公司理财中文版第九版第三章答案

- 格式:doc

- 大小:254.00 KB

- 文档页数:53

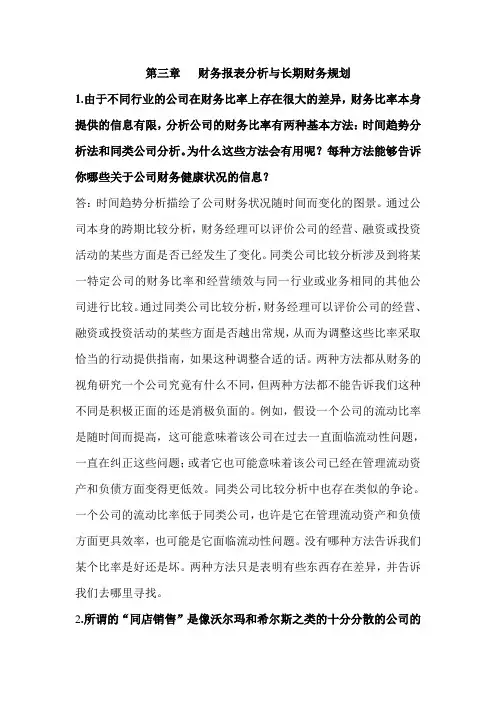

第三章财务报表分析与长期财务规划1.由于不同行业的公司在财务比率上存在很大的差异,财务比率本身提供的信息有限,分析公司的财务比率有两种基本方法:时间趋势分析法和同类公司分析。

为什么这些方法会有用呢?每种方法能够告诉你哪些关于公司财务健康状况的信息?答:时间趋势分析描绘了公司财务状况随时间而变化的图景。

通过公司本身的跨期比较分析,财务经理可以评价公司的经营、融资或投资活动的某些方面是否已经发生了变化。

同类公司比较分析涉及到将某一特定公司的财务比率和经营绩效与同一行业或业务相同的其他公司进行比较。

通过同类公司比较分析,财务经理可以评价公司的经营、融资或投资活动的某些方面是否越出常规,从而为调整这些比率采取恰当的行动提供指南,如果这种调整合适的话。

两种方法都从财务的视角研究一个公司究竟有什么不同,但两种方法都不能告诉我们这种不同是积极正面的还是消极负面的。

例如,假设一个公司的流动比率是随时间而提高,这可能意味着该公司在过去一直面临流动性问题,一直在纠正这些问题;或者它也可能意味着该公司已经在管理流动资产和负债方面变得更低效。

同类公司比较分析中也存在类似的争论。

一个公司的流动比率低于同类公司,也许是它在管理流动资产和负债方面更具效率,也可能是它面临流动性问题。

没有哪种方法告诉我们某个比率是好还是坏。

两种方法只是表明有些东西存在差异,并告诉我们去哪里寻找。

2.所谓的“同店销售”是像沃尔玛和希尔斯之类的十分分散的公司的一项重要指标,顾名思义,分析同店销售就是比较同样的店铺或餐馆在两个不同的时间点上的销售额。

为什么公司总是关注同店销售而不是总销售?答:如果一家公司通过开设新店来不断增长,那么可以推测其总收入将上升。

比较两个不同时点的总销售额可能会误导。

同店销售方法只看在特定时期开设的店铺的销售额控制了这一误差。

3.为什么多数长期财务计划都从销售预测开始?或者说,为什么未来销售额是关键?答:理由是,最终,消费是商业背后的驱动力。

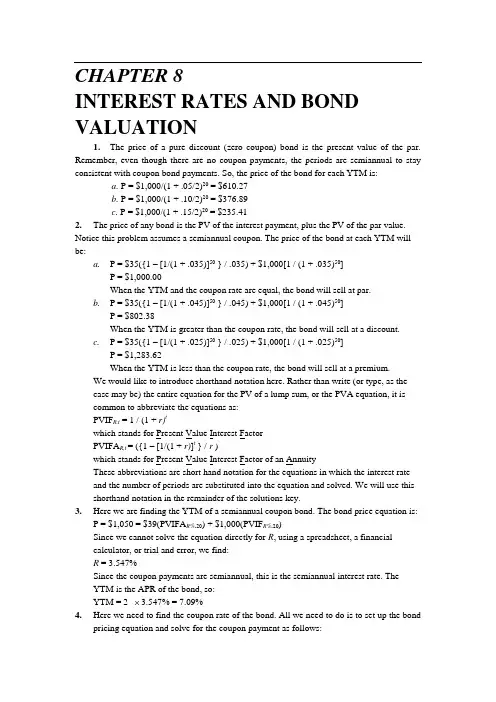

CHAPTER 8INTEREST RATES AND BOND VALUATION1.The price of a pure discount (zero coupon) bond is the present value of the par. Remember, even though there are no coupon payments, the periods are semiannual to stay consistent with coupon bond payments. So, the price of the bond for each YTM is:a. P = $1,000/(1 + .05/2)20 = $610.27b. P = $1,000/(1 + .10/2)20 = $376.89c. P = $1,000/(1 + .15/2)20 = $235.412.The price of any bond is the PV of the interest payment, plus the PV of the par value. Notice this problem assumes a semiannual coupon. The price of the bond at each YTM will be:a.P = $35({1 – [1/(1 + .035)]50 } / .035) + $1,000[1 / (1 + .035)50]P = $1,000.00When the YTM and the coupon rate are equal, the bond will sell at par.b.P = $35({1 – [1/(1 + .045)]50 } / .045) + $1,000[1 / (1 + .045)50]P = $802.38When the YTM is greater than the coupon rate, the bond will sell at a discount.c.P = $35({1 – [1/(1 + .025)]50 } / .025) + $1,000[1 / (1 + .025)50]P = $1,283.62When the YTM is less than the coupon rate, the bond will sell at a premium.We would like to introduce shorthand notation here. Rather than write (or type, as the case may be) the entire equation for the PV of a lump sum, or the PVA equation, it is common to abbreviate the equations as:PVIF R,t = 1 / (1 + r)twhich stands for Present Value Interest FactorPVIFA R,t= ({1 – [1/(1 + r)]t } / r )which stands for Present Value Interest Factor of an AnnuityThese abbreviations are short hand notation for the equations in which the interest rate and the number of periods are substituted into the equation and solved. We will use this shorthand notation in the remainder of the solutions key.3.Here we are finding the YTM of a semiannual coupon bond. The bond price equation is:P = $1,050 = $39(PVIFA R%,20) + $1,000(PVIF R%,20)Since we cannot solve the equation directly for R, using a spreadsheet, a financialcalculator, or trial and error, we find:R = 3.547%Since the coupon payments are semiannual, this is the semiannual interest rate. TheYTM is the APR of the bond, so:YTM = 2 3.547% = 7.09%4.Here we need to find the coupon rate of the bond. All we need to do is to set up the bondpricing equation and solve for the coupon payment as follows:P = $1,175 = C(PVIFA3.8%,27) + $1,000(PVIF3.8%,27)Solving for the coupon payment, we get:C = $48.48Since this is the semiannual payment, the annual coupon payment is:2 × $48.48 = $96.96And the coupon rate is the annual coupon payment divided by par value, so:Coupon rate = $96.96 / $1,000 = .09696 or 9.70%5.The price of any bond is the PV of the interest payment, plus the PV of the par value.The fact that the bond is denominated in euros is irrelevant. Notice this problem assumes an annual coupon. The price of the bond will be:P = €84({1 – [1/(1 + .076)]15 } / .076) + €1,000[1 / (1 + .076)15]P = €1,070.186.Here we are finding the YTM of an annual coupon bond. The fact that the bond is denominated in yen is irrelevant. The bond price equation is:P = ¥87,000 = ¥5,400(PVIFA R%,21) + ¥100,000(PVIF R%,21)Since we cannot solve the equation directly for R, using a spreadsheet, a financial calculator, or trial and error, we find:R = 6.56%Since the coupon payments are annual, this is the yield to maturity.7.The approximate relationship between nominal interest rates (R), real interest rates (r),and inflation (h) is:R = r + hApproximate r = .05 –.039 =.011 or 1.10%The Fisher equation, which shows the exact relationship between nominal interest rates, real interest rates, and inflation is:(1 + R) = (1 + r)(1 + h)(1 + .05) = (1 + r)(1 + .039)Exact r = [(1 + .05) / (1 + .039)] – 1 = .0106 or 1.06%8.The Fisher equation, which shows the exact relationship between nominal interest rates,real interest rates, and inflation, is:(1 + R) = (1 + r)(1 + h)R = (1 + .025)(1 + .047) – 1 = .0732 or 7.32%9. The Fisher equation, which shows the exact relationship between nominal interest rates,real interest rates, and inflation, is:(1 + R) = (1 + r)(1 + h)h = [(1 + .17) / (1 + .11)] – 1 = .0541 or 5.41%10.The Fisher equation, which shows the exact relationship between nominal interest rates,real interest rates, and inflation, is:(1 + R) = (1 + r)(1 + h)r = [(1 + .141) / (1.068)] – 1 = .0684 or 6.84%11.The coupon rate, located in the first column of the quote is 6.125%. The bid price is:Bid price = 119:19 = 119 19/32 = 119.59375% $1,000 = $1,195.9375The previous day’s ask price is found by:Previous day’s asked price = Today’s asked price – Change = 119 21/32 – (–17/32) = 120 6/32The previous day’s price in dollars was:Previous day’s dollar price = 120.1875% $1,000 = $1,201.87512.This is a premium bond because it sells for more than 100% of face value. The current yield is:Current yield = Annual coupon payment / Asked price = $75/$1,347.1875 = .0557 or 5.57%The YTM is located under the “Asked yield” column, so the YTM is 4.4817%.The bid-ask spread is the difference between the bid price and the ask price, so:Bid-Ask spread = 134:23 – 134:22 = 1/32Intermediate13. Here we are finding the YTM of semiannual coupon bonds for various maturity lengths.The bond price equation is:P = C(PVIFA R%,t) + $1,000(PVIF R%,t)Miller Corporation bond:P0 = $45(PVIFA3.5%,26) + $1,000(PVIF3.5%,26) = $1,168.90P1 = $45(PVIFA3.5%,24) + $1,000(PVIF3.5%,24) = $1,160.58P3 = $45(PVIFA3.5%,20) + $1,000(PVIF3.5%,20) = $1,142.12P8 = $45(PVIFA3.5%,10) + $1,000(PVIF3.5%,10) = $1,083.17P12= $45(PVIFA3.5%,2) +$1,000(PVIF3.5%,2) = $1,019.00P13= $1,000Modigliani Company bond:P0 = $35(PVIFA4.5%,26) + $1,000(PVIF4.5%,26) = $848.53P1 = $35(PVIFA4.5%,24) + $1,000(PVIF4.5%,24) = $855.05P3 = $35(PVIFA4.5%,20) + $1,000(PVIF4.5%,20) = $869.92P8 = $35(PVIFA4.5%,10) + $1,000(PVIF4.5%,10) = $920.87P12= $35(PVIFA4.5%,2) +$1,000(PVIF4.5%,2) = $981.27P13= $1,000All else held equal, the premium over par value for a premium bond declines as maturity approaches, and the discount from par value for a discount bond declines as maturity approaches. This is called “pull to par.” In both cases, the largest percentage price changes occur at the shortest maturity lengths.Also, notice that the price of each bond when no time is left to maturity is the par value, even though the purchaser would receive the par value plus the coupon payment immediately. This is because we calculate the clean price of the bond.14.Any bond that sells at par has a YTM equal to the coupon rate. Both bonds sell at par, sothe initial YTM on both bonds is the coupon rate, 8 percent. If the YTM suddenly rises to 10 percent:P Laurel= $40(PVIFA5%,4) + $1,000(PVIF5%,4) = $964.54P Hardy= $40(PVIFA5%,30) + $1,000(PVIF5%,30) = $846.28The percentage change in price is calculated as:Percentage change in price = (New price – Original price) / Original price∆P Laurel% = ($964.54 – 1,000) / $1,000 = –0.0355 or –3.55%∆P Hardy% = ($846.28 – 1,000) / $1,000 = –0.1537 or –15.37%If the YTM suddenly falls to 6 percent:P Laurel= $40(PVIFA3%,4) + $1,000(PVIF3%,4) = $1,037.17P Hardy= $40(PVIFA3%,30) + $1,000(PVIF3%,30) = $1,196.00∆P Laurel% = ($1,037.17 – 1,000) / $1,000 = +0.0372 or 3.72%∆P Hardy% = ($1,196.002 – 1,000) / $1,000 = +0.1960 or 19.60%All else the same, the longer the maturity of a bond, the greater is its price sensitivity to changes in interest rates. Notice also that for the same interest rate change, the gain froma decline in interest rates is larger than the loss from the same magnitude change. For aplain vanilla bond, this is always true.15.Initially, at a YTM of 10 percent, the prices of the two bonds are:P Faulk= $30(PVIFA5%,16) + $1,000(PVIF5%,16) = $783.24P Gonas= $70(PVIFA5%,16) + $1,000(PVIF5%,16) = $1,216.76If the YTM rises from 10 percent to 12 percent:P Faulk= $30(PVIFA6%,16) + $1,000(PVIF6%,16) = $696.82P Gonas= $70(PVIFA6%,16) + $1,000(PVIF6%,16) = $1,101.06The percentage change in price is calculated as:Percentage change in price = (New price – Original price) / Original price∆P Faulk% = ($696.82 – 783.24) / $783.24 = –0.1103 or –11.03%∆P Gonas% = ($1,101.06 – 1,216.76) / $1,216.76 = –0.0951 or –9.51% If the YTM declines from 10 percent to 8 percent:P Faulk= $30(PVIFA4%,16) + $1,000(PVIF4%,16) = $883.48P Gonas= $70(PVIFA4%,16) + $1,000(PVIF4%,16) = $1,349.57∆P Faulk% = ($883.48 – 783.24) / $783.24 = +0.1280 or 12.80%∆P Gonas% = ($1,349.57 – 1,216.76) / $1,216.76 = +0.1092 or 10.92% All else the same, the lower the coupon rate on a bond, the greater is its price sensitivity to changes in interest rates.16.The bond price equation for this bond is:P0 = $960 = $37(PVIFA R%,18) + $1,000(PVIF R%,18)Using a spreadsheet, financial calculator, or trial and error we find:R = 4.016%This is the semiannual interest rate, so the YTM is:YTM = 2 ⨯ 4.016% = 8.03%The current yield is:Current yield = Annual coupon payment / Price = $74 / $960 = .0771 or 7.71%The effective annual yield is the same as the EAR, so using the EAR equation from the previous chapter:Effective annual yield = (1 + 0.04016)2– 1 = .0819 or 8.19%17.The company should set the coupon rate on its new bonds equal to the required return.The required return can be observed in the market by finding the YTM on outstanding bonds of the company. So, the YTM on the bonds currently sold in the market is:P = $1,063 = $50(PVIFA R%,40) + $1,000(PVIF R%,40)Using a spreadsheet, financial calculator, or trial and error we find:R = 4.650%This is the semiannual interest rate, so the YTM is:YTM = 2 ⨯ 4.650% = 9.30%18. Accrued interest is the coupon payment for the period times the fraction of the periodthat has passed since the last coupon payment. Since we have a semiannual coupon bond, the coupon payment per six months is one-half of the annual coupon payment. There are two months until the next coupon payment, so four months have passed since the last coupon payment. The accrued interest for the bond is:Accrued interest = $84/2 × 4/6 = $28And we calculate the clean price as:Clean price = Dirty price – Accrued interest = $1,090 – 28 = $1,06219. Accrued interest is the coupon payment for the period times the fraction of the periodthat has passed since the last coupon payment. Since we have a semiannual coupon bond, the coupon payment per six months is one-half of the annual coupon payment. There are four months until the next coupon payment, so two months have passed since the last coupon payment. The accrued interest for the bond is:Accrued interest = $72/2 × 2/6 = $12.00And we calculate the dirty price as:Dirty price = Clean price + Accrued interest = $904 + 12 = $916.0020.To find the number of years to maturity for the bond, we need to find the price of thebond. Since we already have the coupon rate, we can use the bond price equation, and solve for the number of years to maturity. We are given the current yield of the bond, so we can calculate the price as:Current yield = .0842 = $90/P0P0 = $90/.0842 = $1,068.88Now that we have the price of the bond, the bond price equation is:P = $1,068.88 = $90{[(1 – (1/1.0781)t ] / .0781} + $1,000/1.0781tWe can solve this equation for t as follows:$1,068.88 (1.0781)t = $1,152.37 (1.0781)t– 1,152.37 + 1,000152.37 = 83.49(1.0781)t1.8251 = 1.0781tt = log 1.8251 / log 1.0781 = 8.0004 ≈ 8 yearsThe bond has 8 years to maturity.21.The bond has 10 years to maturity, so the bond price equation is:P = $871.55 = $41.25(PVIFA R%,20) + $1,000(PVIF R%,20)Using a spreadsheet, financial calculator, or trial and error we find:R = 5.171%This is the semiannual interest rate, so the YTM is:YTM = 2 5.171% = 10.34%The current yield is the annual coupon payment divided by the bond price, so:Current yield = $82.50 / $871.55 = .0947 or 9.47%22.We found the maturity of a bond in Problem 20. However, in this case, the maturity isindeterminate. A bond selling at par can have any length of maturity. In other words, when we solve the bond pricing equation as we did in Problem 20, the number of periods can be any positive number.Challenge23.To find the capital gains yield and the current yield, we need to find the price of the bond.The current price of Bond P and the price of Bond P in one year is:P: P0 = $90(PVIFA7%,5) + $1,000(PVIF7%,5) = $1,082.00P1 = $90(PVIFA7%,4) + $1,000(PVIF7%,4) = $1,067.74Current yield = $90 / $1,082.00 = .0832 or 8.32%The capital gains yield is:Capital gains yield = (New price – Original price) / Original priceCapital gains yield = ($1,067.74 – 1,082.00) / $1,082.00 = –0.0132 or –1.32% The current price of Bond D and the price of Bond D in one year is:D: P0 = $50(PVIFA7%,5) + $1,000(PVIF7%,5) = $918.00P1 = $50(PVIFA7%,4) + $1,000(PVIF7%,4) = $932.26Current yield = $50 / $918.00 = 0.0545 or 5.45%Capital gains yield = ($932.26 – 918.00) / $918.00 = 0.0155 or 1.55% All else held constant, premium bonds pay a high current income while having price depreciation as maturity nears; discount bonds pay a lower current income but have price appreciation as maturity nears. For either bond, the total return is still 7%, but this return is distributed differently between current income and capital gains.24.a. The rate of return you expect to earn if you purchase a bond and hold it until maturity is the YTM. The bond price equation for this bond is:P0 = $1,140 = $90(PVIFA R%,10) + $1,000(PVIF R%,10)Using a spreadsheet, financial calculator, or trial and error we find:R = YTM = 7.01%b. To find our HPY, we need to find the price of the bond in two years. The price ofthe bond in two years, at the new interest rate, will be:P2 = $90(PVIFA6.01%,8) + $1,000(PVIF6.01%,8) = $1,185.87To calculate the HPY, we need to find the interest rate that equates the price wepaid for the bond with the cash flows we received. The cash flows we receivedwere $90 each year for two years, and the price of the bond when we sold it. Theequation to find our HPY is:P0 = $1,140 = $90(PVIFA R%,2) + $1,185.87(PVIF R%,2)Solving for R, we get:R = HPY = 9.81%The realized HPY is greater than the expected YTM when the bond was boughtbecause interest rates dropped by 1 percent; bond prices rise when yields fall.25.The price of any bond (or financial instrument) is the PV of the future cash flows. Eventhough Bond M makes different coupons payments, to find the price of the bond, we just find the PV of the cash flows. The PV of the cash flows for Bond M is:P M = $800(PVIFA4%,16)(PVIF4%,12) + $1,000(PVIFA4%,12)(PVIF4%,28) +$20,000(PVIF4%,40)P M = $13,117.88Notice that for the coupon payments of $800, we found the PVA for the coupon payments, and then discounted the lump sum back to today.Bond N is a zero coupon bond with a $20,000 par value; therefore, the price of the bond is the PV of the par, or:P N = $20,000(PVIF4%,40) = $4,165.7826.To find the present value, we need to find the real weekly interest rate. To find the realreturn, we need to use the effective annual rates in the Fisher equation. So, we find the real EAR is:(1 + R) = (1 + r)(1 + h)1 + .107 = (1 + r)(1 + .035)r = .0696 or 6.96%Now, to find the weekly interest rate, we need to find the APR. Using the equation for discrete compounding:EAR = [1 + (APR / m)]m– 1We can solve for the APR. Doing so, we get:APR = m[(1 + EAR)1/m– 1]APR = 52[(1 + .0696)1/52– 1]APR = .0673 or 6.73%So, the weekly interest rate is:Weekly rate = APR / 52Weekly rate = .0673 / 52Weekly rate = .0013 or 0.13%Now we can find the present value of the cost of the roses. The real cash flows are an ordinary annuity, discounted at the real interest rate. So, the present value of the cost of the roses is:PVA = C({1 – [1/(1 + r)]t } / r)PVA = $8({1 – [1/(1 + .0013)]30(52)} / .0013)PVA = $5,359.6427.To answer this question, we need to find the monthly interest rate, which is the APRdivided by 12. We also must be careful to use the real interest rate. The Fisher equation uses the effective annual rate, so, the real effective annual interest rates, and the monthly interest rates for each account are:Stock account:(1 + R) = (1 + r)(1 + h)1 + .12 = (1 + r)(1 + .04)r = .0769 or 7.69%APR = m[(1 + EAR)1/m– 1]APR = 12[(1 + .0769)1/12– 1]APR = .0743 or 7.43%Monthly rate = APR / 12Monthly rate = .0743 / 12Monthly rate = .0062 or 0.62%Bond account:(1 + R) = (1 + r)(1 + h)1 + .07 = (1 + r)(1 + .04)r = .0288 or 2.88%APR = m[(1 + EAR)1/m– 1]APR = 12[(1 + .0288)1/12– 1]APR = .0285 or 2.85%Monthly rate = APR / 12Monthly rate = .0285 / 12Monthly rate = .0024 or 0.24%Now we can find the future value of the retirement account in real terms. The future value of each account will be:Stock account:FVA = C {(1 + r )t– 1] / r}FVA = $800{[(1 + .0062)360 – 1] / .0062]}FVA = $1,063,761.75Bond account:FVA = C {(1 + r )t– 1] / r}FVA = $400{[(1 + .0024)360 – 1] / .0024]}FVA = $227,089.04The total future value of the retirement account will be the sum of the two accounts, or: Account value = $1,063,761.75 + 227,089.04Account value = $1,290,850.79Now we need to find the monthly interest rate in retirement. We can use the same procedure that we used to find the monthly interest rates for the stock and bond accounts, so:(1 + R) = (1 + r)(1 + h)1 + .08 = (1 + r)(1 + .04)r = .0385 or 3.85%APR = m[(1 + EAR)1/m– 1]APR = 12[(1 + .0385)1/12– 1]APR = .0378 or 3.78%Monthly rate = APR / 12Monthly rate = .0378 / 12Monthly rate = .0031 or 0.31%Now we can find the real monthly withdrawal in retirement. Using the present value of an annuity equation and solving for the payment, we find:PVA = C({1 – [1/(1 + r)]t } / r )$1,290,850.79 = C({1 – [1/(1 + .0031)]300 } / .0031)C = $6,657.74This is the real dollar amount of the monthly withdrawals. The nominal monthly withdrawals will increase by the inflation rate each month. To find the nominal dollar amount of the last withdrawal, we can increase the real dollar withdrawal by the inflation rate. We can increase the real withdrawal by the effective annual inflation rate since we are only interested in the nominal amount of the last withdrawal. So, the last withdrawal in nominal terms will be: FV = PV(1 + r)tFV = $6,657.74(1 + .04)(30 + 25)FV = $57,565.3028.In this problem, we need to calculate the future value of the annual savings after the fiveyears of operations. The savings are the revenues minus the costs, or:Savings = Revenue – CostsSince the annual fee and the number of members are increasing, we need to calculate the effective growth rate for revenues, which is:Effective growth rate = (1 + .06)(1 + .03) – 1Effective growth rate = .0918 or 9.18%The revenue for the current year is the number of members times the annual fee, or:Current revenue = 500($500)Current revenue = $250,000The revenue will grow at 9.18 percent, and the costs will grow at 2 percent, so the savings each year for the next five years will be:Year Revenue Costs Savings1 $ 272,950.00 $ 76,500.00 $ 196,450.002 298,006.81 78,030.00 219,976.813 325,363.84 79,590.60 245,773.244 355,232.24 81,182.41 274,049.825 387,842.55 82,806.06 305,036.49Now we can find the value of each year’s savi ngs using the future value of a lump sum equation, so:FV = PV(1 + r)tYear Future Value1 $196,450.00(1 + .09)4 = $277,305.212 $219,976.81(1 + .09)3 = 284,876.353 $245,773.24(1 + .09)2 = 292,003.184 $274,049.82(1 + .09)1 = 298,714.315 305,036.49Total future value of savings = $1,457,935.54He will spend $500,000 on a luxury boat, so the value of his account will be:Value of account = $1,457,935.54 – 500,000Value of account = $957,935.54Now we can use the present value of an annuity equation to find the payment. Doing so, we find:PVA = C({1 – [1/(1 + r)]t } / r )$957,935.54 = C({1 – [1/(1 + .09)]25 } / .09)C = $97,523.83CHAPTER 91.We need to find the required return of the stock. Using the constant growth model, wecan solve the equation for R. Doing so, we find:R = (D1 / P0) + g = ($2.85 / $58) + .06 = .1091 or 10.91%2.The dividend yield is the dividend next year divided by the current price, so the dividendyield is:Dividend yield = D1 / P0 = $2.85 / $58 = .0491 or 4.91%The capital gains yield, or percentage increase in the stock price, is the same as the dividend growth rate, so:Capital gains yield = 6%3.We know the stock has a required return of 13 percent, and the dividend and capitalgains yield are equal, so:Dividend yield = 1/2(.13) = .065 = Capital gains yieldNow we know both the dividend yield and capital gains yield. The dividend is simply the stock price times the dividend yield, so:D1 = .065($64) = $4.16This is the dividend next year. The question asks for the dividend this year. Using the relationship between the dividend this year and the dividend next year:D1 = D0(1 + g)We can solve for the dividend that was just paid:$4.16 = D0 (1 + .065)D0 = $4.16 / 1.065 = $3.914.The price of a share of preferred stock is the dividend divided by the required return.This is the same equation as the constant growth model, with a dividend growth rate of zero percent. Remember that most preferred stock pays a fixed dividend, so the growth rate is zero. Using this equation, we find the price per share of the preferred stock is:R = D/P0 = $6.40/$103 = .0621 or 6.21%5.This stock has a constant growth rate of dividends, but the required return changes twice.To find the value of the stock today, we will begin by finding the price of the stock at Year 6, when both the dividend growth rate and the required return are stable forever.The price of the stock in Year 6 will be the dividend in Year 7, divided by the required return minus the growth rate in dividends. So:P6 = D6(1 + g) / (R–g) = D0(1 + g)7/ (R–g) = $2.75(1.06)7/ (.11 – .06) = $82.70Now we can find the price of the stock in Year 3. We need to find the price here since the required return changes at that time. The price of the stock in Year 3 is the PV of the dividends in Years 4, 5, and 6, plus the PV of the stock price in Year 6. The price of the stock in Year 3 is:P3= $2.75(1.06)4/ 1.14 + $2.75(1.06)5/ 1.142 + $2.75(1.06)6/ 1.143 + $82.70 / 1.143 P3= $64.33Finally, we can find the price of the stock today. The price today will be the PV of the dividends in Years 1, 2, and 3, plus the PV of the stock in Year 3. The price of the stock today is:P0= $2.75(1.06) / 1.16 + $2.75(1.06)2/ (1.16)2+ $2.75(1.06)3/ (1.16)3+ $64.33 /(1.16)3P0= $48.126.The price of a stock is the PV of the future dividends. This stock is paying five dividends,so the price of the stock is the PV of these dividends using the required return. The price of the stock is:P0 = $13 / 1.11 + $16 / 1.112 + $19 / 1.113 + $22 / 1.114 + $25 / 1.115 = $67.927.Here we need to find the dividend next year for a stock experiencing differential growth.We know the stock price, the dividend growth rates, and the required return, but not the dividend. First, we need to realize that the dividend in Year 3 is the current dividend times the FVIF. The dividend in Year 3 will be:D3 = D0(1.30)3And the dividend in Year 4 will be the dividend in Year 3 times one plus the growth rate, or:D4 = D0(1.30)3(1.18)The stock begins constant growth after the 4th dividend is paid, so we can find the price of the stock in Year 4 as the dividend in Year 5, divided by the required return minus the growth rate. The equation for the price of the stock in Year 4 is:P4= D4(1 + g) / (R– g)Now we can substitute the previous dividend in Year 4 into this equation as follows:P4 = D0(1 + g1)3(1 + g2) (1 + g3) / (R–g3)P4= D0(1.30)3(1.18) (1.08) / (.13 – .08) = 56.00D0When we solve this equation, we find that the stock price in Year 4 is 56.00 times as large as the dividend today. Now we need to find the equation for the stock price today.The stock price today is the PV of the dividends in Years 1, 2, 3, and 4, plus the PV of the Year 4 price. So:P0= D0(1.30)/1.13 + D0(1.30)2/1.132+ D0(1.30)3/1.133+ D0(1.30)3(1.18)/1.134+56.00D0/1.134We can factor out D0 in the equation, and combine the last two terms. Doing so, we get: P0 = $65.00 = D0{1.30/1.13 + 1.302/1.132 + 1.303/1.133 + [(1.30)3(1.18) + 56.00] / 1.134} Reducing the equation even further by solving all of the terms in the braces, we get:$65 = $39.86D0D0 = $65.00 / $39.86 = $1.63This is the dividend today, so the projected dividend for the next year will be:D1 = $1.63(1.30) = $2.128.The price of a share of preferred stock is the dividend payment divided by the requiredreturn. We know the dividend payment in Year 5, so we can find the price of the stock in Year 4, one year before the first dividend payment. Doing so, we get:P4 = $7.00 / .06 = $116.67The price of the stock today is the PV of the stock price in the future, so the price today will be:P0 = $116.67 / (1.06)4 = $92.419.To find the number of shares owned, we can divide the amount invested by the stockprice. The share price of any financial asset is the present value of the cash flows, so, tofind the price of the stock we need to find the cash flows. The cash flows are the two dividend payments plus the sale price. We also need to find the aftertax dividends since the assumption is all dividends are taxed at the same rate for all investors. The aftertax dividends are the dividends times one minus the tax rate, so:Year 1 aftertax dividend = $1.50(1 – .28)Year 1 aftertax dividend = $1.08Year 2 aftertax dividend = $2.25(1 – .28)Year 2 aftertax dividend = $1.62We can now discount all cash flows from the stock at the required return. Doing so, we find the price of the stock is:P = $1.08/1.15 + $1.62/(1.15)2 + $60/(1+.15)3P = $41.62The number of shares owned is the total investment divided by the stock price, which is: Shares owned = $100,000 / $41.62Shares owned = 2,402.9810.The required return of a stock consists of two components, the capital gains yield and thedividend yield. In the constant dividend growth model (growing perpetuity equation), the capital gains yield is the same as the dividend growth rate, or algebraically:R = D1/P0 + gWe can find the dividend growth rate by the growth rate equation, or:g = ROE ×bg = .16 × .80g = .1280 or 12.80%This is also the growth rate in dividends. To find the current dividend, we can use the information provided about the net income, shares outstanding, and payout ratio. The total dividends paid is the net income times the payout ratio. To find the dividend per share, we can divide the total dividends paid by the number of shares outstanding. So: Dividend per share = (Net income × Payout ratio) / Shares outstandingDividend per share = ($10,000,000 × .20) / 2,000,000Dividend per share = $1.00Now we can use the initial equation for the required return. We must remember that the equation uses the dividend in one year, so:R = D1/P0 + gR = $1(1 + .1280)/$85 + .1280R = .1413 or 14.13%11. a.If the company does not make any new investments, the stock price will be thepresent value of the constant perpetual dividends. In this case, all earnings are paiddividends, so, applying the perpetuity equation, we get:P = Dividend / RP = $8.25 / .12P = $68.75。

![[公司理财]公司理财原书第九版中文版课后答案](https://uimg.taocdn.com/d563fa6f65ce0508763213f7.webp)

(公司理财)公司理财原书第九版中文版课后答案答案大部分是计算题,参考英文答案翻译,便于理解就好,每章前面几个小题和第八版一样的(附上第八版答案)我自己翻译的,我上传到我的新浪微博上了,你自己去看,我的新浪微博ID:一直在奋斗的大洪这是部分翻译习题答案:第1、2、3、4、5、6、7、8、9、10、14、15、16、17、18、26、27、28章案例答案:第2、3、4、5、15、18章第1章1、在所有权形式的公司中,股东是公司的所有者。

股东选举公司的董事会,董事会任命该公司的管理层。

企业的所有权和控制权分离的组织形式是导致的代理关系存在的主要原因。

管理者可能追求自身或别人的利益最大化,而不是股东的利益最大化。

在这种环境下,他们可能因为目标不一致而存在代理问题。

2、非营利公司经常追求社会或政治任务等各种目标。

非营利公司财务管理的目标是获取并有效使用资金以最大限度地实现组织的社会使命。

3、这句话是不正确的。

管理者实施财务管理的目标就是最大化现有股票的每股价值,当前的股票价值反映了短期和长期的风险、时间以及未来现金流量。

4、有两种结论。

一种极端,在市场经济中所有的东西都被定价。

因此所有目标都有一个最优水平,包括避免不道德或非法的行为,股票价值最大化。

另一种极端,我们可以认为这是非经济现象,最好的处理方式是通过政治手段。

一个经典的思考问题给出了这种争论的答案:公司估计提高某种产品安全性的成本是30美元万。

然而,该公司认为提高产品的安全性只会节省20美元万。

请问公司应该怎么做呢?”5、财务管理的目标都是相同的,但实现目标的最好方式可能是不同的,因为不同的国家有不同的社会、政治环境和经济制度。

6、管理层的目标是最大化股东现有股票的每股价值。

如果管理层认为能提高公司利润,使股价超过35美元,那么他们应该展开对恶意收购的斗争。

如果管理层认为该投标人或其它未知的投标人将支付超过每股35美元的价格收购公司,那么他们也应该展开斗争。

公司理财第九版中文答案这个是word可以自己修改第1章企业融资简介概念问题的答案1。

在企业的所有制形式,股东是公司的所有者。

的股东选出该法团的董事,谁又将委任公司的管理层。

是什么原因造成这种分离,所有权控制在企业的组织形式存在的代理问题。

管理可能在其自己或别人的最佳利益行事,而不是股东。

如果这样的事件发生时,他们可能会最大化的股权,该公司的股价目标相矛盾。

2。

这些组织经常追求社会或政治任务,所以许多不同的目标,是可以想象的。

一个经常被援引的目标是收入最小化,也就是说,提供力所能及的提供商品和服务,在尽可能低的社会成本。

一个更好的办法可能是观察,即使是一个不以营利为目的的企业拥有股权。

因此,一个答案是,在适当的目标是价值最大化的股权。

3。

据推测,目前的股票价值反映风险,所有未来现金流量的时间和幅度,短期和长期的。

如果这是正确的,那么陈述是错误的。

4。

参数可以两种方式。

在一个极端,我们可以认为,在市场经济中,所有这些东西的价格。

因此,有一个最佳的水平,例如,道德和/或非法行为,以及股票估值的框架明确包括这些。

在另一个极端,我们可以说,这些都是非经济现象,并通过政治进程是最好的处理。

一个经典的(高度相关)的思想说明了这一点辩论的问题是这样的:“估计,一个企业之一,其产品的成本,提高了安全额为3,000万元。

不过,该公司认为,提高了产品的安全性,不仅节省了2000万美元的产品责任索赔。

企业应该做些什么?“5。

我们的目标将是相同的,但最好的行动实现这一目标的过程中可能会有所不同,因为不同的社会,政治和经济机构。

6。

管理的目标应该是最大限度地提高现有股东的股价。

如果管理层认为它可以提高公司的盈利能力,从而使股票价格将超过$ 35,那么他们应该争取从外面公司的报价。

如果管理层认为该投标人或其他身份不明的投标人将实际支付超过每股35美元收购该公司,那么他们还是应该打的报价。

但是,如果目前的管理不能增加公司价值超越的买入价,并没有其他出价更高的,当时的管理层不采取行动,战斗要约股东的利益。

公司理财第九版罗斯课后案例答案 Case Solutions CorporateFinance1. 案例一:公司资金需求分析问题:一家公司需要资金支持其新项目。

通过分析现金流量,推断该公司是否需要向外部借款或筹集其他资金。

解答:为了确定公司是否需要外部资金,我们需要分析公司的现金流量状况。

首先,我们需要计算公司的净现金流量(净收入加上非现金项目)。

然后,我们需要将净现金流量与项目的投资现金流量进行对比。

假设公司预计在项目开始时投资100万美元,并在项目运营期为5年。

预计该项目每年将产生50万美元的净现金流量。

现在,我们需要进行以下计算:净现金流量 = 年度现金流量 - 年度投资现金流量年度投资现金流量 = 100万美元年度现金流量 = 50万美元净现金流量 = 50万美元 - 100万美元 = -50万美元根据计算结果,公司的净现金流量为负数(即净现金流出),意味着公司每年都会亏损50万美元。

因此,公司需要从外部筹集资金以支持项目的运营。

2. 案例二:公司股权融资问题:一家公司正在考虑通过股权融资来筹集资金。

根据公司的财务数据和资本结构分析,我们需要确定公司最佳的股权融资方案。

解答:为了确定最佳的股权融资方案,我们需要参考公司的财务数据和资本结构分析。

首先,我们需要计算公司的资本结构比例,即股本占总资本的比例。

然后,我们将不同的股权融资方案与资本结构比例进行对比,选择最佳的方案。

假设公司当前的资本结构比例为60%的股本和40%的债务,在当前的资本结构下,公司的加权平均资本成本(WACC)为10%。

现在,我们需要进行以下计算:•方案一:以新股发行筹集1000万美元,并将其用于项目投资。

在这种方案下,公司的资本结构比例将发生变化。

假设公司的股本增加至80%,债务比例减少至20%。

根据资本结构比例的变化,WACC也将发生变化。

新的WACC可以通过以下公式计算得出:新的WACC = (股本比例 * 股本成本) + (债务比例 * 债务成本)假设公司的股本成本为12%,债务成本为8%:新的WACC = (0.8 * 12%) + (0.2 * 8%) = 9.6%•方案二:以新股发行筹集5000万美元,并将其用于项目投资。

第一章公司理财导论1.代理么问题谁拥有公司?描述所有者控制公司管理层的过程。

代理关系在公司的组织形式中存在的主要原因是什?在这种环境下,可能会出现什么样的问题?2.非营利企业的目标假设你是一家非营利企业(或许是非营利医院)的财务经理,你认为什么样的财务管理目标将会是恰当的?3.公司的目标评价下面这句话:管理者不应该只关注现在的股票价值,因为这么做将会导致过分强调短期利润而牺牲长期利润。

4.道德规范和公司目标股票价值最大化的目标可能和其他目标,比如避免不道德或者非法的行为相冲突吗?特别是,你认为顾客和员工的安全、环境和社会的总体利益是否在这个框架之内,或者他们完全被忽略了?考虑一些具体的情形来阐明你的回答。

5.跨国公司目标股票价值最大化的财务管理目标在外国会有不同吗?为什么?6.代理问题假设你拥有一家公司的股票,每股股票现在的价格是25 美元。

另外一家公司刚刚宣布它想要购买这个公司,愿意以每股35 美元的价格收购发行在外的所有股票。

你公司的管理层立即展开对这次恶意收购的斗争。

管理层是为股东的最大利益行事吗?为什么?7.代理问题和公司所有权公司所有权在世界各地都不相同。

历史上,美国个人投资者占了上市公司股份的大多数,但是在德国和日本,银行和其他金融机构拥有上市公司股份的大部分。

你认为代理问题在德国和日本会比在美国更严重吗?8.代理问题和公司所有权近年来,大型金融机构比如共同基金和养老基金已经成为美国股票的主要持有者。

这些机构越来越积极地参与公司事务。

这一趋势对代理问题和公司控制有什么样的启示?9.高管薪酬批评家指责美国公司高级管理人员的薪酬过高,应该削减。

比如在大型公司中,甲骨文的LarryEllison 是美国薪酬最高的首席执行官之一,2004~2008 年收入高达4.29 亿美元,仅2008 年就有1.93 亿美元之多。

这样的金额算多吗?如果承认超级运动员比如老虎·伍兹,演艺界的知名人士比如汤姆·汉克斯和奥普拉·温弗瑞,还有其他在他们各自领域非常出色的人赚的都不比这少或许有助于回答这个问题。

Company Stock One option in the 401(k) plan is stock in East Coast Yachts. The company is currently privately held. However, when you interviewed with the owner, Larissa Warren, she informed you the company was expected to go public in the next three to four years. Until then, a company stock price is simply set each year by the board of directors.Bledsoe S&P 500 Index Fund This mutual fund tracks the S&P 500. Stocks in the fund are weighted exactly the same as the S&P 500. This means the fund return is approximately the return on the S&P 500, minus expenses. Because an index fund purchases assets based on the composition of the index it is following, the fund manager is not required to research stocks and make investment decisions. The result is that the fund expenses are usually low. The Bledsoe S&P 500 Index Fund charges expenses of .15 percent of assets per year.Bledsoe Small-Cap Fund This fund primarily invests in small-capitalization stocks. As such, the returns of the fund are more volatile. The fund can also invest 10 percent of its assets in companies based outside the United States. This fund charges 1.70 percent in expenses.Bledsoe Large-Company Stock Fund This fund invests primarily in large-capitalization stocks of companies based in the United States. The fund is managed by Evan Bledsoe and has outperformed the market in six of the last eight years. The fund charges 1.50 percent in expenses.Bledsoe Bond Fund This fund invests in long-term corporate bonds issued by U.S.–domiciled companies. The fund is restricted to investments in bonds with an investment-grade credit rating. This fund charges 1.40 percent in expenses.Bledsoe Money Market Fund This fund invests in short-term, high–credit quality debt instruments, which include Treasury bills. As such, the return on the money market fund is only slightly higher than the return on Treasury bills. Because of the credit quality and short-term nature of the investments, there is only a very slight risk of negative return. The fund charges .60 percent in expenses.1. What advantages do the mutual funds offer compared to the company stock?2. Assume that you invest 5 percent of your salary and receive the full 5 percent match from EastCoast Yachts. What EAR do you earn from the match? What conclusions do you draw about matching plans?3. Assume you decide you should invest at least part of your money in large-capitalization stocksof companies based in the United States. What are the advantages and disadvantages of choosing the Bledsoe Large-Company Stock Fund compared to the Bledsoe S&P 500 Index Fund?4. The returns on the Bledsoe Small-Cap Fund are the most volatile of all the mutual funds offeredin the 401(k) plan. Why would you ever want to invest in this fund? When you examine the expenses of the mutual funds, you will notice that this fund also has the highest expenses. Does this affect your decision to invest in this fund?5. A measure of risk-adjusted performance that is often used is the Sharpe ratio. The Sharpe ratiois calculated as the risk premium of an asset divided by its standard deviation. The standard deviations and returns of the funds over the past 10 years are listed here. Calculate the Sharpe ratio for each of these funds. Assume that the expected return and standard deviation of the company stock will be 16 percent and 70 percent, respectively. Calculate the Sharpe ratio for the company stock. How appropriate is the Sharpe ratio for these assets? When would you use the Sharpe ratio?6. What portfolio allocation would you choose? Why? Explain your thinking carefully.。

第一章1.在所有权形式的公司中,股东是公司的所有者。

股东选举公司的董事会,董事会任命该公司的管理层。

企业的所有权和控制权分离的组织形式是导致的代理关系存在的主要原因。

管理者可能追求自身或别人的利益最大化,而不是股东的利益最大化。

在这种环境下,他们可能因为目标不一致而存在代理问题。

2.非营利公司经常追求社会或政治任务等各种目标。

非营利公司财务管理的目标是获取并有效使用资金以最大限度地实现组织的社会使命。

3.这句话是不正确的。

管理者实施财务管理的目标就是最大化现有股票的每股价值,当前的股票价值反映了短期和长期的风险、时间以及未来现金流量。

4.有两种结论。

一种极端,在市场经济中所有的东西都被定价。

因此所有目标都有一个最优水平,包括避免不道德或非法的行为,股票价值最大化。

另一种极端,我们可以认为这是非经济现象,最好的处理方式是通过政治手段。

一个经典的思考问题给出了这种争论的答案:公司估计提高某种产品安全性的成本是30美元万。

然而,该公司认为提高产品的安全性只会节省20美元万。

请问公司应该怎么做呢?”5.财务管理的目标都是相同的,但实现目标的最好方式可能是不同的,因为不同的国家有不同的社会、政治环境和经济制度。

6.管理层的目标是最大化股东现有股票的每股价值。

如果管理层认为能提高公司利润,使股价超过35美元,那么他们应该展开对恶意收购的斗争。

如果管理层认为该投标人或其它未知的投标人将支付超过每股35美元的价格收购公司,那么他们也应该展开斗争。

然而,如果管理层不能增加企业的价值,并且没有其他更高的投标价格,那么管理层不是在为股东的最大化权益行事。

现在的管理层经常在公司面临这些恶意收购的情况时迷失自己的方向。

7.其他国家的代理问题并不严重,主要取决于其他国家的私人投资者占比重较小。

较少的私人投资者能减少不同的企业目标。

高比重的机构所有权导致高学历的股东和管理层讨论决策风险项目。

此外,机构投资者比私人投资者可以根据自己的资源和经验更好地对管理层实施有效的监督机制。

1. We explained that differences in firm size make it difficult to compare financial statements, andwe discussed how to form common-size statements to make comparisons easier and more meaningful.2. Evaluating ratios of accounting numbers is another way of comparing financial statementinformation. We defined a number of the most commonly used ratios, and we discussed the famous Du Pont identity.3. We showed how pro forma financial statements can be generated and used to plan for futurefinancing needs.After you have studied this chapter, we hope that you have some perspective on the uses and abuses of financial statement information. You should also find that your vocabulary of business and financial terms has grown substantially.Concept Questions1. Financial Ratio Analysis A financial ratio by itself tells us little about a company becausefinancial ratios vary a great deal across industries. There are two basic methods for analyzing financial ratios for a company: Time trend analysis and peer group analysis. In time trend analysis, you find the ratios for the company over some period, say five years, and examine how each ratio has changed over this period. In peer group analysis, you compare a company’s financial ratios to those of its peers. Why might each of these analysis methods be useful? What does each tell you about the company’s financial health?2. Industry-Specific Ratios So-called “same-store sales” are a very important measure forcompanies as diverse as McDonald’s and Sears. As the name suggests, examining same-store sales means comparing revenues from the same stores or restaurants at two different points in time.Why might companies focus on same-store sales rather than total sales?3. Sales Forecast Why do you think most long-term financial planning begins with salesforecasts? Put differently, why are future sales the key input?4. Sustainable Growth In the chapter, we used Rosengarten Corporation to demonstrate how tocalculate EFN. The ROE for Rosengarten is about 7.3 percent, and the plowback ratio is about 67 percent. If you calculate the sustainable growth rate for Rosengarten, you will find it is only 5.14 percent. In our calculation for EFN, we used a growth rate of 25 percent. Is this possible? (Hint: Yes. How?)5. EFN and Growth Rate Broslofski Co. maintains a positive retention ratio and keeps its debt–equity ratio constant every year. When sales grow by 20 percent, the firm has a negative projected EFN. What does this tell you about the firm’s sustainable growth rate? Do you know, with certainty, if the internal growth rate is greater than or less than 20 percent? Why? What happens to the projected EFN if the retention ratio is increased? What if the retention ratio is decreased? What if the retention ratio is zero?6. Common-Size Financials One tool of financial analysis is common-size financial statements.Why do you think common-size income statements and balance sheets are used? Note that the accounting statement of cash flows is not converted into a common-size statement. Why do you think this is?7. Asset Utilization and EFN One of the implicit assumptions we made in calculating theexternal funds needed was that the company was operating at full capacity. If the company is operating at less than full capacity, how will this affect the external funds needed?8. Comparing ROE and ROA Both ROA and ROE measure profitability. Which one is more usefulfor comparing two companies? Why?9. Ratio Analysis Consider the ratio EBITD/Assets. What does this ratio tell us? Why might it bemore useful than ROA in comparing two companies?Assets and costs are proportional to sales. Debt and equity are not. A dividend of $1,841.40 was paid, and Martin wishes to maintain a constant payout ratio. Next year’s sales are projected to be $30,960. What external financing is needed?5. Sales and Growth The most recent financial statements for Fontenot Co. are shown here:Assets and costs are proportional to sales. The company maintains a constant 30 percent dividend payout ratio and a constant debt–equity ratio. What is the maximum increase in sales that can be sustained assuming no new equity is issued?6. Sustainable Growth If the Layla Corp. has a 15 percent ROE and a 10 percent payout ratio,what is its sustainable growth rate?7. Sustainable Growth Assuming the following ratios are constant, what is the sustainablegrowth rate?Total asset turnover = 1.90Profit margin = 8.1%Equity multiplier = 1.25Payout ratio = 30%8. Calculating EFN The most recent financial statements for Bradley, Inc., are shown here(assuming no income taxes):Assets and costs are proportional to sales. Debt and equity are not. No dividends are paid. Next year’s sales are projected to be $6,669. What is the external financing needed?9. External Funds Needed Cheryl Colby, CFO of Charming Florist Ltd., has created the firm’s proforma balance sheet for the next fiscal year. Sales are projected to grow by 10 percent to $390 million. Current assets, fixed assets, and short-term debt are 20 percent, 120 percent, and 15 percent of sales, respectively. Charming Florist pays out 30 percent of its net income in dividends.The company currently has $130 million of long-term debt and $48 million in common stock par value. The profit margin is 12 percent.1. Construct the current balance sheet for the firm using the projected sales figure.2. Based on Ms. Colby’s sales growth forecast, how much does Charming Florist need inexternal funds for the upcoming fiscal year?3. Construct the firm’s pro forma balance sheet for the next fiscal year and confirm theexternal funds needed that you calculated in part (b).10. Sustainable Growth Rate The Steiben Company has an ROE of 10.5 percent and a payoutratio of 40 percent.1. What is the company’s sustainable growth rate?2. Can the company’s actual growth rate be different from its sustainable growth rate? Whyor why not?3. How can the company increase its sustainable growth rate?INTERMEDIATE (Questions 11–23)11. Return on Equity Firm A and Firm B have debt–total asset ratios of 40 percent and 30percent and returns on total assets of 12 percent and 15 percent, respectively. Which firm has a greater return on equity?12. Ratios and Foreign Companies Prince Albert Canning PLC had a net loss of £15,834 on salesof £167,983. What was the company’s profit margin? Does the fact that these figures are quoted ina foreign currency make any difference? Why? In dollars, sales were $251,257. What was the netloss in dollars?13. External Funds Needed The Optical Scam Company has forecast a 20 percent sales growthrate for next year. The current financial statements are shown here:1. Using the equation from the chapter, calculate the external funds needed for next year.2. Construct the firm’s pro forma balance sheet for next year and confirm the external fundsneeded that you calculated in part (a).3. Calculate the sustainable growth rate for the company.4. Can Optical Scam eliminate the need for external funds by changing its dividend policy?What other options are available to the company to meet its growth objectives?14. Days’ Sales in Receivables A company has net income of $205,000, a profit margin of 9.3percent, and an accounts receivable balance of $162,500. Assuming 80 percent of sales are on credit, what is the company’s days’ sales in receivables?15. Ratios and Fixed Assets The Le Bleu Company has a ratio of long-term debt to total assets of.40 and a current ratio of 1.30. Current liabilities are $900, sales are $5,320, profit margin is 9.4 percent, and ROE is 18.2 percent. What is the amount of the firm’s net fixed assets?16. Calculating the Cash Coverage Ratio Titan Inc.’s net income for the most recent year was$9,450. The tax rate was 34 percent. The firm paid $2,360 in total interest expense and deducted $3,480 in depreciation expense. What was Titan’s cash coverage ratio for the year?17. Cost of Goods Sold Guthrie Corp. has current liabilities of $270,000, a quick ratio of 1.1,inventory turnover of 4.2, and a current ratio of 2.3. What is the cost of goods sold for the company?18. Common-Size and Common–Base Year Financial Statements In addition to common-size financial statements, common–base year financial statements are often used. Common–base year financial statements are constructed by dividing the current year account value by the base year account value. Thus, the result shows the growth rate in the account. Using the following financial statements, construct the common-size balance sheet and common–base year balance sheet for the company. Use 2009 as the base year.Use the following information for Problems 19, 20, and 22:The discussion of EFN in the chapter implicitly assumed that the company was operating at full capacity. Often, this is not the case. For example, assume that Rosengarten was operating at 90 percent capacity. Full-capacity sales would be $1,000/.90 = $1,111. The balance sheet shows $1,800 in fixed assets. The capital intensity ratio for the company isCapital intensity ratio = Fixed assets/Full-capacity sales = $1,800/$1,111 = 1.62This means that Rosengarten needs $1.62 in fixed assets for every dollar in sales when it reaches full capacity. At the projected sales level of $1,250, it needs $1,250 × 1.62 = $2,025 infixed assets, which is $225 lower than our projection of $2,250 in fixed assets. So, EFN is only $565– 225 = $340.19. Full-Capacity Sales Thorpe Mfg., Inc., is currently operating at only 85 percent of fixed assetcapacity. Current sales are $630,000. How much can sales increase before any new fixed assets are needed?20. Fixed Assets and Capacity Usage For the company in the previous problem, suppose fixedassets are $580,000 and sales are projected to grow to $790,000. How much in new fixed assets are required to support this growth in sales?21. Calculating EFN The most recent financial statements for Moose Tours, Inc., appear below.Sales for 2010 are projected to grow by 20 percent. Interest expense will remain constant; the tax rate and the dividend payout rate will also remain constant. Costs, other expenses, current assets, fixed assets, and accounts payable increase spontaneously with sales. If the firm is operating at full capacity and no new debt or equity is issued, what external financing is needed to support the 20 percent growth rate in sales?22. Capacity Usage and Growth In the previous problem, suppose the firm was operating at only80 percent capacity in 2009. What is EFN now?23. Calculating EFN In Problem 21, suppose the firm wishes to keep its debt–equity ratioconstant. What is EFN now?CHALLENGE (Questions 24–30)24. EFN and Internal Growth Redo Problem 21 using sales growth rates of 15 and 25 percent inaddition to 20 percent. Illustrate graphically the relationship between EFN and the growth rate, and use this graph to determine the relationship between them.25. EFN and Sustainable Growth Redo Problem 23 using sales growth rates of 30 and 352. Ratio Analysis Find and download the “Profitability” spreadsheet for Southwest Airlines (LUV)and Continental Airlines (CAL). Find the ROA (Net ROA), ROE (Net ROE), PE ratio (P/E—high and P/E—low), and the market-to-book ratio (Price/Book—high and Price/Book—low) for each company. Because stock prices change daily, PE and market-to-book ratios are often reported as the highest and lowest values over the year, as is done in this instance. Look at these ratios for both companies over the past five years. Do you notice any trends in these ratios? Which company appears to be operating at a more efficient level based on these four ratios? If you were going to invest in an airline, which one (if either) of these companies would you choose based on this information? Why?3. Sustainable Growth Rate Use the annual income statements and balance sheets under the“Excel Analytics” link to calculate the sustainable growth rate for Coca-Cola (KO) each year for the past four years. Is the sustainable growth rate the same for every year? What are possible reasons the sustainable growth rate may vary from year to year?4. External Funds Needed Look up Black & Decker (BDK). Under the “Financial Highlights” linkyou can find a five-year growth rate for sales. Using this growth rate and the most recent income statement and balance sheet, compute the external funds needed for BDK next year.Mini Case: RATIOS AND FINANCIAL PLANNING AT EAST COAST YACHTSDan Ervin was recently hired by East Coast Yachts to assist the company with its short-term financial planning and also to evaluate the company’s financial performance. Dan graduated from college five years ago with a finance degree, and he has been employed in the treasury department of a Fortune 500 company since then.East Coast Yachts was founded 10 years ago by Larissa Warren. The company’s operations are located near Hilton Head Island, South Carolina, and the company is structured as an LLC. The company has manufactured custom midsize, high-performance yachts for clients over this period, and its products have received high reviews for safety and reliability. The company’s yachts have also recently received the highest award for customer satisfaction. The yachts are primarily purchased by wealthy individuals for pleasure use. Occasionally, a yacht is manufactured for purchase by a company for business purposes.The custom yacht industry is fragmented, with a number of manufacturers. As with any industry, there are market leaders, but the diverse nature of the industry ensures that no manufacturer dominates the market. The competition in the market, as well as the product cost, ensures that attention to detail is a necessity. For instance, East Coast Yachts will spend 80 to 100 hours on hand-buffing the stainless steel stem-iron, which is the metal cap on the yacht’s bow that conceivably could collide with a dock or another boat.To get Dan started with his analyses, Larissa has provided the following financial statements. Dan has gathered the industry ratios for the yacht manufacturing industry.1. Calculate all of the ratios listed in the industry table for East Coast Yachts.2. Compare the performance of East Coast Yachts to the industry as a whole. For each ratio,comment on why it might be viewed as positive or negative relative to the industry. Suppose you create an inventory ratio calculated as inventory divided by current liabilities. How do you interpret this ratio? How does East Coast Yachts compare to the industry average?3. Calculate the sustainable growth rate of East Coast Yachts. Calculate external funds needed(EFN) and prepare pro forma income statements and balance sheets assuming growth at precisely this rate. Recalculate the ratios in the previous question. What do you observe?4. As a practical matter, East Coast Yachts is unlikely to be willing to raise external equity capital,in part because the owners don’t want to dilute their existing ownership and control positions.However, East Coast Yachts is planning for a growth rate of 20 percent next year. What are your conclusions and recommendations about the feasibility of East Coast’s expansion plans?5. Most assets can be increased as a percentage of sales. For instance, cash can be increased byany amount. However, fixed assets often must be increased in specific amounts because it is impossible, as a practical matter, to buy part of a new plant or machine. In this case a company has a “staircase” or “lumpy” fixed cost structure. Assume that East Coast Yachts is currently producing at 100 percent of capacity. As a result, to expand production, the company must set up an entirely new line at a cost of $30 million. Calculate the new EFN with this assumption. What does this imply about capacity utilization for East Coast Yachts next year?。

罗斯《公司理财》(第9版)笔记和课后习题详解第1章公司理财导论1.1复习笔记公司的首要目标——股东财富最大化决定了公司理财的目标。

公司理财研究的是稀缺资金如何在企业和市场内进行有效配置,它是在股份有限公司已成为现代企业制度最主要组织形式的时代背景下,就公司经营过程中的资金运动进行预测、组织、协调、分析和控制的一种决策与管理活动。

从决策角度来讲,公司理财的决策内容包括投资决策、筹资决策、股利决策和净流动资金决策;从管理角度来讲,公司理财的管理职能主要是指对资金筹集和资金投放的管理。

公司理财的基本内容包括:投资决策(资本预算)、融资决策(资本结构)、短期财务管理(营运资本)。

1.资产负债表资产负债表是总括反映企业某一特定日期财务状况的会计报表,它是根据资产、负债和所有者权益之间的相互关系,按照一定的分类标准和一定的顺序,把企业一定日期的资产、负债和所有者权益各项目予以适当排列,并对日常工作中形成的大量数据进行高度浓缩整理后编制而成的。

资产负债表可以反映资本预算、资本支出、资本结构以及经营中的现金流量管理等方面的内容。

2.资本结构资本结构是指企业各种资本的构成及其比例关系,它有广义和狭义之分。

广义资本结构,亦称财务结构,指企业全部资本的构成,既包括长期资本,也包括短期资本(主要指短期债务资本)。

狭义资本结构,主要指企业长期资本的构成,而不包括短期资本。

通常人们将资本结构表示为债务资本与权益资本的比例关系(D/E)或债务资本在总资本的构成(D/A)。

准确地讲,企业的资本结构应定义为有偿负债与所有者权益的比例。

资本结构是由企业采用各种筹资方式筹集资本形成的。

筹资方式的选择及组合决定着企业资本结构及其变化。

资本结构是企业筹资决策的核心问题。

企业应综合考虑影响资本结构的因素,运用适当方法优化资本结构,从而实现最佳资本结构。

资本结构优化有利于降低资本成本,获取财务杠杆利益。

3.财务经理财务经理是公司管理团队中的重要成员,其主要职责是通过资本预算、融资和资产流动性管理为公司创造价值。

公司理财第九版课后习题答案【公司理财第九版课后习题答案】在公司理财的学习过程中,课后习题是巩固知识、检验理解的重要环节。

本文将针对《公司理财第九版》的课后习题进行解答,帮助读者更好地掌握相关知识。

第一章:公司理财概述1. 什么是公司理财?它的目标是什么?公司理财是指公司在经营过程中,通过合理配置资金和资源,实现财务目标的过程。

其目标是最大化股东财富,即通过提高公司的市场价值和股东权益来实现。

2. 公司理财的主要职能有哪些?公司理财的主要职能包括资金筹集、资金配置、资金运营和风险管理。

资金筹集指的是公司通过各种途径获取资金;资金配置是指公司将资金投入到不同的项目和资产中;资金运营是指公司对资金进行有效管理和运用;风险管理是指公司对各种风险进行识别、评估和控制。

第二章:财务报表与财务分析1. 财务报表包括哪些内容?它们的作用是什么?财务报表包括资产负债表、利润表、现金流量表和所有者权益变动表。

资产负债表反映了公司在特定日期的资产、负债和所有者权益的状况;利润表反映了公司在一定期间内的收入、成本和利润的情况;现金流量表反映了公司在一定期间内的现金流入和流出情况;所有者权益变动表反映了公司在一定期间内所有者权益的变动情况。

财务报表的作用是提供给内外部利益相关者对公司财务状况和经营情况进行评估和决策的依据。

2. 财务分析的方法有哪些?它们的应用场景分别是什么?财务分析的方法包括比率分析、趋势分析和财务比较分析。

比率分析通过计算各种财务比率,评估公司的经营状况和财务健康度;趋势分析通过比较公司在不同期间的财务数据,分析其发展趋势和变化情况;财务比较分析通过比较不同公司或同一行业内公司的财务数据,评估其相对优劣和竞争力。

比率分析适用于评估公司的财务状况和经营能力;趋势分析适用于分析公司的发展趋势和变化情况;财务比较分析适用于评估公司的相对竞争力和行业地位。

第三章:资本预算和投资决策1. 什么是资本预算?它的意义是什么?资本预算是指公司在一定时期内,对于可供选择的投资项目进行评估和选择的过程。

1、如果项目带来的是常规的现金流,而且其回收期短于该项目的生命周期,还不能准备判断其净现值的正负。

仍需要其采用的折现率和其内部收益率IRR 做对比。

当折现率小于IRRA 时,净现值为正值,当折现率大于IRRA时,净现值为负值,两者相等时,净现值为零。

如果一个项目的折现回收期短于该项目的生命周期,则净现值一定为正值。

2、项目有常规的现金流,且NPV为正值,则各期流入的现金流折现总和一定大于期初项目资金流出。

而各期流入的现金流总和肯定大于折现总和,所以该项目的回收期一定短于其生命周期。

同时折现回收期是用和净现值同样的NPV计算出来的,所以折现回收期也一定短于其生命周期。

同样净现值为正值,说明初始投资所带来的后续现金流的现值大于初始投资,所以盈利指数PI 一定大于1。

如果使用内部收益率折现各期现金流量时,净现值为零。

而以折现率折现各期现金流量时,净现值为正,说明折现率小于内部收益率。

3、a 回收期是指投资引起的现金流入累计到与投资相等所需要的时间。

它代表收回投资所需要的年限。

回收年限越短,方案越有利。

其缺陷就是忽略了回收期内现金流量的时间序列,也忽略了回收期以后的现金支付,同时对于回收期的选择也存在主观臆断。

选择一个具体的回收期决策标准,当项目的回收期小于标准的就可行,大于标准的则拒绝。

b 平均会计收益率是指为扣除所得税和折旧之后的项目平均收益除以整个项目期限内的平均账面投资额。

其缺陷是使用账面收益而非现金流量,忽略了折旧对现金流量的影响,忽视了净收益的时间分布对项目经济价值的影响。

当项目的平均会计收益率小于目标平均会计收益率时,则拒绝项目,反之接受。

c 内部收益率就是令项目净现值为0的折现率。

其缺点是对于特殊项目无法用一般原则进行判断,并且有些项目可能会出现多个收益率的现象。

同时对于互斥项目容易忽视其规模问题和时间序列问题。

一般原则是当折现率小于IRR时,接受该项目,反之则拒绝。

d 盈利指数是初始投资所带来的后续现金流的现值和初始投资的比值。