金融英语第八章答案

- 格式:doc

- 大小:44.50 KB

- 文档页数:5

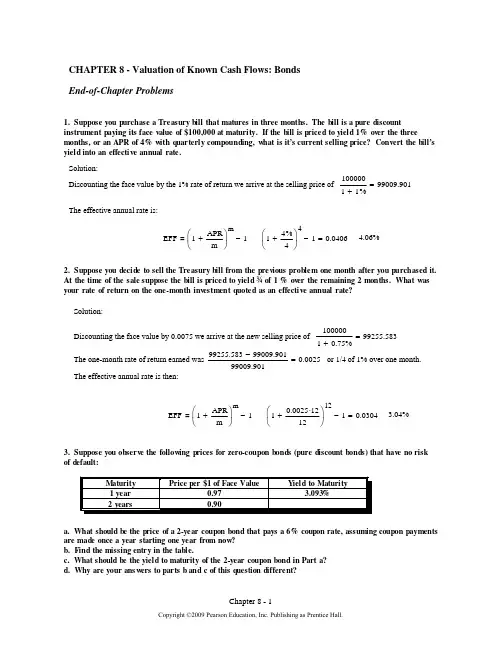

CHAPTER 8VALUATION OF KNOWN CASH FLOWS: BONDSObjectivesTo show how to value contracts and securities that promise a stream of cash flows that are known with certainty.To understand the shape of the yield curve .To understand how bond prices and yields change over time.OutlineUsing Present Value Formulas to Value Known Cash FlowsThe Basic Building Blocks: Pure Discount BondsCoupon Bonds, Current Yield, and Yield to MaturityReading Bond ListingsWhy Yields for the Same Maturity DifferThe Behavior of Bond Prices over TimeSummaryA change in market interest rates causes a change in the opposite direction in the market values of all existing contracts promising fixed payments in the future.The market prices of $1 to be received at every possible date in the future are the basic building blocks for valuing all other streams of known cash flows. These prices are inferred from the observed market prices of traded bonds and then applied to other streams of known cash flows to value them.An equivalent valuation can be carried out by applying a discounted cash flow formula with a different discount rate for each future time period.Differences in the prices of fixed-income securities of a given maturity arise from differences in coupon rates, default risk, tax treatment, callability, convertibility, and other features.Over time the prices of bonds converge towards their face value. Before maturity, however, bond prices can fluctuate a great deal as a result of changes in market interest rates.Solutions to Problems at End of ChapterBond Valuation with a Flat Term Structure1. Suppose you want to know the price of a 10-year 7% coupon Treasury bond that pays interestannually.a. You have been told that the yield to maturity is 8%. What is the price?b. What is the price if coupons are paid semiannually, and the yield to maturity is 8% per year?c. Now you have been told that the yield to maturity is 7% per year. What is the price? Could youhave guessed the answer without calculating it? What if coupons are paid semiannually?SOLUTION:a. With coupons paid once a year:b. With coupons paid twice a year:c. Price = 100. When the coupon rate and yield to maturity are the same, the bond sells at par value . theprice equals the face value of the bond).2. Assume six months ago the US Treasury yield curve was flat at a rate of 4% per year (with annual compounding) and you bought a 30-year US Treasury bond. Today it is flat at a rate of 5% per year. What rate of return did you earn on your initial investment:a.If the bond was a 4% coupon bond?b.If the bond was a zero coupon bond?c.How do your answer change if compounding is semiannual?SOLUTION:a and b.Step 1: Find prices of the bonds six months ago:n i PV FV PMT Result304?1004PV =100 Coupon =4%Zero304?1000PV = couponStep 2: Find prices of the bonds today:n i PV FV PMT Result Coupon =5?1004 4%Zero5?1000 couponStep 3: Find rates of return:Rate of return = (coupon + change in price)/initial price4% coupon bond: r = (4 + 100)/100 = or %Zero-coupon bond: r = (0 + / = or %. Note that the zero-coupon bond is more sensitive to yield changes than the 4% coupon bond.c.Step 1: Find prices of the bonds six months ago:n i PV FV PMT Result Coupon=4602?1002PV =100 %Zero602?1000PV = couponStep 2: Find prices of the bonds today:n i PV FV PMT Result59?1002 Coupon=4%Zero59?1000 couponStep 3: Find rates of return:Rate of return = (coupon + change in price) / initial price4% coupon bond: r= (2 + 100)/100 = or %Zero coupon bond: r= (0 + / = or %. Note that the zero-coupon bond is more sensitive to yield changes than the 4% coupon bond.Bond Valuation With a Non-Flat Term Structure3. Suppose you observe the following prices for zero-coupon bonds (pure discount bonds) that have no risk of default:Maturity Price per $1 of Face Value Yield to Maturity1 year%2 yearsa.What should be the price of a 2-year coupon bond that pays a 6% coupon rate, assuming couponpayments are made once a year starting one year from now?b.Find the missing entry in the table.c.What should be the yield to maturity of the 2-year coupon bond in Part a?d.Why are your answers to parts b and c of this question different?SOLUTION:a. Present value of first year's cash flow = 6 x .97 =Present value of second year's cash flow = 106 x .90 =Total present value =b. The yield to maturity on a 2-year zero coupon bond with price of 90 and face value of 100 is %c. The yield to maturity on a 2-year 6% coupon bond with price of isto maturity.Coupon Stripping4. You would like to create a 2-year synthetic zero-coupon bond. Assume you are aware of the following information: 1-year zero- coupon bonds are trading for $ per dollar of face value and 2-year 7% coupon bonds (annual payments) are selling at $ (Face value = $1,000).a. What are the two cash flows from the 2-year coupon bond?b. Assume you can purchase the 2-year coupon bond and unbundle the two cash flows and sell them.i. How much will you receive from the sale of the first payment?ii. How much do you need to receive from the sale of the 2-year Treasury strip to break even?SOLUTION:a. $70 at the end of the first year and $1070 at the end of year 2.b. i. I would receive .93 x $70 = $ from the sale of the first payment.ii. To break even, I would need to receive $ $ = $ from the sale of the 2-year strip.The Law of One price and Bond Pricing5. Assume that all of the bonds listed in the following table are the same except for their pattern of promised cash flows over time. Prices are quoted per $1 of face value. Use the information in the table and the Law of One Price to infer the values of the missing entries. Assume that coupon payments are annual.SOLUTION:Bond 1:From Bond 1 and Bond 4, we can get the missing entries for the 2-year zero-coupon bond. We know from bond 1 that:= +2. This is also equal to (1+z 1) + (1+z 2)2 where z 1 and z 2 are the yields to maturity on one-year zero-coupon and two-year zero-coupon bonds respectively. From bond 4 , we have z 1, we can find z 2.– = (1+z 2)2, hence z 2 = %.To get the price P per $1 face value of the 2-year zero-coupon bond, using the same reasoning: – = , hence P =To find the entries for bond 3: first find the price, then the yield to maturity. To find the price, we can use z 1 and z 2 found earlier:PV of coupon payment in year 1: x =PV of coupon + principal payments in year 2: x = Total present value of bond 3 =Hence the table becomes:Bond Features and Bond Valuation6. What effect would adding the following features have on the market price of a similar bond which does not have this feature?a.10-year bond is callable by the company after 5 years (compare to a 10-year non-callable bond);b.bond is convertible into 10 shares of common stock at any time (compare to a non-convertiblebond);c.10-year bond can be “put back” to the company after 3 years at par (puttable bond) (compare toa 10-year non-puttable bond)d.25-year bond has tax-exempt coupon paymentsSOLUTION:a.The callable bond would have a lower price than the non-callable bond to compensate thebondholders for granting the issuer the right to call the bonds.b.The convertible bond would have a higher price because it gives the bondholders the right to converttheir bonds into shares of stock.c.The puttable bond would have a higher price because it gives the bondholders the right to sell theirbonds back to the issuer at par.d.The bond with the tax-exempt coupon has a higher price because the bondholder is exempted frompaying taxes on the coupons. (Coupons are usually considered and taxed as personal income).Inferring the Value of a Bond Guarantee7. Suppose that the yield curve on dollar bonds that are free of the risk of default is flat at 6% per year. A 2-year 10% coupon bond (with annual coupons and $1,000 face value) issued by Dafolto Corporation is rates B, and it is currently trading at a market price of $918. Aside from its risk of default, the Dafolto bond has no other financially significant features. How much should an investor be willing to pay for a guarantee against Dafolto’s defaulting on this bond?SOLUTION:If the bond was free of the risk of default, its yield would be 6%.the value of a guarantee against default: = $The implied Value of a Call Provision and Convertibility8. Suppose that the yield curve on bonds that are free of the risk of default is flat at 5% per year. A 20-year default-free coupon bond (with annual coupons and $1,000 face value) that becomes callable after 10 years is trading at par and has a coupon rate of %.a.What is the implied value of the call provision?b. A Safeco Corporation bond which is otherwise identical to the callable % coupon bond describedabove, is also convertible into 10 shares of Safeco stock at any time up to the bond’s maturity. If its yield to maturity is currently % per year, what is the implied value of the conversion feature?SOLUTION:a.We have to find the price of the bond if it were only free of the risk of default.is the implied value of the call provision: – 1000 = $Note that the call provision decreases the value of the bond.b.We have to find the price of the Safeco Corporation:This bond has the same features as the % default free callable bond described above, plus an additional feature: it is convertible into stocks. Hence the implied value of the conversion feature is the difference between the values of both bonds: = $. Note that the conversion feature increases the value of the bond.Changes in Interest Rates and Bond Prices9. All else being equal, if interest rates rise along the entire yield curve, you should expect that:i. Bond prices will fallii. Bond prices will riseiii. Prices on long-term bonds will fall more than prices on short-term bonds.iv. Prices on long-term bonds will rise more than prices on short-term bondsa. ii and iv are correctb. We can’t be certain that prices will changec. Only i is correctd. Only ii is correcte. i and iii are correctSOLUTION:The correct answer is e.Bond prices are inversely proportional to yields hence when yields increase, bond prices fall. Long-term bonds are more sensitive to yield changes than short-term bonds.。

金融专业英语函电写作(答案)第一章第一节I.1. Interna tional Busines s Dept.The Export-ImportBank of ChinaNo. 77, Beiheya n Street, Dongche ng Distric tBeijing 100009ChinaPhone: (8610) 64099988 Telex: 210202EXIM CNFax: (8610) 64005186 SWIFT:EIBCCNB JWebsite: http://www.eximban 2. Policyand Regulat ion Departm entBeijing Municip al Develop ment and Restruc turing Commiss ionNo. 2D, Fuxingm en Neidaji e,Beijing 100031China3. ExportDepartm entJiangxi HuacaiImport& ExportCorpora tion6/F Foreign Trade Buildin g66 ZhanboRoad, Nangcha ng 330000Jiangxi, China4. CreditManagem ent Departm entBank of China410 Fucheng men Neidaji eBeijing 100818P. R. China5. ImportDeparme ntChaoyan g Chemica ls Company23 RenminRoad, HaidianBeijing 100083, P. R. China6.中国建设银行海口市沿江三路分理处7.中国河南南阳市七一路129号,中国银行南阳分行8.邮编100020,中国北京市朝阳区雅宝路8号,中国银行北京分行II.1.Thank you for your letterof Decembe r 9,2010.2.We have receive d with thanksyour letterdated Decembe r 25,2010.3.Pleasei nformus of…4.We shall appreci ate it very much if you would let us know…5.This is in reply to your letterdated…regardi ng…6.In response to your letter ref…of…,we wish to informyou that…7.We refer to the above demanddraft and informyou that…8.In complia n ce with the request in your letterof…,we are pleased to…9.We regret to informyou that…10.As request ed in your letterdated…,we…11.就…日贵行来函之事,现答复如下。

“高职高专商务英语专业规划教材”Unit 1 Financial Market Research练习参考答案I.Read through the text and answer the following questions.1.A financial market is a mechanism that allows people to easily buy andsell (trade) financial securities (such as stocks and bonds), commodities (such as precious metals or agricultural goods), and other fungible items of value at low transaction costs and at prices that reflect the efficient-market hypothesis.2.The raising of capital ;the transfer of risk and international trade3.Capital markets,commodity markets,money markets, derivative markets,insurance markets and foreign exchange markets .4.Financial markets fit in the relationship between lenders andborrowers.5.Individuals, companies, governments, municipalities and publiccorporations.II. Paraphrase the following expressions or abbreviations and translate them into ChineseCheck the answers from the Special Term Lists.III. Fill in the blanks with the proper wordsThe global financial crisis, brewing for a while, really started to show its effects in the middle of 2007 and into 2008. Around the world stock markets have fallen, large financial institutions have collapsed or been bought out, and governments in even the wealthiest nations have had to come up with rescue packages to bail out their financial systems.On the one hand many people are concerned that those responsible for the financial problems are the ones being bailed out, while on the other hand, a global financial meltdown will affect the livelihoods of almost everyone in an increasingly inter-connected world. The problem could have been avoided, if ideologues supporting the current economics models weren’t so vocal, influential and inconsiderate of others’ viewpoints and concerns.IV.Translation.1.金融市场包括很多方面,包括资本市场,华尔街,甚至是市场本身。

米什金货币金融学英文版习题答案chapter8英文习题Economics of Money, Banking, and Financial Markets, 11e, Global Edition (Mishkin) Chapter 8 An Economic Analysis of Financial Structure8.1 Basic Facts About Financial Structure Throughout the World1) American businesses get their external funds primarily fromA) bank loans.B) bonds and commercial paper issues.C) stock issues.D) loans from nonbank financial intermediaries.Answer: DAACSB: Analytical Thinking2) Of the sources of external funds for nonfinancial businesses in the United States, loans from banks and other financial intermediaries account for approximately ________ of the total.A) 6%B) 40%C) 56%D) 60%Answer: CAACSB: Analytical Thinking3) Of the sources of external funds for nonfinancial businesses in the United States, corporate bonds and commercial paper account for approximately ________ of the total.A) 5%B) 10%C) 32%D) 50%Answer: CAACSB: Analytical Thinking4) Of the following sources of external finance for American nonfinancial businesses, the least important isA) loans from banks.B) stocks.C) bonds and commercial paper.D) loans from other financial intermediaries.Answer: BAACSB: Analytical Thinking5) Of the sources of external funds for nonfinancial businesses in the United States, stocks account for approximately ________ of the total.A) 2%B) 11%C) 20%D) 40%Answer: BAACSB: Analytical Thinking6) Of the four sources of external funding for nonfinancial businesses, the least often used in the U.S. isA) bank loans.B) nonbank loans.C) bonds.D) stock.Answer: DAACSB: Analytical Thinking7) Which of the following statements concerning externalsources of financing for nonfinancial businesses in the United States are TRUE?A) Stocks are a far more important source of finance than are bonds.B) Stocks and bonds, combined, supply less than one-half of the external funds.C) Financial intermediaries are the least important source of external funds for businesses.D) Since 1970, more than half of the new issues of stock have been sold to American households.Answer: BAACSB: Reflective Thinking8) Which of the following statements concerning external sources of financing for nonfinancial businesses in the United States are TRUE?A) Issuing marketable securities is the primary way that they finance their activities.B) Bonds are the least important source of external funds to finance their activities.C) Stocks are a relatively unimportant source of finance for their activities.D) Selling bonds directly to the American household is a major source of funding for American businesses.Answer: CAACSB: Reflective Thinking9) With regard to external sources of financing for nonfinancial businesses in the United States, which of the following are accurate statements?A) Marketable securities account for a larger share of external business financing in the United States than in Germany andJapan.B) Since 1970, most of the newly issued corporate bonds and commercial paper have been sold directly to American households.C) Direct finance accounts for more than 50 percent of the external financing of American businesses.D) Smaller businesses almost always raise funds by issuing marketable securities.Answer: AAACSB: Reflective Thinking10) Nonfinancial businesses in Germany, Japan, and Canada raise most of their fundsA) by issuing stock.B) by issuing bonds.C) from nonbank loans.D) from bank loans.Answer: DAACSB: Application of Knowledge11) As a source of funds for nonfinancial businesses, stocks are relatively more important inA) the United States.B) Germany.C) Japan.D) Canada.Answer: DAACSB: Application of Knowledge12) Direct finance involves the sale to ________ of marketable securities such as stocks and bonds.A) householdsB) insurance companiesC) pension fundsD) financial intermediariesAnswer: AAACSB: Application of Knowledge13) Regulation of the financial systemA) occurs only in the United States.B) protects the jobs of employees of financial institutions.C) protects the wealth of owners of financial institutions.D) ensures the stability of the financial system.Answer: DAACSB: Reflective Thinking14) One purpose of regulation of financial markets is toA) limit the profits of financial institutions.B) increase competition among financial institutions.C) promote the provision of information to shareholders, depositors and the public.D) guarantee that the maximum rates of interest are paid on deposits.Answer: CAACSB: Reflective Thinking15) Property that is pledged to the lender in the event that a borrower cannot make his or her debt payment is calledA) collateral.B) points.C) interest.D) good faith money.Answer: AAACSB: Application of Knowledge16) Collateralized debt is also know asA) unsecured debt.B) secured debt.C) unrestricted debt.D) promissory debt.Answer: BAACSB: Application of Knowledge17) Credit card debt isA) secured debt.B) unsecured debt.C) restricted debt.D) unrestricted debt.Answer: BAACSB: Application of Knowledge18) The predominant form of household debt isA) consumer installment debt.B) collateralized debt.C) unsecured debt.D) unrestricted debt.Answer: BAACSB: Analytical Thinking19) If you default on your auto loan, your car will be repossessed because it has been pledged as ________ for the loan.A) interestB) collateralC) dividendD) commodityAnswer: BAACSB: Analytical Thinking20) Commercial and farm mortgages, in which property is pledged as collateral, account forA) one-quarter of borrowing by nonfinancial businesses.B) one-half of borrowing by nonfinancial businesses.C) one-twentieth of borrowing by nonfinancial businesses.D) two-thirds of borrowing by nonfinancial businesses.Answer: AAACSB: Application of Knowledge21) A ________ is a provision that restricts or specifies certain activities that a borrower can engage in.A) residual claimantB) risk hedgeC) restrictive barrierD) restrictive covenantAnswer: DAACSB: Application of Knowledge22) A clause in a mortgage loan contract requiring the borrower to purchase homeowner's insurance is an example of aA) proscriptive covenant.B) prescriptive covenant.C) restrictive covenant.D) constraint-imposed covenant.Answer: CAACSB: Application of Knowledge23) Which of the following is NOT one of the eight basic puzzles about financial structure?A) Stocks are the most important source of finance for American businesses.B) Issuing marketable securities is not the primary way businesses finance their operations.C) Indirect finance, which involves the activities of financial intermediaries, is many times more important than direct finance, in which businesses raise funds directly from lenders in financialmarkets.D) Banks are the most important source of external funds to finance businesses.Answer: AAACSB: Reflective Thinking24) Which of the following is NOT one of the eight basic puzzles about financial structure?A) Debt contracts are typically extremely complicated legal documents that place substantial restrictions on the behavior of the borrower.B) Indirect finance, which involves the activities of financial intermediaries, is many times more important than direct finance, in which businesses raise funds directly from lenders in financial markets.C) Collateral is a prevalent feature of debt contracts for both households and business.D) There is very little regulation of the financial system.Answer: DAACSB: Reflective Thinking8.2 Transaction Costs1) The current structure of financial markets can be best understood as the result of attempts by financial market participants toA) adapt to continually changing government regulations.B) deal with the great number of small firms in the United States.C) reduce transaction costs.D) cartelize the provision of financial services.Answer: CAACSB: Reflective Thinking2) The reduction in transactions costs per dollar of investment as the size of transactions increases isA) discounting.B) economies of scale.C) economies of trade.D) diversification.Answer: BAACSB: Application of Knowledge3) By bundling share purchases of many investors together mutual funds can take advantage of economies of scale and thereby lowerA) adverse selection.B) moral hazard.C) transactions costs.D) diversification.Answer: CAACSB: Analytical Thinking4) Which of the following is NOT a benefit to an individual purchasing a mutual fund?A) reduced riskB) lower transactions costsC) free-ridingD) diversificationAnswer: CAACSB: Analytical Thinking5) Financial intermediaries develop ________ in things such as computer technology whichallows them to lower transactions costs.A) expertiseB) diversificationC) regulationsD) equityAnswer: AAACSB: Information Technology6) Financial intermediaries' low transaction costs allow them to provide ________ services that make it easier for customers to conduct transactions.A) liquidityB) conductionC) transcendentalD) equitableAnswer: AAACSB: Reflective Thinking7) How does a mutual fund lower transactions costs through economies of scale?Answer: The mutual fund takes the funds of the individuals who have purchased shares and uses them to purchase bonds or stocks. Because the mutual fund will be purchasing large blocks of stocks or bonds they will be able to obtain them at lower transactions costs than the individual purchases of smaller amounts could.AACSB: Reflective Thinking8.3 Asymmetric Information: Adverse Selection and Moral Hazard1) A borrower who takes out a loan usually has better information about the potential returns and risk of the investment projects he plans to undertake than does the lender. This inequality of information is calledA) moral hazard.B) asymmetric information.C) noncollateralized risk.D) adverse selection.Answer: BAACSB: Reflective Thinking2) The presence of ________ in financial markets leads to adverse selection and moral hazard problems that interfere with the efficient functioning of financial markets.A) noncollateralized riskB) free-ridingC) asymmetric informationD) costly state verificationAnswer: CAACSB: Analytical Thinking3) The problem created by asymmetric information before the transaction occurs is called________, while the problem created after the transaction occurs is called ________.A) adverse selection; moral hazardB) moral hazard; adverse selectionC) costly state verification; free-ridingD) free-riding; costly state verificationAnswer: AAACSB: Application of Knowledge4) If bad credit risks are the ones who most actively seek loans then financial intermediaries face the problem ofA) moral hazard.B) adverse selection.C) free-riding.D) costly state verification.Answer: BAACSB: Reflective Thinking5) The problem faced by the lender that the borrower may take on additional risk after receiving the loan is calledA) adverse selection.B) moral hazard.C) transactions costs.D) diversification.Answer: BAACSB: Analytical Thinking6) An example of the ________ problem would be if Brian borrowed money from Sean in order to purchase a used car and instead took a trip to Atlantic City using those funds.A) moral hazardB) adverse selectionC) costly state verificationD) agencyAnswer: AAACSB: Ethical understanding and reasoning abilities7) The analysis of how asymmetric information problems affect economic behavior is called________ theory.A) unevenB) parallelC) principalD) agencyAnswer: DAACSB: Application of Knowledge8.4 The Lemons Problem: How Adverse Selection Influences Financial Structure1) The "lemons problem" exists because ofA) transactions costs.B) economies of scale.C) rational expectations.D) asymmetric information.Answer: DAACSB: Application of Knowledge2) Because of the "lemons problem" the price a buyer of a used car pays isA) equal to the price of a lemon.B) less than the price of a lemon.C) equal to the price of a peach.D) between the price of a lemon and a peach.Answer: DAACSB: Analytical Thinking3) Adverse selection is a problem associated with equity and debt contracts arising fromA) the lender's relative lack of information about the borrower's potential returns and risks of his investment activities.B) the lender's inability to legally require sufficient collateral to cover a 100% loss if the borrower defaults.C) the borrower's lack of incentive to seek a loan for highly risky investments.D) the lender's inability to restrict the borrower from changing his behavior once given a loan. Answer: AAACSB: Reflective Thinking4) The ________ problem helps to explain why the private production and sale of information cannot eliminate ________.A) free-rider; adverse selectionB) free-rider; moral hazardC) principal-agent; adverse selectionD) principal-agent; moral hazardAnswer: AAACSB: Reflective Thinking5) The free-rider problem occurs becauseA) people who pay for information use it freely.B) people who do not pay for information use it.C) information can never be sold at any price.D) it is never profitable to produce information.Answer: BAACSB: Reflective Thinking6) In the United States, the government agency requiring that firms that sell securities in public markets adhere to standard accounting principles and disclose information about their sales, assets, and earnings is theA) Federal Communications Commission.B) Federal Trade Commission.C) Securities and Exchange Commission.D) Federal Reserve System.Answer: CAACSB: Analytical Thinking7) Government regulations require publicly traded firms to provide information, reducingA) transactions costs.B) the need for diversification.C) the adverse selection problem.D) economies of scale.Answer: CAACSB: Analytical Thinking8) A lesson of the Enron collapse is that government regulationA) always fails.B) can reduce but not eliminate asymmetric information.C) increases the problem of asymmetric information.D) should be reduced.Answer: BAACSB: Reflective Thinking9) That most used cars are sold by intermediaries (i.e., used car dealers) provides evidence that these intermediariesA) have been afforded special government treatment, since used car dealers do not provide information that is valued by consumers of used cars.B) are able to prevent potential competitors from free-riding off the information that they provide.C) have failed to solve adverse selection problems in this market because "lemons" continue to be traded.D) have solved the moral hazard problem by providing valuable information to their customers. Answer: BAACSB: Reflective Thinking10) Analysis of adverse selection indicates that financial intermediaries, especially banksA) have advantages in overcoming the free-rider problem, helping to explain why indirect finance is a more important source of business finance than is direct finance.B) despite their success in overcoming free-rider problems, nevertheless play a minor role in moving funds to corporations.C) provide better-known and larger corporations a higher percentage of their external funds than they do to newer and smaller corporations which rely to a greater extent on the new issues market for funds.D) must buy securities from corporations to diversify the riskthat results from holdingnon-tradable loans.Answer: AAACSB: Reflective Thinking11) The concept of adverse selection helps to explain all of the following EXCEPTA) why firms are more likely to obtain funds from banks and other financial intermediaries, rather than from the securities markets.B) why indirect finance is more important than direct finance as a source of business finance.C) why direct finance is more important than indirect finance as a source of business finance.D) why the financial system is so heavily regulated.Answer: CAACSB: Reflective Thinking12) As information technology improves, the lending role of financial institutions such as banks shouldA) increase somewhat.B) decrease.C) stay the same.D) increase significantly.Answer: BAACSB: Information Technology13) External financing by ________ should be more important in developing countries than in industrialized countries because information about private firms is more difficult to collect in developing countries.A) financial intermediariesB) bondsC) stockD) direct lendingAnswer: AAACSB: Reflective Thinking14) That only large, well-established corporations have access to securities marketsA) explains why indirect finance is such an important source of external funds for businesses.B) can be explained by the problem of moral hazard.C) can be explained by government regulations that prohibit small firms from acquiring funds in securities markets.D) explains why newer and smaller corporations rely so heavily on the new issues market for funds.Answer: AAACSB: Reflective Thinking15) Because of the adverse selection problemA) good credit risks are more likely to seek loans causing lenders to make a disproportionate amount of loans to good credit risks.B) lenders may refuse loans to individuals with high net worth, because of their greater proclivity to "skip town."C) lenders are reluctant to make loans that are not secured by collateral.D) lenders will write debt contracts that restrict certain activities of borrowers.Answer: CAACSB: Reflective Thinking16) Net worth can perform a similar role toA) diversification.B) collateral.C) intermediation.D) economies of scale.Answer: BAACSB: Analytical Thinking17) The problem of adverse selection helps to explainA) why firms are more likely to obtain funds from banks and other financial intermediaries, rather than from securities markets.B) why collateral is an important feature of consumer, but not business, debt contracts.C) why direct finance is more important than indirect finance as a source of business finance.D) why lenders refuse loans to individuals with high net worth.Answer: AAACSB: Reflective Thinking18) The concept of adverse selection helps to explainA) why collateral is not a common feature of many debt contracts.B) why large, well-established corporations find it so difficult to borrow funds in securities markets.C) why financial markets are among the most heavily regulated sectors of the economy.D) why stocks are the most important source of external financing for businesses.Answer: CAACSB: Reflective Thinking19) Tools to help solve the adverse selection problem in financial markets include all of the following EXCEPTA) diversification.B) government regulations to increase information.C) the use of financial intermediaries.D) the private production and sale of information.Answer: AAACSB: Application of Knowledge20) How does collateral help to reduce the adverse selection problem in credit market? Answer: Collateral is property that is promised to the lender if the borrower defaults thus reducing the lender's losses. Lenders are more willing to make loans when there is collateral that can be sold if the borrower defaults.AACSB: Reflective Thinking8.5 How Moral Hazard Affects the Choice Between Debt and Equity Contracts1) Equity contractsA) are claims to a share in the profits and assets of a business.B) have the advantage over debt contracts of a lower costly state verification.C) are used much more frequently to raise capital than are debt contracts.D) are not subject to the moral hazard problem.Answer: AAACSB: Application of Knowledge2) A problem for equity contracts is a particular type of ________ called the ________ problem.A) adverse selection; principal-agentB) moral hazard; principal-agentC) adverse selection; free-riderD) moral hazard; free-riderAnswer: BAACSB: Reflective Thinking3) Moral hazard in equity contracts is known as the ________ problem because the manager of the firm has fewer incentives to maximize profits than the stockholders might ideally prefer.A) principal-agentB) adverse selectionC) free-riderD) debt deflationAnswer: AAACSB: Reflective Thinking4) Managers (________) may act in their own interest rather than in the interest of the stockholder-owners (________) because the managers have less incentive to maximize profits than the stockholder-owners do.A) principals; agentsB) principals; principalsC) agents; agentsD) agents; principalsAnswer: DAACSB: Ethical understanding and reasoning abilities5) The principal-agent problemA) occurs when managers have more incentive to maximize profits than the stockholders-owners do.B) in financial markets helps to explain why equity is a relatively important source of finance for American business.C) would not arise if the owners of the firm had complete information about the activities of the managers.D) explains why direct finance is more important than indirect finance as a source of business finance.Answer: CAACSB: Reflective Thinking6) The principal-agent problem would not occur if ________ ofa firm had complete information about actions of the ________.A) owners; customersB) owners; managersC) managers; customersD) managers; ownersAnswer: BAACSB: Reflective Thinking7) The recent Enron and Tyco scandals are an example ofA) the free-rider problem.B) the adverse selection problem.C) the principal-agent problem.D) the "lemons problem."Answer: CAACSB: Ethical understanding and reasoning abilities8) The name economists give the process by which stockholders gather information by frequent monitoring of the firm's activities isA) costly state verification.B) the free-rider problem.C) costly avoidance.D) debt intermediation.Answer: AAACSB: Application of Knowledge9) Because information is scarceA) helps explain why equity contracts are used so much more frequently to raise capital than are debt contracts.B) monitoring managers gives rise to costly state verification.C) government regulations, such as standard accounting principles, have no impact on problems such as moral hazard.D) developing nations do not rely heavily on banks for business financing.Answer: BAACSB: Reflective Thinking10) Government regulations designed to reduce the moral hazard problem includeA) laws that force firms to adhere to standard accounting principles.B) light sentences for those who commit the fraud of hiding and stealing profits.C) state verification subsidies.D) state licensing restrictions.Answer: AAACSB: Reflective Thinking11) One financial intermediary in our financial structure that helps to reduce the moral hazard from arising from the principal-agent problem is theA) venture capital firm.B) money market mutual fund.C) pawn broker.D) savings and loan association.Answer: AAACSB: Application of Knowledge12) A venture capital firm protects its equity investment from moral hazard through which of the following means?A) It places people on the board of directors to better monitor the borrowing firm's activities.B) It writes contracts that prohibit the sale of an equity investment to the venture capital firm.C) It prohibits the borrowing firm from replacing itsmanagement.D) It requires a 50% stake in the company.Answer: AAACSB: Reflective Thinking13) One way the venture capital firm avoids the free-rider problem is byA) prohibiting the sale of equity in the firm to anyone except the venture capital firm.B) prohibiting members from serving on the board of directors.C) prohibiting the borrowing firm from replacing management.D) requiring collateral equal to the value of the borrowed funds.Answer: AAACSB: Reflective Thinking14) Equity contracts account for a small fraction of external funds raised by American businesses becauseA) costly state verification makes the equity contract less desirable than the debt contract.B) of the reduced scope for moral hazard problems under equity contracts, as compared to debt contracts.C) equity contracts do not permit borrowing firms to raise additional funds by issuing debt.D) there is no moral hazard problem when using a debt contract.Answer: AAACSB: Reflective Thinking15) Debt contractsA) are agreements by the borrowers to pay the lenders fixeddollar amounts at periodic intervals.B) have a higher cost of state verification than equity contracts.C) are used less frequently to raise capital than are equity contracts.D) never result in a loss for the lender.Answer: AAACSB: Application of Knowledge16) Since they require less monitoring of firms, ________ contracts are used more frequently than ________ contracts to raise capital.A) debt; equityB) equity; debtC) debt; loanD) equity; stockAnswer: AAACSB: Reflective Thinking17) Solutions to the moral hazard in equity contracts include all of the following EXCEPTA) government regulations to increase information.B) the use of financial intermediaries.C) the use of debt contracts.D) government ownership of resources.Answer: DAACSB: Application of Knowledge18) Explain the principal-agent problem as it pertains to equity contracts.Answer: The principals are the stockholders who own most of the equity. The agents are the managers of the firm who generally own only a small portion of the firm. The problemoccurs because the agents may not have as much incentive to profit maximize as the stockholders. AACSB: Reflective Thinking8.6 How Moral Hazard Influences Financial Structure in Debt Markets1) Although debt contracts require less monitoring than equity contracts, debt contracts are still subject to ________ since borrowers have an incentive to take on more risk than the lender would like.A) moral hazardB) agency theoryC) diversificationD) the "lemons" problemAnswer: AAACSB: Reflective Thinking2) A debt contract is incentive compatibleA) if the borrower has the incentive to behave in the way that the lender expects and desires, since doing otherwise jeopardizes the borrower's net worth in the business.B) if the borrower's net worth is sufficiently low so that the lender's risk of moral hazard is significantly reduced.C) if the debt contract is treated like an equity.D) if the lender has the incentive to behave in the way that the borrower expects and desires. Answer: AAACSB: Reflective Thinking3) High net worth helps to diminish the problem of moral hazard problem byA) requiring the state to verify the debt contract.B) collateralizing the debt contract.C) making the debt contract incentive compatible.D) giving the debt contract characteristics of equity contracts.。

金融英语第八章答案.Chapter 8Financial StatementsExercisesI. Answer the following questions in English.1. In what section of the balance sheet would one f ind patents and trademarks?答案:In Assets and Owners’ equity of the balance s heet would one find patents and trademarks.2. Which depreciation method bases depreciation exp ense for a given period on actual use?答案:The usefulness of a machine lessens with use over the years, and therefore becomes a loss from t he initial value of the machine upon its purchase.3. Which financial statement is prepared as of a pa rticular date rather than for a Period ending on a particular date?答案:A balance sheet represents a specific period of time.4. Who has the primary responsibility for the finan cial statements?答案:Shareholders and lenders supply capital (cash) to the company. The capital suppliers have clams on the company.5. At what value is land used in a business shown o n the balance sheet?答案:At Gross Profit is land used in a business sh own on the balance sheet.6. Which of the following results from using the LI FO method of inventory cost flows during a period o f inflation?答案:Inventory for businesses that sell retail will consist ofthe public.7. What reflects the net tax effects of the tempora ry differences between the carrying values of asset s and liabilities for financial reporting purposes a nd amounts used for income tax purposes?答案:Assets are what a company uses for its product ion process, while liabilitiesare obligations to be paid to outside parties.8. What is the cost of a fixed asset less its accu mulated depreciation?答案: Long-term assets, also known as fixed assets, have a life span of over one year.They can refer t o tangible assets such as machinery, computers, bu ildings andland. Depreciation is calculated and de ducted from these types of assets.9.How are held-to-maturity securities reported on the balance sheet?答案: When we look at the balance sheet we need to know how to assess the numbers.Financial ratios ca n be calculated from the balance sheet, and these h elp theinvestor understand the state of liquidity a nd growth potential of the company in question. 10. How many types of inventories does a manufactur ing firm list on its balance sheet?答案: If the firm is manufacturing a product, the i nventory is divided into three different stages: r aw materials, work-in-progress (WlP) and finished goods.11. What does the FIFO inventory method assume abou t the first units purchased?答案: Inventory for businesses that sell retail wil l consist ofthe public.12. What does a company record when it receives a c ash payment for setvices before it performs the ser vices?答案:Cash, the most fundamental of current assets, also includes non-restricted bank accounts and chec ks.Cash equivalents are stocks and other money mar ketinstruments such as U.S. Treasuries that can be quickly changed into money. II. Fill in the each blank with an appropriate word or expression.1. Basic earnings per share are computed by dividing net income by _quarter_.2. Financial statements must be prepared in accorda nce with business .3. The annual depreciation expense using the double -declining-balance method is equal to liabilities .4. Financial instruments that derive their value fr om an underlying asset or index are called assets .5. Accounts receivable are reported on the balance sheet at their assets .6. The book value of property, plant, and equipment is the copyright .7. The reporting of inventory values at the lower of cost or market reflects the accounting principle or convention of production ,8. Financial instruments that derive their value fr om an underlying asset or index are called assets .111. Translate the following sentences into Englis h.1.公司财务报表既反映了公司的财务状况,同时也是公司经营状况的综合反映。

曼昆经济学原理英文版文案加习题答案8章WHAT’S NEW IN THE S EVENTH EDITION:A new In the News box on “The Tax Debate ” has been added.LEARNING OBJECTIVES:By the end of this chapter, students should understand:➢ how taxes reduce consumer and producer surplus.➢ the meaning and causes of the deadweight loss from a tax.➢ why some taxes have larger deadweight losses than others.➢ how tax revenue and deadweight loss vary with the size of a tax.CONTEXT AND PURPOSE:Chapter 8 is the second chapter in a three-chapter sequence dealing with welfare economics. In theprevious section on supply and demand, Chapter 6 introduced taxes and demonstrated how a tax affects the price and quantity sold in a market. Chapter 6 also described the factors that determine how the burden of the tax is divided between the buyers and sellers in a market. Chapter 7 developed welfare economics —the study of how the allocation of resources affects economic well-being. Chapter 8 combines the lessons learned in Chapters 6 and 7 and addresses the effects of taxation on welfare. Chapter 9 will address the effects of trade restrictions on welfare.The purpose of Chapter 8 is to apply the lessons learned about welfare economics in Chapter 7 to the issue of taxation that was addressed in Chapter 6. Students will learn that the cost of a tax to buyers and sellers in a market exceeds the revenue collected by the government. Students will also learn about the factors that determine the degree by which the cost of a tax exceeds the revenue collected by the government.APPLICATION: THE COSTS OF TAXATIONKEY POINTS:• A tax on a good reduces the welfare of buyers and sellers of the good, and the reduction in consumer and producer surplus usually exceeds the revenue raised by the government. The fall in total surplus—the sum of consumer surplus, producer surplus, and tax revenue—is called the deadweight loss of the tax.•Taxes have deadweight losses because they cause buyers to consume less and sellers to produce less, and these changes in behavior shrink the size of the market below the level that maximizes total surplus. Because the elasticities of supply and demand measure how much market participants respond to market conditions, larger elasticities imply larger deadweight losses.•As a tax grows larger, it distorts incentives more, and its deadweight loss grows larger.Because a tax reduces the size of a market, however, tax revenue does not continuallyincrease. It first rises with the size of a tax, but if the tax gets large enough, tax revenue starts to fall.CHAPTER OUTLINE:I. The Deadweight Loss of TaxationA. Remember that it does not matter who a tax is levied on; buyers and sellers will likely share inthe burden of the tax.B. If there is a tax on a product, the price that a buyer pays will be greater than the price the sellerreceives. Thus, there is a tax wedge between the two prices and the quantity sold will be smaller if there was no tax.Figure 1C. How a Tax Affects Market Participants1. We can measure the effects of a tax on consumers by examining the change in consumersurplus. Similarly, we can measure the effects of the tax on producers by looking at the change in producer surplus.2. However, there is a third party that is affected by the tax —the government, which gets total tax revenue of T × Q. If the tax revenue is used to provide goods and services to the public,then the benefit from the tax revenue must not be ignored.3. Welfare without a Taxa. Consumer surplus is equal to: A + B + C.b. Producer surplus is equal to: D + E + F.c. Total surplus is equal to: A + B + C + D + E + F.4. Welfare with a TaxFigure 2 If you spent enough time covering consumer and producer surplus in Chapter7, students should have an easy time with this concept.Figure 3a. Consumer surplus is equal to: A.b. Producer surplus is equal to: F.c. Tax revenue is equal to: B + D.d. Total surplus is equal to: A + B + D + F.5. Changes in Welfarea. Consumer surplus changes by: –(B + C).b. Producer surplus changes by: –(D + E).c. Tax revenue changes by: +(B + D).d. Total surplus changes by: –(C + E).6. Definition of deadweight loss: the fall in total surplus that results from a marketdistortion, such as a tax.D. Deadweight Losses and the Gains from Trade1. Taxes cause deadweight losses because they prevent buyers and sellers from benefiting fromtrade.2. This occurs because the quantity of output declines; trades that would be beneficial to boththe buyer and seller will not take place because of the tax.3. The deadweight loss is equal to areas C and E (the drop in total surplus).4. Note that output levels between the equilibrium quantity without the tax and the quantitywith the tax will not be produced, yet the value of these units to consumers (represented by the demand curve) is larger than the cost of these units to producers (represented by thesupply curve).II. The Determinants of the Deadweight LossA. The price elasticities of supply and demand will determine the size of the deadweight loss that occurs from a tax.1. Given a stable demand curve, the deadweight loss is larger when supply is relatively elastic.2. Given a stable supply curve, the deadweight loss is larger when demand is relatively elastic.B. Case Study: The Deadweight Loss Debate1. Social Security tax and federal income tax are taxes on labor earnings. A labor tax places a tax wedge between the wage the firm pays and the wage that workers receive.2. There is considerable debate among economists concerning the size of the deadweight loss from this wage tax.Figure 53. The size of the deadweight loss depends on the elasticity of labor supply and demand, andthere is disagreement about the magnitude of the elasticity of supply.a. Economists who argue that labor taxes do not greatly distort market outcomes believethat labor supply is fairly inelastic.b. Economists who argue that labor taxes lead to large deadweight losses believe that laborsupply is more elastic.III. Deadweight Loss and Tax Revenue as Taxes VaryA. As taxes increase, the deadweight loss from the tax increases.B. In fact, as taxes increase, the deadweight loss rises more quickly than the size of the tax.1. The deadweight loss is the area of a triangle and the area of a triangle depends on the square of its size.2. If we double the size of a tax, the base and height of the triangle both double so the area of the triangle (the deadweight loss) rises by a factor of four.C. As the tax increases, the level of tax revenue will eventually fall.D. Case Study: The Laffer Curve and Supply-Side Economics1. The relationship between the size of a tax and the level of tax revenues is called a Laffercurve.2. Supply-side economists in the 1980s used the Laffer curve to support their belief that a dropin tax rates could lead to an increase in tax revenue for the government.3. Economists continue to debate Laffer’s argume nt.a. Many believe that the 1980s refuted Laffer’s theory.b. Others believe that the events of the 1980s tell a more favorable supply-side story.c. Some economists believe that, while an overall cut in taxes normally decreases revenue,some taxpayers may find themselves on the wrong side of the Laffer curve.E. In the News: The Tax Debate1. Recently, policymakers have debated the effects of increasing the tax rate, particularly onhigher-income taxpayers.ALTERNATIVE CLASSROOM EXAMPLE:Draw a graph showing the demand and supply of paper clips. (Draw each curve as a 45-degree line so that buyers and sellers will share any tax equally.) Mark theequilibrium price as $0.50 (per box) and the equilibrium quantity as 1,000 boxes. Show students the areas of producer and consumer surplus.Impose a $0.20 tax on each box. Assume that sellers are required to “pay” the tax to the government. Show students that:▪ the price buyers pay will rise to $0.60.▪ the price sellers receive will fall to $0.40.▪ the quantity of paper clips purchased will fall (assume to 800 units).▪ tax revenue would be equal to $160 ($0.20 800).Have students calculate the area of deadweight loss. (You may have to remindstudents how to calculate the area of a triangle.)2. These two opinion pieces from The Wall Street Journal present both sides of the issue.SOLUTIONS TO TEXT PROBLEMS:Quick Quizzes1. Figure 1 shows the supply and demand curves for cookies, with equilibrium quantity Q 1 andequilibrium price P 1. When the government imposes a tax on cookies, the price to buyers rises to P B , the price received by sellers declines to P S , and the equilibrium quantity falls to Q 2. The deadweight loss is the triangular area below the demand curve and above the supply curve between quantities Q 1 and Q 2. The deadweight loss shows the fall in total surplus that results from the tax.Figure 12. The deadweight loss of a tax is greater the greater is the elasticity of demand. Therefore, a tax on beer would have a larger deadweight loss than a tax on milk because the demand forbeer is more elastic than the demand for milk.B.Rank these taxes from smallest deadweight loss to largest deadweight loss.Lowest deadweight loss —tax on children, very inelastic Then —tax on food. Demand is inelastic; supply is elastic.Third —tax on vacation homes Demand is elastic; short-run supply is inelastic. Most deadweight loss —tax on jewelryDemand is elastic; supply is elastic.C. Is deadweight loss the only thing to consider when designing a tax system? No. This can generate a lively discussion. There are a variety of equity or fairnessconcerns. The taxes on children and on food would be regressive. Each of the taxeswould tax certain households at much higher rates than other households with similarincomes.3. If the government doubles the tax on gasoline, the revenue from the gasoline tax could riseor fall depending on whether the size of the tax is on the upward or downward slopingportion of the Laffer curve. However, if the government doubles the tax on gasoline, you canbe sure that the deadweight loss of the tax rises because deadweight loss always rises as thetax rate rises.Questions for Review1. When the sale of a good is taxed, both consumer surplus and producer surplus decline. Thedecline in consumer surplus and producer surplus exceeds the amount of governmentrevenue that is raised, so society's total surplus declines. The tax distorts the incentives ofboth buyers and sellers, so resources are allocated inefficiently.2. Figure 2 illustrates the deadweight loss and tax revenue from a tax on the sale of a good.Without a tax, the equilibrium quantity would be Q1, the equilibrium price would be P1,consumer surplus would be A + B + C, and producer surplus would be D + E + F. Theimposition of a tax places a wedge between the price buyers pay, P B, and the price sellersreceive, P S, where P B = P S + tax. The quantity sold declines to Q2. Now consumer surplus isA, producer surplus is F, and government revenue is B + D. The deadweight loss of the tax isC+E, because that area is lost due to the decline in quantity from Q1 to Q2.Figure 23. The greater the elasticities of demand and supply, the greater the deadweight loss of a tax.Because elasticity measures the responsiveness of buyers and sellers to a change in price,higher elasticity means the tax induces a greater reduction in quantity, and therefore, agreater distortion to the market.4. Experts disagree about whether labor taxes have small or large deadweight losses becausethey have different views about the elasticity of labor supply. Some believe that labor supplyis inelastic, so a tax on labor has a small deadweight loss. But others think that workers canadjust their hours worked in various ways, so labor supply is elastic, and thus a tax on laborhas a large deadweight loss.5. The deadweight loss of a tax rises more than proportionally as the tax rises. Tax revenue,however, may increase initially as a tax rises, but as the tax rises further, revenue eventuallydeclines.Quick Check Multiple Choice1. a2. b3. c4. a5. b6. aProblems and Applications1. a. Figure 3 illustrates the market for pizza. The equilibrium price is P1, the equilibriumquantity is Q1, consumer surplus is area A + B + C, and producer surplus is area D + E +F. There is no deadweight loss, as all the potential gains from trade are realized; totalsurplus is the entire area between the demand and supply curves: A + B + C + D + E +F.Figure 3b. With a $1 tax on each pizza sold, the price paid by buyers, P B, is now higher than theprice received by sellers, P S, where P B = P S + $1. The quantity declines to Q2, consumersurplus is area A, producer surplus is area F, government revenue is area B + D, anddeadweight loss is area C + E. Consumer surplus declines by B + C, producer surplusdeclines by D + E, government revenue increases by B + D, and deadweight lossincreases by C + E.c. If the tax were removed and consumers and producers voluntarily transferred B + D tothe government to make up for the lost tax revenue, then everyone would be better offthan without the tax. The equilibrium quantity would be Q1, as in the case without thetax, and the equilibrium price would be P1. Consumer surplus would be A + C, becauseconsumers get surplus of A + B + C, then voluntarily transfer B to the government.Producer surplus would be E + F, because producers get surplus of D + E + F, thenvoluntarily transfer D to the government. Both consumers and producers are better offthan the case when the tax was imposed. If consumers and producers gave a little bitmore than B + D to the government, then all three parties, including the government,would be better off. This illustrates the inefficiency of taxation.2. a. The statement, "A tax that has no deadweight loss cannot raise any revenue for thegovernment," is incorrect. An example is the case of a tax when either supply or demand is perfectly inelastic. The tax has neither an effect on quantity nor any deadweight loss, but it does raise revenue.b. The statement, "A tax that raises no revenue for the government cannot have anydeadweight loss," is incorrect. An example is the case of a 100% tax imposed on sellers.With a 100% tax on their sales of the good, sellers will not supply any of the good, sothe tax will raise no revenue. Yet the tax has a large deadweight loss, because it reduces the quantity sold to zero.3. a. With very elastic supply and very inelastic demand, the burden of the tax on rubberbands will be borne largely by buyers. As Figure 4 shows, consumer surplus declinesconsiderably, by area A + B, but producer surplus decreases only by area C+D..Figure 4 Figure 5b.With very inelastic supply and very elastic demand, the burden of the tax onrubber bands will be borne largely by sellers. As Figure 5 shows, consumersurplus does not decline much, just by area A + B, while producer surplus fallssubstantially, by area C + D. Compared to part (a), producers bear much more of the burden of the tax, and consumers bear much less.4. a. The deadweight loss from a tax on heating oil is likely to be greater in the fifth year afterit is imposed rather than the first year. In the first year, the demand for heating oil isrelatively inelastic, as people who own oil heaters are not likely to get rid of them rightaway. But over time they may switch to other energy sources and people buying newheaters for their homes will more likely choose gas or electric, so the tax will have agreater impact on quantity. Thus, the deadweight loss of the tax will get larger over time.b. The tax revenue is likely to be higher in the first year after it is imposed than in the fifthyear. In the first year, demand is more inelastic, so the quantity does not decline asmuch and tax revenue is relatively high. As time passes and more people substitute away from oil, the quantity sold declines, as does tax revenue.5. Because the demand for food is inelastic, a tax on food is a good way to raise revenuebecause it leads to a small deadweight loss; thus taxing food is less inefficient than taxing other things. But it is not a good way to raise revenue from an equity point of view, because poorer people spend a higher proportion of their income on food. The tax would affect them more than it would affect wealthier people.6. a. This tax has such a high rate that it is not likely to raise much revenue. Because of thehigh tax rate, the equilibrium quantity in the market is likely to be at or near zero.b. Senator Moynihan's goal was probably to ban the use of hollow-tipped bullets. In thiscase, the tax could be as effective as an outright ban.7. a. Figure 6 illustrates the market for socks and the effects of the tax. Without a tax, theequilibrium quantity would be Q1, the equilibrium price would be P1, total spending byconsumers equals total revenue for producers, which is P1 x Q1, which equals area B + C + D + E + F, and government revenue is zero. The imposition of a tax places a wedgebetween the price buyers pay, P B, and the price sellers receive, P S, where P B = P S + tax.The quantity sold declines to Q2. Now total spending by consumers is P B x Q2, whichequals area A + B + C + D, total revenue for producers is P S x Q2, which is area C + D,and government tax revenue is Q2 x tax, which is area A + B.b. Unless supply is perfectly elastic or demand is perfectly inelastic, the price received byproducers falls because of the tax. Total receipts for producers fall, because producerslose revenue equal to area B + E + F.Figure 6c. The price paid by consumers rises, unless demand is perfectly elastic or supply isperfectly inelastic. Whether total spending by consumers rises or falls depends on theprice elasticity of demand. If demand is elastic, the percentage decline in quantityexceeds the percentage increase in price, so total spending declines. If demand isinelastic, the percentage decline in quantity is less than the percentage increase in price,so total spending rises. Whether total consumer spending falls or rises, consumer surplusdeclines because of the increase in price and reduction in quantity.8. Figure 7 illustrates the effects of the $2 subsidy on a good. Without the subsidy, theequilibrium price is P1 and the equilibrium quantity is Q1. With the subsidy, buyers pay priceP B, producers receive price P S (where P S = P B + $2), and the quantity sold is Q2. Thefollowing table illustrates the effect of the subsidy on consumer surplus, producer surplus,government revenue, and total surplus. Because total surplus declines by area D + H, thesubsidy leads to a deadweight loss in that amount.BeforeSubsidyAfter Subsidy ChangeConsumerSurplus A + B A + B + E + F + G +(E + F + G)ProducerSurplus E + I B + C + E + I +(B + C)Government Revenue 0 –(B + C + D + E + F + G +H)–(B + C + D + E + F + G +H)Total Surplus A + B + E + I A + B – D + E – H + I –(D + H)Figure 79. a. Figure 8 shows the effect of a $10 tax on hotel rooms. The tax revenue is represented byareas A + B, which are equal to ($10)(900) = $9,000. The deadweight loss from the tax is represented by areas C + D, which are equal to (0.5)($10)(100) = $500.Figure 8 Figure 9b. Figure 9 shows the effect of a $20 tax on hotel rooms. The tax revenue is represented byareas A + B, which are equal to ($20)(800) = $16,000. The deadweight loss from the tax is represented by areas C + D, which are equal to (0.5)($20)(200) = $2,000.When the tax is doubled, the tax revenue rises by less than double, while thedeadweight loss rises by more than double. The higher tax creates a greaterdistortion to the market.10. a. Setting quantity supplied equal to quantity demanded gives 2P = 300 –P. Adding P toboth sides of the equation gives 3P = 300. Dividing both sides by 3 gives P = 100.Substituting P = 100 back into either equation for quantity demanded or supplied gives Q = 200.b. Now P is the price received by sellers and P +T is the price paid by buyers. Equatingquantity demanded to quantity supplied gives 2P = 300 − (P+T). Adding P to both sides of the equation gives 3P = 300 –T. Dividing both sides by 3 gives P = 100 –T/3. This is the price received by sellers. The buyers pay a price equal to the price received by sellers plus the tax (P +T = 100 + 2T/3). The quantity sold is now Q = 2P = 200 – 2T/3.c. Because tax revenue is equal to T x Q and Q = 200 – 2T/3, tax revenue equals 200T−2T2/3. Figure 10 (on the next page) shows a graph of this relationship. Tax revenue iszero at T = 0 and at T = 300.Figure 10 Figure 11d. As Figure 11 shows, the area of the triangle (laid on its side) that represents thedeadweight loss is 1/2 × base × height, where the base is the change in the price, which is the size of the tax (T) and the height is the amount of the decline in quantity (2T/3).So the deadweight loss equals 1/2 ×T × 2T/3 = T2/3. This rises exponentially from 0 (when T = 0) to 30,000 when T = 300, as shown in Figure 12.Figure 12e. A tax of $200 per unit is a bad policy, because tax revenue is declining at that tax level.The government could reduce the tax to $150 per unit, get more tax revenue ($15,000 when the tax is $150 versus $13,333 when the tax is $200), and reduce the deadweight loss (7,500 when the tax is $150 compared to 13,333 when the tax is $200).。

第八章思考题详解1.(B)2.(D)3.(C)4.(A)5.( B )6.答案要点:融资租赁,也称为金融租赁或购买性租赁。

是指这样一种交易行为:出租人根据承租人的请求及提供的规格,与第三方(供货商)订立一项供货合同,根据此合同,出租人按照承租人在与其利益有关的范围内所同意的条款取得工厂、资本货物或其他设备(以下简称设备)。

并且,出租人与承租人(用户)订立一项租赁合同,以承租人支付租金为条件授予承租人使用设备的权利。

融资租赁业务的主要形式有:直接融资、转租凭、售后回租、杠杆租赁。

7.答案要点:外国债券是指外国借款人在某国发行的以该国货币表示面值的债券,目前外国债券市场以美元债券为主。

欧洲债券是指在欧洲货币市场上发行、交易的债券,它一般是发行者在债券面值货币发行国以外的国家的金融市场上发行的。

欧洲债券与外国债券的区别,主要是大多数欧洲债券的发行采用不记名的形式,并切有提前赎回的专门条款,与偿债基金。

欧洲债券发行也常通过辛迪加银团的承购包销,辛迪加的组成除8.答案要点:1)外债偿债率指外债还本付息额与当年商品和服务出口额之比。

该国偿债率为:800/4000*100%=20%.2)一般认为,若一国的偿债率高于20%~25%,就属于外债过多,有发生偿债困难和债务危机的危险。

但偿债率并不是考察一国外债规模是否适度的唯一指标,要结合外债结构、币种及本国经济发展状况综合考察。

3)从一般的标准来看,该国应当对其外债规模加以控制,因为它已经接近国际一般的偿债率警戒线。

否则就会有引发债务危机的可能性。

9.答案要点:1)这种“坏政策”可能是指在固定汇率制度下,政府过度使用扩张性财政政策和货币政策。

根据第一代货币危机理论,在固定汇率制度下,政府需要储备一定的外汇储备以维持市场汇率,但是当政府推行扩张性财政货币政策、同时又不想增加国内货币供应量的时候,外汇储备将随之减少,从而使得固定汇率制度无法维持。

在这一过程中,投机因素对货币危机的形成起了催化的作用:正是市场的投机冲击导致政府的外汇储备加速减少,从而令货币危机提前到来。

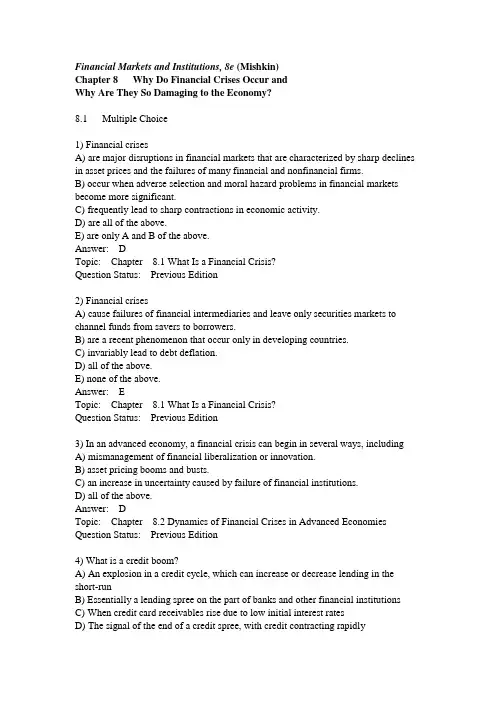

Financial Markets and Institutions, 8e (Mishkin)Chapter 8 Why Do Financial Crises Occur andWhy Are They So Damaging to the Economy?8.1 Multiple Choice1) Financial crisesA) are major disruptions in financial markets that are characterized by sharp declines in asset prices and the failures of many financial and nonfinancial firms.B) occur when adverse selection and moral hazard problems in financial markets become more significant.C) frequently lead to sharp contractions in economic activity.D) are all of the above.E) are only A and B of the above.Answer: DTopic: Chapter 8.1 What Is a Financial Crisis?Question Status: Previous Edition2) Financial crisesA) cause failures of financial intermediaries and leave only securities markets to channel funds from savers to borrowers.B) are a recent phenomenon that occur only in developing countries.C) invariably lead to debt deflation.D) all of the above.E) none of the above.Answer: ETopic: Chapter 8.1 What Is a Financial Crisis?Question Status: Previous Edition3) In an advanced economy, a financial crisis can begin in several ways, includingA) mismanagement of financial liberalization or innovation.B) asset pricing booms and busts.C) an increase in uncertainty caused by failure of financial institutions.D) all of the above.Answer: DTopic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: Previous Edition4) What is a credit boom?A) An explosion in a credit cycle, which can increase or decrease lending in the short-runB) Essentially a lending spree on the part of banks and other financial institutionsC) When credit card receivables rise due to low initial interest ratesD) The signal of the end of a credit spree, with credit contracting rapidlyAnswer: BTopic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: Previous Edition5) The process of deleveraging refers toA) cutbacks in lending by financial institutions.B) a reduction in debt owed by banks.C) both A and B.D) none of the above.Answer: ATopic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: Previous Edition6) When asset prices fall following a boom,A) moral hazard may increase in companies that have lost net worth in the bust.B) financial institutions may see the assets on their balance sheets deteriorate, leading to deleveraging.C) both A and B are correct.D) none of the above are correct.Answer: CTopic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: Previous Edition7) During the 1800s, many U.S. financial crises were precipitated by an increase in ________, often originating in London.A) interest ratesB) housing pricesC) gasoline pricesD) heating oil pricesAnswer: ATopic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: Previous Edition8) Stage Two of a financial crisis in an advanced economy usually involves a________ crisis.A) currencyB) stock marketC) bankingD) commoditiesAnswer: CTopic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: Previous Edition9) Stage Three of a financial crisis in an advanced economy featuresA) a general increase in inflation.B) debt deflation.C) an increase in general price levels.D) a full-fledged financial crisis.Answer: BTopic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: Previous Edition10) Debt deflation refers toA) an increase in net worth, leading to a relative fall in general debt levels.B) a decline in general debt levels due to deleveraging.C) a decline in bond prices as default rates rise.D) a decline in net worth as price levels fall while debt burden remains unchanged. Answer: DTopic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: Previous Edition11) Factors that lead to worsening conditions in financial markets includeA) increases in interest rates.B) declining stock prices.C) increasing uncertainty in financial markets.D) all of the above.E) only A and B of the above.Answer: DTopic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: Previous Edition12) Factors that lead to worsening conditions in financial markets includeA) declining interest rates.B) anticipated increases in the price level.C) bank panics.D) only A and C of the above.E) only B and C of the above.Answer: CTopic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: Previous Edition13) Most financial crises in the United States have begun withA) a steep stock market decline.B) an increase in uncertainty resulting from the failure of a major firm.C) a steep decline in interest rates.D) all of the above.E) only A and B of the above.Answer: ETopic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: Previous Edition14) In addition to having a direct effect on increasing adverse selection problems, increases in interest rates also promote financial crises by ________ firms' and households' interest payments, thereby ________ their cash flow.A) increasing; increasingB) increasing; decreasingC) decreasing; increasingD) decreasing; decreasingAnswer: BTopic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: Previous Edition15) Adverse selection and moral hazard problems increased in magnitude during the early years of the Great Depression asA) stock prices declined to 10 percent of their levels in 1929.B) banks failed.C) the aggregate price level declined.D) a result of all of the above.E) a result of A and B of the above.Answer: DTopic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: Previous Edition16) Stock market declines preceded a full-blown financial crisisA) in the United States in 1987.B) in the United States in 2000.C) in the United States in 1929.D) in all of the above.E) in none of the above.Answer: CTopic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: Updated from Previous Edition17) Which of the following factors led up to the Greece debt crisis in 2009-2010?A) Speculative attacks on the euro and a rise in actual and expected inflationB) A decline in tax revenues resulting from a contraction in economic activityC) A double-digit budget deficitD) All of the aboveE) only B and C of the aboveAnswer: ETopic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: Updated from Previous Edition18) What is a collateralized debt obligation?A) A tranche of an SPV that has been setup based on default riskB) An agreement to exchange interest payments when one party defaultsC) A type of insurance against defaultsD) A contract between credit rating agenciesAnswer: ATopic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: New Question19) Which of the following led to the U.S. financial crisis of 2007-2009?A) Financial innovation in mortgage marketsB) Agency problems in mortgage marketsC) An increase in moral hazard at credit rating agenciesD) All of the aboveE) only A and B of the aboveAnswer: ETopic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: Previous Edition20) Approximately how large was the U.S. subprime mortgage market in 2007?A) $100 millionB) $100 billionC) $500 billionD) $1 trillionAnswer: DTopic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: Previous Edition21) When we refer to the shadow banking system, what are we talking about?A) Hedge funds, investment banks, and other nonbank financial firms that supply liquidityB) The "underground" banking system used for illegal activitiesC) The subsidiaries of depository institutionsD) None of the aboveAnswer: ATopic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: Previous Edition22) The impact of the 2007-2009 financial crisis was widespread, includingA) the first major bank failure in the UK in over 100 years.B) the failure of Bear Stearns, the fifth-largest U.S. investment bank.C) the bailout of Fannie Mae and Freddie Mac by the U.S. Treasury.D) all of the above.E) only B and C of the above.Answer: DTopic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: Previous Edition8.2 True/False1) A financial crisis occurs when information flows in financial markets experience a particularly large disruption.Answer: TRUETopic: Chapter 8.1 What Is a Financial Crisis?Question Status: New Question2) Factors that can lead to worsening conditions in financial markets include increasing interest rates and asset price booms.Answer: TRUETopic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: Previous Edition3) During a bank panic, many banks fail in a very short time period.Answer: TRUETopic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: Previous Edition4) The failure of Ohio Life Insurance and Trust in 1857 did not signal the start of a recession due to prompt actions by the Fed.Answer: FALSETopic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: Previous Edition5) Bank failures have been a feature of all U.S. financial crises from 1800 to 1944. Answer: TRUETopic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: Previous Edition6) Debt deflation refers to the decline in debt values as creditors agree to lower interest rates as an alternative to defaults.Answer: FALSETopic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: Previous Edition7) The Internet stock market bubble of the late 1990s led to one of the worst financial crises in U.S. history. Banks lost billions of dollars as Internet companies went bankrupt.Answer: FALSETopic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: Previous Edition8) An unusual feature of the "Great Recession" in the U.S. from 2007-2009 was that the crisis did not spread to European nations.Answer: FALSETopic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: New Question9) In Europe, Greece was the first nation to face a debt crisis.Answer: TRUETopic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: New Question8.3 Essay1) Explain the relationship between agency theory and a financial crisis.Topic: Chapter 8.1 What Is a Financial Crisis?Question Status: New Question2) Describe the sequence of events in a financial crisis in an advanced economy and explain why they can cause economic activity to decline.Topic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: Previous Edition3) What is the problem with government safety nets, such as deposit insurance, during the formative stages of a financial crisis?Topic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: Previous Edition4) Discuss why some view the Fed as a culprit in the U.S. housing bubble during the 2000s.Topic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: Previous Edition5) Describe a special purpose vehicle. How are they related to the creation of collateralized debt obligations?Topic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: New Question6) Discuss some of the financial innovations in mortgage markets that led to the U.S. financial crisis in 2007.Topic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: Previous Edition7) Why was the shadow banking system important during the 2007-2009 U.S. financial crisis?Topic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: Previous Edition8) Describe how the European debt crisis evolved.Topic: Chapter 8.2 Dynamics of Financial Crises in Advanced Economies Question Status: New Question。