金融机构管理习题答案024

- 格式:doc

- 大小:147.00 KB

- 文档页数:20

金融机构管理第九章课后习题部分答案(1、2、3、6、11、12、13、16)1. 有效期限衡量的是经济定义中资产和负债的平均期限。

有效期限的经济含义是资产价值对于利率变化的利率敏感性(或利率弹性)。

有效期限的严格定义是一种以现金流量的相对现值为权重的加权平均到期期限。

有效期限与到期期限的不同在于,有效期限不仅考虑了资产(或负债)的期限,还考虑了期间发生的现金流的再投资利率。

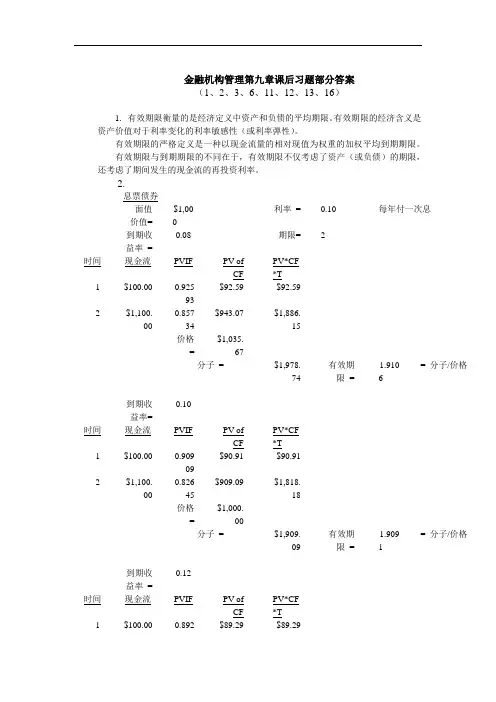

2.息票债券面值价值= $1,00利率= 0.10 每年付一次息到期收益率=0.08 期限= 2时间现金流PVIF PV ofCF PV*CF *T1 $100.00 0.92593$92.59 $92.592 $1,100.00 0.85734$943.07 $1,886.15价格=$1,035.67分子= $1,978.74有效期限=1.9106= 分子/价格到期收益率=0.10时间现金流PVIF PV ofCF PV*CF *T1 $100.00 0.90909$90.91 $90.912 $1,100.00 0.82645$909.09 $1,818.18价格=$1,000.00分子= $1,909.09有效期限=1.9091= 分子/价格到期收益率=0.12时间现金流PVIF PV ofCF PV*CF *T1 $100.00 0.892$89.29 $89.292 $1,100.00 0.79719$876.91 $1,753.83价格=$966.20分子= $1,843.11有效期限=1.9076= 分子/价格b. 到期收益率上升时,有限期限减少。

c.零息债券面值价值= $1,00利率= 0.00到期收益率=0.08 期限= 2时间现金流PVIF PV ofCF PV*CF *T1 $0.00 0.92593$0.00 $0.002 $1,000.00 0.85734$857.34 $1,714.68价格=$857.34分子= $1,714.68有效期限=2.000= 分子/价格到期收益率=0.10时间现金流PVIF PV ofCF PV*CF *T1 $0.00 0.90909$0.00 $0.002 $1,000.00 0.82645$826.45 $1,652.89价格=$826.45分子= $1,652.89有效期限=2.000= 分子/价格到期收益率=0.12时间现金流PVIF PV ofCF PV*CF *T1 $0.00 0.892$0.00 $0.002 $1,000.00 0.79719 $797.19 $1,594.39价格 = $797.19分子 =$1,594.39有效期限 =2.0000= 分子/价格d.到期收益率的变化不影响零息债券的有效期限。

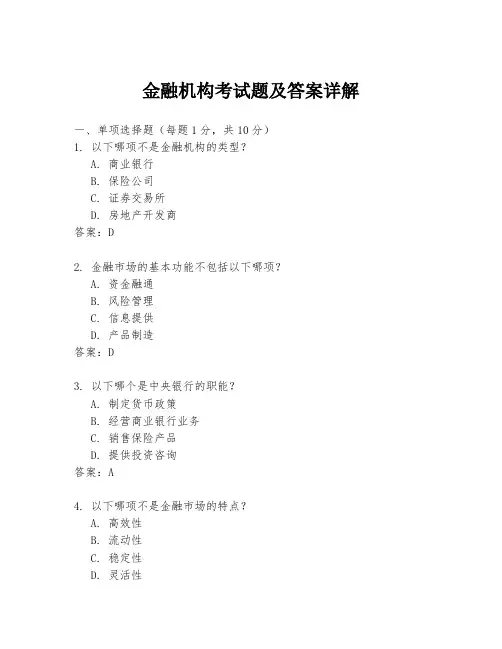

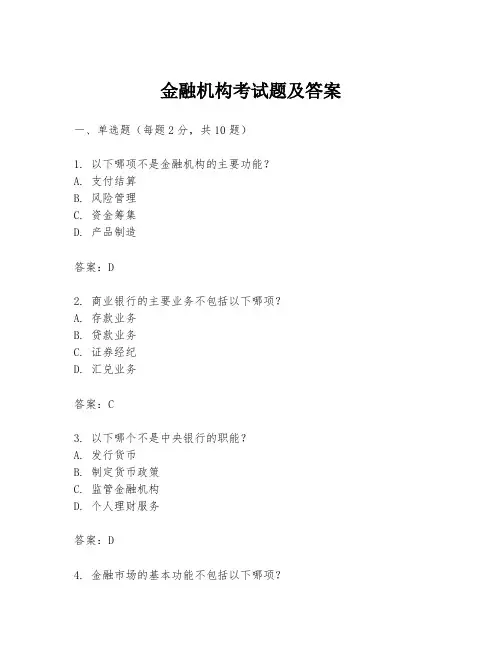

金融机构考试题及答案详解一、单项选择题(每题1分,共10分)1. 以下哪项不是金融机构的类型?A. 商业银行B. 保险公司C. 证券交易所D. 房地产开发商答案:D2. 金融市场的基本功能不包括以下哪项?A. 资金融通B. 风险管理C. 信息提供D. 产品制造答案:D3. 以下哪个是中央银行的职能?A. 制定货币政策B. 经营商业银行业务C. 销售保险产品D. 提供投资咨询答案:A4. 以下哪项不是金融市场的特点?A. 高效性B. 流动性C. 稳定性D. 灵活性答案:C5. 金融机构在进行风险管理时,通常不采用以下哪种方法?A. 风险分散化B. 风险对冲C. 风险转移D. 风险接受答案:D6. 以下哪个不是金融监管的目的?A. 保护投资者利益B. 维护金融市场秩序C. 促进金融机构盈利D. 防范金融风险答案:C7. 以下哪种货币形式属于电子货币?A. 纸币B. 硬币C. 信用卡D. 支票答案:C8. 以下哪个是金融衍生品的特点?A. 低风险B. 高杠杆C. 无风险D. 低杠杆答案:B9. 以下哪个不是金融创新的驱动因素?A. 技术进步B. 市场需求C. 监管政策D. 金融产品过剩答案:D10. 以下哪个是金融中介机构的职能?A. 吸收存款B. 生产商品C. 提供咨询服务D. 销售房地产答案:A二、多项选择题(每题2分,共10分)11. 金融机构可以提供哪些服务?(ABCDE)A. 信贷服务B. 投资服务C. 保险服务D. 咨询服务E. 资产管理服务答案:ABCDE12. 以下哪些是金融监管机构的职责?(ABCD)A. 制定监管政策B. 监督金融机构的合规性C. 处理违规行为D. 维护金融市场稳定E. 为金融机构提供咨询服务答案:ABCD13. 金融市场的参与者包括哪些?(ABCE)A. 个人投资者B. 机构投资者C. 政府D. 房地产开发商E. 金融机构答案:ABCE14. 以下哪些是金融市场的分类?(ABD)A. 货币市场B. 资本市场C. 商品市场D. 外汇市场E. 房地产市场答案:ABD15. 以下哪些是金融风险的类型?(ABC)A. 信用风险B. 市场风险C. 操作风险D. 技术风险E. 法律风险答案:ABC三、判断题(每题1分,共5分)16. 所有金融机构都必须接受金融监管机构的监管。

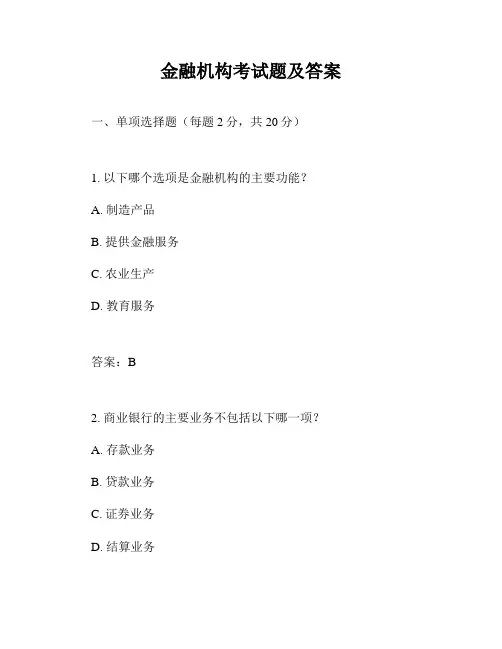

金融机构考试题及答案一、单项选择题(每题2分,共20分)1. 以下哪个选项是金融机构的主要功能?A. 制造产品B. 提供金融服务C. 农业生产D. 教育服务答案:B2. 商业银行的主要业务不包括以下哪一项?A. 存款业务B. 贷款业务C. 证券业务D. 结算业务答案:C3. 以下哪个选项不是中央银行的职能?A. 发行货币B. 制定货币政策C. 监管金融机构D. 投资股票答案:D4. 以下哪个选项是保险公司的主要业务?A. 提供贷款B. 吸收存款C. 销售保险产品D. 证券投资答案:C5. 以下哪个选项是投资银行的主要业务?A. 存款业务B. 贷款业务C. 证券承销D. 货币兑换答案:C6. 以下哪个选项是金融市场的主要功能?A. 提供就业机会B. 促进商品流通C. 资金融通D. 提供教育服务答案:C7. 以下哪个选项不是金融监管的目的?A. 维护金融稳定B. 保护消费者权益C. 促进经济发展D. 增加金融机构利润答案:D8. 以下哪个选项是金融创新的主要驱动因素?A. 技术进步B. 市场竞争C. 消费者需求D. 以上都是答案:D9. 以下哪个选项是金融风险管理的主要方法?A. 风险转移B. 风险规避C. 风险分散D. 以上都是答案:D10. 以下哪个选项是金融科技的主要应用领域?A. 支付结算B. 资产管理C. 风险管理D. 以上都是答案:D二、多项选择题(每题3分,共15分)11. 以下哪些选项是金融机构的类型?A. 商业银行B. 保险公司C. 投资银行D. 非政府组织答案:A、B、C12. 以下哪些选项是中央银行的职能?A. 发行货币B. 制定货币政策C. 监管金融机构D. 提供金融服务答案:A、B、C13. 以下哪些选项是金融市场的类型?A. 货币市场B. 资本市场C. 外汇市场D. 商品市场答案:A、B、C14. 以下哪些选项是金融监管的主要目标?A. 维护金融稳定B. 保护消费者权益C. 促进经济发展D. 增加金融机构利润答案:A、B、C15. 以下哪些选项是金融风险的主要类型?A. 信用风险B. 市场风险C. 操作风险D. 法律风险答案:A、B、C、D三、判断题(每题2分,共20分)16. 金融机构的主要功能是提供金融服务。

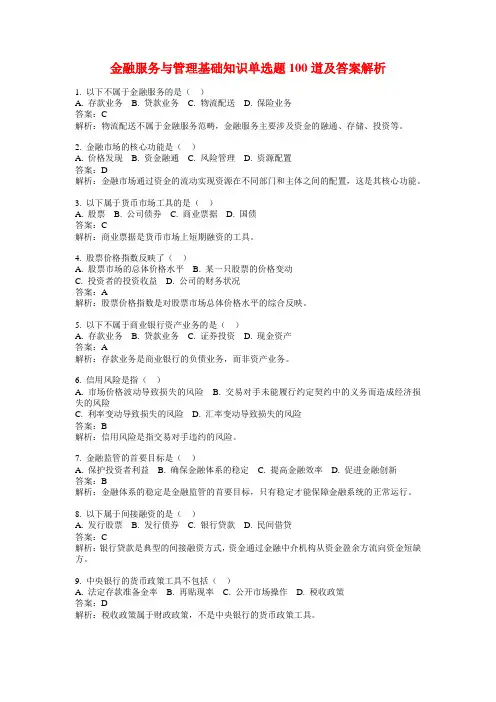

金融服务与管理基础知识单选题100道及答案解析1. 以下不属于金融服务的是()A. 存款业务B. 贷款业务C. 物流配送D. 保险业务答案:C解析:物流配送不属于金融服务范畴,金融服务主要涉及资金的融通、存储、投资等。

2. 金融市场的核心功能是()A. 价格发现B. 资金融通C. 风险管理D. 资源配置答案:D解析:金融市场通过资金的流动实现资源在不同部门和主体之间的配置,这是其核心功能。

3. 以下属于货币市场工具的是()A. 股票B. 公司债券C. 商业票据D. 国债答案:C解析:商业票据是货币市场上短期融资的工具。

4. 股票价格指数反映了()A. 股票市场的总体价格水平B. 某一只股票的价格变动C. 投资者的投资收益D. 公司的财务状况答案:A解析:股票价格指数是对股票市场总体价格水平的综合反映。

5. 以下不属于商业银行资产业务的是()A. 存款业务B. 贷款业务C. 证券投资D. 现金资产答案:A解析:存款业务是商业银行的负债业务,而非资产业务。

6. 信用风险是指()A. 市场价格波动导致损失的风险B. 交易对手未能履行约定契约中的义务而造成经济损失的风险C. 利率变动导致损失的风险D. 汇率变动导致损失的风险答案:B解析:信用风险是指交易对手违约的风险。

7. 金融监管的首要目标是()A. 保护投资者利益B. 确保金融体系的稳定C. 提高金融效率D. 促进金融创新答案:B解析:金融体系的稳定是金融监管的首要目标,只有稳定才能保障金融系统的正常运行。

8. 以下属于间接融资的是()A. 发行股票B. 发行债券C. 银行贷款D. 民间借贷答案:C解析:银行贷款是典型的间接融资方式,资金通过金融中介机构从资金盈余方流向资金短缺方。

9. 中央银行的货币政策工具不包括()A. 法定存款准备金率B. 再贴现率C. 公开市场操作D. 税收政策答案:D解析:税收政策属于财政政策,不是中央银行的货币政策工具。

Chapter Twenty FiveOptions, Caps, Floors, and CollarsChapter Outline IntroductionBasic Features of Options∙Buying a Call Option on a Bond∙Writing a Call Option on a Bond∙Buying a Put Option on a Bond∙Writing a Put Option on a BondWriting versus Buying Options∙Economic Reasons for Not Writing Options∙Regulatory Reasons∙Futures versus Options HedgingThe Mechanics of Hedging a Bond or Bond Portfolio∙Hedging with Bond Options Using the Binomial Model Actual Bond OptionsUsing Options to Hedge Interest Rate Risk on the Balance Sheet Using Options to Hedge Foreign Exchange RiskHedging Credit Risk with OptionsHedging Catastrophe Risk with Call Spread OptionsCaps, Floors, and Collars∙Caps∙Floors∙Collars∙Caps, Floors, Collars, and Credit RiskSummarySolutions to End-of-Chapter Questions and Problems: Chapter Twenty Five1.How does using options differ from using forward or futures contracts?Both options and futures contracts are useful in managing risk. Other than the pure mechanics, the primary difference between these contracts lies in the requirement of what must be done on or before maturity. Futures and forward contracts require that the buyer or seller of the contracts must execute some transaction. The buyer of an option has the choice to execute the option or to let it expire without execution. The writer of an option must perform a transaction only if the buyer chooses to execute the option.2.What is a call option?A call option is an instrument that allows the owner to buy some underlying asset at a prespecified price on or before a specified maturity date.3.What must happen to interest rates for the purchaser of a call option on a bond to makemoney? How does the writer of the call option make money?The call option on a bond allows the owner to buy a bond at a specific price. For the owner of the option to make money, he should be able to immediately sell the bond at a higher price. Thus, for the bond price to increase, interest rates must decrease between the time the option is purchased and the time it is executed. The writer of the call option makes a premium from the sale of the option. If the option is not exercised, the writer maximizes profit in the amount of the premium. If the option is exercised, the writer stands to lose a portion or the entire premium, and may lose additional money if the price on the underlying asset moves sufficiently far.4.What is a put option?A put option is an instrument that allows the owner to sell some underlying asset at a prespecified price on or before a specified maturity date.5.What must happen to interest rates for the purchaser of a put option on a bond to makemoney? How does the writer of the put option make money?The put option on a bond allows the owner to sell a bond at a specific price. For the owner of the option to make money, he should be able to buy the bond at a lower price immediately prior to exercising the option. Thus, for the bond price to decrease, interest rates must increase between the time the option is purchased and the time it is executed. The writer of the put option makes a premium from the sale of the option. If the option is not exercised, the writer maximizes profit in the amount of the premium. If the option is exercised, the writer stands to lose a portion or the entire premium, and may lose additional money if the price on the underlying asset moves sufficiently far.6. Consider the following:a. What are the two ways to use call and put options on T-bonds to generate positive cashflows when interest rates decline? Verify your answer with a diagram.The FI can either (a) buy a call option, or (b) sell a put option on interest rate instruments, such as T-bonds, to generate positive cash flows in the event that interest rates decline. In the case of a call option, positive cash flows will increase as long as interest rates continue to decrease. See Figure 25-1 in the text as an example of positive cash flows minus the premium paid for the option. Although not labeled in this diagram, interest rates areassumed to be decreasing as you move from left to right on the x-axis. Thus bond prices are increasing.The sale of a put option generates positive cash flows from the premium received. Figure 25-4 shows that the payoff will decrease as the price of the bond falls. Of course this can only happen if interest rates are increasing. Again, although not labeled in this diagram, interest rates are assumed to be increasing as you move from right to left on the x-axis.b. Under what balance sheet conditions can an FI use options on T-bonds to hedge itsassets and/or liabilities against interest rate declines?An FI can use call options on T-bonds to hedge an underlying cash position that decreases in value as interest rates decline. This would be true if, in the case of a macrohedge, the FI's duration gap is negative and the repricing gap is positive. In the case of a microhedge, the FI can hedge a single fixed-rate liability against interest rate declines.c. Is it more appropriate for FIs to hedge against a decline in interest rates with long callsor short puts?An FI is better off purchasing calls as opposed to writing puts for two reasons. First,regulatory restrictions limit an FI's ability to write naked short options. Second, since the potential positive cash inflow on the short put option is limited to the size of the putpremium, there may be insufficient cash inflow in the event of interest rate declines tooffset the losses in the underlying cash position.7. In each of the following cases, identify what risk the manager of an FI faces and whetherthe risk should be hedged by buying a put or a call option.a. A commercial bank plans to issue CDs in three months.The bank faces the risk that interest rates will increase. The FI should buy a put option. If rates rise, the CDs can be purchased at a lower price and sold immediately by exercising the option. The gain will offset the higher interest rate the FI must pay in the spot market.b. An insurance company plans to buy bonds in two months.The insurance company (IC) is concerned that interest rates will fall, and thus the price of the bonds will rise. The IC should buy call options that allow the bond purchase at thelower price. The bonds purchased with the options can be sold immediately for a gain that can be applied against the lower yield realized in the market. Or the bonds can be kept and placed in the IC’s portfolio if they are the desired type of asset.c. A thrift plans to sell Treasury securities next month.The thrift is afraid that rates will rise and the value of the bonds will fall. The thrift should buy a put option that allows the sale of the bonds at or near the current price.d. A U.S. bank lends to a French company with a loan payable in francs.The U.S. bank is afraid that the dollar will appreciate (francs will depreciate). Thus the bank should buy a put to sell francs at or near the current exchange rate.e. A mutual fund plans to sell its holding of stock in a British company.The fund is afraid that the dollar will appreciate (£ will depreciate). Thus the fund should buy a put to sell £ at or near the current exchange rate.f. A finance company has assets with a duration of six years and liabilities with a durationof 13 years.The FI is concerned that interest rates will fall, causing the value of the liabilities to rise more than the value of the assets which would cause the value of the equity to decrease.Thus the bond should buy a call option on interest rates (bonds).8. Consider an FI that wishes to use bond options to hedge the interest rate risk in the bondportfolio.a. How does writing call options hedge the risk when interest rates decrease?In the case where the FI is long the bond, writing a call option will provide extra cash flow in the form of a premium. But falling interest rates will cause the value of the bond toincrease, and eventually the option will be exercised at a loss to the writer. But the loss is offset by the increase in value of the long bond. Thus the initial goal of maintaining the interest rate return on the long bond can be realized.b. Will writing call options fully hedge the risk when interest rates increase? Explain.Writing call options provides a premium that can be used to offset the losses in the bond portfolio caused by rising rates up to the amount of the premium. Further losses are not protected.c. How does buying a put option reduce the losses on the bond portfolio when interestrates rise?When interest rates increase, the value of the bond falls, but the put allows the sale of the bond at or near the original price. Thus the profit potential increases as interest ratescontinue to increase, although it is tempered by the amount of premium that was paid for the put.d. Diagram the purchase of a bond call option against the combination of a bondinvestment and the purchase of a bond put option.The profit payoff of a bond call option is given in Figure 25-1. If the price of the bond falls below the exercise price, the purchaser of the call loses the premium. As the price of the bond increases beyond the exercise price, the purchaser recovers the premium and thenrealizes a net profit. Figures 25-6 and 25-7 give the individual and net profit payoff ofholding a bond long and the purchase of a put option. The put option allows a profit ifbond prices drop. This profit will offset the loss on the long bond caused by the decrease in the bond value. If bond prices increase, the option will not be exercised and the investor will realize a gain from the increase in the bonds value. Thus the call option or thecombination of long bond and put option give the same value.9. What are the regulatory reasons that FIs seldom write options?Regulators often prohibit the writing of options because of the unlimited loss potential.10.What are the problems of using the Black-Scholes option pricing model to value bondoptions? What is meant by the term pull to par?The Black-Scholes model assumes unrealistically that short-term interest rates are constant. Second, the model assumes that the variance of returns on the bond is constant over time. In fact, the variance may increase in the initial life of a bond, but it must decrease during the final stages of the bond’s li fe because the bond must trade at par at maturity. The decrease in variance of returns over the final portion of a bond’s life is called the pull-to-par.11. An Fi has purchased a two-year, $1,000 par value zero-coupon bond for $867.43. The FIwill hold the bond to maturity unless it needs to sell the bond at the end of one year forliquidity purposes. The current one-year interest rate is 7 percent, and the one-year rate in one year is forecast to be either 8.04 percent or 7.44 percent with equal likelihood. The FI wishes to buy a put option to protect itself against a capital loss in the event the bond needs to be sold in one year.a. What was the yield on the bond at the time of purchase?PV0 = FV*PVIF n=2,i=?⇒ $867.43 = $1,000* PVIF n=2,i=?⇒ i = 7.37 percentb. What is the market-determined, implied one-year rate one year before maturity?E(r1) = 0.5*0.0804 + 0.5*0.0744 = 0.0774c. What is the expected sale price if the bond has to be sold at the end of one year?E(P1) = $1,000/(1.0774) = $928.16d.e. If the bank buys a put option with an exercise price equal to your answer in part (c),what will be its value at the end of one year?Put Option Value of WeightedExercise Bond Price Put Option Probability Value$928.16 - $925.58 = $2.58 * 0.5 = $1.29$928.16 - $930.75 = $0.00 * 0.5 = $0.00Total value = $1.29f. What should be the premium on the put option today?PV = $1.29/1.07 = $1.2056.g. Diagram the values for the put option on the 2-year zero-coupon bond.h.end of one year were expected to be 8.14 percent and 7.34 percent?The bond prices for the respective interest rates are $924.73 and $931.62. The expected one-year rate and the expected one-year bond price are the same. Further, the call price of the option is the same.Put Option Value of WeightedExercise Bond Price Put Option Probability Value$928.16 - $924.73 = $3.43 * 0.5 = $1.715$928.16 - $931.62 = $0.00 * 0.5 = $0.000Total value = $1.715 PV = $1.715/1.07 = $1.61.12. A pension fund manager anticipates the purchase of a 20-year, 8 percent coupon Treasurybond at the end of two years. Interest rates are assumed to change only once every year at year-end, with an equal probability of a 1 percent increase or a 1 percent decrease. TheTreasury bond, when purchased in two years, will pay interest semiannually. Currently, the Treasury bond is selling at par.a. What is the pension fund manager's interest rate risk exposure?The pension fund manager is exposed to interest rate declines (price increases).b. How can the pension fund manager use options to hedge that interest rate risk exposure?This interest rate risk exposure can be hedged by buying call options on either financialsecurities or financial futures.c. What prices are possible on the 20-year T-bonds at the end of year 1 and year 2?Currently, the bond is priced at par, $1,000 per $1,000 face value. At the end of the first year, either of two interest rates will occur.(a) Interest rates will increase 1 percent to 9 percent (50 percent probability of eitheroccurrence). The 20-year 8 percent coupon Treasury bond's price will fall to $907.9921 per $1,000 face value.(b) Interest rates will decrease 1 percent to 7 percent (50 percent probability ofoccurrence). The 20-year 8 percent coupon Treasury bond's price will increase to$1,106.7754 per $1,000 face value.At the end of two years, one of three different interest rate scenarios will occur.(a) Interest rates will increase another 1 percent to 10 percent (25 percent probability ofoccurrence). The 20 year 8 percent coupon Treasury bond's price will fall to $828.4091 per $1,000 face value.(b) Interest rates will decrease 1 percent to 8 percent or increase 1 percent to 8 percent(50 percent probability of occurrence). The 20-year 8 percent coupon Treasury bond'sprice will return to $1,000 per $1,000 face value.(c) Interest rates will decrease another 1 percent to 6 percent (25 percent probability ofoccurrence). The 20-year 8% coupon Treasury bond's price will increase to$1,231.1477 per $1,000 face value.Note: The diagram for part (d) is on the next page.e. If options on $100,000, 20-year, 8 percent coupon Treasury bonds (both puts and calls)have a strike price of 101, what are the possible (intrinsic) values of the option positionat the end of year 1 and year 2?The call option's intrinsic value at the end of one year will be either:(a) Zero if the price of a $100,000 20-year Treasury bond is $90,799.21 (in the scenariothat interest rates rise to 9 percent); or(b) $110,677.54 - $101,000 (strike price) = $9,677.54 if the price of a $100,000 20-yearTreasury bond is $110,677.54 (in the scenario that interest rates fall to 7 percent).The call option's intrinsic value at the end of two years will be either:(a) Zero if the price of a $100,000 20-year Treasury bond is $82,840.91 (in the scenariothat interest rates rise to 10 percent); or(b) Zero if the price of a $100,000 20-year Treasury bond is $100,000 (in the scenariothat interest rates stay at 8 percent); or(c ) $123,114.77 - $101,000 (strike price) = $22,114.77 if the price of a $100,000 20-year Treasury bond is $123,114.77 (in the scenario that interest rates fall to 6 percent).d.f.g.PV = $9,677.54/1.08 + $22,114.17/(1.08)2 = $10,773.25.13. Why are options on interest rate futures contracts preferred to options on cash instrumentsin hedging interest rate risk?Futures options are preferred to options on the underlying bond because they are more liquid, have less credit risk, are homogeneous, and have the benefit of mark-to-market features common in futures contracts. At the same time, the futures options offer the same asymmetric payoff functions of regular puts and calls.14. Consider Figure 25-12. What are the prices paid for the following futures options:a. June T-bond calls at 116. ⇒ $1,703.125 per $100,000 contract.b. June T-note puts at 116. ⇒ $1,468.750 per $100,000 contract.c. June Eurodollar calls at 9900 (99.00). ⇒ $1,000.000 per $1,000,000 contract.15. Consider Figure 25-12 again. What happens to the price of the following?a. A call when the exercise price increases? ⇒ The call value decreases.b. A call when the time until expiration increases? ⇒ The call value increases.c. A put when the exercise price increases? ⇒ The put value increases.d. A put when the time to expiration increases? ⇒ The put value increases.16. An FI manager writes a call option on a T-bond futures contract with an exercise price of114 at a quoted price of 0-55.a. What type of opportunities or obligations does the manager have?The manager is obligated to sell the interest rate futures contract to the call option buyer at the price of $114,000 per $100,000 contract, if the buyer chooses to exercise the option. If the writer does not own the bond at the time of exercise, the bond must be purchased in the market. The call writer received a premium of $859.38 from the sale of the option.b. In what direction must interest rates move to encourage the call buyer to exercise theoption?Interest rates must decrease so the market price of the bond increases.17. What is the delta of an option (δ)?The delta of an option measures the change in the option value for a $1 change in the value of the underlying asset. The delta of a call option always will be between 0 and 1.0, and the delta of a put option always will be between –1.0 and 0.18. An FI has a $100 million portfolio of six-year Eurodollar bonds that have an 8 percentcoupon. The bonds are trading at par and have a duration of five years. The FI wishes to hedge the portfolio with T-bond options that have a delta of -0.625. The underlying long-term Treasury bonds for the option have a duration of 10.1 years and trade at a market value of $96,157 per $100,000 of par value. Each put option has a premium of $3.25. a. How many bond put options are necessary to hedge the bond portfolio?contracts D B Value Portfolio Bond N p 82474.823157,96$*1.10*625.0000,000,100$**≈=--==δb. If interest rates increase 100 basis points, what is the expected gain or loss on the putoption hedge? A $100,000 20-year, eight percent bond selling at $96,157 implies a yield of 8.4 percent. ∆P = ∆p * N p = 824 * -0.625 * -10.1/1.084 * $96,157 * 0.01 = $4,614,028.00 gain c. What is the expected change in market value on the bond portfolio? ∆PV Bond = -5 * .01/1.08 * $100,000,000 = -$4,629,629.63 d. What is the total cost of placing the hedge?The price quote of $3.25 is per $100 of face value. Therefore the cost of one put contract is $3,250, and the cost of the hedge = 824 contracts * $3,250 per contract = $2,678,000. e. Diagram the payoff possibilities.The diagram of this portfolio position and the corresponding hedge is given in Figures 25-6 and 25-7.f. How far must interest rates move before the payoff on the hedge will exactly offset the cost of placing the hedge? Solving for the change in interest rates gives ∆R = ($3,250*1.084)/(0.625*10.1*$96,157) = 0.005804 or .58 percent.g. How far must interest rates move before the gain on the bond portfolio will exactly offset the cost of placing the hedge? Again solving for ∆R = ($3,250*824*1.08)/(5*$100,000,000) = .0057844 or .58 percent. h. Summarize the gain, loss, cost conditions of the hedge on the bond portfolio in terms of changes in interest rates.If rates increase 0.58 percent, the portfolio will decrease in value approximately equal to the gain on the hedge. This position corresponds to the intersection of the payoff function from the put and the X-axis in Figure 25-6. The FI is out the cost of the hedge, which alsowill be the case for any other increase in interest rates. In effect the cost of the hedge is the insurance premium to assure the yield on the portfolio at the time the hedge is placed.If rates decrease approximately 0.58 percent, the gain on the portfolio will offset the cost of the hedge, and the put option will not be exercised. This position is shown by theintersection of the X-axis and the net payoff function in Figure 25-7. Any increase in rates beyond 0.58 percent will generate positive profits for the portfolio in excess of the cost of the hedge.19. Corporate Bank has $840 million of assets with a duration of 12 years and liabilities worth$720 million with a duration of 7 years. The bank is concerned about preserving the value of its equity in the event of an increase in interest rates and is contemplating a macrohedge with interest rate options. The call and put options have a delta (δ) of 0.4 and –0.4,respectively. The price of an underlying T-bond is 104-34, and its modified duration is 7.6 years. a. What type of option should Corporate Bank use for the macrohedge? The duration gap for the bank is [12 – (720/840)7] = 6. Therefore the bank is concernedthat interest rates may increase, and it should purchase put options. As rates rise, the value of the bonds underlying the put options will fall, but they will be puttable at the higher put option exercise price. b. How many options should be purchased? The bonds underlying the put options have a market value of $104,531.25. Assuming an 8percent bond, these bonds are trading at a yield to maturity of 7.56 percent. Given a modified duration of 7.6, the duration of these bonds is MD*1.0756 = 8.17 years. Thuscontracts or B D A DGAP N p 754,1475.753,1425.531,104$*17.8*)4.(000,000,840$*6***=-==δc. What is the effect on the economic value of the equity if interest rates rise 50 basispoints?Assuming R for the assets is similar to R for the underlying bonds, the change in equityvalue is –DGAP*A*(∆R/(1+R)) = -6($840,000,000)(.005/1.0756) = -$23,428,784. d. What will be the effect on the hedge if interest rates rise 50 basis points? ∆P = N p (δ*-MD*B*∆R) = 14,754*-.4*-7.6*$104,531.25*0.005 = $23,442,262 gain e. What will be the cost of the hedge if each option has a premium of $0.875?A price quote of $0.875 is per $100 face value of the put contract. Therefore, the cost percontract is $875, and the cost of the hedge is $875*14,754 = $12,909,750.f. Diagram the economic conditions of the hedge.The diagram of this portfolio position and the corresponding hedge is given in Figures 25-6 and 25-7. In this particular case, the payoff function for the net long position of the bank (DGAP = 6) should be considered as the payoff function of the bond in Figure 25-6.g. How much must interest rates move against the hedge for the increased value of thebank to offset the cost of the hedge?Let ∆E = $12,909,750, and solve the equation in part (c) above for ∆R. Then∆R = $12,909,750*1.0756/($840,000,000*-6) = -0.002755 or -0.2755 percent.h. How much must interest rates move in favor of the hedge, or against the balance sheet,before the payoff from the hedge will exactly cover the cost of the hedge?Use the equation in part (d) above and solve for ∆R. Then∆R = $12,909,750/[14,754*-.4*-7.6*$104,531.25] = 0.002755 or 0.2755 percent.i. Formulate a management decision rule regarding the implementation of the hedge.If rates increase 0.2755 percent, the equity will decrease in value approximately equal to the gain on the hedge. This position corresponds to the intersection of the payoff function from the put and the X-axis in Figure 25-6. The FI is out the cost of the hedge, which also will be the case for any other increase in interest rates. In effect the cost of the hedge is the insurance premium to assure the value of the equity at the time the hedge is placed.If rates decrease approximately 0.2755 percent, the gain on the equity value will offset the cost of the hedge, and the put option will not be exercised. This position is shown by the intersection of the X-axis and the net payoff function in Figure 25-7. Any increase in rates beyond 0.2755 percent will generate positive increases in value for the equity in excess of the cost of the hedge.20. An FI has a $200 million asset portfolio that has an average duration of 6.5 years. Theaverage duration of its $160 million in liabilities is 4.5 years. The FI uses put options on T-bonds to hedge against unexpected interest rate increases. The average delta (δ) of the put options has been estimated at -0.3, and the average duration of the T-bonds is 7 years. The current market value of the T-Bonds is $96,000.a. What is the modified duration of the T-bonds if the current level of interest rates is 10percent?MD = D/1+.10 = 7/1.10 = 6.3636 yearsb. How many put option contracts should it purchase to hedge its exposure against rising interest rates? The face value of the T-bonds is $100,000.B * D * A * ]D k - D [ = N L A p-δ = [6.5 - 4.5(.80)]*$200,000,000/[(-.3)*(-7.0)*(96,000)] = 2,876.98 or 2,877 contractsc. If interest rates increase 50 basis points, what will be the change in value of the equity of the FI? Assuming R for the assets is similar to R for the underlying bonds, the change in equity value is –DGAP*A*(∆R/(1+R)) = -2.9($200,000,000)(.005/1.10) = -$2,636,363.64.d. What will be the change in value of the T-bond option hedge position? ∆P = N p (δ*-MD*B*∆R) = 2,877*-.3*-6.3636*$96,000*0.005 = $2,636,363.12 gaine. If put options on T-bonds are selling at a premium of $1.25 per face value of $100, what is the total cost of hedging using options on T-bonds? Premium on the put options = 2,877 x $1.25 x 1,000 = $3,596,250.f. Diagram the spot market conditions of the equity and the option hedge.The diagram of this portfolio position and the corresponding hedge is given in Figures 25-6 and 25-7. In this particular case, the payoff function for the net long position of the bank (DGAP = 2.9) should be considered as the payoff function of the bond in Figure 25-6. g. What must be the change in interest rates before the change in value of the balance sheet (equity) will offset the cost of placing the hedge? Let ∆E = $3,596,250, and solve the equation in part (c) above for ∆R. Then ∆R = $3,596,250*1.10/($200,000,000*-2.9) = -0.00682 or -0.68 percent.h. How much must interest rates change before the payoff of the hedge will exactly cover the cost of placing the hedge? Use the equation in part (d) above and solve for ∆R. Then∆R = $3,596,250/[2,877*-.3*-6.3636*$96,000] = 0.00682 or 0.68 percent. i. Given your answer in part (g), what will be the net gain or loss to the FI?If rates decrease by 0.68 percent, the increase in value of the equity will exactly offset the cost of placing the hedge. The options will be allowed to expire unused since the price of the bonds will be higher in the market place than the exercise price of the option.21. A mutual fund plans to purchase $10,000,000 of 20-year T-bonds in two months. Thesebonds have a duration of 11 years. The mutual fund is concerned about interest rateschanging over the next four months and is considering a hedge with a two-month option on a T-bond futures contract. Two-month calls with a strike price of 105 are priced at 1-25, and puts of the same maturity and exercise price are quoted at 2-09. The delta of the call is .5 and the delta of the put is -.7. The current price of a deliverable T-bond is 103-08 per $100 of face value, and its modified duration is nine years. a. What type of option should the mutual fund purchase? The mutual fund is concerned about interest rates falling which would imply that bondprices would increase. Therefore the FI should buy call options to guarantee a certain purchase price. b. How many options should it purchase?options call or B * MD * A* D = N p23775.236250,103$*9*5.000,000,10$*11==-δ c. What is the cost of these options? The quote for T-bond options is 1-25, or 1 + 25/64 =1.390625 per $100 face value. Thisconverts to $1,390.625 per $100,000 option contract. The total cost of the hedge is 237 * $1,390.625 = $329,578.125. d. If rates change +/-50 basis points, what will be the impact on the price of the desired T-bonds? The price on a deliverable T-bond is $103,250 which implies that the yield to maturity inthe market on a 20-year, 8 percent bond is 7.68 percent. Therefore, for a rate increase, the ∆Bond value = -11(0.005)$10,000,000/1.0768 = -$510,772.66. If rates decrease, the valueof the bonds will increase by $510,772.66. e. What will be the effect on the value of the hedge if rates change +/- 50 basis points? If rates decrease, the value of the underlying bonds, and thus the hedge, increases. ∆P = N c (δ*-MD*B*∆R) = 237*0.5*-9*$103,250*(-0.005) = $550,580.62. This occursbecause the FI can buy the bonds at the exercise price and sell them at the higher market price. If rates rise, the options will expire without value because the bonds will be priced lower in the market. f. Diagram the effects of the hedge and the spot market value of the desired T-bonds. The payoff profile of the call option hedge is given in Figure 25-1, and the profile of a longbond is shown in Figure 25-5. The payoff profile of the call option is less than the bond by the amount of the premium, but the call option profile illustrates less opportunity for loss.。

Chapter TwoThe Financial Services Industry: Depository InstitutionsChapter OutlineIntroductionCommercial Banks∙Size, Structure, and Composition of the Industry∙Balance Sheet and Recent Trends∙Other Fee-Generating Activities∙Regulation∙Industry PerformanceSavings Institutions∙Savings Associations (SAs)∙Savings Banks∙Recent Performance of Savings Associations and Savings BanksCredit Unions∙Size, Structure, and Composition of the Industry and Recent Trends∙Balance Sheets∙Regulation∙Industry PerformanceGlobal Issues: Japan, China, and GermanySummaryAppendix 2A: Financial Statement Analysis Using a Return on Equity (ROE) Framework Appendix 2B: Depository Institutions and Their RegulatorsAppendix 3B: Technology in Commercial BankingSolutions for End-of-Chapter Questions and Problems: Chapter Two1.What are the differences between community banks, regional banks, and money-centerbanks? Contrast the business activities, location, and markets of each of these bank groups. Community banks typically have assets under $1 billion and serve consumer and small business customers in local markets. In 2003, 94.5 percent of the banks in the United States were classified as community banks. However, these banks held only 14.6 percent of the assets of the banking industry. In comparison with regional and money-center banks, community banks typically hold a larger percentage of assets in consumer and real estate loans and a smaller percentage of assets in commercial and industrial loans. These banks also rely more heavily on local deposits and less heavily on borrowed and international funds.Regional banks range in size from several billion dollars to several hundred billion dollars in assets. The banks normally are headquartered in larger regional cities and often have offices and branches in locations throughout large portions of the United States. Although these banks provide lending products to large corporate customers, many of the regional banks have developed sophisticated electronic and branching services to consumer and residential customers. Regional banks utilize retail deposit bases for funding, but also develop relationships with large corporate customers and international money centers.Money center banks rely heavily on nondeposit or borrowed sources of funds. Some of these banks have no retail branch systems, and most regional banks are major participants in foreign currency markets. These banks compete with the larger regional banks for large commercial loans and with international banks for international commercial loans. Most money center banks have headquarters in New York City.e the data in Table 2-4 for the banks in the two asset size groups (a) $100 million-$1billion and (b) over $10 billion to answer the following questions.a. Why have the ratios for ROA and ROE tended to increase for both groups over the1990-2003 period? Identify and discuss the primary variables that affect ROA andROE as they relate to these two size groups.The primary reason for the improvements in ROA and ROE in the late 1990s may berelated to the continued strength of the macroeconomy that allowed banks to operate with a reduced regard for bad debts, or loan charge-off problems. In addition, the continued low interest rate environment has provided relatively low-cost sources of funds, and a shifttoward growth in fee income has provided additional sources of revenue in many product lines. Finally, a growing secondary market for loans has allowed banks to control the size of the balance sheet by securitizing many assets. You will note some variance inperformance in the last three years as the effects of a softer economy were felt in thefinancial industry.b. Why is ROA for the smaller banks generally larger than ROA for the large banks?Small banks historically have benefited from a larger spread between the cost rate of funds and the earning rate on assets, each of which is caused by the less severe competition in the localized markets. In addition, small banks have been able to control credit risk moreefficiently and to operate with less overhead expense than large banks.c. Why is the ratio for ROE consistently larger for the large bank group?ROE is defined as net income divided by total equity, or ROA times the ratio of assets to equity. Because large banks typically operate with less equity per dollar of assets, netincome per dollar of equity is larger.d. Using the information on ROE decomposition in Appendix 2A, calculate the ratio ofequity-to-total-assets for each of the two bank groups for the period 1990-2003. Whyhas there been such dramatic change in the values over this time period, and why isthere a difference in the size of the ratio for the two groups?ROE = ROA x (Total Assets/Equity)Therefore, (Equity/Total Assets) = ROA/ROE$100 million - $1 Billion Over $10 BillionYear ROE ROA TA/Equity Equity/TA ROE ROA TA/Equity Equity/TA1990 9.95% 0.78% 12.76 7.84% 6.68% 0.38% 17.58 5.69%1995 13.48% 1.25% 10.78 9.27% 15.60% 1.10% 14.18 7.05%1996 13.63% 1.29% 10.57 9.46% 14.93% 1.10% 13.57 7.37%1997 14.50% 1.39% 10.43 9.59% 15.32% 1.18% 12.98 7.70%1998 13.57% 1.31% 10.36 9.65% 13.82% 1.08% 12.80 7.81%1999 14.24% 1.34% 10.63 9.41% 15.97% 1.28% 12.48 8.02%2000 13.56% 1.28% 10.59 9.44% 14.42% 1.16% 12.43 8.04%2001 12.24% 1.20% 10.20 9.80% 13.43% 1.13% 11.88 8.41%2002 12.85% 1.26% 10.20 9.81% 15.06% 1.32% 11.41 8.76%2003 12.80% 1.27% 10.08 9.92% 16.32% 1.42% 11.49 8.70% The growth in the equity to total assets ratio has occurred primarily because of theincreased profitability of the entire banking industry and the encouragement of theregulators to increase the amount of equity financing in the banks. Increased fee income, reduced loan loss reserves, and a low, stable interest rate environment have produced the increased profitability which in turn has allowed banks to increase equity through retained earnings.Smaller banks tend to have a higher equity ratio because they have more limited assetgrowth opportunities, generally have less diverse sources of funds, and historically have had greater profitability than larger banks.3.What factors have caused the decrease in loan volume relative to other assets on thebalance sheets of commercial banks? How has each of these factors been related to the change and development of the financial services industry during the 1990s and early2000s? What strategic changes have banks implemented to deal with changes in thefinancial services environment?Corporations have utilized the commercial paper markets with increased frequency rather than borrow from banks. In addition, many banks have sold loan packages directly into the capital markets (securitization) as a method to reduce balance sheet risks and to improve liquidity. Finally, the decrease in loan volume during the early 1990s and early 2000s was due in part to the recession in the economy.As deregulation of the financial services industry continued during the 1990s, the position of banks as the primary financial services provider continued to erode. Banks of all sizes have increased the use of off-balance sheet activities in an effort to generate additional fee income. Letters of credit, futures, options, swaps and other derivative products are not reflected on the balance sheet, but do provide fee income for the banks.4.What are the major uses of funds for commercial banks in the United States? What are theprimary risks to the bank caused by each use of funds? Which of the risks is most critical to the continuing operation of the bank?Loans and investment securities continue to be the primary assets of the banking industry. Commercial loans are relatively more important for the larger banks, while consumer, small business loans, and residential mortgages are more important for small banks. Each of these types of loans creates credit, and to varying extents, liquidity risks for the banks. The security portfolio normally is a source of liquidity and interest rate risk, especially with the increased use of various types of mortgage backed securities and structured notes. In certain environments, each of these risks can create operational and performance problems for a bank.5.What are the major sources of funds for commercial banks in the United States? How isthe landscape for these funds changing and why?The primary sources of funds are deposits and borrowed funds. Small banks rely more heavily on transaction, savings, and retail time deposits, while large banks tend to utilize large, negotiable time deposits and nondeposit liabilities such as federal funds and repurchase agreements. The supply of nontransaction deposits is shrinking, because of the increased use by small savers of higher-yielding money market mutual funds,6. What are the three major segments of deposit funding? How are these segments changingover time? Why? What strategic impact do these changes have on the profitable operation of a bank?Transaction accounts include deposits that do not pay interest and NOW accounts that pay interest. Retail savings accounts include passbook savings accounts and small, nonnegotiable time deposits. Large time deposits include negotiable certificates of deposits that can be resold in the secondary market. The importance of transaction and retail accounts is shrinking due to the direct investment in money market assets by individual investors. The changes in the deposit markets coincide with the efforts to constrain the growth on the asset side of the balance sheet.7. How does the liability maturity structure of a bank’s balance sheet compare with thematurity structure of the asset portfolio? What risks are created or intensified by thesedifferences?Deposit and nondeposit liabilities tend to have shorter maturities than assets such as loans. The maturity mismatch creates varying degrees of interest rate risk and liquidity risk.8. The following balance sheet accounts have been taken from the annual report for a U.S.bank. Arrange the accounts in balance sheet order and determine the value of total assets.Based on the balance sheet structure, would you classify this bank as a community bank, regional bank, or a money center bank?Assets Liabilities and EquityCash $ 2,660 Demand deposits $ 5,939Fed funds sold $ 110 NOW accounts $12,816Investment securities $ 5,334 Savings deposits $ 3,292Net loans $29,981 Certificates of deposit $ 9,853Intangible assets $ 758 Other time deposits $ 2,333Other assets $ 1,633 Short-term Borrowing $ 2,080Premises $ 1,078 Other liabilities $ 778Total assets $41,554 Long-term debt $ 1,191Equity $ 3,272Total liab. and equity $41,554This bank has funded the assets primarily with transaction and savings deposits. The certificates of deposit could be either retail or corporate (negotiable). The bank has very little ( 5 percent) borrowed funds. On the asset side, about 72 percent of total assets is in the loan portfolio, but there is no information about the type of loans. The bank actually is a small regional bank with $41.5 billion in assets, but the asset structure could easily be a community bank with $41.5 million in assets.9.What types of activities normally are classified as off-balance-sheet (OBS) activities?Off-balance-sheet activities include the issuance of guarantees that may be called into play at a future time, and the commitment to lend at a future time if the borrower desires.a. How does an OBS activity move onto the balance sheet as an asset or liability?The activity becomes an asset or a liability upon the occurrence of a contingent event,which may not be in the control of the bank. In most cases the other party involved with the original agreement will call upon the bank to honor its original commitment.b.What are the benefits of OBS activities to a bank?The initial benefit is the fee that the bank charges when making the commitment. If the bank is required to honor the commitment, the normal interest rate structure will apply to the commitment as it moves onto the balance sheet. Since the initial commitment does notappear on the balance sheet, the bank avoids the need to fund the asset with either deposits or equity. Thus the bank avoids possible additional reserve requirement balances anddeposit insurance premiums while improving the earnings stream of the bank.c.What are the risks of OBS activities to a bank?The primary risk to OBS activities on the asset side of the bank involves the credit risk of the borrower. In many cases the borrower will not utilize the commitment of the bank until the borrower faces a financial problem that may alter the credit worthiness of the borrower.Moving the OBS activity to the balance sheet may have an additional impact on the interest rate and foreign exchange risk of the bank.e the data in Table 2-6 to answer the following questions.a.What was the average annual growth rate in OBS total commitments over the periodfrom 1992-2003?$78,035.6 = $10,200.3(1+g)11 g = 20.32 percentb.Which categories of contingencies have had the highest annual growth rates?Category of Contingency or Commitment Growth RateCommitments to lend 14.04%Future and forward contracts 15.13%Notional amount of credit derivatives 52.57%Standby contracts and other option contracts 56.39%Commitments to buy FX, spot, and forward 3.39%Standby LCs and foreign office guarantees 7.19%Commercial LCs -1.35%Participations in acceptances -6.11%Securities borrowed 20.74%Notional value of all outstanding swaps 31.76%Standby contracts and other option contracts have grown at the fastest rate of 56.39 percent, and they have an outstanding balance of $214,605.3 billion. The rate of growth in thecredit derivatives area has been the second strongest at 52.57 percent, the dollar volumeremains fairly low at $1,001.2 billion at year-end 2003. Interest rate swaps grew at anannual rate of 31.76 percent with a change in dollar value of $41,960.7 billion. Clearly the strongest growth involves derivative areas.c.What factors are credited for the significant growth in derivative securities activities bybanks?The primary use of derivative products has been in the areas of interest rate, credit, andforeign exchange risk management. As banks and other financial institutions have pursuedthe use of these instruments, the international financial markets have responded byextending the variations of the products available to the institutions.11. For each of the following banking organizations, identify which regulatory agencies (OCC,FRB, FDIC, or state banking commission) may have some regulatory supervisionresponsibility.(a) State-chartered, nonmember, nonholding-company bank.(b)State-chartered, nonmember holding-company bank(c) State-chartered member bank(d)Nationally chartered nonholding-company bank.(e)Nationally chartered holding-company bankBank Type OCC FRB FDIC SBCom.(a) Yes Yes(b) Yes Yes Yes(c) Yes Yes Yes(d) Yes Yes Yes(e) Yes Yes Yes12. What factors normally are given credit for the revitalization of the banking industry duringthe decade of the 1990s? How is Internet banking expected to provide benefits in thefuture?The most prominent reason was the lengthy economic expansion in both the U.S. and many global economies during the entire decade of the 1990s. This expansion was assisted in the U.S. by low and falling interest rates during the entire period.The extent of the impact of Internet banking remains unknown. However, the existence of this technology is allowing banks to open markets and develop products that did not exist prior to the Internet. Initial efforts have focused on retail customers more than corporate customers. The trend should continue with the advent of faster, more customer friendly products and services, and the continued technology education of customers.13. What factors are given credit for the strong performance of commercial banks in the early2000s?The lowest interest rates in many decades helped bank performance on both sides of the balance sheet. On the asset side, many consumers continued to refinance homes and purchase new homes, an activity that caused fee income from mortgage lending to increase and remain strong. Meanwhile, the rates banks paid on deposits shrunk to all-time lows. In addition, the development and more comfortable use of new financial instruments such as credit derivatives and mortgage backed securities helped banks ease credit risk off the balance sheets. Finally, information technology has helped banks manage their risk more efficiently.14. What are the main features of the Riegle-Neal Interstate Banking and Branching EfficiencyAct of 1994? What major impact on commercial banking activity is expected from this legislation?The main feature of the Riegle-Neal Act of 1994 was the removal of barriers to inter-state banking. In September 1995 bank holding companies were allowed to acquire banks in other states. In 1997, banks were allowed to convert out-of-state subsidiaries into branches of a single interstate bank. As a result, consolidations and acquisitions have allowed for the emergence of very large banks with branches across the country.15. What happened in 1979 to cause the failure of many savings associations during the early1980s? What was the effect of this change on the operating statements of savingsassociations?The Federal Reserve changed its reserve management policy to combat the effects of inflation, a change which caused the interest rates on short-term deposits to increase dramatically more than the rates on long-term mortgages. As a result, the marginal cost of funds exceeded the average yield on assets that caused a negative interest spread for the savings associations. Further, because savings associations were constrained by Regulation Q on the amount of interest which could be paid on deposits, they suffered disintermediation, or deposit withdrawals, which led to severe liquidity pressures on the balance sheets.16. How did the two pieces of regulatory legislation, the DIDMCA in 1980 and the DIA in1982, change the operating profitability of savings associations in the early 1980s? What impact did these pieces of legislation ultimately have on the risk posture of the savingsassociation industry? How did the FSLIC react to this change in operating performance and risk?The two pieces of legislation allowed savings associations to offer new deposit accounts, such as NOW accounts and money market deposit accounts, in an effort to reduce the net withdrawal flow of deposits from the institutions. In effect this action was an attempt to reduce the liquidity problem. In addition, the savings associations were allowed to offer adjustable-rate mortgages and a limited amount of commercial and consumer loans in an attempt to improve the profitability performance of the industry. Although many savings associations were safer, more diversified, and more profitable, the FSLIC did not foreclose many of the savings associations which were insolvent. Nor did the FSLIC change its policy of assessing higher insurance premiums on companies that remained in high risk categories. Thus many savings associations failed, which caused the FSLIC to eventually become insolvent.17. How do the asset and liability structures of a savings association compare with the assetand liability structures of a commercial bank? How do these structural differences affect the risks and operating performance of a savings association? What is the QTL test?The savings association industry relies on mortgage loans and mortgage-backed securities as the primary assets, while the commercial banking industry has a variety of loan products, including mortgage products. The large amount of longer-term fixed rate assets continues to cause interestrate risk, while the lack of asset diversity exposes the savings association to credit risk. Savings associations hold considerably less cash and U.S. Treasury securities than do commercial banks. On the liability side, small time and saving deposits remain as the predominant source of funds for savings associations, with some reliance on FHLB borrowing. The inability to nurture relationships with the capital markets also creates potential liquidity risk for the savings association industry.The acronym QTL stands for Qualified Thrift Lender. The QTL test refers to a minimum amount of mortgage-related assets that a savings association must hold. The amount currently is 65 percent of total assets.18. How do savings banks differ from savings and loan associations? Differentiate in terms ofrisk, operating performance, balance sheet structure, and regulatory responsibility.The asset structure of savings banks is similar to the asset structure of savings associations with the exception that savings banks are allowed to diversify by holding a larger proportion of corporate stocks and bonds. Savings banks rely more heavily on deposits and thus have a lower level of borrowed funds. The banks are regulated at both the state and federal level, with deposits insured by t he FDIC’s BIF.19. How did the Financial Institutions Reform, Recovery, and Enforcement Act (FIRREA) of1989 and the Federal Deposit Insurance Corporation Improvement Act of 1991 reversesome of the key features of earlier legislation?FIRREA rescinded some of the expanded thrift lending powers of the DIDMCA of 1980 and the Garn-St Germain Act of 1982 by instituting the qualified thrift lender (QTL) test that requires that all thrifts must hold portfolios that are comprised primarily of mortgages or mortgage products such as mortgage-backed securities. The act also required thrifts to divest their portfolios of junk bonds by 1994, and it replaced the FSLIC with a new thrift deposit insurance fund, the Savings Association Insurance Fund, which was managed by the FDIC.The FDICA of 1991 amended the DIDMCA of 1980 by introducing risk-based deposit insurance premiums in 1993 to reduce excess risk-taking. FDICA also provided for the implementation of a policy of prompt corrective actions (PCA) that allows regulators to close banks more quickly in cases where insolvency is imminent. Thus the ill-advised policy of regulatory forbearance should be curbed. Finally, the act amended the International Banking Act of 1978 by expanding the regulatory oversight powers over foreign banks.20. What is the “common bond” membership qualification under which credit unions havebeen formed and operated? How does this qualification affect the operational objective ofa credit union?The common bond policy allows any one who meets a specific membership requirement to become a member of the credit union. The requirement normally is tied to a place of employment. Because the common bond policy has been loosely interpreted, implementation has allowed credit union membership and assets to grow at a rate that exceeds similar growth inthe commercial banking industry. Since credit unions are mutual organizations where the members are owners, employees essentially use saving deposits to make loans to other employees who need funds.21. What are the operating advantages of credit unions that have caused concern bycommercial bankers? What has been the response of the Credit Union NationalAssociation to the bank criticisms?Credit unions are tax-exempt organizations that often are provided office space by employers at no cost. As a result, because non-interest operating costs are very low, credit unions can lend money at lower rates and pay higher rates on savings deposits than can commercial banks. CUNA has responded that the cost to tax payers from the tax-exempt status is replaced by the additional social good created by the benefits to the members.22. How does the asset structure of credit unions compare with the asset structure ofcommercial banks and savings and loan associations? Refer to Tables 2-5, 2-9, and 2-12 to formulate your answer.The relative proportions of credit union assets are more similar to commercial banks than savings associations, with 20 percent in investment securities and 63 percent in loans. However, nonmortgage loans of credit unions are predominantly consumer loans. On the liability side of the balance sheet, credit unions differ from banks in that they have less reliance on large time deposits, and they differ from savings associations in that they have virtually no borrowings from any source. The primary sources of funds for credit unions are transaction and small time and savings accounts.23. Compare and contrast the performance of the U.S. depository institution industry withthose of Japan, China, and Germany.The entire Japanese financial system was under increasing pressure from the early 1990s as the economy suffered from real estate and other commercial industry pressures. The Japanese government has used several financial aid packages in attempts to avert a collapse of the Japanese financial system. Most attempts have not been successful.The deterioration in the banking industry in China in the early 2000s was caused by nonperforming loans and credits. The remedies include the opportunity for more foreign bank ownership in the Chinese banking environment primarily via larger ownership positions, less restrictive capital requirements for branches, and increased geographic presence.German banks also had difficulties in the early 2000s, but the problems were not universal. The large banks suffered from credit problems, but the small banks enjoyed high credit ratings and low cast of funds because of government guarantees on their borrowing. Thus while small banks benefited from growth in small business lending, the large banks became reliant on fee and trading income.。

金融机构考试题及答案一、单项选择题1. 以下哪个选项不是金融机构的主要功能?A. 支付中介B. 信用创造C. 风险管理D. 产品制造答案:D2. 商业银行的存款准备金率是指:A. 商业银行必须持有的最低现金比例B. 商业银行必须持有的最低存款比例C. 商业银行必须持有的最低贷款比例D. 商业银行必须持有的最低债券比例答案:B3. 金融市场的主要参与者不包括以下哪个?A. 政府B. 企业C. 个人D. 非营利组织答案:D4. 以下哪个不是货币市场工具?A. 短期国债B. 银行承兑汇票C. 长期企业债券D. 回购协议答案:C5. 以下哪个不是金融机构的风险管理工具?A. 风险分散B. 风险转移C. 风险避免D. 风险增加答案:D二、多项选择题6. 以下哪些属于金融机构的监管机构?A. 中国人民银行B. 中国银行保险监督管理委员会C. 中国证券监督管理委员会D. 国家税务总局答案:A, B, C7. 以下哪些属于金融机构的信用风险管理措施?A. 信用评分B. 抵押品要求C. 信用保证保险D. 风险资本计提答案:A, B, C, D8. 以下哪些属于金融市场的分类?A. 货币市场B. 资本市场C. 外汇市场D. 商品市场答案:A, B, C9. 以下哪些属于金融机构的资产负债管理工具?A. 资产负债表B. 利率互换C. 远期合约D. 期权合约答案:A, B, C, D10. 以下哪些属于金融机构的合规要求?A. 反洗钱B. 客户身份识别C. 资本充足率D. 利率市场化答案:A, B, C三、判断题11. 金融机构的资本充足率越高,其风险管理能力越强。

(对)12. 银行的流动性比率越低,其流动性风险越高。

(对)13. 金融机构的杠杆率越高,其风险承担能力越强。

(错)14. 金融机构的信用评级越高,其融资成本越低。

(对)15. 金融机构的内部控制制度越完善,其操作风险越低。

(对)四、简答题16. 简述金融机构在经济中的作用。

金融机构试题及答案一、单选题(每题2分,共10分)1. 以下哪个选项不是金融机构的类型?A. 商业银行B. 证券公司C. 保险公司D. 房地产开发公司答案:D2. 金融机构的主要功能是:A. 投资B. 融资C. 储蓄D. 以上都是答案:D3. 以下哪个不是商业银行的主要业务?A. 存款业务B. 贷款业务C. 保险业务D. 汇兑业务答案:C4. 金融机构在金融市场中扮演的角色是:A. 投资者B. 融资者C. 监管者D. 以上都是答案:D5. 以下哪个不是金融机构的风险管理工具?A. 资产负债管理B. 信用风险评估C. 利率风险管理D. 市场营销策略答案:D二、多选题(每题3分,共15分)1. 金融机构的监管机构可能包括:A. 中央银行B. 证券交易委员会C. 保险监管机构D. 税务部门答案:A B C2. 以下哪些是金融机构的融资工具?A. 股票B. 债券C. 银行贷款D. 租赁答案:A B C3. 金融机构的风险管理包括:A. 信用风险管理B. 市场风险管理C. 操作风险管理D. 法律风险管理答案:A B C D4. 金融机构的资本充足率是指:A. 核心资本与风险加权资产的比例B. 总资本与风险加权资产的比例C. 核心资本与总资产的比例D. 总资本与总资产的比例答案:A B5. 以下哪些是金融机构的负债?A. 存款B. 债券发行C. 股权融资D. 贷款答案:A B三、判断题(每题1分,共5分)1. 所有金融机构都受到政府的严格监管。

(对)2. 金融机构只能通过存款来筹集资金。

(错)3. 金融机构的业务活动不涉及风险。

(错)4. 银行是金融机构的一种。

(对)5. 金融机构的资本充足率越高,其风险管理能力越强。

(对)四、简答题(每题5分,共10分)1. 简述金融机构在经济发展中的作用。

答案:金融机构在经济发展中的作用包括提供资金的中介服务,促进储蓄向投资的转化,分散和转移风险,提供支付结算服务,以及通过信贷政策影响经济活动等。

金融机构考试题及答案一、单选题(每题2分,共10题)1. 以下哪项不是金融机构的主要功能?A. 支付结算B. 风险管理C. 资金筹集D. 产品制造答案:D2. 商业银行的主要业务不包括以下哪项?A. 存款业务B. 贷款业务C. 证券经纪D. 汇兑业务答案:C3. 以下哪个不是中央银行的职能?A. 发行货币B. 制定货币政策C. 监管金融机构D. 个人理财服务答案:D4. 金融市场的基本功能不包括以下哪项?A. 资金融通B. 风险分散C. 价格发现D. 商品交换答案:D5. 以下哪项不是金融监管的目的?A. 维护金融稳定B. 保护消费者权益C. 促进金融创新D. 限制金融自由答案:D二、多选题(每题3分,共5题)6. 金融机构的类型包括哪些?A. 商业银行B. 保险公司C. 证券公司D. 投资基金答案:ABCD7. 以下哪些属于金融衍生品?A. 期货B. 期权C. 债券D. 掉期答案:ABD8. 以下哪些是中央银行的货币政策工具?A. 利率政策B. 公开市场操作C. 存款准备金率D. 外汇管制答案:ABC9. 金融市场的参与者包括哪些?A. 个人投资者B. 金融机构C. 政府机构D. 非金融企业答案:ABCD10. 金融风险管理的方法包括哪些?A. 风险分散B. 风险转移C. 风险对冲D. 风险补偿答案:ABCD三、判断题(每题1分,共5题)11. 银行的资本充足率越高,其抵御风险的能力越强。

(对)12. 利率市场化是指利率完全由市场供求决定,不受任何干预。

(错)13. 金融监管的目的是限制金融市场的发展。

(错)14. 金融衍生品可以用于投机,也可以用于对冲风险。

(对)15. 存款保险制度可以完全消除银行挤兑现象。

(错)四、简答题(每题5分,共2题)16. 简述金融市场的分类。

金融市场可以根据交易的金融工具类型、交易的期限、交易的地域范围等进行分类。

根据交易工具类型,可以分为货币市场和资本市场;根据交易期限,可以分为短期金融市场和长期金融市场;根据交易地域范围,可以分为国内金融市场和国际金融市场。