英文财务指标及计算公式汇总

- 格式:docx

- 大小:11.23 KB

- 文档页数:2

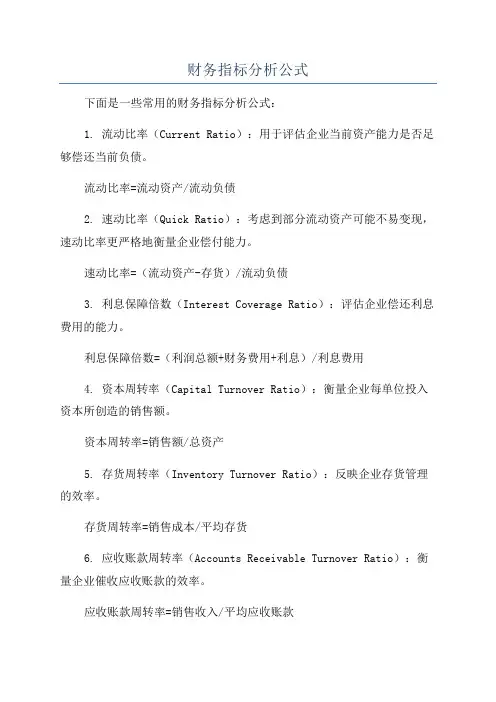

财务指标分析公式下面是一些常用的财务指标分析公式:1. 流动比率(Current Ratio):用于评估企业当前资产能力是否足够偿还当前负债。

流动比率=流动资产/流动负债2. 速动比率(Quick Ratio):考虑到部分流动资产可能不易变现,速动比率更严格地衡量企业偿付能力。

速动比率=(流动资产-存货)/流动负债3. 利息保障倍数(Interest Coverage Ratio):评估企业偿还利息费用的能力。

利息保障倍数=(利润总额+财务费用+利息)/利息费用4. 资本周转率(Capital Turnover Ratio):衡量企业每单位投入资本所创造的销售额。

资本周转率=销售额/总资产5. 存货周转率(Inventory Turnover Ratio):反映企业存货管理的效率。

存货周转率=销售成本/平均存货6. 应收账款周转率(Accounts Receivable Turnover Ratio):衡量企业催收应收账款的效率。

应收账款周转率=销售收入/平均应收账款7. 总资产周转率(Total Asset Turnover Ratio):测量企业利用所有资产创造销售额的效率。

总资产周转率=销售额/总资产8. 净利润率(Net Profit Margin):衡量企业净利润占营业收入的比例。

净利润率=(净利润/营业收入)×100%9. 毛利率(Gross Profit Margin):衡量企业销售产品或提供服务的毛利润水平。

毛利率=(销售额-销售成本)/销售额×100%10. 资产负债率(Debt Ratio):评估企业资产部分由债务融资支持的程度。

资产负债率=总负债/总资产这些公式可以作为开始财务指标分析的基础,但在使用这些公式时,还需要考虑行业的特点、比较企业的历史数据以及其他宏观经济因素,以更准确地评估企业的财务状况和经营绩效。

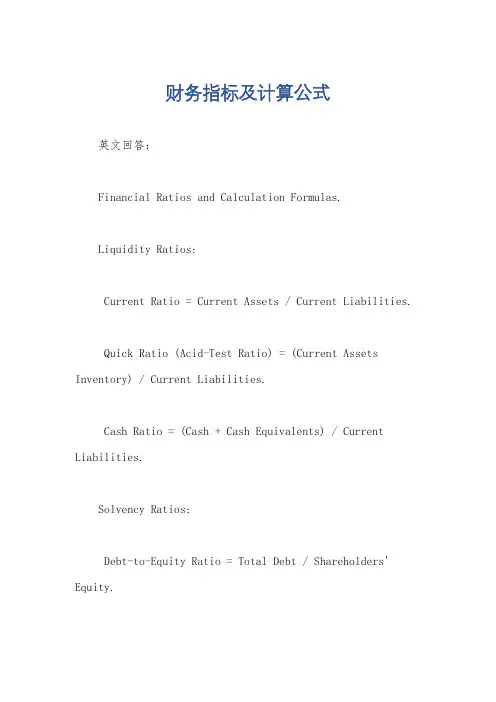

财务指标及计算公式英文回答:Financial Ratios and Calculation Formulas.Liquidity Ratios:Current Ratio = Current Assets / Current Liabilities.Quick Ratio (Acid-Test Ratio) = (Current Assets Inventory) / Current Liabilities.Cash Ratio = (Cash + Cash Equivalents) / Current Liabilities.Solvency Ratios:Debt-to-Equity Ratio = Total Debt / Shareholders' Equity.Debt-to-Asset Ratio = Total Debt / Total Assets.Times Interest Earned Ratio = Operating Income / Interest Expense.Profitability Ratios:Gross Profit Margin = Gross Profit / Revenue.Operating Profit Margin = Operating Income / Revenue.Net Profit Margin = Net Income / Revenue.Return on Assets (ROA) = Net Income / Total Assets.Return on Equity (ROE) = Net Income / Shareholders' Equity.Asset Turnover Ratios:Inventory Turnover Ratio = Cost of Goods Sold / Average Inventory.Accounts Receivable Turnover Ratio = Net Credit Sales / Average Accounts Receivable.Fixed Asset Turnover Ratio = Net Sales / Average Net Fixed Assets.Financial Leverage Ratios:Debt-to-Equity Ratio (see Solvency Ratios)。

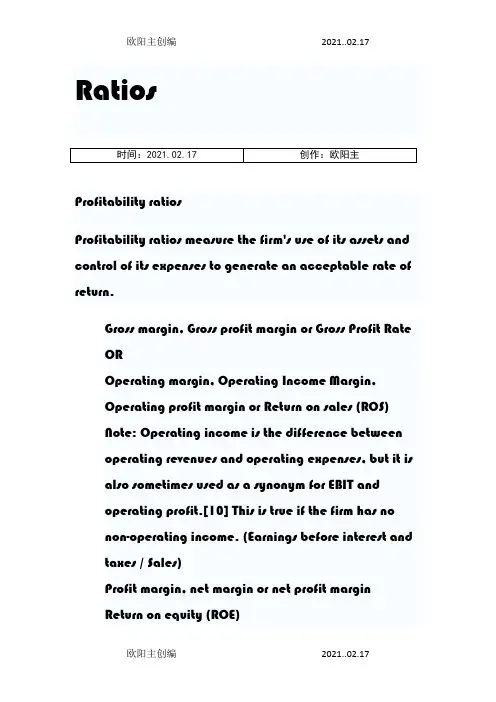

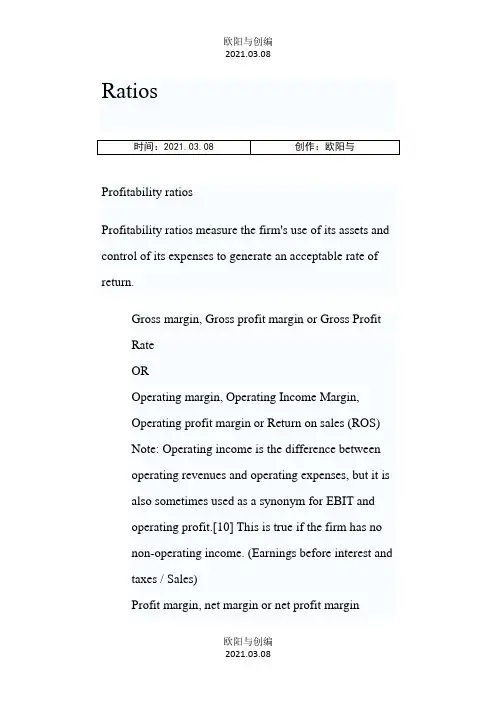

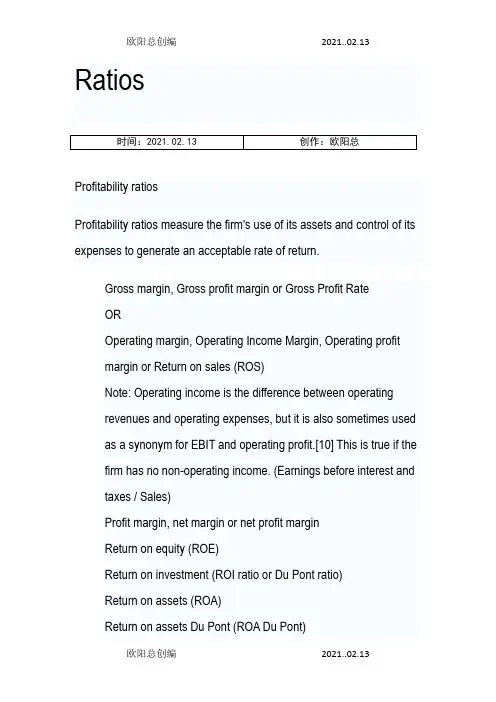

RatiosProfitability ratiosProfitability ratios measure the firm's use of its assets and control of its expenses to generate an acceptable rate of return.Gross margin, Gross profit margin or Gross Profit RateOROperating margin, Operating Income Margin,Operating profit margin or Return on sales (ROS)Note: Operating income is the difference betweenoperating revenues and operating expenses, but it is also sometimes used as a synonym for EBIT andoperating profit.[10] This is true if the firm has nonon-operating income. (Earnings before interest and taxes / Sales)Profit margin, net margin or net profit marginReturn on equity (ROE)Return on investment (ROI ratio or Du Pont ratio)Return on assets (ROA)Return on assets Du Pont (ROA Du Pont)Return on Equity Du Pont (ROE Du Pont)Return on net assets (RONA)Return on capital (ROC)Risk adjusted return on capital (RAROC)ORReturn on capital employed (ROCE)Note: this is somewhat similar to (ROI), whichcalculates Net Income per Owner's EquityCash flow return on investment (CFROI)Efficiency ratioNet gearingLiquidity ratiosLiquidity ratios measure the availability of cash to pay debt.Current ratioAcid-test ratio (Quick ratio)[17]Operation cash flow ratioActivity ratiosActivity ratios measure the effectiveness of the firms use of resources.Average collection periodDegree of Operating Leverage (DOL)DSO RatioAverage payment periodAsset turnoverInventory turnover ratioReceivables Turnover RatioInventory conversion ratioInventory conversion periodReceivables conversion periodPayables conversion periodCash Conversion CycleInventory Conversion Period + ReceivablesConversion Period - Payables Conversion PeriodDebt ratios (leveraging ratios)Debt ratios measure the firm's ability to repay long-term debt. Debt ratios measure financial leverage.Debt ratioDebt to equity ratioLong-term Debt to equity (LT Debt to Equity)Times interest-earned ratioORDebt service coverage ratioMarket ratiosMarket ratios measure investor response to owning a company's stock and also the cost of issuing stock.Earnings per share (EPS)Payout ratioORDividend cover (the inverse of Payout Ratio)P/E ratioDividend yieldCash flow ratio or Price/cash flow ratioPrice to book value ratio (P/B or PBV)Price/sales ratioPEG ratioOther Market RatiosEV/EBITDAEV/SalesCost/Income ratio Sector-specific ratios。

RatiosProfitability ratiosProfitability ratios measure the firm's use of its assets and control of its expenses to generate an acceptable rate of return.Gross margin, Gross profit margin or Gross ProfitRateOROperating margin, Operating Income Margin,Operating profit margin or Return on sales (ROS)Note: Operating income is the difference betweenoperating revenues and operating expenses, but it isalso sometimes used as a synonym for EBIT andoperating profit.[10] This is true if the firm has nonon-operating income. (Earnings before interest andtaxes / Sales)Profit margin, net margin or net profit marginReturn on equity (ROE)Return on investment (ROI ratio or Du Pont ratio)Return on assets (ROA)Return on assets Du Pont (ROA Du Pont)Return on Equity Du Pont (ROE Du Pont)Return on net assets (RONA)Return on capital (ROC)Risk adjusted return on capital (RAROC)ORReturn on capital employed (ROCE)Note: this is somewhat similar to (ROI), whichcalculates Net Income per Owner's EquityCash flow return on investment (CFROI)Efficiency ratioNet gearingLiquidity ratiosLiquidity ratios measure the availability of cash to pay debt.Current ratioAcid-test ratio (Quick ratio)[17]Operation cash flow ratioActivity ratiosActivity ratios measure the effectiveness of the firms use of resources.Average collection periodDegree of Operating Leverage (DOL)DSO RatioAverage payment periodAsset turnoverInventory turnover ratioReceivables Turnover RatioInventory conversion ratioInventory conversion periodReceivables conversion periodPayables conversion periodCash Conversion CycleInventory Conversion Period + ReceivablesConversion Period - Payables Conversion PeriodDebt ratios (leveraging ratios)Debt ratios measure the firm's ability to repay long-term debt. Debt ratios measure financial leverage.Debt ratioDebt to equity ratioLong-term Debt to equity (LT Debt to Equity)Times interest-earned ratioORDebt service coverage ratioMarket ratiosMarket ratios measure investor response to owning a company's stock and also the cost of issuing stock.Earnings per share (EPS)Payout ratioORDividend cover (the inverse of Payout Ratio)P/E ratioDividend yieldCash flow ratio or Price/cash flow ratioPrice to book value ratio (P/B or PBV)Price/sales ratioPEG ratioOther Market RatiosEV/EBITDAEV/SalesCost/Income ratioSector-specific ratios。

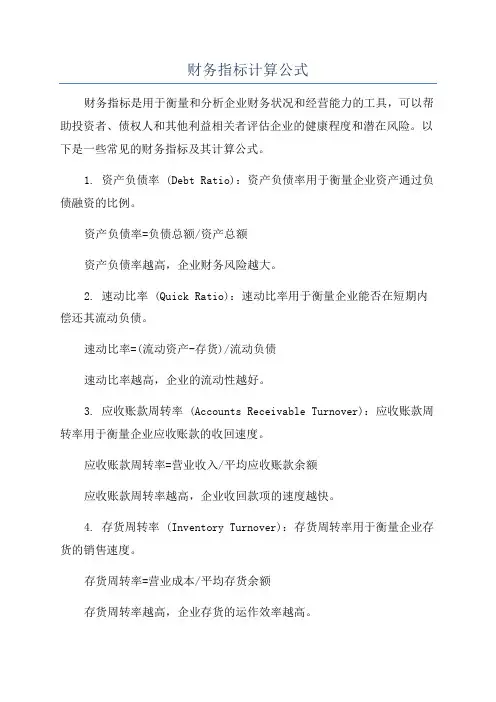

财务指标计算公式财务指标是用于衡量和分析企业财务状况和经营能力的工具,可以帮助投资者、债权人和其他利益相关者评估企业的健康程度和潜在风险。

以下是一些常见的财务指标及其计算公式。

1. 资产负债率 (Debt Ratio):资产负债率用于衡量企业资产通过负债融资的比例。

资产负债率=负债总额/资产总额资产负债率越高,企业财务风险越大。

2. 速动比率 (Quick Ratio):速动比率用于衡量企业能否在短期内偿还其流动负债。

速动比率=(流动资产-存货)/流动负债速动比率越高,企业的流动性越好。

3. 应收账款周转率 (Accounts Receivable Turnover):应收账款周转率用于衡量企业应收账款的收回速度。

应收账款周转率=营业收入/平均应收账款余额应收账款周转率越高,企业收回款项的速度越快。

4. 存货周转率 (Inventory Turnover):存货周转率用于衡量企业存货的销售速度。

存货周转率=营业成本/平均存货余额存货周转率越高,企业存货的运作效率越高。

5. 资本回报率 (Return on Equity, ROE):资本回报率用于衡量投资者对于投资的回报。

资本回报率=净利润/股东权益资本回报率越高,企业对于投资者的回报越好。

6. 利润率 (Profit Margin):利润率用于衡量企业销售收入中的利润。

利润率=净利润/销售收入利润率越高,企业的盈利能力越强。

7. 总资产收益率 (Return on Assets, ROA):总资产收益率用于衡量企业利用资产创造利润的能力。

总资产收益率=净利润/资产总额总资产收益率越高,企业利用资产的效率越高。

8. 销售增长率 (Sales Growth Rate):销售增长率用于衡量企业销售额的增长速度。

销售增长率=(本期销售额-上期销售额)/上期销售额销售增长率越高,企业销售规模扩大的速度越快。

这些是常见的财务指标计算公式,企业可以根据自身需求和情况选择适合的财务指标来评估自己的财务状况和经营能力。

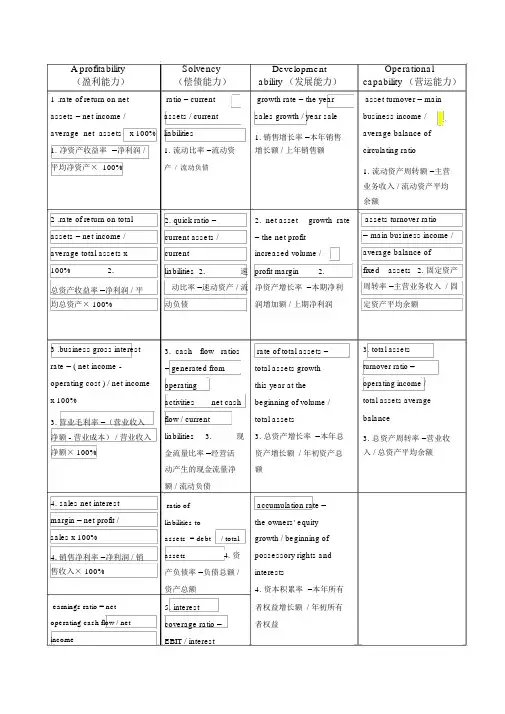

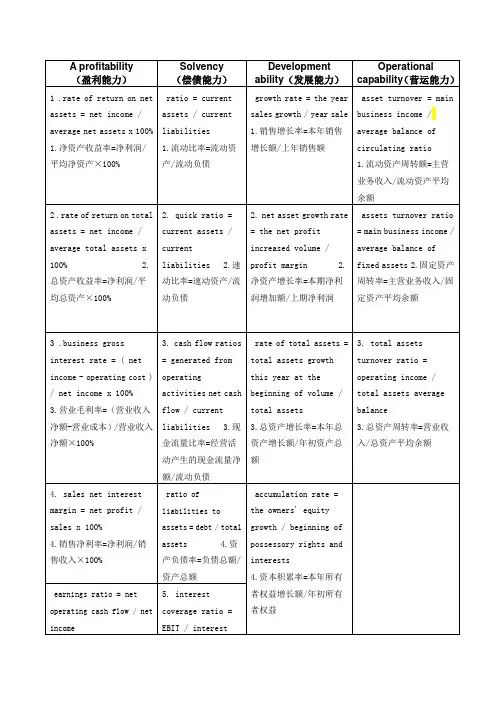

A profitability Solvency Development (盈利能力)(偿债能力)ability (发展能力)Operational capability (营运能力)1 .rate of return on net ratio = current assets = net income /assets / current average net assets x 100% liabilities1. 净资产收益率=净利润 / 1. 流动比率 =流动资平均净资产× 100%产/流动负债growth rate = the yearsales growth / year sale1.销售增长率 =本年销售增长额 / 上年销售额asset turnover = mainbusiness income /average balance ofcirculating ratio1.流动资产周转额 =主营业务收入 / 流动资产平均余额2 .rate of return on total assets = net income / average total assets x 100% 2.总资产收益率 =净利润 / 平均总资产× 100%3 .business gross interest rate = ( net income - operating cost ) / net income x 100%3.营业毛利率 =(营业收入净额 - 营业成本) / 营业收入净额× 100%4.sales net interestmargin = net profit /sales x 100%4.销售净利率 =净利润 / 销售收入× 100%earnings ratio = net operating cash flow / net income 2. quick ratio = 2. net asset growth ratecurrent assets /= the net profitcurrent increased volume /liabilities 2.速profit margin 2.动比率 =速动资产 / 流净资产增长率 =本期净利动负债润增加额 / 上期净利润3. cash flow ratios rate of total assets == generated from total assets growthoperating this year at theactivities net cash beginning of volume /flow / current total assetsliabilities 3.现 3. 总资产增长率 =本年总金流量比率 =经营活资产增长额 / 年初资产总动产生的现金流量净额额 / 流动负债ratio of accumulation rate =liabilities to the owners' equityassets = debt/ total growth / beginning ofassets 4. 资possessory rights and产负债率 =负债总额 /interests资产总额 4. 资本积累率 =本年所有5. interest者权益增长额 / 年初所有coverage ratio =者权益EBIT / interestassets turnover ratio=main business income /average balance offixed assets 2. 固定资产周转率 =主营业务收入 / 固定资产平均余额3.total assetsturnover ratio =operating income /total assets averagebalance3.总资产周转率 =营业收入 / 总资产平均余额5 盈利现金比率=经营现金expense 5.净流量 / 净利润利息保障倍数=息税前利润/ 利息费用。

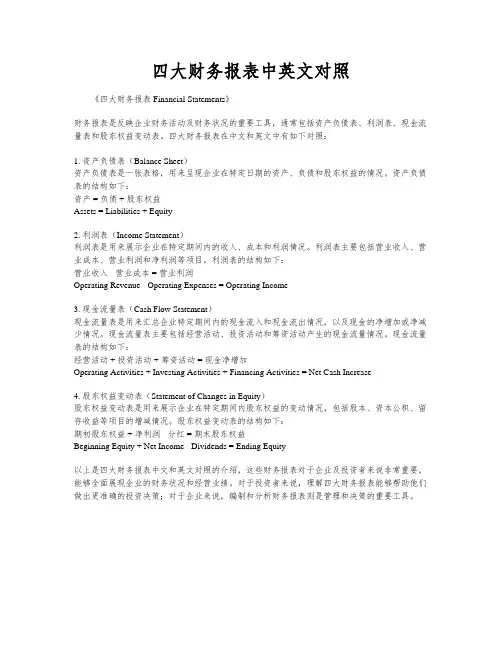

四大财务报表中英文对照《四大财务报表 Financial Statements》财务报表是反映企业财务活动及财务状况的重要工具,通常包括资产负债表、利润表、现金流量表和股东权益变动表。

四大财务报表在中文和英文中有如下对照:1. 资产负债表(Balance Sheet)资产负债表是一张表格,用来呈现企业在特定日期的资产、负债和股东权益的情况。

资产负债表的结构如下:资产 = 负债 + 股东权益Assets = Liabilities + Equity2. 利润表(Income Statement)利润表是用来展示企业在特定期间内的收入、成本和利润情况。

利润表主要包括营业收入、营业成本、营业利润和净利润等项目。

利润表的结构如下:营业收入 - 营业成本 = 营业利润Operating Revenue - Operating Expenses = Operating Income3. 现金流量表(Cash Flow Statement)现金流量表是用来汇总企业特定期间内的现金流入和现金流出情况,以及现金的净增加或净减少情况。

现金流量表主要包括经营活动、投资活动和筹资活动产生的现金流量情况。

现金流量表的结构如下:经营活动 + 投资活动 + 筹资活动 = 现金净增加Operating Activities + Investing Activities + Financing Activities = Net Cash Increase4. 股东权益变动表(Statement of Changes in Equity)股东权益变动表是用来展示企业在特定期间内股东权益的变动情况,包括股本、资本公积、留存收益等项目的增减情况。

股东权益变动表的结构如下:期初股东权益 + 净利润 - 分红 = 期末股东权益Beginning Equity + Net Income - Dividends = Ending Equity以上是四大财务报表中文和英文对照的介绍,这些财务报表对于企业及投资者来说非常重要,能够全面展现企业的财务状况和经营业绩。

RatiosProfitability ratiosProfitability ratios measure the firm's use of its assets and control of its expenses to generate an acceptable rate of return.Gross margin, Gross profit margin or Gross Profit RateOROperating margin, Operating Income Margin, Operating profitmargin or Return on sales (ROS)Note: Operating income is the difference between operatingrevenues and operating expenses, but it is also sometimes used as a synonym for EBIT and operating profit.[10] This is true if the firm has no non-operating income. (Earnings before interest and taxes / Sales)Profit margin, net margin or net profit marginReturn on equity (ROE)Return on investment (ROI ratio or Du Pont ratio)Return on assets (ROA)Return on assets Du Pont (ROA Du Pont)Return on Equity Du Pont (ROE Du Pont)Return on net assets (RONA)Return on capital (ROC)Risk adjusted return on capital (RAROC)ORReturn on capital employed (ROCE)Note: this is somewhat similar to (ROI), which calculates NetIncome per Owner's EquityCash flow return on investment (CFROI)Efficiency ratioNet gearingLiquidity ratiosLiquidity ratios measure the availability of cash to pay debt.Current ratioAcid-test ratio (Quick ratio)[17]Operation cash flow ratioActivity ratiosActivity ratios measure the effectiveness of the firms use of resources.Average collection periodDegree of Operating Leverage (DOL)DSO RatioAverage payment periodAsset turnoverInventory turnover ratioReceivables Turnover RatioInventory conversion ratioInventory conversion periodReceivables conversion periodPayables conversion periodCash Conversion CycleInventory Conversion Period + Receivables Conversion Period -Payables Conversion PeriodDebt ratios (leveraging ratios)Debt ratios measure the firm's ability to repay long-term debt. Debt ratios measure financial leverage.Debt ratioDebt to equity ratioLong-term Debt to equity (LT Debt to Equity)Times interest-earned ratioORDebt service coverage ratioMarket ratiosMarket ratios measure investor response to owning a company's stock and also the cost of issuing stock.Earnings per share (EPS)Payout ratioORDividend cover (the inverse of Payout Ratio)P/E ratioDividend yieldCash flow ratio or Price/cash flow ratioPrice to book value ratio (P/B or PBV)Price/sales ratioPEG ratioOther Market RatiosEV/EBITDAEV/SalesCost/Income ratioSector-specific ratios。

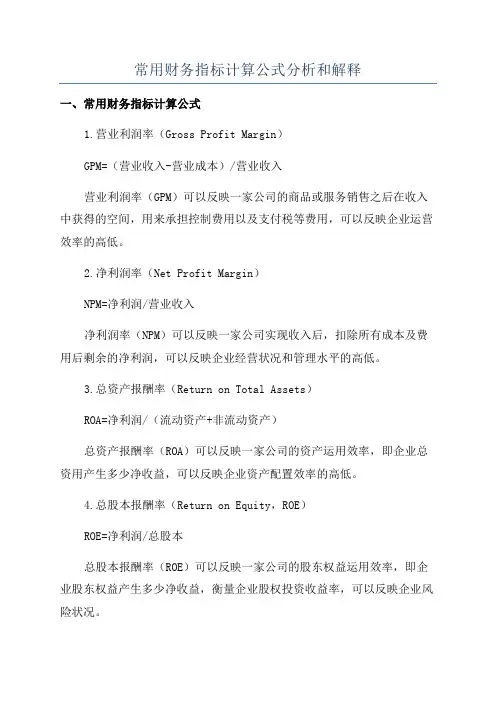

常用财务指标计算公式分析和解释

一、常用财务指标计算公式

1.营业利润率(Gross Profit Margin)

GPM=(营业收入-营业成本)/营业收入

营业利润率(GPM)可以反映一家公司的商品或服务销售之后在收入中获得的空间,用来承担控制费用以及支付税等费用,可以反映企业运营效率的高低。

2.净利润率(Net Profit Margin)

NPM=净利润/营业收入

净利润率(NPM)可以反映一家公司实现收入后,扣除所有成本及费用后剩余的净利润,可以反映企业经营状况和管理水平的高低。

3.总资产报酬率(Return on Total Assets)

ROA=净利润/(流动资产+非流动资产)

总资产报酬率(ROA)可以反映一家公司的资产运用效率,即企业总资用产生多少净收益,可以反映企业资产配置效率的高低。

4.总股本报酬率(Return on Equity,ROE)

ROE=净利润/总股本

总股本报酬率(ROE)可以反映一家公司的股东权益运用效率,即企业股东权益产生多少净收益,衡量企业股权投资收益率,可以反映企业风险状况。

5.现金流量比率(Cash Flow Ratios)

CFR=现金流量/营业收入

CFR是通过对一家公司的现金流量进行分析,可以反映企业现金流量

状况,以及企业的偿债能力,进而反映企业的经营状况以及未来发展前景。

Ratios欧阳家百(2021.03.07)Profitability ratiosProfitability ratios measure the firm's use of its assets and control of its expenses to generate an acceptable rate of return.Gross margin, Gross profit margin or Gross Profit RateOROperating margin, Operating Income Margin, Operating profitmargin or Return on sales (ROS)Note: Operating income is the difference between operatingrevenues and operating expenses, but it is also sometimes used asa synonym for EBIT and operating profit.[10] This is true if thefirm has no non-operating income. (Earnings before interest andtaxes / Sales)Profit margin, net margin or net profit marginReturn on equity (ROE)Return on investment (ROI ratio or Du Pont ratio)Return on assets (ROA)Return on assets Du Pont (ROA Du Pont)Return on Equity Du Pont (ROE Du Pont)Return on net assets (RONA)Return on capital (ROC)Risk adjusted return on capital (RAROC)ORReturn on capital employed (ROCE)Note: this is somewhat similar to (ROI), which calculates NetIncome per Owner's EquityCash flow return on investment (CFROI)Efficiency ratioNet gearingLiquidity ratiosLiquidity ratios measure the availability of cash to pay debt.Current ratioAcid-test ratio (Quick ratio)[17]Operation cash flow ratioActivity ratiosActivity ratios measure the effectiveness of the firms use of resources.Average collection periodDegree of Operating Leverage (DOL)DSO RatioAverage payment periodAsset turnoverInventory turnover ratioReceivables Turnover RatioInventory conversion ratioInventory conversion periodReceivables conversion periodPayables conversion periodCash Conversion CycleInventory Conversion Period + Receivables Conversion Period - Payables Conversion PeriodDebt ratios (leveraging ratios)Debt ratios measure the firm's ability to repay long-term debt. Debt ratios measure financial leverage.Debt ratioDebt to equity ratioLong-term Debt to equity (LT Debt to Equity)Times interest-earned ratioORDebt service coverage ratioMarket ratiosMarket ratios measure investor response to owning a company's stock and also the cost of issuing stock.Earnings per share (EPS)Payout ratioORDividend cover (the inverse of Payout Ratio)P/E ratioDividend yieldCash flow ratio or Price/cash flow ratioPrice to book value ratio (P/B or PBV)Price/sales ratioPEG ratioOther Market RatiosEV/EBITDAEV/SalesCost/Income ratioSector-specific ratiosEV/capacityEV/output。

财务指标分析公式汇总一、财务指标分析概述财务指标分析是通过对企业财务数据进行计算和分析,以评估企业的财务状况和经营绩效。

它是管理者、投资者和其他利益相关者了解企业财务状况的重要工具。

本文将汇总一些常用的财务指标分析公式,以帮助读者更好地理解和应用财务指标分析。

二、财务指标分析公式汇总1. 偿债能力指标1.1 速动比率(Quick Ratio)=(流动资产 - 存货)/ 流动负债1.2 现金比率(Cash Ratio)= 现金及现金等价物 / 流动负债1.3 利息保障倍数(Interest Coverage Ratio)= 息税前利润 / 利息费用2. 营运能力指标2.1 应收账款周转率(Accounts Receivable Turnover)= 营业收入 / 平均应收账款2.2 存货周转率(Inventory Turnover)= 营业成本 / 平均存货2.3 总资产周转率(Total Asset Turnover)= 营业收入 / 总资产3. 盈利能力指标3.1 毛利率(Gross Profit Margin)= (营业收入 - 营业成本)/ 营业收入3.2 净利率(Net Profit Margin)= 净利润 / 营业收入3.3 资产收益率(Return on Assets)= 净利润 / 总资产3.4 权益收益率(Return on Equity)= 净利润 / 股东权益4. 偿债能力指标4.1 负债比率(Debt Ratio)= 总负债 / 总资产4.2 权益比率(Equity Ratio)= 股东权益 / 总资产4.3 长期债务比率(Long-term Debt Ratio)= 长期债务 / 股东权益5. 现金流量指标5.1 经营活动现金流量比率(Operating Cash Flow Ratio)= 经营活动现金流量净额 / 营业收入5.2 现金流量比率(Cash Flow Ratio)= 经营活动现金流量净额 / 总负债5.3 现金再投资比率(Cash Reinvestment Ratio)= 经营活动现金流量净额 / 净利润6. 市场价值指标6.1 市盈率(Price-Earnings Ratio)= 市场价格 / 每股盈余6.2 市净率(Price-to-Book Ratio)= 市场价格 / 每股净资产6.3 市销率(Price-to-Sales Ratio)= 市场价格 / 每股销售额三、财务指标分析的应用财务指标分析可以帮助管理者评估企业的财务状况和经营绩效,以及发现潜在的问题和改进的空间。

英文财务指标及计算公式1. Profitability Ratios:- Gross Profit Margin: (Gross Profit / Net Sales) * 100- Operating Profit Margin: (Operating Profit / Net Sales) * 1002. Liquidity Ratios:- Current Ratio: Current Assets / Current Liabilities- Quick Ratio: (Current Assets - Inventory) / Current Liabilities- Cash Ratio: Cash and Cash Equivalents / CurrentLiabilities3. Solvency Ratios:- Debt-to-Equity Ratio: Total Debt / Shareholders' Equity- Debt Ratio: Total Debt / Total Assets- Equity Ratio: Shareholders' Equity / Total Assets- Interest Coverage Ratio: Earnings Before Interest and Taxes (EBIT) / Interest Expense4. Efficiency Ratios:- Inventory Turnover Ratio: Cost of Goods Sold / Average Inventory- Accounts Receivable Turnover Ratio: Net Credit Sales / Average Accounts Receivable- Accounts Payable Turnover Ratio: Total Purchases / Average Accounts Payable- Asset Turnover Ratio: Net Sales / Average Total Assetsa. Profitability Ratios:- Gross Profit Margin indicates the percentage of sales revenue that covers the cost of goods sold.- Operating Profit Margin shows the percentage of sales revenue remaining after covering all operating expenses.- Net Profit Margin measures the profitability after accounting for all expenses, including taxes.- ROA indicates the profit generated per dollar of assets invested.- ROE shows the return earned on shareholders' investment.b. Liquidity Ratios:- Quick Ratio provides a more conservative measure of liquidity by excluding inventory, which may be difficult to convert into cash quickly.c. Solvency Ratios:- Debt Ratio shows the proportion of assets financed by debt.- Equity Ratio indicates the proportion of assets financed by shareholders' equity.d. Efficiency Ratios:- Inventory Turnover Ratio measures the speed at which inventory is sold within a given period.- Accounts Receivable Turnover Ratio evaluates the effectiveness of credit sales and collection efforts.- Asset Turnover Ratio measures the efficiency of assets in generating sales revenue.。

财务指标计算公式大全财务指标是用来评估企业财务状况和经营情况的重要工具。

下面是一些常用的财务指标及其计算公式:1. 资产负债率(Debt-to-Asset Ratio):反映企业的财务杠杆水平和债务风险。

资产负债率=总负债/总资产2. 杠杆比率(Leverage Ratio):衡量企业使用借债资金进行投资的程度。

杠杆比率=总借债/净资产3. 速动比率(Quick Ratio):衡量企业的流动性状况,反映企业能否偿还短期负债。

速动比率=(流动资产-库存)/流动负债4. 应收账款周转率(Accounts Receivable Turnover):反映企业收回应收账款的能力。

应收账款周转率=销售收入/平均应收账款余额5. 存货周转率(Inventory Turnover):显示企业存货的流通速度。

存货周转率=销售成本/平均存货余额6. 资本周转率(Capital Turnover):反映企业利用资本运作效率。

资本周转率=销售收入/平均总资产7. 总资产收益率(Return on Assets,ROA):衡量投资者从资产中获得的回报率。

ROA=净利润/平均总资产8. 净利润率(Net Profit Margin):反映企业销售收入中的净利润占比。

净利润率=净利润/销售收入9. 总资产周转率(Total Asset Turnover):衡量企业产生销售收入所使用的资产效率。

总资产周转率=销售收入/平均总资产10. 毛利率(Gross Profit Margin):衡量企业销售成本与销售收入之间的关系。

毛利率=销售收入-销售成本/销售收入11. 息税前利润率(Earnings Before Interest and Taxes,EBIT):衡量企业在利息和税费之前的收益率。

EBIT=销售收入-销售成本-营业费用12. 资本结构比例(Capital Structure Ratio):包括负债与净资产的比例,衡量企业的债务风险。

RatiosProfitability ratiosProfitability ratios measure the firm's use of its assets and control of its expenses to generate an acceptablerate of return.Gross margin, Gross profit margin or Gross Profit RateOROperating margin, Operating Income Margin, Operating profit margin or Return on sales (ROS)Note: Operating income is the difference between operating revenues and operating expenses, but itis also sometimes used as a synonym for EBIT and operating profit. [10] This is true if the firm has no non-operating income. (Earnings before interest and taxes / Sales)Profit margin, net margin or net profit marginReturn on equity (ROE)Return on investment (ROI ratio or Du Pont ratio)Return on assets (ROA)Return on assets Du Pont (ROA Du Pont)Return on Equity Du Pont (ROE Du Pont)Return on net assets (RONA)Return on capital (ROC)Risk adjusted return on capital (RAROC)ORReturn on capital employed (ROCE)Note: this is somewhat similar to (ROI), which calculates Net Income per Owner's Equity Cash flow return on investment (CFROI)Efficiency ratioNet gearingLiquidity ratiosLiquidity ratios measure the availability of cash to pay debt.Current ratioAcid-test ratio (Quick ratio)[17]Operation cash flow ratioActivity ratiosActivity ratios measure the effectiveness of the firms use of resources.Average collection periodDegree of Operating Leverage (DOL)DSO RatioAverage payment periodAsset turnoverInventory turnover ratioReceivables Turnover RatioInventory conversion ratioInventory conversion periodReceivables conversion periodPayables conversion periodCash Conversion CycleInventory Conversion Period + Receivables Conversion Period - Payables Conversion PeriodDebt ratios (leveraging ratios)Debt ratios measure the firm's ability to repay long-term debt. Debt ratios measure financial leverage.Debt ratioDebt to equity ratioLong-term Debt to equity (LT Debt to Equity)Times interest-earned ratioORDebt service coverage ratioMarket ratiosMarket ratios measure investor response to owning a company's stock and also the cost of issuing stock.Earnings per share (EPS)Payout ratioORDividend cover (the inverse of Payout Ratio)P/E ratioDividend yieldCash flow ratio or Price/cash flow ratioPrice to book value ratio (P/B or PBV)Price/sales ratioPEG ratioOther Market RatiosEV/EBITDAEV/SalesCost/Income ratio Sector-specific ratiosEV/capacityEV/output。

Ratios

Profitability ratios

Profitability ratios measure the firm's use of its assets and control of its expenses to generate an acceptable rate of return.

, Gross profit margin or Gross Profit Rate

OR

, Operating Income Margin, Operating profit margin or Return on sales (ROS) Note: Operating income is the difference between operating revenues and

operating expenses, but it is also sometimes used as a synonym for EBIT and operating profit. This is true if the firm has no non-operating income. ( / Sales)

, net margin or net profit margin

(ROE)

(ROI ratio or )

(ROA)

(ROA Du Pont)

(ROE Du Pont)

(RONA)

(ROC)

(RAROC)

OR

(ROCE)

Note: this is somewhat similar to (ROI), which calculates Net Income per Owner's Equity

(CFROI)

Liquidity ratios

ratios measure the availability of cash to pay debt.

ratio

Activity ratios

Activity ratios measure the effectiveness of the firms use of resources.

(DOL)

ratio

ratio

Inventory conversion period

Receivables conversion period

Payables conversion period

Inventory Conversion Period + Receivables Conversion Period - Payables

Conversion Period

Debt ratios (leveraging ratios)

Debt ratios measure the firm's ability to repay long-term debt. Debt ratios measure .

(LT Debt to Equity)

OR

Market ratios

Market ratios measure investor response to owning a company's stock and also the cost of issuing stock.

(EPS)

OR

(the inverse of Payout Ratio)

Cash flow ratio or

(P/B or PBV)

Other Market Ratios

Sector-specific ratios。