外刊时文选读

- 格式:docx

- 大小:16.02 KB

- 文档页数:3

2023年高考英语外刊时文精读精练 (2)Rise of the robots机器人的崛起主题语境:人与社会 主题语境内容:科学与技术【外刊原文】(斜体单词为超纲词汇,认识即可;下划线单词为课标词汇,需熟记。

)The word “robot” was coined(创造)in 1920 by the Czech playwright Karel Capek.In“R.U.R.”(“Rossum’s Universal robots”)Capekand sensors(传感器), fast wireless communications and powerful, smallermuch more.than expected from the pandemic(疫情)and some people have left the workforce(劳动力), particularly in America.Warehousing(仓储)hasnow indispensable(必不可少的), picking items off shelves and helping peopleor food right to people’s doors. In a pandemic-ravaged world, short of workers but with lots of elderly folk to look after,having more robotsAnd yet many people fear that robots will destroy jobs. A paper in 2013 by economists at Oxford University was widely misinterpreted(曲解)as的).The evidence suggests robots will be disruptive(扰乱的) but ultimatelyrobot penetration(渗透) but very strong workforces. A Y ale University study that looked at Japanese manufacturing(生产) between 1978 and 2017 found that an increase of one robot unit per 1,000 workers boosted a company’s employment by 2.2%.Research from the Bank of Korea found that robotisation(机器自动化)moved jobs away from manufacturing into other sectors(领域), but that there was no decrease in overall vacancies(空位). Another study, by researchers at the Massachusetts Institute of T echnologyFor all that, the march of the robots will bring big changes to workplaces.Checkout staff who retrain to help customers pick items from aisles may wellday swiping(刷磁卡) barcodes in front of lasers.robots make society as a whole better off. One lesson from the freewheeling (自由放纵的) globalisation of the 1990s and 2000s is that the growth in tradepolitical backlash(反击), because the losers felt left behind. That is one moreretraining and lifelong learning. As jobs change, workers should be helped towill increasingly be their colleagues.The potential gains from the robot revolution are huge. In Capek’s play, the robots revolt (反叛)against their human masters and cause mass unemployment and worse. The beginnings of the world’s real robots have not matched Capek’s satire(讽刺). There is no reason to think that their future needs to either.【课标词汇】1.artificial人造的,人工的;仿造的•clothes made of artificial fibres人造纤维质地的服装•an artificial heart人造心脏•an artificial lake人工湖•artificial fur/sweeteners/flowers人造毛皮/人造甜味剂/假花2.functional 实用的 ;作用的;功能的;(能)起作用的,工作的,运转的Bathrooms don't have to be purely functional. 浴室不必完全只为了实用。

外刊时文选读外刊时文选读Text 1Weekly Address: Ensuring Hardworking Americans Retire with Dignity WASHINGTON, DC —In this week’s address, the President reiterated his commitment to middle-class economics, and to ensuring that all hard-working Americans get the secure and dignified retirement they deserve. While most financial advisers prioritize their clients’ futur es, there are some who direct their clients towards bad investments in return for backdoor payments and hidden fees. That’s why earlier this week the President announced that he is calling on the Department of Labor to update rules to protect families from conflicts of interest by requiring financial advisers to put their clients’ best interest before their own profits.The President emphasized his promise to keep fighting for this policy and for others that benefit millions of working and middle class Americans.Hi everybody. In America, we believe that a lifetime of hard work and responsibility should be rewarded with a shot at a secure, dignified retirement. It’s one of the critical components of middle-class life – and this week, I took new steps to protect it.Six years after the crisis that shook a lot of people’s faith in a secure retirement, our economy is steadily growing. Last year was the best year for job growth since the 1990s. All told, over the past five years, the private sector has added nearly 12 million new jobs. And since I took office, the stock market has more than doubled, replenishing the 401(k)s of millions of families.But while we’ve come a long way, we’ve got more work to do to make sure that our recovery reaches more Americans, not just those at the top. That’s what middle-class economics is all about—the idea that this country does best when everyone gets their fair shot, everybody does their fair share, and everyone plays by the same set of rules.That last part—making sure everyone plays by the same set of rules—is why we passed historic Wall Street Reform and a Credit Card Bill of Rights. It’s why we created a new consumer watchdog agency. And it’s why we’re taking new action to protect hardworking families’ retireme nt security. If you’re working hard and putting away money, you should have the peace of mind that the financial advice you’re getting is sound and that your investments are protected.But right now, there are no rules of the road. Many financial advisers put their clients’ interest first –but some financial advisers get backdoor payments and hidden fees in exchange for steering people into bad investments. All told, bad advice that results from these conflicts of interest costs middle-class and working families about $17 billion every year.This week, I called on the Department of Labor to change that – to update the rules and require that retirement advisers put the best interests of their clients above their own financial interests. Middle-class families cannot afford to lose their hard earned savings after a lifetime of work. They deserve to be treated with fairness and respect. And that’s what this rule would do.While many financial advisers support these basic safeguards to prevent abuse, I know some special interests will fight this with everything they’ve got.But while we welcome differentp erspectives and ideas on how to move forward, what I won’t accept is the notion that there’s nothing we can do to make sure that hard-working, responsible Americans who scrimp and save can retire with security and dignity.We’re going to keep pushing for this rule, because it’s the right thing to do for our workers and for our country. The strength of our economy rests on whether hard-working families can not only share in America’s success, but can also contribute to America’s success.And that’s what I wil l never stop fighting for –an economy where everyone who works hard has the chance to get ahead.Text 2Planet of the phonesThe smartphone is ubiquitous, addictive and transformative THE dawn of the planet of the smartphones came in January 2007, when St eve Jobs, Apple’s chief executive, in front of a rapt audience of Apple acolytes, brandished a slab of plastic, metal and silicon not much bigger tha n a Kit Kat. “This will change everything,” he promised. For once there was no hyperbole. Just eight years later Apple’s iPhone exemplifies the early 21st century’s defining technology.Smartphones matter partly because of their ubiquity. They have become the fastest-selling gadgets in history, outstripping the growth of the simple mobile phones that preceded them. They outsell personal computers four to one. T oday about half the adult population owns a smartphone; by 2020, 80% will. Smartphones have also penetrated every aspect of daily life. The average American is buried in one for over two hours every day. Asked which media they would miss most, British teenagers pick mobile devices over TV sets, PCs and games consoles. Nearly 80%of smartphone-owners check messages, news or other services within 15 minutes of getting up. About 10% admit to having used the gadget during sex.The bedroom is just the beginning. Smartphones are more than a convenient route online, rather as cars are more than engines on wheels and clocks are not merely a means to count the hours. Much as the car and the clock did in their time, so today the smartphone is poised to enrich lives, reshape entire industries and transform societies—and in ways that Snapchatting teenagers cannot begin to imagine.Phono sapiensThe transformative power of smartphones comes from their size and connectivity. Size makes them the first truly personal computers. The phone takes the processing power of yesterday’s supercomputers—even the most basic model has access to more number-crunching capacity than NASA had when it put men on the Moon in 1969—and applies it to ordinary human interactions. Because transmitting data is cheap this power is available on the move. Since 2005 the cost of delivering one megabyte wirelessly has dropped from $8 to a few cents. It is still falling. The boring old PC sitting on your desk does not know much about you. But phones travel around with you—they know where you are, what websites you visit, whom you talk to, even how healthy you are.The combination of size and connectivity means that this knowledge can be shared and aggregated, bridging the realms of bits and atoms in ways that are both professional and personal. Uber connects available drivers to nearby fares at cheaper prices; Tinder puts people intouch with potential dates. In future, your phone mightrecommend a career c hange or book a doctor’s appointment to treat your heart murmur before you know anything is amiss.As with all technologies, this future conjures up a host of worries. Some, such as “text neck” (hunching over a smartphone stresses the spine) are surely transient. Others, such as dependency—smartphone users exhibit “nomophobia” when they happen to find themselves empty-handed—are a measure of utility as much as addiction. After all, people also hate to be without their wheels or their watch.The greater fear is over privacy. The smartphone turns the person next to you into a potential publisher of your most private or embarrassing moments. Many app vendors, who know a great deal about you, sell data without proper disclosure; mobile-privacy policies routinely rival “Hamlet” for length. And if leaked documents are correct, GCHQ, Britain’s signals-intelligence agency, has managed to hack a big vendor of SIM cards in order to be able to listen in to people’s calls. If spooks in democracies are doing this sort of thing, you can be sure that those in authoritarian regimes will, too. Smartphones will give dictators unprecedented scope to spy on and corral their unwilling subjects.The naked appYet three benefits weigh against these threats to privacy. For a start, the autocrats will not have it all their own way. Smartphones are the vehicle for bringing billions more people online. The cheapest of them now sell for less than $40, and prices are likely to fall even further. The same phones that allow governments to spy on their citizens also record the brutality of officials and spread information and dissenting opinions. They feed the demand for autonomy and help protest movements tocoalesce. A device that hands so much power to the individual has the potential to challenge authoritarianism.The second benefit is all those personal data which companies are so keen on. Conventional social sciences have been hampered by the limited data sets they could collect. Smartphones are digital census-takers, creating a more detailed view of society than has ever existed before and doing so in real time. Governed by suitable regulations, anonymised personal data can be used, among many other things, to optimise traffic flows, prevent crime and fight epidemics.The third windfall is economic. Some studies find that in developing countries every ten extra mobile phones per 100 people increase the rate of growth of GDP-per-person by more than one percentage point—by, say, drawing people into the banking system. Smartphones will remake entire industries, at unheard-of speed. Uber is a household name, operating in 55 countries, but has yet to celebrate its fifth birthday. WhatsApp was founded in 2009, and already handles 10 billion more messages a day than the SMS global text-messaging system. The phone is a platform, so startups can cheaply create an app to test an idea—and then rapidly go global if people like it. That is why it will unleash creativity on a planetary scale.By their nature, seminal technologies ask hard questions of society, especially as people adapt to them. Smartphones are no different. If citizens aren’t protected from prying eyes, some will suffer and others turn their backs. Societies will have to develop new norms and companies learn how to balance privacy and profit. Governments will have to define what is acceptable. But in eight short years smartphones have changed the world—and they have hardly begun.。

2023年高考英语外刊时文精读精练 (11)Save the Mountain Lion拯救美洲狮主题语境:人与自然 主题语境内容:野生动植物保护【外刊原文】(斜体单词为超纲词汇,认识即可;下划线单词为课标词汇,需熟记。

)Los Angeles,as everyone knows,is a noodle bowl of highways.As everyone may not know, it is also one of only two cities in the world where big cats wander wild inside the city boundaries (the other is Mumbai). One even live near the Hollywood sign. But big cats and highways do not mix,which is why Los Angeles will soon be home to one of the world’s biggest wildlife corridors(走廊).The cats are mountain lions. They live in the Santa Monica Mountains. Their numbers are stable. Their habitat is mostly wilderness(荒野), full of deer, the lions’ food. The ecology of their range, the largest urban national park in the world, is healthy, thanks in part to their presence. Yet animals can come under threat without habitat loss. Genetic degradation(退化) can be just as deadly.Cutting through the mountains is Route 101,carrying up to 10,000 vehicles an hour.It cuts the Santa Monica range off from a larger wilderness to the north. The southern area is not big enough for all the lions,which each require hunting grounds of 60-150 square miles.The result is a population trapped on an environmental island, with inbreeding(近亲繁殖) and genetic degradation.A study in 2016 found that,given their environment,the Santa Monica mountain lions’chances of extinction in 50 years would be 15-22%;because of their genetic deterioration,the chance of extinction was more like 99.7%.Four years after that study came the first evidence that the big cats were suffering physical damage: a young male was found with a 90-degree kink(扭结) in his tail .Researchers had seen that before.In the early 1990s biologists studying the Florida panther, a closely related animal, found that many of the males had the same genetic flaws(缺陷). The Florida panther escaped extinction only thanks to the introduction of females brought from Texas to refresh the gene pool.California does not need to go that far. There are healthy mountain-lion populations north of the Santa Monica range, separated by the ribbon ofroad.Hidden cameras show the animals crouched (蹲)at the side of the highway,not daring to cross.The solution is a 165-foot-wide dirt bridge which would allow them to travel high over the traffic.Such corridors have worked elsewhere, from large spans for elk(麋鹿) over the Trans-Canada highway to a small clawbridge for migrating red crabs(红蟹) on Christmas st month the governor,Gavin Newsom,launched construction.The animals become sexually mature at 2½to 3 years and have babies every other year. So within ten years of the corridor’s completion the great-grandchildren of the first mating beyond the mountains could have cubs. Genetically,even a few matings would make a difference.“We’ll definitely save the mountain lion,”thinks Paul Edelman of the Mountains Recreation and Conservation Authority. “It’s just a matter of how long it takes.”【课标词汇精讲】1.boundary n.分界线;边界National boundaries are becoming increasingly meaningless in the global economy. 在全球化的经济中,国界已经变得越来越没有意义了。

2023年高考英语外刊时文精读精练 (9)World in a dish: The garden path盘中知世界:花园小径主题语境:人与自我 主题语境内容:健康的生活方式【外刊原文】(斜体单词为超纲词汇,认识即可;下划线单词为课标词汇,需熟记。

)IMAGINE A plate holding two strawberries, identical in appearance. One came out of a supermarket box, meaning it was probably harvested when it was still not ripe, immediately placed in a forced-air cooling unit, loaded onto a truck and driven hundreds of miles. By the time it reached the plate it may have been picked for two weeks. The other strawberry was picked from a garden minutes before being eaten.The first one will probably taste like a slightly mushy(软踏踏的) cucumber withstrong sour flavors. The second is likely to be sweet; the flavour will linger in the mouth, as the scent(香味) will on thehands.Supermarket strawberries are not entirely without advantages: they are convenient and available in the northern hemisphere(半球) in February. But the two berries differ from each other in the same way that hearing Bach’s Mass in B Minor in a concert hall differs from listening to it ona cassette(磁带). The home-grown fruit is an eatable case for cultivating a home garden.Your columnist argued gardening a twee(矫揉造作的) waste of time. Planting cool-weather greens, as gardeners across the north-east of America are now doing, can seem make no sense. Convenient, continuous well-stocked supermarket shelves are available all week, in manyplaces supplemented on weekends by farmers’ markets. But the same could be said of cooking: cheap and good restaurants around, so why bother to make your own meals?That attitude misunderstands the ultimate appeal of gardening: it mistakes the product for the purpose. It is true that a garden can yield peas that taste like the vibrant(生机勃勃的), greenspring; tomatoes and carrots of incomparable sweetness; lettuces and herbs that taste like themselves rather than the plastic they are usually packaged in; and potatoes with richness of earth itself. Growing your own vegetable ensuresa reliable supply.On the other hand ,a garden, especially in the early years, can also yield little but frustration. Beginners may plant the wrong crops for their soil. Squirrels have a habit of taking single bites of cucumbers, beans and tomatoes, then leaving the rest on the vine to rot(腐烂). And even expert gardeners can lose a season’s harvest to un co operative weather.No matter. The real joy of gardening is the time spent doing it. Thedeepest pleasure—as with cooking, writing, bringing up children or almost anything worthwhile—is in the work itself. Agardener’s memories revolve not around the food produced, but around long summer afternoons with hands in the dirt, surrounded by family, if the garden is at home, or deepening acquaintances with friends and neighbours in acommunity garden. To garden is to patiently, lovinglyand diligently help life flourish, in the ground and above it.【课标词汇】1.identical完全相同的;极为相似的I've got three identical blue suits.我有三套完全相同的蓝色西装。

高考英语外刊时文精读专题:2023年高考英语外刊时文精读精练 (8)Perception: A rose by any other name文化认知:情人眼里出西施主题语境:人与社会主题语境内容:社会与文化【外刊原文】(斜体单词为超纲词汇,认识即可;下划线单词为课标词汇,需熟记。

)TO THE SWEDES, there are few smells more pleasant than that of surströmming(鲱鱼罐头). To most non-Swedes there are probably few smells more disgusting. In determining which scents(气味) people find pleasant and which they do not,surströmming suggests culture must play a large part. New research, however, suggests that might not be the case. Artin Arshamian, a neuroscientist at the Karolinska Institute in Sweden, and Asifa Majid, a psychologist at the University of Oxford, began with the expectation that culture would play an important role in determining pleasant smells. They had noticed from their own previous work that people from different cultures described smells differently. They also knew from past experiments by other researchers that culture was important in determining which sorts of faces people found beautiful. Thus, they expected to see a similar phenomenon with smells. To study how scent and culture relate, Dr Arshamian and Dr Majid presented nine different groups of people with ten smell s. The cultures doing the smelling varied widely . They included hunter-gathere r communitiesalong the coast of Mexico, farmers living in the highlands ofEcuador, shoreline foragers, gardeners living in the tropical rainforests of Malaysia, and city folk from Thailand and Mexico City. All 235 participants were asked to rank smells according to pleasantness. The team compared their results to earlier work on New Yorkers who had been exposed to the same scents.Writing in Current Biology this week, the researchers noted that pleasantness rankings ofthe smells were remarkably consistent regardless of where people came from. The smell of isovaleric acid(异戊酸)was disliked by the vast majority of the participants, only eight giving it a score of 1 to 3 on thepleasantness scale (where 1 was very pleasant and 10 was very unpleasant). On the other hand, more than 190 people gave vanilla extract (香草精) a score of 1 to 3 and a tiny minority, only 12 people, found it disgusting enough to rate 8 to 10. Overall, the chemical composition of the smells that the researchers presented explained 41% of the reactions that participants had.In contrast, cultural factors accounted for just 6% of the results. Dr Arshamian and Dr Majid point out that this is very different from how visual perception of faces works—in that case a person’s culture accounts for up to 50% of the e xplanation for which faces they find beautiful.Even so, while culture did not shape perceptions of smells in the way that it is known to shape perceptions of faces, the researchers did find an “eye of the beholder” effect. Randomness, which Dr Arshamian and Dr Majid suggest has to be coming from personal preferences learned from outside individual culture, accounted for 54% of the difference in which smells people liked. “eye of the beholder” effectdoes not slip off the tongue so easily but it too appears to be a real phenomenon.【课标词汇】1.Disgusting令人反感的;令人愤慨的He had the most disgusting rotten teeth.他长着非常恶心的一嘴烂牙。

2023年高考英语外刊时文精读精练(14)Climate change and coral reefs气候变化与珊瑚礁主题语境:人与自然主题语境内容:自然生态【外刊原文】(斜体单词为超纲词汇,认识即可;下划线单词为课标词汇,需熟记。

)Human beings have been altering habitats—sometimes deliberately andsometimes accidentall y—at least since the end of the last Ice Age. Now, though, that change is happening on a grand scale. Global warming is a growing factor. Fortunately, the human wisdom that is destroying nature can also be brought to bear on trying to save it.Some interventions to save ecosystems are hard to imagine andsucceed. Consider a project to reintroducesomething similar to a mammoth(猛犸象)to Siberiaby gene-editing Asian elephants. Their feeding habits could restore the grassland habitat that was around before mammoths died out, increasing the sunlight reflected into space and helping keep carbon compounds(碳化合物)trapped in the soil. But other projects have a bigger chance of making an impact quickly. As we report, one example involves coral reefs.These are the rainforests of the ocean. They exist on vast scales: half a trillion corals line the Pacific from Indonesia to French Polynesia, roughly the same as the number of trees that fill the Amazon. They are equally important harbor of biodiversity. Rainforests cover18% of the land’s surface and offer a home to more than half its vertebrate(脊椎动物的)species. Reefs occupy0.1% of the oceans and host a quarter of marine(海洋的)species.And corals are useful to people, too. Without the protection which reefs afford from crashing waves, low-lying islands such as the Maldives would have flooded long ago, and a billion people would lose food or income. One team of economists has estimated that coral’s global ecosystem services are worth up to $10trn a year. reefs are, however, under threat from rising sea temperatures. Heat causesthe algae(海藻) with which corals co-exist, and on which they depend for food and colour, to generate toxins(毒素)that lead to those algae’s expulsion(排出). This is known as “bleaching(白化)”, and can cause a coral’s death. As temperatures continue to rise, research groups around the world are coming up with plansof action. Their ideas include identifying naturally heat-resistant(耐热的)corals and moving themaround the world; crossbreeding(杂交)such corals to create strains that are yet-more heat-resistant; employing genetic editing to add heat resistance artificially; transplantingheat-resistant symbiotic(共生的)algae; and even repairing with the bacteria and other micro-organismswith which corals co-exist—to see if that will help.The assisted evolution of corals does not meet with universal enthusiasm. Without carbon reduction and decline in coral-killing pollution, even resistant corals will not survive the century. Some doubt whetherhumans will get its act together in time to make much difference. Few of these techniques are ready for action in the wild. Some, such as gene editing, are so controversial that it is doubtful they will be approved any time soon. scale is also an issue.But there are grounds for optimism. Carbon targets are being set and ocean pollution is being dealt with. Countries that share responsibilities for reefs are starting to act together. Scientific methods can also be found. Natural currents can be used to facilitate mass breeding. Sites of the greatest ecological and economical importance can be identified to maximise benefits.This mix of natural activity and human intervention could serve as a blueprint (蓝图)for other ecosystems. Those who think that all habitats should be kept original may not approve. But when entire ecosystems are facing destruction, the cost of doing nothing is too great to bear. For coral reefs, at least, if any are to survive at all, it will be those that humans have re-engineered to handle the future.【课标词汇精讲】1.alter (通常指轻微地)改动,修改;改变,(使)变化We've had to alter some of our plans.我们不得不对一些计划作出改动。

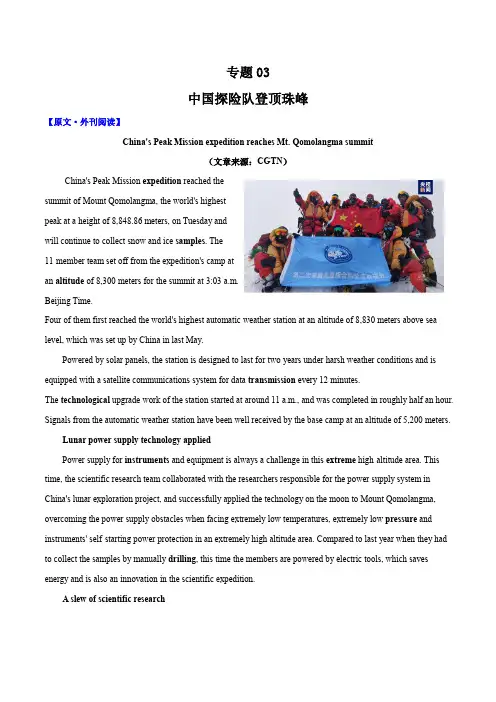

专题03中国探险队登顶珠峰【原文·外刊阅读】China's Peak Mission expedition reaches Mt. Qomolangma summit(文章来源:CGTN)China's Peak Mission expedition reached thesummit of Mount Qomolangma, the world's highestpeak at a height of 8,848.86 meters, on Tuesday andwill continue to collect snow and ice samples. The11-member team set off from the expedition's camp atan altitude of 8,300 meters for the summit at 3:03 a.m.Beijing Time.Four of them first reached the world's highest automatic weather station at an altitude of 8,830 meters above sea level, which was set up by China in last May.Powered by solar panels, the station is designed to last for two years under harsh weather conditions and is equipped with a satellite communications system for data transmission every 12 minutes.The technological upgrade work of the station started at around 11 a.m., and was completed in roughly half an hour. Signals from the automatic weather station have been well received by the base camp at an altitude of 5,200 meters.Lunar power supply technology appliedPower supply for instruments and equipment is always a challenge in this extreme high-altitude area. This time, the scientific research team collaborated with the researchers responsible for the power supply system in China's lunar exploration project, and successfully applied the technology on the moon to Mount Qomolangma, overcoming the power supply obstacles when facing extremely low temperatures, extremely low pressure and instruments' self-starting power protection in an extremely high altitude area. Compared to last year when they had to collect the samples by manually drilling, this time the members are powered by electric tools, which saves energy and is also an innovation in the scientific expedition.A slew of scientific researchDubbed the "roof of the world" and "water tower of Asia," the Qinghai-Xizang Plateau is an important ecological security barrier in China. It is also a natural laboratory for conducting research on the evolution of the Earth and life, the interaction among spheres, and the relationship between man and Earth.Yao Tandong, commander of the Qomolangma expedition, said the 2023 Qomolangma scientific expedition will focus on major scientific issues such as how the extremely high-altitude environment of the mountain changes under the influence of global warming, how the environmental changes interact with the westerly winds and monsoons, and how the environment in the area will affect the "water tower of Asia" in the future. The research team also carried out a comprehensive observation of the glacier on the Qinghai-Xizang Plateau, home to the world's largest glacier besides the North and South Poles, and the source of over ten rivers in Asia as well.At a height of about 5,300 meters, where there is a lake formed by the meltwater from the Rongbuk Glacier, the researchers have observed several indicators, including water temperature, pH, dissolved oxygen, turbidity, carbon dioxide exchange rate at the water-air interface, etc.Wu Guangjian, a researcher at the Institute of Tibetan Plateau Research under the Chinese Academy of Sciences, said the carbon dioxide exchange rate is high, which suggests the carbon dioxide exchange process is strong. "It is of great significance to understand how the melting glacier affects the climate environment," Wu said. To acquire more accurate data, the researchers have set up an additional hydrographic survey ship on the meltwater of the Rongbuk Glacier to measure and map the flow and velocity of the river. The expedition is part of the second comprehensive scientific expedition to the Qinghai-Xizang Plateau which was initiated in 2017.A total of 179 researchers from 13 teams have participated in it, targeting research on water, ecology and human activities at the region. It will be of great significance to study the impact of climate and environment change in the Qomolangma region on the rest of the world. So far, a series of scientific results have been achieved during the expedition, including the synergy and influence of westerly winds and monsoons, the special physiological response of the human body in the Mt. Qomolangma region and the ecological process of the greening of the region.【原创·语法填空】The Qinghai Tibet Plateau is known 1 the "Roof of the World" and the "Water Tower of Asia", and is 2 important ecological security barrier for China. It is also a natural laboratory used to study the evolution of Earth and life, the interactions between spheres, and 3 relationship between humans andEarth. On Tuesday, China's peak mission 4 (explore) team arrived at the world's highest peak, Mount Everest, at an altitude of 8848.86 meters, and will continue 5 (collect) ice and snow samples. The exploration team 6 (consist) of 11 people departed from the 8300 meter high exploration camp at 3:03 am Beijing time and headed to the summit.At a height of 7 (approximate) 5300 meters, there is a lake formed by the melting water of the Rongbu Glacier. Researchers observed several indicators, including water temperature, pH, dissolved oxygen, turbidity, and carbon dioxide exchange rate at the water air interface.179 researchers from 13 teams participated in this study, targeting water, ecology, and human activities in the region. 8 (study) the impact of climate and environmental changes in the Mount Everest region on other parts of the world will be of great significance. So far, a series of scientific achievements 9 (achieve) during the exploration period, including the synergistic effect and influence of westerly and monsoon winds, the special physiological reactions of the human body in the Mount Everest area,10 the ecological process of greening in the area.【答案】1. as2. an3. the4. exploration5. to collect6. consisting7. approximately8. Studying9. have been achieved 10. and【原创·阅读理解】1. What do we know about this expedition?A. The team members were all participating for the first time.B. Collecting samples was one of their tasks.C. They climbed directly to the top from the foot of the mountain.D. Moving into a weather station was also their goal.【答案】B【解析】根据文章第一段可知答案。

2023年高考英语外刊时文精读精练 (3)Carbon emissions碳排放Seeing footprints in the air看到空中的碳足迹主题语境:人与自然主题语境内容:环境保护【外刊原文】(斜体单词为超纲词汇,认识即可;下划线单词为课标词汇,需熟记。

)Chris Jones of the University of California, Berkeley, was on a river in the Amazon rainforest when he put th e finishing touches on the world’s first online household carbon calculator(计算器). That was in 2005. He hoped that, if he could show people how much greenhouse gas was associated with daily activities—driving the car, heating the house—they might change their behaviour and contribute in some small measure to saving the Amazon. Seventeen years later, trackers are providing a wealth of often-neglect ed information about the carbon emissions of everyday life. They provide local and micro data which usefully supplement the global findings of the Intergovernmental Panel on Climate Change.Trackers work by asking users to answer questions such as: how many miles a year do you drive; how much is your annual household electricity bill; how often do you eat meat? They then calculate a personal or household estimate of emissions of carbon-dioxide equivalent (CO2e,二氧化碳当量排放量) per year. Alex Beale, a climate blogger in Atlanta who has studied them, reckons there are dozens of household carbon trackers and hundreds of specialist ones, including those which calculate emissions from food or other industries, such as a new one from the Stockholm Environment Institute (SEI) to track emissions from shipping. For individuals, reckons Mr Beale, the most comprehensive are the Cool Climate tracker run by Dr Jones at Berkeley and the calculator set up by the World Wildlife Fund (WWF) and SEI. What do they tell us?Dr Jones describes the main household polluting activities as “cars, coal, cows and consumption,roughly in that order”.By far the largest single source of emissions is the family vehicle. One car of average fuel efficiency driven 14,000 miles (22,500km) spews out 7 tonnes of carbon, according to Dr Jones’s tracker. Swapping it for an electric vehicle would save over 6 tonnes, or an eighth of the average American household’s yearly emissions.No other change would generate that much saving, though electricity in the homeis responsible for over 5 tonnes of carbon emissions a year, so generating it with solar panels(太阳能电池板) would come close . Like electric vehicles, a roof full of solar panels is not cheap. Changing diets costs less, and American households consume meat worth 2.7 tonnes of CO2e a year, far more than most people. If Americans went vegetarian(素食者), that would be like half an average solar roof.These household averages, however,disguise what may be the most important thing carbon trackers reveal: that apparently similar households produce very different emissions. By combining their tracker’s results with postal(邮政的)code data, the University of California team worked out average emissions by area. Places with high emissions—mostly suburbs(郊区)—produce four or five times as much carbon as inner cities or rural areas, a much larger multiple than might have been ex pected. Chicago’s households produce37 tonnes of CO2e a year; suburban Eola’s, some35 miles (56km) from the Windy City, emit96 tonnes. This is not only because of commuting(通勤). Trips to and from work account for less than a fifth of miles driven; the rest are to shops, schools and so on.Even more striking is the difference air travel makes. The average household contribution from flying is 1.5 tonnes, less than a car. But half of Americans never fly. According to Cool Climate, flying 100,000 miles a yearproduces a stunning(惊人的)43 extra tonnes of CO2. If jet-set households were to cut their travel sharply, they would have a disproportionate(不成比例的)effect on emissions. They might even do something for the Amazon.Over the next 30 years, many countries are promising to move to net-zero carbon, imply ing that household emissions will have to be cut to close to nothing. Stephanie Roe, WWF’s lead climate scientist, reckons that, at best, half the reduction might be achieved through demand-side measures, such as behavioural changes by individuals and households. And even that would require companies and governments to provide more incentives(激励)to change through supply-side investments to make low-carbon options cheaper and more widely available.Trackers, it seems, have daunting(令人怯步的)lessons for public bodies and private households alike.【课标词汇】1.associate将…(与…)联系起来,把…联系在一起Most people associate this brand with good quality.大多数人把这个品牌和优良品质联系在一起。

2023年高考英语外刊时文精读精练(4)Floods and fires洪水和火灾Extreme no more极端天气不再罕见主题语境:人与自然主题语境内容:自然灾害与防范【外刊原文】(斜体单词为超纲词汇,认识即可;下划线单词为课标词汇,需熟记。

)The Wilsons river broke its banks on the night of February 27th while Lismore, a town of around 30,000 in New South Wales, was sleeping. Its residents snoozed(打盹儿) through early-hours emergency warnings that “risk to life was imminent(迫在眉睫)”. Within hours the town was submerged(淹没的). Residents scrambled into their attics(阁楼). Mothers carried children onto rooftops. An army of locals launched tin boats into the floods to save them. Four people died.Eastern Australia has been hammered by what politicians call “once-in-1,000-year” flooding. It has already had a soggy(浸水的)summer because of La Niña, a phenomenon which triggers downpours there. Then on February 23rd, meteorologists warned that an area of low pressure was forming over southern Queensland. It sucked moisture (水分)from the sea, forming an “atmospheric river(大气层河流)” over the east coast. It has dumped quantities of water ever since.Brisbane, Queensland’s capital, received almost 80% of its annual rainfall in less than a week in February, flooding 15,000 homes. As the rain edged i nto northern New South Wales, it ripped up roads and drowned herds of cattle. Storms lashed Sydney on March 8th, causing a dam t o spill over. Some 50,000 people in the state have been forced to evacuate(撤离).Scientists are wary(小心的)of blaming floods on global warming because everything from rainfall to urban development contributes to them. They disagree, too, about whether climate change is a factor in this kind of never-ending downpour(倾盆大雨). No matter the cause, extreme weather is now a regular occurrence in Australia. New South Wales was buffeted(重创) by its last “once-in-100-year”floods, which submerged Western Sydney, just a year ago. In 2019 and 2020 vast lands of the country were torched in bushfireswhich destroyed more than 3,000 homes and killed 33 people. Unlucky towns such as Lismore have in recent years been hit by both fire and floods.It does not help that the state and federal governments’response has been bungled(失败). When disaster strikes, official aid is often slow to come. In 2019 the federal government set aside almost A$4bn ($2.9bn) for a fund that would help it respond to crises(危险)and lessen future ones. But it has spent hardly any of that money. It has now deployed(部署) the army and is dishing out cash to victims, but locals fume(愤怒地说)that they were left for days without power or fuel as supplies of food and water dwindled(减少).A university is putting up the homeless. “Isn’t somebody meant to write a plan for this?”wonders Ella Buckland, a resident of Lismore.A debate now rages about how or even whether places like Lismore should rebuild. Analysts think the floods might trigger insurance claims worth more than A$3bn.Some politicians would like the government to pay companies to insure houses that will inevitably be struck by future fires or floods. “If we are going to start thinking every time there’s a natural disaster that we have to give up and leave because it’s too hard, then where are we going to live?” asks Lismore’s mayor, Steve Krieg. That is becoming a question for ever more Australians.【课标词汇】1.emergency紧急情况;不测事件;突发事件How would disabled people escape in an emergency?如果发生紧急情况,伤残人士如何逃离?Is the emergency exit suitable for wheelchairs?安全出口适合轮椅通行吗?2.scramble(急速而艰难地)移动;爬;攀登She scrambled up the steep hillside and over the rocks.她爬上了陡峭的山坡,翻过岩石。

2023年高考英语外刊时文精读精练 (12)Travel after covid-19 疫情下的出行模式主题语境:人与自我主题语境内容:个人生活【外刊原文】(斜体单词为超纲词汇,认识即可;下划线单词为课标词汇,需熟记。

)In Auckland, the largest city in New Zealand, public-transport fares have been cut in half. In London politicians leave notes on civil servants’ desks telling them to turn up for work and beg people to start going back to the office. Eric Adams, the mayor(市长)of New York, has asked bank bosses to set an exampleby riding the subway.None of it seems to be working. The subway is only two-thirds as busy as it was before covid-19. A uckland’s bus system was half as busy in April as it was three years earlier. Despite fears of “carmageddon”, people have not swapped public transport for the private kind. They are simply moving around less.Although travel is likely to recover a little further, a return to the pre-pandemic pattern seems impossible. One reason is that not all journeys have declined. Parisians made more shopping trips last summer than they did before covid appeared. In New York Sunday travel has held up better than weekday travel. What has collapsed is rush-hour commuting(通勤), particularly among well-paid workers in the knowledge economy. That suggests the change in behaviour is caused not by fear of infection—which might be expected to reduce over time—but by a fundamental change of work habits. Rich countries should accept this new reality, and start building transport systems to match.Infrastructure(基础设施)projects that just add capacity to conventional suburb-to-city-centre routes nowseem pointless, especially in the biggest cities. They are rooted in the idea that urban travel is like an asterisk(星号), with people squeezing onto radial roads and railway lines. Travel is now more like a spiderweb. People take fewer, often shorter journeys along thinner routes; they move to the side, as well as in and out. That explains why buses, which are often used for short journeys, have emptied out less than commuter trains.Now that people travel less predictably, there is a stronger casefor innovations such as on-demand buses and “mobility as a service”, which weaves together public transport and personal modes such as taxis and hired bikes. These make better use of the existing infrastructure, and come closer to the convenience of cars. Antwerp, Genoa and Helsinki lead in this area. British cities need to do something more basic, by integrating their public-transport networks. Outside London, they tend to have some bus companies, some railway lines and perhaps a tram system, all doing their own thing. The result is confusion and often greater cost for the public.Countries should not give up tools on public-transport projects. Their populations are growing, and they will need to cut congestion and carbon emissions. But instead of building more radii(半径交通线), along the lines of London’s new Elizabeth line or the tunnel being dug at huge expense under the East river in New York, they should make it easier to travel around cities, or from one satellite town to another.The transition from asterisks to spiderwebs will be difficult. Everybody from motorists to transport unions will complain. But at least a couple of things have become easier. Because so many people have learned to work from home, engineers should not fear to work on roads or railways between Monday and Friday, rather than disturbing a string of weekends. And any transport union that threatens to strike is welcome to try. The days when unions could paralyse(使瘫痪) cities by shutting down public transport are over. Along with much else.【课标词汇精讲】1.turn up出现,到来,露面Richard had turned up on Christmas Eve with Tony...理查德和托尼在圣诞夜一道露面了。

2023年高考英语外刊时文精读精练 (6)Roaches to the rescue蟑螂救援队主题语境:人与社会主题语境内容:科学与技术【外刊原文】(斜体单词为超纲词汇,认识即可;下划线单词为课标词汇,需熟记。

)Why go to all the trouble of designing and building a drone(无人机)if nature has already done most of the job for you? That is the attitude taken by the small but determined band of researchers who are trying to robotise(机械化)insects. Some are working on turning insects like beetles(甲虫)into such cyborgs(半人半机器的生物)—perhaps for use in military inspection or spying. Others prefer to concentrate on the fearful side of entomology(昆虫学),by taking electronic control of cockroaches(蟑螂).The first cyber-roach(赛博蟑螂) goes back to 1997, when Shimoyama Isao of Tokyo University sent electrical signals to a cockroach's antennae(触角), causing it to turn either left or right depending on which antenna was stimulated. Others have built on this approach by recruiting extra sense organs, such as the rear-facing cerci(后向尾须). They have also begun fitting the insects with instrument packs that might let them do a useful job: searching collapsed buildings for survivors.One such is Sato Hirotaka of Nanyang Technological University, in Singapore. He has been working on cyber-insects for 15 years. Now, he has added another twist to cyber-roaches. Instead of having their movements dictated by remote control, his are autonomous agents. They are run by algorithms(算法)that respond directly to sensors in their backpacks.The insects thus fitted out by Dr Sato are Madagascar hissing(发声) cockroaches, which are about 6cm long. The backpacks contain a communications chip, a carbon-dioxide sensor, a motion sensor, an infrared(红外线)camera and a tiny battery.Released into the rubble(碎石), to crawl their way through while searching for signs of life such as movement, body heat and higher CO2 levels from breathing. The artificial intelligence that decides whether a set of signals actually indicate the presence of a human being is programmed directly intothe camera. If it thinks it has spotted someone, it alerts a rescuer.To test this arrangement, Dr Sato and his team ran trials in a simulated disaster zone. They laid out concrete blocks of various shapes and sizes in an area of 25 square metres. Among these were a number of people, and also some decoys(诱饵), such as a heat lamp, a microwave oven and a laptop. They then released the cyber-roaches, having first programmed into them the search's start and end points. The software proved able to recognise humans correctly 87% of the time, a success rate Dr Sato thinks could be improved still further by collecting multiple images from different angles. The next phase of the project is to refine the system for use out of doors. That done, manufacture of the backpacks and automation of their attachment (附加装置)to the insects will need to be commercialised(商业化). If all goes well, Dr Sato predicts the result could be available for use within five years.【课标词汇】1.design设计;制(图);意图,打算Who designed this building/dress/furniture?是谁设计这座建筑物/这款裙子/这套家俱?This dictionary is designed for advanced learners of English.本词典是为高级英语学习者编写的。

英语时文阅读刊物

1. The Economist:这是一本全球知名的经济学杂志,提供深入的分析和评论,涵盖全球政治、经济、商业和文化等领域。

2. Time:这是一本美国的周刊,报道全球时事、政治、文化、科技和娱乐等方面的新闻。

3. Newsweek:这是一本美国的新闻杂志,提供全球时事、政治、商业、科技和文化等方面的报道。

4. The New York Times:这是一份美国的报纸,提供高质量的新闻报道和评论,涵盖全球各个领域。

5. The Guardian:这是一份英国的报纸,提供广泛的新闻报道和观点,包括政治、社会、文化和环境等方面。

6. National Geographic:这是一本以自然、科学和文化为主题的杂志,提供精美的图片和深入的文章。

7. Scientific American:这是一本科学杂志,提供最新的科学研究和发现,以及对科学、技术和社会的影响的分析。

8. Forbes:这是一本商业和财经杂志,提供关于商业、投资、科技和领导力等方面的文章和排名。

9. Wired:这是一本科技杂志,报道最新的科技趋势、创新和数字文化。

10. Vanity Fair:这是一本时尚和文化杂志,提供关于娱乐、时尚、艺术和名人等方面的报道和评论。

这些刊物都提供了丰富的英语时文阅读材料,可以帮助你了解不同领域的最新动态和观点。

你可以根据自己的兴趣和阅读需求选择适合的刊物。

How to Avoid the Coronavirus? Wash Y our HandsBy Elisabeth RosenthalAmericans are watching with alarm as a new coronavirus spreads in China and cases pop up in the United States. They are barraged with information about what kinds of masks are best to prevent viral spread. Students are handing out masks in Seattle. Masks have run out in Brazos County, Tex.Hang on.I’ve worked as an emergency room physician. And as a New York Times correspondent in China, I covered the SARS outbreak in 2002 and 2003 during which a novel coronavirus first detected in Guangdong sickened more than 8,000 people and killed more than 800. My two children attended elementary school in Beijing throughout the outbreak.Here are my main takeaways from that experience for ordinary people on the ground:1. Wash your hands frequently.2. Don’t go to the office when you are sick. Don’t send your kids to school or day care when they are ill, either.Notice I didn’t say anything about masks. Having a mask with you as a precaut ion makes sense if you are in the midst of an outbreak, as I was when out reporting in the field during those months. But wearing it constantly is another matter. I donned a mask when visiting hospitals where SARS patients had been housed. I wore it in the markets where wild animals that were the suspected source of the outbreak were being butchered, blood droplets flying. I wore it in crowded enclosed spaces that I couldn’t avoid, like airplanes and trains, as I traveled to cities involved in the outbreak, like Guangzhou and Hong Kong. You never know if the guy coughing and sneezing two rows ahead of you is ill or just has an allergy.But outdoors, infections don’t spread well through the air. Those photos of people walking down streets in China wearing masks are dramatic but uninformed. And remember if a mask has, perchance, intercepted viruses that would have otherwise ended up in your body, then the mask is contaminated. So, in theory, to be protected maybe you should use a new one for each outing.Th e simple masks are better than nothing, but not all that effective, since they don’t seal well. For anyone tempted to go out and buy the gold standard, N95 respirators, note that they are uncomfortable. Breathing is more work. It’s hard to talk to people. On one long flight at the height of the outbreak, on which my few fellow passengers were mostly epidemiologists trying to solve the SARS puzzle, many of us (including me) wore our masks for the first couple of hours on the flight. Then the food and beverage carts came.Though viruses spread through droplets in the air, a bigger worry to me was always transmission via what doctors call “fomites,” infected items. A virus gets on a surface — a shoe or a doorknob or a tissue, for example. You touch the surface and then next touch your face or rub your nose. It’s a great way to acquire illness. So after walking in the animal markets, I removed my shoes carefully and did not take them into the hotel room. And of course I washed my hands immediately.Remember, by all indications SARS, which killed about 10 percent of those infected, was a deadlier virus than the new coronavirus circulating now. So keep things in perspective.Faced with SARS, many foreigners chose to leave Beijing or at least to send their children back to the United States. Our family stayed, kids included. We wanted them with us and didn’t want them to miss school, especially during what would be their final year in China. But equally important in making the decision was that the risk of getting SARS on an airplane or in the airport seemed greater than being smart and careful while staying put in Beijing.And we were: I stopped taking my kids to indoor playgrounds or crowded malls or delicious but densely packed neighborhood Beijing restaurants. Out of an abundance of caution we canceled a family vacation to Cambodia — though my fear was less about catching SARS on the flight than that one of the kids would have a fever from an ear infection upon our return at a border screening, and would be stuck in a prolonged quarantine in China. We instead took a vacation within China, where we carried masks with us but didn’t use them except on a short domestic flight.In time, during the SARS outbreak, the government shut down theaters and schools in Beijing, as it is doing now in many Chinese cities because these viruses are more easily transmitted in such crowded places.But there was also a lot of irrational behavior: Entering a village on the way to a hike near the Great Wall, our car was stopped by locals who had set up a roadblock to check the temperature of all passengers. They used an oral thermometer that was only minimally cleaned after each use. What a great way to spread a virus.The International School of Beijing, where my children were students, was one of the few in the capital — perhaps the only one — that stayed open throughout the SARS outbreak, though the classes were emptier, since so many kids had departed to their home countries. It was a studied but brave move, since a parent at the school had gotten SARS at the very beginning of the outbreak on a flight back from Hong Kong. She recovered fine, but it was close to home and families were scared.The school instituted a bunch of simple precautionary policies: a stern note to parents reminding them not to send a child to school who was sick and warning them that students would be screened for fevers with ear thermometers at the school door. There was no sharing of food at lunch. The teacher led the kids in frequent hand washing throughout the day at classroom sinks,while singing a prolonged “hand washing song” to ensure they did more than a cursory pass under the faucet with water only.If a family left Beijing and came back, the child would have to stay at home for an extended period before returning to class to make sure they hadn’t caught SARS elsewhere.With those precautions in place, I observed something of a public health miracle: Not only did no child get SARS, but it seemed no student was sick with anything at all for months on end. No stomach bugs. No common colds. Attendance was more or less perfect.The World Health Organization declared the SARS outbreak contained in July 2003. But, oh, that those habits persisted. The best first-line defenses against SARS or the new coronavirus or most any virus at all are the ones that Grandma and common sense taught us, after all.2020@The New York TimesAmericans are watching with alarm as a new coronavirus spreads in China and cases pop up in the United States. They are barraged with information about what kinds of masks are best to prevent viral spread. Students are handing out masks in Seattle. Masks have run out in Brazos County, Tex.随着一种新型冠状病毒在中国传播,以及美国出现病例,美国人正在警觉地观察。

undeveloped/' Grossman says.1.Why did the authorities buy the land in northwestern Montana?A.To develop the local economy.B.To better preserve wildlife habitats.C.To construct highways in the suburbs.D.To prevent endangered species from migrating.2.What does the author intend to do in paragraph 2?A.To explain a natural phenomenon.B.To provide some advice for readers.C.lb add some background information.D.lb introduce a new topic for discussion.3.Why does (his project concentrate on protecting grizzly bears?A.Their population has declined sharply.B.They play a critical role in the ecosystem.C.They affect the living habits of other wildlife.D.Human activities have done serious harm to them.4.What affects wildlife corridors according to paragraph 4?nd development.munity structure.C.Decreasing investors.D.Geographic locations.【参考答案】:BCBA【单词】1.roam v.漫步2.ecosystem n.生态系统【短语】1.real estate 房地产2.property values 房产价值(二)二氧化碳或将被变成“石头”封存起来随着全球变暖问题日益严峻,怎样处理大气中不断增加的二氧化碳成为了一个世界性难题。

2023年高考英语外刊时文精读精练(10)Dutch ‘Jogger Jo’荷兰“慢跑者乔”主题语境:人与自我主题语境内容:健康的生活方式、积极的生活态度【外刊原文】(斜体单词为超纲词汇,认识即可;下划线单词为课标词汇,需熟记。

)from Maastricht, ran a marathon(马拉松)in a surprising 2hr 54 mins and 19 secs to become the fastest septuagenarian(七旬老人)in history.“I only started jogging at 36 because my doctor told me I had high cholesterol(胆固醇),” he says. “But last ye ar I ran 7,242 km [4,450 miles], which is more than double what I did in my car.”following him on his bike and shouting out his lap(圈数)times. But his legs were starting to get heavier.Eddy Wally’s song Chérieon his phone on repeat. I’ve always loved it. It gave(抽筋)in the final 500 metres, I was able to break the record by four seconds.” It was Schoonbroodt’s75th sub three hour marathon, and it came only four weeks after his 74th, at the Rotterdam marathon. For good measure, the flying Dutchman also holds a number of ultra running records. He is clearly no ordinary Jo. But the secrets of his success might surprise. “Most runners train too hard,”my running.”Schoonbroodt often runs at nine or 10-minute mile pace, far slower than the 6:38-minute miles he ran for 26.2 miles to set his world record, but he saysa training plan or coach and push on even when their body is saying: ‘No, this is not a good day to do it,’” he says. “But if you just do what you feel, it’s easier to keep running and stay injury-free.”course, with all these calories I burn. I love pasta and potatoes. But whatever is on the table, I eat it!” He has a similarly relaxed attitude when it comestoo much, and mostly on weekends. Wine is just a grape drin k, so it’s made from nature. And Belgian beer is special. And if you do all this with your body,”it something back.” Schoonbrot started running on 1 January 1986; he hascalled him Jogger Jo, because he was slow.Being a late bloomer(成功的人), he believes, has actually helped him becausestarted so late, I missed my best years,” he says. “But that’s no problem. Everything is still new to me.” But whileover 70 have run a sub-three-hour marathon – the first of whom, the Canadian Ed Whitlock, who died in 2017, also ran a 3:15 marathon after turning 80. What might explain this phenomenon? John Brewer, a sports scientist at thetechnology all mean that it is more possible for people in their 60s and 70s to produce good performance if they follow the right training,” he said.you can.” Schoonbroodt, meanwhile, has no plans to put his feet up. “Mynext marathon is in two and a half weeks, on an old Roman road built 2,000 yearshour marathon waits for no man. Not even one who is 71.【课标词汇】1.wind down逐渐减小(工作规模);使逐步停止;使逐渐关闭Foreign aid workers have already begun winding down their operation...外国救援人员已开始逐步缩减救援活动。

2023年高考英语外刊时文精读精练 (5)Climate change气候变化Heat island热岛主题语境:人与自然主题语境内容:人与环境【外刊原文】(斜体单词为超纲词汇,认识即可;下划线单词为课标词汇,需熟记。

)On March 13th, as commuters(每日往返上班者)streamed out of Chhatrapati Shivaji Terminus,a gothic revival masterpiece(哥特式复兴建筑——贾特拉帕蒂·希瓦吉终点站)in Mumbai, India’s commercial capital, they were confronted with temperatures approaching40°C, nearly7°C above normal for the time of year. The city is in the midst of a debilitating heatwave, its 13th in the past five decades, nearly half of which occurred in the past 15 years. Mumbai’s average temperature has increased by over 1°C in that period.Had those commuters crossed the street from the station and entered the city’s grand headquarters that day, they might have found cause for optimism. That afternoon politicians from the authority and the state of Maharashtra, of which Mumbai is the capital, had gathered to unveil(揭露)a “climate action plan”. The city aims to reach net-zero emissions by 2050, two decades earlier than the target set by the national government.Mumbai is extremely vulnerable to climate change.A narrow and densely populated(人口密集的)island, surrounded on three sides by the Arabian Sea, it is attacked by monsoon(季候风) rains for four months a year and routinely subject to flooding, especially during high tide. That is bad enough for thecity’s apartment-dwellers(公寓居民). But it is even worse for the 42% of the population who live in slums(贫民窟), which are likely to be washed away or buried by landslides(山体滑坡).The key of the plan is a proposal to decarbonise(去碳化)Mumbai’s energy. Generating the city’s electricity, which produces nearly two-thirds of the city’s emissions, relies mostly on burning fossil fuels, particularly coal. The city wants to increase the share of renewables (可再生资源). It is looking, for instanceinto installing solar panels(装太阳能电池板)on rooftops.Another priority is to improve the quality and efficiency of the city’s buildings.Slums, especially, are heat islands. Made of whatever materials are at hand or cheaply available, they are five or sixdegrees hotter than structures of good quality, making them, as the report puts it, “uninhabitable(不适于居住的)” on hot days. Moreover, the heat, damp and cramped(狭窄的)conditions make slum residents more vulnerable to disease—a less obvious risk of climate change.The plan is, however, short on details of how to achieve its ambition s. Still, in publishing one at all Mumbai has led the way among South Asian metropolises(大都市). Other cities are keen to follow suit, says Shruti Narayan of C40, who helped with the report. Chennai and Bangalore in the south have started work on their plans. Others, including Delhi and Kolkata in India, Dhaka in Bangladesh and Karachi in Pakistan have expressed interest in doing something similar.There is plenty in M umbai’s240-page document to inspire them. One is the fact that it does not rely on using technologies that do not yet exist, a criticism at many countries’ national proposals. Another is the attention given to adaptation(coping with all the bad things already happening) and not just reducing future emissions.Details may anyway be beside the point. The real value of Mumbai’s plan is as a signalling device(信号装置)that “focuses the attention of policymakers”, states Abhas Jha, a climate specialist at the World Bank. The Paris Agreement, which committed the world to the goal of keeping the rise in temperatures to less than 2°C above pre-industrial levels, worked in much the same way, leaving countries to hash out details later. Time, though, is getting ever shorter.【课标词汇】1.stream(一群人,东西)涌,涌动;流动He was watching the taxis streaming past.他看着出租车一辆接着一辆地驶过。

高考英语外刊时文精读精练(30)Unravelling the mystery of autobrewery syndrome解开“自动酿酒综合症”之谜【外刊导读】国外一项研究发现,有些人患有一种罕见病,在滴酒未沾的情况下也会“醉酒”,甚至会出现“大脑断片”的情况。

患者往往会出现胃痛、腹胀、昏迷等酒后反应,身边的人也会误以为他们喝醉了,但实际上他们根本没有饮酒。

这是一种什么样的病?【外刊原文】(斜体单词为超纲词汇,认识即可;下划线单词为课标词汇,需熟记。

)It would happen two to three times a week. Nick Carson would start slurring his words and then become progressively less steady on his feet. His conversations would go around in circles and eventually he would collapse into a deep sleep. The father-of-two was showing all the signs of being drunk. Except Carson hadn't consumed any alcohol."Before this I had never seen him drunk," says Carson's wife, Karen. Carson himself could only recall the events of these episodes in a foggy way the next day."I did not have a clue what was happening." says 64-year-old Carson, who lives in Lowestoft, Suffolk, in the UK. "Six to eight hours later I would wake up like there is nothing wrong with me, very rarely feeling hungover."Eventually Carson and his wife found the intoxication and other symptoms seemed to be triggered after eating meals that were high in carbohydrates, such as potatoes. After multiple visits to doctors and nutritionists, Carson was diagnosed with a rare condition called Auto-Brewery Syndrome.Auto-Brewery Syndrome (ABS), is a largely mysterious condition that raises the levels of alcohol in the blood and produces the symptoms of alcohol intoxication in patients, even when they have had minimal or no alcohol intake. It can lead them to fail breathalyser tests, and brings social and legal consequences for sufferers.But this unusual phenomenon is also highly controversial, not least because its exact cause is still poorly understood.One suggested mechanism underlying the condition revolves around imbalances in gut microbes, which lead to overgrowth of certain microbes that later, under particular conditions, ferment a high-carbohydrate meal into alcohol. But what might be triggering this sudden and dramatic change in the microorganisms living inside our bodies that in the right circumstances leads to ABS?A medical report of two cases from 1984 highlighted another culprit –yeasts living in the patients' digestive tracts. More recently, other studies have revealed it often takes a combination of factors to increase the risk of ABS. A number of alcohol-producing fungi and bacteria can lead to overproduction of alcohol.【链接高考】阅读下面短文,在空白处填入1个适当的单词或括号内单词的正确形式。

外刊时文选读Text 1Weekly Address: Ensuring Hardworking Americans Retire with Dignity WASHINGTON, DC —In this week’s address, the President reiterated his commitment to middle-class economics, and to ensuring that all hard-working Americans get the secure and dignified retirement they deserve. While most financial advisers prioritize their clients’ futur es, there are some who direct their clients towards bad investments in return for backdoor payments and hidden fees. That’s why earlier this week the President announced that he is calling on the Department of Labor to update rules to protect families from conflicts of interest by requiring financial advisers to put their clients’ best interest before their own profits.The President emphasized his promise to keep fighting for this policy and for others that benefit millions of working and middle class Americans.Hi everybody. In America, we believe that a lifetime of hard work and responsibility should be rewarded with a shot at a secure, dignified retirement. It’s one of the critical components of middle-class life – and this week, I took new steps to protect it.Six years after the crisis that shook a lot of people’s faith in a secure retirement, our economy is steadily growing. Last year was the best year for job growth since the 1990s. All told, over the past five years, the private sector has added nearly 12 million new jobs. And since I took office, the stock market has more than doubled, replenishing the 401(k)s of millions of families.But while we’ve come a long way, we’ve got more work to do to make sure that our recovery reaches more Americans, not just those at the top. That’s what middle-class economics is all about—the idea that this country does best when everyone gets their fair shot, everybody does their fair share, and everyone plays by the same set of rules.That last part—making sure everyone plays by the same set of rules—is why we passed historic Wall Street Reform and a Credit Card Bill of Rights. It’s why we created a new consumer watchdog agency. And it’s why we’re taking new action to protect hardworking families’ retireme nt security. If you’re working hard and putting away money, you should have the peace of mind that the financial advice you’re getting is sound and that your investments are protected.But right now, there are no rules of the road. Many financial advisers put their clients’ interest first – but some financial advisers get backdoor payments and hidden fees in exchange for steering people into bad investments. All told, bad advice that results from these conflicts of interest costs middle-class and working families about $17 billion every year.This week, I called on the Department of Labor to change that – to update the rules and require that retirement advisers put the best interests of their clients above their own financial interests. Middle-class families cannot afford to lose their hard earned savings after a lifetime of work. They deserve to be treated with fairness and respect. And that’s what this rule would do.While many financial advisers support these basic safeguards to prevent abuse, I know some special interests will fight this with everything they’ve got.But while we welcome different perspectives and ideas on how to move forward, what I won’t accept is the notion that there’s nothing we can do to make sure that hard-working, responsible Americans who scrimp and savecan retire with security and dignity.We’re going to keep pushing for this rule, because it’s the right thing to do for our workers and for our country. The strength of our economy rests on whether hard-working families can not only share in America’s success, but can also contribute to America’s success.And that’s what I will never stop fighting for – an economy where everyone who works hard has the chance to get ahead.Text 2Planet of the phonesThe smartphone is ubiquitous, addictive and transformativeTHE dawn of the planet of the smartphones came in January 2007, when Steve Jobs, Apple’s chief executive, in front of a rapt audience of Apple acolytes, brandished a slab of plastic, metal and silicon not much bigger tha n a Kit Kat. “This will change everything,” he promised. For once there was no hyperbole. Just eight years later Apple’s iPhone exemplifies the early 21st century’s defining technology.Smartphones matter partly because of their ubiquity. They have become the fastest-selling gadgets in history, outstripping the growth of the simple mobile phones that preceded them. They outsell personal computers four to one. Today about half the adult population owns a smartphone; by 2020, 80% will. Smartphones have also penetrated every aspect of daily life. The average American is buried in one for over two hours every day. Asked which media they would miss most, British teenagers pick mobile devices over TV sets, PCs and games consoles. Nearly 80% of smartphone-owners check messages, news or other services within 15 minutes of getting up. About 10% admit to having used the gadget during sex.The bedroom is just the beginning. Smartphones are more than a convenient route online, rather as cars are more than engines on wheels and clocks are not merely a means to count the hours. Much as the car and the clock did in their time, so today the smartphone is poised to enrich lives, reshape entire industries and transform societies—and in ways that Snapchatting teenagers cannot begin to imagine.Phono sapiensThe transformative power of smartphones comes from their size and connectivity. Size makes them the first truly personal computers. The phone takes the processing power of yesterday’s supercomputers—even the most basic model has access to more number-crunching capacity than NASA had when it put men on the Moon in 1969—and applies it to ordinary human interactions. Because transmitting data is cheap this power is available on the move. Since 2005 the cost of delivering one megabyte wirelessly has dropped from $8 to a few cents. It is still falling. The boring old PC sitting on your desk does not know much about you. But phones travel around with you—they know where you are, what websites you visit, whom you talk to, even how healthy you are.The combination of size and connectivity means that this knowledge can be shared and aggregated, bridging the realms of bits and atoms in ways that are both professional and personal. Uber connects available drivers to nearby fares at cheaper prices; Tinder puts people intouch with potential dates. In future, your phone might recommend a career change or book a doctor’s appointment to treat your heart murmur before you know anything is amiss.As with all technologies, this future conjures up a host of worries. Some, such as “text neck” (hunching over a smartphone stresses the spine) are surely transient. Others, such as dependency—smartphone users exhibit “nomophobia” when they happen to find themselves empty-handed—are a measure of utility as much as addiction. After all, people also hate to be without their wheels or their watch.The greater fear is over privacy. The smartphone turns the person next to you into a potential publisher of your most private or embarrassing moments. Many app vendors, who know a great deal about you, sell data without proper disclosure; mobile-privacy policies routinely rival “Hamlet” for length. And if leaked documents are correct, GCHQ, Britain’s signals-intelligence agency, has managed to hack a big vendor of SIM cards in order to be able to listen in to people’s calls. If spooks in democracies are doing this sort of thing, you can be sure that those in authoritarian regimes will, too. Smartphones will give dictators unprecedented scope to spy on and corral their unwilling subjects.The naked appYet three benefits weigh against these threats to privacy. For a start, the autocrats will not have it all their own way. Smartphones are the vehicle for bringing billions more people online. The cheapest of them now sell for less than $40, and prices are likely to fall even further. The same phones that allow governments to spy on their citizens also record the brutality of officials and spread information and dissenting opinions. They feed the demand for autonomy and help protest movements to coalesce. A device that hands so much power to the individual has the potential to challenge authoritarianism.The second benefit is all those personal data which companies are so keen on. Conventional social sciences have been hampered by the limited data sets they could collect. Smartphones are digital census-takers, creating a more detailed view of society than has ever existed before and doing so in real time. Governed by suitable regulations, anonymised personal data can be used, among many other things, to optimise traffic flows, prevent crime and fight epidemics.The third windfall is economic. Some studies find that in developing countries every ten extra mobile phones per 100 people increase the rate of growth of GDP-per-person by more than one percentage point—by, say, drawing people into the banking system. Smartphones will remake entire industries, at unheard-of speed. Uber is a household name, operating in 55 countries, but has yet to celebrate its fifth birthday. WhatsApp was founded in 2009, and already handles 10 billion more messages a day than the SMS global text-messaging system. The phone is a platform, so startups can cheaply create an app to test an idea—and then rapidly go global if people like it. That is why it will unleash creativity on a planetary scale.By their nature, seminal technologies ask hard questions of society, especially as people adapt to them. Smartphones are no different. If citizens aren’t protected from prying eyes, some will suffer and others turn their backs. Societies will have to develop new norms and companies learn how to balance privacy and profit. Governments will have to define what is acceptable. But in eight short years smartphones have changed the world—and they have hardly begun.。