新编金融专业英语微课版张思成课后答案

- 格式:docx

- 大小:132.18 KB

- 文档页数:10

CHAPTER 4THE U.S. FEDERAL RESERVEAND THE CREATION OF MONEYCENTRAL BANKS AND THEIR PURPOSEThe primary role of a central bank is to maintain the stability of the currency and money supply for a country or a group of countries. The role of central banks can be categorized as: (1) risk assessment, (2) risk reduction, (3) oversight of payment systems, (4) crisis management.One of the major ways a central bank accomplishes its goals is through monetary policy. For this reason, central banks are sometimes called monetary authority. In implementing monetary policy, central banks, acting as a reserve bank, require private banks to maintain and deposit the required reserves with the central bank. In times of financial crisis, central banks perform the role of lender of last resort for the banking system. Countries throughout the world may have central banks. Additionally, the European Central Bank is responsible for implementing monetary policy for the member countries of the European Union.There is widespread agreement that central banks should be independent of the government so that decisions of the central bank will not be influenced for short-term political purposes such as pursuing a monetary policy to expand the economy but at the expense of inflation.In implementing monetary and economic policies, the United States is a member of an informal network of nations. This group started in 1976 as the Group of 6, or G6: US, France, Germany, UK, Italy, and Japan. Thereafter, Canada joined to for the G7. In 1998, Russia joined to form the G8.THE CENTRAL BANK OF THE UNITED STATES: THE FEDERAL RESERVE SYSTEMThe Federal Reserve System consists of 12 banking districts covering the entire country. Created in 1913, the Federal Reserve is the government agency responsible for the management of the US monetary and banking systems. It is independent of the political branches of government. The Fed is managed by a seven-member Board of Governors, who are appointed by the President and approved by Congress.The Fed's tools for monetary management have been made more difficult by financial innovations. The public's increasing acceptance of money market mutual funds has funneled a large amount of money into what are essentially interest-bearing checking accounts. Securitization permits commercial banks to change what once were illiquid consumer loans of several varieties into securities. Selling these securities gives the banks a source of funding that is outside the Fed's influence.INSTRUMENT OF MONETARY POLICY: HOW THE FED INFLUENCES THE SUPPLY OF MONEYThe Fed has three instruments at its disposal to affect the level of reserves.Reserve RequirementsUnder our fractional reserve banking system have to maintain specified fractional amounts of reserves against their deposits. The Fed can raise or lower these required reserve ratios, thereby permitting banks to decrease or increase their lending and investment portfolios. A bank's total reserves equal its required reserves plus any excess reserves.Open Market OperationsThe Fed's most powerful instrument is its authority to conduct open market operation. It buys and sells in open debt markets government securities for its own accounts. The Fed prefers to use Treasury bills because it can make its substantial transactions without seriously disrupting the prices or yields of bills.The Federal Open Market Committee, or FOMC, is the unit that decides on the general issues of changing the rate of growth in the money supply, by open market sales or purchases of securities. The implementation of policy through open market operations is the responsibility of the trading desk of the Federal Reserve Bank of New York.Open Market Repurchase AgreementsThe Fed often employs variants of simple open market purchases and sales, these are called the repurchase agreement (or repo) and the reverse repo. In a repo, the Fed buys a particular amount of securities from a seller that agrees to repurchase the same number of securities for a higher price at some future time. In a reverse repo, the Fed sells securities and makes a commitment to buy them back at a higher price later.Discount RateA bank borrowing from the Fed is said to use the discount window. The discount rate is the rate charged to banks borrowing directly from the Fed. Raising the rate is designed to discourage such borrowing, while lowering should have the opposite effect.DIFFERENT KINDS OF MONEYMoney is that item which serves as a numeraire. In a basic sense money can be defined as anything that serves as a unit of account and medium of exchange. We measure prices in dollars and exchange dollars for goods. Hence coins, currency, and any items readily exchanged into dollars (checking deposits or NOW accounts) constitute our money supply.MONEY AND MONETARY AGGREGATESMonetary aggregates measure the amount of money available to the economy at any time. The monetary base is defined as currency in circulation (coins and federal reserve notes) and reserves in the banking system. The instruments that serve as a medium of exchange can be narrowly defined as Mi, which is currency and demand deposits. M2 is Mi plus time and savings accounts, and money market mutual funds. Finally, M3 is M? plus short-term Treasury liabilities. While all three aggregates are watched and monitored, Mi is the most common form of the money supply, with its trait as being the most liquid. The ratio of the money supply to the economy's income is known as the velocity of money.THE MONEY MULTIPIER: THE EXPANSION OF THE MONEY SUPPLYThe money multiplier effect arises from the fact that a small change in reserves can produce a large change in the money supply. Through our fractional reserve system, a small increase will allow an individual bank, to lend out the greater part of these additional funds. These loans subsequently become deposits in other banks allowing them to expand proportionately. So, while one bank can expand its loans (or deposits) by an amount 1% of reserves required, all banks in the system can do likewise. Thus, in a simple format total change in deposits can be stated as change in reserves divided by the reserve requirement, which is also the formula for perpetuity. For example, if the change in the level of reserves is $100 and the reserve requirement is 20%, the change in total deposits will be $500 for a multiplier of 5. Of course, major assumptions are that banks will fully loan out their excess reserves and that depositors will not withdraw any of these extra reserves. THE IMPACT OF INTEREST RATES ON THE MONEY SUPPLYHigh rates of interest may make keeping excess reserves costly, since unused funds represent loans not made and interest not earned. High rates of interest will also affect the public's demand for holding cash. If deposits pay competitive interest rates, customers will be more willing to hold such bank liabilities and less cash. Therefore, a higher rate of interest can actually spur growth of the money supply. More likely, however, it will deter borrowing and slow monetary growth.THE MONEY SUPPLY PROCESS IN AN OPEN ECONOMYIn the modern era, almost every country has an open economy. Foreign commercial and central banks hold dollar accounts in the United States. Their purchases and sales of these deposits can affect exchange rates of the dollar against their own currency. The Fed has responsibility for maintaining stability in exchange rates. A purchase of foreign exchange with dollars depreciates the dollar's value, but it also adds dollars to the accounts of foreign banks in this country, thus adding to the U.S. monetary base. Most central banks of large economies own or stand ready to own a large amount of each of the world's major currencies, which are considered international reserves. Sales of foreign exchange transactions have monetary base implication and hence consequences for the domestic money supply, emphasis is given to coordinating monetarypolicies among developed nations.ANSWERS TO QUESTIONS FOR CHAPTER 4(Questions are in bold print followed by answers.)1.What is the role of a central bank?The role of a central bank has several functions: risk assessment, risk reduction, oversight of payment systems, and crisis management. It can do this through monetary policies, and through the implementation of regulations.2.Why is it argued that a central bank should be independent of the government?Central banks should be independent of the short-term political interests and political influences generally in setting economic policies.3.Identify each participant and its role in the process by which the money supply changes and monetary policy is implemented.The Fed determines monetary policy and seeks to implement it through changes in reserves. It is up to the nation's banking system to act on changes in reserves thereby affecting deposits, which constitute the greater part of the M| definition of the money supply.4.Describe the structure of the board of governors of the Federal Reserve System.The Board of Governors of the Federal Reserve System consists of 7 members who are appointed to staggered 14-year terms. The Board reviews discount operations and sets legal reserve requirements. In addition, all 7 members of the Board serve on the Federal Open Market Committee (FOMC), which determines the direction and magnitude of open-market operations. Such operations constitute the key instrument for implementing monetary policy.5.a・ Explain what is meant by the statement "the United States has a fractional reserve banking system."b. How are these items related: total reserves, required reserves, and excess reserves?a. A fractional reserve system requires that a fraction or percent of a bank's reserve be placedeither in currency in vault or with the Federal Reserve System.b.Total reserves are the amounts that banks hold in cash or at the Fed. Required reserves areamounts required by the Fed to meet some specific or legal reserve ratio to deposits. Excess reserves are bank reserves in currency and at the Fed which are in excess of legal requirements.Since these amounts are non-interest bearing, banks are often willing to lend these surplus funds to deficit banks at the Fed funds rate.5.What is the required reserve ratio, and how has the 1980 Depository Institutions Deregulation and Monetary Control Act constrained the Fed's control over the ratio?The required reserve ratio is the fraction of deposits a bank must hold as reserves. The DIDMCA constrained the Fed's control over the ratio by letting Congress set ranges of reserves for demand and time deposits.6.In what two forms can a bank hold its required reserves?A bank can hold its reserves in the form of currency in vault or in deposit at the Fed.8.a.What is an open market purchase by the Fed?b.Which unit of the Fed decides on open market policy, and what unit implements thatpolicy?c.What is the immediate consequence of an open market purchase?a.An open market purchase by the Fed consists of the purchase of U.S. Treasury securities.b.The FOMC decides on open market policy and directs the Federal Reserve Bank of New Yorkto implement it through sales and purchases of these securities.c.The immediate consequence of an open market purchase is to supply the seller of the securitywith a check on the Federal Reserve System that he can deposit in his bank, therebyimmediately increasing the excess reserves and thus nation's money supply.7.Distinguish between an open market sale and a matched sale (which is the same as a matched sale-purchase transaction or a reverse repurchase agreement).A matched sale or reverse repo involves the sale of a Treasury security with an agreement to buy it back at a later date and at a higher price as the cost for borrowing the funds. This contrasts with an outright sale at some discounted or premium price.8.What is the discount rate, and to what type of action by a bank does it apply?The discount rate is the rate a bank pays to borrow a t the "discount window” of the Fed. Such borrowings are often undertaken to meet temporary liquidity needs. Bank needs are monitored and the Fed likes to state that borrowing from it is a "privilege and not a right.”IL Define the monetary base and M2The monetary base includes total bank reserves plus currency in the hands of the public. M2 = Mi (currency and demand deposits) + savings and time deposits.12.Describe the basic features of the money multiplier.The money multiplier is crucial to the concept of money creation and is analogous to the idea of the autonomous spending multiplier and formula for a perpetuity. It is the inverse of the required reserve ratio (1/rr). If the reserve ratio is .2 then the money supply will expand five times any increase in new deposits. The multiplier will be less if banks hold excess reserves or experience cash drains.13.Suppose the Fed were to inject $100 million of reserves into the banking system by an open market purchase of Treasury bills. If the required reserve ratio were 10%, what is the maximum increase in Mi that the new reserves would generate? Assume that banks make all the loans their reserves allow, that firms and individuals keep all their liquid assets in depository accounts, and no money is in the form of currency.The maximum increase in Mi will be $1 billion assuming no cash drains in the system, and banks are fully loaned up.14.Assume the situation from question 13, except now assume that banks hold a ratio of0.5% of excess reserves to deposits and the public keeps 20% of its liquid assets in the form of cash. Under these conditions, what is the money multiplier? Explain why this value of the multiplier is so much lower than the multiplier from question 13.Substitute the given values of currency ratio, required reserves ratio, and excess reserves ratio of 20%, 10% and 0.5% respectively into the formula given on page 94 of the textbook. Now we have a lower multiplier value of 3.9=1.20A 305. This is because public and banks do not deposit or lend, all they can.。

CHAPTER 8VALUATION OF KNOWN CASH FLOWS: BONDSObjectives«To show how to value con tracts and securities that promise a stream of cash flows that areknown with certa inty.«To un dersta nd the shape of the yield curve .«To un dersta nd how bond prices and yields cha nge over time.Outline8.1 Us ing Prese nt Value Formulas to Value Known Cash Flows8.2 The Basic Build ing Blocks: Pure Discou nt Bonds8.3 Coupon Bo nds, Curre nt Yield, and Yield to Maturity8.4 Readi ng Bond Listi ngs8.5 Why Yields for the Same Maturity Differ8.6 The Behavior of Bond Prices over TimeSummary* A cha nge in market in terest rates causes a cha nge in the opposite directi on in the market values of all exist ing con tracts promisi ng fixed payme nts in the future.* The market prices of $1 to be received at every possible date in the future are the basic building blocks for valuing all other streams of known cash flows. These prices are inferred from the observed market prices of traded bonds and the n applied to other streams of known cash flows to value them.* An equivale nt valuati on can be carried out by appl ying a discou nted cash flow formula with a differe nt discou nt rate for each future time period.* Differe nces in the prices of fixed-i ncome securities of a give n maturity arise from differe nces in coup on rates, default risk, tax treatme nt, callability, con vertibility, and other features.* Over time the prices of bonds con verge towards their face value. Before maturity, however, bond prices can fluctuatea great deal as a result of cha nges in market in terest rates.Solutions to Problems at End of ChapterBond Valuation with a Flat Term Structure1. Suppose you want to know the price of a 10-year 7% coupon Treasury bond that pays interest annually. a. You have been told that the yield to maturity is 8%. What is the price?b. What is the price if coupons are paid semiannually, and the yield to maturity is 8% per year?c. Now you have been told that the yield to maturity is 7% per year. What is the price? Could you have guessedthe answer without calculating it? What if coupons are paid semiannually?c. Price = 100. When the coup on rate and yield to maturity are the same, the bond sells at par value (i.e. the price equalsthe face value of the bon d).2. Assume six months ago the US Treasury yield curve was flat at a rate of 4% per year (with annualcompounding) and you bought a 30-year US Treasury bond. Today it is flat at a rate of 5% per year. What rate of return did you earn on your initial investment: a. If the bond was a 4% coupon bond? b. If the bond was a zero coupon bond?c. How do your answer change if compounding is semiannual? SOLUTION: a and b.Coupon = 4% 30 4 ? 100 4 PV =100 Zero coupon30 4 ? 100 0 PV =30.83Step 2: Find prices of the bonds today: Coupon = 4% 29.5 5?100 4 84.74 Zero coupon29.5 5 ? 100 0 23.71Step 3: Find rates of retur n:Rate of retur n = (coup on + cha nge in price)/in itial price4% coupon bond: r = (4 + 84.74 —100)/100 = -0.1126 or —11.26%Zero-coupon bon d: r = (0 + 23.71 —30.83)/30.83 = -0.2309 or -23.09%. Note that the zero-coupon bo nd is more sen sitive to yield cha nges tha n the 4% coup on bond. c.Step 1: Find prices of the bonds six mon ths ago:Coup on=4% 60 2 ?100 2 PV =100 Zero coupon 60 2 ? 100 0 PV =30.48 Step 2: Find prices of the bonds today:Coup on=4% 59 2.5? 100 2 84.66 Zero coupon59 2.5 ?10023.30SOLUTION:a. With coup ons paid once a year:Price = 93.29b. With coup ons paid twice a year:Price = 93.20Step 3: Find rates of retur n:Rate of return = (coupon + change in price) / initial price4% coupon bond: r = (2 + 84.66 -100)/100 = -0.1334 or -13.34%Zero coupon bond: r = (0 + 23.30 - 30.48)/30.48 = -0.2356 or -23.56%. Note that the zero-coupon bond is more sen sitive to yield cha nges tha n the 4% coup on bond.Bond Valuatio n With a Non-Flat Term Structure3. Suppose you observe the following prices for zero-coupon bonds (pure discount bonds) that have no risk of default:a. What should be the price of a 2-year coupon bond that pays a 6% coupon rate, assuming coupon paymentsare made once a year starting one year from now?b. Find the missing entry in the table.c. What should be the yield to maturity of the 2-year coupon bond in Part a?d. Why are your answers to parts b and c of this question different?SOLUTION:a. Present value of first year's cash flow = 6 x .97 = 5.82Prese nt value of sec ond year's cash flow = 106 x .90 = 95.4Total prese nt value = 101.22 b^Th^y^^tomaturityon^^^^arzerocoupo^bon^wrt^pr^eof9^an^facevalu^of1^3i^5^^^^^^^^2 I ? I -90 I 100 I 0 1 i = 5.41%c. The yield to maturity on a 2-year 6% coup on bond with price of 101.22 isd. The two bonds are differe nt because they have differe nt coup on rates. Thus they have differe nt yields to maturity.Coupon Stripping4. You would like to create a 2-year synthetic zero-coupon bond. Assume you are aware of the following information: 1-year zero- coupon bonds are trading for $0.93 per dollar of face value and 2-year 7% coupon bonds (annual payments) are selling at $985.30 (Face value = $1,000).a. What are the two cash flows from the 2-year coupon bond?b. Assume you can purchase the 2-year coupon bond and unbundle the two cash flows and sell them.i. How much will you receive from the sale of the first payment?ii. How much do you need to receive from the sale of the 2-year Treasury strip to break even?SOLUTION:a. $70 at the end of the first year and $1070 at the end of year 2.b. i. I would receive .93 x $70 = $65.10 from the sale of the first payment.ii. To break even, I would need to receive $985.30- $65.10 = $920.20 from the sale of the 2-year strip.The Law of One price and Bond Pricing5. Assume that all of the bonds listed in the following table are the same except for their pattern of promised cash flows over time. Prices are quoted per $1 of face value. Use the information in the table and the Law of One Price to infer the values of the missing entries. Assume that coupon payments are annual.6% 2 years 5.5%0 2 years7% 2 years0 1 year $0.95From Bond 1 and Bond 4, we can get the miss ing en tries for the 2-year zero-coup on bond. We know from bond 1 that:2 21.0092 = 0.06/1.055 +1.06/(1.055) . This is also equal to 0.06/(1+z 1) + 1.06/(1+z 2) where z 1 and Z2 are the yields to maturity on on e-year zero-coup on and two-year zero-coup on bonds respectively. From bond 4 , we have z 1, we can find z2.1.0092 -0.06/1.0526 = 1.06/(1+z 2)2, hence z = 5.51%.To get the price P per $1 face value of the 2-year zero-coup on bond, using the same reasoning:1.0092 -0.06x0.95 = 1.06xP, he nee P = 0.8983To find the entries for bond 3: first find the price, then the yield to maturity. To find the price, we can use z 1 and Z2 found earlier: PV of coupon payment in year 1: 0.07 x 0.95 = 0.0665PV of coupon + pri ncipal payme nts in year 2: 1.07 x 0.8983 =0.9612「otal prese nt value of bond 3 二 1.02772 ? 0.07 -1.0277 1 i = 5.50%Hence the table becomes:6% 2 years $1.0092 5.5%0 2 years $0.8983 5.51%SOLUTION:Bond 1:Bond 4:Bond Features and Bond Valuation6. What effect would adding the following features have on the market price of a similar bond which does not have this feature?a. 10-year bond is callable by the company after 5 years (compare to a 10-year non-callable bond);b. bond is convertible into 10 shares of common stock at any time (compare to a non-convertible bond);c. 10-year bond can be “ put back ” to the company after 3 years at par (puttable boiumipare to a 10year non-puttablebond)d. 25-year bond has tax-exempt coupon paymentsSOLUTION:a. The callable bond would have a lower price tha n the non-callable bond to compe nsate the bon dholders for gra nti ng theissuer the right to call the bon ds.b. The con vertible bond would have a higher price because it gives the bon dholders the right to con vert their bonds intoshares of stock.c. The puttable bond would have a higher price because it gives the bondholders the right to sell their bonds back to the issuerat par.d. The bond with the tax-exempt coup on has a higher price because the bon dholder is exempted from pay ing taxes on thecoup ons. (Coup ons are usually con sidered and taxed as pers onal in come).Inferring the Value of a Bond Guarantee7. Suppose that the yield curve on dollar bonds that are free of the risk of default is flat at 6% per year. A 2-year 10% coupon bond (with annual coupons and $1,000 face value) issued by Dafolto Corporation is rates B, and it is currently trading at a market price of $918. Aside from its risk of default, the Dafolto bond has no other financially significant features. How much should an investor be willing to pay for a guarantee against Dafolto ' s defaulting on this bond?The difference between the price of the bond if it were free of default and its actual price (with risk of default) is the value of a guarantee against default: 1073.3-918 = $155.3The implied Value of a Call Provision and Convertibility8. Suppose that the yield curve on bonds that are free of the risk of default is flat at 5% per year. A 20-year default-free coupon bond (with annual coupons and $1,000 face value) that becomes callable after 10 years is trading at par and has a coupon rate of 5.5%.a. What is the implied value of the call provision?b. A Safeco Corporation bond which is otherwise identical to the callable 5.5% coupon bond describedabove, is also convertible into 10 shares of Safeco stock at any time up to the bond ' s maturity. If its yield to maturity is currently 3.5% per year, what is the implied value of the conversion feature?SOLUTION:a. We have to find the price of the bond if it were only free of the risk of default.The bond is traded at par value, hence the differe nee betwee n the value calculated above and the actual traded value is the implied value of the call provisio n: 1062.3 T000 = $62.3Note that the call provisi on decreases the value of the bond.b. We have to find the price of the Safeco Corporati on:This bond has the same features as the 5.5% default free callable bond described above, plus an additional feature: it is con vertible into stocks. Hence the implied value of the con versi on feature is the differe nee betwee n the values of both bonds: 1284.2-1000 = $284.25. Note that the con version feature in creases the value of the bond.Changes in Interest Rates and Bond Prices9. All else being equal, if interest rates rise along the entire yield curve, you should expect that:i. Bond prices will fallii. Bond prices will riseiii. Prices on long-term bonds will fall more than prices on short-term bonds.iv. Prices on long-term bonds will rise more than prices on short-term bondsa. ii and iv are correctb. We can ' t be certain that prices will changec. Only i is correctd. Only ii is correcte. i and iii are correctSOLUTION:The correct an swer is e.Bond prices are in versely proporti onal to yields hence whe n yields in crease, bond prices fall. Lon g-term bonds are more sen sitive to yield cha nges tha n short-term bon ds.。

Chapter One Functions of Financial Markets 一.Translate the following sentences into Chinese.1.China’s banking industry is now supervised by the PBC and CBRC. In addition, the MOFis in charge of financial accounting and taxation part of banking regulation and management.目前中国银行业主要由中国人民银行和银监会进行监管。

此外,财政部负责银行业监管的财务会计及税收方面。

2.Currently Chinese fund management companies are engaged in the following business:securities investment fund, entrusted asset management, investment consultancy, management of national social security funds, enterprise pension funds and QDII businesses.目前中国的基金管理公司主要从事以下业务:证券投资基金业务、受托资产管理业务、投资咨询业务、社保基金管理业务、企业年金管理业务和合格境内机构投资者业务等。

3.China's economy had 10% growth rate in the years before the world financial crisisof 2008. That economic expansion resulted from big trade surpluses and full investment.Now China is seeking to move away from that growth model. The country is working to balance exports with demand at home.在2008年世界经济危机之前的那些年,中国经济增长速度曾达到10%。

Part One1. What are the main roles of banks?答: Although banks share many common features with other profit-seeking business,they play a unique role in the economy through mobilizing savings,allocating capital funds to fiance productive investment,transmitting monetary policy,providing a payment system and transforming risks.3. According to the revised edition of the Law of the People's Republic of China on the People's Bank of China ,what functions does the PBC perform?答: The PBC 's key functions are to conduct monetary policy, prevent and dissolve financial risks, and maintain financial stability under the leadership of the State Council.4. Can you give some examples of indirect instruments for implementing monetary policy?答: Indirect instruments as required reserve ratio, interest rate adjustment and open market operations.9. What is your definition of share and bond?答:Shares are certificates or book entries representingownership in a corporation or similar entity.Bonds are written evidences of debts.13. What is your definition of “securities”?答:Securities are paper certificates (definitive securities) or electronic records (book-entry securities) evidencing ownership of equity (stock) or debt obligations (bonds).Part Two2. What are the objectives of banking supervision?First, the key objective of supervision is to maintain stability and public confidence in financial system.The second goal of bank supervisions to ensure that bank operate in a safe and sound manner and that they hold capital and reserve sufficient to cover the risks that may arise in their business.Third, a related goal is to protect depositors’funds and , if any bank should fail, to minimize the losses to be absorbed by the deposit insurance fund.The fourth goal of bank supervision is to foster an efficient and competition banking system that is responsive to the public need for high quality financial services at reasonable cost.The fifth and final goal of bank supervision is to ensure compliance with banking laws and regulations.3. What risks might the commercial banks have to face?(1)credit risk (2)market risk (3)liquidity risk (4)operational risk (5)legal risk (6)reputation risk4. What are the implication of credit risk, market risk, liquidity risk and operational risk?Credit risk: A major type of risk that banks face is credit risk or the failure of a counterpart to perform according to a contractual arrangement.Market risk: Two specific elements of market risk are foreign exchange risk and interest risk. Banks face a risk of losses in on- and off-balance sheet positions arising from movement in exchange rates. Interest rate risk prefers to the exposure of a bank’s financial condition to adverse movements in interest rates.Liquidity risk: Liquidity risk arises from the inability of a bank to accommodate decreases in liabilities or to fund increases in assets.Operational risk: The most important types of operational risk involve breakdowns in internal controls and corporategovernance..5.At what levels does the Basel Accord set the minimum capital ratio requirements for internationally active banks?The Accord sets minimum capital ratio requirements for internationally active banks of 4% tier one capita and 8% total capital (tier one plus tier two) in relation to risk-weighted assets.Part Three1. What does foreign exchange include ?答:Foreign exchange includes the following means of payments and assets denominated in a foreign currency that can be used for international settlement:●Foreign currencies, including banknotes and coins;●Payment vouchers denominated in foreign currency,including negotiable instruments, bank certificates of deposit and certificates of postal savings;●Securities denominated in foreign currency, includinggovernment bonds, corporate bonds and stocks;●Super-national currencies such as Special Drawing Rightsand the Euro; and●Other assets denominated in foreign currency.3. What are the requirements for domestic institutions for opening foreign exchange accounts abroad?答:Domestic entities which meet one of the following requirements may apply for opening a foreign exchange account abroad:●Expecting small amount income during a certain period of time abroad;●Expecting small amount ex penditure during a certain period of time abroad;●Undertaking overseas construction projects;and issuing securities denominated in foreign currency abroad.6. Give the definition of foreign exchange?答:Foreign exchange , or forex , is foreign money. All foreign currency, consisting of founds held with banks abroad, or bills or cheques, again in foreign currency and payable abroad , are termed foreign exchange.9. Give the definition of spot and forward transaction?答:Spot transactions involve today’s p rices of currency and delivery of the currency within two business days, except forCanadian dollar (CAD), which must be delivered in one day.10. Tell the difference between forward and futures transactions?答:(1) Forward transactions involve today’s pr ices of currency and delivery on a stipulated future date.(2) Futures transactions are always traded on exchanges. In order to be marketable on exchanges, futures contracts are standardized in terms of quantity, settlement dates and quotation.Part Four14. How could a bank earn interest income?答:The principal source of income for the majority of banks is still the interest received on the funds that the institution has at its disposal and is able to lend out in some form.Whenever a bank lends out money it will generally charge interest to the customer.21. Why should a bank keep sufficient liquid assets?答:It is important for a bank to hold sufficient liquid assets to meet the demands of depositors who may seek to withdraw theirfunds. However,maintenance of too high a level of liquid assets could be expensive. Cash balances in particular yield no income,yet will cost the same as any other asset to fund. 25. What are the three major activities included in a bank's Statement of Cash Flows?答:The statement of cash flows reports cash flows relating to operating,investing and financing activities of a bank.Part five4. What are negotiable instruments? list some examples.答:From a functional perspective, negotiable instruments are documents used in commerce to secure the payment of money. Paying large sums of money in cash is both inconvenient and, unfortunately, risky. In all cases, negotiable instruments represent a right to payment. A right is, by definition, a promise and not a tangible piece of property. So, negotiable instruments are classified as choses in action. The three main types of them are the following: Bills of Exchange, Cheques, Promissory Notes.7. What’s the difference between capital lease and operating lease?答:1: Whether the ownership of property is to be transferred by the end of lease term.2: Whether the lease has an operation to purchase the leased property at a bargain price.3: The lease term is long to or short in according to the estimated economic life of the leased property.4: Whether the lease is a cancelable lease.5: Whether the lease is full-payout lease.9. What’s the meaning of Account Receivable Financing?答: Accounts Receivable represents a promise from customers to pay for a goods sold or services rendered. Account Receivable Financing is a form of collateralized lending in which accounts receivables are the collateral.12. What are basic characteristics of money mark securities?答: Money-mark securities, which are discussed in details later in this chapter, have three basic characteristics in common:They are usually sold in large denominations.They have low default risk.They mature in one year or less from their original issue date.Most money marker instruments mature in less than 120 days.Why teasury bills are attractive to investors?答:Teasury bills are attractive to investors because they are backed by the government and therefore are virtually free of default risk .Even if the government ran out of money, it could simply print more to pay them off when they mature.The risk of unexpected changes in inflation is also low because of their short-termmaturity.15. What are the features of inter-bank markets?答:Inter-bank markets are money markets in which short-term funds transferred (lent or borrowed) between financial institutions, usually for one day, that is , they are usually overnight investment . The interest rate for borrowing these funds is close to ,but always slightly higher than ,the rate that is available from the central bank.17.How have NCDs become the second most popular money market instruments?答:Negotiable CDs are in large denominations .Although NCDs denominations are too large for individual investors , they are sometimes purchased by money market funds that have pooledindividua l investor’s funds. Thus , the existence of money market funds allows individuals to be indirect investors in NCDs ,marking a more active NCD market.19.What products does the on-line banking provide?答:basic products and services, intermediate products and services ,advanced products and services.Part Six1,What categories can the loan be divided according to their risk?答:The five-category system classifies bank loans according to their inherent risks as pass(normal),special-mention,substandard,doubtful and loss. What are the commonly used methods of credit analysis?答:Tranditionally,key risk factors have been classified according to the five CS of credit:character,capital,capacity,conditions,and collateral. Golden and Walker identify the five CS of bad credit,representing things to guard against to help prevent problems.These include complacency,carelessness,communicationbreakdown,contingencies,and competition.A useful framework for sorting out the facts and opinions in credit analysis is the 5Ps approach:people,purpose,payment,protection,and perspective. How can a bank take security for an advance?答:A bank has different kinds of security as cover for advance to his customers.There are several ways in which a bank may take security for an advance by lien,pledge,mortgage and hypothecation.1 / 1文档可自由编辑。

新编金融英语教程试题答案一、选择题1. The concept of "leverage" in finance refers to:A. The use of borrowed funds to increase potential returnsB. The process of fixing a broken financial systemC. The ability to move a company to a new locationD. The practice of buying and selling goods in different markets答案:A2. Which of the following is NOT a primary function of the Federal Reserve System in the United States?A. To regulate the nation's monetary policyB. To supervise and regulate banksC. To enforce international trade lawsD. To maintain financial stability答案:C3. A "bear market" is characterized by:A. Rising stock prices and strong investor confidenceB. Falling stock prices and weak investor confidenceC. A market with a surplus of bears (the animal)D. A market where only bear-related products are traded答案:B4. The term "forex" is short for:A. Foreign exchangesB. Forest exchangeC. Forming excellent relationshipsD. Financial expert report答案:A5. Which of the following is a type of financial derivative?A. StockB. BondC. FutureD. Report答案:C二、填空题1. The __________ (一种金融衍生工具) is a contract that gives the buyer the right, but not the obligation, to buy an underlying asset at a predetermined price within a certain period.答案:option2. The __________ is the process by which a company raises capital by issuing new securities to the public for the first time.答案:initial public offering (IPO)3. __________ is the practice of analyzing financial data to make investment decisions.答案:fundamental analysis4. A __________ is a financial instrument that derives its value from a good or an index, such as shares of stock in a company.答案:future5. __________ is the term used to describe the risk that a party to a financial contract may default on their payment obligation.答案:credit risk三、简答题1. Explain the difference between a traditional bank and a shadow bank.答:传统银行是指持有银行牌照、受金融监管机构监管的金融机构,它们提供存款、贷款和其他金融服务。

1.答案可以不一样.答案示例:共产主义制度与亚当斯密的看不见得手是完全相反的.但是最近我们已经注意到了世界范围内许多共产主义国家的失败.在共产主义国家里,据信政府可以做出与私人相比更好的决策去推动经济的繁荣.但是很明显,这种制度没能推动经济的繁荣.亚当斯密认为,完全竞争的市场体制(而不是政府) 一般而言可以更好得配置资源从而推动经济的繁荣.但是,一个完全没有束缚的资本主义社会比如18世纪晚期的西方世界国家可能并不是一个完美的体制.看不见的手使富人更富同时穷人却得不到任何正式的帮助,于是政府计划最终建立了起来促进社会福利和公平.2.在资本主义社会,价格机制有利于做出正确的资源配置决策.资本流向那些能利用它获得最高回报率的部门.从而这样把资本分配到生产率最高的用处,借以增进社会经济的繁荣.而且,金融体系有自己的市场和调解机构,它们可以把风险从最不愿意承担的人那里转移到最愿意承担风险的人那里.一般而言,这将使社会受益而不会有任何的代价.并且,通过允许私人减少或者消除风险,可以形成一个承担商业冒险的社会氛围,这将使社会受益.3.清算和支付:在亚当斯密的时代,正如现在一样有纸币和硬币.但是,由于技术革新(主要是电脑技术的应用与发展)现在有许多其它不同形式的支付手段,例如个人支票,信用卡,资金的借方卡以及电子转帐.而且,某些信用卡和旅行支票在世界上的任何地方都可以被受理,使货币兑换成为过去的一种遗留物.聚集资源和分散股权:在亚当斯密的时代,大部分商业贸易规模都很小,并且由独资企业投资.因此,聚集资源进行大规模投资的需求不像今天这样普遍和重要.而且,电脑和电话技术的革命把全球的资本市场联系起来为更大规模的贸易融资.今天这些公司能进入全世界范围巨大的资产并且找到为大规模工程投资的最便宜的资源转移经济资源:在当代,世界范围内的金融体系使资源和风险及时的从一个人转移到另一个人,从一个地方转移到另一个地方变得更加容易.而在亚当斯密的时代,尽管有金融市场,但是作用有限, 与今天的相比它们都是区域性的,规模小,缺乏效率和创新.风险管理:在亚当斯密的时代,私人和商业都会面对许多与今天相同的风险(财产损毁的风险,金融损失的风险,粮食歉收风险等等)但是,过去只有有限的方法去化解风险.那时虽然有一些保险公司,但主要是管理商业风险而非个人风险,因此也就没有同类型保险去管理个人风险.比如,失业保险.在亚当斯密的时代,农场主几乎没有办法去降低粮食歉收以及粮食价格降低的风险.现在有大量的市场和部门去化解个人及商业风险,还有大量的网络保险公司去把风险从那些想减少的人那里转移到那些想承担更多风险的人那里.价格信息:在亚当斯密的时代,信息传播的速度很慢.当然,那时没有电话,电视和收音机等工具.信息只能通过报纸和信件进行传播.现在,信息可以在世界范围内及时传播.由于电脑和电话技术的发展和创新,安全的价格信息同时在世界范围内通过各种虚拟的途径获得.激励问题:正如上面所讨论的,当代的金融体系是大规模,创新和全球性的.在亚当斯密的时代,如果出现道德风险和逆向选择问题就没有像今天这样高效的金融体系去处理.4. 亚当斯密谈论的自由竞争市场作为一个完整的体系可以把资本分配到使用效率最高和最有价值的地方.在一个自由竞争的股票市场,股票的价格是由供给和需求决定的.那些得到最高回报的公司将会得到最高的价格(或者是最便宜的金融资本).而一些公司将得不到足够的资本因为他们是没有效率的.由于世界范围内的合意投资是巨大的以及有时对于投资者而言很难识别哪个公司是资本最有效率的雇佣者,因此规则应该被制定出来以保证相关的和合乎标准的信息传递给潜在的投资者.这将包括公开和内部的交易以及股票操作方面的规则.但是从市场效率方面而言,一些其它形式的市场规则可能就不是那末重要甚至将有碍整个社会福利的实现.5. 由于大部分学生现在还不能挣钱,也没有积蓄或其它的资本,所以没有哪个中间人会在任何合意的利率水平上承担这样的信用风险.6例如:医药公司;儿童安全设备生产公司;航空公司;银行;医院;环保咨询公司;危险性垃圾处理公司7 我用自己的钱投资的20000美元是(企业主的)股本,其他的80000美元是负债。

CHAPTER 1WHAT IS FINANCE?ObjectivesDefine finance.Explain why finance is worth studying.Introduce the main players in the world of finance—households and firms—and the kinds of financial decisions they make.OutlineDefining FinanceWhy Study Finance?Financial Decisions of HouseholdsFinancial Decisions of FirmsForms of Business OrganizationSeparation of Ownership and ManagementThe Goal of ManagementMarket Discipline: TakeoversThe Role of the Finance Specialist in a CorporationSummaryFinance is the study of how to allocate scarce resources over time. The two features that distinguish finance are that the costs and benefits of financial decisions are spread out over time and are usually not known with certainty in advance by either the decision-maker or anybody else.A basic tenet of finance is that the ultimate function of the system is to satisfy people’s consumption preferences. Economic organizations such as firms and governments exist in order to facilitate the achievement of that ultimate function. Many financial decisions can be made strictly on the basis of improving the tradeoffs available to people without knowledge of their consumption preferences.There are at least five good reasons to study finance:To manage your personal resources.To deal with the world of business.To pursue interesting and rewarding career opportunities.To make informed public choices as a citizen.To expand your mind.The players in finance theory are households and business firms. Households occupy a special place in the theory because the ultimate function of the system is to satisfy the preferences of people, and the theory treats those preferences as given.Finance theory explains household behavior as an attempt to satisfy those preferences. The behavior of firms is viewed from the perspective of how it affects the welfare of households.Households face four basic types of financial decisions:Saving decisions: How much of their current income should they save for the future?Investment decisions: How should they invest the money they have saved?Financing decisions: When and how should they use other people’s money to satisfy their wants and needs?Risk management decisions: How and on what terms should they seek to reduce the economic uncertainties they face or to take calculated risks?There are three main areas of financial decision-making in a business: capital budgeting, capital structure, and working capital management.There are five reasons for separating the management from the ownership of a business enterprise:Professional managers may be found who have a superior ability to run the business.To achieve the efficient scale of a business the resources of many households may have to be pooled.In an uncertain economic environment, owners will want to diversify their risks across many firms. Such efficient diversification is difficult to achieve without separation of ownership and management.Savings in the costs of gathering information.The “learning curve” or “going concern” effect. When the owner is also the manager, the new owner has to learn the business from the old owner in order to manage it efficiently. If the owner is not the manager, then when the business is sold, the manager continues in place and works for the new owner.The corporate form is especially well suited to the separation of ownership and management of firms because it allows relatively frequent changes in owners by share transfer without affecting the operations of the firm.The primary goal of corporate management is to maximize shareholder wealth. It leads managers to make the same investment decisions that each of the individual owners would have made had they made the decisions themselves.A competitive stock market imposes a strong discipline on managers to take actions to maximize the market value of the firm’s shares.Solutions to Problems at End of Chapter1. What are your main goals in life? How does finance play a part in achieving those goals? What are the major trade-offs you face?SAMPLE ANSWER:Finish schoolGet good paying job which I likeGet married and have childrenOwn my own homeProvide for familyPay for children’s educationRetireHow Finance Plays a Role:SAMPLE ANSWER:Finance helps me pay for undergraduate and graduate education and helps me decide whether spending the money on graduate education will be a good investment decision or not.Higher education should enhance my earning power and ability to obtain a job I like.Once I am married and have children I will have additional financial responsibilities (dependents) and I will have to learn how to allocate resources among individuals in the household and learn how to set aside enough money to pay for emergencies, education, vacations etc. Finance also helps me understand how to manage risks such as for disability, life and health.Finance helps me determine whether the home I want to buy is a good value or not. The study of finance also helps me determine the cheapest source of financing for the purchase of that home.Finance helps me determine how much money I will have to save in order to pay for my children’s education as well as my own retirement.Major Trade-Offs:SAMPLE ANSWERSpend money now by going to college (and possibly graduate school) but presumably make more money once I graduate due to my higher education.Consume now and have less money saved for future expenditures such as for a house or car OR save more money now but consume less than some of my friends.2. What is your net worth? What have you included among your assets and your liabilities? What have you excluded that you might have included?SAMPLE ANSWER:$ ____________ (very possibly negative at this point)Assets:Checking account balanceSavings account balanceFurniture/Jewelry (watch)Car (possibly)Liabilities:Student loansCredit card balanceIf renting, remainder of rental agreement (unless subletting is a possibility)Car payments (possibly)Students typically exclude the high value of their potential lifetime earning power when calculating their net worth.3. How are the financial decisions faced by a single person living alone different from those faced by the head of a household with responsibility for several children of school age? Are the tradeoffs they have to make different, or will they evaluate the tradeoffs differently?A single person needs only to support himself and therefore can make every financial decision on his own. If he does not want health insurance (and is willing to bear the financial risks associated with that decision) then no one will be affected by that decision other than that single person. In addition, this person needs to make no decisions about allocating income among dependents. A single person is very mobile and can choose to live almost anywhere. The tradeoffs this individual makes generally concern issues of consuming (or spending) today versus saving for consumption tomorrow. Since this person is supporting only himself, the need to save now is less important than for the head of household discussed next.The head of household with several children must share resources (income) among dependents. This individual must be prepared to deal with risk management issues such as how to be prepared for potential financial emergencies (such as a serious health problem experienced by a member of the family or home owners insurance in case of a fire or other mishap). Because there are more people in this household than with a single person, there are greater risks that someone will getsick or injured. And because there are dependents, the wage earner(s) should think carefully about life and disability insurance. In addition, the family is not as mobile as the single individual. Because of the school age children, the family might want to live near “good schools” thinking that a stronger education will eventually help those children’s future well being and financial situation. Thus, the tradeoffs for the head of household are more complex: more money is needed to consume today (he or she needs to support more dependents), but a lot more money is also needed to save for future expenses such as education and housing and more money is needed for risk management such as life and disability insurance.4. Family A and family B both consist of a father, mother and two children of school age. In family A both spouses have jobs outside the home and earn a combined income of $100,000 per year. In family B, only one spouse works outside the home and earns $100,000 per year. How do the financial circumstances and decisions faced by the two families differ?With two wage earners, there is less risk of a total loss of family income due to unemployment or disability than there is in a single wage earning household. The single wage earning family will probably want more disability and life insurance than the two wage earning family. On the flip side, however, the two wageearning family may need to spend extra money on child care expenses if they need to pay someone to watch the children after school.5. At what age should children be expected to become financially independent?Students will have differing responses to this question depending upon their specific experiences and opinions. Most will probably say independence should come after finishing their education, and they have a decent paying job.6. You are thinking of buying a car. Analyze the decision by addressing the following issues:a.Are there are other ways to satisfy your transportation requirementsbesides buying a car? Make a list of all the alternatives and write down the pros and cons.Takes you directly where you want to goFreeConvenie ntTakes a long timeDestination may be too farTakes you directly to where you want to goFreeConvenie ntRequires physical strength and enduranceDestination may be too farInexpensi veReaches distant destinationsMay not take you directly where you want to goMany stops, not efficientInexpensi veFastMay not take you directly where you want to goLocal destinations onlyReaches distant destinationsMay not take you directly where you want to goAirplan eReachesdistant destinationsFastExpensiveb.What are the different ways you can finance the purchase of a car?Finance through a bank loan or lease, finance through a car dealer with a loan or a lease or finance the car out of your own savings.c.Obtain information from at least three different providers ofautomobile financing on the terms they offer.d.What criteria should you use in making your decision?Your decision will be to select the financing alternative that has the lowest cost to you.When analyzing the information, you should consider the following:Do you have the cash saved to make an outright purchase? What interest rate would you be giving up to make that purchase? Do you pay a different price for the car if you pay cash rather than finance?For differing loan plans, what is the down payment today? What are the monthly payments? For how long? What is the relevant interest rate you will be paying? Does the whole loan get paid through monthly payments or isthere a balloon payment at the end? Are taxes and/or insurance payments included in the monthly payments?For differing lease plans, what is the down payment today? What are the monthly payments? For how long? Do you own the car at the end of the lease? If not, what does it cost to buy the car? Do you have to buy the car at the end of the lease or is it an option? Is there a charge if you decide not to buy the car? What relevant interest rate will you be paying? Are taxes and/or insurance payments included in the monthly payments? Are there mileage restrictions?7. You are thinking of starting your own business, but have no money.a.Think of a business that you could start without having to borrowany money.Any business which involves a student’s own personal service would be cheap to start up. For instance he or she could start a business running errands for others, walking their dogs, shopping etc. Along those same lines they could start some kind of consulting business. Both of these businesses could be run out of their dorm room or their own home and could be started with very little capital. If they wanted to hire additional workers, they would have to be paid on a commission basis to limit upfront expenses.b.Now think of a business that you would want to start if you couldborrow any amount of money at the going market interest rate.Certainly there are many interesting businesses which could be started if one could finance 100% of the business with borrowed capital and no equity. Since you will be able to borrow 100% of the financing, you will be willing to take a lot greater risk than if you were investing your own money.c.What are the risks you would face in this business?[Answer is, of course, dependent on answer to question “b.”]d.Where can you get financing for your new business?Depending upon the size of the financing needed, students should be looking for both debt and equity financing. The sources of this financing ranges from individuals and credit cards (for very small sums) to banks, venture capitalists, public debt and equity markets, insurance companies and pension funds8. Choose an organization that is not a firm, such as a club or church group and list the most important financial decisions it has to make. What are the key tradeoffs the organization faces? What role do preferences play in choosing among alternatives? Interview the financial manager of the organization and check to see if he or she agrees with you.SAMPLE ANSWER:Local Church group. Most important financial decisions:Whether or not to repair damage done to church and grounds during last big hurricane (specifically repairing the leaking roof)What project to put off in order to pay for repair damageHow to pay for renovations to downstairs Sunday school roomsHow to increase member attendance and contributionsHow to organize and solicit volunteers for the annual Church Sale (largest fund raiser of the year)Key Tradeoffs and Preferences:Church group funds are severely limited, so the organization needs to prioritize expenses based upon cost and need. Not all projects that are needed will be undertaken due to the expense involved. An equally large amount of time will be spent trying to raise financing since funds inflow is variable. Since not all projects can be financed, preferences of different important individuals (such as the pastor) take on great significance in the decision-making process.。

Chapter1Ⅰ.1. Money and risk and how they are interrelated.2. Recently a number of websites have been created to give consumers basic price comparisons for services.3. Allows a company to determine how much credit it can extend to customers before it begins to have liquidity problems.4. refer to money used by entrepreneurs and businesses to buy what they need to make their products or provide their services or to that sector of the economy based on its operation, i.e., retail, corporate, investment banking.5. A new discipline that uses mathematical and statistical methodology to understand behavioral biases in conjunction with valuation.6. An area of finance dealing with the financial decisions corporations make and the tools and analysis used to make these decisions.7. A main branch of applied mathematics concerned with the financial markets.8. The application of the principles of finance to the monetary decisions of an individual or family unit.Ⅱ.1.maximize risks2. mathematics statistics3. money offering4. determine liquidity5. aggregates accepts6. economics behavioralⅢ.translate the following sentences into English.1.The commercial management is the important aspects of the business management,Do not have the appropriate financial plan, the enterprise is not likely to be successful.2. Financial institutions is the basic aim of the public welcome by the financial assets into they can accept financial assets.3. Enterprise management is risky, so financial manager must evaluate the risks and management.4. Investment decision first refers to the investment opportunity, often referring to capital investment projects.5. Cash budget is often used to assess whether is the enterprise have enough cash to maintain the daily operation of the enterprise operation and if there is too much cash surplus.6. According to the view of finance, capital is the enterprise to the purchase of goods to produce other goods or provide services of currencyⅣ. Translate the following sentences into chinese.1.现金预算非常重要,特别是为小型企业,因为它允许公司确定多少信用可以向客户开始之前就有流动性问题。

《金融专业英语》习题答案第一篇:《金融专业英语》习题答案《金融专业英语》习题答案Chapter OneFunctions of Financial Markets 一. Translate the following sentences into Chinese.1.China’s banking industry is now supervised by the PBC and CBRC.In addition, the MOF is in charge of financial accounting and taxation part of banking regulation and management.目前中国银行业主要由中国人民银行和银监会进行监管。

此外,财政部负责银行业监管的财务会计及税收方面。

2.Currently Chinese fund management companies are engaged in the following business: securities investment fund, entrusted asset management, investment consultancy, management of national social security funds, enterprise pension funds and QDII businesses.目前中国的基金管理公司主要从事以下业务:证券投资基金业务、受托资产管理业务、投资咨询业务、社保基金管理业务、企业年金管理业务和合格境内机构投资者业务等。

3.China's economy had 10% growth rate in the years before the world financial crisis of 2008.That economic expansion resulted from big trade surpluses and full investment.Now China is seeking to move away from that growth model.The country is working to balance exports with demand at home.在2008年世界经济危机之前的那些年,中国经济增长速度曾达到10%。

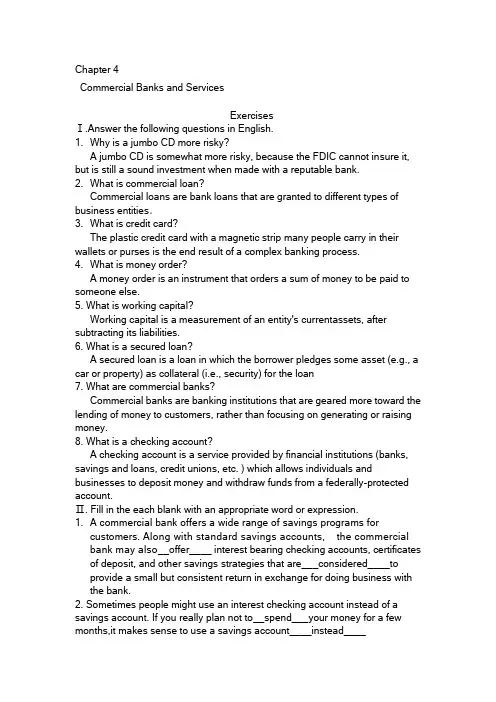

Chapter 4Commercial Banks and ServicesExercisesⅠ.Answer the following questions in English.1.Why is a jumbo CD more risky?A jumbo CD is somewhat more risky, because the FDIC cannot insure it, but is still a sound investment when made with a reputable bank.2.What is commercial loan?Commercial loans are bank loans that are granted to different types of business entities.3.What is credit card?The plastic credit card with a magnetic strip many people carry in their wallets or purses is the end result of a complex banking process.4.What is money order?A money order is an instrument that orders a sum of money to be paid to someone else.5. What is working capital?Working capital is a measurement of an entity's currentassets, after subtracting its liabilities.6. What is a secured loan?A secured loan is a loan in which the borrower pledges some asset (e.g., a car or property) as collateral (i.e., security) for the loan7. What are commercial banks?Commercial banks are banking institutions that are geared more toward the lending of money to customers, rather than focusing on generating or raising money.8. What is a checking account?A checking account is a service provided by financial institutions (banks, savings and loans, credit unions, etc. ) which allows individuals and businesses to deposit money and withdraw funds from a federally-protected account.Ⅱ. Fill in the each blank with an appropriate word or expression.1. A commercial bank offers a wide range of savings programs forcustomers. Along with standard savings accounts, the commercial bank may also__offer____ interest bearing checking accounts, certificates of deposit, and other savings strategies that are___considered____toprovide a small but consistent return in exchange for doing business with the bank.2. Sometimes people might use an interest checking account instead of a savings account. If you really plan not to__spend___your money for a few months,it makes sense to use a savings account____instead____3. A fixed rate mortgage is a mortgage in which the __interestrate___does not change during the___entire_____term of the loan.4. A typical checking account is __handled_____through careful posting of deposits and withdrawals. The account holder has a supply of official checks which___contain____ all of the essential routing and mailing information.5. In recent years there have been some unfortunate seams involving bank drafts that are phony. Since printers are now so capable of ___creating___very realistic appea rin g che cks,pe ople ha ve be en__fooled__into taking bank drafts that don't truly have any value.6.Cred it c ard use ofte n___bec omes____p ro b le mat ic wh en theho lde r_a cc rues___mo re d e b t th a n a re gu la r mo nth ly p a yme n tc a n co ve r.Ⅲ.Trans late the fo llo wing senten ces into Eng lish.1.商业银行应积极开展电话银行转账功能风险评估和分类,依据收款账户的潜在风险高低,相应设置不同的转账额度和次数限制。

翻译:(1) Although banks share many comm on features with other profit-seeki ng busi n esses, they playa unique role in the economy through mobilizing savings, allocating capital funds to finaneeproductive investment, transmitting monetary policy, providing a payment system andtransforming risks.尽管银行与其他以盈利为目的的企业具有许多共同的特征,但它在国民经济中还发挥着特殊的作用。

银行可以动员储蓄,为生产性企业投资调配资金,传递货币政策,提供支付系统,转化风险。

(2) The past few years have seen marked acceleration of China's banking reform, particularly significa nt st re ngthe ning of the cen tral bank's capacity for supervisi on and macroeconomic management, substantial improvement in the management of the commercial banks, andgreater ope rm ess of the banki ng in dustry.在过去的几年中,中国银行业的改革速度显著加快,特别是强化了中央银行的监管职能和对宏观经济的管理职能,对商业银行的管理能力也有了显著的提高,同时银行业也更加开放。

(3) The reform of the financial system and particularly the diversification of banking in stituti onshave in creased competiti on in the banking sector and improved fin ancial services in China.金融体系的改革尤其是金融机构的多元化都增加了银行部门的竞争并且提升了中国的金融服务。