(定价策略)第六章关于鞅方法定价

- 格式:doc

- 大小:1.12 MB

- 文档页数:16

第六章定价策略1成本导向定价法2需求导向定价法3竞争导向定价法国际定价策略41、成本加成定价法(1)公式为:P=C(1+R)即单位产品售价=单位产品成本×(1+成本加成率)1、成本加成定价法例子:➢某企业生产某种产品10000件,单位可变成本为20元,固定总成本为200000元,预期利润率为15%。

➢可计算如下:固定总成本200000元单位固定成本200000/10000=20元/件单位可变成本20元/件单位总成本20+20=40元预期利润率15%产品售价=40+40X15%=46(元/件)1、成本加成定价法(2)优点:不确定性比较少,简单易行。

如果同行业中所有企业都采取这种方法,则价格和加成也大致相似,价格竞争也会因此降至最低程度。

对买方和卖方都比较公平。

(3)缺点:忽视了市场供求关系的变化及影响产品销售的其他因素对产品价格的影响。

2、目标利润定价法:亦称为投资收益率定价法,根据企业总成本和计划的总销售量,加上按投资收益率制定的目标利润作为销售价额的定价方法。

(1)公式为:P=(C+I)/QC:总成本,I:目标总利润,Q:总销量(估计)3、边际贡献定价法:仅计算可变成本,不计算固定成本,在变动成本的基础上加上预期的边际贡献构成产品的价格。

(1)边际贡献:指销售总收入扣除总变动成本后,用于补偿固定成本和取得盈利的那部分收入。

(2)销售总收入=总变动成本+边际贡献(3)单位产品价格=单位产品变动成本+单位产品边际贡献第四节常用的国际定价方法需求导向定价法:需求导向定价法是一种以市场需求强度及消费者感受为主要依据的定价方法。

包括:反向定价法/认知价值定价法/差别定价法第二节常用的定价方法➢1.反向定价法:企业根据消费者能够接受的最终销售价格,计算自己从事经营的成本和利润后,逆向推算出产品的批发价和零售价。

第二节常用的定价方法➢1.反向定价法:➢例子➢消费者对某牌号电视机可接受价格为2500元,电视机零售商的经营毛利20%,批发商的批发毛利5%。

期权定价模型(Option Pricing Mode1)期权定价模型概述期权定价模型的前驱1、巴施里耶(Bachelier,1900)2、斯普伦克莱(Sprenkle,1961)3、博内斯(Boness,1964)4、萨缪尔森(Samuelson,1965)期权定价模型发展过程期权是购买方支付一定的期权费后所获得的在将来允许的时间买或卖一定数量的基础商品(underlying assets)的选择权。

期权价格是期权合约中唯一随市场供求变化而改变的变量,它的高低直接影响到买卖双方的盈亏状况,是期权交易的核心问题。

早在1900年法国金融专家劳雷斯·巴舍利耶就发表了第一篇关于期权定价的文章。

此后,各种经验公式或计量定价模型纷纷面世,但因种种局限难于得到普遍认同。

70年代以来,伴随着期权市场的迅速发展,期权定价理论的研究取得了突破性进展。

在国际衍生金融市场的形成发展过程中,期权的合理定价是困扰投资者的一大难题。

随着计算机、先进通讯技术的应用,复杂期权定价公式的运用成为可能。

在过去的20年中,投资者通过运用布莱克——斯克尔斯期权定价模型,将这一抽象的数字公式转变成了大量的财富。

期权定价是所有金融应用领域数学上最复杂的问题之一。

第一个完整的期权定价模型由Fisher Black和Myron Scholes创立并于1973年公之于世。

B—S 期权定价模型发表的时间和芝加哥期权交易所正式挂牌交易标准化期权合约几乎是同时。

不久,德克萨斯仪器公司就推出了装有根据这一模型计算期权价值程序的计算器。

现在,几乎所有从事期权交易的经纪人都持有各家公司出品的此类计算机,利用按照这一模型开发的程序对交易估价。

这项工作对金融创新和各种新兴金融产品的面世起到了重大的推动作用。

斯克尔斯与他的同事、已故数学家费雪·布莱克(Fischer Black)在70年代初合作研究出了一个期权定价的复杂公式。

与此同时,默顿也发现了同样的公式及许多其它有关期权的有用结论。

第六章关于鞅方法定价在上一章的二项树模型下,我们证明了,当完备市场中不成在套利时机时,市场存在独一概率——等价鞅测度——可以 用来给期权和期货定价。

在这一章,我们先在二项树模型下详细解释等价鞅测度的含义。

接着,我们讨论普通结果。

我们将证明,这个结果在比二项树模型更复杂的经济系统中也成立。

在许多背景下,我们并不需求应用市场平衡来给衍生资产定价,而是应用套利定价原理来停止定价——假设证券市场不存在套利时机,那么衍生证券的价钱完全由别的临时证券的价钱进程来决议。

在这个定价的进程中,我们通常把一个临时证券集的价钱进程视为给定而来停止定价。

这样就自然发生一个效果:如何确定被我们视为给定的价钱进程不存在套利时机? 价钱进程不存在套利时机的充沛必要条件是,经过变换概率测度和对价钱进程停止某种正轨化之后,这些价钱进程是鞅进程。

无套利和鞅进程之间的这种特殊关系也可以直接用来对衍生证券停止定价。

作为一个运用,我们将用这种方法来对期权停止定价,失掉期权定价的一种新的方法。

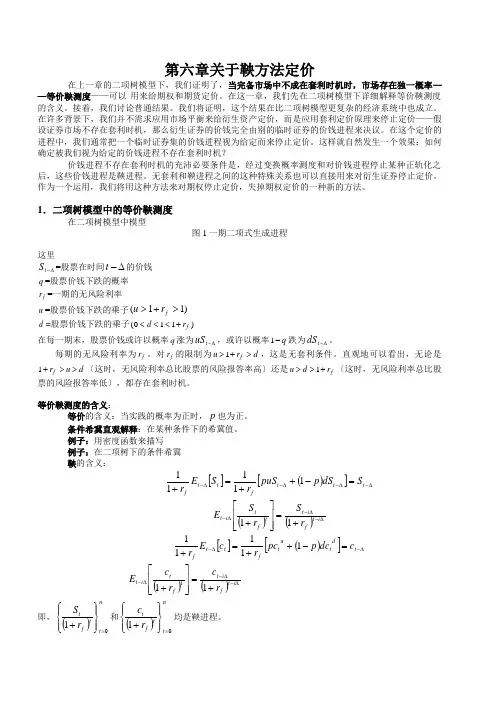

1.二项树模型中的等价鞅测度在二项树模型中模型图1一期二项式生成进程这里∆-t S =股票在时间∆-t 的价钱 q =股票价钱下跌的概率 r f =一期的无风险利率u =股票价钱下跌的乘子)11(>+>f r u d =股票价钱下跌的乘子()011<<<+d r f在每一期末,股票价钱或许以概率q 涨为∆-t uS ,或许以概率1-q 跌为∆-t dS 。

每期的无风险利率为r f 。

对r f 的限制为u r d f >+>1,这是无套利条件。

直观地可以看出,无论是1+>>r u d f 〔这时,无风险利率总比股票的风险报答率高〕还是u d r f >>+1〔这时,无风险利率总比股票的风险报答率低〕,都存在套利时机。

等价鞅测度的含义: 等价的含义:当实践的概率为正时,p 也为正。

条件希冀直观解释:在某种条件下的希冀值。

The Annals of Applied Probability1999,Vol.9,No.2,504–528PRICING CONTINGENT CLAIMS ON STOCKSDRIVEN BY L´EVY PROCESSES1By Terence ChanHeriot-Watt UniversityWe consider the problem of pricing contingent claims on a stock whose price process is modelled by a geometric L´e vy process,in exact analogy withthe ubiquitous geometric Brownian motion model.Because the noise pro-cess has jumps of random sizes,such a market is incomplete and there isnot a unique equivalent martingale measure.We study several approachesto pricing options which all make use of an equivalent martingale measurethat is in different respects“closest”to the underlying canonical measure,the main ones being the F¨o llmer–Schweizer minimal measure and the mar-tingale measure which has minimum relative entropy with respect to thecanonical measure.It is shown that the minimum relative entropy measureis that constructed via the Esscher transform,while the F¨o llmer–Schweizermeasure corresponds to another natural analogue of the classical Black–Scholes measure.1.Introduction.We consider the problem of pricing contingent claims on a stock whose price at time t,S t,is modelled by a geometric L´e vy processdS t=σt S t−dY t+b t S t−dtwhere Y is a general L´e vy process(satisfying some additional conditions)and not merely a Brownian motion.The classical option pricing theory of Black and Scholes relies on the fact that the payoff of every contingent claim can be duplicated by a portfolio consisting of investments in the underlying stock and in a bond paying a riskless rate of interest;in other words,the risk of buying or writing an option can be completely hedged against.In such complete mar-kets,there is a unique measure which is equivalent to the canonical measure (the“real world”measure)and which makes the discounted price process a martingale.The unique fair price of a contingent claim is then the expectation under this martingale measure of the discounted payoff at maturity,which is essentially the content of the famous Black–Scholes formula.For the stock prices described above,there are many equivalent measures under which the discounted price process is a martingale,in contrast to the geometric Brownian model.In other words,such a market is incomplete—that is,contingent claims cannot in general be hedged by a suitable portfolio. Because there does not exist a unique equivalent martingale measure,it is not possible simply to use the martingale measure to price a contingent claim in the manner just described.Instead,additional criteria must be used to select Received April1997;revised November1997.1Supported in part by the Carnegie Trust for the Universities of Scotland.AMS1991subject classifications.Primary90A09,60G35;secondary60J30,60J75.Key words and phrases.Option pricing,incomplete market,equivalent martingale measures.504OPTION PRICING WITH L´EVY PROCESSES505an appropriate martingale measure from among the uncountably many such measures with which to price a contingent claim.Many different approaches to this problem have been proposed in recent years but there is as yet no definitive way of pricing contingent claims in incomplete markets which is preferable to the other possible methods in all situations.Moreover,compared to the large body of work devoted tofinding new approaches to option pricing in incomplete markets,relatively little seems to have been done to compare and to investigate the relationship between the various approaches.Part of the aim of this paper is to go a little way toward redressing the balance.For our particular model,we shall concentrate on various approaches to pricing options which are all based on the idea of using an equivalent martingale measure that is in different respects“closest”to the underlying canonical measure,the main ones being the F¨o llmer–Schweizer minimal measure and the martingale measure which has minimum relative entropy with respect to the canonical measure.2.Description of the model.Before describing the model,wefirst re-view some preliminary results concerning L´e vy processes.For a more detailed treatment,the reader is referred to Protter(1990),Jacod and Shiryaev(1987) and Liptser and Shiryayev(1989).A L´e vy process Y t is simply a process with stationary and independent increments:in other words,Y s+t−Y s is independent of Y u u≤s and has the same distribution as Y t−Y0.All L´e vy processes are semimartingales and throughout this paper we adopt the convention that all L´e vy processes are right continuous with left limits(cadlag).Since Y has stationary independent increments,its characteristic function must take the formE exp −iθY t =exp −tψ θfor some functionψ,called the L´e vy exponent of Y.The L´e vy–Khintchine formula says that2 1 ψ θ =c22θ2+iαθ+ x <1 1−e−iθx−iθx ν dx + x ≥1 1−e−iθx ν dxforα,c∈R and for someσ-finite measureνon R\ 0 satisfying2 2 min 1 x2 ν dx <∞The measureνis called the L´e vy measure of Y.The L´e vy–Khintchine formula(2.1)is intimately connected to the structure of the process Y itself,in particular to the L´e vy decomposition of Y,which we describe below.From the L´e vy–Khintchine formula we can deduce that Y must be a linear combination of a Brownian motion and a quadratic pure jump process X which is independent of the Brownian motion.[A process is506T.CHANsaid to be quadratic pure jump if the continuous part of its quadratic variation X c≡0,in which case its quadratic variation becomes simplyX t= 0<s≤t X s 2where X s=X s−X s−is the jump size at time s.]It will be convenient to explicitly separate out the Brownian component from the quadratic pure jump component X and we therefore write2 3 Y t=cB t+X twhere B is a standard Brownian motion on R and X is quadratic pure jump. We now proceed to describe the L´e vy decomposition of X[the full L´e vy de-composition of Y is then obtained by combining this with(2.3)].Let Q dt dx be a Poisson measure on R+×R\ 0 with expectation(or intensity)measure dt×ν whereνis the L´e vy measure introduced earlier and dt denotes Lebesgue measure.The measureν(or more precisely dt×ν)is also sometimes called the compensator of Q.The L´e vy decomposition of X says that2 4 X t= x <1 x Q 0 t dx −tν dx + x ≥1 x Q 0 t dx +t E X1− x ≥1 xν dx= x <1 x Q 0 t dx −tν dx + x ≥1 x Q 0 t dx +αtwhere we have putα=E X1− x ≥1 xν dxThe parameterαis called the drift of the L´e vy process X.For the purposes of our model,we require the process Y to satisfy certain additional conditions.The key assumption we require of Y is that2 5 E exp −hY1 <∞for all h∈ −h1 h2 ,where0<h1,h2≤∞.This implies that Y t hasfinite moments of all orders, and in particular,E X1 <∞.In terms of the L´e vy measureνof X we havex ≥1 e−hxν dx <∞(2.6a)x ≥1 xγe−hxν dx <∞∀γ>0(2.6b)x ≥1 xν dx <∞(2.6c)OPTION PRICING WITH L´EVY PROCESSES507 for all h∈ −h1 h2 .[Note that as(2.6a)holds for all h in an open interval, (2.6b)and(2.6c)follow from(2.6a).]With these assumptions in mind,(2.4)can be rewritten as2 7 X t= R x Q 0 t dx −tν dx +t E X1 =M t+atwhere M t= R x Q 0 t dx −tν dx is a martingale and a=E X1 .Ob-serve that(2.7)gives the Doob decomposition of X as the sum of a martingale and a previsible process offinite variation.Even though a is not the drift of X in the sense in which the term is usually understood(αis the drift in the technical sense),we shall see later that a plays the role of a drift contribution from the jump component of Y.We refer to a(or more correctly,the process t→at)as the previsible part of X.In addition,(2.5)implies that instead of the characteristic function,one could consider the Laplace transform of Y t instead.By a slight abuse of nota-tion,we also useψto denote the“L´e vy exponent”and write E exp −θY t = exp −tψ θ .Bearing in mind the simplified decomposition(2.7)for processes satisfying(2.5),the L´e vy–Khintchine formula(2.1)now becomes2 8 ψ θ =−c2θ22+aθ+ R 1−e−θx−θx ν dxA very similar analysis can be carried out for more general semimartingales with jumps and in particular for processes with independent but not neces-sarily stationary increments.Jacod and Shiryaev(1987)have a full treat-ment.A random measure Q dt dx is also associated with such a process, but it is not necessarily a Poisson measure.As in the case of L´e vy processes, the measure Q describes the mechanism by which jumps of the process oc-cur.The compensator of Q is the unique previsible measureν dt dx such that Q 0 t −ν 0 t is a martingale for any Borel set ⊂R\ 0 .If the process in question has independent increments,the measureνis neces-sarily deterministic,so Q is an inhomogeneous Poisson measure.[For L´e vy processes,the stationarity of increments implies thatν dt dx =dtν dx .] The compensator can also be characterized as the unique previsible measure such that2 9 E 0 t × H s x Q ds dx =E 0 t × H s x ν ds dxfor any Borel set and any previsible process H.We also have an analogue of the L´e vy–Khintchine formula:E exp −θX t =exp −ψX t θ where 2 10 ψX t θ =a tθ+ R 1−exp −θx −θx ν 0 t dxwhere a t=E X t is the previsible part of X.Together with the quadratic variation of the continuous part of X(which is zero if X is quadratic pure jump as in our case),the compensator measure and previsible part form the508T.CHANthree components of the characteristics of a semimartingale.The following result is also worth noting:for any measurable function f t x ,2 11 0<s≤t f s X s = t0 R f s x Q ds dxNext,we recall Itˆo’s formula for cadlag semimartingales.If X1 X2 X n are cadlag semimartingales and f a C2function,thenf X1t···X n t −f X10···X n0= t0f i X1s−···X n s− dX i s+12 t0f i j X1s−···X n s− d X i X j c s+ 0<s≤t f X1s···X n s −f X1s−···X n s− −f i X1s−···X n s− X i swhere X i X j c is the continuous part of the mutual variation of X i and X j, f i=∂f/∂x i,f i j=∂2f/∂x i∂x j and we have used index summation convention. This will often be abbreviated tod f X1t X2t···X n t=f i X1t−···X n t− dX i t+12f i j X1t−···X n t− d X i X j c t+f X1t···X n t −f X1t−···X n t− −f i X1t−···X n t− X i t Turning now to a description of the model,on a probability space t P ,let Y t=cB t+X t=cB t+M t+at be a L´e vy process of the form described earlier,satisfying the condition(2.5).We assume that thefiltration t is the minimal one generated by Y.The stock price S t is the solution of the stochastic differential equation2 12 dS t=σt S t−dY t+b t S t−dt=σt S t− c dB t+dM t + aσt+b t S t−dtwhere the coefficientsσt and b t are deterministic continuous functions.Equa-tion(2.12)has an explicit solution[see Protter(1991)]given by2 13 S t=S0exp t0σs dY s+ t0 b s−c2σ2s2 ds× 0<s≤t 1+σs Y s exp −σs Y s=S0exp t0cσs dB s+ t0σs dM s+ t0 aσs+b s−c2σ2s2 ds × 0<s≤t 1+σs M s exp −σs M sFrom this we see thatσ S u u≤t = t and so a contingent claim T expiring at time T may be regarded as a nonnegative T-measurable random variable.OPTION PRICING WITH L´EVY PROCESSES509 The Doob decomposition of Y suggests that b t+aσt rather than b t should be regarded as the drift in(2.12).Although in practice,a and b cannot be estimated separately and consequently there is no need to add a drift to X separately from b in(2.12),we have chosen to consider the parameters a and b separately for convenience,because the value of a is often implicit in the specification of a particular process as X and so cannot be chosen indepen-dently(e.g.,if we specify that X be a Poisson process of rateλ,this forces a=λ).In order to ensure that S t≥0for all t almost surely,we needσt M t≥−1 for all t.This in turn implies that the jumps of X must be bounded on at least one side,that is,either bounded from below or bounded from above. Suppose that X t= M t∈ −c1 c2 which is equivalent to saying that the L´e vy measureνis supported on −c1 c2 where c1,c2≥0and one(but not both)of c1,c2may be infinite.This implies that at least one of h1,h2in(2.5) must be infinite.In order to ensure that S t≥0we need2 14 −1c2≤σt≤1c1for all t.As far as the Brownian component of Y is concerned,the sign of the volatilityσis inconsequential,but if one were to keep to the usual convention thatσ>0, then(2.14)shows that the jumps of X should be bounded from below(i.e., c1<∞).The conditions(2.5)and(2.14)will of course rule out any processes with“fat-tailed”distributions such as stable processes.However,the allowable L´e vy processes here include all the processes considered in Gerber and Shiu (1994):for example the gamma,the inverse Gaussian,the Poisson and the difference of two independent Poisson processes.The riskless rate of interest is given by a deterministic continuous function r t and the value P t of a bond or bank account paying this rate of interest evolves according to the ODE˙P t=r t P tAs withσand b,we could also allow r to be adapted to t ,although this is a less useful generalization in practice.For notational convenience,we denote byˆS t the discounted stock price defined by2 15 ˆS t=exp − t0r s ds S tIt will be seen in the next section that,in this model,there are many mea-sures,equivalent to the underlying canonical measure P,which makesˆS t a martingale.We conclude this section by briefly mentioning some other similar models which have been considered by various authors.Bardhan and Chao(1993)con-sidered a similar model where the noise consists of several Brownian motions and several point processes whose jumps are all of size1but whose intensities510T.CHANmay not be time-homogeneous and may be random.However,the contingent claims they considered are on more than one stock,where the number of stocks exactly equals the total number of noise terms(Brownian motions and point processes).This,together with the fact that the jump sizes arefixed,ensure that their model is complete.Aase(1988)is essentially an attempt at a more general model than that of Bardhan and Chao,where the point process may have random jump sizes but still afinite number of jumps in anyfinite time interval.Unfortunately,Aase(1988)claims that the model is also complete even though there are more than one equivalent martingale measure;this is false because it contradicts a well-known theorem of Harrison and Pliska (1981,1983)to the effect that completeness of the market is equivalent to uniqueness of the equivalent martingale measure.Indeed,Aase(1988)claims that every martingale can be represented as an integral with respect toˆS t,in the form2 16 t0θs dˆS swhereθt is a previsible process.(The existence of such a representation is equivalent to completeness.)This is false,as the martingale representation theorem[see,e.g.,Jacod and Shiryaev(1987)]for the jump processes consid-ered in Aase(1988)(which includes certain classes of L´e vy processes)says that every martingale has the representationt0H s x ˜Q ds dx −˜ν ds dxwhere˜Q ds dx is a random jump measure whose compensator is˜ν—analogous,respectively to the Poisson and L´e vy measures associated with a L´e vy process—and where H s x is a previsible Borel function(see the next section for a precise definition).We shall see in the next section that, under any equivalent martingale measure,the jump part ofˆS t has the representationt0γs d˜M s= t0 Rγs x ˜Q ds dx −˜ν ds dxHence,in order that the representation(2.16)holds,we need H s x =θsγs x, which of course is not true in general.Finally,Gerber and Shiu(1994)con-sider the case where the stock price is modelled by a process of the form exp σY t+bt ,whereσand b are constants and Y is a L´e vy process satisfying (2.5).This has many similarities with our present model and both are obvious generalizations of the geometric Brownian model.The program carried out in the next section can be equally well carried out for the Gerber–Shiu model, often with only fairly minor modifications.Each model has its own advantages and disadvantages.The main advantage of the Gerber–Shiu model is that the jumps of X can be of any size and do not have to be bounded from one side. The present model based on(2.12)describes the price dynamics in a mannerOPTION PRICING WITH L´EVY PROCESSES511 which is intuitively more natural and is also more appealing in other mathe-matical respects.This is because the starting point of the classical geometric Brownian model is(2.12);that the price S t also has the form exp σ Y t+b t isa direct consequence of the stochastic calculus involved,in particular,Itˆo’s for-mula.For discontinuous L´e vy processes,Itˆo’s formula is rather different and so a model which takes as its starting point a differential equation like(2.12) and then takes account of the differences in the underlying stochastic calculus in the subsequent computations is more likely to lead to simpler calculations and more attractive results.This point is illustrated in Section3.3in relation to the Esscher transform and minimum relative entropy measure.Gerber and Shiu(1994)deal only with pricing contingent claims by Esscher transforms, without explaining why the Esscher transform is a particularly appropriate martingale measure to use.[However,in their response to the discussions that follow their paper,they give a justification of the Esscher transform in terms of utility;see page175of Gerber and Shiu(1994).]We shall show that it is the martingale measure which has minimum relative entropy with respect to the canonical measure.3.Equivalent martingale measures and pricing formulas.We be-gin by characterizing all equivalent martingale measures Q under which the discounted price processˆS defined at(2.15)is a t -martingale.To this end, wefirst need to characterize all the measures which are absolutely continuous with respect to P.We continue to use the notation established in the previous section.In particular,Y t=cB t+X t is a L´e vy process satisfying(2.5)and X t is a quadratic pure jump L´e vy process with L´e vy measureνsupported on a subset of −c1 c2 ,where at least one of c1,c2isfinite.The Doob–Meyer decompo-sition of X is given by X t=M t+at,where M is a quadratic pure jump martingale with M0=0and a=E X1 .If Q dt dx is the Poisson measure associated with X,let M dt dx =Q dt dx −dtν dx denote the compen-sated measure.Thus,for example,the martingale part of X can be written as M t= t0 R x M ds dx .Further,expectations under the canonical measure P will be denoted by E · while expectations with respect to any other measure Q will be denoted by Q · .Let denote the previsibleσ-algebra on ×R+associated with thefiltra-tion t and let˜ = × ,where is the Borelσ-algebra on R.A function H ω t x which is˜ -measurable will be called Borel previsible.Thus,sup-pressing the explicit dependence onω,a Borel previsible function or process H t x is one such that the process t→H t x is previsible forfixed x and the function x→H t x is Borel-measurable forfixed t.Lemma3.1.Let G t and H t x be previsible and Borel previsible processes respectively.Suppose thatE t0G2s ds <∞512T.CHANand H≥0,H t 0 =1for all t≥0.Let h t x be another Borel previsible process such that3 1 R H t x −1−h t x ν dx <∞Define a process Z t by3 2 Z t=exp t0G s dB s−12 t0G2s ds+ t0 R h s x M ds dx− 0 t ×R H s x −1−h s x ν dx ds × 0<s≤t H s X s exp −h s X sThen Z is a nonnegative local martingale with Z0=1and Z is positive if and only if H>0.Remark.The process h referred to in Lemma3.1is,of course,not unique. However,given H,it is essentially unique in the following sense:suppose that h t x and f t x are two Borel previsible processes such that(3.1)holds;then because R f t x −h t x ν dx <∞,it is an easy exercise to check that the process Z is unchanged if h is replaced by f in(3.2):simply write f= h+ f−h .[However,note that it is crucial that R f t x −h t x ν dx <∞: the terms involving h in(3.2)do not cancel precisely because R h t x ν dx may diverge.]Thus,once H isfixed,Z does not depend on the choice of the process h satisfying(3.1).Of course,the easiest and most obvious choice of h is h≡H−1 However,in the present context,particularly in connection with the Esscher transform discussed below,it is useful to allow more general choices of h.In the case where x→H t x is twice-differentiable,the natural choice of h t x ish t x =x ∂H∂x t 0 =h t x say,for then H t x ∼1+h t x+O x2 as x→0and because of(2.6c)we simply have to choose H so thatx ≥1H t x ν dx <∞We shall henceforth assume that h t x =h t x is related to H t x in this way.Proof of Lemma3.1.It is clear that Z is nonnegative(resp.,positive)if and only if H≥0(resp.,H>0).That Z is a local martingale is a simpleOPTION PRICING WITH L´EVY PROCESSES513consequence of Itˆo’s formula;indeed,noting that Z t−Z t−=Z t− H t X t −1 ,Itˆo’s formula givesZ t=1+ t0G s Z s−dB s+ t0 R h s x Z s−M ds dx− t0 R Z s− H s x −1−h s x ν dx ds+ 0<s≤t Z s− H t X t −1−h s X s=1+ t0G s Z s−dB s+ t0 R h s x Z s−M ds dx+ t0 R Z s− H s x −1−h s x M ds dx=1+ t0G s Z s−dB s+ t0 R Z s− H s x −1 M ds dxThis last expression is a local martingale.2The processes G,H and h can be chosen so that E Z t =1for all t,in which case Z is a martingale.The next result is essentially a summary of Theorems3.24and5.19in Chapter III of Jacod and Shiryaev(1987)as they apply to the present setting.Theorem3.2.Let˜P be a measure which is absolutely continuous with re-spect to P on T.Thend˜Pd P T=Z Twhere Z is as in Lemma3.1,for some G,H and h for which E Z T =1. Moreover,under˜P,the process3 3 ˜B t=B t− t0G s dsis a Brownian motion and the process X is a quadratic pure jump process with compensator measure given by˜ν dt dx =dt˜νt dx ,where3 4 ˜νt dx =H t x ν dxand previsible part given by3 5 ˜a t=˜P X t =at+ t0 R x H s x −1 ν dx dsRemark.Jacod and Shiryaev(1987)treat only the case that h≡H−1 for the process Z in Lemma3.1.Also,in their treatment of characteristics of general semimartingales,Jacod and Shiryaev(1987)introduce truncation functions,and the corresponding results in Theorem3.24of that book depend514T.CHANin part on the choice of truncation function.In the present situation,assump-tion(2.6c)renders the introduction of truncation functions unnecessary.Turning now to the problem of pricing a contingent claim T,we wish to find an equivalent measure Q under which the discounted price processˆS t as defined in(2.15)is a martingale;the price of T is then Q exp − T0r s ds T . By Theorem3.2,under Q,X has Doob–Meyer decomposition3 6 X t=˜M t+at+ t0 R x H s x −1 ν dx dswhere˜M is a Q-martingale.In fact,˜M t=M t− t0 R x H s x −1 ν dx dswhere M is the P-martingale in the Doob–Meyer decomposition of X under P. Note that ˜M t= M t.Therefore,writing the discounted share priceˆS t in terms of the Q-martingale˜M and Q-Brownian motion˜B,we haveˆS t=S0exp t0cσs dB s+ t0σs dM s+ t0 aσs+b s−r s−c2σ2s2 ds × 0<s≤t 1+σs M s exp −σs M s=S0exp t0cσs d˜B s+ t0σs d˜M s+ t0 aσs+cσs G s+b s−r s−c2σ2s2 ds+ t0σs R x H s x −1 ν dx ds × 0<s≤t 1+σs ˜M s e−σs ˜M sSinceexp t0cσs d˜B s+ t0σs d˜M s− t0c2σ2s2ds 0<s≤t 1+σs ˜M s exp −σs ˜M sis a Q-martingale,a necessary and sufficient condition forˆS to be a martingale under Q is the existence of G and H for which the process Z in Lemma3.1isa positive martingale and such that3 7 cσs G s+aσs+b s−r s+ Rσs x H s x −1 ν dx =0for all s,almost surely.Note that h does not appear in(3.7),which is another reflection of the fact that h is essentially unique,given H,in the sense of the remark following Lemma3.1.It will turn out that G and H are in fact deterministic functions in all the cases considered in the sequel;in this case, (2.5)ensures that Z in Lemma3.1is a positive martingale and the key con-dition for an equivalent martingale measure is then(3.7).Moreover,B andOPTION PRICING WITH L´EVY PROCESSES515 X are still independent and have independent increments under Q in this connection,note that˜νis a deterministic measure.Of course,(3.7)does not specify G and H,and hence the equivalent martin-gale measure Q,uniquely.Below,we examine various approaches to choosingG and H based on other criteria,additional to(3.7).3.1.The F¨o llmer–Schweizer minimal measure.Recall that when the noise Y in(2.12)is just a standard Brownian motion,the unique equivalent mar-tingale measure Q is obtained by3 8 d Q d P T=Z Twhere Z satisfiesdZ t=γt Z t dB tand the processγis chosen so as to makeˆS a martingale under Q.In the present setting,a natural analogue of this would be to use the martingale measure Q defined by(3.8),where the Radon–Nikodym derivative Z is now given bydZ t=γt Z t− c dB t+dM tor equivalently3 9 Z t=1+ t0γs Z s− c dB s+dM sIn other words,the Brownian motion in the classical Black–Scholes setting has been replaced by the martingale part of the noise process Y.We saw in the proof of Lemma3.1that,in general,Z t=1+ t0G s Z s−dB s+ t0 R Z s− H s x −1 M ds dx Comparing this last expression with(3.9),we see that we require3 10 H s x −1=c−1G s x=h s xso thatγs=c−1G s.[When c=0,this just boils down to G≡0 H s x −1=γs x.]To obtain a martingale measure,we now use the martingale condition (3.7)together with(3.10).Puttingv= R x2ν dxit is easily verified that the solution to(3.7)and(3.10)is3 11G s=c r s−b s−aσsσs c2+v H s x −1= r s−b s−aσsσs c2+vx516T.CHANIn(3.9),we therefore have3 12 γs=r s−b s−aσsσs c2+vFinally,we need some conditions to ensure that H s X s >0;otherwise, the measure we have obtained will not be a probability measure but only a signed measure.Since we are assuming throughout this paper that the jump size X∈ −c1 c2 ,we require the right-hand side of(3.11)of be greater than −1for all x∈ −c1 c2 ,which is equivalent to the condition that3 13 −1c2< r s−b s−aσsσs c2+v<1c1So far,we have done nothing more than show that one can obtain an equiv-alent martingale measure by drawing an obvious analogy with the classical Black–Scholes setting.It turns out,however,that the martingale measure given by(3.8),(3.9)and(3.12)is precisely the F¨o llmer–Schweizer minimal measure introduced in F¨o llmer and Schweizer(1991),which we shall proceed to show.The minimal measure is closely connected to a hedging portfolio,which minimizes the risk involved in trying to duplicate a contingent claim T(pro-vided such a portfolio exists).We briefly sketch the main ideas below,following closely the treatment in F¨o llmer and Schweizer(1991)but omitting some of the technical assumptions not essential to the exposition.We adopt the notational convention that for any quantity f t,the discounted quantity will be denoted byˆf t=exp − t0r s ds f t.The value V t of any hedg-ing portfolio can be written as V t=ξt S t+ηt exp t0r s ds and hence the discounted value isˆV t=ξtˆS t+ηtwhereξandηare,respectively,the number of units of stock and bond.Only strategies for which V T= T P-a.s.are admissible.Define the cumulative cost at time t byC t=ˆV t− t0ξs dˆS sand the remaining risk byE C T−C t 2 t(In complete markets,C t is constant and hence the risk is zero.)The idea is to look for strategies ξ η which minimizes the remaining risk in a local sense: the risk is minimal under all“infinitesimal perturbations”of the strategy at time t.This is equivalent to the following precise technical definition.Definition3.1.An admissible strategy ξ η is called optimal if the asso-ciated cost C is a square-integrable martingale orthogonal to the martingale part(in the Doob decomposition)ofˆS under P.。

(定价策略)第六章关于鞅方法定价第六章鞅方法定价在上一章的二项树模型下,我们证明了,当完备市场中不成在套利机会时,市场存在唯一概率——等价鞅测度——可以用来给期权和期货定价。

在这一章,我们先在二项树模型下详细解释等价鞅测度的含义。

接着,我们讨论一般结果。

我们将证明,这个结果在比二项树模型更复杂的经济系统中也成立。

在许多背景下,我们并不需要利用市场均衡来给衍生资产定价,而是利用套利定价原理来进行定价——如果证券市场不存在套利机会,则衍生证券的价格完全由别的长期证券的价格过程来决定。

在这个定价的过程中,我们通常把一个长期证券集的价格过程视为给定而来进行定价。

这样就自然产生一个问题:如何确定被我们视为给定的价格过程不存在套利机会?价格过程不存在套利机会的充分必要条件是,通过变换概率测度和对价格过程进行某种正规化之后,这些价格过程是鞅过程。

无套利和鞅过程之间的这种特殊关系也可以直接用来对衍生证券进行定价。

作为一个应用,我们将用这种方法来对期权进行定价,得到期权定价的一种新的方法。

1.二项树模型中的等价鞅测度在二项树模型中模型图1一期二项式生成过程这里=股票在时间的价格=股票价格上涨的概率=一期的无风险利率=股票价格上涨的乘子=股票价格下跌的乘子在每一期末,股票价格或者以概率涨为,或者以概率跌为。

每期的无风险利率为。

对的限制为,这是无套利条件。

直观地可以看出,无论是(这时,无风险利率总比股票的风险回报率高)还是(这时,无风险利率总比股票的风险回报率低),都存在套利机会。

等价鞅测度的含义:等价的含义:当实际的概率为正时,也为正。

条件期望直观解释:在某种条件下的期望值。

例子:用密度函数来刻画例子:在二项树下的条件期望鞅的含义:即,和均是鞅过程。

等价鞅测度存在性:定义,则从的定义可以看出,无套利条件成立当且仅当大于0而小于1(即,是概率)。

等价鞅测度唯一性:上面定义的是使得下式成立(即股票和期权价格的折现值是鞅)的唯一概率。

(Martingales are associated with “fair” gambles because expected values always equal current values. In finance, this sense of fairness translates into prices and a pricing system with no arbitrage opportunities.)性质:在一个二项树模型中,股票和无风险证券之间不存在套利机会的充分必要条件是存在唯一的等价鞅测度。

证明:例子:无套利验证例子:期货合约的无套利定价例子:不完备市场的等价鞅测度不唯一。

注:(1) The importance of this proportion to option pricing cannot be overstated. It takes an economic notion of no arbitrage opportunities and transforms it into a mathematical notion of a martingale. As a mathematical notion, theorems can be proven, formulas derived, and computations performed, which would be impossible using the economic notion alone.(2) 推广:利率衍生产品,利率是随机的,以商品为标的物的衍生产品,外汇衍生产品。

2.一般经济系统2.1 不确定性经济环境我们考虑一个具有唯一易腐消费品的证券市场经济。

如果没有特别地强调,我们用表示不确定经济环境中具有有限状态的状态空间,用F=表示信息结构,对任意。

和第一章一样,我们假设到时间,投资者就完全知道真实的状态且{Ø,}。

证券市场具有+1种长期证券,以作为指标。

长期证券的特征由其红利过程来刻画,这里表示以消费品为单位,在时间支付的随机红利。

红利过程适应于F。

为使得分析简化,我们不妨假设第0种长期证券直到时间才支付红利,在时间,不管哪个状态发生,支付的红利均为一个单位的消费品。

从这个假设我们可以看出,第0种证券事实上是一种期的面值为1的折现债券。

第0种证券在时间的价格以表示,;而第()种证券在时间的分红后价格以表示。

因为价格过程是分红后的价格,所以有。

自然地,我们假设和是关于可测的。

因为在经济均衡中能够确定的只是证券的相对价格,所以不失一般性,我们假设长期证券的价格以唯一的消费品为单位,即消费品的价格为1。

经济中有个个体,以作为指标。

每个个体具有时间可加的效用函数,这些函数是单调增的、严格凹的、可微的。

我们假设,这个假设保证所有个体都选择严格正的消费。

我们假设个体的主观概率为,并且任意不确定状态的概率大于0。

我们假设个体拥有的禀赋是长期证券,份额为,表示个体在时间0拥有的第0种证券的份数。

表示个体在时间0拥有的第种证券的份数。

为了避免退化情形,我们假设对每个个体而言,≥0,≥0且存在某个使得>0。

定义1:一个交易策略是一个维过程,这里,和分别表示个体在时间的交易发生前,持有的从时间-1到时间的第0种证券和第证券的份数。

一个交易过程一定是一个可料过程。

我们引入记号定义2:一个消费计划是一个适应于F的过程:,这里表示以唯一消费品为计量单位,个体在时间的随机消费。

定义3:一个交易策略称为可行的,如果它是可料的且存在一个消费计划使得,对于任意有,(2-1)这里,。

我们用H表示所有的可行的策略形成地集合。

注:1. 关系(2-1)是一种自然的预算约束:在期收入(包括证券组合的市场值和红利)用于消费和下一期的投资(购买下一期的证券组合)。

2. 因为,且对所有的而言,,所以(2-1)的左边为0,从而(2-1)变成+即在期末,所有的财富都用于消费。

3.在(1-24)中的消费计划称为是由交易策略融资的,以来表示。

我们用C表示所有由可行交易策略融资的消费计划的集合。

4. 因为一个长期证券是由它在每个时间的红利来刻画地,所以我们可以把由可行交易策略融资地消费计划视为长期证券。

2.2 套利、状态价格和鞅正如我们在前言中提到的一样,本章的主要目的之一在于,给定价格系统,如何确定其余衍生资产的价格。

因此,我们第一步就是验证这个价格系统是否具有某种意义上的“合理性”,以及为了满足这种合理性该价格系统应该满足的条件。

因为对合理性的要求越弱,这种合理性的应用也就越强,所以我们下面给出价格系统为了具有某种合理性应该满足的条件,并使得这个条件尽可能地弱。

从最理想的角度出发,这个价格系统具有的合理性也应该是一个均衡价格系统应该具有的。

因为经济中的个体具有非满足性,所以要使得一个价格系统是均衡的,这个价格系统就不能存在套利机会。

因此我们把这个均衡价格系统具有的性质作为价格系统必须满足的合理性。

下面给出目前经济环境中套利机会的严格定义。

定义3:一个套利机会指的是由某个可行交易策略融资的消费计划,满足下列条件:1.是非负的,且至少存在某个时间,使得>0的概率严格为正。

2.直观上来说,一个套利机会就是不花钱就能进行消费。

一个价格系统如果具有套利机会就不可能是一个均衡的价格系统,因为每个非满足的个体都会利用这种套利机会,从而市场不可能是出清的。

在本节剩下的内容里,我们任固定某个个体的主观概率,所有的计算都在这个概率之下得到的,为了记号简单,我们简记为。

当证券市场不存在套利机会时,任意一种长期证券的价格过程和它的积累红利,如果以第0种证券为单位,具有如下的性质:在任意时间,它们在将来任意时间的和的条件期望等于它们在时间的和。

这里的期望是某个概率下期望,这个概率不必等同于个体的主观概率,但和个体的主观概率有某种等价性。

等价地,长期证券的价格和它的积累红利之和,以第0种证券为单位,在一个新的概率之下是一个鞅过程。

因为无套利条件是一个经济均衡的必要条件,所以每个均衡价格系统都具有这种鞅性质。

我们可以证明这种鞅性质也是价格系统不具有套利机会的充分条件。

在具体讨论这些性质之前,我们先给出鞅的定义。

定义4:一个过程是一个在概率之下适应于F的鞅,如果对任意有,这里表示在概率之下关于的条件期望。

如果C中两个消费计划,分别是由H中的可行策略和融资地,则对于任意常数a和b,消费计划a+b可由策略融资,从而策略是可行的,而a+b属于C,所以C是所有适应过程形成的空间L的线性子空间。

性质1:价格系统无套利当且仅当存在一个严格增的线性函数R⨯L→R,使得对任意C有。

证明:我们设R+⨯L+=,M= C,由于C是线性空间,所以M也是线性空间。

从而价格系统无套利当且仅当锥R+⨯L+与线性子空间M的交集是空集。

由分离超平面定理,存在一个非零的线性函数使得,对任意M和任意非零的R+⨯L+有。

因为M是线性空间,所以对任意M有,因此对任意非零的R-+⨯L+有,这说明是严格增的。

反过来,如果存在由某个可行交易策略融资的套利机会,则对任意C有,这导致矛盾。

下面的结果给出了在空间R⨯L上的线性函数的Riesz表示定理。

引理:对于每个线性函数R⨯L→R,存在唯一的∈ R⨯L,使得对任意∈ R⨯L有。

如果是严格增的,则是严格正的。

为了研究方便,我们把任何严格正的适应过程称为紧缩算子。

一个紧缩算子称为状态-价格紧缩算子,如果对任意有(2-2)(2-3)当时,(2-2)的左、右两边均为0。

我们能够证明一个紧缩算子为状态-价格紧缩算子当且仅当对任意交易策略有(2-4)这说明一个交易策略在任何时间的市场值等于由它产生地将来消费的状态价格期望折现值。

价格系统的收益过程定义为; 0,, 1。

给定一个紧缩算子,紧缩收益过程为; 0,, 1。

我们可以把这种紧缩过程当作是一种计量单位变换。

我们可以证明是状态-价格紧缩算子当且仅当状态-价格紧缩收益过程是一个鞅。

定理1:价格系统不存在套利机会当且仅当存在一个状态-价格紧缩算子。

证明:假设不存在套利机会,则有性质1知道,存在一个严格增的线性函数R⨯L→R,使得对任意C有。

再由前面的引理有,存在一个紧缩算子使得对任意∈ R⨯L有。

从而对任意策略有0。

我们证明(2-2)、(2-3),或者等价地,我们证明是一个鞅。

显然是一个鞅。

我们下面考虑风险证券。

一个随机过程是鞅当且仅当对于任意有限停时有。

对于任意第种风险证券和任意有限停时,考虑交易策略:;如果,则;如果,则=1,如果,则=0。

因为对任意策略有0。

所以0。

这说明第种风险证券的紧缩收益过程满足。

因为是任意的,所以是一个鞅。

因此是一个鞅。

这证明了无套利隐含着存在一个状态-价格紧缩算子。