公司金融英文试题

- 格式:docx

- 大小:213.52 KB

- 文档页数:11

金融英语模拟试题及答案Reading Comprehension: (10 points)Joseph Glass, CFA, is a consultant who provides advisory services to large manufacturing companies. Glass has been retained by ABCO, a leading manufacturer of widgets for automobiles in the United States. ABCO has hired Glass to evaluate the possibility of e*panding their current base of operations by building an additional facility in South America. Management of ABCO has identified an increase in demand for widgets in South America over the past decade, and any new manufacturing facility would produce goods to satisfy that void and would be distributed and sold across South America.Glass is not familiar with the current economic climate in South America, but is aware that several governments have attempted to encourage economic development in their countries through the enactment of pro-business legislation. Two of these countries, Venezuela and Peru, both have the reputations of being “friendly” to foreign economic investment withintheir borders. The two countries share some similarities: both, until the past twenty years, were primarily agricultural economies with little industrial development. Also, both countries can offer a relatively low-cost labor force, although their workers in general, are not highly skilled.The government of Peru has declared that protecting the country’s environment is of utmost importance, and has established a regulatory body that oversees any environmental concerns that may arise as the country becomes more industrialized. Fairly stringent regulations have already been put into place in order to ensure that going forward, the operating practices of manufacturers within their country’s borders will be in balance with the government’s concern for their county’s natural resources. Regulations cover areas of concern such as air emissions, water conservation and the use of sustainable resources. Glass advised ABCO that a cost-benefit analysis must be performed to accurately determine both the direct and indirect costs of compliance with the regulations.The Venezuelan government has taken steps to ensurethat it can carefully manage the development of its country’s emerging economy, and to ensure that a competitive market is maintained. A regulatory agency was established five years ago to provide guidance for any new manufacturing concern seeking to operate in Venezuela. The head of the agency is Juan Santos, the former CEO of one of the first modernized manufacturing facilities in the country. During his tenure as head of the agency, he has demonstrated his ability to render decisions that attempt to simultaneously satisfy legislators, industry participants, and consumers. Glass is impressed by Santos’ work so far, but realizes that over the past five years, Venezuela has e*perienced a period of relatively slow economic development. Glass believes that Santos’ skills will truly be put to the test in the upcoming years of the anticipated economic e*pansion.Glass acknowledges the need for governmental regulation of industry, but recognizes that there always are offsetting costs, both short-term and long-term of such controls. Based upon his knowledge of events that have occurred in the United States over thepast thirty years, Glass recommends that ABCO continue to carefully monitor economic developments in both countries even after a site for a new manufacturing facility is selected.Part 1)Should ABCO build a new facility in either of the two countries, it is almost a certainty that they would be the low-cost producer of widgets, with the capacity to satisfy nearly all demand in the region. A natural monopolist operating in an unregulated industry will produce at the point where:A. Marginal costs equal marginal revenue.B. Average costs equal marginal revenue.C. Average costs equal average revenue.D. The marginal cost curve intersects the demand schedule.Part 2)The social regulation policies enacted by the government of Peru would least likely to cause which of the following outcomes? ()A. Higher costs of production.B. A disproportionately higher compliance e*pensefor larger firms rather than smaller firms.C. Higher prices for the end consumer.D. Attempts by industry participants to avoid compliance through creative response.Part 3)If ABCO were to build its new facility in Peru, compliance with the country’s regulatory policies will increase the price of their product by appro*imately ten percent. Some consumers may respond by not replacing the widgets in their automobiles as frequently as before, which will cause decreased fuel efficiency. This unintended effect of regulation is an e*ample of: ()A. The capture hypothesis.B. A creative response.C. A feedback effect.D. The share-the-gains, share-the-pains theory.Part 4)The appointment of Santos, an industry “insider”, to head the regulatory agency in Venezuela has the potential to cause a reaction predicted by which of the following theories of regulatory behavior? ()A. Rate-of-return regulation.B. Share-the-gains, share-the-pains theory.C. The capture hypothesis.D. Cost-of-service regulation.Part 5)Santos, as the head of the main regulatory body in Venezuela, must decide how to manage the effects of an unanticipated sharp increase in the cost of electricity. Santos proposed regulation that will allow manufacturers to pass on the increased costs at scheduled intervals over a five year period. This approach is an e*ample of: ()A. Rate of return regulation.B. Cost-of-service regulation.C. Share-the-gains, share-the-pains theory.D. Social regulation.E*planations of terms:(10 points)1. Liquidity2. Cost-push inflation3. Surveillance4. E*ternal debt5. Foreign reserveQuestion3: How many factors to e*plain the reserveholdings?Question4: What is The Monetary Policy Instruments of the Central Bank?Question5: What is Concept of Trust Market?And what the composition of it is?Question6: What is the Money Laundering?。

⾦融英语练习题(附答案)Multiple Choice1. The People’s Bank of China shall have the power to demand financial institutions to submit balance sheets, statements ofD and other financial and accounting reports and materials in pursuance of regulations.A. accountB. financial positionC. cash flowD. profit and loss2. A credit card such as Visa will D .A. gurantee chequesB. enable the holder to cash cheques at any bankC. enable the holder to buy goods on creditD. enable the holder to buy goods, up to certain amounts, on credit from certain persons3. Foreign trade can be conducted on the following terms except for DA. open accountB. documentary collectionC. documentary creditsD. public bonds4. Customers trading abroad in foreign currencies may protect against the exchange risk by arranging C .A. a contract of international sale of goodsB. a contract of marine insuranceC. a forward contract to fix the exchange rate in advance5. The danger to the exporter in open account trading is that by surrendering the shipping documents to the importer, heB before he has obtained payment for them.A. is in control of the goodsB. losses control of the goodsB. retain control of the goods D. gives up control of the goods6. Leasing is an arrangement whereby one party obtains on a long-term basis A which belongs to another party.A. the use of a capital assetB. the use of a current assetC. the use of working capitalD. the use of current liabilities7. From a Chinese bank’s point of view, the currency account which it maintains abroad is known as , while a RMB account operated in China for a foreign bank is termed B .A. a vostro account, a nostro accountB. a nostro account, a vostro accountC. a mirror account, a nostro accountD. a vostro account, a mirror account8. Find the interest on US $65,000 for 14 days at 3 percent per annum.B .A. US $37.91B. US $75.83C. US $113.74D. US $227.499. Which of the following can not be included in the functions ofmoney?D 。

金融英语业务知识练习试卷40(题后含答案及解析) 题型有: 2. 单项选择题单项选择题1.Depletion expense is that portion of the cost of______that is used up in a particular period.A.intangible assetsB.plant assets excluding natural resourcesC.natural resourcesD.none of the above正确答案:C解析:答案为C项。

plant asset“固定资产”,同fixed asset。

Depletion“折耗”。

油田、矿藏、森林和天然气等自然资源是属于使用情况比较特殊的固定资产。

由于这些自然资源随着采掘、采伐逐渐转化成产品,其存量不断下降,成本价值也相应减少,因此,它们又被称作递耗资产(wasting asset)。

将自然资源的成本分期摊配到开发的数量上,称为折耗。

故本题选C项。

知识模块:金融英语业务知识2.XYZ Co. Ltd. pays $500 000 for land that contains an estimated 500 000 board feet of timber. The land can be sold for $100 000 after the timber has been cut. If XYZ harvests 200 000 board feet in the year of purchase, how much depletion should be recorded?______.A.$160 000B.$200 000C.$100 000D.$80 000正确答案:A解析:答案为A项。

board foot“板呎(木材的计量单位)”。

自然资源折耗的计算方法是将扣除残值后的递延资产成本,除以估计总贮藏量,确定单位贮藏量的折耗(折耗率),再乘以当期的采伐(取)量,即为该期的折耗。

18ÙSimple Implementing ofOption Oricing Models!W K1.In the EWMA model and the GARCH(1,1)model,the weights assigned to observa-tions decrease as the observations become older.2.The GARCH(1,1)model differs from the EWMA model in that some weight is alsoassigned to the.3.When the current volatility is above the long-term volatility,the GARCH(1,1)modelestimates a volatility term structure.4.Suppose thatλis0.8,the volatility estimated for a market variable for day n-1is2%per day,and during day n-1the market variable increased by3%.Then the estimate of the volatility for day n is.5.Suppose thatλ=0.9,and the estimate of the correlation between two variables Xand Y on day n-1is0.7.Supposeσx,n−1=2%,σy,n−1=3%,u x,n−1=0.4%,u y,n−1=2.5%.The covariance for day n wouled be.6.For an American option,the value at a node is the greater of,and thediscounted expected value if it is held for a further period of timeδt.7.Finite difference methods solve the underlying by covert it to a differenceequation.8.The explicit method is functionally the same as using a.9.involves dividing the distribution into ranges or intervals and sampling fromeach interval according to its probability.1218ÙSIMPLE IMPLEMENTING OF OPTION ORICING MODELS10.Currencies and futures contracts can,for the purposes of option evaluation,be con-sidered as assets providing known yields.In the case of a currency,the relevant yield is the;in the case of a futures contract,it is the.!üÀK(3z¢K o À Y¥ÀJ ( Y èW\K )ÒS)1.Which model is not used to produce estimates of volatilities()A.EWMAB.ARCHC.CRRD.GARCH2.In an EWMA model,the weights of the u i declines at rate as we move backthrough time.()C.λ2D.1−λA.λB.1λ3.When use variance targeting approach to estimate parameters in GARCH(1,1),thereare only parameters have to be estimated.()A.1B.2C.3D.44.The parameters of a GARCH(1,1)model are estimated asω=0.000004,α=0.05,β=0.92.What is the long-run average volatility?()A.0.00013B.0.013C.0.00025D.0.0255.The most recent estimate of the daily volatility of USD\GBP exchange rate is0.55%and the exchange rate at4p.m.yesterday was1.4950.The parameterλin the EWMA model is0.95.Suppose that the exchange rate at4p.m.today proves to be1.4850,the estimate of the daily volatility is()A.2.900B.2.874C.0.2874D.0.29006.Which of the following can be estimated for an American option by constructing asingle binomial tree?()A.DeltaB.VegaC.GammaD.Theta7.Which is not particularly useful when the holder has early exercise decisions in Amer-ican options?()A.Monte Carlo SimulationB.Binomial Frees modelC.Finite Difference MethodsD.Trinomial Trees model38.Which model can be used when the payoffdepends on the path followed by theunderlying variable S as well as when it depends only on thefinal value of S?()A.Binomial Trees modelB.Trinomial Trees modelC.Finite Difference MethodsD.Monte Carlo Simulation9.Consider a four-month American call option on index futures where the risk-freeinterest rate is9%per annum,and the volatility of the index is40%per annum.We divide the life of the option into four one-month periods for the purposes of con-structing the tree.Then the growth factor a equals:()A.1B.e9%×0.0833C.e9%D.e40%×t0.083310.In a binomial model for a dividend-paying stock,when the dollar amount dividend isknown,there are nodes on the tree at time iδt.()A.i+1B.iC.2iD.i2n!§äK(3 ( K )ÒS y”√”§ Ø K )ÒS y”×”)1.Black-Scholes model assume that the volatility of the underlying asset is not constant.()2.In the EWMA model,some weight is assigned to the long-run average variance rate.()3.When we build up models to forecast volatility,u is assumed to be zero.()4.In the ARCH(m)model,the older an observation,the less weight it is given.()5.The EWMA approach has the attractive feature that relatively little date need tobe stored.At any given time,we need to remember only the current estimate of the variance rate and the most recent observation on the value of the market variable.()6.For a stable GARCH(1,1)process,we requireα+β>1,then the GARCH(1,1)processis’mean reverting’rather than’meanfleeing’.()7.The EWMA model incorporates mean reversion,whereas the GARH(1,1)model dosenot.()8.For a series x i,the autocorrelation with a lag of k is the coefficient of correlationbetween x i and x i+k.()418ÙSIMPLE IMPLEMENTING OF OPTION ORICING MODELS9.When the current volatility is below the long-term volatility,it estimates an downward-sloping volatility term structure.()10.Suppose there is a big move in the market variable on day n-1,the estimate of thecurrent volatility moves upward.()11.Monte Carlo simulation is used primarily for derivatives where the payoffis depen-dent on the history of the underlying variable or where there are several underlying variables.()12.Binomial trees andfinite difference methods are not useful when the holder has earlyexercise decisions to make prior to maturity.()13.In binomial trees model,the derivatives can be value by discounting their expectedvalues at the risk-free interest rate.()14.Currencies can be considered as assets providing known yields,and the relevant yieldis domestic risk-free interest rate.()15.The tree does not recombine when the dividend yield is known.()16.The control variate technique used by binomial trees needs to calculate the Blank-Scholes price of the European option.()17.The CRR is the only way to construct binomial trees.()18.The advantage of Monte Carlo simulation is that it is computationally very time-saving.()19.In Monte Carlo simulation the uncertainty about the value of the derivative is in-versely proportional to the square root of the number of trials.()20.The implicitfinite difference has the advantage of being very robust.It always con-verges to the solution of the differential equation as s and t approach zero.()o!O K1.The volatility of a certain market variable is30%per annum.Calculate a99%confi-dence interval for the size of the percentage daily change in the variable.52.Assume that S&P500at close of trading yesterday was1040and the daily volatility ofthe index was estimated ai1%per day at that time.The parameters in a GARCH(1,1) model areω=0.000002,α=0.06,β=0.92.If the level of the index at close of trading today is1060,what is the new volatility estimate?3.Suppose that the current daily volatilities of asset A and asset B are1.6%and2.5%,respectively.The prices of the assets at close of trading yesterday were$20and$40and the estimate of the coefficient of correlation between the returns on the two assets made at that time was0.25.The parameterλused in the EWMA model is0.95.a.Calculate the current estimate of the covariance between the assets.b.On the assumption that the prices of the assets at close of trading today are$20.5and$40.5,update the correlation estimate.4.A three-month American call option on a stock has a strike a strike price of$20.Thestock price is$20,the risk-free rate is3%per annum,and the volatility is25%per annum.A dividend of$2is expected e a three-step binomial tree to calculate the option price.5.A two-month American put option on a stock index has an exercise price of480.Thecurrent level of the index is484,the risk-free interest rate is10%per annum,the dividend yield on the index is3%per annum,and the volatility of the index is25% per annum.Divide the life of the option into four half-month periods and use the tree approach to estimate the value of the option.6.Provide formulas that can be used for obtaining three random samples from standardnormal distributions when the correlation between sample i and sample j isρi,j.Ê!¶c)º1.maximum likelihood method2.volatility term structure3.mean reversion4.GARCH(1,1)5.antithetic variable technique618ÙSIMPLE IMPLEMENTING OF OPTION ORICING MODELS6.stratified sampling7.finite difference8.hopscotch method8!{ K1.What is the difference between the exponentially weighted moving average modeland the GARCH(1,1)model for updating volatilities?2.A company uses the GARCH(1,1)model for updating volatility.The three parame-ters areω,αandβ.Describe the impact of making a small increase in each of the parameters while keeping the othersfixed.3.Which of the following can be estimated for an American option by constructing asingle binomial tree:delta,gamma,vega,theta,rho?4.Explain how the control variate technique is implemented when a tree is used tovalue American options.5.Explain why the Monte Carlo simulation approach cannot easily be used for American-style derivatives.。

金融英语业务知识练习试卷47(题后含答案及解析) 题型有: 2. 单项选择题单项选择题1.When total reserves are equal to required reserves, the banking system cannot extend loans anymore.A.TrueB.False正确答案:A解析:答案为T。

银行系统的放贷能力主要取决于超额准备金的大小,因此,如果存款准备金总额等于法定准备金时,银行系统无法贷款。

知识模块:金融英语业务知识2.A bill of lading that covers the shipment of goods on two separate vessels is known as thorough bill of lading.A.TrueB.False正确答案:B解析:答案为F。

货物在装运港装船后,要求在中途换装其他船只或其他交通工具,在这种情况下签发的提单被称为全程提单或联运提单(through bill of lading)。

知识模块:金融英语业务知识3.Usually the more liquid asset is less risky.A.TrueB.False正确答案:A解析:答案为T。

通常流动性越强的资产,风险越小。

知识模块:金融英语业务知识4.Where the bill of exchange is not accompanied by documents, these having been sent to the importer, the transaction is known as a clean collection.A.TrueB.False正确答案:A解析:答案为T。

不附带出口业务单据,仪凭清算票据进行的托收被称为“光票托收”(clean collection)。

知识模块:金融英语业务知识5.The velocity of money is the speed with which it can be converted into a liquid asset.A.TrueB.False正确答案:B解析:答案为F。

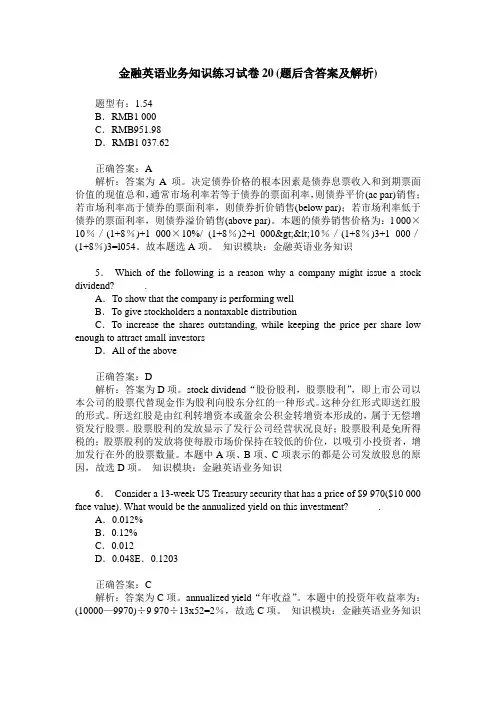

金融英语业务知识练习试卷20(题后含答案及解析)题型有:1.54B.RMB1 000C.RMB951.98D.RMB1 037.62正确答案:A解析:答案为A项。

决定债券价格的根本因素是债券息票收入和到期票面价值的现值总和,通常市场利率若等于债券的票面利率,则债券平价(ac par)销售;若市场利率高于债券的票面利率,则债券折价销售(below par);若市场利率低于债券的票面利率,则债券溢价销售(above par)。

本题的债券销售价格为:l 000×10%/(1+8%)+1 000×10%/ (1+8%)2+l 000><10%/(1+8%)3+1 000/(1+8%)3=l054。

故本题选A项。

知识模块:金融英语业务知识5.Which of the following is a reason why a company might issue a stock dividend?______.A.To show that the company is performing wellB.To give stockholders a nontaxable distributionC.To increase the shares outstanding, while keeping the price per share low enough to attract small investorsD.All of the above正确答案:D解析:答案为D项。

stock dividend“股份股利,股票股利”,即上市公司以本公司的股票代替现金作为股利向股东分红的一种形式。

这种分红形式即送红股的形式。

所送红股是由红利转增资本或盈余公积金转增资本形成的,属于无偿增资发行股票。

股票股利的发放显示了发行公司经营状况良好;股票股利是免所得税的;股票股利的发放将使每股市场价保持在较低的价位,以吸引小投资者,增加发行在外的股票数量。

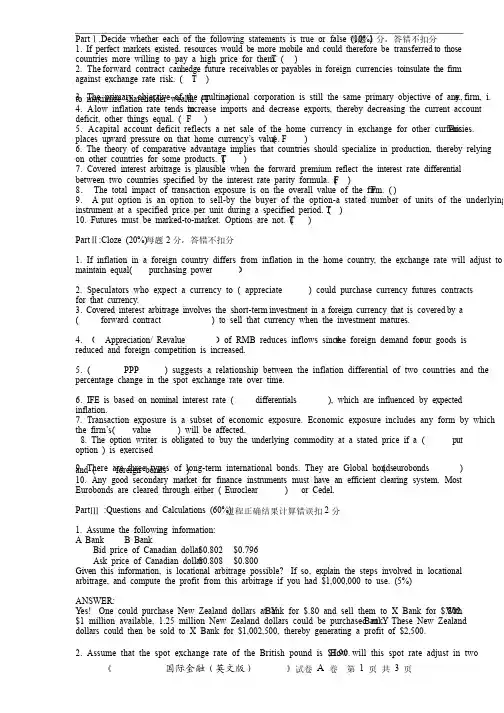

Part Ⅰ.Decide whether each of the following statements is true or false (10%)每题1分,答错不扣分分,答错不扣分1. 1. If If If perfect perfect perfect markets markets markets existed, existed, existed, resources resources resources would would would be be be more more more mobile mobile mobile and and and could could could therefore therefore therefore be transferred be transferred to to those those countries more willing to pay a high price for them. ( T ) 2. The forward contract can h edge hedge hedge future receivables future receivables or or payables payables payables in in in foreign currencies to foreign currencies to i nsulate insulate insulate the the the firm firm against exchange rate risk. ( T ) 3. The primary objective of the multinational corporation is still the same primary objective of any firm, i.e., to maximize shareholder wealth. ( T ) 4. A low inflation rate tends to increase imports and decrease exports, thereby decreasing the current account deficit, other things equal. ( F ) 5. A capital account deficit reflects a net sale of the home currency in exchange for other currencies. This places up ward pressure on that home currency’s value. ( F ) 6. The theory of comparative advantage implies that countries should specialize in production, thereby relying on other countries for some products. ( T ) 7. 7. Covered Covered Covered interest interest interest arbitrage arbitrage arbitrage is is is plausible plausible plausible when when when the the the forward forward forward premium premium premium reflect reflect reflect the the the interest interest interest rate rate rate differential differential between two countries specified by the interest rate parity formula. ( F ) 8. The total impact of transaction exposure is on the overall value of the firm. ( F ) 9. A put option is an option to sell-by the buyer of the option-a stated number of units of the underlying instrument at a specified price per unit during a specified period. ( T ) 10. Futures must be marked-to-market. Options are not. ( T ) Part Ⅱ:Cloze (20%)每题2分,答错不扣分分,答错不扣分1. If inflation in a foreign country differs from inflation in the home country, the exchange rate will adjust to maintain equal( purchasing power )2. Speculators who expect a currency to ( appreciate ) could purchase currency futures contracts for that currency. 3. 3. Covered Covered Covered interest interest interest arbitrage arbitrage arbitrage involves involves involves the short-term the short-term investment investment in in in a a a foreign foreign foreign currency currency currency that that that is covered is covered by by a a ( forward contract ) to sell that currency when the investment matures. 4. ( Appreciation/ Revalue )of RMB reduces inflows since the foreign demand for our goods is reduced and foreign competition is increased. 5. ( PPP ) suggests a relationship between the inflation differential of two countries and the percentage change in the spot exchange rate over time. 6. 6. IFE IFE IFE is is is based based based on on on nominal nominal nominal interest interest interest rate rate rate ( ( differentials ), ), which which which are are are influenced influenced influenced by by by expected expected inflation. 7. Transaction exposure is a subset of economic exposure. Economic exposure includes any form by which the firm’s ( ( value ) will be affected. 8. 8. The The The option option option writer writer writer is is is obligated obligated obligated to to to buy buy buy the the the underlying underlying underlying commodity commodity commodity at at at a a a stated stated stated price price price if if if a a a ( ( put option ) is exercised 9. There are three types of long-term international bonds. They are Global bonds , ( eurobonds ) and ( foreign bonds ). 10. 10. Any Any Any good good good secondary secondary secondary market market market for for for finance finance finance instruments instruments instruments must must must have have have an an an efficient efficient efficient clearing clearing clearing system. system. system. Most Most Eurobonds are cleared through either ( Euroclear ) or Cedel. Part Ⅲ :Questions and Calculations (60%)过程正确结果计算错误扣2分1. Assume the following information: A Bank B Bank Bid price of Canadian dollar $0.802 $0.796 Ask price of Canadian dollar $0.808 $0.800 Given Given this this this information, information, information, is is is locational locational locational arbitrage arbitrage arbitrage possible? possible? If If so, so, so, explain explain explain the the the steps steps steps involved involved involved in in in locational locational arbitrage, and compute the profit from this arbitrage if you had $1,000,000 to use. (5%) ANSWER: Y es! One could purchase New Zealand dollars at Y Bank for $.80 and sell them to X Bank for $.802. With $1 million available, 1.25 million New Zealand dollars could be purchased at Y Bank. These New Zealand dollars could then be sold to X Bank for $1,002,500, thereby generating a profit of $2,500. 2. Assume that the spot exchange rate of the British pound is $1.90. How will this spot rate adjust in two years if if the the the United United United Kingdom Kingdom Kingdom experiences experiences experiences an an an inflation inflation inflation rate rate rate of of of 7 7 7 percent percent percent per per per year year year while while while the the the United United United States States experiences an inflation rate of 2 percent per year?(10%) ANSWER: According to PPP , forward rate/spot=indexdom/indexfor the exchange rate of the pound will depreciate by 4.7 percent. Therefore, the spot rate would adjust to $1.90 × [1 + (–.047)] = $1.8107 3. 3. Assume Assume Assume that that that the spot the spot exchange exchange rate rate rate of the of the Singapore Singapore dollar dollar dollar is is is $0.70. $0.70. The The one-year one-year one-year interest interest interest rate rate rate is is is 11 11 percent in the United States and 7 percent in Singapore. What will the spot rate be in one year according to the IFE? (5%) (5%) ANSWER: according to the IFE,St+1/St=(1+Rh)/(1+Rf) $.70 × (1 + .04) = $0.728 4. Assume that XYZ Co. has net receivables of 100,000 Singapore dollars in 90 days. The spot rate of the S$ is $0.50, and the Singapore interest rate is 2% over 90 days. Suggest how the U.S. firm could implement a money market hedge. Be precise . (10%) ANSWER: The firm could borrow the amount of Singapore dollars so that the 100,000 Singapore dollars to be be received received received could could could be be be used used used to to to pay pay pay off off off the the the loan. loan. This This amounts amounts amounts to to to (100,000/1.02) (100,000/1.02) (100,000/1.02) = = = about about about S$98,039, which S$98,039, which could could be be be converted converted converted to to to about about about $49,020 $49,020 $49,020 and and and invested. invested. The The borrowing borrowing borrowing of of of Singapore Singapore Singapore dollars dollars dollars has has has offset offset offset the the transaction exposure due to the future receivables in Singapore dollars. 5. 5. A A U.S. company ordered ordered a a a Jaguar Jaguar Jaguar sedan. In sedan. In 6 6 months , months , it will pay pay ££30,000 30,000 for for for the the the car. car. car. It It worried worried that that pound ster1ing might rise sharply from the current rate($1.90). So, the company bought a 6 month pound call (supposed contract size = £35,000) with a strike price of $1.90 for a premium of 2.3 cents/£. (1)Is hedging in the options market better if the £ rose to $1.92 in 6 months? (2)what did the exchange rate have to be for the company to break even?(15%)Solution: (1)If the £ rose to $1.92 in 6 months, the U.S. company would rose to $1.92 in 6 months, the U.S. company would exercise the pound call option. The sum of the strike price and premium is $1.90 + $0.023 = $1.9230/£This is bigger than $1.92. So hedging in the options market is not better. (2) when we say the company can break even, we mean that hedging or not hedging doesn’t matter. And only when (strike price + premium )= the exchange rate , hedging or not doesn’t matter. So, the exchange rate =$1.923/£. 6. Discuss the advantages and disadvantages of fixed exchange rate system.(15%) textbook page50 答案以教材第50 页为准页为准P AR T Ⅳ: Diagram(10%) The strike price for a call is $1.67/£. The premium quoted at the Exchange is $0.0222 per British pound. Diagram the profit and loss potential, and the break-even price for this call option Solution: Following diagram shows the profit and loss potential, and the break-even price of this put option: P AR T Ⅴ:Additional Question Suppose Suppose that that that you you you are are are expecting expecting expecting revenues revenues revenues of of of Y Y 100,000 100,000 from from from Japan Japan Japan in in in one one one month. month. Currently, Currently, 1 1 1 month month forward contracts are trading at $1 = $105 Y en. Y ou have the following estimate of the Y en/$ exchange rate in one month. Price Probability 90 Y en/$ 4% 95 Y en/$ 25% 100 Y/$ 45% 105 Y en/$ 20% 110 Y en/$ 6% a) What position in forward contracts would you take to hedge your exchange risk? b) Calculate the expected value of the hedge. c) How could you replicate this hedge in the money market? Y ou are expecting revenues of Y100,000 in one month that you will need to covert to dollars. Y ou could hedge this in forward markets by taking long positions in US dollars (short positions in Japanese Y en). By locking in your price at $1 = Y105, your dollar revenues are guaranteed to be Y100,000/ 105 = $952 On the other hand, you can wait and use the spot markets. Exchange Rate Probability Revenue w/Hedge Revenue w/out Hedge V alue of Hedge 90 Y/$ 4% $1,111 $952 -$159 95 Y/$ 25% $1,052 $952 -$100 100 Y/$ 45% $1,000 $952 -$48 105 Y/$ 20% $952 $952 $0 110 Y/$ 6% $909 $952 $43 Expected V alue = (.02)(-159) + (.25)(-100) + (.45)(-48) + (.20)(0) + (.08)(43) = -$24 Y ou could replicate this hedge by using the following: a) Borrow in Japan b) Convert the Y en to dollars c) Invest the dollars in the US d) Pay back the loan when you receive the Y100,000 。

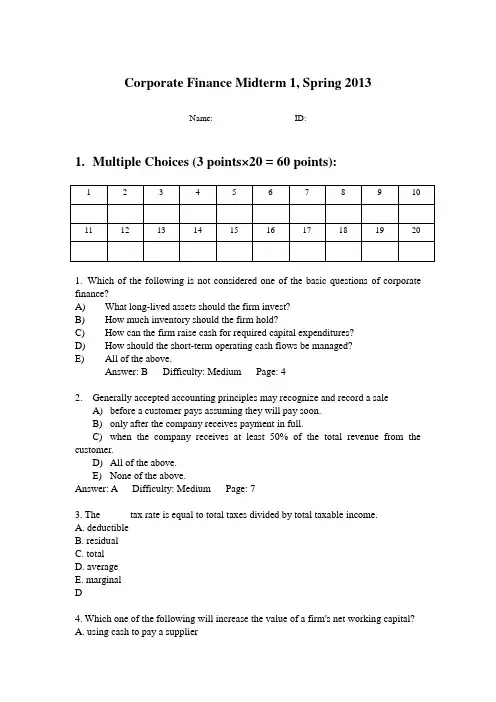

Corporate Finance Midterm 1, Spring 2013Name: ID:1.Multiple Choices (3 points×20 = 60 points):1. Which of the following is not considered one of the basic questions of corporate finance?A) What long-lived assets should the firm invest?B) How much inventory should the firm hold?C) How can the firm raise cash for required capital expenditures?D) How should the short-term operating cash flows be managed?E) All of the above.Answer: B Difficulty: Medium Page: 42. Generally accepted accounting principles may recognize and record a saleA) before a customer pays assuming they will pay soon.B) only after the company receives payment in full.C) when the company receives at least 50% of the total revenue from the customer.D) All of the above.E) None of the above.Answer: A Difficulty: Medium Page: 73. The _____ tax rate is equal to total taxes divided by total taxable income.A. deductibleB. residualC. totalD. averageE. marginalD4. Which one of the following will increase the value of a firm's net working capital?A. using cash to pay a supplierB. depreciating an assetC. collecting an accounts receivableD. purchasing inventory on creditE. selling inventory at a profitE5. The higher the degree of financial leverage employed by a firm, the:A. higher the probability that the firm will encounter financial distress.B. lower the amount of debt incurred.C. less debt a firm has per dollar of total assets.D. higher the number of outstanding shares of stock.E. lower the balance in accounts payable.A6. Depreciation:A. reduces both taxes and net income.B. increases the net fixed assets as shown on the balance sheet.C. reduces both the net fixed assets and the costs of a firm.D. is a noncash expense which increases the net income.E. decreases net fixed assets, net income, and operating cash flows.A7. Which one of the following must be true if a firm had a negative cash flow from assets?A. The firm borrowed money.B. The firm acquired new fixed assets.C. The firm had a net loss for the period.D. The firm utilized outside funding.E. Newly issued shares of stock were sold.D8. A firm has net working capital of $640. Long-term debt is $4,180, total assets are $6,230, and fixed assets are $3,910. What is the amount of the total liabilities?A. $2,050B. $2,690C. $4,130D. $5,590E. $5,860Current assets = $6,230 - $3,910 = $2,320Current liabilities = $2,320 - $640 = $1,680Total liabilities = $1,680 + $4,180 = $5,860E9. Bonner Collision has shareholders' equity of $141,800. The firm owes a total of $126,000 of which 60 percent is payable within the next year. The firm net fixed assets of $161,900. What is the amount of the net working capital?A. $25,300B. $30,300C. $75,600D. $86,300E. $111,500Current liabilities = .60 $126,000 = $75,600Total assets = $141,800 + $126,000 = $267,800Current assets = $267,800 - $161,900 = $105,900Net working capital = $105,900 - $75,600 = $30,300B10. Kaylor Equipment Rental paid $75 in dividends and $511 in interest expense. The addition to retained earnings is $418 and net new equity is $500. The tax rate is 35 percent. Sales are $15,900 and depreciation is $680. What are the earnings before interest and taxes?A. $589.46B. $1,269.46C. $1,331.54D. $1,951.54E. $1,949.46Net income = $75 + $418 = $493Taxable income = $493/(1 - .35) = $758.46Earnings before interest and taxes = $758.46 + $511 = $1,269.46B11. Given the tax rates as shown, what is the average tax rate for a firm with taxable income of $311,360?A. 28.25 percentB. 31.09 percentC. 33.62 percentD. 35.48 percentE. 39.00 percentTax = .15($50,000) + .25($25,000) + .34($25,000) + .39($211,360) = $104,680.40 Average tax rate = $104,680.40/$311,360 = 33.62 percent12. Crandall Oil has total sales of $1,349,800 and costs of $903,500. Depreciation is $42,700 and the tax rate is 34 percent. The firm does not have any interest expense. What is the operating cash flow?A. $129,152B. $171,852C. $179,924D. $281,417E. $309,076Earnings before interest and taxes = $1,349,800 - $903,500 - $42,700 = $403,600 Tax = $403,600 .34 = $137,224Operating cash flow = $403,600 + $42,700 - $137,224 = $309,076E13. At the beginning of the year, a firm had current assets of $121,306 and current liabilities of $124,509. At the end of the year, the current assets were $122,418 and the current liabilities were $103,718. What is the change in net working capital?A. -$19,679B. -$11,503C. -$9,387D. $1,809E. $21,903Change in net working capital = ($122,418 - $103,718) - ($121,306 - $124,509) = $21,903E14. The Lakeside Inn had operating cash flow of $48,450. Depreciation was $6,700 and interest paid was $2,480. A net total of $2,620 was paid on long-term debt. The firm spent $24,000 on fixed assets and decreased net working capital by $1,330. What is the amount of the cash flow to stockholders?A. $5,100B. $7,830C. $18,020D. $19,998E. $20,680Cash flow from assets = $48,450 - (-$1,330) - $24,000 = $25,780Cash flow to creditors =$2,480 - (-$2,620) = $5,100Cash flow to stockholders = $25,780 - $5,100 = $20,680E15. You are scheduled to receive annual payments of $4,800 for each of the next 7 years. The discount rate is 8 percent. What is the difference in the present value if you receive these payments at the beginning of each year rather than at the end of each year?A. $1,999B. $2,013C. $2,221D. $2,227E. $2,304Difference = $26,990 - $24,991 = $1,999Note: The difference = 0.08 $24,991 = $1,999A16. Your local travel agent is advertising an upscale winter vacation package for travel three years from now to Antarctica. The package requires that you pay $25,000 today, $30,000 one year from today, and a final payment of $45,000 on the day you depart three years from today. What is the cost of this vacation in today's dollars if the discount rate is 9.75 percent?A. $86,376B. $89,695C. $91,219D. $91,407E. $93,478A17. You are going to loan a friend $900 for one year at a 5 percent rate of interest, compounded annually. How much additional interest could you have earned if you had compounded the rate continuously rather than annually?A. $0.97B. $1.14C. $1.23D. $1.36E. $1.41Additional interest = $900 (0.0512711 - 0.05) = $1.14B18. First Century Bank wants to earn an effective annual return on its consumer loans of 10 percent per year. The bank uses daily compounding on its loans. By law, what interest rate is the bank required to report to potential borrowers?A. 9.23 percentB. 9.38 percentC. 9.53 percentD. 9.72 percentE. 10.00 percentAPR = 365×[(1 + 0.10)1/365 - 1] = 9.53 percent19. You have just won the lottery and will receive $540,000 as your first payment one year from now. You will receive payments for 26 years. The payments will increase in value by 4 percent each year. The appropriate discount rate is 10 percent. What is the present value of your winnings?A. $6,221,407B. $6,906,372C. $7,559,613D. $7,811,406E. $8,003.1120. Consider a firm with a contract to sell an asset 3 years from now for $90,000. The asset costs $71,000 to produce today. At what rate will the firm just break even on this contract?A. 7.87 percentB. 8.01 percentC. 8.23 percentD. 8.57 percentE. 8.90 percent$90,000 = $71,000×(1 + r)3; r = 8.23 percent2.Concept Questions(1). Companies pa y rating agencies such as Moody’s and S&P to rate their bonds, and the costs can be substantial. However, companies are not required to have their bonds rated; doing so is strictly volunteer. Why do you think they do it? (3 Points)Ans: Companies pay to have their bonds rated simply because unrated bonds can be difficult to sell; many large investors are prohibited from investing in unrated issues.(2) Corporate ownership varies around the world. Historically individuals have owned the majority of shares in public corporations in the United States. In Germany and Japan, however, banks, other large financial institutions, and other companies own most of the stock in public corporations. Do you thinks agency problems are likely to be more or less severe in Germany and Japan than in the United States? Why? In recent years, large financial institutions such as mutual funds and pension funds have been becoming the dominant owners of stock in the United States, and these institutions are becoming more active in corporate affairs. What are the implications of this trend for agency problems and corporate control? (7 Points)Ans: We would expect agency problems to be less severe in countries with a relatively small percentage of individual ownership. Fewer individual owners should reduce the number of diverse opinions concerning corporate goals. The high percentage of institutional ownership might lead to a higher degree of agreement between owners and managers on decisions concerning risky projects. In addition, institutions may be better able to implement effective monitoring mechanisms on managers than can individual owners, based on the institutions’ deeper resources and experiences with their own management. The increase in institutional ownership of stock in the United States and the growing activism of these large shareholder groups may lead to a reduction in agency problems for U.S. corporations and a more efficient market for corporate control.3. Computations(1). (15 points) A local finance company quotes a 16% interest rate on one-year loans. So, if you borrow $25,000, the interest for the year will be $4,000. Because you must repay a total of $29,000 in one year, the finance company requires you to pay$29,000/12 or $2,416.67 per month over the next 12 months. Is this a 16% loan? What rate would legally have to be quoted? What is the effective annual rate?T o find the APR and EAR, we need to use the actual cash flows of the loan. In other words, the interest rate quoted in the problem is only relevant to determine the total interest under the terms given. The interest rate for the cash flows of the loan is:PVA = $25,000 = $2,416.67{(1 – [1 / (1 + r)]12 ) / r }Again, we cannot solve this equation for r, so we need to solve this equation on a financial calculator, using a spreadsheet, or by trial and error. Using a spreadsheet, we find:r = 2.361% per monthSo the APR is:APR = 12(2.361%) = 28.33%And the EAR is:EAR = (1.02361)12– 1 = .3231 or 32.31%(2). (15) You have just won the lottery and will receive $1,000,000 in one year. You will receive payments for 30 years, which will increase 5% per year. If the appropriate discount rate is 8%, what is the present value of your winnings?We can use the present value of a growing perpetuity equation to find the value of your deposits today. Doing so, we find:PV = C {[1/(r–g)] – [1/(r–g)] × [(1 + g)/(1 + r)]t}PV = $1,000,000{[1/(.08 – .05)] – [1/(.08 – .05)] × [(1 + .05)/(1 + .08)]30}PV = $19,016,563.18。

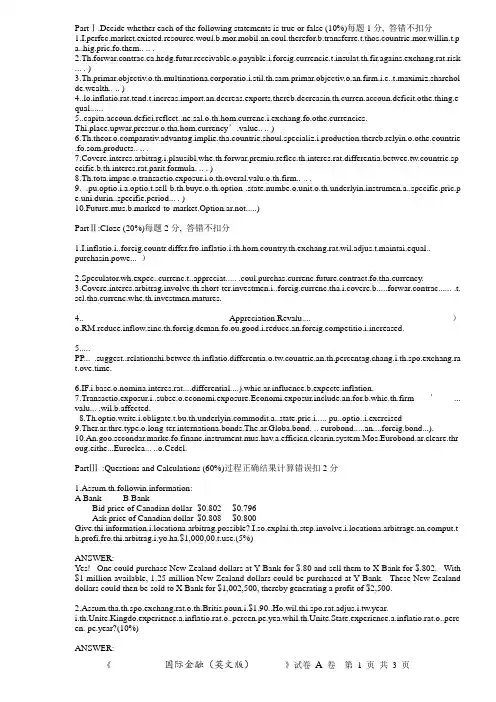

PartⅠ.Decide whether each of the following statements is true or false (10%)每题1分, 答错不扣分1.I.perfec.market.existed.resource.woul.b.mor.mobil.an.coul.therefor.b.transferre.t.thos.countrie.mor.willin.t.pa..hig.pric.fo.them.. .. .2.Th.forwar.contrac.ca.hedg.futur.receivable.o.payable.i.foreig.currencie.t.insulat.th.fir.agains.exchang.rat.risk ... . )3.Th.primar.objectiv.o.th.multinationa.corporatio.i.stil.th.sam.primar.objectiv.o.an.firm.i.e..t.maximiz.sharehol de.wealth.. .. )4..lo.inflatio.rat.tend.t.increas.import.an.decreas.exports.thereb.decreasin.th.curren.accoun.deficit.othe.thing.e qual......5..capita.accoun.defici.reflect..ne.sal.o.th.hom.currenc.i.exchang.fo.othe.currencies.Thi.place.upwar.pressur.o.tha.hom.currency’.value.. .. )parativ.advantag.implie.tha.countrie.shoul.specializ.i.production.thereb.relyin.o.othe.countrie .fo.som.products.. .. .7.Covere.interes.arbitrag.i.plausibl.whe.th.forwar.premiu.reflec.th.interes.rat.differentia.betwee.tw.countrie.sp ecifie.b.th.interes.rat.parit.formula. .. . )8.Th.tota.impac.o.transactio.exposur.i.o.th.overal.valu.o.th.firm.. .. .9. .pu.optio.i.a.optio.t.sell-b.th.buye.o.th.option-.state.numbe.o.unit.o.th.underlyin.instrumen.a..specifie.pric.pe.uni.durin..specifie.period... . )10.Future.mus.b.marked-to-market.Option.ar.not.....)PartⅡ:Cloze (20%)每题2分, 答错不扣分1.I.inflatio.i..foreig.countr.differ.fro.inflatio.i.th.hom.country.th.exchang.rat.wil.adjus.t.maintai.equal.. purchasin.powe... )2.Speculator.wh.expec..currenc.t..appreciat..... .coul.purchas.currenc.future.contract.fo.tha.currency.3.Covere.interes.arbitrag.involve.th.short-ter.investmen.i..foreig.currenc.tha.i.covere.b.....forwar.contrac...... .t. sel.tha.currenc.whe.th.investmen.matures.4.. Appreciation.Revalu....)petitio.i.increased.5.....PP... .suggest..relationshi.betwee.th.inflatio.differentia.o.tw.countrie.an.th.percentag.chang.i.th.spo.exchang.ra t.ove.time.6.IF.i.base.o.nomina.interes.rat....differential....).whic.ar.influence.b.expecte.inflation.7.Transactio.exposur.i..subse.o.economi.exposure.Economi.exposur.include.an.for.b.whic.th.firm’... valu... .wil.b.affected.modit.a..state.pric.i..... pu..optio..i.exercised9.Ther.ar.thre.type.o.long-ter.internationa.bonds.The.ar.Globa.bond. .. eurobond.....an....foreig.bond...).10.An.goo.secondar.marke.fo.financ.instrument.mus.hav.a.efficien.clearin.system.Mos.Eurobond.ar.cleare.thr oug.eithe...Euroclea... ..o.Cedel.PartⅢ:Questions and Calculations (60%)过程正确结果计算错误扣2分rmation:A BankB BankBid price of Canadian dollar $0.802 $0.796Ask price of Canadian dollar $0.808 $0.800rmation.i.locationa.arbitrag.possible?put.t h.profi.fro.thi.arbitrag.i.yo.ha.$1,000,e.(5%)ANSWER:Yes! One could purchase New Zealand dollars at Y Bank for $.80 and sell them to X Bank for $.802. With $1 million available, 1.25 million New Zealand dollars could be purchased at Y Bank. These New Zealand dollars could then be sold to X Bank for $1,002,500, thereby generating a profit of $2,500.2.Assum.tha.th.spo.exchang.rat.o.th.Britis.poun.i.$1.90..Ho.wil.thi.spo.rat.adjus.i.tw.year.i.th.Unite.Kingdo.experience.a.inflatio.rat.o..percen.pe.yea.whil.th.Unite.State.experience.a.inflatio.rat.o..perc en. pe.year?(10%)ANSWER:According to PPP, forward rate/spot=indexdom/indexforth.exchang.rat.o.th.poun.wil.depreciat.b.4..percent.Therefore.th.spo.rat.woul.adjus.t.$1.9..[..(–.047)..$1.81073.Assum.tha.th.spo.exchang.rat.o.th.Singapor.dolla.i.$0.70..Th.one-yea.interes.rat.i.1.percen.i.th.Unite.State.a n..percen.i.Singapore..Wha.wil.th.spo.rat.b.i.on.yea.accordin.t.th.IFE?.(5%)ANSWER: according to the IFE,St+1/St=(1+Rh)/(1+Rf)$.70 × (1 + .04) = $0.7284.Assum.tha.XY.Co.ha.ne.receivable.o.100,00.Singapor.dollar.i.9.days..Th.spo.rat.o.th.S.i.$0.50.an.th.Singap or.interes.rat.i.2.ove.9.days..Sugges.ho.th.U.S.fir.coul.implemen..mone.marke.hedge..B.precis. .(10%)ANSWER: The firm could borrow the amount of Singapore dollars so that the 100,000 Singapore dollars to be received could be used to pay off the loan. This amounts to (100,000/1.02) = about S$98,039, which could be converted to about $49,020 and invested. The borrowing of Singapore dollars has offset the transaction exposure due to the future receivables in Singapore dollars.pan.ordere..Jagua.sedan.I..month..i.wil.pa.£30,00.fo.th.car.I.worrie.tha.poun.ster1in.migh.ris.sharpl.fro.th.curren.rate($1.90)pan.bough...mont.poun.cal.(suppose.contrac.siz..£35,000.wit..strik.pric.o.$1.9.fo..premiu.o.2..cents/£.(1)Is hedging in the options market better if the £ rose to $1.92 in 6 months?(2)what did the exchange rate have to be for the company to break even?(15%)Solution:(1)I.th..ros.t.$pan.woul. exercis.th.poun.cal.option.Th.su.o.th.strik.pric.an.premiu..i.$1.90 + $0.023 = $1.9230/£Thi.i.bigge.tha.$1.92.So hedging in the options market is not better.(2.whe.w.sa.th. compan.ca.brea.even.w.mea.tha.hedgin.o.no.hedgin.doesn’. matter.An.onl.whe.(strik.pric..premiu.).th.exchang.rat.,hedging or not doesn’t matter.So, the exchange rate =$1.923/£.6.Discus.th.advantage.an.disadvantage.o.fixe.exchang.rat.system.(15%)textbook page50 答案以教材第50 页为准PART Ⅳ: Diagram(10%)Th.strik.pric.fo..cal.i.$1.67/£.Th.premiu.quote.a.th.Exchang.i.$0.022.pe.Britis.pound.Diagram the profit and loss potential, and the break-even price for this call optionSolution:Following diagram shows the profit and loss potential, and the break-even price of this put option:PART Ⅴa) b) Calculate the expected value of the hedge.c) How could you replicate this hedge in the money market?Yo.ar.expectin.revenue.o.Y100,00.i.on.mont.tha.yo.wil.nee.t.cover.t.dollars.Yo.coul.hedg.thi.i.forwar.market.b.takin.lon.position.i.U.dollar.(shor.position.i.Japanes.Yen).B.lockin.i.you.pric.a.$..Y105.you.dolla.revenue.ar.guarantee.t.b.Y100,000/ 105 = $952You could replicate this hedge by using the following:a) Borrow in Japanb) Convert the Yen to dollarsc) Invest the dollars in the USd) Pay back the loan when you receive the Y100,000。

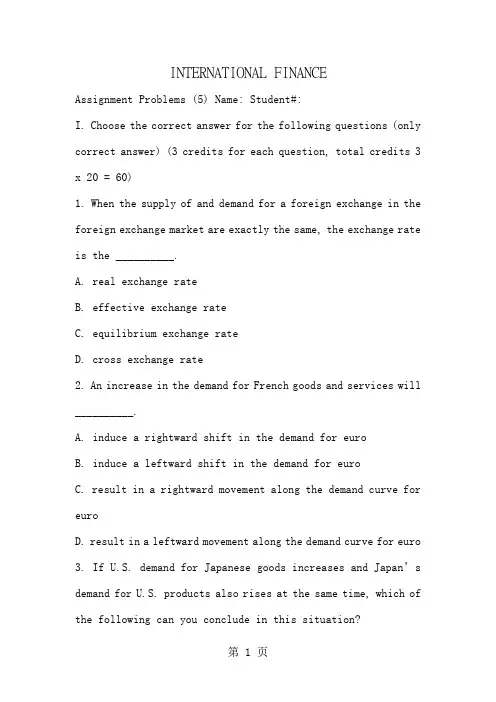

INTERNATIONAL FINANCEAssignment Problems (5) Name: Student#:I. Choose the correct answer for the following questions (only correct answer) (3 credits for each question, total credits 3 x 20 = 60)1. When the supply of and demand for a foreign exchange in the foreign exchange market are exactly the same, the exchange rate is the __________.A. real exchange rateB. effective exchange rateC. equilibrium exchange rateD. cross exchange rate2. An increase in the demand for French goods and services will __________.A. induce a rightward shift in the demand for euroB. induce a leftward shift in the demand for euroC. result in a rightward movement along the demand curve for euroD. result in a leftward movement along the demand curve for euro3. If U.S. dem and for Japanese goods increases and Japan’s demand for U.S. products also rises at the same time, which of the following can you conclude in this situation?A. The U.S. dollar will appreciate against the yen.B. The U.S. dollar will depreciate against the yen.C. The U.S. dollar will not change relative to the yen.D. The U.S. dollar may appreciate, depreciate, or remain unchanged against theyen.4. If the price of a pair of Nike sneakers costs $85 in U.S, and the price of the same sneakers is €80 in Pari s, the spot rate is $1.35 per euro, the euro __________.A. is correctly valued according to PPPB. is correctly valued according to relative PPPC. is undervalued according to PPPD. is overvalued according to PPP5. If the expected exchange rate E (SB/A) according to the relative purchasing power parity is lower than the spot exchange rate (SB/A), we may conclude that __________.A. country B is expected to run huge BOP surplus with country AB. country A’s interest rate is going to be lower than that of country B’sC. the expected inflation rate in country A is higher than the expected inflation rate in country BD. the expected inflation rate in country A is lower than the expected inflation rate in country B6. Assume that PPP holds in the long run. If the price of a tradable good is $20 in the U.S. and 100 pesos in Mexico; and the exchange rate is 7 pesos/$ right now, which of the following changes might we expect in the future?A. an increase in the price of the good in the U.SB. a decrease in the price of the good in MexicoC. an appreciation of the peso in nominal termsD. a depreciation of the peso in nominal terms7. Which basket of goods would be most likely to exhibit absolute purchasing power parity?A. Highly tradable commodities, such as wheatB. The goods in the Consumer Price indexC. Specialized luxury goods, which are subject to different tax rates across countriesD. Locally produced goods, such as transportation services, which are not easily traded8. The absolute purchasing power parity says that the exchange rate between the two currencies should be determined by the __________ .A. relative inflation rate of the two currenciesB. relative price level of the two countriesC. relative interest rate of the two currenciesD. relative money supply of the two countries9. According to the relative PPP, if country A’s inflation rate is higher than country B’s inflation rate by 3%, __________.A. country A’s currency should depreciate against country B’s currency by 3%B. country A’s currency should appreciate against country B’s currency by 3%C. it is hard to say whether country A’s currency should appreciate or depreciate against country B’s currency. The exchange rate is influenced by many factorsD. none of the above is true10. If the law of one price holds for a particular good, we may conclude that __________.A. there is no trade barriers for the good among the different nationsB. the price of the good is the same ignoring the other expensesC. arbitrage for the good does not existD. all of the above are true11. An investor borrows money in one market, sells the borrowed money on the spot market, invests the proceeds of the sale inanother place and simultaneously buys back the borrowed currency on the forward market. This is called __________.A. uncovered interest arbitrageB. covered interest arbitrageC. triangular arbitrageD. spatial arbitrage12. Real return equalization across countries on similar financial instruments is called __________.A. interest rate parityB. uncovered interest parityC. forward parityD. real interest parity13. In which of the following situations would a speculator wish to sell foreign currency on the forward market?14. According to IRP, if the interest rate in country A is higher than that in country B, the forward exchange rate, defined as F1A/B is expected to be __________.A. lower than the spot rate S0A/BB. the same as the spot rate S0A/BC. higher than the spot rate S0A/BD. necessary the same as the future spot rate S1A/B15. For arbitrage opportunities to be practicable, __________.A. arbitragers must have instant access to quotesB. arbitragers must have instant access to executionsC. arbitragers must be able to execute the transactions without an initial sum of money relying on their bank’s credit standingD. All of the above must be true.16. The __________ states that the forward exchange rate quoted at time 0 for delivery at time t is equal to what the spot rate is expected to be at time t.A. interest rate parityB. uncovered interest parityC. forward parityD. real interest parity17. Assume expected value of the U.S. dollar in the future is lower than that now compared to the value of the Japanese yen. The U.S. inflation rate must be higher than Japan’s inflation rate according to __________.A. relative PPPB. Fisher equationC. International Fisher relationD. IRP18. According to covered interest arbitrage if an investor purchases a five-year U.S. bond that has an annual interest rateof 5% rather than a comparable British bond that has an annual interest rate of 6%, then the investor must be expecting the __________ to __________ at a rate at least of 1% per year over the next 5 years.A. British pound; appreciateB. British pound; revalueC. U.S. dollar; appreciateD. U.S. dollar; depreciate19. Covered interest arbitrage moves the market __________ equilibrium because __________.A. toward; investors are now more willing to invest in risky securitiesB. toward; purchasing a currency on the spot market and selling in the forward market narrows the differential between the twoC. away from; purchasing a currency on the spot market and selling in the forward market increases the differential between the twoD. away from; demand for the stronger currency forces up the interest rates on the weaker security20. If the forward exchange rate is an unbiased predictor of the expected future spot rate, which of the following is NOT true?A. The future spot rate will actually be equal to what the forward rate predictsB. The forward premium or discount reflects the expected change in the spot exchange rate.C. Speculative activity ensures that the forward rate does not diverge too far from the market’s consensus expectation.D. All of the above are true.II. Problems (40 credits)1. The Argentine peso was fixed through a currency board at Ps1.00/$ throughout the 1990s. In January 2019 the Argentine peso was floated. On January 29, 2019, it was trading at Ps3.20/$. During that one year period Argentina’s inflation rate was 20% on an annualized basis. Inflation in the United States during that same period was2.2% annualized. (10 credits)a. What should have been the exchange rate in January 2019 if purchasing power parity held?b. By what percentage was the Argentine peso undervalued on an annualized basis?2. Assume that the interest rate paid by an American borrower on a ten-year foreign bond is 10% if the bond is sold in Denmark and 7% if the bond is sold in the Netherland. Will the expectedinflation rate in the Netherlands likely be higher than the expected inflation rate in Denmark? Will the Danish kroner be expected to increase in value against the Dutch guilder? Explain your answer. (5 credits)3. Suppose S = $1.25/₤and the 1-year forward rate is F = $1.20/₤. The real interest rate on a riskless government security is 2 percent in both England and the United States. The U.S. inflation rate is 5 percent. (5 credits)a. What is England’s nominal required rate of return on riskless government securities?b. What is England’s inflation rate if the equilibrium relationships hold?4. Akira Numata, a foreign exchange trader at Credit Suisse (Tokyo), is exploring covered interest arbitrage possibilities. He wants to invest $5,000,000 or its yen equivalent, in a covered interest arbitrage between U.S. dollars and Japanese yen. He faced the following exchange rate and interest rate quotes: (12 credits)5. On a particular day, the spot rate between Czech koruna (CKR) and the U.S. dollar is CKR30.35/$, while the interest rate ona one-year financial instrument in Czech is7.5% and 3.5% in U.S. (8 credits)a. What is your expected spot exchange rate a year later?b. You’re concerned your investment in the Czech Republic because of the economic uncertainty in that country. When you expect the future value of the koruna, you require a risk premium of 2%. What is the expected future spot rate supposed to be?Answers to Assignment Problems (5)Part II1. a. inflation differential (20% -2.2%) = 17.8%U.S. should have appreciated by 17.8%Implied exchange rate 1(1 + 17.8%) = Ps1.178/$b. (1.178 – 3.2 ) / 3.2 = -63.19%2. a. According to international Fisher equation: (1 + id) / (1 + if) = (1 + E[πd]) / (1 + E[πf])id: interest rate in Denmarkif: interest rate in Netherlandπd: Danish inflation rateπf Dutch inflation rateSince (1 + id) / (1 + if) = (1 +10%)/(1 + 7%) > 0So, (1 + E[πd]) / (1 + E[πf]) >0, which means the expected inflation rate in Denmark would be greater than that in Netherland.b. If Danish inflation is higher than Dutch inflation, Danish kroner will be expected to decrease in value against the Dutch guilder. (relative PPP theory)第 11 页。

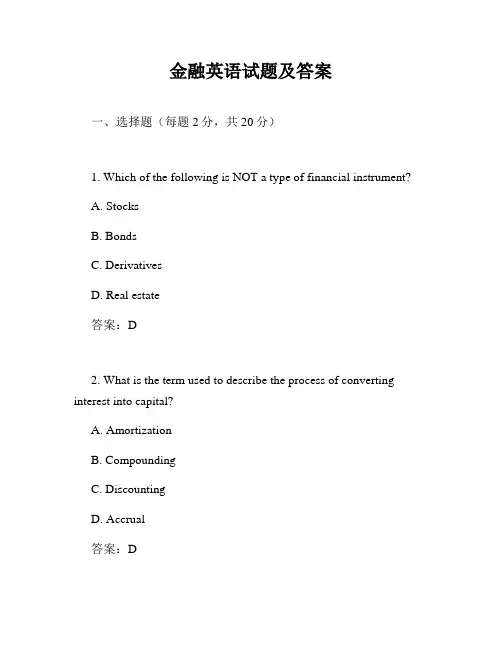

金融英语试题及答案一、选择题(每题2分,共20分)1. Which of the following is NOT a type of financial instrument?A. StocksB. BondsC. DerivativesD. Real estate答案:D2. What is the term used to describe the process of converting interest into capital?A. AmortizationB. CompoundingC. DiscountingD. Accrual答案:D3. In finance, what is the term for the risk that an investor faces due to changes in interest rates?A. Credit riskB. Market riskC. Interest rate riskD. Operational risk答案:C4. Which of the following is NOT a function of a central bank?A. Monetary policy implementationB. Financial regulationC. Currency issuanceD. Stock trading答案:D5. What is the term for the practice of borrowing in a foreign currency to take advantage of lower interest rates?A. ArbitrageB. HedgingD. Carry trade答案:D6. What is the term for a financial contract that obligates the buyer to purchase an asset or the seller to sell an asset at a predetermined future date and price?A. Forward contractB. Futures contractC. Options contractD. Swap contract答案:A7. What is the term used to describe the process of evaluating an investment based on its risk and potential return?A. Portfolio managementB. Risk assessmentC. Due diligenceD. Valuation8. What is the term for the difference between the bid and ask prices of a financial instrument?A. SpreadB. YieldC. DiscountD. Margin答案:A9. In finance, what is the term for the risk that a borrower will default on a loan?A. Liquidity riskB. Credit riskC. Market riskD. Interest rate risk答案:B10. What is the term for a financial institution that provides loans and other financial services to individuals and businesses?A. Investment bankB. Commercial bankC. Insurance companyD. Hedge fund答案:B二、填空题(每题2分,共20分)11. The process of converting future cash flows into their present value is known as ________.答案:Discounting12. A ________ is a financial institution that accepts deposits and channels those deposits into lending activities.答案:Bank13. The ________ is the risk that an asset's value will decrease due to a change in the market or economic conditions.答案:Market risk14. A ________ is a financial instrument that represents an ownership position in a corporation.答案:Stock15. The ________ is the process of determining the value of an asset or security by using financial models.答案:Valuation16. A ________ is a financial instrument that represents a creditor relationship with a financial organization.答案:Bond17. The ________ is the risk that a financial institution will not be able to meet its short-term obligations.答案:Liquidity risk18. A ________ is a financial instrument that gives the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified price.答案:Option19. The ________ is the risk that a financial institution will not be able to meet its long-term obligations.答案:Solvency risk20. A ________ is a financial institution that provides services such as underwriting or acting as a client's agent in the issuance of securities.答案:Investment bank三、简答题(每题10分,共40分)21. Explain the concept of "leverage" in finance.答案:Leverage in finance refers to the use of borrowed funds to increase the potential return of an investment. It is the process of using various financial instruments or borrowed capital to increase the potential return of an investment. However, leverage also increases the risk of loss if the investment's value declines.22. What are the main differences between a commercial bank and an investment bank?答案:A commercial bank primarily deals with retail banking services such as accepting deposits, providing loans, and offering basic financial services to individuals and businesses. An investment bank, on the other hand, focuses on services like securities underwriting, mergers and acquisitions advice, and other capital market activities. Investment banks are typically involved in more complex financial transactions and services related to corporate finance.23. Describe the role of a central bank in an economy.答案:A central bank plays a crucial role in an economy by implementing monetary policy, regulating financial institutions, issuing currency, and maintaining the stability of the financial system. It also acts as a lender of last resort to banks and other financial institutions, and it oversees the payment systems within the country.24. What is the purpose of financial regulation, and why is it important?答案:The purpose of financial regulation is to ensure the stability, integrity, and efficiency of financial markets while protectingconsumers and investors. It is important because it helps to prevent financial crises, maintain confidence in the financial system, and promote economic growth by reducing the risk of fraud, market manipulation, and other unethical practices.四、论述题(每题20分,共20分)25. Discuss the importance of risk management in financial institutions and how it can be implemented.答案:Risk management is crucial in financial institutions as it helps to identify, assess, and mitigate potential risks that could lead to financial losses. It involves the use of various tools and strategies such as diversification, hedging, and stress testing to manage risks effectively. Implementing risk management involves setting up a robust framework that includes risk identification, risk assessment, risk control, and monitoring and reporting. This ensures that financial institutions can operate within acceptable risk parameters and maintain their financial health and stability.。

PartⅠ.Decide whether each of the following statements is true or false (10%)每题1分,答错不扣分1. If perfect markets existed, resources would be more mobile and could therefore be transferred to those countries more willing to pay a high price for them. ( T )2. The forward contract can hedge future receivables or payables in foreign currencies to insulate the firm against exchange rate risk. ( T )3. The primary objective of the multinational corporation is still the same primary objective of any firm, i.e., to maximize shareholder wealth. ( T )4. A low inflation rate tends to increase imports and decrease exports, thereby decreasing the current account deficit, other things equal. ( F )5. A capital account deficit reflects a net sale of the home currency in exchange for other currencies. This places up ward pressure on that home currency’s value. ( F )6. The theory of comparative advantage implies that countries should specialize in production, thereby relying on other countries for some products. ( T )7. Covered interest arbitrage is plausible when the forward premium reflect the interest rate differential between two countries specified by the interest rate parity formula. ( F )8.The total impact of transaction exposure is on the overall value of the firm. ( F )9. A put option is an option to sell-by the buyer of the option-a stated number of units of the underlying instrument at a specified price per unit during a specified period. ( T )10. Futures must be marked-to-market. Options are not. ( T )PartⅡ:Cloze (20%)每题2分,答错不扣分1. If inflation in a foreign country differs from inflation in the home country, the exchange rate will adjust to maintain equal( purchasing power )2. Speculators who expect a currency to ( appreciate ) could purchase currency futures contracts for that currency.3. Covered interest arbitrage involves the short-term investment in a foreign currency that is covered by a ( forward contract ) to sell that currency when the investment matures.4. (Appreciation/ Revalue )of RMB reduces inflows since the foreign demand for our goods is reduced and foreign competition is increased.5. ( PPP ) suggests a relationship between the inflation differential of two countries and the percentage change in the spot exchange rate over time.6. IFE is based on nominal interest rate ( differentials ), which are influenced by expected inflation.7. Transaction exposure is a subset of economic exposure. Economic exposure includes any form by which the firm’s ( value ) will be affected.8. The option writer is obligated to buy the underlying commodity at a stated price if a ( put option ) is exercised9. There are three types of long-term international bonds. They are Global bonds , ( eurobonds ) and ( foreign bonds ).10. Any good secondary market for finance instruments must have an efficient clearing system. Most Eurobonds are cleared through either ( Euroclear ) or Cedel.PartⅢ:Questions and Calculations (60%)过程正确结果计算错误扣2分1. Assume the following information:A BankB BankBid price of Canadian dollar $0.802 $0.796Ask price of Canadian dollar $0.808 $0.800Given this information, is locational arbitrage possible? If so, explain the steps involved in locational arbitrage, and compute the profit from this arbitrage if you had $1,000,000 to use. (5%)ANSWER:Yes! One could purchase New Zealand dollars at Y Bank for $.80 and sell them to X Bank for $.802. With $1 million available, 1.25 million New Zealand dollars could be purchased at Y Bank. These New Zealand dollars could then be sold to X Bank for $1,002,500, thereby generating a profit of $2,500.2. Assume that the spot exchange rate of the British pound is $1.90. How will this spot rate adjust in twoyears if the United Kingdom experiences an inflation rate of 7 percent per year while the United States experiences an inflation rate of 2 percent per year?(10%)ANSWER:According to PPP, forward rate/spot=indexdom/indexforthe exchange rate of the pound will depreciate by 4.7 percent. Therefore, the spot rate would adjust to $1.90 ×[1 + (–.047)] = $1.81073. Assume that the spot exchange rate of the Singapore dollar is $0.70. The one-year interest rate is 11 percent in the United States and 7 percent in Singapore. What will the spot rate be in one year according to the IFE? (5%)ANSWER: according to the IFE,St+1/St=(1+Rh)/(1+Rf)$.70 × (1 + .04) = $0.7284. Assume that XYZ Co. has net receivables of 100,000 Singapore dollars in 90 days. The spot rate of the S$ is $0.50, and the Singapore interest rate is 2% over 90 days. Suggest how the U.S. firm could implement a money market hedge. Be precise . (10%)ANSWER: The firm could borrow the amount of Singapore dollars so that the 100,000 Singapore dollars to be received could be used to pay off the loan. This amounts to (100,000/1.02) = about S$98,039, which could be converted to about $49,020 and invested. The borrowing of Singapore dollars has offset the transaction exposure due to the future receivables in Singapore dollars.5. A U.S. company ordered a Jaguar sedan. In 6 months , it will pay £30,000 for the car. It worried that pound ster1ing might rise sharply from the current rate($1.90). So, the company bought a 6 month pound call (supposed contract size = £35,000) with a strike price of $1.90 for a premium of 2.3 cents/£.(1)Is hedging in the options market better if the £ rose to $1.92 in 6 months?(2)what did the exchange rate have to be for the company to break even?(15%)Solution:(1)If the £ rose to $1.92 in 6 months, the U.S. company would exercise the pound call option. The sum of the strike price and premium is$1.90 + $0.023 = $1.9230/£This is bigger than $1.92.So hedging in the options market is not better.(2) when we say the company can break even, we mean that hedging or not hedging doesn’t matter. And only when (strike price + premium )= the exchange rate ,hedging or not doesn’t matter.So, the exchange rate =$1.923/£.6. Discuss the advantages and disadvantages of fixed exchange rate system.(15%)textbook page50 答案以教材第50 页为准PART Ⅳ: Diagram(10%)The strike price for a call is $1.67/£. The premium quoted at the Exchange is $0.0222 per British pound. Diagram the profit and loss potential, and the break-even price for this call optionSolution:Following diagram shows the profit and loss potential, and the break-even price of this put option:PART Ⅴ:Additional QuestionSuppose that you are expecting revenues of Y 100,000 from Japan in one month. Currently, 1 month forward contracts are trading at $1 = $105 Yen. You have the following estimate of the Yen/$ exchange rate in one month.a)b) Calculate the expected value of the hedge.c) How could you replicate this hedge in the money market?You are expecting revenues of Y100,000 in one month that you will need to covert to dollars. You could hedge this in forward markets by taking long positions in US dollars (short positions in Japanese Yen). By locking in your price at $1 = Y105, your dollar revenues are guaranteed to beY100,000/ 105 = $952You could replicate this hedge by using the following:a) Borrow in Japanb) Convert the Yen to dollarsc) Invest the dollars in the USd) Pay back the loan when you receive the Y100,000。

Corporate Finance Midterm 1, Spring 2013Name: ID:1.Multiple Choices (3 points×20 = 60 points):1. Which of the following is not considered one of the basic questions of corporate finance?A) What long-lived assets should the firm invest?B) How much inventory should the firm hold?C) How can the firm raise cash for required capital expenditures?D) How should the short-term operating cash flows be managed?E) All of the above.Answer: B Difficulty: Medium Page: 42. Generally accepted accounting principles may recognize and record a saleA) before a customer pays assuming they will pay soon.B) only after the company receives payment in full.C) when the company receives at least 50% of the total revenue from the customer.D) All of the above.E) None of the above.Answer: A Difficulty: Medium Page: 73. The _____ tax rate is equal to total taxes divided by total taxable income.A. deductibleB. residualC. totalD. averageE. marginalD4. Which one of the following will increase the value of a firm's net working capital?A. using cash to pay a supplierB. depreciating an assetC. collecting an accounts receivableD. purchasing inventory on creditE. selling inventory at a profitE5. The higher the degree of financial leverage employed by a firm, the:A. higher the probability that the firm will encounter financial distress.B. lower the amount of debt incurred.C. less debt a firm has per dollar of total assets.D. higher the number of outstanding shares of stock.E. lower the balance in accounts payable.A6. Depreciation:A. reduces both taxes and net income.B. increases the net fixed assets as shown on the balance sheet.C. reduces both the net fixed assets and the costs of a firm.D. is a noncash expense which increases the net income.E. decreases net fixed assets, net income, and operating cash flows.A7. Which one of the following must be true if a firm had a negative cash flow from assets?A. The firm borrowed money.B. The firm acquired new fixed assets.C. The firm had a net loss for the period.D. The firm utilized outside funding.E. Newly issued shares of stock were sold.D8. A firm has net working capital of $640. Long-term debt is $4,180, total assets are $6,230, and fixed assets are $3,910. What is the amount of the total liabilities?A. $2,050B. $2,690C. $4,130D. $5,590E. $5,860Current assets = $6,230 - $3,910 = $2,320Current liabilities = $2,320 - $640 = $1,680Total liabilities = $1,680 + $4,180 = $5,860E9. Bonner Collision has shareholders' equity of $141,800. The firm owes a total of $126,000 of which 60 percent is payable within the next year. The firm net fixed assets of $161,900. What is the amount of the net working capital?A. $25,300B. $30,300C. $75,600D. $86,300E. $111,500Current liabilities = .60 $126,000 = $75,600Total assets = $141,800 + $126,000 = $267,800Current assets = $267,800 - $161,900 = $105,900Net working capital = $105,900 - $75,600 = $30,300B10. Kaylor Equipment Rental paid $75 in dividends and $511 in interest expense. The addition to retained earnings is $418 and net new equity is $500. The tax rate is 35 percent. Sales are $15,900 and depreciation is $680. What are the earnings before interest and taxes?A. $589.46B. $1,269.46C. $1,331.54D. $1,951.54E. $1,949.46Net income = $75 + $418 = $493Taxable income = $493/(1 - .35) = $758.46Earnings before interest and taxes = $758.46 + $511 = $1,269.46B11. Given the tax rates as shown, what is the average tax rate for a firm with taxable income of $311,360?A. 28.25 percentB. 31.09 percentC. 33.62 percentD. 35.48 percentE. 39.00 percentTax = .15($50,000) + .25($25,000) + .34($25,000) + .39($211,360) = $104,680.40 Average tax rate = $104,680.40/$311,360 = 33.62 percent12. Crandall Oil has total sales of $1,349,800 and costs of $903,500. Depreciation is $42,700 and the tax rate is 34 percent. The firm does not have any interest expense. What is the operating cash flow?A. $129,152B. $171,852C. $179,924D. $281,417E. $309,076Earnings before interest and taxes = $1,349,800 - $903,500 - $42,700 = $403,600 Tax = $403,600 .34 = $137,224Operating cash flow = $403,600 + $42,700 - $137,224 = $309,076E13. At the beginning of the year, a firm had current assets of $121,306 and current liabilities of $124,509. At the end of the year, the current assets were $122,418 and the current liabilities were $103,718. What is the change in net working capital?A. -$19,679B. -$11,503C. -$9,387D. $1,809E. $21,903Change in net working capital = ($122,418 - $103,718) - ($121,306 - $124,509) = $21,903E14. The Lakeside Inn had operating cash flow of $48,450. Depreciation was $6,700 and interest paid was $2,480. A net total of $2,620 was paid on long-term debt. The firm spent $24,000 on fixed assets and decreased net working capital by $1,330. What is the amount of the cash flow to stockholders?A. $5,100B. $7,830C. $18,020D. $19,998E. $20,680Cash flow from assets = $48,450 - (-$1,330) - $24,000 = $25,780Cash flow to creditors =$2,480 - (-$2,620) = $5,100Cash flow to stockholders = $25,780 - $5,100 = $20,680E15. You are scheduled to receive annual payments of $4,800 for each of the next 7 years. The discount rate is 8 percent. What is the difference in the present value if you receive these payments at the beginning of each year rather than at the end of each year?A. $1,999B. $2,013C. $2,221D. $2,227E. $2,304Difference = $26,990 - $24,991 = $1,999Note: The difference = 0.08 $24,991 = $1,999A16. Your local travel agent is advertising an upscale winter vacation package for travel three years from now to Antarctica. The package requires that you pay $25,000 today, $30,000 one year from today, and a final payment of $45,000 on the day you depart three years from today. What is the cost of this vacation in today's dollars if the discount rate is 9.75 percent?A. $86,376B. $89,695C. $91,219D. $91,407E. $93,478A17. You are going to loan a friend $900 for one year at a 5 percent rate of interest, compounded annually. How much additional interest could you have earned if you had compounded the rate continuously rather than annually?A. $0.97B. $1.14C. $1.23D. $1.36E. $1.41Additional interest = $900 (0.0512711 - 0.05) = $1.14B18. First Century Bank wants to earn an effective annual return on its consumer loans of 10 percent per year. The bank uses daily compounding on its loans. By law, what interest rate is the bank required to report to potential borrowers?A. 9.23 percentB. 9.38 percentC. 9.53 percentD. 9.72 percentE. 10.00 percentAPR = 365×[(1 + 0.10)1/365 - 1] = 9.53 percent19. You have just won the lottery and will receive $540,000 as your first payment one year from now. You will receive payments for 26 years. The payments will increase in value by 4 percent each year. The appropriate discount rate is 10 percent. What is the present value of your winnings?A. $6,221,407B. $6,906,372C. $7,559,613D. $7,811,406E. $8,003.1120. Consider a firm with a contract to sell an asset 3 years from now for $90,000. The asset costs $71,000 to produce today. At what rate will the firm just break even on this contract?A. 7.87 percentB. 8.01 percentC. 8.23 percentD. 8.57 percentE. 8.90 percent$90,000 = $71,000×(1 + r)3; r = 8.23 percent2.Concept Questions(1). Companies pa y rating agencies such as Moody’s and S&P to rate their bonds, and the costs can be substantial. However, companies are not required to have their bonds rated; doing so is strictly volunteer. Why do you think they do it? (3 Points)Ans: Companies pay to have their bonds rated simply because unrated bonds can be difficult to sell; many large investors are prohibited from investing in unrated issues.(2) Corporate ownership varies around the world. Historically individuals have owned the majority of shares in public corporations in the United States. In Germany and Japan, however, banks, other large financial institutions, and other companies own most of the stock in public corporations. Do you thinks agency problems are likely to be more or less severe in Germany and Japan than in the United States? Why? In recent years, large financial institutions such as mutual funds and pension funds have been becoming the dominant owners of stock in the United States, and these institutions are becoming more active in corporate affairs. What are the implications of this trend for agency problems and corporate control? (7 Points)Ans: We would expect agency problems to be less severe in countries with a relatively small percentage of individual ownership. Fewer individual owners should reduce the number of diverse opinions concerning corporate goals. The high percentage of institutional ownership might lead to a higher degree of agreement between owners and managers on decisions concerning risky projects. In addition, institutions may be better able to implement effective monitoring mechanisms on managers than can individual owners, based on the institutions’ deeper resources and experiences with their own management. The increase in institutional ownership of stock in the United States and the growing activism of these large shareholder groups may lead to a reduction in agency problems for U.S. corporations and a more efficient market for corporate control.3. Computations(1). (15 points) A local finance company quotes a 16% interest rate on one-year loans. So, if you borrow $25,000, the interest for the year will be $4,000. Because you must repay a total of $29,000 in one year, the finance company requires you to pay$29,000/12 or $2,416.67 per month over the next 12 months. Is this a 16% loan? What rate would legally have to be quoted? What is the effective annual rate?T o find the APR and EAR, we need to use the actual cash flows of the loan. In other words, the interest rate quoted in the problem is only relevant to determine the total interest under the terms given. The interest rate for the cash flows of the loan is:PVA = $25,000 = $2,416.67{(1 – [1 / (1 + r)]12 ) / r }Again, we cannot solve this equation for r, so we need to solve this equation on a financial calculator, using a spreadsheet, or by trial and error. Using a spreadsheet, we find:r = 2.361% per monthSo the APR is:APR = 12(2.361%) = 28.33%And the EAR is:EAR = (1.02361)12– 1 = .3231 or 32.31%(2). (15) You have just won the lottery and will receive $1,000,000 in one year. You will receive payments for 30 years, which will increase 5% per year. If the appropriate discount rate is 8%, what is the present value of your winnings?We can use the present value of a growing perpetuity equation to find the value of your deposits today. Doing so, we find:PV = C {[1/(r–g)] – [1/(r–g)] × [(1 + g)/(1 + r)]t}PV = $1,000,000{[1/(.08 – .05)] – [1/(.08 – .05)] × [(1 + .05)/(1 + .08)]30}PV = $19,016,563.18。