ACCA F3 中英文单词对照表教学教材

- 格式:doc

- 大小:24.00 KB

- 文档页数:5

序号英语汉语1 ability to perform the work 履行职责的工作能力2 acceptance procedures 承接业务的程序3 accountability 经管责任4 accounting estimate 会计估计5 accounts receivable listing 应收帐款名单6 accounts receivable 应收账款7 accruals listing 应计项目名单8 accruals 应计项目9 accuracy 准确性10 adverse opinion 否定意见11 aged analysis 帐龄分析法12 agents 代理人13 agreed-upon procedures 程序审查(约定审计业务)14 analysis of errors 分析错误15 anomalous error 不正常的错误16 appointment ethics 任命(职业道德)17 appointment 任命18 associated firms 联合企业19 association of chartered certified accounts(ACCA) 注册会计师(ACCA)20 assurance engagement 承担鉴证业务21 assurance 鉴证22 audit 审计,审核,核数23 audit acceptance 接受审计24 audit approach 审计方法25 audit committee 审计委员会,审计小组26 ahudit engagement 审计业务约定书27 audit evaluation 审计评价28 audit evidence 审计证据29 audit plan 审计计划30 audit program 审计程序31 audit report as a means of communication 审计报告(交流方式)32 audit report 审计报告33 audit risk 审计风险34 audit sampling 审计抽样35 audit staffing 审计工作人员36 audit timing 审计及时37 audit trail 审计线索38 auditing standards 审计准则39 auditors' duty of care 审计职业审慎性40 auditors' report 审计报告41 authority attached to ISAs 遵循ISA(国际审计准则)42 automated working papers (电脑)自动生产的工作底稿43 bad debts 坏账44 bank 银行45 bank reconciliation 银行对账单,余额调节表46 beneficial interests 收益权47 best value 最好的价值48 business risk 经营风险49 cadbury committee cadbury 委员会50 cash count 现金盘点51 cash system 现金循环52 changes in nature of engagement 改变债务的性质上53 charges and commitments 费用和佣金54 charities 慈善团体56 chronology of an audit 审计的年表57 CIS application controls CIS 应用控制58 CIS environments stand-alone microcomputers CIS 环境单机微型计算器59 client screening 顾客甄别60 closely connected 紧密联系61 clubs 俱乐部62 communications between auditors and management 在审计员和管理者间沟通63 communications on internal control 内部控制上的沟通64 companies act 公司法65 comparative financial statements 比较财务报表66 comparatives 比较的67 competence 能力68 compilation engagement 承接编制(业务)69 completeness 完整性70 completion of the audit 审计终结71 compliance with accounting regulations 符合会计规则72 computers assisted audit techniques (CAA Ts) 计算器援助的审计技术(CAATs)73 confidence 信任74 confidentiality 保密性75 confirmation of accounts receivable 应收帐款询证函76 conflict of interest 利益冲突77 constructive obligation 工程应付款78 contingent asset 或有资产79 contingent liability 或有负债80 control environment 控制环境81 control procedures 控制程序82 control risk 控制风险[键入文字]83 controversy 争论84 corporate governance 公司治理85 corresponding figures 相关的数值86 cost of conversion 转换成本,加工成本87 cost 成本88 courtesy 优待89 creditors 债权人90 current audit files 本期审计档案91 database management system (DBMS) 数据库管理制度(数据管理系统)92 date of report 报告的日期93 depreciation 折旧94 design of the sample (抽样)样品的选取95 detection risk 检查风险96 direct verification approach 直接核查法97 directional testing 有方向的抽查98 directors' emoluments 董事酬金99 directors' serve contracts 董事服务合约100 disagreement with management 与经营管理者意见不一致 101 disclaimer of opinion 拒绝表示意见102 distributions 分销,分派,分配103 documentation of understanding and assessment of controlrisk控制风险评估的文件编集104 documenting the audit process 审计程序的审计文档 105 due care 应有关注106 due skill and care 应有的技能和谨慎107 economy 经济108 education 教育109 effectiveness 效用,效果110 efficiency 效益,效率111 eligibility / ineligibility 合格、资格/ 无资格 112 emphasis of matter 强调某事项114 engagement letter 业务约定书115 error 错误116 evaluating of results of audit procedures 审计程序结果的评估117 examinations 检查118 existence 存在性119 expectations 期望差距120 expected error 预期的错误121 experience 经验122 expert 专家123 external audit 独立审计124 external review reports 外部复核报告125 fair公正 126 fee negotiation费用谈判127 final assessment of control risk 控制风险的最终评定 128 final audit期末审计 129 financial statement assertions 财政报告公布 130 financial财务 131 finished goods 产成品 132 flowcharts流程图 133 fraud and error 舞弊 134 fraud欺诈 135 fundamental principles 基本原理136 general CIS controls 一般的 CIS 控制 137 general reports to mangement 对管理者的一般报告 138 going concern assumption 持续经营假设 139 going concern持续经营140 goods on sale or return 待出售或者退回商品 141 goodwill 商誉 142 governance统治143 greenbury committeegreenbury 委员会 144 guidance for internal auditors 内部审计员执业指南 145 hampel committee hampel 委员会 146 haphazard selection 随意选择 147 hospitality款待 148 human resources人力资源149 IAPS 1000 inter-bank confirmation proceduresIAPS 1000银行询证程序150 IAPS 1001 CIS environments-stand-alone microcomputersIAPS 1001 CIS 环境-单机微型计算器151 IAPS 1002 CIS environments-on-line computer systemsIAPS 1002 CIS 环境-(与主机)联机计算器系统 152 IAPS 1003 CIS environments-database systems IAPS 1003 CIS 环境- 数据库系统153IAPS 1005 the special considerations in the audit of small entities IAPS 1005小企业审计中的特别考虑154 IAS 2 inventories IAS 2 库存 155 IAS 10 events after the balance sheet date 资产负债表日后事项 156 IFAC's code of ethics for professional accountants IFAC's 职业会计的师道德准则 157 income tax所得税158 incoming auditors 对收入进行审计的审计员 159 independent estimate 独立估计160 ineligible for appointment 无资格被任命 161 information technology信息技术[键入文字]162 inherent risk 固有风险 164 insurance 保险 165 intangibles 无形 166 integrity 完整性 167 interim audit 中期审计 168 internal auditing 内部审计 169 internal auditors内部审计师170 internal control evaluation questionnaires (ICEQs) 内部控制评价调查表(问卷) 171 internal control questionnaires (ICQs) 内部控制调查表 172 internal control system 内部控制系统 173 internal review assignment内部审计的委派174 international audit and assurance standards board (IAASB)国际审计和鉴证准则委员会(IAASB) 175 international auditing practice statements (IAPSs) 国际审计实务声明 (IAPSs) 176 international federation of accountants (IFAC) 国际会计师联合会 (IFAC) 177 inventory system 盘存制度 178 inventory valuation 存货估价 179 ISA 230 documentation 230审计文档 180 ISA 240 fraud and error240 欺诈和错误 181 ISA 250 consideration of law and regulations250 法律法规的考虑182 Isa 260 communications of audit matters with those chargegovernance260 与高官的审计事项沟通183 isa 300 planning 300 审计计划 184 isa 310 knowledge of the business 310 对企业的了解 185 isa 320 audit materiality 320审计重要性 186 isa 400 accounting and internal control 400 会计和内部控制187isa 402 audit considerations relating to entities using service organisations 402 企业外聘服务机构的审计考虑188 isa 500 audit evidence 500审计证据189isa 501 audit evidence-additional considerations for specific items 501审计证据-特殊情况的特殊考虑190 isa 510 external confirmations 510外部询证 191 isa 520 analytical procedures 520分析性复核程序 192 isa 530 audit sampling 530审计抽样 193 isa 540 audit of accounting estimates 540会计估计的审计 194 isa 560 subsequent events 560期后事项 195 isa 580 management representations 580管理当局声明书 196 isa 610 considering the work of internal auditing 610 内部审计的考虑 197 isa 620 using the work of an expert620 使用专家的工作198 isa 700 auditors' report on financial statements 700财务报表的审计报告 199 isa 710 comparatives 710可比性200 isa 720 other information in documents containing auditedfinancial statements720 与财务报表审计相关的其他信息201 isa 910 engagement to review financial statements 910 受托复阅财务报表206 legal and regulations 法律和规则207 legal obligation 法定义务,法定责任208 levels of assurance 鉴证程度209 liability 负债210 limitation on scope 审计范围限制211 limitation of audit 审计的局限性212 limitations of controls system 控制系统的局限性213 litigation and claims 诉讼和赔偿214 litigation 诉讼215 loans 借款,贷款216 long term liabilities 长期负债217 lowballing 低价招揽审计业务218 management 管理219 management integrity 经营完整220 management representation letter 管理当局声明书221 marketing 推销,营销,市场学222 material inconsistency 重要的矛盾223 material misstatements of fact 重大误报224 materiality 重要性225 measurement 计量226 microcomputers 微型计算器227 modified reports 变更报告229 nature 性质230 negative assurance 消极鉴证231 net realizable value 可实现净值232 non-current asset register 非现金资产的登记本233 non-executive directors 非执行董事234 non-sampling risk 非抽样风险235 non-statutory audits 非法定审计236 objectivity 客观性237 obligating event 或有事项238 obligatory disclosure 或有事项披露240 occurrence 出现241 on-line computer systems (与主机)联机计算器系统 242 opening balances 期初余额243 operational audits 经营审计244 operational work plans 经营工作计划[键入文字]245 opinion shopping 意见购买246 other information 其他的信息247 outsourcing internal audit 内审外包248 overall review of financial statements 财务报表的全面复核 249 overdue fees 滞纳金250 overhead absorption 制造费用分配251 periodic plan 定期的计划252 permanent audit files 永久审计档案253 personal relationships 个人的亲属关系254 planning 计划255 population 抽样总体256 precision 精密,准确258 preliminary assessment of control risk 控制风险的初次评估 259 prepayments 预付款项260 presentation and disclosure 表述,披露261 problems of accounting treatment 会计处理的问题262 procedural approach 程序方法263 procedures 程序264 procedures after accepting nomination 接受任命后的审计程序 265 procurement 采购266 professional duty of confidentiality 保密的职业职责268 provision 备抵,准备269 public duty 公共职责270 public interest 公众利益271 publicity 宣传272 purchase ledger 采购分类账273 purchases and expenses system 采购和费用循环276 qualified opinion 保留意见278 qualitative aspects of errors 错误的性质279 random selection 随机选择280 reasonable assurance 合理保证281 reassessing sampling risk 再评估抽样风险282 reliability 可靠性283 remuneration 报酬284 report to management 对经营的报告285 reporting 报告286 research and development costs 研究和开发成本287 reservation of title 资格保留288 reserves 准备,储备289 revenue and capital expenditure 收入和资本支出290 review 复核291 review and capital expenditure 复核和资本支出295 rights and obligations 权力和义务297 risk and materiality 风险和重要性298 risk-based approach 以风险为导向的方法 300 rotation of auditor appointments 审计师的轮换301 rules of professional conduct 职业道德守则303 sales system 销售制度304 sales tax 销售税金,营业税305 sales 销售,销货306 sample size 样本量307 sampling risk 抽样风险308 sampling units 抽样单元309 schedule of unadjusted errors 未调整的错误表310 scope and objectives of internal audit 内部审计的范围和目标 311 segregation of duties 职责划分312 service organization 服务机构313 significant fluctuations or unexpected relationships 重要影响或未预期的亲属关系314 small entity 小企业316 sole traders 个体营业者318 specimen letter on internal control 内部控制上的样本证书319 stakeholders 利益相关者320 standardised working papers 标准工作底稿321 statement 1:integrity,objectivity and independence 声明1: 完整,客观性和独立 322 statement 2:the professional duty of confidence 声明2: 信任的职业责任323 statement 3: advertising ,publicity and obtainingprofessional work声明3: 广告,宣传和获得职业工作324 statement 5:changes in professional appointment 声明5: 审计聘任的变更325 statistical sampling 统计抽样326 statutory audit 法定审计328 statutory duty 法定责任329 stewardship 保管责任人330 strategic plan 战略性计划331 stratification 分层332 subsequent events 期后事项333 substantive procedures 实证性测试程序334 substantive tests 实质性测试335 sufficient appropriate audit evidence 充分的适当审计证据338 supervision 监督339 supervisory and monitoring roles 监督和监控的角色340 suppliers' statements 供应商的声明341 system and internal controls 系统和内部控制342 systematic selection 系统选择法343 systems-based approach 系统为导向的方法[键入文字]344 tangible non-current assets 有形的非流动资产 345 tendering 投标,清偿346 terms of the engagement 委任的条款347 tests of control 控制的测试348 the AGM 股东大会349 the board 委员会350 three Es 三E原则351 timing 准时352 tolerable error 可容忍误差353 trade accounts payable and purchases 应付帐款354 trade accounts payable listing 应付帐款名单355 training 培训356 treasury 国库,库房357 TRUE 真实358 turnbull committee turnbull 委员会359 ultra vires 越权360 uncertainty 不确定性361 undue dependence 未到(支付)期的未决 362 unqualified audit report 无保留的审计报告 364 using the knowledge 使用知识365 using the work of an expert 使用专家的工作366 valuation 计价,估价367 value for money 现金(交易)价格368 voluntary disclosure 自愿披露369 wages and salaries 工资,薪金370 wages system 工资系统371 work in progress 在产品372 working papers 工作底稿。

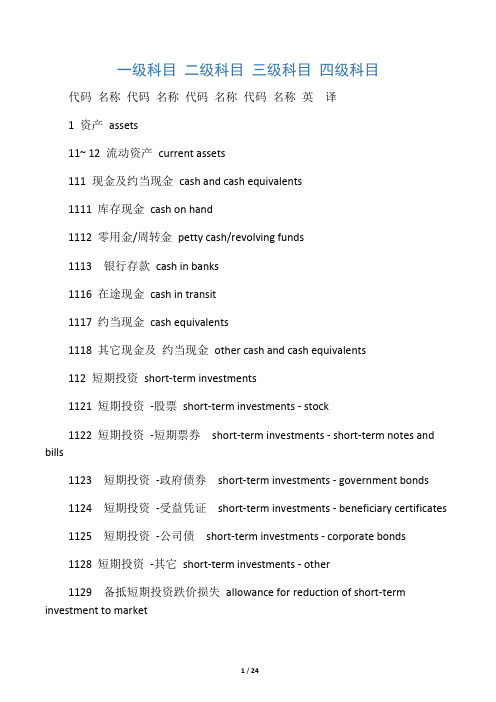

一级科目二级科目三级科目四级科目代码名称代码名称代码名称代码名称英译1 资产assets11~ 12 流动资产current assets111 现金及约当现金cash and cash equivalents1111 库存现金cash on hand1112 零用金/周转金petty cash/revolving funds1113 银行存款cash in banks1116 在途现金cash in transit1117 约当现金cash equivalents1118 其它现金及约当现金other cash and cash equivalents112 短期投资short-term investments1121 短期投资-股票short-term investments - stock1122 短期投资-短期票券short-term investments - short-term notes and bills1123 短期投资-政府债券short-term investments - government bonds1124 短期投资-受益凭证short-term investments - beneficiary certificates1125 短期投资-公司债short-term investments - corporate bonds1128 短期投资-其它short-term investments - other1129 备抵短期投资跌价损失allowance for reduction of short-term investment to market113 应收票据notes receivable1131 应收票据notes receivable1132 应收票据贴现discounted notes receivable1137 应收票据-关系人notes receivable - related parties1138 其它应收票据other notes receivable1139 备抵呆帐-应收票据allowance for uncollec- tible accounts- notes receivable114 应收帐款accounts receivable1141 应收帐款accounts receivable1142 应收分期帐款installment accounts receivable1147 应收帐款-关系人accounts receivable - related parties1149 备抵呆帐-应收帐款allowance for uncollec- tible accounts - accounts receivable118 其它应收款other receivables1181 应收出售远汇款forward exchange contract receivable1182 应收远汇款-外币forward exchange contract receivable - foreign currencies1183 买卖远汇折价discount on forward ex-change contract1184 应收收益earned revenue receivable1187 其它应收款- 关系人other receivables - related parties1188 其它应收款- 其它other receivables - other1189 备抵呆帐- 其它应收款allowance for uncollec- tible accounts - other receivables121~122 存货inventories1211 商品存货merchandise inventory1212 寄销商品consigned goods1213 在途商品goods in transit1219 备抵存货跌价损失allowance for reduction of inventory to market1221 制成品finished goods1222 寄销制成品consigned finished goods1223 副产品by-products1224 在制品work in process1225 委外加工work in process - outsourced1226 原料raw materials1227 物料supplies1228 在途原物料materials and supplies in transit1229 备抵存货跌价损失allowance for reduction of inventory to market125 预付费用prepaid expenses1251 预付薪资prepaid payroll1252 预付租金prepaid rents1253 预付保险费prepaid insurance1254 用品盘存office supplies1258 其它预付费用other prepaid expenses126 预付款项prepayments1261 预付货款prepayment for purchases1268 其它预付款项other prepayments128~129 其它流动资产other current assets1281 进项税额VAT paid ( or input tax)1282 留抵税额excess VAT paid (or overpaid VAT)1283 暂付款temporary payments1284 代付款payment on behalf of others1285 员工借支advances to employees1286 存出保证金refundable deposits1287 受限制存款certificate of deposit-restricted1292 递延兑换损失deferred foreign exchange losses1293 业主(股东)往来owners'(stockholders') current account 1294 同业往来current account with others1298 其它流动资产-其它other current assets - other13 基金及长期投资funds and long-term investments131 基金funds1311 偿债基金redemption fund (or sinking fund)1312 改良及扩充基金fund for improvement and expansion 1313 意外损失准备基金contingency fund1314 退休基金pension fund1318 其它基金other funds132 长期投资long-term investments1321 长期股权投资long-term equity investments1322 长期债券投资long-term bond investments1323 长期不动产投资long-term real estate in-vestments1324 人寿保险现金解约价值cash surrender value of life insurance1328 其它长期投资other long-term investments1329 备抵长期投资跌价损失allowance for excess of cost over market value of long-term investments14~ 15 固定资产property , plant, and equipment141 土地land1411 土地land1418 土地-重估增值land - revaluation increments142 土地改良物land improvements1421 土地改良物land improvements1428 土地改良物-重估增值land improvements - revaluation increments1429 累积折旧-土地改良物accumulated depreciation - land improvements143 房屋及建物buildings1431 房屋及建物buildings1438 房屋及建物-重估增值buildings -revaluation increments1439 累积折旧-房屋及建物accumulated depreciation - buildings144~146 机(器)具及设备machinery and equipment1441 机(器)具machinery1448 机(器)具-重估增值machinery - revaluation increments1449 累积折旧-机(器)具accumulated depreciation - machinery151 租赁资产leased assets1511 租赁资产leased assets1519 累积折旧-租赁资产accumulated depreciation - leased assets152 租赁权益改良leasehold improvements1521 租赁权益改良leasehold improvements1529 累积折旧- 租赁权益改良accumulated depreciation - leasehold improvements156 未完工程及预付购置设备款construction in progress and prepayments for equipment1561 未完工程construction in progress1562 预付购置设备款prepayment for equipment158 杂项固定资产miscellaneous property, plant, and equipment1581 杂项固定资产miscellaneous property, plant, and equipment1588 杂项固定资产-重估增值miscellaneous property, plant, and equipment - revaluation increments1589 累积折旧- 杂项固定资产accumulated depreciation - miscellaneous property, plant, and equipment16 递耗资产depletable assets161 递耗资产depletable assets1611 天然资源natural resources1618 天然资源-重估增值natural resources -revaluation increments 1619 累积折耗-天然资源accumulated depletion - natural resources 17 无形资产intangible assets171 商标权trademarks1711 商标权trademarks172 专利权patents1721 专利权patents173 特许权franchise1731 特许权franchise174 著作权copyright1741 著作权copyright176 商誉goodwill1761 商誉goodwill177 开办费organization costs1771 开办费organization costs178 其它无形资产other intangibles1781 递延退休金成本deferred pension costs1782 租赁权益改良leasehold improvements1788 其它无形资产-其它other intangible assets - other18 其它资产other assets181 递延资产deferred assets1811 债券发行成本deferred bond issuance costs1812 长期预付租金long-term prepaid rent1813 长期预付保险费long-term prepaid insurance1815 预付退休金prepaid pension cost1818 其它递延资产other deferred assets182 闲置资产idle assets1821 闲置资产idle assets184 长期应收票据及款项与催收帐款long-term notes , accounts and overdue receivables1841 长期应收票据long-term notes receivable1842 长期应收帐款long-term accounts receivable1843 催收帐款overdue receivables1847 长期应收票据及款项与催收帐款-关系人long-term notes, accounts and overdue receivables- related parties1848 其它长期应收款项other long-term receivables1849 备抵呆帐-长期应收票据及款项与催收帐款allowance for uncollectible accounts - long-term notes, accounts and overdue receivables185 出租资产assets leased to others1851 出租资产assets leased to others1858 出租资产-重估增值assets leased to others - incremental value from revaluation1859 累积折旧-出租资产accumulated depreciation - assets leased to others186 存出保证金refundable deposit1861 存出保证金refundable deposits188 杂项资产miscellaneous assets1881 受限制存款certificate of deposit - restricted1888 杂项资产-其它miscellaneous assets - other2 负债liabilities21~ 22 流动负债current liabilities211 短期借款short-term borrowings(debt)2111 银行透支bank overdraft2112 银行借款bank loan2114 短期借款-业主short-term borrowings - owners2115 短期借款-员工short-term borrowings - employees2117 短期借款-关系人short-term borrowings- related parties2118 短期借款-其它short-term borrowings - other212 应付短期票券short-term notes and bills payable2122 银行承兑汇票bank acceptance2128 其它应付短期票券other short-term notes and bills payable2129 应付短期票券折价discount on short-term notes and bills payable213 应付票据notes payable2131 应付票据notes payable2137 应付票据-关系人notes payable - related parties2138 其它应付票据other notes payable214 应付帐款accounts pay able2141 应付帐款accounts payable2147 应付帐款-关系人accounts payable - related parties217 应付费用accrued expenses2171 应付薪工accrued payroll2172 应付租金accrued rent payable2173 应付利息accrued interest payable2174 应付营业税accrued VAT payable2175 应付税捐-其它accrued taxes payable- other2178 其它应付费用other accrued expenses payable218~219 其它应付款other payables2181 应付购入远汇款forward exchange contract payable2182 应付远汇款-外币forward exchange contract payable - foreign currencies2183 买卖远汇溢价premium on forward exchange contract2184 应付土地房屋款payables on land and building purchased2185 应付设备款Payables on equipment2187 其它应付款-关系人other payables - related parties2191 应付股利dividend payable2192 应付红利bonus payable2198 其它应付款-其它other payables - other226 预收款项advance receipts2261 预收货款sales revenue received in advance2262 预收收入revenue received in advance2268 其它预收款other advance receipts227 一年或一营业周期内到期长期负债long-term liabilities -current portion2271 一年或一营业周期内到期公司债corporate bonds payable - current portion2272 一年或一营业周期内到期长期借款long-term loans payable - current portion2273 一年或一营业周期内到期长期应付票据及款项long-term notes and accounts payable due within one year or one operating cycle2277 一年或一营业周期内到期长期应付票据及款项-关系人long-term notes and accounts payables to related parties - current portion2278 其它一年或一营业周期内到期长期负债other long-term lia- bilities - current portion228~229 其它流动负债other current liabilities2281 销项税额VAT received(or output tax)2283 暂收款temporary receipts2284 代收款receipts under custody2285 估计售后服务/保固负债estimated warranty liabilities2292 递延兑换利益deferred foreign exchange gain2293 业主(股东)往来owners' current account2294 同业往来current account with others2298 其它流动负债-其它other current liabilities - others23 长期负债long-term liabilities231 应付公司债corporate bonds payable2311 应付公司债corporate bonds payable2319 应付公司债溢(折)价premium(discount) on corporate bonds payable 232 长期借款long-term loans payable2321 长期银行借款long-term loans payable - bank2324 长期借款-业主long-term loans payable - owners2325 长期借款-员工long-term loans payable - employees2327 长期借款-关系人long-term loans payable - related parties2328 长期借款-其它long-term loans payable - other233 长期应付票据及款项long-term notes and accounts payable2331 长期应付票据long-term notes payable2332 长期应付帐款long-term accounts pay-able2333 长期应付租赁负债long-term capital lease liabilities2337 长期应付票据及款项-关系人Long-term notes and accounts payable - related parties2338 其它长期应付款项other long-term payables234 估计应付土地增值税accrued liabilities for land value increment tax2341 估计应付土地增值税estimated accrued land value incremental tax pay-able235 应计退休金负债accrued pension liabilities2351 应计退休金负债accrued pension liabilities238 其它长期负债other long-term liabilities2388 其它长期负债-其它other long-term liabilities - other28 其它负债other liabilities281 递延负债deferred liabilities2811 递延收入deferred revenue2818 其它递延负债other deferred liabilities286 存入保证金deposits received2861 存入保证金guarantee deposit received288 杂项负债miscellaneous liabilities2888 杂项负债-其它miscellaneous liabilities - other3 业主权益owners' equity31 资本capital311 资本(或股本)capital3112 特别股股本capital - preferred stock3113 预收股本capital collected in advance3114 待分配股票股利stock dividends to be distributed3115 资本capital32 资本公积additional paid-in capital321 股票溢价paid-in capital in excess of par3212 特别股股票溢价paid-in capital in excess of par- preferred stock323 资产重估增值准备capital surplus from assets revaluation3231 资产重估增值准备capital surplus from assets revaluation324 处分资产溢价公积capital surplus from gain on disposal of assets3241 处分资产溢价公积capital surplus from gain on disposal of assets326 受赠公积donated surplus3261 受赠公积donated surplus328 其它资本公积other additional paid-in capital3281 权益法长期股权投资资本公积additional paid-in capital from investee under equity method3282 资本公积- 库藏股票交易additional paid-in capital - treasury stock trans-actions33 保留盈余(或累积亏损) retained earnings (accumulated deficit)331 法定盈余公积legal reserve3311 法定盈余公积legal reserve332 特别盈余公积special reserve3321 意外损失准备contingency reserve3322 改良扩充准备improvement and expansion reserve3323 偿债准备special reserve for redemption of liabilities3328 其它特别盈余公积other special reserve335 未分配盈余(或累积亏损) retained earnings-unappropriated (or accumulated deficit)3351 累积盈亏accumulated profit or loss3352 前期损益调整prior period adjustments34 权益调整equity adjustments341 长期股权投资未实现跌价损失unrealized loss on market value decline of long-term equity investments3411 长期股权投资未实现跌价损失unrealized loss on market value decline of long-term equity investments342 累积换算调整数cumulative translation adjustment3421 累积换算调整数cumulative translation adjustments343 未认列为退休金成本之净损失net loss not recognized as pension cost3431 未认列为退休金成本之净损失net loss not recognized as pension costs35 库藏股treasury stock351 库藏股treasury stock3511 库藏股treasury stock36 少数股权minority interest361 少数股权minority interest3611 少数股权minority interest4 营业收入operating revenue41 销货收入sales revenue411 销货收入sales revenue4111 销货收入sales revenue4112 分期付款销货收入installment sales revenue417 销货退回sales return4171 销货退回sales return419 销货折让sales allowances4191 销货折让sales discounts and allowances46 劳务收入service revenue461 劳务收入service revenue4611 劳务收入service revenue47 业务收入agency revenue471 业务收入agency revenue4711 业务收入agency revenue48 其它营业收入other operating revenue488 其它营业收入-其它other operating revenue4888 其它营业收入-其它other operating revenue - other 5 营业成本operating costs51 销货成本cost of goods sold511 销货成本cost of goods sold5111 销货成本cost of goods sold5112 分期付款销货成本installment cost of goods sold 512 进货purchases5121 进货purchases5122 进货费用purchase expenses5123 进货退出purchase returns5124 进货折让charges on purchased merchandise 513 进料materials purchased5131 进料material purchased5132 进料费用charges on purchased material5133 进料退出material purchase returns5134 进料折让material purchase allowances514 直接人工direct labor5141 直接人工direct labor515~518 制造费用manufacturing overhead5151 间接人工indirect labor5152 租金支出rent expense, rent5153 文具用品office supplies (expense)5154 旅费travelling expense, travel5155 运费shipping expenses, freight5156 邮电费postage (expenses)5157 修缮费repair(s) and maintenance (expense ) 5158 包装费packing expenses5161 水电瓦斯费utilities (expense)5162 保险费insurance (expense)5163 加工费manufacturing overhead - outsourced 5166 税捐taxes5168 折旧depreciation expense5169 各项耗竭及摊提various amortization 5172 伙食费meal (expenses)5173 职工福利employee benefits/welfare5176 训练费training (expense)5177 间接材料indirect materials5188 其它制造费用other manufacturing expenses 56 劳务成本制ervice costs561 劳务成本service costs5611 劳务成本service costs57 业务成本gency costs571 业务成本agency costs5711 业务成本agency costs58 其它营业成本other operating costs588 其它营业成本-其它other operating costs-other 5888 其它营业成本-其它other operating costs - other 6 营业费用operating expenses61 推销费用selling expenses615~618 推销费用selling expenses6151 薪资支出payroll expense6152 租金支出rent expense, rent6153 文具用品office supplies (expense)6154 旅费travelling expense, travel6155 运费shipping expenses, freight6156 邮电费postage (expenses)6157 修缮费repair(s) and maintenance (expense) 6159 广告费advertisement expense, advertisement 6161 水电瓦斯费utilities (expense)6162 保险费insurance (expense)6164 交际费entertainment (expense)6165 捐赠donation (expense)6166 税捐taxes6167 呆帐损失loss on uncollectible accounts6168 折旧depreciation expense6169 各项耗竭及摊提various amortization6172 伙食费meal (expenses)6173 职工福利employee benefits/welfare6176 训练费training (expense)6188 其它推销费用other selling expenses62 管理及总务费用general & administrative expenses625~628 管理及总务费用general & administrative expenses 6251 薪资支出payroll expense6252 租金支出rent expense, rent6253 文具用品office supplies6254 旅费travelling expense, travel6255 运费shipping expenses,freight6256 邮电费postage (expenses)6257 修缮费repair(s) and maintenance (expense)6259 广告费advertisement expense, advertisement6261 水电瓦斯费utilities (expense)6262 保险费insurance (expense)6264 交际费entertainment (expense)6265 捐赠donation (expense)6266 税捐taxes6267 呆帐损失loss on uncollectible accounts6268 折旧depreciation expense6269 各项耗竭及摊提various amortization6271 外销损失loss on export sales6272 伙食费meal (expenses)6273 职工福利employee benefits/welfare6274 研究发展费用research and development expense6276 训练费training (expense)6278 劳务费professional service fees6288 其它管理及总务费用other general and administrative expenses 63 研究发展费用research and development expenses635~638 研究发展费用research and development expenses6351 薪资支出payroll expense6352 租金支出rent expense, rent6353 文具用品office supplies6354 旅费travelling expense, travel6355 运费shipping expenses, freight6356 邮电费postage (expenses)6357 修缮费repair(s) and maintenance (expense)6361 水电瓦斯费utilities (expense)6362 保险费insurance (expense)6364 交际费entertainment (expense)6366 税捐taxes6368 折旧depreciation expense6369 各项耗竭及摊提various amortization6372 伙食费meal (expenses)6373 职工福利employee benefits/welfare6376 训练费training (expense)6378 其它研究发展费用other research and development expenses71~74 营业外收入non-operating revenue711 利息收入interest revenue7123 短期投资市价回升利益gain on market price recovery of short-term investment713 兑换利益foreign exchange gain7131 兑换利益foreign exchange gain714 处分投资收益gain on disposal of investments7141 处分投资收益gain on disposal of investments715 处分资产溢价收入gain on disposal of assets7151 处分资产溢价收入gain on disposal of assets748 其它营业外收入other non-operating revenue7484 出售下脚及废料收入revenue from sale of scraps7485 存货盘盈gain on physical inventory7486 存货跌价回升利益gain from price recovery of inventory7487 坏帐转回利益gain on reversal of bad debts7488 其它营业外收入-其它other non-operating revenue- other items75~ 78 营业外费用non-operating expenses751 利息费用interest expense7511 利息费用interest expense752 投资损失investment loss7521 权益法认列之投资损失investment loss recog- nized under equity method7523 短期投资未实现跌价损失unrealized loss on reduction of short-term investments to market753 兑换损失foreign exchange loss7531 兑换损失foreign exchange loss754 处分投资损失loss on disposal of investments7541 处分投资损失loss on disposal of investments755 处分资产损失loss on disposal of assets7551 处分资产损失loss on disposal of assets788 其它营业外费用other non-operating expenses7881 停工损失loss on work stoppages7882 灾害损失casualty loss7885 存货盘损loss on physical inventory7886 存货跌价及呆滞损失loss for market price decline and obsolete and slow-moving inventories7888 其它营业外费用-其它other non-operating expenses- other9 非经常营业损益nonrecurring gain or loss91 停业部门损益gain(loss) from discontinued operations912 停业部门损益-处分损益gain(loss) from disposal of discontinued segments9121 停业部门损益-处分损益gain(loss) from disposal of discontinued segment92 非常损益extraordinary gain or loss921 非常损益extraordinary gain or loss9211 非常损益extraordinary gain or loss93 会计原则变动累积影响数cumulative effect of changes in accounting principles931 会计原则变动累积影响数cumulative effect of changes in accounting principles9311 会计原则变动累积影响数cumulative effect of changes in accounting principles。

Session 1☆Types of business entityA business can be organized in one of the several ways:●Sole trader – a business owned and operated by one person.The simple form of business is the sole trader. This is owned and managed by one person, although there might be any number of employees. A sole trader is fully personally liable for any losses that the business might make.●Partnership – a business owned and operated by two or more people.A partnership is a business owned jointly by a number of partners. The partners are jointly and severely liable for any losses that the business might make.(Traditionally the big accounting firms have been partnerships, although some are converting their status to limited liability companies.)●Limited Liability Company– a business owned by many people and operated by many ( though not necessarily the same) people. Companies are owned by shareholders. Shareholders are also known as members. As a group, they elect the directors who run the business. Companies are always limited companies.In summary, types of business entity should be differentiated in Ownership; Operation right and Liability for the business to undertake.For all three types of entity, the money put up by the individual, the partners or the shareholders, is referred to as the business capital. In the case of a company, this capital is divided into shares.☆Business Transactions: Main types of business transactions for a business include:●Purchase of inventory for resale●Sal es of goods●Purchase of non-current assets●Payment of expenses●Introduction of new capital to the business●Withdrawal of funds from the business by the owner☆Cash and credit transactions:Cash transactions: the buyer pays for the item immediately or possibly in advance.Credit transactions: the buyer does not have to pay for the item on receipt, but is allowed some time ( a credit period) before having to make the payment.☆Definition of accountingRecording : transactions must be recorded as they occur in order to provide up-to-date information for management.Summarizing: the transactions for a period are summarized in order to provide information about the company to interested parties. ☆Types of accountingFinancial accounting vs management accountingFinancial accounting Cost and managementaccountingPurposeRecord financial transactionsInformation of cost of operationsLegal requirementLimited liability company, by law, prepare financial accountsNo legal requirement to prepare management accounts Main user ExternalInternal Time At the end of period regularlyInformationhistorichistoric and forecast☆Users of financial statementsAccounting reports users include:●Management : Need information about the co mpany’s financial situation as it is currently and it is expected to be in the future. This is to enable them to manage the business efficiently and to make effective decisions .●Investors: The providers of risk, capital and their advisers are concerned with the risk inherent in , and return provided by, their investments. They need information to helpthem determine whether they should buy, hold or sell.●Trade payables/ Suppliers: Suppliers and other trade payables. Suppliers and other trade payables are interested in information that enables them to determine whether amounts owing to them will be paid when due. Trade payables are likely to be interested in an enterprise over a shorter period than lenders unless they are dependent upon the continuance of an enterprise as a major customer.●Shareholders: Shareholders are also interested in market value of shares as well as information which enables them to assess the ability of the enterprise to pay dividends.●Lenders: Lenders are interested in information that enables them to determine whether their loans, and the interest attaching to them, will be paid when due.●Customers: Customers have an interest in information about the continuance of an enterprise, especially when they have a long term involvement with or are dependent on, the enterprise.●Government and their agencies:Governments are their agencies are interested in the allocation of resources and, therefore, the activities of enterprises. They also require information in order to regulate the activities of enterprises, determine taxation policies and as the basis for national income and similar statistics.●Employees: Employees and their representative groups are interested in information about the stability and profitability of their employers. They are also interested in information which enables them to assess the ability of the enterprise to prove remuneration, retirement benefits and employment opportunities.●General public:Enterprises affect members of the public in an variety of ways. For example, enterprises may make a substantial contribution to the local economy in many ways including the number of people they employ and their patronage of local suppliers. Financial statements may assist the public by providing information about the trends and recent developments in the prosperity of the enterprise and the range of its activities.☆The business entity conceptThe business entity concept●States that financial accounting information relates only to the activities of the business entity and not to the activities of its owner.●The business entity is treated as separate from its owners.Session 8 Irrecoverable debts and allowancesMain contents:1.Irrecoverable debts2.Allowance for receivables3.Accounting for irrecoverable debts and receivable allowances8.1 Irrecoverable debts●Trade receivables:A trade receivable is a customer who owes money to the business as a result of buying goods or service on credit.●Accruals concept:The accruals concept requires a sale to be included in the ledger accounts at the time that it is made.Credit sales are claimed when the sale is invoiced.The double entry at theinvoice date will be:Dr. Cr.Receivables xxSales xxWhen the customer eventually settles the invoice the double entry will be:Dr. Cr.Cash xxReceivables xxProblems: collecting the amounts owing from customersReasons: bankruptcy, fraud or disputes●Prudence concept:The prudence concept requires some adjustment to reflect the actual or potential loss arising from unpaid debts.●Irrecoverable debt:A debt which is considered to be uncollectible.- Highly unlikely that the amount owed will be received.- Written off by writing it out of the ledger accounts completely.●Accounting for irrecoverable debts- It is prudent to remove the irrecoverable debts from the accounts and to charge the amount as an expense for irrecoverable debts to the I.S.- The original sales remains in the accounts as this did actually take place.Dr.Irrecoverable debts expense xxCr.Receivables control account xxExample:Arctic Co.have total accounts receivable at the end of their accounting period of $45,000.Of these it is discovered that one, Mr.X who woes $790, has been declared bankruptcy, and another who gave his name as Mr.Jones has totally disappeared owing Arctic Co.$1,240.Write up the ledger accounts to reflect the writing off these debts as irrecoverable.Solution:Dr.Irrecoverable debts expense 2,030Cr.Receivables control account 2,030●Accounting for irrecoverable debts recoveredIrrecoverable debts are receivedWhen an irrecoverable debt is recovered, the accounting entry is:Dr.Cash xxCr.Irrecoverable debt expense xxExample:At 1 October 20x6 a business had total outstanding debts of $8,600.During the year to 30 September 20x7: Credit sales amounted to $44,000; Payments from various debtors amounted to $49,000; Two debts, for $180 and $420(both including sales tax)were declared irrecoverable.After the debts was written off, the payment is received before the end of the period, now what journal entry to prepare for the recovery of payment?Dr.Cash 600Cr.Irrecoverable debt expense 6008.2 An allowance for receivables:●Allowance for receivables is an estimate of the percentage of debts which are not expected to be paid.(a)When an allowance is first made, the amount of this initial allowance is charged as an expense in the income statement, for the period in which the allowance is created.(b)When an allowance already exists, but is subsequently increased in size, the amount of the increase in allowance is charged as an expense in the income statement, for the period in which the increased allowance is made.(c)When an allowance already exists, but is subsequently reduced in size, the amount of the decrease in allowance is credited back to the income statement, for the period in which the increased allowance is made.The value of trade receivable in the statement of financial position must be shown after deducting the allowance for receivables.Example:A business has trade receivables outstanding at 30 June 20x5 and decided to create 5% allowances for receivables.(a)In the income statement, the newly created allowance of $2,500 (5% x 50,000 = 2,500)will be shown as an expense.(b)In the statement of financial position, trade accounts receivables will be shownas: $Total receivables 50,000Less: allowance for receivables (2,500)47,5008.3 Accounting for irrecoverable debts and receivable allowances●Irrecoverable debts written off- When the irrecoverable debts are written off, the double entry might be:Dr.Irrecoverable debtsCr.Receivable control account- When an irrecoverable debt is subsequently received, the accounting entries are: Dr.CashCr.Irrecoverable debts●Allowance for receivables(a)Open up an allowance accountDr.Irrecoverable debts account (expense)Cr.Allowance for receivables(b)In subsequent years- calculate the new allowance required- compare it with the existing balance on the allowance account- calculate increase or decrease required(only a movement in the allowance is charged to the I.S.)(i)If a higher allowance is required:Dr.Irrecoverable debts expenseCr.Allowance for receivables(ii)If a lower allowance is required:Dr.Allowance for receivablesCr.Irrecoverable debts expenseExample:A has total receivables outstanding at 31 December 20x2 of $28,000.He believes that about 1% of these balances will not be collected and wishes to make an appropriate allowance.Before now, he has not made any allowance for receivables at all.On 31 December 20x3, his trade accounts receivable amount to $40,000.His experience during the year has convinced him that an allowance of 5% should be made.Required: What accounting entries should he make?Solution:At 31 December 20x2,Allowance required= 1% x 28,000 = $280Dr.Irrecoverable debts expense 280Cr.Allowance for receivables 280In SFPReceivables ledger balances 28,000Less: allowances for receivables 28027,720At 31 December 20x3Allowance required now( 5% x 40,000)2,000Existing allowance (280)Additional allowance required 1,720The double entry will be:Dr.Irrecoverable debts expense 1,720Cr.Allowance for receivables 1,720In SFPReceivables ledger balances 40,000Less: allowance for receivables (2,000)38,000Example 2:Irrecoverable debts are $5,000.Trade accounts receivable at the year end are $120,000.If an allowance for receivables of 5% is required, what are the irrecoverable debts in the income statement?A.$5,000B.$11,000C.$6,000D.$10,750Solution: B120,000 X 5% = 6,000$6000+ $5,000 = $11,000P.S.: The irrecoverable debt expense to be included in I/S should include:Irrecoverable debt written off xx+ Allowance ( movement )for receivables xx= Total irrecoverable debt expense charged to I/SSession 2☆Financial Statements include:- a statement of financial position at the end of the period- a statement of comprehensive income for the period- a statement of changes in equity for the period- statement of cash flows for the period- notes, comprising a summary of accounting policies and other explanatory notesThe statement of financial position:Statement of Financial Position: showing the financial position of a business at a point of time.The Vertical format of the SFP: (Statement of Financial Position as at 31 December 2007)●The top half of the balance sheet shows the assets of the business.●The bottom hal f of the balance sheet shows the capital and liabilities of the business.A Statement of financial position at the end of the period (Balance Sheet):W XangBalance Sheet as at December 31 20X6$ $ Non – current assetsMotor Van 2,400Current assetsInventory 2,390Trade receivables 1,840Cash at bank 1,704Cash in hand 565,990 Total assets 8,390$ $ Capital accountBalance at 1 January 20X6 4,200Add net profit for year 3,450Increase in capital 1,0008,650Less: Drawing for year (2,960)5,690Non – current liabilities 1,000Current liabilitiesPayable 1,700Total 8,390The horizontal format of the SFP: (Statement of Financial Position as at 31 December 2007)●The left half of the balance sheet shows the assets of the business.●The right half of the balance sheet shows the capital and liabilities of the business.W XangStatement of Financial Position as at 31 December 20x6$ $ $ $ Non-current assets Non-current liabilities1,000Motor van 2,400 Trade payable1,7002,400 Total liabilities2,700Capital accountCurrent assets Balance at 1 January 20X6 4,200Inventory 2,390 Add net profit for year 3,450Trade receivables 1,680 Increase in capital 1,000Cash at bank 1,704 8,650Cash in hand 56 Less: Drawing for year -2,960Total current assets5,990 5,690Total assets8,390 Total capital and liabilities8,390☆The accounting equationFinancial accounting is based upon a very simple idea:The amount of resources supplied by the owner is called capital. The actual resources that are then in the business are called assets. Usually, people other than the owner have supplied some, of the assets, for example, a supplier supplies stock of goods on credit. The business is said to owe a liability towards these suppliers. The following accounting equation always holds true:The accounting equation:ASSETS = PROPRITOR’S CAPITAL + LIABILITIES- Any point in time, the assets of the business will be equal to its liabilities plus the capital of the business;- Assets less liabilities equal the capital of the business, which is known as net assets.- Each and every transaction that the business makes or enters into has twoaspects to it and have a double effect on the business and the accountingequation. This is known as the duality concept.Duality concept:Each and every transaction that the business makes or enters into has two aspects to it and has a double effect on the business and the accounting equations. This is known as duality concept.Illustration:1). Carl sets up in business by opening a coffee shop –Carl’s Coffee. He puts $5,000 into a business bank account.The opening accounting equation is:Assets (Cash in bank)= Capital + Liabilities($5,000) = ($5,000) + ($0)2). Carl buys furniture (chairs and tables) for the shop for $1,500, paying the supplier out of the business bank account.The accounting equation after this transaction is:Assets Capital + Liabilties( Cash in bank $3,500) = ($5,000)($0)(Furniture $ 1,500)3). Now Carl spends a further $2,000 to buy coffee-making equipment and $800 on crockery and cutlery, paying cash out of the business bank account.The accounting equation after this transaction is:Assets Capital + Liabilties(Cash in Bank $700)= ($5,000)($0)(Equipment $2,000)(Fitting & Fixture $800)(Furniture $1,500)4). Carl persuades his bank to lend $1,000 to develop the business. The bank loan is accounted for as a liability of the business.The accounting equation is now as follows:Assets Capital + Liabilties(Cash in Bank $1,700) = ($5,000)($1,000)(Equipment $2,000)( Fitting & Fixture $800)(Furniture $ 1,500)5). Carl now buys coffee, tea, milk, sugar, biscuits and cakes for $700, and pays in cash from the business bank account.The accounting equation is now as follows:Assets Capital + Liabilties(Inventory $700) = ($5,000)($1,000)(Equipment $2,000)(Fitting & Fixture $800)(Furniture $1,500)(Cash in Bank $ 1,000)6). In his first day of trading, Carl uses up $650 of his inventory, and makes sales totaling $1,050. All his sales are in cash.The accounting equation at the end of the day is as follows:Assets Capital + Liabilities(Inventory $50) = (Beginning $5,000)($1,000)(Equipment $2,000)( Profit $400)(Fitting & Fixture $800)(Furniture $1,500)( Cash in bank $2,050)☆Classification of Assets and LiabilitiesAssets: An asset is something owned or controlled by the business that will result in future economic benefits to the business. ( an inflow of cash or other assets.)Such as:Current assets:are assets owned by the business with the intention of turning them into cash within one year (accounting period).This definition allows inventory or receivables to quality as current assets, even if they may not be realized into cash within 12 months.Non-current asset:is an asset held for and used in operation(rather than for selling to customer), with a view to earning income or making profits from its use, for over more than one year ( accounting period).Liability: is something owed by the business to someone else.Current liability: These include the debts of the business that are repayable within the next 12 months.Non-current liabilities: are liabilities that do not need to be settled for at least one year. (excluding the current portion of the debt)Capital:Capital is a type of liability. It represents the owner’s net investment in the business. Capital appears as a credit balance on the balance sheet.Assets –Liabilities = PROPRIETOR’S CAPITALNet Assets =( Total )Assets –(Total) LiabilitiesCapital (at SFP date) = Capital introduced + Profit – DrawingsDrawing: Drawings are any amounts taken out of the business by the owner for their own personal use. Drawings will reduce the capital balance reported on the balance sheet.Include:●Money taken out of the business●Goods taken for personal use●Personal expenses paid by the businessIncome statement☆Financial Statements include:- a statement of financial position at the end of the period- a statement of comprehensive income for the period- a statement of changes in equity for the period- statement of cash flows for the period- notes, comprising a summary of accounting policies and other explanatory notes The statement of financial position:Statement of Financial Position: showing the financial position of a business at a point of time.The Vertical format of the SFP: (Statement of Financial Position as at 31 December 2007)●The top half of the balance sheet shows the assets of the business.●The bottom half of the balance sheet shows the capital and liabilities of the business.A Statement of financial position at the end of the period (Balance Sheet):☆Income statement:Mr. W XangIncome statement for the year ended 31 December 20X6$ $Sales revenue33,700Opening inventory 3,200Purchases 24,49027,690Less: Closing inventory (2,390)Cost of sales (25,300)Gross profit8,400Less: Expenseswages 3,385rent 1,200Sundry expenses 365(4,950)Net profit3,450●Showing the financial performance of a business over a period of time.●Reports revenue and expenses for the period.●T he sales revenue shows the income from goods sold in the year●The cost of buying the goods sold must be deducted from the revenue●The current year’s sales will include goods bought in the previous year, so this opening inventory must be added to the current year’s purchases.●Some of this year’s purchases will be unsold at 31/12/20x6 and this closing inventory must be deducted from purchases to be set off against next year’s sales.●The first part gives gross profit. The second part gives net prof it.The I.S. prepared following the accruals concept.Accrual concept:●Income and expenses are recorded in the I.S. as they are earned / incurred regardless of whether cash has been received/ paid.(Sales revenue: income from goods sold in the year, regardless of whether those goods have been paid for.)☆Relationship between a statement of financial position and a statement of income●The balance sheets are not isolated statements, they are linked over time withthe income statement●As the business records a profit in the income statement, that profit is added tothe capital section of the balance sheet, along with any capital introduced. Cash taken out of the business by the proprietor, called drawings, is deducted.Illustration – the accounting equation:The transactions:Day 1 Avon commences business introduction $1,000 cash.Day 2 Buys a motor car for $400 cash.Day 3 Buys inventory for $200 cash.Day 4 Sells all the goods bought on Day 3 for $300 cash.Day 5 Buys inventory for $400 on credit.SFP at the end of each day’s transactions:Solution:Day 1 Assets (Cash $1,000) = Capital ($1,000) + Liabilities ($0)Day 2 Assets (Motor $400) = Capital ($1,000) + Liabilities ($0)(Cash $600)Day 3 Assets ( Inventory $200) = Capital($1,000) + Liabilities ($0)(Motor $400)(Cash $400)Day 4 Assets ( Motor$ 400) = Capital + Liabilities ($0)(Cash $700)(Beginning$1,000)(Profit $100)Day 5 Assets (Inventory $ 400) = Capital + Liabilities( Motor$ 400)(Beginning$1,000)($400)(Cash $700)(Profit $100)AvonStatement of Financial Position as at end of Day 5$ $ Non – current assetsMotor Van 400Current assetsInventory 400Cash in hand 7001,100 Total assets 1,500$ $ Capital accountBalance at Day 1 1,000Add net profit for the period 1001,100 Current liabilitiesPayable 400Total 1,500Example:Continuing from the illustration above, prepare the SFP at the end of each day after accounting for the transactions below:Day 6 Sells half of the goods bought on Day 5 on credit for $250.Day 7 Pays $200 to his supplier.Day 8 Receives $100 from a customer.Day 9 Proprietor draws $75 in cash.Day 10 Pays rent of $40 in cash.Day 11 Receives a loan of $600 repayable in two years.Day 12 Pays cash of $30 for insurance.Your starting point is the SFP at the end of Day 5, from the illustration above.Prepare: SFP at the end of Day 12I.S. for the first 12 days of trading.Solution:Day 6 Assets (Inventory $ 200) = Capital + Liabilities( Motor$ 400)(Beginning$1,000)($400)(Cash $700)(Profit $150)(A/Receivable$250)Day 7 Assets (Inventory $ 200) = Capital + Liabilities( Motor$ 400)(Beginning$1,000)($200)(Cash $500)(Profit $150)(A/Receivable$250)Day 8 Assets (Inventory $ 200) = Capital + Liabilities( Motor$ 400)(Beginning$1,000)($200)(Cash $600)(Profit $150)(A/Receivable$150)Day 9 Assets (Inventory $ 200) = Capital + Liabilities( Motor$ 400)(Beginning$1,000)($200)(Cash $525)(Profit $150)(A/Receivable$150)(Drawing $75)Day 10 Assets (Inventory $ 200) = Capital + Liabilities( Motor$ 400)(Beginning$1,000)($200)(Cash $485)(Profit $110)(A/Receivable$150)(Drawing $75)Day 11 Assets (Inventory $ 200) = Capital + Liabilities( Motor$ 400)(Beginning$1,000)($200)(Cash $1,085)(Profit $110)($600)(A/Receivable$150)(Drawing $75)Day 12 Assets (Inventory $ 200) = Capital + Liabilities( Motor$ 400)(Beginning$1,000)($200)(Cash $1,055)(Profit $80 )($600)(A/Receivable$150)(Drawing $75)AvonStatement of Financial Position as at end of Day 12$ $ Non – current assetsMotor Van 400 Current assetsInventory 200Trade receivables 150Cash in hand 1,0551,405 Total assets 1,805$ $ Capital accountBalance at Day 1 1,000Add net profit for the period 80Less: Drawing for year (75)1,005Non – current liabilities 600Current liabilitiesPayable 200Total 1,805AvonIncome statement for the period ended at Day 12$ $Sales revenue550Opening inventory 0Purchases 600Less: Closing inventory (200)Cost of sales (400)Gross profit150Less: Expensesrent 40insurance 30(70)Net profit80Session 3 Double entry bookkeeping☆The duality concept and double entry bookkeepingDuality concept: each and every transaction has a double effect on the business and the accounting equations.(A= C + L)Rules of double entry bookkeeping:● Each time a trans action is recorded, both effects must be taken into account.● These two effects are equal and opposite such that the accounting equation will always prove correct.Assets – Liabilities = Capital● Traditionally, one effect is referred to as the debi t side ( Dr.) and the other as the credit side of the entry (Cr.)☆Ledger accounts, debits and creditsLedger account:● transactions are recorded in the relevant ledger accounts. There is a ledgeraccount for each asset, liability, revenue and ex penses’ item, and for the owner’scapital.● Each account has two sides: the debit and credit sides.● The duality concept means that each transaction will affect two ledger accounts● One account will be debited and the other credited● Whether an entry is to debit or credit side of an account depend on the types of account and the transaction.☆IN ARRIVING AT RULE FOR DEBIT AND CREDIT, AN ASSUMPTION ISMADE THAT ASSETS ARE OF A DEBIT NATURE.☆Debit entries record Credit entries recordIncrease in Increase inExpense LiabilityAsset IncomeDrawings CapitalRules: treat the transactions as if all performed by cash.(Cash in--- Debit; Cash out --- Credit)Using T- accountT-accounts are frequently used to simplify the thought process behind recording complex transactions. Using T-accounts, the accountant or bookkeeper can analyze the effects to individual accounts and the impact the transactions have on account balances.Steps to record a transaction:1.Identify the two items that are affected.2.Consider whether they are being increased of decreased.3.Decide whether each account should be debited or credited.4.Check that a debit entry and a credit entry have been made and they are both for the same account.☆Recording cash transactionsCash transactions:Payment is made or received immediately.Cheque payments or receipts are classed as cash transactions.Double entry involves the bank ledger:A debit entry is where funds are receivedA credit entry is where funds are paid out.Example: Show the following transactions in ledger accounts:1.Kamran pays $80 for rent by cheque.2.Kamran sells goods for $230 cash which he banks.3.He then takes $70 out of the business for his personal living expenses.4.Kamran sells more goods for cash, receiving $3,400Solution:1.Dr. Rent expense 80Cr. Cash in bank 802.Dr. Cash in bank 230Cr. Sales 2303.Dr. Drawing 70Cr. Cash in bank 704.Dr. Cash in bank 3,400Cr. Sales 3,400。

4.贸易折扣(商业折扣)trade discount5.现金折扣cash discount 第一章6. 不含税exclusive7. 含税 inclusiveasset 1.资产8. 交易事项Transaction liability2.负债9. 取走withdrawasset 3.所有者权益equity=capital=net 第五章 income=revenue=sales 4.收入1.现金 petty cash=cash on hand expense .费用52.支票 chequeplant .厂房63.自动转账 standing order/direct debt machine.机器74.银行给你存款利息 bank interest on intangible asset8.无形资产deposit87 .非流动资产9 Non current asset(6 5.银行收取利息手续费 bank charges )9属于6.银行收取利息 bank interest on petty cash 10.库存现金overdraftcash11.银行存款7.空头支票 dishonored chequetrade receivable=A/R 12.应收账款8.未结清的款项,别人给我的 uncleared inventory.存货13lodgement10 11 12 14(.流动资产 current asset 9.未承兑的汇票 unpresent cheque )属于141310.别人给我支票 undrawn cheque loan15.贷款11.公司业务错误 business error trade payables=A/P16.应付账款12.银行业务错误 bank erroradvance from customers .预收账款1713.银行存款余额调节表 bank 15 16 18.流动负债( current liabilityreconciliation)属于171814.银行透支 overdraftshare capital 19.实收资本15.银行对账单 bank statementshare premium20.资本公积16.现金账簿/银行存款日记账 cash Retained earnings=R/ES 21.留存收益bookstatement of financial .资产负债表2217.总账 control accounts =general position=SOFPledgerof 变益动表statement 权有.23所者18.明细账 individual ledger =personal changes in equity=SOCIEledger=subsidiary ledger=memo account statement of cash flow 24.现金流量表19.应收账款总账 receivable control statement of comprehensive 25.利润表account =receivable general ledger income=SOCI20.应收账款明细账receivable 第二章ledger=sales ledgerdouble-entry bookkeeping .复式记账121.坏账 bad debt=irrecoverable debt Debit 借2. 22.毛利润 gross profitCredit贷3. 23.一般性坏账准备 general allowance prepayment 4. 预付账款24.特殊性坏账准备 specific allowance profit5. 利润 debt第四章 doubtful25.可疑的坏账value added tax=salestax .增值税125.资产减值损失 expense-bad debts input tax 2.进项税额written offoutput tax.销项税额3 allowance for A/R坏账准备26.第六章 life20 确定使用寿命inventoryfinite useful life 1 存货21先进先出 first in first out累计摊销 accumulated amortization 222 每年的折旧3 特殊计价法 specific identification depreciation for eachyear加权平均法 period average=weighted 4第八章 average1或有事项continuous contingencies动5 移加权平均法2.average=continuous weighted average 或有负债 contingentliabilities3.现时义务method=moving weighted average present obligation cost4.或有资产 contingent assets method5.肯定的 certain 6 成本 historical cost6.可能的 net realizable value probable 7 可变现净值7.8 资或许的准备 possible 的失-计提存货跌价产减值损8.遥远的,渺茫的expense-inventory written-downRemote9.perpetual inventory 预计负债 provision9 永续盘存制第九章 system1.periodic inventory 试算平衡 trial Balance制实10 地盘存2.system交易发生 transaction occur3.购货 purchase 复式记账 Double entry 114.12 数量 quantity 结账 Balance off5.期末调整 Year End Adjustment 单价13 unit cost6.错误 gross profit margin14 毛利润率 Errors7.遗漏第七章 omission8. original purchase price任命错误 commission errors买价19.原则性错误site of preparation errors of principle cost 2 场地准备费10.3 运输费 delivery and handling 加总错误 casting errors11.暂记账户安装费4 installationsuspense account第十章员工培训费 employee training51.6资本化后续支出 capital expenditure 预付账款 prepayment2.revenue expenditure 7 费用化后续支出预提费用 accruals3.其他应收款 other receivable 直线法8 straight line method4.递延收入 Deferred income accumulated depreciation 9 累计折旧5. original cost到期 expire 原值106. 值残净estimated 欠款residual arrear 计11 预7.租客value Tenant8. useful life12 预计使用寿命财务报表 financial statements9.余额递减法13 reducing balance method 资产负债表 The Statement of Financial Position账14 net book value=carrying 面价值10.利润表valueThe statement ofcomprehensive income置产资定固15 处fixed disposal of11.asset所有者权益变动表The statement ofchange in equity16 固定资产清理 disposal account第十一章研究性支出17 research cost1.18 现金流量表 The statement of cash development cost开发性支出flowindefinite useful 不确定使用寿命192.经营活动 operating activities3.投资活动 investing activities4.筹资活动 financing activities5.直接法 The direct method6.间接法 indirect method7.付出利息 Interest paid8.付出所得税 Income tax paid9.付出红利 Dividends paid第十二章1.资产负债表日后事项 Events after thereporting period2.调整事项 adjusting event3.非调整事项 Non-adjustingevent第十三章1.会计政策 Accounting policyAccounting Estimate 会计估计2.。

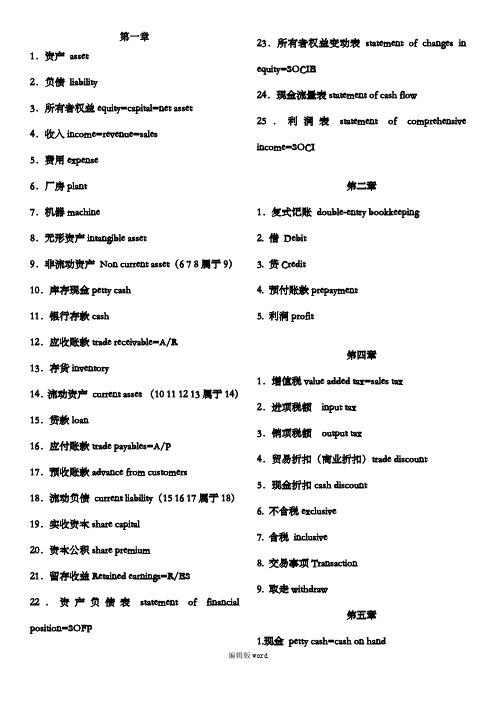

第一章1.资产asset2.负债liability3.所有者权益equity=capital=net asset4.收入income=revenue=sales5.费用expense6.厂房plant7.机器machine8.无形资产intangible asset9.非流动资产Non current asset(6 7 8属于9)10.库存现金petty cash11.银行存款cash12.应收账款trade receivable=A/R13.存货inventory14.流动资产current asset (10 11 12 13属于14)15.贷款loan16.应付账款trade payables=A/P17.预收账款advance from customers18.流动负债current liability(15 16 17属于18)19.实收资本share capital20.资本公积share premium21.留存收益Retained earnings=R/ES22.资产负债表statement of financial position=SOFP 23.所有者权益变动表statement of changes in equity=SOCIE24.现金流量表statement of cash flow25.利润表statement of comprehensive income=SOCI第二章1.复式记账double-entry bookkeeping2. 借Debit3. 贷Credit4. 预付账款prepayment5. 利润profit第四章1.增值税value added tax=sales tax2.进项税额input tax3.销项税额output tax4.贸易折扣(商业折扣)trade discount5.现金折扣cash discount6. 不含税exclusive7. 含税inclusive8. 交易事项Transaction9. 取走withdraw第五章1.现金petty cash=cash on hand2.支票cheque3.自动转账standing order/direct debt4.银行给你存款利息bank interest on deposit5.银行收取利息手续费bank charges6.银行收取利息bank interest on overdraft7.空头支票dishonored cheque8.未结清的款项,别人给我的uncleared lodgement9.未承兑的汇票unpresent cheque10.别人给我支票undrawn cheque11.公司业务错误business error12.银行业务错误bank error13.银行存款余额调节表bank reconciliation14.银行透支overdraft15.银行对账单bank statement16.现金账簿/银行存款日记账cash book17.总账control accounts =general ledger18.明细账individual ledger =personal ledger=subsidiary ledger=memo account19.应收账款总账receivable control account =receivable general ledger20.应收账款明细账receivable ledger=sales ledger21.坏账bad debt=irrecoverable debt22.毛利润gross profit23.一般性坏账准备general allowance 24.特殊性坏账准备specific allowance25.可疑的坏账doubtful debt25.资产减值损失expense-bad debts written off26.坏账准备allowance for A/R第六章1 存货inventory2 先进先出first in first out3 特殊计价法specific identification4 加权平均法period average=weighted average5 移动加权平均法continuous average=continuous weighted average cost method=moving weighted average method6 成本historical cost7 可变现净值net realizable value8 资产减值损失-计提的存货跌价准备expense-inventory written-down9 永续盘存制perpetual inventory system10 实地盘存制periodic inventory system11 购货purchase12 数量quantity13 单价unit cost14 毛利润率gross profit margin第七章1 买价original purchase price2 场地准备费cost of site preparation3 运输费delivery and handling4 安装费installation5 员工培训费employee training6资本化后续支出capital expenditure7 费用化后续支出revenue expenditure8 直线法straight line method9 累计折旧accumulated depreciation10 原值original cost11 预计净残值estimated residual value12 预计使用寿命useful life13 余额递减法reducing balance method14 账面价值net book value=carrying value15 固定资产处置disposal of fixed asset16 固定资产清理disposal account17 研究性支出research cost18 开发性支出development cost19 不确定使用寿命indefinite useful life20 确定使用寿命finite useful life21累计摊销accumulated amortization22 每年的折旧depreciation for each year第八章1或有事项contingencies2.或有负债contingent liabilities3.现时义务present obligation4.或有资产contingent assets5.肯定的certain6.可能的probable7.或许的possible8.遥远的,渺茫的Remote9.预计负债provision第九章1.试算平衡trial Balance2.交易发生transaction occur3.复式记账Double entry4.结账Balance off5.期末调整Year End Adjustment6.错误Errors7.遗漏omission8.任命错误commission errors9.原则性错误errors of principle10.加总错误casting errors11.暂记账户suspense account第十章1.预付账款prepayment2.预提费用accruals3.其他应收款other receivable4.递延收入Deferred income5.到期expire6.欠款arrear7.租客Tenant8.财务报表financial statements9.资产负债表The Statement of Financial Position10.利润表The statement of comprehensive income11.所有者权益变动表The statement of change in equity第十一章1.现金流量表The statement of cash flow2.经营活动operating activities3.投资活动investing activities4.筹资活动financing activities5.直接法The direct method6.间接法indirect method7.付出利息Interest paid8.付出所得税Income tax paid9.付出红利Dividends paid第十二章1.资产负债表日后事项Events after the reporting period2.调整事项adjusting event3.非调整事项Non-adjusting event第十三章1.会计政策Accounting policy2.会计估计Accounting Estimate(此文档部分内容来源于网络,如有侵权请告知删除,文档可自行编辑修改内容,供参考,感谢您的配合和支持)。

acca中英文对照表ACCA(Association of Chartered Certified Accountants,特许公认会计师公会)是国际上具有影响力的财会职业会员组织。

以下是ACCA中英文对照表:1. 铂金级(Platinum Level)2. 金牌级(Gold Level)3. 银牌级(Silver Level)4. 考试(Exam)5. 论文(Paper)6. 知识模块(Knowledge Module)7. 技能模块(Skills Module)8. 战略商业领导力模块(Strategic Business Leadership Module)9. 应用知识(Applied Knowledge)10. 应用技能(Applied Skills)11. 核心领域(Core Area)12. 选修领域(Elective Area)13. 战略财务管理(Strategic Financial Management)14. 业绩管理(Performance Management)15. 财务报告(Financial Reporting)16. 企业与法律环境(Business and the Legal Environment)17. 审计与鉴证业务(Audit and Assurance)18. 税收管理(Taxation)19. 企业社会责任(Corporate Social Responsibility)20. 财务策划与咨询(Financial Planning and Consultancy)21. 企业金融(Corporate Finance)22. 风险管理与内部控制(Risk Management and Internal Control)23. 营销与沟通(Marketing and Communication)24. 人力资源管理(Human Resource Management)25. 业务分析与决策(Business Analysis and Decision Making)。

ACCA考试知识点总结:F3易混词汇列举ACCA考试科目中,F3阶段的词汇是非常多的。

并且,有些词汇无论是意思还比较的相近。

为了重点区分这些词,中公财经小编在这里就给大家简单列举了以下;owed to vs owed fromowed to后面跟的是债主,是应该收钱的人;owed from后面跟的是欠钱的人;e.g.He owed money to many people;the number was probably in the thousands.Thousands of people were owed money from him.他欠了很多人的钱,他的债主可能有几千人。

due to vs due fromdue to后面跟的是债主,是应该收钱的人;due from后面跟的是欠钱的人;e.g.Have they been paid the money due to them?Have they been paid the money due from others?他们是否已经得到了别人欠他们的钱?F3中的due to还有“因为、由于”的意思,表示要寻找原因。

Du e to some errors,the total amount of the trial balance’s debit side was not equaled to the credit side.mark up on costvsmark up on sales pricee.g.1)A sold goods to B at a price of$10,000.The profit mark-up was 40%on the sales prices.mark up on sales price意味着sales=100%,profit=40%,cost=100%-40%=60%所以sales=10,000,profit=40%*10,000=4,000,cost=60%*10,000=6,0002)A sold goods to B at a price of$10,000.The profit mark-up was 40%on the cost.mark up on cost意味着cost=100%,profit=40%,sales=cost+profit=140%所以sales=10,000,cost=10,000*100%/140%=7143,profit=10,000*40%/140%=2857Invoice vs receiptsInvoice是发票,是卖方用来提醒买方所须付的金额;receipt是收据,也是卖方给买方的。

ACCA ACCA 特许公认会计师公会F3-Financial Accountting主讲老师:Martin Wang一、课程介绍总共26章,财务会计的入门课程,全面讲解财务会计的理念与基础知识。

后续课程有F7&P2。

一、课程介绍二、考试介绍时间:2014年6月10日下午15点考试:2小时形式:全英文,选择题(每题2分),50分及格 2013年12月考试通过率:57%备考时间:14周授课计划:6+2复习计划:。

三、学习方法建议1、课后复习2、相关习题3、制定好学习及复习计划,打好基础,前紧后松不慌张。

4、考前模拟,练好考试状态;考试时仔细审题章节目录CONTENTS PAGE02 The main financial statements 03 Nature of FR Chapter1 Context & purposes of FR01 The purpose of financial reporting04 Users 05 Governance一、学习目标•Define financial reporting and understand the nature, principles and scope of financial reporting.•Identify and define the different business entities of: sole trader, partnership and limited liability company and recognise the legal differences between them. •Identify the advantages and disadvantages of operating as each of the three types of business entity.•Identify the users of financial statements and state and differentiate between their information needs.•Understand and identify the purpose of each of the main financial statements. •Define and identify assets, liabilities, equity, revenue and expenses.一、学习目标(Continued)•Explain what is meant by governance specifically in the context of the preparation of financial statements.•Describe the duties and responsibilities of directors and other parties covering the preparation of financial statements.二、知识结构第1章What is a business?•A business of whatever size or nature exist to make a profit.Types of business entity•Sole traders – refers to ownership, sole traders can have employees •Partnerships– two or more people working together to earn profits •Limited liability company – owners have liability limited to the amount they pay for their shares•A limited liability company has a separate legal identity from its owners. •Advantages and disadvantages of the above types of businesses.•Financial reporting is a way of recording, analysing and summarising financial data.•Financial data is the name given to the actual transactions carried out by a business eg sales of goods.•Financial data is recorded in the book's of prime entry. •Transactions are analysed in the books of prime entry and the totals are posted to the ledger accounts.•The transactions are summarised in the financial statements.认识财务报表:资产负债表认识财务报表:利润表•Asset = Liability + Equity•Sales revenue – Cost= Profit•Closing equity=opening equity+sales-cost(expense) •Asset+cost(expense)=Liability + Equity+sales•The statement of financial position is a list of all the assets owned and all the liabilities owed by a business at a particular date.•An asset is a resource controlled by an entity as a result of past events and from which future economic benefits are expected to flow to the entity.•A liability is a present obligation of the entity arising from past events, the settlement of which is expected to result in an outflow from the entity of resources embodying economic benefits.•Equity is the residual interest in the assets of the entity after deducting all its liabilities.—Always headed ‘as at’, for the date of the statement of financial position.—Non-current assets - assets held and used in the business over the long-term (i.e. more than one year).—Current assets - not non-current assets! Conventionally listed in increasing order of liquidity (i.e. closeness of assets to cash).The statement of financial position is a snapshot of the business at one point in time.•An income statement is a record of income generated and expenditure incurred over a given period.•Income is increases in economic benefits during the accounting period in the form of inflows or enhancements of assets or decreases of liabilities that result in increases in equity, other than those relating to contributions from equity participants.•Expenses are decreases in economic benefits during the accounting period in the form of outflows or depletions of assets or incurrences of liabilities that result in decreases in equity, other than those relating to distributions to equity participants.An income statement for a sole trader will have the following key features:— Headed up with the period for which the income and expenses are being included.— The top part is the trading account which records sales, less cost of sales, to arrive at the gross profit.— Expenses (rent, electricity, wages and salaries etc) are deducted from the gross profit to arrive at the profit for the year.Profit is the excess of total income over total expenditure.Users of Financial Statements •Managers of the company •Shareholders of the company •Trade contacts•Providers of finance to the company •Taxation authorities •Employees of the company •Financial analysts and advisors •Government and their agencies •The publicFinancial accounting and management accounting•Financial accounting and management accounting are different: •Financial Accounting is mainly a method of reporting the financial performance and financial position of a business.•Management Accounting is a mgt info sys which analyses data to provide info asa basis for managerial action.GovernanceThe system by which companies and other entities are directed and controlled .DirectorsMain aim – to create wealth for shareholders.Have a duty of care to show reasonable competence; may have to indemnify the company against loss caused by their negligence.Are in a fiduciary position in relation to the company which means that they must act honestly in what they consider to be the best interests of the company and in good faith.Are responsible for the preparation of the financial statements of the company.让我们一起为明天拼搏……感谢您选择高顿财经. 本章结束!。

A C C A F3中英文单词对照表第一章1.资产 asset2.负债 liability3.所有者权益equity=capital=net asset 4.收入income=revenue=sales5.费用expense6.厂房plant7.机器machine8.无形资产intangible asset9.非流动资产 Non current asset(6 7 8属于9)10.库存现金petty cash11.银行存款cash12.应收账款trade receivable=A/R13.存货inventory14.流动资产 current asset (10 11 12 13属于14)15.贷款loan16.应付账款trade payables=A/P17.预收账款advance from customers 18.流动负债 current liability(15 16 17属于18)19.实收资本share capital 20.资本公积share premium21.留存收益Retained earnings=R/ES 22.资产负债表statement of financial position=SOFP23.所有者权益变动表statement of changes in equity=SOCIE24.现金流量表statement of cash flow 25.利润表statement of comprehensive income=SOCI第二章1.复式记账 double-entry bookkeeping2. 借 Debit3. 贷Credit4. 预付账款prepayment5. 利润profit第四章1.增值税value added tax=sales tax2.进项税额 input tax3.销项税额 output tax4.贸易折扣(商业折扣)trade discount 5.现金折扣cash discount6. 不含税exclusive7. 含税 inclusive8. 交易事项Transaction9. 取走withdraw第五章1.现金 petty cash=cash on hand2.支票 cheque3.自动转账 standing order/direct debt4.银行给你存款利息 bank interest on deposit5.银行收取利息手续费 bank charges6.银行收取利息 bank interest on overdraft7.空头支票 dishonored cheque8.未结清的款项,别人给我的 uncleared lodgement9.未承兑的汇票 unpresent cheque10.别人给我支票 undrawn cheque11.公司业务错误 business error12.银行业务错误 bank error13.银行存款余额调节表 bank reconciliation14.银行透支 overdraft15.银行对账单 bank statement16.现金账簿/银行存款日记账 cash book17.总账 control accounts =general ledger18.明细账 individual ledger =personal ledger=subsidiary ledger=memo account 19.应收账款总账 receivable control account =receivable general ledger 20.应收账款明细账receivable ledger=sales ledger21.坏账 bad debt=irrecoverable debt22.毛利润 gross profit23.一般性坏账准备 general allowance24.特殊性坏账准备 specific allowance25.可疑的坏账doubtful debt25.资产减值损失 expense-bad debts written off26.坏账准备 allowance for A/R第六章1 存货inventory2 先进先出 first in first out3 特殊计价法 specific identification4 加权平均法 period average=weighted average5 移动加权平均法 continuousaverage=continuous weighted average cost method=moving weighted average method6 成本 historical cost7 可变现净值 net realizable value8 资产减值损失-计提的存货跌价准备 expense-inventory written-down9 永续盘存制 perpetual inventory system10 实地盘存制 periodic inventory system11 购货 purchase12 数量 quantity13 单价 unit cost14 毛利润率 gross profit margin第七章1 买价 original purchase price2 场地准备费 cost of site preparation3 运输费 delivery and handling4 安装费 installation5 员工培训费 employee training6资本化后续支出 capital expenditure7 费用化后续支出revenue expenditure8 直线法 straight line method9 累计折旧 accumulated depreciation10 原值 original cost11 预计净残值 estimated residual value12 预计使用寿命 useful life13 余额递减法 reducing balance method14 账面价值 net book value=carrying value15 固定资产处置 disposal of fixed asset16 固定资产清理 disposal account17 研究性支出 research cost18 开发性支出 development cost19 不确定使用寿命 indefinite useful life20 确定使用寿命 finite useful life 21累计摊销 accumulated amortization 22 每年的折旧 depreciation for each year第八章1或有事项 contingencies2.或有负债 contingent liabilities3.现时义务 present obligation4.或有资产 contingent assets5.肯定的 certain6.可能的 probable7.或许的 possible8.遥远的,渺茫的 Remote9.预计负债 provision第九章1.试算平衡 trial Balance2.交易发生 transaction occur3.复式记账 Double entry4.结账 Balance off5.期末调整 Year End Adjustment6.错误 Errors7.遗漏 omission8.任命错误 commission errors9.原则性错误 errors of principle10.加总错误 casting errors11.暂记账户 suspense account第十章1.预付账款 prepayment2.预提费用 accruals3.其他应收款 other receivable4.递延收入 Deferred income5.到期 expire6.欠款 arrear7.租客 Tenant8.财务报表 financial statements9.资产负债表 The Statement of Financial Position10.利润表 The statement of comprehensive income11.所有者权益变动表The statement of change in equity第十一章1.现金流量表 The statement of cash flow2.经营活动 operating activities3.投资活动 investing activities4.筹资活动 financing activities5.直接法 The direct method6.间接法 indirect method7.付出利息 Interest paid8.付出所得税 Income tax paid9.付出红利 Dividends paid第十二章1.资产负债表日后事项 Events after the reporting period2.调整事项 adjusting event3.非调整事项 Non-adjusting event第十三章1.会计政策 Accounting policy2.会计估计 Accounting Estimate。