最新moneyandbanking第二章金融工具3

- 格式:ppt

- 大小:1.18 MB

- 文档页数:83

Money,Banking and Financial Markets_江西财经大学中国大学mooc课后章节答案期末考试题库2023年1.Markets in which funds are transferred from those who have excess fundsavailable to those whohave a shortage of available funds are called ______答案:financial markets.pared to interest rates on ernment bonds, interest rateson _____ fluctuatemore and are lower on average答案:three-month Treasury bills3.Because it is a store of value, money答案:is none of the above4.An individual’s annual salary is her答案:income5.Money reduces transaction costs, allowing people to specialize in what theydo best. Money, therefore, promotes答案:the division of labor6.The narrowest measure of money that the Fed reports is答案:M17.Which of the following is not included in the measure of M1?答案:Repurchase agreements8. f a security pays $110 next year and $121 the year after that, what is its yieldto maturity if it sells for $200?答案:10%9. A security that pays $52.50 in one year and $110.25 in two years, with aninterest rate of 5 percent, has a present value of答案:$15010. A credit market instrument that provides the borrower with an amount offunds that must be repaid at the maturity date along with an interestpayment is known as a答案:simple loan11.Which of the following are not true of fixed payment loans?答案:The borrower repays both the principal and interest at the maturity date 12. A coupon bond pays the owner of the bond答案:a fixed-interest payment every period and repays the face value at thematurity date13.The price of a consol答案:equals the coupon payment divided by the interest rate14. A consol paying $20 annually when the interest rate is 5 percent has a priceof答案:$40015.An $8,000 coupon bond with a $400 coupon payment every year has acoupon rate of答案:5%16.Which of the following $1,000 face-value securities has the highest yield tomaturity?答案:A 14 percent coupon bond selling for $1,00017. A discount bond currently selling for $4000, that matures in one year with aface value of $5000, has a yield to maturity of答案:25%18.Which of the following are true for the current yield?答案:The current yield is defined as the yearly coupon payment divided by theprice of the security19.If the expected return on ABC stock is unchanged and the expected return onCBS stock falls from 10 to 5 percent, then the expected return of holding CBS stock _____ relative to ABC stock and the demand for ABC stock _____答案:falls; rises20.When the interest rate is above the equilibrium interest rate, there is anexcess _____ for (of) money and the interest rate will _____答案:supply; fall21.The risk structure of interest rates is答案:the relationship among interest rates of different bonds with the samematurity22. If 1-year interest rates for the next three years are expected to be 4, 2, and3 percent, and the 3-year term premium is 1 percent, than the 3-year bondrate will be答案:4%23.Dividends are paid from答案:net earningsing the one-period valuation model, assuming a year-end dividend of $1.00,an expected sales price of $100, and a required rate of return of 5%, thecurrent price of the stock would be答案:$96.19ing the Gordon growth formula, if D1 is $1.00, ke is 10% or 0.10, and g is 5%or 0.05, then the current stock price is答案:$2026.The presence of _____ in financial markets leads to adverse selection andmoral hazard problems that interfere with the efficient functioning offinancial markets答案:asymmetric information27.When you deposit $50 in currency at Old National Bank,答案:each of the above occurs28. In the simple deposit expansion model, a decline in checkable deposits of$500 when the required reserve ratio is equal to 10 percent implies that the central bank答案:sold $50 in government bonds29. If a bank has excess reserves of $20,000 and demand deposit liabilities of$80,000, and if the reserve requirement is 20 percent, then the bank has total reserves of答案:$3600030.Open market operations as a monetary policy tool have the advantages that答案:all of the above。

第2章金融市场与金融工具A. 多项选择题2.1 下面哪些不是货币市场工具的特征?a.流动性b.可销售性c.长期限d.股金变现e. c和d2.2 下面哪些不是货币市场工具()?a.短期国库券b.存款单c.商业票据d.长期国债e. 欧洲美元2.3 为筹集基金,美国短期国库券最初是由()发行的。

a. 商业银行b. 美国政府c. 地方政府或州政府d. 联邦政府机构e. b和d2.4 短期国库券在二级市场的出价是()。

a. 交易商愿意出售的价格b. 交易商愿意购买的价格c. 高于短期国库券的卖方报价d. 投资者的购买价格e. 不在财务压力下开价2.5 商业票据是由谁为筹资而发行的短期证券()?a. 联邦储备银行b. 商业银行c. 大型著名公司d. 纽约证券交易所e. 地方政府或州政府2.6 下面哪项内容最有效地阐述了欧洲美元的特点()?a. 存在欧洲银行的美元b. 存在美国的外国银行分行的美元c. 存在外国银行和在美国国土外的美国银行的美元d. 存在美国的美国银行的美元e. 和欧洲现金交易过的美元2.7 商业银行在联邦储备银行的存款叫()。

a.银行承兑汇票b.回购协议c.定期存款d.联邦基金e. 准备金要求2.8 为满足准备金要求,银行为在美联储借的隔夜的超额保证金所支付的利率是()。

a.优惠利率b.贴现利率c.联邦基金利率d.买入利率e. 货币市场利率2.9 下面哪些论述是正确的()?a. 中期国债期限可达10年b. 长期国债期限可达10年c. 中期国债期限可达10 ~ 30年d. 中期国债可随时支取e. 短期国库券期限可达10年2.10 关于市政债券,下例哪些说法是正确的()?I. 市政债券是州政府或地方政府发行的一种债券II. 市政债券是联邦政府发行的一种债券III. 由市政债券所得的利息收入可免缴联邦税I V. 由市政债券所得利息收入可免缴发行所在地的州政府税和地方政府税a. 只有I和I Ib. 只有I和I IIc. 只有I、II和IIId. 只有I、III和IVe. 上述各项均不准确2.11 关于公司债券,下面哪些说法是正确的()?a. 公司的提前赎回债券允许债券持有者按一定比例将债券转换成公司普通股b. 公司信用债券是经担保的债券c. 公司证券契约是经担保的债券d. 公司可转换债券允许债券持有者按一定比例将债券转换成公司普通股e. 公司债券持有者在公司有选举权2.12 在公司破产事件中()。

FinanceLecture 2An Overview of the Financial System I•Function of Financial Markets •Structure of Financial Markets •Financial Market Instruments •Internationalization of Financial MarketsLearning ObjectivesCompare direct and indirect finance.Identify the structure and components of financial markets. Describe different types of financial market instruments.Recognize the international dimensions of financial markets.Part 1Function of Financial Markets1.1 Financial MarketsFinancial Markets (P2):Markets in which funds are transferred from people who have an excess of available funds to people who have a shortage.金融市场:资金从那些可用资金过剩的人转移到资金短缺的人的市场。

1.2 Direct FinanceIn direct finance (P23), borrowers borrow funds directly from lenders in financial markets by selling the lenders securities (also called financial instruments).在直接融资中,借款人通过在金融市场出售证券(也称为金融工具),直接从贷款人手中借入资金。

《投资学》第2章金融市场与金融工具在当今的经济社会中,金融市场和金融工具扮演着至关重要的角色。

它们不仅是资金融通的重要渠道,也是投资者实现财富增值和风险管理的重要手段。

金融市场,简单来说,就是资金供求双方进行资金交易的场所。

它可以分为不同的类型,比如按照交易期限的长短,可分为货币市场和资本市场。

货币市场主要是进行短期资金融通的市场,交易的金融工具期限通常在一年以内,像国库券、商业票据、银行承兑汇票等。

这些工具具有流动性强、风险低的特点。

而资本市场则是长期资金交易的场所,包括股票市场、债券市场等,交易的金融工具期限较长,如股票、长期债券等,其风险相对较高,但潜在的收益也可能更大。

金融市场还可以按照交易对象的不同,分为现货市场和期货市场。

现货市场中,交易是即时进行的,买卖双方当场成交并交割。

而期货市场则是交易双方在未来某个约定的时间按照约定的价格进行交易,它的主要作用是帮助投资者进行套期保值和价格发现。

再来说说金融工具。

金融工具是在金融市场中可交易的金融资产,它是资金融通的载体。

常见的金融工具包括股票、债券、基金、期货、期权等。

股票,作为一种重要的金融工具,代表着对公司的所有权。

投资者购买股票,就成为了公司的股东,有权分享公司的利润,同时也要承担公司经营风险。

股票的价格会受到公司业绩、宏观经济环境、行业发展等多种因素的影响,具有较高的不确定性和波动性。

债券则是一种债务工具,是发行者向投资者借款的一种凭证。

债券通常有固定的利率和到期日,投资者在到期时可以收回本金和利息。

相比股票,债券的风险较低,但收益也相对较稳定。

基金是一种集合投资工具,它通过汇集众多投资者的资金,由专业的基金经理进行投资管理。

基金的种类繁多,有股票型基金、债券型基金、混合型基金等,可以满足不同投资者的风险偏好和投资目标。

期货和期权则是金融衍生品,它们的价值取决于基础资产的价格变动。

期货合约是双方约定在未来某个特定时间以特定价格买卖一定数量的某种商品或金融资产的标准化合约。

FinanceChapter4 Central Banking and the Conduct of Monetary PolicyCentral BanksThe Money Supply ProcessTools of Monetary PolicyLecture 10Tools of Monetary Policy•Goals of Monetary Policy and Conventional Monetary Policy Tools•The Market for Reserves and the Federal Funds Rate •How Tools of Monetary Policy Affect the Federal Funds Rate •Advantages and Disadvantages of Conventional Monetary Policy ToolsLearning ObjectivesSummarize how conventional monetary policy tools are implemented and the relative advantages and limitations of each toolIllustrate the market for reserves, and demonstrate how changes in monetary policy can affect the equilibrium federal funds rate.Part 1Goals of Monetary Policy and Conventional Monetary Policy Tools1.1 Goals of Monetary Policy•Price stability (*)•High Employment•Economic Growth•Stability of Financial Markets •Interest-Rate Stability•Stability in Foreign Exchange Markets1.2 Monetary Policy ToolsMonetary policy tools are the instruments used by the central bank to regulate the money supply and interest rates in order to achieve the goal of monetary policy.Conventional monetary policy tools :•Open market operations•Discount lending•Reserve requirementsNonconventional Monetary Policy Tools:Quantitative Easing, Credit Easing, Liquidity Provision, Large-Scale Asset Purchases, Forward Guidance and the Commitment to Future Policy ActionsPart 2The Market for Reserves and the Federal Funds Rate2.1 Goals of the Fed's Monetary PolicyThe goals of the Fed's monetary policy:According to the Federal Reserve Act, the goal of U.S. monetary policy is to control inflation and promote full employment.Intermediate goals of the Fed's monetary policy:The Fed uses the federal funds rate as the main monetary policy monitoring indicator and manipulation target.2.2 The Market for Reserves and the Federal Funds Rate•Demand CurveRR dd= Required reserves + Excess reservesThe trend of demand curve:As the federal funds rate ii ffff decreases, other things being equal, the opportunity cost of holding excess reserves decreases and the demand for excess reserves increases——the demand curve is downward sloping——but the process is not over.2.2 The Market for Reserves and the Federal Funds Rate•Demand CurveThe trend of demand curve:Since 2008, the Fed has paid interest on reserves at a level that is typically set at a fixed amount below the federal funds rate target.Suppose the interest rate paid on reserves is ii oooo, when federal funds rate ii ffff begins to fall below ii oooo, banks do not lend in the overnight market at a lower interest rate. Instead, they just keep on adding to their holdings of excess reserves indefinitely——the demand curve becomes flat (infinitely elastic)2.2 The Market for Reserves and the Federal Funds Rate2.2 The Market for Reserves and the Federal Funds Rate•Supply CurveRR ss= Nonborrowed reserves (NBR)+ borrowed reserves (BR) NBR: Amount of reserves that are supplied by the Fed’s open market operations. BR: Amount of reserves borrowed from the Fed, the interest rate charged by the Fed on these loans is the discount rate,ii dd, which is set at a fixed amount above the federal funds target rate.2.2 The Market for Reserves and the Federal Funds Rate•Supply CurveThe trend of supply curve:Borrowing federal funds from other banks is a substitute for borrowing (taking out discount loans) from the Fed.When ii ffff< ii dd,banks will not borrow from the Fed because borrowing in the federal funds market is cheaper, so BR=0, R s= NBR. And so the supply curve will be vertical. When ii ffff> ii dd, banks will want to keep borrowing more and more at ii dd and then lending out the proceeds in the federal funds market at the higher rate, ii ffff. The supply curve becomes flat (infinitely elastic) at ii dd.2.2 The Market for Reserves and the Federal Funds Rate2.2 The Market for Reserves and the Federal Funds Rate•Market EquilibriumMarket equilibrium occurs when the quantity of reserves demanded equals the quantity supplied, RR dd=RR ssEquilibrium therefore occurs at the intersection of the demand curve RR dd and the supply curve RR ss, with an equilibrium federal funds rate of ii ffff∗When ii ffff>ii ffff∗, more reserves are supplied than are demanded (excess supply). When ii ffff<ii ffff∗, more reserves are demanded than are supplied (excess demand).2.2 The Market for Reserves and the Federal Funds Rateii dd>ii ffff>ii ooooPart 3How Tools of Monetary Policy Affect the Federal Funds RateOpen market purchase leads to greater quantity of reserves supplied, which increases nonborrowed reserves.Open market sale leads to less quantity of reserves supplied, which decreases nonborrowed reservesThe effect of an open market operation depends on whether the supply curve initially intersects the demand curve in its downward-sloped section or in its flat section.If the intersection initially occurs on the downward-sloped section of the demand curve, an open market purchase causes the federal funds rate to fall, whereas an open market sale causes the federal funds rate to rise. (typical situation)If the supply curve initially intersects the demand curve on its flat section, open market operations have no effect on the federal funds rate, because the interest rate paid on reserves, ii oooo, sets a floor for the federal funds rateThe effect of a discount rate change depends on whether the demand curve intersects the supply curve in its vertical section or its flat section.If the intersection occurs on the vertical section of the supply curve, there is no discount lending and borrowed reserves (BR=0). When the discount rate (ii dd) is lowered by the Fed, no change occurs in the equilibrium federal fundsrate. (typical situation)If the demand curve intersects the supply curve on its flat section, there is some discount lending (BR>0). When the discount rate (ii dd) is lowered by the Fed, the equilibrium federal funds rate falls, and BR increases.When the required reserve ratio increases, required reserves increase and hence the quantity of reserves demanded increases for any given interest rate.When the Fed raises reserve requirements, the federal funds rate rises.When the Fed decreases reserve requirements, the federal funds rate fallsMonetary PolicyTools How to Affect Money Supply and ii ffffOpen Market Operations•Affect Money Supply: Open Market Purchase → MB↑→M↑•Affect ii ffff : a) Open Market Purchase → ii ffff ↓ (Usually)b) Open Market Purchase → ii ffff remains unchangedDiscount Lending •Affect Money Supply: a) Discount rate change → M is unchanged (Usually)b) Discount rate ↓ → M↑•Affect ii ffff : a) Discount rate change →ii ffff remains unchanged (Usually)b) Discount rate ↓ → ii ffff ↓Reserve Requirements•Affect Money Supply: rr ↑→M↓•Affect ii ffff : rr ↑→ii ffff ↑3.4 Summary3. How Monetary Policy Tools Affect ii ffffPart 4Advantages and Disadvantages of Conventional Monetary Policy ToolsMonetaryPolicy ToolsAdvantages DisadvantagesOpen Market Operations •The initiative lies with the centralbank•Flexible and precise•Can be executed quicklyMust be based on well-developed financialmarkets, i.e. there must be a sufficient variety andnumber of securitiesDiscount Lending •Central bank can act as the lenderof last resort•Central banks can realize theirpolicy intentions by increasing ordecreasing the discount rate•Central banks can only affect discount rate,but cannot command banks to borrow•When ii dd remains unchanged, changes in ii ffffmay change discount loans and money supply.•Central bank's changes in the discount ratemay be misinterpreted by the market.MonetaryPolicy ToolsAdvantages DisadvantagesReserve Requirements •The initiative lies with the central bank•Can have a rapid, powerful and widespreadimpact on the money supply•Acts on all banks or depository financialinstitutions, and is objective and fair to allfinancial institutions.•Can reflect the policy intention of the centralbank.•The effect on the money supplyis too violent and lack ofelasticity;•The expected effect of thepolicy is largely limited by theamount of excess reserves in thebanking system.SummaryT H A N K S。

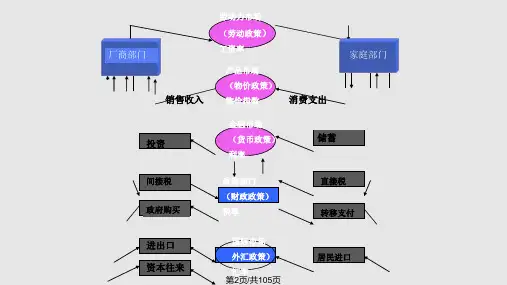

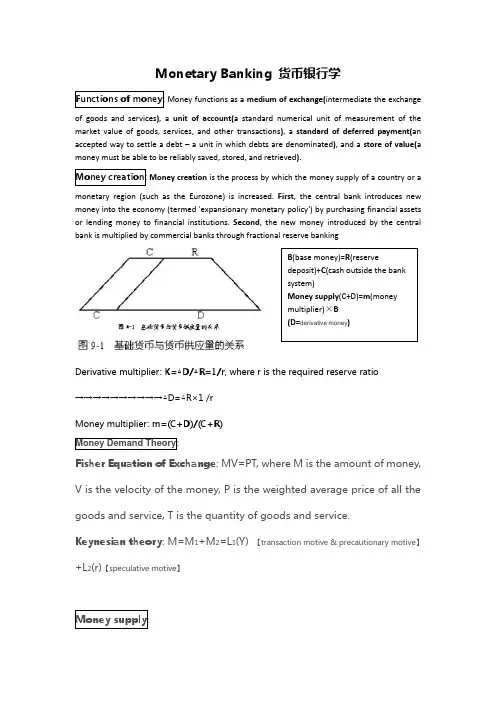

Monetary Banking 货币银行学Functions of money : Money functions as a medium of exchange(intermediate the exchangeof goods and services), a unit of account(a standard numerical unit of measurement of the market value of goods, services, and other transactions), a standard of deferred payment(an accepted way to settle a debt – a unit in which debts are denominated), and a store of value(a money must be able to be reliably saved, stored, and retrieved).Money creation: Money creation is the process by which the money supply of a country or amonetary region (such as the Eurozone) is increased. First, the central bank introduces new money into the economy (termed 'expansionary monetary policy') by purchasing financial assets or lending money to financial institutions. Second, the new money introduced by the central bank is multiplied by commercial banks through fractional reserve bankingB(base money)=R(reservedeposit)+C(cash outside the banksystem)Money supply(C+D)=m(moneymultiplier)×B(D=derivative money)Derivative multiplier: K=△D/△R=1/r, where r is the required reserve ratio→→→→→→→→→→△D=△R×1 /rMoney multiplier: m=(C+D)/(C+R)Money Demand Theory:Fisher Equation of Exchange: MV=PT, where M is the amount of money, V is the velocity of the money, P is the weighted average price of all the goods and service, T is the quantity of goods and service.Keynesian theory: M=M1+M2=L1(Y) 【transaction motive & precautionary motive】+L2(r)【speculative motive】Money supply:The different types of money are typically classified as "M"s:M0=cash in circulationM1=M0+demand deposits --------------------------------------------------------------narrow moneyM2=M1+time deposits + saving deposits + other deposits -------------------broad moneyLetting r denote the real interest rate, i denote the nominal interest rate, and let π denote the inflation rate, the Fisher equation is:i = r + πMonetary policy is the process by which the monetary authority of a country controls the supply of money, often targeting a rate of interest for the purpose of promoting economic growth and stability. The official goals usually include relatively stable prices and low unemploymentIt is referred to as either being expansionary or contractionary, where an expansionary policy increases the total supply of money in the economy more rapidly than usual, and contractionary policy expands the money supply more slowly than usual or even shrinks it.Tools: open market operation & adjusting in the discount rate & adjusting the required reserve ratioFiscal policy is the use of government expenditure and revenue collection (taxation) to influence the economy.Changes in the level and composition of taxation and government spending can impact the following variables in the economy:1.Aggregate demand and the level of economic activity; 总需求和经济活动水平2.The pattern of resource allocation; 资源分配模式3. The distribution of income. 收入再分配Stances of fiscal policy:A neutral stance of fiscal policy implies a balanced economy. This results in a large tax revenue. Government spending is fully funded by tax revenue and overall the budget outcome has a neutral effect on the level of economic activity.An expansionary stance of fiscal policy involves government spending exceeding tax revenue.A contractionary fiscal policy occurs when government spending is lower than tax revenue.。

The Economics of Money, Banking, and Financial Markets, 9e (Mishkin)Chapter 3 What Is Money?3.1 Meaning of Money1) To an economist, ________ is anything that is generally accepted in payment for goods and services or in the repayment of debt.A) wealthB) incomeC) moneyD) creditAnswer: CQues Status: Previous Edition2) Money isA) anything that is generally accepted in payment for goods and services or in the repayment of debt.B) a flow of earnings per unit of time.C) the total collection of pieces of property that are a store of value.D) always based on a precious metal like gold or silver.Answer: AQues Status: Previous Edition3) Currency includesA) paper money and coins.B) paper money, coins, and checks.C) paper money and checks.D) paper money, coins, checks, and savings deposits.Answer: AQues Status: Previous Edition4) Even economists have no single, precise definition of money becauseA) money supply statistics are a state secret.B) the Federal Reserve does not employ or report different measures of the money supply.C) the "moneyness" or liquidity of an asset is a matter of degree.D) economists find disagreement interesting and refuse to agree for ideological reasons. Answer: CQues Status: Revised5) The total collection of pieces of property that serve to store value is a person'sA) wealth.B) income.C) money.D) credit.Answer: AQues Status: New6) A person's house is part of herA) money.B) income.C) liabilities.D) wealth.Answer: DQues Status: Previous Edition7) ________ is used to make purchases while ________ is the total collection of pieces of property that serve to store value.A) Money; incomeB) Wealth; incomeC) Income; moneyD) Money; wealthAnswer: DQues Status: Previous Edition8) ________ is a flow of earnings per unit of time.A) IncomeB) MoneyC) WealthD) CurrencyAnswer: AQues Status: Previous Edition9) An individual's annual salary is herA) money.B) income.C) wealth.D) liabilities.Answer: BQues Status: Previous Edition10) When we say that money is a stock variable, we mean thatA) the quantity of money is measured at a given point in time.B) we must attach a time period to the measure.C) it is sold in the equity market.D) money never loses purchasing power.Answer: AQues Status: New11) The difference between money and income is thatA) money is a flow and income is a stock.B) money is a stock and income is a flow.C) there is no difference money and income are both stocks.D) there is no difference money and income are both flows.Answer: BQues Status: Previous Edition12) Which of the following is a true statement?A) Money and income are flow variables.B) Money is a flow variable.C) Income is a flow variable.D) Money and income are stock variables.Answer: CQues Status: Revised13) Which of the following statements uses the economists' definition of money?A) I plan to earn a lot of money over the summer.B) Betsy is rich she has a lot of money.C) I hope that I have enough money to buy my lunch today.D) The job with New Company gave me the opportunity to earn more money.Answer: CQues Status: Previous Edition3.2 Functions of Money1) Of money's three functions, the one that distinguishes money from other assets is its function as aA) store of value.B) unit of account.C) standard of deferred payment.D) medium of exchange.Answer: DQues Status: Previous Edition2) If peanuts serve as a medium of exchange, a unit of account, and a store of value, then peanuts areA) bank deposits.B) reserves.C) money.D) loanable funds.Answer: CQues Status: Previous Edition3) ________ are the time and resources spent trying to exchange goods and services.A) Bargaining costs.B) Transaction costs.C) Contracting costs.D) Barter costs.Answer: BQues Status: Previous Edition4) Compared to an economy that uses a medium of exchange, in a barter economyA) transaction costs are higher.B) transaction costs are lower.C) liquidity costs are higher.D) liquidity costs are lower.Answer: AQues Status: Previous Edition5) When compared to exchange systems that rely on money, disadvantages of the barter system include:A) the requirement of a double coincidence of wants.B) lowering the cost of exchanging goods over time.C) lowering the cost of exchange to those who would specialize.D) encouraging specialization and the division of labor.Answer: AQues Status: Previous Edition6) The conversion of a barter economy to one that uses moneyA) increases efficiency by reducing the need to exchange goods and services.B) increases efficiency by reducing the need to specialize.C) increases efficiency by reducing transactions costs.D) does not increase economic efficiency.Answer: CQues Status: Previous Edition7) Which of the following statements best explains how the use of money in an economy increases economic efficiency?A) Money increases economic efficiency because it is costless to produce.B) Money increases economic efficiency because it discourages specialization.C) Money increases economic efficiency because it decreases transactions costs.D) Money cannot have an effect on economic efficiency.Answer: CQues Status: Previous Edition8) When economists say that money promotes ________, they mean that money encourages specialization and the division of labor.A) bargainingB) contractingC) efficiencyD) greedAnswer: CQues Status: Previous Edition9) Money ________ transaction costs, allowing people to specialize in what they do best.A) reducesB) increasesC) enhancesD) eliminatesAnswer: AQues Status: Previous Edition10) For a commodity to function effectively as money it must beA) easily standardized, making it easy to ascertain its value.B) difficult to make change.C) deteriorate quickly so that its supply does not become too large.D) hard to carry around.Answer: AQues Status: Previous Edition11) All of the following are necessary criteria for a commodity to function as money exceptA) it must deteriorate quickly.B) it must be divisible.C) it must be easy to carry.D) it must be widely accepted.Answer: AQues Status: New12) Whatever a society uses as money, the distinguishing characteristic is that it mustA) be completely inflation proof.B) be generally acceptable as payment for goods and services or in the repayment of debt.C) contain gold.D) be produced by the government.Answer: BQues Status: Previous Edition13) All but the most primitive societies use money as a medium of exchange, implying thatA) the use of money is economically efficient.B) barter exchange is economically efficient.C) barter exchange cannot work outside the family.D) inflation is not a concern.Answer: AQues Status: Previous Edition14) Kevin purchasing concert tickets with his debit card is an example of the ________ function of money.A) medium of exchangeB) unit of accountC) store of valueD) specializationAnswer: AQues Status: Previous Edition15) When money prices are used to facilitate comparisons of value, money is said to function as aA) unit of account.B) medium of exchange.C) store of value.D) payments-system ruler.Answer: AQues Status: Previous Edition16) A problem with barter exchange when there are many goods is that in a barter systemA) transactions costs are minimized.B) there exists a multiple number of prices for each good.C) there is only one store of value.D) exchange of services is impossible.Answer: BQues Status: Previous Edition17) In a barter economy the number of prices in an economy with N goods isA) [N(N - 1)]/2.B) N(N/2).C) 2N.D) N(N/2) - 1.Answer: AQues Status: Previous Edition18) If there are five goods in a barter economy, one needs to know ten prices in order to exchange one good for another. If, however, there are ten goods in a barter economy, then one needs to know ________ prices in order to exchange one good for another.A) 20B) 25C) 30D) 45Answer: DQues Status: Previous Edition19) If there are four goods in a barter economy, then one needs to know ________ prices in order to exchange one good for another.A) 8B) 6C) 5D) 4Answer: BQues Status: Previous Edition20) Because it is a unit of account, moneyA) increases transaction costs.B) reduces the number of prices that need to be calculated.C) does not earn interest.D) discourages specialization.Answer: BQues Status: Previous Edition21) Dennis notices that jackets are on sale for $99. In this case money is functioning as a________.A) medium of exchangeB) unit of accountC) store of valueD) payments-system rulerAnswer: BQues Status: Previous Edition22) As a store of value, moneyA) does not earn interest.B) cannot be a durable asset.C) must be currency.D) is a way of saving for future purchases.Answer: DQues Status: Revised23) Patrick places his pocket change into his savings bank on his desk each evening. By his actions, Patrick indicates that he believes that money is aA) medium of exchange.B) unit of account.C) store of value.D) unit of specialization.Answer: CQues Status: Revised24) ________ is the relative ease and speed with which an asset can be converted into a medium of exchange.A) EfficiencyB) LiquidityC) DeflationD) SpecializationAnswer: BQues Status: Previous Edition25) Increasing transactions costs of selling an asset make the assetA) more valuable.B) more liquid.C) less liquid.D) more moneylike.Answer: CQues Status: Previous Edition26) Since it does not have to be converted into anything else to make purchases, ________ is the most liquid asset.A) moneyB) stockC) artworkD) goldAnswer: AQues Status: New27) Of the following assets, the least liquid isA) stocks.B) traveler's checks.C) checking deposits.D) a house.Answer: DQues Status: Previous Edition28) Ranking assets from most liquid to least liquid, the correct order isA) savings bonds; house; currency.B) currency; savings bonds; house.C) currency; house; savings bonds.D) house; savings bonds; currency.Answer: BQues Status: Previous Edition29) People hold money even during inflationary episodes when other assets prove to be better stores of value. This can be explained by the fact that money isA) extremely liquid.B) a unique good for which there are no substitutes.C) the only thing accepted in economic exchange.D) backed by gold.Answer: AQues Status: Previous Edition30) If the price level doubles, the value of moneyA) doubles.B) more than doubles, due to scale economies.C) rises but does not double, due to diminishing returns.D) falls by 50 percent.Answer: DQues Status: Previous Edition31) A fall in the level of pricesA) does not affect the value of money.B) has an uncertain effect on the value of money.C) increases the value of money.D) reduces the value of money.Answer: CQues Status: Previous Edition32) A hyperinflation isA) a period of extreme inflation generally greater than 50% per month.B) a period of anxiety caused by rising prices.C) an increase in output caused by higher prices.D) impossible today because of tighter regulations.Answer: AQues Status: New33) During hyperinflations,A) the value of money rises rapidly.B) money no longer functions as a good store of value and people may resort to barter transactions on a much larger scale.C) middle-class savers benefit as prices rise.D) money's value remains fixed to the price level; that is, if prices double so does the value of money.Answer: BQues Status: Previous Edition34) Because inflation in Germany after World War I sometimes exceeded 1,000 % per month, one can conclude that the German economy suffered fromA) deflation.B) disinflation.C) hyperinflation.D) superdeflation.Answer: CQues Status: Revised35) If merchants in the country Zed choose to close their doors, preferring to be stuck with rotting merchandise rather than worthless currency, then one can conclude that Zed is experiencing aA) superdeflation.B) hyperdeflation.C) disinflation.D) hyperinflation.Answer: DQues Status: Previous Edition36) Explain how cigarettes could be called "money" in prisoner-of-war camps of World War II. Answer: The cigarettes performed the three functions of money. They served as the medium of exchange because individuals did exchange items for cigarettes. They served as a unit of account because prices were quoted in terms of the number of cigarettes required for the exchange. They served as a store of value because an individual would be willing to save their cigarettes even if they did not smoke because they believed that they could exchange the cigarettes for something that they did want at some time in the future.Ques Status: Previous Edition3.3 Evolution of the Payments System1) The payments system isA) the method of conducting transactions in the economy.B) used by union officials to set salary caps.C) an illegal method of rewarding contracts.D) used by your employer to determine salary increases.Answer: AQues Status: New2) As the payments system evolves from barter to a monetary system,A) commodity money is likely to precede the use of paper currency.B) transaction costs increase.C) the number of prices that need to be calculated increase rather dramatically.D) specialization decreases.Answer: AQues Status: Previous Edition3) A disadvantage of ________ is that it is very heavy and hard to transport from one place to another.A) commodity moneyB) fiat moneyC) electronic moneyD) paper moneyAnswer: AQues Status: Previous Edition4) Paper currency that has been declared legal tender but is not convertible into coins or precious metals is called ________ money.A) commodityB) fiatC) electronicD) funnyAnswer: BQues Status: Previous Edition5) When paper currency is decreed by governments as legal tender, legally it must be ________.A) paper currency backed by goldB) a precious metal such as gold or silverC) accepted as payment for debtsD) convertible into an electronic paymentAnswer: CQues Status: Previous Edition6) The evolution of the payments system from barter to precious metals, then to fiat money, then to checks can best be understood as a consequence of the fact thatA) paper is more costly to produce than precious metals.B) precious metals were not generally acceptable.C) precious metals were difficult to carry and transport.D) paper money is less accepted than checks.Answer: CQues Status: Previous Edition7) Compared to checks, paper currency and coins have the major drawbacks that theyA) are easily stolen.B) are hard to counterfeit.C) are not the most liquid assets.D) must be backed by gold.Answer: AQues Status: Previous Edition8) Introduction of checks into the payments system reduced the costs of exchanging goods and services. Another advantage of checks is thatA) they provide convenient receipts for purchases.B) they can never be stolen.C) they are more widely accepted than currency.D) the funds from a deposited check are available for use immediately.Answer: AQues Status: New9) The evolution of the payments system from barter to precious metals, then to fiat money, then to checks can best be understood as a consequence ofA) government regulations designed to improve the efficiency of the payments system.B) government regulations designed to promote the safety of the payments system.C) innovations that reduced the costs of exchanging goods and services.D) competition among firms to make it easier for customers to purchase their products. Answer: CQues Status: Previous Edition10) Compared to an electronic payments system, a payments system based on checks has the major drawback thatA) checks are less costly to process.B) checks take longer to process, meaning that it may take several days before the depositor can get her cash.C) fraud may be more difficult to commit when paper receipts are eliminated.D) legal liability is more clearly defined.Answer: BQues Status: Previous Edition11) Which of the following sequences accurately describes the evolution of the payments system?A) Barter, coins made of precious metals, paper currency, checks, electronic funds transfersB) Barter, coins made of precious metals, checks, paper currency, electronic funds transfersC) Barter, checks, paper currency, coins made of precious metals, electronic funds transfersD) Barter, checks, paper currency, electronic funds transfersAnswer: AQues Status: Previous Edition12) During the past two decades an important characteristic of the modern payments system has been the rapidly increasing use ofA) checks and decreasing use of currency.B) electronic fund transfers.C) commodity monies.D) fiat money.Answer: BQues Status: Previous Edition13) Which of the following is not a form of e-money?A) a debit cardB) a credit cardC) a stored-value cardD) a smart cardAnswer: BQues Status: Previous Edition14) A smart card is the equivalent ofA) cash.B) savings bonds.C) savings deposits.D) certificates of deposit.Answer: AQues Status: Previous Edition15) An electronic payments system has not completely replaced the paper payments system because of all of the following reasons exceptA) expensive equipment is necessary to set up the system.B) security concerns.C) privacy concerns.D) transportation costs.Answer: DQues Status: Revised16) In explaining the evolution of moneyA) government regulation is the most important factor.B) commodity money, because it is valued more highly, tends to drive out paper money.C) new forms of money evolve to lower transaction costs.D) paper money is always backed by gold and therefore more desirable than checks. Answer: CQues Status: Previous Edition17) What factors have slowed down the movement to a system where all payments are made electronically?Answer: The equipment necessary to set up the system is expensive, security of the information, and privacy concerns are issues that need to be addressed before an electronic payments system will be widely accepted.Ques Status: Previous Edition3.4 Measuring Money1) Recent financial innovation makes the Federal Reserve's job of conducting monetary policyA) easier, since the Fed now knows what to consider money.B) more difficult, since the Fed now knows what to consider money.C) easier, since the Fed no longer knows what to consider money.D) more difficult, since the Fed no longer knows what to consider money.Answer: DQues Status: Previous Edition2) Defining money becomes ________ difficult as the pace of financial innovation ________.A) less; quickensB) more; quickensC) more; slowsD) more; stopsAnswer: BQues Status: Previous Edition3) Monetary aggregates areA) measures of the money supply reported by the Federal Reserve.B) measures of the wealth of individuals.C) never redefined since "money" never changes.D) reported by the Treasury Department annually.Answer: AQues Status: New4) ________ is the narrowest monetary aggregate that the Fed reports.A) M0B) M1C) M2D) M3Answer: BQues Status: Previous Edition5) The currency component includes paper money and coins held in ________.A) bank vaultsB) ATMsC) the hands of the nonbank publicD) the central bankAnswer: CQues Status: Previous Edition6) The components of the U.S. M1 money supply are demand and checkable deposits plusA) currency.B) currency plus savings deposits.C) currency plus travelers checks.D) currency plus travelers checks plus money market deposits.Answer: CQues Status: Previous Edition7) The M1 measure of money includesA) small denomination time deposits.B) traveler's checks.C) money market deposit accounts.D) money market mutual fund shares.Answer: BQues Status: Previous Edition8) Which of the following is not included in the measure of M1?A) NOW accounts.B) Demand deposits.C) Currency.D) Savings deposits.Answer: DQues Status: Previous Edition9) Which of the following is not included in the M1 measure of money but is included in the M2 measure of money?A) CurrencyB) Traveler's checksC) Demand depositsD) Small-denomination time depositsAnswer: DQues Status: Previous Edition10) Which of the following is included in both M1 and M2?A) CurrencyB) Savings depositsC) Small-denomination time depositsD) Money market deposit accountsAnswer: AQues Status: Previous Edition11) Which of the following is not included in the monetary aggregate M2?A) CurrencyB) Savings bondsC) Traveler's checksD) Checking depositsAnswer: BQues Status: Previous Edition12) Which of the following is included in M2 but not in M1?A) NOW accountsB) Demand depositsC) CurrencyD) Money market mutual fund shares (retail)Answer: DQues Status: Previous Edition13) Of the following, the largest isA) money market deposit accounts.B) demand deposits.C) M1.D) M2.Answer: DQues Status: Previous Edition14) If an individual redeems a U.S. savings bond for currencyA) M1 stays the same and M2 decreases.B) M1 increases and M2 increases.C) M1 increases and M2 stays the same.D) M1 stays the same and M2 stays the same.Answer: BQues Status: Previous Edition15) If an individual moves money from a small-denomination time deposit to a demand deposit account,A) M1 increases and M2 stays the same.B) M1 stays the same and M2 increases.C) M1 stays the same and M2 stays the same.D) M1 increases and M2 decreases.Answer: AQues Status: Previous Edition16) If an individual moves money from a demand deposit account to a money market deposit account,A) M1 decreases and M2 stays the same.B) M1 stays the same and M2 increases.C) M1 stays the same and M2 stays the same.D) M1 increases and M2 decreases.Answer: AQues Status: Previous Edition17) If an individual moves money from a savings deposit account to a money market deposit account,A) M1 decreases and M2 stays the same.B) M1 stays the same and M2 increases.C) M1 stays the same and M2 stays the same.D) M1 increases and M2 decreases.Answer: CQues Status: Previous Edition18) If an individual moves money from currency to a demand deposit account,A) M1 decreases and M2 stays the same.B) M1 stays the same and M2 increases.C) M1 stays the same and M2 stays the same.D) M1 increases and M2 stays the same.Answer: CQues Status: Previous Edition19) If an individual moves money from a money market deposit account to currency,A) M1 increases and M2 stays the same.B) M1 stays the same and M2 increases.C) M1 stays the same and M2 stays the same.D) M1 increases and M2 decreases.Answer: AQues Status: Previous Edition20) Small-denomination time deposits refer to certificates of deposit with a denomination of less than ________.A) $1,000B) $10,000C) $100,000D) $1,000,000Answer: CQues Status: Previous Edition21) Which of the following statements accurately describes the two measures of the money supply?A) The two measures do not move together, so they cannot be used interchangeably by policymakers.B) The two measures' movements closely parallel each other, even on a month-to-month basis.C) Short-run movements in the money supply are extremely reliable.D) M2 is the narrowest measure the Fed reports.Answer: AQues Status: Previous Edition22) The decade during which the growth rates of monetary aggregates diverged the most isA) the 1960s.B) the 1970s.C) the 1980s.D) the 1990s.Answer: DQues Status: Previous Edition23) Why are most of the U.S. dollars held outside of the United States?Answer: Concern about high inflation eroding the value of their own currency causes many people in foreign countries to hold U.S. dollars as a hedge against inflation risk.Ques Status: Previous Edition3.5 How Reliable are the Money Data?1) The Fed revises its estimates of the monetary aggregates, sometimes by large amounts, becauseA) large depository institutions need only report their deposits infrequently.B) weekly monetary data need to be adjusted for the "weekend effect."C) monthly monetary data need to be adjusted for the "payday effect."D) seasonal adjustments become more precise only as more data becomes available.Answer: DQues Status: Previous Edition2) The Fed estimates initial monetary aggregate reports because ________ depository institutions report the amount of their deposits infrequently.A) allB) smallC) largeD) stateAnswer: BQues Status: Previous Edition3) The increase in holiday spending is not the same every year causing the Fed's adjustment for ________ to be revised as more data becomes available.A) seasonal variationB) reporting discrepancyC) market churningD) transactions discrepancyAnswer: AQues Status: Previous Edition4) An examination of revised money supply statistics, when compared to the initial statistics, suggests that the initial statisticsA) are pretty good.B) do not provide a good guide to short-run movements in the money supply.C) provide a poor guide of monetary policy because they are usually underestimates of the revised statistics.D) provide a good guide of monetary policy, though they are usually underestimates of the revised statistics.Answer: BQues Status: Previous Edition5) Generally, the initial money supply data reported by the FedA) is not a reliable guide to the short-run behavior of the money supply.B) is not a reliable guide to the long-run behavior of the money supply.C) is a reliable guide to the short-run behavior of the money supply.D) usually underestimate the revised statistics.Answer: AQues Status: Revised6) The initial money supply data reported by the Fed are not a reliable guide to short-run movements in the money supply such as a ________, but are reasonably reliable for longer periods such as a ________.A) month; yearB) day; monthC) year; decadeD) decade; centuryAnswer: AQues Status: New。