Chapter 2货币市场

- 格式:ppt

- 大小:766.00 KB

- 文档页数:17

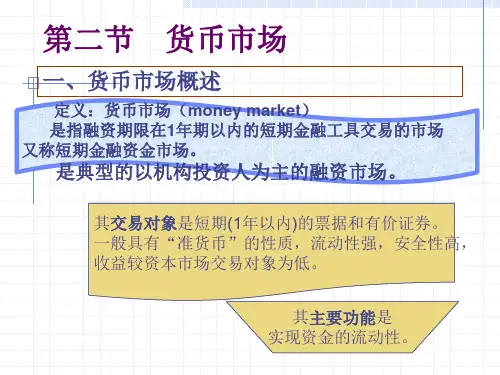

Section 2.1 Text⏹CharacteristicsMoney market instruments, which are discussed in detail later in this chapter, have three basic characteristics in common:* They are usually sold in large denominations.* They have low default risk.* They mature in one year or less from their original issue date. Most money market instruments mature in less than 120 days.⏹Participants of Money Market* The GovernmentIn money market, the government is unique because it is always a supplier and demander of money market funds. The U.S. Treasury is the largest of all money market borrowers worldwide.It issues Treasury bills(often called T-bills) and other securities that are popular with other money market participants. Short-term issues enable the government to raise the maturing issues.* The Central BankThe Central Bank is the Treasury’s agent for the distribution of government securities.The central bank holds vast quantities of Treasury securities that it sells if it believes that the money supply should be reduced. Similarly, the central bank purchases Treasury securities if it believes that the money supply should be expanded. The central bank’s responsibility for the money supply makes it the single most influential participant in the money market.* Commercial BanksCommercial banks hold a larger percentage of government securities than any other group of financial institutions. This is partly because of regulations that limit the investment opportunities available to banks. Specifically, banks are prohibited from owning risky securities, such as stocks or corporate bonds. There are no restrictions against holding Treasury securities because of their low risk and high liquidity.Banks are also the major issuer of negotiable certificates of deposit(CDs), banker’s acceptances, and repurchase agreements. In addition to money market securities to help manage their own liquidity, many banks trade on behalf of their customers.* BusinessesMany businesses buy and sell securities in the money market. Such activity is usually limited to major corporations because of the large transactions involved. As discussed earlier, the money market is used extensively by businesses both to warehouse surplus funds and to raise short-term funds.* Investment CompaniesLarge diversified brokerage firms are active in money markets. The primary function of these dealers is to “make a market” for money market securities by maintaining an inventory from which to buy or sell. These firms are very important to the liquidity of the money market becausethey help ensure that both buyers and sellers can readily market their securities in the primary market as well as in the secondary market.* Insurance CompaniesProperty and casualty insurance companies must maintain liquidity because of their unpredictable need for funds. To meet this demand, the insurance companies sell some of their money market securities to raise cash.As to the life insurance companies, because their obligations are reasonably predictable, large money market security holdings are unnecessary. However, it is a common practice that an individual can have his/her money invested in the money market through the agent department of banks and investment companies, to earn a higher interest rate than otherwise deposited in the banks.Instruments of Money Market* Treasury BillsTo finance the national debt, the government issues a variety of debt securities. The most widely held liquid security is the Treasury bill, which is commonly issued by the ministry of finance. However, some Treasury bills, like the Treasury bill of the U. S. government, do not actually pay interest. Instead they are issued at a discount from par(their value at maturity).The investor’s yield comes from the increase in the value of the security between the time it was purchased and the time it matures.* Inter-bank MarketsInter-bank markets are money markets in which short-term funds transferred (loaned or borrowed) between financial institutions, usually for a period of one day, that is, they are usually overnight investment. The interest rate for borrowing these funds is close to, but always slightly higher than rate that is available from the central bank.* Commercial PaperCommercial paper is a short term debt instrument issued only by well-known, larger and creditworthy corporations. It is typically unsecured, and the interest rate placed on it reflects the firm’s level of risk. It is normally issued to provide liquidity or finance a firm’s investment and accounts receivable. The issuance of commercial paper is an alternative to short-term bank loan.* NCDs or CDsA negotiable certificate of deposit is a bank-issued security that documents a deposit andspecifies the interest rate and the maturity date. It was firstly issued in 1961 by Citibank.Because a maturity date is specified, a CD is a term security as opposed to a demand deposit.Term securities have a specified maturity date while demand deposits can be withdrawn at any time. A CD is also called a bearer instrument. This means that whoever holds the instrument at maturity receives the principal and interest. The CD can be bought and sold until maturity.* Bank’s AcceptancesA bank’s acceptance is an order to pay a specified amount of money to the bearer on a givendate. Banker’s acceptances have been in use since the twelfth century, and are commonly used for international trade transactions.Section 2.2 Specialized TermsMonetary adj.Greece has approved a plan to raise taxes, cut spending and sell government-owned assets. This clears the way for seventeen billion dollars in loans from the International Monetary Fund and the European Union.A series of measures taken by central banks to decrease or increase the amount of currency in the market so as to achieve monetary objectives.Money laundering is the process of concealing the source of large amounts of money that have been gained through illegitimate means.anti-money launderingDefault v.The firm defaulted in his payments on the loan.He appealed to parliament to do everything possible to avoid defaulting on the debts of the birthplace of democracy.Default n.the risk of default by borrowersRisk n.risk sharingoffset riskstransfer riskThe most common types of risk for a commercial bank are credit risk, market risk and operational risk. A commercial bank may also suffer from other losses, such as liquidity risk, reputational risk, legal risk and strategic risk.Mature adj.It is term deposit, and has already been mature.Your fixed account is mature and can be withdrawn any time.Mature v.This note to the bank matured the day before yesterday.I have a time deposit here. But it'll mature two months later.As the business matures, an initial public offering may take place, or the business merged or sold, or other sources of capital found.Issue v.The government is expected to issue a statement about the financial crisis.The seller has to issue a tax invoice.The most widely held liquid security is the Treasury bill, which is commonly issued by the ministry of finance.Issue n.Shortage of funds is still very much a live issue.We should raise the issue of fiscal deficit with the council.issuance of new securities or moneyTreasury n.The Treasury was opposed in principle to the proposals.How much money is in the company's treasury?The New York Stock Exchange is the world's most famous stock market and a symbol of American capitalism. Treasury Secretary Tim Geithner says New York will remain at the heart of the world's financial system for a long time to come.Deposit v.A foreign joint venturer shall be encouraged to deposit foreign exchange which it is entitled to remit abroad in the Bank of China.You have to deposit enough money before you can write out checks.Property n.property management companyproperty developerForeign investment and low interest rates inflated a property bubble, raising prices to levels that could not be supported.Account n.open accountto audit accountsPlease settle your account immediately.We are duly in receipt of your letter of the 5th May, enclosing a draft, value $51,250, to Balance your account.Return n.We guarantee a high return on your investment.As long as international investors reach consensus to purchase our invested companies, our rate of return will be definitely higher.Means n.a person of meansThis foreign firm has little(not much)means.China will continue to offer assistance to Africa within its means, including assistance gratis, concessional loans and interest-free loansThey tried to shore up the failing economy by means of tax increases.Yield n.The yields on his shares have increased in this year.The yield on that investment was too variable and unstable.Negotiable adj.In general, payment will be made by Irrevocable Letter of Credit negotiable against presentation of shipping documentsWhen a Bill of Exchange has been accepted by the drawee it becomes negotiable. Commercial adj.Clean collection means the collection of financial documents not accompanied by commercial documents.On 2007 National Financial Work Conference, the direction of CDB's commercial reform was confirmed formally.Transaction n.Renminbi forward transaction premium is more than 8 percent a year.The contemporary noteworthy fictitious economy is derivative financial commodity transaction, e-currency and Internet bank.transaction costFX spot transaction of RMBForward RMB exchange transactionCorporate adj.Corporate governance of listed company directly affects the development of security market and financial market.It is an efficient system to actualize ESO to improvement of corporate governance structure.Section 2.3 Subject TopicCentral BankA: What is a central bank?B: A central bank is a government agency in charge of a country’s finance. It controls the credit activities of financial institutions by making relevant policies, rules and regulations. A central bank restricts the credit scale of commercial banks with monetary tools. At the same time a central bank also has the characteristics of an ordinary bank.For example, it also engages in some credit and clearing operations.A: What are the functions of a central bank?B: Basically, a central bank performs three main functions. Firstly, it is the only bank that can issue currency in a country. Secondly, it is called “the government bank.”A central bank makes and carries out monetary policies and regulates all financialactivities in a country. Finally, a central bank is also called “the banks’ bank”because it is the lender of last resort to commercial banks.A: Which bank is the central bank in China?B: The People’s Bank of China is the central bank of China.A: In order to establish a modern financial system, the government has taken reforming the management of the central bank as a priority. The People’s Bank of China will close all the provincial branches and set up the so-called “trans-administrative regional banks”. The purpose of this is to enhance its independence and authority in supervision.What do you think might be the significance of this move?B: The establishment of trans-administrative regional banks will help to maintain the central bank’s independence. Interference from local governments can be avoided. Such interference would probably lead to excessive of currency and inflation.A:The establishment of such banks should also improve the development of the regions where they are located. Therefore, we can promote the coordination of the national economy.B:All in all, it is a key step in the financial reform to perfect our socialist market-oriented financial system. In order to reform the financial system, the central bank will encourage mergers between banks on the provincial and city level, and cut down the number of branches with heavy losses. Moreover, the central bank will organize commercial banks to establish a multi-level financial system.A: This year, the People’s Bank of China has gradually turned its direct macro-economic control system into an indirect control system. What exactly did the central bank do? B: Right. There were three steps. From the 1st of January, the central bank replaced the credit line system with the asset-liability management system. This was a very important measure. With the abolition of the basic credit line, commercial banks will obtain more independence in their operation. They will obtain more freedom to determine their credit scale and to provide more financial support for state-owned enterprises. This new measure will also optimize the asset and liability structure of commercial banks and improve their operation efficiency.A: As far as the central bank is concerned, the abolition of the basic credit line shows that the central bank has achieve great progress in its approach to the indirect control over commercial banks.B:The second step was to reform the reserve requirement policy. The central bank canceled the reserve fund account and reduced the reserve requirement system as a monetary policy tool.A:I think it will also decrease the interest burden of commercial banks because they will no longer have to depend too much on the central bank for loans.B: The third step was that the central bank has reduced interest rates three times this year in order to regulate the macro economy.Section 2.4 Questions and Answers1.What is Capital Adequacy Ratio?— Capital Adequacy Ratio is the ratio of the total capital base to the total risk weighted assets.2.Which two forms are there of inflation?— They are demand-full inflation and cost-push inflation.3.What are the functions of a central bank?— It is :a. Banker to the government.b. Banker to the commercial banks.c. Lender of last resort.。