房产税常见稽查风险点及实务案例35页PPT

- 格式:ppt

- 大小:5.23 MB

- 文档页数:35

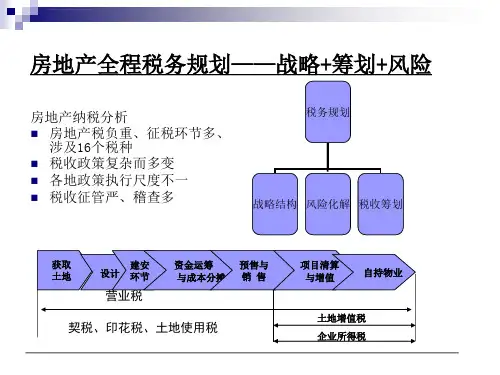

房地产交易税收管理风险分析及防控措施电子版课件目录一、房地产交易概述.........................................21.房地产交易概念及流程....................................32.房地产市场现状分析......................................43.房地产交易重要性........................................5二、房地产交易税收管理.....................................61.税收政策与法规..........................................7(1)国家房地产税收政策....................................8 (2)地方房地产税收规定...................................102.税收征收与管理机制.....................................11(1)税收征收流程.........................................12 (2)税收管理机制.........................................13三、房地产交易税收管理风险分析............................151.税收政策风险...........................................16(1)政策变化风险.........................................17 (2)政策执行风险.........................................182.税收征管风险...........................................19(1)征管流程风险.........................................20(2)征管人员素质风险.....................................223.纳税人风险.............................................23(1)纳税人行为风险.......................................24(2)纳税人信息不透明风险.................................25四、房地产交易税收管理防控措施............................261.政策层面防控措施.......................................27(1)完善税收政策体系.....................................28(2)加强政策宣传与培训...................................292.征收管理层面防控措施...................................31(1)优化征收流程.........................................32(2)提高征管人员素质.....................................333.纳税人层面防控措施.....................................35(1)加强纳税人诚信体系建设...............................36(2)强化纳税人法律意识...................................37五、案例分析与实践应用....................................38一、房地产交易概述1.房地产交易定义房地产交易是指房地产权利人(以下称转让人)与房地产受让人(以下称受让人)之间,为转让房地产所有权而发生的权利义务关系。