金融英语第三章答案

- 格式:doc

- 大小:46.50 KB

- 文档页数:3

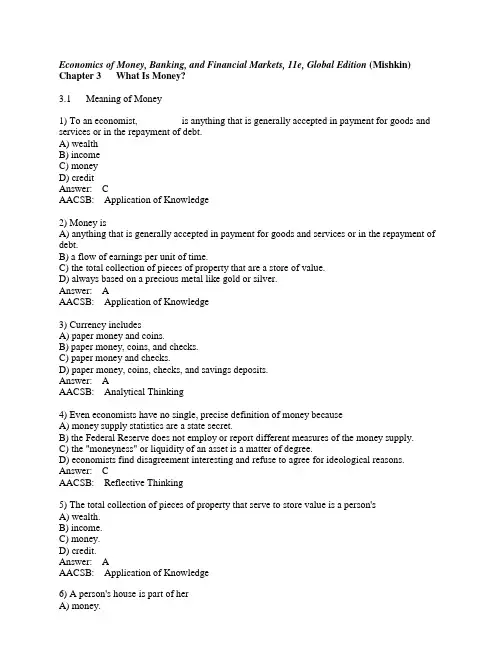

Economics of Money, Banking, and Financial Markets, 11e, Global Edition (Mishkin) Chapter 3 What Is Money?3.1 Meaning of Money1) To an economist, ________ is anything that is generally accepted in payment for goods and services or in the repayment of debt.A) wealthB) incomeC) moneyD) creditAnswer: CAACSB: Application of Knowledge2) Money isA) anything that is generally accepted in payment for goods and services or in the repayment of debt.B) a flow of earnings per unit of time.C) the total collection of pieces of property that are a store of value.D) always based on a precious metal like gold or silver.Answer: AAACSB: Application of Knowledge3) Currency includesA) paper money and coins.B) paper money, coins, and checks.C) paper money and checks.D) paper money, coins, checks, and savings deposits.Answer: AAACSB: Analytical Thinking4) Even economists have no single, precise definition of money becauseA) money supply statistics are a state secret.B) the Federal Reserve does not employ or report different measures of the money supply.C) the "moneyness" or liquidity of an asset is a matter of degree.D) economists find disagreement interesting and refuse to agree for ideological reasons. Answer: CAACSB: Reflective Thinking5) The total collection of pieces of property that serve to store value is a person'sA) wealth.B) income.C) money.D) credit.Answer: AAACSB: Application of Knowledge6) A person's house is part of herA) money.B) income.C) liabilities.D) wealth.Answer: DAACSB: Analytical Thinking7) ________ is used to make purchases while ________ is the total collection of pieces of property that serve to store value.A) Money; incomeB) Wealth; incomeC) Income; moneyD) Money; wealthAnswer: DAACSB: Reflective Thinking8) ________ is a flow of earnings per unit of time.A) IncomeB) MoneyC) WealthD) CurrencyAnswer: AAACSB: Application of Knowledge9) An individual's annual salary is herA) money.B) income.C) wealth.D) liabilities.Answer: BAACSB: Analytical Thinking10) When we say that money is a stock variable, we mean thatA) the quantity of money is measured at a given point in time.B) we must attach a time period to the measure.C) it is sold in the equity market.D) money never loses purchasing power.Answer: AAACSB: Reflective Thinking11) The difference between money and income is thatA) money is a flow and income is a stock.B) money is a stock and income is a flow.C) there is no difference—money and income are both stocks.D) there is no difference—money and income are both flows.Answer: BAACSB: Reflective Thinking12) Which of the following is a TRUE statement?A) Money and income are flow variables.B) Money is a flow variable.C) Income is a flow variable.D) Money and income are stock variables.Answer: CAACSB: Reflective Thinking13) Which of the following statements uses the economists' definition of money?A) I plan to earn a lot of money over the summer.B) Betsy is rich—she has a lot of money.C) I hope that I have enough money to buy my lunch today.D) The job with New Company gave me the opportunity to earn more money.Answer: CAACSB: Analytical Thinking3.2 Functions of Money1) Of money's three functions, the one that distinguishes money from other assets is its function as aA) store of value.B) unit of account.C) standard of deferred payment.D) medium of exchange.Answer: DAACSB: Reflective Thinking2) If peanuts serve as a medium of exchange, a unit of account, and a store of value, then peanuts areA) bank deposits.B) reserves.C) money.D) loanable funds.Answer: CAACSB: Reflective Thinking3) ________ are the time and resources spent trying to exchange goods and services.A) Bargaining costsB) Transaction costsC) Contracting costsD) Barter costsAnswer: BAACSB: Application of Knowledge4) Compared to an economy that uses a medium of exchange, in a barter economyA) transaction costs are higher.B) transaction costs are lower.C) liquidity costs are higher.D) liquidity costs are lower.Answer: AAACSB: Reflective Thinking5) When compared to exchange systems that rely on money, disadvantages of the barter system includeA) the requirement of a double coincidence of wants.B) lowering the cost of exchanging goods over time.C) lowering the cost of exchange to those who would specialize.D) encouraging specialization and the division of labor.Answer: AAACSB: Reflective Thinking6) The conversion of a barter economy to one that uses moneyA) increases efficiency by reducing the need to exchange goods and services.B) increases efficiency by reducing the need to specialize.C) increases efficiency by reducing transactions costs.D) does not increase economic efficiency.Answer: CAACSB: Reflective Thinking7) Which of the following statements best explains how the use of money in an economy increases economic efficiency?A) Money increases economic efficiency because it is costless to produce.B) Money increases economic efficiency because it discourages specialization.C) Money increases economic efficiency because it decreases transactions costs.D) Money cannot have an effect on economic efficiency.Answer: CAACSB: Reflective Thinking8) When economists say that money promotes ________, they mean that money encourages specialization and the division of labor.A) bargainingB) contractingC) efficiencyD) greedAnswer: CAACSB: Reflective Thinking9) Money ________ transaction costs, allowing people to specialize in what they do best.A) reducesB) increasesC) enhancesD) eliminatesAnswer: AAACSB: Application of Knowledge10) For a commodity to function effectively as money it must beA) easily standardized, making it easy to ascertain its value.B) difficult to make change.C) deteriorate quickly so that its supply does not become too large.D) hard to carry around.Answer: AAACSB: Reflective Thinking11) All of the following are necessary criteria for a commodity to function as money EXCEPTA) it must deteriorate quickly.B) it must be divisible.C) it must be easy to carry.D) it must be widely accepted.Answer: AAACSB: Analytical Thinking12) Whatever a society uses as money, the distinguishing characteristic is that it mustA) be completely inflation proof.B) be generally acceptable as payment for goods and services or in the repayment of debt.C) contain gold.D) be produced by the government.Answer: BAACSB: Reflective Thinking13) All but the most primitive societies use money as a medium of exchange, implying thatA) the use of money is economically efficient.B) barter exchange is economically efficient.C) barter exchange cannot work outside the family.D) inflation is not a concern.Answer: AAACSB: Reflective Thinking14) Kevin purchasing concert tickets with his debit card is an example of the ________ function of money.A) medium of exchangeB) unit of accountC) store of valueD) specializationAnswer: AAACSB: Analytical Thinking15) When money prices are used to facilitate comparisons of value, money is said to function as aA) unit of account.B) medium of exchange.C) store of value.D) payments-system ruler.Answer: AAACSB: Analytical Thinking16) When there are many goods is that in a barter systemA) transactions costs are minimized.B) there exists a multiple number of prices for each good.C) there is only one store of value.D) exchange of services is impossible.Answer: BAACSB: Reflective Thinking17) In a barter economy the number of prices in an economy with N goods isA) [N(N - 1)]/2.B) N(N/2).C) 2N.D) N(N/2) - 1.Answer: AAACSB: Analytical Thinking18) If there are five goods in a barter economy, one needs to know ten prices in order to exchange one good for another. If, however, there are ten goods in a barter economy, then one needs to know ________ prices in order to exchange one good for another.A) 20B) 25C) 30D) 45Answer: DAACSB: Analytical Thinking19) If there are four goods in a barter economy, then one needs to know ________ prices in order to exchange one good for another.A) 8B) 6C) 5D) 4Answer: BAACSB: Analytical Thinking20) Because it is a unit of account, moneyA) increases transaction costs.B) reduces the number of prices that need to be calculated.C) does not earn interest.D) discourages specialization.Answer: BAACSB: Reflective Thinking21) Dennis notices that jackets are on sale for $99. In this case money is functioning as aA) medium of exchange.B) unit of account.C) store of value.D) payments-system ruler.Answer: BAACSB: Analytical Thinking22) As a store of value, moneyA) does not earn interest.B) cannot be a durable asset.C) must be currency.D) is a way of saving for future purchases.Answer: DAACSB: Analytical Thinking23) Patrick places his pocket change into his savings bank on his desk each evening. By his actions, Patrick indicates that he believes that money is aA) medium of exchange.B) unit of account.C) store of value.D) unit of specialization.Answer: CAACSB: Analytical Thinking24) ________ is the relative ease and speed with which an asset can be converted into a medium of exchange.A) EfficiencyB) LiquidityC) DeflationD) SpecializationAnswer: BAACSB: Application of Knowledge25) Increasing transactions costs of selling an asset make the assetA) more valuable.B) more liquid.C) less liquid.D) more moneylike.Answer: CAACSB: Reflective Thinking26) Since it does not have to be converted into anything else to make purchases, ________ is the most liquid asset.A) moneyB) stockC) artworkD) goldAnswer: AAACSB: Reflective Thinking27) Of the following assets, the least liquid isA) stocks.B) traveler's checks.C) checking deposits.D) a house.Answer: DAACSB: Analytical Thinking28) Ranking assets from most liquid to least liquid, the correct order isA) savings bonds; house; currency.B) currency; savings bonds; house.C) currency; house; savings bonds.D) house; savings bonds; currency.Answer: BAACSB: Analytical Thinking29) People hold money even during inflationary episodes when other assets prove to be better stores of value. This can be explained by the fact that money isA) extremely liquid.B) a unique good for which there are no substitutes.C) the only thing accepted in economic exchange.D) backed by gold.Answer: AAACSB: Reflective Thinking30) If the price level doubles, the value of moneyA) doubles.B) more than doubles, due to scale economies.C) rises but does not double, due to diminishing returns.D) falls by 50 percent.Answer: DAACSB: Analytical Thinking31) A fall in the level of pricesA) does not affect the value of money.B) has an uncertain effect on the value of money.C) increases the value of money.D) reduces the value of money.Answer: CAACSB: Analytical Thinking32) A hyperinflation isA) a period of extreme inflation generally greater than 50% per month.B) a period of anxiety caused by rising prices.C) an increase in output caused by higher prices.D) impossible today because of tighter regulations.Answer: AAACSB: Analytical Thinking。

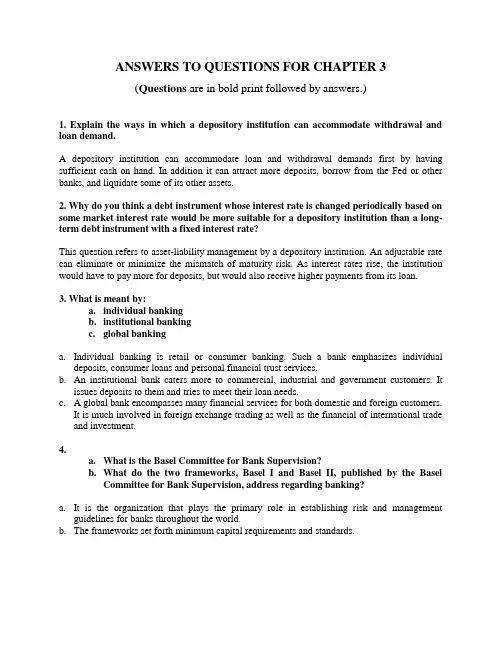

ANSWERS TO QUESTIONS FOR CHAPTER 3(Questions are in bold print followed by answers.)1. Explain the ways in which a depository institution can accommodate withdrawal and loan demand.A depository institution can accommodate loan and withdrawal demands first by having sufficient cash on hand. In addition it can attract more deposits, borrow from the Fed or other banks, and liquidate some of its other assets.2. Why do you think a debt instrument whose interest rate is changed periodically based on some market interest rate would be more suitable for a depository institution than a long-term debt instrument with a fixed interest rate?This question refers to asset-liability management by a depository institution. An adjustable rate can eliminate or minimize the mismatch of maturity risk. As interest rates rise, the institution would have to pay more for deposits, but would also receive higher payments from its loan.3. What is meant by:a.individual bankingb.institutional bankingc.global bankinga.Individual banking is retail or consumer banking. Such a bank emphasizes individualdeposits, consumer loans and personal financial trust services.b.An institutional bank caters more to commercial, industrial and government customers. Itissues deposits to them and tries to meet their loan needs.c. A global bank encompasses many financial services for both domestic and foreign customers.It is much involved in foreign exchange trading as well as the financial of international trade and investment.4.a.What is the Basel Committee for Bank Supervision?b.What do the two frameworks, Basel I and Basel II, published by the BaselCommittee for Bank Supervision, address regarding banking?a.It is the organization that plays the primary role in establishing risk and managementguidelines for banks throughout the world.b.The frameworks set forth minimum capital requirements and standards.5. Explain each of the following:a.reserve ratiob.required reservesa.The reserve ratio is the percentage of deposits a bank must keep in a non-interest-bearingaccount at the Fed.b.Required reserves are the actual dollar amounts based on a given reserve ratio.6. Explain each of the following types of deposit accounts:a.demand depositb.certificate of depositc.money market demand accounta.Demand deposits (checking accounts) do not pay interest and can be withdrawn at any time(upon demand).b.Certificates of Deposit (CDs) are time deposits which pay a fixed or variable rate of interestover a specified term to maturity. They cannot be withdrawn prior to maturity without a substantial penalty. negotiable CDs (large business deposits) can be traded so that the original owner still obtains liquidity when needed.c.Money Market Demand Accounts (MMDAs) are basically demand or checking accounts thatpay interest. Minimum amounts must be maintained in these accounts so that at least a 7-day interest can be paid. Since many persons find it not possible to maintain this minimum (usually around $2500) there are still plenty of takers for the non-interest-bearing demand deposits.7. How did the Glass-Steagall Act impact the operations of a bank?The Glass-Steagall Act prohibited banks from carrying out certain activities in the securities markets, which are principal investment banking activities. It also prohibited banks from engaging in insurance activities.28. The following is the book value of the assets of a bank:Asset Book Value (in millions)U.S. Treasury securities $ 50Municipal general obligationbonds50Residential mortgages 400Commercial loans 200Total book value $700a.Calculate the credit risk-weighted assets using the following information:Asset Risk WeightU.S. Treasury securities 0%Municipal general obligationbonds20Residential mortgages 50Commercial loans 100b.What is the minimum core capital requirement?c.What is the minimum total capital requirement?a.The risk weighted assets would be $410b.The minimum core capital is $28 million (.04X700) i.e., 4% of book value.c.Minimum total capital (core plus supplementary capital) is 32.8 million, .08X410, which is8% of the risk-weighted assets.9. In later chapters, we will discuss a measure called duration. Duration is a measure of the sensitivity of an asset or a liability to a change in interest rates. Why would bank management want to know the duration of its assets and liabilities?a.Duration is a measure of the approximate change in the value of an asset for a 1% change ininterest rates.b.If an asset has a duration of 5, then the portfolio’s value will change by approximately 5% ifinterest rate changes by 100 basis points.3-310.a.Explain how bank regulators have incorporated interest risk into capitalrequirements.b.Explain how S&L regulators have incorporated interest rate risk into capitalrequirements.a.The FDIC Improvement Act of 1991, required regulators of DI to incorporate interest raterisk into capital requirements. It is based on measuring interest rate sensitivity of the assets and liabilities of the bank.b.The OST adopted a regulation that incorporates interest rate risk for S&L. It specifies that ifthrift has greater interest rate risk exposure, there would be a deduction of its risk-based capital. The risk is specified as a decline in net profit value as a result of 2% change in market interest rate.11. When the manager of a bank’s portfolio of securities considers alternative investments, she is also concerned about the risk weight assigned to the security. Why?The Basel guidelines give weight to the credit risk of various instruments. These weights are 0%, 20%, 50% and 100%. The book value of the asset is multiplied by the credit risk weights to determine the amount of core and supplementary capital that the bank will need to support that asset.12. You and a friend are discussing the savings and loan crisis. She states that “the whole mess started in the early 1980s.When short-term rates skyrocketed, S&Ls got killed—their spread income went from positive to negative. They were borrowing short and lending long.”a.What does she mean by “borrowing short and lending long”?b.Are higher or lower interest rates beneficial to an institution that borrows shortand lends long?a.In this context, borrowing short and lending long refers to the balance sheet structure ofS&Ls. Their sources of funds (liabilities) are short-term (mainly deposits) and their uses (assets) are long-term in nature (e.g. residential mortgages).b.Since long-term rates tend to be higher than short-term ones, stable interest rates would bethe best situation. However, rising interest rates would increase the cost of funds for S&Ls without fully compensating higher returns on assets. Hence a decline in interest rate spread or margin. Thus lower rates, having an opposite effect, would be more beneficial.13. Consider this headline from the New York Times of March 26, 1933: “Bankers will fight Deposit Guarantees.” In this article, it is stated that bankers argue that deposit guarantees will encourage bad banking. Explain why.The barrier imposed by Glass-Steagall act was finally destroyed by the Gramm-Leach Bliley Act of 1999. This act modified parts of the BHC Act so as to permit affiliations between banks and insurance underwriters. It created a new financial holding company, which is authorized to4engage in underwriting and selling securities. The act preserved the right of state to regulate insurance activities, but prohibits state actions that have would adversely affected bank-affiliated firms from selling insurance on an equal basis with other insurance agents.14. How did the Gramm-Leach-Bliley Act of 1999 expand the activities permitted by banks?a.Deposit insurance provides a safety net and can thus make depositors indifferent to thesoundness of the depository recipients of their funds. With depositors exercising little discipline through the cost of deposits, the incentive of some banks owners to control risk-taking accrue to the owners. It becomes a “heads I win, tails you lose” situation.b.One the positive side, deposit insurance provides a comfort to depositors and thus attractsdepositors to financial institutions. But such insurance carries a moral hazard, it can be costly and, unless premiums are risk-based, it forces the very sound banks to subsidize the very risky ones.15. The following quotation is from the October 29, 1990 issue of Corporate Financing Week:Chase Manhattan Bank is preparing its first asset-backed debt issue, becomingthe last major consumer bank to plan to access the growing market, Street asset-backed officialsSaid…Asset-backed offerings enable banks to remove credit card or other loanreceivables from their balance sheets, which helps them comply with capitalrequirements.a.What capital requirements is this article referring to?b.Explain why asset securitization reduces capital requirements.a.The capital requirements mentioned are risk based capital as specified under the BaselAgreement, which forces banks to hold minimum amounts of equity against risk-based assets.b.Securitization effectively eliminates high risk based loans from the balance sheet. The capitalrequirements in the case of asset securitization are lower than for a straight loan.16. Comment on this statement: The risk-based guidelines for commercial banks attempt to gauge the interest rate risk associated with a bank’s balance sheet.This statement is incorrect. The risk-based capital guidelines deal with credit risk, not interest-rate risk, which is the risk of adverse changes of interest rates on the portfolio position.17.a.What is the primary asset in which savings and loan associations invest?b.Why were banks in a better position than savings and loan associations toweather rising interest rates?a.Savings and Loans invest primarily in residential mortgages.b.During 1980's, although banks also suffered from the effects of deregulation and rising3-5interest rates, relatively they were in a better position than S&L association because of their superior asset-liability management.618. What federal agency regulates the activities of credit unions?The principal federal regulatory agency is the National Credit Union Administration.3-7。

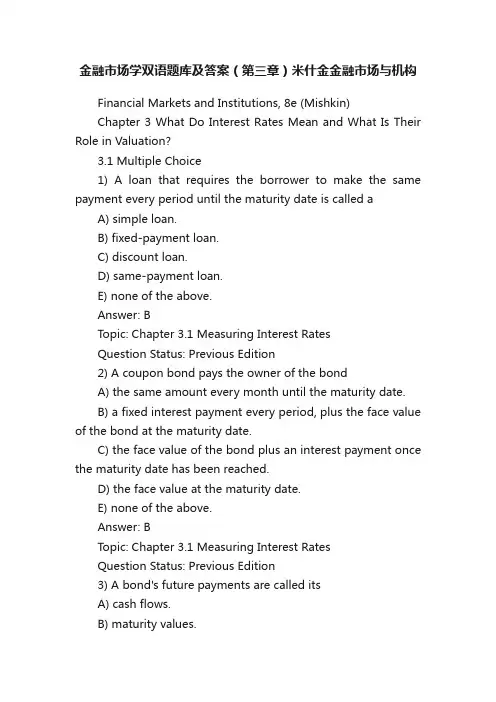

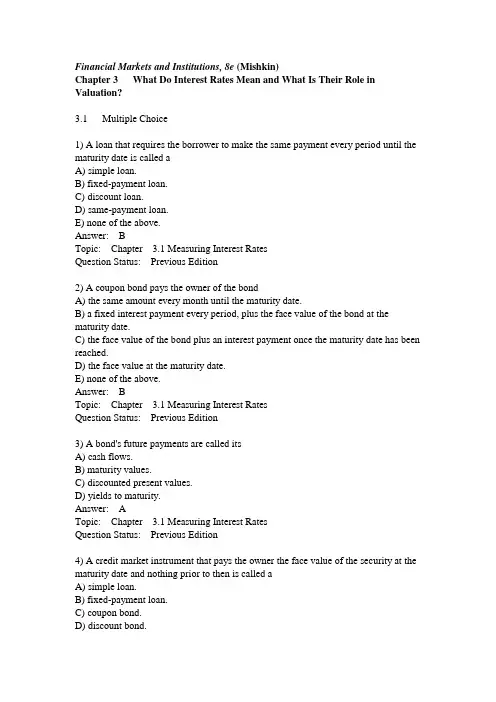

金融市场学双语题库及答案(第三章)米什金金融市场与机构Financial Markets and Institutions, 8e (Mishkin)Chapter 3 What Do Interest Rates Mean and What Is Their Role in Valuation?3.1 Multiple Choice1) A loan that requires the borrower to make the same payment every period until the maturity date is called aA) simple loan.B) fixed-payment loan.C) discount loan.D) same-payment loan.E) none of the above.Answer: BTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition2) A coupon bond pays the owner of the bondA) the same amount every month until the maturity date.B) a fixed interest payment every period, plus the face value of the bond at the maturity date.C) the face value of the bond plus an interest payment once the maturity date has been reached.D) the face value at the maturity date.E) none of the above.Answer: BTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition3) A bond's future payments are called itsA) cash flows.B) maturity values.C) discounted present values.D) yields to maturity.Answer: ATopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition4) A credit market instrument that pays the owner the face value of the security at the maturity date and nothing prior to then is called aA) simple loan.B) fixed-payment loan.C) coupon bond.D) discount bond.Answer: DTopic: Chapter 3.1 Measuring Interest Rates Question Status: Previous Edition5) (I) A simple loan requires the borrower to repay the principal at the maturity date along with an interest payment.(II) A discount bond is bought at a price below its face value, and the face value is repaid at the maturity date.A) (I) is true, (II) false.B) (I) is false, (II) true.C) Both are true.D) Both are false.Answer: CTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition6) Which of the following are true of coupon bonds?A) The owner of a coupon bond receives a fixed interest payment every year until the maturity date, when the face or par value is repaid.B) U.S. Treasury bonds and notes are examples of coupon bonds.C) Corporate bonds are examples of coupon bonds.D) All of the above.E) Only A and B of the above.Answer: DTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition7) Which of the following are generally true of all bonds?A) The longer a bond's maturity, the lower is the rate of return that occurs as a result of the increase in the interest rate.B) Even though a bond has a substantial initial interest rate, its return can turn out to be negative if interest rates rise.C) Prices and returns for long-term bonds are more volatile than those forshorter-term bonds.D) All of the above are true.E) Only A and B of the above are true.Answer: DTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition8) (I) A discount bond requires the borrower to repay the principal at the maturity date plus an interest payment.(II) A coupon bond pays the lender a fixed interest payment every year until the maturity date, when a specified final amount (face or par value) is repaid.A) (I) is true, (II) false.B) (I) is false, (II) true.C) Both are true.D) Both are false.Answer: BTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition9) If a $5,000 coupon bond has a coupon rate of 13 percent, then the coupon payment every year isA) $650.B) $1,300.C) $130.D) $13.E) None of the above.Answer: ATopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition10) An $8,000 coupon bond with a $400 annual coupon payment has a coupon rate ofA) 5 percent.B) 8 percent.C) 10 percent.D) 40 percent.Answer: ATopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition11) The concept of ________ is based on the notion that a dollar paid to you in the future is less valuable to you than a dollar today.A) present valueB) future valueC) interestD) deflationAnswer: ATopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition12) Dollars received in the future are worth ________ than dollars received today. The process of calculating what dollars received in the future are worth today is called ________.A) more; discountingB) less; discountingC) more; inflatingD) less; inflatingAnswer: BTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition13) The process of calculating what dollars received in the future are worth today is calledA) calculating the yield to maturity.B) discounting the future.C) compounding the future.D) compounding the present.Answer: BTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition14) With an interest rate of 5 percent, the present value of $100 received one year from now is approximatelyA) $100.B) $105.C) $95.D) $90.Answer: CTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition15) With an interest rate of 10 percent, the present value ofa security that pays $1,100 next year and $1,460 four years from now is approximatelyA) $1,000.B) $2,000.C) $2,560.D) $3,000.Answer: BTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition16) With an interest rate of 8 percent, the present value of $100 received one year from now is approximatelyA) $93.B) $96.C) $100.D) $108.Answer: ATopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition17) With an interest rate of 6 percent, the present value of $100 received one year from now is approximatelyA) $106.B) $100.C) $94.D) $92.Answer: CTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition18) The interest rate that equates the present value of the cash flow received from a debt instrument with its market pricetoday is theA) simple interest rate.B) discount rate.C) yield to maturity.D) real interest rate.Answer: CTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition19) The interest rate that financial economists consider to be the most accurate measure is theA) current yield.B) yield to maturity.C) yield on a discount basis.D) coupon rate.Answer: BTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition20) Financial economists consider the ________ to be the most accurate measure of interest rates.A) simple interest rateB) discount rateC) yield to maturityD) real interest rateAnswer: CTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition21) For a simple loan, the simple interest rate equals theA) real interest rate.B) nominal interest rate.C) current yield.D) yield to maturity.Answer: DTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition22) For simple loans, the simple interest rate is ________ the yield to maturity.A) greater thanB) less thanC) equal toD) not comparable toAnswer: CTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition23) The yield to maturity of a one-year, simple loan of $500 that requires an interest payment of $40 isA) 5 percent.B) 8 percent.C) 12 percent.D) 12.5 percent.Answer: BTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition24) The yield to maturity of a one-year, simple loan of $400 that requires an interest payment of $50 isA) 5 percent.B) 8 percent.C) 12 percent.D) 12.5 percent.Answer: DTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition25) A $10,000, 8 percent coupon bond that sells for $10,000 has a yield to maturity ofA) 8 percent.B) 10 percent.C) 12 percent.D) 14 percent.Answer: ATopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition26) A $10,000, 8 percent coupon bond that sells for $10,100 has a yield to maturity ________.A) equal to 8 percentB) greater than 8 percentC) less than 8 perfectD) that cannot be calculatedAnswer: CTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: New Question27) Which of the following $1,000 face value securities has the highest yield to maturity?A) A 5 percent coupon bond selling for $1,000B) A 10 percent coupon bond selling for $1,000C) A 12 percent coupon bond selling for $1,000D) A 12 percent coupon bond selling for $1,100Answer: CTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition28) Which of the following $1,000 face value securities has the highest yield to maturity?A) A 5 percent coupon bond selling for $1,000B) A 10 percent coupon bond selling for $1,000C) A 15 percent coupon bond selling for $1,000D) A 15 percent coupon bond selling for $900Answer: DTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition29) Which of the following $1,000 face value securities has the lowest yield to maturity?A) A 5 percent coupon bond selling for $1,000B) A 7 percent coupon bond selling for $1,100C) A 15 percent coupon bond selling for $1,000D) A 15 percent coupon bond selling for $900Answer: BTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: New Question30) Which of the following are true for a coupon bond?A) When the coupon bond is priced at its face value, the yield to maturity equals the coupon rate.B) The price of a coupon bond and the yield to maturity are negatively related.C) The yield to maturity is greater than the coupon rate when the bond price is below the par value.D) All of the above are true.E) Only A and B of the above are true.Answer: DTopic: Chapter 3.1 Measuring Interest Rates Question Status: Previous Edition31) Which of the following are true for a coupon bond?A) When the coupon bond is priced at its face value, the yieldto maturity equals the coupon rate.B) The price of a coupon bond and the yield to maturity are negatively related.C) The yield to maturity is greater than the coupon rate when the bond price is above the par value.D) All of the above are true.E) Only A and B of the above are true.Answer: ETopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition32) Which of the following are true for a coupon bond?A) When the coupon bond is priced at its face value, the yield to maturity equals the coupon rate.B) The price of a coupon bond and the yield to maturity are positively related.C) The yield to maturity is greater than the coupon rate when the bond price is above the par value.D) All of the above are true.E) Only A and B of the above are true.Answer: ATopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition33) A consol bond is a bond thatA) pays interest annually and its face value at maturity.B) pays interest in perpetuity and never matures.C) pays no interest but pays its face value at maturity.D) rises in value as its yield to maturity rises.Answer: BTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition34) The yield to maturity on a consol bond that pays $100 yearly and sells for $500 isA) 5 percent.B) 10 percent.C) 12.5 percent.D) 20 percent.E) 25 percent.Answer: DTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition35) The yield to maturity on a consol bond that pays $200 yearly and sells for $1000 isA) 5 percent.B) 10 percent.C) 20 percent.D) 25 percent.Answer: CTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition36) A frequently used approximation for the yield to maturity on a long-term bond is theA) coupon rate.B) current yield.C) cash flow interest rate.D) real interest rate.Answer: BTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition37) The current yield on a coupon bond is the bond's ________ divided by its________.A) annual coupon payment; priceB) annual coupon payment; face valueC) annual return; priceD) annual return; face valueAnswer: ATopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition38) When a bond's price falls, its yield to maturity ________ and its current yield________.A) falls; fallsB) rises; risesC) falls; risesD) rises; fallsAnswer: BTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition39) The yield to maturity for a one-year discount bond equalsA) the increase in price over the year, divided by the initial price.B) the increase in price over the year, divided by the face value.C) the increase in price over the year, divided by the interest rate.D) none of the above.Answer: ATopic: Chapter 3.1 Measuring Interest Rates Question Status: Previous Edition40) If a $10,000 face value discount bond maturing in oneyear is selling for $8,000, then its yield to maturity isA) 10 percent.B) 20 percent.C) 25 percent.D) 40 percent.Answer: CTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition41) If a $10,000 face value discount bond maturing in one year is selling for $9,000, then its yield to maturity is approximatelyA) 9 percent.B) 10 percent.C) 11 percent.D) 12 percent.Answer: CTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition42) If a $10,000 face value discount bond maturing in one year is selling for $5,000, then its yield to maturity isA) 5 percent.B) 10 percent.C) 50 percent.D) 100 percent.Answer: DTopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition43) If a $5,000 face value discount bond maturing in one year is selling for $5,000, then its yield to maturity isA) 0 percent.B) 5 percent.C) 10 percent.D) 20 percent.Answer: ATopic: Chapter 3.1 Measuring Interest RatesQuestion Status: Previous Edition44) The Fisher equation states thatA) the nominal interest rate equals the real interest rate plus the expected rate of inflation.B) the real interest rate equals the nominal interest rate less the expected rate of inflation.C) the nominal interest rate equals the real interest rate less the expected rate of inflation.D) both A and B of the above are true.E) both A and C of the above are true.Answer: DTopic: Chapter 3.2 Distinction Between Real and Nominal Interest Rates Question Status: Previous Edition45) If you expect the inflation rate to be 15 percent next year and a one-year bond hasa yield to maturity of 7 percent, then the real interest rate on this bond isA) 7 percent.B) 22 percent.C) -15 percent.D) -8 percent.E) none of the above.Answer: DTopic: Chapter 3.2 Distinction Between Real and Nominal Interest Rates Question Status: Previous Edition46) If you expect the inflation rate to be 5 percent next year and a one-year bond has a yield to maturity of 7 percent, then the real interest rate on this bond isA) -12 percent.B) -2 percent.C) 2 percent.D) 12 percent.Answer: CTopic: Chapter 3.2 Distinction Between Real and Nominal Interest Rates Question Status: Previous Edition47) The nominal interest rate minus the expected rate of inflationA) defines the real interest rate.B) is a better measure of the incentives to borrow and lend than the nominal interest rate.C) is a more accurate indicator of the tightness of credit market conditions than the nominal interest rate.D) all of the above.E) only A and B of the above.Answer: DTopic: Chapter 3.2 Distinction Between Real and Nominal Interest RatesQuestion Status: Previous Edition48) The nominal interest rate minus the expected rate of inflationA) defines the real interest rate.B) is a less accurate measure of the incentives to borrow and lend than is the nominal interest rate.C) is a less accurate indicator of the tightness of credit market conditions than is the nominal interest rate.D) defines the discount rate.Answer: ATopic: Chapter 3.2 Distinction Between Real and Nominal Interest Rates Question Status: Previous Edition49) In which of the following situations would you prefer to be making a loan?A) The interest rate is 9 percent and the expected inflation rate is 7 percent.B) The interest rate is 4 percent and the expected inflation rate is 1 percent.C) The interest rate is 13 percent and the expected inflation rate is 15 percent.D) The interest rate is 25 percent and the expected inflation rate is 50 percent. Answer: BTopic: Chapter 3.2 Distinction Between Real and Nominal Interest Rates Question Status: Previous Edition50) In which of the following situations would you prefer to be borrowing?A) The interest rate is 9 percent and the expected inflation rate is 7 percent.B) The interest rate is 4 percent and the expected inflation rate is 1 percent.C) The interest rate is 13 percent and the expected inflation rate is 15 percent.D) The interest rate is 25 percent and the expected inflation rate is 50 percent. Answer: DTopic: Chapter 3.2 Distinction Between Real and Nominal Interest Rates Question Status: Previous Edition51) What is the return on a 5 percent coupon bond that initially sells for $1,000 and sells for $1,200 one year later?A) 5 percentB) 10 percentC) -5 percentD) 25 percentE) None of the aboveAnswer: DTopic: Chapter 3.3 Distinction Between Interest Rates and ReturnsQuestion Status: Previous Edition52) What is the return on a 5 percent coupon bond that initially sells for $1,000 and sells for $900 one year later?A) 5 percentB) 10 percentC) -5 percentD) -10 percentE) None of the aboveAnswer: CTopic: Chapter 3.3 Distinction Between Interest Rates and ReturnsQuestion Status: Previous Edition53) The return on a 5 percent coupon bond that initially sells for $1,000 and sells for $1,100 one year later isA) 5 percent.B) 10 percent.C) 14 percent.D) 15 percent.Answer: DTopic: Chapter 3.3 Distinction Between Interest Rates and ReturnsQuestion Status: Previous Edition54) The return on a 10 percent coupon bond that initially sells for $1,000 and sells for $900 one year later isA) -10 percent.B) -5 percent.C) 0 percent.D) 5 percent.Answer: CTopic: Chapter 3.3 Distinction Between Interest Rates and ReturnsQuestion Status: Previous Edition55) Which of the following are generally true of all bonds?A) The only bond whose return equals the initial yield to maturity is one whose time to maturity is the same as the holding period.B) A rise in interest rates is associated with a fall in bond prices, resulting in capital losses on bonds whose term to maturities are longer than the holding period.C) The longer a bond's maturity, the greater is the price change associated with a given interest rate change.D) All of the above are true.E) Only A and B of the above are true.Answer: DTopic: Chapter 3.3 Distinction Between Interest Rates and ReturnsQuestion Status: Previous Edition56) Which of the following are true concerning the distinction between interest rates and return?A) The rate of return on a bond will not necessarily equal the interest rate on that bond.B) The return can be expressed as the sum of the current yieldand the rate of capital gains.C) The rate of return will be greater than the interest rate when the price of the bond falls between time t and time t + 1.D) All of the above are true.E) Only A and B of the above are true.Answer: ETopic: Chapter 3.3 Distinction Between Interest Rates and ReturnsQuestion Status: Previous Edition57) If the interest rates on all bonds rise from 5 to 6 percent over the course of the year, which bond would you prefer to have been holding?A) A bond with one year to maturityB) A bond with five years to maturityC) A bond with ten years to maturityD) A bond with twenty years to maturityAnswer: ATopic: Chapter 3.3 Distinction Between Interest Rates and ReturnsQuestion Status: Previous Edition58) Suppose you are holding a 5 percent coupon bond maturing in one year with a yield to maturity of 15 percent. If the interest rate on one-year bonds rises from 15 percent to 20 percent over the course of the year, what is the yearly return on the bond you are holding?A) 5 percentB) 10 percentC) 15 percentD) 20 percentAnswer: CTopic: Chapter 3.3 Distinction Between Interest Rates and ReturnsQuestion Status: Previous Edition59) (I) Prices of longer-maturity bonds respond more dramatically to changes in interest rates.(II) Prices and returns for long-term bonds are less volatile than those for short-term bonds.A) (I) is true, (II) false.B) (I) is false, (II) true.C) Both are true.D) Both are false.Answer: A。

金融英语翻译题第三章第三章1、Depository institutions are highly regulated because of the important role that they play in the country’s financial system. Demand deposit accounts are the principal means that individuals and business entities use for making payments,and government monetary policy is implemented through the banking system.Because of their important role,depository institutions are afforded special privileges such as access to federal deposit insurance and access to a government entity that provides funds for liquidity or emergency needs.由于存款机构在国家金融体系中起着至关重要的作用,对其监管也是非常严格。

活期存款账户是个人和企业主要的支付工具,且政府货币政策也是通过银行系统来实施的。

由于其重要作用,存款机构被赋予许多特权,如可以加入联邦存款保险,或是在流动性需求和紧急情况下求助于政府机构提供现金。

2、All depository institutions face interest rate risk.Managers of a depository institution who have particular expectations about the future direction of interest rates will seek to benefit from these expectations.Those who expect interest rates to rise may pursue a policy to borrow funds for a long time horizon范围,界限and lend funds for a short time horizon.If interest rates are expected to drop, managers may elect to borrow short and lend long.所有的存款机构都面临着利率风险。

ANSWERS TO QUESTIONS FOR CHAPTER 3(Questions are in bold print followed by answers.)1. Explain the ways in which a depository institution can accommodate withdrawal and loan demand.A depository institution can accommodate loan and withdrawal demands first by having sufficient cash on hand. In addition it can attract more deposits, borrow from the Fed or other banks, and liquidate some of its other assets.2. Why do you think a debt instrument whose interest rate is changed periodically based on some market interest rate would be more suitable for a depository institution than a long-term debt instrument with a fixed interest rate?This question refers to asset-liability management by a depository institution. An adjustable rate can eliminate or minimize the mismatch of maturity risk. As interest rates rise, the institution would have to pay more for deposits, but would also receive higher payments from its loan.3. What is meant by:a.individual bankingb.institutional bankingc.global bankinga.Individual banking is retail or consumer banking. Such a bank emphasizes individualdeposits, consumer loans and personal financial trust services.b.An institutional bank caters more to commercial, industrial and government customers. Itissues deposits to them and tries to meet their loan needs.c. A global bank encompasses many financial services for both domestic and foreign customers.It is much involved in foreign exchange trading as well as the financial of international trade and investment.4.a.What is the Basel Committee for Bank Supervision?b.What do the two frameworks, Basel I and Basel II, published by the BaselCommittee for Bank Supervision, address regarding banking?a.It is the organization that plays the primary role in establishing risk and managementguidelines for banks throughout the world.b.The frameworks set forth minimum capital requirements and standards.5. Explain each of the following:a.reserve ratiob.required reservesa.The reserve ratio is the percentage of deposits a bank must keep in a non-interest-bearingaccount at the Fed.b.Required reserves are the actual dollar amounts based on a given reserve ratio.6. Explain each of the following types of deposit accounts:a.demand depositb.certificate of depositc.money market demand accounta.Demand deposits (checking accounts) do not pay interest and can be withdrawn at any time(upon demand).b.Certificates of Deposit (CDs) are time deposits which pay a fixed or variable rate of interestover a specified term to maturity. They cannot be withdrawn prior to maturity without a substantial penalty. negotiable CDs (large business deposits) can be traded so that the original owner still obtains liquidity when needed.c.Money Market Demand Accounts (MMDAs) are basically demand or checking accounts thatpay interest. Minimum amounts must be maintained in these accounts so that at least a 7-day interest can be paid. Since many persons find it not possible to maintain this minimum (usually around $2500) there are still plenty of takers for the non-interest-bearing demand deposits.7. How did the Glass-Steagall Act impact the operations of a bank?The Glass-Steagall Act prohibited banks from carrying out certain activities in the securities markets, which are principal investment banking activities. It also prohibited banks from engaging in insurance activities.28. The following is the book value of the assets of a bank:Asset Book Value (in millions)U.S. Treasury securities $ 50Municipal general obligationbonds50Residential mortgages 400Commercial loans 200Total book value $700a.Calculate the credit risk-weighted assets using the following information:Asset Risk WeightU.S. Treasury securities 0%Municipal general obligationbonds20Residential mortgages 50Commercial loans 100b.What is the minimum core capital requirement?c.What is the minimum total capital requirement?a.The risk weighted assets would be $410b.The minimum core capital is $28 million (.04X700) i.e., 4% of book value.c.Minimum total capital (core plus supplementary capital) is 32.8 million, .08X410, which is8% of the risk-weighted assets.9. In later chapters, we will discuss a measure called duration. Duration is a measure of the sensitivity of an asset or a liability to a change in interest rates. Why would bank management want to know the duration of its assets and liabilities?a.Duration is a measure of the approximate change in the value of an asset for a 1% change ininterest rates.b.If an asset has a duration of 5, then the portfolio’s value will change by approximately 5% ifinterest rate changes by 100 basis points.3-310.a.Explain how bank regulators have incorporated interest risk into capitalrequirements.b.Explain how S&L regulators have incorporated interest rate risk into capitalrequirements.a.The FDIC Improvement Act of 1991, required regulators of DI to incorporate interest raterisk into capital requirements. It is based on measuring interest rate sensitivity of the assets and liabilities of the bank.b.The OST adopted a regulation that incorporates interest rate risk for S&L. It specifies that ifthrift has greater interest rate risk exposure, there would be a deduction of its risk-based capital. The risk is specified as a decline in net profit value as a result of 2% change in market interest rate.11. When the manager of a bank’s portfolio of securities considers alternative investments, she is also concerned about the risk weight assigned to the security. Why?The Basel guidelines give weight to the credit risk of various instruments. These weights are 0%, 20%, 50% and 100%. The book value of the asset is multiplied by the credit risk weights to determine the amount of core and supplementary capital that the bank will need to support that asset.12. You and a friend are discussing the savings and loan crisis. She states that “the whole mess started in the early 1980s.When short-term rates skyrocketed, S&Ls got killed—their spread income went from positive to negative. They were borrowing short and lending long.”a.What does she mean by “borrowing short and lending long”?b.Are higher or lower interest rates beneficial to an institution that borrows shortand lends long?a.In this context, borrowing short and lending long refers to the balance sheet structure ofS&Ls. Their sources of funds (liabilities) are short-term (mainly deposits) and their uses (assets) are long-term in nature (e.g. residential mortgages).b.Since long-term rates tend to be higher than short-term ones, stable interest rates would bethe best situation. However, rising interest rates would increase the cost of funds for S&Ls without fully compensating higher returns on assets. Hence a decline in interest rate spread or margin. Thus lower rates, having an opposite effect, would be more beneficial.13. Consider this headline from the New York Times of March 26, 1933: “Bankers will fight Deposit Guarantees.” In this article, it is stated that bankers argue that deposit guarantees will encourage bad banking. Explain why.The barrier imposed by Glass-Steagall act was finally destroyed by the Gramm-Leach Bliley Act of 1999. This act modified parts of the BHC Act so as to permit affiliations between banks and insurance underwriters. It created a new financial holding company, which is authorized to4engage in underwriting and selling securities. The act preserved the right of state to regulate insurance activities, but prohibits state actions that have would adversely affected bank-affiliated firms from selling insurance on an equal basis with other insurance agents.14. How did the Gramm-Leach-Bliley Act of 1999 expand the activities permitted by banks?a.Deposit insurance provides a safety net and can thus make depositors indifferent to thesoundness of the depository recipients of their funds. With depositors exercising little discipline through the cost of deposits, the incentive of some banks owners to control risk-taking accrue to the owners. It becomes a “heads I win, tails you lose” situation.b.One the positive side, deposit insurance provides a comfort to depositors and thus attractsdepositors to financial institutions. But such insurance carries a moral hazard, it can be costly and, unless premiums are risk-based, it forces the very sound banks to subsidize the very risky ones.15. The following quotation is from the October 29, 1990 issue of Corporate Financing Week:Chase Manhattan Bank is preparing its first asset-backed debt issue, becomingthe last major consumer bank to plan to access the growing market, Street asset-backed officialsSaid…Asset-backed offerings enable banks to remove credit card or other loanreceivables from their balance sheets, which helps them comply with capitalrequirements.a.What capital requirements is this article referring to?b.Explain why asset securitization reduces capital requirements.a.The capital requirements mentioned are risk based capital as specified under the BaselAgreement, which forces banks to hold minimum amounts of equity against risk-based assets.b.Securitization effectively eliminates high risk based loans from the balance sheet. The capitalrequirements in the case of asset securitization are lower than for a straight loan.16. Comment on this statement: The risk-based guidelines for commercial banks attempt to gauge the interest rate risk associated with a bank’s balance sheet.This statement is incorrect. The risk-based capital guidelines deal with credit risk, not interest-rate risk, which is the risk of adverse changes of interest rates on the portfolio position.17.a.What is the primary asset in which savings and loan associations invest?b.Why were banks in a better position than savings and loan associations toweather rising interest rates?a.Savings and Loans invest primarily in residential mortgages.b.During 1980's, although banks also suffered from the effects of deregulation and rising3-5interest rates, relatively they were in a better position than S&L association because of their superior asset-liability management.618. What federal agency regulates the activities of credit unions?The principal federal regulatory agency is the National Credit Union Administration.3-7。

Unit 3Short DialoguesTask 1 Multiple ChoiceScripts & AnswersDialog 1M: Hi, Xiaohong. There is news about bankruptcies of some U.S. banks. It seems the banks are subject to some risks in their operation.W: Yes. Excessive interest rate risk can pose a significant threat to a bank’s earnings and capital base.M: Do you know the exact meaning of the interest rate risk?W: It is difficult to explain it in a few words. Let me see, eh… Generally speaking, interest rate risk is the risk arising from the change in value ofan interest-bearing asset, such as a loan or a bond, due to fluctuation in interest rates. As rates rise, the price of a fixed rate bond will fall. As rates fall, the price of the bond will rise.M: So the task of control over the interest rate risk would be critical to banks, because the change in interest rates will affect the value of a bank’sinterest-bearing assets.W: Right, but sometimes it is beyond the control of one bank.Question: What is usually considered the cause of interest rate risk according to the woman? (D译文男:嗨 , 晓红。

⾦融英语视听说-第三章听⼒原⽂及答案解析Unit 3Short DialoguesTask 1 Multiple ChoiceScripts & AnswersDialog 1M: Hi, Xiaohong. There is news about bankruptcies of some U.S. banks. Itseems the banks are subject to some risks in their operation.W: Yes. Excessive interest rate risk ca n pose a significant threat to a bank’s earnings and capital base.M: Do you know the exact meaning of the interest rate risk?W: It is difficult to explain it in a few words. Let me see, eh… Generally speaking, interest rate risk is the risk arising from the change in value ofan interest-bearing asset, such as a loan or a bond, due to fluctuation ininterest rates. As rates rise, the price of a fixed rate bond will fall. As ratesfall, the price of the bond will rise.M: So the task of control over the interest rate risk would be critical to banks, because the change in interest rates will affect the value of a bank’sinterest-bearing assets.W: Right, but sometimes it is beyond the control of one bank.Question: What is usually considered the cause of interest rate risk according to the woman? (D)译⽂男:嗨,晓红。

INTERNATIONAL FINANCEAssignment Problems (3) Name: Student#: I. Choose the correct answer for the following questions (only ONE correct answer) (2 credits for each question, total credits 2 x 25 = 50)1. Interbank quotations that include the United States dollars are conventionally given in __________, which state the foreign currency price of one U.S. dollar, such as a bid price of SFr 0.85/$.A. indirect quoteB. direct quoteC. American quoteD. European quote2. The spot exchange rate published in financial newspapers is usually the __________.A. nominal exchange rateB. real exchange rateC. effective exchange rateD. equilibrium exchange rate3. The foreign exchange refers to the __________.A. foreign bank notes and coinsB. demand deposits in foreign banksC. foreign securities that can be easily cashedD. all of the above4. The functions of the foreign exchange market come down to __________.A. converting the currency of one country into the currency of anotherB. providing some insurance against the foreign exchange riskC. making the foreign exchange speculation easyD. Only A and B are true.5. Which of the following is NOT true regarding the foreign exchange market?A. It is the place through which people exchange one currency for another.B. The exchange rate nowadays is mainly determined by the market forces.C. Most foreign exchange transactions are physically completed in this market.D. All of the above are true.6. The world largest foreign exchange markets are __________ respectively.A. London, New York and TokyoB. London, Paris and FrankfurtC. London, Hong Kong and SingaporeD. London, Zurich and Bahrain7. The foreign exchange market is NOT efficient because __________.A. monetary authorities dominate the foreign exchange market and everybody knows that by definition, central banks are inefficientB. commercial banks and other participants of the market do not compete with one another due to the fact that transaction takes place around the world and not in a single centralized locationC. foreign exchange dealers have different prices such as bid and ask pricesD. None of the reasons listed are correct because the foreign exchange market is an efficient market8. __________ earn a profit by a bid-ask spread on currencies they buy and sell. __________ on the other hand, earn a profit by bringing together buyers and sellers of foreign exchanges and earning a commission on each sale and purchase.A. Foreign exchange brokers; foreign exchange dealersB. Foreign exchange dealers; foreign exchange brokersC. arbitragers; speculatorsD. commercial banks; central banks9. Most foreign exchange transactions are through the U.S. dollars. If the transaction is expressed as the currencies per dollar, this is known as __________ whereas __________ are expressed as dollars per currency.A. direct quote; indirect quoteB. indirect quote; direct quoteC. European quote; American quoteD. American quote, European quote10. From the viewpoint of a Japanese investor, which of the following would be a direct quote?A. SFr 1.25/€B. $1.55/₤C. ¥ 110/€D. €0.0091/ ¥11. Which of the following is true about the foreign exchange market?A. It is a global network of banks, brokers, and foreign exchange dealers connected by electronic communications system.B. The foreign exchange market is usually located in a particular place.C. The foreign exchange rates are usually determined by the related monetary authorities.D. The main participants in this market are currency speculators from different countries.12. The extent to which the income from individual transactions is affected by fluctuations in foreign exchange values is considered to be _________.A. Translation exposureB. economic exposureC. transaction exposureD. accounting exposure13. Which of the following exchange rates is adjusted for price changes?A. nominal exchange rateB. real exchange rateC. effective exchange rateD. equilibrium exchange rate14. Suppose the exchange rate of the RMB versus U.S. dollar is ¥6.8523/$ now. If the RMB were to undergo a 10% depreciation, the new exchange rate in terms of ¥/$ would be:A. 6.1671B. 7.5375C. 6.9238D. 7.613515. At least in a U.S. MNC’s financial accounting statement, if the value of the euro depreciates rapidly against that of the dollar over a year, this would reduce the dollar value of the euro profit made by the European subsidiary. This is a typical __________.A. transaction exposureB. translation exposureC. economic exposureD. operating exposure16. A Japanese-based firm expects to receive pound-payment in 6 months. The company has a (an) __________.A. economic exposureB. accounting exposureC. long position in sterlingD. short position in sterling17 The exposure to foreign exchange risk known as Translation Exposure may be defined as __________.A. change in reported owner’s equity in consolidated financial statements caused by a change in exchange ratesB. the impact of settling outstanding obligations entered into before change in exchange rates but to be settled after change in exchange ratesC. the change in expected future cash flows arising from an unexpected change in exchange ratesD. All of the above18 When a firm deals with foreign trade or investment, it usually has foreign exchange risk exposure. So if an American firm expects to receive a dollar-paymentfrom a Chinese company in the next 30 days, the U.S. firm has the possible __________.A. economic exposureB. transaction exposureC. translation exposureD. none of the above19. In order to avoid the possible loss because of the exchange rate fluctuations, a firm that has a __________ position in foreign exchanges can __________ that position in the forward market.A. short; sellB. long; sellC. long; buyD. none of the above20. A forward contract to deliver Japanese yens for Swiss francs could be described either as __________ or __________,A. selling yens forward; buying francs forwardB. buying francs forward; buying yens forwardC. selling yens forward; selling francs forwardD. selling francs forward; buying yens forward21. Dollars are trading at S0SFr/$=SFr0.7465/$ in the spot market. The 90-day forward rate is F1SFr/$=SFr0.7432/$. So the forward __________ on the dollar in basis points is __________:A. discount, 0.0033B. discount, 33C. premium, 0.0033D. premium, 3322. If the spot rate is $1.35/€, 3-month forward rate is $1.36/€, which of the following is NOT true?A. euro is at forward premium by 100 points.B. dollar is at forward discount by 100 points.C. dollar is at forward discount by 55 points.D. euro is at forward premium by 2.96% p.a.23. If the spot C$/$ rate is 1.0305/15, forward dollar is 25/30 premium, the outright forward quote in American term should be __________.A. 1.0330 – 1.0345B. 1.0280 – 1.0285C. 0.9681 – 0.9667D. 0.9728 – 0.972324. If the spot C$/$ rate is 1.0305/15, forward dollar is 25/30 premium, the $/C$ forward quote in terms of points should be __________.A. 30/25B. 25/30C. – (23/28)D. – (28/23)25. The current U.S. dollar exchange rate is ¥85/$. If the 90-day forward dollar rate is ¥90/$, then the yen is selling at a per annum __________ of __________.A. premium; 5.88%B. discount; 5.56%C. premium; 23.52%D. discount; 22.23%II. ProblemsQuestions 1 through 10 are based on the information presented in Table 3.1. (2 credits for each question, total credits 2 x 10 = 20)Table 3.1Country Exchange rate Exchange rate CPI V olume of Volume of (2008) (2009) (2008) exports to U.S imports from U.S. Germany €0.75/$ €0.70/$ 102.5 $200m $350m Mexico Mex$11.8/$ Mex$12.20/$ 110.5 $120m $240mU.S. 105.31. The real exchange rate of the dollar against the euro in 2009 was __________.2. The real exchange rate of the dollar against the peso in 2009 was __________.3. The dollar was __________ against the euro in nominal term by __________.A. appreciated; 6.67%B. depreciated; 6.67%C. appreciated; 7.14%D depreciated; 7.14%4. The Mexican peso was __________ against the dollar in nominal term by __________.A. appreciated; 3.39%B. depreciated; 3.39%C. appreciated; 3.28%D. depreciated; 3.28%5. The volume of the German foreign trade with the U.S. was __________.6. The volume of the Mexican foreign trade with the U.S. was __________.7. Assume the U.S. trades only with the Germany and Mexico. Now if we want to calculate the dollar effective exchange rate in 2009 against a basket of currencies of euro and Mexican peso, the weight assigned to the euro should be __________.8. The weight assigned to the peso should be __________.9. Assume the 2008 is the base year. The dollar effective exchange rate in 2009 was __________.10. Was the dollar generally stronger or weaker in 2009 according to your calculation?11. The following exchange rates are available to you.Fuji Bank ¥80.00/$United Bank of Switzerland SFr0.8900/$Deutsche Bank ¥95.00/SFrAssume you have an initial SFr10 million. Can you make a profit via triangular arbitrage? If so, show steps and calculate the amount of profit in Swiss francs. (8 credits)12. If the dollar appreciates 1000% against the ruble, by what percentage does the ruble depreciate against the dollar? (5 credits)13. As a percentage of an arbitrary starting amount, about how large would transactions costs have to be to make arbitrage between the exchange rates S SFr/$= SFr1.7223/$, S$/¥= $0.009711/¥, and S¥/SFr = ¥61.740/SFr unprofitable? Explain. (7 credits14. You are given the following exchange rates:S¥/A$ = 67.05 – 68.75S£/A$ = 0.3590 – 0.3670Calculate the bid and ask rate of S¥/£: (5 credits)15. Suppose the spot quotation on the Swiss franc (CHF) in New York is USD0.9442 –52 and the spot quotation on the Euro (EUR) is USD1.3460 –68. Compute the percentage bid-ask spreads on the CHF/EUR quote. ( 5 credits)Answers to Assignment Problems (3)Part II1. 0.70 x (105.3/102.5) = 0.7 x 1.0273 = 0.71912. 12.2 x (105.3/110.5) = 12.2 x .9529 = 11.62593. B (0.7 /.75) – 1 = -6.67%4. D (1/12.2)/(1/11.8) – 1 = -3.28%5. 5506. 3607. 550/910 = 60.44%8. 360/910 = 39.569. (0.70/0.75)(60.44%) + (12.2/11.8)(39.56%) = .5641 + 0.4090 = .9731 = 97.31%10. weaker, because dollar depreciated by 2.69%.11. Since S¥/$S$/SFr S SFr/¥= 80 x 1/0.8900 x 1/95.00 = 0.946186 < 1, there is an arbitrage opportunity.Steps:①Buy ¥ from Deutsche Bank, SFr10 million x 95.00 = ¥950 million②Buy $from Fuji Bank, $950 m / 80.00 = $11.875 m③Buy SFr from UBS, $11.875 x 0.8900 = SFr10.56875 mProfit (ignoring transaction fees):SFr10.56875 – SFr10 = 0.56875 million = 568,75012. (x – 1) = 1000%; 1/11 – 1 = 90.9%13. S SFr/$ S$/¥S¥/SFr = SFr1.7223/$ x $0.009711/¥ x ¥61.740/SFr = 1.0326If transaction costs exceed $0.0326 (3.26%), the arbitrage is unprofitable.14. Given: S¥/A$ = 67.05 – 68.75S£/A$ = 0.3590 – 0.3670So, S¥/₤ = 67.05/0.3670 = 182.70 (bid)S£/₤ = 68.75/0.3590 = 191.50 (ask)15. Given: USD0.9442 – 52/SFrUSD1.3460 – 68/SFrSo, S SRr/€ = 1.3460/0.9452 =1.424 (bid)S SFr/€ = 1.3468/0.9442 = 1.4264 (ask)Bid-ask margin = (1.4264 – 1.424) / 1.4264 = 0.1683%。

INTERNATIONAL FINANCEAssignment Problems (3) Name: Student#: I. Choose the correct answer for the following questions (only ONE correct answer) (2 credits for each question, total credits 2 x 25 = 50)1. Interbank quotations that include the United States dollars are conventionally given in __________, which state the foreign currency price of one U.S. dollar, such as a bid price of SFr 0.85/$.A. indirect quoteB. direct quoteC. American quoteD. European quote2. The spot exchange rate published in financial newspapers is usually the __________.A. nominal exchange rateB. real exchange rateC. effective exchange rateD. equilibrium exchange rate3. The foreign exchange refers to the __________.A. foreign bank notes and coinsB. demand deposits in foreign banksC. foreign securities that can be easily cashedD. all of the above4. The functions of the foreign exchange market come down to __________.A. converting the currency of one country into the currency of anotherB. providing some insurance against the foreign exchange riskC. making the foreign exchange speculation easyD. Only A and B are true.5. Which of the following is NOT true regarding the foreign exchange market?A. It is the place through which people exchange one currency for another.B. The exchange rate nowadays is mainly determined by the market forces.C. Most foreign exchange transactions are physically completed in this market.D. All of the above are true.6. The world largest foreign exchange markets are __________ respectively.A. London, New York and TokyoB. London, Paris and FrankfurtC. London, Hong Kong and SingaporeD. London, Zurich and Bahrain7. The foreign exchange market is NOT efficient because __________.A. monetary authorities dominate the foreign exchange market and everybody knows that by definition, central banks are inefficientB. commercial banks and other participants of the market do not compete with one another due to the fact that transaction takes place around the world and not in a single centralized locationC. foreign exchange dealers have different prices such as bid and ask pricesD. None of the reasons listed are correct because the foreign exchange market is an efficient market8. __________ earn a profit by a bid-ask spread on currencies they buy and sell. __________ on the other hand, earn a profit by bringing together buyers and sellers of foreign exchanges and earning a commission on each sale and purchase.A. Foreign exchange brokers; foreign exchange dealersB. Foreign exchange dealers; foreign exchange brokersC. arbitragers; speculatorsD. commercial banks; central banks9. Most foreign exchange transactions are through the U.S. dollars. If the transaction is expressed as the currencies per dollar, this is known as __________ whereas __________ are expressed as dollars per currency.A. direct quote; indirect quoteB. indirect quote; direct quoteC. European quote; American quoteD. American quote, European quote10. From the viewpoint of a Japanese investor, which of the following would be a direct quote?A. SFr 1.25/€B. $1.55/₤C. ¥ 110/€D. €0.0091/ ¥11. Which of the following is true about the foreign exchange market?A. It is a global network of banks, brokers, and foreign exchange dealers connected by electronic communications system.B. The foreign exchange market is usually located in a particular place.C. The foreign exchange rates are usually determined by the related monetary authorities.D. The main participants in this market are currency speculators from different countries.12. The extent to which the income from individual transactions is affected by fluctuations in foreign exchange values is considered to be _________.A. Translation exposureB. economic exposureC. transaction exposureD. accounting exposure13. Which of the following exchange rates is adjusted for price changes?A. nominal exchange rateB. real exchange rateC. effective exchange rateD. equilibrium exchange rate14. Suppose the exchange rate of the RMB versus U.S. dollar is ¥6.8523/$ now. If the RMB were to undergo a 10% depreciation, the new exchange rate in terms of ¥/$ would be:A. 6.1671B. 7.5375C. 6.9238D. 7.613515. At least in a U.S. MNC’s financial accounting statement, if the value of the euro depreciates rapidly against that of the dollar over a year, this would reduce the dollar value of the euro profit made by the European subsidiary. This is a typical __________.A. transaction exposureB. translation exposureC. economic exposureD. operating exposure16. A Japanese-based firm expects to receive pound-payment in 6 months. The company has a (an) __________.A. economic exposureB. accounting exposureC. long position in sterlingD. short position in sterling17 The exposure to foreign exchange risk known as Translation Exposure may be defined as __________.A. change in reported owner’s equity in consolidated financial statements caused by a change in exchange ratesB. the impact of settling outstanding obligations entered into before change in exchange rates but to be settled after change in exchange ratesC. the change in expected future cash flows arising from an unexpected change in exchange ratesD. All of the above18 When a firm deals with foreign trade or investment, it usually has foreign exchange risk exposure. So if an American firm expects to receive a dollar-paymentfrom a Chinese company in the next 30 days, the U.S. firm has the possible __________.A. economic exposureB. transaction exposureC. translation exposureD. none of the above19. In order to avoid the possible loss because of the exchange rate fluctuations, a firm that has a __________ position in foreign exchanges can __________ that position in the forward market.A. short; sellB. long; sellC. long; buyD. none of the above20. A forward contract to deliver Japanese yens for Swiss francs could be described either as __________ or __________,A. selling yens forward; buying francs forwardB. buying francs forward; buying yens forwardC. selling yens forward; selling francs forwardD. selling francs forward; buying yens forward21. Dollars are trading at S0SFr/$=SFr0.7465/$ in the spot market. The 90-day forward rate is F1SFr/$=SFr0.7432/$. So the forward __________ on the dollar in basis points is __________:A. discount, 0.0033B. discount, 33C. premium, 0.0033D. premium, 3322. If the spot rate is $1.35/€, 3-month forward rate is $1.36/€, which of the following is NOT true?A. euro is at forward premium by 100 points.B. dollar is at forward discount by 100 points.C. dollar is at forward discount by 55 points.D. euro is at forward premium by 2.96% p.a.23. If the spot C$/$ rate is 1.0305/15, forward dollar is 25/30 premium, the outright forward quote in American term should be __________.A. 1.0330 – 1.0345B. 1.0280 – 1.0285C. 0.9681 – 0.9667D. 0.9728 – 0.972324. If the spot C$/$ rate is 1.0305/15, forward dollar is 25/30 premium, the $/C$ forward quote in terms of points should be __________.A. 30/25B. 25/30C. – (23/28)D. – (28/23)25. The current U.S. dollar exchange rate is ¥85/$. If the 90-day forward dollar rate is ¥90/$, then the yen is selling at a per annum __________ of __________.A. premium; 5.88%B. discount; 5.56%C. premium; 23.52%D. discount; 22.23%II. ProblemsQuestions 1 through 10 are based on the information presented in Table 3.1. (2 credits for each question, total credits 2 x 10 = 20)Table 3.1Country Exchange rate Exchange rate CPI V olume of Volume of (2008) (2009) (2008) exports to U.S imports from U.S. Germany €0.75/$ €0.70/$ 102.5 $200m $350m Mexico Mex$11.8/$ Mex$12.20/$ 110.5 $120m $240mU.S. 105.31. The real exchange rate of the dollar against the euro in 2009 was __________.2. The real exchange rate of the dollar against the peso in 2009 was __________.3. The dollar was __________ against the euro in nominal term by __________.A. appreciated; 6.67%B. depreciated; 6.67%C. appreciated; 7.14%D depreciated; 7.14%4. The Mexican peso was __________ against the dollar in nominal term by __________.A. appreciated; 3.39%B. depreciated; 3.39%C. appreciated; 3.28%D. depreciated; 3.28%5. The volume of the German foreign trade with the U.S. was __________.6. The volume of the Mexican foreign trade with the U.S. was __________.7. Assume the U.S. trades only with the Germany and Mexico. Now if we want to calculate the dollar effective exchange rate in 2009 against a basket of currencies of euro and Mexican peso, the weight assigned to the euro should be __________.8. The weight assigned to the peso should be __________.9. Assume the 2008 is the base year. The dollar effective exchange rate in 2009 was __________.10. Was the dollar generally stronger or weaker in 2009 according to your calculation?11. The following exchange rates are available to you.Fuji Bank ¥80.00/$United Bank of Switzerland SFr0.8900/$Deutsche Bank ¥95.00/SFrAssume you have an initial SFr10 million. Can you make a profit via triangular arbitrage? If so, show steps and calculate the amount of profit in Swiss francs. (8 credits)12. If the dollar appreciates 1000% against the ruble, by what percentage does the ruble depreciate against the dollar? (5 credits)13. As a percentage of an arbitrary starting amount, about how large would transactions costs have to be to make arbitrage between the exchange rates S SFr/$= SFr1.7223/$, S$/¥= $0.009711/¥, and S¥/SFr = ¥61.740/SFr unprofitable? Explain. (7 credits14. You are given the following exchange rates:S¥/A$ = 67.05 – 68.75S£/A$ = 0.3590 – 0.3670Calculate the bid and ask rate of S¥/£: (5 credits)15. Suppose the spot quotation on the Swiss franc (CHF) in New York is USD0.9442 –52 and the spot quotation on the Euro (EUR) is USD1.3460 –68. Compute the percentage bid-ask spreads on the CHF/EUR quote. ( 5 credits)Answers to Assignment Problems (3)Part II1. 0.70 x (105.3/102.5) = 0.7 x 1.0273 = 0.71912. 12.2 x (105.3/110.5) = 12.2 x .9529 = 11.62593. B (0.7 /.75) – 1 = -6.67%4. D (1/12.2)/(1/11.8) – 1 = -3.28%5. 5506. 3607. 550/910 = 60.44%8. 360/910 = 39.569. (0.70/0.75)(60.44%) + (12.2/11.8)(39.56%) = .5641 + 0.4090 = .9731 = 97.31%10. weaker, because dollar depreciated by 2.69%.11. Since S¥/$S$/SFr S SFr/¥= 80 x 1/0.8900 x 1/95.00 = 0.946186 < 1, there is an arbitrage opportunity.Steps:①Buy ¥ from Deutsche Bank, SFr10 million x 95.00 = ¥950 million②Buy $from Fuji Bank, $950 m / 80.00 = $11.875 m③Buy SFr from UBS, $11.875 x 0.8900 = SFr10.56875 mProfit (ignoring transaction fees):SFr10.56875 – SFr10 = 0.56875 million = 568,75012. (x – 1) = 1000%; 1/11 – 1 = 90.9%13. S SFr/$ S$/¥S¥/SFr = SFr1.7223/$ x $0.009711/¥ x ¥61.740/SFr = 1.0326If transaction costs exceed $0.0326 (3.26%), the arbitrage is unprofitable.14. Given: S¥/A$ = 67.05 – 68.75S£/A$ = 0.3590 – 0.3670So, S¥/₤ = 67.05/0.3670 = 182.70 (bid)S£/₤ = 68.75/0.3590 = 191.50 (ask)15. Given: USD0.9442 – 52/SFrUSD1.3460 – 68/SFrSo, S SRr/€ = 1.3460/0.9452 =1.424 (bid)S SFr/€ = 1.3468/0.9442 = 1.4264 (ask)Bid-ask margin = (1.4264 – 1.424) / 1.4264 = 0.1683%。