英文版罗斯公司理财习题答案Chap002

- 格式:doc

- 大小:244.50 KB

- 文档页数:17

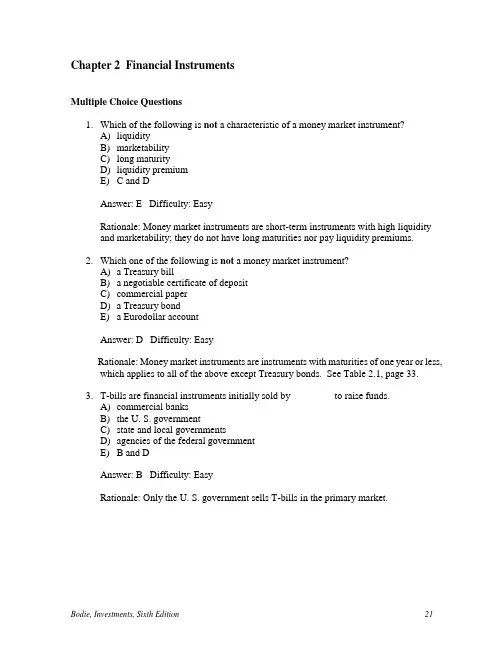

Multiple Choice Questions1. Which of the following is not a characteristic of a money market instrument?A) liquidityB) marketabilityC) long maturityD) liquidity premiumE) C and DAnswer: E Difficulty: EasyRationale: Money market instruments are short-term instruments with high liquidityand marketability; they do not have long maturities nor pay liquidity premiums.2. Which one of the following is not a money market instrument?A) a Treasury billB) a negotiable certificate of depositC) commercial paperD) a Treasury bondE) a Eurodollar accountAnswer: D Difficulty: EasyRationale: Money market instruments are instruments with maturities of one year or less, which applies to all of the above except Treasury bonds. See Table 2.1, page 33.3. T-bills are financial instruments initially sold by ________ to raise funds.A) commercial banksB) the U. S. governmentC) state and local governmentsD) agencies of the federal governmentE) B and DAnswer: B Difficulty: EasyRationale: Only the U. S. government sells T-bills in the primary market.4. The bid price of a T-bill in the secondary market isA) the price at which the dealer in T-bills is willing to sell the bill.B) the price at which the dealer in T-bills is willing to buy the bill.C) greater than the asked price of the T-bill.D) the price at which the investor can buy the T-bill.E) never quoted in the financial press.Answer: B Difficulty: EasyRationale: T-bills are sold in the secondary market via dealers; the bid price quoted in the financial press is the price at which the dealer is willing to buy the bill.5. Commercial paper is a short-term security issued by ________ to raise funds.A) the Federal Reserve BankB) commercial banksC) large, well-known companiesD) the New York Stock ExchangeE) state and local governmentsAnswer: C Difficulty: EasyRationale: Commercial paper is short-term unsecured financing issued directly by large, presumably safe corporations.6. Which one of the following terms best describes Eurodollars:A) dollar-denominated deposits in European banks.B) dollar-denominated deposits at branches of foreign banks in the U. S.C) dollar-denominated deposits at foreign banks and branches of American banksoutside the U. S.D) dollar-denominated deposits at American banks in the U. S.E) dollars that have been exchanged for European currency.Answer: C Difficulty: ModerateRationale: Although originally Eurodollars were used to describe dollar-denominated deposits in European banks, today the term has been extended to apply to anydollar-denominated deposit outside the U. S.7. Deposits of commercial banks at the Federal Reserve Bank are called __________.A) bankers' acceptancesB) repurchase agreementsC) time depositsD) federal fundsE) reserve requirementsAnswer: D Difficulty: EasyRationale: The federal funds are required for the bank to meet reserve requirements, which is a way of influencing the money supply. No substitutes for fed funds arepermitted.8. The interest rate charged by banks with excess reserves at a Federal Reserve Bank tobanks needing overnight loans to meet reserve requirements is called the_________.A) prime rateB) discount rateC) federal funds rateD) call money rateE) money market rateAnswer: C Difficulty: Easy9. Which of the following statements is (are) true regarding municipal bonds?I) A municipal bond is a debt obligation issued by state or local governments.II) A municipal bond is a debt obligation issued by the federal government.III)The interest income from a municipal bond is exempt from federal income taxation.IV)The interest income from a municipal bond is exempt from state and local taxation in the issuing state.A) I and II onlyB) I and III onlyC) I, II, and III onlyD) I, III, and IV onlyE) I and IV onlyAnswer: D Difficulty: ModerateRationale: State and local governments and agencies thereof issue municipal bonds on which the interest income is free from all federal taxes and is exempt from state and local taxation in the issuing state.10. Which of the following statements is true regarding a corporate bond?A) A corporate callable bond gives the holder the right to exchange it for a specifiednumber of the company's common shares.B) A corporate debenture is a secured bond.C) A corporate indenture is a secured bond.D) A corporate convertible bond gives the holder the right to exchange the bond for aspecified number of the company's common shares.E) Holders of corporate bonds have voting rights in the company.Answer: D Difficulty: EasyRationale: Statement D is the only true statement; all other statements describesomething other than the term specified.11. In the event of the firm's bankruptcyA) the most shareholders can lose is their original investment in the firm's stock.B) common shareholders are the first in line to receive their claims on the firm's assets.C) bondholders have claim to what is left from the liquidation of the firm's assets afterpaying the shareholders.D) the claims of preferred shareholders are honored before those of the commonshareholders.E) A and D.Answer: E Difficulty: ModerateRationale: Shareholders have limited liability and have residual claims on assets.Bondholders have a priority claim on assets, and preferred shareholders have priority over common shareholders.12. Which of the following is true regarding a firm's securities?A) Common dividends are paid before preferred dividends.B) Preferred stockholders have voting rights.C) Preferred dividends are usually cumulative.D) Preferred dividends are contractual obligations.E) Common dividends usually can be paid if preferred dividends have been skipped.Answer: C Difficulty: EasyRationale: The only advantages of preferred dividends over common dividends are that preferred dividends must be paid first and any skipped preferred dividends must be paid before common dividends may be paid.13. Which of the following is true of the Dow Jones Industrial Average?A) It is a value-weighted average of 30 large industrial stocks.B) It is a price-weighted average of 30 large industrial stocks.C) The divisor must be adjusted for stock splits.D) A and C.E) B and C.Answer: E Difficulty: EasyRationale: The Dow Jones Industrial Average is a price-weighted index of 30 large industrial firms and the divisor must be adjusted when any of the stocks on the index split.14. Which of the following indices is (are) market-value weighted?I)The New York Stock Exchange Composite IndexII)The Standard and Poor's 500 Stock IndexIII)The Dow Jones Industrial AverageA) I onlyB) I and II onlyC) I and III onlyD) I, II, and IIIE) II and III onlyAnswer: B Difficulty: ModerateRationale: The Dow Jones Industrial Average is a price-weighted index.15. The Dow Jones Industrial Average (DJIA) is computed by:A) adding the prices of 30 large "blue-chip" stocks and dividing by 30.B) calculating the total market value of the 30 firms in the index and dividing by 30.C) adding the prices of the 30 stocks in the index and dividing by a divisor.D) adding the prices of the 500 stocks in the index and dividing by a divisor.E) adding the prices of the 30 stocks in the index and dividing by the value of thesestocks as of some base date period.Answer: C Difficulty: EasyRationale: When the DJIA became a 30-stock index, response A was true; however, as stocks on the index have split and been replaced, the divisor has been adjusted. InJanuary 2003 the divisor was 0.146.Use the following to answer questions 16-18:Consider the following three stocks:Stock Price N um ber of shares outstandingStock A$40 200Stock B$70 500Stock C$10 60016. The price-weighted index constructed with the three stocks isA) 30B) 40C) 50D) 60E) 70Answer: B Difficulty: EasyRationale: ($40 + $70 + $10)/3 = $40.17. The value-weighted index constructed with the three stocks using a divisor of 100 isA) 1.2B) 1200C) 490D) 4900E) 49Answer: C Difficulty: ModerateRationale: The sum of the value of the three stocks divided by 100 is 490: [($40 x 200) + ($70 x 500) + ($10 x 600)] /100 = 490.18. Assume at these prices the value-weighted index constructed with the three stocks is490. What would the index be if stock B is split 2 for 1 and stock C 4 for 1?A) 265B) 430C) 355D) 490E) 1000Answer: D Difficulty: ModerateRationale: Value-weighted indexes are not affected by stock splits.19. The price quotations of Treasury bonds in the Wall Street Journal show an ask price of104:08 and a bid price of 104:04. As a buyer of the bond what is the dollar price you expect to pay?A) $10,480.00B) $10,425.00C) $10,440.00D) $10,412.50E) $10,404.00Answer: B Difficulty: ModerateRationale: You pay the asking price of the dealer, 104 8/32, or 104.25% of $10,000, or $10,425.00.20. An investor purchases one municipal and one corporate bond that pay rates of return of8% and 10%, respectively. If the investor is in the 20% marginal tax bracket, his or her after tax rates of return on the municipal and corporate bonds would be ________ and ______, respectively.A) 8% and 10%B) 8% and 8%C) 6.4% and 8%D) 6.4% and 10%E) 10% and 10%Answer: B Difficulty: ModerateRationale: r c = 0.10(1 - 0.20) = 0.08, or 8%; r m = 0.08(1 - 0) = 8%.21. If a Treasury note has a bid price of $975, the quoted bid price in the Wall Street Journalwould beA) 97:50.B) 97:16.C) 97:80.D) 94:24.E) 97:75.Answer: B Difficulty: EasyRationale: Treasuries are quoted as a percent of $1,000 and in 1/32s.22. In calculating the Standard and Poor's stock price indices, the adjustment for stock splitoccurs:A) by adjusting the divisor.B) automatically.C) by adjusting the numerator.D) quarterly, on the last trading day of each quarter.E) none of the above.Answer: B Difficulty: EasyRationale: The calculation of the value-weighted S&P indices includes both price and number of shares of each of the stocks in the index. Thus, the effects of stock splits are automatically incorporated into the calculation.23. Which of the following statements regarding the Dow Jones Industrial Average (DJIA)is false?A) The DJIA is not very representative of the market as a whole.B) The DJIA consists of 30 blue chip stocks.C) The DJIA is affected equally by changes in low and high priced stocks.D) The DJIA divisor needs to be adjusted for stock splits.E) The value of the DJIA is much higher than individual stock prices.Answer: C Difficulty: EasyRationale: The high priced stocks have much more impact on the DJIA than do the lower priced stocks.24. The index that includes the largest number of actively traded stock is:A) the NASDAQ Composite Index.B) the NYSE Composite Index.C) the Wilshire 5000 Index.D) the Value Line Composite Index.E) the Russell Index.Answer: C Difficulty: EasyRationale: The Wilshire 5000 is the largest readily available stock index, consisting of the stocks traded on the organized exchanges and the OTC stocks.25. A 5.5% 20-year municipal bond is currently priced to yield 7.2%. For a taxpayer in the33% marginal tax bracket, this bond would offer an equivalent taxable yield of:A) 8.20%.B) 10.75%.C) 11.40%.D) 4.82%.E) none of the above.Answer: B Difficulty: ModerateRationale: 0.072 = r m (1-t); 0.072 = r m / (0.67); r m = 0.1075 = 10.75%.26. If the market prices of each of the 30 stocks in the Dow Jones Industrial Average (DJIA)all change by the same percentage amount during a given day, which stock will have the greatest impact on the DJIA?A) The stock trading at the highest dollar price per share.B) The stock with total equity has the higher market value.C) The stock having the greatest amount of equity in its capital structure.D) The stock having the lowest volatility.E) All will have an equal impact.Answer: A Difficulty: ModerateRationale: Higher priced stocks affect the DJIA more than lower priced stocks; other choices are not relevant.27. The Value Line Index is an equally weighted geometric average of the return of about1,700 firms. What is the value of an index based on the geometric average returns of three stocks, where the returns on the three stocks during a given period were 20%, -10%, and 5%?A) 4.3%B) 5.0%C) 11.7%D) 13.4%E) 12.2%Answer: A Difficulty: ModerateRationale: [(1.2)(0.9)(1.05)]1/3 - 1 = 4.28%.28. The stocks on the Dow Jones Industrial AverageA) have remained unchanged since the creation of the index.B) include most of the stocks traded on the NYSE.C) are changed occasionally as circumstances dictate.D) consist of stocks on which the investor cannot lose money.E) B and C.Answer: C Difficulty: EasyRationale: The stocks on the DJIA are only a small sample of the entire market, have been changed occasionally since the creation of the index, and one can lose money on any stock. See text box on page 50 for a list of DJIA stock changes.29. Federally sponsored agency debtA) is legally insured by the U. S. Treasury.B) would probably be backed by the U. S. Treasury in the event of a near-default.C) has a small positive yield spread relative to U. S. Treasuries.D) B and C.E) A and C.Answer: D Difficulty: EasyRationale: Federally sponsored agencies, such as the FHLB, are not government owned.These agencies' debt is not insured by the U.S. Treasury, but probably would be backed by the Treasury in the event of an agency near-default. As a result, the issues are very safe and carry a yield only slightly higher than that of U. S. Treasuries.30. Brokers' callsA) are funds used by individuals who wish to buy stocks on margin.B) are funds borrowed by the broker from the bank, with the agreement to repay thebank immediately if requested to do so.C) carry a rate that is usually about one percentage point lower than the rate on U.S.T-bills.D) A and B.E) A and C.Answer: D Difficulty: EasyRationale: Brokers' calls are funds borrowed from banks by brokers and loaned toinvestors in margin accounts.31. A form of short-term borrowing by dealers in government securities isA) reserve requirements.B) repurchase agreements.C) banker's acceptances.D) commercial paper.E) brokers' calls.Answer: B Difficulty: EasyRationale: Repurchase agreements are a form of short-term borrowing where a dealer sells government securities to an investor with an agreement to buy back those same securities at a slightly higher price.32. Which of the following securities is a money market instrument?A) Treasury noteB) Treasury bond.C) municipal bond.D) commercial paper.E) mortgage security.Answer: D Difficulty: EasyRationale: Only commercial paper is a money market security. The others are capital market instruments.33. The call provision in Treasury securitiesI)is used with Treasury Notes.II)is used with Treasury Bonds.III)gives the Treasury the right to repurchase the security at par.IV)gives the Treasury the right to repurchase the security at a premium over par.A) II and III are correct.B) II and IV are correct.C) I, II and III are correct.D) I, II and IV are correct.E) Only II is correct.Answer: A Difficulty: ModerateRationale: Call provisions, giving the Treasury the right to repurchase the security at par, are included in some Treasury Bonds. No callable bonds have been issued since 1984.34. The yield to maturity reported in the financial pages for Treasury securitiesA) is calculated by compounding the semiannual yield.B) is calculated by doubling the semiannual yield.C) is also called the bond equivalent yield.D) is calculated as the yield-to-call for premium bonds.E) Both B and C are true.Answer: E Difficulty: EasyRationale: The yield to maturity shown in the financial pages is an APR calculated by doubling the semi-annual yield.35. Which of the following is not a mortgage-related government or government sponsoredagency?A) The Federal Home Loan BankB) The Federal National Mortgage AssociationC) The U.S. TreasuryD) Freddie MacE) Ginnie MaeAnswer: C Difficulty: EasyRationale: Only the U.S. Treasury issues securities that are not mortgage-backed. 36. The Tax Reform Act of 1986 limited the issue of mortgage revenue and tax-exemptbondsA) to $150 billion per state.B) to the larger of $50 per capita or $150 million per state.C) to the amount outstanding in 1980.D) to maturities of 20 years or less.E) None of the above statements are correct.Answer: B Difficulty: ModerateRationale: The Tax Reform Act of 1986 limited the issue of mortgage revenue and tax exempt bonds for each state to $50 per capita or $150 million in order to limit the drain of potential tax revenue from the Federal Government.37. In order for you to be indifferent between the after tax returns on a corporate bondpaying 8.5% and a tax-exempt municipal bond paying 6.12%, what would your taxbracket need to be?A) 33%B) 72%C) 15%D) 28%E) Cannot tell from the information givenAnswer: D Difficulty: ModerateRationale: .0612 = .085(1-t); (1-t) = 0.72; t = .2838. Which of the following are true about Treasury Bills?A) T-Bills are capital market instruments.B) T-Bills yields are quoted in the financial pages as effective annual rates of return.C At the T-Bill's maturity, the holder receives the face value of the Bill.C) Both A and C are correct.D) All of the above.Answer: D Difficulty: Moderate39. What does the term, “negotiable” mean with regard to negotiable certificates of deposit?A) The CD can be sold to another investor if the owner needs to cash it in before itsmaturity date.B) The rate of interest on the CD is subject to negotiation.C) The CD is automatically reinvested at its maturity date.D) The CD has staggered maturity dates built in.E) The interest rate paid on the CD will vary with a designated market rate.Answer: A Difficulty: Easy40. Freddie Mac and Ginnie Mae were organized to provideA) a primary market for mortgage transactions.B) liquidity for the mortgage market.C) a primary market for farm loan transactions.D) liquidity for the farm loan market.E) a source of funds for government agencies.Answer: B Difficulty: Easy41. The type of municipal bond that is used to finance commercial enterprises such as theconstruction of a new building for a corporation is calledA) a corporate courtesy bond.B) a revenue bond.C) a general obligation bond.D) a tax anticipation note.E) an industrial development bond.Answer: E Difficulty: Easy42. Suppose an investor is considering a corporate bond with a 7.17% before-tax yield and amunicipal bond with a 5.93% before-tax yield. At what marginal tax rate would the investor be indifferent between investing in the corporate and investing in the muni?A) 15.4%B) 23.7%C) 39.5%D) 17.3%E) 12.4%Answer: D Difficulty: ModerateRationale: t m = 1-(5.93%/7.17%) = 17.29%43. An individual can invest in student loan securities by buyingA) Sallie MaesB) Ginnie MaesC) Fanny MaesD) Freddie MacsE) Stacey JoesAnswer: A Difficulty: Easy44. Which of the following are characteristics of preferred stock?I)It pays its holder a fixed amount of income each year, at the discretion of itsmanagers.II)It gives its holder voting power in the firm.III)Its dividends are usually cumulative.IV)Failure to pay dividends may result in bankruptcy proceedings.A) I, III, and IVB) I, II, and IIIC) I and IIID) I, II, and IVE) I, II, III, and IVAnswer: C Difficulty: Moderate45. Bond market indexes can be difficult to construct becauseA) they cannot be based on firms' market values.B) bonds tend to trade infrequently, making price information difficult to obtain.C) there are so many different kinds of bonds.D) prices cannot be obtained for companies that operate in emerging markets.E) corporations are not required to disclose the details of their bond issues.Answer: B Difficulty: Moderate46. With regard to a futures contract, the long position is held byA) the trader who bought the contract at the largest discount.B) the trader who has to travel the farthest distance to deliver the commodity.C) the trader who plans to hold the contract open for the lengthiest time period.D) the trader who commits to purchasing the commodity on the delivery date.E) the trader who commits to delivering the commodity on the delivery date.Answer: D Difficulty: Easy47. In order for you to be indifferent between the after tax returns on a corporate bondpaying 9% and a tax-exempt municipal bond paying 7%, what would your tax bracket need to be?A) 17.6%B) 27%C) 22.2%D) 19.8%E) Cannot tell from the information givenAnswer: C Difficulty: ModerateRationale: .07 = .09(1-t); (1-t) = 0.777; t = .22248. In order for you to be indifferent between the after tax returns on a corporate bondpaying 7% and a tax-exempt municipal bond paying 5.5%, what would your tax bracket need to be?A) 22.6%B) 21.4%C) 26.2%D) 19.8%E) Cannot tell from the information givenAnswer: B Difficulty: ModerateRationale: .055 = .07(1-t); (1-t) = 0.786; t = .21449. An investor purchases one municipal and one corporate bond that pay rates of return of6% and 8%, respectively. If the investor is in the 25% marginal tax bracket, his or her after tax rates of return on the municipal and corporate bonds would be ________ and ______, respectively.A) 6% and 8%B) 4.5% and 6%C) 4.5% and 8%D) 6% and 6%E) None of the aboveAnswer: D Difficulty: ModerateRationale: r c = 0.08(1 - 0.25) = 0.06, or 6%; r m = 0.06(1 - 0) = 6%.50. An investor purchases one municipal and one corporate bond that pay rates of return of7.2% and 9.1%, respectively. If the investor is in the 15% marginal tax bracket, his orher after tax rates of return on the municipal and corporate bonds would be ________ and ______, respectively.A) 7.2% and 9.1%B) 7.2% and 7.735%C) 6.12% and 7.735%D) 8.471% and 9.1%E) None of the aboveAnswer: B Difficulty: ModerateRationale: r c = 0.091(1 - 0.15) = 0.07735, or 7.735%; r m = 0.072(1 - 0) = 7.2%.51. For a taxpayer in the 25% marginal tax bracket, a 20-year municipal bond currentlyyielding 5.5% would offer an equivalent taxable yield of:A) 7.33%.B) 10.75%.C) 5.5%.D) 4.125%.E) none of the above.Answer: A Difficulty: ModerateRationale: 0.055= r m(1-t); 0.0733 = r m / 0.75).52. For a taxpayer in the 15% marginal tax bracket, a 15-year municipal bond currentlyyielding 6.2% would offer an equivalent taxable yield of:A) 6.2%.B) 5.27%.C) 8.32%.D) 7.29%.E) none of the above.Answer: D Difficulty: ModerateRationale: 0.062= r m(1-t); 0.062 = r m / (0.85); r m = 0.0729 = 7.29%.53. With regard to a futures contract, the short position is held byA) the trader who bought the contract at the largest discount.B) the trader who has to travel the farthest distance to deliver the commodity.C) the trader who plans to hold the contract open for the lengthiest time period.D) the trader who commits to purchasing the commodity on the delivery date.E) the trader who commits to delivering the commodity on the delivery date.Answer: E Difficulty: Easy54. A call option allows the buyer toA) sell the underlying asset at the exercise price on or before the expiration date.B) buy the underlying asset at the exercise price on or before the expiration date.C) sell the option in the open market prior to expiration.D) A and C.E) B and C.Answer: E Difficulty: EasyRationale: A call option may be exercised (allowing the holder to buy the underlying asset) on or before expiration; the option contract also may be sold prior to expiration.55. A put option allows the holder toA) buy the underlying asset at the striking price on or before the expiration date.B) sell the underlying asset at the striking price on or before the expiration date.C) sell the option in the open market prior to expiration.D) B and C.E) A and C.Answer: D Difficulty: EasyRationale: A put option allows the buyer to sell the underlying asset at the striking price on or before the expiration date; the option contract also may be sold prior to expiration.56. The ____ index represents the performance of the German stock market.A) DAXB) FTSEC) NikkeiD) Hang SengE) None of the aboveAnswer: A Difficulty: Easy57. The ____ index represents the performance of the Japanese stock market.A) DAXB) FTSEC) NikkeiD) Hang SengE) None of the aboveAnswer: C Difficulty: Easy58. The ____ index represents the performance of the U.K. stock market.A) DAXB) FTSEC) NikkeiD) Hang SengE) None of the aboveAnswer: B Difficulty: Easy59. The ____ index represents the performance of the Hong Kong stock market.A) DAXB) FTSEC) NikkeiD) Hang SengE) None of the aboveAnswer: D Difficulty: Easy60. The ultimate small stock index in the U.S. is theA) Wilshire 5000.B) DJIA.C) S&P 500.D) Russell 2000.E) None of the above.Answer: A Difficulty: Easy61. The ____ is an example of a U.S. index of large firms.A) Wilshire 5000B) DJIAC) DAXD) Russell 2000E) All of the aboveAnswer: B Difficulty: Easy62. The ____ is an example of a U.S. index of small firms.A) S&P 500B) DJIAC) DAXD) Russell 2000E) All of the aboveAnswer: D Difficulty: EasyShort Answer QuestionsUse the following to answer questions 63-64:P Q P Q P QStock AStock BStock C63. Based on the information given, for a price-weighted index of the three stocks calculate:a.the rate of return for the first period (t=0 to t=1).b.the value of the divisor in the second period (t=2). Assume that Stock A had a 2-1split during this period.c.the rate of return for the second period (t=1 to t=2).Difficulty: DifficultAnswer:A.The price-weighted index at time 0 is (70+85+105)/3 = 86.67. The price-weightedindex at time 1 is (72+81+98)/3 = 83.67. The return on the index is 83.67/86.67 – 1 = -3.46%.B.The divisor must change to reflect the stock split. Because nothing elsefundamentally changed, the value of the index should remain 83.67. So the newdivisor is (36+81+98)/83.67 = 2.57. The index value is (36+81+98)/2.57 = 83.67.C.The rate of return for the second period is 83.67/83.67-1 = 0.00%64. Based on the information given for the three stocks, calculate the first-period rates ofreturn (from t=0 to t=1) ona. a market-value-weighted index.b.an equally-weighted index.c. a geometric index.Difficulty: DifficultAnswer:A.The total market value at time 0 is $70*200 + $85*500 + $105*300 = $88,000. Thetotal market value at time 1 is $72*200 + $81*500 + $98*300 = $84,300. The return is $84,300/$88,000 – 1 = -4.20%.B.The return on Stock A for the first period is $72/$70-1 = 2.86%. The return onStock B for the first period is $81/$85-1 = -4.71%. The return on Stock C for thefirst period is $98/$105-1 = -6.67%. The return on an equally weighted index of the three stocks is (2.86%-4.71%-6.67%)/3 = -2.84%.C.The geometric average return is [(1+.0286)(1-.0471)(1-.0667)](1/3)-1 =[(1.0286)(0.9529)(0.9333)]0.3333 -1 = -2.92%。

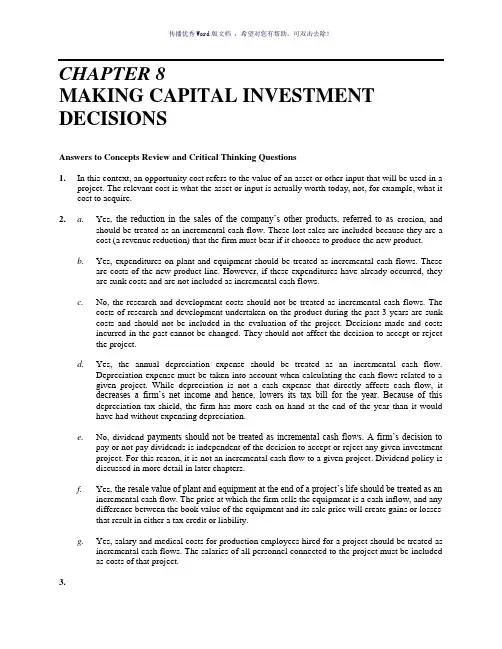

CHAPTER 8MAKING CAPITAL INVESTMENT DECISIONSAnswers to Concepts Review and Critical Thinking Questions1.In this context, an opportunity cost refers to the value of an asset or other input that will be used in aproject. The relevant cost is what the asset or input is actually worth today, not, for example, what it cost to acquire.2. a.Yes, the reduction in the sales of the company’s other products, referred to as erosion, andshould be treated as an incremental cash flow. These lost sales are included because they are a cost (a revenue reduction) that the firm must bear if it chooses to produce the new product.b. Yes, expenditures on plant and equipment should be treated as incremental cash flows. Theseare costs of the new product line. However, if these expenditures have already occurred, they are sunk costs and are not included as incremental cash flows.c. No, the research and development costs should not be treated as incremental cash flows. Thecosts of research and development undertaken on the product during the past 3 years are sunk costs and should not be included in the evaluation of the project. Decisions made and costs incurred in the past cannot be changed. They should not affect the decision to accept or reject the project.d. Yes, the annual depreciation expense should be treated as an incremental cash flow.Depreciation expense must be taken into account when calculating the cash flows related to a given project. While depreciation is not a cash expense that directly affects cash flow, it decreases a firm’s net income and hence, lowers its tax bill for the year. Because of this depreciation tax shield, the firm has more cash on hand at the end of the year than it would have had without expensing depreciation.e.No, dividend payments should not be treated as incremental cash flows. A firm’s decision topay or not pay dividends is independent of the decision to accept or reject any given investment project. For this reason, it is not an incremental cash flow to a given project. Dividend policy is discussed in more detail in later chapters.f.Yes, the resale value of plant and equipment at the end of a project’s life should be treated as anincremental cash flow. The price at which the firm sells the equipment is a cash inflow, and any difference between the book value of the equipment and its sale price will create gains or lossesthat result in either a tax credit or liability.g.Yes, salary and medical costs for production employees hired for a project should be treated asincremental cash flows. The salaries of all personnel connected to the project must be included as costs of that project.3.Item I is a relevant cost because the opportunity to sell the land is lost if the new golf club is produced. Item II is also relevant because the firm must take into account the erosion of sales of existing products when a new product is introduced. If the firm produces the new club, the earnings from the existing clubs will decrease, effectively creating a cost that must be included in the decision.Item III is not relevant because the costs of Research and Development are sunk costs. Decisions made in the past cannot be changed. They are not relevant to the production of the new clubs.4.For tax purposes, a firm would choose MACRS because it provides for larger depreciationdeductions earlier. These larger deductions reduce taxes, but have no other cash consequences.Notice that the choice between MACRS and straight-line is purely a time value issue; the total depreciation is the same; only the timing differs.5.It’s probably only a mild over-simplification. Current liabilities will all be paid, presumably. Thecash portion of current assets will be retrieved. Some receivables won’t be collected, and some inventory will not be sold, of course. Counterbalancing these losses is the fact that inventory sold above cost (and not replaced at the end of the project’s life) acts to increase working capital. These effects tend to offset one another.6.Management’s discretion to set the firm’s capital structure is applicable at the firm level. Since anyone particular project could be financed entirely with equity, another project could be financed with debt, and the firm’s overall capital structure remains unchanged, financing cost s are not relevant in the analysis of a project’s incremental cash flows according to the stand-alone principle.7.The EAC approach is appropriate when comparing mutually exclusive projects with different livesthat will be replaced when they wear out. This type of analysis is necessary so that the projects havea common life span over which they can be compared; in effect, each project is assumed to existover an infinite horizon of N-year repeating projects. Assuming that this type of analysis is valid implies that the project cash flows remain the same forever, thus ignoring the possible effects of, among other things: (1) inflation, (2) changing economic conditions, (3) the increasing unreliability of cash flow estimates that occur far into the future, and (4) the possible effects of future technology improvement that could alter the project cash flows.8.Depreciation is a non-cash expense, but it is tax-deductible on the income statement. Thusdepreciation causes taxes paid, an actual cash outflow, to be reduced by an amount equal to the depreciation tax shield, t c D. A reduction in taxes that would otherwise be paid is the same thing as a cash inflow, so the effects of the depreciation tax shield must be added in to get the total incremental aftertax cash flows.9.There are two particularly important considerations. The first is erosion. Will the “essentialized”book simply displace copies of the existing book that would have otherwise been sold? This is of special concern given the lower price. The second consideration is competition. Will other publishers step in and produce such a product? If so, then any erosion is much less relevant. A particular concern to book publishers (and producers of a variety of other product types) is that the publisher only makes money from the sale of new books. Thus, it is important to examine whether the new book would displace sales of used books (good from the publisher’s perspective) or new books (not good). The concern arises any time there is an active market for used product.10.Definitely. The damage to Porsche’s reputation is definitely a factor the company needed to consider.If the reputation was damaged, the company would have lost sales of its existing car lines.11.One company may be able to produce at lower incremental cost or market better. Also, of course,one of the two may have made a mistake!12.Porsche would recognize that the outsized profits would dwindle as more products come to marketand competition becomes more intense.Solutions to Questions and ProblemsNOTE: All end-of-chapter problems were solved using a spreadsheet. Many problems require multiple steps. Due to space and readability constraints, when these intermediate steps are included in this solutions manual, rounding may appear to have occurred. However, the final answer for each problem is found without rounding during any step in the problem.Basicing the tax shield approach to calculating OCF, we get:OCF = (Sales – Costs)(1 – t C) + t C DepreciationOCF = [($5 × 2,000 – ($2 × 2,000)](1 – 0.35) + 0.35($10,000/5)OCF = $4,600So, the NPV of the project is:NPV = –$10,000 + $4,600(PVIFA17%,5)NPV = $4,7172.We will use the bottom-up approach to calculate the operating cash flow for each year. We also mustbe sure to include the net working capital cash flows each year. So, the total cash flow each year will be:Year 1 Year 2 Year 3 Year 4 Sales Rs.7,000 Rs.7,000 Rs.7,000 Rs.7,000Costs 2,000 2,000 2,000 2,000Depreciation 2,500 2,500 2,500 2,500EBT Rs.2,500 Rs.2,500 Rs.2,500 Rs.2,500Tax 850 850 850 850Net income Rs.1,650 Rs.1,650 Rs.1,650 Rs.1,650OCF 0 Rs.4,150 Rs.4,150 Rs.4,150 Rs.4,150Capital spending –Rs.10,000 0 0 0 0NWC –200 –250 –300 –200 950Incremental cashflow –Rs.10,200 Rs.3,900 Rs.3,850 Rs.3,950 Rs.5,100The NPV for the project is:NPV = –Rs.10,200 + Rs.3,900 / 1.10 + Rs.3,850 / 1.102 + Rs.3,950 / 1.103 + Rs.5,100 / 1.104NPV = Rs.2,978.333. Using the tax shield approach to calculating OCF, we get:OCF = (Sales – Costs)(1 – t C) + t C DepreciationOCF = (R2,400,000 – 960,000)(1 – 0.30) + 0.30(R2,700,000/3)OCF = R1,278,000So, the NPV of the project is:NPV = –R2,700,000 + R1,278,000(PVIFA15%,3)NPV = R217,961.704.The cash outflow at the beginning of the project will increase because of the spending on NWC. Atthe end of the project, the company will recover the NWC, so it will be a cash inflow. The sale of the equipment will result in a cash inflow, but we also must account for the taxes which will be paid on this sale. So, the cash flows for each year of the project will be:Year Cash Flow0 – R3,000,000 = –R2.7M – 300K1 1,278,0002 1,278,0003 1,725,000 = R1,278,000 + 300,000 + 210,000 + (0 – 210,000)(.30)And the NPV of the project is:NPV = –R3,000,000 + R1,278,000(PVIFA15%,2) + (R1,725,000 / 1.153)NPV = R211,871.465. First we will calculate the annual depreciation for the equipment necessary for the project. Thedepreciation amount each year will be:Year 1 depreciation = R2.7M(0.3330) = R899,100Year 2 depreciation = R2.7M(0.4440) = R1,198,800Year 3 depreciation = R2.7M(0.1480) = R399,600So, the book value of the equipment at the end of three years, which will be the initial investment minus the accumulated depreciation, is:Book value in 3 years = R2.7M – (R899,100 + 1,198,800 + 399,600)Book value in 3 years = R202,500The asset is sold at a gain to book value, so this gain is taxable.Aftertax salvage value = R202,500 + (R202,500 – 210,000)(0.30)Aftertax salvage value = R207,750To calculate the OCF, we will use the tax shield approach, so the cash flow each year is:OCF = (Sales – Costs)(1 – t C) + t C DepreciationYear Cash Flow0 – R3,000,000 = –R2.7M – 300K1 1,277,730.00 = (R1,440,000)(.70) + 0.30(R899,100)2 1,367,640.00 = (R1,440,000)(.70) + 0.30(R1,198,800)3 1,635,630.00 = (R1,440,000)(.70) + 0.30(R399,600) + R207,750 + 300,000Remember to include the NWC cost in Year 0, and the recovery of the NWC at the end of the project.The NPV of the project with these assumptions is:NPV = – R3.0M + (R1,277,730/1.15) + (R1,367,640/1.152) + (R1,635,630/1.153)NPV = R220,655.206. First, we will calculate the annual depreciation of the new equipment. It will be:Annual depreciation charge = €925,000/5Annual depreciation charge = €185,000The aftertax salvage value of the equipment is:Aftertax salvage value = €90,000(1 – 0.35)Aftertax salvage value = €58,500Using the tax shield approach, the OCF is:OCF = €360,000(1 – 0.35) + 0.35(€185,000)OCF = €298,750Now we can find the project IRR. There is an unusual feature that is a part of this project. Accepting this project means that we will reduce NWC. This reduction in NWC is a cash inflow at Year 0. This reduction in NWC implies that when the project ends, we will have to increase NWC. So, at the end of the project, we will have a cash outflow to restore the NWC to its level before the project. We also must include the aftertax salvage value at the end of the project. The IRR of the project is:NPV = 0 = –€925,000 + 125,000 + €298,750(PVIFA IRR%,5) + [(€58,500 – 125,000) / (1+IRR)5]IRR = 23.85%7.First, we will calculate the annual depreciation of the new equipment. It will be:Annual depreciation = £390,000/5Annual depreciation = £78,000Now, we calculate the aftertax salvage value. The aftertax salvage value is the market price minus (or plus) the taxes on the sale of the equipment, so:Aftertax salvage value = MV + (BV – MV)t cVery often, the book value of the equipment is zero as it is in this case. If the book value is zero, the equation for the aftertax salvage value becomes:Aftertax salvage value = MV + (0 – MV)t cAftertax salvage value = MV(1 – t c)We will use this equation to find the aftertax salvage value since we know the book value is zero. So, the aftertax salvage value is:Aftertax salvage value = £60,000(1 – 0.34)Aftertax salvage value = £39,600Using the tax shield approach, we find the OCF for the project is:OCF = £120,000(1 – 0.34) + 0.34(£78,000)OCF = £105,720Now we can find the project NPV. Notice that we include the NWC in the initial cash outlay. The recovery of the NWC occurs in Year 5, along with the aftertax salvage value.NPV = –£390,000 – 28,000 + £105,720(PVIFA10%,5) + [(£39,600 + 28,000) / 1.15]NPV = £24,736.268.To find the BV at the end of four years, we need to find the accumulated depreciation for the firstfour years. We could calculate a table with the depreciation each year, but an easier way is to add the MACRS depreciation amounts for each of the first four years and multiply this percentage times the cost of the asset. We can then subtract this from the asset cost. Doing so, we get:BV4 = $9,300,000 – 9,300,000(0.2000 + 0.3200 + 0.1920 + 0.1150)BV4 = $1,608,900The asset is sold at a gain to book value, so this gain is taxable.Aftertax salvage value = $2,100,000 + ($1,608,900 – 2,100,000)(.40)Aftertax salvage value = $1,903,5609. We will begin by calculating the initial cash outlay, that is, the cash flow at Time 0. To undertake theproject, we will have to purchase the equipment and increase net working capital. So, the cash outlay today for the project will be:Equipment –€2,000,000NWC –100,000Total –€2,100,000Using the bottom-up approach to calculating the operating cash flow, we find the operating cash flow each year will be:Sales €1,200,000Costs 300,000Depreciation 500,000EBT €400,000Tax 140,000Net income €260,000The operating cash flow is:OCF = Net income + DepreciationOCF = €260,000 + 500,000OCF = €760,000To find the NPV of the project, we add the present value of the project cash flows. We must be sure to add back the net working capital at the end of the project life, since we are assuming the net working capital will be recovered. So, the project NPV is:NPV = –€2,100,000 + €760,000(PVIFA14%,4) + €100,000 / 1.144NPV = €173,629.3810.We will need the aftertax salvage value of the equipment to compute the EAC. Even though theequipment for each product has a different initial cost, both have the same salvage value. The aftertax salvage value for both is:Both cases: aftertax salvage value = $20,000(1 – 0.35) = $13,000To calculate the EAC, we first need the OCF and NPV of each option. The OCF and NPV for Techron I is:OCF = – $34,000(1 – 0.35) + 0.35($210,000/3) = $2,400NPV = –$210,000 + $2,400(PVIFA14%,3) + ($13,000/1.143) = –$195,653.45EAC = –$195,653.45 / (PVIFA14%,3) = –$84,274.10And the OCF and NPV for Techron II is:OCF = – $23,000(1 – 0.35) + 0.35($320,000/5) = $7,450NPV = –$320,000 + $7,450(PVIFA14%,5) + ($13,000/1.145) = –$287,671.75EAC = –$287,671.75 / (PVIFA14%,5) = –$83,794.05The two milling machines have unequal lives, so they can only be compared by expressing both on an equivalent annual basis, which is what the EAC method does. Thus, you prefer the Techron II because it has the lower (less negative) annual cost.。

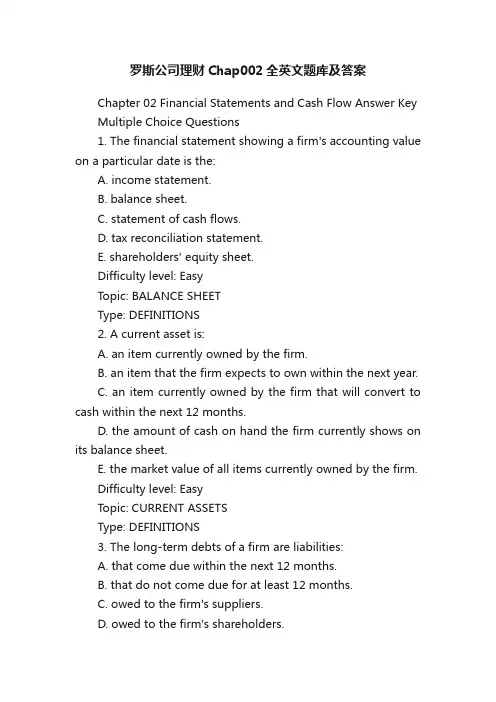

罗斯公司理财Chap002全英文题库及答案Chapter 02 Financial Statements and Cash Flow Answer Key Multiple Choice Questions1. The financial statement showing a firm's accounting value on a particular date is the:A. income statement.B. balance sheet.C. statement of cash flows.D. tax reconciliation statement.E. shareholders' equity sheet.Difficulty level: EasyTopic: BALANCE SHEETType: DEFINITIONS2. A current asset is:A. an item currently owned by the firm.B. an item that the firm expects to own within the next year.C. an item currently owned by the firm that will convert to cash within the next 12 months.D. the amount of cash on hand the firm currently shows on its balance sheet.E. the market value of all items currently owned by the firm.Difficulty level: EasyTopic: CURRENT ASSETSType: DEFINITIONS3. The long-term debts of a firm are liabilities:A. that come due within the next 12 months.B. that do not come due for at least 12 months.C. owed to the firm's suppliers.D. owed to the firm's shareholders.E. the firm expects to incur within the next 12 months.Difficulty level: EasyTopic: LONG-TERM DEBTType: DEFINITIONS4. Net working capital is defined as:A. total liabilities minus shareholders' equity.B. current liabilities minus shareholders' equity.C. fixed assets minus long-term liabilities.D. total assets minus total liabilities.E. current assets minus current liabilities.Difficulty level: EasyTopic: NET WORKING CAPITALType: DEFINITIONS5. A(n) ____ asset is one which can be quickly converted into cash without significant loss in value.A. currentB. fixedC. intangibleD. liquidE. long-termDifficulty level: EasyTopic: LIQUID ASSETSType: DEFINITIONS6. The financial statement summarizing a firm's accounting performance over a period of time is the:A. income statement.B. balance sheet.C. statement of cash flows.D. tax reconciliation statement.E. shareholders' equity sheet.Difficulty level: EasyTopic: INCOME STATEMENTType: DEFINITIONS7. Noncash items refer to:A. the credit sales of a firm.B. the accounts payable of a firm.C. the costs incurred for the purchase of intangible fixed assets.D. expenses charged against revenues that do not directly affect cash flow.E. all accounts on the balance sheet other than cash on hand.Difficulty level: EasyTopic: NONCASH ITEMSType: DEFINITIONS8. Your _____ tax rate is the amount of tax payable on the next taxable dollar you earn.A. deductibleB. residualC. totalD. averageE. marginalDifficulty level: EasyTopic: MARGINAL TAX RATESType: DEFINITIONS9. Your _____ tax rate is the total taxes you pay divided by your taxable income.A. deductibleB. residualC. totalD. averageE. marginalDifficulty level: EasyTopic: AVERAGE TAX RATESType: DEFINITIONS10. _____ refers to the cash flow that results from the firm's ongoing, normal business activities.A. Cash flow from operating activitiesB. Capital spendingC. Net working capitalD. Cash flow from assetsE. Cash flow to creditorsDifficulty level: MediumTopic: CASH FLOW FROM OPERATING ACTIVITIESType: DEFINITIONS11. _____ refers to the changes in net capital assets.A. Operating cash flowB. Cash flow from investingC. Net working capitalD. Cash flow from assetsE. Cash flow to creditorsDifficulty level: MediumTopic: CASH FLOW FROM INVESTINGType: DEFINITIONS12. _____ refers to the difference between a firm's current assets and its current liabilities.A. Operating cash flowB. Capital spendingC. Net working capitalD. Cash flow from assetsE. Cash flow to creditorsDifficulty level: EasyTopic: NET WORKING CAPITALType: DEFINITIONS13. _____ is calculated by adding back noncash expenses to net income and adjusting for changes in current assets and liabilities.A. Operating cash flowB. Capital spendingC. Net working capitalD. Cash flow from operationsE. Cash flow to creditorsDifficulty level: MediumTopic: CASH FLOW FROM OPERATIONSType: DEFINITIONS14. _____ refers to the firm's interest payments less any net new borrowing.A. Operating cash flowB. Capital spendingC. Net working capitalD. Cash flow from shareholdersE. Cash flow to creditorsDifficulty level: MediumTopic: CASH FLOW TO CREDITORSType: DEFINITIONS15. _____ refers to the firm's dividend payments less any net new equity raised.A. Operating cash flowB. Capital spendingC. Net working capitalD. Cash flow from creditorsE. Cash flow to stockholdersDifficulty level: MediumTopic: CASH FLOW TO STOCKHOLDERSType: DEFINITIONS16. Earnings per share is equal to:A. net income divided by the total number of shares outstanding.B. net income divided by the par value of the common stock.C. gross income multiplied by the par value of the common stock.D. operating income divided by the par value of the common stock.E. net income divided by total shareholders' equity.Difficulty level: MediumTopic: EARNINGS PER SHAREType: DEFINITIONS17. Dividends per share is equal to dividends paid:A. divided by the par value of common stock.B. divided by the total number of shares outstanding.C. divided by total shareholders' equity.D. multiplied by the par value of the common stock.E. multiplied by the total number of shares outstanding.Difficulty level: MediumTopic: DIVIDENDS PER SHAREType: DEFINITIONS18. Which of the following are included in current assets?I. equipmentII. inventoryIII. accounts payableIV. cashA. II and IV onlyB. I and III onlyC. I, II, and IV onlyD. III and IV onlyE. II, III, and IV onlyDifficulty level: MediumTopic: CURRENT ASSETSType: CONCEPTS19. Which of the following are included in current liabilities?I. note payable to a supplier in eighteen monthsII. debt payable to a mortgage company in nine monthsIII. accounts payable to suppliersIV. loan payable to the bank in fourteen monthsA. I and III onlyB. II and III onlyC. III and IV onlyD. II, III, and IV onlyE. I, II, and III onlyDifficulty level: MediumTopic: CURRENT LIABILITIESType: CONCEPTS20. An increase in total assets:A. means that net working capital is also increasing.B. requires an investment in fixed assets.C. means that shareholders' equity must also increase.D. must be offset by an equal increase in liabilities and shareholders' equity.E. can only occur when a firm has positive net income.Difficulty level: MediumTopic: BALANCE SHEETType: CONCEPTS21. Which one of the following assets is generally the most liquid?A. inventoryB. buildingsC. accounts receivableD. equipmentE. patentsDifficulty level: MediumTopic: LIQUIDITYType: CONCEPTS22. Which one of the following statements concerning liquidity is correct?A. If you sold an asset today, it was a liquid asset.B. If you can sell an asset next year at a price equal to its actual value, the asset is highly liquid.C. Trademarks and patents are highly liquid.D. The less liquidity a firm has, the lower the probability the firm will encounter financial difficulties.E. Balance sheet accounts are listed in order of decreasing liquidity.Difficulty level: MediumTopic: LIQUIDITYType: CONCEPTS23. Liquidity is:A. a measure of the use of debt in a firm's capital structure.B. equal to current assets minus current liabilities.C. equal to the market value of a firm's total assets minus its current liabilities.D. valuable to a firm even though liquid assets tend to be lessprofitable to own.E. generally associated with intangible assets.Difficulty level: MediumTopic: LIQUIDITYType: CONCEPTS24. Which of the following accounts are included in shareholders' equity?I. interest paidII. retained earningsIII. capital surplusIV. long-term debtA. I and II onlyB. II and IV onlyC. I and IV onlyD. II and III onlyE. I and III onlyDifficulty level: MediumTopic: SHAREHOLDERS' EQUITYType: CONCEPTS25. Book value:A. is equivalent to market value for firms with fixed assets.B. is based on historical cost.C. generally tends to exceed market value when fixed assets are included.D. is more of a financial than an accounting valuation.E. is adjusted to market value whenever the market value exceeds the stated book value. Difficulty level: Medium Topic: BOOK VALUEType: CONCEPTS26. When making financial decisions related to assets, youshould:A. always consider market values.B. place more emphasis on book values than on market values.C. rely primarily on the value of assets as shown on the balance sheet.D. place primary emphasis on historical costs.E. only consider market values if they are less than book values.Difficulty level: MediumTopic: MARKET VALUEType: CONCEPTS27. As seen on an income statement:A. interest is deducted from income and increases the total taxes incurred.B. the tax rate is applied to the earnings before interest and taxes when the firm has both depreciation and interest expenses.C. depreciation is shown as an expense but does not affect the taxes payable.D. depreciation reduces both the pretax income and the net income.E. interest expense is added to earnings before interest and taxes to get pretax income. Difficulty level: MediumTopic: INCOME STATEMENTType: CONCEPTS28. The earnings per share will:A. increase as net income increases.B. increase as the number of shares outstanding increase.C. decrease as the total revenue of the firm increases.D. increase as the tax rate increases.E. decrease as the costs decrease.Difficulty level: MediumTopic: EARNINGS PER SHAREType: CONCEPTS29. Dividends per share:A. increase as the net income increases as long as the number of shares outstanding remains constant.B. decrease as the number of shares outstanding decrease, all else constant.C. are inversely related to the earnings per share.D. are based upon the dividend requirements established by Generally Accepted Accounting Procedures.E. are equal to the amount of net income distributed to shareholders divided by the number of shares outstanding.Difficulty level: MediumTopic: DIVIDENDS PER SHAREType: CONCEPTS30. Earnings per shareA. will increase if net income increases and number of shares remains constant.B. will increase if net income decreases and number of shares remains constant.C. is number of shares divided by net income.D. is the amount of money that goes into retained earnings on a per share basis.E. None of the above.Difficulty level: MediumTopic: EARNINGS PER SHAREType: CONCEPTS31. According to Generally Accepted Accounting Principles,costs are:A. recorded as incurred.B. recorded when paid.C. matched with revenues.D. matched with production levels.E. expensed as management desires.Difficulty level: MediumTopic: MATCHING PRINCIPLEType: CONCEPTS32. Depreciation:A. is a noncash expense that is recorded on the income statement.B. increases the net fixed assets as shown on the balance sheet.C. reduces both the net fixed assets and the costs of a firm.D. is a non-cash expense which increases the net operating income.E. decreases net fixed assets, net income, and operating cash flows.Difficulty level: MediumTopic: NONCASH ITEMSType: CONCEPTS33. When you are making a financial decision, the most relevant tax rate is the _____ rate.A. averageB. fixedC. marginalD. totalE. variableDifficulty level: MediumTopic: MARGINAL TAX RATEType: CONCEPTS34. An increase in which one of the following will cause the operating cash flow to increase?A. depreciationB. changes in the amount of net fixed capitalC. net working capitalD. taxesE. costsDifficulty level: MediumTopic: OPERATING CASH FLOWType: CONCEPTS35. A firm starts its year with a positive net working capital. During the year, the firm acquires more short-term debt than it does short-term assets. This means that:A. the ending net working capital will be negative.B. both accounts receivable and inventory decreased during the year.C. the beginning current assets were less than the beginning current liabilities.D. accounts payable increased and inventory decreased during the year.E. the ending net working capital can be positive, negative, or equal to zero.Difficulty level: MediumTopic: CHANGE IN NET WORKING CAPITALType: CONCEPTS36. The cash flow to creditors includes the cash:A. received by the firm when payments are paid to suppliers.B. outflow of the firm when new debt is acquired.C. outflow when interest is paid on outstanding debt.D. inflow when accounts payable decreases.E. received when long-term debt is paid off.Difficulty level: MediumTopic: CASH FLOW TO CREDITORSType: CONCEPTS37. Cash flow to stockholders must be positive when:A. the dividends paid exceed the net new equity raised.B. the net sale of common stock exceeds the amount of dividends paid.C. no income is distributed but new shares of stock are sold.D. both the cash flow to assets and the cash flow to creditors are negative.E. both the cash flow to assets and the cash flow to creditors are positive. Difficulty level: MediumTopic: CASH FLOW TO STOCKHOLDERSType: CONCEPTS38. Which equality is the basis for the balance sheet?A. Fixed Assets = Stockholder's Equity + Current AssetsB. Assets = Liabilities + Stockholder's EquityC. Assets = Current Long-Term Debt + Retained EarningsD. Fixed Assets = Liabilities + Stockholder's EquityE. None of the aboveDifficulty level: MediumTopic: BALANCE SHEETType: CONCEPTS39. Assets are listed on the balance sheet in order of:A. decreasing liquidity.B. decreasing size.C. increasing size.D. relative life.E. None of the above.Difficulty level: MediumTopic: BALANCE SHEETType: CONCEPTS40. Debt is a contractual obligation that:A. requires the payout of residual flows to the holders of these instruments.B. requires a repayment of a stated amount and interest over the period.C. allows the bondholders to sue the firm if it defaults.D. Both A and B.E. Both B and C.Difficulty level: MediumTopic: DEBTType: CONCEPTS41. The carrying value or book value of assets:A. is determined under GAAP and is based on the cost of the asset.B. represents the true market value according to GAAP.C. is always the best measure of the company's value to an investor.D. is always higher than the replacement cost of the assets.E. None of the above.Difficulty level: MediumTopic: CARRYING VALUEType: CONCEPTS42. Under GAAP, a firm's assets are reported at:A. market value.B. liquidation value.C. intrinsic value.D. cost.E. None of the above.Difficulty level: MediumTopic: GAAPType: CONCEPTS43. Which of the following statements concerning the income statement is true?A. It measures performance over a specific period of time.B. It determines after-tax income of the firm.C. It includes deferred taxes.D. It treats interest as an expense.E. All of the above.Difficulty level: MediumTopic: INCOME STATEMENTType: CONCEPTS44. According to generally accepted accounting principles (GAAP), revenue is recognized as income when:A. a contract is signed to perform a service or deliver a good.B. the transaction is complete and the goods or services are delivered.C. payment is requested.D. income taxes are paid.E. All of the above.Difficulty level: MediumTopic: GAAP INCOME RECOGNITIONType: CONCEPTS45. Which of the following is not included in the computation of operating cash flow?A. Earnings before interest and taxesB. Interest paidC. DepreciationD. Current taxesE. All of the above are includedDifficulty level: MediumTopic: OPERATING CASH FLOWType: CONCEPTS46. Net capital spending is equal to:A. net additions to net working capital.B. the net change in fixed assets.C. net income plus depreciation.D. total cash flow to stockholders less interest and dividends paid.E. the change in total assets.Difficulty level: MediumTopic: NET CAPITAL SPENDINGType: CONCEPTS47. Cash flow to stockholders is defined as:A. interest payments.B. repurchases of equity less cash dividends paid plus new equity sold.C. cash flow from financing less cash flow to creditors.D. cash dividends plus repurchases of equity minus new equity financing.E. None of the above.Difficulty level: MediumTopic: CASH FLOW TO STOCKHOLDERSType: CONCEPTS48. Free cash flow is:A. without cost to the firm.B. net income plus taxes.C. an increase in net working capital.D. cash that the firm is free to distribute to creditors and stockholders.E. None of the above.Difficulty level: MediumTopic: FREE CASH FLOWType: CONCEPTS49. The cash flow of the firm must be equal to:A. cash flow to stockholders minus cash flow to debtholders.B. cash flow to debtholders minus cash flow to stockholders.C. cash flow to governments plus cash flow to stockholders.D. cash flow to stockholders plus cash flow to debtholders.E. None of the above.Difficulty level: MediumTopic: CASH FLOWType: CONCEPTS50. Which of the following are all components of the statement of cash flows?A. Cash flow from operating activities, cash flow from investing activities, and cash flow from financing activitiesB. Cash flow from operating activities, cash flow from investing activities, and cash flow from divesting activitiesC. Cash flow from internal activities, cash flow from external activities, and cash flow from financing activitiesD. Cash flow from brokering activities, cash flow from profitable activities, and cash flow from non-profitable activitiesE. None of the above.Difficulty level: MediumTopic: STATEMENT OF CASH FLOWSType: CONCEPTS51. One of the reasons why cash flow analysis is popular is because:A. cash flows are more subjective than net income.B. cash flows are hard to understand.C. it is easy to manipulate, or spin the cash flows.D. it is difficult to manipulate, or spin the cash flows.E. None of the above.Difficulty level: MediumTopic: CASH FLOW MANAGEMENTType: CONCEPTS52. A firm has $300 in inventory, $600 in fixed assets, $200 in accounts receivable, $100 in accounts payable, and $50 in cash. What is the amount of the current assets?A. $500B. $550C. $600D. $1,150E. $1,200Current assets = $300 + $200 + $50 = $550Difficulty level: MediumTopic: CURRENT ASSETSType: PROBLEMS53. Total assets are $900, fixed assets are $600, long-term debt is $500, and short-term debt is $200. What is the amount of net working capital?A. $0B. $100C. $200D. $300E. $400Net working capital = $900 - $600 - $200 = $100Difficulty level: MediumTopic: NET WORKING CAPITALType: PROBLEMS54. Brad's Company has equipment with a book value of $500 that could be sold today at a 50% discount. Its inventory is valued at $400 and could be sold to a competitor for that amount. The firm has $50 in cash and customers owe it $300. What is the accounting value of its liquid assets?A. $50B. $350C. $700D. $750E. $1,000Liquid assets = $400 + $50 + $300 = $750Difficulty level: MediumTopic: LIQUIDITYType: PROBLEMS55. Martha's Enterprises spent $2,400 to purchase equipment three years ago. This equipment is currently valued at $1,800 on today's balance sheet but could actually be sold for $2,000. Net working capital is $200 and long-term debt is $800. Assuming the equipment is the firm's only fixed asset, what is the book value of shareholders' equity?A. $200B. $800C. $1,200D. $1,400E. The answer cannot be determined from the informationprovidedBook value of shareholders' equity = $1,800 + $200 - $800 = $1,200Difficulty level: MediumTopic: BOOK VALUEType: PROBLEMS。

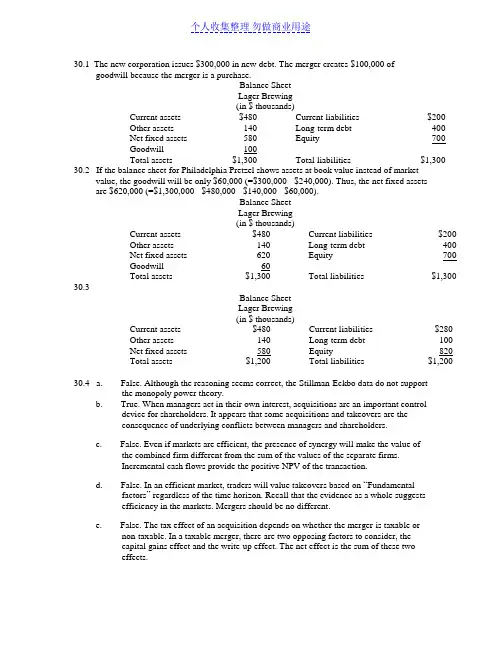

30.1 The new corporation issues $300,000 in new debt. The merger creates $100,000 ofgoodwill because the merger is a purchase.Balance SheetLager Brewing(in $ thousands)Current assets $480 Current liabilities $200Other assets 140 Long-term debt 400Net fixed assets 580 Equity 700Goodwill 100Total assets $1,300 Total liabilities $1,300 30.2 If the balance sheet for Philadelphia Pretzel shows assets at book value instead of marketvalue, the goodwill will be only $60,000 (=$300,000 - $240,000). Thus, the net fixed assetsare $620,000 (=$1,300,000 - $480,000 - $140,000 - $60,000).Balance SheetLager Brewing(in $ thousands)Current assets $480 Current liabilities $200Other assets 140 Long-term debt 400Net fixed assets 620 Equity 700Goodwill 60Total assets $1,300 Total liabilities $1,300 30.3Balance SheetLager Brewing(in $ thousands)Current assets $480 Current liabilities $280Other assets 140 Long-term debt 100Net fixed assets 580 Equity 820Total assets $1,200 Total liabilities $1,200 30.4 a. False. Although the reasoning seems correct, the Stillman-Eckbo data do not supportthe monopoly power theory.b. True. When managers act in their own interest, acquisitions are an important controldevice for shareholders. It appears that some acquisitions and takeovers are theconsequence of underlying conflicts between managers and shareholders.c. False. Even if markets are efficient, the presence of synergy will make the value ofthe combined firm different from the sum of the values of the separate firms.Incremental cash flows provide the positive NPV of the transaction.d. False. In an efficient market, traders will value takeovers based on “Fundamentalfactors” regardless of the time horizon. Recall that the evidence as a whole suggestsefficiency in the markets. Mergers should be no different.e. False. The tax effect of an acquisition depends on whether the merger is taxable ornon-taxable. In a taxable merger, there are two opposing factors to consider, thecapital gains effect and the write-up effect. The net effect is the sum of these twoeffects.f. True. Because of the coinsurance effect, wealth might be transferred from thestockholders to the bondholders. Acquisition analysis usually disregards this effectand considers only the total value.30.530.6 a. The weather conditions are independent. Thus, the joint probabilities are theproducts of the individual probabilities.Possible states Joint probabilityRain Rain 0.1 x 0.1=0.01Rain Warm 0.1 x 0.4=0.04Rain Hot 0.1 x 0.5=0.05Warm Rain 0.4 x 0.1=0.04Warm Warm 0.4 x 0.4=0.16Warm Hot 0.4 x 0.5=0.20Hot Rain 0.5 x 0.1=0.05Hot Warm 0.5 x 0.4=0.20Hot Hot 0.5 x 0.5=0.25Since the state Rain Warm has the same outcome (revenue) as Warm Rain, theirprobabilities can be added. The same is true of Rain Hot, Hot Rain and Warm Hot,Hot Warm. Thus the joint probabilities arePossibleJoint probabilitystatesRain Rain 0.01Rain Warm 0.08Rain Hot 0.10Warm Warm 0.16Warm Hot 0.40Hot Hot 0.25The joint values are the sums of the values of the two companies for the particularstate.Possible states Joint valueRain Rain $200,000Rain Warm 300,000Warm Warm 400,000Rain Hot 500,000Warm Hot 600,000Hot Hot 800,000b. Recall, if a firm cannot service its debt, the bondholders receive the value of the assets.Thus, the value of the debt is the value of the company if the face value of the debt isgreater than the value of the company. If the value of the company is greater than the value of the debt, the value of the debt is its face value. Here the value of the common stock is always the residual value of the firm over the value of the debt.Joint Prob. Joint Value Debt Value Stock Value0.01 $200,000 $200,000 $00.08 300,000 300,000 00.16 400,000 400,000 00.10 500,000 400,000 100,0000.40 600,000 400,000 200,0000.25 800,000 400,000 400,000c. To show that the value of the combined firm is the sum of the individual values, youmust show that the expected joint value is equal to the sum of the separate expected values.Expected joint value= 0.01($200,000) + 0.08($300,000) + 0.16($400,000) + 0.10($500,000) +0.40($600,000) + 0.25($800,000)= $580,000Since the firms are identical, the sum of the expected values is twice the expectedvalue of either.Expected individual value = 0.1($100,000) + 0.4($200,000) + 0.5($400,000) = $290,000 Expected combined value = 2($290,000) = $580,000d. The bondholders are better off if the value of the debt after the merger is greater thanthe value of the debt before the merger.Value of the debt before the merger:The value of debt for either company= 0.1($100,000) + 0.4($200,000) + 0.5($200,000) = $190,000Total value of debt before the merger = 2($190,000) = $380,000Value of debt after the merger= 0.01($200,000) + 0.08($300,000) + 0.16($400,000) + 0.10($400,000) +0.40($400,000) +0.25($400,000)= $390,000The bondholders are $10,000 better off after the merger.30.7 The decision hinges upon the risk of surviving. The final decision should hinge on thewealth transfer from bondholders to stockholders when risky projects are undertaken.High-risk projects will reduce the expected value of the bondholders’ claims on the firm.The telecommunications business is riskier than the utilities business. If the total value of the firm does not change, the increase in risk should favor the stockholder. Hence,management should approve this transaction. Note, if the total value of the firm dropsbecause of the transaction and the wealth effect is lower than the reduction in total value, management should reject the project.30.8 If the market is “smart,” the P/E ratio will not be constant.a. Value = $2,500 + $1,000 = $3,500b. EPS = Post-merger earnings / Total number of shares=($100 + $100)/200 =$1c. Price per share = Value/Total number of shares=$3,500/200 =$17.50d. If the market is “fooled,” the P/E ratio will be constant at $25.Value = P/E * Total number of shares= 25 * 200 = $5,000EPS = Post-merger earnings / Total number of shares=$5,000/200 = $25.0030.9 a. After the merger, Arcadia Financial will have 130,000 [=10,000 + (50,000)(6/10)]shares outstanding. The earnings of the combined firm will be $325,000. The earningsper share of the combined firm will be $2.50 (=$325,000/130,000). The acquisition will increase the EPS for the stockholders from $2.25 to $2.50.b. There will be no effect on the original Arcadia stockholders. No synergies exist in thismerger since Arcadia is buying Coldran at its market price. Examining the relativevalues of the two firms sees the latter point.Share price of Arcadia = (16 * $225,000) / 100,000=$36Share price of Coldran = (10.8 * $100,000) / 50,000=$21.60The relative value of these prices is $21.6/$36 = 0.6. Since Coldran’s shareholdersreceive 0.6 shares of Arcadia for every share of Coldran, no synergies exist.30.10 a. The synergy will be the discounted incremental cash flows. Since the cash flows areperpetual, this amount isb. The value of Flash-in-the-Pan to Fly-by-Night is the synergy plus the current marketvalue of Flash-in-the-Pan.V = $7,500,000 + $20,000,000= $27,500,000c. Cash alternative = $15,000,000Stock alternative = 0.25($27,500,000 + $35,000,000)= $15,625,000d. NPV of cash alternative = V - Cost=$27,500,000 - $15,000,000=$12,500,000NPV of stock alternative = V - Cost=$27,500,000 - $15,625,000=$11,875,000e. Use the cash alternative, its NPV is greater.30.11 a. The value of Portland Industries before the merger is $9,000,000 (=750,000x12). Thisvalue is also the discounted value of the expected future dividends.$9,000,000 =r = 0.1025 = 10.25%r is the risk-adjusted discount rate for Portland’s expected future dividends.the value of Portland Industries after the merger isThis is the value of Portland Industries to Freeport.b. NPV = Gain - Cost= $14,815,385 - ($40x250, 000)= $4,815,385c. If Freeport offers stock, the value of Portland Industries to Freeport is the same, but thecost differs.Cost = (Fraction of combined firm owned by Portland’s stockholders)x(Value of the combined firm)Value of the combined firm = (Value of Freeport before merger)+ (Value of Portland to Freeport)= $15x1,000,000 + $14,815,385= $29,815,385Cost = 0.375x$29,815,385= $11,180,769NPV= $14,815,385 - $11,180,769=$3,634,616d. The acquisition should be attempted with a cash offer since it provides a higher NPV.e. The value of Portland Industries after the merger isThis is the value of Portland Industries to Freeport.NPV = Gain-Cost=$11,223,529 - ($40x250,000)=$1,223,529If Freeport offers stock, the value of Portland Industries to Freeport is the same, but the cost differs.Cost = (Fraction of combined firm owned by Portland’s stockholders)x(Value of the combined firm)Value of the combined firm = (Value of Freeport before merger)+ (Value of Portland to Freeport)= $15x1,000,000 + $11,223,529= $26,223,529Cost = 0.375 * $26,223,529=$9,833,823NPV = $11,223,529 - $9,833,823=$1,389,706The acquisition should be attempted with a stock offer since it provides a higher NPV.30.12 a. Number of shares after acquisition=30 + 15 = 45 milStock price of Harrods after acquisition = 1,000/45=22.22 poundsb. Value of Selfridge stockholders after merger:α * 1,000 = 300α = 30%New shares issued = 12.86 mil12.86:20 = 0.643:1The proper exchange ratio should be 0.643 to make the stock offer’s value to Selfridgeequivalent to the cash offer.30.13 To evaluate this proposal, look at the present value of the incremental cash flows.Cash Flows to Company A(in $ million)Year 0 1 2 3 4 5Acquisition of B -550Dividends from B 150 32 5 20 30 45Tax-loss carryforwards 25 25Terminal value 600Total -400 32 30 45 30 645 The additional cash flows from the tax-loss carry forwards and the proposed level of debt should be discounted at the cost of debt because they are determined with very littleuncertainty.The after-tax cash flows are subject to normal business risk and must be discounted at anormal rate.Beta coefficient for the bond = 0.25 = [(8%-6%)/8%].Beta coefficient for the company = 1 = [(0.25)2 + (1.25)(0.75)]Discount rate for normal operations:r = 6% + 8% (1) = 14%Discount rate for dividends:The new beta coefficient for the company, 1, must be the weighted average of the debtbeta and the stock beta.1 = 0.5(0.25) + 0.5(βs)βs = 1.75r = 6% + 8%(1.75) = 20%Because the NPV of the acquisition is negative, Company A should not acquireCompany B.30.14 The commonly used defensive tactics by target-firm managers include:i. corporate charter amendments like super-majority amendment or staggering theelection of board members.ii. repurchase standstill agreements.iii. exclusionary self-tenders.iv. going private and leveraged buyouts.v. other devices like golden parachutes, scorched earth strategy, poison pill, ..., etc.Mini Case: U.S.Steel’s case.You have 3 choices: tender, or do not tender or sell in the market. If you do sell your shares in the market, at some point, somebody else would need to make a decision in “tender” or “not tender” as well.It is important to recognize that the firm has about 60 million shares outstanding (since 30 million shares will give US Steel 50.1% of Marathon shares). Let’s consider the possible sellingthe market price.If you choose not to tender, and 30 million shares were tendered US Steel succeeds to gain50.1% control, you will only receive $85 a share. If you do tender, the price you will receive will be no worse than $85 a share and can be as high as $125 a share. Depending on the number of shares tendered, you will receive one of the following prices.If only 50.1% tendered, you will get $125 per share.If the shares tendered exceed 50.1% but less than 100%, you will get more than $105 ashare.If all 60 million shares were tendered, you will get $105 per share. (which is )It is clear that, in the above 3 cases, when you are not sure about whether US Steel will succeed or not, you will be better off to tender your shares than not tender. This is because at best, you will only receive $85 per share if you choose not to tender.版权申明本文部分内容,包括文字、图片、以及设计等在网上搜集整理。

(完整版)公司理财-罗斯课后习题答案-CAL-FENGHAI-(2020YEAR-YICAI)_JINGBIAN第一章1.在所有权形式的公司中,股东是公司的所有者。

股东选举公司的董事会,董事会任命该公司的管理层。

企业的所有权和控制权分离的组织形式是导致的代理关系存在的主要原因。

管理者可能追求自身或别人的利益最大化,而不是股东的利益最大化。

在这种环境下,他们可能因为目标不一致而存在代理问题。

2.非营利公司经常追求社会或政治任务等各种目标。

非营利公司财务管理的目标是获取并有效使用资金以最大限度地实现组织的社会使命。

3.这句话是不正确的。

管理者实施财务管理的目标就是最大化现有股票的每股价值,当前的股票价值反映了短期和长期的风险、时间以及未来现金流量。

4.有两种结论。

一种极端,在市场经济中所有的东西都被定价。

因此所有目标都有一个最优水平,包括避免不道德或非法的行为,股票价值最大化。

另一种极端,我们可以认为这是非经济现象,最好的处理方式是通过政治手段。

一个经典的思考问题给出了这种争论的答案:公司估计提高某种产品安全性的成本是30美元万。

然而,该公司认为提高产品的安全性只会节省20美元万。

请问公司应该怎么做呢?”5.财务管理的目标都是相同的,但实现目标的最好方式可能是不同的,因为不同的国家有不同的社会、政治环境和经济制度。

6.管理层的目标是最大化股东现有股票的每股价值。

如果管理层认为能提高公司利润,使股价超过35美元,那么他们应该展开对恶意收购的斗争。

如果管理层认为该投标人或其它未知的投标人将支付超过每股35美元的价格收购公司,那么他们也应该展开斗争。

然而,如果管理层不能增加企业的价值,并且没有其他更高的投标价格,那么管理层不是在为股东的最大化权益行事。

现在的管理层经常在公司面临这些恶意收购的情况时迷失自己的方向。

7.其他国家的代理问题并不严重,主要取决于其他国家的私人投资者占比重较小。

较少的私人投资者能减少不同的企业目标。