Auditing Quality, Auditor Tenure, Client Importance, and

- 格式:pdf

- 大小:53.40 KB

- 文档页数:20

audit risk归纳总结Audit Risk是指在进行审计工作时可能面临的各种风险和挑战。

它是审计师在开展工作时需要关注和评估的重要因素,直接影响着审计结果的准确性和可靠性。

为了更好地理解和应对Audit Risk,本文将对其进行归纳总结。

一、Audit Risk概述Audit Risk包括三个基本要素:固有风险(Inherent Risk)、控制风险(Control Risk)和检测风险(Detection Risk)。

这些风险互相作用,共同决定了审计风险的程度和审计程序的设计。

审计师需要综合考虑这些风险因素,以保证审计工作的有效性和可靠性。

二、固有风险固有风险是指与被审计对象本身相关的风险。

它由经营环境、行业特征、财务报表性质等多种因素引起。

固有风险越高,表示被审计对象的财务报表越容易出现错误或欺诈。

审计师需要充分了解被审计对象的业务性质和特点,评估其固有风险程度,并相应调整审计程序和资源的分配。

三、控制风险控制风险是指由于内部控制的不足或弱点而导致的错误或欺诈的可能性。

内部控制是组织为了保护公司利益和财务报表准确性而建立和执行的一系列措施和程序。

审计师需要对被审计对象的内部控制环境进行评估,确定其有效性和可靠性,并根据评估结果决定是否依赖于内部控制,以及相应的审计程序是否需要加强。

四、检测风险检测风险是指由于审计程序的选择和执行不当而导致未能检测到错误或欺诈的可能性。

审计师需要根据固有风险和控制风险的评估结果,设计和实施相应的审计程序,以减少检测风险的发生。

同时,审计师还需要对审计程序的有效性和适用性进行监控和评估,确保其能够充分揭示被审计对象的错误或欺诈行为。

五、应对Audit Risk的策略为了应对Audit Risk,审计师可以采取以下策略:1. 充分了解被审计对象的业务性质和特点,准确评估其固有风险;2. 对被审计对象的内部控制环境进行全面评估,确定其有效性和可靠性;3. 基于固有风险和控制风险的评估结果,设计和执行适当的审计程序;4. 监控和评估审计程序的有效性和适用性,及时调整并采取必要的措施;5. 实施全面的审计工作文件审查和质量控制,确保审计工作的准确性和可靠性;6. 与被审计对象保持积极沟通和合作,及时解决问题和疑虑,提高审计工作的效率和质量。

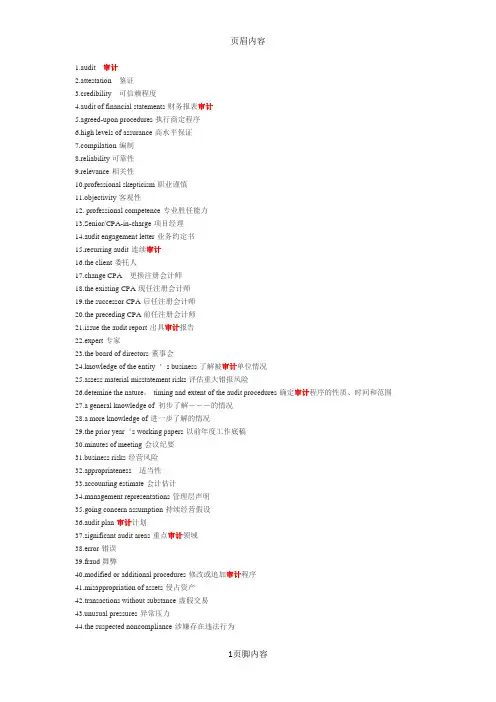

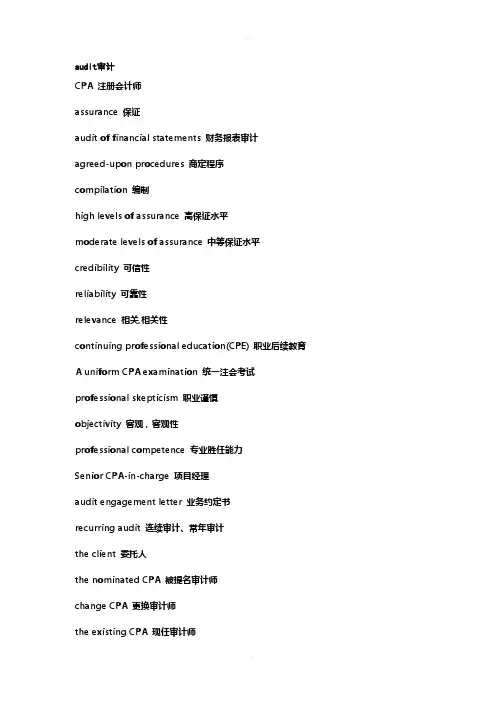

1.audit 审计2.attestation 鉴证3.credibility 可信赖程度4.audit of financial statements财务报表审计5.agreed-upon procedures执行商定程序6.high levels of assurance高水平保证pilation编制8.reliability可靠性9.relevance相关性10.professional skepticism职业谨慎11.objectivity客观性12. professional competence专业胜任能力13.Senior/CPA-in-charge项目经理14.audit engagement letter业务约定书15.recurring audit连续审计16.the client委托人17.change CPA更换注册会计师18.the existing CPA现任注册会计师19.the successor CPA后任注册会计师20.the preceding CPA前任注册会计师21.issue the audit report出具审计报告22.expert专家23.the board of directors董事会24.knowledge of the entity‘s business了解被审计单位情况25.assess material misstatement risks评估重大错报风险26.detemine the nature,timing and extent of the audit procedures确定审计程序的性质、时间和范围27.a general knowledge of 初步了解―――的情况28.a more knowledge of进一步了解的情况29.the prior year‘s working papers以前年度工作底稿30.minutes of meeting会议纪要31.business risks经营风险32.appropriateness适当性33.accounting estimate会计估计34.management representations管理层声明35.going concern assumption持续经营假设36.audit plan审计计划37.significant audit areas重点审计领域38.error错误39.fraud舞弊40.modified or additional procedures修改或追加审计程序41.misappropriation of assets侵占资产42.transactions without substance虚假交易43.unusual pressures异常压力44.the suspected noncompliance涉嫌存在违法行为45.materialiy重要性46.exceed the materiality level超过重要性水平47.approach the materiality level接近重要性水平48.an acceptably low level可接受水平49.the overall financial statement level and in related account balances and transaction levels财务报表层和相关账户、交易层50.misstatements or omissions错报或漏报51.aggregate总计52.subsequent events期后事项53.adjust the financial statements调整财务报表54.perform additional audit procedures实施追加的审计程序55.audit risk审计风险56.detection risk检查风险57.inappropriate audit opinion不适当的审计意见58.material misstatement重大的错报59.tolerable misstatement可容忍错报60.the acceptable level of detection risk可接受的检查风险61.assessed levelof material misstatement risk重大错报风险的评估水平62.simallbusiness小规模企业63.accountingsystem会计系统64.testof control控制测试65.walk-throughtest穿行测试munication沟通67.flowchart流程图68.reperformanceof internal control重新执行69.auditevidence审计证据70.substantiveprocedures实质性程序71.assertions认定72.esistence存在73.occurrence发生pleteness完整性75.rightsand obligations权利和义务76.valuationand allocation计价和分摊77.cutoff截止78.accuracy准确性79.classification分类80.inspection检查81.supervisionof counting监盘82.observation观察83.confirmation函证putation计算85.analyticalprocedures分析程序86.vouch核对87.trace追查88.auditsampling审计抽样89.error误差90.expectederror预期误差91.population总体92.samplingrisk抽样风险93.non-sampling risk非抽样风险94.samplingunit抽样单位95.statisticalsampling统计抽样96.tolerableerror可容忍误差97.therisk of under reliance信赖不足风险98.therisk of over reliance信赖过度风险99.therisk of incorrect rejection误拒风险100.the risk of incorrect acceptance误受风险101.workingtrial balance试算平衡表102.indexand cross-referencing索引和交叉索引103.cashreceipt现金收入104.cashdisbursement现金支出105.bankstatement银行对账单106.bankreconciliation银行存款余额调节表107.balancesheet date资产负债表日realizable value可变现净值109.storeroom仓库110.saleinvoice销售发票111.pricelist价目表112.positiveconfirmation request积极式询证函113.negativeconfirmation request消极式询证函114.purchaserequisition请购单115.receivingreport验收报告116.grossmargin毛利117.manufacturingoverhead制造费用118.materialrequisition领料单119.inventory-taking存货盘点120.bondcertificate债券121.stockcertificate股票122.auditreport审计报告123.entity被审计单位124.addresseeof the audit report审计报告的收件人125.unqualifiedopinion无保留意见126.qualifiedopinion保留意见127.disclaimerof opinion无法表示意见128.adverseopinion否定意见1 ability to perform the work 能力履行工作2 acceptance procedures 承兑程序过程3 accountability 经管责任,问责性4 accounting estimate 会计估计5 accounts receivable listing 应收帐款挂牌6 accounts receivable 应收账款7 accruals listing 应计项目挂牌8 accruals 应计项目9 accuracy 准确性10 adverse opinion 否定意见11 aged analysis 年老的分析(法,学)研究12 agents 代理人13 agreed-upon procedures 约定审查业务14 analysis of errors 错误的分析(法,学)研究15 anomalous error 反常的错误16 appointment ethics 任命伦理学17 appointment 任命18 associated firms 联合的坚挺19 association of chartered certified accounts(ACCA)特计的证(经执业的结社(ACCA)20 assurance engagement 保证债务21 assurance 保证22 audit审计,审核,核数23 audit acceptance 审计承兑24 audit approach 审计靠近25 audit committee审计委员会,审计小组26 ahudit engagement审计业务约定书27 audit evaluation 审计评价28 audit evidence审计证据29 audit plan审计计划30 audit program审计程序31 audit report as a means of communication 审计报告如一个通讯方法32 audit report 审计报告33 audit risk审计风险34 audit sampling审计抽样35 audit staffing审计工作人员36 audit timing 审计定时37 audit trail审计线索38 auditing standards审计准则39 auditors duty of care 审计(查帐)员的抚养责任40 auditors report审计报告41 authority attached to ISAs 代理权附上到国际砂糖协定42 automated working papers 自动化了工作文件43 bad debts 坏账44 bank 银行45 bank reconciliation 银行对账单,余额调节表46 beneficial interests 受益权47 best value 最好的价值48 business risk 经营风险49 cadbury committee cadbury 委员会50 cash count 现金盘点51 cash system 兑现系统52 changes in nature of engagement 改变债务的性质上53 charges and commitments 费用和评论54 charities 宽大55 tom walls tom 墙壁56 chronology of an audit 一审计的年代表57 CIS application controls CIS 申请控制58 CIS environments stand-alone microcomputers CIS 环境单机微型计算器59 client screening 委托人甄别60 closely connected 接近地连接61 clubs 俱乐部62 communications between auditors and management 通讯在审计(查帐)员和经营之间63 communications on internal control 内部控制上的通讯64 companies act 公司法65 comparative financial statements 比较财务报表66 comparatives 比较的67 competence 能力68 compilation engagement 编辑债务69 completeness 完整性70 completion of the audit审计的结束71 compliance with accounting regulations 符合~的作法会计规则72 computers assisted audit techniques (CAATs)计算器援助的审计技术(CAATs)73 confidence 信任74 confidentiality 保密性75 confirmation of accounts receivable 应收帐款的查证76 conflict of interest 利益冲突77 constructive obligation 建设的待付款78 contingent asset 或有资产79 contingent liability 或有负债80 control environment 控制环境81 control procedures 控制程序82 control risk 控制风险83 controversy 论战84 corporate governance 公司治理,公司管制85 corresponding figures 相应的计算86 cost of conversion 转换成本,加工成本87 cost 成本88 courtesy 优待89 creditors 债权人90 current audit files 本期审计档案91 database management system (DBMS)数据库管理制度(数据管理系统)92 date of report 报告的日期93 depreciation 折旧,贬值94 design of the sample 样品的设计95 detection risk 检查风险96 direct verification approach 直接核查法97 directional testing 方向的抽查98 directors emoluments 董事酬金99 directors serve contracts 董事服务合约100 disagreement with management 与经营的不一致101 disclaimer of opinion 拒绝表示意见102 distributions 分销,分派103 documentation of understanding and assessment of control risk 控制风险的协商和评定的文件编集 104 documenting the audit process 证明审计程序105 due care 应有关注106 due skill and care 到期的技能和谨慎107 economy 经济108 education 教育109 effectiveness 效用,效果110 efficiency 效益,效率111 eligibility / ineligibility 合格/ 无被选资格112 emphasis of matter 物质的强调113 engagement economics 债务经济学114 engagement letter 业务约定书115 error 差错116 evaluating of results of audit procedures 审计手序的结果评估117 examinations 检查118 existence 存在性119 expectations 期望差距120 expected error 预期的错误121 experience 经验122 expert 专家123 external audit 独立审计124 external review reports 外部的评论报告125 fair 公正126 fee negotiation 费谈判127 final assessment of control risk 控制风险的确定评定128 final audit 期末审计129 financial statement assertions 财政报告宣称130 financial 财务131 finished goods 产成品132 flowcharts 流程图133 fraud and error 舞弊134 fraud 欺诈135 fundamental principles 基本原理136 general CIS controls 一般的CIS 控制137 general reports to mangement 对(牛犬等的)疥癣的一般报告138 going concern assumption 持续经营假设139 going concern 持续经营140 goods on sale or return 货物准许退货买卖141 goodwill 商誉142 governance 统治143 greenbury committee greenbury 委员会144 guidance for internal auditors 指导为内部审计员145 hampel committee hampel 委员会146 haphazard selection 随意选择147 hospitality 款待148 human resources 人力资源149 IAPS 1000 inter-bank confirmation procedures IAPS 1000 在中间- 银行查证程序过程150 IAPS 1001 CIS environments-stand-alone microcomputers IAPS 1001 CIS 环境-单机微型计算器151 IAPS 1002 CIS environments-on-line computer systems IAPS 1002 CIS 环境-(与主机)联机计算器系统 152 IAPS 1003 CIS environments-database systems IAPS 1003 CIS 环境- 数据库系统153 IAPS 1005 the special considerations in the audit of small entities 在小的个体审计中的IAPS 1005 特别的考虑154 IAS 2 inventories 信息家电2 库存155 IAS 10 events after the balance sheet date 在平衡sheeet 日期後面的信息家电10 事件156 IFACs code of ethics for professional accountants IFACs 道德准则为职业会计师157 income tax 所得税158 incoming auditors 收入审计(查帐)员159 independent estimate 独立的估计160 ineligible for appointment 无被选资格的为任命161 information technology 信息技术162 inherent risk 固有风险163 initial communication 签署通讯164 insurance 保险165 intangibles 无形166 integrity 完整性167 interim audit 中期审计168 internal auditing 内部审计169 internal auditors 内部审计师170 internal control evaluation questionnaires (ICEQs)内部控制评价调查表171 internal control questionnaires (ICQs)内部控制调查表172 internal control system 内部控制系统173 internal review assignment 内部的评论转让174 international audit and assurance standards board (IAASB)国际的审计和保证标准登船(IAASB) 175 international auditing practice statements (IAPSs)国际的审计实务声明(IAPSs)176 international federation of accountants (IFAC)国际会计师联合会(IFAC)177 inventory system 盘存制度178 inventory valuation 存货估价179 ISA 230 documentation 文件编制180 ISA 240 fraud and error 国际砂糖协定240 欺诈和错误181 ISA 250 consideration of law and regulations 法和规则的国际砂糖协定250 考虑182 Isa 260 communications of audit matters with those charge governance审计物质的国际砂糖协定260 通讯由于那些索价统治183 isa 300 planning isa 300 计划编制184 isa 310 knowledge of the business 企业的isa 310 知识185 isa 320 audit materiality审计重要性186 isa 400 accounting and internal control isa 400 会计和内部控制187 isa 402 audit considerations relating to entities using service organisations 与正在使用的个体有关的isa 402个审计考虑服务组织188 isa 500 audit evidence审计证据189 isa 501 audit evidence-additional considerations for specific items isa 501个审计证据- 补偿为特殊条款 190 isa 510 external confirmations isa 510个外部的查证191 isa 520 analytical procedures 分析性程序192 isa 530 audit sampling审计抽样193 isa 540 audit of accounting estimates 解释估计的isa 540审计194 isa 560 subsequent events 期后事项195 isa 580 management representations 管理当局声明书196 isa 610 considering the work of internal auditing isa 610 以内部审计的工作看来197 isa 620 using the work of an expert isa 620 使用专家的工作198 isa 700 auditors report on financial statements 财务报表上的isa 700审计(查帐)员的报告199 isa 710 comparatives isa 710个比较的200 isa 720 other information in documents containing audited financial statements isa 720 证券包含audited 财务报表的其他信息201 isa 910 engagement to review financial statements isa 910 债务复阅财务报表202 isas and rss isas 和rss203 joint monitoring unit 连接检验单位204 knowledge of the entitys business 个体的企业知识205 law and regulations 法和规则206 legal and regulations 法定权利和规则207 legal obligation 法定义务,法定责任208 levels of assurance 保险程度,保障水平209 liability 负债210 limitation on scope审计范围限制211 limitation of audit 审计的提起诉讼的限期212 limitations of controls system 控制系统的提起诉讼的限期213 litigation and claims 诉讼和赔偿214 litigation 诉讼215 loans 借款,贷款216 long term liabilities 长期负债217 lowballing lowballing218 management 管理219 management integrity 经营完整220 management representation letter 管理当局声明书221 marketing 推销,营销,市场学222 material inconsistency 决定性的前后矛盾223 material misstatements of fact 重大误报224 materiality 重要性225 measurement 计量226 microcomputers 微型计算器227 modified reports 变更报告228 narrative notes 叙述证券229 nature 性质230 negative assurance 消极保证231 net realizable value 可实现净值232 non-current asset register 非本期的财产登记233 non-executive directors 非执行董事234 non-sampling risk 非抽样风险235 non-statutory audits 目标236 objectivity 客观性237 obligating event 负有责任事件238 obligatory disclosure 有拘束的揭示239 obtaining work 获得工作240 occurrence 出现241 on-line computer systems (与主机)联机计算器系统242 opening balances 期初余额243 operational audits 经营审计,作业审计244 operational work plans 操作上的工作计划245 opinion shopping 意见购物246 other information 其他的信息247 outsourcing internal audit 支援外包的内部核数248 overall review of financial statements 财务报表的包括一切的评论 249 overdue fees 超储未付费250 overhead absorption 管理费用分配251 periodic plan 定期的计划252 permanent audit files 永久审计档案253 personal relationships 个人的亲属关系254 planning 计划编制255 population 抽样总体256 precision 精密257 preface to ISAs and RSs 国际砂糖协定的序文和债券附卖回交易 258 preliminary assessment of control risk 控制风险的预备评定259 prepayments 预付款项260 presentation and disclosure 提示和揭示261 problems of accounting treatment 会计处理的问题262 procedural approach 程序上的靠近263 procedures 程序264 procedures after accepting nomination 程序过程在接受提名之后 265 procurement 采购266 professional duty of confidentiality 保密的职业责任267 projection of errors 错误的规划268 provision 备抵,准备269 public duty 公共职责270 public interest 公众利益271 publicity 宣传272 purchase ledger 购货分类账273 purchases and expenses system 买和费用系统274 purchases cut-off 买截止275 put on enquiry 询价上的期货买卖276 qualified opinion 保留意见277 qualifying disclosure 合格揭示278 qualitative aspects of errors 错误的性质上的方面279 random selection 随机选择280 reasonable assurance 合理保证281 reassessing sampling risk 再评价抽样风险282 reliability 可靠性283 remuneration 报酬284 report to management 对经营的报告285 reporting 报告286 research and development costs 研究和开发成本287 reservation of title 保留288 reserves 准备,储备289 revenue and capital expenditure 岁入和资本支出290 review 评论291 review and capital expenditure 评论和资本支出292 review 评论293 review engagement 复阅债务294 rights 认股权295 rights and obligations 认股权和待付款296 rights to information 对信息的认股权297 risk and materiality 风险和重要性298 risk-based approach 以风险为基础的方式299 romalpa case romalpa 个案300 rotation of auditor appointments 审计(查帐)员任命的循环301 rules of professional conduct 职业道德守则302 sales cut-off 销售截止303 sales system 销售(货)制度304 sales tax 销售税,营业税305 sales 销售,销货306 sample size 样本量307 sampling risk 抽样风险308 sampling units 抽样单位309 schedule of unadjusted errors 未调整的错误表310 scope and objectives of internal audit 内部核数的范围和目标311 segregation of duties 职责划分312 service organization 服务组织313 significant fluctuations or unexpected relationships 可重视的(市价)波动或不能预料的亲属关系314 small entity 小的个体315 smaller entities 比较小的个体316 sole traders 个体营业者317 sources of knowledge 知识的根源318 specimen letter on internal control 内部控制上的样本证书319 stakeholders 赌款保存人320 standardised working papers 标准化工作文件321 statement 1:integrity,objectivity and independence 声明1: 完整,客观性和独立322 statement 2:the professional duty of confidence 声明2: 信任的职业责任323 statement 3: advertising ,publicity and obtaining professional work 声明3: 广告法(学),宣传和获得专业性工作324 statement 5:changes in professional appointment 声明5: 在职业上的任命中的改变325 statistical sampling 统计抽样326 statutory audit 法定审计327 statutory books 法定卷册328 statutory duty 法定责任329 stewardship 总管的职务330 strategic plan 战略性计划331 stratification 分层332 subsequent events 期后事项333 substantive procedures 实词程序过程334 substantive tests 实质性测试335 sufficient appropriate audit evidence 充分的适当审计证据336 summarising errors summarising 错误337 sundry accruals 杂的应计项目338 supervision 监督339 supervisory and monitoring roles 监督的和检验角色340 suppliers statements 供应商的声明341 system and internal controls 系统和内部的控制342 systematic selection 系统选择法343 systems-based approach 以系统为基础的方式344 tangible non-current assets 有形的非流动资产345 tendering 投标,清偿346 terms of the engagement 债务的条件347 tests of control 控制的证人348 the AGM 周年大会349 the board 委员会350 three Es 三Es351 timing 定时352 tolerable error 可容忍误差353 trade accounts payable and purchases 贸易应付帐款和买 354 trade accounts payable listing 贸易应付帐款挂牌355 training 培训356 treasury 国库,库房357 TRUE 真实358 turnbull committee turnbull 委员会359 ultra vires 越权360 uncertainty 不确定性361 undue dependence 未到(支付)期的未决362 unqualified audit report 无条件的审计报告363 unqualified report 无条件的报告364 using the knowledge 使用知识365 using the work of an expert 使用专家的工作366 valuation 计价,估价367 value for money 现金(交易)价格368 voluntary disclosure 自愿披露369 wages and salaries 工资,薪金370 wages system 工资系统371 work in progress 在产品372 working papers 工作底稿。

AUDITOR-INDEPENDENCE–ITS IMPORTANCE TO THE EXTERNAL AUDITOR'S ROLE INBANKING REGULATION AND SUPERVISIONMarianne Ojo Oxford Brookes UniversityABSTRACTThe role of the external auditor in the supervisory process requires standards such as independence,objectivity and integrity to be achieved. Even though the regulator and external auditor perform similar functions,namely the verification of financial statements,they serve particular interests. The regulator works towards safeguarding financial stability and investor interests. On the other hand,the external auditor serves the private interests of the shareholders of a company. The financial audit remains an important aspect of corporate governance that makes management accountable to shareholders for its stewardship of a company. The external auditor may however,have a commercial interest too. The debate surrounding the role of external auditors focusses in particular on auditor independence. A survey by the magazine“Financial Director”shows that the fees derived from audit clients in terms of non-audit services are significant in comparison with fees generated through auditing. Accounting firms sometimes engage in a practice called“low balling” whereby they set audit fees at less than the market rate and make up for the deficit by providing non audit services. As a result,some audit firms have commercial interests to protect too. There is concern that the auditor's interests to protect shareholders of a company and his commercial interests do not conflict with each other. Sufficient measures need to be in place to ensure that the external auditor's independence is not affected. Brussels proposed a new directive for auditors to try to prevent further scandals such as those of Enron and Parmalat. The new directive states that all firms listed on the stock market must have independent audit committees which will recommend an auditor for shareholder approval. It also states that auditors or audit partners must berotated but does not mention the separation of auditors from consultancy work despite protests that there is a link to compromising the independence of auditors. However this may be because Brussels also shares the view that there is no evidence confirming correlation between levels of non-audit fees and audit failures and that as a result,sufficient safeguards are in place.Definitions of integrity,objectivity and independenceThe APB ethical standards govern issues relating to the integrity,objectivity and independence of auditors. Guidance on other ethical matters and statements of fundamental ethical principles governing the work of all professional accountants are issued by professional accountancy bodies.Integrity is a requirement for those acting in public interest and it is vital that auditors act and are seen to act with integrity. This requires not only honesty but a wide range of qualities such as fairness,candour,courage,intellectual honesty and confidentiality. Objectivity is a state of mind which excludes bias,prejudice and compromise and which gives fair and impartial consideration to all matters that are relevant to the present task,disregarding those that are not. Objectivity requires the auditor's judgement not to be affected by conflicts of interests and that he adopts a thorough approach preparing to disagree where necessary with the director's judgements. The necessity for objectivity arises due to the fact that many important issues involved in the preparation of financial statements do not relate to questions of fact but rather to questions of judgement.The concept of independence is not the easiest to define. Definitions include:“the conditional probability of reporting a discovered breach”by DeAngelo(1981a:186);the ability to resist client pressure(Knapp;1985);a function of character–with characteristics of integrity and trustworthiness being essential(Magill and Previts;1991);and an absence of interests that create an unacceptable risk of bias. The need for independence arises because in many cases,users of financial statements and other third parties do not have sufficient information to enable them judge whether the auditors are,in fact,objective. The reality and notion of auditor independence is vital to public confidence in financial reporting. Public confidence in financial markets and the conduct of public interest entities relies partly onthe credibility of the opinions and reports given by auditors in relation with financial audits.The role of the auditThe primary aim of the audit today is the verification of financial statements. The audit is an important part of the capital market framework as it not only reduces the cost of information exchange between managers and shareholders but also provides a signalling mechanism to the markets that the information which management is providing is reliable. The auditor provides independent verification on the financial statements of a company and as a result,the audit loses its value when such independence which gives credibility to the financial statements,is undermined. According to accounting literature,the traditional role of the audit was mainly the detection and prevention of fraud. The move to verification of financial statements arose from the growing investment in the railway,insurance and banking industry. Suggestions have been made that this situation occurred because in these particular industries,the shareholding was more dispersed and more priority given to financial performance rather than on management's honesty. Bank failures such as those of BCCI and Johnson Matthey resulted to a re-think of the objective of an audit to include the detection and prevention of fraud.The auditor's role and dutyThe first time that the role of the auditor was formally addressed in British banking regulation was when the right to communicate was introduced in the Banking Act 1987. Section 47 of the Banking Act 1987 gave the auditor the right to report any matters of prudential concern to the Bank of England. In its notice to auditors,the Bank's first example of circumstances to be reported is breach of the trigger capital ratio set by the Bank. As long as auditors had communicated in good faith,they were not considered to have breached any duty of confidentiality. Apart from a duty to communicate matters of concern immediately to prudential supervisors,the auditor was granted powers to furnish“special”reports under sections 39 and 41 of the Banking Act 1987.The Bingham Report on the BCCI affair proposed changing the auditor's right to communicate into a duty. The Board of Banking Supervision recommended extendingsection 39 reports to subsidiaries in foreign jurisdictions and to replace annual section 39 reports with a more flexible approach based on regulatees' changing circumstances. The relationship between supervisory authorities and the external auditors of a credit institution and the duties of these auditors was identified as an important lesson from the BCCI case. Because of auditors' access to financial undertakings' accounts and other essential material,they are in a position to play an important role in the overall supervisory process.An analysis of BCCI showed that measures,additional to those already existing,needed to be taken to eliminate (i)The opaqueness of financial structures and(ii)Strengthen co-operation between all bodies or persons involved in the supervision of such complex financial structures.As a result,the Basle Committee for Banking Supervision issued “minimum standards” which lay down rules for effective consolidated supervision and the co-operation of supervisory authorities. This was aimed at strengthening international co-operation between prudential supervisors and to improve transparency of financial and in particular, group and international structures.Apart from their ability to audit the capital adequacy ratio,bank regulators rely on the expertise of auditors in terms of the technology they possess. Until 1987,banking supervision relied mainly on prudential returns and other disclosures made voluntarily by the management of authorised institutions-however,this practice was open to abuse.The collapse of Johnson Matthey Bankers also drew attention to the possibility of auditors failing to conduct detailed inquiries about quality of bank loans,quality or effectiveness of internal controls and that accuracy of prudential returns could be totally unjustified. As a result of this,more detailed statutory arrangements were introduced,paving the way for a direct involvement of bank auditors in the supervisory process through their role as alternative bank examiners and the extension of auditor liability. Generally producers of consumables owe a “duty of care” to third parties. However it was held in Caparo Industries plc v Dickman and Others that generally,auditors only owe a duty of care”to the company as a legal person and that they do not owe a“duty of care”to any individual shareholder,creditor,pension scheme members or any other stakeholder.The government has been criticised for failing to give more protection to auditstakeholders as the regulating accounting bodies often campaign to demand liability and other concessions for auditing firms. It has also not fully considered why auditing firms would have any economic incentives to reflect on the negative consequences of their activities–especially in the absence of a“duty of care”.The Department of Trade and Industry,the DTI,having joint responsibility for regulating the UK auditing industry,has also been criticised for not having adequate staff to perform duties of examining unexpected corporate collapses and frauds. The inspectors it appoints to examine these collapses have been said to rarely examine the impact of organisational culture and values on audit failures. Prem Sikka adds that the threat of a punitive action by the DTI could create economic incentives for accounting firms to reflect on the consequences of there actions–as a reduction in their revenue,due to fines incurred,would make them think twice before indulging in acts with negative consequences. Since the Companies Act 1989,the accountancy bodies have formally been given powers to act as regulators of the UK auditing industry and Prem Sikka states that accounting bodies could call for changes to the legal and institutional structures in order to persuade auditing firms to revise values that influenced an audit.。

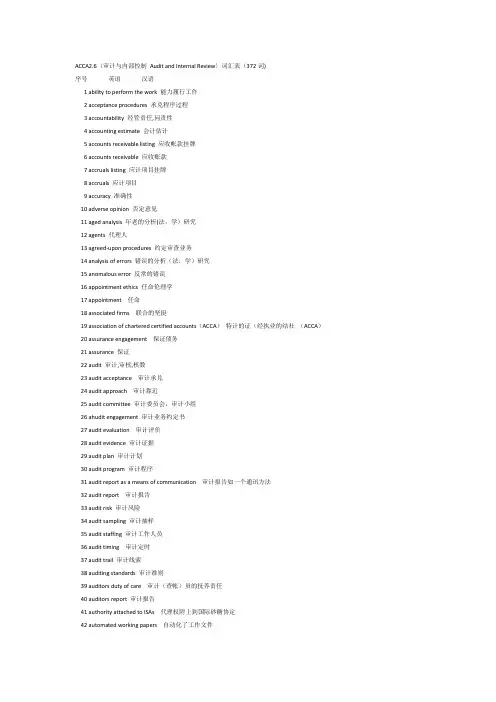

ACCA2.6〈审计与内部控制Audit and Internal Review〉词汇表(372词)序号英语汉语1 ability to perform the work 能力履行工作2 acceptance procedures 承兑程序过程3 accountability 经管责任,问责性4 accounting estimate 会计估计5 accounts receivable listing 应收帐款挂牌6 accounts receivable 应收账款7 accruals listing 应计项目挂牌8 accruals 应计项目9 accuracy 准确性10 adverse opinion 否定意见11 aged analysis 年老的分析(法,学)研究12 agents 代理人13 agreed-upon procedures 约定审查业务14 analysis of errors 错误的分析(法,学)研究15 anomalous error 反常的错误16 appointment ethics 任命伦理学17 appointment 任命18 associated firms 联合的坚挺19 association of chartered certified accounts(ACCA)特计的证(经执业的结社(ACCA)20 assurance engagement 保证债务21 assurance 保证22 audit 审计,审核,核数23 audit acceptance 审计承兑24 audit approach 审计靠近25 audit committee 审计委员会,审计小组26 ahudit engagement 审计业务约定书27 audit evaluation 审计评价28 audit evidence 审计证据29 audit plan 审计计划30 audit program 审计程序31 audit report as a means of communication 审计报告如一个通讯方法32 audit report 审计报告33 audit risk 审计风险34 audit sampling 审计抽样35 audit staffing 审计工作人员36 audit timing 审计定时37 audit trail 审计线索38 auditing standards 审计准则39 auditors duty of care 审计(查帐)员的抚养责任40 auditors report 审计报告41 authority attached to ISAs 代理权附上到国际砂糖协定42 automated working papers 自动化了工作文件43 bad debts 坏账44 bank 银行45 bank reconciliation 银行对账单,余额调节表46 beneficial interests 受益权47 best value 最好的价值48 business risk 经营风险49 cadbury committee cadbury 委员会50 cash count 现金盘点51 cash system 兑现系统52 changes in nature of engagement 改变债务的性质上53 charges and commitments 费用和评论54 charities 宽大55 tom walls tom 墙壁56 chronology of an audit 一审计的年代表57 CIS application controls CIS 申请控制58 CIS environments stand-alone microcomputers CIS 环境单机微型计算器59 client screening 委托人甄别60 closely connected 接近地连接61 clubs 俱乐部62 communications between auditors and management 通讯在审计(查帐)员和经营之间63 communications on internal control 内部控制上的通讯64 companies act 公司法65 comparative financial statements 比较财务报表66 comparatives 比较的67 competence 能力68 compilation engagement 编辑债务69 completeness 完整性70 completion of the audit 审计的结束71 compliance with accounting regulations 符合~的作法会计规则72 computers assisted audit techniques (CAATs)计算器援助的审计技术(CAATs)73 confidence 信任74 confidentiality 保密性75 confirmation of accounts receivable 应收帐款的查证76 conflict of interest 利益冲突77 constructive obligation 建设的待付款78 contingent asset 或有资产79 contingent liability 或有负债80 control environment 控制环境81 control procedures 控制程序82 control risk 控制风险83 controversy 论战84 corporate governance 公司治理,公司管制85 corresponding figures 相应的计算86 cost of conversion 转换成本,加工成本87 cost 成本88 courtesy 优待89 creditors 债权人90 current audit files 本期审计档案91 database management system (DBMS)数据库管理制度(数据管理系统)92 date of report 报告的日期93 depreciation 折旧,贬值94 design of the sample 样品的设计95 detection risk 检查风险96 direct verification approach 直接核查法97 directional testing 方向的抽查98 directors emoluments 董事酬金99 directors serve contracts 董事服务合约100 disagreement with management 与经营的不一致101 disclaimer of opinion 拒绝表示意见102 distributions 分销,分派103 documentation of understanding and assessment of control risk 控制风险的协商和评定的文件编集 104 documenting the audit process 证明审计程序105 due care 应有关注106 due skill and care 到期的技能和谨慎107 economy 经济108 education 教育109 effectiveness 效用,效果110 efficiency 效益,效率111 eligibility / ineligibility 合格/ 无被选资格112 emphasis of matter 物质的强调113 engagement economics 债务经济学114 engagement letter 业务约定书115 error 差错116 evaluating of results of audit procedures 审计手序的结果评估117 examinations 检查118 existence 存在性119 expectations 期望差距120 expected error 预期的错误121 experience 经验122 expert 专家123 external audit 独立审计124 external review reports 外部的评论报告125 fair 公正126 fee negotiation 费谈判127 final assessment of control risk 控制风险的确定评定128 final audit 期末审计129 financial statement assertions 财政报告宣称130 financial 财务131 finished goods 产成品132 flowcharts 流程图133 fraud and error 舞弊134 fraud 欺诈135 fundamental principles 基本原理136 general CIS controls 一般的CIS 控制137 general reports to mangement 对(牛犬等的)疥癣的一般报告138 going concern assumption 持续经营假设139 going concern 持续经营140 goods on sale or return 货物准许退货买卖141 goodwill 商誉142 governance 统治143 greenbury committee greenbury 委员会144 guidance for internal auditors 指导为内部审计员145 hampel committee hampel 委员会146 haphazard selection 随意选择147 hospitality 款待148 human resources 人力资源149 IAPS 1000 inter-bank confirmation procedures IAPS 1000 在中间—银行查证程序过程150 IAPS 1001 CIS environments-stand—alone microcomputers IAPS 1001 CIS 环境—单机微型计算器151 IAPS 1002 CIS environments-on—line computer systems IAPS 1002 CIS 环境—(与主机)联机计算器系统152 IAPS 1003 CIS environments-database systems IAPS 1003 CIS 环境—数据库系统153 IAPS 1005 the special considerations in the audit of small entities 在小的个体审计中的IAPS 1005 特别的考虑 154 IAS 2 inventories 信息家电2 库存155 IAS 10 events after the balance sheet date 在平衡sheeet 日期後面的信息家电10 事件156 IFACs code of ethics for professional accountants IFACs 道德准则为职业会计师157 income tax 所得税158 incoming auditors 收入审计(查帐)员159 independent estimate 独立的估计160 ineligible for appointment 无被选资格的为任命161 information technology 信息技术162 inherent risk 固有风险163 initial communication 签署通讯164 insurance 保险165 intangibles 无形166 integrity 完整性167 interim audit 中期审计168 internal auditing 内部审计169 internal auditors 内部审计师170 internal control evaluation questionnaires (ICEQs)内部控制评价调查表171 internal control questionnaires (ICQs)内部控制调查表172 internal control system 内部控制系统173 internal review assignment 内部的评论转让174 international audit and assurance standards board (IAASB)国际的审计和保证标准登船(IAASB)175 international auditing practice statements (IAPSs)国际的审计实务声明(IAPSs)176 international federation of accountants (IFAC)国际会计师联合会(IFAC)177 inventory system 盘存制度178 inventory valuation 存货估价179 ISA 230 documentation 文件编制180 ISA 240 fraud and error 国际砂糖协定240 欺诈和错误181 ISA 250 consideration of law and regulations 法和规则的国际砂糖协定250 考虑182 Isa 260 communications of audit matters with those charge governance 审计物质的国际砂糖协定260 通讯由于那些索价统治183 isa 300 planning isa 300 计划编制184 isa 310 knowledge of the business 企业的isa 310 知识185 isa 320 audit materiality 审计重要性186 isa 400 accounting and internal control isa 400 会计和内部控制187 isa 402 audit considerations relating to entities using service organisations 与正在使用的个体有关的isa 402个审计考虑服务组织188 isa 500 audit evidence 审计证据189 isa 501 audit evidence-additional considerations for specific items isa 501个审计证据—补偿为特殊条款190 isa 510 external confirmations isa 510个外部的查证191 isa 520 analytical procedures 分析性程序192 isa 530 audit sampling 审计抽样193 isa 540 audit of accounting estimates 解释估计的isa 540 审计194 isa 560 subsequent events 期后事项195 isa 580 management representations 管理当局声明书196 isa 610 considering the work of internal auditing isa 610 以内部审计的工作看来197 isa 620 using the work of an expert isa 620 使用专家的工作198 isa 700 auditors report on financial statements 财务报表上的isa 700 审计(查帐)员的报告199 isa 710 comparatives isa 710个比较的200 isa 720 other information in documents containing audited financial statements isa 720 证券包含audited 财务报表的其他信息201 isa 910 engagement to review financial statements isa 910 债务复阅财务报表202 isas and rss isas 和rss203 joint monitoring unit 连接检验单位204 knowledge of the entitys business 个体的企业知识205 law and regulations 法和规则206 legal and regulations 法定权利和规则207 legal obligation 法定义务,法定责任208 levels of assurance 保险程度,保障水平209 liability 负债210 limitation on scope 审计范围限制211 limitation of audit 审计的提起诉讼的限期212 limitations of controls system 控制系统的提起诉讼的限期213 litigation and claims 诉讼和赔偿214 litigation 诉讼215 loans 借款,贷款216 long term liabilities 长期负债217 lowballing lowballing218 management 管理219 management integrity 经营完整220 management representation letter 管理当局声明书221 marketing 推销,营销,市场学222 material inconsistency 决定性的前后矛盾223 material misstatements of fact 重大误报224 materiality 重要性225 measurement 计量226 microcomputers 微型计算器227 modified reports 变更报告228 narrative notes 叙述证券229 nature 性质230 negative assurance 消极保证231 net realizable value 可实现净值232 non—current asset register 非本期的财产登记233 non-executive directors 非执行董事234 non—sampling risk 非抽样风险235 non-statutory audits 目标236 objectivity 客观性237 obligating event 负有责任事件238 obligatory disclosure 有拘束的揭示239 obtaining work 获得工作240 occurrence 出现241 on—line computer systems (与主机)联机计算器系统242 opening balances 期初余额243 operational audits 经营审计,作业审计244 operational work plans 操作上的工作计划245 opinion shopping 意见购物246 other information 其他的信息247 outsourcing internal audit 支援外包的内部核数248 overall review of financial statements 财务报表的包括一切的评论 249 overdue fees 超储未付费250 overhead absorption 管理费用分配251 periodic plan 定期的计划252 permanent audit files 永久审计档案253 personal relationships 个人的亲属关系254 planning 计划编制255 population 抽样总体256 precision 精密257 preface to ISAs and RSs 国际砂糖协定的序文和债券附卖回交易 258 preliminary assessment of control risk 控制风险的预备评定259 prepayments 预付款项260 presentation and disclosure 提示和揭示261 problems of accounting treatment 会计处理的问题262 procedural approach 程序上的靠近263 procedures 程序264 procedures after accepting nomination 程序过程在接受提名之后 265 procurement 采购266 professional duty of confidentiality 保密的职业责任267 projection of errors 错误的规划268 provision 备抵,准备269 public duty 公共职责270 public interest 公众利益271 publicity 宣传272 purchase ledger 购货分类账273 purchases and expenses system 买和费用系统274 purchases cut-off 买截止275 put on enquiry 询价上的期货买卖276 qualified opinion 保留意见277 qualifying disclosure 合格揭示278 qualitative aspects of errors 错误的性质上的方面279 random selection 随机选择280 reasonable assurance 合理保证281 reassessing sampling risk 再评价抽样风险282 reliability 可靠性283 remuneration 报酬284 report to management 对经营的报告285 reporting 报告286 research and development costs 研究和开发成本287 reservation of title 保留288 reserves 准备,储备289 revenue and capital expenditure 岁入和资本支出290 review 评论291 review and capital expenditure 评论和资本支出292 review 评论293 review engagement 复阅债务294 rights 认股权295 rights and obligations 认股权和待付款296 rights to information 对信息的认股权297 risk and materiality 风险和重要性298 risk—based approach 以风险为基础的方式299 romalpa case romalpa 个案300 rotation of auditor appointments 审计(查帐)员任命的循环301 rules of professional conduct 职业道德守则302 sales cut-off 销售截止303 sales system 销售(货)制度304 sales tax 销售税,营业税305 sales 销售,销货306 sample size 样本量307 sampling risk 抽样风险308 sampling units 抽样单位309 schedule of unadjusted errors 未调整的错误表310 scope and objectives of internal audit 内部核数的范围和目标311 segregation of duties 职责划分312 service organization 服务组织313 significant fluctuations or unexpected relationships 可重视的(市价)波动或不能预料的亲属关系314 small entity 小的个体315 smaller entities 比较小的个体316 sole traders 个体营业者317 sources of knowledge 知识的根源318 specimen letter on internal control 内部控制上的样本证书319 stakeholders 赌款保存人320 standardised working papers 标准化工作文件321 statement 1:integrity,objectivity and independence 声明1: 完整,客观性和独立322 statement 2:the professional duty of confidence 声明2: 信任的职业责任323 statement 3: advertising ,publicity and obtaining professional work 声明3: 广告法(学),宣传和获得专业性工作 324 statement 5:changes in professional appointment 声明5: 在职业上的任命中的改变325 statistical sampling 统计抽样326 statutory audit 法定审计327 statutory books 法定卷册328 statutory duty 法定责任329 stewardship 总管的职务330 strategic plan 战略性计划331 stratification 分层332 subsequent events 期后事项333 substantive procedures 实词程序过程334 substantive tests 实质性测试335 sufficient appropriate audit evidence 充分的适当审计证据336 summarising errors summarising 错误337 sundry accruals 杂的应计项目338 supervision 监督339 supervisory and monitoring roles 监督的和检验角色340 suppliers statements 供应商的声明341 system and internal controls 系统和内部的控制342 systematic selection 系统选择法343 systems—based approach 以系统为基础的方式344 tangible non—current assets 有形的非流动资产345 tendering 投标,清偿346 terms of the engagement 债务的条件347 tests of control 控制的证人348 the AGM 周年大会349 the board 委员会350 three Es 三Es351 timing 定时352 tolerable error 可容忍误差353 trade accounts payable and purchases 贸易应付帐款和买 354 trade accounts payable listing 贸易应付帐款挂牌355 training 培训356 treasury 国库,库房357 TRUE 真实358 turnbull committee turnbull 委员会359 ultra vires 越权360 uncertainty 不确定性361 undue dependence 未到(支付)期的未决362 unqualified audit report 无条件的审计报告363 unqualified report 无条件的报告364 using the knowledge 使用知识365 using the work of an expert 使用专家的工作366 valuation 计价,估价367 value for money 现金(交易)价格368 voluntary disclosure 自愿披露369 wages and salaries 工资,薪金370 wages system 工资系统371 work in progress 在产品372 working papers 工作底稿。

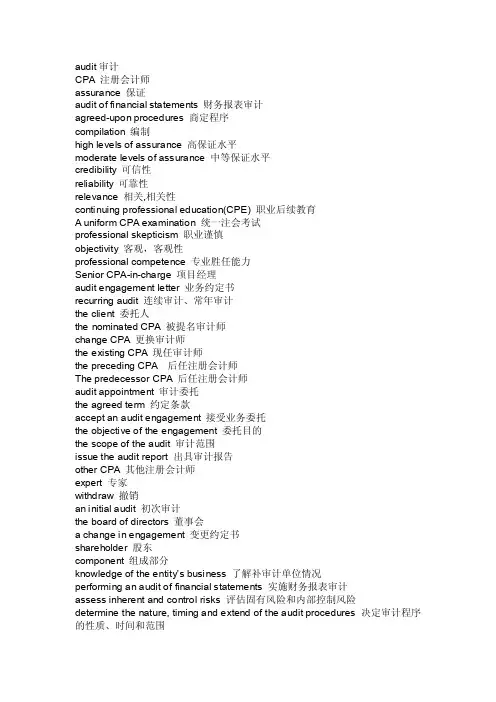

audit审计CPA 注册会计师assurance 保证audit of financial statements 财务报表审计agreed-upon procedures 商定程序compilation 编制high levels of assurance 高保证水平moderate levels of assurance 中等保证水平credibility 可信性reliability 可靠性relevance 相关,相关性continuing professional education(CPE) 职业后续教育A uniform CPA examination 统一注会考试professional skepticism 职业谨慎objectivity 客观,客观性professional competence 专业胜任能力Senior CPA-in-charge 项目经理audit engagement letter 业务约定书recurring audit 连续审计、常年审计the client 委托人the nominated CPA 被提名审计师change CPA 更换审计师the existing CPA 现任审计师the preceding CPA 后任注册会计师The predecessor CPA 后任注册会计师audit appointment 审计委托the agreed term 约定条款accept an audit engagement 接受业务委托the objective of the engagement 委托目的the scope of the audit 审计范围issue the audit report 出具审计报告other CPA 其他注册会计师expert 专家withdraw 撤销an initial audit 初次审计the board of directors 董事会a change in engagement 变更约定书shareholder 股东component 组成部分knowledge of the entity’s business 了解被审计单位情况performing an audit of financial statements 实施财务报表审计assess inherent and control risks 评估固有风险和内部控制风险determine the nature, timing and extend of the audit procedures 决定审计程序的性质、时间和范围a general knowledge of, 初步了解a preliminary knowledge of 初步了解a more particular knowledge of 进一步了解prior to accepting an engagement 接受业务委托之前following acceptance of the engagement 接受业务委托之后update and revaluate information gathered previously 更新并重新评价以前收集的信息the prior year’s working papers 以前年度工作底稿director 董事senior operating personnel 高级管理人员internal audit personnel 内部审计人员internal audit reports 内部审计报告minutes of meeting 会议纪要material sent to shareholders or filed with regulatory authorities 寄送股东或报送临管部门备案的资料interim financial reports 中期财务报告management policy manual 管理政策手册chart of accounts 会计科目表exercise professional judgment 做出专业判断business risks(of the client) 经营风险management response thereto管理当局的对策appropriateness 适当性accounting estimate 会计估计management representations 管理层声明related party 关联方related party transaction 关联方交易going concern assumption 持续经营假设audit plan 审计计划the overall audit plan 总体审计计划the detailed audit plan 具体审计计划efficient audit 审计效率the size of the entity 被审计单位的规模the complexity of the audit 审计的复杂性the specific methodology and technology 具体的方法和技术financial performance 财务业绩material misstatement 重大遗漏significant audit areas 重点审计领域coordination 协调review 复核statutory responsibility 法定责任time budget 时间预算error 错误fraud 舞弊modified or additional procedure 修改或追加审计程序plan and perform audit procedure 计划和实施审计程序adequate accounting and internal control system 适当的会计和内部控制系统reduce but not eliminate 减少但不能消除manipulation 篡改falsification 伪造alteration of records or documents 更改文件或凭证misappropriation of assets 侵占资产transactions without substance 虚构交易misapplication of accounting policies 滥用会计政策the underlying records 原始凭证oversight or misinterpretation 疏忽或误解unusual pressures 异常压力accounting policy alternative 会计政策变更unusual transactions 异常交易incomplete files 不完整文件out of balance control accounts 财户余额不平衡lack of proper authorization 缺乏恰当的授权computer information systems environment 计算机信息系统环境inherent limitations of audit test 审计测试的固有限制discuss with management 与管理层讨论the remedial action 纠正措施seek legal advice 寻求法律咨询laws and regulations 法律与规章noncompliance 没有遵守withdrawal from the engagement 解除业务约定senior management 高级管理层detect noncompliance laws and regulations 发现没有遵守法律与规章的行为deliberate failure to record transactions 故意漏记交易senior management override of control 高级管理层逾越控制intentional misrepresentations being made to the CPA 故意对CPA做出错误陈述written representation 管理层声明the suspected noncompliance 涉嫌存在违法行为audit committee 审计委员会supervisory board 监事会regulatory and enforcement authorities 监管和执法机构materiality 重要性exceed the materiality level 超过重要性水平approach the materiality level 接近重要性水平an acceptably low level 可接受的低水平the overall financial statement level and in related 财务报表层面和account balances and transaction levels 相关账户、交易层面the detected but uncorrected misstatements or omissions 已发现但尚未调整的错报或漏报misstatements or omissions 错报或漏报the detected and the projected misstatements or omissions 已发现和推断的错报或漏报aggregate 累计subsequent events 期后事项contingencies 或有事项extend the scope of the substantive test 扩大实质性测试范围adjust the financial statements 调整财务报表perform additional audit procedures 执行追加的审计程序carry out extended or additional tests of control 实施扩大或追加的控制测试modify the nature, timing and extend 修改实质性程序的性质、时间of planned substantive procedures 和范围audit risk 审计风险inherent risk 固有风险control risk 控制风险detection risk 检查风险inappropriate audit opinion 不恰当的审计意见material misstatement 重大错报analytical procedures risk 分析性测试风险substantive tests of the detail risk 细节测试风险tolerable misstatement 可容忍错报the combined level of inherent and control risks 固有风险和控制风险的综合水平the acceptable of detection risk 可接受的检查风险planned assessed level of control risk 计划评估的控制风险small business 小规模企业accounting system 会计系统internal control system 内部控制系统control environment 控制环境control procedures 控制程序compliance test 符合性程序test of control 控制测试walk-through test 穿行测试management letter 管理建议书material weakness in internal control 内部控制的重大缺陷risk assessment 风险评估control activities 控制活动information 信息communication 沟通monitoring 监督procedures manual 程序手册job descriptions 工作说明flow chart 流程图written narrative 文字叙述questionnaire 调查问卷reperformance of internal control 重新执行内部控制computer-assisted audit techniques 计算机辅助审计程序communication with management 与管理导沟通audit evidence 审计证据tests of control 控制测试substantive procedures 实质性程序sufficiency of audit evidence 审计证据的充分性appropriateness of audit evidence 审计证据的恰当性assertions 认定existence or occurrence 存在或发生completeness 完整性rights and obligations 权利与义务valuation or allocation 估价与分摊presentation and disclosure 表达与披露validity 合法性cut-off 截止mechanical accuracy 机械准确性classification 分类disclosure 披露inspection 检查supervision of counting 监盘observation 观察enquiry 询问confirmation 函证computation 计算analytical procedures 分析性程序vouch 核对aged trial balance 账龄分析表trace 追查audit sampling 审计抽样error 错误anomalous error 偶发性错误expected error 预期误差population 总体sampling risk 抽样风险non-sampling risk 非抽样风险sampling unit 抽样单位statistical sampling 统计抽样stratification 分层tolerable error 可容忍误差the risk of under reliance 信赖不足风险the risk of over reliance 信赖过度风险the risk of incorrect rejection 误拒风险the risk of incorrect acceptance 误受风险the rate of deviation 偏离程度sample size 样本量required confidence level 可信赖水平the number of sampling units in the population 总体中样本的数量methods used 所选用的方法effective audit 审计效果efficient audit 审计效率audit working papers(documentation) 审计工作底稿working trial balance 试算平衡表adjusting and reclassification entries 调整和重分类分录audit mark 审计标识indexing and cross-referencing 索引和交叉索引permanent audit files 永久性档案current audit files 当期档案comprehensive working papers 综合类工作底稿audit-oriented working papers 业务类工作底稿reference working papers 备查类工作底稿the use of standardized working papers 使用标准工作底稿checklists 核对用清单cash receipt 现金收据cash disbursement 现金支出petty cash 零用现金custody 保管custodian 保管人internal control questionnaire 内部控制调查问卷walk-through of the system 系统的穿行测试segregation of duties 职责划分deposit slip 存款凭单purchase order 采购订单receiving report 验收报告general ledger 总分类账bank statement 银行对账单bank reconciliation 银行存款余额调节表balance sheet date 资产负债表日check outstanding 未兑现支票change fund 找零备用金cash count 现金盘点kiting 开空头支票float period 浮游期cut-off bank statement 截止性银行对账单unearned revenue 预收账款net realizable value 可变现净值collateral 抵押sales order 销售通知单storeroom 仓库storekeeper 仓库保管员perpetual inventory record 永续盘存记录shipping document 货运文件bill of lading 提货单billing 开票sales invoice 销售发票footing 加总、合计price list 价目表aging schedule 账龄分析表aged trial balance 过期账项试算表break down 分解、按细目分类delinquent account 过期账户confirmation 函证positive confirmation request 积极式函证negative confirmation request 消极式函证advance 预付款purchase requisition 请购单purchase order 订购单vouchers payable 应付凭单vendor’s invoice 卖方发票discrepancy 差异description 货物的说明、种类vouchers 付款凭单treasurer 出纳员remittance 汇款、付款gross margin 毛利reasonableness 合理性authenticity 真实性overhead 期间费用manufacturing overhead 制造费用bill of materials 用料单inspection record 验收记录job cost 订单成本计算单labor cost distribution 人工成本分配表material requisition 领料单payroll summary 工资汇总表payroll ledger 工资登记薄production order 生产通知单production runs 生产流程rate and deduction authorization form 工资率及扣减授权表time card 计时卡time ticket 计时单accountability 成本会计routing sheet 流程表supplies 机物料消耗utilities 公用事业费job order 分批工作通知单inventory-taking 存货盘点test count 抽点inventory tag 存货标签bond certificate 债券stock certificate 股票broker’s advice 经纪人意见书paid-in-capital 实收资本treasury stock 库存股bond debenture 债券契约portfolio 证券组合投资leasehold 租赁的asset retirement order 资产报废通知单registrar 注册管理机构transfer agent 过户代理人trust company 信托公司negotiable instrument 流通票据collateral 抵押品liens and mortgages 留置与抵押minutes of board of directors 董事会会议记录trustee 受托管理人restrictive covenant 限制性条款contributed capital 实缴资本stub 存根audit report 审计报告the truthfulness of the audit report 审计报告的真实性the legitimacy of the audit report 审计报告的合法性entity 被审计单位、客户addressee of the audit report 审计报告的收件人unqualified opinion 无保留意见qualified opinion 保留意见disclaimer of opinion 无法表示意见adverse opinion 否定意见introductory paragraph 引言段scope paragraph 范围段opinion paragraph 意见段explanatory paragraph 说明段material 重要professional language 专业术语scope limitation 范围限制unadjusted events 未调整事项adequately disclosed 适当披露the extent of impact on the financial statements 对会计报表反映的影响程序audit report on special purpose engagements 特殊目的的审计报告Audit Law, Audit Act审计法the Implementary Rules of the Audit law审计法实施条例audit criteria,audit standard审计标准auditing standard审计准则auditing principles审计原则audit manual审计手册Generally Accepted Auditing Standards公认审计准则audit laws and regulations审计法律规范audit system审计体制audit purview;audit jurisdiction;audit mandate审计权限audit responsibility审计职责audit supervision;supervision through auditing审计监督audit jurisdiction审计管辖权implementation of audit laws and regulations审计执法audit sanction审计处理audit penalty审计处罚conduct auditing in accordance with laws依法审计audit opinion审计意见audit decision审计决定audit suggestion, audit recommendation审计建议conclusion of audit review复核意见audit appeal审计复议audit hearing审计听证audit review审计复核audit strategy审计战略audit plan审计计划auditing program审计方案auditing objective审计目标audit scope 审计范围audit coverage审计内容audit conclusion审计结论audit assignments审计任务audit finding审计结果audit report审计报告audit method审计方法auditing process审计过程audit evidence审计证据audit test审计测试audit risk审计风险audit sampling审计抽样audit software审计软件auditing procedures审计程序audit investigation审计调查audit team审计小组audit trail审计线索working paper工作底稿auditing around the computer绕过计算机审计auditing through the computer通过计算机审计computer-assisted audit计算机辅助审计IT audit信息技术审计compliance audit, regularity audit合法性审计compliance audit合规性审计comprehensive audit综合审计value for money audit (VFM audit)效益审计performance audit绩效审计financial audit财务审计financial statement audit 财务报表审计audit of financial revenues and expenditures财务收支审计final account audit决算审计term-end accountability audit离任经济责任审计management audit管理审计project audit项目审计external audit外部审计internal audit内部审计government audit政府审计joint audit联合审计field audit实地审计final audit期末审计interim audit期中审计periodic audit定期审计initial audit初次审计preliminary audit初步审计post-audit 事后审计pre-audit事前审计concurrent audit事中审计special audit专项审计statutory audit法定审计successive audit后续审计follow up audit跟踪审计whole process auditing全过程审计surprise audit突击审计accountability audit经济责任审计middle term accountability audit任中经济责任审计audit report审计报告standard report标准报告long-form report长式报告short-form report短式报告audit working report审计工作报告Announcementof Audit Findings审计结果公告Auditor General审计长Deputy Auditor General 副审计长chief auditor审计主任senior auditor资深审计师auditor审计师(员)certified internal auditor(CIA)注册内部审计师certified information systems auditor(CISA)注册信息系统审计师certified public accountant(CPA)注册公共会计师chartered accountant(CA)特许会计师audit funds审计经费audit operating expense审计业务费special funds for auditing审计专项经费。

政治关联英文文献索引1.T he stock market implication of political connections: evidence from firms' dividend policy 政治关系的证券市场含义:来自公司股利政策的证据(Cao et al.2012)2.C orporate ownership, corporate governance reform and timeliness of earnings: Malaysian evidence公司所有权、公司治理改革与盈余及时性:马来西亚的证据3.P olitical connections, bank deposits, and formal deposit insurance: Evidence from an emerging economy政治关系、银行存款与正式的存款保险:来自新兴经济体的证据(June 18, 2013)4.P olitical connections and investment efficiency: Evidence from Chinese listed private firms 政治关系与投资效率:来自中国民营上市公司的证据(August 27, 2013)5.T he Political Determinants of the Cost of Equity: Evidence from Newly Privatized Firms权益资本成本的政治因素:来自刚刚私有化公司的证据(August 2008)6.C ronyism and Capital Controls: Evidence from Malaysia任人唯亲与资本管制:来自马来西亚的证据7.Capital Structure and Political Patronage: Evidence from China资本结构与政治庇护:来自中国的证据8.P olitical Connection and Government Patronage:Evidence from Chinese Manufacturing Firms政治关联与政府赞助:来自中国制造业企业的证据9.P olitical Connections and Firm V alue: Evidence from the Regression Discontinuity Design of Close Gubernatorial Elections政治关联与公司价值:来自临近州长竞选的不连续回归设计的证据10.How does state ownership affect tax avoidance? Evidence from China国家所有权如何影响避税?来自中国的证据11.Do Strong Corporate Governance Firms Still Require Political Connection? And Vice V ersa公司治理强的企业仍然需要政治关系吗?反之亦然12.Political Connections and Preferential Access to Finance: The Role of Campaign Contributions政治关联与优先获得融资:竞选捐款的作用13.Political Connections and the Cost of Equity Capital政治关联与权益资本成本(Boubakri et al. January 2012)14.The Impact of Political Connections on Firms' Operation Performance and Financing Decisions政治关联对公司经营业绩及融资决策的影响(Boubakri et al. November 29, 2011)15.Political Connections and the Cost of Bank Loans政治关系与银行贷款成本(Houston et al. February 15, 2012)16.Politicians and the IPO Decision: The impact of impending political promotions on IPO activity in China政治家与IPO决策:即将来临的政治晋升对中国IPO活动的影响17.Accounting Conservatism and Bankruptcy Risk会计稳健性与破产风险(Biddle et al. October 7, 2013)18.Accounting Conservatism and its Effects on Financial Reporting Quality:A Review of the Literature会计稳健性及其对影响财务报告质量:文献综述(September 9, 2011)19.Conservatism, Disclosure and the Cost of Equity Capital稳健性、披露与权益资本成本(Artiach et al. January 2012)20.Does Access to Finance Lower Firms’ Cost of Capital? Empirical Evidence from International Manufacturing Data获得融资降低了企业的资本成本吗?来自国际制造业数据的实证证据21.Political connections, founding family ownership and leverage decision of privately owned firms政治关联、创始家族所有权与私有企业杠杆决策22.The Impact of Political Connectedness on Firm V alue and Corporate Policies: Evidence from Citizens United政治关系对公司价值及公司政策的影响:来自美国公民的证据23.The Quality of Accounting Information in Politically Connected Firms政治关联企业的会计信息质量24.The political economy of corporate governance, cost of equity, and earnings quality: evidence from newly privatized firms公司治理的政治经济、权益资本成本与盈余质量:来自刚刚私有化公司的证据25.Do Political Connections Help Firms Gain Access to Bank Credit in Vietnam政治关系帮助越南企业获得银行信贷吗?26.Firm performance effects of nurturing political connections through campaign contributions通过竞选捐款培育政治关系的公司绩效效应27.The Chrysler Effect: The Impact of the Chrysler Bailout on Borrowing Cost克莱斯勒效应:克莱斯勒救助对借贷成本的影响28.Politically connected firms in Poland and their access to bank financing波兰的政治关联企业及他们获得银行融资29.Political Connections and Corporate Bailouts政治关系与企业救助30.The characteristics of politically connected firms政治关联企业的特征31.Rent Seeking Incentives, Political Connections and Organizational Structure: Empirical Evidence from Listed Family Firms in China寻租动机、政治关系与组织结构:来自中国上市家族企业的经验证据32.The V alue of Connections In Turbulent Times: Evidence from the United States在动荡的时代关系价值:来自美国的证据33.Malaysian Capital Controls: Macroeconomics and Institutions马来西亚的资本控制:宏观经济和制度34.Rent Seeking and Corporate Finance: Evidence from Corruption Cases寻租与公司融资:腐败案件的证据35.Political Motivation, Over-investment and Firm Performance政治动机、过度投资与公司绩效36.Political connections and earnings quality: evidence from malaysia政治关系与盈余质量——来自马来西亚的证据37.Political Connections and Minority-Shareholder Protection: Evidence from Securities-Market Regulation in China政治关系与少数股东保护:来自中国证券市场监管的经验证据38.Accounting Conservatism, Corporate Governance and Political Influence: Evidence from Malaysia会计稳健性、公司治理与政治影响:来自马来西亚的证据39.Internationalization and Capital Structure: Evidence from Malaysian Manufacturing Firm国际化和资本结构:来自马来西亚制造企业的证据40.Firm size and corporate financial leverage choice in a developing economy Evidence from Nigeria企业规模和企业财务杠杆的选择:来自尼日利亚发展中经济的证据41.Ownership and the V alue of Political Connections: Evidence from China所有权和政治关系的价值:来自中国的证据42.Ownership Types, CEO and Chairman Political Connections, and Long-run Post-IPO Performance: Evidence from China所有权类型、CEO和董事长的政治联系与IPO后长期绩效:来自中国的证据43.Theoretical Investigation on Determinants of Government-Linked Companies Capital Structure关于政府联系公司资本结构的影响因素的理论研究44.Auditor Choice in Privatized Firms: Empirical Evidence on the Role of State and Foreign Owners私有化企业的审计师选择:来自国家和外国所有者作用的经验证据45.The Political Economy of Residual State Ownership in Privatized Firms: Evidence from Emerging Markets私有化企业中剩余政府所有权的政治经济:从新兴市场的证据46.Political Connections and the Process of Going Public: Evidence from China政治关系和上市的过程:来自中国的证据47.Public policy, political connections,and effective tax rates: Longitudinal evidence from Malaysia公共政策、政治关系与有效税率:来自马来西亚的纵向证据48.Why do countries adopt International Financial Reporting Standards为什么各国采用国际财务报告准则49.Political Relationships, Global Financing and Corporate Transparency政治关系、全球融资与公司透明度50.Politically Connected CEOs and Corporate Outcomes: Evidence from France政治关系的首席执行官和公司的结果:来自法国的证据51.Corporate Lobbying, Political Connections, and the Bailout of Banks公司游说、政治关系与银行救助52.Corruption, Political Connections, and Municipal Finance腐败、政治关系与城市金融53.Political connections, corporate governance and preferential bank loans政治联系、公司治理与优惠的银行贷款54.Politically connected firms: an international event study政治关系的企业:一个国际事件研究55.Politicians at work:The private returns and social costs of political connections政客们在工作:私人收益与政治关系的社会成本56.Political Connection, Financing Frictions, and Corporate Investment: Evidence from Chinese Listed Family Firms政治联系、融资摩擦与企业投资——来自中国上市家族企业的证据57.The Role Political Connections Play in Access to Finance:Evidence from Cross-Listing 政治关系在获得融资中发挥的作用:来自交叉上市的证据58.Auditor Choice in Politically Connected Firms政治关联公司的审计师选择59.Financial liberalization, financing constraints and political connection: evidence from Chinese firms金融自由化、融资约束与政治联系:来自中国上市公司的经验证据60.Effects of Financial Liberalization and Political Connection on Listed Chinese Firms' Financing Constraints金融自由化与政治关系对中国上市公司融资约束的影响61.Auditor Tenure, Non-Audit Services and Earnings Conservatism: Evidence from Malaysia审计任期,非审计服务与盈余稳健性——来自马来西亚的证据62.Political Connections of Newly Privatized Firms新私有化企业的政治关系63.Social network, entertainment expenditures and bank lending decisions: Evidence from China’s nonSOE firms社会网络、娱乐支出和银行贷款决策:来自中国非国有企业的证据64.Bank connection, corruption and collateral in China银行联系、腐败和担保:来自中国的证据65.Red Capitalists: Political Connections and Firm Performance in China红色资本家:政治关系与中国公司的业绩66.Political connections, bank deposits, and formal deposit insurance: Evidence from an emerging economy政治关系、银行存款与正式存款保险:来自新兴经济体的证据67.Executive’s former banking experience, entertainment expenditures and bank lending decisions: Evidence from China’s non-SOE firms执行官以前的银行业经验、娱乐支出与银行信贷决策:来自中国的非国有企业的证据68.The effect of political connections on the level and value of cash holdings: International evidence政治关联对现金持有水平及其价值的影响:国际证据69.The Effect of Political Influence and Corporate Transparency on Firm Performance: Empirical Evidence From Indonesian Listed Companies政治影响力与企业透明度对企业绩效的影响:来自印尼股票上市公司的经验证据70.Going Public Process and Political Connections: Evidence from an Emerging Market上市过程与政治联系:来自新兴市场的证据71.Do IPOs Reduce Firms’ Cost of Bank Loans? Evidence from ChinaIPO降低企业的银行贷款成本?来自中国的证据72.Public governance and corporate finance: Evidence from corruption cases公共治理与公司融资:腐败案件的证据73.Dividends, ownership structure and board governance on firm value: empirical evidence from malaysian listed firms股利、股权结构和董事会治理与公司价值:来自马来西亚上市公司的经验证据74.Management Quality and the Cost of Debt: Does Management Matter to Lenders管理质量和债务成本:管理对贷款人重要吗75.Do Educational Ties with Politicians Increase Agency Problems教育与政客联结增加代理问题吗76.Red Capitalists: Political Connections and the Growth and survival of Start-up Companies in China红色资本家:政治关系、成长和中国创业企业的生存77.The Impact of Legal and Political Institutions on Equity Trading Costs: A Cross-Country Analysis法律和政治制度对股票交易成本的影响:一个跨国家分析78.Expropriation of minority shareholders in politically connected firms政治关系企业中侵占小股东利益79.The Political Economy of Residual State Ownership in Privatized Firms: Evidence from Emerging Markets私有化企业中剩余政府所有权的政治经济:来自新兴市场的证据80.Does Financial Globalization Discipline Politically Connected Firms金融全球化约束政治关联的企业吗81.Audit fees in malaysia: does corporate governance matter马来西亚的审计费用:公司治理重要吗82.The Costs of Political Influence: Firm-Level Evidence from Developing Countries政治影响的成本:来自发展中国家的企业层面的证据83.Corporate social responsibility disclosure and its relation on institutional ownership企业社会责任披露及其与机构所有权的关系84.Political Connections and the Process of Going Public: Evidence from China政治关系和上市过程:来自中国的证据85.The Economic Benefits of Political Connections in Late Victorian Britain英国维多利亚时代后期政治关系的经济效益86.Corporate Cash Holdings, Board Structure, and Ownership Concentration: Evidence from Singapore企业现金持有量、董事会结构与股权集中度:来自新加坡的证据Political Uncertainty and Corporate Investment Cycles政治的不确定性与企业投资周期The Chinese Corporate Savings Puzzle: A Firm-Level Cross-Country Perspective中国公司储蓄的困惑:一个企业层面跨国家的视角Chinese firms’ political connection, ownership, and financing constraints中国企业的政治联系,、所有权与融资约束Political Relations and Overseas Stock Exchange Listing: Evidence from Chinese StateownedEnterprises政治关系和海外证券交易所上市:来自中国国有企业的证据Determinants and Effects of Corporate Lobbying企业游说的影响因素及影响Tunneling or Propping: Evidence from Connected Transactions in China隧道还是支持:来自中国关联交易的证据Sheltering Corporate Assets from Political Extraction保护公司资产从政治的提取Bank Power and Cash Holdings: Evidence from Japan银行权利与现金持有:来自日本的证据OLIGARCHIC FAMIL Y CONTROL, SOCIAL ECONOMIC OUTCOMES, AND THE QUALITY OF GOVERNMENT寡头的家族控制、社会的经济成果与政府质量Government Ownership and Corporate Governance: Evidence from the EU政府所有权与公司治理:来自欧盟的证据The Political Economy of Financial Systems金融体系的政治经济Escaping Political Extraction: Political Participation, Institutions, and Cash Holdings in China逃避政治的提取:政治参与、制度与中国的现金持有The value of local political connections in a low-corruption environment地方政治关系在低的腐败环境中的价值Retained State Shareholding in Chinese PLCs: Does Government Ownership Reduce Corporate Value中国上市公司保留的国有股:政府所有权降低企业价值吗Ownership Structure, Institutional Development, and Political Extraction: Evidence from China所有权结构、制度发展与政治提取:来自中国的证据How Do Agency Costs Affect Firm Value? Evidence from China代理成本如何影响公司价值吗?来自中国的证据Corporate Lobbying and Financial Performance公司游说与财务绩效Rights Issues in China as Evidence for the Existence of Two Types of Agency Problems中国人权问题作为两类代理问题存在的证据Auditor Choice in Politically Connected Firms政治关联公司的审计师选择(Journal of Accounting Research,V ol. 52 No. 1 March 2014)Transparency in Politically Connected Firms: Evidence from Private Sector Firms in China政治关联公司的透明度:来自中国私营公司的证据Capital Structure and Political Patronage: Evidence from China资本结构与政治赞助:来自中国的证据Competitive Pressure and Corporate Policies竞争压力与公司政策Political Capital and Moral Hazard1政治资本与道德风险The Effects of Government Quality on Corporate Cash Holdings政府质量对企业现金持有量的影响Corruption in Developing Countries腐败在发展中国家Large investors, capital expenditures, and firm value: Evidence from the Chinese stock market大投资者、资本支出与企业价值:来自中国证券市场的经验证据Firm Investment & Credit Constraints in India, 1997 – 2006: A stochastic frontier approach印度公司的投资与信贷约束,1997–2006:随机前沿方法State Ownership, Soft-Budget Constraint and Cash Holdings:Evidence from China’s Privatized Firms政府所有权、软预算约束与现金持有:来自中国私有化企业的证据Why Do Firms Hold Less Cash为什么公司持有更少的现金Directors’ Political Conn ections and Compliance with Board of Directors Regulations: The Case of S&P/Tsx 300 Companies董事会的政治关系和董事会遵守:标准普尔/ TSX 300公司为例Political Connection and Firm Value政治联系与企业价值The Impact of Political Connectedness on Firm Value and Corporate Policies: Evidence from Citizens United政治关系对公司价值和公司政策的影响:来自美国公民的证据The Impact of Political Connectedness on Cash Holdings: Evidence from Citizens United政治关系对现金持有的影响:来自美国公民的证据Political power and blood-related firm performance政治权力与有血缘关系的公司绩效Politically-Connecte d Boards and the Structure of Chief Executive Officer Compensation Packages in Taiwanese Firms政治关联董事会和台湾公司CEO薪酬结构Government Ownership and Agency Problems in Equity Offerings in China政府所有权与中国股票发行的代理问题Political Uncertainty and Accounting Conservatism: Evidence from the U.S. Presidential Election Cycle 政治不确定性与会计稳健性:来自美国总统选举周期的证据Effect of political uncertainty and corporate investment cycles in Nepal政治不确定性对尼泊尔企业投资周期的影响CEOs’ Connectedness, Social Capital, and Corporate InvestmentCEO关联、社会资本与企业投资Sovereign Wealth Funds and Politically Connected Firms主权财富基金与政治关联企业Political reforms and family-related firm performance政治改革与家族企业绩效Family connections in a low-corruption environment: Evidence from revised municipality borders在一个较低的腐败环境中家族联系:来自修订市边界的证据Does Political Uncertainty Affect Capital Structure Choices政治不确定性影响资本结构的选择吗Corporate Political Connections and Tax Aggressiveness企业政治关系与税收激进性Executive Compensation vis-à-vis Firm Performance: Identifying Future Research Agenda经理薪酬相对于公司绩效:识别未来的研究议程,Does Organizational-level Affiliation of Internal Audit Influence Corporate Risk-Taking? -Evidences from Chinese Listed Companies内部审计风险水平影响企业组织的联系吗?——来自中国股票上市公司的证据Principal-Principal Conflicts under Weak Institutions: A Study of Corporate Takeovers in China较弱制度下的委托代理冲突:中国公司并购的研究Earnings Management Practices Between Government Linked and Chinese Family Linked Companies 政府关联公司与中国家族关联企业之间的盈余管理实践Managerial Agency Costs of Socialistic Internal Capital Markets: Empirical Evidence from China社会主义内部资本市场的经理人代理成本:来自中国的经验证据Firm Size, Sovereign Governance, and Value Creation公司规模、主权治理与价值创造Bank firm relationship and firm performance under a state-owned bank system: evidence from China银企关系与企业国有银行制度下的绩效:来自中国的证据Excess control rights and corporate acquisitions超额控制权与公司并购Bank loan and the agency costs of debt in indonesia; free cash flows and managerial perks perspective 银行贷款和印度尼西亚债务的代理成本:自由现金流与管理津贴的视角CEO Compensation and Political ConnectednessCEO薪酬与政治关联Enterprises, Political Connections and Public Procurement at a Time of Landmark企业、政治关系与公共采购:一次具有里程碑意义的The Political Determinants of the Cost of Equity: Evidence from Newly Privatized Firms股权成本的政治因素:来自刚刚私有化的公司的证据Managerial Attributes and Executive Compensation管理者特征与高管薪酬An Empirical Investigation into the Political Economy of the Firm in a Globalizing World Economy: How Domestic Political Connections Affect Cross-listing Choices实证研究在全球化的世界经济的坚定的政治经济:国内政治关系如何影响交叉上市的选择Capital Markets and Capital Allocation:Implications for Economies of Transition资本市场与资本配置:经济转型的影响Responding to Financial Crisis: The Rise of State Ownership and Implications for Firm Performance应对金融危机:国家所有权上升对企业绩效的影响Influential ownership and capital structure有影响力的所有权与资本结构The Strategic Role Firms’ Political Connections Play in Access to Finance: Coercion of Domestic Banks or Implicit Property Rights Protections企业政治关系在获得融资中的战略作用:国内银行或隐含产权保护的强制手段Corporate Bailouts: the Role of Costly External Finance and Operating Performance企业救助:昂贵的外部融资的作用与经营绩效Do Political Connections Matter? Empirical Evidence from Listed Firms in Pakistan政治联系重要吗?来自巴基斯坦上市公司的经验证据Tycoons Turned Leaders: Market Valuation of Political Connections富豪转身领导:政治联系的市场价值Political Contributions and CEO Pay政治捐款和首席执行官工资Valuing Changes in Political Networks: Evidence from Campaign Contributions to Close Congressional 重视政治网络的变化:从运动的贡献接近国会的证据Corruption in state asset sales – Evidence from China国有资产销售中的腐败–来自中国的证据Investor Protection and Interest Group Politics投资者保护与利益集团政治Privatization, Large Shareholders’ In centive to Expropriate, and Firm Performance私有化、大股东掠夺激励与公司绩效Advances in Measuring Corruption in the Field腐败测量领域的进展Macroeconomic Conditions and the Puzzles of Credit Spreads and Capital Structure宏观经济条件、信用利差的困惑与资本结构Family Ownership and the Cost of Under Diversification家族所有权与多元化的成本Political Geography and Corporate Political Strategy政治地理学与企业政治策略Evidence on the existence and impact of corruption in state asset sales in China中国国有资产出售中腐败现象的存在及影响的证据Stock versus cash dividends: signaling or catering股票与现金股利:信号或宴会The impact of corruption on state asset sales – Evidence from China腐败对国有资产出售的影响-来自中国的证据Executive Compensation and CEO Equity Incentives in China’s Listed Firms高管薪酬与中国上市公司首席执行官的股权激励Political Constraints, Organizational Forms, and Privatization Performance:Evidence from China政治约束、组织形式与民营化绩效:来自中国的证据State Ownership, Political Institutions, and Stock Price Informativeness: Evidence from Privatization政府所有权、政治制度与股价信息含量:来自私有化的证据Corporate Governance in Emerging Markets: A Survey新兴市场的公司治理:文献综述Politically Connected Boards and Top Executive Pay In Chinese Listed Firms1.Political connection and leverage: Some Malaysian evidence2.Do political connections affect the role of independent audit committees and CEO Duality? Someevidence from Malaysian audit pricing3.Board, audit committee and restatement-induced class action lawsuits4.The Political Determinants of the Cost of Equity: Evidence from Newly Privatized Firms5.The impact of political connections on firms’ operating performance and financing decisionsernment Connections and Financial Constraints:Evidence from a Large Representative Sampleof Chinese Firms7.Listing approach, political favours and earnings quality: Evidence from Chinese family firms8.Political connections and tax-induced earnings management: evidence from China9.Ownership Concentration, State Ownership, and Effective Tax Rates: Evidence from China's ListedContext: European Evidence10.Impact of financial reporting quality on the implied cost of equity capital: Evidence from theMalaysian listed firms公允价值会计准则在新兴市场实施的挑战:来自中国采用国际财务报告准则的证据制度环境、政治关系与融资约束——来自中国民营企业的证据(March 1, 2012)政治关联、终极控制人性质与权益资本成本政治关联、盈余质量与权益资本成本政治联系、市场化进程与权益资本成本——来自中国民营上市公司的经验证据政府干预、政治关联与权益资本成本民营企业的政治关联能降低权益资本成本吗。

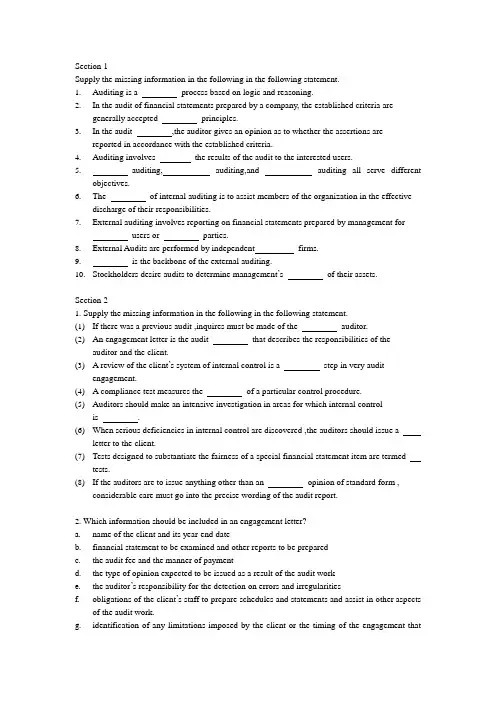

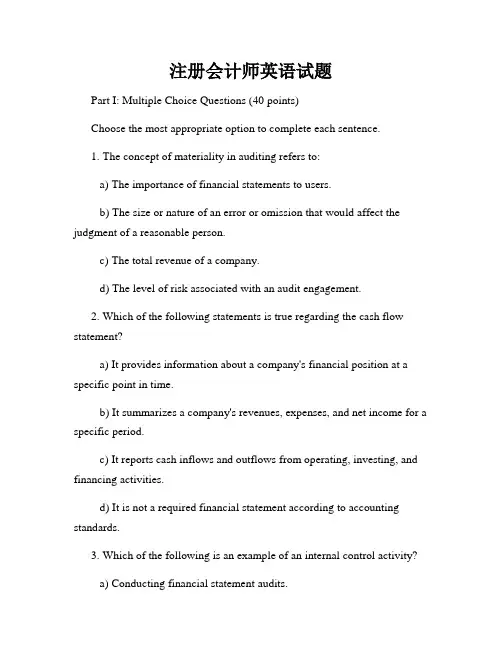

Section 1Supply the missing information in the following in the following statement.1.Auditing is a process based on logic and reasoning.2.In the audit of financial statements prepared by a company, the established criteria aregenerally accepted principles.3.In the audit ,the auditor gives an opinion as to whether the assertions arereported in accordance with the established criteria.4.Auditing involves the results of the audit to the interested users.5.auditing, auditing,and auditing all serve differentobjectives.6.The of internal auditing is to assist members of the organization in the effectivedischarge of their responsibilities.7.External auditing involves reporting on financial statements prepared by management forusers or parties.8.External Audits are performed by independent firms.9.is the backbone of the external auditing.10.Stockholders desire audits to determine management’s of their assets.Section 21. Supply the missing information in the following in the following statement.(1)If there was a previous audit ,inquires must be made of the auditor.(2)An engagement letter is the audit that describes the responsibilities of theauditor and the client.(3) A review of the client’s system of internal control is a step in very auditengagement.(4) A compliance test measures the of a particular control procedure.(5)Auditors should make an intensive investigation in areas for which internal controlis .(6)When serious deficiencies in internal control are discovered ,the auditors should issue aletter to the client.(7)Tests designed to substantiate the fairness of a special financial statement item are termedtests.(8)If the auditors are to issue anything other than an opinion of standard form ,considerable care must go into the precise wording of the audit report.2. Which information should be included in an engagement letter? of the client and its year-end dateb.financial statement to be examined and other reports to be preparedc.the audit fee and the manner of paymentd.the type of opinion expected to be issued as a result of the audit worke.the auditor’s responsibility for the detection on errors and irregularitiesf.obligations of the client’s staff to prepare schedules and statements and assist in other aspectsof the audit work.g.identification of any limitations imposed by the client or the timing of the engagement thatmay affect the auditor’s ability to gather sufficient competent evidential matter in support of the financial statementsSection 31. Supply the missing information in the following statements.(1)The standard report consists of a scope paragraph and an paragraph.(2)There are four types of audit reports. They are the unqualified opinion report, the qualifiedopinion report, the opinion report and the of opinion report.(3)When a disclaimer of opinion is issued, the auditor’s report must disclose all of thereasons for the disclaimer.2. Choose the best answer.An auditor may issue report when he or she has reached the following conclusion: 1) The financial statements present fairly overall financial position, results of operations, and changes in financial position in conformity with GAAP or other comprehensive basis of accounting. 2) GAAP or the other comprehensive basis of accounting applied on a basis consistent with that of the proceeding period. 3) The financial statements have adequate information disclosure.A.an unqualified opinionB. a qualified opinionC.an adverse opinionD. a disclaimer of opinion3. Choose the best answer.An auditor may issue report when he or she has reached the conclusion that the financial statements present fairly overall in conformity with GAAP or other comprehensive basis of accounting, but there is an exception regarding a material item:1) The scope of the auditor’s examination was restricted by the circumstances of the engagement, condition of the client’s records, or other reasons.2) There is material uncertainty regarding the statements.3) Disclosure is lacking.4) An accounting principle or the method of its application is not in conformity with GAAP.5) Accounting principles followed in the current period are not consistent with those in the proceeding period.A.an unqualified opinionB. a qualified opinionC.an adverse opinionD. a disclaimer of opinion4. Choose the best answer.When the restriction on the auditor’s ability to gather to gather evidence is so pervasive that the auditor can’t support an overall opinion on the financial statement, is issued.A.an unqualified opinionB. a qualified opinionC.an adverse opinionD. a disclaimer of opinion5. Choose the best answer.is issued for scope restriction relating to a material item which is not so pervasive as to impair the ability to issue an overall opinion on the financial statements.A.An unqualified opinionB. A qualified opinionC.An adverse opinionD. A disclaimer of opinion6. Choose the best answer.Which of the following reasons can make an auditor issue a disclaimer of opinion?A.The auditor is unable to apply procedures deemed necessary in an audit engagement and theeffect is so pervasive that a qualified opinion is not appropriate.B.An uncertainty regarding the financial statements is so pervasive that a qualified opinion isnot appropriate.C.The auditor has not audited the financial statements.D.The financial statements have adequate information disclosure.。