投资学讲义.doc

- 格式:doc

- 大小:1.54 MB

- 文档页数:245

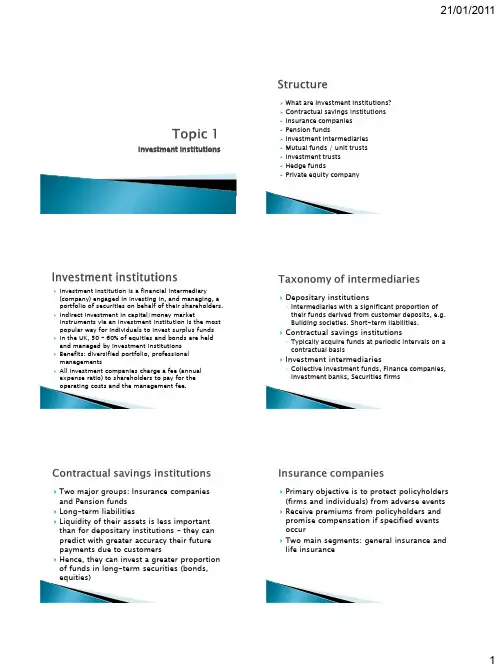

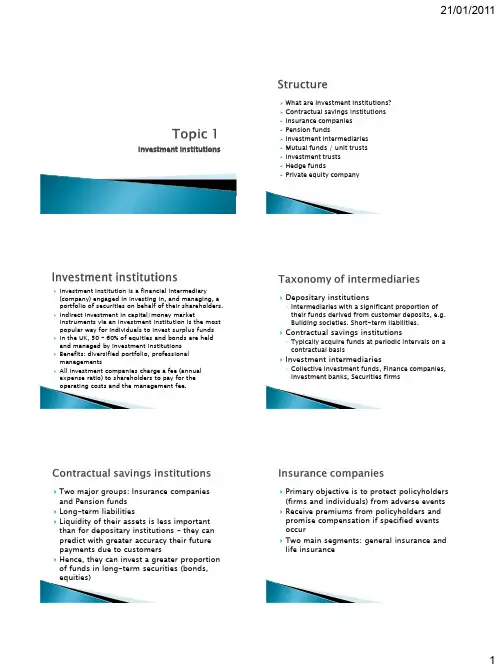

Investment InstitutionsWhat are Investment institutions? Contractual savings institutions -Insurance companies -Pension fundsInvestment intermediaries -Mutual funds / unit trusts -Investment trusts -Hedge funds-Private equity company❝Investment institution is a financial intermediary (company) engaged in investing in, and managing, a portfolio of securities on behalf of their shareholders. ❝Indirect investment in capital/money marketinstruments via an investment institution is the most popular way for individuals to invest surplus funds ❝In the UK, 50 –60% of equities and bonds are held and managed by investment institutions ❝Benefits: diversified portfolio, professional managements❝All investment companies charge a fee (annual expense ratio) to shareholders to pay for theoperating costs and the management fee.❝Depositary institutions◦Intermediaries with a significant proportion of their funds derived from customer deposits, e.g. Building societies. Short-term liabilities.❝Contractual savings institutions◦Typically acquire funds at periodic intervals on a contractual basis❝Investment intermediaries◦Collective investment funds, Finance companies,Investment banks, Securities firms❝Two major groups: Insurance companies and Pension funds ❝Long-term liabilities❝Liquidity of their assets is less important than for depositary institutions –they can predict with greater accuracy their future payments due to customers❝Hence, they can invest a greater proportion of funds in long-term securities (bonds,equities)❝Primary objective is to protect policyholders (firms and individuals) from adverse events ❝Receive premiums from policyholders and promise compensation if specified events occur❝Two main segments: general insurance and life insurance❝Protection against personal injury and liabilities such as accidents, theft and fire❝Usually over a fixed time period e.g. 1 year ❝Claims usually made soon after the event so liabilities are mostly short term❝Hence they hold a greater proportion of liquid assets than life insurers. Holding financial assets might be viewed as a byproduct of the business.❝Some authors (e.g. B&T) do not view this category as an investment intermediary❝Protects the policyholder in the event of death, illness or retirement; hence long-term liabilities❝Term assurance, Whole-of-life policy, Endowment policy, Annuities❝Term assurance: provides insurance cover, for specifiedperiod, against the risk of death. If the insured survivesthe specified period then no payment is made.❝Whole-of-life policy pays a capital sum on the death ofthe person assured, whenever that event occurs.❝Endowment policy pays a capital sum at the end ofsome specified term or earlier if the assured dies withinthe term.-The premium for Whole-of-life and endowment policieswill be higher than for term assurance.❝Annuities: A policyholder pay an initial lump sumwhich used by the insurance company to providean agreed income until death.-The insurance company immediately creates a fund❝Risk: certain sums are guaranteed to be paid in thefuture and these sums exceed the value of thepremiums over the life of the contract.❝Match the term structure of its assets and liabilities❝Invest in long-term assets e.g. bonds, equities andmortgages.❝Provide retirement income (in the form ofannuities) to employees covered by a pension plan❝Personal scheme and public (state) scheme❝Funded scheme and unfunded (pay-as-you-go)scheme❝Funded scheme: Receive contributions fromemployers and/or employees and invest thesefunds in assets, including equities and bonds.Returns from the investment are used to paybenefits to members of the scheme.❝Two main types of funded scheme: defined benefit(DB) and defined contribution (DC)❝DB: the sponsor agrees to pay members ofthe scheme a pension equal to apredetermined percentage of their finalsalary (average salary), subject to themember‟s years of service❝DC: the return on the investmentsdetermines pension benefits❝Occupational schemes where the sponsor isthe employer have historically been DB,while private pensions are DC❝Risk: benefits to be paid are not known with certainty;inflation complications as it increases the benefits to bepaid by fund.❝Benefit from tax deferral: in the UK, contributions arenot taxable, pensioner pays income tax❝Pension fund trustees will determine the overallinvestment strategy❝They will often decide what proportion of assets to beheld in different asset classes❝Asset mix will be influenced by the maturity of the fund❝Long-term liabilities hence long-term assets❝Index-linked bonds, Equities❝Investment companies are classified, depending on whether their own capitalisation (number of shares outstanding) is constantly changing or fixed:-Open-end : capitalisation constantly changing; new investors buy additional shares from the company and some existing shareholders sell their shares back to the company.-Closed-end : fixed capitalization; share traded onexchange.open-ended❝Mutual funds / unit trusts❝Open-ended investment companies OEICsClosed ended❝Investment trusts ❝Hedge funds❝Private equity company❝Pool resources from many individuals andcompanies and invest these in a range of assets ❝Provide opportunities for small investors to investin a diversified fund at low cost❝Take advantage of lower transaction costs in trading larger blocks of securities❝Trusts in the legal sense; controlled and monitored by trustees; who act as guardian of the assets on behalf of the beneficial owners ❝Investment decisions❝When an investor buys a stake in a unit trust, he/she purchases a new unit in the fund (unless matched with a seller by the fund manager)❝Open-ended fund where the size of the fund can varyaccording to the number of contributors to the fund ❝Price of each unit reflects current value of the fund divided by the number of outstanding units❝All sales and purchases of units are made with the trust manager.❝Do not trade on stock exchange.❝Dual pricing structure: offer price (investors buy units)and bid price (investors sell units back to the trust)❝Annual management fee (usually 0.5 -1% of the funds under management), plus the bid-offer spread on buying and selling units❝Limited in the amount that can be invested in any single security❝Total return for a mutual fund includes reinvestment dividends and capital gain.❝A cumulative total return measures the actual performance over 3, 5 or 10 years.❝In Jan 2009, 8,000 domestic mutual funds withassets of $9.4 trillion in the US.❝Short-term funds:-Money market mutual funds ❝Long-term funds: -Capital market funds;-Equity (stock) funds, Bond funds or Hybrid(balanced) funds (hold combination of stocks and bonds)-Index funds: mutual funds holding an managed portfolio of bonds or stocks designed to match particular market index, such as S&P 500. Has low expenses ratio.❝OEICs operate similarly to a unit trust in the sense that they are open-ended❝But an OEIC has a company structure and can be listed on the stock exchange ❝Shares will reflect the value of the fund ❝Shares will have a single price (rather than the separate buying and selling prices indicated for unit trusts)❝Companies whose business is the investment of funds in financial assets.❝A closed-end fund, only able to raise more funds through rights issue shares or borrowing (bonds) ❝Not a trust in the legal sense; limited liability company with listed shares (traded in stock market).❝Investors can purchase ordinary shares of the ITC ❝A portfolio, managed by ITC‟s board of directors who determine the investment strategy❝Not faced with outflow of funds, so investment strategy does not depend on maintaining cash flows to meet future liabilities❝The existence of borrowed funds in the capitalstructure implies a …gearing effect‟ on the value of the ITC shares❝Net asset value (NAV) per share is the value of assetsless debt divided by number of issued shares-E.g. ITC capital structure: £8m in equities (4m shares) + £2m debt. Thus the NAV per share = £2-If the value of ITC asset portfolio were to doubled to £20m, then the NAV per would increase to £4.5 (£18m/4m shares)-A 100% in the value of assets held has led to an increase in the NAV per share of 125%❝The gearing effect is of benefit to shareholders in a rising stock market.❝The hedge funds are largely unregulated❝Reputation is as risky funds, shrouded by mystery and only accessible to the wealthy.❝According to IFSL, the number of hedge funds increased from 4,000 with $324bn of assets in 1999 to peak of 11,000 with $2,150bn in 2007, and then declined to 10,000 hedge funds and $1,500bn by the start of 2009. ❝There is no unique definition of hedge fund since it is an industry term rather than a legal term❝“Includes a multitude of skill -based investment strategies with a broad range of risk and returnobjectives. A common element is the use of investment and risk management skills to seek positive returns regardless of market direction.”❝A hedge fund is an actively managed investment fund ❝Seeks an attractive …absolute return‟, a return whether the market go up or down.❝Do not follow any benchmark, but rather just try to generate high returns (larger than ordinary available return) while managing risks, by exploiting various market opportunities❝Typical strategies include -Short selling,-Borrowing, Leverage -Use of derivatives❝Fees include a fixed fee and management fee e.g. 1-2% of assets plus 20-25% of upside performance.Hedge fundsMutual funds and pension fundsInvestment trusts FreedomLimitation on borrowing, short selling, and the use of derivatives May borrow Limitations on short selling, and the use of derivatives❝Typical investors◦Wealthy individuals ◦Pension funds◦Other hedge funds, creating …funds of hedge funds‟ –diversity in strategy and risk❝Returns and risk can vary a great deal among the different hedge fund strategies❝Market neutral (or relative value arbitrage) funds ◦Attempt to produce returns that have no or low correlation with e.g. equity markets◦Highly quantitative portfolio construction◦Concentrate on the relative value of individual shares, bonds, currencies ...◦Commonly apply arbitrage strategies-e.g. exploit mispricing between an underlying asset and a derivative instrument-Concentrate on the difference in performance of two given securities in homogenous universe. E.g. belief that BP will do better than X in oil firm; go long on BP and short on X.-Take position with convertible bonds❝Long/short funds-Generally invest in equity and bonds, taking directional bets on individual security or sector-Analyse individual companies and individual shares-Micro investors (look at individual/specific stocks)-Some may specialize in geographical sectors -Others may specialize in either small or large companies -E.g. 130/30-Timing is crucial-Stock-picking skill (short selling overpriced stocks and buying underpriced stocks)-Not automatically market neutral e.g. could havestrong positive correlation with equityGlobal (macro) asset funds-Look at stocks, bonds, currencies, and commodities from a global point of view -Macro-investors (look at broad themes) -Have positive exposure to the market-A fund might go long in sectors they believe will provide good returns, and short on countries they believe will have negative returns❝Event driven funds-Looks to exploit special situations -Take over bids-Merger, Corporate restructuring❝A group of individuals set up a limited liabilitypartnership, might have a limited life of around 10 years.❝Make good returns by buying public companies or neglected subsidiaries at good price and turning them into more attractive business❝They will gear up with debt that a public company would not want to risk.❝Normally be turned into non-quoted company❝They get involved in the business, bringing their own expertise and give managers big incentives to improve the business❝They seek cut costs, squeeze suppliers and sell unwanted assets, sell and lease back property ❝Large amount of leverage involved❝They take their profit in a variety of ways:-Refloat the company-Sell the company to someone else in the same business -Refinancing❝The private equity market was boosted in the early 2000s.❝IFSL shows that the global private equity investment amounted to $176.6bn in 2000, this increased to $317.6bn in 2007, then hit by the credit crisis andfell to $189bn.❝In the UK, well-known firms that are or have been owned by private equity groups: Boots, Iceland, Debenhams, New Look, Kwik-Fit❝E.g. In Dec. 2003, a group of private equity firms-Texas Pacific, CVC and Merrill Lynch Global Private Equity-bough Debenhams for £1.7bn, of which £600m was their own capital.❝In two refinancing in 2004 and 2005, they reconstructed the balance sheet with new borrowings and paid themselves back £1.3bn(twice of their original capital) in about 18 months. ❝They refloated Debenhams in May 2006.Explain the different types of investment institution. Identify and analyse the factors that will influence the investment strategy applied by each type of institution.。

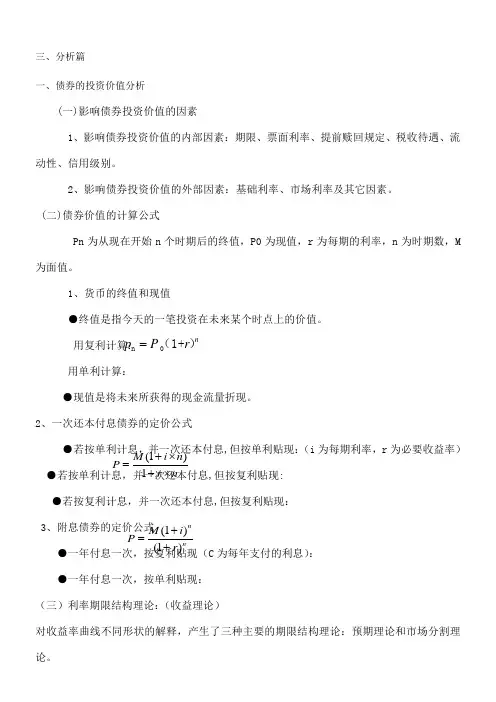

三、分析篇一、债券的投资价值分析(一)影响债券投资价值的因素1、影响债券投资价值的内部因素:期限、票面利率、提前赎回规定、税收待遇、流动性、信用级别。

2、影响债券投资价值的外部因素:基础利率、市场利率及其它因素。

(二)债券价值的计算公式Pn 为从现在开始n 个时期后的终值,P0为现值,r 为每期的利率,n 为时期数,M 为面值。

1、货币的终值和现值●终值是指今天的一笔投资在未来某个时点上的价值。

用复利计算: 用单利计算:●现值是将未来所获得的现金流量折现。

2、一次还本付息债券的定价公式●若按单利计息,并一次还本付息,但按单利贴现:(i 为每期利率,r 为必要收益率) ●若按单利计息,并一次还本付息,但按复利贴现: ●若按复利计息,并一次还本付息,但按复利贴现:3、附息债券的定价公式 ●一年付息一次,按复利贴现(C 为每年支付的利息): ●一年付息一次,按单利贴现:(三)利率期限结构理论:(收益理论)对收益率曲线不同形状的解释,产生了三种主要的期限结构理论:预期理论和市场分割理论。

n p P r =n 0(1+)(1)1M i n P r n +⨯=+⨯(1)(1)n n Mi P r +=+预期理论:认为对未来短期利率的预期可能影响到对未来远期利率的预期。

根据是否承认还有其他因素的影响,可以进一步划分为完全预期理论、流动性偏好理论和集中偏好理论。

②流动性偏好理论:根据流动性偏好理论,不同期限的债券之间存在一定的替代性,这意味着一种债券的预期收益确实可以影响不同期限债券的收益。

但是不同期限的债券并非是完全可替代的,因为投资者对不同期限的债券具有不同的偏好。

远期利率除了包括预期信息之外,还包括了风险因素,它可能是对流动性的补偿。

影响短期债券被扣除补偿的因素包括:不同期限债券的可获得程度及投资者对流动性的偏好程度。

在债券定价中,流动性偏好导致了价格的差别。

这一理论假定,大多数投资者偏好持有短期证券。

为了吸引投资者持有期限较长的债券,必须向他们支付流动性补偿,而且流动性补偿随着时间的延长而增加,因此,实际观察到的收益率曲线总是要比预期假说所预计的高。

Investment InstitutionsWhat are Investment institutions? Contractual savings institutions -Insurance companies -Pension fundsInvestment intermediaries -Mutual funds / unit trusts -Investment trusts -Hedge funds-Private equity company❝Investment institution is a financial intermediary (company) engaged in investing in, and managing, a portfolio of securities on behalf of their shareholders. ❝Indirect investment in capital/money marketinstruments via an investment institution is the most popular way for individuals to invest surplus funds ❝In the UK, 50 –60% of equities and bonds are held and managed by investment institutions ❝Benefits: diversified portfolio, professional managements❝All investment companies charge a fee (annual expense ratio) to shareholders to pay for theoperating costs and the management fee.❝Depositary institutions◦Intermediaries with a significant proportion of their funds derived from customer deposits, e.g. Building societies. Short-term liabilities.❝Contractual savings institutions◦Typically acquire funds at periodic intervals on a contractual basis❝Investment intermediaries◦Collective investment funds, Finance companies,Investment banks, Securities firms❝Two major groups: Insurance companies and Pension funds ❝Long-term liabilities❝Liquidity of their assets is less important than for depositary institutions –they can predict with greater accuracy their future payments due to customers❝Hence, they can invest a greater proportion of funds in long-term securities (bonds,equities)❝Primary objective is to protect policyholders (firms and individuals) from adverse events ❝Receive premiums from policyholders and promise compensation if specified events occur❝Two main segments: general insurance and life insurance❝Protection against personal injury and liabilities such as accidents, theft and fire❝Usually over a fixed time period e.g. 1 year ❝Claims usually made soon after the event so liabilities are mostly short term❝Hence they hold a greater proportion of liquid assets than life insurers. Holding financial assets might be viewed as a byproduct of the business.❝Some authors (e.g. B&T) do not view this category as an investment intermediary❝Protects the policyholder in the event of death, illness or retirement; hence long-term liabilities❝Term assurance, Whole-of-life policy, Endowment policy, Annuities❝Term assurance: provides insurance cover, for specifiedperiod, against the risk of death. If the insured survivesthe specified period then no payment is made.❝Whole-of-life policy pays a capital sum on the death ofthe person assured, whenever that event occurs.❝Endowment policy pays a capital sum at the end ofsome specified term or earlier if the assured dies withinthe term.-The premium for Whole-of-life and endowment policieswill be higher than for term assurance.❝Annuities: A policyholder pay an initial lump sumwhich used by the insurance company to providean agreed income until death.-The insurance company immediately creates a fund❝Risk: certain sums are guaranteed to be paid in thefuture and these sums exceed the value of thepremiums over the life of the contract.❝Match the term structure of its assets and liabilities❝Invest in long-term assets e.g. bonds, equities andmortgages.❝Provide retirement income (in the form ofannuities) to employees covered by a pension plan❝Personal scheme and public (state) scheme❝Funded scheme and unfunded (pay-as-you-go)scheme❝Funded scheme: Receive contributions fromemployers and/or employees and invest thesefunds in assets, including equities and bonds.Returns from the investment are used to paybenefits to members of the scheme.❝Two main types of funded scheme: defined benefit(DB) and defined contribution (DC)❝DB: the sponsor agrees to pay members ofthe scheme a pension equal to apredetermined percentage of their finalsalary (average salary), subject to themember‟s years of service❝DC: the return on the investmentsdetermines pension benefits❝Occupational schemes where the sponsor isthe employer have historically been DB,while private pensions are DC❝Risk: benefits to be paid are not known with certainty;inflation complications as it increases the benefits to bepaid by fund.❝Benefit from tax deferral: in the UK, contributions arenot taxable, pensioner pays income tax❝Pension fund trustees will determine the overallinvestment strategy❝They will often decide what proportion of assets to beheld in different asset classes❝Asset mix will be influenced by the maturity of the fund❝Long-term liabilities hence long-term assets❝Index-linked bonds, Equities❝Investment companies are classified, depending on whether their own capitalisation (number of shares outstanding) is constantly changing or fixed:-Open-end : capitalisation constantly changing; new investors buy additional shares from the company and some existing shareholders sell their shares back to the company.-Closed-end : fixed capitalization; share traded onexchange.open-ended❝Mutual funds / unit trusts❝Open-ended investment companies OEICsClosed ended❝Investment trusts ❝Hedge funds❝Private equity company❝Pool resources from many individuals andcompanies and invest these in a range of assets ❝Provide opportunities for small investors to investin a diversified fund at low cost❝Take advantage of lower transaction costs in trading larger blocks of securities❝Trusts in the legal sense; controlled and monitored by trustees; who act as guardian of the assets on behalf of the beneficial owners ❝Investment decisions❝When an investor buys a stake in a unit trust, he/she purchases a new unit in the fund (unless matched with a seller by the fund manager)❝Open-ended fund where the size of the fund can varyaccording to the number of contributors to the fund ❝Price of each unit reflects current value of the fund divided by the number of outstanding units❝All sales and purchases of units are made with the trust manager.❝Do not trade on stock exchange.❝Dual pricing structure: offer price (investors buy units)and bid price (investors sell units back to the trust)❝Annual management fee (usually 0.5 -1% of the funds under management), plus the bid-offer spread on buying and selling units❝Limited in the amount that can be invested in any single security❝Total return for a mutual fund includes reinvestment dividends and capital gain.❝A cumulative total return measures the actual performance over 3, 5 or 10 years.❝In Jan 2009, 8,000 domestic mutual funds withassets of $9.4 trillion in the US.❝Short-term funds:-Money market mutual funds ❝Long-term funds: -Capital market funds;-Equity (stock) funds, Bond funds or Hybrid(balanced) funds (hold combination of stocks and bonds)-Index funds: mutual funds holding an managed portfolio of bonds or stocks designed to match particular market index, such as S&P 500. Has low expenses ratio.❝OEICs operate similarly to a unit trust in the sense that they are open-ended❝But an OEIC has a company structure and can be listed on the stock exchange ❝Shares will reflect the value of the fund ❝Shares will have a single price (rather than the separate buying and selling prices indicated for unit trusts)❝Companies whose business is the investment of funds in financial assets.❝A closed-end fund, only able to raise more funds through rights issue shares or borrowing (bonds) ❝Not a trust in the legal sense; limited liability company with listed shares (traded in stock market).❝Investors can purchase ordinary shares of the ITC ❝A portfolio, managed by ITC‟s board of directors who determine the investment strategy❝Not faced with outflow of funds, so investment strategy does not depend on maintaining cash flows to meet future liabilities❝The existence of borrowed funds in the capitalstructure implies a …gearing effect‟ on the value of the ITC shares❝Net asset value (NAV) per share is the value of assetsless debt divided by number of issued shares-E.g. ITC capital structure: £8m in equities (4m shares) + £2m debt. Thus the NAV per share = £2-If the value of ITC asset portfolio were to doubled to £20m, then the NAV per would increase to £4.5 (£18m/4m shares)-A 100% in the value of assets held has led to an increase in the NAV per share of 125%❝The gearing effect is of benefit to shareholders in a rising stock market.❝The hedge funds are largely unregulated❝Reputation is as risky funds, shrouded by mystery and only accessible to the wealthy.❝According to IFSL, the number of hedge funds increased from 4,000 with $324bn of assets in 1999 to peak of 11,000 with $2,150bn in 2007, and then declined to 10,000 hedge funds and $1,500bn by the start of 2009. ❝There is no unique definition of hedge fund since it is an industry term rather than a legal term❝“Includes a multitude of skill -based investment strategies with a broad range of risk and returnobjectives. A common element is the use of investment and risk management skills to seek positive returns regardless of market direction.”❝A hedge fund is an actively managed investment fund ❝Seeks an attractive …absolute return‟, a return whether the market go up or down.❝Do not follow any benchmark, but rather just try to generate high returns (larger than ordinary available return) while managing risks, by exploiting various market opportunities❝Typical strategies include -Short selling,-Borrowing, Leverage -Use of derivatives❝Fees include a fixed fee and management fee e.g. 1-2% of assets plus 20-25% of upside performance.Hedge fundsMutual funds and pension fundsInvestment trusts FreedomLimitation on borrowing, short selling, and the use of derivatives May borrow Limitations on short selling, and the use of derivatives❝Typical investors◦Wealthy individuals ◦Pension funds◦Other hedge funds, creating …funds of hedge funds‟ –diversity in strategy and risk❝Returns and risk can vary a great deal among the different hedge fund strategies❝Market neutral (or relative value arbitrage) funds ◦Attempt to produce returns that have no or low correlation with e.g. equity markets◦Highly quantitative portfolio construction◦Concentrate on the relative value of individual shares, bonds, currencies ...◦Commonly apply arbitrage strategies-e.g. exploit mispricing between an underlying asset and a derivative instrument-Concentrate on the difference in performance of two given securities in homogenous universe. E.g. belief that BP will do better than X in oil firm; go long on BP and short on X.-Take position with convertible bonds❝Long/short funds-Generally invest in equity and bonds, taking directional bets on individual security or sector-Analyse individual companies and individual shares-Micro investors (look at individual/specific stocks)-Some may specialize in geographical sectors -Others may specialize in either small or large companies -E.g. 130/30-Timing is crucial-Stock-picking skill (short selling overpriced stocks and buying underpriced stocks)-Not automatically market neutral e.g. could havestrong positive correlation with equityGlobal (macro) asset funds-Look at stocks, bonds, currencies, and commodities from a global point of view -Macro-investors (look at broad themes) -Have positive exposure to the market-A fund might go long in sectors they believe will provide good returns, and short on countries they believe will have negative returns❝Event driven funds-Looks to exploit special situations -Take over bids-Merger, Corporate restructuring❝A group of individuals set up a limited liabilitypartnership, might have a limited life of around 10 years.❝Make good returns by buying public companies or neglected subsidiaries at good price and turning them into more attractive business❝They will gear up with debt that a public company would not want to risk.❝Normally be turned into non-quoted company❝They get involved in the business, bringing their own expertise and give managers big incentives to improve the business❝They seek cut costs, squeeze suppliers and sell unwanted assets, sell and lease back property ❝Large amount of leverage involved❝They take their profit in a variety of ways:-Refloat the company-Sell the company to someone else in the same business -Refinancing❝The private equity market was boosted in the early 2000s.❝IFSL shows that the global private equity investment amounted to $176.6bn in 2000, this increased to $317.6bn in 2007, then hit by the credit crisis andfell to $189bn.❝In the UK, well-known firms that are or have been owned by private equity groups: Boots, Iceland, Debenhams, New Look, Kwik-Fit❝E.g. In Dec. 2003, a group of private equity firms-Texas Pacific, CVC and Merrill Lynch Global Private Equity-bough Debenhams for £1.7bn, of which £600m was their own capital.❝In two refinancing in 2004 and 2005, they reconstructed the balance sheet with new borrowings and paid themselves back £1.3bn(twice of their original capital) in about 18 months. ❝They refloated Debenhams in May 2006.Explain the different types of investment institution. Identify and analyse the factors that will influence the investment strategy applied by each type of institution.。

投资学(现代投资理论)前言我们先考虑如下三个问题1Finance是什么?2Finance金融体系内容是什么?3投资学(现代投资理论)是什么?Finance,在中文中有这么几个意思:理财(对个人、家庭、企业、公司)、财务(企业或公司)、金融(投融资机构:基金公司,银行等)、财政(国家)等意思所以把Finance仅仅翻译成金融是不恰当的。

有三本著名的金融财务杂志(1)JFE(Journal of Financial Economics)(2)JF(Journal of Finance这是美国金融学会的)(3)RFS(Reviews of Financial Studies)有三个国际性的证书考试:(1) CFA(Chartered Financial Analyst特许金融分析师:是证券投资与管理界的一种职业资格称号,由美国“特许金融分析师学院”(ICFA)发起成立,每年在全球范围内举行资格考试。

CFA 协会主办的CFA 课程和考试被认为全球投资专业里最为严格的考试,在投资知识、专业标准及道德操守方面制定了全球准则。

CFA特许状持有人可以向其客户、雇主和同事表明他已经修读了一套严谨的专业课程,知识涵盖了广泛的投资领域,并且承诺遵守最高的职业道德准则。

因此,CFA特许状被投资业看成一个“黄金标准”,投资者也希望找到那些持有CFA特许状的专业人士,因为这一资格被认为是投资业界中具有专业技能和职业操守的承诺。

)要上万美元的考试费。

特许金融分析师 (CFA)报考条件:大四学生及以上。

取得资格所需时间(平均):3-4 年。

取得资格所需费用(不含培训):RMB18,000。

国际认可程度:高,全球投资领域通行证。

国内认可程度:高,是高端金融领域“王牌”认证,目前12000 名考生,800-1000 名持证人,2007 年考生增长57%。

薪酬水平:对投资行业薪酬状况的调查表明,雇主愿意提供高额奖金给拥有CFA特许资格认证的投资专业人士。

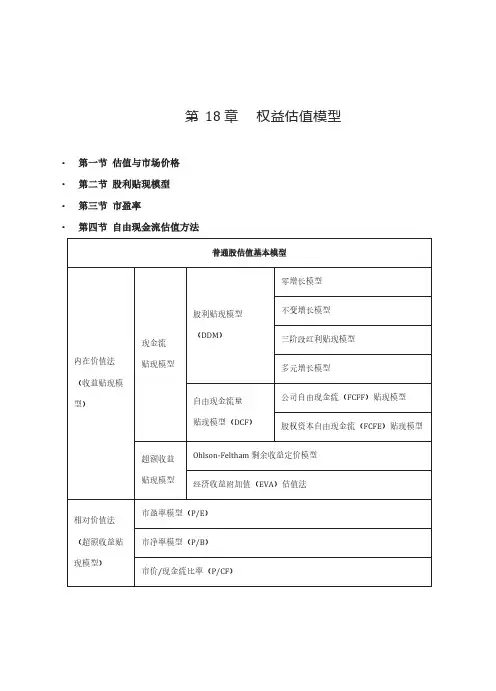

第18章权益估值模型•第一节估值与市场价格•第二节股利贴现模型•第三节市盈率•第四节自由现金流估值方法第一节 估值与市场价格一、比较估值1.公司的价值比率与行业平均水平相比较2.股价/销售收入这一比率对评估处于起步阶段的公司和行业很有用,因为他们通常还没有正的收益。

3.账面价值建立在历史成本之上,并不是真正的市场价值。

尽管这种情况不常见,但总有一些公司的市场价值小于其账面价值。

4.每股清算价值是股价“底线” 或最小值。

5.托宾q 值是市值与重置成本的比值。

二、内在价值与市场价格股票收益是由现金股利和资本利得或损失构成的。

期望收益率可能高于或低于基于股票风险的必要收益率。

[]1100()()Expected HPR= ()E D E P P E r P +-=• 资本资产定价模型可以用来估计必要收益率k:()f M f k r E r r β⎡⎤=+-⎣⎦ •如果股价定价是正确的,k 就等于期望收益率。

•市场对k 达成共识,则k 是市场资本化率。

•内在价值(IV) 是基于模型估计的真实价值。

•市场价格(MV) 是所有市场参与者达成共识的价格。

• 交易信号:IV > MV 购买 IV < MV 出售或卖空IV = MV 持有或公平的定价三、例子假设股票持有期1年,ABC股票预期每股红利E(D1)=4元,现价P0=48元,年底的预期价格E(P1)=52元,则投资者预期的持有期收益率为:E(r)={E(D1)+[E(P1)-P0]}/P0={4+[52-48]}/48=0.167或16.7%由CAPM模型,假定r f=6%,E(R M)-r f=5%, =1.2,则投资者对ABC股票的期望收益率为k=6%+1.2×5%=12%,这个收益率是投资者对具有相同风险投资所要求的收益率,即必要收益率。

由以上可知:预期收益率超出必要收益率4.7%,应增加更多的ABC股票判断股票是否被低估的另一方法是比较内在价值与市场价格:股票的每股内在价值(用V0表示)被定义为投资者从股票上所能得到的全部现金回报,包括红利和最终卖出股票的损益,是用正确反映了风险调整的利率k贴现所得的现值。

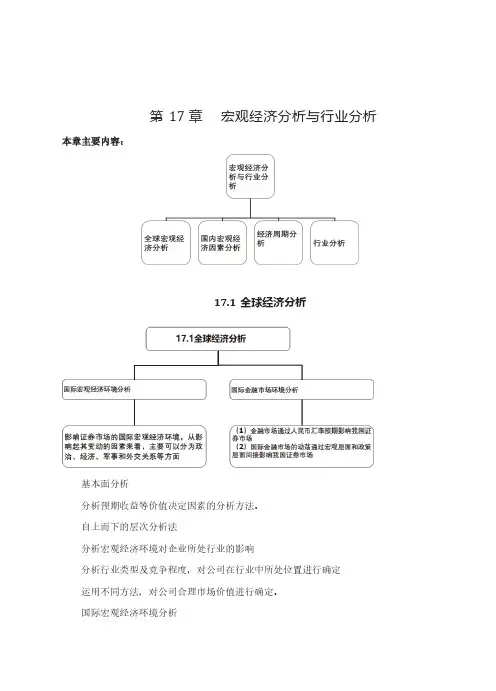

第17章宏观经济分析与行业分析本章主要内容:17.1全球经济分析基本面分析分析预期收益等价值决定因素的分析方法。

自上而下的层次分析法分析宏观经济环境对企业所处行业的影响分析行业类型及竞争程度,对公司在行业中所处位置进行确定运用不同方法,对公司合理市场价值进行确定。

国际宏观经济环境分析国际政治关系政治、经济、军事、外交国际经济关系全球或者区域经济增长、国际金融以及利率和汇率变动、股市波动、贸易关系等国际金融市场环境分析市场之间的流动(比如黄金市场低迷,股市)汇率影响证券实际升值,进口增加,出口减少,影响相应行业预期升值,人民币增加国际金融市场动荡,影响证券17.2.1国内宏观因素分析1.内生产总值( Gross Domestic Product)快速增长的GDP +结构合理表示该国经济正迅速扩张,经济结构趋于合理,上市公司有充足的机会来提高销售量,利润也会持续上升,从而使人们对经济形势产生良好的预期,增加了,人们投资的积极性,从而促进证券市场价格上扬;非均衡状态时,可能激发各种矛盾,从而导致经济衰退,进而证券市场价格就会下降。

2. 通货膨胀( Inflation )(1)高水平的通货膨胀会导致中央银行提高利率, 严控信贷规模, 从而导致股价下跌。

(2)通货膨胀使生产成本增加, 特别对于产品价格增加慢于成本增加的企业,经营状况恶化、盈利下降以至陷入亏损, 这些企业的股价将因此下降并拖累大市下跌。

(3)一部分产品价格上涨大于成本增加幅度的生产企业和相当一部分消费型商业企业会从价格上涨中获得利益, 一些资本密集型企业则会从资产增值中获得利益,其股价就会上涨。

(4)通货膨胀不但会产生经济影响, 还有可能产生社会影响, 从而影响人们的心理和预期, 进而对股价产生影响。

3.失业率( Unemployment rate )失业率是指正在寻找工作的劳动力占总劳动力(即包括正在工作和正积极寻找工作的劳动力) 的百分比。

第3章证券是如何交易的3.1公司如何发行证券①一级市场:公司通过发行债券或股票为投资项目募集资金,投资银行将新发行的证券推销给投资者的市场②二级市场:投资者交易已发行证券的市场一二级市场之间的关系:一级市场是基础,二级市场是一级市场的延续,一级市场为二级市场提供了可交易证券,二级市场为证券提供流动性,二级市场发展对一级市场具有促进作用③IPO(首次公开发行):公司初次采取公开方式将股票发行给公众,募集资金并使本公司股票可在二级市场自由交易(上市)④增发:已经上市的公司再次向投资者增加发行股票,募集资金的行为3.2证券如何交易3.2.1 市场类型①直接搜索市场买卖双方自我寻求交易对手,组织性最差,交易效率极低。

②经纪人市场经纪人利用自己掌握的信息,为买卖双方撮合交易,并从中收取费用。

③交易商市场交易商利用自我账户专注于某类资产的买入和卖出,获取差价收入。

④拍卖市场组织性最强的市场,所有交易都聚集在同一场所进行,相比交易商市场无需去需求最优交易价格,降低买卖差价。

3.2.2 交易指令的类型①市价委托指令是按当前市场价格立即执行的买入或卖出指令,成交迅速,按照对手最优价格即时成交卖方报价买方报价序号价格(元/股)数量(手)序号价格(元/股)数量(手)1 33.11 82 33.09 102 33.12 123 33.08 63 33.13 134 33.07 204 33.14 205 33.06 185 33.14 356 33.05 30②限价交易指令投资者严格设定希望买卖证券的价格,限价买入指令要求经纪人在股价降到或低于某一价格时买入一定量证券,限价卖出指令要求经纪人在股价升到或高于某一价格时卖出一定量证券。

③止损指令类似于限价指令,只有股票价格触及价格界限时指令才会被执行。

对卖出止损指令而言,只有股价跌到指定价格时才会卖出股票。

买入止损指令则是当股价上升到某价格时才会买入股票。

交易实例:判断成交情况卖方报价买方报价序号价格(元/股)数量(手)序号价格(元/股)数量(手)1 33.80 182 33.79 122 33.81 223 33.78 173 33.82 134 33.77 204 33.83 205 33.76 185 33.84 356 33.75 30A、买入指令33.80元/股,数量18手B、买入指令33.81元/股,数量18手C、卖出指令33.78元/股,数量20手33.79成交12手,33.78成交8手3.2.3 交易机制①交易商市场(场外交易市场OTC)②电子交易所自动撮合成交③专家做市商每种证券都被分配给一个专家做市商,同时报出买价和卖价,并在此价格下接受成交,为市场提供流动性,利润来自于买卖差价,但差价比较小。

投资学讲义第一章財務管理概論恐龍蛋遊戲軟體設計公司,前一陣子推出「水滸傳」網路遊戲軟體。

這個公司成立迄今已有三年,已推出四個頗受市場歡迎的遊戲軟體,公司預計本年度的營收將達2億元。

目前,這家公司資本額為2千萬元,此外,為了籌措營運所需資金,公司準備將自有的廠房及倉庫抵押給銀行以取得4千萬元擔保放款。

這家公司還計畫進一步將營業項目擴展到商用以及教育應用軟體的開發設計。

為因應這些擴充計劃,公司財務副總經理發現現有的資金籌措方式將不足以應付未來公司對資金的需求。

更嚴重的是,公司將立即面臨短期營運現金不足的問題。

這家公司所面臨的幾個問題也正是財務管理這門課所關注的課題:(1)這家公司的未來投資策略應是什麼?(即,這家公司為何要進入商用及教育應用軟體的開發與生產?)如何評估並選擇最佳的投資計劃?(即,錢怎麼投資?)(2)一旦選定投資計畫,公司如何籌措投資計畫所需的資金?(即,錢從那裡來?)(3)這家公司日常營運需要多少週轉金?(即,如何管理現金?)企業選擇最適的投資策略前,必須先確立企業的經營目標。

選定後,經營目標的達成須借助投資計畫的評估,選擇以及執行。

投資計畫的評估,選擇就是投資決策的範疇。

投資決策(或稱資本預算決策,capital budgeting decisions),就是將公司資本支出預算用於購置公司營運所需的固定資產(如:廠房、機器設備)以及無形資產(如:商譽、商標及專利權),而公司經營目標就是追求所購置的資產創造最大的價值且必須大於資本支出。

亦即,若企業投資決策的目標是追求所購置的資產所創造的淨價值最大,則企業經營績效勢必取決於各項投資計畫能為股東創造多少的價值?故企業營運最終的目標就應是追求企業所有人所增加的財富極大。

1. 何謂財務管理?假設朱一決定自行創業成立公司生產CPU專用的散熱風扇。

公司設立前,朱一必須聘請會計、財務以及採購管理人員負責採購生產原物料以及財務、人事管理,找到合適的廠房、機器設備,並招募到足夠的工人從事生產。

依財務管理的用語,朱一這些決策已涉及了廠房、機器設備的購置或租賃、存貨以及人力資源管理與運用等投資行為。

這些投資所需支出等於公司應籌措的金額。

假如CPU 散熱專用風扇的銷售狀況如事前的預期,扣除各項成本支出後,所剩餘的就是公司投資所創造的價值。

當初朱一所以願意成立公司生產CPU散熱用風扇,無非就是預期到這些投資的活動能為朱一及公司其他股東在未來創造最大的價值。

購買廠房、機器、土地或累積存貨或保有現金等於公司資產的增加,這些資產投入公司與營運會為公司未來各期創造收益,這些收益若大於購置資產的支出,就表示投資計畫是值得的。

由於未來的收益分屬不同期間,如何將這些收益轉換為同一單位來衡量是評估投資計畫的首要步驟。

也就是說,財務管理第一要處理就是時間要素,如此才能給何謂「價值」找答案!為籌措執行投資計劃所需的資金,朱一可借款或發行債券或發行新股,此屬於融資決策(financing decisions)範疇。

一旦決定籌措資金方式將會改變公司負債及股東權益的大小與結構比重。

2. 公司資產負債表模型由前節的例子可以看出,財務管理的重點可分為三部份:應取得哪些資產(投資決策),以何種籌資方式來取得資產(融資政策),如何適當營運管理,為股東創造最大價值(或利益),如何分配這些利益(股利政策)。

由於投資與籌措資金的決策都會造成資產、負債與股東權益的變化,而公司的資產負債表正是提供一個表現財務管理績效重要資訊來源。

任何時點上,公司資產必須和負債及股東權益總值相等,此為資產負債表最基本的概念。

公司的資產負債表左邊所列的是在某一特定時點上,公司擁有的各項資產,包括固定資產(fixed assets),屬長期性的資產,如廠房及機器設備是有形的固定資產,另一些則是無形資產,如:專利權、商標、商譽以及經營團隊的品質。

除固定資產與無形資產之外,另一個重要的資產項目就是流動資產(current asset),屬於短期性資產,如:現金、應收帳款及存貨。

公司一旦決定投資計劃後,接下來的工作就是籌措執行這個投資計畫所需的資金。

籌資方式則表現在資產負債表的右邊。

資產負債表右邊主要的項目有負債(debt)以及股東權益(sha reholders’ equity)。

如同資產一般,負債亦可區分為流動負債(current debt),如:應付帳款及一年期以下的貸款或負債以及長期負債(long-term debt)。

而股東權益則是資產價值扣除負債總額的殘值,當資產價值大於負債總額時,股東權益才是正數,這也是為何股東權益屬於股東對公司資產的殘餘價值(資產價值扣除負債)的請求權。

一個典型的資產負債表可表現如下:資產負債流動資產流動負債現金、應收帳款、存貨應付帳款固定資產長期負債廠房、土地、機器設備無形資產股東權益商標、專利、商譽資產負債表可刻劃出財務管理所關注的四大決策:(1)資本預算決策:公司應投資多少?購置何種固定資產?這個問題涉及資產負債表左邊所呈現的價值大小及內涵。

資產面所表現的當然和公司營運與投資有關。

在投資、融資、股利及現金管理四大決策中,投資決策是最重要的一項。

投資決策就是公司有限資源用於最有競爭力途徑上,以創造最大的公司價值,財務管理就是提供一個清楚的概念以及完善的架構,使財務管理人能夠做出正確的決策。

依財務管理的用語,資本預算決策(或稱為投資決策),將決定一家公司的資本支出規模以及所持有的資產組合及內涵。

(2)財務決策:公司如何籌措資本預算所需的資金?這個問題涉及資本負債表右邊的變動。

亦即,財務決策會影響公司的資本結構。

資本結構簡單的說就是反映過去資本預算支出所需資金有多少籌自於發行新股而有多少籌自於發行債券。

(3)股利政策:公司如何將投資與營運所創造的收益分配給股東?有多少盈餘要以股利方式發放給股東,又有多少要保留在公司。

發放愈多給股東固可滿足股東對現金回饋的要求,但亦會稅負增加的缺點;另一方面,保留盈餘減少會讓公司成長速度變慢。

兩者之間如何取得平衡點是股利政策的核心。

(3)現金管理:短期營運資金如何管理?營運過程中,由於營運現金流入與營運現金流出的金額大小及時點經常不一致,致時而產生不確定性。

財務管理人員第三個主要課題就是對現金流入與流出金額差距以及時點不一致性做最適的管理。

依會計用語,流動資產與流動負債的差距即為:淨營運資本(net working capital)≣流動資產- 流動負債淨營運資本的變動則反映短期營運資金管理的績效。

3. 有價證券與金融市場籌措投資計畫所需的資本支出的管道很多;其中最重要的方式就是由公司發行有價證券(securities)。

這些有價證券亦稱為財務工具(financial instruments),其價值則決定於發行公司投資與營運所創造出來的價值以及分配方式。

一般而言,公司最常用的財務工具為股東權益(equity)和負債(debt)(或稱為股票(stocks)和債券(bonds))。

這兩種財務工具最主要的差異在於這兩種財務工具投資報酬與公司價值間的關係,這兩種金融性資產的差異更是現代財務管理最基本的差別。

財務管理人員必須了解這兩種財務工具的價值如何決定,以及和公司價值間的關係。

如此,才能預估公司發行有價證券所能籌得的資金,也才會知道應何時發行。

股票及債券兩者最大的差異在哪裡?債券最基本的特質在於它是一種在事先確定的時點上對債券持有者給付一定金額的承諾(此即所謂契約),除非債券發行者在給付日時缺乏足夠現金履行此項承諾(此時,債券發行的公司就處於破產狀態),不然,其承諾金額不受契約條件以外的因素改變所影響。

而股東權益則是公司兌現所應支付的承諾後,若仍有剩餘價值,股東對這些殘餘價值的請求權(residual claims)。

現以下圖說明兩者差異:F0 F X)股東的給付由上圖可知,若公司因投資與營運所創造的價值(X)大於公司對債券持有人的承諾(F)(X≧F),其中F為債券持有人應得的給付,而X-F則為股東所得的部分。

當X<F 時,X為債券持有者實得的給付,此時,股東所得的部分為0。

由此可知,債券和股票的價值皆取決於公司投資、經營所創造的價值,但決定方式則大不相同。

債券和股票雖皆屬於或有型請求權(contingent claim)的有價證券,但或有關係則大不相同。

由於企業最主要的籌資管道來自於發行有價證券(股票及債券),有價證券交易的場所稱之為金融市場(financial market),金融市場依交易標的不同分為貨幣市場(money market)以及資本市場(capital market),一個優秀的財務管理人員必須對資本市場及貨幣市場的制度與運作有充分了解。

如此,才能充分運用資本市場及貨幣市場為企業籌集營運及投資所需資金。

4. 資本結構與股利政策資本預算決策將影響到公司資產價值與內涵。

若我們將公司投資與營運所創造的價值想成一個派餅(pie),一個公司資本預算決策愈正確且執行愈有績效,所產生的派餅就愈大。

另一方面,執行這些資本預算需要有足夠的資金以支應必須的資本支出,公司籌資的方式就決定未來的派餅如何切分。

參予切分派餅有兩種人:公司所發行各種債券的持有人稱為公司債權人,而股票的持有人稱為公司股東。

公司過去各項投資計劃的籌資方式決定了公司的資本結構(capital structure)。

舉例說,若公司改變某一投資計畫籌措資本支出的方式,改以發行較多的債券以及較少的股票,此項決定將改變公司的資本結構。

由於前節資產負債表左右兩邊的金額必須相等可知:V = B + E,式中V是公司的資產價值,此決定於公司的資本預算的決策與執行績效,B為負債總值,而E表示股東權益的價值。

資本結構可用於B/ E的比率表現。

在上面例子中,該特定計劃的籌措方式會讓B/ E比率下降。

股利發放水準以及發放方式決定公司資本結構。

所以,一個完整的財務決策必須將股利政策(dividend policy)納入考量。

股利政策包括現金股利、股票股利的發放和庫藏股的買回。

股利發放水準同時還影響到公司保留盈餘的金額。

如果公司或廠商保留大部分的稅後盈餘,此固然讓股東所取得的股利減少;保留盈餘增加,公司在籌措資本支出財源時,依賴外來資金的程度會降低,由於兩者之間存在抵換(trade-off)關係,因此公司或廠商的財務管理人員必須決定股利發放水準以及方式。

5. 財務管理人員的角色。