公司金融final模拟题和答案

- 格式:doc

- 大小:97.50 KB

- 文档页数:16

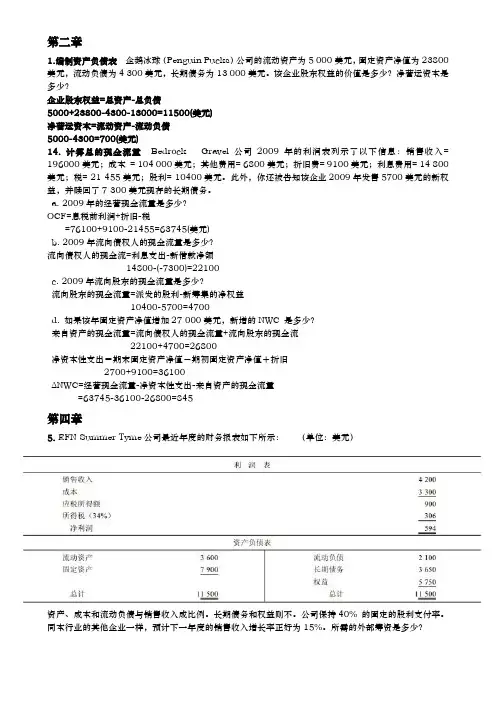

第二章1.编制资产负债表企鹅冰球(Penguin Pucks)公司的流动资产为5 000美元,固定资产净值为23800美元,流动负债为4 300美元,长期债务为13 000美元。

该企业股东权益的价值是多少?净营运资本是多少?企业股东权益=总资产-总负债5000+23800-4300-13000=11500(美元)净营运资本=流动资产-流动负债5000-4300=700(美元)14. 计算总的现金流量Bedrock Gravel 公司2009年的利润表列示了以下信息:销售收入= 196000美元;成本= 104 000美元;其他费用= 6800美元;折旧费= 9100美元;利息费用= 14 800美元;税= 21 455美元;股利= 10400美元。

此外,你还被告知该企业2009年发售5700美元的新权益,并赎回了7 300美元现存的长期债务。

a. 2009年的经营现金流量是多少?OCF=息税前利润+折旧-税=76100+9100-21455=63745(美元)b. 2009年流向债权人的现金流量是多少?流向债权人的现金流=利息支出-新借款净额14800-(-7300)=22100c. 2009年流向股东的现金流量是多少?流向股东的现金流量=派发的股利-新筹集的净权益10400-5700=4700d. 如果该年固定资产净值增加27 000美元,新增的NWC 是多少?来自资产的现金流量=流向债权人的现金流量+流向股东的现金流22100+4700=26800净资本性支出=期末固定资产净值-期初固定资产净值+折旧2700+9100=36100∆NWC=经营现金流量-净资本性支出-来自资产的现金流量=63745-36100-26800=845第四章5. EFN Summer Tyme公司最近年度的财务报表如下所示:(单位:美元)资产、成本和流动负债与销售收入成比例。

长期债务和权益则不。

公司保持40% 的固定的股利支付率。

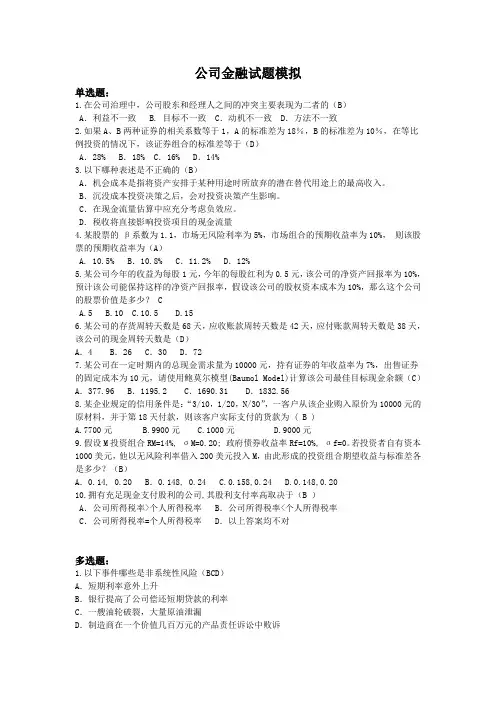

公司金融试题模拟单选题:1.在公司治理中,公司股东和经理人之间的冲突主要表现为二者的(B)A.利益不一致 B. 目标不一致 C.动机不一致 D.方法不一致2.如果A、B两种证券的相关系数等于1,A的标准差为18%,B的标准差为10%,在等比例投资的情况下,该证券组合的标准差等于(D)A.28% B.18% C.16% D.14%3.以下哪种表述是不正确的(B)A.机会成本是指将资产安排于某种用途时所放弃的潜在替代用途上的最高收入。

B.沉没成本投资决策之后,会对投资决策产生影响。

C.在现金流量估算中应充分考虑负效应。

D.税收将直接影响投资项目的现金流量4.某股票的β系数为1.1,市场无风险利率为5%,市场组合的预期收益率为10%,则该股票的预期收益率为(A)A. 10.5% B.10.8% C.11.2% D.12%5.某公司今年的收益为每股1元,今年的每股红利为0.5元,该公司的净资产回报率为10%,预计该公司能保持这样的净资产回报率,假设该公司的股权资本成本为10%,那么这个公司的股票价值是多少? CA.5B.10C.10.5D.156.某公司的存货周转天数是68天,应收账款周转天数是42天,应付账款周转天数是38天,该公司的现金周转天数是(D)A.4 B.26 C.30 D.727.某公司在一定时期内的总现金需求量为10000元,持有证券的年收益率为7%,出售证券的固定成本为10元,请使用鲍莫尔模型(Baumol Model)计算该公司最佳目标现金余额(C)A.377.96 B.1195.2 C.1690.31 D.1832.568.某企业规定的信用条件是:“3/10,1/20,N/30”,一客户从该企业购入原价为10000元的原材料,并于第18天付款,则该客户实际支付的货款为 ( B )A.7700元B.9900元C.1000元D.9000元9.假设M投资组合RM=14%, σM=0.20; 政府债券收益率Rf=10%, σf=0。

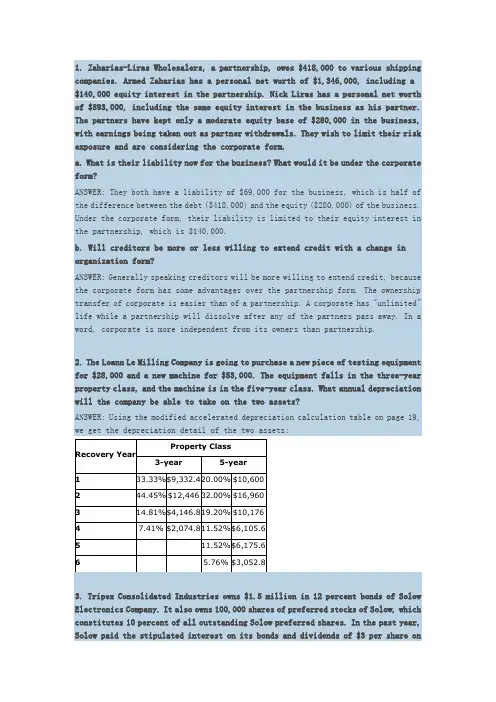

1. Zaharias-Liras Wholesalers, a partnership, owes $418,000 to various shipping companies. Armed Zaharias has a personal net worth of $1,346,000, including a $140,000 equity interest in the partnership. Nick Liras has a personal net worth of $893,000, including the same equity interest in the business as his partner. The partners have kept only a moderate equity base of $280,000 in the business, with earnings being taken out as partner withdrawals. They wish to limit their risk exposure and are considering the corporate form.a. What is their liability now for the business? What would it be under the corporate form?ANSWER: They both have a liability of $69,000 for the business, which is half of the difference between the debt ($418,000) and the equity ($280,000) of the business. Under the corporate form, their liability is limited to their equity interest in the partnership, which is $140,000.b. Will creditors be more or less willing to extend credit with a change in organization form?ANSWER: Generally speaking creditors will be more willing to extend credit, because the corporate form has some advantages over the partnership form. The ownership transfer of corporate is easier than of a partnership. A corporate has "unlimited" life while a partnership will dissolve after any of the partners pass away. In a word, corporate is more independent from its owners than partnership.2. The Loann Le Milling Company is going to purchase a new piece of testing equipment for $28,000 and a new machine for $53,000. The equipment falls in the three-year property class, and the machine is in the five-year class. What annual depreciation will the company be able to take on the two assets?ANSWER: Using the modified accelerated depreciation calculation table on page 19, we get the depreciation detail of the two assets:Recovery YearProperty Class3-year5-year133.33%$9,332.420.00%$10,600244.45%$12,44632.00%$16,960314.81%$4,146.819.20%$10,17647.41%$2,074.811.52%$6,105.6511.52%$6,175.66 5.76%$3,052.83. Tripex Consolidated Industries owns $1.5 million in 12 percent bonds of Solow Electronics Company. It also owns 100,000 shares of preferred stocks of Solow, which constitutes 10 percent of all outstanding Solow preferred shares. In the past year, Solow paid the stipulated interest on its bonds and dividends of $3 per share onits preferred stock. The marginal tax rate of Tripex is 34 percent. What taxes must Tripex pay on this interest and dividend income?ANSWER: The amount of interest Tripex received from Solow is$1,500,000*0.12=$180,000. The total of dividends Tripex received is $300,000. Because Tripex owns 10% of all outstanding Solow preferred shares, 70% of the dividend it received from Solow is tax exempt. So the tax Tripex must pay is ($180,000+$300,000*30%)*34%=$99,800.4. The Castle Cork Company was founded in 19X1 and had the following taxable income through 19X5:19X119X219X319X419X5$0$35,000$68,000-$120,000$52,000Compute the corporate income tax or tax refund in each year, assuming the graduated tax rates discussed in the chapter.ANSWER:YEAR19X119X219X319X419X5Income$0$35,000$68,000-$120,000$52,000 Original Tax$0$4,550$12,000$0$8,000 Income after Carryback and Carryfoward$0$0$0$0$35,000 Tax after$0$0$0$0$4,550 Final Tax (Refund)$0($4550)($12,000)$0$4,5505. Loquat Foods Company is able to borrow at an interest rate of 9 percent for one year. For the year, market participants expect 4 percent inflation.a. What approximate real rate of return does the lender expect? What is the inflation premium embodied in the nominal interest rate?ANSWER: The approximate real rate of return the lender expects is 5 percent (9 percent minus 4 percent). The inflation premium embodied in the nominal interest rate is4 percent.b. If inflation proves to be 2 percent for the year, does the lender suffer? Does the borrower suffer? Why?ANSWER: If the inflation turns out to be 2 percent, the borrower suffers. Because the real rate of return it pays are 7 percent rather than 5 percent, which means2 percent more cost.c. If inflation proves to be 6 percent, who gains and who loses?ANSWER: If the inflation proves to be 6 percent, the borrower gains because the real rate of return it pays are 3 percent rather than 5 percent, which means 2 percent cost saved. The lenders lose because the actual real rate of return is 2 percent lower than expected.。

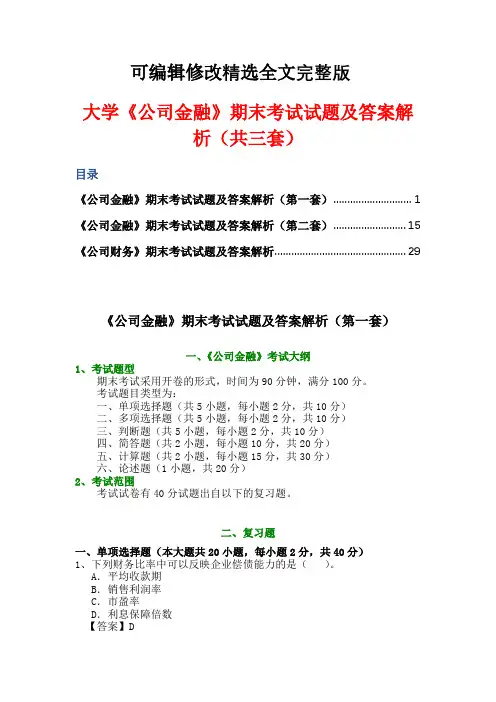

可编辑修改精选全文完整版大学《公司金融》期末考试试题及答案解析(共三套)目录《公司金融》期末考试试题及答案解析(第一套) (1)《公司金融》期末考试试题及答案解析(第二套) (15)《公司财务》期末考试试题及答案解析 (29)《公司金融》期末考试试题及答案解析(第一套)一、《公司金融》考试大纲1、考试题型期末考试采用开卷的形式,时间为90分钟,满分100分。

考试题目类型为:一、单项选择题(共5小题,每小题2分,共10分)二、多项选择题(共5小题,每小题2分,共10分)三、判断题(共5小题,每小题2分,共10分)四、简答题(共2小题,每小题10分,共20分)五、计算题(共2小题,每小题15分,共30分)六、论述题(1小题,共20分)2、考试范围考试试卷有40分试题出自以下的复习题。

二、复习题一、单项选择题(本大题共20小题,每小题2分,共40分)1、下列财务比率中可以反映企业偿债能力的是()。

A.平均收款期B.销售利润率C.市盈率D.利息保障倍数【答案】D2、在某公司的财务报表中,营业收入为20万元,应收账款年末为10万元,年初为6万元,应收账款周转次数为()。

A.1B.2C.3D.以上均不对【答案】A3、已知每年年底存款5 000元,欲计算第五年末的价值总额,应该利用()。

A.复利终值系数B.复利现值系数C.年金终值系数D.年金现值系数【答案】C4、第一次收付发生在第二期或以后各期的年金被称为()。

A.普通年金B.预付年金C.递延年金D.永续年金【答案】C5、某企业拟发行面值为100元,票面利率为10%,期限为3年的债券,当市场利率为10%时,该债券的发行价格为()。

A.80元B.90元C.100元D.110元【答案】C6、下列哪项属于普通股筹资的优点()。

A.筹资成本低B.不稀释公司的控制权C.发行新股时,会增加每股净收益,引起股价上升D.发行普通股形成自有资金可增强公司举债能力【答案】D7、某钢铁集团并购某石油公司,这种并购方式属于()。

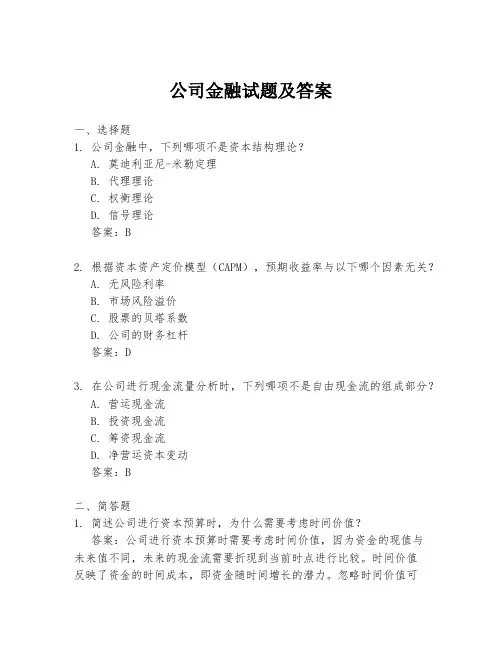

公司金融试题及答案一、选择题1. 公司金融中,下列哪项不是资本结构理论?A. 莫迪利亚尼-米勒定理B. 代理理论C. 权衡理论D. 信号理论答案:B2. 根据资本资产定价模型(CAPM),预期收益率与以下哪个因素无关?A. 无风险利率B. 市场风险溢价C. 股票的贝塔系数D. 公司的财务杠杆答案:D3. 在公司进行现金流量分析时,下列哪项不是自由现金流的组成部分?A. 营运现金流B. 投资现金流C. 筹资现金流D. 净营运资本变动答案:B二、简答题1. 简述公司进行资本预算时,为什么需要考虑时间价值?答案:公司进行资本预算时需要考虑时间价值,因为资金的现值与未来值不同,未来的现金流需要折现到当前时点进行比较。

时间价值反映了资金的时间成本,即资金随时间增长的潜力。

忽略时间价值可能导致投资决策的失误。

2. 什么是财务杠杆,它如何影响公司的财务风险和收益?答案:财务杠杆是指公司使用债务融资来增加其资本结构中的债务比例。

财务杠杆可以放大公司的收益,因为债务融资的成本(利息)通常低于公司的盈利率。

然而,它也增加了财务风险,因为公司必须支付固定的利息费用,即使在收益不佳时也是如此。

三、计算题1. 假设某公司计划进行一项投资,初始投资成本为$100,000,预期在接下来的5年内每年产生$20,000的现金流。

如果公司的折现率为10%,请计算净现值(NPV)。

答案:NPV = -$100,000 + ($20,000 / (1+0.1)^1) + ($20,000 / (1+0.1)^2) + ($20,000 / (1+0.1)^3) + ($20,000 / (1+0.1)^4) + ($20,000 / (1+0.1)^5) = -$100,000 + $18,181.82 + $16,513.51 + $15,025.68 + $13,704.91 + $12,539.13 = $5,975.152. 如果一家公司的贝塔系数为1.2,无风险利率为3%,市场风险溢价为6%,计算该公司的预期收益率。

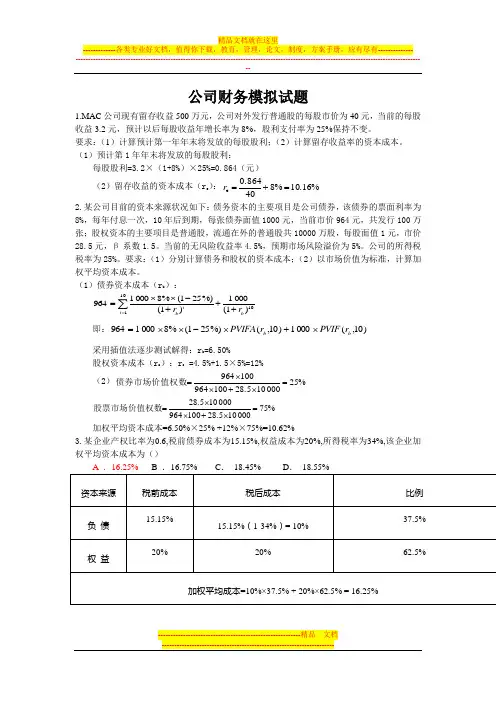

公司财务模拟试题1.MAC 公司现有留存收益500万元,公司对外发行普通股的每股市价为40元,当前的每股收益3.2元,预计以后每股收益年增长率为8%,股利支付率为25%保持不变。

要求:(1)计算预计第一年年末将发放的每股股利;(2)计算留存收益率的资本成本。

(1)预计第1年年末将发放的每股股利:每股股利=3.2×(1+8%)×25%=0.864(元)(2)留存收益的资本成本(r e ):%16.10%8400.864e =+=r 2.某公司目前的资本来源状况如下:债务资本的主要项目是公司债券,该债券的票面利率为8%,每年付息一次,10年后到期,每张债券面值1000元,当前市价964元,共发行100万张;股权资本的主要项目是普通股,流通在外的普通股共10000万股,每股面值1元,市价28.5元,β系数1.5。

当前的无风险收益率4.5%,预期市场风险溢价为5%。

公司的所得税税率为25%。

要求:(1)分别计算债务和股权的资本成本;(2)以市场价值为标准,计算加权平均资本成本。

(1)债券资本成本(r b ):10101)1(0001)1(%)251(%80001964b t t b r r +++-⨯⨯=∑=即:)10,(0001)10,(%)251(%80001964b b r PVIF r PVIFA ⨯+⨯-⨯⨯= 采用插值法逐步测试解得:r b =6.50%股权资本成本(r s ):r s =4.5%+1.5×5%=12% (2)%250001028.5100964100964=⨯+⨯⨯=债券市场价值权数%750001028.51009640001028.5=⨯+⨯⨯=股票市场价值权数加权平均资本成本=6.50%×25% +12%×75%=10.62%3.某企业产权比率为0.6,税前债券成本为15.15%,权益成本为20%,所得税率为34%,该企业加权平均资本成本为()产权比例的概念产权比率又叫债务股权比率,是负债总额与股东权益总额之比率。

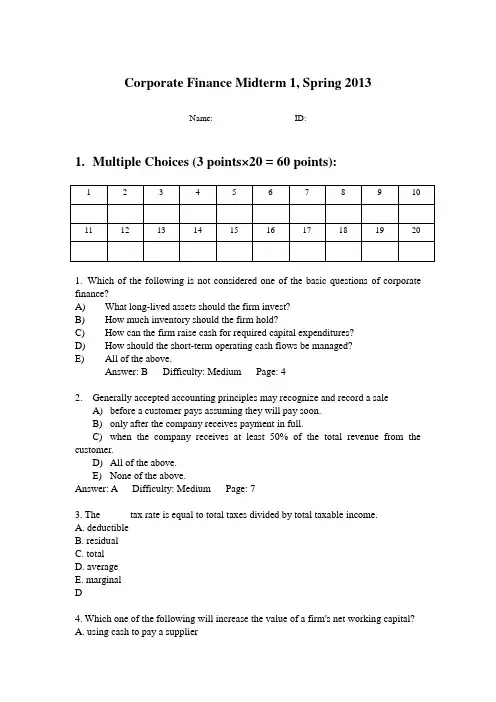

Corporate Finance Midterm 1, Spring 2013Name: ID:1.Multiple Choices (3 points×20 = 60 points):1. Which of the following is not considered one of the basic questions of corporate finance?A) What long-lived assets should the firm invest?B) How much inventory should the firm hold?C) How can the firm raise cash for required capital expenditures?D) How should the short-term operating cash flows be managed?E) All of the above.Answer: B Difficulty: Medium Page: 42. Generally accepted accounting principles may recognize and record a saleA) before a customer pays assuming they will pay soon.B) only after the company receives payment in full.C) when the company receives at least 50% of the total revenue from the customer.D) All of the above.E) None of the above.Answer: A Difficulty: Medium Page: 73. The _____ tax rate is equal to total taxes divided by total taxable income.A. deductibleB. residualC. totalD. averageE. marginalD4. Which one of the following will increase the value of a firm's net working capital?A. using cash to pay a supplierB. depreciating an assetC. collecting an accounts receivableD. purchasing inventory on creditE. selling inventory at a profitE5. The higher the degree of financial leverage employed by a firm, the:A. higher the probability that the firm will encounter financial distress.B. lower the amount of debt incurred.C. less debt a firm has per dollar of total assets.D. higher the number of outstanding shares of stock.E. lower the balance in accounts payable.A6. Depreciation:A. reduces both taxes and net income.B. increases the net fixed assets as shown on the balance sheet.C. reduces both the net fixed assets and the costs of a firm.D. is a noncash expense which increases the net income.E. decreases net fixed assets, net income, and operating cash flows.A7. Which one of the following must be true if a firm had a negative cash flow from assets?A. The firm borrowed money.B. The firm acquired new fixed assets.C. The firm had a net loss for the period.D. The firm utilized outside funding.E. Newly issued shares of stock were sold.D8. A firm has net working capital of $640. Long-term debt is $4,180, total assets are $6,230, and fixed assets are $3,910. What is the amount of the total liabilities?A. $2,050B. $2,690C. $4,130D. $5,590E. $5,860Current assets = $6,230 - $3,910 = $2,320Current liabilities = $2,320 - $640 = $1,680Total liabilities = $1,680 + $4,180 = $5,860E9. Bonner Collision has shareholders' equity of $141,800. The firm owes a total of $126,000 of which 60 percent is payable within the next year. The firm net fixed assets of $161,900. What is the amount of the net working capital?A. $25,300B. $30,300C. $75,600D. $86,300E. $111,500Current liabilities = .60 $126,000 = $75,600Total assets = $141,800 + $126,000 = $267,800Current assets = $267,800 - $161,900 = $105,900Net working capital = $105,900 - $75,600 = $30,300B10. Kaylor Equipment Rental paid $75 in dividends and $511 in interest expense. The addition to retained earnings is $418 and net new equity is $500. The tax rate is 35 percent. Sales are $15,900 and depreciation is $680. What are the earnings before interest and taxes?A. $589.46B. $1,269.46C. $1,331.54D. $1,951.54E. $1,949.46Net income = $75 + $418 = $493Taxable income = $493/(1 - .35) = $758.46Earnings before interest and taxes = $758.46 + $511 = $1,269.46B11. Given the tax rates as shown, what is the average tax rate for a firm with taxable income of $311,360?A. 28.25 percentB. 31.09 percentC. 33.62 percentD. 35.48 percentE. 39.00 percentTax = .15($50,000) + .25($25,000) + .34($25,000) + .39($211,360) = $104,680.40 Average tax rate = $104,680.40/$311,360 = 33.62 percent12. Crandall Oil has total sales of $1,349,800 and costs of $903,500. Depreciation is $42,700 and the tax rate is 34 percent. The firm does not have any interest expense. What is the operating cash flow?A. $129,152B. $171,852C. $179,924D. $281,417E. $309,076Earnings before interest and taxes = $1,349,800 - $903,500 - $42,700 = $403,600 Tax = $403,600 .34 = $137,224Operating cash flow = $403,600 + $42,700 - $137,224 = $309,076E13. At the beginning of the year, a firm had current assets of $121,306 and current liabilities of $124,509. At the end of the year, the current assets were $122,418 and the current liabilities were $103,718. What is the change in net working capital?A. -$19,679B. -$11,503C. -$9,387D. $1,809E. $21,903Change in net working capital = ($122,418 - $103,718) - ($121,306 - $124,509) = $21,903E14. The Lakeside Inn had operating cash flow of $48,450. Depreciation was $6,700 and interest paid was $2,480. A net total of $2,620 was paid on long-term debt. The firm spent $24,000 on fixed assets and decreased net working capital by $1,330. What is the amount of the cash flow to stockholders?A. $5,100B. $7,830C. $18,020D. $19,998E. $20,680Cash flow from assets = $48,450 - (-$1,330) - $24,000 = $25,780Cash flow to creditors =$2,480 - (-$2,620) = $5,100Cash flow to stockholders = $25,780 - $5,100 = $20,680E15. You are scheduled to receive annual payments of $4,800 for each of the next 7 years. The discount rate is 8 percent. What is the difference in the present value if you receive these payments at the beginning of each year rather than at the end of each year?A. $1,999B. $2,013C. $2,221D. $2,227E. $2,304Difference = $26,990 - $24,991 = $1,999Note: The difference = 0.08 $24,991 = $1,999A16. Your local travel agent is advertising an upscale winter vacation package for travel three years from now to Antarctica. The package requires that you pay $25,000 today, $30,000 one year from today, and a final payment of $45,000 on the day you depart three years from today. What is the cost of this vacation in today's dollars if the discount rate is 9.75 percent?A. $86,376B. $89,695C. $91,219D. $91,407E. $93,478A17. You are going to loan a friend $900 for one year at a 5 percent rate of interest, compounded annually. How much additional interest could you have earned if you had compounded the rate continuously rather than annually?A. $0.97B. $1.14C. $1.23D. $1.36E. $1.41Additional interest = $900 (0.0512711 - 0.05) = $1.14B18. First Century Bank wants to earn an effective annual return on its consumer loans of 10 percent per year. The bank uses daily compounding on its loans. By law, what interest rate is the bank required to report to potential borrowers?A. 9.23 percentB. 9.38 percentC. 9.53 percentD. 9.72 percentE. 10.00 percentAPR = 365×[(1 + 0.10)1/365 - 1] = 9.53 percent19. You have just won the lottery and will receive $540,000 as your first payment one year from now. You will receive payments for 26 years. The payments will increase in value by 4 percent each year. The appropriate discount rate is 10 percent. What is the present value of your winnings?A. $6,221,407B. $6,906,372C. $7,559,613D. $7,811,406E. $8,003.1120. Consider a firm with a contract to sell an asset 3 years from now for $90,000. The asset costs $71,000 to produce today. At what rate will the firm just break even on this contract?A. 7.87 percentB. 8.01 percentC. 8.23 percentD. 8.57 percentE. 8.90 percent$90,000 = $71,000×(1 + r)3; r = 8.23 percent2.Concept Questions(1). Companies pa y rating agencies such as Moody’s and S&P to rate their bonds, and the costs can be substantial. However, companies are not required to have their bonds rated; doing so is strictly volunteer. Why do you think they do it? (3 Points)Ans: Companies pay to have their bonds rated simply because unrated bonds can be difficult to sell; many large investors are prohibited from investing in unrated issues.(2) Corporate ownership varies around the world. Historically individuals have owned the majority of shares in public corporations in the United States. In Germany and Japan, however, banks, other large financial institutions, and other companies own most of the stock in public corporations. Do you thinks agency problems are likely to be more or less severe in Germany and Japan than in the United States? Why? In recent years, large financial institutions such as mutual funds and pension funds have been becoming the dominant owners of stock in the United States, and these institutions are becoming more active in corporate affairs. What are the implications of this trend for agency problems and corporate control? (7 Points)Ans: We would expect agency problems to be less severe in countries with a relatively small percentage of individual ownership. Fewer individual owners should reduce the number of diverse opinions concerning corporate goals. The high percentage of institutional ownership might lead to a higher degree of agreement between owners and managers on decisions concerning risky projects. In addition, institutions may be better able to implement effective monitoring mechanisms on managers than can individual owners, based on the institutions’ deeper resources and experiences with their own management. The increase in institutional ownership of stock in the United States and the growing activism of these large shareholder groups may lead to a reduction in agency problems for U.S. corporations and a more efficient market for corporate control.3. Computations(1). (15 points) A local finance company quotes a 16% interest rate on one-year loans. So, if you borrow $25,000, the interest for the year will be $4,000. Because you must repay a total of $29,000 in one year, the finance company requires you to pay$29,000/12 or $2,416.67 per month over the next 12 months. Is this a 16% loan? What rate would legally have to be quoted? What is the effective annual rate?T o find the APR and EAR, we need to use the actual cash flows of the loan. In other words, the interest rate quoted in the problem is only relevant to determine the total interest under the terms given. The interest rate for the cash flows of the loan is:PVA = $25,000 = $2,416.67{(1 – [1 / (1 + r)]12 ) / r }Again, we cannot solve this equation for r, so we need to solve this equation on a financial calculator, using a spreadsheet, or by trial and error. Using a spreadsheet, we find:r = 2.361% per monthSo the APR is:APR = 12(2.361%) = 28.33%And the EAR is:EAR = (1.02361)12– 1 = .3231 or 32.31%(2). (15) You have just won the lottery and will receive $1,000,000 in one year. You will receive payments for 30 years, which will increase 5% per year. If the appropriate discount rate is 8%, what is the present value of your winnings?We can use the present value of a growing perpetuity equation to find the value of your deposits today. Doing so, we find:PV = C {[1/(r–g)] – [1/(r–g)] × [(1 + g)/(1 + r)]t}PV = $1,000,000{[1/(.08 – .05)] – [1/(.08 – .05)] × [(1 + .05)/(1 + .08)]30}PV = $19,016,563.18。

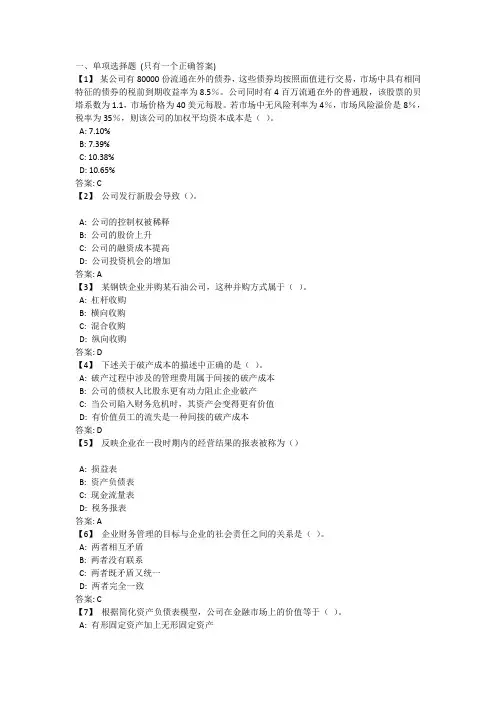

一、单项选择题(只有一个正确答案)【1】某公司有80000份流通在外的债券,这些债券均按照面值进行交易,市场中具有相同特征的债券的税前到期收益率为8.5%。

公司同时有4百万流通在外的普通股,该股票的贝塔系数为1.1,市场价格为40美元每股。

若市场中无风险利率为4%,市场风险溢价是8%,税率为35%,则该公司的加权平均资本成本是()。

A: 7.10%B: 7.39%C: 10.38%D: 10.65%答案: C【2】公司发行新股会导致()。

A: 公司的控制权被稀释B: 公司的股价上升C: 公司的融资成本提高D: 公司投资机会的增加答案: A【3】某钢铁企业并购某石油公司,这种并购方式属于()。

A: 杠杆收购B: 横向收购C: 混合收购D: 纵向收购答案: D【4】下述关于破产成本的描述中正确的是()。

A: 破产过程中涉及的管理费用属于间接的破产成本B: 公司的债权人比股东更有动力阻止企业破产C: 当公司陷入财务危机时,其资产会变得更有价值D: 有价值员工的流失是一种间接的破产成本答案: D【5】反映企业在一段时期内的经营结果的报表被称为()A: 损益表B: 资产负债表C: 现金流量表D: 税务报表答案: A【6】企业财务管理的目标与企业的社会责任之间的关系是()。

A: 两者相互矛盾B: 两者没有联系C: 两者既矛盾又统一D: 两者完全一致答案: C【7】根据简化资产负债表模型,公司在金融市场上的价值等于()。

A: 有形固定资产加上无形固定资产B: 销售收入减去销货成本C: 现金流入量减去现金流出量D: 负债的价值加上权益的价值答案: D【8】如果股利和资本利得适用相同的所得税率,两者的纳税效果仍然会不同,是因为()。

A: 资本利得纳税是实际发生的,而股利纳税只在账面体现B: 股利纳税是实际发生的,而资本利得纳税只在账面体现C: 股利所得税在股利分派之后交纳,而资本利得税可以延迟到股票出售的时候D: 资本利得税在股利分派之后交纳,而股利所得税可以延迟到股票出售的时候答案: C【9】甲方案在五年中每年年初付款2000元,乙方案在五年中每年年末付款2000元,若利率相同,则两者在第五年年末时的终值()。

单选题下列不属于期间费用项目的是()B.制造费用财务杠杆说明()D.增加息税前利润对每股利润的影响以下关于兼并、收购、合并和并购之间关系的描述,不正确的是:()D.广义兼并包括合并和收购以下可以用来预防敌意收购的反收购措施是:( )。

D.降落伞计划资金每增加一个单位而增加的成本叫()。

D.边际资本成本在强势有效市场中,证券组合的管理者期望获取的收益率是()。

D.无风险利率股东财富最大化目标和经理追求的目标之间总存在差异,理由是()D.所有权和控制权的分离企业对风险管理进行监控的方法是()。

D.持续监控和个别评估普通年金终值的计算公式是()。

C.V=A×[(1+i)n-1]/i下列不属于公司金融研究的内容是D.组织决策下列说法中不正确的是()D.回收期法和会计收益率法都没有考虑回收期满后的现金流量状况。

下列筹集方式中,资本成本相对最低的是()收藏A.长期借款现有两个投资项目甲和乙,已知:k甲=10%,k乙=15%,s甲=20%,s乙=25%,那么()。

B.甲项目的风险程度大于乙项目的风险程度组合风险是()。

D.相对于部门的目标和风险容忍度而言的当市场利率大于债券票面利率时,债券采用的发行方式是()B.折价发行单位内部审计的三大目标是()。

B.工程安全、资金安全和干部安全剩余股利政策一般适用于公司的()阶段。

C.初创企业价值评估的一般范围即企业的资产范围是从企业()的角度界定的。

B.产权经营杠杆给企业带来的风险是指()D.业务量变动导致息税前利润更大变动的风险运用直接法评估企业价值,选择什么口径的收益额作为评估参数是依据()。

B.企业价值评估的目标企业建立内部控制体系的基础是()。

D.风险管理以下关于企业价值评估现金流量折现法的表述中,错误的是()。

B.预测基数应为上一年的实际数据,不能对其进行调整资本成本很高且财务风险很低的是()C.发行股票某项投资4年后可得收益40,000元,年利率为6%,则现在应投入()。

Final Practice for the course Goal of firm Answer: d MEDIUM i. The primary operating goal of a publicly-owned firm interested in serving its stockholders should be to

a. Maximize its expected total corporate income. b. Maximize its expected EPS. c. Minimize the chances of losses. d. Maximize the stock price per share over the long run, which is the stock’s intrinsic value. e. Maximize the stock price on a specific target date. Firm organization Answer: c EASY

ii. Which of the following statements is CORRECT?

a. One of the advantages of the corporate form of organization is that it avoids double taxation. b. It is easier to transfer one’s ownership interest in a partnership than in a corporation. c. One of the disadvantages of a sole proprietorship is that the proprietor is exposed to unlimited liability. d. One of the advantages of a corporation from a social standpoint is that every stockholder has equal voting rights, i.e., “one person, one vote.” e. Corporations of all types are subject to the corporate income tax.

Dividends, retained earnings Answer: b EASY/MEDIUM iii. Fine Breads Inc. paid out $26,000 common dividends during 2005, and it ended the year with $150,000 of retained earnings. The prior year’s retained earnings were $145,000. What was the firm's 2005 net income?

a. $30,000 b. $31,000 c. $32,000 d. $33,000 e. $34,000

Statement of cash flows Answer: d MEDIUM iv. Which of the following statements is CORRECT?

a. In the statement of cash flows, depreciation charges are reported as a use of cash. b. In the statement of cash flows, a decrease in accounts receivable is reported as a use of cash. c. In the statement of cash flows, a decrease in inventories is reported as a use of cash. d. In the statement of cash flows, a decrease in accounts payable is reported as a use of cash. e. Dividends do not show up in the statement of cash flows because dividends are considered to be a financing activity, not an operating activity. Effect of reducing costs on ROE Answer: a MEDIUM v. Last year, Candle Corp had $200,000 of assets, $300,000 of sales, $20,000 of net income, and a debt-to-total-assets ratio of 40%. The new CFO believes a new computer program will enable it to reduce costs and thus raise net income to $30,000. Assets, sales, and the debt ratio would not be affected. By how much would the cost reduction improve the ROE?

a. 8.33% b. 8.67% c. 9.00% d. 9.33% e. 9.67%

Du Pont equation: basic calculation Answer: b EASY vi. Midwest Lumber had a profit margin of 5.1%, a total assets turnover of 1.6, and an equity multiplier of 1.8. What was the firm's ROE?

a. 14.39% b. 14.69% c. 14.99% d. 15.29% e. 15.59%

Current ratio Answer: e EASY vii. A firm wants to strengthen its financial position. Which of the following actions would INCREASE its current ratio?

a. Borrow using short-term debt and use the proceeds to repay debt that has a maturity of more than one year. b. Reduce the company’s days’ sales outstanding ratio to the industry average and use the resulting cash savings to purchase plant and equipment. c. Use cash to increase inventory holdings. d. Use cash to repurchase some of the company’s own stock. e. Issue new stock and use some of the proceeds to purchase additional inventory and hold the remainder of the funds received as cash.

Estimating the 1-year forward rate Answer: e MEDIUM viii. Suppose the interest rate on a 1-year T-bond is 5.0% and that on a 2-year T-bond is 6.0%. Assuming the pure expectations theory is correct, what is the market's forecast for 1-year rates 1 year from now?

a. 6.65% b. 6.74% c. 6.83% d. 6.92% e. 7.01%

Default risk premium Answer: b EASY ix. If 10-year T-bonds have a yield of 5.2%, 10-year corporate bonds yield 7.5%, the maturity risk premium on all 10-year bonds is 1.1%, and corporate bonds have a 0.2% liquidity premium versus a zero liquidity premium for T-bonds, what is the default risk premium on the corporate bond?

a. 2.00% b. 2.10% c. 2.20% d. 2.30% e. 2.40%

Amortization Answer: a MEDIUM x. Which of the following statements regarding a 30-year, $100,000 mortgage with a nominal interest rate of 10%, compounded monthly, is NOT CORRECT?

a. The monthly payments will decline over time. b. The proportion of the monthly payment that represents interest will be lower for the last payment than for the first payment on the loan. c. The total dollar amount of principal being paid off each month gets larger as the loan approaches maturity. d. The amount paid toward interest in the first payment would be lower if the nominal interest rate were 8%. e. Over 90% of the first payment goes toward interest