricted capital reserve of equity investments311105 拨款转入Government grants received311106 外币资本折算差额Foreign currency capital conversion difference311107 其他资本公积Other capital reserve3121 盈余公积Surplus reserve312101 法定盈余公积Statutory surplus reserve312102 任意盈余公积Discretionary earning surplus312103 法定公益金Statutory public welfare fund 312104 储备基金Reserve fund312105 企业发展基金Enterprise development fund312106 利润归还投资Profit return for investment3131 本年利润Profit & loss summary 3141 利润分配Distribution profit 314101 其他转入Other adjustments314102 提取法定盈余公积金Extract for statutory surplus reserve314103 提取法定公益金Extract for statutory public welfare fund314104 提取储备基金Extract for reserve fund314105 提取企业发展基金Extract for enterprise development fund314106 提取职工奖励及福利基Extract for staff bonus and welfare fund金314107 利润归还投资Profit return of capital invested314108 应付优先股股利Preference share dividend payable314109 提取任意盈余公积Extract for discretionary earning surplus314110 应付普通股股利Ordinary share dividend payable314111 转作资本(或股本)的普通股股利Ordinary share dividend transfer to capital (orshare)314115 未分配利润Undistributed profit 4101 生产成本Cost of production410101 基本生产成本Basic production cost410102 辅助生产成本Auxiliary production cost4105 制造费用Manufacturing overheads 4107 劳务成本Labor cost5101 主营业务收入Sales revenue5102 其他业务收入Revenues from other operations5201 投资收益Investment income 5203 补贴收入Subsidy income5301 营业外收入Non-operating profit5401 主营业务成本Cost of sales5402 主营业务税金及附加Sales tax5405 其他业务支出Cost of other operations5501 营业费用Operating expenses5502 管理费用General and administrative expenses 5503 财务费用Financial expenses5601 营业外支出Non-operating expenses5701 所得税Income tax5801 以前年度损益调整Prior period profit & loss adjustment。